Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CO & PA 1999D Limited Partnership | d681997d8k.htm |

| EX-99.1 - EX-99.1 - CO & PA 1999D Limited Partnership | d681997dex991.htm |

| EX-99.2 - EX-99.2 - CO & PA 1999D Limited Partnership | d681997dex992.htm |

| EX-10.2 - EX-10.2 - CO & PA 1999D Limited Partnership | d681997dex102.htm |

| EX-16.1 - EX-16.1 - CO & PA 1999D Limited Partnership | d681997dex161.htm |

Exhibit 10.1

NOTICE OF CONFIDENTIALITY RIGHTS: IF YOU ARE A NATURAL PERSON, YOU MAY REMOVE OR STRIKE ANY OR ALL OF THE FOLLOWING INFORMATION FROM ANY INSTRUMENT THAT TRANSFERS AN INTEREST IN REAL PROPERTY BEFORE IT IS FILED FOR RECORD IN THE PUBLIC RECORDS: YOUR SOCIAL SECURITY NUMBER OR YOUR DRIVER’S LICENSE NUMBER.

ASSIGNMENT, BILL OF SALE, AND CONVEYANCE

| STATE OF COLORADO | PLEASE RETURN TO: | |||

| TOGAC | ||||

| COUNTY OF WELD | P O BOX 671787 | |||

| HOUSTON, TX 77267-1787 |

THIS ASSIGNMENT, BILL OF SALE, AND CONVEYANCE (“Assignment”) is executed and delivered by CO and PA 1999D Limited Partnership, a West Virginia limited partnership (the “Assignor”) to [PDC Energy, Inc.], a [Corporation] (“Assignee”).

ARTICLE I

CONVEYANCE OF ASSETS

Assignor, for valuable consideration, the receipt and sufficiency of which are hereby acknowledged, does by these presents SELL, ASSIGN, CONVEY, TRANSFER, SET OVER, and DELIVER unto Assignee, as of 7:00 a.m. (Central Time) on December 1, 2013 (the “Effective Time”), the properties and interests described in Sections 1 through 11 below (the “Assets”):

1. Oil and Gas Leases. All of Assignor’s interest in the oil and gas leases described on Exhibit A (including all working interests, royalty interests, overriding royalty interests, net profits interests, production payments, reversionary rights and all other interests therein, whether described or not), insofar, and only insofar as such leases cover the lands and, where indicated, depths described on Exhibit A (the “Lands”) (such leases, insofar as they cover the Lands, being referred to herein as the “Leases”).

2. Properties. All of Assignor’s interest in all equipment, fixtures, facilities, improvements and other real, personal and mixed property used, or held for use, in exploring, developing, operating, producing, maintaining or repairing the Wells, Leases or Units, (“Properties”), to the extent such Properties relate to the well(s) being assigned.

3. Wells. All of Assignor’s interest in the well(s) identified on Exhibit A (“Wells”).

4. Easements. To the extent assignable or transferable, all of Assignor’s interest in easements, rights of way, licenses, permits, servitudes and other rights, privileges, benefits and powers to the extent used in connection with the operation of the Leases, Units (hereinafter defined), Wells, or Related Assets (hereinafter defined) (collectively, the “Easements”), to the extent such Easements relate to the well(s) being assigned.

5. Units. All of Assignor’s rights, obligations and interests in any unit or pooled area in which the Wells are included, together with the rights in and to all existing and effective unitization, pooling and communitization agreements, declarations and orders, and the properties covered and the Units created thereby, to the extent they relate to or affect any of the Wells (the “Units”).

6. Hydrocarbons. All of Assignor’s interest in all of the oil and gas and associated hydrocarbons in, on and under or that may be produced from or otherwise attributable to the Wells (“Hydrocarbons”) from and after the Effective Time.

Sale No. 260C

Lot No. 20

7. Contracts. To the extent assignable and applicable to the Wells, all Assignor’s interest in each hydrocarbon purchase and sale agreement, farmin agreement, farmout agreement, bottom hole agreement, acreage contribution agreement, operating agreement, unit agreement, processing agreement, option, lease of equipment or facilities, joint venture agreement, pooling agreement, transportation agreement, right-of-way and other contract, agreement and right, which is owned by Assignor, in whole or in part, and are appurtenant to the Wells, Units or Properties, or used in connection with the sale, distribution or disposal of Hydrocarbons or water from the Wells, Units or Properties (collectively, the “Contracts”).

