Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SYNTHESIS ENERGY SYSTEMS INC | v371303_8k.htm |

CORPORATE OVERVIEW March 2014 Synthesis Energy Systems, Inc. UNLOCKING VALUE Through TRANSFORMATIVE CLEAN ENERGY TECHNOLOGY NASDAQ: SYMX www.synthesisenergy.com

Forward - Looking Statements Forward - looking statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected . Among those risks, trends and uncertainties are the development stage of our operations ; the ability of the ZZ joint venture to effectively operate XE’s methanol plant and produce methanol ; the ability of the Yima project to produce earnings and pay dividends ; our ability to complete the approval process with ZCM for our joint venture and then to develop and expand business in the joint venture territory ; our ability to develop our power business unit and marketing arrangement with GE and our other business verticals, steel and renewables ; our ability to successfully develop our licensing business ; our ability to reduce operating costs ; the limited history and viability of our technology ; commodity prices and the availability and terms of financing opportunities ; our ability to obtain the necessary approvals and permits for future projects ; our ability to raise additional capital and our estimate of the sufficiency of existing capital sources ; the sufficiency of internal controls and procedures ; and our results of operations in foreign countries where we are developing projects . Although we believe that in making such forward - looking statements our expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected . We cannot assure you that the assumptions upon which these statements are based will prove to have been correct . 2

SES Gasification Technology CO 2 CAPTURE CAPABLE LOW GRADE COAL BIOMASS SYNGAS PROCESSING SYNTHESIS GAS (CO+ H 2 ) SULFUR ASH NATURAL GAS FUELS DRI STEEL POWER CHEMICALS FERTILIZERS $1.50/MMBTU Typical Feedstock Input Cost SES VALUE ADDITION $4 - 8 MMBTU vs. $12 - 17 MMBTU Crude O il/LNG HIGH - VALUE END PRODUCTS WASTES CONVERTING LOW - GRADE FEEDSTOCK TO HIGH - VALUE PRODUCTS 3

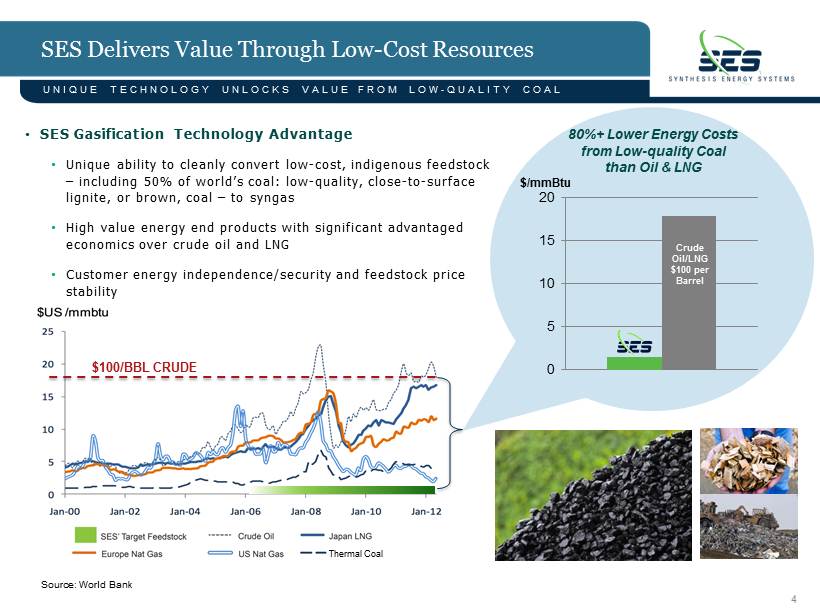

SES Delivers Value T hrough Low - Cost Resources 4 Source: World Bank $100/BBL CRUDE $100/BBL CRUDE • SES Gasification Technology Advantage • Unique ability to cleanly convert low - cost, indigenous feedstock – including 50% of world’s coal: low - quality, close - to - surface lignite, or brown, coal – to syngas • High value energy end products with significant a dvantaged economics over crude oil and LNG • Customer energy independence/security and feedstock price stability 0 5 10 15 20 Crude Oil/LNG $100 per Barrel $/ mmBtu Thermal Coal UNIQUE TECHNOLOGY UNLOCKS VALUE FROM LOW - QUALITY COAL 80%+ Lower Energy Costs from Low - quality Coal than Oil & LNG

