Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AERIE PHARMACEUTICALS INC | d683122d8k.htm |

Leading Innovation in Glaucoma

The Next Generation

Company Overview

February 26, 2014

Exhibit 99.1 |

Any

discussion of the potential use or expected success of our product candidates is subject to our

product

candidates

being

approved

by

regulatory

authorities.

In

addition,

any

discussion

of

clinical

data

results for our AR-13324 product candidate relate to the results in our Phase 2

clinical trials. Our product candidate PG324 has only been tested in

preclinical animal models. The information in this presentation is current

only as of its date and may have changed or may change in the future. We

undertake no obligation to update this information in light of new information, future

events or otherwise. We are not making any representation or warranty that the

information in this presentation is accurate or complete.

2

Important Information

Certain

statements

in

this

presentation

are

“forward-looking statements”

within

the

meaning

of

the

federal securities laws, including beliefs, expectations, estimates, projections

and statements relating to our business plans, prospects and objectives, and

the assumptions upon which those statements are based.

Words

such

as

“may,”

“will,”

“should,”

“would,”

“could,”

“believe,”

“expects,”

“anticipates,”

“plans,”

“intends,”

“estimates,”

“targets,”

“projects”

or similar expressions are intended to identify these forward-

looking statements.

These statements are based on the Company’s current plans and

expectations.

Known and unknown risks, uncertainties and other factors could cause actual

results to differ

materially

from

those

contemplated

by

the

statements.

In

evaluating

these

statements,

you

should

specifically consider various factors that may cause our actual results to differ

materially from any forward-looking statements. These risks and

uncertainties are described more fully in our prospectus filed with the SEC

on October 28, 2013 and in the quarterly and annual reports that we file with the SEC,

particularly

in

the

sections

titled

“Risk

Factors”

and

“Management’s

Discussion

and

Analysis

of

Financial

Condition and Results of Operation.”

Such forward-looking statements only speak as of the date they

are made.

