Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Noranda Aluminum Holding CORP | a2013q4earningsrelease8-k.htm |

| EX-99.1 - EXHIBIT 99.1 FOURTH QUARTER EARNINGS RELEASE - Noranda Aluminum Holding CORP | a2013q4earningsreleaseexhi.htm |

| EX-99.3 - EXHIBIT 99.3 DIVIDEND RELEASE - Noranda Aluminum Holding CORP | a2013q4dividendreleaseexhi.htm |

4th Quarter 2013 Earnings Conference Call Noranda Aluminum Holding Corp February 19, 2014 10:00 AM Eastern / 9:00 AM Central Exhibit 99.2

The presentation and comments made by Noranda’s management on the quarterly conference call contain “forward- looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements about future, not past, events and involve certain important risks and uncertainties, any of which could cause the Company’s actual results to differ materially from those expressed in forward-looking statements, including, without limitation: the cyclical nature of the aluminum industry and fluctuating commodity prices, which cause variability in earnings and cash flows; a downturn in general economic conditions, including changes in interest rates, as well as a downturn in the end-use markets for certain of the Company’s products; fluctuations in the relative cost of certain raw materials and energy compared to the price of primary aluminum and aluminum rolled products; the effects of competition in Noranda’s business lines; Noranda’s ability to retain customers, a substantial number of which do not have long-term contractual arrangements with the Company; the ability to fulfill the business’ substantial capital investment needs; labor relations (i.e. disruptions, strikes or work stoppages) and labor costs; unexpected issues arising in connection with Noranda’s operations outside of the United States; the ability to retain key management personnel; and Noranda’s expectations with respect to its acquisition activity, or difficulties encountered in connection with acquisitions, dispositions or similar transactions. Forward-looking statements contain words such as “believes,” “expects,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” “anticipates” or similar expressions that relate to Noranda’s strategy, plans or intentions. All statements Noranda makes relating to its estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to the Company’s expectations regarding future industry trends are forward-looking statements. Noranda undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management's current estimates, projections, expectations or beliefs. For a discussion of additional risks and uncertainties that may affect the future results of Noranda, please see the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Forward-Looking Statements 2

