Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Approach Resources Inc | d682365d8k.htm |

| EX-99.1 - EX-99.1 - Approach Resources Inc | d682365dex991.htm |

Fourth Quarter & Full-Year

2013 Results

FEBRUARY 24, 2014

Exhibit 99.3 |

Forward-looking statements

Fourth Quarter 2013 Results –

February 2014

2

This

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933

and

Section

21E

of

the

Securities

Exchange

Act

of

1934.

All

statements,

other

than

statements

of

historical

facts,

included

in

this

presentation

that

address

activities,

events

or

developments

that

the

Company

expects,

believes

or

anticipates

will

or

may

occur

in

the

future

are

forward-looking

statements.

Without

limiting

the

generality

of

the

foregoing,

forward-looking

statements

contained

in

this

presentation

specifically

include

the

expectations

of

management

regarding

plans,

strategies,

objectives,

anticipated

financial

and

operating

results

of

the

Company,

including

as

to

the

Company’s

Wolfcamp

shale

resource

play,

estimated

resource

potential

and

recoverability

of

the

oil

and

gas,

estimated

reserves

and

drilling

locations,

capital

expenditures,

typical

well

results

and

well

profiles,

type

curve,

and

production

and

operating

expenses

guidance

included

in

the

presentation.

These

statements

are

based

on

certain

assumptions

made

by

the

Company

based

on

management's

experience

and

technical

analyses,

current

conditions,

anticipated

future

developments

and

other

factors

believed

to

be

appropriate

and

believed

to

be

reasonable

by

management.

When

used

in

this

presentation,

the

words

“will,”

“potential,”

“believe,”

“intend,”

“expect,”

“may,”

“should,”

“anticipate,”

“could,”

“estimate,”

“plan,”

“predict,”

“project,”

“target,”

“profile,”

“model”

or

their

negatives,

other

similar

expressions

or

the

statements

that

include

those

words,

are

intended

to

identify

forward-looking

statements,

although

not

all

forward-looking

statements

contain

such

identifying

words.

Such

statements

are

subject

to

a

number

of

assumptions,

risks

and

uncertainties,

many

of

which

are

beyond

the

control

of

the

Company,

which

may

cause

actual

results

to

differ

materially

from

those

implied

or

expressed

by

the

forward-looking

statements.

In

particular,

careful

consideration

should

be

given

to

the

cautionary

statements

and

risk

factors

described

in

the

Company's

most

recent

Annual

Report

on

Form

10-K

and

Quarterly

Reports

on

Form

10-Q.

Any

forward-looking

statement

speaks

only

as

of

the

date

on

which

such

statement

is

made

and

the

Company

undertakes

no

obligation

to

correct

or

update

any

forward-looking

statement,

whether

as

a

result

of

new

information,

future

events

or

otherwise,

except

as

required

by

applicable

law.

The

Securities

and

Exchange

Commission

(“SEC”)

permits

oil

and

gas

companies,

in

their

filings

with

the

SEC,

to

disclose

only

proved,

probable

and

possible

reserves

that

meet

the

SEC’s

definitions

for

such

terms,

and

price

and

cost

sensitivities

for

such

reserves,

and

prohibits

disclosure

of

resources

that

do

not

constitute

such

reserves.

The

Company

uses

the

terms

“estimated

ultimate

recovery”

or

“EUR,”

reserve

or

resource

“potential,”

and

other

descriptions

of

volumes

of

reserves

potentially

recoverable

through

additional

drilling

or

recovery

techniques

that

the

SEC’s

rules

may

prohibit

the

Company

from

including

in

filings

with

the

SEC.

These

estimates

are

by

their

nature

more

speculative

than

estimates

of

proved,

probable

and

possible

reserves

and

accordingly

are

subject

to

substantially

greater

risk

of

being

actually

realized

by

the

Company.

EUR

estimates,

identified

drilling

locations

and

resource

potential

estimates

have

not

been

risked

by

the

Company.

Actual

locations

drilled

and

quantities

that

may

be

ultimately

recovered

from

the

Company’s

interest

may

differ

substantially

from

the

Company’s

estimates.

There

is

no

commitment

by

the

Company

to

drill

all

of

the

drilling

locations

that

have

been

attributed

these

quantities.

Factors

affecting

ultimate

recovery

include

the

scope

of

the

Company’s

ongoing

drilling

program,

which

will

be

directly

affected

by

the

availability

of

capital,

drilling

and

production

costs,

availability

of

drilling

and

completion

services

and

equipment,

drilling

results,

lease

expirations,

regulatory

approval

and

actual

drilling

results,

as

well

as

geological

and

mechanical

factors

Estimates

of

unproved

reserves,

type/decline

curves,

per

well

EUR

and

resource

potential

may

change

significantly

as

development

of

the

Company’s

oil

and

gas

assets

provides

additional

data.

Type/decline

curves,

estimated

EURs,

resource

potential,

recovery

factors

and

well

costs

represent

Company

estimates

based

on

evaluation

of

petrophysical

analysis,

core

data

and

well

logs,

well

performance

from

limited

drilling

and

recompletion

results

and

seismic

data,

and

have

not

been

reviewed

by

independent

engineers.

