Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - China Housing & Land Development, Inc. | v371080_ex32-2.htm |

| EX-23.1 - EXHIBIT 23.1 - China Housing & Land Development, Inc. | v371080_ex23-1.htm |

| EX-31.2 - EXHIBIT 31.2 - China Housing & Land Development, Inc. | v371080_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - China Housing & Land Development, Inc. | v371080_ex31-1.htm |

| EX-23.2 - EXHIBIT 23.2 - China Housing & Land Development, Inc. | v371080_ex23-2.htm |

| EX-32.1 - EXHIBIT 32.1 - China Housing & Land Development, Inc. | v371080_ex32-1.htm |

| EX-21.1 - EXHIBIT 21.1 - China Housing & Land Development, Inc. | v371080_ex21-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 2

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

Commission file number: 001-34065

China Housing & Land Development, Inc.

(Exact name of registrant as specified in our charter)

| NEVADA | 20-1334845 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1008 Liuxue Road, Baqiao District

Xi’an, Shaanxi Province

China 710038

(Address of principal executive offices) (Zip Code)

86-29-82582632

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year,

if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $ .001 par value per share | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: none.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K/A/A or any amendment to this Form 10-K/A. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer, large accelerated filer and smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares outstanding of our common stock as of June 30, 2012, was 35,438,079 shares. The aggregate market value of the common stock held by non-affiliates (16,925,107 shares), based on the closing market price ($1.97 per share) of the common stock as of June 30, 2012 was $33,342,461.

As of March 31, 2013 the number of shares of the registrant’s classes of common stock outstanding was 35,086,599.

DOCUMENTS INCORPORATED BY REFERENCE

| Document | Parts Into Which Incorporated | |

| None | Not applicable |

Explanatory Note

| The Company is filing this Amendment No. 2 to the Original Filing ("Amendment No. 2") to include (a) the reissued report of MSCM for the December 31, 2011 comparative period, dated March 29, 2012, and MSCM's consent to the inclusion of same, and (b) MNP's updated report on the December 31, 2012 financial statements and the adjustments described in Note 2 that were applied to restate the December 31, 2011 and 2010 financial statements, and MNP's consent to the Company's inclusion of same. |

Amendment No.2 relates entirely to the auditors' reports and consents thereon. Amendment No.2 does not contain any additional amendments to the financial statements on which the auditors' reports have been issued beyond those described in Note 2 of the financial statements as filed under Amendment No.1.

TABLE OF CONTENT

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | 1 | |

| PART I | 2 | |

| ITEM 1 | BUSINESS (As restated) | 2 |

| ITEM 1A | RISK FACTORS | 17 |

| ITEM 1B | UNRESOLVED STAFF COMMENTS | |

| ITEM 2 | PROPERTIES | 30 |

| ITEM 3 | LEGAL PROCEEDINGS | 30 |

| ITEM 4 | MINE SAFETY DISCLOSURES | 30 |

| PART II | 31 | |

| ITEM 5 | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 31 |

| ITEM 6 | SELECTED FINANCIAL DATA (As restated) | 32 |

| ITEM 7 | MANAGEMENT DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (As restated) | 33 |

| ITEM 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 46 |

| ITEM 8 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA (As restated) | 47 |

| ITEM 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 81 |

| ITEM 9A | CONTROLS AND PROCEDURES | 81 |

| ITEM 9B | OTHER INFORMATION | 82 |

| PART III | 83 | |

| ITEM 10 | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 83 |

| ITEM 11 | EXECUTIVE COMPENSATION | 88 |

| ITEM 12 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 90 |

| ITEM 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, DIRECTOR INDEPENDENCE | 91 |

| ITEM 14 | PRINCIPAL ACCOUNTING FEES AND SERVICES | 93 |

| PART IV | ||

| ITEM 15 | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 94 |

| SIGNATURES | 96 | |

Except as otherwise indicated by the context, references in this Form 10-K/A to:

| “U.S. Dollar,” “$” and “US$” mean the legal currency of the United States of America. |

| “RMB” means Renminbi, the legal currency of China. |

| “China” or the “PRC” are references to the People’s Republic of China. |

| “SEC” is a reference to the Securities & Exchange Commission of the United States of America. |

| “CHLN”, the “Company”, “we”, “our”, or “us” are references to China Housing & Land Development, Inc. |

| “U.S.” is a reference to the United States of America. |

| “GFA” means gross floor area. |

This report contains additional trade names and trademarks of other companies. We do not intend our use or display of other companies’ trade names or trademarks to imply an endorsement of us by such companies, or any relationship with any of these companies.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements, including, but not limited to, statements regarding our future financial position, business strategy and plans and objectives of management for future operations. When used in this filing, the words believe, may, will, estimate, continue, anticipate, intend, expect, and similar expressions are intended to identify forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to certain risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to the risks discussed under the heading “Risk Factors”. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements.

In light of these risks, uncertainties, and assumptions, the forward-looking events and circumstances discussed in this annual report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, readers are cautioned not to place undue reliance on such forward-looking statements.

| 1 |

PART I

ITEM 1. BUSINESS

OUR COMPANY

We are a leading residential developer with a focus on fast growing Tier II and Tier III cities in western China. We are dedicated to providing quality, and affordable housing to middle class families. The majority of our customers are first time home buyers and first time up-graders, who, we believe, will benefit from China’s rapid gross domestic product (“GDP”) growth and the middle classes’ corresponding increase in purchasing power.

We commenced our operations in Xi’an in 1999 and have been considered one of the industry leaders and one of the largest private residential developers in the region. We have experienced significant growth in the past 13 years and have developed over 1.5 million square meters of residential projects. Through the utilization of modern design and technology, as well as a strict cost control system, we are able to offer our customers high quality, cost-effective products. Most of our projects are designed by world-class architecture firms from the United States, Canada and Europe that have introduced advanced “eco” and “green” technologies into our projects.

As we are focusing primarily on the demand from first time home buyers and first time up-graders in western China, the majority of our apartments range in size from 70 square meters to 120 square meters; with such sizes considered to be a stable market section of the residential real estate market in western China. Our typical residential project is approximately 100,000 square meters in size and consists of multiple high-rise, middle-rise and low-rise buildings as well as a community center, commercial units, educational facilities (such as kindergartens) and other auxiliary facilities. In addition, we provide property management services to our developments and have exclusive membership systems for our customers. We typically generate a large portion of our sales through referrals from our existing customers.

We acquire our land reserves and development sites primarily from the local government, open-market auctions, acquisitions of old factories from the government and acquisitions of distressed assets from commercial banks. We do not depend on a single method of land acquisition, which enables us to acquire land at reasonable costs and, generally enables us to generate higher returns from our developments. We intend to continue our expansion into other strategically selected cities in western China by leveraging our brand name and scalable business model.

Our Strategies

We are primarily focused on the development, construction, management and sale of residential real estate properties to capitalize on the rising demand for real estate from China’s emerging middle class. We seek to become the market leader in western China and plan to implement the following specific strategies to achieve our goal:

Consolidate through Acquisition and Partnership. Currently, the residential real estate market in western China is fragmented with many small players. We believe that this market fragmentation will provide us with opportunities for acquisitions or partnerships. We believe acquisitions will provide us better leverage in negotiations and better economies of scale.

Expand into Other Tier II and Tier III Cities. We believe our proven business model and expertise can be replicated in other Tier II and Tier III cities, especially in western China. For example, in 2011, we entered into the Ankang city market for a residential project. Furthermore, we have identified certain other cities that possess attractive replication dynamics.