Operational SES Gasification Technology JV Plants ZZ PLANT - Zao Zhuang New Gas Company 97% SES Ownership, 2 SES Gasifiers • JV with Xuecheng Energy ( 97% SES / 3% XE ) • Projected to generate $30 MM/YR, based on current prevailing methanol prices in China • SES resumed operations November 1, 2013 upon assuming majority control in 4Q13; methanol sales from coke oven gas and syngas • Plant previously operational December 2008 to September 2011; facility completed December 2007 • Proven successful operation on waste coals with ash content up to 55% WT YIMA PLANT – Henan Province 25% SES Ownership, 3 SES Gasifiers • JV with Yima Coal Industry Group (75% Yima / 25% SES) • JV revenues projected at $130 MM/YR, based on current prevailing methanol prices in China • Ramping up production to design capacity of 300K TPY methanol • First methanol production December 2012 • High pressure, 10 bar operation 5 COMMERCIAL METHANOL PRODUCTION AND CUSTOMER FEEDSTOCK TESTS

Global Energy Market/Macroeconomics 6 LOW - COST ALTERNATIVE TO LNG AND OIL IN LARGE MARKET VERTICALS METHANOL AMMONIA Highly complex, massive industrial commodity markets with growth tied to GDP, including: methanol, olefins, and glycols . Economic alternative to current natural gas Next - generation , clean and efficient Direct Reduced Iron (DRI ) replaces outdated blast furnaces and addresses high need for steel plants in developing markets, such as India, China and Indonesia, where LNG is cost - prohibitive 3,500 antiquated fertilizer plants , requiring expensive high - quality coal, in China need to be shut down or replaced. SES Gasification Technology can provide new low - cost capacity for ammonia and urea Coal - fueled Synthetic Natural Gas (SNG) is projected to be a large and fast - growing energy source in China (est. 50B Normal Cubic Meters by 2020). Represents 194 coal - to - liquid (CTL) SES gasification systems (1 ) Distributed power is projected to grow 40% faster than global electricity demand between now and 2020 Transportation fuels – diesel, jet fuel and gasoline – potential for 30MM tonnes per day production capacity in China alone, with India also vying for alternative to $100 MMBTU oil (1) Notes: SES Economics based on (1) Combination of Beijing 12th 5 - Year Plan and SES Internal data Total Available Market for all verticals is estimated by SES at 500 gasifier systems worldwide over 10 years. ( 1)

SES: Globally Competitive Economics 7 $3.40 $15.00 LNG MKT (ASIAN SPOT) COST PER MMBTU COST PER GALLON $1.19 $2.91 US PRICE (WHOLESALE) GASOLINE FROM OIL @ $100/BBL $185 $123 METHANOL AMMONIA COST PER TONNE ASIAN MKT $425/MT ASIAN MKT $350/MT LARGE VALUE POTENTIAL PER PROJECT SNG - $ 10.11B METHANOL - $0.52B GASOLINE - $2.33B AMMONIA - $0.69B Notes: SES Economics based on SES Internal data (1) 50/50 Debt/Equity; 6% Int over 7 yr term; China/India (2) 70/30 Debt/Equity; 8% Int over 10 yr term; US Wyoming (3) Coal price ~$1.50/mmbtu SES GASIFICATION TECHNOLOGY IS THE KEY TO UNLOCKING VALUE 4B NM 3 /YR 18,000 BPD 300,000 MTPA 2,200 MTPD Total Project NPV Potential 75% IRR (1) Potential 25% IRR (2 ) Potential 35% IRR (1) Potential 18% IRR (1) COST PER TONNE GASOLINE NG (LNG/SNG )

Synthesis Energy Systems, Inc. Overview 8 • Premiere Gasification Technology • Industry leading range of low - quality coal, coal waste, biomass, and wastes • Unique and efficient performance • Environmentally clean • Multi - decade development and deployment of technology • High barrier to entry with $400 MM+ investment by GTI members, US Gov’t and SES • SES Gasification based on U - GAS ® exclusively licensed from Gas Technology Institute ( GTI) NASDAQ : SYMX MARKET CAP $114 MM SHARES OUTSTANDING 63.72 MM PUBLIC FLOAT 50.4 MM % HELD BY INSIDERS 21% % HELD BY INSTITUTIONS 22% PREMIERE TECHNOLOGY, EXPERIENCED TEAM, GLOBAL OPPORTUNITY 8 Technologies Company, Inc . • Deep Industry Experience: Management and Board of Directors • Fortune 100 gasification engineering and business backgrounds Market Verticals China India SES - ZCM ZZ JV Yima JV Regional Platforms Synthesis Energy Systems, Inc. March 10, 2014

