Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Knowles Corp | d677910d8k.htm |

Knowles:

The Acoustics Pioneer

February 2014

Exhibit 99.1 |

| Cautionary Statements

2

A number of forward-looking statements are included in this presentation,

including 1Q14 projections and mid-term targets. Forward-looking

statements are any statements that are not historical facts. The words

“believe,” “project,”

“plan,”

“potential,”

“will,”

“target,”

and similar

expressions, among others, generally identify forward-looking statements. These

forward-looking statements are based on the current plans and

expectations of Knowles and are expressed in good faith and believed to have

a reasonable basis, but there can be no assurance that such plans or

expectations will be achieved. Because forward-looking statements involve risks and

uncertainties, Knowles’

actual results could differ materially from those projected, anticipated or

implied in these statements. Factors that could cause actual results or events to

differ materially from those anticipated include the matters described under

the sections entitled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations”

in

Knowles’

information statement filed as an exhibit to its Form 10 with the SEC and available

at www.knowles.com.

The financial data included in this presentation for the quarter

and year ended December 31, 2013

are preliminary and unaudited and subject to, among others, completion of financial

closing procedures, audit and other adjustments. The content of this

presentation contains time-sensitive information that speaks only as of

the date of this presentation. Knowles will not be reviewing or updating the

material that is contained herein, except as required by applicable law. If

any portion of this presentation is retransmitted or accessed at a later

date, the information contained herein may be outdated.

|

| Non-GAAP Disclaimer

3

In addition to the GAAP financial measures included in this presentation, Knowles

has presented certain non-GAAP financial measures. Knowles uses

non-GAAP measures as supplements to its GAAP results of operations in

evaluating certain aspects of its business, and its Board of Directors and

executive management team focus on non-GAAP items as key measures of

Knowles’ performance for business planning purposes. These measures

assist Knowles in comparing its performance between various reporting

periods on a consistent basis, as these measures remove from operating

results the impact of items that, in Knowles’

opinion, do not reflect its core operating performance. Knowles

believes

that its presentation of non-GAAP information is useful because it provides

investors and securities analysts with the same information that Knowles

uses internally for purposes of assessing its core operating

performance. For a reconciliation of these non-GAAP measures to

the most directly related GAAP measure, please see the appendices hereto and

the reconciliation tables included in Knowles’ information statement

filed as an exhibit to its Form 10 with the SEC.

|

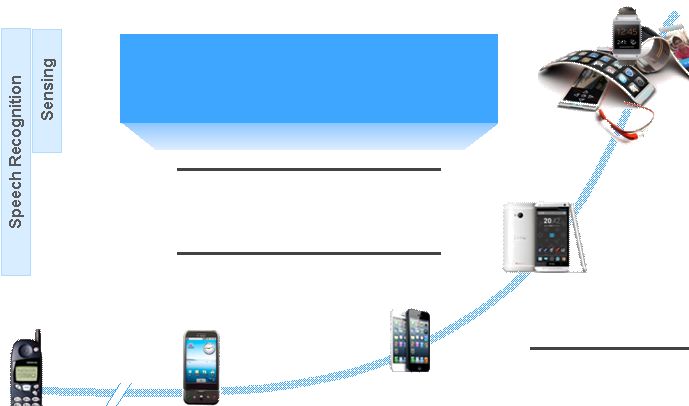

John

Anderson Senior Vice President &

Chief Financial Officer

Introduction of Presenters

4

Jeffrey Niew

President &

Chief Executive Officer

Mobile Consumer Electronics

Specialty Components

Michael Adell

Co-President,

Microphones

Christian Scherp

Co-President, Speakers

& Receivers

Gordon Walker

Co-President,

Acoustics & Hearing

Health

David Wightman

Co-President,

Precision Devices |

| Discussion Agenda

5

I.

Knowles Highlights

II.

Specialty Components (SC)

III.

Mobile Consumer Electronics (MCE)

IV.

Financial Overview

V.

Conclusion / Q&A

VI.

