Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - McEwen Mining Inc. | a14-7529_1ex23d1.htm |

| EX-10.8 - EX-10.8 - McEwen Mining Inc. | a14-7529_1ex10d8.htm |

| EX-31.2 - EX-31.2 - McEwen Mining Inc. | a14-7529_1ex31d2.htm |

| EX-31.1 - EX-31.1 - McEwen Mining Inc. | a14-7529_1ex31d1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-33190

MCEWEN MINING INC.

(Name of registrant as specified in its charter)

|

Colorado |

|

84-0796160 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

181 Bay Street, Suite 4750, Toronto, Ontario Canada |

|

M5J 2T3 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(866) 441-0690

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Common Stock, no par value |

|

NYSE |

|

Title of each class |

|

Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

|

Accelerated filer x |

|

Non-accelerated filer o |

|

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 29, 2012 (the last business day of the registrant’s second fiscal quarter), the aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant was $602,360,000 based on the closing price of $3.01 per share as reported on the NYSE. There were 215,205,891 shares of common stock outstanding (and 81,880,468 exchangeable shares exchangeable into McEwen Mining Inc. common stock on a one-for-one basis) on March 4, 2013.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Proxy Statement for the 2013 Annual Meeting of Shareholders are incorporated into Part III, Items 10 through 14 of this report.

EXPLANATORY NOTE

McEwen Mining Inc. (“we”, “us”, or the “Company”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to its Annual Report on Form 10-K for the year ended December 31, 2012 filed with the U.S. Securities and Exchange Commission (“SEC”) on March 11, 2013 (the “Original Filing”) to: (i) amend Item 2: Properties and Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations to remove tonnage and grades estimated by using geologic inference (inferred resources) from mineralized material tabulations; (ii) amend Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations to provide additional disclosures relating to the tonnage, grade, and recovery rate of our mining operations; and (iii) file as Exhibit 10.8 a copy of our refining agreement. As required by Rule 13a-14(a) and 15d-14(a) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), new certifications of our principal executive officer and principal financial officer are also being filed as exhibits to this Report.

No attempt has been made in this Amendment to modify or update the disclosures in the Original Filing except as required to reflect the effect of the revisions discussed herein. Except as otherwise noted herein, this Amendment continues to describe conditions as of the date of the Original Filing and the disclosures contained herein have not been updated to reflect events, results or developments that occurred after the date of the Original Filing, or to modify or update those disclosures affected by subsequent events. Among other things, forward-looking statements made in the Original Filing have not been revised to reflect events, results or developments that occurred or facts that became known to us after the date of the Original Filing, and such forward-looking statements should be read in conjunction with our filings with the SEC subsequent to the filing of the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and the Company’s other filings with the SEC subsequent to March 11, 2013.

ITEM 2. PROPERTIES

We classify our mineral properties into two categories: “Production and Development Properties” and “Exploration Properties”. Our designation of certain properties as “Production and Development Properties” should not suggest that we have proven or probable reserves at those properties as defined by the SEC. Our significant production and development and exploration properties are described below.

Production and Development Properties

San José Mine, Argentina (49%)

Overview and History

The San José Mine is a silver-gold underground producing mine located on the San José property in Santa Cruz Province, Argentina and operated by an affiliate of Hochschild, MSC. We acquired our interest in this property in connection with the acquisition of Minera Andes in January 2012. The San José property covers a total area of approximately 195 square miles (505 square kilometers) and consists of 50 contiguous mining concessions (consisting of 18 “Minas” or approved mining claims; and 32 “Manifestations” or claims that are in the application process for mining claim status). The Property was acquired by Minera Andes in 1997, following completion of a regional study. Minera Andes embarked on an exploration program from 1997 to 2001, which led to the discovery of the silver and gold bearing Huevos Verdes and Saavedra West Zones. In March 2001 (and subsequently amended by agreements dated May 14, 2002, August 27, 2002, September 10, 2004, and September 17, 2010), an option and joint venture agreement (“OJVA”) was signed between Minera Andes (49%) and Hochschild (51%). Under the terms of the OJVA, a subsidiary of Hochschild acquired a majority interest in the property and title to the San José Property and the San José Mine is held by Minera Santa Cruz, S.A. (“MSC”), the holding and operating company set up under the terms of the OJVA. MSC has purchased the land and corresponding occupation rights that are necessary to conduct its operations. All of the known mineralized zones, mineral resources and mineral reserves and active mine workings, existing tailing ponds, waste, etc., are within MSC’s concessions. Also, there are no back-in rights, payments or other agreements or encumbrances to which the property is subject.

In October 2005, MSC completed a bankable feasibility study that led to the development of the San José Mine as an underground mine. In March 2006, an environmental impact assessment, the primary document for permitting the San José Mine, was approved by the Province of Santa Cruz and a final decision was made to place the San José Mine into production. Pre-commissioning production commenced at the San José processing facility during the second half of 2007 and full commercial production of 750 metric tonnes per day was reached in the first quarter of 2008. Before achieving commercial production, MSC initiated a project to double the capacity of the San José processing facility to 1,500 metric tonnes per day which was completed in October 2008.

Location and Access

The San José property is located in the District of Perito Moreno, in Santa Cruz, Argentina, lying approximately between latitude 46°41’S and 46°47’S and longitude 70°17’W and 70°00’W. The mine is 1,087 miles (1,750 kilometers) south-southwest of Buenos Aires and 143 miles (230 kilometers) southwest of the Atlantic port of Comodoro Rivadavia. The principal access route to San José comprises a good unsealed (dirt) road section of 20 miles (32 kilometers) and then tarmac road to the port of Comodoro Rivadavia, a total distance of 217 miles (350 kilometers). Comodoro Rivadavia has scheduled national air services to Buenos Aires, the capital of Argentina, with international air connections. The nearest town is Perito Moreno, which is approximately 19 miles (30 kilometers) west of San José.

The San José property is within an arid to semi-arid area of Argentina, with short, warm summers reaching temperatures above 70°F (21°C) and winters with temperatures commonly below 32°F (0°C). Strong and persistent winds are common especially during the warmer months (October to May). Average rainfall at the site is estimated to be 5.7 inches (144 millimeters) and snowfall amounts to 1.3 inches (32.5 millimeters). Annual average temperature is 48°F (8.9°C). MSC has maintained a weather station at the property since January 2005. Mining and exploration continue year round in this part of Argentina.

Vegetation comprises low scrub bushes and grass, typical of harsh climate and poor soils. Fauna consists of birds, small mammals and reptiles. Most of the property area is uninhabited; however, it is used by local farmers for sheep and cattle grazing.

Geology and Mineralization

The San José property is located in the northwest corner of the 23,166 square mile (60,000 square-kilometer) Deseado Massif of the Santa Cruz Province, Argentina. The Deseado Massif consists of Paleozoic metamorphic basement rocks unconformably overlain by Middle to Upper Jurassic bimodal andesitic and rhyolitic volcanics and volcaniclastics. Cretaceous sediments and Tertiary to Quaternary basalts overlie the Jurassic volcanics. The Jurassic Bajo Pobre Formation is the main host of gold and silver vein mineralization at mine as well as many regional prospects. The Formation also hosts some of the mineralization at Saavedra West Zone. The formation comprises a lower andesite volcaniclastic unit and an upper andesite lava flow and has a maximum thickness of 394 feet (120 meters). Mineralization in the San José area occurs as low sulfidation epithermal quartz veins, breccias and stockwork systems accompanying normal-sinistral faults striking 330° to 340°. The main structural trend of fault and vein systems on the property is west-northwest to north-northwest.

Facilities and Infrastructure

The property consists of camp facilities that can accommodate up to 712 personnel, a medical clinic, a security building, a maintenance shop, processing facilities, a mine and process facility warehouse, a surface tailings impoundment, support buildings and mine portals, a change house, a core warehouse, an administration building and offices. MSC has installed a satellite-based telephone/data/internet communication system.

The San José Mine is a ramp access underground mining operation. The San José veins are accessed from three main portals: the Tehuelche Portal, the Kospi Portal and the Güer Aike Portal. The main ramps are located about 164 feet (50 meters) from the vein, depending on the dip of the ore. Cross-cuts to the ramp are centrally positioned on the vein and usually have an ore pass and a waste/backfill pass.

