Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - EAGLE ROCK ENERGY PARTNERS L P | sunray8k1.htm |

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

EAGLE ROCK FIELD SERVICES SUNRAY RAW PRODUCT PURCHASE AND SALE AGREEMENT

THIS RAW PRODUCT PURCHASE AND SALE CONTRACT (the “Contract”) is made and entered into as of the 5th day of December, 2013, by and between Phillips 66 Company, a Delaware corporation (“Buyer”), and Eagle Rock Field Services, L.P., a Texas Limited Partnership (“Seller”), sometimes referred to collectively as “Parties” or singularly as “Party.”

WHEREAS, the Parties desire to set forth certain terms and conditions applicable to the purchase and sale of Raw Product available for sale by Seller at the Delivery Point;

NOW, THEREFORE, in consideration of the premises and mutual covenants contained herein, Buyer and Seller mutually agree as follows:

Section 1. DEFINITIONS

1.01 “Actual Delivered Volume” has the meaning set forth in Section 3.2.

1.02 | “Allocation Event” shall mean an event that does not constitute a force majeure event, but includes (1) an NGL Facility's planned or unplanned maintenance, (2) a force majeure event declared by an NGL Facility, (3) refusal by an NGL Facility to accept Raw Product deliveries from Buyer, or (4) any other action by an NGL Facility that reduces Buyer's ability to use the NGL Facility. |

1.03 | “Barrel” shall mean forty-two (42) U.S. Gallons, where a “Gallon” contains two hundred thirty-one (231) cubic inches when the liquid is corrected to a temperature of sixty degrees Fahrenheit (60°F) by use of the Volume Correction/Reduction Tables applicable to that product as published by the American Petroleum Institute and/or other accepted industry standard and in effect on the date of delivery. |

1.04 | “[***]” shall mean the plant, equipment, and Raw Product storage facilities located within the refinery that is currently owned and operated by [***] at or near [***], used for fractionation of Raw Product received from various parties, including Buyer. |

1.05 | “Business Day” shall mean a day from 8:00 a.m. to 5:00 p.m. prevailing Central Time, except a Saturday, Sunday, or a Federal Reserve Bank holiday. |

1.06 | “CPI-U Index” means the Consumer Price Index, All Urban Consumers, U.S city average, All Items, 1982-84=100 (unadjusted) as published by the United States Bureau of Labor Statistics or any successor agency thereto. |

1.07 | “[***]” shall mean the plant, equipment, and Raw Product storage located on the plant site that is currently owned and operated by [***] at or near [***], used for fractionation of Raw Product received from various parties, including Buyer. |

