Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KINDRED HEALTHCARE, INC | d692079d8k.htm |

Lender

Presentation March 12, 2014

Exhibit 99.1 |

2

Forward-Looking Statements

2

This presentation includes forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All

statements regarding the Company’s expected future financial position, results of

operations, cash flows, financing plans, business strategy, budgets, capital expenditures, competitive positions, growth opportunities, plans and

objectives of management and statements containing the words such as “anticipate,”

“approximate,” “believe,” “plan,” “estimate,” “expect,” “project,” “could,” “should,” “will,” “intend,” “may” and other similar

expressions, are forward-looking statements. Statements in this presentation

concerning the Company’s business outlook or future economic performance, anticipated profitability, revenues, expenses or other financial items, and product or

services line growth, together with other statements that are not historical facts, are

forward-looking statements that are estimates reflecting the best judgment of the Company based upon currently available information.

Such forward-looking statements are inherently uncertain, and stockholders and other

potential investors must recognize that actual results may differ materially from the Company’s expectations as a result of a

variety of factors, including, without limitation, those discussed below. Such

forward-looking statements are based upon management’s current expectations and include known and unknown risks, uncertainties and other factors,

many of which the Company is unable to predict or control, that may cause the Company’s

actual results or performance to differ materially from any future results or performance expressed or implied by such forward-looking

statements. These statements involve risks, uncertainties and other factors discussed below and

detailed from time to time in the Company’s filings with the Securities and Exchange Commission.

In addition to the factors set forth above, other factors that may affect the Company’s

plans, results or stock price include, without limitation, (a) the impact of healthcare reform, which will initiate significant changes

to the United States healthcare system, including potential material changes to the delivery of

healthcare services and the reimbursement paid for such services by the government or other third party payors, including reforms

resulting from the Patient Protection and Affordable Care Act and the Healthcare Education and

Reconciliation Act (collectively, the “ACA”) or future deficit reduction measures adopted at the federal or state level. Healthcare

reform is affecting each of the Company’s businesses in some manner. Potential future

efforts in the U.S. Congress to repeal, amend, modify or retract funding for various aspects of the ACA create additional uncertainty about the

ultimate impact of the ACA on the Company and the healthcare industry. Due to the substantial

regulatory changes that will need to be implemented by the Centers for Medicare and Medicaid Services (“CMS”) and others, and

the numerous processes required to implement these reforms, the Company cannot predict which

healthcare initiatives will be implemented at the federal or state level, the timing of any such reforms, or the effect such reforms or

any other future legislation or regulation will have on the Company’s business, financial

position, results of operations and liquidity, (b) the impact of the final rules issued by CMS on August 1, 2012 which, among other things, will

reduce Medicare reimbursement to the Company’s transitional care (“TC”)

hospitals in 2013 and beyond by imposing a budget neutrality adjustment and modifying the short-stay outlier rules, (c) the impact of the final rules

issued by CMS on July 29, 2011 which significantly reduced Medicare reimbursement to the

Company’s nursing centers and changed payments for the provision of group therapy services effective October 1, 2011, (d) the impact of

the Budget Control Act of 2011 (as amended by the American Taxpayer Relief Act of 2012 (the

“Taxpayer Relief Act”)) which instituted an automatic 2% reduction on each claim submitted to Medicare beginning April 1, 2013, (e)

the Company’s ability to adjust to the new patient criteria for long-term acute care

(“LTAC”) hospitals under the Pathway for SGR Reform Act of 2013, which will reduce the population of patients eligible for the Company’s

hospital services and change the basis upon which the Company is paid, (f) the impact of the

Taxpayer Relief Act which, among other things, reduces Medicare payments by an additional 25% for subsequent procedures when

multiple therapy services are provided on the same day. At this time, the Company believes that

the rules related to multiple therapy services will reduce the Company’s Medicare revenues by $25 million to $30 million on an

annual basis, (g) changes in the reimbursement rates or the methods or timing of payment from

third party payors, including commercial payors and the Medicare and Medicaid programs, changes arising from and related to the

Medicare prospective payment system for LTAC hospitals, including potential changes in the

Medicare payment rules, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, and changes in Medicare and

Medicaid reimbursement for the Company’s TC hospitals, nursing centers, inpatient

rehabilitation hospitals and home health and hospice operations, and the expiration of the Medicare Part B therapy cap exception process, (h)

the effects of additional legislative changes and government regulations, interpretation of

regulations and changes in the nature and enforcement of regulations governing the healthcare industry, (i) the ability of the Company’s

hospitals and nursing centers to adjust to medical necessity reviews, (j) the costs of

defending and insuring against alleged professional liability and other claims (including those related to pending whistleblower and wage and

hour class action lawsuits against the Company) and the

Company’s ability to predict the estimated costs and reserves related to such claims, including the impact of differences in actuarial assumptions and estimates compared

to eventual outcomes, (k) the impact of the Company’s significant level of indebtedness on

the Company’s funding costs, operating flexibility and ability to fund ongoing operations, development capital expenditures or other

strategic acquisitions with additional borrowings, (l) the Company’s ability to

successfully redeploy its capital and proceeds of asset sales in pursuit of its business strategy and pursue its development activities, including through

acquisitions, and successfully integrate new operations, including the realization of

anticipated revenues, economies of scale, cost savings and productivity gains associated with such operations, as and when planned, including

the potential impact of unanticipated issues, expenses and liabilities associated with those

activities, (m) the Company’s ability to pay a dividend as, when and if declared by the Board of Directors, in compliance with applicable

laws and the Company’s debt and other contractual arrangements, (n) the failure of the

Company’s facilities to meet applicable licensure and certification requirements, (o) the further consolidation and cost containment efforts

of managed care organizations and other third party payors, (p) the Company’s ability to

meet its rental and debt service obligations, (q) the Company’s ability to operate pursuant to the terms of its debt obligations, and comply

with its covenants thereunder, and the Company’s ability to operate pursuant to its master

lease agreements with Ventas, Inc. (NYSE:VTR), (r) the condition of the financial markets, including volatility and weakness in the equity,

capital and credit markets, which could limit the availability and terms of debt and equity

financing sources to fund the requirements of the Company’s businesses, or which could negatively impact the Company’s investment

portfolio, (s) the Company’s ability to control costs, particularly labor and employee

benefit costs, (t) the Company’s ability to successfully reduce (by divestiture of operations or otherwise) its exposure to professional liability and

other claims, (u) the Company’s obligations under various laws to self-report

suspected violations of law by the Company to various government agencies, including any associated obligation to refund overpayments to

government payors, fines and other sanctions, (v) national and regional economic, financial,

business and political conditions, including their effect on the availability and cost of labor, credit, materials and other services, (w)

increased operating costs due to shortages in qualified nurses, therapists and other healthcare

personnel, (x) the Company’s ability to attract and retain key executives and other healthcare personnel, (y) the Company’s ability to

successfully dispose of unprofitable facilities, (z) events or circumstances which could result

in the impairment of an asset or other charges, such as the impact of the Medicare reimbursement regulations that resulted in the

Company recording significant impairment charges in the last three fiscal years, (aa) changes

in generally accepted accounting principles (“GAAP”) or practices, and changes in tax accounting or tax laws (or authoritative

interpretations relating to any of these matters), and (bb) the Company’s ability to

maintain an effective system of internal control over financial reporting. Many of these factors are beyond the Company’s control. The Company cautions investors

that any forward-looking statements made by the Company are not guarantees of future performance. The Company

disclaims any obligation to update any such factors or to announce publicly the results of any

revisions to any of the forward-looking statements to reflect future events or developments. The Company has provided information in

this presentation to compute certain non-GAAP measurements for specified periods before

certain charges or on a core basis. A reconciliation of the non-GAAP measurements to the GAAP measurements are included in the

appendix to this presentation and on our website at

www.kindredhealthcare.com under the heading “investors.”

