Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - ThermoGenesis Holdings, Inc. | ex23_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 18, 2014

CESCA THERAPEUTICS INC.

(Formerly Known As ThermoGenesis Corp.)

(Exact name of registrant as specified in its charter)

|

Delaware

|

000-16375

|

94-3018487

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

2711 Citrus Road

Rancho Cordova, California 95742

(Address and telephone number of principal executive offices) (Zip Code)

(916) 858-5100

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

INTRODUCTORY NOTE

On February 18, 2014, Cesca Therapeutics Inc. (formerly known as ThermoGenesis Corp.) (the “Company”) completed the acquisition of TotipotentRX Corporation (“TotipotentRX”) pursuant to the terms of the previously announced Agreement and Plan of Merger, dated as of July 15, 2013 (the “Merger Agreement”), by and among the Company, TotipotentRX, Mitchel Sivilotti, and Kenneth Harris.

The following is certain historical information regarding TotipotentRX’s business, its financial information and pro forma information regarding the Company and TotipotentRX.

Item 8. Other Matters.

TotipotentRX’s Business

Company Overview

TotipotentRX Corporation or TotipotentRX, is focused in the research, development, and commercialization of autologous cell-based therapeutics for use in regenerative medicine.

TotipotentRX Corporation (formerly MK Alliance) is the surviving corporation of a merger whereby TotipotentRX merged with and into MK Alliance, Inc. and MK Alliance changed its name to TotipotentRX. Through this merger, in addition to its U.S. operation, TotipotentRX has two wholly-owned subsidiaries in Gurgaon, a suburb of New Dehli, India. Unless otherwise indicated, reference to TotipotentRX includes its predecessors and its subsidiaries. (TotipotentRX Cell Therapy Pvt. Ltd. and TotipotentSC Scientific Product Pvt. Ltd.).

TotipotentRX Strategy

Regenerative Medicine is the future of healthcare and TotipotentRX is focused on commercializing innovative and cost effective ways of treating our aging population. As we live longer, our dependency on chronic health supportive therapies grows and the resulting long-term economic impact is not sustainable. Clearly, the ideal treatment options for medicine are curative in nature, and similarly to surgical procedures, only cellular therapy can provide sustainable physiological improvements. According to the Alliance for Regenerative Medicine, Annual Report 2013, by reducing hospital care, physician and professional services, and nursing/home healthcare through sustainable “curative therapies,” the U.S. could reduce its healthcare costs by up to $250 billion/year. Allogeneic cell developments introduce unknown levels of safety risk, which may or may not be offset by the potential benefit. In contrast, autologous therapies bridge this safety gap, though the absolute prerequisite to fulfill treatment efficacy (cell potency), reproducibility, and eventual commercialization requirements have remained challenging until now. TotipotentRX’s strategy has been to address these gaps through process control-optimization and controlling all high impact variables so the autologous cells (active material) can achieve their endpoint(s).

Today, over $200 million of autologous cell therapy type products are sold around the globe. TotipotentRX believes that the reason the market isn’t larger isn’t due to a lack of physician and patient interest – it’s the result of an oversimplification and general misunderstanding of the process steps surrounding both scientific (the cell handling and treatment methods) as well as market commercialization (scale up) needs.

2

TotipotentRX’s strategy is to maximize the cellular treatment benefit by addressing the critical steps necessary for introducing viable functional cells required for each clinical indication. TotipotentRX manages this process through absolute control of all parameters involved in the cell production and delivery process:

Parameters with major impact on clinical outcomes in cellular therapies:

| · | Environmental & chemical exposure (Safety & Efficacy) |

| · | Equipment & disposable impact (Safety & Efficacy) |

| · | Cell source and patient specific variabilities (Efficacy) |

| · | Treatment protocol (critical analysis of each step from collection through delivery) (Safety & Efficacy) |

| · | Cell Dosage and Purity (Safety & Efficacy) |

| · | Clinical Trial Design (Safety, Efficacy & Commercialization) |

In order to achieve competitive advantages in these parameters, TotipotentRX has created a framework that surrounds and controls the cell therapeutic research, development, and commercialization process through “in-house” clinical laboratory and cell production capabilities, “in-house” clinical trials through our clinical research organization, “in-house” customized medical device development as well as unparalleled access to patients and leading surgeons through long-term partnerships with leading healthcare providers, such as Fortis Healthcare.

TotipotentRX’s Current Business

TotipotentRX is focused on four companion core competencies to serve patients, physicians and partners in the regenerative medicine market space:

| · | Therapeutic |

| · | Contract Clinical Trial Services |

| · | Cell Manufacturing and Banking |

| · | Medical Device Development and Commercialization |

Therapeutic

TotipotentRX views the combination product as the key to the autologous market. Through control of a mobile manufacturing process with a disposable single use “pharma manufacturing in a box,” every parameter of the cellular treatment is controlled in the operation theater and/or catheterization lab. We believe the direct result of a rapid intra-operative process is a marked improvement in cellular safety and a reduction in the loss of potency and thus speaks to the fundamental premise that using our technology with autologous cells equals clinical efficacy.

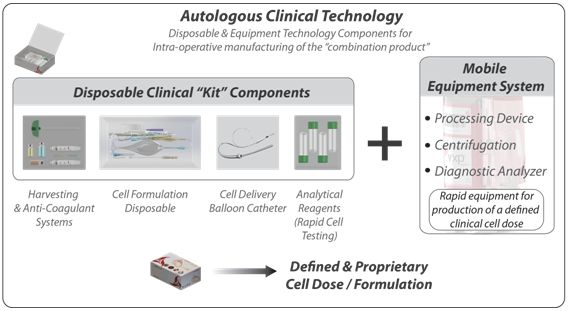

The chart below (Autologous Clinical Technology) summarizes the salient features of the proprietary bedside manufacturing process (in a kit) in clinical trials by TotipotentRX. In brief, each specific clinical indication is independently reviewed, studied, engineered, and tested with three main goals: (i) to ensure cell safety, viability, potency for each appropriate application by our clinical research and development team; (ii) to ensure rapid, reproducible (user independent) cell delivery addressing the constraints faced by surgeons conducting surgical treatments on a day to day basis; and (iii) to ensure patient safety. TotipotentRX believes it is essential to provide assurance of potent cellular product and equally essential to provide a process which can be conducted by surgeons and healthcare professionals with ease, without the risk of operator error, and in a rapid cost effective manner. Through many years of direct physician and patient exposure we have distilled the elements of our mobile bedside manufacturing technology to the precise therapy specific needs in a easy to use disposable “kit”, ancillary equipment system, and indication specific protocol; each configured and customized to one of our therapeutic candidates. It is expected this technology system and therapeutic biological will follow the U.S. FDA PMA “combination product” process in the U.S., and be available for use in any operating room (O.R.) for on-label treatments with minimal user training.

3

The disposable clinical kit, specific to each clinical indication, is designed to provide a customized pre-market approved solution for each of our clinical applications. The purpose of the kit is to provide a highly controlled, regulated and fully integrated solution to surgeons eliminating any perceived need for additional uncontrolled products/processes during the treatment protocol. TotipotentRX believes that this complete end-to-end solution is a necessity for both regulatory approval and surgeon adoption. Not only does this approach address quality control deviations and directly address the FDA’s requirement for combination product quality, but it also provides an ease of use to the physician user by eliminating the need for pre-surgery preparations such as disposable supply chain and/or cold chain cell management. Each disposable kit contains the four major component categories, which work in concert with the mobile equipment system and in conjunction with the proprietary protocol:

Autologous Clinical Technology Kit Component Categories:

1. Cell Harvest and Anti-coagulation System

2. Cell Processing and Formulation System

3. Cell Diagnostic System

4. Cell Delivery System

TotipotentRX Proprietary Solution – The Combination Product

Component 1: In brief, depending on the source and quantity of the cellular material (i.e. bone marrow, peripheral blood, and cord blood), an integrated cell collection system is provided, which is fully validated to the precise cell collection scenario experienced by the physician at the point-of-care. Using the example of bone marrow source material, TotipotentRX has optimized a proprietary formulation of cell and patient-tested anti-coagulant (an FDA approved polypeptide) designed to minimize adverse effects on the stem cells. To provide further detail on the unique specification of this, TotipotentRX can provide an overview of the features critical to its anti-coagulant system (a chemical added to bone marrow aspirate to prevent the formation of microthrombae) without inhibiting the chemokine receptor 4 (CXCR4)/stromal cell-derived factor-1 (SDF-1) axis, which plays a crucial role in homing to and engraftment of progenitor cells (1, 2). The importance of the CXCR4/SDF-1 axis is unambiguous in the arena of regenerative medicine, and chemicals that interfere with this mechanism impact the overall efficacy of the infused cellular product. Heparins are the most commonly employed anticoagulants for bone marrow aspiration, and are reported to disrupt the pivotal CXCR4/SDF-1 axis (3). The heparin-treated bone marrow cells become unresponsive due to inhibition of the CXCR4 receptor internalization that further blocks CXCR4 downstream signaling. In response to this data, TotipotentRX has created a proprietary formulation designed to avoid this cell inactivation mechanism; a major differentiator to our platform.