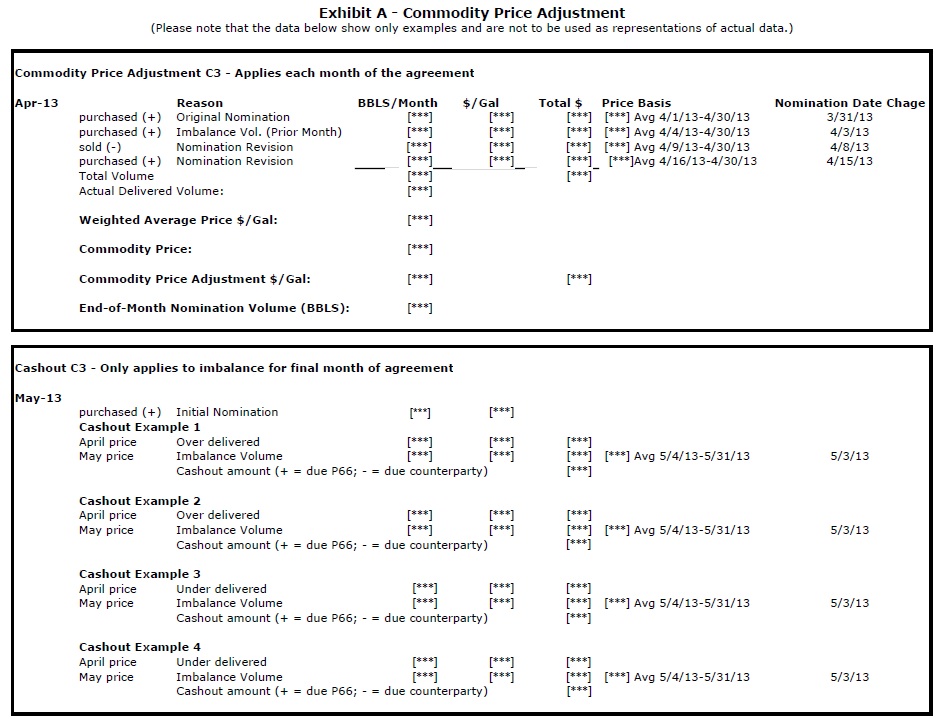

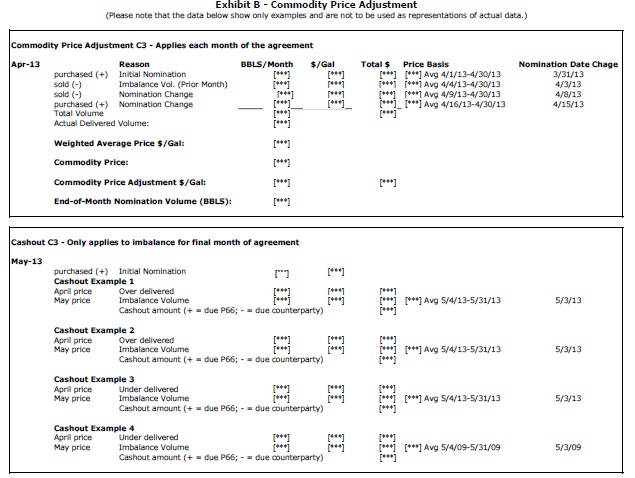

1.08 | “Commodity Price” shall be the price described in Section 4.1. |

1.09 | “Commodity Price Adjustment” has the meaning set forth in Section 4.2. |

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

1.10 | “Component” shall mean one of ethane, propane, normal butane, isobutane or natural gasoline. |

1.11 | “Component Imbalance Determination Date” has the meaning set forth in Section 3.2. |

1.12 | “Component Imbalance Volume” has the meaning set forth in Section 3.2. |

1.13 | “Current Month Nomination Price Adjustment” has the meaning set forth in Section 4.3. |

1.14 | “Deficiency Fee” shall mean for each Barrel of Raw Product not delivered by Seller to Buyer below the Minimum Volume a fee equal to the product of then current Fixed Component portion of the Monthly Fractionation Fee multiplied by 42. |

1.15 | “Delivery Period” has the meaning set forth in Section 2. |

1.16 | “Delivery Point” shall mean the inlet flange to the Buyer’s pipeline connection at Seller’s Sunray Gas Plant. |

1.17 | “End-of-Month Nomination Volume” shall mean the volume in Gallons of the sum of the Original Nomination and all Nomination Revisions on the last day of the month as shown in the attached Exhibits A and B. |

1.18 | “Gathering Pipelines” shall mean the Sherhan NGL System and/or the Skellytown NGL System as depicted on the attached Exhibit D and the connecting within the [***] owned and operated by [***]. |

1.19 | “Historical Volume” shall mean Buyer’s total receipts of Raw Product from each Supplier during the most recent twelve (12) calendar months for which data is available prior to the first day of the calendar month during which capacity is being prorated. |

1.20 | “[***]” shall mean the segment of [***] pipeline system that receives Raw Product from [***] Demethanized Mix Origin Points as defined in [***] FERC [***] or its successor. |

1.21 | “Maximum Volume” shall mean [***] Barrels per day on a monthly average basis. |

1.22 | “Minimum Volume” shall mean [***] Barrels per day on a monthly average basis. |

1.23 | "NGL Facility" shall mean any or all of the (1) Gathering Pipelines, (2) [***], (3) [***] or (4) [***]. |

1.24 | “Nomination Revision(s)” shall mean one or more volume revisions made to an Original Nomination during the Delivery Month, which may be positive or negative (e.g., more of a Component is expressed as a positive number and less of a Component is expressed as a negative number). |

1.25 | “Off-Spec Raw Product” shall mean any Raw Product that does not comply with the requirements of set forth in Section 5.1. |

1.26 | “Original Nomination” has the meaning set forth in Section 3.2. |

1.27 | “Raw Product” shall mean the mixture of demethanized liquid hydrocarbons and any accompanying non-hydrocarbon substances requiring fractionation that meet the specifications set forth in Section 5.1. |

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

1.28 | “Sherhan NGL System” shall mean the segment of pipeline operated by Phillips 66 Pipeline LLC and owned by Phillips 66 Company that transports Raw Product from Delivery Point to Skellytown NGL System as depicted on the attached Exhibit D. |

1.29 | “Skellytown NGL System” shall mean the segment of pipeline operated by Phillips 66 Pipeline LLC and owned by Phillips 66 Company that transports Raw Product from Sherhan NGL System to [***] as depicted on the attached Exhibit D. |

1.30 | “Supplier” shall mean an entity, including Seller, which delivers Raw Product to Buyer for transportation on the Gathering Pipelines or [***], or for fractionation at the [***]. |

Section 2. DELIVERY PERIOD

Subject to the provision of this Section, the Delivery Period shall commence on January 1, 2014, and shall continue through and including December 31, 2016.