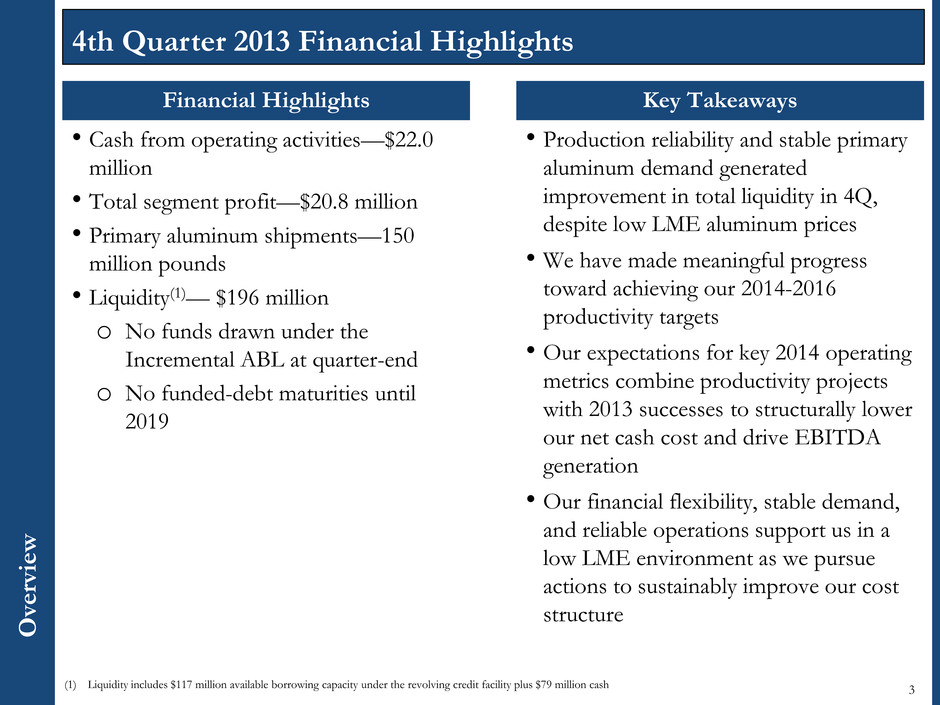

Ove rv ie w Key Takeaways • Production reliability and stable primary aluminum demand generated improvement in total liquidity in 4Q, despite low LME aluminum prices • We have made meaningful progress toward achieving our 2014-2016 productivity targets • Our expectations for key 2014 operating metrics combine productivity projects with 2013 successes to structurally lower our net cash cost and drive EBITDA generation • Our financial flexibility, stable demand, and reliable operations support us in a low LME environment as we pursue actions to sustainably improve our cost structure Financial Highlights • Cash from operating activities—$22.0 million • Total segment profit—$20.8 million • Primary aluminum shipments—150 million pounds • Liquidity(1)— $196 million o No funds drawn under the Incremental ABL at quarter-end o No funded-debt maturities until 2019 4th Quarter 2013 Financial Highlights 3 (1) Liquidity includes $117 million available borrowing capacity under the revolving credit facility plus $79 million cash

271 262 276 298 298 290 0 50 100 150 200 250 300 350 Q3-12 Q4-12 Q1-13 Q2-13 Q3-13 Q4-13 Km ts CGA External SGA External SGA Intercompany 98 87 94 102 100 77 0 20 40 60 80 100 120 140 Q3-12 Q4-12 Q1-13 Q2-13 Q3-13 Q4-13 Po un ds in m ill io ns Primary Aluminum Shipments Bauxite Shipments 4 Quarterly Shipment Information Flat-Rolled Product Shipments 139 145 142 148 149 150 0 50 100 150 Q3-12 Q4-12 1-13 Q2-13 Q3-13 Q4-13 Po un ds in m illi on s Value-Added External sow Intercompany Alumina Shipments 1,267 1,185 1,209 1,149 1,127 1,222 0 300 600 900 1,200 1,50 Q3-12 Q4-12 Q1-13 Q2-13 Q3-13 Q4-13 Km ts Internal ExternalD e man d

We continue to believe in aluminum’s long-term fundamentals • The global economy is becoming more aluminum- intensive. • Record Midwest premiums in 1Q-14 driven by strong underlying US demand. We have seen positive signs of rationalizing marginal capacity • Curtailments and improving demand in developed economies are positives. – Aluminum prices near historical lows in real terms have lead to ~4 million MT curtailed since 2012. – Outside of China, closures have created market supply deficits, as consumption steadily improves, mainly in developed countries. – CRU expects an additional 500,000 tpy of smelting capacity in the world ex. China will be closed by 2015. – CRU reports closures in China. While small relative to total production, actions represent first signs of rationalization in China. • Growing surpluses in China could offset those positives in the near term. Noranda is committed to continue to driving structural LME-independent improvements Aluminum’s Favorable Long-Term Fundamentals Sna p shot o f Alumi n um Fundam e nta ls 5 Source: (1) HARBOR Intelligence – January 2014 The Global Economy is Becoming More Aluminum Intensive (1) (thousand tons of aluminum consumption per billion dollars of global working age population income) 2002 2.25 2013f 3.13 LME Aluminum Price in Real Terms

Productivity Complements Growth in Creating Value P rodu c ti v it y 6 • CORE fundamental to Noranda’s integrated strategy − = Cost Out, Reliability & Effectiveness − Designed to offset input cost inflation, offset unplanned events, drive continuous improvement • CORE program generates: − EBITDA through volume growth, cost savings and avoidance − Includes recurring and non-recurring items − Capital expenditure savings and avoidance − Working capital reduction • Noranda has a stable track record of CORE program achievement − Achieved 2011-13 CORE target in 2Q13 − Established $225 million target for 2014-16 • Evaluate effectiveness & efficiency of organizational structure • Includes review of comp & benefits Functional streamlining • Improve usage rates and eliminate cost activities at each step in value-chain Production Processes • Identify alternative sources, more favorable pricing for key inputs Strategic Sourcing • Grow capacity by improving utilization & de-bottlenecking • Improve operational predictability Reliability & Effectiveness Key 2014-16 CORE Program Tenets $140 $225 $15.0 $50.0 $20.0 $- $50 $100 $150 $200 $250 Historical CORE target Companywide workforce reduction Rate design Other 2014-16 CORE Target $ in millions 2014-2016: A Step Change in Cost Structure 2014-16 CORE Program – Contribution by Type EBITDA, 95% Working Capital, 3% Capex, 2% Estimate

