Attached files

| file | filename |

|---|---|

| 8-K - 8-K FEDERAL HOME LOAN BANK OF SEATTLE BUSINESS UPDAED PRESENTATION MARCH 2014 - Federal Home Loan Bank of Seattle | a8-kmarch2014businessupdat.htm |

Federal Home Loan Bank of Seattle Business Update Prepared for: Loan Portfolio Management Workshop OBA / ICBO Presented by: Michael Wilson President and CEO Federal Home Loan Bank of Seattle March 13, 2014

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including preliminary highlights of financial statements and information as of and for the year ended December 31, 2013, and on which the Seattle Bank's external auditor has not completed its audit. Forward- looking statements are subject to known and unknown risks and uncertainties. Actual financial performance and condition, and other actions, including those relating to the Amended Consent Arrangement and payments of dividends and repurchases of shares, may differ materially from that expected or implied in forward-looking statements because of many factors. Such factors may include, but are not limited to, finalization of the financial statements and information as of and for the year ended December 31, 2013, changes in general economic and market conditions (including effects on, among other things, U.S. debt obligations and mortgage-related securities), demand for advances, regulatory and legislative actions and approvals (including those of the FHFA), changes in the bank's membership profile or the withdrawal of one or more large members, shifts in demand for the bank's products and consolidated obligations, business and capital plan and policy adjustments and amendments, competitive pressure from other Federal Home Loan Banks and alternative funding sources, the Seattle Bank's ability to meet adequate capital levels, accounting adjustments or requirements (including changes in assumptions and estimates used in the bank's financial models), interest-rate volatility, changes in projected business volumes, the bank's ability to appropriately manage its cost of funds, the cost-effectiveness of the bank's funding, changes in the bank's management and Board of Directors, and hedging and asset-liability management activities. Additional factors are discussed in the Seattle Bank's most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q, as amended. The Seattle Bank does not undertake to update any forward-looking statements made in this presentation. Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 2

