Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SEALED AIR CORP/DE | d679018d8k.htm |

Jerome A. Peribere

President & CEO

Carol P. Lowe

Senior Vice President & CFO

Barclays Industrial Select Conference, February 20, 2014

Company Overview

Exhibit 99.1 |

| 2

These

materials

contain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Forward-looking

statements

can

be

identified

by

such

words

as

“anticipates,”

“believes,”

“plan,”

“assumes,”

“could,”

“estimates,”

“expects,”

“intends,”

“may,”

“plans

to,”

“will”

and

similar

expressions.

These

statements

reflect

our

beliefs

and

expectations

as

to

future

events

and

trends

affecting

our

business,

our

consolidated

financial

position

and

our

results

of

operations.

Examples

of

these

forward-looking

statements

include

expectations

regarding

our

anticipated

effective

income

tax

rate,

the

potential

cash

tax

benefits

associated

with

the

W.

R.

Grace

&

Co.

settlement,

potential

volume,

revenue

and

operating

growth

for

future

periods,

expectations

and

assumptions

associated

with

our

restructuring

programs,

availability

and

pricing

of

raw

materials,

success

of

our

growth

initiatives,

economic

conditions,

and

the

success

of

pricing

actions.

A

variety

of

factors

may

cause

actual

results

to

differ

materially

from

these

expectations,

including

general

domestic

and

international

economic

and

political

conditions,

changes

in

our

raw

material

and

energy

costs,

credit

ratings,

the

success

of

restructuring

plans,

currency

translation

and

devaluation

effects,

the

competitive

environment,

the

effects

of

animal

and

food-related

health

issues,

environmental

matters,

and

regulatory

actions

and

legal

matters.

For

more

extensive

information,

see

“Risk

Factors”

and

“Cautionary

Notice

Regarding

Forward-

Looking

Statements,”

which

appear

in

our

most

recent

Annual

Report

on

Form

10-K,

as

filed

with

the

Securities

and

Exchange

Commission,

and

as

revised

and

updated

by

our

Quarterly

Reports

on

Form

10-Q

and

Current

Reports

on

Form

8-K.

While

we

may

elect

to

update

these

forward-looking

statements

at

some

point

in

the

future,

we

specifically

disclaim

any

obligation

to

do

so,

whether

as

a

result

of

new

information,

future

events,

or

otherwise.

Our

management

uses

non-U.S.

GAAP

financial

measures

to

evaluate

the

Company’s

performance,

which

exclude

items

we

consider

unusual

or

special

items.

We

believe

the

use

of

such

financial

measures

and

information

may

be

useful

to

investors.

We

believe

that

the

use

of

non-U.S.

GAAP

measures

helps

investors

to

gain

a

better

understanding

of

core

operating

results

and

future

prospects,

consistent

with

how

management

measures

and

forecasts

the

Company's

performance,

especially

when

comparing

such

results

to

previous

periods

or

forecasts.

Please

see

Sealed

Air’s

February

6,

2014

earnings

press

release,

supplement

and

presentation

available

on

our

website

for

important

information

about

the

use

of

non-U.S.

GAAP

financial

measures

relevant

to

this

presentation,

including

applicable

reconciliations

to

U.S.

GAAP

financial

measures.

Website Information

We

routinely

post

important

information

for

investors

on

our

website,

www.sealedair.com,

in

the

"Investor

Relations"

section.

We

use

this

website

as

a

means

of

disclosing

material,

non-public

information

and

for

complying

with

our

disclosure

obligations

under

Regulation

FD.

Accordingly,

investors

should

monitor

the

Investor

Relations

section

of

our

website,

in

addition

to

following

our

press

releases,

SEC

filings,

public

conference

calls,

presentations

and

webcasts.

The

information

contained

on,

or

that

may

be

accessed

through,

our

website

is

not

incorporated

by

reference

into,

and

is

not

a

part

of,

this

document.

Safe Harbor and Regulation G Statement |

VISION:

To create a better way for life

We Re-imagine

™

the industries we serve to

create a world that feels, tastes and

works better.