Continue to Focus on the Middle Market. Since the middle class has growing purchasing power and, as a result of prevailing Chinese culture and values, a strong desire to own homes, we believe the demands for residential real estate from the emerging middle class will offer attractive opportunities for the growth of our Company. Thus, we plan to leverage our brand name, experience and design capabilities to meet this middle class demands.

Our Competitive Strengths

We believe we have the following competitive strengths that will enable us to compete effectively and to capitalize on the growth opportunities in our market:

Leading position in our market and industry

We are one of the largest private residential real estate developers in western China. We believe that we have strong design and sales capabilities as well as a well-regarded brand name in the region. Due to strong local project experience and long-term relationships with the central and local governments, we have been able to acquire significant land assets at reasonable costs, thereby providing a strong pipeline of potential future business and revenue over the next three to five years.

| 2 |

Attractive market opportunity

The real estate market in western China has grown slower than that of eastern China. We believe the region is well positioned to grow at faster rates for the next few years due to social and economic factors. Our business model has proven to be efficient and we plan to expand into other Tier II and Tier III cities in western China. Our growth strategy is focused on western China, and we believe we will significantly benefit from the Chinese government’s “Go West” policy, which encourages economic development in and population movement to western China.

Unique and proven business model

Due to strong local project experience and long-term working relationships with the central and local governments, we generally have been able to acquire land assets at prices more reasonable than those obtained by our competitors. We are primarily focused on capitalizing on rising demand for properties from China’s emerging middle class, which has significant purchasing power and a strong demand for residential housing. In order to leverage our brand to appeal to the middle class, we use various advertising media to market our property developments and to reach our target demographic, including newspapers, magazines, television, radio, e-marketing and outdoor billboards. We believe that our brand is widely recognized in our market and is known for high quality products at cost-effective prices.

Experienced management team

We have an experienced management team with a proven track record of developing and expanding our operations. Our four primary officers have more than 70 years of experience developing residential properties. As a result, we have developed extensive core competencies that are supplemented by in-house training and development programs. We believe that our management’s core competencies, extensive industry experience and long-term vision and strategy will enable us to effectively realize growth opportunities.

Greater access to financing through multiple channels

We enjoy multiple long-term relationships with a number of high quality Chinese banks and these relationships ensure timely access to capital. Our loan facilities are mainly used for development projects and the day to day operation our business. Besides traditional banks, we also work with other financial institutions, such as trust companies and real estate funds to diversity our funding channels and risks.

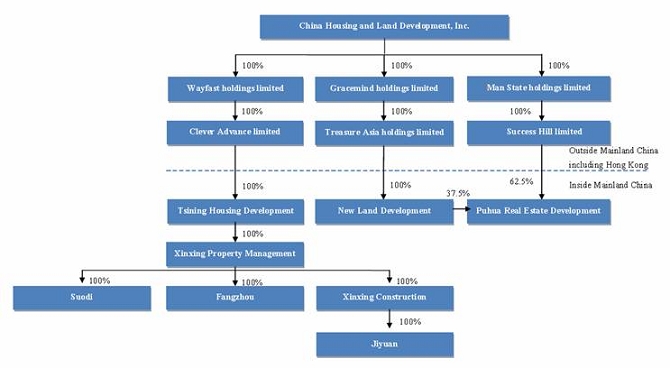

Corporate History

We are a Nevada company and conduct substantially all of our business through our operating subsidiaries in China. We were incorporated in the state of Nevada on July 6, 2004, as Pacific Northwest Productions Inc. On May 5, 2006, we changed our name to China Housing & Land Development, Inc. Currently we own 8 operating subsidiaries, 3 Hong Kong Special Purpose Vehicles (“SPV”) and 3 British Virgin Island holding companies (“BVI”). The BVI holding companies and Hong Kong SPVs are used as holding companies.

On April 21, 2006, we acquired 100% of the shares of Xi’an Tsining Housing Development Co., Ltd (“Tsining”) through a share purchase agreement.

On March 9, 2007, we acquired 100% of the shares of Xi’an New Land Development Co., Ltd. (“New Land”).

On November 5, 2008, the Company and Prax Capital entered into a Joint Venture agreement to set up Puhua (Xi’an) Real Estate Development Co., Ltd.(“Puhua”). On May 10, 2010, the Company signed an Amended and Restated Shareholders’ Agreement with Prax Capital which became effective on January 1, 2010. The Company was committed to redeeming Prax Capital’s investment. Thus, the Company acquired 100% ownership of Puhua in 2010.

On January 20, 2009, we signed an equity purchase agreement with the shareholders of Xi’an Xinxing Property Management Co., Ltd. (“Xinxing Property”) and acquired 100% ownership of Xinxing Property.

On January 15, 2010, we acquired 100% ownership of Suodi Co., Ltd., (“Suodi”).

On March 31, 2010, we incorporated Xinxing Fangzhou Housing Development Co., Ltd., (“Fangzhou”).

On October 1, 2010, we acquired 100% shares of Xinxing Construction Co., Ltd, (“Xinxing Construction”).

On July 28, 2011, we established Ankang Xinxing Jiyuan Real Estate Development Co., Ltd. (“Jiyuan”).

| 3 |

BUSINESS

Overview

We are a leading real estate development company headquartered in Xi’an doing business primarily in the western part of China. As such, we focus on real estate development opportunities in that region.

Through our subsidiaries located in China, we are engaged in the development, construction, sale and management of residential and commercial real estate units, as well as land development in Shaanxi province, China. Tsining has completed a number of significant real estate development projects in Xi’an. Through Tsining, we will continue to expand our business into other developing urban markets in western China.

Since its inception, our business model has proven to be efficient and profitable. We divide each project into five deployment phases, spanning from land acquisition to after sale services.

Our average project development lasts over two years and begins to provide us with revenues after three quarters.

Land Acquisition

To date, we have been successful in acquiring land from many sources including open market auctions, co-development with local governments and through the acquisition of distressed assets, such as bankrupt factories. We have achieved this through our long-term relationships with the central and local governments. We rarely engage in open bidding for land.

| 4 |

Planning & Design

We work with world class architecture firms for most of our projects and maintain an in-house design team to supplement projects with our significant local knowledge. We also deploy an advanced cost control system and an enterprise resource planning system, which enables us to monitor and analyze our construction costs and progress on a daily basis.

Construction

We acquired Xinxing Construction on October 1, 2010. Through ownership of our own construction arm, we can better guarantee our customers receive high quality housing products. We can also enhance our cost control procedures in monitoring the construction process and thereby increase our margins. Furthermore, we can maintain our strong track record of providing quality products on-time.

Marketing & Pre-Sales

We initiate the pre-sales process once we finish foundation construction and receive the requisite pre-sales permits from the government – our sales efforts are partly outsourced to external professionals. Currently, we work with well-known sales agents, such as E-House and World Union Properties, which ranked number 1 and 2 in China, respectively. Pre-sales provide us with cash inflow and many of our projects become cash flow positive within nine months.

After Sales Service

We always follow-up with our customers after a sale to foster good and lasting relationships as well as to help secure future recommendations. We also have a wholly-owned property management company which performs integrated after-sales services, such as maintenance.

Corporate Information

In October 2012, we moved to a new office building located at 1008 Liuxue Road, Baqiao District, Xi’an, 710038, People’s Republic of China. Our telephone number at this address is (86-29) 8258-2632 and our fax number is (86-29) 8258-2640.

Investor inquiries should be directed to us at the address and telephone number of our principal executive offices set forth above. Our website is http://www.chldinc.com.