2013 Financial Results 2014 Initiatives Legislative Update Our Commitment to Our Members Agenda 3

2013 Financial Results: Building a Platform for Growth 4

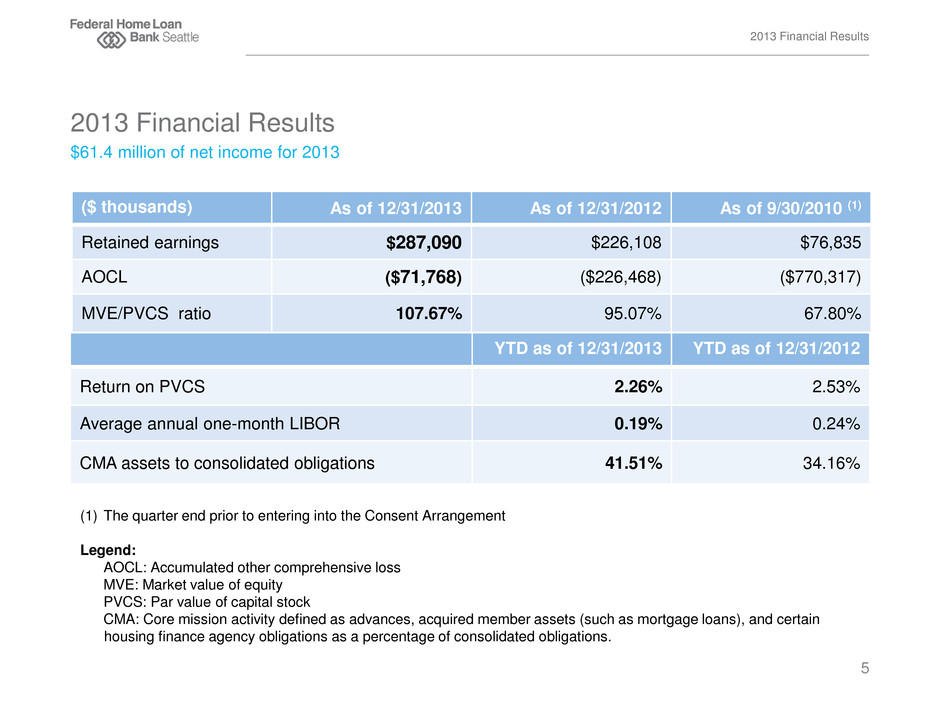

$61.4 million of net income for 2013 2013 Financial Results 2013 Financial Results 5 ($ thousands) As of 12/31/2013 As of 12/31/2012 As of 9/30/2010 (1) Retained earnings $287,090 $226,108 $76,835 AOCL ($71,768) ($226,468) ($770,317) MVE/PVCS ratio 107.67% 95.07% 67.80% YTD as of 12/31/2013 YTD as of 12/31/2012 Return on PVCS 2.26% 2.53% Average annual one-month LIBOR 0.19% 0.24% CMA assets to consolidated obligations 41.51% 34.16% (1) The quarter end prior to entering into the Consent Arrangement Legend: AOCL: Accumulated other comprehensive loss MVE: Market value of equity PVCS: Par value of capital stock CMA: Core mission activity defined as advances, acquired member assets (such as mortgage loans), and certain housing finance agency obligations as a percentage of consolidated obligations.

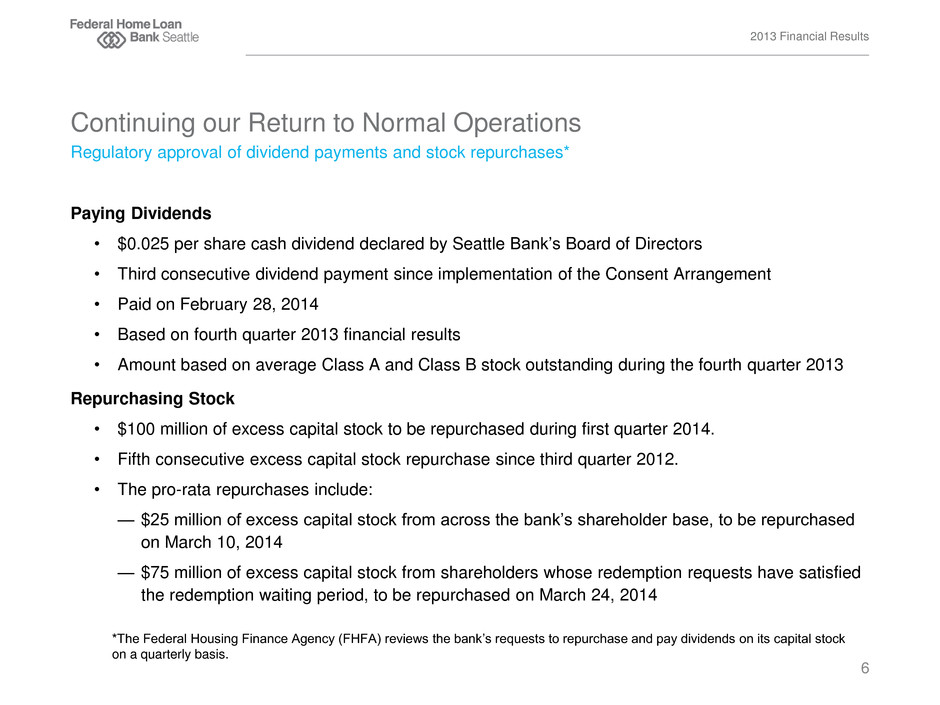

Regulatory approval of dividend payments and stock repurchases* 2013 Financial Results Continuing our Return to Normal Operations 6 Paying Dividends • $0.025 per share cash dividend declared by Seattle Bank’s Board of Directors • Third consecutive dividend payment since implementation of the Consent Arrangement • Paid on February 28, 2014 • Based on fourth quarter 2013 financial results • Amount based on average Class A and Class B stock outstanding during the fourth quarter 2013 Repurchasing Stock • $100 million of excess capital stock to be repurchased during first quarter 2014. • Fifth consecutive excess capital stock repurchase since third quarter 2012. • The pro-rata repurchases include: — $25 million of excess capital stock from across the bank’s shareholder base, to be repurchased on March 10, 2014 — $75 million of excess capital stock from shareholders whose redemption requests have satisfied the redemption waiting period, to be repurchased on March 24, 2014 *The Federal Housing Finance Agency (FHFA) reviews the bank’s requests to repurchase and pay dividends on its capital stock on a quarterly basis.