Section 3. DELIVERY OBLIGATIONS, NOMINATIONS AND IMBALANCES

3.1 Subject to the provisions herein, Seller shall deliver and sell and Buyer shall receive and purchase at the Delivery Point each month a volume of Raw Product that shall be no less than the Minimum Volume and no more than the Maximum Volume for that month (the “Delivery Month”). Unless excused by either force majeure or Buyer’s failure to accept delivery for any reason, including force majeure or an Allocation Event, if Seller delivers less than the Minimum Volume for the Delivery Month, Seller shall pay the Deficiency Fee. In the event that Seller’s performance is excused in accordance with the prior sentence, then for the purpose of calculating the Deficiency Fee, the Minimum Volume for that Delivery Month shall be reduced on a pro-rated basis for each day that Seller’s performance was excused. Notwithstanding the foregoing, the Parties may mutually agree in writing to deliver, sell, purchase and receive Raw Product in excess of the Maximum Volume in a given Delivery Month. Title and risk of loss shall transfer from Seller to Buyer at the Delivery Point. All volumes sold hereunder shall be owned or controlled by Seller.

3.2 Prior to the Delivery Month, Seller shall estimate a monthly volume for each Component in Raw Product to be delivered to Buyer (“Original Nomination”) at the Delivery Point. On or before the fifteenth day of the month prior to any Delivery Month, Seller shall send to Buyer by email, the Original Nomination for such Delivery Month, which Seller may revise at any time prior to the start of the applicable Delivery Month. During each Delivery Month, the Parties will monitor actual deliveries, and Seller will email to Buyer Nomination Revisions as required to keep the nominations reasonably close to the volume actually delivered. For each Delivery Month, Buyer will purchase Seller’s Raw Product delivered at the Delivery Point as reported by the Sherhan NGL System (“Actual Delivered Volume”). The Parties understand such report is typically provided on the third Business Day after each Delivery Month. As soon as practicable during the month immediately following the Delivery Month, the Parties shall determine the difference in volume between the End-of-Month Nomination Volume and the Actual Delivered Volume for each Component during the said Delivery Month (the “Component Imbalance Volume”). The Business Day immediately after the day the Sherhan NGL System informs Buyer of the Actual Delivered Volume shall be the “Component Imbalance Determination Date”.

3.3 At any time during the Delivery Period, if Buyer’s ability or rights to utilize an NGL Facility is curtailed because of an Allocation Event, Buyer’s obligation to purchase and receive Raw Product from Seller shall be excused for the duration of such Allocation Event provided, however, to the extent

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

permitted under Buyer’s contractual obligations, Buyer will allocate its purchases from Suppliers pro-rata based on Historical Volume.

3.4 Seller will be solely responsible for any imbalances at the Delivery Point arising from differences in the quantity of Raw Product owned and controlled by Seller at the Delivery Point and the quantity of Raw Product delivered to Buyer at the Delivery Point. Any imbalance downstream of the Delivery Point will be the sole responsibility of Buyer. Notwithstanding a Party’s responsibility for any imbalance according to the foregoing, the provisions for Commodity Price Adjustment for each Component Imbalance Volume during the Delivery Period shall apply.

Section 4. PRICE

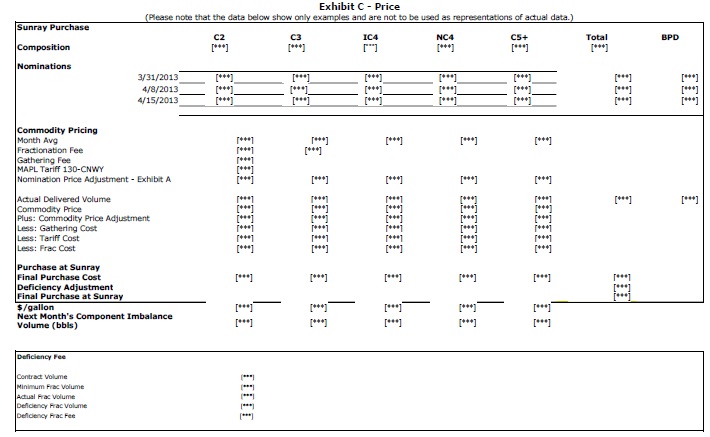

4.1 The purchase price for each Gallon of Component contained in the Raw Product delivered and sold hereunder shall be the Commodity Price plus the Commodity Price Adjustment, less the Gathering Fee, less the Transportation fee, less the Monthly Fractionation Fee.

(a) | The “Commodity Price” for each Component shall be the monthly average of the “any month” OPIS Index, as Published by the Oil Price Information System or any successor publication, for the delivery month. For each Component the corresponding OPIS Index shall be as follows: |

Component OPIS Index,

Ethane [***] Ethane [***]

Propane [***] Propane

Iso Butane [***] Iso Butane

Normal Butane [***] Normal Butane

Natural Gasoline [***] Natural Gasoline

Methane shall have no value.