Our Industry

We focus primarily on the development, construction, sale and management of residential real estate properties in order to provide affordable housing to middle class consumers in western China. Our target demographic primarily consists of first time purchasers and first time up-graders. Our current development projects are located in Xi’an, Shaanxi Province, in the PRC. We have expanded into Ankang, a Tier III city in Shaanxi Province, and we will continue our expansion into other Tier II and Tier III cities in western China.

Overall Industry Overview

In early 2000, the Chinese real estate industry started to transition towards a market-oriented system. Although the Chinese government still owns all of the urban land in China, land use rights, with terms of up to 70 years, can be granted to, and owned or leased by, private individuals and companies. A large and active market in the private sector has developed for sales and transfers of land use rights that were initially granted by the Chinese government. All property units built on such land belongs to private developers for the period indicated. The recent transition in the real estate industry’s structure in China has fostered the development of real estate-related businesses, such as property development, property management and real estate agencies.

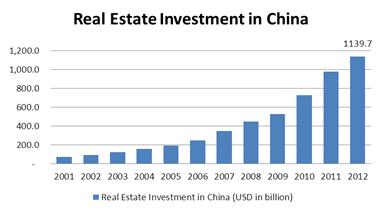

The significant growth of the Chinese economy during the past decade has led to a significant expansion of the real estate industry. This expansion has been supported by other factors, including increasing urbanization, growing personal wealth, as well as the emergence of the mortgage lending market. Meanwhile, culturally, as real estate is the most important asset to many Chinese families, it attracts serious attention from the government. Thus, the Chinese government has imposed a series of policies intended to help the real estate industry to grow in a rational and healthy fashion. The following table sets forth selected statistics for the overall real estate industry in mainland China for the periods indicated.

| 5 |

Source: China Statistic Year Book (all government data is based on calendar year)

With the advent of the global financial crisis in second half of 2008, the Chinese government instituted a number of measures designed to enhance the real estate industry and stimulate the economy. However, the average selling price of real estate increased dramatically and, in the second half of 2009, the government had to undertake measure to curb real estate prices.

Government Policies

Starting in April 2010, the Chinese central government introduced a number of polices to restrain housing prices from irrational increases. These polices mainly included differentiating mortgage purchases interest rates among first, and second home buyers (first time up-graders) and speculators, limiting housing demand by restricting housing purchases by non-resident buyers, increasing land supply and taxation measures.

On the demand side, the Chinese central government took the following measures to reduce total demand in the real estate market: Since April 2010, the Chinese central government increased the mortgage rates for second home buyers to 110% of the benchmark rates and ceased approving third home mortgages. The down payments amount for second time home purchasers was also increased to up to 50% of the home cost. Further, though varied in different cities, most Tier I and Tier II cities forbade non-resident home purchases and resident third time home purchases in order to restrict speculation. In addition, a 20% capital gains tax would be collected for secondary housing transactions on real estate properties with a holding period of less than five years. A property tax was applied in Shanghai and Chongqing and will be expanded to cover more cities with large housing stocks.

On the supply side, according to the China Ministry of Land and Resources, land supply for residential development was planned to increase to 1,726 million square meters during 2012, an increase of 38% compared with actual land supply in 2011. Social housing construction will accelerate to increase the housing supplies for first time home buyers. According to the Ministry of Housing and Urban-Rural Development (MOHURD), the Chinese government will complete 4.7 million new social housing units in 2013, compared with 5 million units in 2012, and begin construction of 6.3 million units in 2013, compared with 7 million units in 2012.

Apart from adjusting supply and demand, the central government required local governments to take certain measures to prevent real estate average selling prices (ASP) from increasing too fast as compared to local GDP growth rates or local income growth rates.

During 2012, the Chinese real estate industry continued to be heavily influenced by government policies designed to create rational and healthy real estate industry growth.

Although heavily regulated, the Chinese real estate industry still has strong fundamentals.

Growth Drivers

Western China

We believe the residential real estate industry is well positioned to grow at comparable rates to economy growth for the next few years due to social, economic and government stimulus-related factors. Key growth drivers include the following:

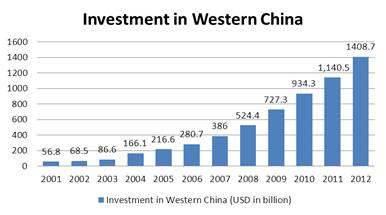

| • | “Go West” policy. The “Go West” policy encourages economic development in and population movement to western China, which includes 6 provinces, 5 autonomous regions and 1 municipality. These areas comprise 56% of mainland China’s land but only approximately 23% of its population. The policy was issued in 1999, and the plan is divided into 3 phases. Phase I (2001-2010) includes the development of infrastructure (transport, hydropower plants, energy, and telecommunications), enticement of foreign investment, increased ecological protection efforts (such as reforestation), promotion of education, and retention of talent that would otherwise flow to more affluent provinces. Based on improved infrastructure, strategic structuring, and system development from Phase I, Phase II (2011-2030) will foster specialized industry and further facilitate economic growth from industrialization and marketization, etc. Phase III (2031-2050) will further improve living standards for all the residents of western China, especially people in remote areas. As a result, significant foreign and domestic investments in Xi’an and throughout western China are set to support the growth of middle class incomes. |

| 6 |

Source: China Statistic Year Book (all government data is based on calendar year)

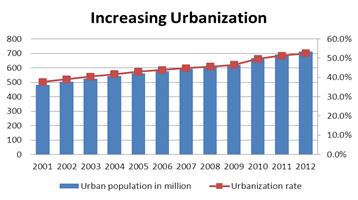

| • | Increasing Urbanization in China. The strong demand for residential properties is also driven, in part, by increasing urbanization. The urban population in China has grown significantly over the past 10 years, creating higher demand for housing in many cities. In 2012, China’s urbanization rate surpassed 52%, reaching 52.6%. The central government reiterated the importance of urbanization stimulation in early 2013. The table set forth below shows China’s urban population, total population and urbanization rates. |

| • | New urbanization trends of population to the West. The urbanization rate in Tier II cities is higher than the total population growth of China. Over 300 million urban new comers are expected to need housing in the next two decades. According to data from the Xi’an Statistical Bureau, in 2012 the population of Xi’an was 8.55 million, and the urbanization rate was 71.5%. The government projects the population will increase to 10.7 million and the urbanization rate will reach 80% in 2020. |

Source: National Bureau of Statistics.

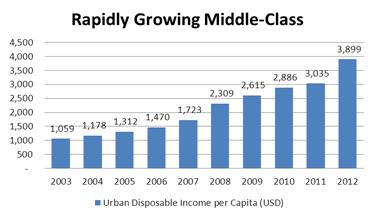

| • | China’s Rapidly Growing Middle-Class Population. China’s current population stands at over 1.3 billion and is expected to reach 1.4 billion by 2026. The middle-class is the fastest growing segment of the population with 130 million people in 2006 and is expected to grow to 500 million by 2026. The middle class is currently defined as house-holds with an annual income of between $6,000 and $25,000, with housing the number one expense category. Rapid urbanization and growth in consumer spending coupled with significant growth in disposable income per capita in urban areas (almost tripled from 2005 to 2012) and low levels of home ownership compared to western countries make the middle class a massive driver of the future growth in the Chinese real estate market. |

| 7 |

|

|

Source: Global Demographics, PRC State Council Development Research Center and National Bureau of Statistics.

Type of Cities in China

According to Chinese Academy of Social Sciences, China had 118 cities with populations of over 1 million as of the end of 2008. These cities are divided into three categories/tiers.