MISSION:

2013

FINANCIALS:

Total Sales: $7.7B; Free Cash Flow: $509M

Adjusted EBITDA, excl SARs: $1.038B

3 |

•

Engineered Solutions & Packaging Systems

•

Packaging Design & Testing

•

Lean Six Sigma Expertise

•

Service & Support

•

Packaging/Hygiene Solutions

•

Engineering Plant Designs

•

Full Range of Equipment/Systems

•

Manage Water, Energy

•

Building & Kitchen Care Services

•

Infection Prevention

•

Fabric Care

•

Consulting Services & Consumer Brands

How We Deliver Value

2013 Sales: $1.6B

24% of 2013

Adj. EBITDA

2013 Sales: $2.2B

21% of 2013

Adj. EBITDA, excl SARs

2013 Sales: $3.8B

55% of 2013

Adj. EBITDA, excl SARs

4 |

DISTRIBUTION ACCOUNTS

FOR APPROX. 65% OF SALES

Who We Serve

DIVERSEY CARE

PRODUCT CARE

FOOD CARE

TOP 20 CUSTOMERS

ACCOUNT FOR NEARLY 20%

OF SALES; DISTRIBUTION

ACCOUNTS FOR APPROX.

35% OF SALES

TOP 20 CUSTOMERS

ACCOUNT FOR APPROX.

25% OF SALES

5 |

DIVERSEY CARE

PRODUCT CARE

FOOD CARE

31%

Fresh Red Meat

Dairy Solids

Other Food

Smoked & Processed

Poultry

Beverages

11%

17%

16%

12%

13%

43%

Consumer Applications

Industrial/Manufacturing

E-Commerce

3PL/Fulfillment

General Protection

18%

13%

14%

12%

10%

12%

11%

11%

35%

11%

Building Service Contractors

Health Care

Other

Food Service

Retail

Hospitality

Distribution

10%

GLOBAL ADDRESSABLE

MARKET: APPROX. $5B

ESTIMATED GLOBAL

MARKET SHARE: 32%

GLOBAL ADDRESSABLE

MARKET: APPROX. $28B

ESTIMATED GLOBAL

MARKET SHARE: 8%

GLOBAL ADDRESSABLE

MARKET: APPROX. $20B

ESTIMATED GLOBAL

MARKET SHARE: 19%

Source: Sealed Air Estimates

2013 Net Sales by End Market

6 |

DIVERSEY CARE

PRODUCT CARE

FOOD CARE

SEALED AIR

North America

Europe

Latin America

AMAT

Japan/ANZ

2013 Net Sales by Region

8%

7 |

8

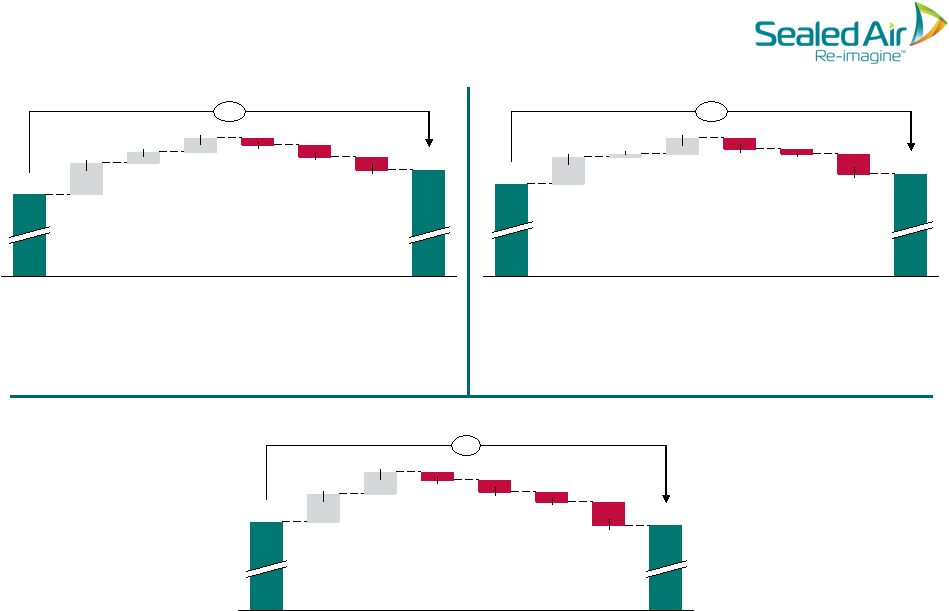

Total Company Net Sales Bridge

1.7% Reported

2.7% Constant Currency

2013 Net Sales

7,691

-76

Foreign Exchange

Price/Mix

+94

Volume

+114

2012 Net Sales

7,559

($ in millions)

