Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

________________________________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

________________________________________

SGWONE, Inc.

(D/B/A MOBIUnplugged)

|

Nevada

|

5731

|

45-4821643

|

||

|

(State or other jurisdiction of incorporation or organization)

|

(Primary Standard Industrial Classification Code)

|

(IRS Employer Identification No.)

|

|

10120 S. Eastern Avenue, Suite 200

Henderson, Nevada 89052

(630) 251-1285

|

|

(Address and Telephone Number of Registrant’s Principal

Executive Offices and Principal Place of Business)

|

|

John Vanhara Eastbiz.Com, Inc.

5348 Vegas Drive

Las Vegas, Nevada 89108

(702) 871-8678

|

|

(Name, Address, and Telephone Number for Agent of Service)

|

Please send copies of all communications to:

Law Office of Andrew Coldicutt

1220 Rosecrans Street, PMB 258, San Diego, CA 92106

(619) 228-4970

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the Securities Act registration Statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer (do not check if smaller reporting company) o

|

Smaller reporting company þ

|

CALCULATION OF REGISTRATION FEE

|

Title of Class of Securities to be Registered

|

Amount to be Registered

|

Proposed Maximum Aggregate Price Per Share

|

Proposed Maximum Aggregate Offering Price (3)

|

Amount of Registration Fee(2)

|

||||||||||||

|

Common Stock Issued and Outstanding to be registered as part of a Secondary Offering by certain Selling Security Holders (as hereinafter defined)

|

4,000,000 | $ | 1.00 | (1) | $ | 4,000,000 | $ | 515.20 | ||||||||

|

Newly Issued Common Stock to be registered as part of a Primary Offering (as hereinafter defined)

|

5,000,000 | $ | 1.00 | (1) | $ | 5,000,000 | $ | 644.00 | ||||||||

|

Total

|

9,000,000 | $ | 9,000,000 | $ | 1,159.20 | |||||||||||

1) There is no current market for the securities. Although the Registrant’s common stock has a par value of $0.01, the Registrant believes that the calculations offered pursuant to Rule 457(f)(2) are not applicable and, as such, the Registrant has valued the common stock, in good faith and for purposes of the registration fee. In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

2) Registration Fee has been paid via Fedwire.

3) Estimated Solely for the purpose of calculating the registration fee pursuant to Rule 457.

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o). We have agreed to bear the expenses relating to the registration of the shares for the selling security holders.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

PART I – INFORMATION REQUIRED IN PROSPECTUS

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where an offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED _______, 2014 |

SGWONE, Inc.

(D/b/a MOBIUnplugged)

$9,000,000

5,000,000 Shares of Common Stock Offered by the Company

4,000,000 Shares of Common Stock Offered by the Selling Security Holders

No Minimum

This prospectus relates to the sale of 9,000,000 shares of our Common Stock. The Company is registering 5,000,000 shares of common stock, par value $0.01, of SGWone, Inc. (referred to herein as the “Company” or “SGWone”), at a price of $1.00 per share, on a best efforts basis (the “Primary Offering”). The offering will commence promptly on the date upon which the registration statement is declared effective. The offering will be for 180 days. At the discretion of our management, we may extend the offering for up to 90 days following the expiration of the 180-day offering period. This is the initial offering of common stock of the Company. The Company is offering the shares on a self-underwritten, “best efforts” basis directly through its officers and directors. The total proceeds from the Primary Offering will not be escrowed or segregated but will be available to the Company immediately. There is no minimum amount of common shares required to be purchase and therefore, the total proceeds received by the Company might not be enough to continue operations or a market may not develop. No commission or other compensation related to the sale of the shares will be paid.

In addition, there are 4,000,000 shares of our common stock, par value of $0.01, being registered by the following existing holders of the securities, referred to as “Selling Security Holders” throughout this document (the “Secondary Offering”): The Selling Security Holders will be offering their shares of common stock at the Primary Offering price per share until a market develops and thereafter at prevailing market prices or privately negotiated prices. The Company will not receive any of the proceeds from the sale of shares being sold by the Selling Security Holders. The existence of this secondary offering makes it less likely that we will sell all of the shares offered in the Primary Offering. No underwriting arrangements have been entered into by any of the Selling Security Holders. The Selling Security Holders and any intermediaries through whom such securities are sold may be deemed “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”) with respect to the securities offered and any profits realized or commissions received may be deemed underwriting compensation.

There has been no market for our securities and a public market may not develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the Over-The-Counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”), for our common stock to eligible for trading on the OTC Bulletin Board and/or OTCMarkets.com. We do not yet have a market maker who has agreed to file such application.

WE ARE AN “EMERGING GROWTH COMPANY” UNDER THE FEDERAL SECURITIES LAWS AND WILL THEREFORE BE SUBJECT TO REDUCED PUBLIC COMPANY REPORTING REQUIREMENTS. INVESTMENT IN THE COMMON STOCK OFFERED BY THIS PROSPECTUS INVOLVES A HIGH DEGREE OF RISK. YOU MAY LOSE YOUR ENTIRE INVESTMENT. CONSIDER CAREFULLY THE “RISK FACTORS” BEGINNING ON PAGE 12 OF THIS PROSPECTUS BEFORE INVESTING.

NEITHER THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (“SEC”), NOR ANY STATE SECURITIES COMMISSION, HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED ON THE ACCURACY OR ADEQUACY. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of This Prospectus is: _________, 2014