We undertake no obligation to publicly update or revise any forward-looking

statements, whether because of new information, future events or otherwise,

except as otherwise required by law. |

3

Aerie –

Next Generation in Glaucoma Therapies

AR-13324

Novel Dual Action

All Products Fully

Owned by Aerie

PG324 Breakthrough

Triple Action

•

Fixed combination of AR-13324 and latanoprost

•

Potential for maximal IOP lowering

•

Expect P2b results mid-2014, P3

readiness mid-2015

•

Inhibits ROCK and NET, targets diseased tissue

•

Consistent IOP lowering,

may lower EVP

•

Expect P3 efficacy data mid-2015, NDA filing mid-2016

Large Market

Opportunity

•

$4.5B US/EU/JP Market with significant unmet needs

•

Multiple MOAs, once daily, high efficacy and safety

•

Late-stage/potential blockbuster revenue opportunity

•

Full patent protection through at least 2030

•

Will retain US rights and plan to partner in

JP/EU |

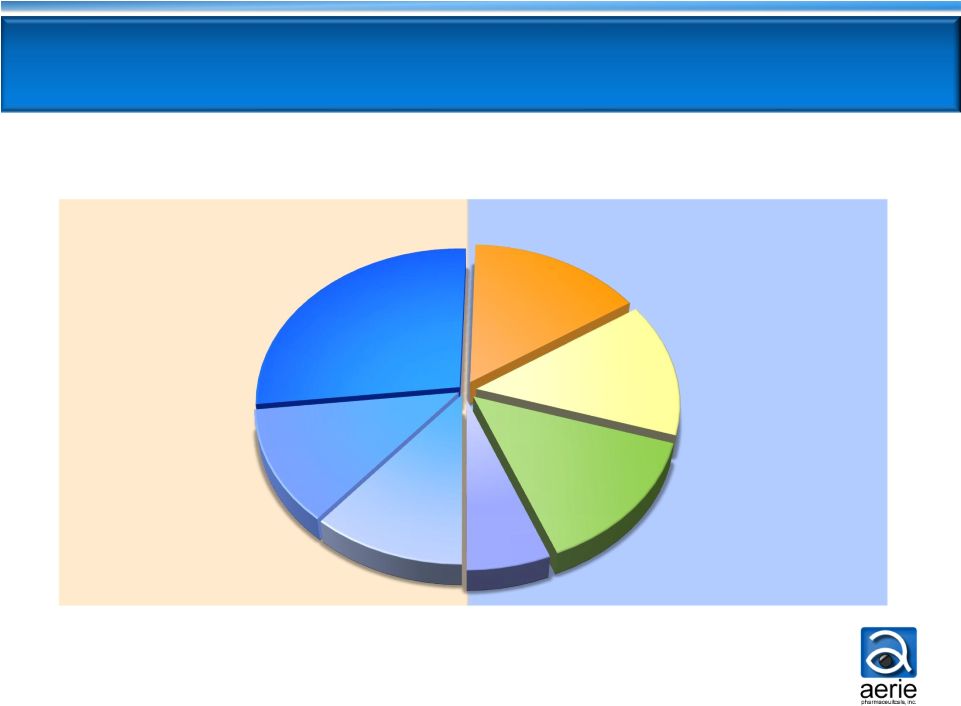

4

Currently Prescribed Glaucoma Therapies

Once Daily

2-3 Times

Daily

Non-PGA

Market

PGA: Prostaglandin Analogue; BB: Beta Blocker; AA: Alpha Agonist; CAI: Carbonic

Anhydrase Inhibitor US Glaucoma Market

IMS TRx data, FY 2012

PGA

Market

Bimatoprost,

11%

Travoprost,

12%

Latanoprost,

27%

BB, 15%

BB Fixed

Combo, 14%

AA, 14%

CAI, 6% |

Largest Rx market in ophthalmology

-

US 28.5M Rx; annual US sales $1.9B ($4.5B US/EU/JP)

2.2M glaucoma patients in the US expected to grow to

over 3M by 2020

~50% of patients use multiple medications to control

disease

No drugs with new MOA launched in 20 years

None of the existing drugs target the diseased tissue, or

Trabecular Meshwork (primary drain), or lower EVP

None of the existing drugs have shown consistent

efficacy across a broad range of pressures

Significant Glaucoma Market Opportunities

1

National Eye Institute

1

5 |

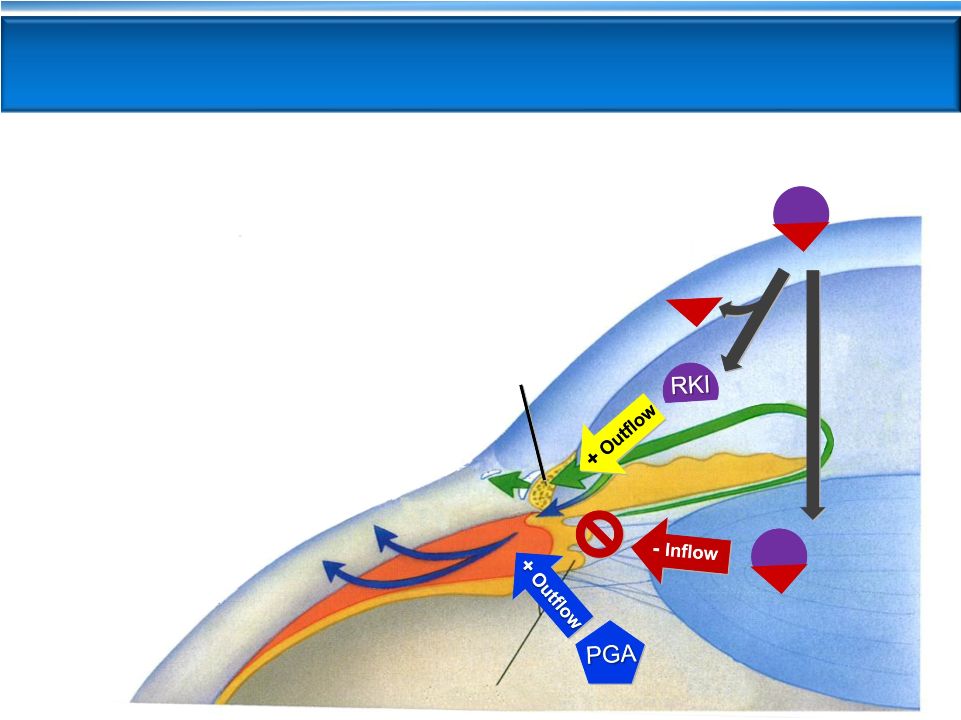

Inflow (fluid production)

