Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DARLING INGREDIENTS INC. | d680915d8k.htm |

February 25,

2014 Exhibit

99.1

Creating sustainable food, feed and fuel

ingredients for a growing population

J.P. Morgan

Global High Yield &

Leverage Finance Conference

1 |

1.

Company Profile

4

2.

New Business Segments

12

3.

Growth Strategy

23

4.

Financial Review

32

2

Table of Contents |

Creating

sustainable food, feed and fuel ingredients for a growing population 3

Safe Harbor Statement

This presentation contains forward-looking statements regarding the business operations

and prospects of Darling International and industry factors affecting it. These

statements are identified by words such as “may,” “will,”

“begin,” “look forward,” “expect,” “believe,” “intend,” “anticipate,” “should,” “potential,”

“estimate,” “continue,” “momentum” and other words referring to

events that may occur in the future. These statements reflect Darling International's

current view of future events and are based on its assessment of, and are subject to, a

variety of risks and uncertainties beyond its control, including the Company’s

ability to successfully integrate and operate Rothsay and Darling Ingredients International,

disturbances in world financial, credit, commodities, stock markets and climatic conditions;

unanticipated changes in national and international regulations affecting the

Company’s products; a decline in consumer confidence and discretionary spending;

the general performance of the U.S. and global economies; global demands for

bio-fuels and grain and oilseed commodities, which have exhibited volatility, and

can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering

feedstock and selling prices for the Company’s products; risks associated with the

renewable diesel plant in Norco, Louisiana owned and operated by a joint venture

between Darling International and Valero Energy Corporation, including possible

unanticipated operating disruptions and marketing challenges; risks relating to

possible third party claims of intellectual property infringement; economic disruptions

resulting from the European debt crisis; continued or escalated conflict in the Middle East;

and the Company’s relatively high level of indebtedness, each of which could cause

actual results to differ materially from those indicated in the

forward-looking statements. Other risks and uncertainties regarding Darling

International, its business and the industry in which it operates are referenced from

time to time in the Company’s filings with the Securities and Exchange Commission.

Darling International is under no obligation to (and expressly disclaims any such

obligation to) update or alter its forward- looking statements whether as a result

of new information, future events or otherwise.

|

4

Company Profile

From Then to Now

Company Profile

Business Segments

Growth Strategy

Financial Review |

From... The oldest, largest and most

innovative recycling solutions

company serving the nation’s food

industry...

•

120 operating facilities across U.S.

•

Approx. 4,000 employees

•

Over $1.7 billion in revenues

Company Profile

Business Segments

Growth Strategy

Financial Review

January 2013

5 |

6

To...

A global growth platform for the

development and production of

sustainable natural ingredients

from edible and inedible bio-nutrients,

creating a wide range of products and

customized specialty solutions

Food

Feed

Fuel

Company Profile

Business Segments

Growth Strategy

Financial Review

•

Over 200 operation facilities on 5 continents

•

Approx. 10,000 employees

•

Over $4 billion in revenues

January 2014 |

•

Strong, market leading position to add value to animal by-products worldwide

•

Global

platform

in

the

key

growth

areas

for

expansion

into

other

activities

•

Broadest product portfolio with unique focus on R&D/product development

•

Significant cash generation

•

INTELLECTUAL AND FINANCIAL PROWESS TO CREATE EXPANDING POSITION

SUPPORTING THE ANIMAL BY-PRODUCT/BAKERY/RESTAURANT INDUSTRIES

Our

Our

Strengths

Strengths

Today:

Today:

TRS

TRS

7

RAW MATERIAL SOURCING EXPANSION-

Wastewater value add;

Access to DAF/SPN from food processing plants diversifies commodity exposure

COMMODITY BUSINESS

Mixed meat renderer with good used cooking oil business (particularly east/west coasts)

Pre 2004

Pre 2004

VALUE ADD & REDUCTION OF COMMODITY EXPOSURE (countercyclical)

Higher value use for fats produced by Darling, should be countercyclical to fat prices