4

Component 2: TotipotentRX’s cell processing and formulation system is designed in exclusive collaboration with ThermoGenesis to integrate “smart” and time-tested medical technology into one of the most critical steps of TotipotentRX’s bedside cell manufacturing system. This automated computer-aided technology enables a “hands-free” user-independent infrared cellular selection system that defines a unique cell dose in less than 30 minutes. TotipotentRX refers to this platform as the VXP™ technology as is based on an evolution of the ThermoGenesis AXP™ System, a technology which has been used in processing over 600,000 cellular samples and several thousand human transplants over the past 10 years. The AXP’s quality record ensures that one of the cornerstones of our process will operate to a clinical commercial standard and is scalable.

Component 3: In advance of the cell delivery, the importance of cellular diagnostics has, until now, not been adequately addressed at the point-of-care in both the autologous and allogeneic cell therapy arena. The FDA has underlined this gap in various communications where “No lot of any licensed product shall be released by the manufacturer prior to the completion of tests for conformity with standards applicable to such product.” (21 CFR 610.1), which include tests for potency, sterility, purity, and identity (21 CFR Part 610 B). These requirements apply to all biological products, including autologous and single patient allogeneic products, where a lot may be defined as a single dose (U.S. FDA Guidance for Industry. Potency Tests for Cellular and Gene Therapy Product CBER, Jan. 2011). TotipotentRX addresses this requirement through a mobile cell diagnostic platform designed to specifically and rapidly address pre-transplant cell diagnostics. TotipotentRX’s system, which we anticipate to be part of the combination product, a rapid feedback system provides a clear differentiator that ensures a traceable record of defined cellular doses specific to the clinical application, and in the event of cellular insufficiency, and immediate notification to the surgical team to harvest additional cells thus ensuring each patient is treated with an effective dose.

Component 4: The cell delivery system is a cell friendly system designed to ensure cells being injected/transplanted into the patient are unchanged by the physics and chemistry of and throughout the delivery device’s lumen and surface coating, including control of the cell product physical inputs, and the location of the target delivery is a highly refined, controlled and measurable process. Each step is created to minimize potential harm to the cellular product during delivery to the patient’s target organ of interest and can survive to initiate therapeutic benefit. Though in retrospect TotipotentRX considers this principle of cell-based treatments obvious, many examples of competitive poor delivery dynamics have likely been the cause of poor study results and as a result, TotipotentRX has engaged leading medical technology partners to collaborate with TotipotentRX’s scientific and clinical team on the customized design and integration of cell delivery devices into the TotipotentRX cell manufacturing kit. Taken together, the Cell Therapy Combination Product Kit (Disposable, Equipment, Diagnostics and Protocol) is a controlled cellular production process under the control of the physician as represented by an example from the TotipotentRX AMIRST study procedure below.

5

References in this section:

| (1) | Takahashi M. (2011) Role of the SDF-1/CXCR4 system in myocardial infarction. Circ. J., 74, 418 |

| (2) | Prokoph S, Chavakis E, Levental KR et al. (2012) Sus- tained delivery of SDF-1a from heparin-based hydrogels to attract circulating pro-angiogenic cells, Biomaterials, 33, 4792 |

| (3) | Seeger FH, Rasper T, Fischer A, Reinholz MM, Hergenrei- der, E, Dimmeler S et al. (2012) Heparin disrupts the CXCR4/SDF-1 axis and impairs the functional capacity of bone marrow-derived mononuclear cells used for cardio- vascular repair, Circ Res., 111, 854 |

Therapy Candidates:

TotipotentRX's lead therapeutic technology core combination product platform just outlined is TotiCell™ an intraoperative rapid system for harvesting, preparing, testing, and delivering a therapeutic dose of autologous bone marrow derived or peripheral blood derived cells and proteins. TotipotentRX’s integrated treatment kits (unique to each indication) are designed to comply with the FDA's Combination Product definition and as a result combine a proprietary, effective and safe cell formulation specific to the disease indication with all the required medical devices to harvest, process, quality control and deliver the therapeutic cell dose at the patient's bedside in 60-90 minutes.

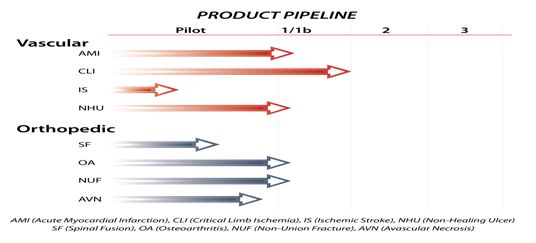

The TotiCell platform is currently in various stages of Pilot and Phase 1b trials as a potential treatment for vascular and orthopedic indications.

| · | To date TotipotentRX has completed 10 pilot or phase 1b clinical trials, having a net non-dilutive market “cost equivalent” value exceeding $17M. |

| · | Approximately 600 patients have been treated to date using the TotiCell approach. |

The therapeutic candidates of primary focus by TotipotentRX include advancing the development in acute myocardial infarction, critical limb ischemia and orthopedic regeneration spinal fusion and avascular necrosis. TotipotentRX anticipates receiving regulatory clinical trial approval for advancing to the next stage of clinical trials in each. Initial safety pilot or Phase 1b (safety & efficacy) studies have been executed in several additional indications (see Therapy Pipeline Chart below), and TotipotentRX anticipates pursuing partnerships in the other indications prior to advancing into Phase II.

6

Key Target Indications

The company will initially focus on the following three indications:

| 1) | Acute Myocardial Infarction (AMI): |

AMI is a rapid development of myocardial necrosis due to a critical imbalance between oxygen supply and demand to the myocardium (heart muscle) often caused by the occlusion of a coronary artery – commonly known as a heart attack. Certain patients who suffer an AMI may experience a Left Ventricular Ejection Fraction below 40.0%, and therefore often proceed to suffer from near and medium term ischemic cardiomyopathy, a process leading to chronic heart failure and a high morbidity and mortality rate. This progression of disease and the management of it is extremely expensive to society, health care payers, and government. Our treatment intends to limit the deterioration of the patient towards heart failure, and thus having a significant positive benefit to the patient (quality of life and economic contribution) and healthcare payer system (economic contribution).

Cardiovascular disease (CVD) is the number one cause of morbidity and mortality worldwide. An estimated 17.3 million people died from CVDs in 2008, representing 30.0% of all global deaths. Of these deaths, an estimated 7.3 million were due to coronary heart disease. TotipotentRX’s treatment focuses on patients who have low ejection fractions (<40.0%) three to ten days post AMI, and have a predictably high mortality rate one to five years post infarct. TotipotentRX estimates the resulting addressable market to be a more than 700,000 patients per annum worldwide with 90,000 to 100,000 patients in the U.S. alone.