AA, BB, CAI

PGAs

decrease

increase

increase

Aerie’s Novel Products Address All IOP

Control Mechanisms and May Lower EVP

Outflow

Secondary Drain

(Uveoscleral)

Outflow

Primary Drain

(Trabecular Meshwork)

6

Triple Action

PG324

Dual Action

AR-13324 |

7

The Competitive Landscape

Clinical

Efficacy

Dosing/

Day

Tolerability

Peak Product

Sales*

(US/EU)

Targeting

Diseased

Tissue

PGA

High

1x

Hyperemia

Iris Color Change

Other Cosmetic

$1.7B

No

Beta

Blocker

Moderate

2x

Cardiopulmonary

Contraindications

>$500M

No

CAI

Low

2 -

3x

Sulfonamide

Contraindication

Bitter Taste

>$500M

No

Alpha

Agonist

Low

2 -

3x

Allergy

Drowsiness

>$400M

No

AR-13324

High;

Consistent

1x

Hyperemia

Yes

PG324

Potentially

Highest

1x

TBD

Yes

* Peak sales for best-in-class franchise |

8

New PGAs -

not usable as add-on to current PGAs

Glaucoma Competitors in Pipeline

AR-13324 is the only new MOA drug dosed once-daily

AR

-13324 (Aerie)

ROCK/NET inhibitor (qd)

Phase 2b

K-115 (Kowa)

ROCK inhibitor (bid)

Phase 3

AMA0076

(Amakem)

ROCK inhibitor (bid)

Phase 2a

INO-8875 (Inotek)

Adenosine-A1 agonist (bid)

Phase 2

OPA-6566

(Acucela)

Adenosine-A2a receptor

Phase 1/2

SYL040012 (Sylentis)

beta

Phase 2

New MOAs

RNAi

blocker (bid)

(Japan)

New PGAs

BOL-303259 (B+L)

NO donating

latanoprost

(qd)

Phase 3

DE-117 (Santen)

EP2

agonist (qd)

Phase 2a

ONO-9054 (Ono)

FP/EP3 agonist

(qd)

Phase 1

(bid) |

9

Once-daily, consistent IOP lowering

1 drug -

2 MOAs, targets diseased

tissue, and may lower EVP

Well tolerated; no systemic

drug-related AEs

Efficacy expected to be >

current

drugs for majority of patients

Once-daily

Combination of 2 drugs -

3 MOAs,

and may lower EVP

Well tolerated; no systemic

drug-related AEs

Efficacy expected to be superior to all

current drugs

AR-13324 Dual-Action

PG324 Triple-Action

Future drug of choice for 80%

of patients -

IOP <26mmHg

Future drug of choice for

patients requiring maximal

IOP lowering

Aerie Franchise: Highly

Differentiated

Product Profiles |

10

AR-13324

AR-13324

NET

RKI

Trabecular

Meshwork

1.

ROCK inhibition relaxes TM, increases outflow

2.

NET inhibition reduces fluid production

3.

