Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Intrawest Resorts Holdings, Inc. | s000496x1_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Intrawest Resorts Holdings, Inc. | s000496x1_ex99-1.htm |

Exhibit 99.2

Fiscal Second Quarter 2014 Earnings Presentation March 17, 2014

Important Information The following slides are part of a presentation by Intrawest Resorts Holdings, Inc . (“Company ”) in connection with reporting quarterly financial results and are intended to be viewed as part of that presentation . No representation is made that the information in these slides is complete . For additional financial, statistical and business related information, as well as information regarding business and segment trends, see the earnings release and financial supplement furnished as exhibits to the Company's Current Report on Form 8 - K and the Company’s Quarterly Report on Form 10 - Q, each of which were filed today with the Securities and Exchange Commission (“SEC”) and are available on the Company’s website (www . intrawest . com) and the SEC’s website (www . sec . gov) . This document contains forward - looking statements . These forward - looking statements are based on current expectations, estimates and projections about the industry and markets in which Intrawest will operate as well as the Company’s beliefs and assumptions regarding our operations and financial performance, all of which are subject to known and unknown risks, uncertainties and others factors that may cause our actual results, performance or achievements, industry results or market trends to differ materially from those expressed or implied by such forward - looking statements . Therefore any statements contained herein that are not statements of historical fact may be forward - looking statements and should be evaluated as such . Without limiting the foregoing, words such as “Expects”, “Anticipates”, “Should”, “Intends”, “Plans”, “Believes”, “Seeks”, “Estimates”, “Projects”, and variations of such words and similar expressions are intended to identify such forward - looking statements . These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions which are difficult to predict, including those described in “Risk Factors” in our P rospectus filed with the SEC, pursuant to Rule 424 (b) under the Securities Act of 1933 , as amended, on January 31 , 2014 . Therefore , actual outcomes and results may differ materially from what is expressed or forecasted in such forward - looking statements . The actual performance of Intrawest may differ from the budget, projections and returns set forth herein and may differ materially . Certain information contained herein has been obtained from published and non - published sources . Such information has not been independently verified by Intrawest . Except where otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof . This presentation includes certain non - GAAP financial measures, including Adjusted EBITDA (“Adj . EBITDA”), Leverage and Unlevered Free Cash Flow . Non - GAAP financial measures such as Adj . EBITDA, Leverage and Unlevered Free Cash Flow should be considered only as supplemental to, and not as superior to, financial measures prepared in accordance with GAAP . Please refer to the appendix and footnotes of this presentation for a reconciliation of the non - GAAP financial measures included in this presentation to the most directly comparable financial measures prepared in accordance with GAAP . We use Adj . EBITDA as a measure of our operating performance . Adj . EBITDA is a supplemental non - GAAP financial measure . Our board of directors and management team focus on Adj . EBITDA as a key performance and compensation measure . Adj . EBITDA assists us in comparing our performance over various reporting periods because it removes from our operating results the impact of items that our management believes do not reflect our core operating performance . The compensation committee of our board of directors will determine the annual variable compensation for certain members of our management team, based in part, on Adj . EBITDA . Adj . EBITDA is not a substitute for net income (loss), income (loss) from continuing operations, cash flows from operating activities or any other measure prescribed by GAAP . There are limitations to using non - GAAP measures such as Adj . EBITDA . Although we believe that Adj . EBITDA can make an evaluation of our operating performance more consistent because it removes items that do not reflect our core operations, other companies in our industry may define Adj . EBITDA differently than we do . As a result, it may be difficult to use Adj . EBITDA to compare the performance of those companies to our performance . Adj . EBITDA should not be considered as a measure of the income generated by our business or discretionary cash available to us to invest in the growth of our business . Our management compensates for these limitations by reference to our GAAP results and using Adj . EBITDA as a supplemental measure . 1

SNOW Management Travis Mayer E VP Operations & Business Development ▪ 10+ years of experience in the ski & leisure industry ▪ Joined Intrawest in 2007 ▪ MBA from Harvard Business School ▪ Olympic silver medalist in skiing Bill Jensen Chief Executive Officer ▪ 35+ years of experience in the ski & leisure industry ▪ CEO since 2008 ▪ Former CEO of WhistlerBlackcomb Holdings, Inc. ▪ Former President of Mountain Division at Vail Resorts, Inc. Gary Ferrera Chief Financial Officer ▪ 20+ years of accounting & finance experience, primarily focused in media & leisure industries ▪ Former CFO of Great Wolf Resorts, Inc. ▪ Former CFO of National CineMedia, Inc. ▪ Former Director in Leveraged Finance and Global Media & Leisure groups at Citigroup 2