Over the past decade, the use of regenerative medicine methodologies for cardiovascular disease, and specifically bone marrow derived progenitor cell therapy for AMI has been tested in more than 35 Phase I and Phase II clinical studies demonstrating overall safety and measurable clinical benefit 12-61 months post treatment as evaluated by improvement of the Left Ventricular Ejection Fraction (LVEF) post AMI. Delewi, et al, European Heart Journal, Sept 2013, reported in a meta-analysis study the impact of intracoronary bone marrow cells showed a positive 2.55% LVEF improvement in six months or less with a 95.0% confidence interval in 1641 patients comprising 16 randomized controlled trials.

In 2010, TotipotentRX began developing the TotiCell program with the intent of targeting the low LVEF post AMI indication. This program was named AMIRST (Acute Myocardial Infarction Rapid-Delivery of Stem cell Therapy) and the estimated time to market is 7 years from the commencement of the Phase 1 double blinded randomized controlled clinical study.

7

In September 2013, TotipotentRX completed a 24 month case study follow-up on a 43 year old, non-diabetic, non-obese, smoker male who presented with symptoms of AMI. On admission, the AMI was confirmed with electrocardiogram ST elevation and biochemical tests. The patient was normo-tensive with no family history of ischemic heart disease. The patient presented with two hours of chest pain with a 2 mm ST segment elevation in the anterior leads. The patient’s Left Ventricular Ejection Fraction, LVEF, was estimated to be around 35.0 % by bedside 2D ECHO. Primary PCA was performed using a routine technique, and a single drug-eluting stent was deployed in the proximal LAD with TIMI-3 grade flow results. Post- procedure, the patient’s LVEF remained < 40.0% at the 120 hour point as measured by MuGA and ECHO, which met our inclusion criteria and is predictive of a higher than acceptable one year mortality rate. The patient was advised that he met the inclusion criteria for a clinical trial program using his own (autologous) bone marrow concentrated progenitor stem cells. The clinical trial is registered with clinicaltrials.gov (NCT01536106) and is approved by the Institutional Ethics Committee (IEC) (IEC Approval # TIEC/2011/32/02). The patient, Primary Investigator and Clinical Investigator concurred, and consent was obtained. On the 6th day post PTCA/stent implant, the patient was transferred to the heart catheterization laboratory, and the AMIRST protocol was completed. The entire procedure was completed within 90 minutes. As a safety study, the patient was followed up for 24 months and evaluated with standard diagnostic metrics. No serious adverse event or re-hospitalization event was reported, demonstrating the safety of this adjuvant treatment. The patient’s LVEF improved from 35.0% at the time of the AMIRST treatment to 60.3% on the 24 month final exam.

TotipotentRX has designed a 30 patient Phase Ib (Safety and Preliminary Efficacy), Randomized Double-Blind, Placebo-Controlled, multi-center study to be conducted at Fortis Escorts Hospital (New Delhi), Fortis Flt. Lt. Rajan Dhall Hospital (New Delhi), and Care Hospital (Hyderabad). This study is scheduled to commence in the fourth quarter of calendar 2014 and TotipotentRX anticipates completion within 18 months.

The protocol in brief:

| · | Bone marrow is aspirated in all the patients and they may or may not receive the bone marrow for their treatment depending on a blinded random selection process. |

| · | The aspirated bone marrow enters the TotiCell process – controlled collection, processing, and delivery at a recorded dosage and within 60-90 minutes to each patient selected for the treatment arm. Patients not selected for immediate treatment (placebo arm) will have their cell dose cryopreserved for a potential cross-over study. |

| · | The manufactured cells are infused through a specialized catheter into the infarct-related artery in the same operative procedure less than 10 days following an AMI), which TotipotentRX believes is the optimum time for cellular intervention immediately following the pro-inflammatory reaction of the body to the ischemic injury. |

| · | Infusate cells migrate / home to areas of cardiac need in response to controlled ischemic events. |

The objective of this Phase 1b is to:

| · | Evaluate the safety of intracoronary infusion of our unique composition of autologous bone marrow mononuclear cells utilizing the TotiCell proprietary process for the treatment of patients with acute myocardial infarction (AMI). |

| · | To measure changes in ventricular hemodynamic, infarct size, viable myocardium and cardiac remodeling following intracoronary of the TotiCell Cellular product. |

| · | Measure the rehospitalization rate specific to understanding the anticipated positive economics for supporting reimbursement. |

8

| 2) | Critical Limb Ischemia (CLI): |

Inadequate blood flow to the limbs leading to chronic ischemic rest pain, ulcers, or gangrene of the feet, legs or both. CLI is a serious form of peripheral artery disease (PAD) also often referred to as peripheral vascular disease (PVD), which is caused by atherosclerosis, the hardening and narrowing of the arteries over time due to the buildup of fatty deposits called plaque.

Prevalence of CLI has been increasing in recent years, affecting several million people across the globe. PAD has been estimated to occur in 10.0-25.0% percent of adults older than 55. The standard of therapy for severe limb-threatening ischemia is either surgical or endovascular revascularization that aims to improve the blood flow to the affected extremity. In the absence of revascularization options (up to 40.0% of CLI patients are not candidates for revascularization) or the subsequent failure, of such surgical inventions, such patients with CLI will require amputation within 6 months. Patients requiring major amputation face a diminished quality of life, an unfavorable life expectancy and extensive resources for their post-amputation rehabilitation and course. The 1-year amputation-free survival rate for patients diagnosed with CLI is 45.0%; the mortality rate is approximately 25.0% and may be as high as 45.0% in those who have undergone amputation. Management of this end-stage disease process consumes a significant amount of healthcare resources.

TotipotentRX estimates the resulting number of “no-option” CLI patients to exceed 250,000 in the U.S., a large addressable market.

Bone marrow (BM)-derived stem and progenitor cells have been identified as a potential new therapeutic option to induce therapeutic angiogenesis, and have demonstrated positive outcomes in both pre-clinical and early clinical models. This approach aims at improving the vascularization of the ischemic leg so that perfusion improves sufficiently for wound healing to occur, and at resolving resting pain ultimately allowing limb salvage.

In 2011, in collaboration with ThermoGenesis, TotipotentRX began a 17 patient Phase Ib (Safety and Preliminary Efficacy), single-center open label study at Fortis Escorts Hospital (New Delhi). The purpose was to demonstrate the safety and efficacy of TotiCell manufactured bone marrow mononuclear cells injected into ischemic tissue of patients with non-reconstructable critical limb ischemia. The one-year follow-up of this study was concluded in August of 2013 and the results were published in January 2014. In advance of publishing the final results TotipotentRX provided the market with interim updates which showed that TotipotentRX achieved the primary endpoint of safety after 12 months and the patients had retained their leg and showed measurable improvement in blood flow and pain scores. The final published results of the feasibility/Phase Ib were:

| • | Major limb Amputation free survival rates - 82.4% |

| • | Pain reduction - mean VAS score pre-therapy 7.8 ± 0.97 and 12 month follow-up 0.2 ± 0.58 on a scale of 0-10, p=0.0005 |

| • | 6-minute walking distance - mean distance pre-therapy of 14.5 meters ± 37.57 and 12 month follow-up of 157 meters ± 100.92, p=0.0039 |

| • | Open wound healing - 11 patients had gangrene with or without ulceration pre-treatment and all patients had neither gangrene nor ulceration at 12 month follow-up |

| • | Vasculogenesis in the treated leg - both collateral vessel numbers improved, p=0.0156 in distal thigh, p=0.0313 in proximal leg, and vessel size improvements in the distal thigh, p=0.0156 and proximal leg, p=0.0625, and TcPO2 levels (mean pre-therapy of 14.66 ± 6.93 improved to 35.75 ± 17.04, p=0.0032) |

9

This study also served as the proof of principle for our acute myocardial infarction therapy, demonstrating that vasculogenesis was possible in the human subject using TotipotentRX’s combination product.

This program name has been updated to CLIRST (Critical Limb Ischemia Rapid-delivery of Stem cell Therapy) and we will initiate our application of the pivotal study to commence the next phase of TotipotentRX’s clinical data collection in the U.S., European Union and India.