Lunch / Demos

5 |

CULTURE OF INNOVATION

Knowles: Who We Are

GLOBAL

SCALE

TOP

TIER

CUSTOMER

ENGAGEMENT

6

units

patents |

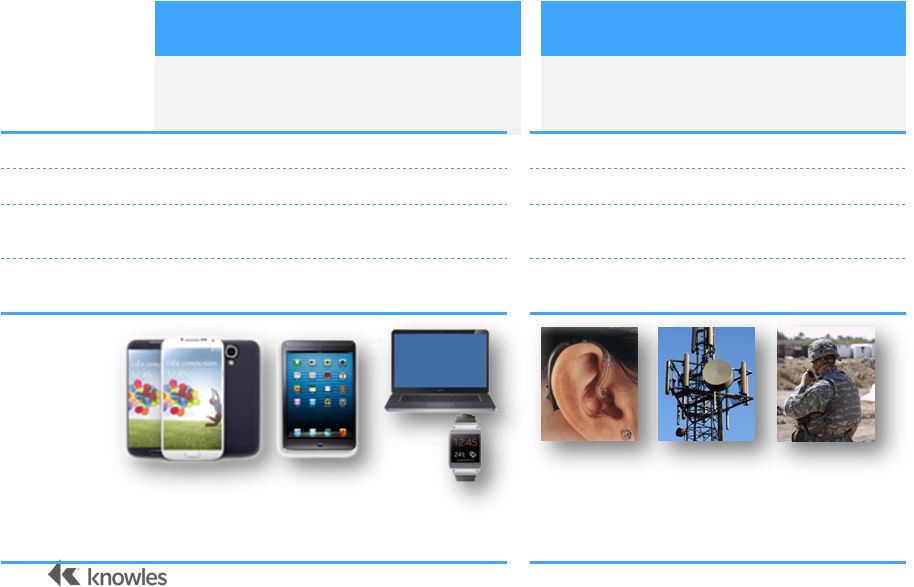

Knowles: What We Do

Mobile Consumer Electronics

Mobile Consumer Electronics

Specialty Components

Specialty Components

Provides the acoustic backbone to

smartphones, tablets, headsets, laptops and

other electronic products

Includes acoustic solutions for hearing aids,

and oscillators and capacitors used in a

broad range of electronic equipment

2013 REVENUE

$778mm

$437mm

% total

64%

36%

2013

ADJ. EBITDA*

$246mm

$106mm

Adj. EBITDA

margin*

32%

24%

Mobile consumer electronics

Medical

Telecommunications

Technology

Infrastructure Military / Aerospace Industrial

Markets 7

*Segment information. Adj. EBITDA is defined as earnings before income taxes plus

