Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Kraft Foods Group, Inc. | d695467d8k.htm |

Kraft Foods

Group CAGE Conference

March 17, 2014

Exhibit 99.1 |

Chris

Jakubik Head of Investor Relations |

| 3

Kraft Foods Group, Inc.

Forward-Looking Statements

This

presentation

contains

a

number

of

forward-looking

statements.

The

words

“plan,”

“drive,”

“make,”

“develop,”

“progress,”

“change,”

“deliver,”

“extend,”

“invest,”

“become,”

“improve,”

“grow,”

“target”

and

similar

expressions

are

intended

to

identify

the

forward-looking

statements.

Examples

of

forward-looking

statements

include,

but

are

not

limited

to,

statements

regarding

Kraft’s

growth,

progress,

investments,

plans

relating

to

efficiency,

business

process

and

simplification,

productivity,

overheads,

innovation,

marketing

and

advertising,

share

of

voice,

cost

management

and

cost

savings

plans,

long-term

targets

and

outlook

for

the

North

American

Food

and

Beverage

market,

priorities

for

free

cash

flow

and

dividends.

These

forward-looking

statements

are

not

guarantees

of

future

performance

and

are

subject

to

a

number

of

risks

and

uncertainties,

many

of

which

are

beyond

Kraft’s

control.

Important

factors

that

could

cause

actual

results

to

differ

materially

from

those

indicated

in

the forward-

looking

statements

include,

but

are

not

limited

to,

increased

competition;

Kraft’s

ability

to

maintain,

extend

and

expand

its

reputation

and

brand

image;

Kraft’s

ability

to

differentiate

its

products

from

other

brands;

increasing

consolidation

of

retail

customers;

changes

in

relationships

with

significant

customers

and

suppliers;

Kraft’s

ability

to

predict,

identify

and

interpret

changes

in

consumer

preferences

and

demand;

Kraft’s

ability

to

drive

revenue

growth

in

its

key

product

categories,

increase

its

market

share,

or

add

products;

volatility

in

commodity,

energy

and

other

input

costs;

changes

in

Kraft’s

management

team

or

other

key

personnel;

Kraft’s

geographic

focus

in

North

America;

changes

in

regulations;

legal

claims

or

other

regulatory

enforcement

actions;

product

recalls

or

product

liability

claims;

unanticipated

business

disruptions;

Kraft’s

ability

to

complete

or

realize

the

benefits

from

potential

acquisitions,

alliances,

divestitures

or

joint

ventures;

Kraft’s

indebtedness

and

ability

to

pay

such

indebtedness;

disruptions

in

information

technology

networks

and

systems;

Kraft’s

inability

to

protect

intellectual

property

rights;

weak

economic

conditions;

tax

law

changes;

volatility

of

market-based

impacts

to

post-employment

benefit

plans;

pricing

actions;

and

other

factors.

For

additional

information

on

these

and

other

factors

that

could

affect

Kraft’s

forward-looking

statements,

see

Kraft’s

risk

factors,

as

they

may

be

amended

from

time

to

time,

set

forth

in

its

filings

with

the

Securities

and

Exchange

Commission,

including

its

most

recently

filed

Annual

Report

on

Form

10-K

and

subsequent

reports

on

Form

10-Q

and

Form

8-K.

Kraft

disclaims

and

does

not

undertake

any

obligation

to

update

or

revise

any

forward-looking

statement

in

this

presentation,

except

as

required

by

applicable

law

or

regulation. |

| 4

Kraft Foods Group, Inc.

Kraft Foods Group

•

Our Plan and Our Progress

•

Driving Profitable Growth in Our Industry

•

Q&A |

5

We

Have

the

Best

Sandbox

in

Our

Industry |

6

Kraft Foods Group, Inc.

Superior

Dividend

Payout

Profitable

Top-Line

Growth

Consistent

Bottom-Line

Growth

Make

Kraft

North

American

Food

&

Beverage

Company

Best

Investment

in

the

Industry |

7

Kraft Foods Group, Inc.