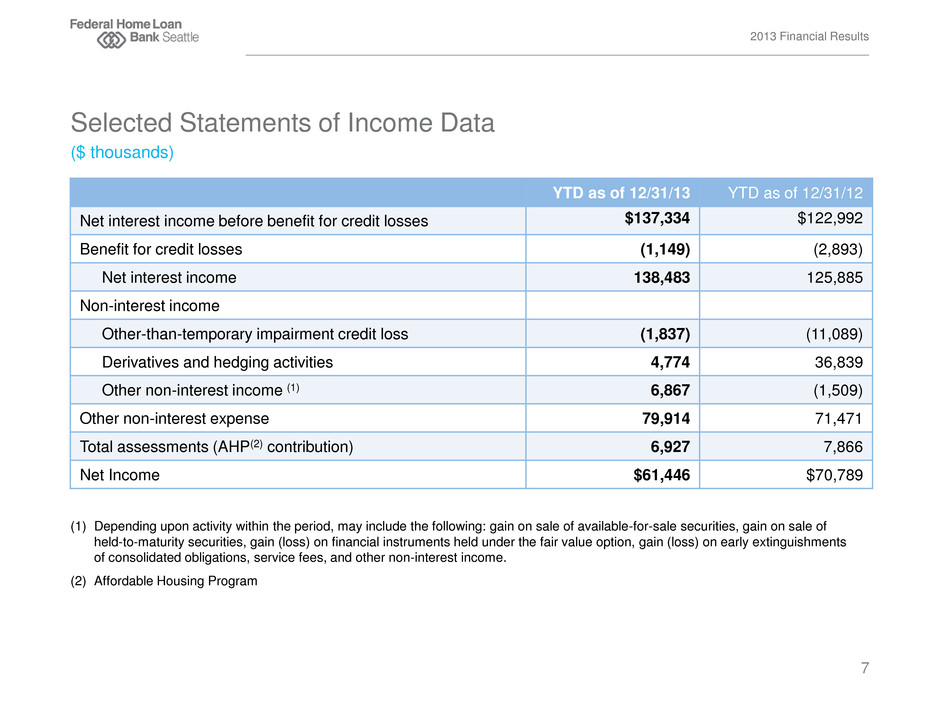

YTD as of 12/31/13 YTD as of 12/31/12 Net interest income before benefit for credit losses $137,334 $122,992 Benefit for credit losses (1,149) (2,893) Net interest income 138,483 125,885 Non-interest income Other-than-temporary impairment credit loss (1,837) (11,089) Derivatives and hedging activities 4,774 36,839 Other non-interest income (1) 6,867 (1,509) Other non-interest expense 79,914 71,471 Total assessments (AHP(2) contribution) 6,927 7,866 Net Income $61,446 $70,789 2013 Financial Results ($ thousands) Selected Statements of Income Data 7 (1) Depending upon activity within the period, may include the following: gain on sale of available-for-sale securities, gain on sale of held-to-maturity securities, gain (loss) on financial instruments held under the fair value option, gain (loss) on early extinguishments of consolidated obligations, service fees, and other non-interest income. (2) Affordable Housing Program

