Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOLLY ENERGY PARTNERS LP | form8-kxheppresentationmar.htm |

Holly Energy Partners, L.P. Morgan Stanley Midstream MLP Corporate Access Event March 2014

Statements made during the course of this presentation that are not historical facts are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are inherently uncertain and necessarily involve risks that may affect the business prospects and performance of Holly Energy Partners L.P. and/or HollyFrontier Corporation. Actual results may differ materially from those discussed during this presentation. Such risks and uncertainties include, but are not limited to, actions of actual or potential competitive suppliers and transporters of refined petroleum products in Holly Energy Partners’ and HollyFrontier’s markets, the demand for and supply of crude oil and refined products, the spread between market prices for refined products and market prices for crude oil, the possibility of constraints on the transportation of refined products, the possibility of inefficiencies or shutdowns in refinery operations or pipelines, effects of governmental regulations and policies, the availability and cost of financing to Holly Energy Partners and HollyFrontier, the effectiveness of Holly Energy Partners’ and HollyFrontier’s capital investments, marketing and acquisition strategies, the possibility of terrorist attacks and the consequences of any such attacks, and general economic conditions. Additional information on risks and uncertainties that could affect the business prospects and performance of Holly Energy Partners and HollyFrontier are provided in the most recent reports of Holly Energy Partners and HollyFrontier filed with the Securities and Exchange Commission. All forward-looking statements included in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. Holly Energy Partners and HollyFrontier undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Safe Harbor Disclosure Statement 2

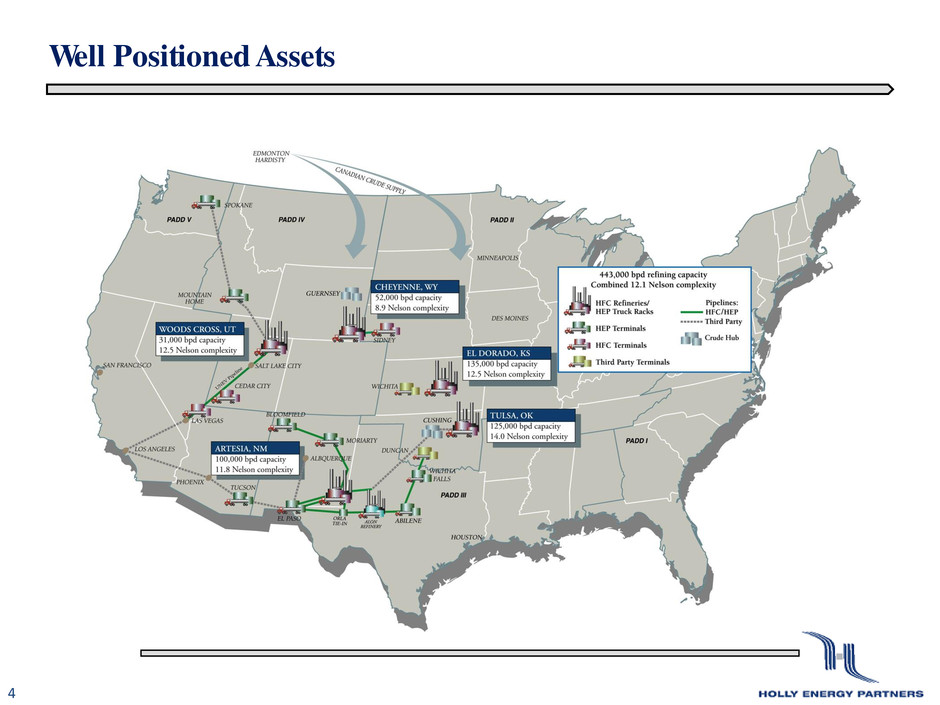

Holly Energy Partners, L.P. (“HEP”) Investment Highlights 3 Well positioned assets serve high growth markets Revenues are 100% fee based with no commodity ownership risk Long-term contracts support cash flow stability HEP benefits from strong sponsor relationship with HollyFrontier Corporation (“HFC”) Successful execution of growth plan has resulted in consistent distribution increases Increased focus on crude transportation for near-term growth