(i) depreciation and amortization expense and (ii) interest expense,

excluding restructuring costs, stock-based compensation, and other items. See

Appendices for non-GAAP to GAAP reconciliations. |

Knowles: Why We Win

8

CULTURE OF INNOVATION

PIONEERING ACOUSTICS EXPERTISE ENTRENCHED CUSTOMER RELATIONSHIPS PROPRIETARY MANUFACTURING PROCESSES DIFFERENTIATED

PRODUCTS |

Market-Leading Acoustic Supplier with Strong

Engineering Relationships

Key Investment Highlights

9

1

2

3

4

5

Attractive End-Markets

Innovative Technology Drives Differentiated

Solutions

Proprietary Operational Capabilities with Margin

Expansion Potential

Experienced Management with Proven Track

Record |

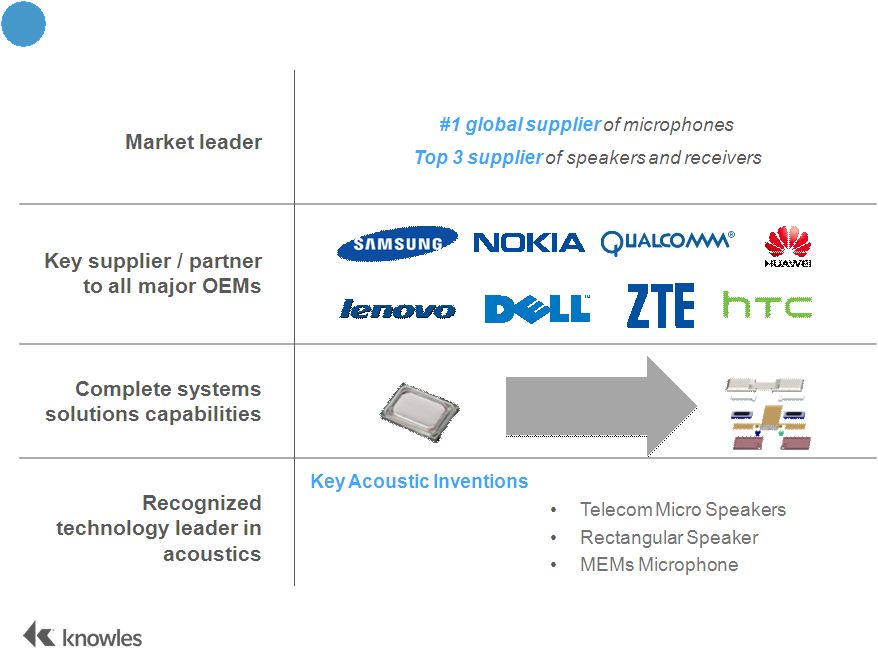

Market Leading Acoustics Supplier,

Strong

Engineering Relationships

10

MARKET

LEADERSHIP

Strong Financial

Performance

Acoustic Content

Growth

Product Development

Leadership and

Operational Excellence

Hearing Aid

Solutions

#1 Global Supplier

Top 3 Supplier

#1 Global Supplier

1

Microphones

Speakers /

Receivers

CUSTOMERS |

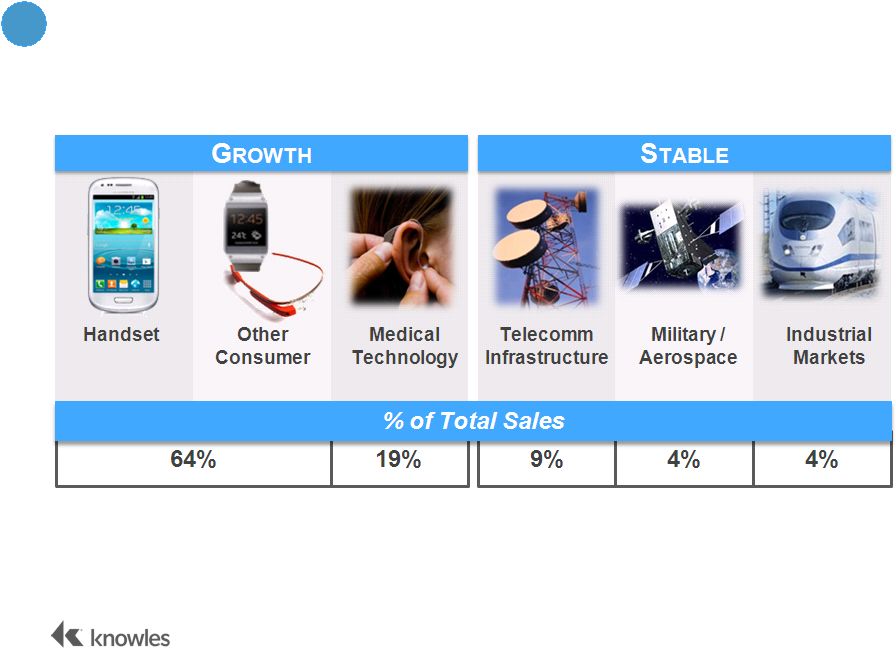

Attractive Markets

11

2

Note: % of total sales based 2013 information. |

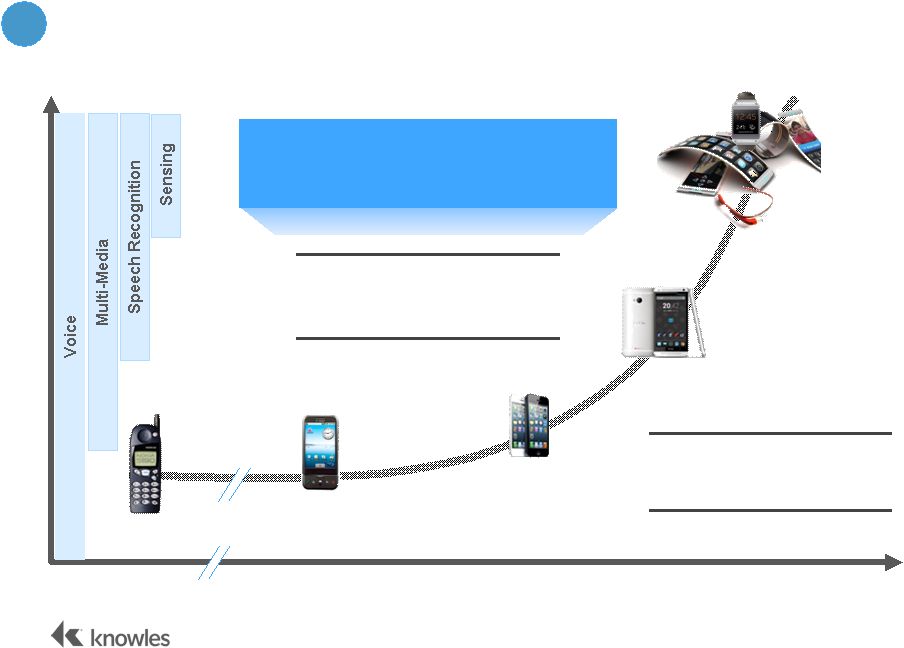

Innovative Technology

Drives Differentiated Solutions 12

2000

2015+

2010

Pace of acoustic features

growing exponentially

in recent years

Microphones

Speakers & Receivers

High Performance

Solutions

Integration

Embedded Software +

Hardware Modules

Knowles Acoustic

Subsystems enable smart

Knowles’

technology stems

from 500+ patents

Audio $ Content

3

audio optimization

device |

Global Operational Capabilities with Margin

Expansion Potential

13

18

18

11

11

4

More efficient manufacturing footprint

Lower cost geographies

Focus on productivity and low cost sourcing

TODAY

MID TERM

1: Exclusive of costs associated with restructuring. Restructuring of 4 of the 7

facilities has been announced and commenced. Annualized cost savings from

restructuring costs incurred in 2012 & 2013 are expected to be approximately $19 million of the

targeted amount.

Targeting $40mm

- $50mm of Annualized Cost Savings¹ |

Experienced and Successful Team

14

15+ yrs

Average Years of

Industry

Experience

>10 yrs*

7 Team Members with

>10 Years

Knowles Experience

5 |

Knowles: Investment Thesis

15

INVESTMENT

HIGHLIGHTS

Calendar year ending December

Goal to deliver strong operating margin leverage & enhanced shareholder

value Profitable revenue growth

Well positioned in high

growth mobile consumer

electronics business

Stable revenues and cash

flow from specialty

components

Realize cost efficiencies

through operational

improvements

STRONG AND

PROFITABLE

REVENUE

GROWTH

Note:

EBITDA

is

defined

as

earnings

before

income

taxes

plus

(i)

depreciation

and

amortization

expense

and

(ii)

interest

expense.

See

Form

10

and

appendices for non-GAAP to GAAP reconciliations.

|

Knowles Specialty

Components (SC)

16

Gordon Walker

Co-President, Acoustics &

Hearing Health |

Specialty Components Snapshot

17

KEY

PRODUCTS

TOTAL REVENUE

($MM) AND

% CHANGE

BUSINESS DYNAMICS

ADJ.

EBITDA

($MM)

1

AND

%

MARGIN

Microphones /

Receivers

Capacitors /

Oscillators

$473

$448

$437

Stable markets

Customer intimacy

Attractive margin and cash flow dynamics

Adds stability and diversity to Knowles portfolio

1

Adj.