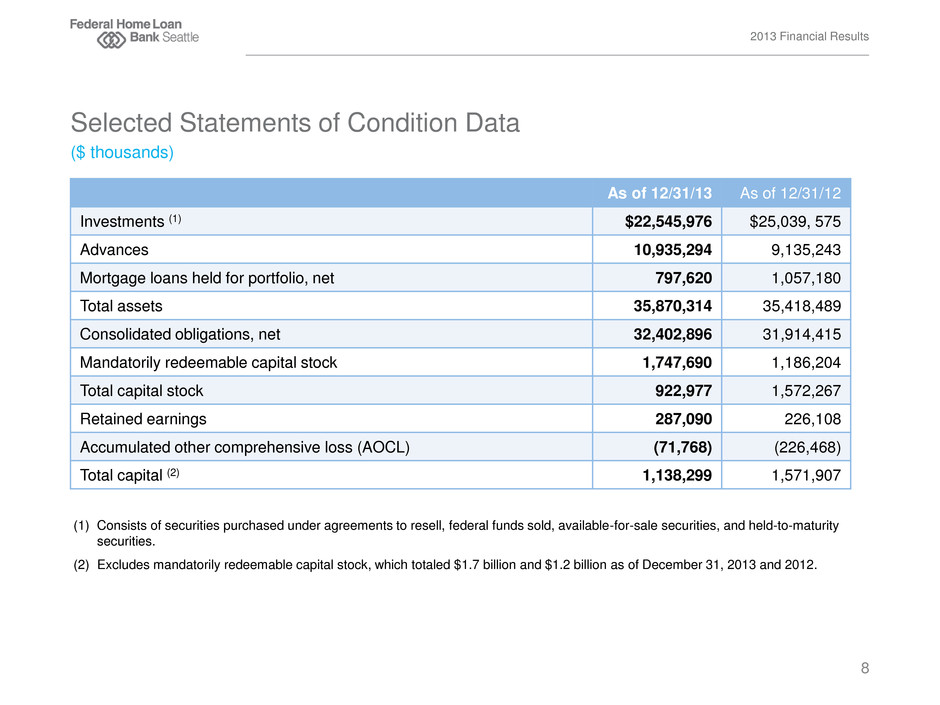

($ thousands) 2013 Financial Results Selected Statements of Condition Data 8 As of 12/31/13 As of 12/31/12 Investments (1) $22,545,976 $25,039, 575 Advances 10,935,294 9,135,243 Mortgage loans held for portfolio, net 797,620 1,057,180 Total assets 35,870,314 35,418,489 Consolidated obligations, net 32,402,896 31,914,415 Mandatorily redeemable capital stock 1,747,690 1,186,204 Total capital stock 922,977 1,572,267 Retained earnings 287,090 226,108 Accumulated other comprehensive loss (AOCL) (71,768) (226,468) Total capital (2) 1,138,299 1,571,907 (1) Consists of securities purchased under agreements to resell, federal funds sold, available-for-sale securities, and held-to-maturity securities. (2) Excludes mandatorily redeemable capital stock, which totaled $1.7 billion and $1.2 billion as of December 31, 2013 and 2012.