D EMO N STR A TE D A B IL IT Y T O CONT R O L CO S T S Summary of Noranda’s Power Proposal (New Madrid) 7 • We expect to file with the Missouri Public Service Commission (PSC) in February 2014 a request to change the rate design for Ameren Missouri customers – Filing includes supporting stipulations from other consumer groups, as well as supporting testimony from union leadership and community leaders o We expect the requested rate design change to increase annual rates for other customers by 1.8% or less o This increase is lower than the amount of fixed costs other rate payers would absorb if Noranda left the Ameren system • Key provisions include: – Proposed rate structure has a 10 year term – $30/Mwh initial rate with no fuel adjustment charges, and no seasonal power surcharges – 2% annual cap from any general rate increase • Financial impact – Savings equates to over $0.08 reduction in net cash cost – New Madrid consumed approximately 4.2 million Mwh of electricity in 2013 – 2013 rate, including fuel adjustment charges, was ~ $42/Mwh – No fuel adjustment charges, and no seasonal power surcharges • Process and timing – The PSC has complete latitude in determining the time necessary to consider the filing – Filing requests expedited treatment by PSC, asking that new pricing take effect on or before August 1, 2014

$1,395 $1,363 $1,344 $900 $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 Q4-12 Q3-13 Q4-13 $ i n m illi on s R esu lts O ve rv ie w TTM MWTP $1.01 $0.98 $0.95 $0.80 $0.85 $0.90 $0.95 $1.00 $1.05 $1.10 Q4-12 Q3-13 Q4-13 $ p er po un d TTM Revenue TTM Net Cash Cost $135 $103 $93 $0 $20 $40 $60 $80 $100 $120 $140 $160 4-12 Q3-13 Q4-13 $ i n m illi on s Key Performance Indicators – Trailing Twelve Months (“TTM”) 8 $0.81 $0.84 $0.83 0.2 0.3 0.4 $0.50 $0.60 $0.70 $0.80 $0.90 Q4-12 Q3-13 Q4-13 $ p er p ou nd TTM Segment Profit

Se g men t R esu lt s 9 Segment Profit Summary Q4 2012 Q3 2013 Q4 2013 Integrated upstream segment profit $27.8 $4.9 $19.2 Flat-Rolled Products segment profit 10.3 13.6 8.4 Corporate costs (7.2) (7.5) (6.8) Total segment profit $30.9 $11.0 $20.8

10 Upstream Segment Profit Q4 2012 Q3 2013 Q4 2013 Average realized Midwest transaction price $ 1.01 $ 0.92 $ 0.90 Net Cash Cost 0.82 0.89 0.78 Integrated upstream margin per pound $ 0.19 $ 0.03 $ 0.12 Total Primary Aluminum segment shipments 145.1 149.0 150.5 Integrated upstream segment profit $ 27.8 $ 4.9 $ 19.2 Se gm ent R es u lt s