Our Plan

Make Our

People Our

Competitive

Edge

Execute with

Excellence

Turbocharge

Our Iconic

Brands

Redefine

Efficiency |

8

Kraft Foods Group, Inc.

Remaking Kraft

•

Recruit the best

•

Develop the best

•

Reward the best |

9

Kraft Foods Group, Inc.

Right Tools

•

Lean

Six

Sigma

gaining

traction

•

Integrated

Business

Planning

implementation

on

track

•

Top-rated

sales

capabilities |

10

Kraft Foods Group, Inc.

Rejuvenating Our Brands, One-by-One

•

Good-better-best

price/value

ladders

in

two-thirds

of

franchises

•

Realizing

solid

returns

on

investments

made

•

Improving

our

share

of

voice |

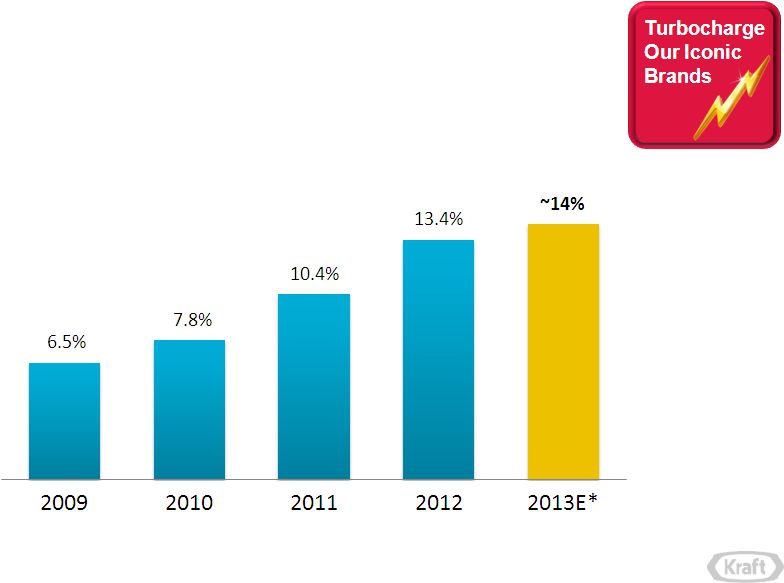

11

Kraft Foods Group, Inc.

Innovation Where it Needs to be

%

Net

Revenue

from

New

Product

Innovation

Over

Prior

3

Years

Source:

U.S.

Nielsen

Consumption

-

3-Outlet

(2009-2011)

and

All

Outlet-xAOC

(2012-2013),

*2013

Estimate |

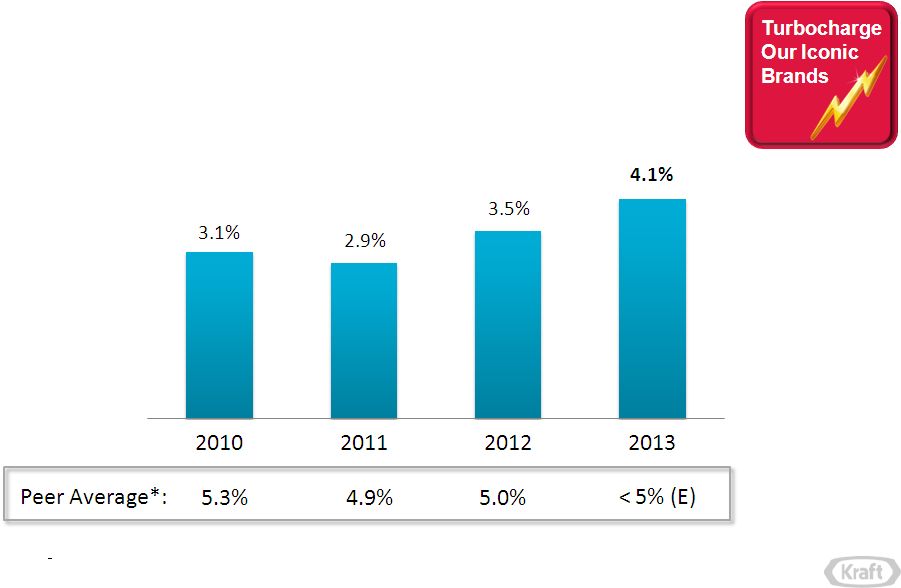

12

Kraft Foods Group, Inc.