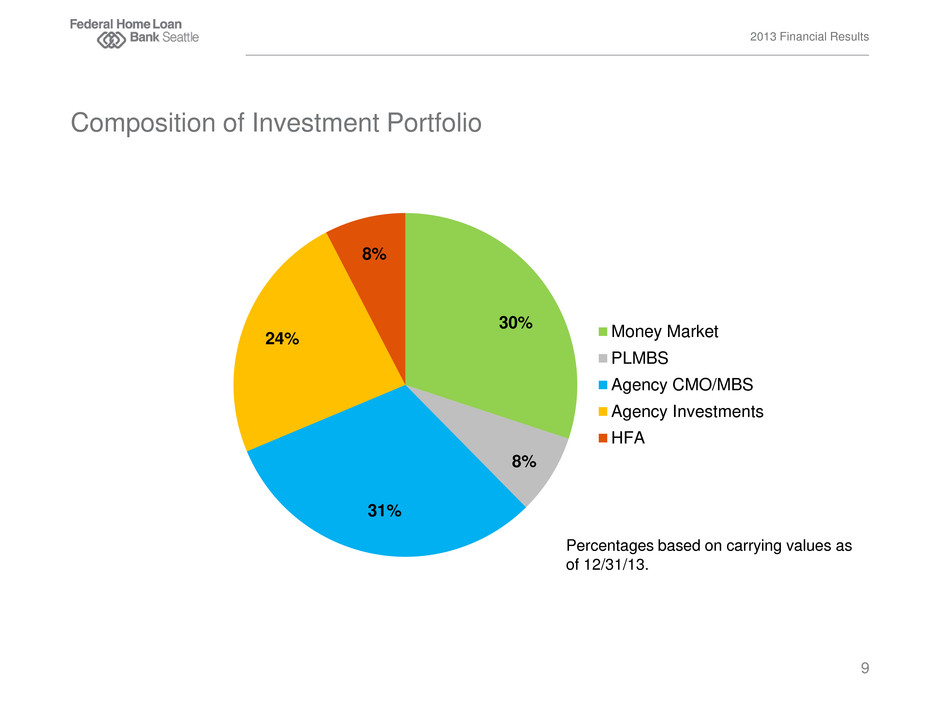

2013 Financial Results Composition of Investment Portfolio 9 Money Market PLMBS Agency CMO/MBS Agency Investments HFA 30% 8% 31% 24% 8% Percentages based on carrying values as of 12/31/13.

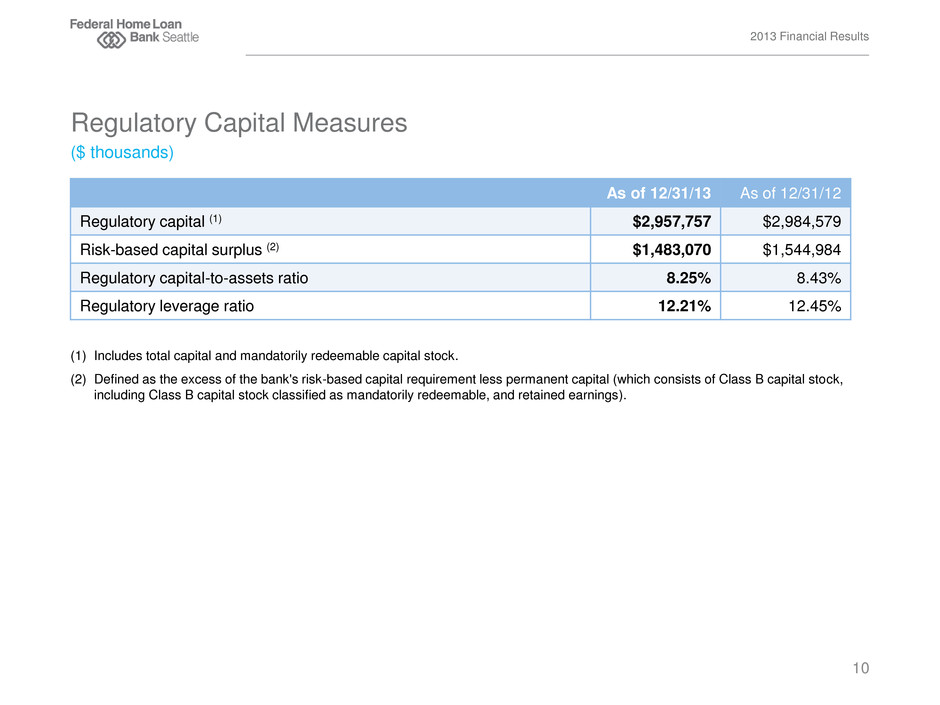

($ thousands) 2013 Financial Results Regulatory Capital Measures 10 As of 12/31/13 As of 12/31/12 Regulatory capital (1) $2,957,757 $2,984,579 Risk-based capital surplus (2) $1,483,070 $1,544,984 Regulatory capital-to-assets ratio 8.25% 8.43% Regulatory leverage ratio 12.21% 12.45% (1) Includes total capital and mandatorily redeemable capital stock. (2) Defined as the excess of the bank's risk-based capital requirement less permanent capital (which consists of Class B capital stock, including Class B capital stock classified as mandatorily redeemable, and retained earnings).