|

3

Special Notice to Public-Siders

THE BORROWER HAS REPRESENTED AND WARRANTED TO THE ARRANGER THAT:

THE INFORMATION IN THIS DOCUMENT DOES NOT CONSTITUTE OR CONTAIN ANY MATERIAL NON-PUBLIC

INFORMATION WITH RESPECT TO THE BORROWER OR ANY PARTY RELATED THERETO (COLLECTIVELY,

“PARTIES”) OR THEIR RESPECTIVE SECURITIES FOR PURPOSES OF UNITED STATES

FEDERAL AND STATE SECURITIES LAWS. However, the information contained in this document

is subject to, and must be kept confidential in accordance with, the Notice to and

Undertaking by Recipients accompanying this document. |

4

Kindred Healthcare’s Management Team

•

Paul J. Diaz, Chief Executive Officer

•

Stephen D. Farber, Executive Vice President and Chief Financial Officer

|

Transaction

Overview 5

*

*

*

*

*

*

*

*

*

* |

Transaction

Summary •

Kindred Healthcare (“Kindred”

or the “Company”) is the largest diversified

provider of post-acute care services in the United States

•

The

Company

is

looking

to

take

advantage

of

favorable

conditions

in

the

leveraged finance markets to refinance its existing debt. The financing will

consist of:

•

New $750 million ABL R/C Facility due 2019

•

New $1,000 million Term Loan B Facility due 2021

•

Other unsecured indebtedness

•

The refinancing will improve the maturity profile, reduce interest expense

and provide operational flexibility of the Company

•

Pro

forma

for

the

transaction,

senior

secured

and

total

leverage

will

be

3.18x

and

4.58x,

respectively,

based

on

12/31/13

Adjusted

EBITDA

of

$361

million

6

(1)

See Appendix for non-GAAP reconciliation.

1 |

Sources &

Uses and Pro Forma Capitalization ($M)

12/31/13

12/31/13

Pro forma

Cash

$36

$36

Existing ABL

256

-

New ABL

-

153

Existing Term Loan B

(1)

777

-

New Term Loan B

-

1,000

Total Secured Debt

$1,033

$1,153

8.250% Senior Notes

550

-

Other Unsecured Debt

-

500

Other Debt

5

5

Total Debt

$1,588

$1,658

FY 2013 Adjusted EBITDA

(2)

$361

$361

FY 2013 LTM Rent Expense

$318

$318

FY 2013 Adjusted EBITDAR

(2)

$679

$679

Secured Debt / EBITDA

2.86x

3.19x

Net Secured Debt / EBITDA

2.76x

3.09x

Total Debt / EBITDA

4.40x

4.59x

Net Debt / EBITDA

4.30x

4.49x

Adjusted Debt

(3)

/ EBITDAR

5.15x

5.25x

Net Adjusted Debt

(3)

/ EBITDAR

5.10x

5.20x

Sources & Uses

Pro Forma Capitalization

7

(1)

Net of $6M OID.

(2)

See Appendix for Non-GAAP reconciliation.

(3)

Calculated with 6.0x cap rate.

Sources ($M)

New ABL R/C

$153

New Term Loan B

1,000

Other Unsecured Debt

500

Total

$1,653

Uses ($M)

Refi existing ABL R/C

$256

Refi existing Term Loan B

783

Refi Unsecured Debt

590

Fees and expenses

24

Total

$1,653

(1)

We continue evaluate options available with respect to refinancing the senior

unsecured indebtedness, including through the incurrence of additional

senior secured indebtedness and/or new unsecured indebtedness

1 |

Borrower

Kindred Healthcare, Inc. (“KND” or the “Borrower”)

Facility

$1,000.0 million Senior Secured Term Loan B

Tenor

7 years

Guarantors

Substantially all existing and future wholly-owned domestic subsidiaries

Security

First priority claim on the equipment, inventory, fixtures, IP, real property (excluding leaseholds),

Capital stock (100% of domestic and 66% of foreign stock) and investment property

Second priority claim on the ABL collateral (eligible accounts receivable, cash, securities accounts,

deposit accounts, books and records related to and proceeds of the foregoing)

Pricing

L+300 bps / 1.00% LIBOR floor / 99.50 - 99.75 OID

Call protection

101 soft call for 6 months; prepayable at par thereafter

Incremental

$100.0mm (shared with ABL R/C) + unlimited amount up to 3.50x secured leverage net of up to $100.0mm

of cash Amortization

1% per annum, payable in quarterly installments, with remainder at maturity

Financial covenants

Maximum total adjusted leverage ratio: 5.75x

Minimum consolidated fixed charge coverage ratio: 1.25x

Maximum capex: $300.0 million per annum

Summary Terms:

Term Loan B

8 |

Kindred Healthcare,

Inc. (“KND” or the “Borrower”) Borrower

Facility

$750.0 million ABL Revolving Credit Facility (“ABL R/C”)

Tenor

5 years

Guarantors

Substantially all existing and future wholly-owned domestic subsidiaries

Security

First priority claim on eligible accounts receivable, cash, securities accounts, deposit accounts,

books and records related to and proceeds of the foregoing

Drawn pricing

L+200 - 250 bps, depending on availability

Undrawn pricing

37.5 bps

Incremental

$100.0mm (shared with Term Loan B) + unlimited amount up to 3.50x secured leverage net of up to

$100.0mm of cash Financial covenants

Minimum consolidated fixed charge coverage ratio: 1.25x

Maximum capex: $300.0 million per annum

Upfront costs

25.0 bps

Summary Terms:

ABL Revolving Credit Facility

9 |

Date

Event

March 12th

Lender call

March 25th

March 26th

Commitments due from Term Loan B Lenders

Commitments due from ABL R/C Lenders

April 9th

Closing and funding

Key syndication event

Timetable

March 2014

April 2014

S

M

T

W

T

F

S

S

M

T

W

T

F

S

1

1

2

3

4

5

2

3

4

5

6

7

8

6

7

8

9

10

11

12

9

10

11

12

13

14

15

13

14

15

16

17

18

19

16

17

18

19

20

21

22

20

21

22

23

24

25

26

23

24

25

26

27

28

29

27

28

29

30

30

31

10 |

Company

Overview 11

*

*

*

*

*

*

*

*

*

* |

Kindred

Healthcare’s Diversified Business and Revenue Mix

(1) Revenues for the twelve months ended December 31, 2013 (before intercompany

eliminations). (2) As of December 31, 2013.

(3) For the twelve months ended December 31, 2013.

