Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PAR PACIFIC HOLDINGS, INC. | d693203d8k.htm |

Exhibit 99.1

| Investor Background MaterialsMarch 2014 |

| Forward Looking Disclaimer The information contained in this presentation has been prepared to assist you in making your own evaluation of the Company and does not purport to contain all of the information you may consider important in deciding whether to invest in shares of the Company's common stock. Any estimates or projections with respect to future performance have been provided to assist you in your evaluation but should not be relied upon as an accurate representation of future results. Certain statements, estimates and ?nancial information contained in this presentation constitute forward- looking statements. Such forward-^^looking statements involve known and unknown risks and uncertainties that could cause actual events or results to di?er materially from the results implied or expressed in such forward-^^looking statements. While presented with numerical speci?city, certain forward-^^looking statements are based (1) upon assumptions that are inherently subject to signi?cant business, economic, regulatory, environmental, seasonal and competitive uncertainties, contingencies and risks including, without limitation, the ability to maintain adequate liquidity, realize the potential benefit of our net operating loss tax carryforwards, obtain sufficient debt and equity ?nancings, capital costs, well production performance, operating costs, commodity pricing, di?erentials or crack spreads and other known and unknown risks (all of which are di?cult to predict and many of which are beyond the Company's control) some of which are further discussed in the Company's periodic and other filings with the SEC and (2) upon assumptions with respect to future business decisions that are subject to change.There can be no assurance that the results implied or expressed in such forward-^^looking statements or the underlying assumptions will be realized and that actual results of operations or future events will not be materially di?erent from the results implied or expressed in such forward-^^looking statements. Under no circumstances should the inclusion of the forward-^^looking statements be regarded as a representation, undertaking, warranty or prediction by the Company or any other person with respect to the accuracy thereof or the accuracy of the underlying assumptions, or that the Company will achieve or is likely to achieve any particular results. The forward-^^looking statements are made as of the date hereof and the Company disclaims any intent or obligation to update publicly or to revise any of the forward-^^looking statements, whether as a result of new information, future events or otherwise. Recipients are cautioned that forward-^^looking statements are not guarantees of future performance and, accordingly, recipients are expressly cautioned not to put undue reliance on forward-^^looking statements due to the inherent uncertainty therein. |

| Table of Contents Executive SummaryBusiness Unit OverviewHawaii Independent Energy LLCPiceance Energy LLCTexadian Energy LLC |

| Par Petroleum - Executive Summary Diversified energy company with unique portfolio of upstream, downstream, logistics and tax assetsLargest fuel supplier to the State of Hawaii via operations of distillate weighted refinery configuration matching to island's demand profileControl energy infrastructure in the form of tankage, refined product terminals, mooring equipment and pipelinesExposure to rapidly changing North American crude landscape via Hawaii Independent Energy & Texadian EnergyValuable logistics positions allowing for moving heavy Canadian crude via historical positions on key pipelines originating in AlbertaSignificant stake in a low-cost, liquids rich asset base with deep inventory of undrilled locations substantially held by productionTax asset in the form of an unrestricted $1.3 billion Net Operating Loss Carryforward ("NOL") |

| Overview of Par Petroleum Par Petroleum(OTCQB: PARR) Piceance Energy Description of Assets40,165 net acres across Colorado's southern Piceance basin99% of acreage is held by productionApproximately 19% by volume is liquids (Natural Gas Liquids or Condensate)Substantially all of acreage is operated by Piceance Energy management team Non-Op Upstream 6% non-op interest offshore California180 bopd of crude oil production as of 9/30/13 $1.3 Billion Unrestricted Net Operating Loss Carryforward ("NOL") 33.34% 100% Texadian Energy Description of Assets4,000 bopd of historical shipper status on key Canadian ? US pipelines178 leased railcarsTerminal and dock access in St. Louis area Marine expertise in moving Canadian crude on inland riverway systems Hawaii Independent Energy Description of Assets94,000 bopd refinery 5 MM barrels of crude and clean product storage5 refined product / crude terminals27 miles of clean / black oil product pipelines31 retail locationsSingle Point Mooring (SPM) 100% 100% |