The Protocol in brief:

| · | Bone marrow is aspirated in all the patients (all subjects treated) in the heart catheterization lab. TotipotentRX only considered “no option” patients for inclusion in response to the requirements of the institutional ethics committee overseeing this study. |

| · | The aspirated bone marrow enters the TotiCell process – controlled collection, processing, and delivery at a recorded dosage and within 60-90 minutes to each subject selected for the treatment arm. |

| · | The bedside manufactured cells are injected intra-muscularly into the affected limb in accordance with a grid-based strategy to ensure appropriate cell distribution. |

| · | Cells migrate / home to areas of vascular need in response to ongoing ischemia in the affected limb. |

| 3) | Orthopedic Repair: |

TotipotentRX has two lead candidates in the orthopedics space: (1) Degenerative Disc Disease and (2) Avascular Necrosis.

Degenerative disc disease refers to a condition in which pain is caused from a damaged spine disc. A wide range of symptoms and severity is associated with this condition, and in more than 400,000 patients per year in the U.S. leads to surgical removal of the diseased disc. Once the disc (vertebral cushion) is removed between two discs, the effected vertebrae are “fused” both mechanically and biologically. The biological fusion is typically completed by inserting a bone scaffold between the vertebrae, and seeding the scaffold with biologicals (proteins, growth factors and/or stem cells) to induce growth of a solid supportive boney fusion. Over the past decade the use of recombinant human bone morphogenic protein (BMP) has been used to supercharge the biological growth of the bone implant. However, recent studies have raised significant safety concerns about the use of this growth factor, and most recently Lad et al (Neurology 2013) reported that the use of rhBMP increases the risk of non-malignant tumors by more than 30.0%. The current rhBMP U.S. market is believed to exceed $700 million. In a recent survey of orthopedic physicians asked what they would be replacing BMP should the U.S. FDA take steps to restrict the on-label allowances of rhBMP, more than 31.0% said they would use autologous bone graft with stem cells.

TotipotentRX believes the addressable U.S. market is large, with more than 120,000 procedures per year.

This procedure involves the use of autologous bone marrow stem cells, and as it is a minimally manipulated homologous use of the patients own cells TotipotentRX, upon consultation with the U.S. FDA, anticipates in will seek CBER approval to complete a Phase II/III Investigational Device Exemption (IDE) clinical trial. If this path is approved, the potential time to market will be considerably shorter than our other product indications.

10

This program is called the Vertebrae Fusion Rapid Implant Stem cell Therapy (VFIRST).

Avascular necrosis (AVN) is a disease resulting from the temporary or permanent loss of blood supply to the bones. Without blood, the bone tissue dies, and ultimately the bone may collapse. If the process involves the bones near a joint (typically the hip), it often leads to collapse of the joint surface. AVN is also known as osteonecrosis, aseptic necrosis, and ischemic necrosis.

| · | The incidence rate of AVN is 1 in 27,200 U.S. adults (approx. 10,000 – 20,000 new cases per year) |

| · | There are five (5) grades of disease development: |

Grade I (least severe): painful but difficult to diagnose on MRI

Grade II: still asymptomatic but recognizable in MRI

Grade III: painful and flattening of femoral head

Grade IV: increased pain and collapse of necrotic segment

Grade V: cystic changes are seen

We have completed a pilot study (investigator initiated) of 15 subjects having Grade II and II/III AVN of the femoral head. Our procedure involves the use of autologous bone marrow derived enriched progenitor cells, a allogeneic bone graft in combination with autologous (patient’s own) biologics to enhance cell survival. The company has filed a patent on both the methods and on a device for calculating the allograft to cell volume ratio. The company is considering options for seeking fast track status of its AVN therapy in pediatric patients.

In addition to our initial pursuit of the above four indications, we have the following in-human clinical initiatives also underway:

|

Other Target Diseases and Treatments

|

||

|

Indication

|

|

Status

|

|

Osteoarthritis

|

|

Pilot Phase

|

|

Non-Union Fracture

|

|

Pilot Complete, Under Review

|

|

Chronic Dermal Wounds

|

|

Pilot Phase

|

|

Ischemic Brain Injury

|

|

Under Review

|

Contract Clinical Trial Services

TotipotentRX has a leading cell therapy CRO team of clinical scientists, physicians, and graduate level scientific associates. This program emerged as a necessity for conducting cell-based clinical trials as few CRO’s understand the complexities of conducting autologous cellular therapy programs. TotipotentRX combines its expertise in intra-operative medical management, cellular manufacturing, device validation and regulatory affairs to provide complete and seamless cellular drug and device clinical services. This service is now being marketed to regenerative medicine biotech and academic centers seeking high quality, rapid enrollment, and lower cost clinical trial studies.

TotipotentRX’s full service cellular biological and medical device services include clinical study design, cost effective contract Phase I-II clinical trials, regulatory consultation, physician/surgeon training and support for cellular product potency validation, handling and delivery of the cellular therapy, and fully validated laboratory services for cellular bioanalytics. The services offered ensure patient safety under Good Clinical Practices (GCP), quality laboratory documentation under Good Laboratory Practices (GLP), and quality cell processing and handling under both Good Manufacturing Practices (GMP) and Good Tissue Practices (GTP).

11

TotipotentRX's scientific and clinical team's comprehension of the complex issues of cellular therapy trials translates into earlier identification of potential problems, hands on decision making, patient and care giver support, physician training and support all leading to superior results. We believe TotipotentRX’s experience in cellular therapy allows us to work smarter, minimize cost, and maximize time efficiencies for TotipotentRX's client trials.

Employee Expertise includes:

| · | Project Management |

| · | Clinical Research Associates for Clinical Support & Monitoring |

| · | Medical Monitors and Physician Oversight |

| · | Quality Assurance teams |

| · | Regulatory Specialists |

TotipotentRX’s exclusive partnership with Fortis Healthcare has also lead to unique marketing opportunities where the CRO offering has been strategically planned in cooperation and co-marketing programs are underway. The first such co-marketing program was launched at the 2012 International Stem Cell Society Meeting in Seattle Washington. Leveraging Fortis’ experience and traditional clinical trial infrastructure, which includes more than 100 trials underway presently, allowing TotipotentRX to focus on the cell therapy unique requirements without additional overhead.

Cell Manufacturing and Banking

Over the past decade, the use of adult cell tissues such as bone marrow cells, cord blood cells and adipose cells have held great promise for treatments of debilitating diseases such as genetic abnormalities, cancer, cardiovascular disease, neurological injury, and secondary effects of adult onset diabetes. TotipotentRX operates advanced clinical cell manufacturing, processing, testing, and storage facilities compliant with GMP, GTP, and GLP and registered with the U.S. FDA and Indian Drug Control (DCGI). With our current infrastructure including the GLP laboratory, GMP development and GCP compliant clinical research teams we house an extremely broad set of capabilities available for internal development needs as well as to outside clients. In exploiting our world-class infrastructure within the Fortis Healthcare network, we provide cell banking (cryopreservation) and cell manufacturing services to both clinical trial clients and patient clients.

Cell Banking

TotipotentRX operates a premium private cord blood and tissue banking service within the Fortis Healthcare system. As a contractual component of TotipotentRX’s services to Fortis, the NovaCord™ brand was created and deployed at five Fortis Hospitals across New Delhi as well as other Fortis locations in the surrounding regions. The GMP facility is marketed through traditional and telesales teams to pregnant mothers planning to deliver their babies at Fortis Hospitals pan-India.

To support the cryogenic storage requirements of the cord blood industry as well as clinical trial clients, TotipotentRX operates a state-of-the-art cryopreservation facility fully equipped with semi-automated controlled rate freezing and stem cell sample long term storage containment dewars as well as a patient sample bank for quality control purposes. TotipotentRX has implemented robust standard operating procedures (SOPs), quality processes, and in-house diagnostic testing to ensure every sample has full traceability, and the facility is licensed by the state and national drug control departments and certified by the British Standards Institute for ISO 9001, GMP, GCP, and GLP.

