Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ameris Bancorp | d691120d8k.htm |

| EX-2.1 - EX-2.1 - Ameris Bancorp | d691120dex21.htm |

| EX-99.1 - EX-99.1 - Ameris Bancorp | d691120dex991.htm |

Acquisition of

Coastal Bankshares, Inc. March 11, 2014

Exhibit 99.2 |

Cautionary

Statements 2

This

presentation

contains

certain

performance

measures

determined

by

methods

other

than

in

accordance

with

accounting

principles

generally

accepted

in

the

United

States

of

America

(“GAAP”).

Management

of

Ameris

Bancorp

(the

“Company”)

uses

these

non-GAAP

measures

in

its

analysis

of

the

Company’s

performance.

These

measures

are

useful

when

evaluating

the

underlying

performance

and

efficiency

of

the

Company’s

operations

and

balance

sheet.

The

Company’s

management

believes

that

these

non-GAAP

measures

provide

a

greater

understanding

of

ongoing

operations,

enhance

comparability

of

results

with

prior

periods

and

demonstrate

the

effects

of

significant

gains

and

charges

in

the

current

period.

The

Company’s

management

believes

that

investors

may

use

these

non-GAAP

financial

measures

to

evaluate

the

Company’s

financial

performance

without

the

impact

of

unusual

items

that

may

obscure

trends

in

the

Company’s

underlying

performance.

These

disclosures

should

not

be

viewed

as

a

substitute

for

financial

measures

determined

in

accordance

with

GAAP,

nor

are

they

necessarily

comparable

to

non-GAAP

performance

measures

that

may

be

presented

by

other

companies.

Tangible

common

equity

and

Tier

1

capital

ratios

are

non-GAAP

measures.

The

Company

calculates

the

Tier

1

capital

using

current

call

report

instructions.

The

Company’s

management

uses

these

measures

to

assess

the

quality

of

capital

and

believes

that

investors

may

find

them

useful

in

their

evaluation

of

the

Company.

These

capital

measures

may,

or

may

not

be

necessarily

comparable

to

similar

capital

measures

that

may

be

presented

by

other

companies.

This

presentation

may

contain

statements

that

constitute

“forward-looking

statements”

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended,

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended.

The

words

“believe”,

“estimate”,

“expect”,

“intend”,

“anticipate”

and

similar

expressions

and

variations

thereof

identify

certain

of

such

forward-looking

statements,

which

speak

only

as

of

the

dates

which

they

were

made.

The

Company

undertakes

no

obligation

to

publicly

update

or

revise

any

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

Readers

are

cautioned

that

any

such

forward-looking

statements

are

not

guarantees

of

future

performance

and

involve

risks

and

uncertainties

and

that

actual

results

may

differ

materially

from

those

indicated

in

the

forward-looking

statements

as

a

result

of

various

factors.