| Par Petroleum - Key Statistics Strong shareholder base including Zell Credit Opportunities Fund and Whitebox Advisors Shares outstanding include penny warrantsBalance sheet totals based on the 9/30/2013 results Key Statistics: Shareholder Base: |

| Par Petroleum - History December 2011: Delta Petroleum (NYSE: DPTR) files for Chapter 11 protection September 1, 2012: Delta Petroleum emerges from Chapter 11 successfully converting $265 million of unsecured debt into equity. Company is renamed Par Petroleum ("Par"). September 1, 2012: Par Petroleum enters into joint venture transaction with Laramie Energy II by forming Piceance Energy. December 31, 2012: Par closes on $14 million + working capital acquisition of SEACOR Energy, subsequently renamed Texadian Energy. Acquisition funded by $35 MM Tranche B facility. June 25, 2013: Par announces agreement to purchase Tesoro Hawaii from Tesoro Corporation for $75 MM + working capital + share of turnaround costs. September 25, 2013: Par announces successful restart of Tesoro Hawaii refinery and closes acquisition alongside $200 million PIPE, Barclays supply & exchange agreements and $125 million ABL facility. Tesoro Hawaii renamed Hawaii Independent Energy. November 18, 2013: Announces closing of HIE Retail financing with Bank of Hawaii for $30 million and repayment of Par Petroleum Exit Facility January 29, 2014: 10-1 reverse stock split 2011 2012 2013 2014 |

| Hawaii Independent Energy LLC |

| Overview of Hawaii Independent Energy (1) Refinery Integrated Logistics Retail 94,000 BPD capacity5.7x Nelson Complexity2.4 MMBbls crude oil & feedstock storage2.5 MMBbls refined product storage 5 refined product terminals with approximately 247,000 Bbls of working capacity11 pipelines with a total length of 27 milesSingle Point Mooring and associated subsea crude oil and refined product pipelines2 dedicated time charter tug / barges 31 retail outlets on Hawaii, Maui and Oahu islands Refining Unit Capacity (MBPD) Crude Unit 94 Vacuum Distillation Unit 36 Hydrocracker 18 Catalytic Reformer 13 Visbreaker 11 Hydrogen Plant (MMCFD) 18 Naphtha Hydrotreater 13 Asset Map (1) Includes HIE Retail |

| Hawaii Market Characteristics Source: Energy Information Association as of October 2013Source: Department of Business, Economic Development and Tourism Majority of power generation on islands generated by Fuel OilJet fuel demand is significant portion of product demand largely driven by tourism and the militaryMotor gasoline demand is stabilizing on the islands following downturn during recession Hawaii Power Generation Feedstock % (1) Hawaii Visitor Trends (2) (CHART) |

| Piceance Energy LLC |

| Piceance Energy Overview Concentrated acreage footprint in the historically prolific Piceance basinUnderlying geology characterized by consistent Williams Fork sand with deeper Mancos / Niobrara potentialOver 304 producing Williams Fork wellsAmong the lowest cost gas-weighted basins in the continental U.S.Liquids production of 19% on a volume basis in the form NGLs / Condensate Over 3,500 undeveloped Williams Fork locationsAlmost all leasehold interests held by productionSignificant undeveloped resource base from the Mancos / Niobrara shale Required Henry Hub ($ / MCF )Price to Generate 11% IRR (1) Source: Goldman Sachs Global Investment Research |