There are significant differences distinguishing Tier I cities from Tier II and Tier III cities in China:

Tier I

A group of four cities, located near the East Coast of China, compose the group of Tier I cities: Beijing, Shanghai, Shenzhen, and Guangzhou. These cities are more urbanized and have higher GDPs per capita than Tier II and Tier III cities. The residential real estate prices in Tier I cities have been skyrocketing and these price increases are the catalyst for many government policy changes. These cities have been targets of restrictive government policies.

Tier II

There are over 20 cities viewed as Tier II cities that have populations over 5 million people. The demand for real estate in Tier II cities is strong. Industrial expansion and improved infrastructure will support continued urbanization and fuel the growth of the real estate sector in these cities. However, we do see speculation and high housing prices in many tier II cities, and restrictive policies are enforced in tier II cities.

Tier III

Tier III cities are seldom affected by restrictive policies. Demand in such cities is great and mainly from first time home buyers who are encouraged by government policies. However, we do see increased competition in these cities as more developers expand into these cities to take advantage of the relatively fewer restrictive policies.

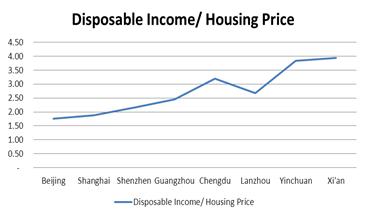

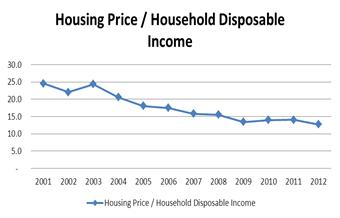

Typically, housing is affordable for consumers in Tier II and Tier III cities compared to Tier I cities. Disposable income in Tier II and Tier III cities has increased faster than real estate prices.

|

|

Source: Bureau of Statistics of the above cities

| 8 |

Economic Developments

Rapid economic growth in eastern China has made Tier I cities more mature, making Tier II and Tier III cities a viable alternative for companies looking to reduce their costs. This has subsequently caused movement towards these Tier II and Tier III cities. Multinational corporations have been expanding out of mega cities along the east coast of China, such as Beijing, Shanghai, and Shenzhen, into neighboring and inland cities. Intel, for example, recently opened a development center in Chengdu, while the Liberty Mutual Group, the U.S. insurance giant, has chosen Chongqing for its Chinese headquarters. Unilever relocated its Chinese headquarters from Shanghai to the neighboring province of Hefei due to the lower labor and land costs as well as the city’s strategic location.

The Chinese government has also been instrumental in stimulating regional growth by designating certain Tier II regions as priority zones. These actions are benefitting Xi’an, our primary market.

City of Xi’an

Background

Xi’an served as the capital of China during 13 dynasties (from West Zhou in 1066 BC to Tang in 907 AD) and is well known for its Terracotta Army and other famous historic landmarks. Today, the city’s economic leadership is derived from its high-tech, pharmaceutical, national defense, aerospace, tourism, and advanced education industries. The PRC government’s “Go West” policy has designated Xi’an as the regional economic hub of western China. To further encourage western China’s development, the central government plans to establish the Central Shaanxi Plain Economic Region that will help enable the free flow of people, skills, capital, and trade amongst the western provinces. Xi’an, as the economic center of western China, will play a unique leadership role among the western Tier II cities.

Xi’an is becoming an international city that boasts a large and educated work force. The city has China’s third largest university-educated workforce, making it a hotbed for research & development (“R&D”), high-tech manufacturing and information technology (“IT”) solutions. Xi’an has begun to attract high-tech companies, including IBM, Applied Materials, Micron Technology, and Infineon. Applied Materials, for example, selected Xi’an for its $255 million phase one R&D center that will design and develop equipment for semiconductor chip manufacturing. In addition, Micron Technology has invested $250 million in Xi’an for packaging and testing of semiconductor chips, and GE established its China innovation center in Xi’an in 2011.

China has announced its intention to become a world-class center for information technology R&D, production, outsourcing and services to in order rival and perhaps surpass the success of India’s IT industry. Xi’an, having been designated by the government as one of five China “Outsourcing Bases”, is expected to play an important role in that effort. Similar to Bangalore and Hyderabad in India, the Xi’an local government is carving out a niche in IT outsourcing by creating the 400,000 square-meter Xi’an Software Park (the “Park”). The Park has already attracted top software and technology companies, including IBM, which is the government’s joint venture partner in creating the Park. Sybase, SPSS, Nortel, and NEC are already operating in the Park.

The Xi’an local government has laid out a master plan through the year 2020 to foster economic transformation and urbanization. For example, Xi’an is now limiting development in the city’s famous historical “Gated Wall City” (or “Inner Ring”), which will be revamped primarily for tourism. The city plans to relocate about 450,000 residents from the Inner Ring to the second, third, and fourth rings of the city and beyond. One of the most ambitious plans is the development of a new satellite city in the Baqiao district, about eight kilometers from Xi’an’s city center. The Xi’an local government is developing the Baqiao district into the “First Water City of the West”, complete with high-end residential properties and hotels, international convention centers and a high-tech industry center. The new urban area will be home to 900,000 middle-to-upper income residents, to firms in industries that include R&D, services and high-tech, and to the potential headquarters for the Chinese operations of multinational corporations.

Emerging as an International City

Xi’an has been designated by the PRC government to be one of three international cities in China along with Beijing and Shanghai. Thus, Xi’an’s local government has been proactive in enhancing the city’s international image by hosting world class events like the Euro-Asia Economic Forum every second year and the Formula One Powerboat World Championship. To attract international tourists, Xi’an is leveraging its famous historical and cultural significance. Xi’an has revamped its tourism infrastructure in numerous ways, including the redevelopment of the famous Terracotta Army historical park. It also has selected China’s largest construction company to build a RMB 20 billion ($3 billion) theme park and residential and commercial redevelopment project on the grounds of the famous Da Ming Gong Palace that was built 1,300 years ago during the Tang Dynasty. The city has also built out infrastructure to attract international travelers and, in turn, is drawing large foreign retailers. Several large retailers have entered Xi’an, including Wal-Mart, Carrefour, and Metro of Germany. Xi’an’s historic mystique and economic potential have also lured top luxury brands, including Louis Vuitton, Gucci, Prada and Versace to open outlets in the city.

| 9 |

Xi’an Real Estate Market

Strong fundamentals

During 2012, the GDP of Xi’an increased 11.8% to RMB 436.9 billion (US$69.4 billion). Average urban disposable income increased to RMB 29,982 (US$4,759), a real increase of 12.3% compared with that of 2011. Real estate investment in 2012 totaled RMB 128.2 billion (US$20.3 billion), an increase of 28.6%.

We believe that demographic and economic factors, including the emerging high-tech industries and the increasing influx of foreign capital will stimulate Xi’an’s future growth. In 2012, the Xi’an population was 8.6 million people; the average urban living area per person was 33 square meters. Despite the solid economic growth and rising housing demand, average real estate prices in Xi’an are still less than half of those in the mega cities such as Shanghai, Beijing and Shenzhen.