8. Related Assets. All of Assignor’s interest in all well equipment, pipelines, flowlines, gathering systems, plants, piping, buildings, treatment facilities, disposal facilities, injection facilities, compressors, casing, tanks, tubing, pumps, pumping units, motors, fixtures, machinery and other equipment located in or on the Wells, Units or Properties or used in the operation thereof which are owned by Assignor, in whole or in part (the “Related Assets”).

9. Permits and Licenses. To the extent assignable, all Assignor’s interest in governmental permits, licenses and authorizations, as well as any applications for the same, related to the Wells, Units, Properties, Contracts or Related Assets, or the use thereof.

10. Records. All of Assignor’s files, records and data relating to the items described in subsections (1) through (10) above, including, without limitation, all lease, well, division order and other title records (including title curative documents); surveys, maps and drawings; contracts; correspondence; regulatory, geological records and information; production records, electric logs, core data, pressure data, decline curves, graphical production curves and all related matters and construction documents; and Assignor’s proprietary geophysical and seismic records and interpretations of same, data and related information, if any, that is not subject to contractual restrictions on disclosure or transfer (collectively, the “Records”).

11. Excluded Assets. Notwithstanding the foregoing provisions in Sections 1 through 11 above, the following assets shall not constitute Assets and are hereby reserved and retained by Assignor and excepted unto Assignor and shall not be sold, assigned or conveyed to Assignee pursuant to this Assignment (such assets as described herein below, the “Excluded Assets”):

(a) all credits, rebates, refunds, adjustments, accounts, instruments and general intangibles, and all insurance claims, all to the extent attributable to the Assets with respect to any period of time prior to the Effective Time;

(b) all claims of Assignor for refunds of or loss carry forwards with respect to (i) ad valorem, severance, production or any other taxes attributable to any period prior to the Effective Time, (ii) income or franchise taxes of Assignor, or (iii) any taxes attributable to the other Excluded Assets, and such other refunds, and rights thereto, for amounts paid in connection with the Assets and attributable to any period of time prior to the Effective Time, including refunds of amounts paid under any gas gathering or transportation agreement;

(c) all proceeds, income or revenues (and any security or other deposits made) attributable to (i) the Assets for any period of time prior to the Effective Time, or (ii) any other Excluded Assets;

(d) all of Assignor’s proprietary computer software, technology, patents, trade secrets, copyrights, names, trademarks, logos and other intellectual property;

(e) all of Assignor’s rights and interests in geological and geophysical data which cannot be transferred without the consent of, or payment to, any third party, unless Assignee obtains the applicable consent or makes the applicable payment;

(f) all documents and instruments of Assignor that are protected by an attomey-client privilege;

(g) data and other information that cannot be disclosed or assigned to Assignee as a result of confidentiality or similar arrangements under agreements with persons unaffiliated with Assignor;

(h) any and all files, records, contracts and documents relating to Assignor’s efforts to sell the Assets (or any other discussions or negotiations regarding the sale or other disposition of any of the Assets), including any research, valuation or pricing information prepared by Assignor and/or its consultants in connection therewith, and any bids received for such interests and information and correspondence in connection therewith;

Sale No. 260C

Lot No. 20

(i) all audit rights arising under any of the Contracts or otherwise with respect to any period of time prior to the Effective Time or with respect to any of the other Excluded Assets;

(j) all corporate, partnership, and income tax records of Assignor;

(k) all claims arising from acts, omissions or events, or damage to or destruction of the Assets attributable to any period of time prior to the Effective Time and all rights, titles, claims and interests of Assignor related thereto (i) under any policy or agreement of insurance or indemnity, (ii) under any bond or letter of credit, or (iii) to any insurance or condemnation proceeds or awards; and

(l) all bonds posted by Assignor.