In the event the applicable [***] OPIS Index ceases to be published, the Parties shall promptly agree upon an alternative index to be utilized.

(b) | The term “Gathering Fee” shall initially be [***] cents per Gallon. Effective January 1, 2015, the Gathering Fee shall be increased or decreased in accordance with the methodology specified in the Federal Energy Regulatory Commission (“FERC”) oil pipeline pricing index. On each July 1st of each year of this Contract, commencing July 1, 2015, the Gathering Fee shall again be increased or decreased in accordance with the methodology specified in the FERC oil pipeline pricing index. In no event shall the adjusted Gathering Fee be less than the initial Gathering Fee of [***] cents per Gallon. |

(c) | The “Transportation Fee” shall mean the fee in cents per Gallon charged by [***] for transporting Raw Product from [***] to [***], for any Delivery Month or the rates charged in the replacement tariffs, if any. |

(d) | The “Monthly Fractionation Fee” shall be calculated as follows and stated in in cents per Gallon: |

([***] x SSC) + Fixed Component

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

“SSC” equals the natural gas price in dollars per MMBTU as reported in Inside FERC for the Southern Star Central (Texas, Oklahoma, Kansas) Index for the delivery month. In the event the applicable Inside FERC Index ceases to be published, the Parties shall promptly agree upon an alternative index to be utilized.

The “Fixed Component” shall initially mean [***] cents per Gallon. Effective January 1, 2016, the Fixed Component shall be increased or decreased based on the change in the CPI-U Index from November 2013 to November 2015 provided, however, that the adjusted Fixed Component shall never be less than the [***] cents per Gallon.

4.2 The “Commodity Price Adjustment” shall have meaning as set forth below:

(a) | Each Nomination Revision during a Delivery Month shall result in a Commodity Price Adjustment equal to the OPIS average for each Component for the balance of the month starting the day after Seller notifies Buyer of the Nomination Revision. If Seller notifies Buyer of a Nomination Revision on the last day of the month, the Commodity Price Adjustment would equal the OPIS average for each Component for the balance of the month starting that day. For changes increasing the Original Nomination, Buyer shall pay Seller the balance of the month price for the increased Nomination Revision added to the monthly average price for the Original Nomination. For changes decreasing the Original Nomination, Buyer shall deduct the balance of the month price for the decreased Nomination Revision from the monthly average price for the Original Nomination. The Commodity Price Adjustment shall be included in determining the Commodity Price as demonstrated in the attached Exhibits A and B. |

(b) | The prior month’s Component Imbalance Volume shall also result in a Commodity Price Adjustment equal to the OPIS average for each Component for the balance of the month starting the day of the Component Imbalance Determination Date. A positive Component Imbalance Volume and price shall be included in the Commodity Price Adjustment by increasing the volume and pricing as demonstrated in the attached Exhibit A. A negative Component Imbalance Volume and price shall be included in the Commodity Price Adjustment by decreasing the volume and related pricing as demonstrated in the attached Exhibit B. |

(c) | Both the Nomination Revision and Component Imbalance Volume calculations and pricing described in 4.2 (a) and 4.2 (b) will be applied to the Actual Delivered Volume as demonstrated in the attached Exhibit C. |

4.3 The month after the Contract terminates the parties will financially settle the Component Imbalance Volume for the prior Delivery Month. Accordingly, the price for the financial settlement for each Component shall be the prior Delivery Month’s price less the OPIS average for each Component for the balance of the month starting the day after the Component Imbalance Determination Date less the Gathering Fee for the month after the last Delivery Month less the Transportation Fee for the month after the last Delivery Month less the Monthly Fractionation Fee for the month after the last Delivery Month. The attached Exhibits A & B contain examples of how to calculate the financial settlement amount.

Section 5. QUALITY AND MEASUREMENT

5.1 All Raw Product delivered by Seller shall meet the then current quality specifications of [***], and [***] Demethanized Mix specifications as amended from time to time (“[***] Specs”). Buyer may reject any Raw Product that does not meet the [***] Specs. In the event that Buyer accepts delivery and purchases Off-Spec Raw Product and Buyer is assessed any fees, penalties or other costs, expenses or

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

liabilities as a result of such Off-Spec Raw Product, Buyer may deduct such fees, penalties or other costs, expenses or liabilities from the purchase price. If such Off-Spec Raw Product is commingled with other Raw Product and contaminates the commingled stream, Buyer may treat or otherwise dispose of the contaminated stream in a reasonably commercial manner that minimizes the amount of losses and the reasonable costs thereof.