These

are

presented

as

hypothetical

recoveries

if

assumptions

and

estimates

regarding

recoverable

hydrocarbons,

recovery

factors

and

costs

prove

correct.

The

Company

has

very

limited

production

experience

with

these

projects,

and

accordingly,

such

estimates

may

change

significantly

as

results

from

more

wells

are

evaluated.

Estimates

of

resource

potential

and

EURs

do

not

constitute

reserves,

but

constitute

estimates

of

contingent

resources

which

the

SEC

has

determined

are

too

speculative

to

include

in

SEC

filings.

Unless

otherwise

noted,

IRR estimates

are

before

taxes

and

assume

NYMEX

forward-curve

oil

and

gas

pricing

and

Company-generated

EUR

and

decline

curve

estimates

based

on

Company

drilling

and completion

cost

estimates

that

do

not

include

land,

seismic

or

G&A

costs.

Cautionary statements regarding oil & gas quantities

|

Company overview

AREX OVERVIEW

ASSET OVERVIEW

Enterprise value $1 BN

High-quality reserve base

115 MMBoe proved reserves

$1.1 BN proved PV-10

99% Permian Basin

Permian core operating area

163,000 gross (146,000 net) acres

~1+ BnBoe gross, unrisked resource potential

~2,000+ Identified HZ drilling locations targeting

Wolfcamp A/B/C

2014 Capital program of $400 MM

Running 3 HZ rigs in the Wolfcamp shale play to

drill 70 wells during 2014

Notes:

Proved

reserves

and

acreage

as

of

12/31/2013.

All

Boe

and

Mcfe

calculations

are

based

on

a

6

to

1

conversion

ratio.

Enterprise

value

is

equal

to

market

capitalization

using

the

closing

share

price

of

$20.65

per

share

on

2/21/2014,

plus

net

debt

as

of

12/31/2013.

See

“PV-10

(unaudited)”

slide.

3

Fourth Quarter 2013 Results –

February 2014 |

Key investment highlights

Fourth Quarter 2013 Results –

February 2014

4

Low-Risk, Oil-Rich Asset Base

Oil and liquids-weighted asset base in Midland Basin

•

163,000 gross (146,000 net) primarily contiguous acres

•

Proved reserves are 69% liquids; 4Q13 production is 72% liquids

(46% oil)

High Degree of Operational Control

Operate 100% reserve base with ~ 100% working interest

Track Record of Growth at Competitive Cost

Reserve and production CAGR since 2004 of 31% and 34%, respectively

Low-cost operator with competitive F&D and low lifting costs

•

2013 Drill bit F&D cost $10.63/Boe

•

4Q13 Lease operating expense of $5.19/Boe vs. $7.29/Boe (4Q12)

Strong Financial Position

Liquidity of $408 MM

Active hedging program

Accelerating Development, Reducing Well Costs

2014 Production growth target 40%

•

Drilling 55%+ more HZ wells with 3 rig program

Development D&C cost of $5.5 MM, working on further cost reductions

Note:

Estimated

acreage

and

proved

reserves

as

of

12/31/2013.

See

“Drill-bit

F&D

cost

(unaudited)”

and

“Strong,

simple

balance

sheet”

