UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2014

MB FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

|

Maryland |

|

0-24566-01 |

|

36-4460265 |

|

(State or other jurisdiction |

|

(Commission File No.) |

|

(IRS Employer |

|

800 West Madison Street, Chicago, Illinois |

|

60607 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (888) 422-6562

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure

Forward-Looking Statements

When used in this Current Report on Form 8-K and in other reports filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,” “will,” “should,” “will likely result,” “are expected to,” “will continue” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. These statements may relate to our future financial performance, strategic plans or objectives, revenues or earnings projections, or other financial items. By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements.

Important factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following: (1) expected revenues, cost savings, synergies and other benefits from the pending Taylor Capital merger and our other merger and acquisition activities might not be realized within the anticipated time frames or at all, and costs or difficulties relating to integration matters, including but not limited to, customer and employee retention, might be greater than expected; (2) the possibility that the requisite regulatory approval for the pending Taylor Capital merger might not be obtained; (3) the credit risks of lending activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses, which could necessitate additional provisions for loan losses; (4) results of examinations by the Office of Comptroller of Currency, the Board of Governors of the Federal Reserve System and other regulatory authorities, including the possibility that any such regulatory authority may, among other things, require us to increase our allowance for loan losses or write-down assets; (5) competitive pressures among depository institutions; (6) interest rate movements and their impact on customer behavior and net interest margin; (7) the impact of repricing and competitors’ pricing initiatives on loan and deposit products; (8) fluctuations in real estate values; (9) the ability to adapt successfully to technological changes to meet customers’ needs and developments in the market place; (10) our ability to realize the residual values of our direct finance, leveraged, and operating leases; (11) our ability to access cost-effective funding; (12) changes in financial markets; (13) changes in economic conditions in general and in the Chicago metropolitan area in particular; (14) the costs, effects and outcomes of litigation; (15) new legislation or regulatory changes, including but not limited to, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and regulations adopted thereunder, changes in capital requirements pursuant to the Dodd-Frank Act and the implementation of the Basel III capital standards, other governmental initiatives affecting the financial services industry and changes in federal and/or state tax laws or interpretations thereof by taxing authorities; (16) changes in accounting principles, policies or guidelines; (17) our future acquisitions of other depository institutions or lines of business; and (18) future goodwill impairment due to changes in our business, changes in market conditions or other factors.

MB Financial does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which the forward-looking statement is made.

Set forth below are investor presentation materials.

|

|

February 2014 NASDAQ: MBFI Investor Presentation |

|

|

Forward-Looking Statements 1 Forward-Looking Statements When used in this presentation and in reports filed with or furnished to the Securities and Exchange Commission, in press releases or other public stockholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,” “will,” “should,” “will likely result,” “are expected to,” “will continue” “is anticipated,” “estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. These statements may relate to our future financial performance, strategic plans or objectives, revenues or earnings projections, or other financial items. By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements. Important factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following: (1) expected revenues, cost savings, synergies and other benefits from the pending Taylor Capital merger and our other merger and acquisition activities might not be realized within the anticipated time frames or at all, and costs or difficulties relating to integration matters, including but not limited to, customer and employee retention, might be greater than expected; (2) the possibility that the requisite regulatory approval for the pending Taylor Capital merger might not be obtained; (3) the credit risks of lending activities, including changes in the level and direction of loan delinquencies and write-offs and changes in estimates of the adequacy of the allowance for loan losses, which could necessitate additional provisions for loan losses; (4) results of examinations by the Office of Comptroller of Currency, the Board of Governors of the Federal Reserve System and other regulatory authorities, including the possibility that any such regulatory authority may, among other things, require us to increase our allowance for loan losses or write-down assets; (5) competitive pressures among depository institutions; (6) interest rate movements and their impact on customer behavior and net interest margin; (7) the impact of repricing and competitors’ pricing initiatives on loan and deposit products; (8) fluctuations in real estate values; (9) the ability to adapt successfully to technological changes to meet customers’ needs and developments in the market place; (10) our ability to realize the residual values of our direct finance, leveraged, and operating leases; (11) our ability to access cost-effective funding; (12) changes in financial markets; (13) changes in economic conditions in general and in the Chicago metropolitan area in particular; (14) the costs, effects and outcomes of litigation; (15) new legislation or regulatory changes, including but not limited to, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act") and regulations adopted thereunder, changes in capital requirements pursuant to the Dodd-Frank Act and the implementation of the Basel III capital standards, other governmental initiatives affecting the financial services industry and changes in federal and/or state tax laws or interpretations thereof by taxing authorities; (16) changes in accounting principles, policies or guidelines; (17) our future acquisitions of other depository institutions or lines of business; and (18) future goodwill impairment due to changes in our business, changes in market conditions or other factors. We do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which the forward-looking statement is made. |