•

Constant currency 2013 sales growth in every region, except for a

slight decline Europe

•

Sales in Developing Regions increased 9% in constant currency and

accounted for 26% of 2013 net sales |

DIVERSEY CARE

Net Sales by Division

PRODUCT CARE

FOOD CARE

Packaging

Hygiene

3,049

3,106

691

705

3,740

3,811

2012

2013

9

* Constant Currency Net Sales Growth: 3.3%

* Constant Currency Net Sales Growth: 2.0%

* Constant Currency Net Sales Growth: 2.4%

($ in millions)

1.9%*

1.4%*

1.9%* |

10

1,038

41

40

112

981

5.8%

2013

Adj.

EBITDA

Other/FX

(2)

-61

Perf-

based

Incentive

Comp

(1)

-41

SG&A/

Other

-34

Mix &

Price/

Cost Spread

Volume

Cost

Synergies

2012

Adj.

EBITDA

Adjusted EBITDA, excluding SARs

(1)

Performance-based incentive compensation includes an increase of $25M for

the annual incentive plan & $16M of non-cash

profit sharing expenses in U.S.

(2) Others include ($46M) supply chain costs primarily related to non-material

inflation; FX: ($5.9M) Adjusted EBITDA Margin, excl SARs:

2013: 13.5%

2012: 13.0%

($ in millions) |

DIVERSEY CARE

Adj. EBITDA, excl SARs, by Division

PRODUCT CARE

FOOD CARE

25

20

58

Cost

Synergies

2012

535

-13

+8%

SG&A

-21

Perf-

based

Incentive

Comp

-24

Other/

FX*

579

Mix &

Price/Cost

Spread

Volume

2013

Adj. EBITDA Margin, excl SARs:

2013: 15.2%

2012: 14.3%

20

5

34

2013

223

Other/

FX*

-25

Perf-

based

Incentive

Comp

-7

SG&A

-14

Mix &

Price/Cost

Spread

Volume

Cost

Synergies

2012

210

+6%

* Other includes ($12M) supply chain costs primarily related to non-material

inflation & inventory obsolescence; Also includes bad debt allowance of

($4M) recorded in Q3 for large customer in AMAT; FX: ($1.2M)

* Other includes ($13M) supply chain costs primarily related to non-material

inflation; FX: ($3.9M)

16

19

Volume

Cost

Synergies

2012

250

Other/

FX*

247

2013

-1%

Mix &

Price/Cost

Spread

-9

SG&A

-7

Perf-

based

Incentive

Comp

-17

-6

* Other includes ($12M) supply chain costs primarily related to LIFO adjustment

& non-material inflation; FX: ($1.0M)

Adj. EBITDA Margin, excl SARs:

2013: 10.3%

2012: 9.8%

Adj. EBITDA Margin:

2013: 15.4%

2012: 15.8%

11

($ in millions) |

SIGNIFICANT YoY IMPROVEMENT

12

Year Ended December 31

Free Cash Flow

(1)

Profit sharing expense is funded with Sealed Air stock

(2)

Accounts Receivable, Inventories & Accounts Payable

($ in millions)

($ in millions)

Free Cash Flow

2012

2013

Adjusted Net Earnings

$193

$263

Depreciation and Amortization

317

308

Profit sharing expense

(1)

19

35

Settlement agreement & Other Non-Cash Interest

61

67

Restructuring Payments

(103)

(107)

Tax Payments

(109)

(111)

SARs Payments

(24)

(46)

Net change in working capital items

(2)

(77)

96

Other

117

120

Cash Flow from Operations

$394

$625

Capital Expenditures

(123)

(116)