12

Cell Manufacturing

TotipotentRX offers cGMP-compliant cell therapy manufacturing through its ISO Class 7 (Class 10,000) clean room infrastructure meeting U.S. and international requirements. We have experience with multiple platforms of closed-system processing and can adapt to the specific cell culturing strategy of our client. At request, we can also employ our medical device assets to provide customized disposable systems specific to the unique needs of an individual project.

A testament to TotipotentRX cell therapy service capabilities, in August 2013, in collaboration with the Fortis Memorial Research Institute, TotipotentRX announced the successful launch of its pediatric bone marrow transplant program at the Fortis-TotiRX Centre for Cellular Medicine in New Delhi, India. The new program achieved its first 100-day survival milestone following an allogeneic bone marrow engraftment in a pediatric patient with aplastic anemia. The successful transplant was performed through the use of our cell manufacturing and cryopreservation facilities and has paved the way for the expansion of the bone marrow transplant program at Fortis, a much needed service in the region.

Medical Device Development and Commercialization

TotipotentRX currently operates a medical device assembly and supply business at its Gurgaon (New Delhi N.C.R.) facility in India. This facility was designed to house the organizations sales and operations departments, which cater specifically to the design, assembly and supply of medical devices and kits to the regenerative medicine market, primarily private cord blood banks. This business segment can be divided into two distinct groups:

1. Device Manufacturing

TotipotentRX’s device assembly facility is ISO 13485 certified (British Standards Institute) and has manufacturing clean room infrastructure validated to ISO Class 7 to meet the requirements of European CE marking and U.S. FDA 510(k) for sterile disposable assembly and sterile liquid filling applications. This facility has the capability to assemble regulated product disposables and medical convenience kits. This flexibility allows a unique position to provide rapid, low cost, customized products to the regenerative medicine disposables market.

To support the sales and distribution department the operations group is comprised of the following specialized departments to ensure our customer base is supplied with high quality products:

| · | Finance & Accounts |

| · | Regulatory (product registrations, dossier creation and updates, facility registrations) |

| · | Quality Assurance (quality management, product occurrence tracking and vigilance systems) |

| · | Logistics & Supply Chain |

| · | Engineering (Product Design and advanced engineering support) |

| · | Production |

| · | Warehouse (controlled raw material and finished product storage) |

2. Medical Device Sales and Distribution

TotipotentRX markets a growing product line of consumables under the “TotipotentSC” brand. These products are currently sold to the South Asian and European cord blood bank markets for use in umbilical cord blood collection, processing, and cryopreservation as well as transport of umbilical cord tissue.

13

Cord Blood Banking disposables are either:

| · | Manufactured / assembled in-house |

| · | Sourced through long-term strategic private label agreements |

| · | Distributed in collaboration with specialized suppliers |

TotipotentRX primary customers are private (or public) cord blood banks, which provide an offering to pregnant parents to collect and store their cord blood. These products are sold for single use applications in the GMP laboratory of cord blood banks. Product sales are generally smooth as a business-to-business sale based on annual or multi-year purchase contracts with defined pricing and delivery periods.

Major Products

|

Description

|

Market

|

Distribution / TotiSC Brand

|

Regulatory Approval

|

Sales Territory

|

|

Collection Bag

|

Cord Blood

|

Distribution

|

CE, DCGI

|

Global (outside U.S.)

|

|

Manual Processing Set

|

Cord Blood

|

TotiSC Brand

|

CE, DCGI

|

Global (outside U.S. & EU)

|

|

Manual Processing Set

|

Cord Blood

|

Distribution

|

CE, U.S. FDA, DCGI

|

India and South Asia

|

|

Cord Blood Stem Cell Freezing Bags

|

Cord Blood

|

TotiSC Brand

|

CE, DCGI

|

Global (outside U.S. & EU)

|

|

Stem Cell Freezing Bags

|

Regen. Med.

|

TotiSC Brand

|

CE, DCGI

|

Global (outside U.S.)

|

|

Cryo Overwraps Bags

|

Cord Blood

|

TotiSC Brand

|

N/A

|

Global

|

|

Bone Marrow Processing

|

Regen Med.

|

Distribution

|

CE, U.S. FDA

|

India and South Asia

|

|

Cord Blood Collection Kits

|

Cord Blood

|

TotiSC Brand

|

Convenience Kit (not required)

|

Global

|

|

GMP Cell Expansion Reagents

|

Regen. Med.

|

Distribution

|

N/A

|

India

|

Government Regulations

The development, clinical trials, and marketing of our cell therapy products are subject to the laws and regulations of the U.S. (FDA), European Union (EMEA) and other countries including India as projected in TotipotentRX’s commercial sales strategy. TotipotentRX’s belief is that its clinical approach represents a moderately low regulatory and patient risk due to the following characteristics of its products:

| 1. | Autologous cell source |

| 2. | Cells are non-manipulated (or minimally manipulated) |

| 3. | Homologous (orthopedic indications) and Non-Homologous (vascular indications) |

14

In accordance with historical regulatory publications, rules, and decisions, we assess our regulatory risk to be lower than our competitors. TotipotentRX ranks the risk profile of its clinical candidates in order of highest to lowest risk as AMI, CLI and Spinal Fusion or Avascular Necrosis, respectively. Moreover, relative to TotipotentRX’s competition, it believes that it has a meaningful reduction in time to market where in spite of positive trial outcomes, these competitors’ allogeneic risks remain unknown and may require additional years (and comparatively larger patient populations) in the pivotal studies to conclusively demonstrate the absence of adverse or unpredicted results.

The trials TotipotentRX has conducted in India were all compliant with the applicable Indian Council for Medical Research, and Ministry of Health Order No. V.25011/375/2010-HR rules specific to oversight and rulemaking related to stem cell research and therapy in addition to requisite institutional ethics board and institutional stem cell committee approvals, and all future studies will be compliant with the newest guidelines issued by the Drugs Controller General (India) in the second half of 2013. Both the U.S. and E.U. regulatory agencies are experienced with accepting Indian clinical trial data(1)(2). The U.S. Food and Drug Administration issued a Final Rule in October 2008 revising §21 CFR 312.120(a) and further clarifying their position in a Guidance Document in March 2012, where they will accept as support for a U.S. Investigational New Drug (IND) or application for marketing approval a well-designed and well-conducted foreign clinical study not conducted under a U.S. IND if the study is conducted in accordance with Good Clinical Practices (GCP) and where the sponsor is able to validate the data from the study through an onsite inspection by FDA if necessary. GCP includes review and approval by an IEC before initiating a study, continuing review of an ongoing study by an IEC, and obtaining and documenting the freely given informed consent of the subject before initiating a study.

India has become a major region for conducting clinical studies of equivalent quality and regulatory stringency to the U.S.(3), with the advantage of recognizing a significant savings in clinical costs, accessing many more patients, and enrolling patients faster. Nevertheless, we understand the necessity to conduct multi-centered trials and aim, in all cases, to select sites in countries, which are on TotipotentRX’s commercialization roadmap. TotipotentRX anticipates doing all pilot and Phase I trials in our economically advantageous CRO in India, and then moving onto market/region specific multi-center trials in Phases 2 & 3.

| (1) | Fortis Escorts has completed two U.S. FDA approved cellular therapy CLI studies for competitors prior to initiating the TotipotentRX-ThermoGenesis study. |

| (2) | Foreign clinical trials conducted in India exceeded $2.5 billion. |

| (3) | Fortis Healthcare currently serves as a clinical trial facility for more than 100 U.S. or EMEA IND/IDE multi-site clinical trials per annum, demonstrating their proficiency and acceptable Good Clinical Practices as required by the U.S. FDA. |

TotipotentRX’s regulatory plan focuses on obtaining pre-market approval (PMA) from the FDA or the equivalent via the EMEA and national authorities in Europe as well as other national territories. Therefore, TotipotentRX has designed and anticipates that our studies comply with the guidelines of these regulatory authorities per the Combination Products as defined by the U.S. FDA.