ROCK inhibition may lower Episcleral

Venous Pressure (EVP)

Episcleral

Veins

Schlemm’s

Canal

Mechanisms of Action:

NET

RKI

Cornea

Ciliary Processes

Uveoscleral

Outflow |

11

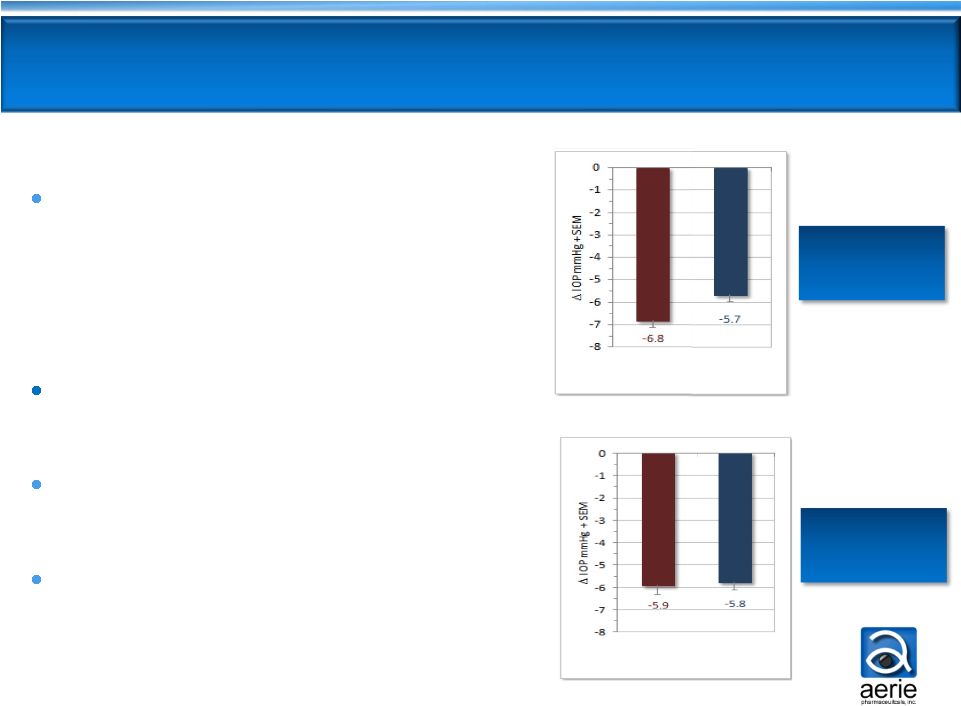

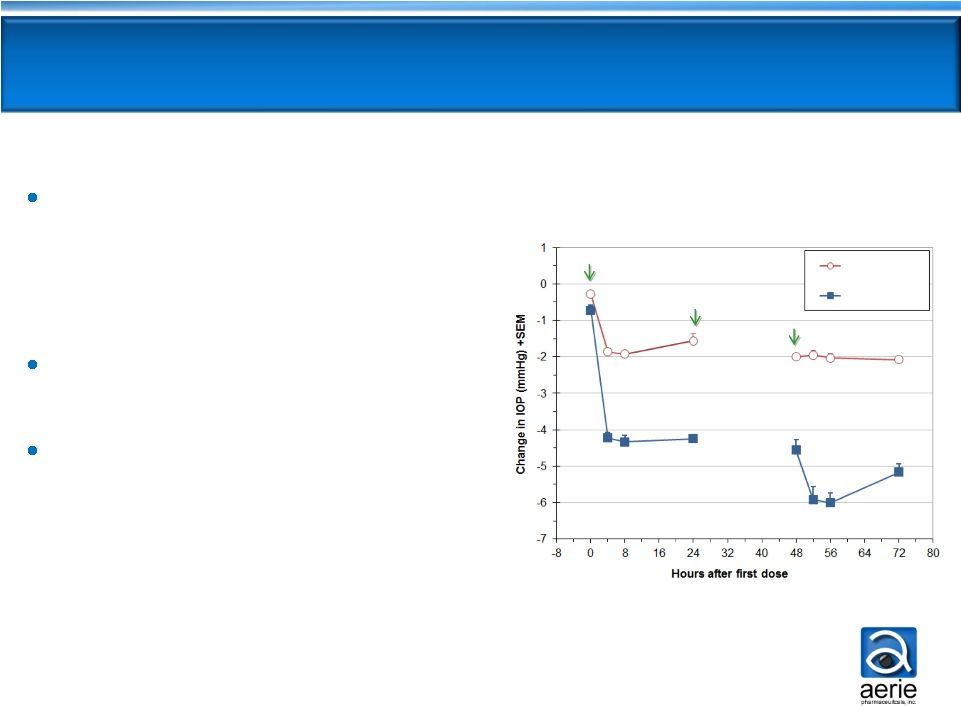

AR-13324 Demonstrated Strong IOP Lowering

in Phase 2b

13 glaucoma NCEs advanced from Phase 2 to Phase 3

since 1970s -

All approved

Once-daily PM dosing of

0.02% AR-13324 is highly

effective

-

IOP -5.7 and -6.2 mmHg on

D28 and D14

-

Consistent efficacy through D28

AR-13324 efficacy results

within ~1 mmHg of

latanoprost

Favorable tolerability profile

No systemic side effects

AR-13324 Efficacy at 8 AM