|

|

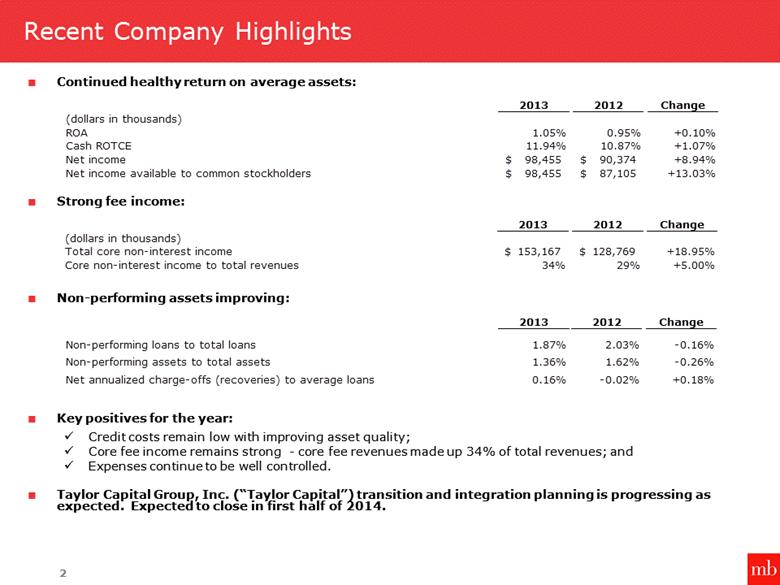

Continued healthy return on average assets: Strong fee income: Non-performing assets improving: Key positives for the year: Credit costs remain low with improving asset quality; Core fee income remains strong - core fee revenues made up 34% of total revenues; and Expenses continue to be well controlled. Taylor Capital Group, Inc. (“Taylor Capital”) transition and integration planning is progressing as expected. Expected to close in first half of 2014. Recent Company Highlights 2 2013 2012 Change Non-performing loans to total loans 1.87% 2.03% -0.16% Non-performing assets to total assets 1.36% 1.62% -0.26% Net annualized charge-offs (recoveries) to average loans 0.16% -0.02% +0.18% 2013 2012 Change (dollars in thousands) Total core non-interest income 153,167 $ 128,769 $ +18.95% Core non-interest income to total revenues 34% 29% +5.00% 2013 2012 Change (dollars in thousands) ROA 1.05% 0.95% +0.10% Cash ROTCE 11.94% 10.87% +1.07% Net income $ 98,455 $ 90,374 +8.94% Net income available to common stockholders $ 98,455 $ 87,105 +13.03% |

|

|

Company Strategy Build a bank with lower risk and consistently better returns than peers over the long term Develop balance sheet with superior profitability and lower risk Add great customers, whether they borrow or not Maintain low credit risk and low credit costs Attract low cost and stable funding Maintain strong liquidity and capital Focus intensely on fee income Fees need to be high quality, recurring, and profitable Not an easy task; requires meaningful investment Emphasize leasing, capital markets, international banking, cards, commercial deposit fees, treasury management, and trust and asset management Grow select fee businesses nationally (leasing, cards and treasury management) Invest in human talent Recruit and retain the best staff – very low turnover rate of “A” employees Maintain strong training programs – large commercial banker training program Be the employer of choice; Awards received – ranked in the top 10 among the large employer category in the Chicago Tribune's Top 100 Workplaces survey three years in a row, and ranked among best places to work in National Top Workplace Survey Make opportunistic acquisitions Skilled and disciplined acquirer Long track record of successful integrations 3 |

|

|

Banking Segment – Lines of Business 4 Retail Banking Provides the majority of funding for commercial lending business; provides 57% of deposits and 16% of loans High percentage of core funding Low reliance on CDs Focuses on business banking customers and individuals that live or work near our branches Key fee initiatives include card services and treasury management services for business banking customers Wealth Management Provides customized private banking, trust, investment management, brokerage, and retirement plan services through a team of experienced advisors Specializes in serving business owners, high-net worth families, foundations, and endowments Focused on asset management, low-cost deposits, and private banking services Manages more than $3.2 billion of client assets through trust department and asset management subsidiary (Cedar Hill Associates, LLC) Commercial Banking Lending and depository services to middle-market companies with revenues ranging from $10 to $250mm “Relationship banking” culture; calling officers have 20+ years average experience Commercial and industrial and commercial real estate loan portfolio – terms generally range from 1 to 5 years; 91% with total relationship credit exposure of $25 million or less; approximately 60% have a floating rate of interest (72% indexed to LIBOR and 28% indexed to Prime) Key fee initiatives include treasury management, capital markets, international banking and cross-selling wealth management products Note: Business line financial data as of December 31, 2013 Lease Banking Lease banking – provides banking services to lessors located throughout the U.S.; lease and working capital loans and lease equity investments Lease loans totaled $1.5 billion at 12/31/13 Lease loans are underwritten primarily on the creditworthiness of the lessee Lessees include mostly investment grade “Fortune 1000” companies located throughout the U.S. and large middle-market companies |

|

|

Leasing Segment Lease originations and related services Leases originated through our lease subsidiaries, LaSalle Systems Leasing, Inc. and Celtic Leasing Corp. Lease equipment to “Fortune 1000,” large middle-market companies, and healthcare providers located throughout the U.S. Leased equipment generally consists of technology-related and material handling equipment Direct finance and leverage leases are included in lease loans and operating leases are included in lease investments, net Lessors generally finance much of their equipment cost with debt (85% to 95% of original equipment cost) Specialize in brokering third party equipment maintenance contracts to large companies 5 |