Well Positioned Assets 4

Fee-based Revenues with No Commodity Risk 5 Fee-based revenues • Tariffs from pipeline movements • Storage and transfer fees for terminal activity • Loading fees for loading rack activity • Capacity lease commitments With no commodity ownership risk • HEP shippers own hydrocarbon inventory • No inventory hedging program required

Long Term Contracts Support Cashflow Stability 6 Major refiner customers have entered into 15-year long term contracts Contracts require minimum payment obligations for volume and/or revenue commitments Earliest contract matures in 2018 Minimum annualized commitments will result in over $259 million in revenue Approximately $225 million minimum annual revenues from contracts with HollyFrontier Over 80% of revenues tied to long term contracts and minimum commitments

Strategic Relationship with HollyFrontier 7 HEP’s assets are integral to HollyFrontier’s five refineries Currently, subsidiaries of HFC own 37% of the MLP through limited partner interests and 2% through a general partner interest As HFC grows, HEP is positioned to benefit by partnering with HFC to build and/or acquire supporting logistic assets HEP generally has right of first refusal on all logistics assets HFC builds or acquires

Successful Execution of Growth Plan Over Time 8 Organic growth: Increase cash flow via logical additions to existing assets, volume growth and annual contractual PPI-related growth HFC growth: Partner with HFC to grow current asset base with projects and joint acquisitions Third party growth: Acquire third party assets and/or businesses

HEP Growth Chronology: IPO to Present 9 2004 2005 2006 2007 2008 2009 MLP IPO ( Jul 2004 ) Holly intermediate feedstock pipeline acquisition ( Jul 2005 ) 25 % JV with Plains for SLC pipeline ( Mar 2009 ) Holly Tulsa loading rack dropdown acquisition ( Tulsa West) ( Aug 2009 ) Holly crude oil and tankage assets acquisition ( Mar 2008 ) Alon pipeline and terminal asset acquisition ( Feb 2005 ) Holly 16 " Intermediate pipeline facilities acquisition ( Jun 2009 ) Sinclair Tulsa ( Tulsa East) & Roadrunner / Beeson acquisitions ( Dec 2009 ) Sale of 70 % interest in Rio Grande to Enterprise ( Dec 2009 ) 2010 Purchase of additional Tulsa tanks and racks ; Lovington rack ( March 2010 ) 2011 HFC Dropdown of El Dorado & Cheyenne assets ( Nov 2011 ) Holly South line expansion project ( 2007 - 08 ) Holly Corporation and Frontier Oil Corporation complete merger (July 2011) 2012 HEP purchases 75% interest in UNEV from HFC (July 2012) Tulsa interconnect pipelines (Sep 2011) 2013 Begin Crude Gathering System Expansion (2013)