slides. |

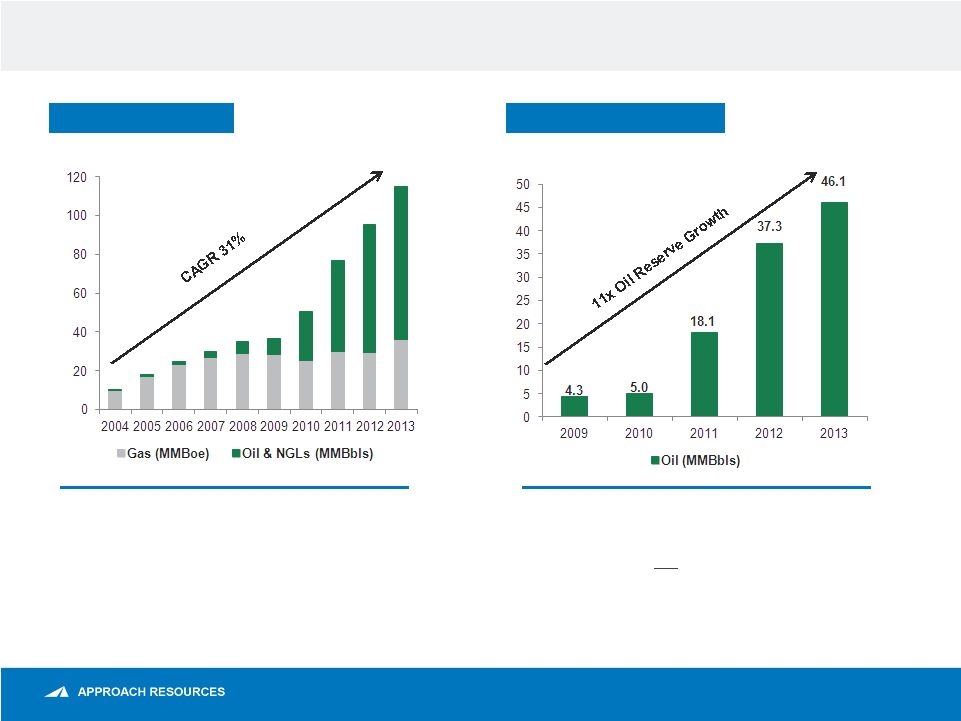

Strong track record of reserve growth

Fourth Quarter 2013 Results –

February 2014

5

RESERVE GROWTH

OIL RESERVE GROWTH

•

YE13 reserves up 20% YoY

•

Replaced 776% of reserves at a drill-bit F&D

cost of $10.63/Boe

•

81.6 MMBoe proved reserves booked to HZ

Wolfcamp play

•

Strong, organic oil reserve growth driven by

HZ Wolfcamp shale

•

Oil reserves up 11x

since YE09

•

Oil reserves up 24% YoY

Note:

See

“Drill-bit

F&D

cost

(unaudited)”

slide.