1

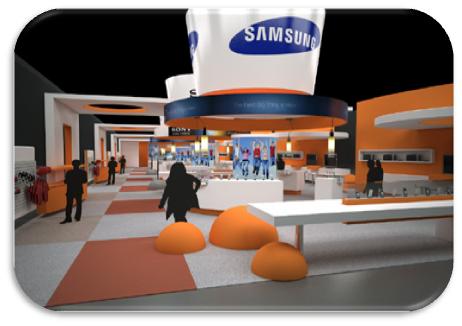

STORE DESIGN

2

3

TABLE OF CONTENTS

|

PAGE

|

|

|

PART I – INFORMATION REQUIRED IN PROSPECTUS

|

1

|

|

ITEM 3. PROSPECTUS SUMMARY

|

5

|

|

THE OFFERING

|

7

|

|

SUMMARY FINANCIAL DATA

|

10

|

|

RISK FACTORS

|

10

|

|

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

|

18

|

|

ITEM 4. USE OF PROCEEDS

|

19

|

|

ITEM 5. DETERMINATION OF OFFERING PRICE

|

21

|

|

ITEM 6. DILUTION

|

21

|

|

ITEM 7. SELLING SECURITY HOLDERS

|

22

|

|

ITEM 8. PLAN OF DISTRIBUTION

|

25

|

|

ITEM 9. DESCRIPTION OF SECURITIES TO BE REGISTERED

|

28

|

|

ITEM 10. INTERESTS OF NAMED EXPERTS AND COUNSEL

|

29

|

|

ITEM 11. INFORMATION WITH RESPECT TO THE REGISTRANT

|

29

|

|

A. DESCRIPTION OF THE BUSINESS

|

29

|

|

B. DESCRIPTION OF PROPERTY

|

37

|

|

C. LEGAL PROCEEDINGS

|

37

|

|

D. MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

37

|

|

E. FINANCIAL STATEMENTS

|

38

|

|

F. SELECTED FINANCIAL DATA

|

38

|

|

G. SUPPLEMENTARY FINANCIAL INFORMATION

|

38

|

|

H. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

|

39

|

|

I. CHANGES IN, AND DISAGREEMENTS WITH, ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

42

|

|

J. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

42

|

|

K. DIRECTORS, EXECUTIVE MANAGEMENT, PROMOTERS AND CONTROL PERSONS

|

42

|

|

L. EXECUTIVE COMPENSATION AND CORPORATE GOVERNANCE

|

44

|

|

M. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

46

|

|

N. TRANSACTIONS WITH RELATED PERSONS, PROMOTERS AND CERTAIN CONTROL PERSONS

|

47

|

|

PART II – INFORMATION NOT REQUIRED IN PROSPECTUS

|

II-1

|

|

ITEM 13. OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

|

II-1

|

|

ITEM 14. INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

II-1

|

|

ITEM 15. RECENT SALES OF UNREGISTERED SECURITIES

|

II-1

|

|

ITEM 16. EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

II-2

|

|

ITEM 17. UNDERTAKINGS

|

II-2

|

|

SIGNATURES

|

II-3

|

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. The Selling Security Holders are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front of this prospectus

4

ITEM 3. PROSPECTUS SUMMARY

SGWONE, INC.

(D/B/A MobiUnplugged)

(A Development Stage Company)

One should read the following summary together with the more detailed business information, financial statements and related notes that appear elsewhere in this prospectus. In this prospectus, unless the context otherwise denotes, references to "we," "us," "our," the “Company,” “Branded Shopping Live,” “SGWOne, Inc.,” “MOBI-Unplugged,” and “MOBI” refer to MOBIUnplugged.

This summary highlights some information from this prospectus, and it may not contain all of the information that is important to you. You should read the following summary together with the more detailed information regarding our company and the common stock being sold in this offering, including “Risk Factors” and our consolidated financial statements and related notes, included elsewhere in, or incorporated by reference into, this prospectus.

ABOUT OUR COMPANY

General Information about the Company

Our Company, SGWone, Inc. was incorporated in the State of Nevada by our Chief Executive Officer, Robert J. McNulty, on February 21, 2012. We are a development stage company. The primary business of our Company is the distribution, marketing, selling of skin care products, and the sale of environmental management solutions. We have recorded no revenue, have had net losses of $370,345 for the year ended December 31, 2013, and we expect our losses to continue, and for that reason our audit firm has issued a going concern opinion. After this offering 69% of the common stock outstanding will be held by our Chief Executive Officer Robert J. McNulty, President Mark Guest and Chief Financial Officer Mark V. Noffke.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (the “JOBS Act”).

SGWone, Inc., through its Mobi-Unplugged branding, will provide both online and offline retail sales of mobile and wireless products. Mobi will allow the customer to discover a unique mobile experience that is useful, innovative, and intuitive to the consumer. This unique experience allows the consumer to compare, learn, and address their needs be it they are looking for the latest and greatest name brand hardware, phones, tablets, speakers and pairing those mobile electronic devices to the most suitable mobile and wireless plans.

We want to create a prototypical electronics specialty store, focused on the explosive growth in the mobile market place. We will develop two store sizes: (a) a 12,000 square foot store and (b) an 8,000 square foot store. The purpose of developing two different store footprints is to address specific demographics market by market. Our stores will introduce and provide support for the hottest branded products in the mobile market, from all manufacturers and competitors. The store format will be a showroom type store, with the entire inventory, stored in the back room. The following are our key drivers to success: we will provide superior levels of customer service by having knowledgeable experts giving accurate and useful information to our customers so our customers can make the right decision for their product needs. We want to provide a friendly and inviting shopping experience, so the customer can play, learn, share and have a fun user experience with all the available branded products. Our business model is based on our belief that customers will want to come in to our stores, try the products that they are interested in, learn about the products strengths, weaknesses, accessories, see what the wireless service providers are offering in regards to those products, and then make an educated decision on which new product to purchase.