|

|

Great Branch Footprint for Serving Business Customers 6 Chicago MSA – 84 branches Regularly optimize branch network (closed 2 branches in 2013, 3 branches in 2012 and 2 branches in 2011) Branches predominantly located in Cook and DuPage counties in the Chicago MSA where approximately 80% of middle-market companies are located Source: SNL Financial (11/2012) |

|

|

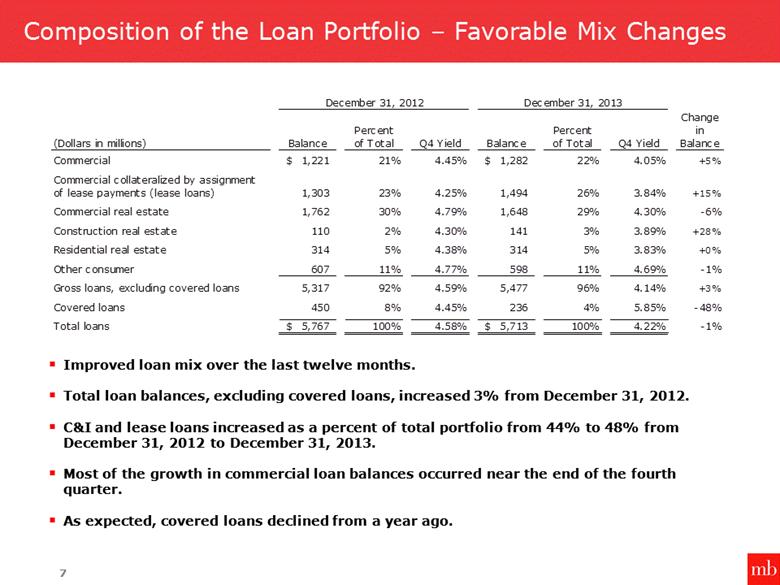

Composition of the Loan Portfolio – Favorable Mix Changes Improved loan mix over the last twelve months. Total loan balances, excluding covered loans, increased 3% from December 31, 2012. C&I and lease loans increased as a percent of total portfolio from 44% to 48% from December 31, 2012 to December 31, 2013. Most of the growth in commercial loan balances occurred near the end of the fourth quarter. As expected, covered loans declined from a year ago. 7 (Dollars in millions) Balance Percent of Total Q4 Yield Balance Percent of Total Q4 Yield Change in Balance Commercial 1,221 $ 21% 4.45% 1,282 $ 22% 4.05% +5% Commercial collateralized by assignment of lease payments (lease loans) 1,303 23% 4.25% 1,494 26% 3.84% +15% Commercial real estate 1,762 30% 4.79% 1,648 29% 4.30% -6% Construction real estate 110 2% 4.30% 141 3% 3.89% +28% Residential real estate 314 5% 4.38% 314 5% 3.83% +0% Other consumer 607 11% 4.77% 598 11% 4.69% -1% Gross loans, excluding covered loans 5,317 92% 4.59% 5,477 96% 4.14% +3% Covered loans 450 8% 4.45% 236 4% 5.85% -48% Total loans 5,767 $ 100% 4.58% 5,713 $ 100% 4.22% -1% December 31, 2012 December 31, 2013 |

|

|

NPL Composition December 31, 2013 Asset Quality Statistics – Improvement Continues 8 Payment Status of NPLs At or For the Year Ended Ratio 12/31/2009 12/31/2010 12/31/2011 12/31/2012 12/31/2013 ALLL to total loans 2.71% 2.90% 2.13% 2.15% 1.96% NPLs to total loans 4.16% 5.48% 2.17% 2.03% 1.87% ALLL to non-performing loans 65.26% 53.03% 98.00% 106.17% 104.87% Net charge-offs (recoveries) to average loans 3.09% 3.42% 2.90% (0.02%) 0.16% |

|

|

|

|

|

Liquidity Ratios – Robust Liquidity (A) Total deposits (excluding brokered deposits) and customer repurchase agreements/Total deposits, customer repurchase agreements and other borrowings. 9 Strong liquidity Not reliant on non-core funding High lending capacity |