MMBoe

MMBbls |

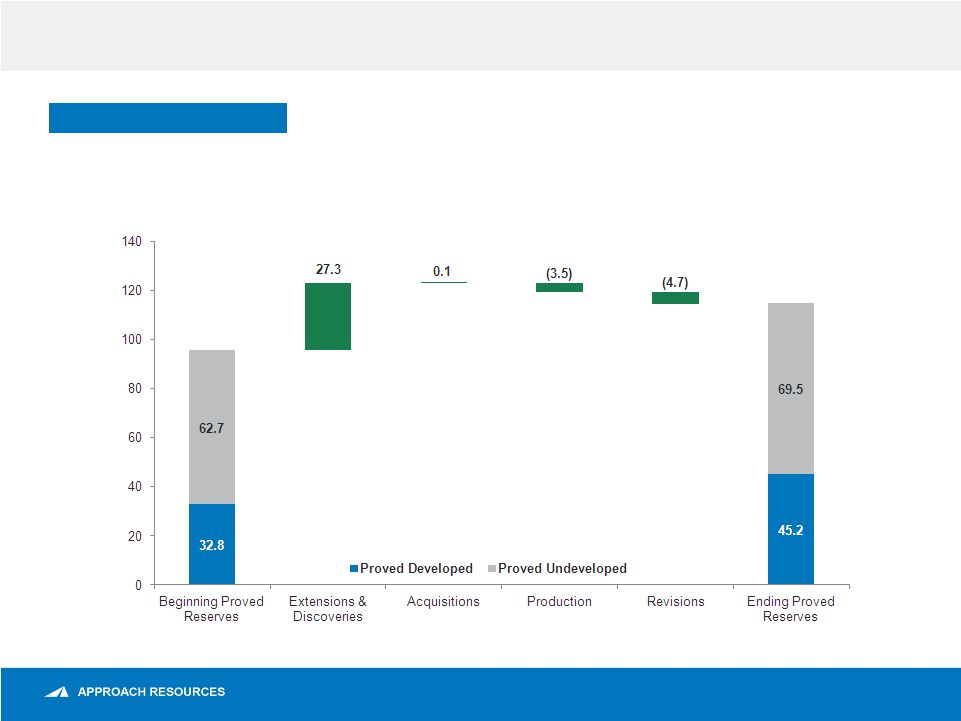

Proved reserves walk-forward

Fourth

Quarter

2013

Results

–

February

2014

6

YE13 PROVED RESERVES

•

Proved reserves increase 20% YoY

•

HZ Wolfcamp proved reserves increase 52% YoY

•

Proportion of proved developed reserves increased to 39%, up from 34% at YE12

95.5

114.7

MMBoe |

Strong track record of production growth

Fourth Quarter 2013 Results –

February 2014

7

PRODUCTION GROWTH

OIL PRODUCTION GROWTH

•

2013 Production increased 19% YoY

•

Targeting 40% production growth in 2014

4,790 MBoe in 2014

2014E Production mix ~44.5% oil (72.5% total

liquids), based on midpoint of guidance

•

Strong, organic oil production growth driven

by HZ Wolfcamp shale

•

Oil production up 7x

since FY09

•

Oil production up 49% YoY

MBbls

MBoe/d |

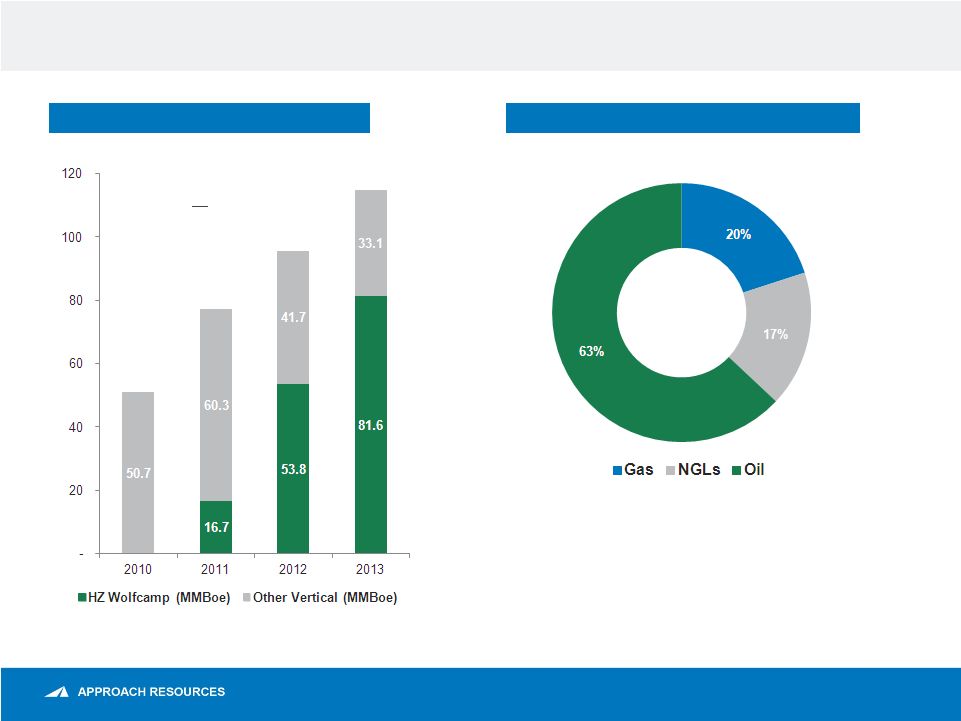

HZ

Wolfcamp proved reserves up 5x

since 2011

Horizontal Wolfcamp reserve growth driving oil production growth

Fourth Quarter 2013 Results –

February 2014

8

HZ WOLFCAMP RESERVE GROWTH

FY13 HZ WOLFCAMP PRODUCTION MIX

114.7

95.5

77.0

Began drilling

HZ Wolfcamp

MMBoe |

4Q13 Operational Update |

4Q13 Operating highlights

OPERATING HIGHLIGHTS

Driving Down

Costs

•

LOE of $5.19/Boe (down 29% YoY)

•

Oil differential of $(6.09)/Bbl (improved 38% YoY)

Delivering

Strong Well

Results &

Advancing

Delineation

•

4Q13 HZ Wolfcamp average IP 766 Boe/d

•

Transitioned Wolfcamp C to development mode and advanced understanding of

stacked wellbore development

•

Stacked Wolfcamp C in central Pangea IPs at 970 Boe/d (offsetting Wolfcamp B

wells with an average IP of 886 Boe/d)

•

HZ well results continue to track at or above type curve

Accelerating

Development

•

Completed 14 HZ

wells

•

Total production 11.3 MBoe/d (exceeded guidance)

•

4Q13 production 46% oil (up 59% YoY and 51% QoQ)

•

2014 production growth target 40%, made up of 43%-46%

oil Fourth Quarter 2013 Results –

February 2014

10 |

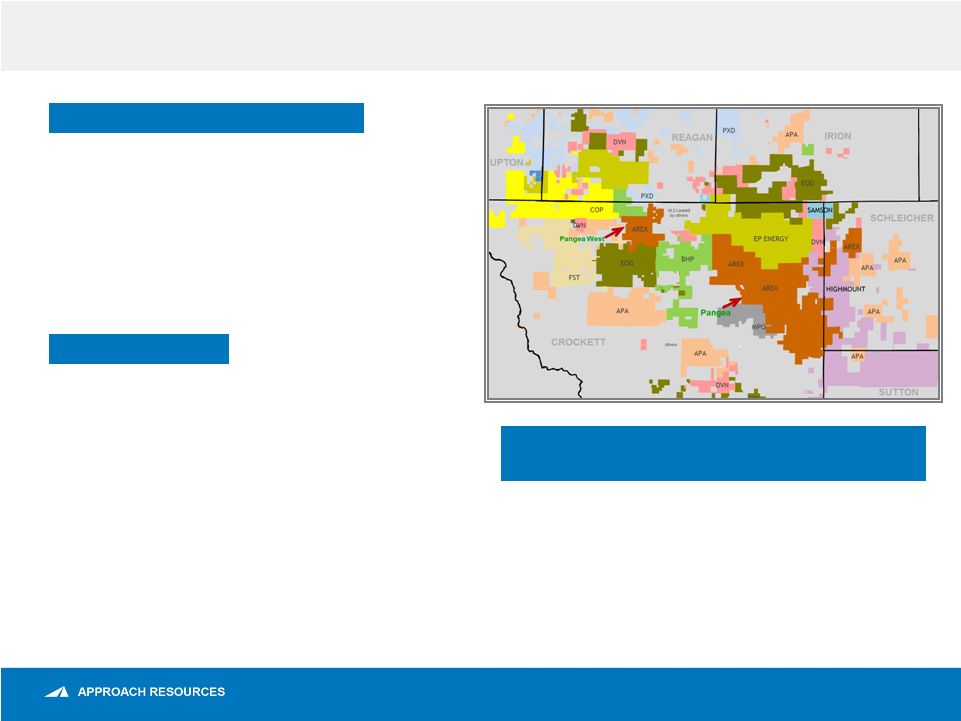

AREX Wolfcamp shale oil resource play

Fourth Quarter 2013 Results –

February 2014

11

PERMIAN CORE OPERATING AREA

Large, primarily contiguous acreage position

Oil-rich, multiple pay zones

163,000 gross (146,000 net) acres

Low acreage cost ~$500 per acre

~2,000 Identified HZ Wolfcamp locations

Large, primarily contiguous acreage

position with oil-rich, multiple pay zones

2014

OPERATIONS

Plan to drill ~70 HZ wells with 3 rigs

~ 1BnBoe gross, unrisked HZ Wolfcamp

resource potential

Field infrastructure systems contributing to lower

LOE/Boe and HZ D&C costs

Compressing spud-to-sales times

Focusing activity around field infrastructure systems

Testing “stacked-wellbore”