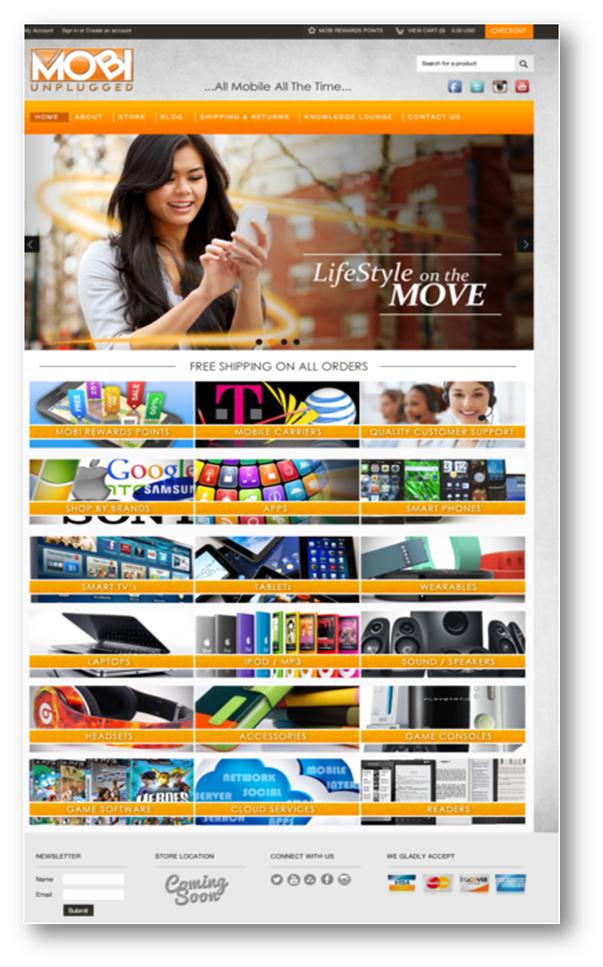

Our mission both online and offline is to discover and promote unique mobile electronic experiences that are useful, innovative and intuitive to the consumer. Our website, www.mobiunplugged.com’s distinctive tile like, one click navigation design is focused on the three pillars of e-Commerce success: acquire, convert and retain. Just like at our proposed Mobi-Unplugged retail location the experience is unlike anything, currently within the mobile and wireless marketplace. This unique experience allows the consumer to compare, learn, and address their needs whether they are looking for the latest and greatest name brand hardware, phones, tablets, speakers, or mobile accessories, to the most suitable mobile and wireless plans.

5

The Company’s business strategy is aimed at uniting the sale and education of customers through the use of our interactive store models. Brands such as: Apple, Samsung, E-Readers, Sony, Kindle Acer, Surface, Blackberry, Nexus, HP And Dell, LG, Kyocera, Motorola, HTC, Nokia, and Sharp, all provide mobile products, such as, phones, tablets, laptops and accessories; however, they do not provide the wireless service plans that allow those products to be mobile. We will go one step further, by providing our customers with the resources, services, activation, and diagnostics as well as educational classes to give our customer the highest quality of information to use their mobile electronic devices. No check out registers, all our sales are done on mobile devices by our highly trained sales associates. The stores look and feel will be a friendly tech experience, serviced with each brand experience, geographically defined by round tables featuring their products made of carbon fiber identified by their branded logo. There will be a customer service bar area to have our customers’ personal mobile electronic needs managed by our highly qualified technology experts. The store will be welcoming by having a small coffee cafe for customers who want to stay awhile and relax while looking at products, participating in one of our educational seminars, chat with others about products they are thinking of buying or just to socialize. All of the aforementioned are drivers to success along with a strong pricing model.

The Company’s fiscal year end is December 31st.

Where You Can Find Us

Our corporate headquarters are located at 10120 S. Eastern Avenue, Suite 200, Henderson, Nevada 89052. Our telephone number is (630) 251-1285. We maintain a website at www.mobiunplugged.com that contains information about our company, but that information is not a part of this prospectus.

Our History

The Company was originally incorporated as Branded Shopping Live, Inc., in the State of Nevada on February 21, 2012.

On June 4, 2012, the Company increased the authorized capital from 1.0 million shares of common stock to 30 million shares of capital stock, of which 25 million shares are common stock, par value $0.01 per share, and 5.0 million shares are preferred stock, par value $0.01 per share (“Preferred Stock”). The Company also adopted Amended and Restated Bylaws of the Company on the same date.

On June 5, 2012 the Company filed Amended and Restated Articles of Incorporation of the Company with the Secretary of State of Nevada and changed the corporate name from “Branded Shopping Live, Inc.,” to “SGWOne, Inc.”. The name change was to better represent our business plan of entering into the business of mobile electronic device sales, through the utilization of iconic store layouts, locations, superior customer service and the selling of all mobile electronic device brands and wireless providers.

On September 18, 2013, the Company increased the authorized capital from 30 million shares of common stock to 210 million shares of capital stock, of which 200 million shares are common stock, par value $0.01 per share, and 10 million shares are preferred stock, par value $0.01 per share (“Preferred Stock”). The Company also adopted Amended and Restated Bylaws of the Company on the same date.

On September 20, 2013 the Company issued an aggregate of 36,985,500 shares in a private placement to consultants and service providers as compensation for services provided in the initial business development of the Company.

6

Selling Security Holders

Shares being Registered by the Company

This is the Company’s initial public offering. The Company is registering a total of 9,000,000 shares of its Common Stock. Of the shares being registered, 4,000,000 are being registered for sale by the Selling Security Holders that are currently issued and outstanding. The Company will not receive any proceeds from the sale of any of the 4,000,000 shares of the common stock being sold by the Selling Security Holders. The Selling Security Holders may sell, as soon as practicable following the effectiveness of this registration at a fixed price of $1.00 until the shares are quoted on the Over the Counter Bulletin Board (“OTCBB”) and thereafter at prevailing market prices or in privately negotiated transactions.

The Company is offering 4,000,000 Shares for sale in a self-underwritten, best-efforts offering. Each Share consists of one share of the Company’s Common Stock. The Company will receive up to $5,000,000 in the event that all the 5,000,000 shares of common stock are sold, of which there can be no assurance.

The Company will not receive any proceeds from the sales by the Selling Security Holders. The proceeds, if any, will be used for general working capital purposes. This offering will terminate on the earlier of the sale of all of the shares offered or 180 days after the date of the prospectus, unless extended an additional 90 days by the board of directors.

The Company qualifies as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (the “JOBS Act”). We intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a non-binding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. As well, our election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until they apply to private companies. Therefore, as a result of our election, our financial statements may not be comparable to companies that comply with public company effective dates.

THE OFFERING

Terms of The Offering

As of the date of this prospectus, SGWONE, Inc., has 36,985,500 shares of Common Stock issued and outstanding. The Company is registering an additional 5,000,000 shares of its Common Stock for sale at the price of $1.00 per share. There is no arrangement to address the possible effect of the Offering on the price of the stock.

In connection with the Company’s selling efforts in the Offering, Robert J. McNulty, Mark Guest and Mark V. Noffke will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an Offering of the issuer’s securities. Mr. McNulty, Mr. Guest and Mr. Noffke, are not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act. Mr. McNulty, Mr. Guest and Mr. Noffke will not be compensated in connection with their participation in the Offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in the securities. Mr. McNulty, Mr. Guest and Mr. Noffke are not, nor have they been within the past 12 months, a broker or dealer, and they have not, nor have they been within the past 12 months, an associated person of a broker or dealer. At the end of the Offering, Mr. McNulty, Mr. Guest and Mr. Noffke will continue to primarily perform substantial duties for the Company or on its behalf otherwise than in connection with transactions in securities. Mr. McNulty, Mr. Guest and Mr. Noffke have not participated in another offering of securities pursuant to the Exchange Act Rule 3a4-1 in the past twelve months. Additionally, they have not and will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on the Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

In order to comply with the applicable securities laws of certain states, the securities will be offered or sold in those states only if they have been registered or qualified for sale; an exemption from such registration or if qualification requirement is available and with which SGWONE, Inc., has complied. In addition, and without limiting the foregoing, the Company will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective.