5.2 If Buyer has reason to believe that Raw Product does not meet the quality requirements specified above, Buyer shall have the right to immediately reject further deliveries. The Parties shall then collect a Raw Product sample and submit it to the [***] laboratory or another mutually agreeable independent laboratory for analysis. The results obtained by the laboratory analysis shall be conclusive. Costs for the sampling and testing shall be borne by the Party requesting the test. Either Buyer or Seller may secure third party inspectors to perform gauging, sampling, and testing of the Product, subject to any safety or other requirements of the owner/operator of the applicable NGL Facility.

5.3. All measurement and sampling equipment, procedures, calculations, and practices shall be performed in accordance, and in all aspects, with ASTM Standards, API Manual of Petroleum Measurement Standards (MPMS) and/or corresponding International measurement, sampling and testing standards, NIST Handbook 44, and the Gas Processors Association (GPA) Technical Standards and Publications in their latest revision. Volumes of Products delivered by Seller shall be measured and calculated in accordance with Chapters 14, 11 and 12 of the API Manual of Petroleum Measurement Standards (GPA TP-27) in their latest revision. Buyer shall be allowed to have representatives present during testing, calibration of equipment, meter proving, meter reading, and sampling provided adequate notice is provided by Buyer to Seller and to owner/operator of the applicable pipeline. Quantities of Product delivered will be determined at the Delivery Point by a mutually acceptable metering system. Product measured volumetrically at pressure above equilibrium vapor pressure must also include compressibility factor corrections.

Section 6. FORCE MAJEURE.

Suspension. In the event of either Party being rendered unable, wholly or in part, by Force Majeure to carry out its obligations under this Agreement, other than to make payments due hereunder, the obligations of the Party suffering Force Majeure shall be suspended to the extent affected by and for the period of such Force Majeure condition. Such Party suffering Force Majeure shall give notice and full particulars of such Force Majeure in writing or by facsimile to the other Party as soon as possible after the occurrence of the cause. Such cause shall as far as possible be remedied with all reasonable dispatch.

Definition. The term “Force Majeure,” as employed herein and for all purposes relating hereto, shall mean acts of God, strikes, lockouts, work stoppages, or other industrial disturbances, acts of the public enemy, acts of terror, wars, blockades, insurrections, riots, epidemics, landslides, lightning, earthquakes, fires, storms, storm and/or hurricane warnings, crevasses, floods, washouts, arrests and restraints of governments and people, civil disturbance, explosions, mechanical failures, breakage or accident to equipment installations, machinery, compressors, plants or lines of pipe, the necessity for making repairs or alterations to machinery, compressors, plants or lines of pipe, capacity constraints, weather related events affecting an entire geographic region or causing the evacuation thereof, such as low temperatures that cause freezing or failure of wells, lines of pipe, or processing facilities, electric power unavailability or shortages, interruptions by government or court orders, inability of any Party to obtain necessary materials, supplies or permits due to existing or future rules, regulations, orders, laws or proclamations of governmental authorities (whether federal or state, civil or military), and any other causes whether of the kind herein enumerated or otherwise, not within the control of the Party claiming suspension and which by the exercise of due diligence such Party is unable to prevent or overcome.

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

Labor Disputes. It is understood and agreed that the settlement of strikes or lockouts shall be entirely within the discretion of the Party having the difficulty, and that the above requirements that any Force Majeure shall be remedied with all reasonable dispatch shall not require the settlement of strikes or lockouts by acceding to the demands of the opposing party when such course is inadvisable in the discretion of the Party having difficulty.

Section 7. PAYMENT

7.1 After each Delivery Month, Seller shall invoice Buyer for the Actual Delivered Volume for such Delivery Month, the Current Month Nomination Price Adjustment, the Commodity Price Adjustment, and if applicable, shall include any applicable Deficiency Fees for such Delivery Month.

7.2 Buyer shall pay the net amount owed by wire transfer no more than five (5) Business Days after receipt of Seller’s invoice, except in the event that Buyer shall in good faith dispute any invoiced amounts, in which case, Buyer shall pay only the undisputed portion. Buyer may request, and Seller shall provide, revised invoices specifying the undisputed and disputed amounts. The Parties shall endeavor to resolve such dispute. If it is determined that Buyer owes the disputed amount, Buyer shall promptly pay such amount after resolution of the dispute. If Buyer shall fail to timely pay any amount owed, interest shall accrue from the due date to date of payment at the lesser of (a) the prime rate of interest published in The Wall Street Journal, from time to time, plus [***] percent ([***]%), or (b) the maximum non-usurious interest rate.

7.3 The Party receiving the report showing Actual Delivered Volume at the Delivery Point will provide a copy of the report to the other Party as soon as practicable, but no later than three (3) Business Days after receiving such report.