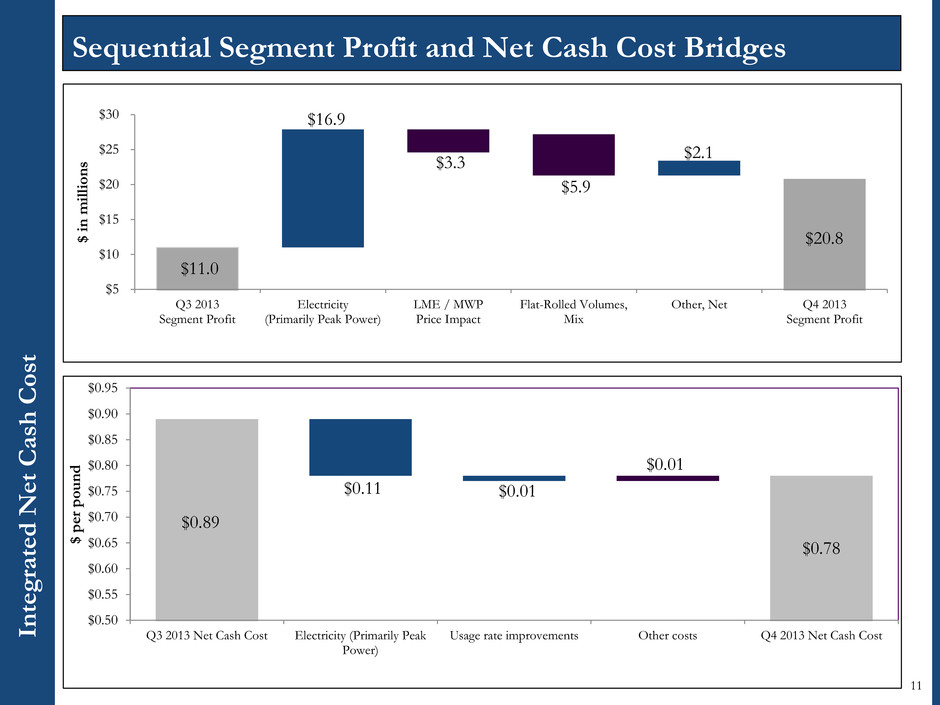

In te g ra te d Net Cash Cos t 11 Sequential Segment Profit and Net Cash Cost Bridges $0.78 $0.11 $0.01 $0.01 $0.89 $0.50 $0.55 $0.60 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 $0.95 Q3 2013 Net Cash Cost Electricity (Primarily Peak Power) Usage rate improvements Other costs Q4 2013 Net Cash Cost $ pe r p o u n d $20.8 $3.3 $5.9 $16.9 $2.1 $11.0 $5 $10 $15 $20 $25 $30 Q3 2013 Segment Profit Electricity (Primarily Peak Power) LME / MWP Price Impact Flat-Rolled Volumes, Mix Other, Net Q4 2013 Segment Profit $ in m illi o n s

In te g ra te d Net Cash Cos t 12 Year-over-Year Segment Profit and Net Cash Cost Bridges $0.78 $0.03 $0.06 $0.03 $0.02 $0.82 $0.50 $0.55 $0.60 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 Q4 2012 Net Cash Cost LME Price Impact (Offset Sales) Non LME-linked Price (Offset Sales) Primary Power Cost Productivity improvements Q4 2013 Net Cash Cost $ pe r p o u n d $20.8 $23.4 $2.9 $2.2 $1.4 $4.3 $2.8 $12.7 $30.9 $- $5 $10 $15 $20 $25 $30 $35 Q4 2012 Segment Profit LME / MWP Price Impact Non LME- linked price Primary power cost Natural gas price Other commodity input price Flat-Rolled volume, mix Productivity improvements Q4 2013 Segment Profit $ in m illi o n s

In te g ra te d Net Cash Cos t 13 Year-to-Date Segment Profit and Net Cash Cost Bridges $0.83 $0.03 $0.01 $0.03 $0.03 $0.03 $0.03 $0.81 $0.50 $0.55 $0.60 $0.65 $0.70 $0.75 $0.80 $0.85 $0.90 2012 Net Cash Cost LME Price Impact (Offset Sales) Non LME-linked Price (VA Premiums, Bauxite) Primary Power Cost Natural Gas Price Other Commodity Input Prices Productivity improvements 2013 Net Cash Cost $ pe r p o u n d $93.1 $49.5 $16.4 $17.1 $0.3 $12.3 $6.5 $22.9 $134.7 $- $20 $40 $60 $80 $100 $120 $140 $160 2012 Segment Profit LME / MWP Price Impact Non LME- linked price Primary power cost Natural gas price Other commodity input price Flat-Rolled volume Productivity improvements 2013 Segment Profit $ in m illi o n s

Ne t In c ome (Los s) , E x c ludin g Sp e cia l It e m s 14 Bridge of Segment Profit to Net Income, Excluding Special Items Q4 2012 Q3 2013 Q4 2013 Segment profit $ 30.9 $ 11.0 $ 20.8 LIFO/LCM (4.6) 1.1 3.7 Other recurring non-cash items (0.8) (4.9) (1.9) EBITDA, excluding special items 25.5 7.2 22.6 Depreciation and amortization, excluding special items (28.3) (24.3) (22.8) Interest expense, net (8.9) (12.6) (12.6) Pre-tax income (loss), excluding special items (11.7) (29.7) (12.8) Income tax (expense) benefit 3.9 9.4 4.3 Net income (loss), excluding special items $ (7.8) $ (20.3) $ (8.5)