7

There is no guarantee the Company will be able to sell the shares being offered in this prospectus. If it is unable to sell enough shares to complete its plan of operations, the business could fail.

Following is a brief summary of this offering. Please see the “Plan of Distribution” section for a more detailed description of the terms of the offering.

|

Securities being Offered by the Selling Security Holders:

|

4,000,000 shares of common stock, par value 0.01

|

|

|

Offering price for Selling Security Holders::

|

$1.00 per share until a market develops and thereafter at market prices or prices negotiated in private transactions

|

|

|

Securities Being Offered by the Company:

|

5,000,000 shares of common stock

|

|

|

Offering price for Securities Being Offered by the Company:

|

$1.00 per share

|

|

|

Number of shares outstanding prior to the offering:

|

36,985,500 shares of common stock | |

|

Number of shares outstanding after the offering:

|

41,985,500 shares of common stock | |

|

Market for the common stock:

|

There has been no market for our securities and a public market may not develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the Over-The-Counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”), for our common stock to eligible for trading on the OTC Bulletin Board and/or OTCMarkets.com. We do not yet have a market maker who has agreed to file such application.

There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale.

|

|

|

Net Proceeds to the Company

|

$5,000,000 if all the Shares are sold.

|

|

|

Use of proceeds:

|

|||

|

Approximate Offering Expenses

|

$ 25,500

|

||

|

Remodel Store Cost

|

$ 150,000

|

||

| Store Fixtures |

125,000

|

||

| Inventory |

800,000

|

||

| Pre-marketing |

100,000

|

||

|

Legal / Accounting

|

19,500

|

||

|

Onboarding Associates

|

100,000

|

||

|

General Administration

|

50,000

|

||

| Subtotal |

$ 1,370,000

|

||

|

Working Capital

|

3,630,000

|

||

|

Total

|

$ 5,000,000

|

||

8

|

Risk Factors:

|

See “Risk Factors‚” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock.

|

|

|

Subscriptions:

|

Subscriptions are to be made payable to:

SGWOne, Inc.,

10120 S. Eastern Avenue, Suite 200

Henderson, Nevada 89052-4395

|

The Company’s officers, directors and control persons do not intend to purchase any shares in this offering.

Jumpstart Our Business Startups Act:

The Company is a development stage, company and qualifies as an “emerging growth company” as defined in the Jumpstart our Business Startups Act (the “JOBS Act”). For so long as we are an emerging growth company, we will not be required to:

| ● | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

| ● | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| ● | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;” and |

| ● | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO’s compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We will remain an emerging growth company for up to five full fiscal years, although if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30 before that time, we would cease to be an emerging growth company as of the following December 31, or if our annual revenues exceed $1 billion, we would cease to be an emerging growth company the following fiscal year, or if we issue more than $1 billion in non-convertible debt in a three-year period, we would cease to be an emerging growth company immediately.

We will elect to take advantage of the extended transition period for complying with new or revised accounting standards under section 102(b)(1). This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies.

9

SUMMARY FINANCIAL DATA

The summarized financial data presented below is derived from, and should be read in conjunction with, our audited financial statements and related notes from February 21, 2012 (date of inception) to December 31, 2013, included on Page F-1 in this prospectus and the reviewed financial statements for the year ended December 31, 2013.

|

Financial Summary

|

December 31,

2013

($)

|

December 31,

2012

($)

|

||||||

|

Cash and Deposits

|

1,225 | - | ||||||

|

Total Assets

|

1,387 | 162 | ||||||

|

Total Liabilities

|

345,491 | 10,906 | ||||||

|

Total Stockholder’s Deficit

|

(344,104 | ) | (10,744 | ) | ||||

|

Statement of Operations

|

Accumulated From

February 21,

2012

(Inception) to

December 31,

2013

($)

|

|||

|

Revenues

|

- | |||

|

Cost of Revenues

|

- | |||

|

Total Expenses

|

381,089 | |||

|

Net Loss for the Period

|

381,089 | |||

We have just commenced our operations and are currently have no revenue. Our accumulated deficit at December 31, 2013, was $(381,089). We anticipate that we will continue to incur net losses from our operations for the foreseeable future.

RISK FACTORS

The following risk factors should be considered carefully in addition to the other information contained in this report. This report contains forward-looking statements. Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other similar words. These statements are only predictions. The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties and other factors that may cause our customers’ or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking statements, to differ. “Risk Factors,” “Management’s Discussion and Analysis,” and “Business,” as well as other sections in this report, discuss some of the factors that could contribute to these differences.

1. The forward-looking statements made in this report relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events

An investment in our common stock involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. If any of the events discussed below occur, or any other material risks occur, the trading price could decline due to any of these events, and an investor may lose all or part of his or her investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

Risks Relating to Our Business and Structure

2. We have a limited operating history, which makes it difficult to evaluate our prospects.

Our current business and our current operations consist of the business and operations that we established in July 2012. SGWone Inc., is a new, development stage company and has had limited operations. Because our business is so new, we only have a limited operating history, which investors can use to evaluate our business prospects. As a result, investors do not have access to the same type of information in assessing a proposed investment as would be available to purchasers in a company with a longer operating history.

10

3. As a development stage company, we face many of the risks normally associated with a new business.

Because we have had less than one year’s of operations and are still in the development stage of our business, we face all the risks inherent in a new business, including the expenses, difficulties, complications and delays frequently encountered in connection with conducting new operations. These uncertainties include establishing our internal organization structure, developing our brand name, penetrating a new market, raising capital to meet our initial working capital requirements, developing a customer base, and otherwise effectively implementing our business plan. If we are not effective in addressing these risks, we will not be able to operate profitably in the future, and we may not have adequate working capital to meet our obligations as they become due.

4. We will need significant additional capital to implement our business plan, which may not be available to us; and if we raise additional capital, it may dilute your ownership in us.