2014 Initiatives Helping Our Members Succeed 11

2014 Initiatives Enhancing the suite of tools we offer our members: • Advances • Mortgage products • Community investment funding Diversifying our customer base by reaching new markets: • Insurance Companies • Housing Finance Agencies • Industrial Loan Companies Focusing on each member’s success. Key Initiatives for 2014 12

2014 Initiatives The Seattle Bank is a Strategic Partner. Multi-disciplinary teams of financial strategists • Relationship managers • Funding experts • Collateral specialists • Risk managers Focused on each member’s success • Customized financial strategies • Flexible funding tools • Best-practices education on critical topics (IRR, marginal cost of funds, interpreting regulations) Collaborating across our members’ organizations • Executives (CEO, CFO, Treasurer) • Staff (Secondary markets staff, loan managers, risk managers) • ALCO, Board of Directors • External consultants (ALM, balance sheet advisors) More than a Wholesale Funding Vendor… 13

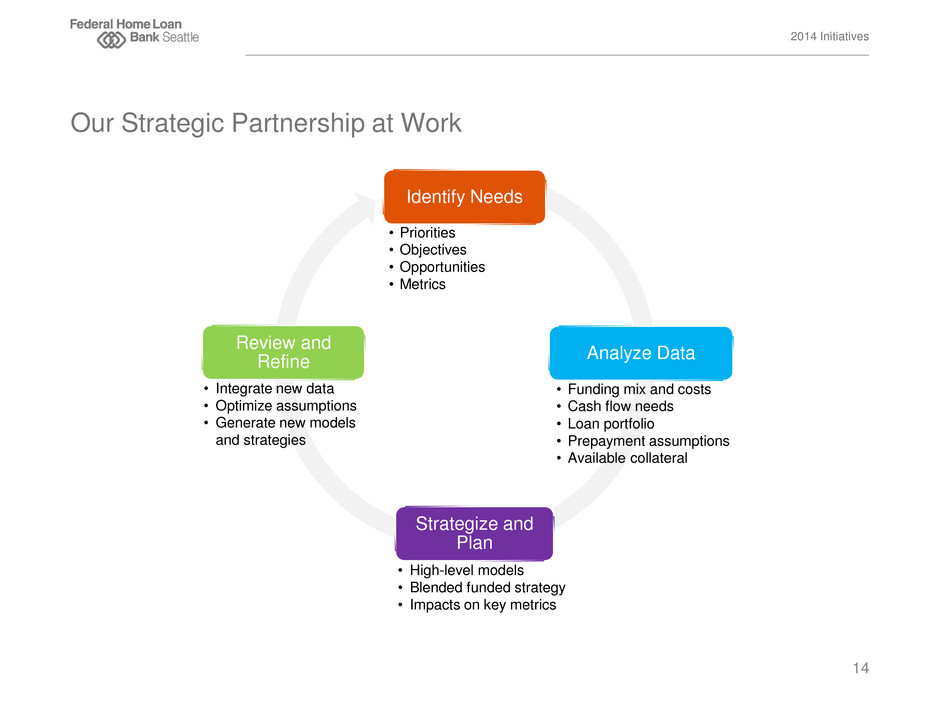

Identify Needs Analyze Data Strategize and Plan Review and Refine 2014 Initiatives Our Strategic Partnership at Work 14 • Priorities • Objectives • Opportunities • Metrics • Funding mix and costs • Cash flow needs • Loan portfolio • Prepayment assumptions • Available collateral • High-level models • Blended funded strategy • Impacts on key metrics • Integrate new data • Optimize assumptions • Generate new models and strategies

