Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FMC CORP | fmc8k03102014.htm |

| EX-99.1 - PRESS RELEASE - FMC CORP | fmcex99103102014.htm |

Creation of Two Independent Public Companies March 10, 2014

Safe Harbor Statement and Non-GAAP Terms Safe Harbor Statement • These slides and the accompanying presentation contain “forward-looking statements” that represent management’s best judgment as of the date hereof based on information currently available. Actual results of the company may differ materially from those contained in the forward-looking statements. • Additional information concerning factors that may cause results to differ materially from those in the forward-looking statements is contained in the company’s periodic reports filed under the Securities Exchange Act of 1934, as amended. • The company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. • Pro forma revenues and EBIT referred to in these slides are defined as FMC Corporation’s full year revenue EBIT, realigned according to the expected business structures of the two corporations, assuming separation as of January 1, without other adjustments. Non-GAAP Financial Terms • Earnings before interest and taxes (EBIT) for FMC Corporation is the sum of Income (loss) from continuing operations before income taxes less Net income attributable to non controlling interests, plus the sum of Corporate special (charges) income and Interest expense, net. EBIT margin is the quotient of EBIT (defined above) divided by Revenue. Reconciliations of non-GAAP figures to the nearest available GAAP term are available on the website. • New FMC EBIT represents the sum of 2013 FMC Agricultural Solutions and FMC Health and Nutrition segment earnings. FMC Minerals EBIT represents FMC Minerals segment operating profit. Both amounts exclude any impact associated with corporate costs as well as Corporate special (charges) income, income taxes, noncontrolling interests and interest expense, net. • New FMC Return on Capital Employed represents the sum of FMC Agricultural Solutions and FMC Health and Nutrition segment earnings for each year multiplied by an estimated effective tax rate divided by the two point average of operating capital employed. FMC Minerals Return on Capital Employed represents the sum of FMC Minerals segment earnings for each year multiplied by an estimated effective tax rate divided by the two point average of operating capital employed. Operating capital employed consists of assets, net of liabilities reported by each of our segment operations and excludes corporate items such as cash, debt, pension liabilities, income taxes and LIFO reserves, and is our primary measure of segment capital. Please see Note 20 to our financial statements included in our 2013 Form 10-K for disclosures on our segment earnings and segment capital employed. 2