DGD

DGD

GEOGRAPHIC EXPANSION OF U.S. FOOTPRINT INTO CANADA

Increase of both rendering and biodiesel

Rothsay

Rothsay

GREW EXISTING BUSINESS ADDING PRODUCT DIVERSIFICATION;

INITIAL MOVE TO VALUE ADD AND REDUCTION OF COMMODITY EXPOSURE

Intro to frozen parts; diversified into poultry offal; incorporated value add concept for

proteins; added significant bakery by-product business; developing hexane

extraction NBP & Griffin

NBP & Griffin

2006 2010

2006 2010

GLOBAL PRESENCE/PRODUCT LINE EXPANSION INTO FOOD INGREDIENTS

Provides access to raw material sourcing in Europe/Australia/Brazil/China

(Brazil and China areas where animal slaughter will increase);

Product segment diversification: Blood/Gelatin/Casings/Specialty Products;

High added value proposition

VION

VION

Ingredients

Ingredients

2014

2014

Company Profile

Business Segments

Growth Strategy

Financial Review

The Evolution of Darling International |

Creating

sustainable food, feed and fuel ingredients for a growing population

•

Gelatin

•

Casings

•

Functional Proteins

•

Food Grade Fats

•

Heparin

•

Proteins •

Fats

•

Bone China Bodies

•

Bakery Feeds •

Glue

•

Organic Fertilizers

•

Plasmas •

Hides

•

Biofuels

•

Green Gas

•

Green Electricity

Global footprint:

5

continents

Production facilities:

Over

200

Founded:

1882

Listed:

1994

Publicly traded:

NYSE:

DAR

Principal segments:

Three

Products:

400+

Industries served:

Food, pet food,

restaurant, feed,

pharmaceutical,

fuel, fertilizer

LTM Sept.’13 pro forma revenue:

Over $4.0

billion Employees:

Approx.

10,000

Headquarters:

Irving, Texas, USA

8

Food

Feed

Fuel

A World Leader in Bio-Nutrient Transformation

Improvement by Nature

|

Over 200

operations on 5 continents Over 400 products sold worldwide

9

Company Profile

Business Segments

Growth Strategy

Financial Review

A World Leader in Bio-Nutrient Transformation

Improvement

by Nature |

Pro forma LTM

Sept. 2013 Revenue LTM Sept. 2013 Revenue USA

Feed

63%

Fuel

8%

Bakery

17%

Rendering

83%

Europe

41%

USA

42%

Canada 6%

So. Amer. 4%

China 6%

Other Asia

2%

10

Food

29%

Shown with new

acquisitions by our

new business segments

Does not include

pro forma DGD

revenue

Year of Tremendous Growth

Uniquely Diversified

Company Profile

Business Segments

Growth Strategy

Financial Review

1

Includes Terra Renewal Services (“TRS”) results from August 26, 2013 through

September 28, 2013. Does not include Darling’s share of Adjusted EBITDA of

(or any potential cash distributions from) DGD 2

Q4 2012 Revenue and Adjusted EBITDA translated at period average exchange rate of

1.2837. Q1-Q3 2013 Revenue and Adjusted EBITDA translated at

period average exchange rate of 1.315.

As shown

by

country |

Continues to

explore growth and value creation opportunities

•

Entrepreneurship

•

Transparency

•

Integrity

11

Creating sustainable food, feed and fuel ingredients for a growing population

Highly Experienced and International Executive Team

Colin T. Stevenson

EVP – Global Finance

& Admin.

Darling International

John F. Sterling

EVP – General

Counsel

Darling International

Dirk Kloosterboer

Chief Operating

Officer

Darling International

Marty W. Griffin

EVP – Chief Oper-

ating Officer, N.A.