Section 8. EVENTS OF DEFAULT

If a Party (the “Defaulting Party”): (a) is the subject of a bankruptcy, insolvency, reorganization or other similar proceeding, (b) fails to pay its debts generally as they become due or otherwise is bankrupt or insolvent, (c) fails to provide within two Business Days of a request, adequate assurances of payment or performance if the other Party has reasonable grounds for insecurity; or (d) fails to pay any obligation hereunder and such failure continues for five Business Days after notice, (each a “default”) then the other party (the “Non-Defaulting Party”), shall have the right, exercisable in its sole discretion and at any time or times, to terminate this Contract and any or all other agreements between the parties for the purchase and sale of crude oil, petroleum products, natural gas liquids or electricity, swaps with respect to the prices thereof or options on any of the foregoing (collectively, “transactions”) then outstanding by closing-out this Contract and any other transactions being liquidated (whereupon they shall automatically be terminated, except for the payment obligation referred to below), calculating its loss, costs and gains, if any, for this Contract, and aggregating or netting such amounts and (at the liquidating Party’s election) any and all other amount owing under this Contract or any other transaction being liquidated to a single liquidated settlement payment that will be due and payable within one Business Day after the liquidation is completed. In addition, after a default, the Non-Defaulting Party (at its election) shall have a general right of setoff with respect to any or all amounts owing between the Parties (whether under this Contract, under another transaction or otherwise and whether or not then due), provided that any amounts not then due shall be discounted to present value. After a default, the Defaulting Party is also responsible for any other costs and expenses (including, without limitation, reasonable attorneys’ fees and disbursements) incurred by the Non-Defaulting Party in connection with such default.

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

The Parties understand and agree that (i) the obligations hereunder constitute “forward contracts” within the meaning of title 11 of the United States Bankruptcy Code (the “Bankruptcy Code”); (ii) each Party is a “forward contract merchant” within the meaning of the Bankruptcy Code; (iii) all payments made or to be made by one Party to the other Party pursuant to this Contract constitute “settlement payments” within the meaning of the Bankruptcy Code; (iv) all transfers of credit support by one Party to the other Party under this Contract constitute “margin payments” within the meaning of the Bankruptcy Code; (v) each Party’s rights under this Section 8 constitutes a “contractual right to liquidate” the transactions within the meaning of Section 556 of the Bankruptcy Code, and (vi) this Contract is a Master Netting Agreement within the meaning of Section 561 of the Bankruptcy Code.

Section 9. TAXES.

9.1. Seller assumes liability for, and must pay, all taxes assessed on or in connection with production, extraction, processing (excluding odorization), manufacture or transport of the Raw Product prior to delivery to the Delivery Point, (including, without limitation, assuring that severance taxes, royalties, working interest payments and similar burdens imposed with relation to extraction and production of same are borne by Seller or prior suppliers of same). Any personal property or similar ad valorem taxes levied or assessed by any governmental authority upon ownership of the Raw Product must be paid by the Party having title thereto at the time of such assessment. Other than such taxes and fees as are allocated under this Section, the Buyer assumes liability, and must pay or reimburse Seller in addition to the price specified herein, for all other taxes, fees, charges or any other exactions, levied or assessed by any federal, state, local or other governmental authority (but excluding the Seller’s net income, gross margin, excess profits or corporate franchise taxes) imposed by any governmental authority upon the sale, use, delivery or receipt of the Raw Product at or after the delivery to Buyer.

9.2 If either Party is exempt from the payment of any taxes allocated to such Party under the foregoing provisions, such Party must furnish the other Party hereto proper exemption documentation.

9.3 EACH PARTY AGREES TO INDEMNIFY AND HOLD THE OTHER PARTY HARMLESS FROM AND AGAINST ALL CLAIMS, CAUSES OF ACTION, PROCEEDINGS, JUDGMENTS, INTEREST, PENALTIES, FEES OR OTHER LIABILITIES BROUGHT BY OR AWARDED TO THIRD PARTIES ARISING OUT OF OR CONNECTED WITH TAXES TO BE PAID BY SUCH PARTY PURSUANT TO THIS SECTION, including the payment of attorneys’ fees and expenses incurred in defense of said claims, proceedings or causes of action. The Parties agree to cooperate with each other in defending non-taxable status of the Raw Product purchased and sold pursuant to this Contract if a Party is audited by or on behalf of a taxing jurisdiction for ad valorem, sales, use, excise, or similar taxes.