Xi’an: Growing, leading, and still affordable

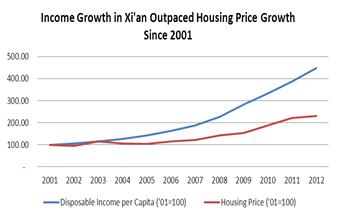

In conjunction with its role as the economic hub of western China, Xi’an’s disposable income per capita has increased significantly over the past several years, as shown below. However, compared with other cities, Xi’an’s housing is relatively affordable.

|

| |

| Source: NBS, Xi’an Bureau of Statistics, CEIC | Source: NBS, Xi’an Bureau of Statistics, CEIC |

2012 Real estate market impacted by government policies

During 2012, the central government continued restrictive policies on the real estate market. Most cities saw slower real estate investment, stable or reduced transaction volumes and average selling prices, and some cities even experienced reduced average selling prices. Through enforcement of affordable housing investment, the central government intended to restructure the real estate market in China. As a Tier II city, Xi’an implemented all the restrictive policies required by the central government. In late February of 2011, Xi’an’s local government put forward local restrictive policies limiting housing purchases. Additionally, Xi’an’s local government required that the average selling price increase of newly built residential products should be less than 15%, and such an increase must not surpass Xi’an’s GDP growth rate and disposable income growth rate. During 2012, the Xi’an local government carried out an additional policy limiting real estate profit margin to 10%. However, compared with other tier I and tier II cities, Xi’an’s restrictive policies were characterized as fairly mild.

2012 Xi’an Market update

Overall, the restrictive policies resulted in lower transaction volumes during the year. According to E-House (China), Xi’an’s transaction volume reached 11.6 million square meters in 2012, representing a 26.6% decrease as compared with that of 2011. Average selling price increased 4.0% from RMB 7,324 to RMB 7,619 per square meter.

| 10 |

According to a Chinese Real Estate Investment Council’s (the “CRIC”) research report, the supply outpaced the demand in Xi’an’s real estate market in 2012. This imbalance has caused an increase in market inventory to 11.7 million square meters, which would take 12 months to destock. Generally, under rebounding demand and restrictive policies, Xi’an real estate market was stable in both transaction volume and average selling price.

2013 Xi’an Real Estate Market Outlook

We believe that these government policies will still play an important role in Xi’an’s real estate market. The central government will continue restrictive policies and tighten credit policies, but the local government will take certain measures to boost local GDP and local government fiscal revenue. Additionally, we saw customer hesitation created by government policies starting to decline with increased demand from first time home buyers. In general we believe the real estate market in Xi’an will be stable in 2013.

City of Ankang and Ankang Real Estate Market

Ankang city is located 260 kilometers to the south of Xi’an, has a population of over 2.6 million. According to the Ankang Bureau of Statistics, during 2012, Ankang’s GDP totaled RMB 51.3 billion (US$8.1 billion) with a year over year growth rate of 15.2%, ranking it second in Shaanxi Province. Average urban disposable income achieved US$3,222 with a growth rate of 16.9%.

Real Estate in Ankang is much less subject to restrictive policies compared with tier I and tier II cities. Real estate purchases in Ankang are mainly from first time home buyers. During 2012, the average selling price of real estate in Ankang was about RMB 4,500 (US$714) per square meter, compared with RMB 7,619 (US$1,209) in Xi’an. Given the lower cost of labor and materials, real estate development in Ankang could achieve around 30% gross margins, which is on the same historical level as projects we have completed in Xi’an.

Competitive Landscape

The real estate development business in China is organized into four levels under the structure of the “Qualification Certificate for Real Estate Development Enterprises”. The starting level is Level 4 (see table below). A company may climb the scale to participate in larger projects. However, only one level may be ascended per year. We attained Level 1 status under the Chinese Ministry of Construction licensing policy in December 2009.

| 11 |

| Registered Capital (million) | Experience (years) | Developed Area (square feet) | |||||||||

| Level 1 | US$ | 6.25 | 5 | 3,229,278 | |||||||

| Level 2 | US$ | 2.5 | 3 | 1,614,639 | |||||||

| Level 3 | US$ | 1 | 2 | 538,213 | |||||||

| Level 4 | US$ | 0.125 | 1 | N/A | |||||||

On the national level, there are numerous Level 1 companies involved in real estate projects across China (to develop in multiple regions a Level 1 status is required). There are 180 housing and land development companies listed on the Shanghai, Shenzhen and Hong Kong Stock Exchanges. We continued to see increased competition in the Xi’an real estate market. According to E-house (China), during 2012, the top 10 real estate companies accounted for 34% of the total market, compared with 33% and 27% in 2011 and 2010, respectively. Most of these companies are national players, but we are aware of three companies in Xi’an which could be considered to be our direct competitors in the small to medium sized project sector:

Xi’an Tande co., ltd. (Level 1) (“Tande”) is one of the largest real estate developers in Xi’an. Tande is a state-owned enterprise that was established in May 1991 and was subsequently listed on the Shanghai Exchange in 2006. Tande generally undertakes larger scale projects and has expanded its business into Shengzhen, Suzhou, Shanghai and Tianjin. As Tande is state-owned, it needs to complete a certain amount of government projects including building public spaces and infrastructure. These requirements can negatively impact Tande’s profitability.

| 12 |

Xi’an Titan Real Estate co., ltd (Level 1) (“Titan”) was established in 2001 and mainly operates in Xi’an. The company has nine projects on sale and two projects in the planning phase in Xi’an. The company has recently entered Chengdu, Jinan, Kunshan and Nanjing.

Xi’an Ziwei Development Company (Level 1) (“Ziwei”) is a state-owned enterprise that was established in 1999. This company has completed eight projects and has eight projects currently under development. Since Ziwei is controlled by the Xi’an High-Tech Zone Government most of Ziwei’s developments are located in the northwest section of Xi’an city.

Our Projects

Projects Under Construction

| Project Name | Type of Projects | Actual or Estimated Construction Period | Actual or Estimated Pre-sale Commencement Date | Total Site Area (m2 ) | Total Gross Floor Area (m2 ) | Sold GFA by December 31, 2012 (m2 ) | ||||||||||||

| Puhua Phase Two | Multi-Family residential & Commercial | Q2/2010 - Q4/2013 | Q2/2010 | 47,300 | 261,090 | 119,629 | ||||||||||||

| Ankang Project | Multi-Family residential & Commercial | Q2/2012 - Q3/2015 | Q4/2012 | 74,820 | 243,152 | 2,200 | ||||||||||||

| Park Plaza | Multi-Family residential & Commercial | Q1/2012 - Q2/2014 | Q1/2013 | 44,250 | 149,822 | 0 | ||||||||||||

| Puhua Phase Three | Multi-Family residential & Commercial | Q2/2012 - Q2/2014 | Q1/2013 | 30,600 | 129,300 | 0 | ||||||||||||

| Project name | Total Number of Units | Number of Units sold by December 31, 2012 | Estimated Revenue ($ millions) | Contracted Revenue by December 31, 2012 ($ millions) | Recognized Revenue by December 31, 2012 ($ millions) | |||||||||||||||

| Puhua Phase Two | 1,587 | 1,026 | 246.7 | 103.3 | 61.7 | |||||||||||||||

| Ankang Project | 2,121 | 106 | 206.3 | 6.9 | 0 | |||||||||||||||

| Park Plaza | 694 | 0 | 154.0 | 0 | 0 | |||||||||||||||

| Puhua Phase Three | 1,899 | 0 | 152.9 | 0 | 0 | |||||||||||||||

Puhua Phase Two: The construction of Puhua Phase Two began in the second quarter of 2010. It is one of Puhua’s four projects; it’s total estimated revenue is $256.5 million. The contract revenue for Puhua Phase Two was $103 million as of December 31, 2012.

Ankang Project: The Ankang project is located in Ankang city, which is approximately 260 kilometers south of Xi’an in China’s Shaanxi Province. The project consists of residential buildings and a commercial area. Construction started in the second quarter of 2012, and presales started in the fourth quarter of 2012, but because it did not meet revenue recognition criteria, we were unable to recognize any revenue during the fourth quarter of 2012. Total GFA of the project is expected to reach 243,152 square meters. Total projected revenue is estimated to be $171.9 million.