SES Platform for Growth: Market Vertical Partnerships 9 • POWER • SES and GE jointly marketing a small - to medium - scale power plant product • 50 - 200 MW power generation units combining SES Gasification Technology with GE’s aeroderivative gas turbines • Scalable and replicable/modular, year - over - year order stream • CHINA • Partnership with leading coal - chemical equipment manufacturer – Zhangjiagang Chemical Machinery Co., Ltd. ( ZCM) • Joint venture: ZCM - SES Sino - U.S. Clean Energy Technologies Ltd. – 35 % SES, 65% ZCM • Announced January 2014; customary Chinese government approvals expected by mid - year 2014 • Market verticals: Synthetic Natural Gas (SNG), large scale chemicals, and transportation fuels – China and select Asian markets • JV Holdings: • Zao Zhuang New Gas Company ( ZZ ) – 97% SES, 3% Xuecheng Energy • Yima Plant, Henan Province ( Yima ) – 25% SES, 75% Yima Coal Industry Group • SYNERGISTIC PARTNERSHIPS INITIATIVE – next phase • Market Verticals: DRI Steel – developing a product alternative for DRI steel industry; advanced discussions with potential partner • Global Regional Markets: India – regional marketing partner/investor, Zuari and its subsidiary, Simon Engineering; robust deal pipeline GROWTH OPPORTUNITIES FOLLOW PROVEN COMMERCIALIZATION 9

2014 POWER: Co - Marketing Partner with GE 10 • Distributed Power in Developing Regions • Co - marketing partner: General Electric’s Packaged Power division • SES Gasification T echnology ideally suited for GE’s fuel - flexible LM2500+G4 aeroderivative gas turbines • Regional Collaborators: Istroenergo Group (IEG ), engineering, procurement and construction (EPC) , and TUTEN Ltd ., feasibility and project management • First Project • LOI with Karachi Electric Supply Company, large electric utility in Karachi, Pakistan, announced January 2014 • Feasibility engineering financial evaluation of 90 - 200 MW capacity SES coal gasification technology power generation project underway • Robust Pipeline • Active discussions for additional coal - based gasification systems in Pakistan, as well as Turkey and African nations • Early discussions for renewables - based gasification systems in Japan and Asian regions Global Collaboration Focused on High - Need Electric Grid Instability 10 “ Distributed power will grow 40% faster than global electricity demand between now and 2020.” – GE press release, Feb 2014, reference to GE’s “The Rise of Distributed Power” W hite Paper, Feb 2014 “Currently, about 1.5 billion people – almost a quarter of the world’s population – a re without electric power. The International Energy Agency estimates that world energy demand (for all forms of energy, including transportation fuels) will increase by 36% by 2035 and fossil fuels, such as coal, will continue to play a critical role in meeting this demand.” – Gasification Technologies Council “Coal’s share of the global energy mix continues to rise, and by 2017 coal will come close to surpassing oil as the world’s top energy source… thanks to abundant supplies and insatiable demand for power from emerging markets… China and India lead the growth in coal consumption over the next five years.” – International Energy Agency, December 2012

