Attached files

| file | filename |

|---|---|

| 8-K - OPEXA THERAPEUTICS, INC. 8-K - Acer Therapeutics Inc. | a50814168.htm |

Exhibit 99.1

Opexa Therapeutics, Inc. NASDAQ: OPXA Q4 2013 Earnings Call Precision Immunotherapy February 27, 2014 The Woodlands, TX

Forward-Looking Statements This earnings presentation contains forward-looking statements which are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements contained in this earnings release, other than statements of historical fact, constitute “forward-looking statements.” The words “expects,” “believes,” “hopes,” “anticipates,” “estimates,” “may,” “could,” “intends,” “exploring,” “evaluating,” “progressing,” “proceeding,” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. These risks and uncertainties include, but are not limited to, risks associated with: market conditions; our capital position; our ability to compete with larger, better financed pharmaceutical and biotechnology companies; new approaches to the treatment of our targeted diseases such as multiple sclerosis; our expectation of incurring continued losses; our uncertainty of developing a marketable product; our ability to raise additional capital to continue our development programs (including to undertake and complete any ongoing or further clinical studies for Tcelna or clinical studies related to our T-cell platform); our ability to satisfy various conditions required to access the financing potentially available under the purchase agreements with Lincoln Park Capital Fund, LLC (“Lincoln Park”) or sell shares of our common stock to Lincoln Park or under our at-the-market (ATM) facility; our ability to maintain compliance with NASDAQ listing standards; the success of our clinical trials (including the Phase IIb trial for Tcelna in Secondary Progressive Multiple Sclerosis which, depending upon results, may determine whether Ares Trading SA (“Merck”) elects to exercise its option for an exclusive license to Tcelna for the treatment of Multiple Sclerosis (the “Option”)); whether Merck exercises the Option and, if so, whether we receive any development or commercialization milestone payments or royalties from Merck pursuant to the Option; our dependence (if Merck exercises the Option) on the resources and abilities of Merck for the further development of Tcelna; the efficacy of Tcelna for any particular indication; our ability to develop and commercialize products; our ability to obtain required regulatory approvals; our compliance with all FDA regulations; our ability to obtain, maintain and protect intellectual property rights; the risk of litigation regarding our intellectual property rights or the rights of third parties; the success of third party development and commercialization efforts with respect to products covered by intellectual property rights that we may license or transfer; our limited manufacturing capabilities; our dependence on third-party manufacturers; our ability to hire and retain skilled personnel; our volatile stock price; and other risks detailed in our filings with the SEC. These forward-looking statements speak only as of the date made. We assume no obligation or undertaking to update any forwardlooking statements to reflect any changes in expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. You should, however, review additional disclosures we make in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC. 2

Opexa’s Mission To lead the field of Precision ImmunotherapyTM by aligning the interests of patients, employees and shareholders. 3

Strong 2013: Positions Opexa well for 2014 Clinical As of February 27, 2014, enrolled over 80% of the total number of patients expected to be enrolled in the Phase IIb “Abili-T” clinical study of Tcelna (imilecleucel-T) in patients with Secondary Progressive MS Furthered the accumulation of comprehensive patient data to support Opexa’s Immune Monitoring Program which is being conducted in conjunction with the Abili-T trial. Financing Ended the year with $23.6 million in cash & cash equivalents Projected cash runway into Q4 2015, based on current burn rate and current clinical activities Partnering Secured an option and license agreement with Merck Serono for Opexa’s MS program – which, if successful, could bring in up to $220 million in milestone payments and royalties in the 8-15% range. 4