In March 2009, construction of an 81 mile (130 kilometer) 132 kV electric transmission line was completed to connect the San José Mine processing facility to the national power grid.

The mining equipment consists of development and production drills, scoop trams, haul trucks, service vehicles and personnel transport vehicles. Scooptrams range in size from 1.5 cubic yards to 6.0 cubic yards. A fleet of 20-tonne trucks is used to haul the ore to the surface.

The San José processing plant is composed of conventional crushing, grinding and flotation circuits. Approximately half of the silver-gold flotation concentrate is processed in an intensive cyanide leaching circuit with the dissolved gold and silver recovered by electrowinning of a clarified solution following by smelting to produce doré bullion. The balance of the flotation concentrate is filtered and shipped to a smelter. Flotation and leached tailings are stored in side-by-side engineered, zero discharge facilities. A Merrill Crowe circuit recovers small amounts of gold and silver from the

electrowinning discharge solution. At the end of 2012 the crushing circuit was modified, which is expected to lead to a 10% increase in mill throughput.

Exploration Activities

Exploration by Minera Andes on the San José property from 1997 to 2001 was concentrated over the northern part of the property and consisted of geological mapping, sampling, trenching, geophysics, alteration and metallurgical studies and reverse circulation (‘‘RC’’) and diamond drilling. In 2001, an extensive exploration program was undertaken which included detailed topographic surveying of the property, induced polarization (‘‘IP’’) geophysics and drilling. Exploration during 2003-2004 consisted of underground exploration/development, environmental and metallurgical studies and the construction and commissioning of a pilot plant at the Huevos Verdes Vein. Surveying of the topography, planned access and infrastructure in the Huevos Verdes and Frea areas was carried out during 2005 to 2007. From 2007 to 2008, a total of 193 diamond drill holes totaling 155,108 feet (47,277 meters) and focused on regional prospects as well as strike extensions of known veins with most of the drilling concentrated on the Ayelén, Frea and Odin veins. From 2009 to 2010, a total of 261,056 feet (79,570 meters) of diamond core drilling was completed in 380 holes, which were successful, as 11 new veins were discovered. The goal of the 2011 exploration program was to replace depleted reserves and to discover new mineralized veins, whereby a total of 204,301 feet (62,271 meters) were drilled in 248 holes. In 2012, a total of 321,161 feet (97,890 meters) of diamond drilling was completed, of which 117,444 feet (35,797 meters) was for near mine, 128,583 feet (39,192 meters) was for infill and 75,135 feet (22,901 meters) was for prospecting.

Reserves

The following is the reserve information calculated by Hochschild for the San José Mine as at December 31, 2011 and therefore does not account for 2012 production or reserves delineated during 2012. The 2011 information is the most recent available to us. We expect that Hochschild will report updated reserves as at December 31, 2012 by the second quarter of 2013.

These figures, reported on a 100% basis, were prepared by Hochschild and audited by P&E Mining Consultants Inc. whose report dated August 8, 2012, concluded that the reserve estimates for the San José Mine prepared by Hochschild at December 31, 2011 provide a reliable estimation of reserves in accordance with the standards of the Joint Ore Reserve Committee of the Australian Institute of Mining and Metallurgy (“JORC”), NI 43-101, the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) best practices and SEC Guide 7. The mineral reserve was estimated using metal prices of $1,080 per ounce of gold and $18 per ounce of silver with a marginal revenue cut-off value of $88.31 per tonne.

|

Property |

|

Category |

|

Tonnes |

|

Silver |

|

Silver |

|

Gold |

|

Gold |

|

|

San José Mine |

|

Proven |

|

805 |

|

475 |

|

12.3 |

|

6.99 |

|

180.9 |

|

|

|

|

Probable |

|

876 |

|

354 |

|

10.0 |

|

5.79 |

|

163.0 |

|

|

|

|

Proven & Probable |

|

1,681 |

|

412 |

|

22.3 |

|

6.36 |

|

343.7 |

|

See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation” for detailed information regarding production statistics on the San José Mine.

El Gallo Complex, Mexico (100%)

Overview and History

The Company owns property in Sinaloa State, Mexico called the El Gallo Complex, which includes the El Gallo and Palmarito silver deposits, along with the Magistral gold deposit.

The El Gallo silver deposit is a new discovery made by our geologists in November 2008. Although there is a long history of mining in the area, based on field observations, only a minimal amount of artisanal mining appears to have taken place at El Gallo. There is no recorded history of prior exploration having occurred at El Gallo.

The Palmarito silver deposit is a historic silver producing area that has an estimated historical production of 15,300,000 million ounces of silver and 49,250 ounces of gold from open pit and underground workings before mining ceased in 1950. Palmarito is considered to be one of the major historical producers of silver in Sinaloa State.

The Magistral Mine produced approximately 70,000 ounces of gold from 2002 to 2005 before it was shut down due to higher than anticipated operating costs, a lack of working capital, and poor recoveries. In October 2006, while still owned by an independent third party, the Magistral Mine was placed on care and maintenance with the operating permit remaining in place. In August 2011, following our acquisition of Nevada Pacific Gold Ltd. and significant exploration, the Company announced it had approved Phase 1 construction in order to bring the Magistral Mine back into production.

The El Gallo Complex consists of 710 square miles (1,839 square kilometers) of concessions held through ownership of Pangea Resources Inc., which in turn holds 100% ownership of Compania Minera Pangea S.A. de C.V. (“Minera Pangea”). Concession titles are granted under Mexican mining law and are issued by Secretaria de Economia, Coordinacion General de Minera, Direccion General de Minas.

The following map depicts the location of the El Gallo Complex:

The El Gallo Complex is being developed in two phases. Phase 1 production, which began in September 2012, refers to the Magistral Mine, and is expected to average 30,000 ounces of gold per year. During 2012, a total of 6,863 ounces of gold and 4,492 ounces of silver were produced. Commercial production was accomplished on January 1, 2013. Phase 1 is presently permitted for production and all surface agreements are in place. Phase 2, for which a feasibility study on the El Gallo and Palmarito silver deposits was completed in September 2012, is expected to contribute an additional 5.0 million ounces of silver and 6,000 ounces of gold per year. Production from Phase 2 is anticipated for 2014.

An annual lease agreement for surface access is currently in place between Minera Pangea and certain of our employees who hold the surface rights. These lease agreements provide for access and site preparation to accommodate exploration activities and drilling. The employees who hold the surface rights have commenced the required legal process to convert the land into private ownership so it can be sold to us. We are not required to make any additional payments, as the purchase price was agreed to and paid at the time of the lease agreements. Although the agreements cover a large area around the project, there can be no assurances that additional surface rights will not be required.

Various environmental permits, are required in order perform exploration drilling in Sinaloa state, Mexico. Permitting requirements are dependent upon the level of disturbance. Exemptions can generally be obtained if drilling occurs in areas where no new disturbance will occur and vegetation will not be removed (agricultural areas, dirt roads, previously mined sites). If drilling occurs on previously undisturbed land and vegetation will be removed, an

Environmental Impact Study and Land Use Change are required. Each of the areas where we are currently conducting exploration drilling has the required permit or exemption.

On December 6, 2001, our predecessor received an Environmental Mining Permit (“MIA”) for Magistral. The MIA was prepared by the environmental consulting firm, Soluciones de Ingeniería y Calidad Ambiental, S. A. de C. V. (SICA). The Environmental Mining Permit has 69 conditions that we must follow. Examples of these conditions include groundwater quality monitoring at four points, recycling of used oil and the development of an Accident Prevention Plan, among others. The current Magistral operating permit expires in June 2022. Minera Pangea holds permits for explosive purchase and use at Magistral. This permit is renewed on an annual basis. A quarterly permit is also issued by the local Sinaloa military authority for the buying and transporting of explosives. In addition, the President of the local municipality must approve the use of explosives at the site. We are currently preparing a separate application for a new explosive permit for El Gallo and Palmarito.