Increasing Our Share of Voice

*

Fiscal

year

average

of

Campbell

Soup,

Coca-Cola,

ConAgra,

Dr

Pepper

Snapple,

General

Mills,

Heinz,

Hershey,

Hillshire,

Hormel,

Kellogg,

McCormick,

Mondelez,

Nestle,

PepsiCo,

Smithfield,

J.M.

Smucker,

Unilever;

Source:

Company

SEC

filings

Advertising

as

a

%

of

Net

Revenue |

13

Kraft Foods Group, Inc.

Established Our Building Blocks

Integrated L6S

World Class Maintenance

Collaborative Supplier

Integration

Network Optimization

Integrated Business Planning

World Class Innovation

Business Process Excellence |

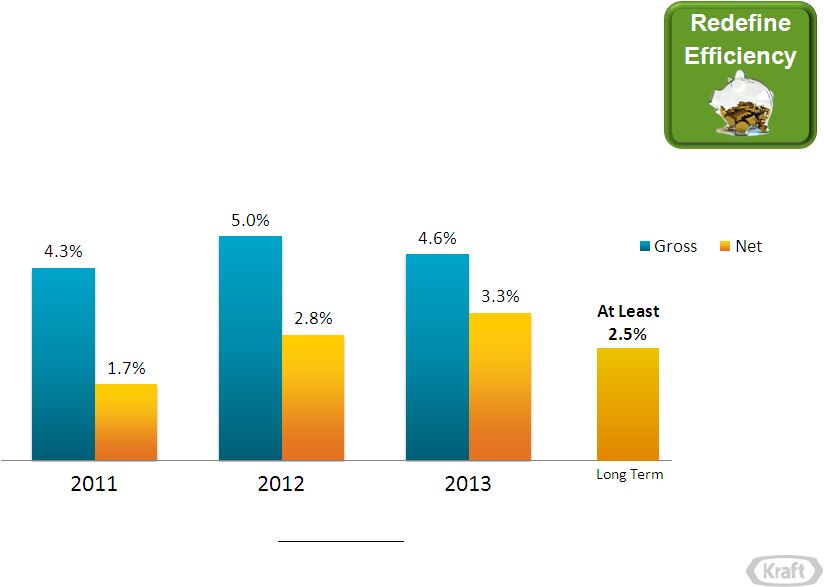

14

Kraft Foods Group, Inc.