TO HAVE AND TO HOLD all and singular the Assets, together with all rights, titles, interests, estates, remedies, powers and privileges thereunto appertaining unto Assignee and their respective successors, legal representatives and assigns forever, subject to all matters of record, all matters visible or apparent on the ground and subject to the reservation and exception contained herein. THIS ASSIGNMENT IS MADE BY ASSIGNOR AND ACCEPTED BY ASSIGNEE WITHOUT WARRANTY, EITHER EXPRESS OR IMPLIED EXCEPT ASSIGNOR SHALL WARRANT AND DEFEND THE TITLE TO THE ASSETS AGAINST EVERY PERSON WHOMSOEVER LAWFULLY CLAIMING THE ASSETS OR ANY PART THEREOF BY, THROUGH OR UNDER ASSIGNOR, BUT NOT OTHERWISE. Except for the special warranty of title in the proceeding sentence, the Assets are to be sold AS IS AND WHERE IS AND WITHOUT WARRANTY OF ANY KIND, WHETHER EXPRESS, STATUTORY, OR IMPLIED, INCLUDING, WITHOUT LIMITATION, ANY WARRANTY OF TITLE, MERCHANTABILITY, CONDITION OR FITNESS FOR A PARTICULAR PURPOSE. PRIOR TO EXECUTION DATE, ASSIGNEE SHALL HAVE INSPECTED THE ASSETS AND UPON EXECUTION DATE WILL ACCEPT THE ASSETS “AS IS,” “WHERE IS,” AND “WITH ALL FAULTS” AND IN THEIR PRESENT CONDITION AND STATE OF REPAIR.

ARTICLE II

ALLOCATION OF REVENUE AND EXPENSES UPON THE EFFECTIVE TIME

1. Imbalances. Assignee shall assume all rights and obligations of Assignor arising from Imbalances pertaining to the Assets as of the Effective Time (whether overproduced or underproduced). The term “Imbalance” means any Hydrocarbons production or pipeline imbalance existing as of the Effective Time with respect to any of the Assets, together with any related rights or obligations as to future cash and/or gas or product balancing, as a result of, production or pipeline delivery imbalances.

2. Allocation of Refunds and Receivables as of the Effective Time. Assignor shall retain all receivables, refunds and other amounts attributable to the ownership or operation of the Assets prior to the Effective Time to the extent received by Assignee or Assignor. If Assignee collects any such receivable, refund or other amount, then Assignee shall promptly remit any such amount to Assignor. Assignee shall own all receivables, refunds and other amounts attributable to the ownership or operation of the Assets on or after the Effective Time. If Assignor collects any such receivable, refund or other amount, then Assignor shall promptly remit any such amount to Assignee.

3. Audit Adjustments. Assignor shall retain all rights and obligations relating to adjustments resulting from any operating agreement and other audit claims asserted by or against third party operators to the extent attributable to ownership or operation of the Assets prior to the Effective Time. Any credit received by Assignee pertaining to such an audit claim shall be paid to Assignor within thirty (30) days after receipt.

Sale No. 260C

Lot No. 20

4. Taxes. (A) All ad valorem, severance, property or other taxes (other than income and sale or use taxes) paid or payable with respect to or attributable to the Assets (“Asset Taxes”) shall be prorated between Assignee and Assignor as of the Effective Time for all taxable periods that include the Effective Time. All Asset Taxes attributable to periods, including partial periods, prior to the Effective Time are the obligation of, and shall be borne by, Assignor. Assignor shall pay to Assignee, at the time of Assignee’s remittance, Assignor’s share of such taxes; (B) for the taxable periods that include the Effective Time, Assignor agrees to immediately forward to Assignee any tax reports and returns received by Assignor and to provide Assignee with any information in Assignor’s possession that is necessary for Assignee to timely file any required tax reports and returns. With respect to taxable periods that include the Effective Time, Assignee shall file all tax returns and reports applicable to the Assets required to be filed and shall indemnify the Assignor against liability for the payment of Asset Taxes with respect to such tax returns and reports and the filing of such tax returns and reports; (C) refunds of Asset Taxes shall be promptly paid as follows (or to the extent payable but not paid due to offset against other taxes shall be promptly paid (or retained, as appropriate) by the Party receiving the benefit of the offset as follows): (i) to Assignor to the extent attributable to periods prior to the Effective Time; and (ii) to Assignee to the extent attributable to periods from and after the Effective Time; and (D) Assignor and Assignee believe that no sales, transfer or similar tax is applicable to the transactions contemplated herein and, accordingly, no such tax will be collected from Assignee in connection with this transaction. If, however, this transaction is later deemed to be subject to sales, transfer or similar tax, for any reason, Assignee agrees to be solely responsible, and shall indemnify and hold Assignor (and its affiliates, and its and their directors, officers, employees, attorneys, contractors and agents) harmless, for any and all sales, transfer or other similar taxes (including related penalty, interest or legal costs) due by virtue of this transaction on the Assets transferred pursuant hereto and the Assignee shall remit such taxes at that time. Assignor and Assignee agree to cooperate with each other in demonstrating that the requirements for exemptions from such taxes have been met.