Readers

are

cautioned

not

to

place

undue

reliance

on

these

forward-looking

statements

and

are

referred

to

the

Company’s

periodic

filings

with

the

Securities

and

Exchange

Commission

for

a

summary

of

certain

factors

that

may

impact

the

Company’s

results

of

operations

and

financial

condition. |

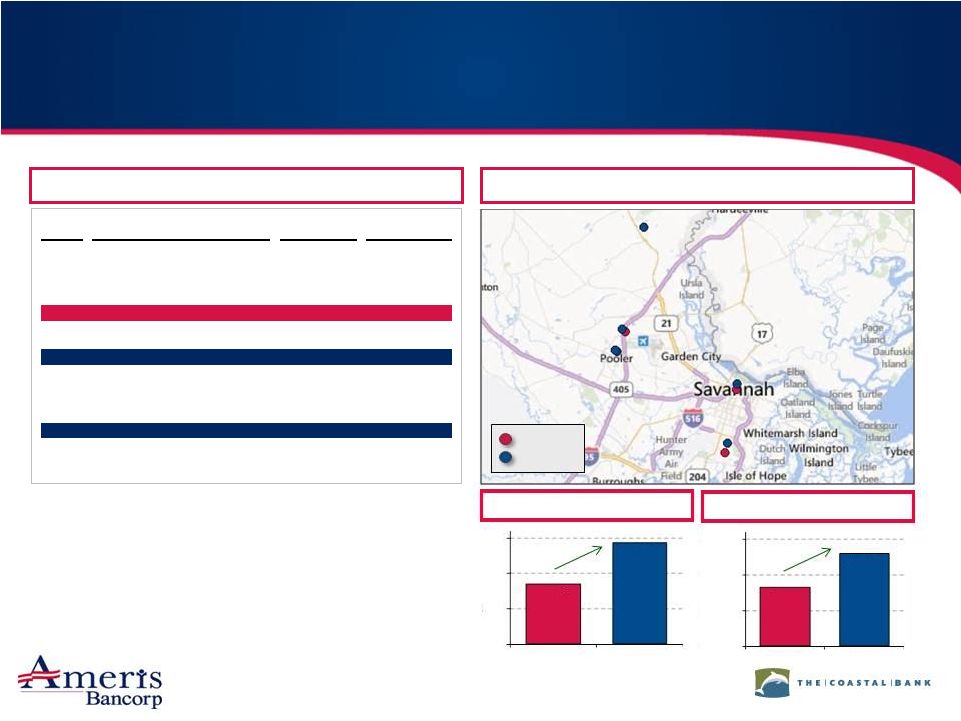

Overview of Pro

Forma Franchise 3

Pro Forma Highlights

(1)

Financial data as of 12/31/13

Map and branch count exclude Coastal’s administrative branch at 605 US Highway 80 West in

Savannah (1)

Excludes purchase accounting adjustments

•

Complementary in-market

transaction

•

Significant branch overlap

with 3 of 6 branches within

one mile

•

Expanding our presence in the

Savannah market

Savannah

Charleston

Jacksonville

Atlanta

Tallahassee

Montgomery

Greenville

Columbia

St. Augustine

Moultrie

Ameris

Coastal

Assets

……………

$4.1

bn

Loans

……………

2.8

Deposits

……………

3.4

Branches

……………

74 |

4

•

In-market extension with like-minded community bank

•

Leverages management experience and infrastructure in Savannah

•

Experienced

Southeast

acquiror

–

11

deals

in

the

last

4

years

•

Thorough due diligence process completed with over 70% of the total loan and OREO

portfolios reviewed

Transaction Rationale

Strategic

Rationale

Financially

Accretive

Low-Risk

•

10% EPS accretion once cost savings are fully realized

•

Manageable initial tangible book value dilution and earnback period inside 3.0 years

•

Ameris to remain “well-capitalized”

•

Internal rate of return over 20%

•

Strengthens and solidifies our Savannah market presence

•

Significant market overlap allows for considerable cost savings opportunities

•

Improves

deposit

market

share

rank

in

Savannah

MSA

from

12

th

to

5

th

pro

forma

•

Positions

Ameris

as

the

largest

community

bank

by

market

share

along

the

Georgia

coast

(1)

Source: SNL Financial; deposit data as of 6/30/13

(1)

Includes the following Georgia counties: Bryan, Camden, Chatham, Glynn, Liberty and

McIntosh. Pro forma market share of 8.2%, behind SunTrust at 19.3%, Wells Fargo at 16.9% and Bank of America at 10.6% |

Acquiror:

Ameris Bancorp (NASDAQ: ABCB)

Target:

Coastal Bankshares, Inc. (Private)

Transaction Value:

(1)

$36.7 million

Consideration Mix:

100% Stock

Per Share Consideration:

0.4671 shares of ABCB stock

Price / Tangible Book Value (%):

(1)

166%

Capital Raise:

No additional capital required to complete the transaction

Required Approvals:

Customary Regulatory and Coastal shareholder approvals

Expected Closing:

Late second quarter / early third quarter of 2014

(1)

Summary of Transaction Terms

5

Based on ABCB’s 3-day average closing price of $21.41 as of 3/7/14 and a fixed

exchange ratio of 0.4671x; includes in the money warrants; based upon total Coastal common shares outstanding

of 3,423,488 |

Transaction

Assumptions 6

Assumptions

•

50% of Coastal's noninterest expense

•

50% realized in 2014 and 100% thereafter

•

Includes cost savings from Coastal and in-market Ameris cost savings

Merger-Related Expenses

•

$4.5 million after-tax

•

Gross credit mark to loans and OREO of $20.2 million

•

5.5% mark to loans, 22.1% mark to OREO

•

Loan mark represents 2.2x total nonperforming loans as of 12/31/13, including accruing