$5.1

billion

total

revenues

(1)

2,280

locations,

310

facilities

in

47

states

(2)

500,000

patients

and

residents

(3)

63,000

dedicated

employees

(2)

40%

($2.0 billion)

Medicare

Medicaid

Revenue

Mix

(1)

Business

Mix

(1)

21%

($1.1 billion)

Business-to-

Business

Commercial

Insurance/

Private

11%

($0.6 billion)

28%

($1.4 billion)

25%

($1.3 billion)

21%

($1.1 billion)

49%

($2.5 billion)

Hospitals

(LTAC/IRF)

RehabCare

Nursing and

Rehabilitation

Centers

5%

($0.2 billion)

Care

Management

12 |

Leading

Diversified Post-Acute Provider With Focus on Developing

Integrated Care Market Capabilities

Transitional Care Hospitals (101)

Inpatient Rehabilitation Hospitals (5)

Hospital-Based Acute Rehab Units (104)

Nursing and Rehabilitation Centers (100)

RehabCare Total Sites of Service (1,789)

Home Health, Hospice and Private Duty

in 16 Integrated Care Markets (159)

Regional Support Centers

As of December 31, 2013

Integrated Care Market (12)

Targeted Integrated Care Market (10)

13 |

Kindred’s

Value Proposition and our •

Be a leader in helping to coordinate and deliver high quality care at the

lowest

cost

(particularly

for

those

patients

who

are

the

highest

users

of

healthcare

services)

–

By providing superior clinical outcomes in the most appropriate setting, with

an approach which is patient-centered, disciplined and transparent

•

Lower healthcare costs by reducing rehospitalizations and lengths-of-stay

in acute care hospitals and throughout an episode of care

–

By transitioning patients home at the highest possible level of function

and wellness

•

Participate in the development of new care delivery and payment models

–

To better coordinate care and manage patients with chronic conditions,

including the dual-eligibles, with our partners through our integrated care

management teams and protocols

14

“Continue

The

Care”

Campaign |

…

and More Quickly…

(Reducing Average

Length-of-Stay)

2

Sending More Patients

Home…

1

Kindred Healthcare

Delivering on Quality, Value and Innovation in Patient Care Delivery

Outperforming

National Quality Benchmarks

500,000

Patients and Residents were

cared for in settings across the

continuum

Kindred Hospitals, Nursing Centers, and Home Health and Hospice

continue to improve on quality indicators and beat industry benchmarks

…

Reducing

Rehospitalization

2

•

56%

of

our

Nursing

Center

patients go home

after

32

days

•

70%

of

our

Hospital

patients

go home or to a Lower Level

of

Care

after

27

days

Reduced the total average length

of stay

•

by

10.3%

in

our

Hospitals

•

by

11%

in

our

Nursing

Centers

Kindred Hospitals reduced

rehospitalization rates by

14%

Kindred Nursing Centers have

reduced rehospitalization rates by

15%

(1)

2013 results

(2)

Same-store comparison 2013 to 2009

15 |

117

106

100

44

27

19

16

0

20

40

60

80

100

120

140

Hospital Division

$2.5 billion Revenues

(1)

$545 million Operating Income

(2)

Transitional Care Hospitals (certified as LTAC hospitals)

•

101 Transitional Care Hospitals

(3)

•

7,315 licensed beds

(3)

Inpatient Rehabilitation Hospitals (IRFs)

•

5 IRFs

(3)

•

215 licensed beds

(3)

(1)

Revenues for the twelve months ended December 31, 2013 (divisional revenues before

intercompany eliminations).

(2)

Operating income for the twelve months ended December 31, 2013.

(3)

As of December 31, 2013.

(4)

Before certain disclosed items.

#2 Operator of Long-Term Acute

Care Hospitals and Inpatient

Rehabilitation Facilities

•

Consistently outperforms national benchmarks on key

quality indicators

•

Sale of 16 facilities to Vibra Healthcare, LLC

—Divestiture of 14 Transitional Care Hospitals, 1 inpatient

rehabilitation hospital and 1 skilled nursing facility

—$180 million of net sales proceeds

•

In Q4 2013, cost per patient day outpaced revenue compared

to Q4 2012, which resulted in an operating income margin

decline

to

21.9%

from

22.9%

(4)

•

Q4 2013 operating income declined to $135 million versus

$148

million

last

year

(4)

6%

33%

Medicare

Medicaid

Insurance/Other

Revenue

Mix

(1)

61%

16 |

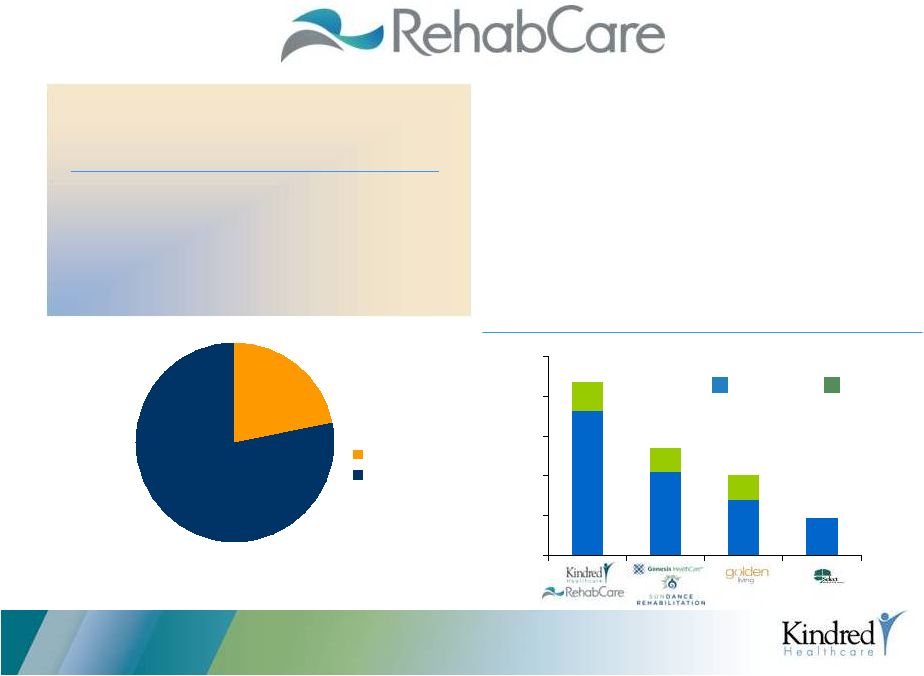

•

2,185 sites of service served through

20,300

therapists

(3)

•

Including 104 hospital-based acute

rehabilitation

units

(3)

#1 Contract Rehab Manager

Third Party

Affiliated

•

Provides a compelling value proposition to our Hospital

(HRS) and Skilled Nursing (SRS) partners through

advanced tech systems, clinical programs and highly

trained therapist team

•

Q4

2013

operating

margin

at

10.2%

(4)

,

showing

stability

while implementing significant recent Medicare rule

changes

•

In October 2013, acquired TherEX which provides

on-site, hospital-based rehabilitation services in 11 states

$1.3

billion

Revenues

(1)

$142

million

Operating

Income

(2)

Business

Mix

(1)

HRS

SRS

22%

$0.3 billion

78%

$1.0 billion

(1)

Revenues for the twelve months ended December 31, 2013 (divisional revenues

before intercompany eliminations).

(2)

Operating income for the twelve months ended December 31, 2013.

(3)

As of December 31, 2013.

(4)

Before certain disclosed items

1,903

1,042

700

471

282

300

0

500

1,000

1,500

2,000

2,500

2,185

1,350

1,000

471

17

308 |

Revenue

Mix

(1)

Nursing Center Division

48 Transitional Care Centers (Sub-Acute facilities licensed

as

SNFs)

(3)

13 Nursing and Rehabilitation Centers

(with

Transitional

Care

Units)

(3)

12

Hospital-Based

Sub-Acute

Units

(3)

39

Skilled

Nursing

Centers

(Traditional

SNFs)

(3)

•

Challenging operating environment

under RUGs IV rules and ongoing

Medicaid rate pressures

•

Divestiture or non-renewal of 123

nursing centers proceeding toward

completion

•

New Transitional Care Centers

(“TCCs”) and hospital based sub-acute

core growth continuing

•

Division overhead restructuring near

completion, allowing for a smaller, but

more profitable business

•

HCP transaction to acquire real estate

will eliminate $9 million of annual rent

for the Nursing Center Division

37%

34%

29%

Medicaid

Medicare

Private/Other

$1.1

billion

Revenues

(1)

$140

million

Operating

Income

(2)

(1)

Revenues for the twelve months ended December 31, 2013 (divisional revenues

before intercompany eliminations).