Competition

The field of cell therapy development is competitive. There are a number of companies that are developing stem cell-based therapies for cardiovascular and/or orthopedic indications, including, but not limited to MesoBlast, Ltd., Osiris Therapeutics, Inc., Baxter International, Inc., Athersys, Ltd., Neostem, Inc., Aastrom Biosciences, Inc., Cytori Therapeutics, Inc., Cytomedix, Inc., Pluristem Therapeutics Inc., and Bioheart, Inc. These companies are utilizing a number of different cellular approaches in pursuit of commercially successful therapeutics. TotipotentRX’s competitors employ either autologous or allogeneic-based development programs with cells from three main sources: bone marrow derived cells, fat derived cells, and peripheral blood or cord blood/tissue cells.

15

To our knowledge, TotipotentRX is the only company providing point-of-care fully integrated autologous combination products.

TotipotentRX’s sees the following main advantages to its approach:

Autologous vs. Allogeneic. TotipotentRX employs an autologous cell source (donor and recipient are the same person) to all of its therapeutic candidates) therefore having an inherently lower safety risk profile with respect to transplantation related toxicity, cell durability, and the potential need for immunosuppressive drugs. Allogeneic sources (that is where the donor and recipient are different persons) face a series of technical limitations that we believe will likely impact their clinical value through both an increased risk of treatment success (therapeutic efficacy from a single cell source), potential immunogenicity and the risk of extensive (and expensive) reviews and potential delays by regulatory authorities for safety concerns.

TotiCell is Minimally Manipulated. The majority of TotipotentRX’s competitors employ one or more cell manipulation techniques in order to manufacture their final cell product. The listing of these techniques would be exhaustive, however, we can attempt to summarize these to the following: (i) exposure to chemical agents (i.e. for cell isolation/purification), (ii) cell expansion (ex vivo laboratory-based culturing to achieve necessary cell quantities), (iii) cryopreservation (maintenance of cell stock for “off the shelf” supply for patient treatment) and (iv) transport (between multiple laboratory-based devices and through the hands of many different human technicians at collection sites, within laboratory environments and when transporting between geographical locations). Of note, the U.S. National Institutes of Health “NIH” released a critical study in May 2011 showing expanded mesenchymal stem cells (MSCs) experience unacceptable genetic changes after 2 expansion cycles (Campasi et al, ISCT Annual Meeting, Rotterdam, 2011). To achieve a therapeutic dose, one typically needs to carryout 4-6 expansion cycles. Therefore, this “cell-in-a-bottle” concept appears to have considerably more risk than originally believed. Additionally, Galipeau et al published a landmark paper in 2012 demonstrating that cryopreserved MSCs display a loss of immunosuppression (their main benefit) compared to fresh MSC cells - thus, cryopreserved “cells in a bottle” may have challenges meeting their primary efficacy endpoints without some additional process steps immediately prior to injection to overcome the negative impact of the heat shock protein up regulation due to cryopreservation. These two stability concerns demonstrate challenges that allogeneic cells face in gaining regulatory approval in any conditions which are non-life threatening (no-option). TotipotentRX believes even under the most stringent controls these manipulation steps may have a functional impact on cells, a manifestation that could present itself early in the development path or later after extensive clinical trial investment. Our approach has been to eliminate as many variables and handling steps as possible in producing the cellular product through rapid (60min) intraoperative automation assisted bedside protocols. By providing fresh cells that have only been subjected to short-term ex vivo exposure TotipotentRX believes it maximizes the potency while minimizing the complexity (risk) of the cell treatment process.

Bone Marrow As A Cell Source. Bone marrow has long been studied and has repeatedly demonstrated its direct involvement in the regenerative process in humans and animals. Though initially associated only with hematopoiesis (creation and maintenance of the blood system), bone marrow has been shown not only to contain and produce vascular and bone progenitor cells (endothelial, osteoblasts, mesenchymal cells) but also actively release these cells from the bone marrow interior into the blood stream in response to acute injuries such as a cardiovascular ischemic event. This natural healing process provides a highly logical approach to exploit and to build a therapeutic platform as designed by TotipotentRX in the TotiCell technology.

16

Experienced Cell Therapy Development Company. TotipotentRX has been developing point of care cell therapies for over six years and as a result we believe our experience in testing and commercializing combination products (devices/biologic therapeutics) and translating protocols into a point of care environment is unmatched in this space. TotipotentRX believes it is likely the only company providing a front to back systemized process from collection of the cells to controlled delivery with time tested medical device technologies - all with extreme attention to the surgeon’s requirements and today’s evolving surgical environment.

TotipotentRX’s approach maximizes simplicity to avoid the inherent pitfalls of complex product systems; use the body’s own cells and cellular factors in a therapeutically viable dose without significant manipulation and delivers them to the required target in minutes versus days or weeks. With this approach TotipotentRX believes it is optimally positioned in the market to provide large patient populations access to safe, effective and economically curative treatments.

Collaborations

TotipotentRX applies great value to effective partnerships; both for clinical development and corporate commercial goals, often these are combined for the collective benefit of all stakeholders. A testament to this are ongoing collaborations with many orthopedic and vascular surgeons, and interventional cardiologists through TotipotentRX’s global reach. Though TotipotentRX cannot provide a complete list of its dedicated collaborators TotipotentRX can name those involved in projects that have graduated to the next level of clinical development:

(1) Prof. (Dr.) Sheila Kar, M.D. Dr. Kar is the past Chief of Cardiology at Cedars Sinai Medical Center in Los Angeles, and Assistant Clinical Professor of Medicine at the University of California, Los Angeles. Project Involvement: AMI Study.

(2) Dr. Ashok Seth, M.D. Dr. Seth is currently the Chairman and Head of Cardiology at Fortis Escorts in New Delhi. Dr. Seth has contributed extensively to the growth, development and scientific progress of Cardiology especially Interventional Cardiology in India and across the world. Project Involvement: AMI / CLI Studies.

(3) Dr. Harsha Hegde, M.B.B.S., M.S., Dr. Hegde, previously the Head of Orthopedics for the Fortis Hospital Group in New Delhi, and presently Director of Orthopedics at Nova Healthcare (a Goldman Sachs backed Indian hospital chain). Dr. Hedge is ranked as one of the top five spinal surgeons in Asia, and currently leads the orthopedic stem cell program with TotipotentRX. Project involvement: Spinal Fusion.

In response to TotipotentRX’s clinical translation and commercialization interests, in 2010, TotipotentRX signed a five (5) plus a one (1) year extension exclusive partnership with Fortis Healthcare Limited, the largest hospital and clinical conglomerate in Asia. In essence, TotipotentRX’s corporate partnership with Fortis provides it with access to the following unparalleled market advantages:

| 1. | World Class Facilities and Equipment |

| · | Daily exposure to the administrative and working structure within the healthcare network provides meaningful intelligence on product and service design in order to exceed the expectation of the clinical customers, patients, regulators and payer companies by providing solutions which speak to a completely optimized economically delivered cell treatment approach. |

17

| · | Fortis Healthcare also prides itself on staying at the forefront of medical technologies, where TotipotentRX is given access to the latest diagnostic and imaging systems, a necessity for high quality clinical data collection. |

| · | Fortis Healthcare is an accredited clinical research organization, with its centralized ethics oversight committee approved by the Indian Drugs Controller General. Additionally, its Escorts operations which houses the central ethics oversight committee holds accreditation from the Joint Commission International, the accrediting body for hospitals in the U.S. and abroad. Currently, Fortis participates in more than 100 international clinical trials. |

| 2. | Access to Patients and Internationally Trained Physicians |

| · | 72 Hospitals (6 countries), 10,000 inpatient beds comprising a hospital group twice the size as Kaiser Permanente, with access to economic, clinical, and epidemiological statistics from a database built on 15,000 patients entering Fortis’ facilities every day. |

| · | Diverse and numerous patient populations meeting our study inclusion requirements thus reducing trial related risks particularly with patient selection and adequate enrollment within aggressive timelines. |

| · | The Fortis Hospital brand attracts world class internationally trained and recognized physicians, a critical component of our clinical strategy. |

| 3. | Hospital Embedded Contract Research Organization. |

| · | TotipotentRX’s in-house CRO, benefits from the facilities, technology, patient and physician access in this exclusive relationship with Fortis Healthcare. The combined benefit of this unique advantage is highly controlled studies produced more quickly and economically than TotipotentRX’s competitors. |