|

|

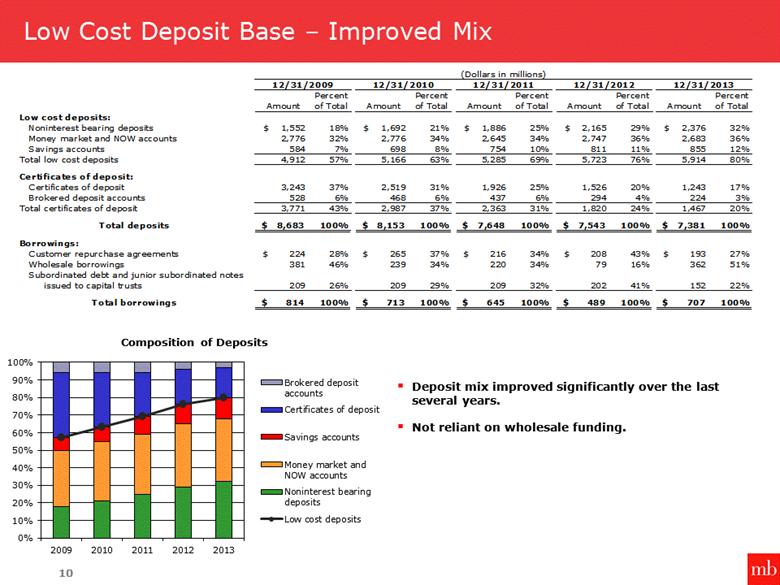

Low Cost Deposit Base – Improved Mix Deposit mix improved significantly over the last several years. Not reliant on wholesale funding. 10 Percent Percent Percent Percent Percent Amount of Total Amount of Total Amount of Total Amount of Total Amount of Total Noninterest bearing deposits 1,552 $ 18% 1,692 $ 21% 1,886 $ 25% 2,165 $ 29% 2,376 $ 32% Money market and NOW accounts 2,776 32% 2,776 34% 2,645 34% 2,747 36% 2,683 36% Savings accounts 584 7% 698 8% 754 10% 811 11% 855 12% 4,912 57% 5,166 63% 5,285 69% 5,723 76% 5,914 80% Certificates of deposit 3,243 37% 2,519 31% 1,926 25% 1,526 20% 1,243 17% Brokered deposit accounts 528 6% 468 6% 437 6% 294 4% 224 3% 3,771 43% 2,987 37% 2,363 31% 1,820 24% 1,467 20% 8,683 $ 100% 8,153 $ 100% 7,648 $ 100% 7,543 $ 100% 7,381 $ 100% Customer repurchase agreements 224 $ 28% 265 $ 37% 216 $ 34% 208 $ 43% 193 $ 27% Wholesale borrowings 381 46% 239 34% 220 34% 79 16% 362 51% Subordinated debt and junior subordinated notes issued to capital trusts 209 26% 209 29% 209 32% 202 41% 152 22% 814 $ 100% 713 $ 100% 645 $ 100% 489 $ 100% 707 $ 100% Total borrowings Total deposits Low cost deposits: Total low cost deposits Certificates of deposit: Total certificates of deposit Borrowings: 12/31/2010 12/31/2011 12/31/2012 (Dollars in millions) 12/31/2013 12/31/2009 |

|

|

Capital Composition 12/31/2013 11 Simple capital structure. Dominated by common equity. |

|

|

Summary Income Statement – Profitability has “Normalized” 12 2009 2010 2011 2012 2013 Interest income 394 $ 430 $ 385 $ 335 $ 298 $ Interest expense 143 90 59 43 26 Net interest income 251 340 325 293 272 Provision for credit losses 232 246 121 (9) (6) Net interest income after provision for credit losses 19 94 205 302 278 Non-interest income 127 195 123 129 154 Non-interest expenses 224 268 284 304 295 Income (loss) before income taxes (78) 21 44 127 137 Applicable income tax expense (benefit) (45) 0 5 37 39 Income (loss) from continuing operations (33) 21 38 90 98 Income from discontinued operations, net of income tax 7 - - - - Net income (loss) (26) 21 38 90 98 Dividends and discount accretion on preferred shares 10 10 10 3 - Net income (loss) available to common stockholders (36) $ 10 $ 28 $ 87 $ 98 $ (In millions) Year Ended December 31, |

|

|

Performance Ratios – Reflects Improving Operations 13 |

|

|

Key Fee Initiatives – Becoming More Meaningful 14 Capital markets fees Team built in first quarter of 2012 Includes fees for the following services: derivatives and interest rate risk solutions, capital solutions, merger and acquisition advisory and real estate debt placement International banking fees Team built two years ago Includes fees for the following services: trade services (letters of credit), export trade finance, and foreign exchange Commercial deposit and treasury management fees Includes fees for the following services: account management, payments systems access, information management, and fraud and risk mitigation Expanding nationally where we have expertise Lease financing Includes fees related to equipment leases as well as brokering third party equipment maintenance contracts Trust and asset management fees Wealth management solutions for individuals, corporations and not-for-profits Includes fees for the following services: investment management, custody, personal trust, financial planning, and wealth advisory services for high net worth individuals Card fees Expanded into prepaid and credit cards in 2012 Includes fees for debit, credit, prepaid, incentive and gift cards 2009 2010 2011 2012 2013 Key fee initiatives: Capital markets and international banking fees 502 $ 344 $ 1,870 $ $ 5,086 $ $ 3,560 $ Commercial deposit and treasury management fees 16,545 21,806 23,559 23,636 24,867 Lease financing, net 18,528 21,853 26,939 36,382 61,243 Trust and asset management fees 12,593 15,037 17,324 17,990 19,142 Card fees 4,558 7,057 7,032 9,368 11,013 Total key fee initiatives 52,726 $ 66,097 $ 76,724 $ 92,462 $ 119,825 $ (In Thousands) Year Ended December 31, |