(2)

Operating income for the twelve months ended December 31, 2013.

(3)

As of December 31, 2013.

18 |

•

Acquired Senior Home Care which operated 47

home health locations throughout Florida and

Louisiana with $143 million in revenue

•

Building management team, including sales,

clinical operations and IT capabilities to support

accelerated expansion

•

While implementation of Homecare Homebase

IT system contributed to performance issues in

2013, all branches (including Senior Home Care)

will be fully operational and standardized by Q1

2014

•

Q4 2013 revenues of $66 million

19

Including our key affiliates:

•Senior Home Care

•IntegraCare

•Professional Healthcare at

Home •Signature Health

Services •Acclaim Hospice

and Palliative Care •

209 sites of service in 13 states

•

67 in Kindred’s Integrated Care Markets

•

4,940

caregivers serving over 17,000

patients on a daily basis

Care Management Division/Kindred At Home

$354

million

Pro

Forma

Annualized

Revenues

(1

)

Care Management Division and

(1)

Includes historical results of Senior Home Care acquisition, plus Kindred at Home revenues for

the twelve months ended December 31, 2013 (divisional revenues before intercompany

eliminations). Commercial

Insurance/

Other

($68 million)

Private Duty

Hospice

Home Health

Revenue Mix

(1)

Business Mix

(1)

80%

15%

5%

Medicaid

($13 million)

Medicare

($273 million)

4%

77%

19% |

Kindred’s

Five-Year Strategic Plan Creating Value for Patients, Payors, Teammates and

Shareholders Fee-For-Service World

Succeed Today

in a

Value-Based Payment World

Prepare for a Future

Succeed In

The Core

Reposition

Portfolio

Aggressively Grow

Kindred at Home,

RehabCare, and

Assisted Living

Business

Develop Care

Management

Capabilities

Advance

Integrated Care

Market Strategy

Improve Capital

Structure and Enhance

Shareholder Returns

1

2

3

4

5

6

–

In Integrated

Care Markets

–

Redeploy

Capital to

Higher

Margin

Businesses

–

To Operationalize

Continue

The

Care

–

Support new Risk-

Based Payment

Arrangements

–

People Services

–

Quality and

Clinical

Outcomes

–

Organic Growth

–

Manage Cost

and Capital

–

Partner with

Hospitals, Payors

and ACOs

–

Continue to Delever

–

Acquire Facility Real

Estate

–

Grow Dividend

20 |

Executing on

Kindred’s 5-Year Strategic Plan •

People Initiatives (Led by new Chief People Officer)

–

Increase Teammate Engagement and Satisfaction

–

Leadership Development, especially leaders who can operate across silos

–

Reduce Turnover / Improve Retention

–

Advance Culture of Patient Safety

–

Lead move to Shared Services Model

•

Quality and Organizational Excellence, especially at a time of constrained resources and

system-wide change

–

Develop Quality Indicators and Clinical Programs that support Continue-the-Care and

patient transitions and improve clinical outcomes

–

Re-energize Performance Improvement Programs

•

Growth (Sales and Marketing / Managed Care)

•

Cost Effectiveness, including overhead re-sizing and transformation (e.g. Project

Apollo) •

Capital Management, with specific focus on cash to fund development and/or shareholder return

strategy

Despite $100 million of reimbursement cuts in 2013, and significant

organizational change, the Company is executing well on its People,

Clinical and Financial Goals

Succeed in the Core

1

21 |

2010 A

2013 A

2014 E

Change in Business Mix, Increased Facility Ownership and Reduction

in Lease Obligations Significantly Improves Future Growth and

Profitability

Repositioning

Strategy

2

Executing on Kindred’s 5-Year Strategic Plan

(1) Revenue before intercompany eliminations; (2) Leases capitalized using 6x rent;

Equity represents market cap as of 12/31 and Funded Debt as of 12/31 of each year.

Business

Mix

Owned vs

Leased

Facilities

(1)

Nursing

47%

Hospital

42%

Rehab

10%

Care

Mgmt

1%

Nursing

21%

Hospital

49%

Rehab

25%

Care

Mgmt

5%

Nursing

21%

Hospital

48%

Rehab

24%

Care

Mgmt

7%

NCD

63%

NCD Owned

9%

HD

Owned

5%

HD

23%

NCD

36%

NCD

Owned

13%

HD

Owned

9%

HD

42%

NCD

35%

NCD

Owned

15%

HD

Owned

9%

HD

41%

Equity

23%

Funded

Debt

11%

Capitalized

Leases

66%

Equity

23%

Funded

Debt

35%

Capitalized

Leases

42%

Equity

25%

Funded

Debt

32%

Capitalized

Leases

43%

22

Capital

Structure

(2) |

TherEX

Acquisition completed in October 2013 to Expand RehabCare’s Hospital (IRF) Business

and Home Care Acquisitions Advance Care Management Capabilities

Aggressively Grow Kindred

at Home and RehabCare

3

Executing on Kindred’s 5-Year Strategic Plan

•

209 sites of service in 13

states

•

67

in Kindred’s Integrated

Care

Markets

(1)

•4,940 caregivers serving over

17,000 patients on a daily

basis

Care Management

Division/Kindred At

Home $354 million Pro

Forma Annualized

Revenues

(1)

23

•

Acquired Senior Home Care

–

Operated 47 home health locations throughout Florida and Louisiana,

with $143 million in revenues

–

$95 million purchase price

–

$0.07 to $0.09 EPS accretion anticipated in 2014

•

While implementation of Homecare Homebase IT

system contributed to performance issues in 2013,

all branches (including Senior Home Care) will be

fully operational and standardized by Q1 2014

•

Building management team, clinical operations, and

functional support to enable platform for continued

growth

(1)

Revenues

based

upon

historical

Sr.

Home

Care

results

plus

actual

Kindred

at

Home

operations

for

the

twelve

months

ended

December

31,

2013

(divisional

revenues

before

intercompany

eliminations). |

24

Kindred’s Patient-Centered Care Management Model

4 |

Boston

Cleveland

Indianapolis

Las Vegas

Houston

“New”

Dallas/Fort

Worth

Single Market

Leadership

Incentive Alignment

Post-Acute

Physician

Leadership

Standardized

Quality Measures

Centralized

Placement and

Admissions

Dedicated Care

Managers

I-T Interoperability /

Info Sharing

Integrated Care Market Strategy

Market Implementation Update

Advance Integrated Care

Market Strategy and

Implement Care

Management

Capabilities

5

Executing on Kindred’s 5-Year Strategic Plan

25 |

•

Purchased

Tampa

Hospital

and

Bridgewater

TCC

Real

Estate

for

$35

million

•

Purchased certain facilities leased from HCP REIT

•

In

February

2014,

completed

the

acquisition

of

9

skilled

nursing

facilities

for

a

total

of

$83

million

•

Facilities have been removed from master lease expiring January 31, 2017, thereby eliminating

annual rent escalator

•

Transaction expected to be accretive to earnings $0.04 and cash flow $4.3 million in

2014 •

Ownership provides additional flexibility with regard to strategic decisions:

Expansion/Relocation/Repurposing

Disposition of facilities deemed non-strategic and/or underperforming

•

Proposed refinancing will reduce annual interest costs, extend maturities, and improve

covenant flexibility

•

Announced quarterly dividend of $0.12 per share, reflecting the Company’s confidence in its

ability to generate meaningful and sustainable Free Cash Flow

Improve Capital

Structure and

Enhanced Returns

6

Real Estate Purchases, Improved Senior Financing

Arrangements and Dividend Initiation

Executing on Kindred’s 5-Year Strategic Plan

26 |

Legislative and Financial Review

27

*

*

*

*

*

*

*

*

* |

LTAC

Legislation Enacted Providing Long Term Strategic Opportunity and Visibility

•

Key Provisions, Timeline and

Preliminary View of Impact

•

Strategic Considerations and

Opportunities

6%

33%

Medicare Fee For Service

Medicaid

Insurance/Medicare

Advantage/Other

61%

The Bipartisan Budget Act of 2013, signed by the President

on December 26, brings long-sought patient and facility

criteria to long-term care hospitals

Hospital

Division

Revenue

Mix

(1)

(1)

Revenues for the twelve months ended December 31, 2013 (divisional revenues before

intercompany eliminations). 28 |

Overview of Key Payment Provisions

in LTAC Criteria Legislation

•

Definition of Patients Eligible for LTAC Rate

–

Patients

will

continue

to

be

eligible

for

payment

under

the

current

LTAC

PPS

if

they

meet

either

one

of

two criteria: patients with 3 or more days in an acute care hospital Intensive Care

Unit (ICU); or patients receiving

“prolonged

mechanical

ventilation”

(greater

than

96

hours)

in

the

LTAC

•

Definition of Patients Eligible for “Site Neutral”

Rate

–

Other

medically

complex

patients

may

still

be

admitted

to

LTACs

and

receive

a

“site

neutral”

rate

that

is

either

at

LTAC

cost

or

at

a

per

diem

rate

“comparable”

to

payments

made

to

acute

care

hospitals

under

the IPPS payment system

•

Effective Date and Phase-In

–

Effective date: Two-year Phase-in of criteria begins after October 1, 2015, linked to

each LTAC’s cost- reporting period

–

About 70% of Kindred LTACs have cost-reporting periods that begin July of each year;

phase-in of new criteria would not begin for most Kindred LTACs until Summer

2016 –

During

phase-in,

cases

receiving

“site

neutral”

rate

get

paid

50%

based

on

current

LTAC

rate

and

50%

based on the “site neutral”

rate

The

new

criteria

would

not

become

fully

effective

until

Summer

2018

for

most

Kindred

LTACS.

29 |

Other

Key Provisions •

25 Day Length of Stay Requirement

–

Will not

apply to cases receiving the “site neutral”

rate

–

Will not

apply to Medicare Advantage Cases

–

Taken together, these provisions create a platform for effective

care management, managed care

products and better align payment with clinical outcomes

•

25% Rule Relief (effective immediately)

–

25% Rule does not apply to free-standing LTACs* for four years

–

25% Rule compliance level frozen at 50% for HIH LTACs for four years (75% for rural / MSA

dominant LTACs)

•

Moratorium

–

Effective January 1, 2015 through 2017

•

Compliance Threshold

–

Beginning in 2020, at least 50% of patients must be paid at LTAC

rate to maintain Medicare

Certification as an LTAC

* certified prior to October 1, 2004

30 |

31

2014

2015

2016

2017

2018

Oct. 1

July 1

Oct. 1

July 1

Oct. 1

July 1

Oct. 1

July 1

Oct. 1

July 1

1. Patient Criteria

2. Site Neutral IPPS

Equivalent Rate:

•

50/50 Blend

•

Full Site Neutral

Rate

3. 25-Day Length of Stay

Rule Relief

4. 25% Rule Relief

5. Moratorium

6. “50%”

Compliance

Test

2020

LTAC Legislation Phase-in and Timeline for the

Majority of Kindred’s Hospitals

Jan 1, 2014

Jan 1, 2015

Summer 2016

Summer 2016

Summer 2016

Summer

2018 |

Strategic Considerations

•

Affirms role of LTACs in healthcare continuum for severely ill, medically

complex patients at LTAC rate and many other medically complex patients

at site neutral rate.

•

Creates strategic platform for “managed care”

and “episodic”

LTAC services

–

Elimination of 25-day length of stay requirement for MA patients

–

Direct admits to LTACs at site neutral IPPS comparable rates

–

Continued development of co-located Sub-Acute Units to create patient

care continuum for recovering critically chronically ill patients in need of

inpatient and rehabilitation services

•

Opportunity to develop clinical programs and services that better align cost

and care (including risk-based arrangements) over the implementation

period to appeal to ACOs, managed care organizations and others

LTAC legislation provides significant clarity and will allow Kindred to

organically grow patient volumes and leverage existing capacity.

32 |

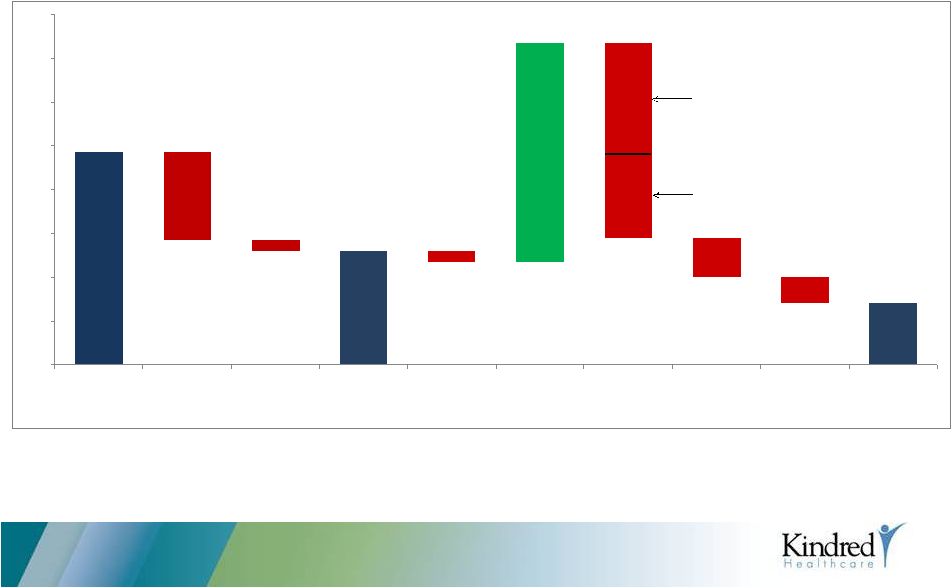

Cash

Sources/Uses 2013 $243

$130

$130

$117

$117

$144

$100

($29)

$71

($101)

($12)

($13)

$251

($96)

($44)

($128)

$0

$50

$100

$150

$200

$250

$300

$350

$400

Adj cash from

operations

Routine

CAPEX

Development

(De Novo

Facilities)

Free cash flow

Dividends

Proceeds from

asset sales

Acquisitions

One-time

payments

Cornerstone/ Net pay down

other

of debt

Home Health,

Rehab and other

Real Estate

33 |

Net Free Cash

Flows 2014 Mid-Point of Guidance (As of February 20, 2014)

(a)

The guidance for cash flows excludes the effect of (1) payments for litigation, (2) any other

reimbursement changes and (3) any further acquisition or divestitures (except as

otherwise noted). (b)

Includes approximately $36 million of working capital cash release for VTR 59.