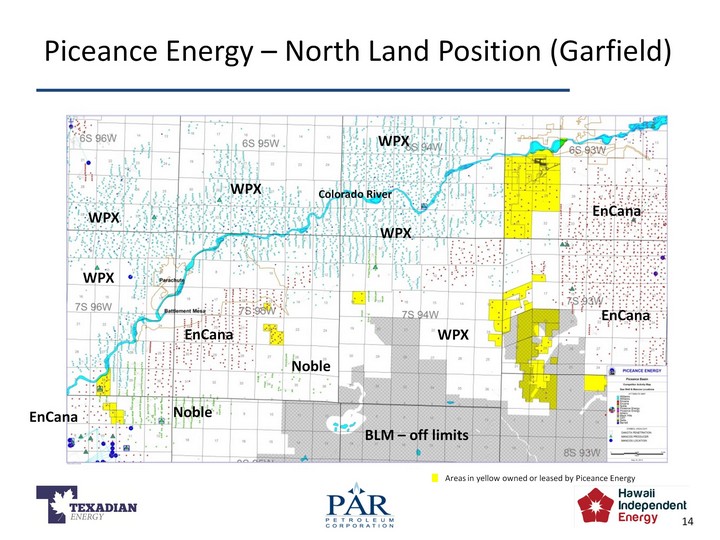

| Piceance Energy - Land Summary Acreage located in two counties and three principal areas surrounded by major operators WPX Energy, EnCana, and Occidental:Almost all operated acreage in topographically accessible areasAlmost all of the leasehold acreage is held by production / held by unit - no significant drilling obligationsHigh Working interests across acreageWilliams Fork acreage approved for 10-acre spaced vertical wells |

| Piceance Energy - North Land Position (Garfield) Piceance Energy - North Land Position (Garfield) EnCana WPX BLM - off limits Noble WPX EnCana EnCana WPX Noble WPX WPX WPX EnCana Colorado River Areas in yellow owned or leased by Piceance Energy |

| Piceance Energy - South Land Position (Mesa) EnCana Oxy 1 sq. mile Axia BLM - off limits BLM - off limits Oxy Oxy EnCana EnCana Areas in yellow owned or leased by Piceance Energy |

| Texadian Energy LLC |

| Texadian Energy - Overview Pipeline Positions Texadian acquired from SEACOR Holdings on December 31, 2012Primary assets consist of the following as of December 31, 2013:Historical pipeline positions on attractive lines moving Canadian barrels from north to south178 leased railcarsLeased tow and barge equipmentFavorable relationships with major inland marine providersSignificant marine expertise in moving Canadian barrels via barge from St. Louis to the lower Mississippi river Financed separately with access to $50 MM trade credit facilityAccess to recently commissioned terminal and dock facility in Wood River, IL B C D B A |

| Appendices |

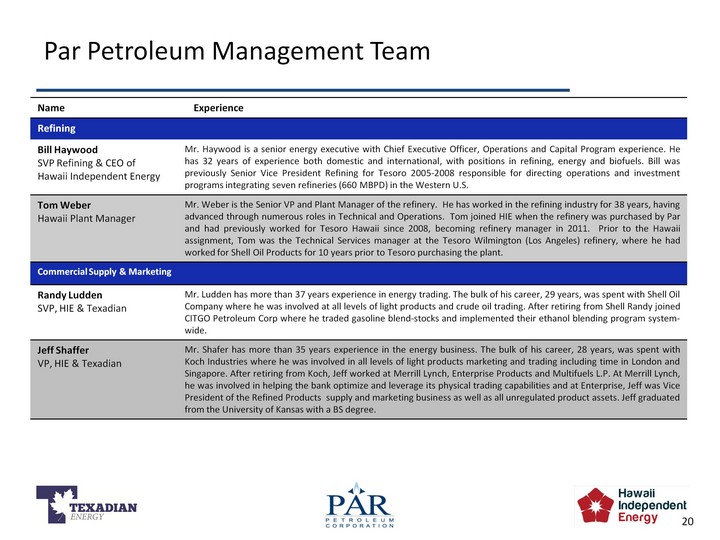

| Par Petroleum Management Team Par Petroleum Management Team |

| Par Petroleum Management Team Par Petroleum Management Team |