Currently, El Gallo is only permitted for exploration and no mining permits have been approved. We have received the water permit from CONAGUA for 1.2 million cubic meters per year.

In preparation for Phase 2 operations, we completed three production water wells during 2012 and the results from the pumping tests indicate there is sufficient water to meet our needs. We also received approval from Mexico’s Federal Electricity Commission for our designs to connect Phase 2 to the national electrical grid. Environmental permits to construct the power line were submitted at the end of 2012. Environmental permits for construction and operations, which include MIA, ETJ and RA are progressing and are expected to be submitted to Mexico’s Environmental and Natural Resources Ministry during the first quarter of 2013. We expect to receive all necessary approvals for construction by the third quarter of 2013. We also expect to begin procurement in the first quarter of 2013 of long lead time equipment such as the ball mill, filter presses for dry stack tailings, Merrill Crowe plant, leach tanks and electrical substation.

Location and Access

The El Gallo Complex is located in northwestern Mexico, within Sinaloa state, Mocorito Municipality. It is situated approximately 60 miles (100 kilometers) by air northwest of the Sinaloa state capital city of Culiacan in the western foothills of the Sierra Madre Occidental mountain range. The concessions are located approximately 2.5 miles (4.0 kilometers) by road from the village of Mocorito, approximately 10 miles (16 kilometers) from the town of Guamuchil. Access is either by paved or well maintained, two-way, dirt roads.

Geology and Mineralization

Gold mineralization at the Magistral Mine area occurs in four deposits along two distinct structural trends. A northwest trend hosts the San Rafael and Samaniego deposits and is the most important in terms of contained ounces of gold. The second structural trend is northeast-striking and includes the Sagrado Corazón and Lupita deposits. Along these structural trends the mineralization is located within numerous sub-structures that may be parallel, oblique or even perpendicular to the principal trends.

Mineralization within the various deposits of the Magistral Mine area is generally very similar, with the individual structural zones consisting of quartz stockwork, breccia, and local quartz vein mineralization occurring within propylitically altered andesitic volcanic rocks.

Silver mineralization at El Gallo is hosted in siliceous breccia and quartz stockwork zones within the dominantly andesitic rock package. These zones often occur at lithologic contacts, particularly contacts of porphyritic Tertiary intrusions. Multi-lithologic breccias zones are often adjacent to these contacts and these breccias are locally mineralized.

Mineralized zones commonly have gently-dipping tabular geometry. Often, these zones reflect control by sill contacts of the Tertiary intrusives.

Silver mineralization at Palmarito occurs along or near the contact of andesitic-dacitic volcanic country rocks and a Tertiary rhyolite intrusive, forming a horseshoe-shaped zone which wraps around the margin of the intrusive. Generally, mineralization occurs in a breccia zone and is associated with strong silicification in the form of siliceous breccia, stockwork veining and silica flooding.

Facilities and Infrastructure

The El Gallo Complex has well developed infrastructure and a local work force that is familiar with mining operations. At Magistral, significant infrastructure is present, acquired by us with the acquisition of Nevada Pacific Gold Ltd. in 2007 and improved in connection with the Phase 1 production that commenced in September 2012. There is a truck shop that consists of a large steel-frame building with an overhead crane and four bays for servicing heavy mobile equipment. There is also a warehouse, two core logging facilities, heap leach pad, process ponds, laboratory, three stage crushing plant and an ADR process plant with a capacity of 3,000 tonnes per day. The laboratory is equipped to process all assays (core, chips, soil) and incorporates fire assaying and atomic absorption equipment.

The Magistral Mine’s infrastructure was upgraded and constructed during 2011 and 2012 with a cost of $13.5 million, $1.5 million below original estimate. The construction was completed during the third quarter of 2012 and we had our first gold bar poured in September 2012. In order to reduce capital expenditures, we are engaging contractors to perform the mining and blasting functions.

Cell phone coverage throughout McEwen Mining’s concession area is considered good. We have connection to the local phone network and also Internet access at El Gallo and Magistral. Supervisory staff and most vehicles are equipped with two-way radios.

Medical service is currently available from a nurse who is present on the day shift and Magistral is equipped with an ambulance. Fire protection is provided by hand-held extinguishers and a water truck is equipped with a fire water monitor. Employee transportation is provided by buses.

Primary water supply for Magistral comes from two currently operating water wells located 0.9 mile (1.5 kilometers) from the process facility. Wells are powered by a generator that pumps water into a raw water pond, and it is then used for operations. Phase 1 average water demand is 5.5 liters/second. Combining Sinaloa’s annual precipitation 32 inches (~830 mm) with the site’s current water well production capacity, McEwen Mining has sufficient supply for Phase 1 production.

Primary water supply for El Gallo Phase 2 will come from three locally drilled water wells. Each well is located within 1.2 miles (2 kilometers) of the proposed El Gallo process facility. Wells will be powered by electricity and will pump water into a raw water storage tank for usage. Phase 2 average water demand is estimated to be 17 liters/second. McEwen Mining has received a water aquifer study from Investigacion y Desarrollo de Acuiferos y Ambiente (IDEAS) estimating that it will have sufficient water supply for Phase 2 production.

Exploration Activities

Modern exploration activities at the Magistral Mine Property started in early 1995, initially for Mogul Mining NL and subsequently for Santa Cruz Gold Inc. From mid-1995 to early 1997, extensive drilling was conducted by Minera Pangea/Santa Cruz Gold on the San Rafael and Samaniego Hill deposit areas, as well as locally extensive drilling on the Sagrado Corazón-Central-Lupita deposit area. In 1998, Santa Cruz conducted a limited amount of additional drilling for metallurgical samples, reverse circulation grade verification, in-fill purposes, and condemnation of potential surface

facility locations. In 1999, after a merger with Santa Cruz Gold, Queenstake conducted a limited drilling program to step-out/in-fill drill in the Samaniego Hill deposit and to obtain pit-slope geotechnical samples from both the San Rafael and Samaniego Hill deposits. Queenstake conducted a drilling campaign from late 2001 to early 2002 in the La Prieta Zone of the Samaniego Hill deposit to delineate extensions of the high grade La Prieta zone along strike and down dip. Between 2004 and 2005, Nevada Pacific Gold Ltd. conducted further drilling on the Samaniego Hill and Lupita areas and determined that the mineralized intercepts expanded the Lupita envelope at depth to the southeast. Between 2008 and 2012, McEwen Mining also conducted drilling in the Samaniego Hill, San Rafael, Sagrado Corazon and Lupita areas and determined that mineralized intercepts within those holes show continued down dip extension and lateral extension of the Lupita and Sagrado Corazon deposits, in particular. We continue to drill at Magistral with the objective of extending the mine life. During 2011 and 2012, we drilled a total of 60,561 feet (18,549 meters) of core drilling.

McEwen Mining acquired El Gallo and the surrounding mineral concessions when it completed its takeover of Nevada Pacific Gold Ltd. in 2007. We initiated exploration in the area in January 2008. The first evidence of mineralization at El Gallo occurred in the summer of 2008 when rock samples from surface outcropping returned encouraging silver values. McEwen Mining has been the sole operator of the El Gallo project since drilling began in January 2009. By December 2012, a total of 350,843 feet (106,937 meters) of core drilling had been completed. Drilling was conducted throughout the El Gallo project area and included condemnation drilling done for planned mine facilities and infrastructure peripheral to the mineralized material.

We have also recently focused our drilling efforts within other areas of the El Gallo Complex, which include Chapotillo, Haciendita, Mina Grande and San Dimas, in order to expand mineralization for anticipated Phase 2 production.

No Proven or Probable Reserves

We have yet not demonstrated the existence of proven or probable reserves at the El Gallo Complex as defined by SEC Guide 7.