$260

($22)

$135

$109

$109

($103)

($26)

$0

$50

$100

$150

$200

$250

$300

Cash Flow from

Operations

(a)(b)

Routine

Capital Spending

Development

Capital Spending

Free Cash Flow

Dividends

Net Cash (a)

34 |

Attractive

Investment Considerations Kindred Substantially Repositioned Going Into 2015

35

•

Repositioned to faster growth, higher

margin and less capital intensive businesses

•

Through repositioning, $1 billion of

revenues shifted from Nursing Centers

to

Hospital, Rehab and Home Health Care

since 2011.

1)

As of 12/31/13

2)

Pro Forma 2014 rents of $338M at 6x

Improving Business

Mix

(Revenues)

Enhanced Future

Earnings, Margin and

Free Cash Flow

Profile

(as of February 20, 2014)

($ in millions)

•

$125 million -

$145 million of free cash

flows

•

$80 million of ABL Revolver net paid down

since June 2013

•

$700 million reduction in lease adjusted

obligations

Improved Capital

Structure

($ in millions)

•

Enterprise EBITDAR Multiple: 6.4x

•

Dividend Yield: 2.4%

•

Free

Cash

Flow

Yield

4

:

12.6%

•

TAD / EBITDAR: 4.9x

3)

Market

value

calculated

as

of

close

of

business

on

12/31/13

($19.74).

4) Free Cash Flow Yield represents free cash flow mid-point divided by Market

Value of Equity. 2010

2014E

Hospital Services

42%

48%

Rehab Services

10%

24%

Nursing Center

47%

21%

Care Management /

Home Health Care

1%

7%

Total

100%

100%

EBITDAR

Cash Flows from

Operations

CAPEX

Free Cash Flow

Outstanding Share Count

Dividend

$120 -

$130

$725 -

$742

$26

$125 -

$145

$245 -

$275

54 million

Funded debt

1

$1,588

Lease obligations

2

$2,028

Total adjusted debt (TAD)

$3,616

Market value of equity

3

$1,069

Enterprise Value

$4,685 |

Investment

Rationale •

Each year, nearly 9 million people –

24,000 a day –

are discharged from short-

term acute care hospitals and require some form of post-acute care

•

As the largest diversified post-acute provider, Kindred is uniquely positioned to

grow and succeed in what will be an increasingly integrated healthcare delivery

system

•

Kindred has a track record of providing quality, cost-effective care, operational

excellence and consistent levels of free cash flows

•

Our experienced management team, robust technology platform, and

demonstrated ability to adapt to change, together with our development and

repositioning strategy, offer the potential for creating significant value for

shareholders over time

36 |

37

*

*

*

*

* |

Appendix

38

*

*

*

*

*

*

*

*

*

* |

2014 Earnings

Guidance ($ millions, except statistics)

As of February 20, 2014

Low

High

Operating income

725

$

742

$

Rent

338

338

Depreciation and amortization

165

165

Interest, net

106

106

Income from continuing operations before income taxes

116

133

Provision for income taxes

45

52

Income from continuing operations

71

81

Earnings attributable to noncontrolling interests

(13)

(13)

Income from continuing operations attributable to the Company

58

68

Allocation to participating unvested restricted stockholders

(2)

(2)

Available to common stockholders

56

$

66

$

Earnings per diluted share

1.05

$

1.25

$

Shares used in computing earnings per diluted share

53.2

53.2

The earnings guidance excludes the effect of reimbursement changes, severance and retirement

costs, litigation costs, transaction-related costs, any further acquisitions or

divestitures (except as otherwise noted), any impairment charges, and any repurchases

of common stock. 39 |

Explanation of

Non-GAAP Measures 40

The enclosed presentation includes financial measures referred to as operating income, or

earnings before interest, income taxes, depreciation, amortization and rent. The

Company’s management uses operating income as a meaningful measure of operational performance in addition to other measures. The

Company uses operating income to assess the relative performance of its operating divisions as

well as the employees that operate these businesses. In addition, the Company believes

this measurement is important because securities analysts and investors use this measurement to compare the Company’s

performance to other companies in the healthcare industry. The Company believes that income

(loss) from continuing operations is the most comparable GAAP measure. Readers of the

Company’s financial information should consider income (loss) from continuing operations as an important measure of the

Company’s financial performance because it provides the most complete measure of its

performance. Operating income should be considered in addition to, not as a substitute

for, or superior to, financial measures based upon GAAP as an indicator of operating performance. A reconciliation of operating income to

income (loss) from continuing operations is provided in the enclosed Appendix.

In addition to the results provided in accordance with GAAP, the Company provides information

in the enclosed presentation compute certain non-GAAP measurements before certain

charges or on a core basis. The charges that were excluded from core operating results are denoted in the tables in the enclosed

Appendix. The use of these non-GAAP measurements are not intended to replace the

presentation of the Company's financial results in accordance with GAAP. The Company

believes that the presentation of core operating results provides additional information to investors to facilitate the comparison between

periods by excluding certain charges that the Company believes are not representative of its

ongoing operations due to the materiality and nature of the charges. The Company's core

operating results also represent a key performance measure for the purpose of evaluating performance internally. . The Compan

believes that income (loss) from continuing operations is the most comparable GAAP measure.

Readers of the Company’s financial information should consider income (loss) from

continuing operations as an important measure of the Company’s financial performance because it provides the most complete measure of

its performance.

The Company also includes the financial measure of free cash flows excluding certain

items. The Company recognizes that free cash flows excluding certain items is a

non-GAAP measurement and is not intended to replace the presentation of the Company’s cash flows in accordance with GAAP. The Company

believes that this non-GAAP measurement provides important information to investors

related to the amount of discretionary cash flows that are available for other

investing and financing activities. In addition, management uses free cash flows excluding certain items in making decisions related to acquisitions,

development capital expenditures, dividends, long-term debt repayments and other uses. The

Company believes net cash flows provided by operating activities is the most comparable

GAAP measure. Readers of the Company’s financial information should consider net cash flows provided by operating

activities as an important measure of the Company’s financial performance because it

provides the most complete measure of its performance. Free cash flows excluding certain

items should be considered in addition to, not as a substitute for, or superior to, financial measures based upon GAAP as an indicator of

operating performance. A reconciliation of net cash flows provided by operating activities to

free cash flows excluding certain items is included in the enclosed Appendix.

|

Reconciliation

of

Non-GAAP

Measures

(in

thousands)

41

2012 Quarters

2013 Quarters

First

Second

Third

Fourth

Year

First

Second

Third

Fourth

Year

Revenues:

Hospital division

679,813

$

645,714

$

633,972

$

645,426

$

2,604,925

$

674,363

$

621,454

$

606,488

$

619,344

$

2,521,649

$

Nursing center division

274,358

269,986

273,265

274,807

1,092,416

275,141

269,501

270,210

274,908

1,089,760

Rehabilitation division:

Skilled nursing rehabilitation services:

253,370

253,013

252,134

244,485

1,003,002

257,557

248,321

243,974

241,938

991,790

Hospital rehabilitation services

74,369

73,402

71,899

73,910

293,580

74,523

69,777

68,296

74,017

286,613

327,739

326,415

324,033

318,395

1,296,582

332,080

318,098

312,270

315,955

1,278,403

Care management division

28,432

28,872

35,943

50,093

143,340

51,621

53,039

53,801

66,466

224,927

1,310,342

1,270,987

1,267,213

1,288,721

5,137,263

1,333,205

1,262,092

1,242,769

1,276,673

5,114,739

Eliminations:

Skilled nursing rehabilitation services:

(27,888)

(27,551)

(27,037)

(26,123)

(108,599)

(29,303)

(29,257)

(28,698)

(28,728)

(115,986)

Hospital rehabilitation services

(24,686)

(24,225)

(23,666)

(24,200)

(96,777)

(24,362)

(23,855)

(23,080)

(22,696)

(93,993)

Nursing centers

(636)

(875)

(861)

(1,006)

(3,378)

(1,213)

(1,001)

(1,161)

(875)

(4,250)

(53,210)

(52,651)

(51,564)

(51,329)

(208,754)

(54,878)

(54,113)

(52,939)

(52,299)

(214,229)

1,257,132

$

1,218,336

$

1,215,649

$

1,237,392

$

4,928,509

$

1,278,327

$

1,207,979

$

1,189,830

$

1,224,374

$

4,900,510

$

Income (loss) from continuing operations:

Operating income (loss):

Hospital division

151,784

$

132,358

$

131,041

$

147,041

$

562,224

$

150,043

$

132,170

$

113,014

$

127,929

$

(a)

523,156

$

Nursing center division

34,067

36,215

38,960

32,016

141,258

29,844

36,678

32,146

36,694

135,362

Rehabilitation division:

Skilled nursing rehabilitation services:

10,679

19,351

16,929

21,001

67,960

12,046

20,297

(8,565)

12,918

(b)

36,696

Hospital rehabilitation services

16,116

17,860

16,977

18,792

69,745

18,132

19,573

18,215

18,005

(c)

73,925

26,795

37,211

33,906

39,793

137,705

30,178

39,870

9,650

30,923

110,621

Care management division

2,341

2,789

3,645

4,933

13,708

2,786

3,961

1,085

2,131

(d)

9,963

Corporate:

Overhead

(42,728)

(44,723)

(45,883)

(45,729)

(179,063)

(45,582)

(43,199)

(39,151)

(48,563)

(e)

(176,495)

Insurance subsidiary

(482)

(600)

(545)

(500)

(2,127)

(509)

(384)

(482)

(539)

(1,914)

(43,210)

(45,323)

(46,428)

(46,229)

(181,190)

(46,091)

(43,583)

(39,633)

(49,102)

(178,409)

Impairment charges

(356)

(108)

(376)

(108,113)

(108,953)

(187)

(438)

(441)

(76,127)

(77,193)

Transaction costs

(485)

(597)

(482)

(667)

(2,231)

(944)

(108)

(613)

(447)

(2,112)

Operating income

170,936

162,545

160,266

68,774

562,521

165,629

168,550

115,208

72,001

521,388

Rent

(76,092)

(77,379)

(78,485)

(78,222)

(310,178)

(78,134)

(78,970)

(78,410)

(82,563)

(318,077)

Depreciation and amortization

(39,098)

(40,318)

(40,973)

(42,296)

(162,685)

(42,322)

(39,303)

(37,267)

(38,437)

(157,329)

Interest, net

(26,288)

(26,455)

(26,452)

(27,683)

(106,878)

(28,084)

(27,609)

(24,399)

(23,906)

(103,998)

Income (loss) from continuing operations

before income taxes

29,458

18,393

14,356

(79,427)

(17,220)

17,089

22,668

(24,868)

(72,905)

(58,016)

Provision (benefit) for income taxes

12,083

7,820

6,022

3,782

29,707

6,391

9,103

(7,530)

(21,168)

(13,204)

17,375

$

10,573

$

8,334

$

(83,209)

$

(46,927)

$

10,698

$

13,565

$

(17,338)

$

(51,737)

$

(44,812)

$

(a)

Includes costs of $0.5 million in connection with the closing of

a TC hospital and a litigation charge of $7.0 million.

(b)

Includes $0.1 million of severance and retirement costs.

(c)

Includes $1.1 million of severance and retirement costs.

(d)

Includes $0.1 million of severance and retirement costs.

(e)

Includes $2.4 million of severance and retirement costs. |

42

Three months ended December 31, 2013

Charges

Severance

Facility

Before

and retirement

closing

Impairment

Transaction

As

charges

costs

costs

Litigation

charges

costs

Total

reported

Income (loss) from continuing operations:

Operating income (loss):

Hospital division

135,428

$

-

$

(499)

$

(7,000)

$

-

$

-

$

(7,499)

$

127,929

$

Nursing center division

36,694

-

-

-

-

-

-

36,694

Rehabilitation division:

Skilled nursing rehabilitation services

13,057

(139)

-

-

-

-

(139)

12,918

Hospital rehabilitation services

19,093

(1,088)

-

-

-

-

(1,088)

18,005

32,150

(1,227)

-

-

-

-

(1,227)

30,923

Care management division

2,206

(75)

-

-

-

-

(75)

2,131

Corporate:

Overhead

(46,202)

(2,361)

-

-

-

-

(2,361)

(48,563)

Insurance subsidiary

(539)

-

-

-

-

-

-

(539)

(46,741)

(2,361)

-

-

-

-

(2,361)

(49,102)

Impairment charges

(45)

-

-

-

(76,082)

-

(76,082)

(76,127)

Transaction costs

-

-

-

-

-

(447)

(447)

(447)

Operating income

159,692

(3,663)

(499)

(7,000)

(76,082)

(447)

(87,691)

72,001

Rent

(82,563)

-

-

-

-

-

-

(82,563)

Depreciation and amortization

(38,437)

-

-

-

-

-

-

(38,437)

Interest, net

(23,906)

-

-

-

-

-

-

(23,906)

Income (loss) from continuing operations

before income taxes

14,786

(3,663)

(499)

(7,000)

(76,082)

(447)

(87,691)

(72,905)

Provision (benefit) for income taxes

4,064

(1,443)

(202)

(5,455)

(17,803)

(329)

(25,232)

(21,168)

10,722

$

(2,220)

$

(297)

$

(1,545)

$

(58,279)

$

(118)

$

(62,459)

$

(51,737)

$

Three months ended December 31, 2012

Charges

Lease

Before

Severance

Impairment

Transaction

cancellation

As

charges

and other

charges

costs

charges

Total

reported

Income (loss) from continuing operations:

Operating income (loss):

Hospital division

147,730

$

(689)

$

-

$

-

$

-

$

(689)

$

147,041

$

Nursing center division

33,917

(1,901)

-

-

-

(1,901)

32,016

Rehabilitation division:

Skilled nursing rehabilitation services

21,318

(317)

-

-

-

(317)

21,001

Hospital rehabilitation services

18,889

(97)

-

-

-

(97)

18,792

40,207

(414)

-

-

-

(414)

39,793

Care management division

5,083

(150)

-

-

-

(150)

4,933

Corporate:

Overhead

(44,680)

(1,049)

-

-

-

(1,049)

(45,729)

Insurance subsidiary

(500)

-

-

-

-

-

(500)

(45,180)

(1,049)

-

-

-

(1,049)

(46,229)

Impairment charges

(214)

-

(107,899)

-

-

(107,899)

(108,113)

Transaction costs

-

-

-

(667)

-

(667)

(667)

Operating income

181,543

(4,203)

(107,899)

(667)

-

(112,769)

68,774

Rent

(78,046)

-

-

-

(176)

(176)

(78,222)

Depreciation and amortization

(42,296)

-

-

-

-

-

(42,296)

Interest, net

(27,683)

-

-

-

-

-

(27,683)

Income (loss) from continuing operations

before income taxes

33,518

(4,203)

(107,899)

(667)

(176)

(112,945)

(79,427)

Provision for income taxes

11,955

(1,673)

(6,150)

(273)

(77)

(8,173)

3,782

21,563

$

(2,530)

$

(101,749)

$

(394)

$

(99)

$

(104,772)

$

(83,209)

$

Reconciliation

of

Non-GAAP

Measures

(Cont.)