EBITDA

is

defined

as

earnings

before

income

taxes

plus

(i)

depreciation

and

amortization

expense

and

(ii)

interest

expense,

excluding

restructuring

costs, stock-based compensation, and acquisition transaction costs. See

Appendices for non-GAAP to GAAP reconciliations.

ACOUSTIC

PRODUCTS

PRECISION

DEVICES |

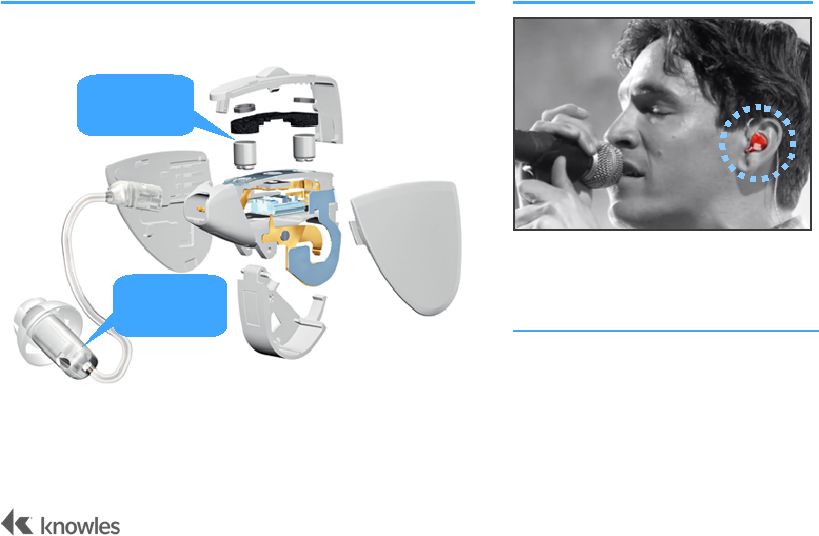

Acoustic Products: What We Do

HEARING HEALTH

PREMIUM AUDIO

“In Ear Monitors”

for musicians

and

enthusiasts

Typically >$100 retail

(up to $1,000)

Receiver content:

1 -

8 receivers per ear

18

Source: Knowles Management

Hearing Aid

Microphones

Hearing Aid

Receiver |

Acoustic Products: Key Themes

19

1

2

3

Leader in Stable, Resilient Market with

Favorable Macro Trends

Trusted Partner and Technology Leader

Strong Margin Expansion Opportunities |

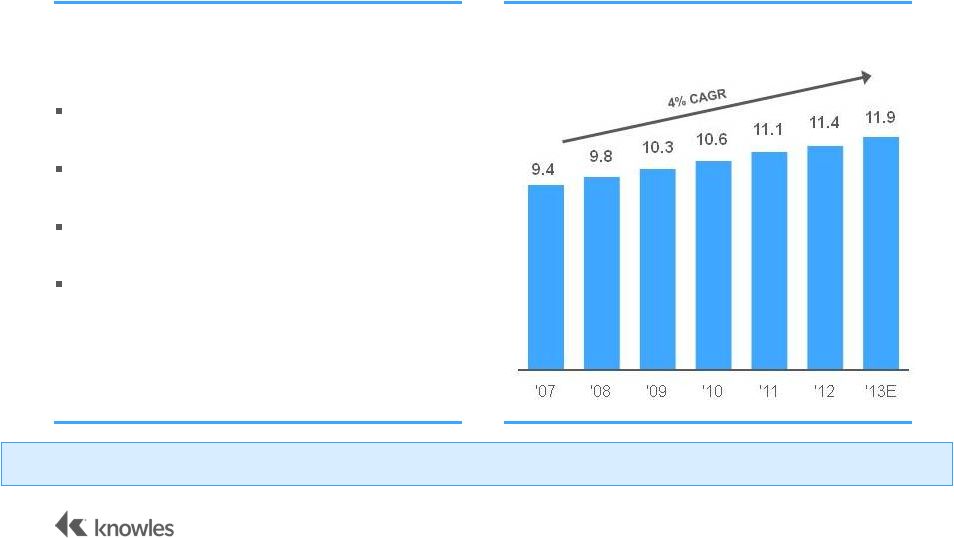

Market Overview –

Hearing Health Acoustics

20

ATTRACTIVE MARKET

DYNAMICS STABILITY

OF HEARING MARKET

Stable market

Limited Competition

Market Leader

Strong market position with all

hearing-aid manufacturers (OEMs)

Worldwide Hearing Units Sold (Millions of units)