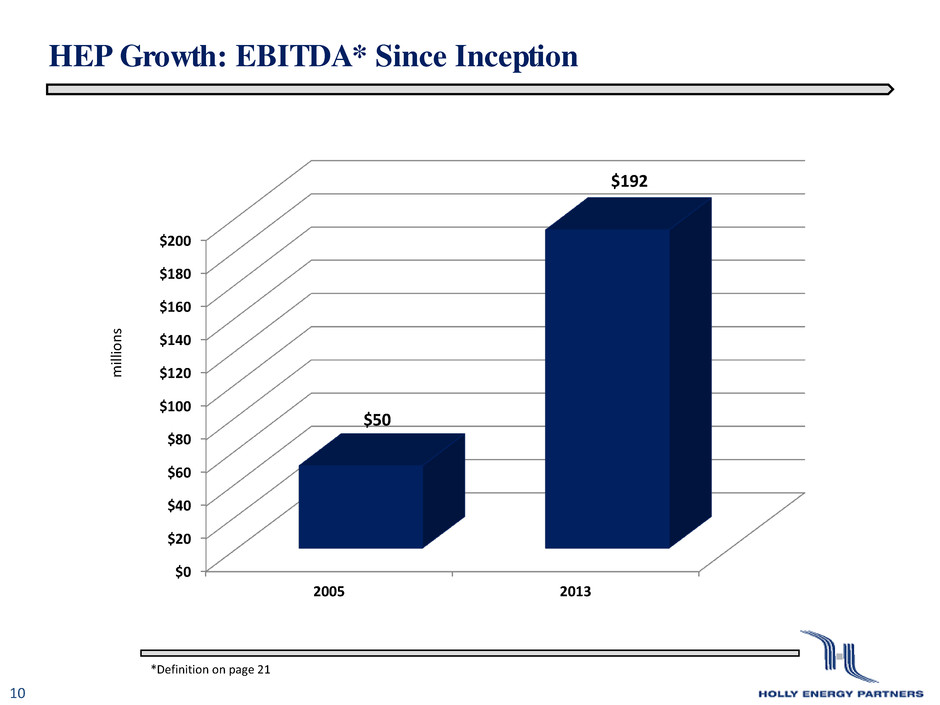

HEP Growth: EBITDA* Since Inception 10 *Definition on page 21 milli o n s $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 $200 2005 2013 $50 $192

HEP Statistics: Then and Now 11 *FY2013 EBITDA **Units and distributions are split adjusted reflecting the January 2013 two-for-one unit split. Unit price as of 2/21/2014 NYSE close IPO July 2004 Current Pipeline miles 1,000 2,900 Product terminals 9 11 Loading racks 2 15 Storage (mm bbls) 2.0 12.3 Annual EBITDA ($mm)* $35 $192 Quarterly distribution ($/unit)** $0.25 $0.50 Unit price ($/unit)** $11.125 $32.880 LP unit yield** 9.0% 6.1% LP units outstanding (mm)** 28.0 58.7 Market capitalization ($mm)** $312 $1,929

HEP Growth: Limited Partner Distributions 12 Distribution has been increased every quarter since IPO—37 consecutive quarters Current distribution (Q4 2013) annual run rate: $2.002 1Distributions are split adjusted reflecting HEP’s January 2013 two-for-one unit split 2Annualized distribution based on January 2014 rate of $0.50/unit Annual Distribution ($/unit) 1 $1.00 $1.25 $1.50 $1.75 $2.00 2005 2006 2007 2008 2009 2010 2011 2012 2013 $1.11 $1.29 $1.39 $1.48 $1.56 $1.64 $1.72 $1.84 $1.96

Southeastern New Mexico Crude Gathering System Expansion 13 HEP Crude Assets • 800 miles of pipeline in SE New Mexico • Connections to major clearing points • Centurion to Cushing • Bisti to Midland/Crane • Expansion project improves • Flexibility to supply Navajo Refinery crude slate • Increased delivery capacity of up to 100,000 bpd Permian Production: 200 – 300m bpd growth per year thru 2015 Source: Goldman Sachs Investment Research

Southeastern New Mexico Crude Gathering System Expansion 14 Key System Enhancements Additional delivery capacity to HFC Navajo Refinery and Centurion Pipeline New Connection to Bisti Pipeline Expanded gathering footprint and additional lease connections De-bottlenecking of mainline capacity Expansion Economics Budget estimate for current scope: $45 - $50 million* Minimum mainline commitments of $7.5 million per year Estimated gathering revenue from known connections of $1.5 - $3.5 million per year Potential for additional connections after assessing degree of excess system capacity Expansion Timing Project will be completed in phases with some gathering connections currently in service Expansion is estimated to be fully complete by August 2014 *Additional Capital Expenditure for change in scope of System Expansion is expected to be reimbursed to HEP by HollyFrontier over first 5-years of operations