development and

optimizing well spacing and completion design

Decreasing well costs and increasing efficiencies |

AREX Wolfcamp activity

Fourth Quarter 2013 Results –

February 2014

12

NORTH &

CENTRAL PANGEA

SOUTH PANGEA

PANGEA WEST

Note: Acreage as of 12/31/2013.

•

19,000 gross acres

•

Pad drilling with AB and AC “stacked”

wellbores

Schleicher

Crockett

Irion

Reagan

•

55,000 gross acres

•

Continuing completion

design improvement

•

89,000 gross acres

•

Pad drilling with AB, AC, and BC “stacked”

wellbores

Sutton

Legend

Vertical Producer

¦

HZ Producer

¦

HZ –

Waiting on Completion

¦

HZ –

Drilling |

AREX HZ Wolfcamp Well Performance

13

AREX HZ WOLFCAMP (BOE/D)

Fourth Quarter 2013 Results –

February 2014

Note: Daily production normalized for operational downtime.

Production Data from AREX

A Bench Wells (8)

450 MBoe Type Curve

Wolfcamp Shale Oil

Production Data from AREX

B Bench Wells (56)

Production Data from AREX C

Bench Wells (2) |

AREX HZ Wolfcamp economics

14

Notes: Identified locations based on multi-bench development and 120-acre

spacing for HZ Wolfcamp. No locations assigned to south Project Pangea.

HZ

Wolfcamp

economics

assume

NYMEX

–

Henry

Hub

strip

and

NGL

price

based

on

40%

of

WTI.

Play Type

Horizontal

Wolfcamp

Avg. EUR (gross)