Darling International

John Bullock

EVP – Chief Strategy

Officer

Darling International

Randall C. Stuewe

Chairman & CEO

Darling International

Company Profile

Business Segments

Growth Strategy

Financial Review |

12

Our New Business Segments

Company Profile

Business Segments

Growth Strategy

Financial Review

Food, Feed & Fuel |

Creating

sustainable food, feed and fuel ingredients for a growing population Renewable

Butane

Renewable

Propane

Renewable

Diesel

Green Electricity

and Gas

Biodiesel

13

Food Grade Fats

Heparin

Peptan®

Gelatin

(Pharma)

Natural

Casings

Gelatin

(Food)

Bone China

Plasma

Leather

Organic

Fertilizer

Proteins

Fats

Cookie Meal®

Pet Food

MucoPro®

Naphtha

General products

Specialty

products

Fuel

Food

Food

Pharma

Fuel

products

Generated thru

DGD production

Company Profile

Business Segments

Growth Strategy

Financial Review

Provides broad stabilized market exposure worldwide Unique Diversified

Portfolio Feed |

Creating

sustainable food, feed and fuel ingredients for a growing population 14

Research and development are at our Company’s strategic core to achieve

product leadership by creating the highest value-add for its raw material and end

products strong

relationships

with

our

customers

by

co-development

of

specific

products

for

their

end

markets

Efforts focus on product development as well as continuous improvement of existing

products •

BP-95 is developed by Darling Ingredients International’s

R&D team and combines expertise from Sonac and

Rousselot activities

•

BP-95 is an innovative collagen protein which adds

functionality (binding water/ fat) in meat

products like hot dogs,

salami, cooked hams and luncheon meat

•

Main growth areas are the

emerging markets

•

Strengthens our portfolio of

functional proteins for the consumer

protein industry

BP-95

Innovative high functional collagen

protein developed for the consumer

protein industry

•

DAF/SPN are solid residuals

with nutritional value

that are left in the

wastewater stream

of animal processing and

industrial facilities

•

Process creates value add

products from these

recovered fats and protein

•

Water is restored at

water treatment plants

Hexane Extraction

Fat: ~10-15%

Protein: ~10-15%

Recovering protein and fat residuals

from solids in wastewater for feed

and fuel use

Research and Development

Water ~75% |

Ingredients

for living. Darling’s food ingredients are sold to a worldwide market that

includes the pharmaceutical,

food

and

cosmetic

industries.

Rousselot

is

the

world’s

leading supplier of gelatin and collagen peptides to the food and

pharmaceutical

industries.

Peptan®

collagen

peptides

have

proven

their

health benefits in nutraceutical and nutricosmetic applications worldwide.

CTH

is a turnkey supplier of natural sausage casings on a global scale.

Hepac

delivers

heparin

to

a

global

pharmaceutical

market

serving

a

growing

population.

SONAC

Fats

holds

a

leading

position

in

Europe

in

the

production

of food grade fats and proteins.

15

Global Market

For Food Ingredients

Gelatin

Food

Grade Fats

Casings

Heparin

Our Food Ingredients

Creating sustainable food, feed and fuel ingredients for a growing population

|

•

Food grade fats

•

Schmalz

•

Natural casings (hanks)

•

Specialty meats

•

Heparin

Products

Activities

Raw Material

Source

•

Fat

•

Bowel packages

•

Runners

•

Mucosa

Creating sustainable food, feed and fuel ingredients for a growing population

16

•

Pig skin •

Fish skin

•

Bovine hides/bones

•

Porcine bone

•

Gelatin

•

Hydrolysates

•

Collagen peptides

Company Profile

Business Segments

Growth Strategy

Financial Review

Adding Value in the Food Segment |

Nutrients for

growth. Our feed ingredients compose the largest segment of our business, with

sales to feed and pet food manufacturers worldwide or used to produce

our own fertilizers. The Company’s DAR PRO Solutions, Rothsay and

Sonac

brands collect and transform meat and animal by-products into

protein meals, fats, minerals and tallows that are value-added nutritional

ingredients for the animal feed and pet food industries as well as bone

and blood specialty products.

Bakery

Feeds

collects

residuals

from

commercial

bakery

and

snack

producers, repurposing these materials into Cookie Meal®, a premium,

high-energy animal feed ingredient.

Nature

Safe

manufactures

a

premium

organic

fertilizer

made

from

our

protein meals; Terra Renewal reclaims the nutritional elements from

industrial wastewaters and sludge for agricultural land application.