3.5 3.2 3.1 3.2 2.8 3.1 646 214 309 70 2 0 – 100 200 300 400 500 600 700 Intrawest History ▪ Fortress acquired Intrawest in 2006 – two main business lines: 1) real estate development & 2) mountain operations ▪ Emergence of financial crisis caused real estate business to experience sharp decline ▪ Core mountain operations business continued to perform well Real Estate New Unit Sales Decline Sharply (1) Stable Mountain Performance Through Crisis Intrawest Skier Visits (2) (mm) (1) Condo units. (2) Same - store Skier Visits . A Skier Visit represents an individual’s use of a paid or complimentary ticket, frequency card or season pass to ski or sno wbo ard at our Steamboat , Winter Park, Tremblant, Stratton and Snowshoe resorts for any part of one day. Worst North American snowfall in 20 years 3

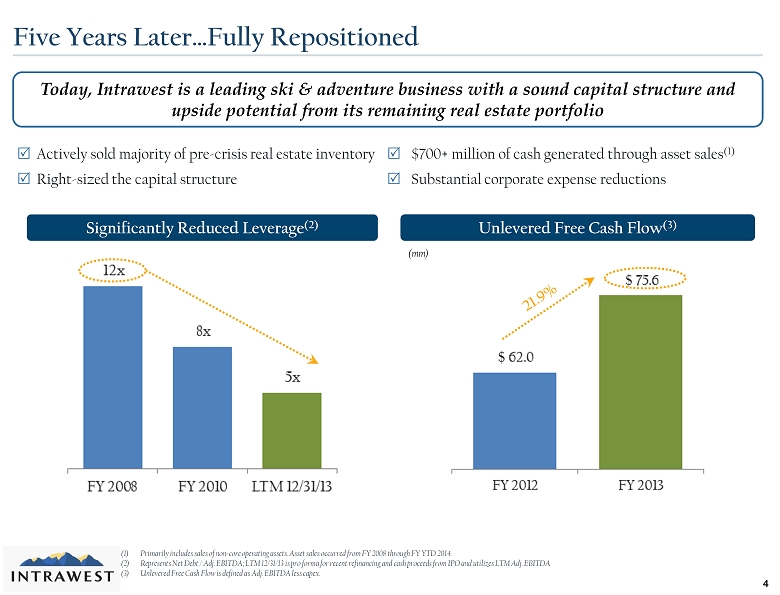

Five Years Later…Fully Repositioned Actively sold majority of pre - crisis real estate inventory Right - sized the capital structure $700+ million of cash generated through asset sales (1) Substantial corporate expense reductions Unlevered Free Cash Flow (3) Significantly Reduced Leverage (2) Today, Intrawest is a leading ski & adventure business with a sound capital structure and upside potential from its remaining real estate portfolio (1) Primarily includes sales of non - core operating assets. Asset sales occurred from FY 2008 through FY YTD 2014. (2) Represents Net Debt / Adj. EBITDA; LTM 12/31/13 is pro forma for recent refinancing and cash proceeds from IPO and utilizes L TM Adj. EBITDA (3) Unlevered Free Cash Flow is defined as Adj. EBITDA less c apex. (mm) 4

Diversified Footprint Across North America Diversified Footprint Across North America Intrawest Overview ▪ Leading North American mountain resort and adventure company founded in 1976 ▪ Providing distinctive experiences to more than 6 million annual visitors (1) ▪ Three complementary business segments with significant synergies Intrawest Portfolio ▪ 7 leading North American ski resorts (2) ▪ 6 mm+ annual resort visitors (1) , 11 K+ skiable acres ▪ 69% of FY 2013 Adj. EBITDA ▪ Largest heli - ski operator in North America ▪ 3.1 mm acres of terrain ▪ 19% of FY 2013 Adj. EBITDA ▪ $153mm of developable land at mountain resorts (3) ▪ Real estate management and sales ▪ 12% FY 2013 Adj. EBITDA Adventure (CMH) Mountain Resorts Real Estate (1) B ased on fiscal year (“FY”) 2013 results (2) Intrawest owns a 50% equity interest in Blue Mountain and a 15% equity interest in Mammoth Mountain. Note: The financial results of Mammoth are not included in the Mountain segment results. Intrawest also owns a 50% equity interest in the entity that runs the hospitality and lodging operations at Mammoth Mountain, the results of wh ich are included in the Real Estate segment . (3) Represents fair market values based on third party appraisals as of December 31, 2013. 5