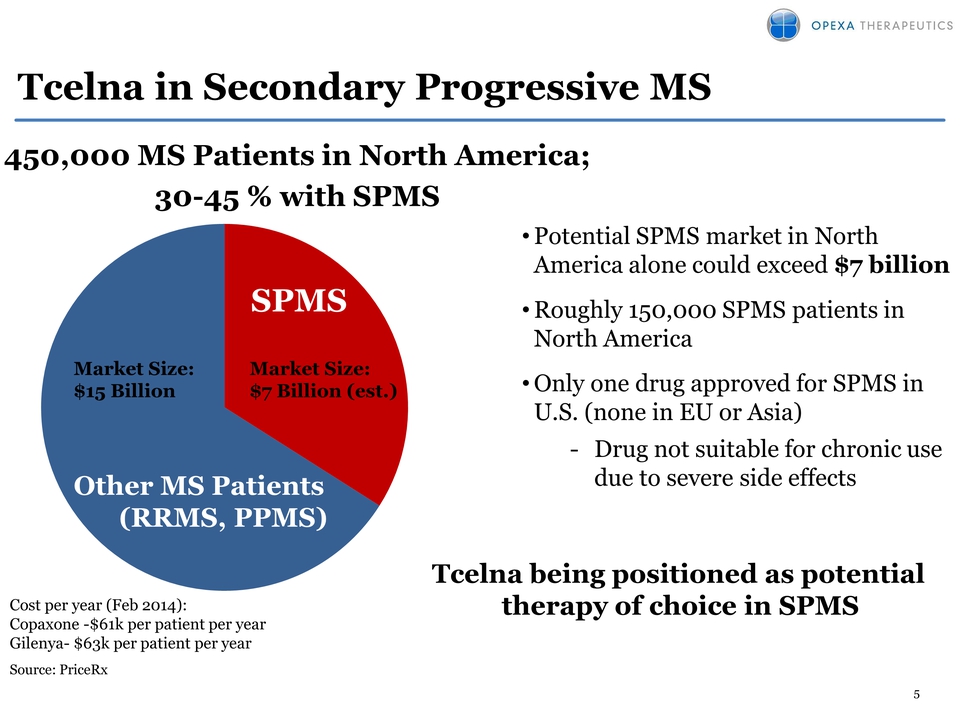

Tcelna in Secondary Progressive MS 450,000 MS Patients in North America; 30-45 % with SPMS SPMS Market Size: $7 Billion (est.) Market Size: $15 Billion Other MS Patients (RRMS, PPMS) Cost per year (Feb 2014): Copaxone -$61k per patient per year Gilenya- $63k per patient per year Source: PriceRx Potential SPMS market in North America alone could exceed $7 billion Roughly 150,000 SPMS patients in North America Only one drug approved for SPMS in U.S. (none in EU or Asia) Drug not suitable for chronic use due to severe side effects Tcelna being positioned as potential therapy of choice in SPMS 5

Abili-T : Landmark trial in SPMS Abili-T Phase IIb clinical trial in SPMS is ongoing Double-blind, 1:1 randomized, placebo-controlled Inclusion criteria: Secondary Progressive MS with EDSS of 3 to 6 Immune Monitoring program conducted on a blinded basis Fast Track designation granted by FDA for Tcelna in SPMS 180 Patients expected to be enrolled SPMS population Approximately 35 sites in USA and Canada 2 annual courses of personalized therapy 6

Immune Monitoring Program: Biomarker analysis Assessment of 180 SPMS patient samples (both placebo and active) may provide valuable information on directional movement of antiinflammatory and pro-inflammatory biomarkers Purpose Investigate the impact of Tcelna® treatment on systemic immunity Further define the Mechanism of Action of Tcelna Further elucidate the Immunopathology of SPMS Value Identify potential early markers of efficacy to aid in design of Phase III trials Potentially develop a diagnostic tool/surrogate marker for the early detection of a drug response post-market Support FDA regulatory discussions Strengthening of IP position through potential identification of novel biomarkers 7

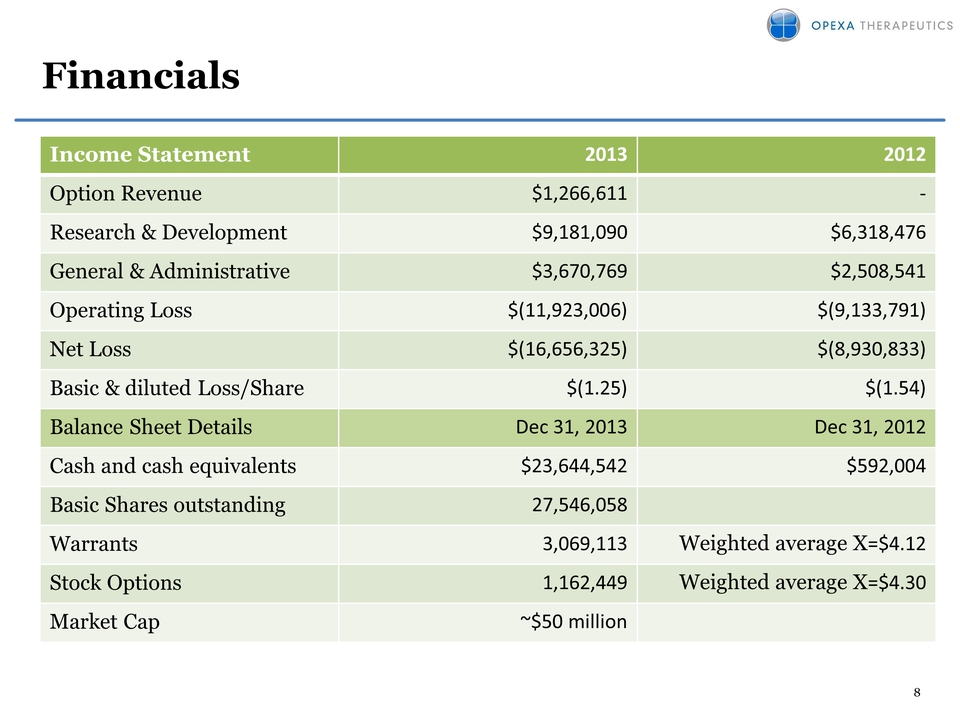

Financials Income Statement 2013 2012 Option Revenue $1,266,611 ‐ Research & Development $9,181,090 $6,318,476 General & Administrative $3,670,769 $2,508,541 Operating Loss $(11,923,006) $(9,133,791) Net Loss $(16,656,325) $(8,930,833) Basic & diluted Loss/Share $(1.25) $(1.54) Balance Sheet Details Dec 31, 2013 Dec 31, 2012 Cash and cash equivalents $23,644,542 $592,004 Basic Shares outstanding 27,546,058 Warrants 3,069,113 Weighted average X=$4.12 Stock Options 1,162,449 Weighted average X=$4.30 Market Cap ~$50 million 8

Opexa Highlights MS franchise progressing Expecting to complete enrollment of Abili-T trial in Q2 2014 Strong potential partner in Merck Serono Immune Monitoring Program generating comprehensive data set to support potential Phase III and commercialization plans Seeking to Leverage ImmPath® T-cell platform Exploring multiple potential disease indications Subject to availability of sufficient resources Precision Immunotherapy Opexa a leader in developing personalized immunotherapies tailored to individual disease profiles 9