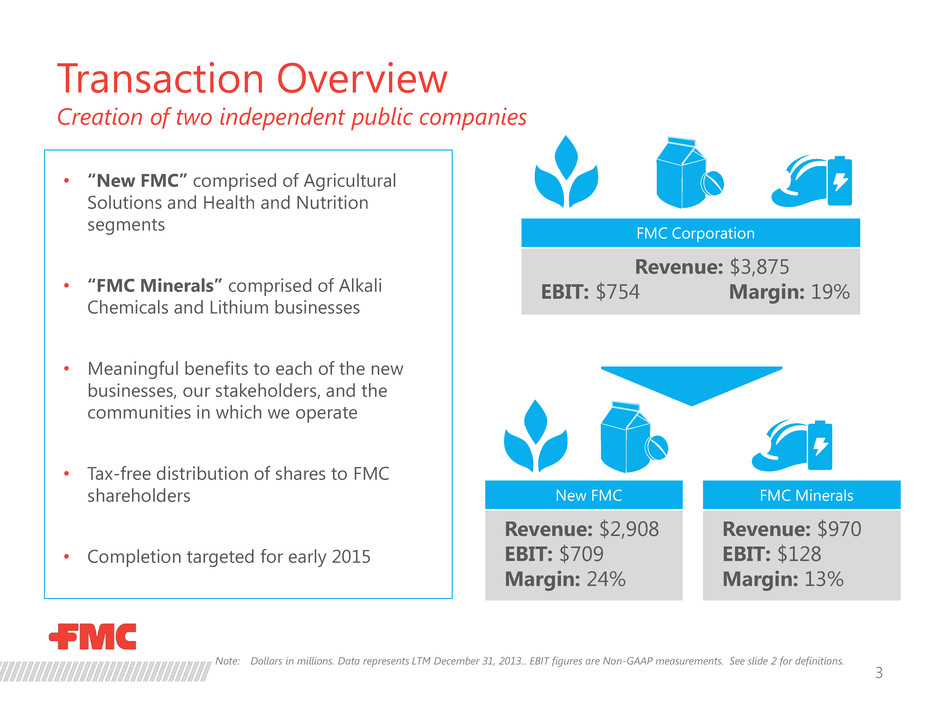

Transaction Overview Creation of two independent public companies Note: Dollars in millions. Data represents LTM December 31, 2013.. EBIT figures are Non-GAAP measurements. See slide 2 for definitions. FMC Corporation Revenue: $3,875 EBIT: $754 Margin: 19% New FMC Revenue: $2,908 EBIT: $709 Margin: 24% FMC Minerals Revenue: $970 EBIT: $128 Margin: 13% • “New FMC” comprised of Agricultural Solutions and Health and Nutrition segments • “FMC Minerals” comprised of Alkali Chemicals and Lithium businesses • Meaningful benefits to each of the new businesses, our stakeholders, and the communities in which we operate • Tax-free distribution of shares to FMC shareholders • Completion targeted for early 2015 3

Rationale for the Separation Distinct operating characteristics and business models New FMC • Growth driven by global megatrends • Customer relationships based on delivering technology and innovation • High and predictable operating margins • Low correlation to GDP cycles • Low fixed asset intensity with strong cash flow characteristics and an appropriate dividend policy • Importance of financial policies consistent with strong investment grade credit rating FMC Minerals • Demand driven by GDP, industrial production, and energy storage applications growth • Structurally-advantaged Alkali Chemicals and Lithium businesses • Low cost manufacturing , operational excellence, and strong logistical capabilities serving customers around the world • Attractive operating margin and cash flow profile across the cycle • Balance sheet and dividend policy appropriate to cash flow profile and fixed asset base Better alignment and focus of management strategies and policies for each business, as well as greater financial flexibility 4