Becoming a Low Cost Producer

•

Delivering industry-leading productivity

Gross and Net Productivity

*

as a % of COGS

*

Net

Productivity

Gross

productivity

less

inflation,

business

investments

and

changes

in

HQ

overhead

supporting

COGS |

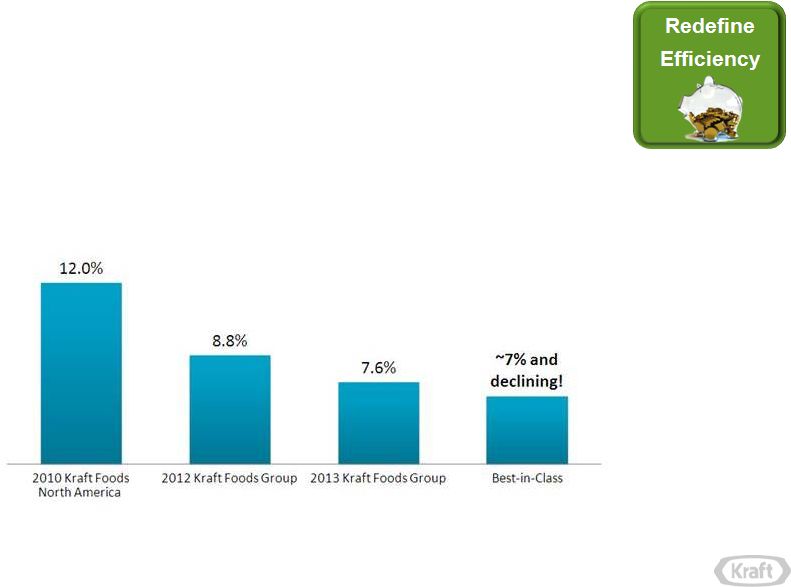

15

Kraft Foods Group, Inc.

Becoming a Low Cost Producer

•

Redefining

lowest-cost

overheads

while

investing

in

people

and

net

job

creation

Overhead Costs as a % of Net Revenue |

16

Kraft Foods Group, Inc.

On Plan with Our Plan

Make

Our

People

Our

Competitive

Edge

Execute with

Excellence

Turbocharge

Our

Iconic

Brands

Redefine

Efficiency |

Teri

List-Stoll Chief Financial Officer |

| 18

Kraft Foods Group, Inc.

Our Market is Changing…

Fast

•

Kraft

products

are

in

98%

of

North

American

households

•

We

have

an

obligation

to

our

consumers

and

customers

to

innovate

and

contemporize

our

portfolio

•

We’re

facing

an

unprecedented

confluence

of

factors |

19

Kraft Foods Group, Inc.

C’s of Change

Photo

Source:

ABC

Modern

Family

-

TV

Guide

Magazine |

20

Kraft Foods Group, Inc.

Several Megatrends are Changing the Game

Low

Income

Middle

Income

High

Income

26.5%

54.9%

18.6%

2009

28.9%

52.7%

18.4%

2012

Source:

Kraft

Foods

Group,

Nielsen

Homescan

Panel,

2009

&2013

(L52

weeksending

Q4,

2013);

Low

Income

(<$30K)

Middle

Income

($30K

-

$100K)

High

Income

($100K+)

30.0%

51.1%

18.9%

2013

Modern

Families

Hispanic

consumers

represent

17%

of

U.S.

population

today

Millennials

represent

26%

of

U.S.

population

today

Keep

it

Real

Cultural

shift

toward

quality

of

life

and

“real

food”

“Less

processed”

credentials

becoming

primary

purchase

drivers |

21

Kraft Foods Group, Inc.

C’s of Change |

22

Kraft Foods Group, Inc.