Source: William Demant “Trends and Directions in the Hearing Healthcare

Market”, Knowles Management Market

Leader

for

>60

Years

in

an

Attractive,

Stable

Market

with

Favorable

Macro

Trends |

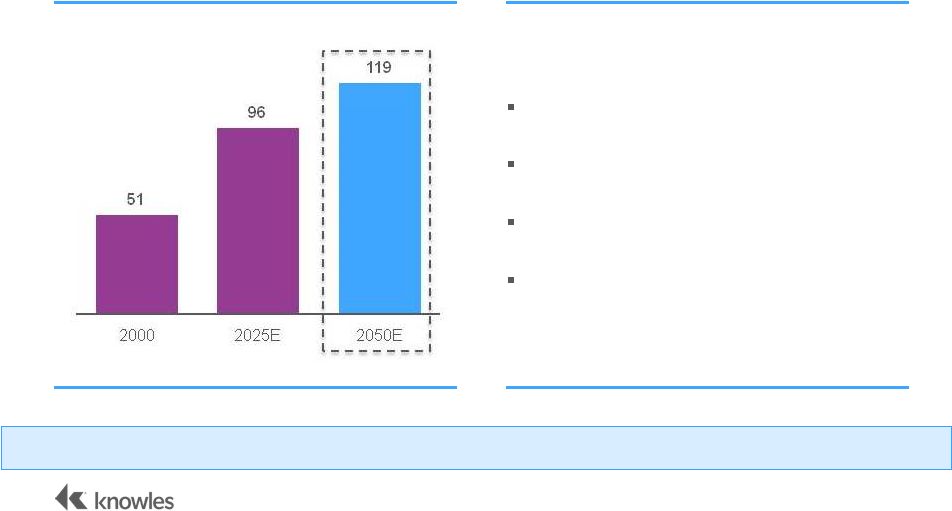

Mega

Trends: Hearing Health 21

Rapidly aging population

Longer life expectancy

Increasingly affluent

Improved distribution infrastructure

NORTH AMERICA AGING

POPULATION

EMERGING

MARKETS

Aged +60 (mm of people in North America)

Source: United Nations, DESA (Population Division)

Population of Adults Aged 60+ Expected to Increase from ~600 million to 2 billion in

2050 |

Acoustic Products: Why We Win

22

Leading Product Portfolio

1

2

3

4

Critical Role in Customers’

Products

Collaborative Engineering and Development

Relationships

Most Reliable Partner in the Industry |

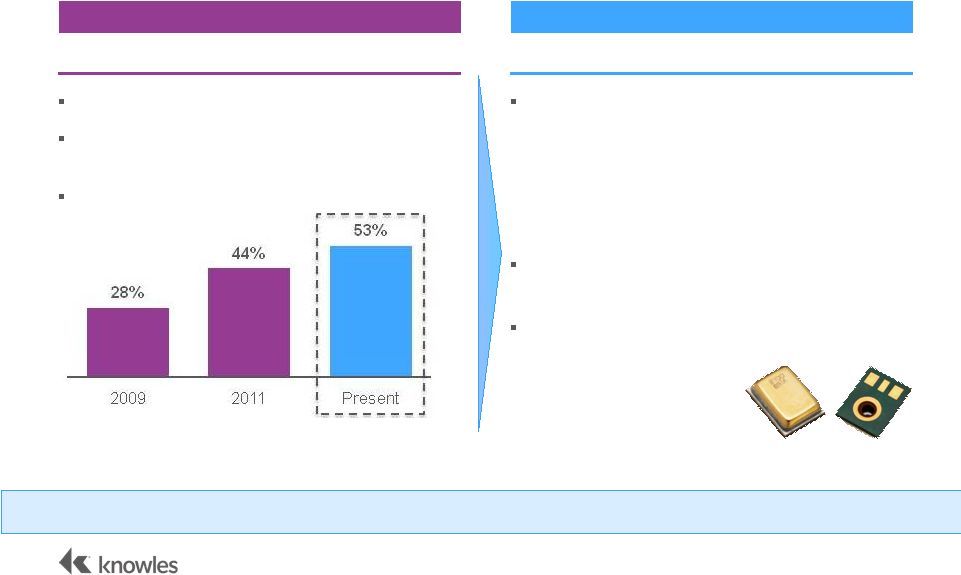

Partnered with lead customer in 2004

Became principal supplier to RIC segment from

inception

Today over 50% of world market

is RIC

Where We Are Going

23

Present

Future

Product-Technology leadership, MEMs solves

two problems

for OEMs:

1.

Hearing Instruments require greater stability,

consistency

2.

High labor costs from manual assembly

MEMs provides a highly scalable

solution with

superior acoustics

Recent design wins

with 3 of the top 6 hearing

aid OEMs

RECEIVER-IN

-CANAL

INSTRUMENTS

MEMS

MICROPHONES

RIC % of Total U.S. Market

Source: US Hearing Industries Association

Knowles Position in MEMs Microphones Demonstrates Technological Leadership

|

Low-Cost Manufacturing, Expanding Margins

24

…

LED TO

RELOCATION OF

SPEAKER & RECEIVER

MANUFACTURING Announced August 2013

First Tranche January 2014

To Be Completed Mid-2015

Suzhou, China

Cebu,

Philippines

Estimated ~$10mm in Savings per Year

CONTINUED INFLATION

AND

FX PRESSURE IN

CHINA… |

Acoustic Products: Key Takeaways

25

1

2

3

Profitable Leader in a Range of Attractive End

Markets

Product and Technology Leader with

Close Customer Relationship

Significant Margin Expansion Opportunity |

Knowles Specialty

Components (SC)