Park Plaza: In July 2009, the Company entered into a Letter of Intent to acquire 44,250 square meters of land in the center of Xi’an for the Park Plaza project. In March 2011, the Company officially acquired the land use right for Park Plaza. The Company intends to develop a large mid-upper income residential and commercial project on this site, with a gross floor area of 141,822 square meters. The four-year construction of Park Plaza started in the second quarter 2012. We have started accepting pre-sale purchase agreements and revenues from pre-sale agreements will begin to be recognized when all revenue recognition criteria have been met. The total revenue from Park Plaza is estimated to be $154 million.

Puhua Phase Three: Puhua Phase Three project covers 30,600 square meters with a total GFA of 177,193 square meters. We have started pre-sale of Puhua Phase Three during the first quarter of 2013 and we will start recognizing revenues based on the percentage of completion method.

| 13 |

Projects Under Planning and in Process

| Project Name | Type of Projects | Estimated Construction Period | Estimated Pre-sale Commencement | Total Site Area (m2 ) | Total GFA (m2) | Total Number of Units | ||||||||||

| Baqiao New Development Zone | Land Development | 2009- 2020 | N/A | N/A | N/A | N/A | ||||||||||

| Puhua Phase Four | Multi-Family residential & Commercial | Q2/2013 - Q4/2014 | Q3/2013 | 61,087 | 263,833 | N/A | ||||||||||

| Golden Bay | Multi-Family residential & Commercial | Q2/2013 - Q4/2014 | Q3/2013 | 146,099 | 252,540 | N/A | ||||||||||

| Textile City | Multi-Family residential & Commercial | Q3/2013 - Q3/2018 | Q3/2014 | 433,014 | 630,000 | N/A | ||||||||||

Baqiao New Development Zone: On March 9, 2007, we entered into a Share Transfer Agreement with the shareholders of Xi’an New Land Development Co., Ltd. (“New Land”), under which the Company acquired 32,000,000 shares of New Land, constituting 100% equity ownership of New Land. This acquisition gave the Company the exclusive right to develop and sell 487 acres of land in a newly designated satellite city of Xi’an (the “Baqiao Project”).

Xi’an has designated the Baqiao District as a major resettlement zone where the city expects 900,000 middle to upper income inhabitants to settle. The Xi’an local government intends to create a thriving commercial and residential zone similar to Pudong, Shanghai, which has provided many new economic opportunities and significant amounts of housing for Shanghai’s growing population.

The Xi’an municipal government plans investments of RMB 50 billion (over $7.6 billion) in infrastructure in the Baqiao New Development Zone. The construction of a large-scale public wetland park is well underway. It will enhance the natural environment adjacent to China Housing’s Baqiao Project.

Through our New Land subsidiary, we sold 18.4 acres to another developer in 2007 and generated about $24.41 million in revenue.

In 2008, we established a joint venture with Prax Capital Real Estate Holdings Limited (“Prax Capital”) to develop 79 acres within the Baqiao Project, which will be the first phase of the Baqiao Project’s development. Prax Capital invested $29.3 million in the joint venture. The joint venture is further described in the Puhua section below.

In December 2010, we signed a preliminary contract with the government disclosing our intention to acquire an additional 107 acre tract of land for another project. The Company has not acquired the land use right because the government is clearing the land and otherwise making the land sellable. It is common practice in China for the government to clear all the existing buildings and move all existing residences prior to selling a tract of land. However, because we signed the preliminary land acquisition agreement with the government, the Company has first priority to purchase the land. We estimate that we may obtain the land use right for this piece of land by the end of 2013.

After selling 18.4 acres, placing 79 acres in the Puhua project and approximately 42 acres in the Golden Bay project and setting aside 107 acres for a future project, approximately 241 acres remain available for the Company to develop in the Baqiao area. The Company has a $42.7 million deposit on land use rights as of December 31, 2012. The Company intends to utilize this deposit to offset the actual acquisition price of the land use rights of the 42 acres for Golden Bay, the 107 acres for the future project and the remaining 241 acres of land.

However, the actual acquisition price for these land use rights will be determined at the time of the actual land use right acquisition by negotiating with the government. The Company will pay for any additional amount in excess of the $42.7 million deposit according to the final bidding price.

Pursuant to an exclusive development right agreement, the government is obligated to sell the land to the Company.

Puhua Phase Four: Puhua Phase Four covers 61,087 square meters with a total GFA of 216,611 square meters. Construction is anticipated to begin in the second quarter of 2013, and we expect to begin accepting pre-sale purchase agreements in the following quarter.

Golden Bay: The Golden Bay project is located within the Baqiao project, with a total GFA of 252,540 square meters. The Golden Bay project will consist of residential buildings as well as a commercial area. Construction was anticipated to begin in the second quarter of 2013, and we expect to begin accepting pre-sale purchase agreements in the third quarter of 2013. The Company is planning on obtaining the land use right from the government in April 2013. This will be funded by a private fund company. The estimated price for the land use right will be around $40 million.

Textile City: The Textile City project is located within the Baqiao New Development Zone. The project consists of residential buildings and a commercial area. Construction is expected to start in the fourth quarter of 2013, and the entire project will take five years.

| 14 |

Major Completed Projects with Units Available for Sale

| Project name | Type of Projects |

Completion Date |

Total Site Area (m2 ) |

Total GFA (m2 ) |

Total Number of Units |

Number of Units sold by December 31, 2012 |

||||||||||||||

| Puhua Phase One | Multi-Family residential & Commercial | Q4/2012 | 47,600 | 137,137 | 858 | 832 | ||||||||||||||

| JunJing III | Multi-Family residential & Commercial | Q4/2012 | 8,094 | 52,220 | 531 | 522 | ||||||||||||||

| JunJing II Phase One | Multi-Family residential & Commercial | Q4/2009 | 39,524 | 142,214 | 1,215 | 1,211 | ||||||||||||||

| JunJing I | Multi-Family residential & Commercial | Q3/2006 | 55,588 | 167,931 | 1,671 | 1,668 | ||||||||||||||

Puhua Phase One: Puhua Phase One is one of Puhua’s four phases. The total estimated revenue for the project is $130 million and the Company has generated contract revenue of $107 million as of December 31, 2012.

JunJing III: JunJing III is located near our JunJing II project and the city expressway. It has a GFA of about 52,220 square meters. The project consists of three high rise buildings, each 28 to 30 stories high. The project is targeting middle to high income customers who require a high quality living environment and convenient transportation to the city center. We started construction during the fourth quarter of 2010 and pre-sales began during the fourth quarter of 2011. The project was completed in the fourth quarter of 2012. As of December 31, 2012, we have recognized $49.5 million in revenue out of $50.2 million in contract sales.

JunJing II Phase One: We started the construction of JunJing II Phase One in the third quarter of 2007 and started the pre-sale campaign in the second quarter of 2007. The project was completed in December 2009 and generated total revenue of $100.8 million. JunJing II Phase Two has been mostly sold out.

Tsining JunJing I: 369 North Jinhua Road, Xi’an. That is the first “German” style residential & commercial community in Xi’an, designed by the world-famous WSP architectural firm. Its target customers were local middle income families. The project has 15 residential apartment buildings consisting of 1,671 one to five bedroom apartments. The project features secured parking, cable TV, hot water, heating systems, and access to natural gas. Total GFA is 167,931 square meters. JunJing I is also a commercial venture that houses small businesses serving the needs of JunJing I residents and surrounding residential communities. The project was completed in September 2006.