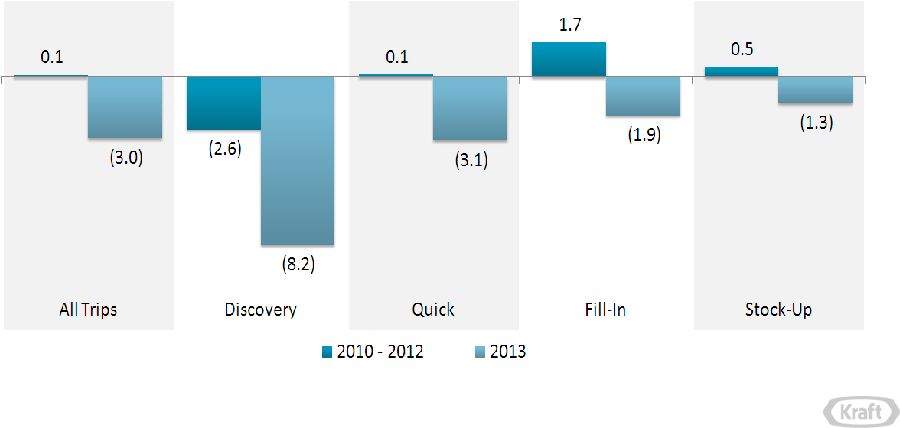

Shopping Behavior More Planned, Purposed

Shopper Trips by Type

% Change vs Prior Year

Source: Nielsen Household Panel (US), Total F&B |

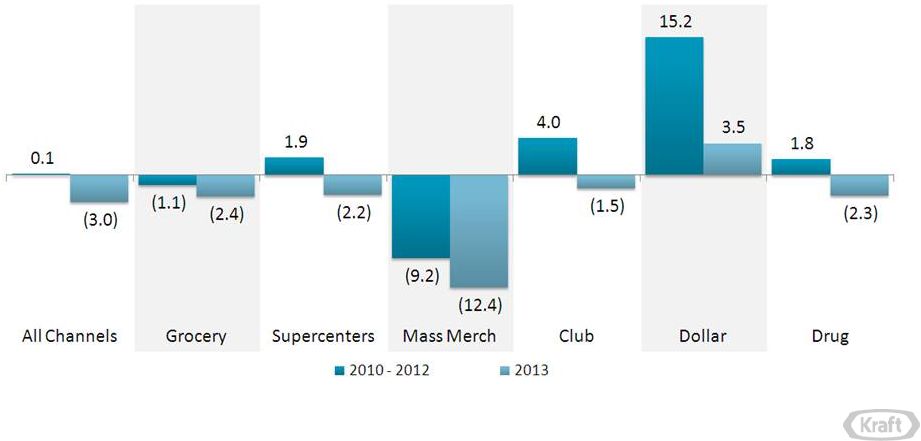

Source:

Nielsen Household Panel (US), Total F&B Consumers Shopping Less, Migrating

Channels Total Shopper Trips

% Change vs Prior Year

23

Kraft Foods Group, Inc. |

24

Kraft Foods Group, Inc.

C’s of Change |

25

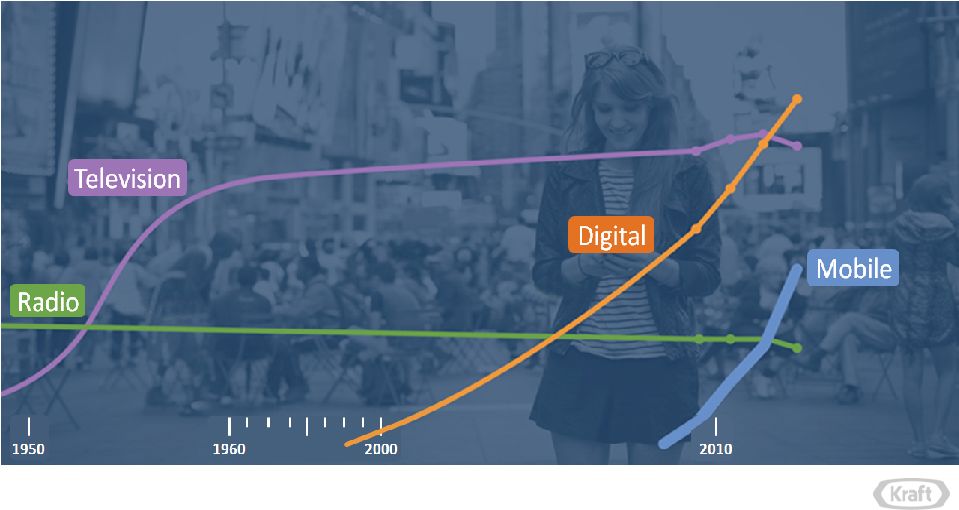

Kraft Foods Group, Inc.

Digital Surpasses TV in 2013

Source:

eMarketer,

US

,

July

2013 |

26

Kraft Foods Group, Inc.

Opportunity Resides in Some Key Areas

•

Hispanics

•

Millennials

•

Economically-strapped consumers

•

Tech savvy consumers

•

Nutrition & Well-Being

•

Alternative channels |

27

Kraft Foods Group, Inc.