26

David Wightman

Co-President

Precision Devices |

Precision Devices Snapshot

27

KEY PRODUCTS

Crystal Oscillators

SAW Filters

Thin Film Filters

Single Layer Capacitors

Multi-Layer Capacitors

High Reliability Capacitors

Precision Devices –

Chosen by Engineers |

Precision Devices: Key Themes

28

Why We Win

1

2

3

4

5

Attractive Dynamics in Our Chosen Markets

Selected Market Segments

Innovation to Solve Customer Problems

Margin Expansion Opportunity |

Precision Devices: Why We Win

29

Customer

Intimacy

Product

Innovation

Market Segment

Focus

Operational

Excellence |

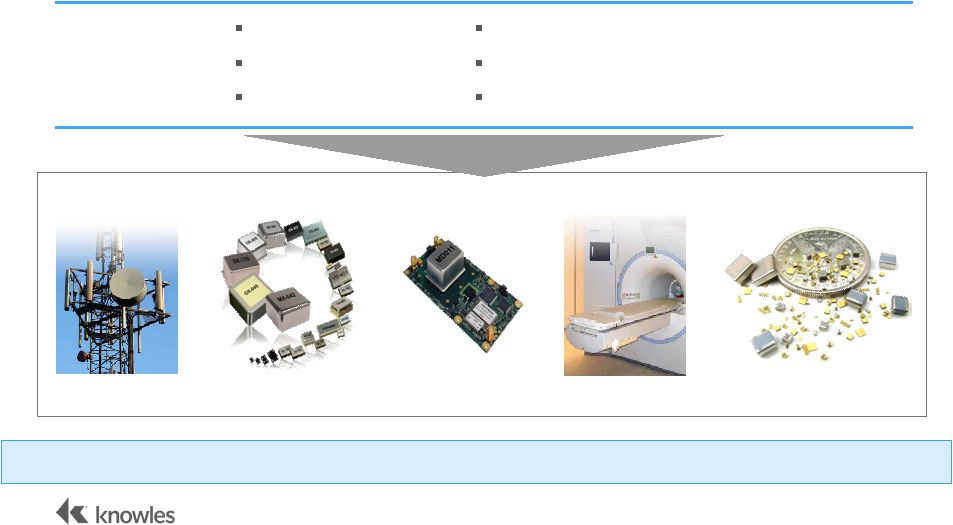

Attractive Dynamics in Our Chosen Markets

30

Military and Space

Smart Phone Technology advancements pushes global

military communications

Telecoms

Small Cell deployments supporting Data Traffic

Cloud Computing supporting large data centers

Medical

Medical equipment for an aging population

Increasing standards of care in emerging markets

Industrial

Test and Measurement equipment for next generation

networks

Increased applications in harsh operating environments

Technology Driven Solutions to

Meet Customer Specific Demands |

Focused on Specific, Mission-Critical Market

Segments

31

Medical

Military and

Aerospace

Telecom

Industrial

Opportunity for

Portfolio

Expansion via

Low Cost

Manufacturing

Consumer Electronics

Knowles Focuses on Mission Critical Segments where

Competitive Differentiation Leads to Strong Margins

|

Knowles Recipe for Success –

Capacitor Innovation

32

IDENTIFY THE

PROBLEM

MRI Case Study

Material development of ceramic and

electrode systems

New plating technique

New tests for high energy pulse requirements

Soldering techniques for high volume

assembly

Requires high-energy, non-magnetic

capacitors capable of withstanding

high energy pulses

CREATE A

SOLUTION

Primary source for the full range of

non-magnetic capacitors as Knowles

Capacitors

can now provide a “one

source”

solution

ACHIEVE A

BENEFICIAL OUTCOME

Knowles Identifies the Problem, Creates a Solution, and Becomes a Preferred

Source |

Margin Expansion Opportunity

33

Reduction in

Footprint

Direct Labor

Savings

Operational

Excellence /

SG&A

Transition from four

capacitor units into

one global operation

Relocating UK

manufacturing to

Suzhou, China

Overhead and SG&A

reduction

opportunities

Positioned for $9mm of Annualized Savings

|

Precision Devices: Key Takeaways

34

Profitable Leader in a Diversity of Carefully

Selected End Markets

1

2

3

Positioned to Build-On Knowles Attributes:

Customer Intimacy, Product Leadership,

Relationship with Engineering Communities

Significant Margin Expansion Opportunity |

Mobile Consumer

Electronics (MCE)

35

Christian Scherp

Co-President,

Speakers & Receivers

Michael Adell

Co-President,

Microphones |

Speakers / Receivers

Mobile Consumer Electronics Snapshot

36

Microphones

TOTAL

REVENUE

($MM)¹

AND

%

GROWTH

ADJ. EBITDA ($MM)²

AND

% MARGIN

KEY

PRODUCTS

STRONG FINANCIAL

PROFILE ¹

2011 includes a partial year of Sound Solutions revenue

²

Adj.

EBITDA

is

defined

as

earnings

before

income

taxes

plus

(i)

depreciation

and

amortization

expense

and

(ii)

