Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - J.B. Hunt Transport, Inc. | xjbt20140306_8k.htm |

| EX-4 - EXHIBIT 4.2 - J.B. Hunt Transport, Inc. | ex4-2.htm |

| EX-4 - EXHIBIT 4.4 - J.B. Hunt Transport, Inc. | ex4-4.htm |

| EX-1 - EXHIBIT 1.1 - J.B. Hunt Transport, Inc. | ex1-1.htm |

Exhibit 5.1

J.B. Hunt Transport Services, Inc.

615 J.B. Hunt Corporate Drive

Lowell, Arkansas 72745-0130

Ladies and Gentlemen:

We have acted as counsel to J.B. Hunt Transport Services, Inc., an Arkansas corporation (the “Company”), and J.B. Hunt Transport, Inc., a Georgia corporation (the “Guarantor”), in connection with the registration by the Company under the Securities Act of 1933, as amended (the “Act”), of: (i) one or more series of debt securities (the “Debt Securities”) and (ii) guarantees of the Debt Securities (the “Guarantees”) by the Guarantor, pursuant to the registration statement on Form S-3, filed with the Securities and Exchange Commission (the “Commission”) on February 26, 2014, Registration No. 333-194163 (the “Registration Statement”). As described in the Registration Statement, the Debt Securities and Guarantees may be issued from time to time in one or more offerings. This opinion is issued with respect to an offering of Debt Securities on the date hereof, consisting of $250,000,000 face amount of 2.400% Notes due 2019 and $250,000,000 face amount of 3.850% Notes due 2024, both issued by the Company (collectively, the “Notes”), and the related Guarantee issued by the Guarantor (the “Note Guarantee”), as described in a prospectus supplement dated the date hereof (the “Prospectus Supplement”).

We have reviewed such corporate records, certificates and other documents, and such questions of law, as we have considered necessary or appropriate for the purposes of this opinion. We have assumed that all signatures are genuine, that all documents submitted to us as originals are authentic and that all copies of documents submitted to us conform to the originals. We have relied as to certain matters on information obtained from public officials, officers of the Company and the Guarantor, and other sources believed by us to be responsible.

J.B. Hunt Transport Services, Inc.

March 6, 2014

Page 2

Based upon the foregoing, we are of the opinion that when, as and if the Notes have been duly executed by the Company and authenticated by the trustee in accordance with the applicable supplemental indenture and the Notes have been duly issued and delivered against payment therefor as contemplated in the Registration Statement and the Prospectus Supplement, then, upon the happening of such events, the Notes and the related Note Guarantee will constitute the valid and binding obligations of the Company and the Guarantor, respectively, enforceable against the Company and the Guarantor, respectively, in accordance with their terms, subject to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and other laws of general applicability relating to or affecting creditors’ rights and to general equity principles.

We do not express any opinion herein on any laws other than the law of the State of Arkansas, the law of the State of New York, the Georgia Business Corporation Code, and the federal law of the United States of America.

We hereby consent to the filing of this opinion as an exhibit to the Current Reports on Form 8-K of the Company and the Guarantor filed the date hereof, and to its incorporation by reference into the Registration Statement. We also hereby consent to the reference to our firm under the heading “Legal Matters” in the Prospectus Supplement. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission.

|

|

Very truly yours, |

|

|

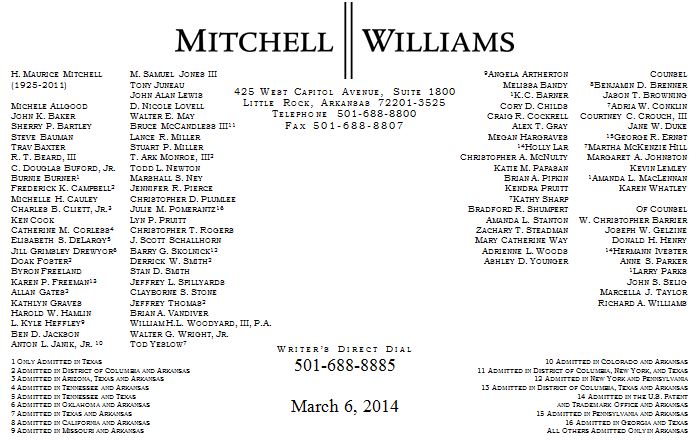

/s/ Mitchell, Williams, Selig, Gates & Woodyard, P.L.L.C. |

|

|

MITCHELL, WILLIAMS, SELIG, |

|

|

GATES & WOODYARD, P.L.L.C |