In September 2012, a feasibility study (“FS”) for the El Gallo Complex Phase 2 project was completed by various consultants including M3 Engineering & Technology Corporation, Independent Mining Consultants, Pincock, Allen & Holt, and SRK Consulting (USA) Inc. The FS included a new NI 43-101 compliant resource estimate of 24 million tonnes of mineralized material (only the El Gallo and Palmarito deposits) with a weighted average grade of 0.1 gpt gold and 68.9 gpt silver, including measured and indicated resources only. Based on the FS, it is estimated that Phase 2 could produce approximately 5.0 million ounces of silver and 6,000 ounces of gold or 105,000 ounces of gold equivalent per year for 6 years at an overall life of mine operating cost of $28.74 per tonne of ore processed, including refining charges, royalties and a by-product credit for gold. Assuming a life-of-mine average gold price of $1,415 per ounce and $25 per ounce of silver, the Net Present Value at a 5% discount rate is $190.0 million. Initial capital expenditures for the project are estimated at $180 million. The full FS technical report is available on SEDAR at www.sedar.com and on our website at http://www.mcewenmining.com/files/doc_downloads/egtechreport.pdf

Royalties

Global Royalty Corp., a private Canadian company, holds a sliding scale net smelter return (“NSR”) on gold or gold equivalent recovered from the Magistral and El Gallo mineralized material areas. The royalty is calculated at a rate of 1 percent of NSR on the initial 30,000 ounces of gold equivalent production, at a rate of 3.5% of NSR on the next 350,000 ounces of gold equivalent production, and thereafter, at a rate of 1 percent of NSR on gold recovered from the areas, in perpetuity. To date, the mineralized material areas have produced approximately 77,000 ounces of gold.

For Palmarito, a 2 percent NSR royalty exists on certain claims around the area that were optioned from a third party. The NSR affects strike extensions and down-dip portions of the in-situ mineralized material and the majority of historic tailings.

Gold Bar Project, Nevada (100%)

Overview and History

The Gold Bar Project is a proposed mined development project consisting of a conventional open pit mine with an oxide gold heap leach recovery circuit. The project is located within the Battle Mountain-Eureka-Cortez gold trend in Eureka County, central Nevada. The property was previously mined from 1987 to 1994 by Atlas Precious Metals Inc. The Gold Bar project is currently in the permitting phase with construction expected to begin in 2014, and gold production expected in 2015. A pre-feasibility study (“PFS”) was completed by SRK Consulting and published in November 2011. We have yet not demonstrated the existence of proven or probable reserves for the Gold Bar Project as defined by SEC Guide 7. McEwen Mining’s objective is to obtain permits required to construct and operate the Gold Bar Project. The timeline to obtain permits is uncertain, but similar projects on public lands in Nevada have required between 18-36 months.

The PFS included a new NI 43-101 resource estimate of 19.5 million tonnes of mineralized material at a grade of 0.95 gpt gold. Based on the PFS, it is estimated that the Gold Bar Project could produce approximately 50,000 ounces of gold per year for 8 years at a cost of $700 per ounce. Assuming a life-of-mine average gold price of $1,300 per ounce, the Net Present Value at an 8% discount rate is $45.1 million. Initial capital expenditures for the project are estimated at $53.1 million including an allocation of $7.2 million for contingencies. The full PFS technical report is available on SEDAR at www.sedar.com and on our website at http://www.mcewenmining.com/files/technical_report/20120200_goldbar_ni_43_101_resource.pdf.

Location and Access

The Gold Bar Complex is in the Roberts Creek Mountains, in Eureka County, Nevada, approximately 30 miles (48 km) northwest of the town of Eureka. The Complex may be accessed by traveling approximately 26 miles (42 kilometers) west of Eureka on U.S. Highway 50, 17 miles (27 kilometers) north on county-maintained and graded Three Bar Road. Several unimproved dirt roads lead from there up into the project area.

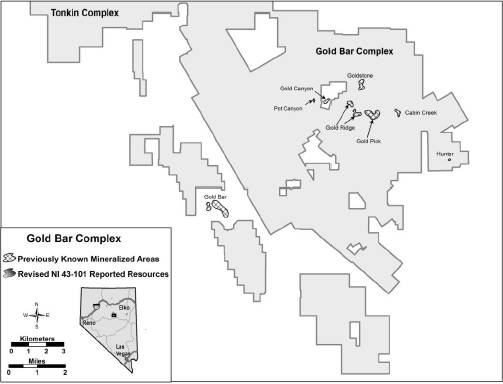

The following graphic depicts the Gold Bar Complex:

Geology and Mineralization

The Gold Pick-Gold Ridge area occurs on the Battle Mountain-Eureka mineral belt in a large window of lower-plate carbonate rocks surrounded by upper-plate rocks. The lower-plate carbonates at Gold Pick-Gold Ridge consist of an east-dipping section of Silurian Lone Mountain Dolomite, Devonian McColley Canyon Formation, Devonian Denay Formation, and Devonian Devils Gate Limestone (from oldest to youngest). Northwest-trending and northeast-trending structures cut the area; the Gold Pick mineralization is localized in an apparent northwest-trending horst of McColley Canyon Formation which is cut by a series of northeast-trending structures.

Gold mineralization is hosted primarily in the Bartine Member of the McColley Canyon Formation, which consists of carbonate wackestones and packstones approximately 250 to 380 feet thick. Minor amounts of mineralization are found in the underlying dolomitic limestone Kobeh Member of the McColley Canyon Formation when it is adjacent to apparent feeder structures. Gold Pick-Gold Ridge is “Carlin-Type” sediment-hosted gold mineralization with typical associated alteration (decalcification, silicification) and trace elements (antimony, arsenic, mercury, and barium).

Three-dimensional modeling by our geologists has led to the identification of an unconformity (erosional surface) between the basement and gold host rocks at the Gold Bar Project. Channels in this unconformity were filled with porous limestone, which then acted as preferred pathways for gold mineralization. Much of the gold mineralization in the Gold Pick-Gold Ridge area occurs in the porous limestones above these channels.

Exploration Activities

Since the formal permitting process began in 2012, we are unable to drill any additional holes.

No Proven or Probable Reserves

We have yet not demonstrated the existence of proven or probable reserves at the Gold Bar Complex as defined by SEC Guide 7.

Exploration Properties

Los Azules Copper Project, Argentina (100%)

Los Azules is a 100% owned advanced-stage porphyry copper exploration project located in the cordilleran region of San Juan Province, Argentina near the border with Chile. We acquired this property, along with other Argentina exploration properties, in connection with the acquisition of Minera Andes in January 2012. Located at approximately 31°13’30” south latitude and 70°13’50” west longitude, Los Azules is 4 miles (6 km) east of the Chilean-Argentine border. It is accessible by road except for seasonal closures in winter. The elevation at site ranges between 11,500 feet — 14,750 feet (3,500 m — 4,500 m) above sea level.

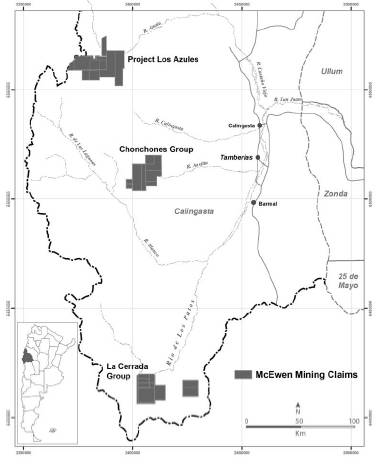

The following map illustrates the location of the Los Azules Copper Project as well as our other properties in the Province of San Juan:

The deposit is located within a copper porphyry belt that is host to some of the world’s largest copper mines. The upper part of the system consists of a barren leached cap, which is underlain by a high-grade secondary enrichment blanket. Primary mineralization below the secondary enrichment zone has been intersected in drilling up to a depth of more than 3,280 feet (1,000 meters) below surface. The property encompasses 127 square miles (328 square kilometers) and surrounds a large alteration zone that is approximately 5 miles (8 kilometers) long by 1.2 miles (2 kilometers) wide.

Drilling programs have been undertaken at Los Azules between 1998 and 2012 by four different mineral exploration companies: Battle Mountain Gold (now Newmont Mining Inc.), Mount Isa Mines S.A. (now Xstrata Copper Plc.), Minera Andes and McEwen Mining. Drilling, including early reverse circulation programs, focused initially on gold exploration and subsequently on diamond drilling for porphyry style copper mineralization. Drilling conditions are difficult, especially in highly faulted zones and in areas of unconsolidated surface scree or talus. Due to snow conditions on two mountain passes on the access road to the site, seasonal exploration typically commences in December and extends into late April or early May.