UNEV Pipeline Volume Growth 15 Though shipments have exceeded minimums for short periods of time, UNEV volumes are running at or below minimums on average UNEV to continue contributing to DCF at planned levels until SLC area refinery expansions, expected to be completed in 2015 UNEV Las Vegas rack expansion will be completed in Spring 2014 in advance of SLC area refinery expansions* An additional 10,000 bpd of volume throughput should generate $11.8 million** of annual pipeline revenue at committed tariffs and $17.4 million** at spot tariffs *TSO expanding crude capacity by approximately 5m bpd in late 2014; HFC expanding by approximately 14m bpd in late 2015 **Revenue estimates are 100% of UNEV revenues, not a reflection of 75% interest allocable to Holly Energy Partners; assumes shipment to N. Las Vegas terminal only, and does not include terminal revenues

Focus on Crude Transportation 16

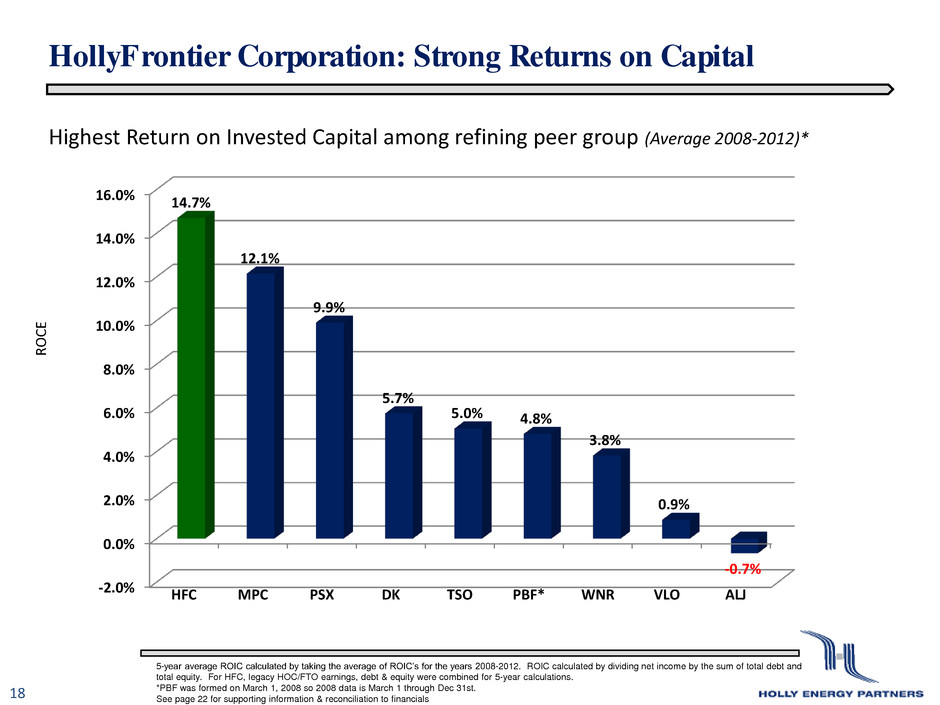

HollyFrontier Business Highlights 17 Pure play competitive refiner 5 refineries with 443,000 bbls per day of refining capacity High refining complexity – combined Nelson complexity of over 12.0. Multiple sources of crude oil – all crude oil ‘WTI’ price-based Attractive markets Geographic: Rockies, Southwest and Mid-Continent Plains states Advantaged crude supply: High growth Canadian, Bakken, Permian, Niobrara Product mix: Balanced gasoline and diesel product slate plus high margin specialty lubricants Strong Financial Performance Historical industry leading return on invested capital among peers Historical industry leading earnings per barrel among peers Low debt among peers and history of conservative financial management Investment Grade Credit Rating

HollyFrontier Corporation: Strong Returns on Capital 18 Highest Return on Invested Capital among refining peer group (Average 2008-2012)* 5-year average ROIC calculated by taking the average of ROIC’s for the years 2008-2012. ROIC calculated by dividing net income by the sum of total debt and total equity. For HFC, legacy HOC/FTO earnings, debt & equity were combined for 5-year calculations. *PBF was formed on March 1, 2008 so 2008 data is March 1 through Dec 31st. See page 22 for supporting information & reconciliation to financials R O C E -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% HFC MPC PSX DK TSO PBF* WNR VLO ALJ 14.7% 12.1% 9.9% 5.7% 5.0% 4.8% 3.8% 0.9% -0.7%