2014 CHINA: ZCM - SES Sino - U.S. Clean Energy Technologies Ltd. 11 • Partner: Zhangjiagang Chemical Machinery Company (ZCM) • One of China’s largest and most respected coal - chemical equipment manufacturers • RMB 5 billion market cap, l ast year sales est. RMB 1.8 billion, 3,000+ employees, public company • SES relationship begun at Yima Plant • JV announced January 2014; customary Chinese government approvals expected by mid - year • ZCM - SES Sino - U.S. Clean Energy Technologies Ltd. • Delivering comprehensive equipment, engineering and gasification technology solutions for multibillion - dollar coal - chemicals and energy industries in China and key Asian markets • Expanding scope of SES gasification technology to include equipment and engineering • Penetrating key market while protecting technology • Leading to modular, turnkey SES gasification plants throughout China and select Asian markets • Additional plans to leverage low - cost, high - quality equipment and engineering supply source for global business Strategic JV to Establish Market Leader in Clean Coal Gasification 11 “During the next five years, coal gasification will contribute more to China’s gas supply than shale gas . …the potential scale of projects in China involving coal to produce synthetic natural gas… is enormous. If this were to become reality it would mark not just an important development in coal markets but would also imply revisions to gas and oil forecasts.” – International Energy Agency, Dec 2013 “Syngas capacity growth in Asia/Australia will be the second largest of all world regions, with 25 new plants to be added and capacity plans for 2011 through 2016 totaling 20,811 MW th – a growth rate for that region of 79% from its 2010 level of 26,418 MW th . Seventeen of the plants will be in China, all processing coal – 14 to produce chemicals and three to produce power .” – U.S. Department of Energy, 2010 “World gasification capacity is projected to grow by more than 70% by 2015. Most of that growth will occur in Asia, with China expected to achieve the most rapid growth .” – Gasification Technologies Council

SES: Strengths and Value Drivers • World’s Premiere Technology To Convert Low - Value Feedstock Into High Value Products • Unmatched, Commercially Proven , Clean Energy Technology with Superior Economics • Massive Market Opportunities and Need/Demand Around the World, Especially in Developing Countries • Revenue - producing ZZ Plant from Methanol Sales; ZZ and Yima Plants Both Ramping Production • Synergistic Partnerships with Well - capitalized Industry and Regional Leaders • Large Global Opportunities in Multiple Market Verticals, with Forecasted Year - Over - Year SES Gasification Technology System Orders UNLOCKING VALUE Through TRANSFORMATIVE CLEAN ENERGY TECHNOLOGY ZZ Plant : Methanol COG - Syngas Production

Appendix 13 • Management 13

Management 14 • Robert W. Rigdon , President and Chief Executive Officer • Steered GE’s gasification business in multiple capacities including Manager of Gasification Engineering, Director of IGCC Commercialization and Director of Gasification Industrials and Chemicals Business, 2004 - 2008 • 23 - year previous tenure at Texaco, later ChevronTexaco, in Worldwide Power & Gasification group positions including Engineering Manager, Project Director and Vice President of Gasification Technology • B.S., Mechanical Engineering, Lamar University • Donald Bunnell, J.D . , Chief Commercial Officer • 10 years’ China power industry project development and JV experience with companies including Enron/Messer/Texaco, Coastal Power Corp (El Paso) • J.D., William & Mary; B.A., Miami University • Francis Lau, Senior Vice President and Chief Technology Officer • 36 - year tenure at the Gas Technology Institute, with six years serving as GTI’s Executive Director of Gasification and Gas Processing Center; 2003 Pitt Award recipient for coal conversion R&D • M.S., Chemical Engineering, Northwestern University; B.S., Chemical Engineering, University of Wisconsin • Charles Costenbader, Chief Financial Officer • Extensive energy investment and commodity risk management in power, natural gas, methanol production and pulverized coal sectors with affiliations including GE Capital, Macquarie Bank Ltd. and Galveston Bay Biodiesel • M.B.A., Columbia University, B.S., Mechanical Engineering, Lafayette College Fortune 100 Backgrounds with China Market Expertise 14

Management 15 • Kevin Kelly, Chief Accounting Officer, Controller and Secretary • A Certified Public Accountant, who has held controllership and treasury management positions with a variety of publicly traded companies, most recently with W - H Energy Services before joining SES in 2008 • B.A., Accounting and Management, Houston Baptist University • John Winter, Ph.D., SVP of Engineering and Project Operations • 30 - year petrochemical industry experience, including 15 years of gasification technology research, engineering design, tech services and gasification operations. Past senior positions include GE Energy, Texaco/ChevronTexaco, Allied Plastics and Dow Chemical • Ph.D., Chemical Engineering, University of Houston, M.S. and B.S., Chemical Engineering, University of Alabama • Carrie Lalou, Vice President of Business Development • Holds specific expertise in coal gasification and IGCC design and performance, with previous project management and sales positions with GreatPoint Energy and GE’s gasification business. Previously , a process engineer in engineering, procurement and construction (EPC) industry • B.S., Chemical Engineering, University of Notre Dame Fortune 100 Backgrounds with China Market Expertise 15