TDRs Revenue Synergies

•

None assumed

Core Deposit Intangible

•

1.5% of transaction accounts

Ameris Preferred Equity Repayment

•

Assumes repayment of Ameris' $28 million of preferred equity prior to the end of the first

quarter of 2014 Cost Savings

Credit Mark |

Credit Due

Diligence 7

Credit Diligence Process

•

Comprehensive review process for Coastal’s loans and OREO portfolios

•

Experienced credit review team

+

Ameris has reviewed over $3.0 billion of loans and OREO through the evaluation of 30 FDIC

transactions

•

Completed

ten

FDIC-assisted

acquisitions

and

one

whole

bank

transaction

in

GA

and

FL

through cycle

•

Credit team reviewed 71% of the dollar balance of Coastal’s loan portfolio

+

100% of commercial loans greater than $300K

+

100% of all watch list loans over $200K

•

Reviewed 88% of OREO properties

+

On-site visits to the majority of OREO properties |

Coastal’s

Core Earnings Ability 8

Source: SNL Financial

Note: Securities gain of $4.0 thousand not shown

(1)

Includes provision expense and losses on the sale of OREO

(2)

Based on Coastal’s reported 2013 noninterest expense of $17.4 million

•

Transaction will allow Ameris to unlock Coastal’s core earnings ability

•

Significant expense savings opportunities

2013 Core Earnings Reconciliation ($mm) |

Source: SNL

Financial Ameris current capital ratios as of 12/31/13

(1)

Financial Impact

9

Transaction Impact

•

10% EPS accretion once cost savings are fully realized

•

No revenue synergies assumed in pro forma results but substantial

opportunities identified

•

Tangible book value earnback period inside 3.0 years

•

TCE / TA above 7.0% within 2 quarters

Pro Forma

Current

at Close

(1)

TCE / TA

6.8

%

6.8

%

Tier 1 Leverage Ratio

9.0

8.4

Tier 1 Risk-Based Ratio

14.2

12.8

Total Risk-Based Ratio

15.2

13.7

Estimated pro forma capital ratios at close; assumes transaction is 100% stock consideration;

includes repayment of legacy TARP preferred equity |

Strengthened

Market Presence 10

•

Leverages our presence in the

Savannah market

+

On

a

pro

forma

basis,

Ameris

is

the

2

nd

largest

community bank in the Savannah MSA

Savannah MSA Deposit Market Share

Savannah MSA

Source: SNL Financial; deposit data as of 6/30/13

Market demographics deposit-weighted by county

Ameris

Coastal

Deposits

Market

Rank

Institution

($mm)

Share

1

Wells Fargo & Co.

$1,166

21.8

%

2

SunTrust Banks Inc.

1,050

19.6

3

Bank of America Corp.

664

12.4

4

First Financial Holdings Inc.

594

11.1

Pro Forma

390

7.3

5

BB&T Corp.

362

6.8

6

FCB Financial Corp.

342

6.4

7

Coastal Bankshares Inc.

315

5.9

8

Synovus Financial Corp.

181

3.4

9

Heritage Financial Group Inc.

131

2.4

10

Putnam-Greene Financial Corp.

104

2.0

11

United Community Banks Inc.

80

1.5

12

Ameris Bancorp

75

1.4

13

CertusHoldings Inc.

49

0.9

14

Regions Financial Corp.

46

0.9

15

Liberty Shares Inc.

45

0.9

’13 –

’18 Proj. Pop. Growth (%)

Proj. ’18 Median HHI ($)

4.3%

7.2%

0.0%

2.5%

5.0%

7.5%

ABCB

Coastal

$48,302

$52,945

$40,000

$45,000

$50,000

$55,000

ABCB

Coastal |

Conclusion

11

•

Financially attractive for both of our shareholders

•

Enhances current footprint in a high-growth Southeastern

market

•

Compatible community banking model |

Appendix:

Additional Information |

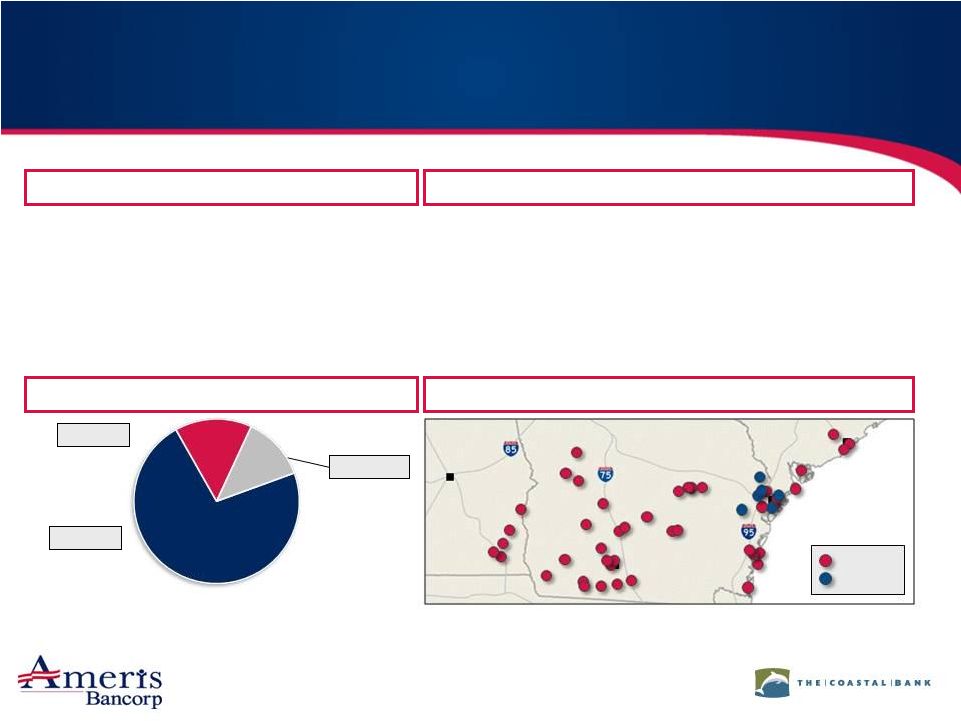

Overview of

Coastal Bankshares, Inc. 13

•

Headquartered in Savannah, GA

•

Founded in 1954

•

6 branch Georgia footprint

+

Savannah MSA (5)

+

Hinesville MSA (1)

Financial Highlights

Company Highlights

Deposit Composition by County

(2)

Chatham

Liberty

Effingham

Total Assets

……………………………

$432.8

mm

Total Loans

……………………………

295.4

Total Deposits

……………………………

364.4

% Core Deposits

(1)

……………………………

83.4

%

Loans / Deposits

……………………………

81.1

Pro Forma Footprint

72%

15%

13%

Savannah

Montgomery

Moultrie

Ameris

Coastal

Source: SNL Financial; financial data as of 12/31/13

Branch count excludes Coastal’s administrative branch

Note: Map excludes Ameris’ branches in Northern Georgia, Northern South Carolina, and

Florida and Coastal’s administrative branch at 605 US Highway 80 West in Savannah

(1)

Core deposits defined as total deposits less jumbo time deposits greater than $100,000 (2)