Capture Profitable Growth by Evolving Our Playbook

Kraft Playbook 1.0

Great marketing

Best-in-industry innovation

Good-Better-Best price/value ladders

Lowest delivered cost

Reinvest 50¢

of every $ of cost savings

back into brands and people

Kraft Playbook 2.0

Reinvent marketing

Extend innovation to renovation

Brand ubiquity across retail channels

Total cost management

Reinvest 50¢

of every $ of cost savings

back into brands and people |

28

Kraft Foods Group, Inc.

Search, Buzz, Blog

Online User Reviews

Social Networks

Online Purchase

Friending

Links, Likes, Create Buzz

TV, Radio, Outdoor

Direct Mail

Product Test

In-store Purchase

Reward Points

Reinventing Marketing at Kraft

TRADITIONAL

BROADCAST MARKETING

TODAY’S

CONSUMER NETWORK |

29

Kraft Foods Group, Inc.

Kraft as Publisher and Purveyor

Over 100 brand and

promotional web sites

kraftrecipes.com

comidakraft.com

web / mobile sites

2 online stores

Over 30 social

destinations

Brand

Destinations

Consumer

Relationship

Marketing

E-Commerce

Social |

30

Kraft Foods Group, Inc.

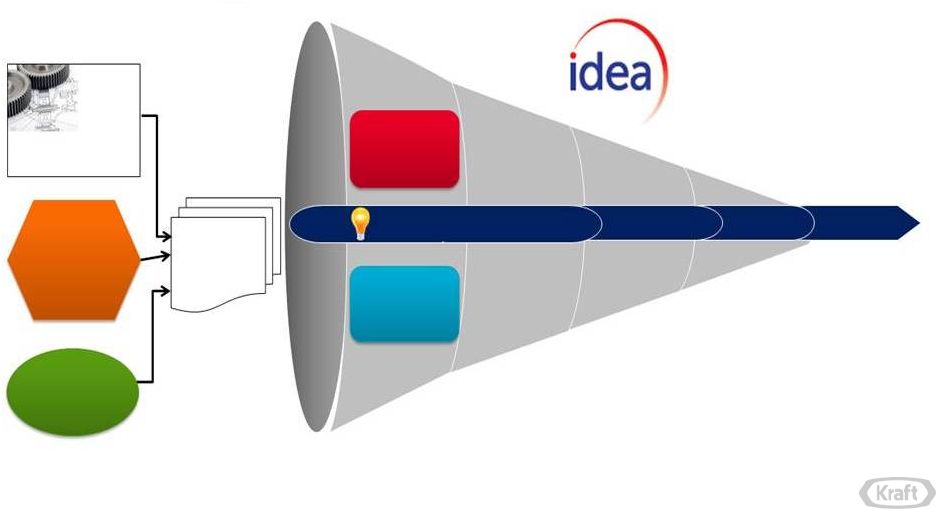

Extending Innovation to Renovation

Innovation

Renovation

Execute

Assess

Develop

Ideate

Emerging

Technology

MegaTrends

MegaTrends

/Consumer

/Consumer

Insights

Insights

Brand

Brand

Destination

Destination

Product/

Package

Platforms |

31

Kraft Foods Group, Inc.

Innovation, Renovation Through a Broader Lens

Simpler

Ingredient Lines

Farm to Consumer

Reduced Calories &

Nutrients to Limit

Beneficial

Substances,

Food Groups and

Nutrients to

Encourage |

32

Kraft Foods Group, Inc.

2014 Big Bets |

33

Kraft Foods Group, Inc.