Free Cash Flow

$271

$509

Year Ended

December 31 |

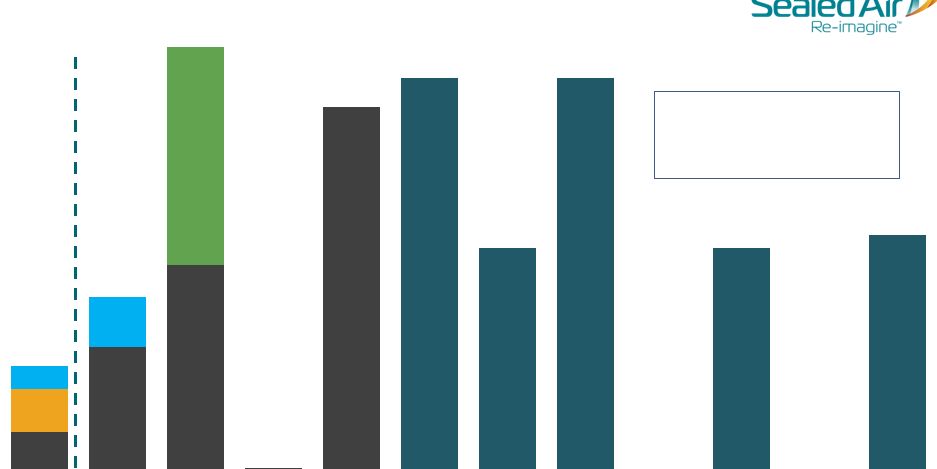

Liquidity & Net Debt

13

Liquidity Position

Net Debt

Lower net debt as a result of cash

generated from operating activities &

asset sales, partially offset by capital

expenditures & dividend payments

($ in millions) |

71

234

391

2

694

420

750

425

750

425

450

82

45

96

2014

2015

2016

2017

2018

2019

2020

2021

2023

2033

Credit Facility Term Loans

Credit Facility Revolver

Senior Notes

Short Term Borrowings

AR Securitization

8.125%

6.5%

8.375%

5.25%

6.875%

Pro Forma Debt Maturity Schedule

(1)

14

($ in millions)

Weighted Average

Interest Rate:

Approx. 5.6%

2014

•

Funded W. R. Grace & Co. Settlement on February 3, 2014 with $555 million of

accumulated cash and cash equivalents and $375 million from committed

credit facilities

•

Repaid 12% $150M Senior Notes on February 14, 2014

(1) As of December 31, 2013, pro forma for payment of Grace and

12% Senior Notes in Q1 2014. |

De-Leveraging Balance Sheet

15

•

De-leveraging balance sheet to optimize capital structure that can be

sustained throughout-out end market cycles and economic downturns

•

Return excess cash to shareholders

0.0x

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

2010

2011

(Diversey

Acquisition)

2012

2013

2014E

2015E

2016E

Net Debt

Net Debt/Adjusted EBITDA |

Adjusted EBITDA: $1.05B –

$1.07B

(D&A: $315M; Interest Expense: $295M)

Net Sales: Approx. $7.7B

(Organic growth offset by product rationalization and more than 2% unfavorable

FX) 2014 Outlook

Adjusted EPS: $1.50 –

$1.60

(Anticipated core tax rate of approx. 25%)

Free Cash Flow: Approx. $410M

(Assumes: Approx. $170M capex, $150M cash restructuring and $280M cash interest

expense) Note:

Adjusted EPS includes $0.12 benefit related to the W.R. & Co. Settlement

agreement. Adjusted EBITDA is net of $40M of non-cash profit

sharing Adjusted EBITDA and EPS exclude the potential impact of SARs &

the impact of special items. 16 |

Implementing sales &

marketing and pricing

effectiveness;

Rationalizing portfolio

Investing for higher

margin growth

•

Optimize portfolio & re-segment markets

•

Optimize supply chain network

•

Drive incremental profit capture through pricing

•

Build out hygiene portfolio and drive synergy sales

Getting the basics right &

creating path for quality

growth

How We Are Getting Fit

•

Innovate with focus on differentiation & ROI

•

Higher participation in emerging markets

•

Build critical mass in the US market

•

Right pricing mechanisms for higher profit capture

•

Implement new sales tools & pricing disciplines

•

Change in ownership of pricing decisions

•

Rationalize low return General Use globally

•

Grow solutions with higher returns

17 |

Evolve

offer

comprised

of

high

value,

differentiated

solutions

Drive higher margin

revenue through

innovation & value-add

•

Develop new technology to improve processor yields

•

Reduce food safety risk throughout food chain

•

Reduce waste through end-to-end innovation

•

Provide integrated systems to drive efficiency

Transform towards

knowledge-based

business model

How We Will Change The Game

•

Provide lowest Total Cost of Ownership (TCO) by

integrating data, equipment & applications

•

Establish smart service programs for strategic

sectors

•

Provide focused solutions for e-commerce,

fulfillment & other target market segments

•

Develop new products and solutions to capitalize on

changing market opportunities

18 |

|

Appendix |

Net

Sales Performance Product Price/Mix & Volume

21

By Division

2013

Food Care

1.6%

Diversey Care

1.5%

Product Care

(0.2%)