Contact Information: Holly Energy Partners, L.P. (NYSE: HEP) For investor relations questions please contact: Julia Heidenreich, VP, Investor Relations Blake Barfield, Investor Relations 2828 N. Harwood, Suite 1300 Dallas, Texas 75201 (214) 954-6511 investors@hollyenergy.com 19

Appendix 20

Definitions 21 BPD: Barrels per day DISTRIBUTABLE CASH FLOW: Distributable cash flow (DCF) is not a calculation based upon GAAP. However, the amounts included in the calculation are derived from amounts separately presented in our consolidated financial statements, with the exception of excess cash flows over earnings of SLC Pipeline, maintenance capital expenditures and distributable cash flow from discontinued operations. Distributable cash flow should not be considered in isolation or as an alternative to net income or operating income as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. Distributable cash flow is not necessarily comparable to similarly titled measures of other companies. Distributable cash flow is presented here because it is a widely accepted financial indicator used by investors to compare partnership performance. We believe that this measure provides investors an enhanced perspective of the operating performance of our assets and the cash our business is generating. Our historical distributable cash flow is reconciled to net income in footnote 4 to the table in "Item 6. Selected Financial Data" of HEP's 2013 10-K. EBITDA: Earnings before interest, taxes, depreciation and amortization which is calculated as net income plus (i) interest expense net of interest income and (ii) depreciation and amortization. EBITDA is not a calculation based upon U.S. generally accepted accounting principles (“U.S. GAAP”). However, the amounts included in the EBITDA calculation are derived from amounts included in our consolidated financial statements. EBITDA should not be considered as an alternative to net income or operating income, as an indication of our operating performance or as an alternative to operating cash flow as a measure of liquidity. EBITDA is not necessarily comparable to similarly titled measures of other companies. EBITDA is presented here because it is a widely used financial indicator used by investors and analysts to measure performance. EBITDA is also used by our management for internal analysis and as a basis for compliance with financial covenants. Our historical EBITDA is reconciled to net income in footnote 4 to the table in “Item 6. Selected Financial Data” of HEP’s 2013 10-K. STEADY STATE EBITDA: EBITDA as defined above calculated on the basis of our projection of normal pipeline and terminal volumes from our customers, applicable tariffs and fees, and normal expense levels, and assuming no material unplanned shutdowns or unavailable capacity.

Financial Metrics for HFC 22 * HFC debt excludes HEP debt: All amounts are based on publicly-available financial statements, which we have assumed to be accurate. Company 2012 ROIC 2011 ROIC 2010 ROIC 2009 ROIC 2008 ROIC 5 Yr. Ave ROIC HFC 26.5% 22.6% 4.8% -2.3% 21.8% 14.7% MPC 22.5% 18.6% 5.1% 3.8% 10.6% 12.1% PSX 14.8% 20.2% 2.8% 1.7% 10.5% 9.9% DK 21.6% 14.6% -10.8% 0.1% 3.2% 5.7% TSO 12.7% 10.2% -0.6% -2.8% 5.8% 5.0% PBF* 20.0% 22.0% -10.0% -33.0% 25.0% 4.8% WNR 28.3% 8.2% -1.0% -19.4% 3.0% 3.8% VLO 8.3% 8.7% 1.4% -9.0% -5.1% 0.9% ALJ 6.5% 2.9% -9.8% -8.5% 5.4% -0.7% HOLLYFRONTIER 2012 2011 2010 2009 2008 5-Yr Ave ROIC Net Income 1,727$ 1,333$ 142$ (65)$ 347$ Debt EX HEP 471$ 689$ 675$ 726$ 5$ Total Equity 6,642$ 5,204$ 2,275$ 2,152$ 1,587$ ROI 27% 23 5% -2% 22% 14.7%