From 1998 to the end of 2012, a total of 174,154 feet (53,082 meters) were drilled on the property.

We began the 2012-2013 drill season in October 2012, two months earlier than prior seasons, with a total of five core drills and one rotary drill, which are more powerful than the ones used in the prior season. In addition, the drilling has consistently achieved drill hole depths greater than 700 meters. Significantly, all of the deeper drill holes ended in mineralization. Drilling will continue to focus on expanding the mineralized material. This season’s exploration program is on track to achieve our objective of completing 15,000 meters of drilling by the end of April 2013.

In August 2012, Samuel Engineering Inc. issued a 43-101 Technical Report, which showed an estimated 323 million tonnes of mineralized material with a weighted average grade of 0.65 percent copper, including measured and indicated resources only. In February 2013 we announced an updated estimate prepared by SIM Geological Inc., which showed an estimated 310 million tonnes of mineralized material with a weighted average grade of 0.65 percent copper, again including only measured and indicated resources. The February 2013 estimate incorporated the results of the drilling accomplished from October through December 2012.

In November 2012, McEwen Mining and TNR Gold Corp. settled all outstanding litigation with respect to the Los Azules Copper Project. See “Item 3. Legal Proceedings” for further details.

Other Argentina Exploration Properties

In addition to the San José Mine and the Los Azules Copper Project, the Company also owns a 100% interest in numerous exploration properties totaling 796 square miles (2,062 square kilometers) located in the Province of Santa Cruz and San Juan where generally limited exploration has been performed. We do not presently consider these properties significant to our exploration program or our operations.

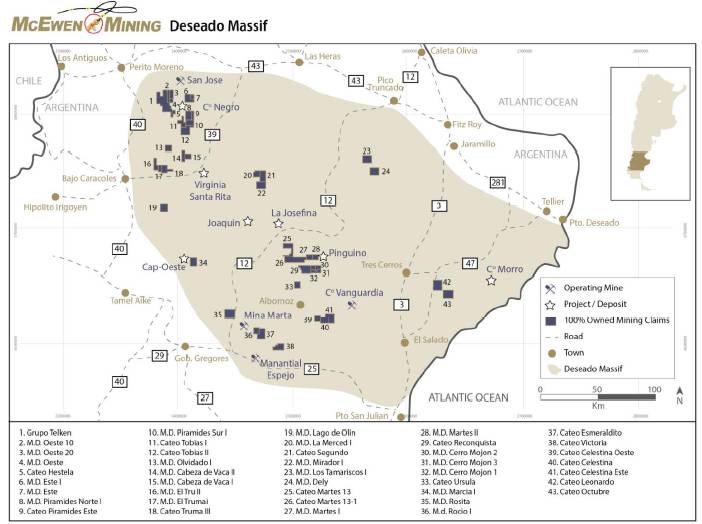

The following map illustrates the properties in Santa Cruz:

During 2012, our exploration focus was on the Celestina (#39 to 41 from the above map), Telken (#1 to 5 from the above map) and Cerro Mojon (#29 to 32 from the above map) projects. During 2012, a total of 36,583 feet (11,150 meters) of percussion drilling was completed on our Celestina project and a total of 26,539 feet (8,089 meters) of blast holes and diamond drilling was completed on our Cerro Mojon project. Exploration work ceased towards the end of May 2012 with the onset of Argentinean winter. In September 2012, we received the drill permits for the Telken project, one of our 100% owned claim package adjacent to the San José Mine. During the fourth quarter of 2012, we commenced drilling at Telken with a reverse-circulation drill rig for a total of 5,100 ft. (1,554 m). The plan is to drill approximately 8,201 ft. (2,500 m) for the 2012-2013 drilling season.

Nevada Exploration Properties

The following table summarizes the U.S. land position of our company as of December 31, 2012:

|

Complex Summary |

|

|

|

Claims |

|

Approx |

|

|

Tonkin Complex (Exploration) |

|

|

|

3,302 |

|

98.76 |

|

|

Gold Bar Complex (Development) |

|

|

|

2,667 |

|

81.09 |

|

|

Limo Complex (Exploration) |

|

|

|

1,499 |

|

46.76 |

|

|

Battle Mountain Complex (Exploration) |

|

|

|

935 |

|

27.95 |

|

|

Other United States Properties (Exploration) |

|

|

|

1,141 |

|

38.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

9,544 |

|

292.59 |

|

Only Gold Bar, discussed in more detail above, is considered to be a significant property in Nevada at the time of filing this report.

We generally hold mineral interests in Nevada through unpatented mining and mill site claims, leases of unpatented mining claims, and joint venture and other agreements. Unpatented mining claims are held subject to paramount title in the United States. In order to retain these claims, we must pay annual maintenance fees to the BLM, and to the counties within which the claims are located. Rates for these jurisdictions vary and may change over time. Other obligations which must be met include continuing assessment work, obtaining and maintaining necessary regulatory permits, and lease and option payments to claim owners.

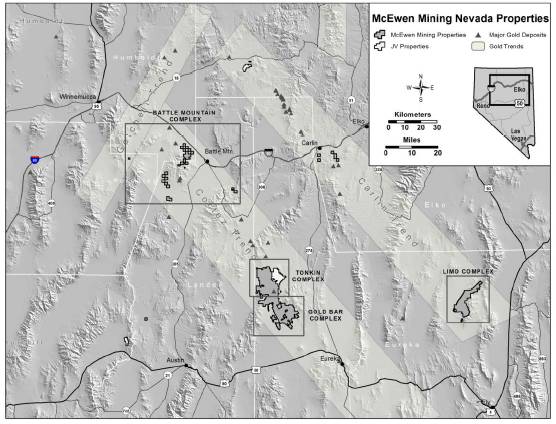

The following Nevada trend map and property location map is presented to generally indicate the location of the trends and our properties:

Tonkin Complex

The Tonkin Complex represents our largest holding in the State of Nevada at approximately 93 sq. miles (241 sq. km). The Tonkin Project is a gold mining property located within the Battle Mountain-Eureka Trend in Eureka County, Nevada. From 1985 through 1989, Tonkin produced approximately 30,000 ounces gold utilizing an oxide heap leach and a separate ball mill involving bioxidation to treat the problematic sulphide ore. Due to cost escalation and recovery issues associated with the refractory and preg-robbing carbonaceous mineralogy, the operation was forced to shut down.

During 2012, we made a decision to sell the majority of the inactive milling equipment and its related assets at the project to supplement our working capital. The items that were sold included the ball mill, process facility, thickener, mobile homes and other miscellaneous equipment. Total proceeds received for these assets were $1.7 million.

We are currently performing additional metallurgical test work to further evaluate conventional flotation and bioxidation possibilities at Tonkin. If a viable solution is found to extract the gold economically, we will proceed with a preliminary economic assessment.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Introduction

The following discussion summarizes what management believes is relevant to our results of operations for three fiscal years ended December 31, 2012 and our financial condition at December 31, 2012 and 2011, with a particular emphasis on the year ended December 31, 2012. With regard to properties or projects that are not in production, we provide some details of our plan of operation. The discussion also presents certain Non-GAAP financial measures that are important to management in its evaluation of our operating results and which are used by management to compare our performance with what we perceive to be peer group mining companies and relied on as part of management’s decision-making process. Management believes these measures may also be important to investors in evaluating our performance. For a detailed description of each of the Non-GAAP financial measures, please see the discussion under “Non-GAAP Measures” below.

The information in this section should be read in conjunction with our consolidated financial statements and the notes thereto included in this annual report.

Reliability of Information: Minera Santa Cruz S.A., the owner of the San José Mine, is responsible for and has supplied to us all reported results from the San José Mine. The technical information contained herein is, with few exceptions as noted, based entirely on information provided to us by Minera Santa Cruz S.A. (“MSC”). Our joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy or accuracy of this document. As we are not the operator of the San José Mine, there can be no assurance that production information reported to us by MSC is accurate, we have not independently verified such information and readers are therefore cautioned regarding the extent to which they should rely upon such information.