In addition to physician and hospital-focused partnerships, TotipotentRX has also invested heavily into the essential devices integral to our combination products. Though several of these partnerships remain confidential they are built upon gaining the unique positioning for the following:

| 1. | The requirement for unique, proprietary and portable device technology critical to the production of rapid cellular transplants. Our mobile manufacturing requires unique instruments, disposable devices and reagents from collection through patient delivery. |

| 2. | The requirement for rapid commercialization (therapeutic market access). TotipotentRX recognizes the regulatory, market penetration and competitive challenges in the industry and has taken definitive steps which mitigate our risks by utilizing partnerships having particular expertise in their technology area. |

Research and Development

TotipotentRX’s current technology has been in development since 2009 through low cost investigator-initiated, or TotipotentRX sponsored, or co-sponsored studies with corporate partners such as ThermoGenesis. By leveraging these development models we have achieved our clinical data generation goals by conducting trials in lower cost world class facilities with a direct investment exceeding $2 million. We estimated this approach has saved our company and shareholders an estimated $12 million to date (due to our in-house CRO and the intelligent use of our foreign facilities and partnerships) as compared to a similar clinical investment funded in the U.S. During this period, having completed ten pilot/phase 1 studies, TotipotentRX has selected 3 indications for immediate investment including AMI, CLI, and Bone Regeneration in either spinal fusion or avascular necrosis as previously detailed in the therapeutic candidates section above. Upon commencement of the next round of clinical studies, TotipotentRX will be assessing its capacity to expand beyond its current targets by considering Phase 1b trials in ischemic stroke, non-healing dermal ulcers and osteoarthritis.

18

Infrastructure, Licenses & Certifications

Collectively, TotipotentRX currently operates four global locations, three in India and one in Los Angeles, California. In India, TotipotentRX has designed and built two specialized facilities specifically catering to the needs of the cell therapy market and a third facility housing administrative activities for the Asia region. In total, the facilities in India cover approximately 12,000 square feet of space.

TotipotentRX Centre for Cellular Medicine (Fortis Collaboration) is located within the newly opened Fortis Memorial Research Institute (FMRI), which is the flagship hospital of Fortis Healthcare, a group comprised of more than 72 primary and tertiary care facilities. TotipotentRX is located within the Oncology wing of FMRI and enjoys exclusive rights in providing all cellular therapies/services through this collaboration. TotipotentRX’s unique facility (details below) was designed to maximize our ability to advance our stem cell clinical development goals as well as provide immediate commercial services to the Fortis Healthcare network.

Cellular Medicine Facility

Location: Gurgaon (New Delhi N.C.R.), India inside FMRI

Major Certifications/Registrations: U.S. FDA Registered; GLP/GMP/GCP and ISO 9001 Certified from the British Standards Institute (BSI); Cord Blood Banking License from the Drug Controller of India

| 1. | Class 10,000 Cell Manufacturing & Cell Expansion Suites |

| 2. | Dedicated Cord Blood & Tissue Banking Suites |

| 3. | Clinical Diagnostic, Research Analytical Instrumentation, and Cryopreservation Facilities |

| 4. | Contract Research Organization |

| 5. | Research & Development Laboratory |

Located within 5 miles of our Cellular Medicine Facility TotipotentRX leases a property custom designed by TotipotentRX to house capabilities for proprietary medical device design and GMP production. Understanding the unique needs of the regenerative medicine market, we believe that the ability to create customized kits and device solutions “in-house” is a necessity to support our internal clinical goals as well as support a growing market.

Device Manufacturing Facility

Location: Gurgaon (New Delhi N.C.R.), India

Major Certifications: ISO 13485 (BSI)

| 1. | Class 10,000 Clean Rooms and requisite functional facilities for quality, regulatory, manufacturing, logistics etc. |

| 2. | Sterile Product Capabilities: Non-Drug Liquid Filling and Medical Device Assembly/Tailing |

| 3. | Non-Sterile Capabilities: Medical Convenience Kit production |

Intellectual Property

TotipotentRX believes that patent protection is important for products and methods to maintain a proprietary position. In the U.S., TotipotentRX currently has four provisional patents pending (submitted to the USPTO) and two additional methods (in patent drafting mode) to protect the methods and or designs of products, which TotipotentRX intends to market. In addition, TotipotentRX has service marks for certain products and services.

19

Intellectual Property Summary (Patent and Publication List)

| 1. | Sanghi, V, et al. (2013) Clinical Case Report: Safety Study of Autologous Bone Marrow Concentrate Enriched in Progenitor Cells (BMCEPC) as an Adjuvant in the Treatment of Acute Myocardial Infarction (Manuscript under preparation) |

| 2. | Bukhari S, et al. (2013) Safety and Efficacy of Autologous Bone Marrow Mononuclear Cells in Patients With Severe Critical Limb Ischemia (Manuscript under preparation) |

| 3. | Ponemone V, et al. (2012) Intrathecal administration of autologous bone marrow cells with 10.0% hematocrit – RBCs are clinically safe, Annual ISCT Meeting, Poster 116, Seattle, WA |

| 4. | Ponemone V, et al. (2012) Autologous bone marrow derived stem cell graft facilitates remodeling of non union fractures, Annual ISCT Meeting, Poster 191, Seattle, W A |

Pending Patent Applications

| 1. | PCT/US2014/010745 – Rapid Infusion of Autologous Bone Marrow Derived Stem Cells |

Employees

As of November 30, 2013, TotipotentRX had 46 employees, 14 of whom were engaged in manufacturing, providing cell-based services, procurement and quality control, 9 in research and new product development, and 23 in sales, marketing and administration. None of its employees are represented by a collective bargaining agreement, nor has it experienced any work stoppage.

Facilities

Collectively, TotipotentRX currently operates four global locations, three in India and one in Los Angeles, California. In India, TotipotentRX has designed and built two specialized facilities specifically catering to the needs of the cell therapy market and a third facility housing administrative activities for the Asia region. In total, the facilities in India cover approximately 12,000 square feet of space.

Legal Proceedings

TotipotentRX is not a party to nor is any of its property subject to any pending legal proceedings. In the normal course of operations, TotipotentRX may have disagreements or disputes with employees, vendors or customers. These disputes are seen by TotipotentRX’s management as a normal part of business, and there are no currently pending actions or threatened actions that management believes would have a significant material impact on TotipotentRX’s financial position.

Market for TotipotentRX’s Common Stock and Dividend Matters

TotipotentRX’s common stock is not traded on any exchange or quoted on any automated quotation system. As of February 18, 2014, there were approximately 13 stockholders of record. TotipotentRX has not paid cash dividends on its common stock.

20

TotipotentRX Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

CERTAIN STATEMENTS CONTAINED IN THIS SECTION AND OTHER PARTS OF THIS DOCUMENT WHICH ARE NOT HISTORICAL FACTS ARE FORWARD-LOOKING STATEMENTS AND ARE SUBJECT TO CERTAIN RISKS AND UNCERTAINTIES. TOTIPOTENTRX’S ACTUAL RESULTS MAY DIFFER SIGNIFICANTLY FROM THOSE RESULTS.

The following discussion should be read in conjunction with TotipotentRX’s consolidated financial statements.

Overview

TotipotentRX Corporation is engaged in the research, development, and commercialization of cell-based services, therapeutics and devices for use in regenerative medicine. TotipotentRX is focused on four companion competencies to serve patients, physicians and partners: Therapeutic, Contract Clinical Trial Services, Cell Manufacturing and Banking and Medical Device Development and Commercialization. TotipotentRX sells medical devices and equipment for collection, transportation, and processing of cord blood, cord tissue, bone marrow, and peripheral blood; reagents for culturing and assaying stem cells; and services to hospital and surgeons for processing autologous cellular therapies at the point of care.