450 MBoe

Targeted Well Cost

$5.5 MM

Potential Locations

~2,000

Gross Resource

Potential

~1 Bn

Boe

BTAX IRR SENSITIVITIES

•

Horizontal drilling improves recoveries and

returns

•

Targeting Wolfcamp A / B / C

•

7,000’+ lateral length

•

~80% of EUR made up of oil and NGLs

Fourth Quarter 2013 Results –

February 2014 |

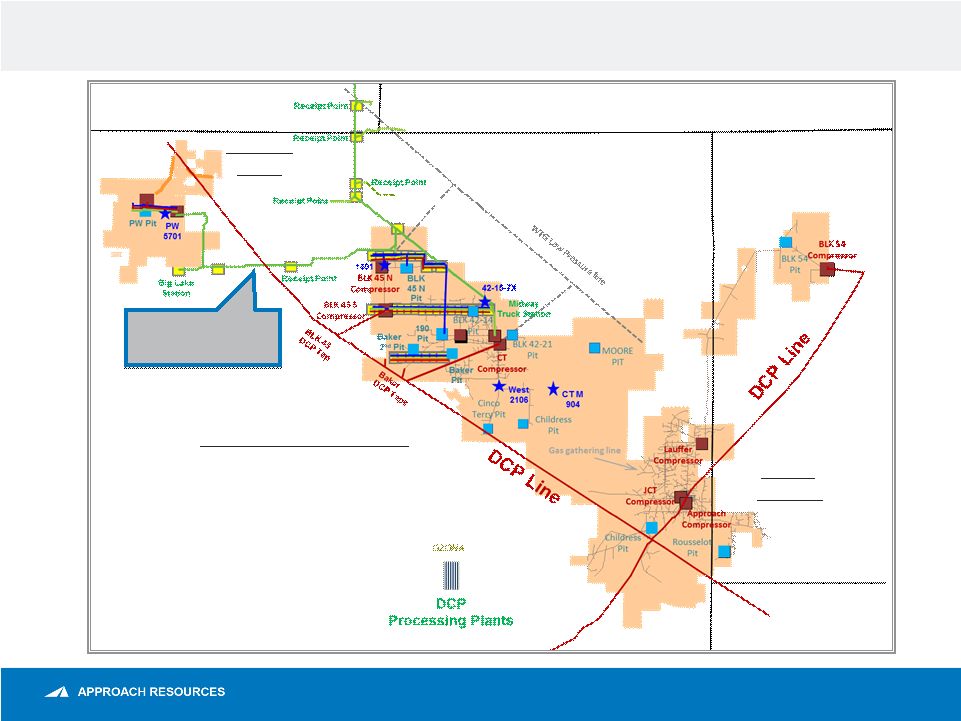

Infrastructure for large-scale development

Fourth Quarter 2013 Results –

February 2014

15

•

Reducing D&C cost

•

Reducing LOE

•

Increasing project profit margin

•

Minimizing truck traffic and surface

disturbance

Pangea

West

North & Central Pangea

South

Pangea

Schleicher

Crockett

Irion

Reagan

Sutton

50-Mile Oil Pipeline

100,000 Bbls/d

Capacity |

Key field infrastructure & equipment systems

Fourth Quarter 2013 Results –

February 2014

16

•

Safely and securely transport water across Project Pangea and Pangea West

•

Reduce time and money spent on water hauling and disposal and also reduces

truck traffic

•

Replace rental equipment and contractors with Company-owned and operated

equipment and personnel; reduce money spent on flowback operations

•

Facilitate large-scale field development

•

Reduce fresh water use and water costs

Water transfer equipment

SWD wells

Gas lift system and flowback

equipment

Non-potable water source wells

Water recycling systems

BENEFITS

Infrastructure and equipment systems are key to large-scale field development

and to reducing D&C costs and LOE/Boe cost

INFRASTRUCTURE

•

First-mover oil pipeline system in the southern Midland Basin

•

50-mile pipeline with 100 MBoe/d throughput capacity

•

Sold in October 2013 for 6x ROI

•

Maintain competitive oil transportation fee and firm takeaway

Oil pipeline and marketing

agreements |

4Q13 Financial update |

4Q13 Financial highlights

FINANCIAL HIGHLIGHTS

Significant Cash

Flow

•

Record quarterly EBITDAX (non-GAAP) of $41.1 MM (up 99% YoY), or $1.05 per

diluted share (up 98% YoY)

•

Capital expenditures $74.9 MM

Strong Financial

Position

•

Liquidity

of

$408

MM

at

December

31

st

•

Undrawn borrowing base of $350 MM

•

26% Debt-to-capital ratio

Increasing

Revenues

•

Revenues of $58.6 MM (up 66% YoY)

•

Net income of $64.3 MM, or $1.65 per diluted share

•

Adjusted net income (non-GAAP) of $8 MM, or $0.20 per diluted share

Strong Balance Sheet and Liquidity to Develop

HZ Wolfcamp Shale

Note:

See

“Adjusted

Net

Income,”

“EBITDAX”

and

“Strong,

Simple

Balance

Sheet”

slides

in

appendix.

Fourth Quarter 2013 Results –

February 2014

18 |

•

Oil production growth, lower costs generating margin improvement

•

4Q13 Total cash costs $17.18/Boe (9% lower than 4Q12)

•

Unhedged cash margin $39.09/Boe (50% higher than 4Q12)

Cash margin improvement

Fourth Quarter 2013 Results –

February 2014

19

4Q13 UNHEDGED CASH MARGIN ($/BOE) |

Oil & liquids-weighted reserves, production & revenue

Fourth Quarter 2013 Results –

February 2014

20

YE13 RESERVE MIX

FY13 PRODUCTION MIX

FY14-E PRODUCTION MIX

FY13 REVENUE MIX

9.4

MBoe/d

13.1

MBoe/d

$181.3

MM

114.7

MMBoe

Based on midpoint of FY14 guidance. |

Strong, simple balance sheet

Fourth Quarter 2013 Results –

February 2014

21

FINANCIAL RESULTS ($MM)

As of

12/31/2013

Summary Balance Sheet

Cash

$58.8

Credit Facility

–

Senior Notes

250.0

Total Long-Term Debt

$250.0

Shareholders’

Equity

710.5

Total Book Capitalization

$960.5

Liquidity

Borrowing Base

$350.0

Cash and Cash Equivalents

58.7

Long-term Debt under Credit Facility

–

Undrawn Letters of Credit

(0.3)

Liquidity

$408.4

Key Metrics

LTM EBITDAX

$127.8

Total Reserves (MMBoe)

114.7

Proved Developed Reserves (MMBoe)

45.2

% Proved Developed

39%

% Liquids

69%

Credit Statistics

Net Debt

Total Debt

Debt / Capital

20%

26%

Debt / 4Q13 Annualized EBITDAX

1.2x

1.5x

Debt / Proved Reserves ($/Boe)

$1.67

$2.18 |

Current hedge position

Fourth Quarter 2013 Results –

February 2014

22

Commodity & Period

Contract Type

Volume

Contract Price

Crude Oil

January 2014 –

December 2014

Collar

550 Bbls/d

$90.00/Bbl -

$105.50/Bbl

January 2014 –

December 2014

Collar

950 Bbls/d

$85.05/Bbl -

$95.05/Bbl

January 2014 –

December 2014

Collar

2,000 Bbls/d

$89.00/Bbl -

$98.85/Bbl

April 2014 –

March 2015

Collar

1,500 Bbls/d

$85.00/Bbl -

$95.30/Bbl

January 2015 –

December 2015

Collar

2,600 Bbls/d

$84.00/Bbl -

$91.00/Bbl

Natural Gas Liquids

Propane

January 2014 –

December 2014

Swap

500 Bbls/d

$41.16/Bbl

Natural Gasoline

January 2014 –

December 2014

Swap

175 Bbls/d

$83.37/Bbl

Natural Gas

January 2014 –

December 2014

Swap

360,000 MMBtu/month

$4.18/MMBtu

February 2014 –

December 2014

Swap

35,000 MMBtu/month

$4.29/MMBtu

March 2014 –

December 2014

Swap

160,000 MMBtu/month

$4.40/MMBtu

September 2014 –

June 2015

Collar

80,000 MMBtu/month

$4.00/MMBtu -

$4.74/MMBtu

January 2015 –

December 2015

Swap

200,000 MMBtu/month

$4.10/MMBtu

January 2015 –

December 2015

Collar

130,000 MMBtu/month

$4.00/MMBtu -

$4.25/MMBtu |

Production and expense guidance

Fourth Quarter 2013 Results –

February 2014

23

2014 Guidance

Production

Total (MBoe)