|

|

Market Leading Operating Performance 15 Net non-interest expense / average assets (%) Asset yields - FTE (%) Cost of funds (%) MBFI Chicago Peers Median Net interest margin - FTE (%) (1) Year to date annualized Core non-interest income / revenues - FTE (%) Source: Company filings, SNL Financial Note: Chicago peers consist of median data for public banks headquartered in Chicago MSA with assets between $2.0 billion and $18.1 billion at December 31, 2013 and include: First Midwest, Old Second, PrivateBancorp, Taylor Capital, Wintrust; median of peer group presented in charts 25 25 27 29 34 25 23 24 29 32 2009 2010 2011 2012 2013 1.67 0.70 0.52 0.32 1.73 1.13 0.90 0.66 0.50 0.99 2009 2010 2011 2012 2013 2.97 3.90 3.73 3.59 3.83 3.40 3.46 3.52 3.51 3.04 2009 2010 2011 2012 2013 1.33 1.37 1.46 1.47 1.46 1.44 1.71 1.59 1.51 1.52 2009 2010 2011 2012 2013 |

|

|

Stronger Capital Than Local Peers 16 TCE / TA (%) Tier I Capital Ratio (%) Total Risk-Based Capital Ratio (%) TCE / RWA (%) MBFI Chicago Peers Median Source: Company filings, SNL Financial Note: Chicago peers consist of median data for public banks headquartered in Chicago MSA with assets between $2.0 billion and $18.1 billion at December 31, 2013 and include: First Midwest, Old Second, PrivateBancorp, Taylor Capital, Wintrust; median of peer group presented in charts 6.2 7.5 8.4 9.1 9.7 5.5 7.3 7.6 7.6 8.2 2009 2010 2011 2012 2013 8.8 10.9 12.5 13.1 13.3 6.5 8.8 9.0 8.9 9.2 2009 2010 2011 2012 2013 15.5 17.8 19.4 16.6 16.5 13.6 14.0 14.0 13.4 13.1 2009 2010 2011 2012 2013 17.3 15.8 15.3 14.7 13.5 12.3 11.7 11.4 11.2 11.2 2009 2010 2011 2012 2013 |

|

|

17 Source: Company filings, SNL Financial Note: Chicago peers consist of median data for public banks headquartered in Chicago MSA with assets between $2.0 billion and $18.1 billion at December 31, 2013 and include: First Midwest, Old Second, PrivateBancorp, Taylor Capital, Wintrust; median of peer group presented in charts NPAs / Assets (%) Reserves/Loans (%) Reserves / NPLs (%) Credit Metrics Similar to Local Peers Reserves / Loans (%) NPLs / Loans (%) MBFI Chicago Peers Median 2.84 4.21 2.12 1.62 1.36 3.72 3.93 2.93 1.59 1.26 2009 2010 2011 2012 2013 65 53 98 106 105 62 63 82 106 102 2009 2010 2011 2012 2013 2.71 2.90 2.13 2.15 1.96 2.71 2.75 2.18 2.00 1.73 2009 2010 2011 2012 2013 5.48 4.41 4.55 4.16 3.05 2.17 2.03 1.80 1.87 1.49 2009 2010 2011 2012 2013 |

|

|

Valuable Position in the Chicago MSA Rank Institution Branch Count Total Deposits in Market ($mm) Total Market Share (%) 1 JPMorgan Chase 443 76,626 23.4 2 BMO Financial Group 227 39,536 12.1 3 Bank of America 172 26,188 8.0 4 Northern Trust 11 21,402 6.5 5 Wintrust Financial 116 13,985 4.3 6 Citigroup 72 12,171 3.7 7 Fifth Third 178 12,087 3.7 8 PNC Financial Services 153 11,280 3.4 9 MB Financial, Post Taylor1 94 11,143 3.4 9 PrivateBancorp 20 9,256 2.8 10 MB Financial1 84 7,445 2.3 11 First Midwest 79 6,165 1.9 12 US Bancorp 90 6,040 1.8 13 Royal Bank of Scotland 105 5,999 1.8 14 TCF Financial 199 4,421 1.3 All other institutions 1,110 63,924 19.5 MSA Total 3,153 327,668 100.0 Rank Institution Branch Count Total Deposits in Market ($mm) Total Market Share (%) 1 JPMorgan Chase 326 38,407 16.0 2 ABN Amro (LaSalle Bank) 140 30,957 12.9 3 Harris (Bank of Montreal) 192 23,237 9.7 4 Northern Trust 18 8,461 3.5 5 Fifth Third 123 8,052 3.4 6 Royal Bank of Scotland 136 6,446 2.7 7 Wintrust Financial 55 6,019 2.5 8 Corus Bankshares 14 5,500 2.3 9 Citigroup 51 5,441 2.3 10 MAF Bancorp 49 4,904 2.0 11 National City 59 4,528 1.9 12 First Midwest 56 4,488 1.9 13 Bank of America 31 4,159 1.7 14 MB Financial 39 3,770 1.6 15 FBOP Corp 25 2,824 1.2 All other institutions 1,686 82,474 34.4 MSA Total 3,000 239,667 100.0 Current Chicago MSA Rankings 2005 Chicago MSA Rankings Source: SNL Financial Note: Data as of June 30, 2013 reflects announced acquisitions post June 30, 2013 1 Deposits as of 6/30/2013 18 |

|

|

Market Share of Top Banks in 10 Largest U.S. MSAs 19 Market share of top 10 banks in 10 largest U.S. MSAs Market share of top 3 banks in 10 largest U.S. MSAs Source: SNL Financial as 6/30/2013 |