Sales and Marketing

Pre-Sales and Sales

In China, developers typically start to market and offer properties before construction is completed. Under PRC pre-sales regulations, property developers must satisfy specific conditions before they can pre-sell properties that are under construction. These mandatory conditions include:

| • | the land premium must have been paid in full; |

| • | the land use rights certificate, the construction site planning permit, the construction work planning permit and the construction permit must have been obtained; |

| • | at least 25% of the total project development cost must have been incurred; |

| • | the progress and the expected completion and delivery date of the construction must be fixed; |

| • | the pre-sale permit must have been obtained; and |

| • | the completion of certain milestones in the construction process, which have been specified by the local government authorities, must occur. |

These mandatory conditions require a certain level of capital expenditure and substantial progress in project construction occur before commencement of pre-sales. Developers are required to file all pre-sale contracts with the local land bureaus and real estate administrations after entering into such contracts.

We benefit from a strong sales and marketing platform which is complemented by the efforts of professional third party sales agents. As we strive to develop lasting relationships with our customers, the majority of our sales are generated by recommendations from existing customers. The new sales initiatives of our sales department generate approximately 60% of our total sales. More than 80% of our customers are first time home buyers.

After-sale Services and Delivery

We assist customers in arranging financing as well as in various title registration procedures related to their properties. We have also set up an ownership certificate team to assist purchasers in obtaining property ownership certificates.

We closely monitor the progress of construction of our property projects and conduct pre-delivery property inspections to ensure timely delivery of a high quality product. The time frame for delivery is set out in the sale and purchase agreements we enter into with our customers and we are subject to penalty payments to the purchasers for any delays in delivery caused by us. Once a property development has been completed and has passed the requisite government inspections, we will notify our customers and hand over their keys as well as possession of their properties.

We operate a wholly owned property management company that manages our properties and their ancillary facilities. We frequently follow-up with our customers after the sale to foster good and lasting relationships as well as future referrals.

| 15 |

Marketing

As of December 31, 2012, we maintain a marketing and sales force for our development projects with 26 professionals specializing in marketing and sales. We also train and use outside real estate agents to market and increase the public awareness of our products and our brand. However, we primarily let our own sales force represent our brand and our projects rather than rely on third-party brokers or agents as we believe our own dedicated sales representatives are better motivated to serve our customers and to control the pricing and selling expenses of our properties.

Quality Control

We utilize various quality controls to ensure that our buildings and residential units meet high standards. Through our contractors, we provide customers with warranties covering the building structure as well as certain fittings and facilities of our property developments in accordance with the relevant regulations. To ensure construction quality, our construction contracts contain quality warranties and penalty provisions for poor work quality. We do not allow contractors to subcontract or transfer their contractual obligations to third parties. We typically withhold 5% of the agreed construction fees for two to five years after completion of the construction as a deposit against any construction quality issues. This deposit helps to incentivize contractors to deliver a quality product.

Governmental and environmental Regulations

To date, we have been compliant with all registrations and requirements for the issuance and maintenance of all licenses required by the applicable governing authorities in China. These licenses include:

| • | “Qualification Certificate for Real Estate Development” authorized by the Shaanxi Construction Bureau, effective from December 20, 2009 to December 20, 2012. License No: JianKaiQi (2006) 603. The Company has applied for the renewal of the qualification and is waiting for the approval from government and the Company is confident in obtaining the renewal. The housing and land development process is regulated by the Ministry of Construction and authorized by the local offices of the Ministry. Each development project must obtain the following licenses: |

| Ø | “License for Construction Area Planning” and “License for Construction Project Planning”, authorized by Xi’an Bureau of Municipal Design; and |

| Ø | “Building Permit” authorized by the Committee of Municipal and Rural Construction. |

After construction is complete, the project must meet certain standards in order to obtain a validation certificate. These standards are regulated by the local Ministry of Construction Bureau.

Housing and land development sales companies are regulated by the Ministry of Land & Natural Resources and are authorized by the local office of the Ministry. Each project has to be authorized and must obtain a “Commercial License for Housing Sale” from the Real Estate Bureau.

Employees

As of December 31, 2012, we had 611 employees.

We believe we have a good working relationship with our employees. We are not a party to any collective bargaining agreements. At present, no significant change in our staffing is expected over the next 12 months. All employees are eligible for performance-based compensation.

| 16 |

ITEM 1A. RISK FACTORS

An investment in our securities is speculative and involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before purchasing any of our securities. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties may also adversely impair our business operations. If any of the events described in the risk factors below actually occur, our business, financial condition or results of operations could suffer significantly. In such case, the value of your investment could decline and you may lose all or part of the money you paid to buy our securities.

In addition to other matters identified or described by us from time to time in filings with the SEC, there are several important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or results that are reflected from time to time in any forward-looking statement. Some of these important factors, but not necessarily all important factors, include the following:

Risks Related to Our Business

Our home sales and operating revenues could decline due to macro-economic and other factors outside of our control, such as changes in consumer confidence and declines in employment levels.

Changes in national and regional economic conditions, as well as local economic conditions where the Company conducts its operations and where prospective purchasers of its homes live, may result in more caution on the part of homebuyers and consequently fewer home purchases. These economic uncertainties involve, among other things, conditions of supply and demand in local markets and changes in consumer confidence and income, employment levels, and government regulations. These risks and uncertainties could periodically have an adverse effect on consumer demand for and the pricing of our homes, which could cause our operating revenues to decline. In addition, builders are subject to various risks, many of them outside the control of the homebuilder including competitive overbuilding, availability and cost of building lots, materials and labor, adverse weather conditions, cost overruns, changes in government regulations, and increases in real estate taxes and other local government fees. A reduction in our revenues could in turn negatively affect the market price of our securities.

An increase in mortgage interest rates or the unavailability of mortgage financing may reduce consumer demand for the Company’s homes.

Virtually all purchasers of our homes finance their acquisitions through lenders providing mortgage financing. A substantial increase in mortgage interest rates or unavailability of mortgage financing would adversely affect the ability of prospective homebuyers to obtain the financing they would need in order to purchase our homes, as well as adversely affect the ability of prospective upgrading homebuyers to sell their current homes. For example, if mortgage financing becomes less available, demand for our homes could decline. A reduction in demand could also have an adverse effect on the pricing of our homes because we and our competitors may reduce prices in an effort to better compete for home buyers. Price reductions could result in a decline in our revenues and in our margins.

We could experience a reduction in home sales and revenues or reduced cash flows if we are unable to obtain reasonably priced financing to support our homebuilding and land development activities.

The real estate development industry is capital intensive, and development requires significant up-front expenditures to acquire land and begin development. Accordingly, we incur substantial indebtedness to finance our homebuilding and land development activities. Although we believe that internally generated funds and current borrowing capacity will be sufficient to fund our capital and other expenditures (including land acquisition, development and construction activities), the amounts available from such sources may not be adequate to meet our needs. If such sources are not sufficient, we would seek additional capital in the form of debt or equity financing from a variety of potential sources, including bank financings and securities offerings. Our ability to secure sufficient financing for land use rights acquisition and property development depends on a number of factors that are beyond our control, including market conditions in the capital markets, investors’ perception of our securities, lenders’ perception of our creditworthiness, the PRC economy and the PRC government regulations that affect the availability and cost of financing for real estate companies. Furthermore, the availability of borrowed funds to be utilized for land acquisition or development and construction, may decline, and, as a result, the lending community may require increased amounts of equity to be invested in a project by borrowers in connection with new loans and this could render obtaining funds more difficult if not impossible. In turn, the failure to obtain sufficient capital to fund our planned capital and other expenditures could have a material adverse effect on our business.