Diurnal Average IOP -

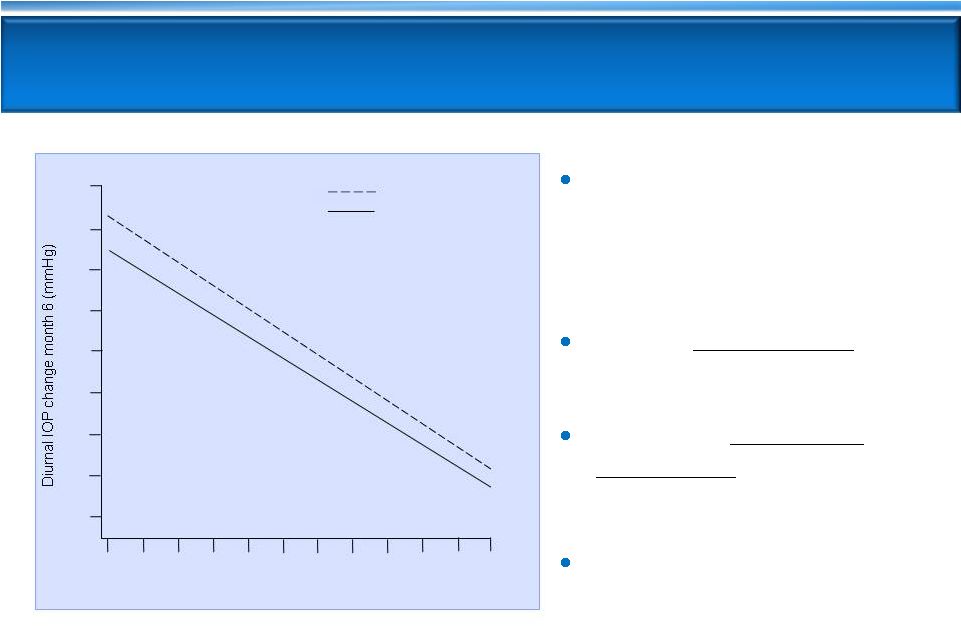

Entry IOP 22-36 mmHg (n=221) |

AR-13324 and latanoprost

clinically and statistically

equivalent in patients with

moderately elevated

IOPs of 22

- 26 mmHg

Latanoprost loses ~1 mmHg

efficacy

AR-13324 maintains consistent

efficacy

Latanoprost does not target the

diseased tissue –

AR-13324 does

Latanoprost

0.02%

AR-13324

Latanoprost

0.02%

AR-13324

Phase

2b

baseline

IOP

entry

requirements:

24,

22,

22

mmHg

(8am,

10am,

4pm)

Full Patient Population

Moderately Elevated IOP

12

Differentiated AR-13324 Efficacy

Profile Informs

Phase 3 Study Design Baseline

22 –

36 mmHg

(n=221)