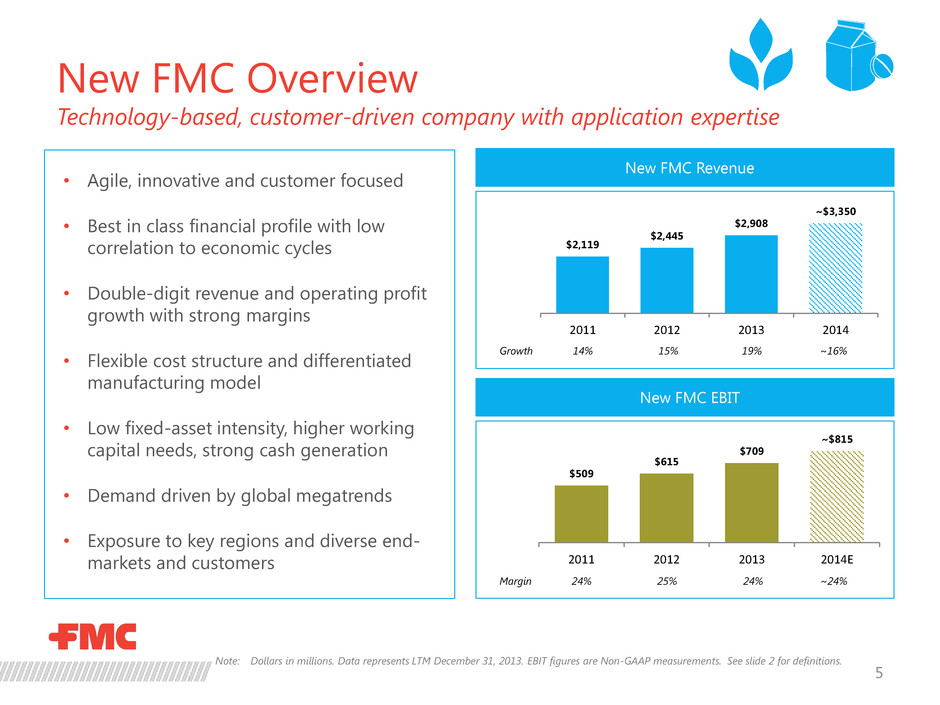

New FMC Overview Technology-based, customer-driven company with application expertise 5 • Agile, innovative and customer focused • Best in class financial profile with low correlation to economic cycles • Double-digit revenue and operating profit growth with strong margins • Flexible cost structure and differentiated manufacturing model • Low fixed-asset intensity, higher working capital needs, strong cash generation • Demand driven by global megatrends • Exposure to key regions and diverse end- markets and customers $2,119 $2,445 $2,908 ~$3,350 2011 2012 2013 2014 $509 $615 $709 ~$815 2011 2012 2013 2014E Growth 14% 15% 19% 24% 25% 24% Margin New FMC Revenue New FMC EBIT Note: Dollars in millions. Data represents LTM December 31, 2013. EBIT figures are Non-GAAP measurements. See slide 2 for definitions. ~16% ~24%

New FMC Profile Growth driven by global megatrends 6 55% 9% 43% 24% 32% 26% 15% 25% 17% 6% 34% 13% Agricultural Solutions Health and Nutrition New FMC Latin America North America Asia Pacific EMEA Exposure to Key Regions (Sales %) Diverse End-Markets and Applications (Sales %) Agricultural Solutions 74% Health and Nutrition 26% Herbicides Insecticides Fungicides / Other Soybeans Cotton Sugarcane TFV Rice Corn Other Food Pharma / Nutraceuticals Binders / Disintegrants Colloidal MCC Carrageenan Alginates Omega-3 / Other Agricultural Solutions Health and Nutrition Agricultural Solutions Health and Nutrition Agricultural Solutions Health and Nutrition New FMC Sales by Product Sales by Application

FMC Minerals Overview Structurally-advantaged business with attractive end markets 7 • Globally cost-advantaged positions in alkali chemicals and lithium • World-class mining operations with long reserve life and best-in-class technologies • Manufacturing excellence focused on cost and process efficiencies • Opportunities to continue to expand production with limited capital outlay through manufacturing excellence programs • Attractive market structure, including significant barriers to entry • Integrated supply chain is key to delivering customer service for both alkali chemicals and lithium • Double-digit operating margin across the cycle and attractive cash flow and return profile Note: Dollars in millions. Data represents LTM December 31, 2013. EBIT figures are Non-GAAP measurements. See slide 2 for definitions. FMC Minerals Revenue FMC Minerals EBIT $917 $966 $970 ~$1,000 2011 2012 2013 2014E $176 $171 $128 ~$150 2011 2012 2013 2014E Growth 10% 5% 0% 19% 18% 13% Margin ~15% ~7%

FMC Minerals Profile Low cost manufacturing and operational excellence 8 • Alkali Chemicals • World’s largest natural soda ash producer • Only producer using longwall and solution mining technologies • Significant cost advantage over synthetic producers • Diversified end-markets result in stable demand patterns over time • Lithium • Only integrated brine to metals producer globally • Broadest product portfolio in the industry • Strong underlying growth largely driven by energy storage market Polymer 26% Energy 29% Synthesis (Pharma) 18% Industrial 27% Other Glass 7% Detergents 10% Other 11% Glass Containers 25% Flat Glass 18% Chemicals 27% Pulp & Paper 2% Alkali Chemicals: Sales by Product Lithium: Sales by Product

Summary 9 • Separation will create two independent public companies – New FMC and FMC Minerals •Will deliver meaningful benefits to each of the new businesses, the communities in which we operate, and all of our stakeholders • Expected to be completed by early 2015 New FMC • Technology-based and customer-driven company • Growth driven by global megatrends • High and predictable operating margins • Low fixed asset intensity with strong cash flow characteristics FMC Minerals • Structurally-advantaged company in attractive markets • Low cost manufacturing and operational excellence • Attractive operating margin and cash flow profile across the cycle