The net proceeds from this Offering are currently estimated to fund our operations only through one year after the Offering closes. Our capital requirements for scaling up our current operations and the transition to full commercial operations may be significant. Although we anticipate that our revenues will significantly increase by the end of December 2014, we currently project that we may need additional capital at that time to continue to increase our operations and to reach profitability. Obtaining additional financing will be subject to a number of factors, including market conditions, our operating performance and investor sentiment. These factors may make the timing, amount, terms and conditions of additional financing unattractive to us. We cannot assure you that we will be able to obtain any additional financing at terms favorable to us, if at all. Additionally, if we do undertake any such financing in the future, we may have to issue shares of our capital stock thereby diluting your ownership interest in the Company. If we are unable to obtain financing as and when needed, our ability to execute our business strategy will be impaired, which may adversely affect our future operations, our future profitability, and even our future viability.

5. If our business strategy is unsuccessful, we will not be profitable and our stockholders could lose their investment.

To our knowledge, there is no track record for companies pursuing a business plan that is identical to ours. Accordingly, it is uncertain that our strategy will be successful or profitable. If our strategy is unsuccessful, we may fail to meet our objectives and not realize the revenues or profits we anticipate from our business plan. Such failure may cause the value of our common stock to decrease, thereby potentially causing our stockholders to lose their investment.

6. We may not be able to effectively control and manage our growth, which would negatively impact our operations.

We have operated our current line of business for less than one year, and we expect to grow rapidly in the near future as our business develops and becomes established. If our business grows as we anticipate, it will be necessary for us to manage our expansion in an orderly fashion. Any significant growth in our activities or in the market for our services will require extension of our managerial, operational, marketing and other resources. Future growth will also impose significant added responsibilities upon the members of management to identify, recruit, maintain, integrate, and motivate new employees. Aside from increased difficulties in the management of human resources, we may face challenges in managing expanding the number of our store locations. For effective growth management, we will have to continue improving our operations and services. Our failure to manage growth effectively may lead to operational inefficiencies that will have a negative effect on our profitability. We cannot assure investors that we will be able to effectively manage any future growth we experience.

11

7. Our ability to implement our business plan and grow our business infrastructure will depend on our ability to successfully execute numerous operations, some of which may be hindered by factors beyond our control.

We currently have a limited corporate infrastructure. Among other things, we will need to continue to build our infrastructural and operational capabilities as our business grows. Our ability to execute our business plan successfully could be affected by any one or more of the following factors:

|

●

|

our ability to raise capital, as needed, to fund the implementation of our business plan;

|

|

●

|

our ability to execute our business strategy as contemplated;

|

|

●

|

the ability of our brand and services to achieve market acceptance;

|

|

●

|

our ability to attract and retain qualified personnel;

|

|

●

|

our ability to accurately address our target marketplace; and

|

|

●

|

our ability to accurately predict and respond to rapid technological changes in our industry.

|

Our failure to adequately address any one or more of the foregoing factors could have a significant impact on our ability to execute our business plan.

8. Our success may depend on the development of a strong brand, and if we do not develop and enhance our brand, our ability to attract and retain our customers may be impaired.

We believe that our brand will be a critical part of our success. Developing and enhancing our brand may require us to make substantial investments with no assurance that these investments will yield the expected benefits. If we fail to promote and develop the “SGWone,” “Mobi-Unplugged” or other brands we may utilize, our ability to attract and retain customers may be impaired, which would in turn adversely impact our profitability. We anticipate that developing, maintaining, enhancing and protecting our brand will become increasingly important, difficult and expensive.

9. Our intellectual property rights are valuable, and any failure to protect them could reduce the value of our products, services and brand.

Our trademarks, trade secrets, and other intellectual property rights are important assets for us. We have not yet filed an application with the United States Patent and Trademark Office for registration of the trademark “SGWOne” or “Mobi-Unplugged.” We may file additional trademark applications in other jurisdictions. There can be no assurance that such applications will be granted. In addition, various events outside of our control pose a threat to our intellectual property rights as well as to our products and services. For example, effective intellectual property protection may not be available in every country in which our products and services may be made available through the Internet. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual property rights is costly and time consuming. The unauthorized use of our intellectual property could make it more expensive to do business and harm our operating results.

10. In providing our services we could infringe on the intellectual property rights of others, which may cause us to engage in costly litigation and, if we do not prevail, impair our ability to operate our business as contemplated.

In connection with offering our services, third parties may assert infringement or other intellectual property claims against us. We may have to pay substantial damages, if it is ultimately determined that our operations infringe a third party’s intellectual proprietary rights. Even if claims are without merit, defending a lawsuit takes significant time and resources, may be expensive, and may divert management’s attention from our primary business concerns – all of which may negatively affect our profitability.

11. Our business may be adversely affected by malicious applications that interfere with, or exploit security flaws in, our services.

Our business is partially dependent upon transactions and interactions that occur over the Internet. As a result, our business may be adversely affected by malicious applications that alter, change, modify our website and interfere with our e-commerce platform. Any future interference with our Internet operations is expected to occur without disclosure to or consent from us, and may result in a negative experience to our customers. If our efforts to combat these malicious applications are unsuccessful, or if our website is taken down by these malicious applications for an extended period of time, our reputation may be harmed and our website traffic could decline, which would damage our business.

12

12. We are not subject to all of the requirements of the Securities Exchange Act of 1934 ("34 Act") and this will limit information available about us.

We will be subject to the information and reporting requirements of the Securities Exchange Act of 1934 and filed current reports, periodic reports, annual reports, and other information with the Securities and Exchange Commission, after the effective date of the Registration Statement of which this prospectus forms a part. We also anticipate that we will file a 1934 Act registration statement. Accordingly, we may become subject to proxy rules and Section 16 or 14 of the 1934 Act. However, until such time as we do file a 34 Act registration statement information regarding securities holdings of our officers, directors and 10% stockholders will not be made available on a current basis and we will be able to take shareholder actions without complying with the SEC's proxy rules. In addition, Section 15(d) of the 34 Act provides an automatic suspension of the periodic reporting obligation as to any fiscal year (except the fiscal year in which the registration statement became effective) if an issuer has fewer than 300 security holders of record at the beginning of such fiscal year. Although we intend to file periodic reports, we could cease to do so at any time.