Financia l Mana g em e nt Revie w 15 Liquidity and Capitalization Highlights $21.5 $1.5 $15.6 $1.9 $20.8 $24.2 $11.0 $63.9 $85.9 $79.4 $0 $20 $40 $60 $80 $100 $120 Cash, September 2013 Segment profit Operating working capital Cash interest payments Cash taxes and other Cash available for investment, distribution Capital expenditures Proceeds from project-specific capital financing Cash dividends, Term B debt payments Cash, December 2013 $ in m illi o n (1) Liquidity represents $117 million available borrowing capacity under the revolving credit facility plus $79 million cash • Net debt (debt minus cash) – $579.5million • Net debt to trailing twelve month segment profit – 6.1x • Cash flow positive in quarter, increasing cash by $15.5 million • No funded debt maturities before 2019 • Liquidity - $196 million(1)

2 0 14 Ou tloo k Key 2014 Expectations 16 Driver Annual Outlook Comments Primary Aluminum • Shipments • 581 to 584 million pounds • Quarterly seasonality comparable to 2013 actuals Integrated Cash Cost • $0.75 to $0.78 per pound(1,2) • Additional LME sensitivity: $0.03 decrease for each $0.10 cent increase in LME • Quarterly trends above (below) annual level: Q1: +8%, Q2: +2%, Q3: -1% Q4: -9% Flat-Rolled Products • Shipments • Margin • 367 to 371 million pounds • $0.14 to $0.15 per pound • Quarterly seasonality comparable to 2013 actuals Corporate • $30 to $32 million • Ratable across quarters Other recurring non-cash P&L • $15 to $20 million Non-LIFO • $4 to $6 million LIFO(1) • Total $19 to $26 million • Non-LIFO generally ratable • LIFO sensitive to changes in inventory levels, LME, input costs Capex • $50 to $60 million sustaining • $30 to $40 million incremental growth/productivity spending • Majority of growth/productivity spending capital will be funded by project-specific financing See slide 2 for important information about forward looking statements (1) Based on LME aluminum forward curve as of January 31, 2014 (2) Based on Henry Hub forward curve as of January 31, 2014 $0.75 $0.01 $0.04 $0.01 $0.05 $0.01 $0.02 $0.83 $0.65 $0.70 $0.75 $0.80 $0.85 2013 Net Cash Cost LME Price Impact (Offset Sales) Non LME-linked Price (VA Premiums, Bauxite) Primary Power Cost Natural Gas Price Other Commodity Input Prices Other Productivity: Throughput, Usage, Cost Out 2014 Net Cash Cost $ pe r p o u n d

Production reliability and stable primary aluminum demand generated improvement in total liquidity in 4Q, despite low LME aluminum prices – Key performance metrics were consistent with previously communicated expectations – Overall shipment volumes continued to be stable, with stable value-added and fabrication premiums for key aluminum products – Record Midwest premiums driven by strong underlying US demand We have made meaningful progress on 2014-2016 productivity targets – Filed petition with Missouri PSC to reduce smelter power rate by over $0.08 per pound annually – December 2013 workforce reduction expected to create $15 million annual savings Our expectations for key 2014 operating metrics combine productivity projects with 2013 successes to structurally lower our net cash cost and drive EBITDA generation – A $0.05 to $0.08 per pound reduction in integrated net cash cost, driven by productivity improvements – Aluminum and alumina product volumes and premiums comparable to 2013 – Alumina production comparable to 2013, bauxite capacity expanded – Sustaining capex at or below 2013 levels – Growth capex funded by project-specific financing Our financial flexibility, stable demand, and reliable operations support us in a low LME environment as we pursue actions to sustainably improve our cost structure – Approximately $196 million of liquidity as of end of 4Q-13(1) – No significant funded debt maturities until 2019 Key Takeaways 17 1 2 Summa ry 3 4 (1) Liquidity includes $117 million available borrowing capacity under the revolving credit facility plus $79 million cash

Non-GAAP Measure: Disclaimer No n -GA A P M ea sure: Disclaim er This presentation contains non-GAAP financial measures as defined by SEC rules. We believe these measures are helpful to investors in measuring our financial performance and comparing our performance to our peers. However, our non-GAAP financial measures may not be comparable to similarly titled non- GAAP financial measures used by other companies. These non-GAAP financial measures have limitations as an analytical tool and should not be considered in isolation or as a substitute for U.S. GAAP financial measures. To the extent we disclose any non-GAAP financial measures, a reconciliation of each measure to the most directly comparable U.S. GAAP measure is available in the Press Release included as an exhibit to the Current Report on Form 8-K to which this presentation is also an exhibit. As such, this presentation should be read in conjunction with our Press Release. 18