interest

expense,

excluding

restructuring

costs,

stock-based compensation, and acquisition transaction costs. See Appendices for

non-GAAP to GAAP reconciliations. Profitable Business with Attractive

Growth Opportunities |

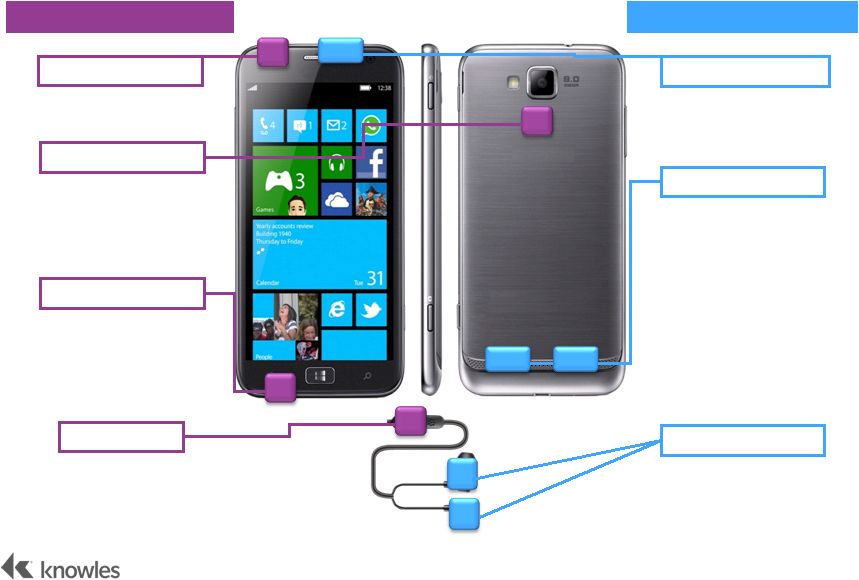

Typical Smartphone Acoustics Applications

37

Main Microphone

High Definition

Loud Speaker

Ear-Bud Speakers

Hands-Free

Reduces background

noise

Improves Video

Sound Recording

Calls / Voice

Recognition

Noise Canceling

Microphones

Clear sounds

High Definition Media

Playback

High Performance

Speakers

Microphones

Speakers / Receivers

Noise Cancelling

Voice Call Receiver |

MCE:

Key Themes 38

Attractive Growth Markets

1

2

3

4

5

Market Leadership

Commitment to Innovation

Acoustic Content Growth

Transition to Integrated Audio Solutions |

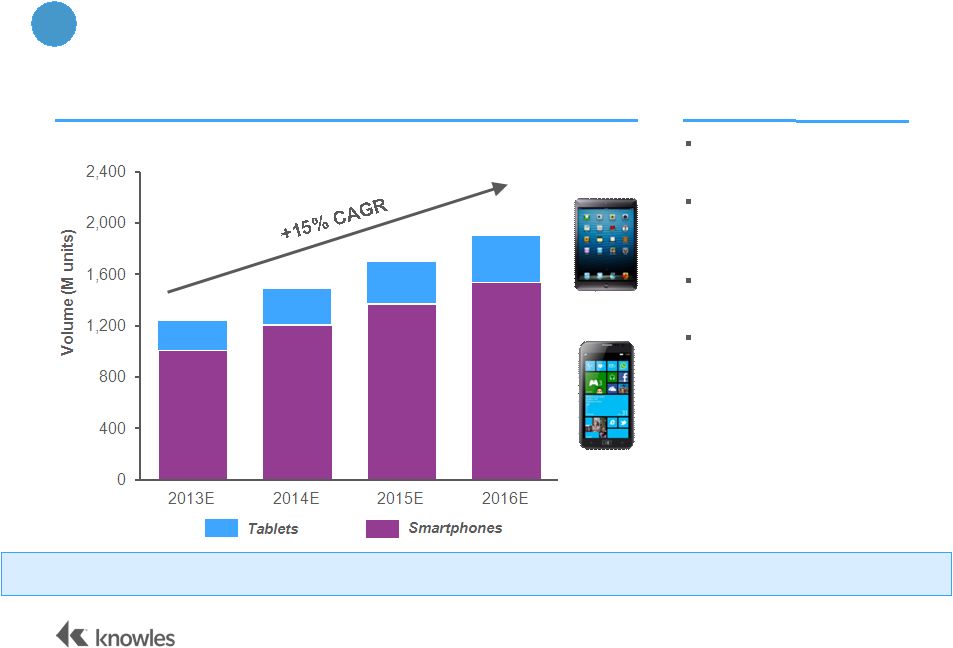

Attractive End-Markets

39

SMARTPHONES AND TABLETS VOLUME Overall “total”