|

|

20 Skilled Acquirer Skilled acquirer of both depository and non-depository entities Sixteen acquisitions since 2000 Disciplined financial analyses focused on: Internal rates of return Returns on invested capital Long-term per share earnings accretion Long track record of successful and rapid employee, customer and systems integrations Ability to manage multiple integrations simultaneously Branch network size and location makes acquired branch consolidations more likely to result in enhanced expense savings opportunities Company culture suited for acquisitions |

|

|

21 2001 2002 2004 2006 2008 2004 First SecurityFed Financial (Chicago, IL) January 9, 2004 2002 South Holland Bancorp (South Holland, IL) November 1, 2002 LaSalle Systems Leasing, Inc. July 22, 2002 2006 First Oak Brook Bancshares (Oak Brook, IL) May 1, 2006 2009 Heritage Community Bank (Glenwood, IL) February 27, 2009 InBank (Oak Forest IL) September 4, 2009 Corus Bank (Chicago, IL) September 11, 2009 Benchmark Bank (Aurora, IL) December 4, 2009 Source: Company filings Note: Transaction dates indicate announcement date 2008 Cedar Hill Associates, LLC (Chicago, IL) April 18, 2008 Track Record of Being a Disciplined Acquirer and Experienced Integrator 2009 2010 2010 Broadway Bank (Chicago, IL) April 23, 2010 New Century Bank (Chicago, IL) April 23, 2010 2001 FSL Holdings, Inc. (South Holland, IL) February 8, 2001 MidCity Financial (Chicago, IL) April 19, 2001 First Lincolnwood (Lincolnwood, IL) December 27, 2001 2012 2012 Celtic Leasing Corp. (Irvine, CA) December 28, 2012 2003 2005 2007 2011 2013 2013 Taylor Capital Group, Inc. (Rosemont, IL) July 14, 2013 2014 |

|

|

Taylor Capital Acquisition – Combination of complementary commercial banks with similar business models Strategically attractive combination Financially compelling, high-return, low-risk opportunity Two leading Chicago commercial banks merging to better serve the metropolitan community: $14.9bn assets, $9.0bn gross loans, and $11.1bn deposits Complementary commercial customer bases with shared lending philosophies Nearly doubles middle-market commercial banking market share Attractive national businesses Increased presence in attractive Cook county (top 5 pro forma) Combined management team with strong Chicago roots Allows MB Financial to deploy excess capital in an attractive manner: 15%+ EPS accretion with fully phased-in synergies, 3.5 years tangible book value per share earnback, and 15%+ IRR Maintain strong capital position with 8%+ tangible common equity ratio Compelling returns with pro-forma profitability significantly above peer median Achievable cost savings estimated at 30% of Taylor’s core operating expenses, excluding the mortgage business line Management team with significant merger integration experience Mortgage business provides a potential additional fee revenue source for MB Financial 22 |

|

|

Taylor Capital Acquisition – Combined Loans(1) 12/31/2013 23 (1) Includes gross loans, excluding covered loans and loans held for sale. MB Financial Taylor Capital Combined Total: $5.5 billion Total: $3.6 billion Total: $9.1 billion |

|

|

Taylor Capital Acquisition – Combined Deposits 12/31/2013 24 MB Financial Taylor Capital Combined Total: $7.4 billion Total: $3.7 billion Total: $11.1 billion |

|

|

Combination with Taylor Capital meets previously stated strategic priorities Build a bank with lower risk and consistently better returns than peers over the long-term Develop balance sheet with superior profitability and lower risk Focus intensely on fee income Invest in human talent Make opportunistic acquisitions Meaningfully improves ROA and ROATCE Deploys excess capital and improves strategic flexibility Further diversifies revenue stream and asset generation capabilities Effectively utilizes balance sheet liquidity to fund commercial loan growth Diversifies loan portfolio into new asset classes Provides opportunities to cross-sell fee income products Mortgage business provides another source of fee income Adds depth and additional capabilities to commercial banking Brings expertise in other areas, including asset-based lending Transaction solidifies MB Financial’s market position in Chicago Significantly increases scarcity value – largest independent bank in Chicago MSA by market capitalization 25 |