Overview

McEwen Mining Inc. was organized under the laws of the State of Colorado on July 24, 1979. We are a mining and minerals exploration company focused on precious metals in Argentina, Mexico and the United States. On January 24, 2012, we changed our name from US Gold Corporation to McEwen Mining Inc. after the completion of the acquisition, by way of a statutory plan of arrangement pursuant to the laws of the Province of Alberta, Canada, of Minera Andes Inc. (“Minera Andes”). Our principal assets consists of our 49% interest in the San José Mine in Santa Cruz, Argentina; the El Gallo Complex in Sinaloa, Mexico; the Gold Bar Project in Nevada, United States; the Los Azules Project in San Juan, Argentina, and a large portfolio of exploration properties in Argentina, Nevada and Mexico.

In this report, Au represents gold, Ag represents silver, oz represents ounce, opt represents troy ounces per short ton, gpt represents grams per metric tonne, ft. represents feet, m represents meters, km represents kilometer, and sq. represents square. All of our financial information is reported in United States (“U.S.”) dollars, unless otherwise noted.

Development and Exploration Activities

El Gallo Complex, Mexico

In September 2012, we had our first gold pour at El Gallo Phase 1 upon completion of the Phase 1 construction, which had a total cost of $13.5 million. Total production for 2012 was 6,863 oz of gold and 4,492 oz of silver during the start up period. A total of 356,000 tonnes were mined and 248,000 tonnes processed between September and December

2012. Tonnes mined represent tonnes of ore extracted, while tonnes processed represent tonnes of ore crushed and placed on the leach pads. The difference between tonnes mined and processed remained in stockpile inventory. Due to long process cycles, actual recoveries are difficult to measure and may fluctuate significantly based on the timing, quantity and metallurgical attributes of new mineralized material placed on the leach pads, amongst other variables. The cumulative recovery rate for gold production from September 1, 2012 (start of production) to December 31, 2012 was approximately 60%.

El Gallo Phase 1 achieved commercial production on January 1, 2013. In 2013, production for Phase 1 is forecasted to be approximately 27,500 oz of gold.

The following table summarized production and sales totals for El Gallo 1 for 2012. As production for operational purposes was only achieved on January 1, 2013, certain measures such as total cash costs and all-in sustaining costs are not computed.

El Gallo Phase 1 - Production and Sales

|

|

|

2012 |

|

Q4 2012 |

| ||

|

El Gallo 1 Mine |

|

|

|

|

| ||

|

Tonnes mined (thousands) |

|

357 |

|

287 |

| ||

|

Average grade gold (gpt) |

|

1.21 |

|

1.21 |

| ||

|

Tonnes processed (thousands) |

|

340 |

|

261 |

| ||

|

Average grade gold (gpt) |

|

1.05 |

|

1.13 |

| ||

|

Gold ounces (thousands) |

|

|

|

|

| ||

|

Produced |

|

6.9 |

|

6.6 |

| ||

|

Sold |

|

3.2 |

|

3.0 |

| ||

|

Silver ounces (thousands) |

|

|

|

|

| ||

|

Produced |

|

4.5 |

|

4.4 |

| ||

|

Sold |

|

0.3 |

|

0.2 |

| ||

|

Gold equivalent ounces (thousands) (1) |

|

|

|

|

| ||

|

Produced |

|

6.9 |

|

6.7 |

| ||

|

Sold |

|

3.2 |

|

3.0 |

| ||

|

Net sales (thousands) |

|

$ |

5,966 |

|

$ |

5,510 |

|

(1) Gold equivalent ounces calculated using an average silver to gold ratio of 52:1.

In September 2012, the feasibility study for Phase 2 was completed and it reported an estimate of 24 million tonnes of mineralized material (including only the El Gallo and Palmarito deposits) with a weighted average grade of 0.1 gpt of gold and 68.9 gpt of silver. The report projected an average annual production rate of 5.0 million oz of silver and 6,000 oz of gold during each of the first six years at a cash operating cost of $9.86 per silver oz (net of gold by-product and including royalties). The feasibility study also estimated initial capital expenditures to be $180 million, including a 14.4% contingency.

In preparation for Phase 2 operations, we completed three production water wells during 2012 and the results from the pumping tests indicate there is sufficient water to meet our needs. We also received approval from Mexico’s Federal Electricity Commission for our designs to connect Phase 2 to the national electrical grid. Environmental permits to construct the power line were submitted at the end of 2012. Environmental permits for construction and operations are progressing and are expected to be submitted to Mexico’s Environmental and Natural Resources Ministry during the first quarter of 2013. We also expect to begin procurement in the first quarter of 2013 of long lead time equipment such as the ball mill, filter presses for dry stack tailings, Merrill Crowe plant, leach tanks and electrical substation.

During 2012, approximately 131,486 ft. (40,077 m) of drilling was completed at the El Gallo Complex. We expect to drill approximately 65,000 ft. (20,000 m) during 2013 with a total exploration budget of approximately $10 million.

Gold Bar Project, Nevada

During 2012, we continued to advance the Gold Bar Project through the permitting process. Baseline studies were completed in support of the U.S. Bureau of Land Management (“BLM”) and State of Nevada permitting required for mine development and construction. We expect to submit our Plan of Operations permit application during the second half of 2013. As the official permitting process has begun, we are unable to perform any drilling activities at Gold Bar. Our 2013 budget for Gold Bar, primarily for permitting activities, is $1.2 million.

Los Azules Copper Project, Argentina

In August 2012, the Company issued a NI 43-101 compliant Technical Report, which estimated 323 million tonnes of mineralized material with a weighted average grade of 0.65 percent copper. In February 2013 we announced an updated estimate, which estimated 310 million tonnes of mineralized material with a weighted average grade of 0.65 percent copper. The February 2013 estimate incorporated the results of the drilling completed from October through December 2012.

During the prior drill season in the first half of 2012, drilling at the project was slow due to difficult ground conditions and equipment problems. A total of 9,301 ft. (2,835 m) was drilled during the 2011-2012 field season in eight holes, which ran from early January to late April 2012 and fell short of the 26,247 ft. (8,000 m) target originally planned. Although significant intercepts of copper mineralization were encountered, most of the drill holes started were unable to reach their target depth due to difficult ground conditions.

We began the 2012-2013 drill season in October 2012 with a total of five core drills and one rotary drill which are more powerful than the ones used in the prior season. A total of 31,000 ft. (9,436 m) was drilled during the fourth quarter of 2012. The current drilling season is expected to end in April 2013. We plan to drill a total of 49,215 ft. (15,000 m) over the current drilling season. The budget for the entire 2012-2013 drilling season is estimated to be $26 million.

In November 2012, McEwen Mining and TNR Gold Corp. agreed that all claims and counterclaims would be discontinued or resolved. The material terms of the settlement included that: (i) TNR would receive 1,000,000 common shares of McEwen Mining; (ii) TNR would transfer the Escorpio IV claim to McEwen Mining; and (iii) the Xstrata-Solitario Agreement will be amended so TNR will retain a Back-in Right for up to 25% of the equity in the Solitario Properties. The Back-in Right is only exercisable after the completion of a feasibility study. To exercise, TNR must pay two times the expenses attributable to the back-in percentage (i.e. paying 2 x 25% all of the costs attributable to the Solitario Properties). Upon backing-in, TNR may elect to continue to participate in the project or be diluted down to a 0.6% NSR on Solitario Properties.

Santa Cruz Exploration, Argentina

During 2012, a total of 36,583 ft. (11,150 m) of percussion drilling was completed on our Celestina project and a total of 26,539 ft. (8,089 m) of blast holes and diamond drilling was completed on our Cerro Mojon project. Exploration work ceased towards the end of May 2012 with the onset of Argentinean winter.

In September 2012, we received the drill permits for the Telken project, one of our 100% owned claim package adjacent to the San José Mine. During the fourth quarter of 2012, we commenced drilling at Telken with a reverse-circulation drill rig for a total of 5,100 ft. (1,554 m). The plan is to drill approximately 8,201 ft. (2,500 m) for the 2012-2013 drilling season.