4,790

Percent oil

43% -

46%

Percent total liquids

71% -

74%

Operating costs and expenses (per Boe)

Lease operating

$5.00 -

$6.00

Production and ad valorem taxes

7.25% of oil & gas revenues

Cash general and administrative

$4.50 -

$5.00

Exploration

$0.50 -

$1.00

Depletion, depreciation and amortization

$22.00 -

$24.00

Capital expenditures (in millions)

Approx. $400

Horizontal wells

70 |

Adjusted net income (unaudited)

Fourth Quarter 2013 Results –

February 2014

24

(in thousands, except per-share amounts)

Three Months Ended

December 31,

2013

2012

Net income (loss)

$

64,321

$

(837)

Adjustments for certain items:

Unrealized loss (gain) on commodity derivatives

1,348

(1,292)

Gain on sale of equity method investment

(90,743)

—

Related income tax effect

33,076

439

Adjusted net income (loss)

$

8,002

$

(1,690)

Adjusted net income (loss) per diluted share

$

0.20

$

(0.04)

The

amounts

included

in

the

calculation

of

adjusted

net

income

and

adjusted

net

income

per

diluted

share

below

were

computed

in

accordance

with

GAAP.

We

believe

adjusted

net

income

and

adjusted

net

income

per

diluted

share

are

useful

to

investors

because

they

provide

readers

with

a

more

meaningful

measure

of

our

profitability

before

recording

certain

items

whose

timing

or

amount

cannot

be

reasonably

determined.

However,

these

measures

are

provided

in

addition

to,

and

not

as

an

alternative

for,

and

should

be

read

in

conjunction

with,

the

information

contained

in

our

financial

statements

prepared

in

accordance

with

GAAP

(including

the

notes),

included

in

our

SEC

filings

and

posted

on our

website.

The

following

table

provides

a

reconciliation

of

adjusted

net

income

to

net

income

(loss)

for

the

three

months

ended

December

31,

2013

and

2012. |

EBITDAX (unaudited)

Fourth Quarter 2013 Results –

February 2014

25

We

define

EBITDAX

as

net

income

(loss),

plus

(1)

exploration

expense,

(2)

gain

on

the

sale

of

our

equity

method

investment,

(3)

depletion,

depreciation

and

amortization

expense,

(4)

share-based

compensation

expense,

(5)

unrealized

loss

(gain)

on

commodity

derivatives,

(6)

interest

expense

and

(7)

income

taxes.

EBITDAX

is

not

a

measure

of

net

income

or

cash

flow

as

determined

by

GAAP.

The

amounts

included

in

the

calculation

of

EBITDAX

were

computed

in

accordance

with

GAAP.

EBITDAX

is

presented

herein

and

reconciled

to

the

GAAP

measure

of

net

income

because

of

its

wide

acceptance

by

the

investment

community

as

a

financial

indicator

of

a

company's

ability

to

internally

fund

development

and

exploration

activities.

This

measure

is

provided

in

addition

to,

and

not

as

an

alternative

for,

and

should

be

read

in

conjunction

with,

the

information

contained

in

our

financial

statements

prepared

in

accordance

with

GAAP

(including

the

notes),

included

in

our

SEC

filings

and

posted

on

ourwebsite.

The

following

table

provides

a

reconciliation

of

EBITDAX

to

net

income

(loss)

for

the

three

months

ended

December

31,

2013

and

2012.

(in thousands, except per-share amounts)

Three Months Ended

December 31,

2013

2012

Net income (loss)

$

64,321

$

(837)

Exploration

228

2,131

Gain on sale of equity method investment

(90,743)

—

Depletion, depreciation and amortization

22,005

18,027

Share-based compensation

512

2,472

Unrealized loss (gain) on commodity derivatives

1,348

(1,292)

Interest expense, net

5,225

926

Income tax provision (benefit)

38,207

(781)

EBITDAX

$

41,103

$

20,646

EBITDAX per diluted share

$

1.05

$

0.53 |

F&D costs (unaudited)

Fourth Quarter 2013 Results –

February 2014

26

F&D Cost reconciliation

Cost summary (in thousands)

Property acquisition costs

Unproved properties

$

5,857

Proved properties

1,000

Exploration costs

2,238

Development costs

287,898

Total costs incurred

$

296,993

Reserves summary (MBoe)

Balance –

12/31/2012

95,479

Extensions & discoveries

27,282

Acquisition

109

Production (1)

(3,517)

Revisions to previous estimates

(4,692)

Balance –

12/31/2013

114,661

F&D cost ($/Boe)

All-in F&D cost

$

13.08

Drill-bit F&D cost

10.63

Reserve replacement ratio

Drill-bit

776%

All-in

finding

and

development

(“F&D”)

costs

are

calculated

by

dividing

the

sum

of

property

acquisition

costs,

exploration

costs

and

development

costs

for

the

year

by

the sum

of

reserve

extensions

and

discoveries,

purchases

of

minerals

in

place

and

total revisions

for

the

year.