5. Other Proceeds and Expenses. (A) All monies, refunds, proceeds, receipts, credits, receivables, accounts and income attributable to the Assets conveyed hereunder (i) for all periods of time from and after the Effective Time shall be the property and entitlement of Assignee, and, to the extent received by Assignor, Assignor shall fully disclose and account therefor to Assignee promptly, and (ii) for the period of time prior to the Effective Time shall be the sole property and entitlement of Assignor and to the extent received by Assignee, Assignee shall fully disclose and account therefor to Assignor promptly and, similarly, (B) all operating expenses and capital expenditures relating to the ownership and operation of the Assets (i) which are attributable to periods prior to the Effective Time shall be the sole responsibility of Assignor, and Assignor shall promptly pay same, or if paid by Assignee, promptly reimburse Assignee for same and (ii) which are attributable to periods from and after the Effective Time shall be the sole obligation of Assignee and Assignee shall promptly pay same, or if paid by Assignor, promptly reimburse Assignor for same.

6. Cooperation. Each Party covenants and agrees to promptly inform the other with respect to amounts owing under this Article II.

ARTICLE III

ASSUMED OBLIGATIONS

Assignee assumes, agrees to pay and perform, and expressly releases and discharges Assignor, and Assignor’s affiliates, and Assignor’s and its affiliates’ managers, members, officers, directors, trustees, employees, agents, contractors, and partners from all of the following obligations, liabilities, and duties with respect to the Assets (collectively, the “Assumed Obligations”):

| i. | All obligations, liabilities and duties with respect to the ownership and operation of the Assets attributable to periods from and after the Effective Time, including, without limitation, to the extent, in each case, attributable to periods from and after the Effective Time: |

| a) | The obligation to pay all operating expenses, and capital expenditures attributable to the Assets; |

| b) | The obligation to perform all express obligations and covenants under the terms of the Leases, the Easements and the Contracts and any implied obligations and covenants under the Leases; |

| c) | The obligation to pay all royalties, rentals, shut-in payments, and other burdens or encumbrances to which the Leases are subject; and |

| d) | The obligation to comply with all applicable laws, ordinances, rules, orders, and regulations pertaining to the Assets; |

| ii. | All obligations, liabilities, and duties with respect to plugging, abandonment, surface restoration, and site clearance operations relating to the Assets, and all required remediation relating to the Assets, whether arising before, on, or after the Effective Time, all in accordance with applicable laws. |

Sale No. 260C

Lot No. 20

| iii. | The Imbalances with respect to the Assets, whether arising before or after the Effective Time; and |

| iv. | All obligations, liabilities and duties with respect to the environmental condition of the Assets, the compliance of the Assets or the operation thereof with Environmental Laws or the presence, release, disposal or storage of pollution, contamination, hazardous substances, wastes, materials and products by or in connection with the Assets, whether arising before, on, or after the Effective Time, and regardless of whether resulting from any negligent acts or omissions or strict liability of Assignor, Assignor’s affiliates, or Assignor’s and its affiliates’ managers, members, officers, directors, trustees, employees, agents, contractors, and partners, or Assignee, or the condition of the Assets when acquired, including, without limitation, clean-up responses, remediation, control, assessment, and compliance with respect to air, water, surface, or subsurface pollution, and other obligations, liabilities, and duties relating to the presence or release of pollution or contamination, including pollution or contamination by oil and gas, brine, NORM or other materials or the release or disposal of any hazardous substances, wastes, materials and products generated by or used in connection with the ownership or operation of the Assets. The term “Environmental Laws” means any statute, law, ordinance, rule, regulation, code, order, judicial writ, injunction, notice to lessees or decree issued by any federal, state, or local governmental authority in effect as of the Effective Time relating to the control of any pollutant or protection of the air, water, land, or environment or the release or disposal of hazardous materials, hazardous substances or waste materials. |