We are continuing with our review of our 100% owned properties in the province of Santa Cruz, Argentina with extensive sampling and mapping taking place, along with selective drilling of prospective targets. We have budgeted $1.2 million towards exploration in Santa Cruz for 2013.

Corporate Development Activities

Rights Offering

During the fourth quarter of 2012, we launched a transferrable rights offering, in which all existing holders of common stock and holders of Exchangeable Shares had the opportunity to participate on an equal and proportional basis in purchasing additional common stock or Exchangeable Shares at a price of $2.25 (or C$2.24) per share, which represented a 50% discount to the closing share price prior to the announcement. Shareholders received one right for each share of common stock or Exchangeable Share and 10 rights were needed to purchase an additional share of the same class. Mr. McEwen purchased 2.8 million shares of common stock and 3.9 million Exchangable Shares for a total cost of $15.1 million. Upon completion of the rights offering, we issued an additional 19.6 million shares of common stock and 7.8 million Exchangeable Shares for proceeds of approximately $60.4 million, net of $1.2 million in expenses.

Business Acquisition

On January 24, 2012, we completed the acquisition of Minera Andes through a court-approved plan of arrangement under Alberta, Canada law (the “Arrangement”), under which Minera Andes, a Canadian company, became an indirect wholly-owned subsidiary of McEwen Mining.

Our management and Board of Directors believes that the combination with Minera Andes is in the best interests of our company and our shareholders because the combined company is expected to have a stronger combined cash position and balance sheet, sources of revenue, active mining operations, enhanced trading liquidity, a significant growth profile, an expanded exploration program and additional technical expertise.

On the closing date of the Arrangement, holders of Minera Andes’ common stock received a number of exchangeable shares of McEwen Mining - Minera Andes Acquisition Corp. (“Exchangeable Shares”), an indirect wholly-owned Canadian subsidiary of McEwen Mining, equal to the number of Minera Andes shares, multiplied by the exchange ratio of 0.45. In the aggregate, former Minera Andes shareholders received 127,331,498 Exchangeable Shares. Our common stock began trading on the NYSE and TSX under the symbol “MUX” and the Exchangeable Shares began trading on the TSX under the symbol “MAQ” on January 27, 2012.

In June 2011, Robert R. McEwen, our Chairman, President, Chief Executive Officer and largest shareholder and then also the Chairman, President, Chief Executive Officer and largest shareholder of Minera Andes, proposed the Arrangement. In connection with the Arrangement, Mr. McEwen received approximately 38.7 million Exchangeable Shares. Mr. McEwen owns approximately 25% of the shares of the Company.

As a result of the Arrangement and on the date of closing, the combined company was held approximately 52% by then-existing McEwen Mining shareholders and 48% by former Minera Andes shareholders. On a diluted basis, the combined company was held approximately 53% by then-existing McEwen Mining shareholders and 47% by former Minera Andes shareholders.

The Exchangeable Shares are exchangeable for our common stock on a one-for-one basis. Option holders of Minera Andes received replacement options entitling them to receive, upon exercise, shares of our common stock, reflecting the exchange ratio of 0.45 with the appropriate adjustment of the exercise price per share. The option life and vesting period of the replacement options has not changed from the option life granted under the Minera Andes option plan.

The estimated fair value of the vested portion of the replacement options of $3.2 million have been included as part of the purchase price consideration at their fair values based on the Black-Scholes pricing model as illustrated below.

The principal assumptions used in applying the Black-Scholes option pricing model were as follows:

|

|

|

January 24, 2012 |

|

|

Risk-free interest rate |

|

0.02% to 0.39% |

|

|

Dividend yield |

|

n/a |

|

|

Volatility factor of the expected market price of common stock |

|

46% to 77% |

|

|

Weighted-average expected life of option |

|

1.4 years |

|

The acquisition has been accounted for using the acquisition method in accordance with ASC Topic 805, Business Combinations, with McEwen Mining being identified as the acquirer. The measurement of the purchase consideration was based on the market price of our common stock on January 24, 2012, which was $5.22 per share. The total purchase price, including the fair value of the options, amounted to $667.8 million. The total transaction costs incurred through December 31, 2012 by us was $5.4 million, of which $3.9 million was reported in the year ended December 31, 2011 in general and administrative expenses, and $1.5 million for the year ended December 31, 2012 in acquisition costs in the consolidated statements of operations and comprehensive loss.

The allocation of the purchase price, based on the estimated fair value of assets acquired and liabilities assumed on January 24, 2012, is summarized in the following table (in thousands).

2. Business Acquisition

Calculation of the Purchase Price Equation

|

|

|

Fair Value |

| |

|

Purchase price: |

|

|

| |

|

Exchangeable shares of McEwen Mining-Minera Andes Acquisition Corp. |

|

$ |

664,671 |

|

|

Stock options to be exchanged for options of McEwen Mining Inc. |

|

3,175 |

| |

|

|

|

$ |

667,846 |

|

|

|

|

|

| |

|

Net assets acquired: |

|

|

| |

|

Cash and cash equivalents |

|

$ |

31,385 |

|

|

Short-term investments |

|

4,952 |

| |

|

Other current assets |

|

9,828 |

| |

|

Inventories |

|

1,362 |

| |

|

Mineral property interests |

|

539,092 |

| |

|

Investment in Minera Santa Cruz S.A. |

|

262,883 |

| |

|

Equipment |

|

1,647 |

| |

|

Accounts payable |

|

(5,323 |

) | |

|

Deferred income tax liability |

|

(177,980 |

) | |

|

|

|

$ |

667,846 |

|

For the purposes of our financial statements, the purchase consideration has been allocated to the fair value of assets acquired and liabilities assumed, based on an independent valuation report and management’s best estimates and taking into account all available information at the time these consolidated financial statements were prepared. Mineral property interests acquired relate primarily to the Los Azules Copper Project while the Investment in Minera Santa Cruz S.A. reflects the 49% ownership of the San José Mine. The deferred income tax liability arises due to the excess of the fair market values reflected herein compared to the underlying tax values of those assets.

Dividend Receivable

As a result of the acquisition of Minera Andes, we also acquired a dividend receivable of $9.4 million due from MSC which was paid on February 24, 2012. During the remainder of 2012, we received an additional $9.8 million in dividends for a total of $19.2 million in dividends from MSC during 2012.

Liquidity and Capital Resources

As of December 31, 2012, we had working capital of $66.7 million, comprised of current assets of $91.9 million and current liabilities of $25.2 million. This represents an increase of approximately $24.9 million from the working capital of $41.8 million at fiscal year end December 31, 2011.

With the acquisition of Minera Andes on January 24, 2012, our working capital in 2012 increased by approximately $42.2 million, including the dividend receivable from MSC of $9.4 million. We expect to receive further dividends from MSC during 2013, although the timing and amount of those dividends will depend upon silver and gold prices, production levels, operating costs, capital expenditures, Argentine central bank and government restrictions, and a variety of other factors beyond our control.

Net cash used in operations for the year ended December 31, 2012 increased to $71.5 million from $59.0 million for 2011 and from $25.9 million in 2010, primarily due to an increase in cash paid to suppliers and employees, partially offset by dividends received from MSC of $9.8 million and cash received from gold and silver sales from Mexico of $5.6 million. Cash paid to suppliers and employees increased to $87.1 million for the 2012 period from $59.1 million and $26.0 million during the 2011 and 2010 periods respectively, as a result of the acquisition of Minera Andes and the increased development and construction expenditures of El Gallo Phase 1.

Cash provided by investing activities for the year ended December 31, 2012 was $65.1 million, primarily due to cash received from the acquisition of Minera Andes of $36.3 million as well as proceeds from the sale of gold and silver bullion of $23.8 million. This compares to cash used in investing activities of $40.3 million in the comparable period of 2011, primarily due to additional purchases of gold and silver bullion of $31.3 million, acquisition of mineral property interests in Nevada and Mexico of $10.1 million, additional purchases of property and equipment of $8.0 million mostly in Mexico, and investment in short-term Canadian Treasury Bills of $3.9 million, partially offset by proceeds from the sale of gold and silver bullion and marketable securities aggregating $13.6 million. This compares to cash provided by investing activities in 2010 of $3.9 million, primarily due to the redemption of our short-term US and Canadian Treasury Bills of $12.9 million, partially offset by additional purchases of gold bullion of $1.8 million, investment in marketable equity securities of $4.0 million, acquisition of mining concessions in Mexico of $1.3 million and property and equipment in Mexico of $2.0 million.