We may require additional capital in the future, which may not be available on favorable terms or at all.

Our future capital requirements will depend on many factors, including industry and market conditions, our ability to successfully implement new branding and marketing initiatives and expansion of our production capabilities. We anticipate that we may need to raise additional funds in order to grow our business and implement our business strategy. We anticipate that any such additional funds may be raised through equity or debt financings. In addition, we may enter into a revolving credit facility or a term loan facility with one or more syndicates of lenders. Any equity or debt financing, if available at all, may be on terms that are not favorable to us. Even if we are able to raise capital through equity or debt financings, as to which there can be no assurance, the interest of existing shareholders in our company may be diluted, and the securities we issue may have rights, preferences and privileges that are senior to those of our common stock or may otherwise materially and adversely affect the holdings or rights of our existing shareholders. If we cannot obtain adequate capital, we may not be able to fully implement our business strategy, and our business, results of operations and financial condition could be adversely affected. See also “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” In addition, we have and will continue to raise additional capital through private placements or registered offerings, in which broker-dealers may be engaged. The activities of such broker-dealers are highly regulated and we cannot assure that the activities of such broker-dealers will not violate relevant regulations and generate liabilities despite our expectations otherwise.

| 17 |

We are subject to extensive government regulation which could make it difficult for us to obtain adequate funding or additional funding.

Various PRC regulations restrict our ability to raise capital through external financings and other methods, including, but not limited to, the following:

| • | we cannot pre-sell uncompleted residential units in a project prior to achieving certain development milestones specified in related regulations; |

| • | PRC banks are prohibited from extending loans to real estate companies to fund the purchase of land use rights; |

| • | we cannot borrow from a PRC bank for a particular project unless we fund at least 35% of the total investment amount of that project using our own capital; |

| • | we cannot borrow from a PRC bank for a particular project if we do not obtain the land use right certificate for that project; |

| • | property developers are strictly prohibited from using the proceeds from a loan obtained from a local bank to fund property developments outside of the region where the bank is located; and |

| • | PRC banks are prohibited from accepting properties that have been vacant for more than three years as collateral for a loan. |

The PRC government may introduce other measures that limit our access to additional capital. In November 2007, the China Bank Regulatory Commission, or the CBRC, provided policy guidelines to PRC banks and Chinese subsidiaries of foreign banks that loans outstanding at December 31, 2007 should not exceed the level of outstanding loans as of October 31, 2007. This lending freeze may limit our ability to access additional loans or to roll over existing loans as they mature, and may also prevent or delay potential customers’ abilities to secure mortgage loans to purchase residential properties. In addition, on July 10, 2007, the State Administration of Foreign Exchange, or SAFE, issued a circular restricting a foreign invested property developer’s ability to raise capital through foreign debt, if such developer is established after June 1, 2007 or increases its registered capital after June 1, 2007. Under this circular, our ability to utilize the proceeds of this offering to provide funding to our PRC operations is significantly limited. We cannot assure you that we will be able to obtain sufficient funding to finance intended purchases of land use rights, develop future projects or meet other capital needs as and when required at a commercially reasonable cost or at all. Failure to obtain adequate funding at a commercially reasonable cost may limit our ability to commence new projects or to continue the development of existing projects or may increase our borrowing costs.

We are subject to extensive government regulation which may cause us to incur significant liabilities or may restrict our business activities.

Regulatory requirements could cause us to incur significant liabilities and operating expenses and could restrict our business activities. We are subject to statutes and rules regulating, among other things, certain developmental matters, building and site design, and matters concerning the protection of health and the environment. Our operating expenses may be increased by governmental regulations such as building permit allocation ordinances and impacts as well as other fees and taxes, which may be imposed to defray the cost of providing certain governmental services and improvements. Any delay or refusal from government agencies to grant us necessary licenses, permits and approvals could have an adverse effect on our operations.

Our shareholders may be subject to substantial dilution.

On January 28, 2008, we issued $20,000,000 in our 5.0% Senior Secured Convertible Notes (“Notes”). The Investors have the right to convert up to 45% ($9 million) of the principal amount of the Convertible Debt into common shares at an initial conversion price of $5.57, subject to an upward adjustment. The Company, at its discretion, may redeem the remaining non-convertible portion of Convertible Debt ($11 million) (the “Non-convertible Portion”) at 100% of the principle amount, plus any accrued and unpaid interest. In addition, we issued warrants to acquire shares of our common stock at $6.07 per share of common stock (the “Warrants”), exercisable at any time after January 28, 2008 to and including February 28, 2013, the expiration date of the Warrants. These securities have anti-dilution protection provisions, which will become operative upon our issuance of additional securities at prices below specified dollar amounts. In addition, the holders of these securities were granted registration rights. The holders may choose to convert part or all of their Notes into our common shares. If we issue additional securities at a price lower than the specified amount, we may have to issue additional securities to the holders. If any, or a combination of such events occurs, the proportionate ownership interest of our existing shareholders may be diluted. On June 10, 2010, the Company and the Investors entered into an amendment (the “Amendment”), which granted Investors the rights to convert the $11 million Non-convertible Portion of the Convertible Debt. The rights expire five business days after the effective date of the registration statement registering the shares to be issued on the conversion.

| 18 |

The warrants issued in 2008 were amended as well to permit the investors to exercise the Warrants on a cashless basis and receive one common share for every two Warrants held if the investor converts at least 55% of face amount of Convertible Debt held.

Upon entering the Amendment, certain investors had agreed to convert 55% of the aggregate face amount of debt to common shares and convert the Warrants by receiving one common share for every two warrants held within five business days after the effective date of the registration statement filed by the Company.

On January 25, 2011, certain investors requested and the Company’s Board approved the request to convert the $9,763,000 non-convertible portion of the convertible debt into 1,752,778 common shares with the related warrants exercised on a two-one cashless basis. The conversion became effective on February 16, 2011.

Since the Company’s registration statement became effective on February 25, 2011, the right to convert the $11 million non-convertible portion of the Convertible Debt and to exercise the warrants on a cashless basis and receive one common share for every two warrants expired as of December 31, 2011.

The Company repaid all the convertible debt by the end of 2012.

We may be unable to acquire desired development land sites at commercially reasonable costs.

Our revenue depends on the completion and sale of our projects, which in turn depend on our ability to acquire development sites. Our land use rights costs are a major component of our cost of real estate sales and increases in such costs could diminish our gross margin. In China, the PRC government controls the supply of land and regulates land sales and transfers in the secondary market. As a result, the policies of the PRC government, including those related to land supply and urban planning, affect our ability to acquire, and our costs of acquiring, land use rights for our projects. In recent years, the government has introduced various measures attempting to limit investment in the property market in China. Although we believe that these measures are generally targeted at the luxury property market and speculative purchases of land and properties, we cannot assure you that the PRC government will not introduce other measures in the future that adversely affect our ability to obtain land for development. We currently acquire some of our development sites through company bankruptcies. Under current regulations, land use rights acquired from government authorities for commercial and residential development purposes must be purchased through a public tender, auction or listing-for-sale. We may not be able to continue to purchase land use rights from companies in bankruptcy and our land use rights costs may increase in the future, which may lead to a decrease in our profit margin. In addition, we may not successfully obtain desired development sites due to the increasingly intense competition in the land acquisition process. Moreover, the supply of potential development sites in any given city will diminish over time and we may find it increasingly difficult to identify and acquire attractive development sites at commercially reasonable costs in the future.

We depend on the availability of additional human resources for future growth.