| v. | To the extent required by any applicable laws and except to the extent that Assignee will, as of the Execution Date, be covered by the bonds of third party operators of the applicable Assets, Assignee will have as of the Execution Date, and will thereafter continue to maintain, all bonds or any other surety as may be required by, and in accordance with, all applicable laws governing the ownership of such Assets, and Assignee shall file any and all required reports necessary for such ownership with the all governmental entities having jurisdiction over such ownership. Without limiting the foregoing. Assignee shall obtain, prior to the Execution Date, the necessary bonds, letters of credit, or other adequate surety required by all governmental entities having jurisdiction for the plugging and abandonment of all Wells and the dismantling of any Related Assets and provide Assignor with a copy of same. |

| vi. | From and after the Execution Date, Assignee shall have in force and effect insurance policies in compliance with all applicable agreements, including, but not limited to, operating agreements and participation agreements relating to the Assets. |

ARTICLE IV

MISCELLANEOUS

1. This Assignment is made with full substitution and subrogation of Assignee in and to all covenants and warranties by others heretofore given or made in respect of the Assets or any part thereof.

2. Any notice, request, demand, or consent required or permitted to be given hereunder shall be in writing and delivered in person or by certified mail, with return receipt requested or by prepaid overnight delivery service, by e-mail (confirmed by a return e-mail from the recipient), or by facsimile addressed to the party for whom intended at the addresses indicated on the signature pages of this Assignment.

3. This Assignment may be executed in any number of counterparts and each of such counterparts shall for all purposes be deemed to be an original, and all such counterparts shall together constitute but one and the same Assignment. To facilitate recordation, certain counterparts hereof may include only that portion of Exhibit A, which contain descriptions of the properties located in the County and State in which the particular counterpart is to be recorded, and other portions of such Exhibit shall be included in such counterparts by reference only. Complete copies of this Assignment containing the entire Exhibit have been retained by Assignee.

Sale No. 260C

Lot No. 20

4. The terms, covenants and conditions contained in this Assignment are binding upon and inure to the benefit of Assignor and Assignee and their respective successors and assigns.

5. Assignor agrees to execute, acknowledge and deliver to Assignee, from time to time, without further consideration, such other additional instruments, notices, division orders, transfer orders and other documents, and to do all such other and further acts and things as may be reasonably necessary to more fully and effectively grant, convey and assign to Assignee the Assets granted and assigned herein.

6. THIS ASSIGNMENT SHALL BE GOVERNED AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF [COLORADO] WITHOUT GIVING EFFECT TO ANY PRINCIPLES OF CONFLICTS OF LAWS.

[SIGNATURE PAGES TO FOLLOW]

Sale No. 260C

Lot No. 20

IN WITNESS WHEREOF, the parties hereto have caused this Assignment to be duly executed on the latest date indicated on the notary acknowledgements below (the “Execution Date”). This Assignment shall be effective at the Effective Time.

| ASSIGNOR: | ||

| CO AND PA 1999D LIMITED PARTNERSHIP | ||

| By: |

/s/ Karen Nicolaou | |

| Name: Karen Nicolaou | ||

| Title: Responsible Party | ||

| Address of Assignor: | CO and PA 1999D Limited Partnership Karen Nicolaou c/o Atropos, Inc. 569 Trianon Street Houston, TX 77024 |

| STATE OF Texas | § | |

| § | ||

| COUNTY OF Harris | § |

This instrument was acknowledged before me on the 11th day of Dec., 2013, by Karen Nicolaou, as Responsible Party of CO and PA 1999D Limited Partnership, a West Virginia limited partnership, on behalf of said limited partnership.