Key Markets for

Feed Ingredients

17

Creating sustainable food, feed and fuel ingredients for a growing population

Our Food Ingredients

|

•

Wastewater

•

Sludge material

•

Used cooking oil

•

Meat processing

or butchery

by-products

•

Expired grocery meats

Products

Activities

Raw Material

Source

•

Bones •

Fat

•

Blood •

Hair

•

Mucosa •

Hides

•

Soft byproducts

•

Deadstock

•

Residuals from

production of cereals,

breads, crackers,

cookies, etc.

•

Packaging materials

•

Used cooking oil

•

Yellow Grease

•

Fats and tallow

•

Protein meals

•

Pet food

•

Fats, protein meals, tallow

•

Fertilizer •

Prepared hides

•

Bone ash, glue, chips

•

Pet food

•

Plasma

•

Land applied organic fertilizer

•

Residuals for our extraction

facility

•

Cookie Meal®, a high-energy

ingredient for animal feed

18

Company Profile

Business Segments

Growth Strategy

Financial Review

Adding Value in the Feed Segment |

Energy for

today’s world. For the past two decades, Darling has led the way in biofuel

innovation and

development.

Diamond

Green

Diesel

1

,

a

partnership

with

Valero

Energy

Corp.,

is

the

Company’s

most

innovative

and

largest-scale

effort

to

meet the growing demand for renewable energy. Located in Norco, LA,

the facility recycles animal fats and used cooking oils into 137

million

gallons per year (or 9,300 barrels per day) of renewable diesel.

Our

Bio-G

3000,

Rothsay

Biodiesel

and

Ecoson

brands

also

produce

biofuels, green electricity and gas, biophosphate and other green energy

from organic residuals, manure, animal by-products, fats and cooking oils.

Europe

Ecoson

Current Markets for

Fuel Ingredients

North America

Diamond Green Diesel

Bio G-3000

Rothsay Biodiesel

19

Creating

sustainable

food,

feed

and

fuel

ingredients

for

a

growing

population

1

DGD is not included in the Fuel

segment for SEC reporting

Our Fuel Ingredients |

Creating

sustainable food, feed and fuel ingredients for a growing population

•

Fallen stock

•

By-product residuals

•

Organic Sludges •

C1 Fat

•

Drain fat •

Manure

•

Catering remains

•

Used cooking oil

•

Greases and fats

•

Animal fats

•

Refined fats •

Green gas

•

Green electricity

•

Biophosphate

•

Animal fats

•

Fats & meals for industrial

energy production

•

Biodiesel

•

Renewable diesel

Products

Activities

Raw Material

Source

•

Biodiesel

•

Renewable diesel

•

Animal fats

•

Specialty methyl-esters

•

Solvents, glycerides

Creating sustainable food, feed and fuel ingredients for a growing population

20

Company Profile

Business Segments

Growth Strategy

Financial Review

Adding Value in the Fuel Segment |

Creating

sustainable food, feed and fuel ingredients for a growing population Leader in Biofuel

Innovation Pioneering in 1998

Began the first continuous-

running bio-diesel plant in

the U.S. utilizing used

cooking oils and animal fats,

located in Butler, KY

Innovating in 2013

–

Startup of

the nation’s largest animal fat-to-

renewable diesel facility;