|

|

Non-GAAP Disclosure Appendix 26 |

|

|

Non-GAAP Disclosure Reconciliations This presentation contains certain financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (GAAP). These measures include net interest margin on a fully tax equivalent basis; ratio of core non-interest income to total revenue on a fully tax equivalent basis and ratio of net non-interest expense to average assets, with net gains on investment securities, net gains and losses on sale of other assets, net gain on sale of loans held for sale, acquisition related gains and increase (decrease) in market value of assets held in trust for deferred compensation excluded from the calculations of the non-interest income and core non-interest income components of these ratios, and the FDIC special assessment expense, impairment charges, prepayment fees on interest-bearing liabilities, net gains and losses on other real estate owned, merger related expenses and increase (decrease) in market value of assets held in trust for deferred compensation excluded from the non-interest expense components of the ratio of net non-interest expense to average assets with tax equivalent adjustments for tax-exempt interest income and increase in cash surrender value of life insurance; ratios of tangible common equity to risk weighted assets and tangible common equity to tangible assets; core funding to total funding; and cash return on average tangible common equity (net cash flow available to common stockholders divided by average tangible common equity). Our management uses these non-GAAP measures, together with the related GAAP measures, in its analysis of our performance and in making business decisions. Management also uses these measures for peer comparisons. The tax equivalent adjustments to net interest margin, non-interest income and total revenue recognizes the income tax savings when comparing taxable and tax-exempt assets and assumes a 35% tax rate. Management believes that others within the banking industry present these measures on a fully tax equivalent basis, and accordingly believes that providing these measures may be useful for peer comparison purposes. For the same reasons, management believes the tax equivalent adjustments for tax-exempt interest income and increase in cash surrender value of life insurance are useful. Management believes that core and non-core non-interest income and expense are useful in assessing our operating performance and in understanding the primary drivers of our non-interest income and expense when comparing periods. Management, likewise, believes that presenting the ratio of core funding to total funding is useful in understanding our funding sources when comparing periods. Management also believes that by excluding net gains on investment securities, net gains and losses on sale of other assets, net gain on sale of loans held for sale, acquisition related gains and increase (decrease) in market value of assets held in trust for deferred compensation from the other (non-interest) income components and excluding the FDIC special assessment expense, impairment charges, prepayment fees on interest-bearing liabilities, net gains and losses on other real estate owned, merger related expenses and increase (decrease) in market value of assets held in trust for deferred compensation from the other (non-interest) expense components of the ratio of net non-interest expense to average assets and, in the case of the income-related items, the ratio of core non-interest income to total revenue on a fully tax equivalent basis, this information better reflects our operating performance, as the excluded items do not pertain to our core business operations and their exclusion makes this information more meaningful when comparing our operating results from period to period. 27 |

|

|

Non-GAAP Disclosure Reconciliations (Continued) The ratios of tangible common equity to tangible assets and tangible common equity to risk-weighted assets exclude goodwill and other intangible assets, net of tax benefits, in determining tangible assets and tangible common equity. Management believes that the presentation of these measures excluding the impact of such items provides useful supplemental information that is helpful in understanding our financial results, as they provide a method to assess management’s success in utilizing our tangible capital as well as our capital strength. Management also believes that providing measures that exclude balances of goodwill and other intangible assets, which are subjective components of valuation, facilitates the comparison of our performance with the performance of our peers. In addition, management believes that these are standard financial measures used in the banking industry to evaluate performance. The non-GAAP disclosures contained herein should not be viewed as substitutes for the results determined to be in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. The following table reconciles net interest margin on a fully tax equivalent basis to net interest margin for the year presented: 28 Net interest margin 2009 2010 2011 2012 2013 Net interest margin 2.85% 3.72% 3.75% 3.49% 3.31% Plus: tax equivalent effect 0.12% 0.11% 0.15% 0.24% 0.28% Net interest margin, fully tax equivalent 2.97% 3.83% 3.90% 3.73% 3.59% (1) Annualized |

|

|

Non-GAAP Disclosure Reconciliations (Continued) The following table presents a reconciliation of tangible common equity to common stockholders’ equity (in thousands): 29 The following table presents a reconciliation of average tangible common equity to average common stockholders’ equity for the years presented (in thousands): The following table presents a reconciliation of net cash flow available to common stockholders to net income available to common stockholders for the years presented (in thousands): 2009 2010 2011 2012 2013 1,057,658 $ 1,150,682 $ 1,198,308 $ 1,275,770 $ 1,326,682 $ Less: goodwill 387,069 387,069 387,069 423,369 423,369 Less: other intangible, net of tax benefit 24,510 22,853 19,171 19,183 15,228 646,079 $ 740,760 $ 792,068 $ 833,218 $ 888,085 $ Common stockholders' equity - as reported Tangible common equity As of December 31, 2009 2010 2011 2012 2013 Net income available to common stockholders - as reported (36,424) $ 10,146 $ 28,314 $ 87,105 $ 98,455 $ Add: other intangible amortization expense, net of tax 2,919 4,039 3,682 3,257 3,955 (33,505) $ 14,185 $ 31,996 $ 90,362 $ 102,410 $ Net cash flow available to common stockholders 2009 2010 2011 2012 2013 Average common stockholders' equity - as reported 932,509 $ 1,135,189 $ 1,164,316 $ 1,235,780 $ 1,297,991 $ Less: goodwill 387,069 387,069 387,069 387,168 423,369 Less: other intangible, net of tax benefit 18,971 23,154 20,865 17,465 17,111 526,469 $ 724,966 $ 756,382 $ 831,147 $ 857,511 $ Average tangible common equity |

|

|

Non-GAAP Disclosure Reconciliations (Continued) The following table presents a reconciliation of tangible assets to total assets (in thousands): 30 2009 2010 2011 2012 2013 10,865,393 $ 10,320,364 $ 9,833,072 $ 9,571,805 $ 9,641,427 $ Less: goodwill 387,069 387,069 387,069 423,369 423,369 Less: other intangible, net of tax benefit 24,510 22,853 19,171 19,183 15,228 10,453,814 $ 9,910,442 $ 9,426,832 $ 9,129,253 $ 9,202,830 $ Total assets - as reported Tangible assets As of December 31, |