Deposit data as of 6/30/13 |

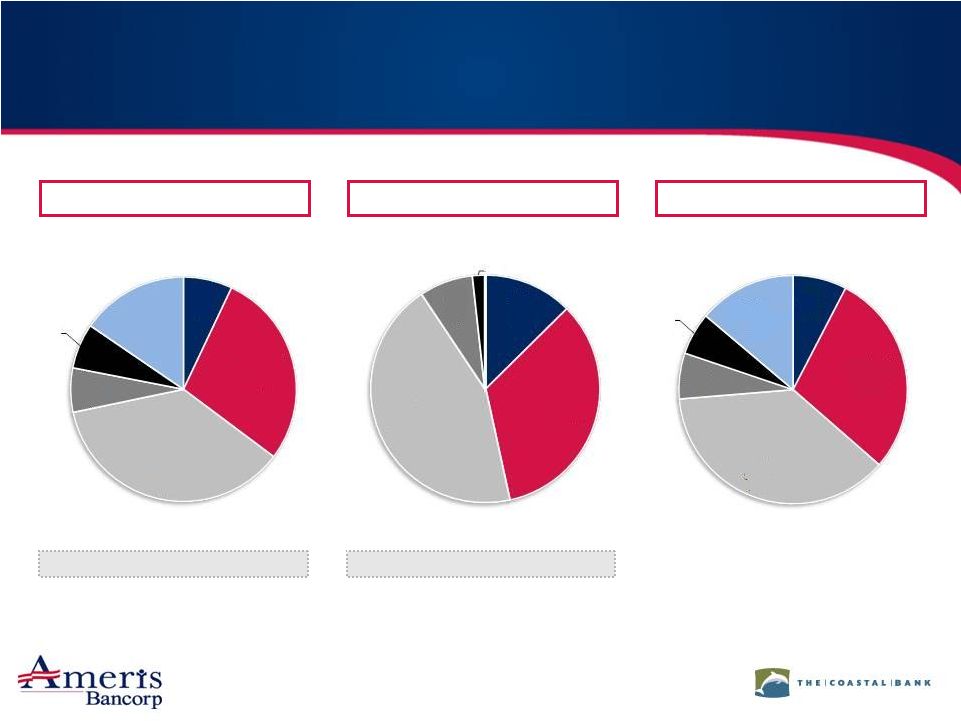

Strong Core

Funding 14

Dollars in millions

Source: SNL Financial

Data as of 12/31/13

Note: Jumbo time deposits defined as time deposits greater than $100,000

Ameris

Pro Forma

Coastal

Ameris Cost of Deposits: 0.32%

Coastal Cost of Deposits: 0.41%

Demand

Deposits

$179

6%

NOW Accounts

$129

4%

Money Market

& Savings

$1,940

65%

Retail Time

Deposits

$372

12%

Jumbo Time

Deposits

$379

13%

Demand

Deposits

$70

19%

NOW Accounts

$66

18%

Money Market

& Savings

$110

30%

Retail Time

Deposits

$58

16%

Jumbo Time

Deposits

$61

17%

Demand

Deposits

$249

7%

NOW Accounts

$196

6%

Money Market

& Savings

$2,050

61%

Retail Time

Deposits

$430

13%

Jumbo Time

Deposits

$440

13% |

Pro Forma Loan

Composition 15

Ameris

Pro Forma

(1)

Dollars in millions

Source: SNL Financial

Data as of 12/31/13

(1)

Excludes purchase accounting adjustments

Ameris Yield on Loans: 5.57%

Coastal Yield on Loans: 5.83%

Coastal

C&D

$178

7%

Residential

$712

28%

CRE

$921

37%

C&I

$160

6%

Consumer &

Other

$164

7%

FDIC Covered

$390

15%

C&D

$37

12%

Residential

$100

34%

CRE

$130

44%

C&I

$23

8%

Consumer &

Other

$5

2%

C&D

$215

8%

Residential

$812

29%

CRE

$1,051

37%

C&I

$183

6%

Consumer &

Other

$169

6%

FDIC Covered

$390

14% |

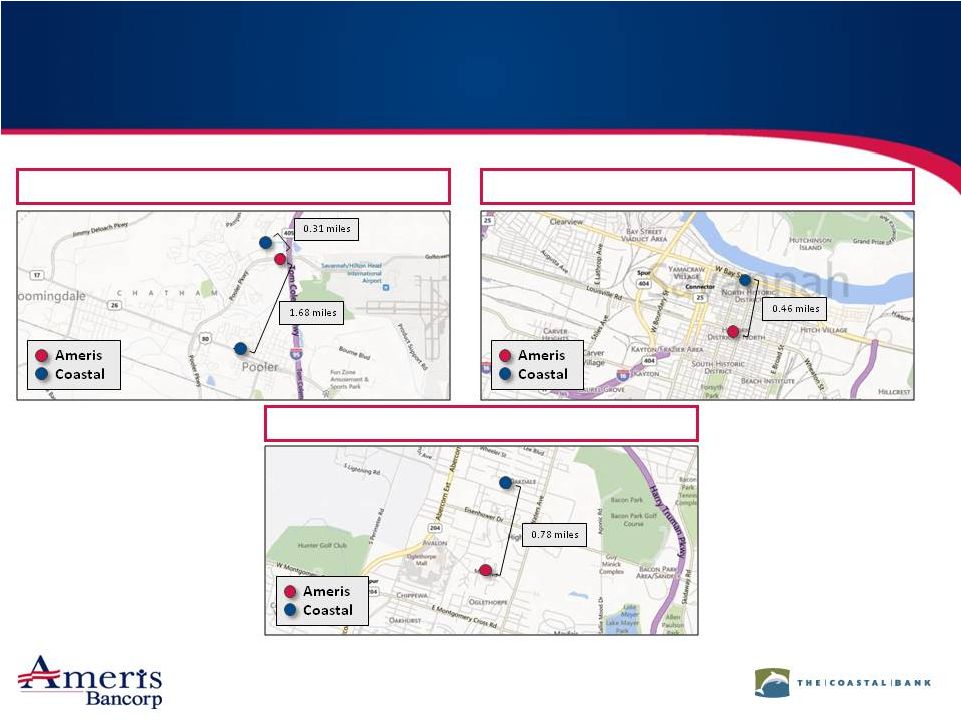

Branch Overlap

Detail 16

Map excludes Coastal’s administrative branch at 605 US Highway 80 West in Savannah

Pooler

Downtown Historic District

Southside |

Branch

Locations 17

Hinesville Office

Godley Station

Rincon Office

Stephenson Avenue Office

Pooler Office

Johnson Square Office |