13. We face intense competition from similar businesses that have greater resources, and we may not be able to successfully compete.

Our business is rapidly evolving and intensely competitive, and we have many competitors in different industries, including retail, e-commerce services, digital and web services. Many of our current and potential competitors have greater resources, longer histories, more customers, and greater brand recognition. They may secure better terms from vendors, adopt more aggressive pricing and devote more resources to technology, fulfillment, and marketing.

Competition may intensify as our competitors enter into business combinations or alliances and established companies in other market segments expand into our market segments. In addition, new and enhanced technologies, including search, web services, and digital, may increase our competition. The Internet facilitates competitive entry and comparison shopping and renders e-commerce inherently more competitive than other retail. Increased competition may reduce our sales and profits.

14. Government regulation of the Internet, e-commerce and other aspects of our business is evolving and unfavorable changes could harm our business.

We are subject to general business regulations and laws, as well as regulations and laws specifically governing the Internet and e-commerce. Existing and future laws and regulations may impede our growth. These regulations and laws may cover taxation, privacy, data protection, pricing, content, electronic contracts and other communications, consumer protection, the provision of online payment services, unencumbered Internet access to our services, the design and operation of websites, and the characteristics and quality of products and services sold on the Internet. Additionally, it is not clear how existing laws governing issues such as property ownership, libel, and personal privacy apply to the Internet and e-commerce. Unfavorable regulations and laws affecting the Internet or e-commerce could diminish the demand for our services and increase the cost of doing business online.

15. If we do not continue to innovate and offer the products and services that are useful and convenient to our customers, we may not remain competitive, and our revenues and operating results could suffer.

Our success depends on providing products and services that make the purchasing and understanding of mobile electronics and the accompanying wireless plans to our customers more convenient and user friendly. As a result, we must continue to invest significant resources in research and development in order to enhance our operations, continually educate our employees, and improving the means by which we deliver our services. If we are unable to provide quality products and services, then our customers may become dissatisfied and move to a competitor for their mobile electronic shopping needs. Our operating results would also suffer if our innovations are not responsive to the needs of our customers and are not appropriately timed with market opportunities or are not effectively brought to market. As our competitors continue to develop, they may be able to offer products and services that are, or that are perceived to be, substantially similar to or better than ours. This may force us to compete in different ways and expend significant resources in order to remain competitive.

13

16. We process, store and use personal information and other data, which subjects us to governmental regulation and other legal obligations related to privacy, and our actual or perceived failure to comply with such obligations could harm our business.

We receive, store and process personal information and other customer data, and we enable our customers to share their personal information with each other and with third parties. There are numerous federal, state and local laws around the world regarding privacy and the storing, sharing, use, processing, disclosure and protection of personal information and other customer data, the scope of which are changing, subject to differing interpretations, and may be inconsistent between countries or conflict with other rules. We generally comply with industry standards and are subject to the terms of our privacy policies and privacy-related obligations to third parties (including voluntary third-party certification bodies such as TRUSTe). We strive to comply with all applicable laws, policies, legal obligations and industry codes of conduct relating to privacy and data protection, to the extent possible. However, it is possible that these obligations may be interpreted and applied in a manner that is inconsistent from one jurisdiction to another and may conflict with other rules or our practices. Any failure or perceived failure by us to comply with our privacy policies, our privacy-related obligations to customers or other third parties, or our privacy-related legal obligations, or any compromise of security that results in the unauthorized release or transfer of personally identifiable information or other customer data, may result in governmental enforcement actions, litigation or public statements against us by consumer advocacy groups or others and could cause our customers to lose trust in us, which could have an adverse effect on our business. Additionally, if third parties we work with, such as vendors or developers, violate applicable laws or our policies, such violations may also put our customers’ information at risk and could in turn have an adverse effect on our business.

17. We rely on highly skilled personnel and, if we are unable to hire, motivate and retain qualified personnel, we may not be able to grow effectively.

Our success depends in large part upon the abilities and continued service of our executive officers and other key employees, including our Chief Executive Officer, Robert J McNulty, President, Mark Guest and Chief Financial Officer, Mark Noffke. There can be no assurance that we will be able to retain the services of such officers and employees. Our failure to retain the services of Messrs. McNulty, Guest and Noffke, and other key personnel could have a material adverse effect on the Company. We currently have employment agreements with Messrs. McNulty, Guest and Noffke; however, we have not procured key person life insurance policies. In order to support any future growth, we may need to effectively recruit, hire, train and retain additional qualified management personnel. Our inability to attract and retain the necessary personnel could have a material adverse effect on our business.

Risks Related to our Common Stock

18. If quoted, the price of our common stock may be volatile, which may substantially increase the risk that you may not be able to sell your shares at or above the price that you may pay for the shares.

Even if our shares are quoted for trading on the Over-the-Counter Bulletin Board or other Over-the-Counter market following this offering and a public market develops for our common stock, the market price of our common stock may be volatile. It may fluctuate significantly in response to the following factors:

|

●

|

variations in quarterly operating results;

|

|

●

|

our announcements of the acquisition of assets and achievement of milestones, or the inability to so acquire assets or achieve milestones;

|

|

●

|

our relationships with other companies or capital commitments;

|

|

●

|

additions or departures of key personnel;

|

|

●

|

sales of capital stock or termination of stock transfer restrictions;

|

| ● |

changes in financial estimates by securities analysts, if any; and

|

|

●

|

fluctuations in stock market price and volume.

|

14

19. We are registering the resale of a maximum of 9,000,000 shares of common stock, including 5,000,000 shares that are not yet outstanding, the sale of which could depress the market price of our common stock.

We are registering the resale of a maximum of 9,000,000 shares of common stock under the registration statement of which this prospectus forms a part. The sale of these shares into the public market by the selling stockholders could depress the market price of our common stock. As of February 18, 2014, 36,985,500 shares of our common stock issued and outstanding.

20. The market price and trading volume of shares of our common stock may be volatile.

The market price of our common stock could fluctuate significantly for many reasons, including for reasons unrelated to our specific performance, such as reports by industry analysts, investor perceptions, or negative announcements by customers, or competitors regarding their own performance, as well as general economic and industry conditions. In addition, when the market price of a company’s shares drops significantly, stockholders could institute securities class action lawsuits against the company. A lawsuit against us could cause us to incur substantial costs and could divert the time and attention of our management and other resources.