Drill-bit

F&D

costs

are

calculated

by

dividing

the

sum

of

exploration

costs

and

development

costs

for

the

year

by

the

total

of

reserve

extensions

and

discoveries

for

the

year.

We

believe

that

providing

F&D

cost

is

useful

to

assist

in

an

evaluation

of

how

much

it

costs

the

Company,

on

a

per

Boe

basis,

to

add

proved

reserves.

However,

these

measures

are

provided

in

addition

to,

and

not

as

an

alternative

for,

and

should

be

read

in

conjunction

with,

the

information

contained

in

our

financial

statements

prepared

in

accordance

with

GAAP

(including

the

notes),

included

in

our

previous

SEC

filings

and

to

be

included

in

our

annual

report

on

Form

10-K

to

be

filed

with

the

SEC

on

or

before

March

3,

2014.

Due

to

various

factors,

including

timing

differences,

F&D

costs

do

not

necessarily

reflect

precisely

the

costs

associated

with

particular

reserves.

For

example,

exploration

costs

may

be

recorded

in

periods

before

the

periods

in

which

related

increases

in

reserves

are

recorded,

and

development

costs

may

be

recorded

in

periods

after

the

periods

in

which

related

increases

in

reserves

are

recorded.

In

addition,

changes

in

commodity

prices

can

affect

the

magnitude

of

recorded

increases

(or

decreases)

in

reserves

independent

of

the

related

costs

of

such

increases.

As

a

result

of

the

above

factors

and

various

factors

that

could

materially

affect

the

timing

and

amounts

of

future

increases

in

reserves

and

the

timing

and

amounts

of

future

costs,

including

factors

disclosed

in

our

filings

with

the

SEC,

we

cannot

assure

you

that

the

Company’s

future

F&D

costs

will

not

differ

materially

from

those

set

forth

above.

Further,

the

methods

used

by

us

to

calculate

F&D

costs

may

differ

significantly

from

methods

used

by

other

companies

to

compute

similar

measures.

As

a

result,

our

F&D

costs

may

not

be

comparable

to

similar

measures

provided

by

other

companies.

The

following

table

reconciles

our

estimated

F&D

costs

for

2013

to

the

information

required

by

paragraphs

11

and

21

of

ASC

932-235.

(1) Production includes 560 MMcf related to field fuel.

|

PV-10 (unaudited)

Fourth Quarter 2013 Results –

February 2014

27

The

present

value

of

our

proved

reserves,

discounted

at

10%

(“PV-10”),

was

estimated

at

$1.1

billion

at

December

31,

2013,

and

was

calculated

based

on

the

first-of-the-month,

twelve-month

average

prices

for

oil,

NGLs

and

gas,

of

$97.28

per

Bbl

of

oil,

$30.16

per

Bbl

of

NGLs

and

$3.66

per

MMBtu

of

natural

gas.

PV-10

is

our

estimate

of

the

present

value

of

future

net

revenues

from

proved

oil

and

gas

reserves

after

deducting

estimated

production

and

ad

valorem

taxes,

future

capital

costs

and

operating

expenses,

but

before

deducting

any

estimates

of

future

income

taxes.

The

estimated

future

net

revenues

are

discounted

at

an

annual

rate

of

10%

to

determine

their

“present

value.”

We

believe

PV-10

to

be

an

important

measure

for

evaluating

the

relative

significance

of

our

oil

and

gas

properties

and

that

the

presentation

of

the

non-GAAP

financial

measure

of

PV-10

provides

useful

information

to

investors

because

it

is

widely

used

by

professional

analysts

and

investors

in

evaluating

oil

and

gas

companies.

Because

there

are

many

unique

factors

that

can

impact

an

individual

company

when

estimating

the

amount

of

future

income

taxes

to

be

paid,

we

believe

the

use

of

a

pre-tax

measure

is

valuable

for

evaluating

the

Company.

We

believe

that

PV-10

is

a

financial

measure

routinely

used

and

calculated

similarly

by

other

companies

in

the

oil

and

gas

industry.

The

following

table

reconciles

PV-10

to

our

standardized

measure

of

discounted

future

net

cash

flows,

the

most

directly

comparable

measure

calculated

and

presented

in

accord-

ance with

GAAP.

PV-10

should

not

be

considered

as

an

alternative

to

the

standardized

measure

as

computed

under

GAAP.

(in millions)

December 31,

2013

PV-10

$

1,132

Less income taxes:

Undiscounted future income taxes

(919)

10% discount factor

463

Future discounted income taxes

(456)

Standardized measure of discounted future net cash flows

$

676 |

Contact information

MEGAN P. HAYS

Director, Investor Relations & Corporate Communications

817.989.9000

mhays@approachresources.com

www.approachresources.com |