Second Quarter Fiscal 2014 Highlights 6 Note: Second fiscal quarter results as of December 31, 2013 Strong Early Season Performance ▪ Skier visits up 12 . 4 % and lift revenue up 4 . 7 % in second fiscal quarter ▪ Skier visits up 8 . 0 % and lift revenue up 4 . 7 % through January 6 , 2014 ▪ Season pass and frequency product sales for the 2013 / 2014 ski season increased 23 . 9 % through second fiscal quarter ▪ Positive Adjusted EBITDA of $ 1 . 7 million compared to break even in the prior year quarter Solid Adjusted EBITDA Growth Significantly Improved Capital Structure Well Positioned for Growth ▪ Refinanced outstanding debt, dramatically lowering interest expense ▪ Successfully completed Initial Public Offering ▪ Significant organic growth from existing assets ▪ Attractive external acquisition opportunities ▪ Opportunity to re - start Real Estate business

Second Quarter Fiscal 2014 Financial Highlights 2Q14 vs. Prior Year Commentary Three Months Ended 2Q14 Comparison Mountain ▪ Improved snowfall and better ski conditions drove higher visitation and revenue ; Lower ETP was a function of increased visits by season pass holders Adventure ▪ Lower variable expenses attributable to reduced firefighting activity and lower maintenance expense ; In addition, $ 1 . 5 mm EBITDA loss removed due to restructure of Alpine Helicopters ; CMH down slightly due to challenging early season ski conditions and trip cancellations/reschedules Real Estate ▪ Prior year’s quarter included a $3.0mm one time payment of accelerated commissions from the sale of Playground’s brokerage business in Maui 7 ($ in millions) Second Quarter Results 2Q14 2Q13 Variance Skier Visits 742,287 660,443 12% ETP $42.17 $45.25 (7)% Revenue per Visit (Mtn) $102.37 $109.08 (6)% Reportable Segement Revenue Mountain $76.0 $72.0 5% Adventure 11.5 13.1 (12)% Real Estate 13.9 17.1 (19)% Total $101.5 $102.3 (1)% Adjusted EBITDA Mountain $3.1 $1.2 151% Adventure1 (3.1) (6.0) (49)% Real Estate 1.7 4.8 (65)% Total $1.7 $(0.0) NM Note: Totals may not add up due to rounding. (1) Prior to the restructuring in January 2013, Intrawest shared in 100% of operating losses during periods of limited flight operations for CMH or fire suppression. Intraw est now receives a contractual lease payment each month regardless of whether or not the underlying operations are profitable for the month.

Significantly Improved Capital Structure ▪ Meaningful cash available for investment ▪ Recently put in place a more flexible capital structure with pre - payable debt ▪ $540 million 1st Lien Term loan (L+450, maturing in December 2020) ▪ $25 million Revolver (maturing in December 2018) ▪ $55 million Letter of Credit Facility (maturing in December 2018) ▪ Significantly reduced the cost of term debt from 7.8 % to 5.5% Capital Structure 8 Q2 2014 Pro-Forma 12/31/13 IPO Available Revolver $25.0 $0.0 $0.0 Term Loan N/A 540.0 540.0 LC Facility $55.0 0.0 0.0 Senior Secured Debt $540.0 $540.0 Capital Leases 39.9 39.9 Other Debt 4.7 4.7 Total Debt $584.6 $584.6 Less: Cash & Cash Equivalents (42.0) (71.0) Net Debt $542.6 $513.6 LTM EBITDA -- $100.3 Net Debt / LTM EBITDA 5.1x

Intrawest Today – Poised for Growth Opportunity to Re - Start Real Estate Business Substantial upside from development of 1,150+ acres of prime land Significant Organic Growth from Existing Assets Longstanding, proven ski and adventure businesses Attractive External Acquisition Opportunities Highly fragmented industry that favors multi - resort operators 9

Q & A