21. If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

As a public reporting company, we are required to establish and maintain appropriate internal controls over financial reporting. Failure to establish those controls, or any failure of those controls once established, could adversely impact our public disclosures regarding our business, financial condition or results of operations. Any failure of these controls could also prevent us from maintaining accurate accounting records and discovering accounting errors and financial frauds. Rules adopted by the SEC pursuant to Section 404 of the Sarbanes-Oxley Act of 2002 require annual assessment of our internal control over financial reporting, and may require attestation of this assessment by our independent registered public accountants. The standards that must be met for management to assess the internal control over financial reporting as effective are complex, and require significant documentation, testing and possible remediation to meet the detailed standards. We may encounter problems or delays in completing activities necessary to make an assessment of our internal control over financial reporting. In addition, the attestation process by our independent registered public accountants is new and we may encounter problems or delays in completing the implementation of any requested improvements and receiving an attestation of our assessment by our independent registered public accountants. If we cannot assess our internal control over financial reporting as effective, or our independent registered public accountants are unable to provide an unqualified attestation report on such assessment, investor confidence and share value may be negatively impacted. In addition, management’s assessment of internal controls over financial reporting may identify weaknesses and conditions that need to be addressed in our internal controls over financial reporting or other matters that may raise concerns for investors. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting, or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

22. Compliance with changing regulation of corporate governance and public disclosure will result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and related SEC regulations, have significantly increased the costs and risks associated with accessing the public markets and public reporting. Our management team will need to invest significant management time and financial resources to comply with both existing and evolving standards for public companies, which will lead to increased general and administrative expenses and a diversion of management time and attention from revenue generating activities to compliance activities.

15

23. Our common stock may be considered a “penny stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult to sell.

Our common stock may be a “penny stock” if it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on a “recognized” national exchange; (iii) it is not quoted on the Nasdaq Capital Market, or even if so, has a price less than $5.00 per share; or (iv) is issued by a company that has been in business less than three years with net tangible assets less than $5 million.

The principal result or effect of being designated a “penny stock” is that securities broker-dealers participating in sales of our common stock will be subject to the “penny stock” regulations set forth in Rules 15-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for the investor’s account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information, that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment objectives. Compliance with these requirements may make it more difficult and time consuming for holders of our common stock to resell their shares to third parties or to otherwise dispose of them in the market or otherwise.

24. If securities or industry analysts do not publish research or reports or publish unfavorable research about our business, the price and trading volume of our common stock could decline.

The future trading market for our common stock will be influenced in part by any research and or reports that securities or industry analysts publish about us or our business. We do not currently have and may never obtain research coverage by securities and industry analysts. If no securities or industry analysts commence coverage of us the trading price for our common stock and other securities would be negatively affected. In the event we obtain securities or industry analyst coverage, if one or more of the analysts who covers us downgrades our securities, the price of our securities would likely decline. If one or more of these analysts ceases to cover us or fails to publish regular reports on us, interest in the purchase of our securities could decrease, which could cause the price of our common stock and other securities and their trading volume to decline.

25. We do not foresee paying cash dividends in the foreseeable future and, as a result, our investors’ sole source of gain, if any, will depend on capital appreciation, if any.

We do not plan to declare or pay any cash dividends on our shares of common stock in the foreseeable future and currently intend to retain any future earnings for funding growth. As a result, investors should not rely on an investment in our securities if they require the investment to produce dividend income. Capital appreciation, if any, of our shares may be investors’ sole source of gain for the foreseeable future. Moreover, investors may not be able to resell their shares of our common stock at or above the price they paid for them.

26. If we are deemed to be an issuer of “penny stock”, the protection provided by the federal securities laws relating to forward looking statements will not apply to us.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, if we are a penny stock, we will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

16

27. Financial Industry Regulatory Authority (“FINRA”) sales practice requirements may also limit a stockholder’s ability to buy and sell our common stock.

FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

28. We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

The JOBS Act permits “emerging growth companies” like us to rely on some of the reduced disclosure requirements that are already available to smaller reporting companies, which are companies that have a public float of less than $75 million. As long as we qualify as an emerging growth company or a smaller reporting company, we would be permitted to omit the auditor’s attestation on internal control over financial reporting that would otherwise be required by the Sarbanes-Oxley Act, as described above and are also exempt from the requirement to submit “say-on-pay”, “say-on-pay frequency” and “say-on-parachute” votes to our stockholders and may avail ourselves of reduced executive compensation disclosure that is already available to smaller reporting companies.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the exemption from complying with new or revised accounting standards provided in Section 7(a)(2)(B) of the Securities Act as long as we are an emerging growth company. An emerging growth company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this until we are no longer an emerging growth company or until we affirmatively and irrevocably opt out of this exemption. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We may take advantage of these reporting exemptions until we are no longer an emerging growth company. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. Until such time, however, we cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile and could cause our stock price to decline.

29. Any trading market that may develop may be restricted by virtue of state securities “Blue Sky” laws that prohibit trading absent compliance with individual state laws. These restrictions may make it difficult or impossible to sell shares in those states.

There is currently no established public market for our common stock, and there can be no assurance that any established public market will develop in the foreseeable future. Transfer of our common stock may also be restricted under the securities or securities regulations laws promulgated by various states and foreign jurisdictions, commonly referred to as “Blue Sky” laws. Absent compliance with such individual state laws, our common stock may not be traded in such jurisdictions. Because the securities registered hereunder have not been registered for resale under the blue sky laws of any state, the holders of such shares and persons who desire to purchase them in any trading market that might develop in the future, should be aware that there may be significant state blue sky law restrictions upon the ability of investors to sell the securities and of purchasers to purchase the securities. These restrictions prohibit the secondary trading of our common stock. We currently do not intend to and may not be able to qualify securities for resale in at least 17 states which do not offer manual exemptions (or may offer manual exemptions but may not to offer one to us if we are considered to be a shell company at the time of application) and require shares to be qualified before they can be resold by our shareholders. Accordingly, investors should consider the secondary market for our securities to be a limited one. See also “Plan of Distribution-State Securities-Blue Sky Laws.”