Diamond Green Diesel is designed

to produce 9,300 barrels of

renewable diesel per day

First in Canada-

2001

The first commercial facility in Canada,

located near Montreal, Quebec,

producing premium biodiesel from

used cooking oils and animal fats

Note: Our Ecoson

and Rendac

brands also provide biofuel and

green energy to segments of the European market

21

Company Profile

Business Segments

Growth Strategy

Financial Review |

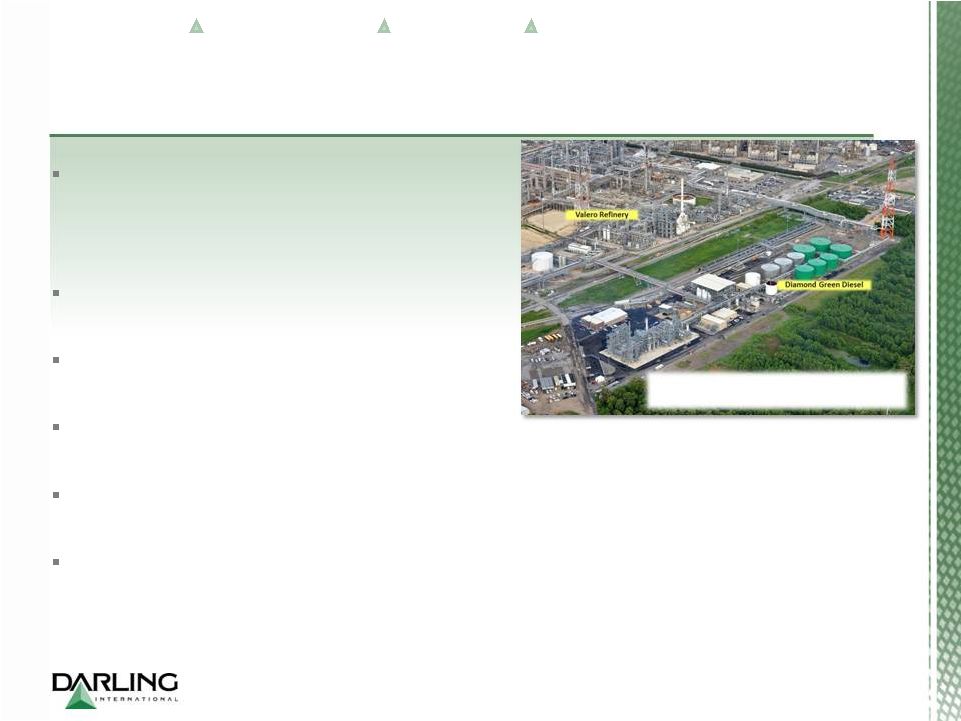

$445

million

joint

venture

between

Valero

Energy

Corporation

and

Darling

International

to

fulfill

nearly 15% of the national biomass-based diesel

mandate (under RFS2)

Most economical feedstock available –

1.135 billion lbs annually

A low

cost

producer

of

biomass-based

diesel

to the U.S. market

Annual production of 137 million gallons

(or 9,300 barrels/day)

Advantage

of

multiple

synergies

due

to

location

next

to

Valero’s

St.

Charles

refinery

–

Valero

markets

the

renewable

diesel,

distributing

via

pipeline

using

its

distribution

network

Renewable

butane,

renewable

propane

and

NAPTHA

are

valuable

co-products

of

DGD

process

22

Company Profile

Business Segments

Growth Strategy

Financial Review

What is Diamond Green Diesel?

Located in Norco, LA, U.S.A.