|

|

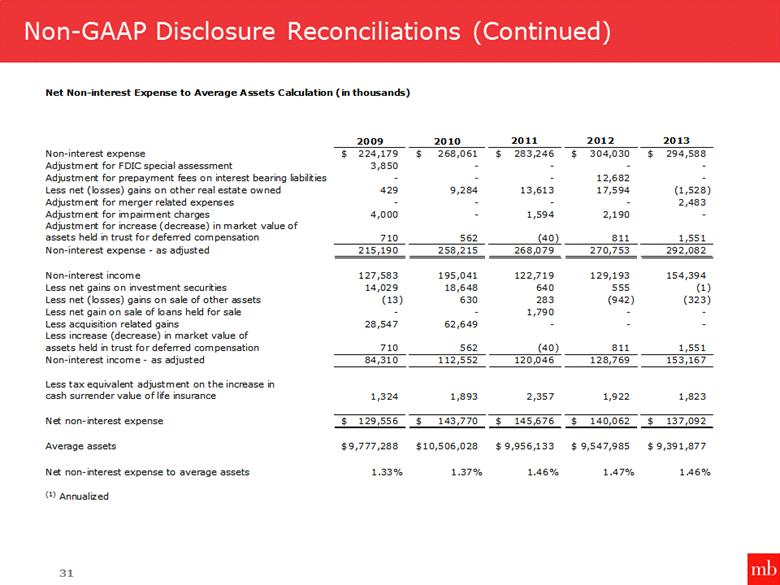

Non-GAAP Disclosure Reconciliations (Continued) 31 Net Non-interest Expense to Average Assets Calculation (in thousands) 2009 2010 2011 2012 2013 Non-interest expense 224,179 $ 268,061 $ 283,246 $ 304,030 $ 294,588 $ Adjustment for FDIC special assessment 3,850 - - - - Adjustment for prepayment fees on interest bearing liabilities - - - 12,682 - Less net (losses) gains on other real estate owned 429 9,284 13,613 17,594 (1,528) Adjustment for merger related expenses - - - - 2,483 Adjustment for impairment charges 4,000 - 1,594 2,190 - Adjustment for increase (decrease) in market value of assets held in trust for deferred compensation 710 562 (40) 811 1,551 Non-interest expense - as adjusted 215,190 258,215 268,079 270,753 292,082 Non-interest income 127,583 195,041 122,719 129,193 154,394 Less net gains on investment securities 14,029 18,648 640 555 (1) Less net (losses) gains on sale of other assets (13) 630 283 (942) (323) Less net gain on sale of loans held for sale - - 1,790 - - Less acquisition related gains 28,547 62,649 - - - Less increase (decrease) in market value of assets held in trust for deferred compensation 710 562 (40) 811 1,551 Non-interest income - as adjusted 84,310 112,552 120,046 128,769 153,167 Less tax equivalent adjustment on the increase in cash surrender value of life insurance 1,324 1,893 2,357 1,922 1,823 Net non-interest expense 129,556 $ 143,770 $ 145,676 $ 140,062 $ 137,092 $ Average assets 9,777,288 $ 10,506,028 $ 9,956,133 $ 9,547,985 $ 9,391,877 $ Net non-interest expense to average assets 1.33% 1.37% 1.46% 1.47% 1.46% (1) Annualized |

|

|

Non-GAAP Disclosure Reconciliations (Continued) 32 Core non-interest income (in thousands) 2009 2010 2011 2012 2013 Net interest income 127,583 $ 195,041 $ 122,719 $ 129,193 $ 154,394 $ Less net gains on investment securities 14,029 18,648 640 555 (1) Less net (losses) gains on sale of other assets (13) 630 283 (942) (323) Less net gains on sale of loans held for sale - - 1,790 - - Less acquisition related gains 28,547 62,649 - - - Less increase (decrease) in market value of assets held in trust for deferred compensation 710 562 (40) 811 1,551 Total core non-interest income 84,310 112,552 120,046 128,769 153,167 Plus tax equivalent adjustment on the increase in cash surrender value of life insurance 1,324 1,893 2,357 1,922 1,823 Core non-interest income, fully tax equivalent 85,634 $ 114,445 $ 122,403 $ 130,691 $ 154,990 $ 2009 2010 2011 2012 2013 Net interest income $ 250,552 $ 339,772 $ 325,273 $ 292,788 $ 272,336 Plus: tax equivalent effect 10,625 10,458 13,188 20,429 22,709 Net interest income, fully tax equivalent 261,177 350,230 338,461 313,217 295,045 Core non-interest income 84,310 112,551 120,046 128,769 153,167 Plus: tax equivalent adjustment on the increase in cash surrender value of life insurance 1,324 1,893 2,357 1,922 1,823 Total revenues, fully tax equivalent $ 346,811 $ 464,674 $ 460,864 $ 443,908 $ 450,035 Core non-interest income to revenues, fully tax equivalent 25% 25% 27% 29% 34% |

|

|

February 2014 NASDAQ: MBFI Investor Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

MB FINANCIAL, INC. | |

|

|

| |

|

Date: February 27, 2014 |

By: |

/s/Jill E. York |

|

|

|

Jill E. York |