On July 2, 2013, TotipotentRX merged with and into MK Alliance which existed as the surviving company and subsequently changed its name to TotipotentRX. Prior to the merger, TotipotentRX was a 77.0% owned subsidiary of MK Alliance.

Research and Development Activities

Over the last five years TotipotentRX has invested approximately $2,000,000 in research and development activities associated with conducting clinical trials and introducing new products in the regenerative medicine market. In addition to research and development costs of $197,000 disclosed in Footnote 1 of the Financial Statements of TotipotentRX, TotipotentRX also incurred other costs associated with conducting clinical trials including capital expenditures and executive time to design and manage clinical trials.

Critical Accounting Policies

TotipotentRX’s discussion and analysis of its financial condition and results of operations are based upon TotipotentRX’s consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the U.S. The preparation of these consolidated financial statements requires TotipotentRX to make estimates and judgments that affect reported amounts of assets, liabilities, revenues and expenses and related disclosure of contingent assets and liabilities. TotipotentRX bases its estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

TotipotentRX believes the following critical accounting policies affect its more significant judgments and estimates used in the preparation of its consolidated financial statements.

Revenue Recognition

Revenues from the sale of TotipotentRX’s products and services are recognized when persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the price is fixed or determinable, and collectability is reasonably assured. Amounts billed in excess of revenue recognized are recorded as deferred revenue on the balance sheet.

21

Revenue arrangements with multiple delivered are divided into units of accounting if certain criteria are met, including whether the delivered item(s) has value to the customer on a stand-alone basis. Revenue for each unit of accounting is recognized as the unit of accounting is delivered. Arrangement consideration is allocated to each unit of accounting based upon the relative fair value determined from third-party evidence of the separate units of accounting. TotipotentRX accounts for collection, processing and testing of the umbilical cord blood and the storage as separate units of accounting. Revenue generated from storage contracts is deferred and recorded ratably over the life of the agreement, up to 21 years.

Inventory Reserves

TotipotentRX states inventories at lower of cost or market value determined on a first-in, first-out basis. TotipotentRX provides inventory allowances when conditions indicate that the selling price could be less than cost due to physical deterioration, obsolescence, changes in price levels, or other causes, which it includes as a component of cost of revenues. Additionally, TotipotentRX provides reserves for excess and slow-moving inventory on hand that are not expected to be sold to reduce the carrying amount of slow-moving inventory to its estimated net realizable value. The reserves are based upon estimates about future demand from our customers and distributors and market conditions. Because some of TotipotentRX products are highly dependent on current customer use and validation, and completion of regulatory and field trials, there is a risk that we will forecast incorrectly and purchase or produce excess inventories. As a result, actual demand may differ from forecasts and TotipotentRX may be required to record additional inventory reserves that could adversely impact the gross margins. Conversely, favorable changes in demand could result in higher gross margins when products previously reserved are sold.

Shipping and handling fees billed to customers are included in net revenues, while the related costs are included in cost of goods sold.

Allowance for Doubtful Accounts

TotipotentRX evaluates the collectability of accounts receivable and determines the appropriate reserve for doubtful accounts based on a combination of factors. TotipotentRX writes off uncollectible accounts receivable based upon specific criteria, including when internal and/or external efforts to collect the amounts are unsuccessful, whether a customer has accounts past due over a specified period of time, and whether a customer has filed for or has been placed in bankruptcy. Allowances are recorded for all other receivables based on analysis of historical trends of write-offs and recoveries. In addition, in circumstances where we are aware of a specific customer’s inability to meet its financial obligation, a specific allowance for doubtful accounts is recorded to reduce the receivable to the net amount reasonably expected to be collected. Our judgment is required as to the impact of certain of these items and other factors as to ultimate realization of our accounts receivable. If the financial condition of our customers were to deteriorate, additional allowances may be required.

Stock-Based Compensation

TotipotentRX measures compensation expense for all share-based awards at fair value on the date of grant and recognizes compensation expense over the service period for awards expected to vest. TotipotentRX uses the Black-Scholes option-pricing model to determine the fair-value for awards and recognizes compensation expense on a straight-line basis over the awards’ vesting periods. Management has determined the Black-Scholes fair value of stock option awards and related share-based compensation expense with the assistance of third-party valuation specialists. Determining the fair value of stock options at the grant date requires the use of highly subjective assumptions, including the expected term of the option and the expected volatility of TotipotentRX’s stock price. The determination of the grant date fair value of options using an option-pricing model is affected by TotipotentRX’s estimated common stock fair value as well as assumptions regarding a number of other complex and subjective variables. In valuing the options, management makes assumptions about risk-free interest rates, dividend yields, volatility, and weighted-average expected lives, of the options.

22

Risk-free rate. Risk-free interest rates are derived from U.S. Treasury securities as of the option grant date.

Expected dividend yields. Expected dividend yields are based on TotipotentRX’s historical dividend payments, which have been zero to date.

Volatility. Absent a public market for its shares, TotipotentRX estimated volatility of its share price based on the volatilities of industry peers in the regenerative medicine space in which

TotipotentRX operates.

Expected term. TotipotentRX estimates the weighted-average expected life of options as the average of the vesting option schedule and the term of the award, which is known as the simplified method, since, due to the limited period of time share-based awards have been exercisable, TotipotentRX does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate the expected term.

Forfeiture rate. As the majority of the stock options granted were immediately vested, a 0% forfeiture rate was used.

Income Taxes

We account for income taxes using the asset and liability method, under which we recognize deferred tax assets and liabilities for the future tax consequences attributable to temporary differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and for net operating loss and tax credit carryforwards. Tax positions that meet a more-likely-than-not recognition threshold are recognized in the first reporting period that it becomes more-likely-than-not such tax position will be sustained upon examination. We record potential accrued interest and penalties related to unrecognized tax benefits in income tax expense.

As a multinational corporation, we are subject to complex tax laws and regulations in various jurisdictions. The application of tax laws and regulations is subject to legal and factual interpretation, judgment, and uncertainty. Tax laws themselves are subject to change as a result of changes in fiscal policy, changes in legislation, evolution of regulations and court rulings. Therefore, the actual liability for U.S. or foreign taxes may be materially different from our estimates, which could result in the need to record additional liabilities or potentially to reverse previously recorded tax liabilities.

Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the period that includes the enactment date. A valuation allowance is recorded against any deferred tax assets when, in the judgment of management, it is more likely than not that all of or part of a deferred tax asset will not be realized. In assessing the need for a valuation allowance, we consider all positive and negative evidence, including recent financial performance, scheduled reversals of temporary differences, projected future taxable income, availability of taxable income in carryback periods and tax planning strategies. Based on a review of such information, we believe that insufficient positive evidence exists to support that we will more likely than not be able to realize the majority of our foreign and U.S. federal and state deferred tax assets. Therefore, we have recorded a valuation allowance against our deferred tax assets to the extent that they are not expected to be recoverable against taxes previously paid in available carryback periods.

23

Results of Operations

The following is management’s discussion and analysis of certain significant factors which have affected TotipotentRX’s financial condition and results of operations during the periods included in the accompanying consolidated financial statements.

Results of Operations for the Nine Months ended September 30, 2013 as Compared to the Nine Months ended September 30, 2012

Net Revenues

Net revenues for the nine months ended September 30, 2013 were $1,130,000 compared to $791,000 for the nine months year ended September 30, 2012, an increase of $339,000 or 43%. The increase is primarily due a large cord blood banking customer that resumed placing regular orders in late calendar 2012, new cord blood banking customers and growth in the Company’s own cord blood banking program of $333,000.

Gross Profit

Gross profit was $301,000 or 27% of revenues for the nine months ended September 30, 2013, as compared to $275,000 or 35% of revenues for the nine months ended September 30, 2012. The increase in gross profit of $26,000 or 9% was primarily the result of increased revenue, partially offset by a change in the mix of products and services sold and an increase in contractual expenses associated with the Company’s own cord blood banking program. The decrease in the gross profit margin is due to an increase in cord blood banking revenues which have a lower gross profit margin than point of care revenues.

Selling, General and Administrative