Medical/New Ventures

2.3%

Total

1.2%

By Region

2013

North America

1.5%

Europe

(0.2%)

Latin America

5.1%

AMAT

2.0%

JANZ

(0.6%)

Total

1.2%

Product Price/Mix (% Change)

By Division

2013

Food Care

1.7%

Diversey Care

0.5%

Product Care

2.6%

Medical/New Ventures

(1.2%)

Total

1.5%

By Region

2013

North America

0.6%

Europe

(0.1%)

Latin America

4.6%

AMAT

6.8%

JANZ

1.1%

Total

1.5%

Volume (% Change)

By Division

2013

Food Care

3.3%

Diversey Care

2.0%

Product Care

2.4%

Medical/New Ventures

0.6%

Total

2.7%

By Region

2013

North America

2.1%

Europe

(0.3%)

Latin America

9.7%

AMAT

8.8%

JANZ

0.5%

Total

2.7%

Constant Dollar Sales (% Change) |

2013 Adj. EPS Calculation

22

Reported U.S. GAAP Measures :

•

Q4 2013 Operating Income: $172.6M; Net Income: $3.6M; 2013 Operating Income:

$602.1M; Net Income: $93.7M •

Q4 2013: Recognized $0.11 in discontinued operations, including $0.10 per share

gain on Medical Rigids sale •

2013: Recognized $0.14 in discontinued operations, including $0.10 per share gain

on Medical Rigids sale ($ in millions, except Adjusted EPS)

(1)

Comprised of $160.2M of property and equipment

depreciation, $123.2M of amortization of intangibles and

$24.1M of share-based compensation, net of ($5.3M)

special items

(2)

Additional detail on cash-settled stock appreciation rights

(“SARs”) granted as part of the Diversey acquisition is

provided in Sealed Air’s February 6, 2014 earnings press

release and supplementary information

2013 Adjusted EBITDA, excl SARs

$1,038.0

Depreciation and amortization

(1)

302.2

Interest expense

361.0

Stock Appreciation Rights (SARs)

(2)

38.1

Adjusted pre-tax earnings

$336.7

Core taxes (21.8%)

73.5

Adjusted net earnings

$263.2

Diluted Shares

213.5

2013 Adjusted EPS

$1.23

2013 Adjusted EPS, excl SARs

$1.39 |

23

GAAP Operating Profit (Loss)

(1)

(1)

The supplementary information included in this presentation can be found in

Sealed Air’s February 6, 2014 earnings press release, which is preliminary and subject

to change prior to the filing of our upcoming Annual Report on Form 10-K with

the Securities and Exchange Commission. (2)

In December 2013, we completed the sale of our rigid medical packaging business

(“Medical Rigids”). The financial results of the Medical Rigids business

are

reported as discontinued operations, net of tax, and, accordingly all previously

reported financial information has been revised. 2013

2012

2013

2012

Revised

(2)

Revised

(2)

Operating profit (loss):

Food Care

$

119.6

$

(95.0)

$

431.4

$

(170.9)

As a % of Food Care net sales

11.8

%

(9.6)

%

11.3

%

(4.6)

%

Diversey Care

11.2

(322.4)

57.9

(1,278.4)

As a % of Diversey Care net sales

2.1

%

(60.4)

%

2.7

%

(60.0)

%

Product Care

56.7

56.9

200.4

207.5

As a % of Product Care net sales

13.4

%

14.0

%

12.5

%

13.1

%

Other Category: Medical Applications business and New Ventures

(1.9)

(24.5)

(12.7)

(36.0)

As a % of Medical Applications and New Ventures net

sales (6.2)

%

(86.0)

%

(11.4)

%

(32.8)

%

Total segments and other category

185.6

(385.0)

677.0

(1,277.8)

As a % of total net sales

9.2

%

(19.7)

%

8.8

%

(16.9)

%

Costs related to the acquisition and integration of Diversey

0.4

2.6

1.1

7.4

Restructuring and other charges

12.6

32.4

73.8

142.5

Total

$

172.6

$

(420.0)

$

602.1

$

(1,427.7)

As a % of total net sales

8.6

%

(21.5)

%

7.8

%

(18.9)

%

December 31,

December 31,

(Unaudited, $ in millions)

Year Ended

Three Months Ended |