Establishing Brand Ubiquity Across Channels

•

Establishing Kraft’s fair share across

channels is ~$1 billion net revenue

opportunity over next 3 years

•

Changing process and mindset is key

–

Ensure channels are part of

conversation when decisions made

–

Shift focus from gross margin to

operating income dollars

–

Manufacturing capable of multiple

pack sizes at effective cost

Kraft

Non Traditional

Channels

Total F&B

2010-2013 % Growth Contribution

Note: Non-traditional Channels include Value, Drug, Club, Convenience,

and Differentiated Grocery Stores (e.g., Trader Joe’s, Whole Foods, and

Aldi) Source: The Cambridge Group Analysis using Nielsen Homescan and

Scantrack 2013 and 2012; Progressive Grocer; Mintel; Kantar Retail; First Research

68%

32%

41%

59%

Grocery

+

Mass |

34

Kraft Foods Group, Inc.

Capture Profitable Growth by Evolving Our Playbook

Kraft Playbook 1.0

Great marketing

Best-in-industry innovation

Good-Better-Best price/value ladders

Lowest delivered cost

Reinvest 50¢

of every $ of cost savings

back into brands and people

Kraft Playbook 2.0

Redefine great marketing

Extend innovation to renovation

Brand ubiquity across retail channels

Total cost management

Reinvest 50¢

of every $ of cost savings

back into brands and people |

35

Kraft Foods Group, Inc.

Defining Total Cost Management at Kraft |

36

Kraft Foods Group, Inc.

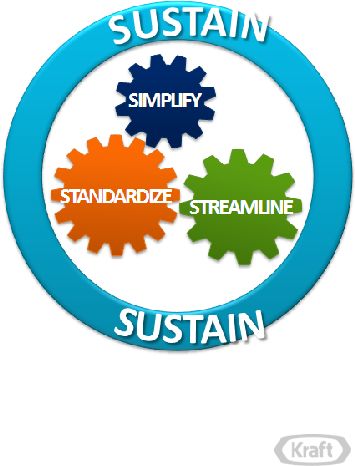

Driving “Mandated Best Practices”

•

SIMPLIFY

end-to-end processes with a

maniacal passion

•

STANDARDIZE

with rigor and discipline

based on “mandated best practices”

•

STREAMLINE

our capabilities to ensure

realization of benefits

•

SUSTAIN

through robust change

management

and disciplined governance |

37

Kraft Foods Group, Inc.

*

*

*

* |

38

Kraft Foods Group, Inc.

Capture Profitable Growth by Evolving Our Playbook

Kraft Playbook 1.0

Great marketing

Best-in-industry innovation

Good-Better-Best price/value ladders

Lowest delivered cost

Reinvest 50¢

of every $ of cost

savings back into brands and people

Kraft Playbook 2.0

Redefine great marketing

Extend innovation to renovation

Brand ubiquity across retail channels

Total cost management

Reinvest 50¢

of every $ of cost

savings back into brands and people |

39

Kraft Foods Group, Inc.

A Sustainable Long-term Growth Algorithm

Metric

Long-Term Target

1

Market defined as the North American Food & Beverage market.

2

Operating Income, EPS and Free Cash Flow long-term targets exclude market-based

impacts to post-employment benefit plans. 3

Free Cash Flow defined as cash flow from operations less capital expenditures.

Organic Net Revenue

Operating Income

Dividends

Profitable growth at or above market growth

1

Consistent mid-single-digit growth

2

Consistent mid-single-digit growth

EPS

Consistent mid-to-high, single-digit growth

2

Free Cash Flow

At least 90% of net income

2,3

ROIC

Consistent year-to-year improvement |

40

Kraft Foods Group, Inc.

Priorities for Free Cash Flow

Fund a highly competitive dividend

Fund a highly competitive dividend

Reinvest in the

business

Acquisitions that quickly

achieve EPS accretion and

an IRR > risk-adjusted

hurdle rate

Share

repurchase |

41

Kraft Foods Group, Inc.

Make Kraft North American

Food & Beverage Company

Best Investment in the Industry

Profitable

Top-Line

Growth

Consistent

Bottom-Line

Growth

Superior

Dividend

Payout |

|