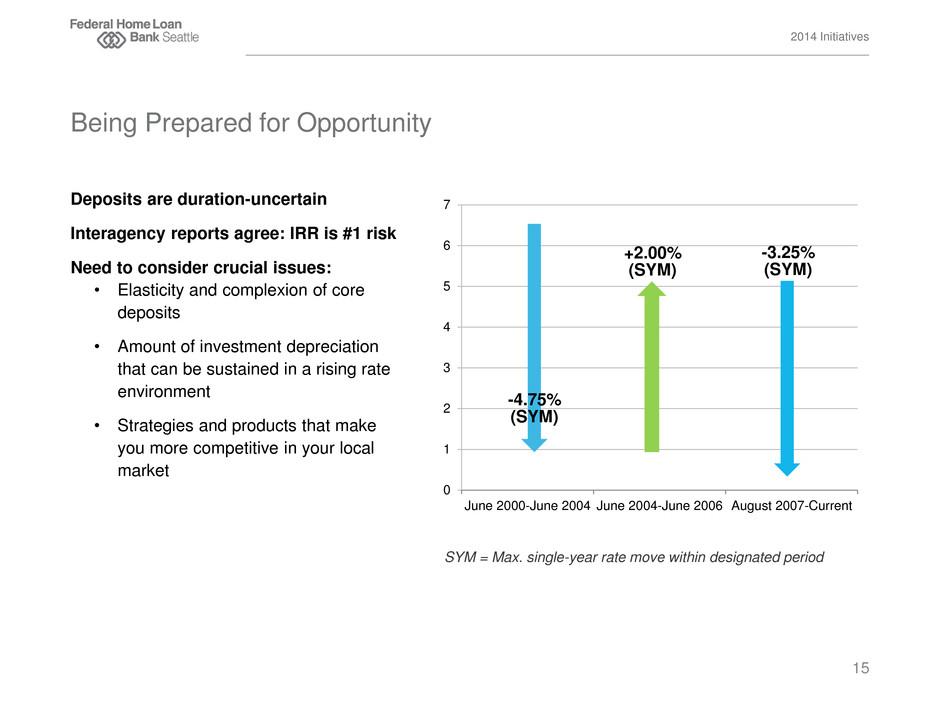

2014 Initiatives Deposits are duration-uncertain Interagency reports agree: IRR is #1 risk Need to consider crucial issues: • Elasticity and complexion of core deposits • Amount of investment depreciation that can be sustained in a rising rate environment • Strategies and products that make you more competitive in your local market Being Prepared for Opportunity 15 SYM = Max. single-year rate move within designated period 0 1 2 3 4 5 6 7 June 2000-June 2004 June 2004-June 2006 August 2007-Current -3.25% (SYM) -4.75% (SYM) +2.00% (SYM)

2014 Initiatives Advances are flexible cost-effective tools to help you: • Manage your balance sheet • Diversify your funding base • Hedge against interest rate risk • Increase your competitiveness in your local market Increasingly, our members are finding that the right mix of advances is often cheaper than: • Their weighted average cost of capital • The cost of raising new deposits — Factoring in cannibalization of existing deposit base and impact on marginal cost of funds Seattle Bank Advances: More than Just “Disaster Insurance” 16

Legislative Update 17

Legislative Update Multiple bills/visions While timing/details are in flux, we should be prepared for change. At the Seattle Bank, we believe it is vital to: • Protect community banks’ engagement in the housing finance system • Preserve the FHLBanks’ role in supporting housing finance, economic development, affordable housing initiatives and member financial institutions • Ensure equal access to funding for all FHLBank members • Maintain a regional FHLBank structure responsive to diverse needs across the United States In order to be heard, we all must speak: • To your FHLBank • Through your trade organization • To your elected federal officials and their staffs Comprehensive Housing Reform Snapshot 18

Our Commitment to Our Members 19

Our Commitment to Our Members The Seattle Bank exists to provide members with funding and liquidity. Our reliability is crucial. We have an obligation to safeguard the capital our members have entrusted to us. We strive to return a reasonable dividend on members’ capital investments in the Seattle Bank cooperative. We are innovating to help members and their cooperative grow and succeed in a challenging environment. • More than just a vendor, we want to be your indispensable business partner. • Not sure how to make the best use of your investment in your FHLBank cooperative? • Talk to us. We have strategies and solutions to address your needs. Our Commitment to Seattle Bank Members 20