($ in thousands) |

Reconciliation

of

Non-GAAP

Measures

(Cont.)

($ in thousands)

Year ended December 31, 2013

Charges

Severance

Facility

Senior debt

Before

One-time

and retirement

closing

Impairment

Transaction

modification

As

charges

bonus

costs

costs

Litigation

charges

costs

charges

Total

reported

Income (loss) from continuing operations:

Operating income (loss):

Hospital division

544,879

$

(7,997)

$

-

$

(6,026)

$

(7,700)

$

-

$

-

$

-

$

(21,723)

$

523,156

$

Nursing center division

140,132

(4,706)

-

(64)

-

-

-

-

(4,770)

135,362

Rehabilitation division:

Skilled nursing rehabilitation service

65,037

(5,052)

(139)

-

(23,150)

-

-

-

(28,341)

36,696

Hospital rehabilitation services

76,556

(1,255)

(1,376)

-

-

-

-

-

(2,631)

73,925

141,593

(6,307)

(1,515)

-

(23,150)

-

-

-

(30,972)

110,621

Care management division

11,924

(833)

(676)

(452)

-

-

-

-

(1,961)

9,963

Corporate:

Overhead

(172,355)

(315)

(3,366)

-

-

-

-

(459)

(4,140)

(176,495)

Insurance subsidiary

(1,914)

-

-

-

-

-

-

-

-

(1,914)

(174,269)

(315)

(3,366)

-

-

-

-

(459)

(4,140)

(178,409)

Impairment charges

(1,111)

-

-

-

-

(76,082)

-

-

(76,082)

(77,193)

Transaction costs

-

-

-

-

-

-

(2,112)

-

(2,112)

(2,112)

Operating income

663,148

(20,158)

(5,557)

(6,542)

(30,850)

(76,082)

(2,112)

(459)

(141,760)

521,388

Rent

(318,077)

-

-

-

-

-

-

-

-

(318,077)

Depreciation and amortization

(157,329)

-

-

-

-

-

-

-

-

(157,329)

Interest, net

(102,537)

-

-

-

-

-

-

(1,461)

(1,461)

(103,998)

Income (loss) from continuing operations

before income taxes

85,205

(20,158)

(5,557)

(6,542)

(30,850)

(76,082)

(2,112)

(1,920)

(143,221)

(58,016)

Provision (benefit) for income taxes

30,870

(7,932)

(2,186)

(2,312)

(12,139)

(17,803)

(947)

(755)

(44,074)

(13,204)

54,335

$

(12,226)

$

(3,371)

$

(4,230)

$

(18,711)

$

(58,279)

$

(1,165)

$

(1,165)

$

(99,147)

$

(44,812)

$

Year ended December 31, 2012

Charges

Lease

Before

Severance

Impairment

Transaction

cancellation

As

charges

and other

Litigation

charges

costs

charges

Total

reported

Income (loss) from continuing operations:

Operating income (loss):

Hospital division

571,448

$

(4,224)

$

(5,000)

$

-

$

-

$

-

$

(9,224)

$

562,224

$

Nursing center division

144,069

(2,811)

-

-

-

-

(2,811)

141,258

Rehabilitation division:

Skilled nursing rehabilitation service

68,313

(353)

-

-

-

-

(353)

67,960

Hospital rehabilitation services

69,853

(108)

-

-

-

-

(108)

69,745

138,166

(461)

-

-

-

-

(461)

137,705

Care management division

13,858

(150)

-

-

-

-

(150)

13,708

Corporate:

Overhead

(177,979)

(1,084)

-

-

-

-

(1,084)

(179,063)

Insurance subsidiary

(2,127)

-

-

-

-

-

-

(2,127)

(180,106)

(1,084)

-

-

-

-

(1,084)

(181,190)

Impairment charges

(1,054)

-

-

(107,899)

-

-

(107,899)

(108,953)

Transaction costs

-

-

-

-

(2,231)

-

(2,231)

(2,231)

Operating income

686,381

(8,730)

(5,000)

(107,899)

(2,231)

-

(123,860)

562,521

Rent

(308,487)

-

-

(1,691)

(1,691)

(310,178)

Depreciation and amortization

(162,685)

-

-

-

-

-

-

(162,685)

Interest, net

(106,878)

-

-

-

-

-

-

(106,878)

Income (loss) from continuing operations

before income taxes

108,331

(8,730)

(5,000)

(107,899)

(2,231)

(1,691)

(125,551)

(17,220)

Provision for income taxes

42,502

(3,427)

(1,962)

(6,150)

(592)

(664)

(12,795)

29,707

65,829

$

(5,303)

$

(3,038)

$

(101,749)

$

(1,639)

$

(1,027)

$

(112,756)

$

(46,927)

$

43 |

Reconciliation

of Non-GAAP Measures (Cont.) 44

($ in thousands) |

Reconciliation

of Non-GAAP Measures (Cont.) ($ in thousands)

Three months ended

Year ended

December 31,

December 31,

2013

2012

2013

2012

Reconciliation of net cash flows provided by operating

activities to free cash flows:

Net cash flows provided by operating activities

$10,195

$71,475

$199,412

$262,562

Less:

Routine capital expenditures

(37,956)

(38,371)

(100,908)

(115,175)

Development capital expenditures

(1,115)

(12,147)

(11,824)

(50,322)

(39,071)

(50,518)

(112,732)

(165,497)

Free cash flows including certain items

(28,876)

20,957

86,680

97,065

Adjustments to remove certain payments (including payments

made for discontinued operations) included in net cash flows

provided by operating activities:

One-time employee bonus

-

-

26,345

-

Ventas lease termination fee

20,000

-

20,000

-

Transaction costs

1,877

932

10,427

3,404

Severance and retention

617

1,715

5,406

3,719

Lease cancellation

-

176

-

1,691

Financing costs capitalized as deferred financing

-

2,940

6,189

2,940

Benefit of reduced income tax payments resulting from

certain payments

(9,018)

(922)

(24,667)

(3,244)

13,476

4,841

43,700

8,510

Free cash flows excluding certain items

($15,400)

$25,798

$130,380

$105,575

45 |

Reconciliation

of Non-GAAP Measures (Cont.) 46

Year ended

December 31,

2013

Reconciliation of operating income to Adjusted EBITDA:

Operating income before disclosed charges

$521,388

Disclosed charges (as detailed above)

141,760

Core operating income

663,148

Other covenant adjustments:

Other non-cash impairment charges

1,111

Non-cash compensation expense

11,183

Insurance subsidiary loss

1,914

Investment income

4,051

Cost savings run rate adjustment

1,000

Noncontrolling interests

(3,657)

15,602

Adjusted EBITDAR

678,750

Less Rent

318,077

Adjusted EBITDA

$360,673

The Company recognizes that Adjusted EBITDA

and Adjusted EBITDAR are non- GAAP measurements. The Company believes that these

non-GAAP measurements provide important information to lenders related to the

defined measurements used for purposes of compliance with the Company's debt covenant

calculations. The following reconcilation presents Adjusted EBITDAR and Adjusted

EBITDA consistent with the definitions of both the ABL Credit Agreement and the Term

Loan Agreement. |