next to Valero’s St. Charles Refinery

Creating sustainable food, feed and fuel ingredients for a growing population

|

23

How We Will Grow and

Sustain Our Business

Growth Strategy

Company Profile

Business Segments

Growth Strategy

Financial Review |

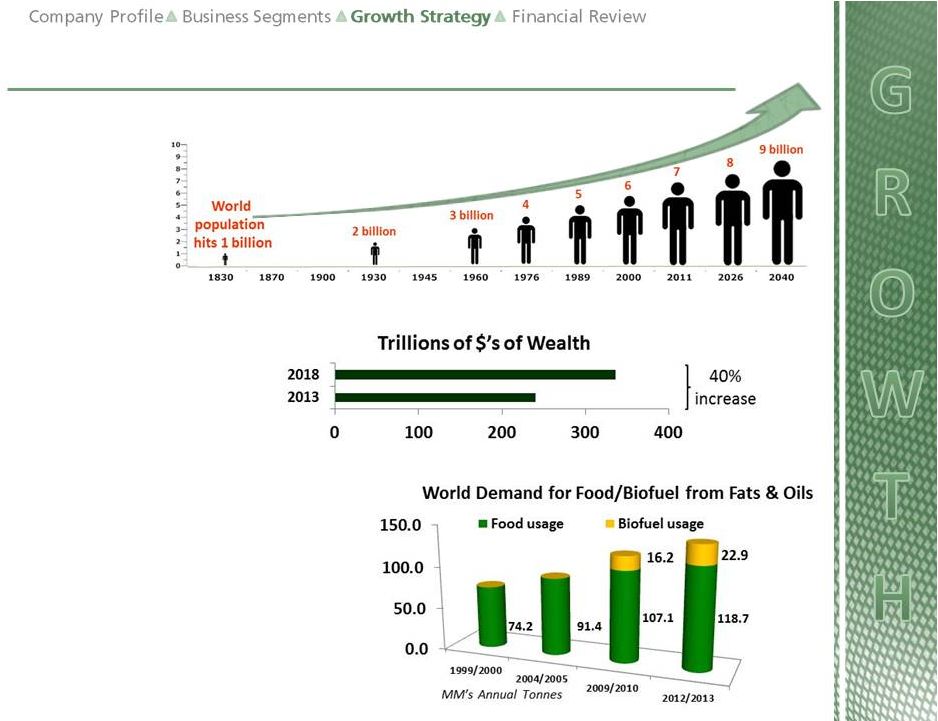

24

Strong growth

in world

population...

...and more wealth

created in key

growth areas (Asia

and Latin America)...

...exponentially

increases

the

demand

for

food,

feed

and

fuel...

thus increasing the need for our

innovative ingredients and

customized services which provide

a sustainable means of meeting the

world’s consumption needs

Our growth is a response to our growing world |

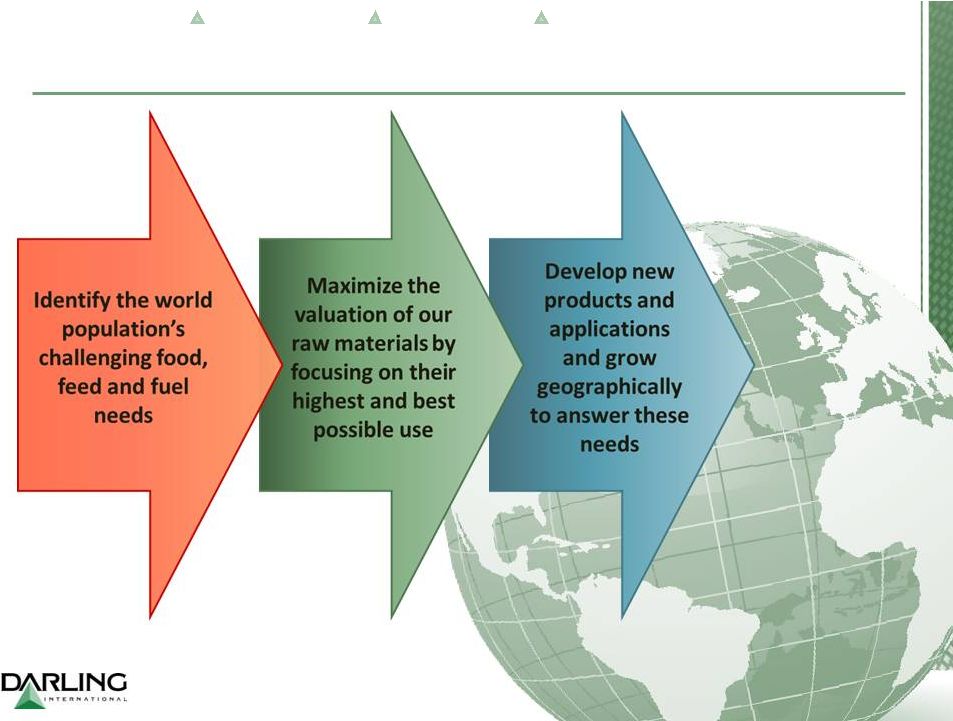

Darling

targets employing capital at a 15% or higher rate while maintaining a conservative

balance sheet Strengthen Current Position

Capture Growth Opportunities

•

Operational excellence:

-

Optimizing integration of global supply chains

-

Consolidation and realignment across brands of

current raw materials, products and services

-

Use advanced and sustainable technology

•

Product

innovation:

Continue

to

research

and

evaluate new ideas and uses for our raw materials

and develop new products & applications (R&D)

•

Customer intimacy:

Build strong customer loyalty

with increased products and services

•

Greenfield:

Expand our operation facilities in new

growing markets through our global platforms

•

Acquisitions:

Strategically grow our business

through acquisitions in growing and fragmented

areas

•

Expansions:

Expansions

of

our

existing

operating

facilities

25

Company Profile

Business Segments

Growth Strategy

Financial Review

Darling’s growth strategy is centered on…

…while holding to our core values:

Entrepreneurship, Transparency and Integrity |

Success

is consistently

providing

maximum value

to the supply

chain

Creating sustainable food, feed and fuel ingredients for a growing population

26

Company Profile

Business Segments

Growth Strategy

Financial Review

How we accomplish our growth goals… |

•

Expansion of blood plants in US/Canada

•

Grow hemoglobin/plasma business

Diamond Green Diesel –

Norco, LA

•

Renewable diesel expansion

27

•

Grow the used cooking oil/

restaurant services and

Terra Renewal Services

•

Optimize finished product

margins

•

Potential investment in new

bone facilities

•

Continued USA expansion

of gelatin business

North America

Capture Growth Opportunities

Rothsay –

Canada

Sonac –

Upper Midwest

Rousselot |

28

Current Terra Renewal operations

Capture Growth Opportunities

North America

Company Profile

Business Segments

Growth Strategy

Financial Review

Combine Synergies:

•

Solid and semi-solid residuals from

Terra’s processing will be further refined

through our Hexane extraction process

Hexane Extraction

Currently operating one

plant in Hampton, FL What is

it?

•

Protein and fat recovery

process from industrial

residuals

•

Discovering additional

value and products

•

Restoring water stream to

water treatment plants

Growth Opportunities

•

Explore new extraction

plant

construction Terra Renewal

Permitted and active for land

application in blue states What is

it?

•

Repurposing nutrient-rich

industrial residuals into

eco-friendly fertilizer

•

Professional service and

equipment

•

250,000 acres permitted

•

Environmentally sound

Growth Opportunities

•

Grow wastewater

solids recovery

•

Expand across

USA & Canada

•

Bundle services

with key customers

|

Rousselot

- Brazil

•

Continue to expand gelatin

•

Grow the Peptan®

brand

29

Sonac

•

Explore animal

by-product processing

opportunities

Capture Growth Opportunities

South America |

30

Capture Growth Opportunities

Europe

Sonac

•

Capture animal by-product

processing opportunities in

South and East Europe

Ecoson

-

Son, Netherlands

•

Expand biophosphate production |

Sonac

- China

•

Blood expansion

•

Explore animal

by-product

processing

opportunities

Rousselot -

China

•

Gelatin expansion

31

Growth Opportunities

China |

32

Financials

Company Profile

Business Segments

Growth Strategy

Financial Review |

Note:

The

LTM

Sep-13

period

includes

TRS

results

from

August

26,

2013

through

September

28,

2013;

for

a

reconciliation

to

LTM

figures,

please

see

page

39

Net Sales ($ millions)

Adjusted EBITDA ($ millions)

Capital Expenditures ($ millions)

Adjusted

EBITDA

–

Capital

Expenditures

($

millions)

33

$1,797

$1,701

$1,720

2011

2012

LTM Sep-13

$393

$317

$290

2011

2012

LTM Sep-13

$60

$115

$117

2011

2012

LTM Sep-13

$333

$202

$173

2011

2012

LTM Sep-13

Creating sustainable food, feed and fuel ingredients for a growing population

Historical

Darling

Operating

Performance |

Rothsay ($ in millions) VION ($ in millions)