Section 10. REPRESENTATIONS, WARRANTIES AND INDEMNITIES

10.1 Seller represents and warrants to Buyer that: (i) Seller has good and merchantable title to the Raw Product sold and delivered hereunder and will be the owner of the Raw Product sold hereunder at the Delivery Point; and (ii) Raw Product delivered and sold hereunder shall be delivered in full compliance with all federal and state laws, rules and regulations and orders that may be applicable thereto. SELLER AGREES TO INDEMNIFY, DEFEND AND HOLD BUYER HARMLESS FROM AND AGAINST ANY LOSS, CLAIM OR DEMAND BY REASON OF ANY FAILURE OF SUCH TITLE OR RIGHT OR BREACH OF THIS WARRANTY.

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

10.2 Except as expressly set forth in this contract, neither party makes any representations or warranties, express, implied or statutory, with respect to the Product or otherwise, including, without limitation, any warranty of merchantability or fitness for a particular purpose, even if such purpose is known to the parties.

10.3 Each Party represents and warrants to the other Party that: (a) it is duly organized, validly existing and in good standing under the laws of the jurisdiction of its formation; (b) the execution, delivery and performance of this Contract are within its powers, have been duly authorized by all necessary action and do not violate any of the terms and conditions in its governing documents, any contract to which it is a Party or any law, rule, regulation, order or the like applicable to it; (c) this Contract constitutes its legally valid and binding obligation enforceable against it in accordance with its terms, subject, as to enforceability only, to applicable bankruptcy, moratorium, insolvency or similar laws affecting the rights of creditors generally and to general principles of equity; and (d) it is not bankrupt and there are no proceedings pending or being contemplated by it or, to its knowledge, threatened against it which would result in it being or becoming bankrupt.

Section 11. MISCELLANEOUS.

11.1 NOTICES. Addresses for notices, communications and statements are:

Addresses for notices, communications and statements are:

If to Seller for correspondence: If to Buyer for correspondence:

[***] [***]

If to Seller for invoices only: If to Buyer for invoices only:

[***] [***]

Payments to Seller: Payments to Buyer:

[***] [***]

Nominations: Nominations:

[***] [***]

11.2 GREENHOUSE GAS. As of the date first set forth above in this Contract, neither the U.S. Congress, the U.S. Environmental Protection Agency, nor any states relevant to this Contract have agreed to, and therefore have not enacted or promulgated, any final laws or regulations with regard to costs for or taxation or regulation of the carbon content of Raw Product. Therefore, in a desire to finalize the Contract, but fully cognizant of the fact that there exists pending legislation and there may be future proposals regarding taxation, “cap and trade” requirements, or other regulations or imposts on the carbon content of the Raw Product handled under this Contract (“Legislation”), when and if the Legislation is finalized, Seller and Buyer shall meet to attempt to reform this Contract in a manner satisfactory to both Seller and Buyer specifically to address the impact of the Legislation on the Parties or on the carbon content of the Raw Product. In the event that the Parties are not able to agree to reform this Contract in a manner satisfactory to both Parties, either Party can terminate this Contract by providing ninety (90) days’ prior written notice.

11.3 LIMITATION OF LIABILITY. Neither party shall be liable to the other party for any lost profits or indirect, incidental, punitive, exemplary, consequential or special damageS. Each party waives any rights to assert any claim relating to the subject matter herein based on non-contractual theory of law or equity.

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

11.4 ASSIGNMENT. This Contract shall extend to and be binding upon the parties hereto, their successors and assigns, but it is expressly agreed that neither Party shall assign this Contract without the prior written consent of the other Party, which consent shall not be unreasonably withheld.

11.5 GOVERNING LAW; JURISDICTION. This Contract shall be subject to the jurisdiction of, governed by, and construed in accordance with the laws of the State of Texas without regard to those laws that would reference the laws of another jurisdiction. Any legal action or proceedings against a Party with respect to any Contract shall be brought exclusively in a federal or state court located in Houston, Texas; and the Parties irrevocably and unconditionally, submit to the jurisdiction of such courts. Each Party waives its right to any jury trial with respect to any litigation arising under or in connection with this Contract.

11.6 INDEMNITIES AND LIABILITY

(a) | SELLER AGREES, TO THE FULLEST EXTENT PERMITTED BY LAW AND REGARDLESS OF THE PRESENCE OR ABSENCE OF INSURANCE, TO DEFEND, INDEMNIFY AND HOLD BUYER, ITS AFFILIATES, AND ALL OF ITS AND THEIR RESPECTIVE DIRECTORS, OFFICERS, EMPLOYEES, BORROWED SERVANTS AND AGENTS (THE “BUYER INDEMNITEES”) HARMLESS FROM ANY AND ALL CLAIMS, DEMANDS, CAUSES OF ACTION, COSTS AND EXPENSES (INCLUDING COURT COSTS, ANY COST OR EXPENSE OF INCIDENT INVESTIGATION AND REASONABLE ATTORNEY’S FEES), OR ANY LIABILITY ARISING FROM OR ON ACCOUNT OF INJURY, DEATH OR DAMAGE WHICH OCCURS BEFORE DELIVERY OF PRODUCT TO BUYER OR ITS AGENTS UNDER THIS CONTRACT AND/OR ARISE IN CONNECTION WITH SELLER’S OR ITS REPRESENTATIVE’S OR AGENT’S LOADING, TRANSPORTATION, STORAGE, OR HANDLING OF PRODUCT COVERED BY THIS CONTRACT; PROVIDED, HOWEVER, SELLER’S INDEMNITY OBLIGATION SHALL NOT APPLY TO THE EXTENT THAT SUCH INJURIES OR DAMAGES ARE CAUSED BY THE NEGLIGENCE, GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF ANY BUYER INDEMNITEE. |