Baseline

22 –

26 mmHg

(n=106) |

13

New MOA

May Represent Breakthrough

Recently reported study confirms AR-13324 lowered EVP by

35%

in

a

preclinical

in

vivo

model

2

1

Aerie Phase 1 PK Study Press Release dated January 9, 2014

2

Aerie Press Release dated February 25, 2014

AR-13324

lowered

average

IOP

by

over

30%

-

from

16

to

11

mmHg

1

Currently available drugs are typically less effective at lower IOPs

Consistent efficacy of AR-13324 across baseline IOPs may be

explained by lowering of EVP

High efficacy of AR-13324 in normotensive volunteers with

average IOP of 16 mmHg also supports lowering of EVP

No currently marketed products are known to lower EVP,

which contributes up to half of IOP in normotensive subjects

|

10,444 individuals were

screened for the prevalence of Primary Open-Angle Glaucoma (POAG)

Baltimore Eye Survey

* Sommer A, Tielsch JM, Katz J et al. Relationship between intraocular pressure and

primary open angle glaucoma among white and black Americans: The Baltimore

eye survey. Arch Ophthalmol 1991;109:1090-1095 14

Baseline IOP

(mmHg)

Percentage of POAG

Patients Identified

Cumulative Percentage

<

15

13%

13%

16-18

24%

37%

19-21

22%

59%

22-24

19%

78%

25-29

10%

88%

30-34

9%

97%

>

35

3%

100%

~80% of Glaucoma IOPs Are <

26 mmHg

at Time of Diagnosis |

Latanoprost and timolol

lose 0.5 mmHg efficacy for

every 1 mmHg drop in

baseline IOP

Timolol less effective

than

latanoprost at all baselines

AR-13324 equivalent/

non-inferior

to latanoprost

at baselines 22 –

26 mmHg

Timolol is the standard

comparator for glaucoma

Phase 3 trials

Pooled data from three latanoprost registration studies.

Hedman and Alm; European Journal Ophthalmology;2000

0

-2

-4

-6

-8

-10

-12

-14

-16

Timolol (n = 369)

Latanoprost (n = 460)

16

18

20

22

24

26

28

30

32

34

36

38

Untreated diurnal IOP (mmHg)

Latanoprost and Timolol Show Reduced Efficacy

at Lower Baseline IOPs

15 |

AR-13324 Registration Trial Design

Primary efficacy endpoint: IOP at all

time points through Day 90

Non-inferiority design vs. timolol

-

95% CI within 1.5 mmHg at all time points,

within 1.0 mmHg at a majority of time points

Planned entry IOP:

Minimum

21 mmHg, maximum 26 mmHg

-

FDA has agreed to Aerie proposal for entry IOPs

with no expected impact on label

-

AR-13324 non-inferior to latanoprost at entry

IOPs of 22-26 mmHg in Phase 2b

Phase 3 Protocol

AR-13324 0.02%

dosed QD PM

vs.

Timolol

dosed BID

~1200 patients

90 days efficacy

100+

patients for

1 year safety

16 |

17

AR

-

13324 Summary

Potential drug of choice for 80% of patients –

those

with

IOPs <

26mmHg

Once daily, high efficacy, consistent IOP lowering, good

tolerability and safety profile through Phase 2

The only drug to target the diseased tissue, with added MOAs

of lowering fluid production and potentially lowering EVP

Next Steps:

Phase 3 expected to commence in mid-2014

Phase 3 90-day efficacy and short-term safety results expected

mid-2015 NDA filing expected by

mid-2016

|

AR-13324 FIXED COMBINATION WITH

LATANOPROST

AR-13324

MOAs:

NET

RKI

18

TM

Outflow

Ciliary Processes

Uveoscleral

Outflow

Latanoprost

Cornea

1.

ROCK inhibition restores TM outflow

2.

NET inhibition reduces fluid production

3.

ROCK inhibition may lower

Episcleral Venous Pressure

4.

PGA receptor

activation

increases uveoscleral

outflow

Triple-Action PG324

NET

RKI |

First product to lower IOP through

all three known mechanisms, and

also potentially lower EVP

-

Once-daily: 1 drop, 2 drugs, 3 MOAs

High efficacy in predictive

primate model

Human proof of concept

established in prior ROCKi/PGA

combination trials

-

Demonstrated significant IOP

lowering beyond PGA alone

Dose

Dose

Dose

PG324 vs. Latanoprost, Primates (n=6/group)

Latanoprost

0.02% PG324

19

Day 2 -

No IOP

measured

PG324: Triple-Action Fixed Combination |

Primary efficacy endpoint: Mean

diurnal IOP on Day 28

Two concentrations of PG324 vs.