Cash provided by financing activities for 2012 was $64.3 million from the rights offering of 19.6 million shares of common stock and 7.8 million shares of Exchangeable Shares and the exercise of stock options, compared to $106.2 million from the public offering of 17.25 million shares and the exercise of stock options in the comparable period of 2011. Cash provided by financing activities in 2010 was $0.8 million. Overall, our cash increased by $57.5 million in 2012, providing us needed capital.

We believe our working capital at December 31, 2012 is sufficient to fund ongoing exploration and corporate activities over the next 12 months. Our sources of working capital at December 31, 2012 include cash on hand, other current assets, revenue from Phase 1 of El Gallo and any distributions from the San José Mine. However, in order to fund the development of El Gallo Phase 2, pending receipt of regulatory approvals, we will need to raise additional capital

given the capital cost is estimated at approximately $180 million which significantly exceeds our available working capital.

Tabular Disclosure of Contractual Obligations

Schedule of Contractual Obligations. The following table summarizes our obligations and commitments as of December 31, 2012 to make future payments under certain contracts, aggregated by category of contractual obligation, for specified time periods:

|

|

|

|

|

Payments due by period |

| |||||||||||

|

Contractual Obligations |

|

Total |

|

Less than |

|

1-3 years |

|

4-5 years |

|

More than |

| |||||

|

|

|

(in thousands) |

| |||||||||||||

|

Operating Lease Obligations |

|

$ |

13,793 |

|

$ |

3,971 |

|

$ |

8,744 |

|

$ |

1,043 |

|

$ |

35 |

|

|

Purchase Obligations |

|

1,530 |

|

1,026 |

|

504 |

|

— |

|

— |

| |||||

|

Accounts Payable & Accrued Liabilitites |

|

21,635 |

|

21,235 |

|

400 |

|

— |

|

— |

| |||||

|

Asset Retirement Obligations |

|

6,360 |

|

130 |

|

2,299 |

|

39 |

|

3,892 |

| |||||

|

Total |

|

$ |

43,318 |

|

$ |

26,362 |

|

$ |

11,947 |

|

$ |

1,082 |

|

$ |

3,927 |

|

Results of Operations — MSC

Overview

The following discussion relates only to MSC and is disclosed on a 100% basis of which we indirectly own 49%. We account for our investment in MSC using the equity method. Furthermore, this discussion is based on the results for the full year of 2012 whereas we have only recorded income from our equity investment for the period from January 25, 2012 to December 31, 2012. MSC, the entity which owns and operates the San José Mine, is responsible for and has supplied to us all reported results and operational updates from the San José Mine.

For the year ended December 31, 2012, MSC reported net income of $61.8 million. The amortization of the fair value increments arising from the purchase price allocation decreased the reported net income from MSC for the year ended December 31, 2012 by $9.1 million.

During the year ended December 31, 2012, production was 85,768 ounces of gold and 5,952,534 ounces of silver, compared to production of 80,948 ounces of gold and 5,869,564 ounces of silver in 2011. This represents an increase of 5% for gold production and 1% for silver production.

The following table sets out production totals, sales totals, total cash costs, and all-in sustaining cash costs (on a co-product basis) for the San José Mine for 2012 and 2011. Total cash costs and all-in sustaining cash costs are considered to be non-GAAP measures (see non-GAAP measures, page 30). Also included below are the production figures on a 49% attributable basis

MSC - Production and Sales

|

|

|

2012 |

|

Q4 2012 |

|

Q3 2012 |

|

Q2 2012 |

|

Q1 2012 |

|

2011 |

| ||||||

|

San José Mine - 100% |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Tonnes mined (thousands) |

|

548 |

|

136 |

|

140 |

|

139 |

|

133 |

|

499 |

| ||||||

|

Average grade (gpt): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Gold |

|

5.40 |

|

6.04 |

|

5.04 |

|

4.85 |

|

5.33 |

|

5.88 |

| ||||||

|

Silver |

|

422 |

|

466 |

|

422 |

|

384 |

|

397 |

|

461 |

| ||||||

|

Tonnes processed (thousands) |

|

510 |

|

129 |

|

136 |

|

129 |

|

116 |

|

463 |

| ||||||

|

Average grade (gpt): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Gold |

|

5.79 |

|

6.00 |

|

5.24 |

|

5.98 |

|

5.98 |

|

5.86 |

| ||||||

|

Silver |

|

417 |

|

422 |

|

402 |

|

430 |

|

416 |

|

444 |

| ||||||

|

Average recovery (%): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Gold |

|

90.4 |

|

91.1 |

|

91.1 |

|

88.6 |

|

91.6 |

|

92.9 |

| ||||||

|

Silver |

|

86.6 |

|

87.9 |

|

87.9 |

|

84.2 |

|

87.8 |

|

88.8 |

| ||||||

|

Gold ounces (thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Produced |

|

86 |

|

23 |

|

21 |

|

22 |

|

20 |

|

81 |

| ||||||

|

Sold |

|

84 |

|

23 |

|

29 |

|

18 |

|

14 |

|

83 |

| ||||||

|

Silver ounces (thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Produced |

|

5,953 |

|

1,545 |

|

1,552 |

|

1,500 |

|

1,356 |

|

5,870 |

| ||||||

|

Sold |

|

5,897 |

|

1,553 |

|

2,166 |

|

1,146 |

|

1,032 |

|

6,086 |

| ||||||

|

Net sales (thousands) |

|

$ |

310,384 |

|

$ |

77,946 |

|

$ |

116,299 |

|

$ |

56,375 |

|

$ |

59,764 |

|

$ |

325,302 |

|

|

Total cash costs (thousands) |

|

$ |

146,020 |

|

$ |

38,578 |

|

$ |

54,066 |

|

$ |

29,844 |

|

$ |

23,532 |

|

$ |

134,682 |

|

|

Total cash costs per ounce sold ($/oz): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Gold |

|

$ |

760 |

|

$ |

770 |

|

$ |

766 |

|

$ |

811 |

|

$ |

686 |

|

$ |

628 |

|

|

Silver |

|

$ |

13.90 |

|

$ |

13.35 |

|

$ |

14.66 |

|

$ |

13.54 |

|

$ |

13.27 |

|

$ |

13.63 |

|

|

All-in sustaining costs (thousands) |

|

$ |

232,145 |

|

$ |

61,512 |

|

$ |

79,451 |

|

$ |

48,918 |

|

$ |

42,264 |

|

$ |

206,475 |

|

|

All-in sustaining costs per ounce sold ($/oz): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Gold |

|

$ |

1,208 |

|

$ |

1,228 |

|

$ |

1,226 |

|

$ |

1,329 |

|

$ |

1,233 |

|

$ |

962 |

|

|

Silver |

|

$ |

22.11 |

|

$ |

21.29 |

|

$ |

21.54 |

|

$ |

22.20 |

|

$ |

23.83 |

|

$ |

20.89 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

McEwen Mining - 49% attributable share |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Gold ounces produced (thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

|

Gold |

|

42 |

|

11 |

|

10 |

|

11 |

|

10 |

|

40 |

| ||||||

|

Silver |

|

2,917 |

|

757 |

|

761 |

|

735 |

|

664 |

|

2,876 |

| ||||||

|

Gold equivalent (1) |

|

98 |

|

26 |

|

25 |

|

25 |

|

23 |

|

95 |

| ||||||

(1) Gold equivalent ounces calculated using an average silver to gold ratio of 52:1.

Sales

Net sales realized by MSC from the sale of gold and silver for the year ended December 31, 2012 totaled $310.4 million as compared to $325.3 million for the same period in 2011, a decrease of $14.9 million or 5%. The decrease in sales revenue was primarily due to a reduction in the realized price of silver, partially offset by an increase in both the realized price and number of ounces of gold sold.