34

Net

Revenue

Operating

Income

plus D&A

$227

$236

2012

LTM Sep-13

$2,088

$2,185

2012

LTM Sep-13

$87

$85

2012

LTM Sep-13

$251

$265

2012

LTM Sep-13

Creating sustainable food, feed and fuel ingredients for a growing population

Historical Rothsay and VION Operating Performance

Company Profile

Business Segments

Growth Strategy

Financial Review |

Net Sales ($ in millions) Pro Forma Adjusted EBITDA ($ in

millions) $653

$647

$4,141

2012

LTM Sep. 13

35

Darling

VION Rothsay

1701

1720

2088

2185

227

236

0

500

1000

1500

2000

2500

3000

3500

4000

4500

2012

LTM Sept. 13

Company Profile

Business Segments

Growth Strategy

Financial Review

$4,017

Note: The 2012 and LTM Sep-13 periods do not include financial impact of

Diamond Green Diesel or TRS (other than in the LTM Sep-13 period which includes TRS results from August 26, 2013

through

September

28,

2013;

for

a

reconciliation

to

LTM

figures,

please

see

page

39).

Numbers

may

not

add

to

total

due

to

rounding.

Pro Forma Operating Performance

Creating sustainable food, feed and fuel ingredients for a growing population

|

36

Appendix

Company Profile

Business Segments

Growth Strategy

Financial Review |

(mm in

USD) Annual

Nine Months Ended September

LTM

2011

2012

2012

2013

Sep-2013

Net Sales

$

1,797

$

1,701

$

1,277

$

1,295

$

1,720

Adjusted EBITDA

$

393

$

317

$

245

$

218

$

290

Capital Expenditures

$

60

$

115

$

84

$

86

$

117

(mm in USD)

Annual

Nine Months Ended September

LTM

2012

2012

2013

Sep-2013

Operating Income

$

167

$

126

$

142

$

183

Plus: Depreciation and Amortization

$

84

$

58

$

55

$

82

Operating Income plus Depreciation and Amortization

$

251

$

183

$

197

$

265

(mm in USD)

Annual

Nine Months Ended September

LTM

2011

2012

2012

2013

Sep-2013

Net Revenues

$

223

$

227

$

172

$

181

$

236

Net Revenues less Direct Costs and Operating Expenses

$

87

$

73

$

58

$

57

$

72

Plus: Depreciation

$

12

$

14

$

10

$

10

$

13

Operating Income plus Depreciation

$

99

$

87

$

68

$

66

$

85

Reconciliation of Non-GAAP Items

Rothsay

Darling

VION

Creating sustainable food, feed and fuel ingredients for a growing population

37

Company Profile

Business Segments

Growth Strategy

Financial Review |

Darling

FYE

2005

Darling

FYE

2006

Darling

FYE

2007

Darling

FYE

2008

Darling

FYE

2009

Darling

FYE

2010

Darling

FYE

2011

Darling

FYE

2012

Pro Forma Combined

FYE 2012

Pro Forma Combined

LTM Sep-13

Net Income

$8

$5

$46

$55

$42

$44

$169

$131

$183

$182

Depreciation

15

21

23

24

25

32

79

85

243

245

Goodwill impairment

0

0

0

16

0

0

0

0

0

0

Acquisition costs

0

0

0

0

0

0

0

0

0

1

Interest expense

6

7

5

3

3

9

37

24

125

125

Income tax expense

3

2

29

35

25

26

103

76

99

99

Other, net

(0)

5

1

(0)

1

3

3

(2)

(10)

(8)

Equity in net (income)/loss

of unconsolidated subsidiary

Non-controlling interest

0

0

0

0

0

0

0

0

9

10

Adjusted EBITDA - Pro Forma

$32

$40

$104

$133

$96

$114

$393

$317

$653

$647

(8)

0

0

0

0

0

0

2

3

3

Adjusted EBITDA Reconciliation

Pro Forma Adjusted EBITDA

Reconciliation

1

($ millions)

Historical Adjusted EBITDA Reconciliation

($ millions)

Creating sustainable food, feed and fuel ingredients for a growing population

38

Company Profile

Business Segments

Growth Strategy

Financial Review

Source: Management

1

Amounts for Rothsay and VION represent their historical results after giving effect to the pro

forma adjustments to such amounts reflected in the unaudited pro forma condensed consolidated

financial information of Darling International Inc.

|

Creating

sustainable food, feed and fuel ingredients for a growing population

39 |