AR-13324 0.02% and latanoprost

Trial design similar to registration

trial for fixed-dose combination

-

1-3 mmHg superiority vs. components

previously accepted by FDA

20

PG324 Phase 2b Clinical Trial Design

Phase 2b Protocol

PG324 0.01%

vs.

PG324 0.02%

vs.

AR-13324 0.02%

vs.

Latanoprost

All dosed QD PM

~300 patients

28 days |

Potential for use by patients requiring maximal IOP lowering

and/or patients with advanced disease state

Potential to be the most efficacious IOP-lowering drug in

glaucoma with at least three and potentially four MOAs

Expected to be the first PGA fixed combination product in the

US, and dosed as a single drop once daily

Next Steps:

Phase 2b first patient dosed early 1Q 2014

Phase 2b results expected mid-2014

Phase 3 preparatory work commences second half of 2014

Phase 3 readiness expected mid

2015

PG324

Summary

21 |

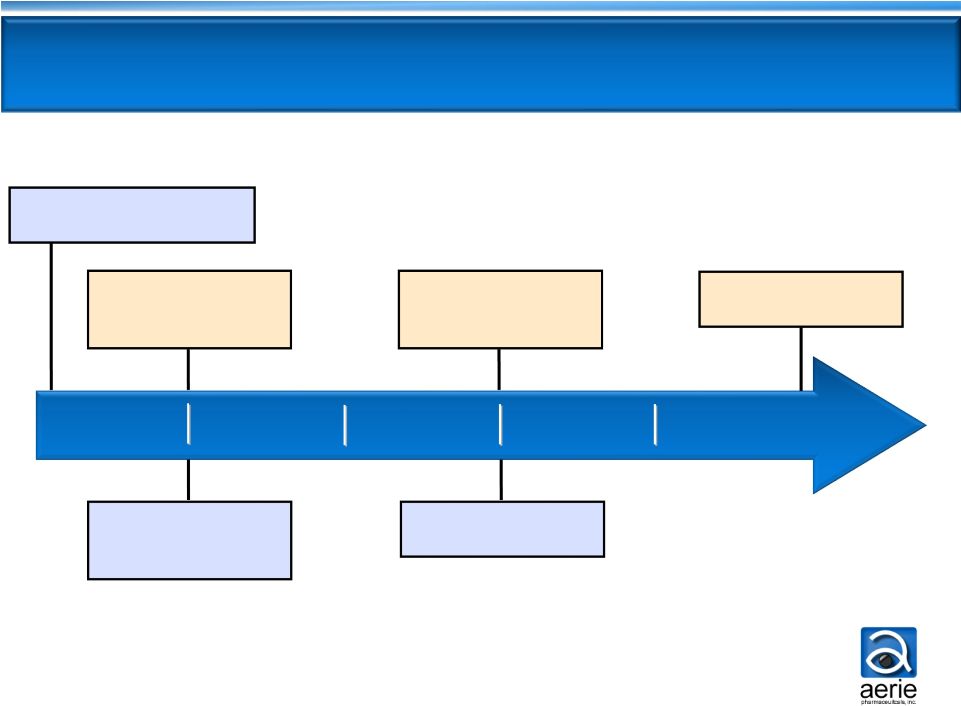

H1

2014 H2 2014

H2 2015

H1 2015

H1 2016

22

Key Milestones Financed by IPO Proceeds

Early-2014

:

PG324

Start Phase 2b clinical trial

Mid-2014

:

AR-13324

Start Phase 3

registration trials

Mid-2015

AR-13324

Efficacy results from

Phase 3 expected

Mid-2016

AR-13324

NDA filing expected

Mid-2014: PG324

Results from Phase

2b expected

Mid-2015

:

PG324

Phase 3-prep

:

: |

Financial Summary

AR-13324

Phase 3 registration trials

Direct clinical -

$25.0M

Non-clinical -

$12.4M

PG324

Phase 2b clinical trial

Direct clinical -

$2.5M

Non-clinical -

$1.0M

Phase 3 enabling activities

Non-clinical -

$6.3M

G&A and working capital -

$20.8M

Use of IPO Proceeds:

$68M through Mid-2016

Additional PG324 Needs:

$40M through Mid-2017

PG324

Phase 3 registration trials

Direct clinical -

$27.5M

12 Months G&A

and

working capital -

$12.5

23

Targeted

Mid-2017:

Expected NDA Approval

for

AR

-

13324

Expected NDA Filing for PG324 |

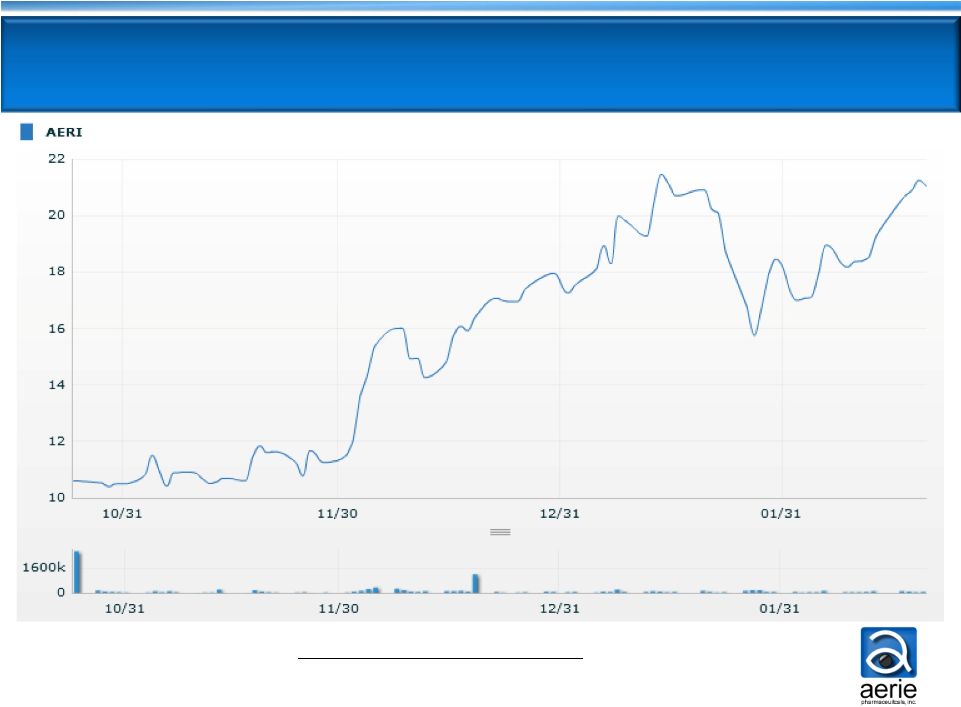

Market

Cap

(dollars

in

millions)

24

Stock & Market Cap Performance

10/31/13

-

$243.7

12/31/13

-

$418.2

2/21/14

-

$490.6 |

AR-13324

Novel Dual Action

All Products Fully

Owned by Aerie

PG324 Breakthrough

Triple Action

•

Fixed combination of AR-13324 and latanoprost

•

Potential for maximal IOP lowering

•

Expect P2b results mid-2014, P3

readiness

mid-2015

•

Inhibits ROCK and NET, targets diseased tissue

•

Consistent

IOP

lowering,

may

lower

EVP

•

Expect P3 efficacy data mid-2015, NDA filing mid-2016

Large Market

Opportunity

•

$4.5B US/EU/JP Market with significant unmet needs

•

Multiple MOA’s, once daily, high efficacy and safety

•

Late-stage/potential blockbuster revenue opportunity

•

Full patent protection through at least 2030

•

Will retain US rights and plan to partner in

JP/EU

25

Aerie –

Next Generation in Glaucoma Therapies |