17

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus contains projections and statements relating to the Company that constitute “forward-looking statements.” These forward-looking statements may be identified by the use of predictive, future-tense or forward-looking terminology, such as “intends,” “believes,” “anticipates,” “expects,” “estimates,” “may,” “will,” “might,” “outlook,” “could,” “would,” “pursue,” “target,” “project,” “plan,” “seek,” “should,” “assume,” or similar terms or the negatives thereof. Such statements speak only as of the date of such statement, and the Company undertakes no ongoing obligation to update such statements. These statements appear in a number of places in this Prospectus and include statements regarding the intent, belief or current expectations of the Company, and its respective directors, officers or advisors with respect to, among other things:

|

●

|

trends affecting the Company’s financial condition, results of operations or future prospects

|

|

●

|

the Company’s business and growth strategies

|

|

●

|

the Company’s financing plans and forecasts

|

|

●

|

the factors that management expects to contribute to its success and the Company’s ability to be successful in the future

|

|

●

|

the Company’s business model and strategy for realizing positive results when sales begin

|

|

●

|

competition, including the Company’s ability to respond to such competition and its expectations regarding continued competition in the market in which the Company competes;

|

|

●

|

expenses

|

|

●

|

the Company’s expectations with respect to continued disruptions in the global capital markets and reduced levels of consumer spending and the impact of these trends on its financial results

|

|

●

|

the Company’s ability to meet its projected operating expenditures and the costs associated with development of new projects

|

|

●

|

the Company’s ability to pay dividends or to pay any specific rate of dividends, if declared

|

|

●

|

the impact of new accounting pronouncements on its financial statements

|

|

●

|

that the Company’s cash flows from operating activities will be sufficient to meet its projected operating expenditures for the next twelve months

|

|

●

|

the Company’s market risk exposure and efforts to minimize risk

|

|

●

|

development opportunities and its ability to successfully take advantage of such opportunities

|

|

●

|

regulations, including anticipated taxes, tax credits or tax refunds expected

|

|

●

|

the outcome of various tax audits and assessments, including appeals thereof, timing of resolution of such audits, the Company’s estimates as to the amount of taxes that will ultimately be owed and the impact of these audits on the Company’s financial statements

|

|

●

|

the Company’s overall outlook including all statements under Management’s Discussion and Analysis or Plan of Operation

|

|

●

|

that estimates and assumptions made in the preparation of financial statements in conformity with US GAAP may differ from actual results, and

|

|

●

|

expectations, plans, beliefs, hopes or intentions regarding the future.

|

Potential investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve significant risks and uncertainties, and that, should conditions change or should any one or more of the risks or uncertainties materialize or should any of the underlying assumptions of the Company prove incorrect, actual results may differ materially from those projected in the forward-looking statements as a result of various factors, some of which are unknown. The factors that could adversely affect the actual results and performance of the Company include, without limitation:

|

●

|

the Company’s inability to raise additional funds to support operations if required

|

|

●

|

the Company’s inability to effectively manage its growth

|

|

●

|

the Company’s inability to achieve greater and broader market acceptance in existing and new market segments

|

|

●

|

the Company’s inability to successfully compete against existing and future competitors

|

|

●

|

the effects of intense competition that exists in the industry

|

|

●

|

the economic downturn and its effect on consumer spending

|

|

●

|

the risk that negative industry or economic trends, reduced estimates of future cash flows, disruptions to the Company’s business or lack of growth in the business, may result in significant write-downs or impairments in future periods

|

|

●

|

the effects of events adversely impacting the economy or the effects of the current economic recession, war, terrorist or similar activity or disasters

|

|

●

|

financial community perceptions of the Company and the effect of economic, credit and capital market conditions on the economy and,

|

|

●

|

other factors described elsewhere in this Prospectus, or other reasons.

|

18

Potential investors are urged to carefully consider such factors. All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by the foregoing cautionary statements and the “Risk Factors” described herein.

ITEM 4. USE OF PROCEEDS

This Offering is being made without the involvement of underwriters or broker-dealers. This means the Company will receive $5,000,000 if all of the Shares of Common Stock offered hereunder are purchased. However, the Company cannot guarantee that it will sell any or all of the Shares being offered by the Company. The “Use of Proceeds” Chart below estimates the use of proceeds, given the varying levels of success of the Offering.

Based on an initial public offering price of $1.00 per share, our net proceeds from the sale of the 5,000,000 shares of our common stock will be approximately $5,000,000. Since this is a self-underwritten there will be no over-allotment option.

The principal purposes of this offering are to:

| ● |

increase our working capital,

|

|

●

|

create a public market for our common stock,

|

|

●

|

facilitate future access by us to public equity markets, and

|

|

●

|

provide increased visibility and credibility to us.

|

|

Shares Offered (% Sold)

|

5,000,000 Shares Sold (100%)

|

3,750,000 Shares Sold (75%)

|

2,500,000 Shares Sold (50%)

|

500,000 Shares Sold (10%)

|

||||||||||||

|

Gross Offering Proceeds

|

$ | 5,000,000 | $ | 3,750,000 | $ | 2,500,000 | $ | 500,000 | ||||||||

|

Approximate Offering Expenses(1)

|

$ | 25,500 | 25,500 | 25,500 | 25,500 | |||||||||||

|

Remodel Store Cost

|

$ | 150,000 | 100,000 | 65,000 | 40,000 | |||||||||||

|

Store Fixtures

|

$ | 125,000 | 100,000 | 60,000 | 35,000 | |||||||||||

|

Inventory

|

$ | 800,000 | 600,000 | 400,000 | 300,000 | |||||||||||

|

Pre-marketing

|

$ | 100,000 | 75,000 | 50,000 | 25,000 | |||||||||||

|

Legal / Accounting

|

$ | 19,500 | 19,500 | 19,500 | 19,500 | |||||||||||

|

Onboarding Associates

|

$ | 100,000 | 75,000 | 40,000 | 30,000 | |||||||||||

|

General Administration

|

$ | 50,000 | 37,500 | 25,000 | 25,000 | |||||||||||

|

Subtotal (2)

|

$ | 1,370,000 | 1,032,500 | 685,000 | 500,000 | |||||||||||

|

Working Capital

|

$ | 3,630,000 | 2,967,500 | 1815,000 | -0- | |||||||||||

|

Total

|

$ | 5,000,000 | 3,750,000 | 2,500,000 | 500,000 | |||||||||||

(1) Offering expenses have been rounded to $25,500.

(2) Any line item amounts not expended completely shall be held in reserve as working capital and subject to reallocation to other line item expenditures as required for ongoing operations.

19