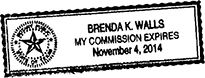

| Brenda K. Walls | ||||

| Notary Public In and For The State of | ||||

Sale No. 260C

Lot No. 20

| ASSIGNEE: | ||

| PDC Energy, Inc. | ||

| By: |

/s/ Lance A. Lauck | |

| Name: Lance A. Lauck | ||

| Title: Senior V. P. | ||

| Address of Assignee: | PDC Energy, Inc. | |

|

|

1775 Sherman Dr Ste 3000, | |

| Denver, CO 80203 | ||

| STATE OF Texas | § | |||||

| § | ||||||

| COUNTY OF Harris | § |

This instrument was acknowledged before me on the 11 day of December, 2013 by Lance A. Lauck, as Senior V. P. of PDC Energy, Inc., a Corporation, on behalf of said Corporation.

| Terrell T. Gerard | ||||

| Notary Public In and For The State of TX | ||||

Sale No. 260C

Lot No. 20

EXHIBIT “A”

Weld County, Colorado

| [ILLEGIBLE] | ||||||||||||||||||

| Booth 25-32 |

5N | 67W | 25 | SWNE | United Pacific Resources Company | United States Exploration, Inc | 2/29/00 | — | 2788619 | |||||||||

| Briggs 1-32 |

3N | 67W | 1 | SWNE | Union Pacific Resources Company | United States Exploration | 5/15/98 | — | 2614662 | |||||||||

| Guttersen 21-31 |

3N | 64W | 21 | NWNE | Union Pacific Land Resources Corporation | United States Exploration, Inc. | 5/15/98 | — | 2614627 | |||||||||

| Guttersen 21-42 |

3N | 64W | 21 | SENE | Union Pacific Land Resources Corporation | United States Exploration, Inc. | 5/15/98 | — | 2614627 | |||||||||

| Guttersen 23-32 |

3N | 64W | 23 | SWNE | Union Pacific Land Resources Corporation | United States Exploration, Inc. | 5/15/98 | — | 2614626 | |||||||||

| J&L Farms 23-21 |

6N | 64W | 23 | NENW | Union Pacific Resources Company | United States Exploration Inc | 3/21/00 | — | 2806579 | |||||||||

| J&L Farms 23-22 |

6N | 64W | 23 | SENW | Union Pacific Resources Company | United States Exploration Inc | 3/21/00 | — | 2806579 | |||||||||

| J&L Farms 29-34 |

6N | 63W | 29 | SWSE | J & L Farms, a Colorado Partnership | Wishbone Resources, Inc. | 3/23/88 | 1190 | 2136094 | |||||||||

| J&L Farms 44-29 |

6N | 63W | 29 | SESE | J & L Farms, a Colorado Partnership | Wishbone Resources, Inc. | 3/23/88 | 1190 | 2136094 | |||||||||

| Kirby 29-11 |

4N | 67W | 29 | NWNW | Union Pacific Land Resources Corporation | United States Exploration, Inc. | 2/25/00 | — | 2806578 | |||||||||

| Marcy 31-32 |

6N | 64W | 31 | SWNE | Henry Printz Jr. and Mary Lou Printz, husband and wife | Cody Nordell Inc. | 11/19/81 | 954 | 1876412 | |||||||||

| National Hog Farm 17-11 |

5N | 63W | 17 | NWNW | Union Pacific Land Resources Corporation | United States Exploration, Inc | 3/27/00 | — | 2794916 | |||||||||

| National Hog Farm 17-12 |

5N | 63W | 17 | SWNW | Union Pacific Land Resources Corporation | United States Exploration, Inc | 3/27/00 | — | 2794916 | |||||||||

| State 5519 8-34 |

5N | 63W | 8 | SWSE | State of Colorado 80/5519-5 | J. Robert Outerbridge & Associates, Inc. | 8/20/80 | 1207 | 2153524 | |||||||||

| State 5519 8-43 |

5N | 63W | 8 | NESE | State of Colorado 80/5519-5 | J. Robert Outerbridge & Associates, Inc. | 8/20/80 | 1207 | 2153524 | |||||||||

| Page 1 of 1 | Sale No. 260C Lot No. 20 |