(b) | BUYER AGREES, TO THE FULLEST EXTENT PERMITTED BY LAW AND REGARDLESS OF THE PRESENCE OR ABSENCE OF INSURANCE, TO DEFEND, INDEMNIFY AND HOLD SELLER, ITS AFFILIATES, AND ALL OF ITS AND THEIR RESPECTIVE DIRECTORS, OFFICERS, EMPLOYEES, BORROWED SERVANTS AND AGENTS (THE “SELLER INDEMNITEES”) HARMLESS FROM ANY AND ALL CLAIMS, DEMANDS, CAUSES OF ACTION, COSTS AND EXPENSES (INCLUDING COURT COSTS, ANY COST OR EXPENSE OF INCIDENT INVESTIGATION AND REASONABLE ATTORNEY’S FEES), OR ANY LIABILITY ARISING FROM OR ON ACCOUNT OF INJURY, DEATH OR DAMAGE WHICH OCCURS AFTER DELIVERY OF PRODUCT TO BUYER OR ITS AGENTS UNDER THIS CONTRACT AND/OR ARISE IN CONNECTION WITH BUYER’S OR ITS REPRESENTATIVE’S OR AGENT’S LOADING, TRANSPORTATION, STORAGE, OR HANDLING OF PRODUCT COVERED BY THIS CONTRACT; PROVIDED, HOWEVER, BUYER’S INDEMNITY OBLIGATION SHALL NOT APPLY TO THE EXTENT THAT SUCH INJURIES OR DAMAGES ARE CAUSED BY THE NEGLIGENCE, GROSS NEGLIGENCE OR WILLFUL MISCONDUCT OF ANY SELLER INDEMNITEE. |

11.7 IMAGED AGREEMENT. This Contract may be scanned and stored electronically, or stored on computer tapes and disks, as may be practicable (the “Imaged Agreement”). The Imaged Agreement if introduced as evidence in printed format, in any judicial, arbitration, mediation or administrative proceedings, will be admissible as between the Parties to the same extent and under the same conditions

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

as other business records originated and maintained in documentary form. Neither Party shall object to the admissibility of any Imaged Agreement (or photocopies of the transcription of such Imaged Agreement) on the basis that such were not originated or maintained in documentary form under either the hearsay rule or the best evidence rule. However, nothing herein shall be construed as a waiver of any other objection to the admissibility of such evidence.

11.8 INTEGRATION. Effective December 31, 2013 this Contract replaces and supersedes the BP Sunray Raw Product Purchase and Sale Agreement dated as of December 15, 2010 by and between ConocoPhillips Company, and assigned to Buyer, and BP Products North America Inc., and assigned to Seller (collectively, the “Prior Agreements”). Except with respect to amounts invoiced and not yet paid for and invoices not generated from the final Delivery Month of Prior Agreements, the Prior Agreements are terminated in all respects and neither Party shall have any rights or obligations thereunder. This Contract constitutes the entire agreement of the Parties relating to the subject matter hereof. There are no agreements, promises, terms, conditions, obligations, representations or warranties other than those contained in this Contract. This Contract may not be changed or amended orally, but only by an agreement in writing, signed by the Party against whom enforcement is sought.

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

IN WITNESS WHEREOF, the Parties hereto have caused this Contract to be executed by their respective duly authorized representatives as of the date specified in Section 2.

Eagle Rock Field Services, L.P. Phillips 66 Company

By: Eagle Rock Pipeline GP, LLC

Its General Partner

By: /s/ J.A. Mills By:/s/ John W. Wright

Name: J.A. Mills Name: John W. Wright

Title: CEO Title: SVP, COMMERCIAL

Date: 12/20/2013 Date: 12/23/2013

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

Specific Terms in this Exhibit have been redacted because confidential treatment for those terms has been requested. The redacted material has been separately filed with the Securities and Exchange Commission, and the terms have been marked at the appropriate place with three asterisks [***].

Exhibit D

Gathering Pipelines

[***]