market

growing at ~6% CAGR

Smartphone market

slowing to low double

digit growth

Notebook declines

offset by Tablet

Knowles is well

positioned in growth

markets

HIGHLIGHTS

1

Focus Markets Continue to Grow

Source: IDC (Nov. 2013), Management Projections |

Attractive Growth Markets –

Evolving Market Demands

40

Time

Traditional Communication

Music, movies and games

Augmented Listening

Speech recognition

1

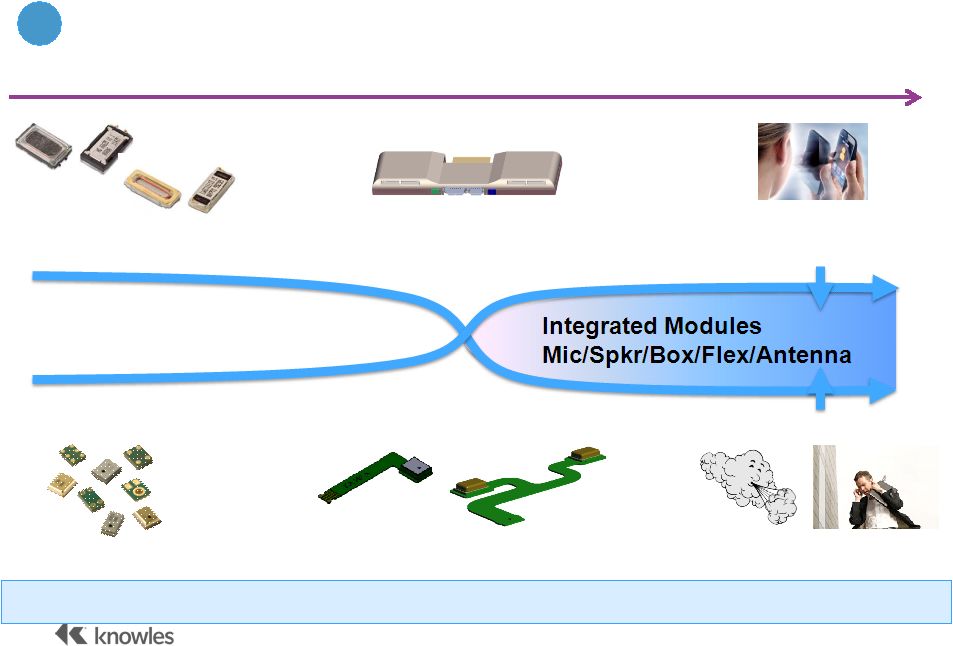

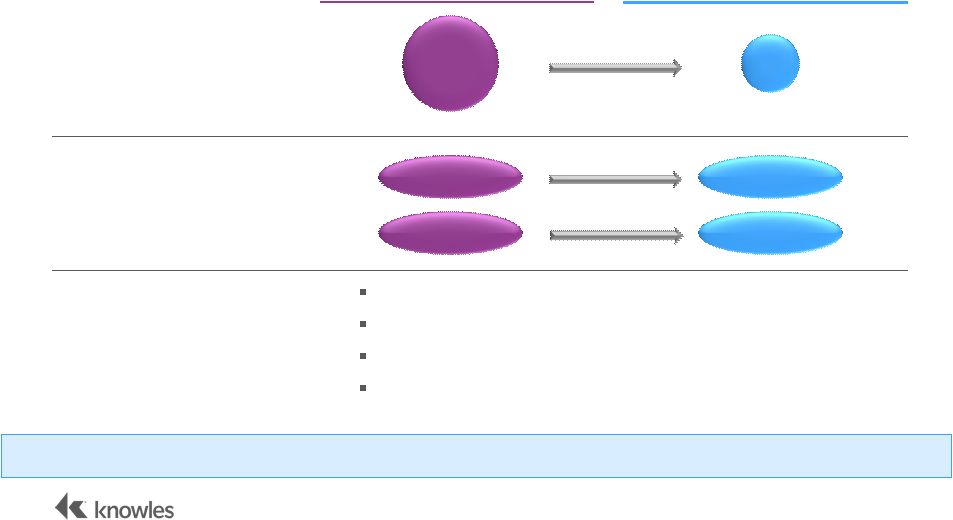

Market Demands Driving Growth |

Market Leadership

41

Shift towards

Integrated

Solutions

Shift towards

Integrated

Solutions

Standalone Components

System Solution

2 |

Competitive Landscape

42

2

Knowles’

unique combination of application knowledge, silicon design, and proprietary

manufacturing Source: Knowles Management |

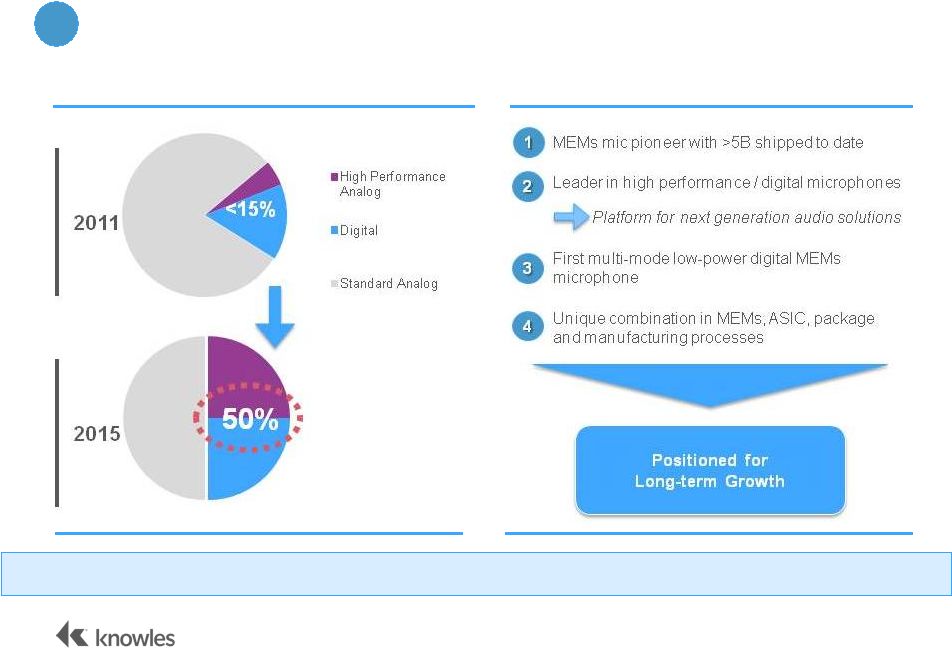

Commitment to Innovation

43

3

Knowles is Constantly Innovating Across its Entire Business

|

Commitment to Innovation –

Microphones

44

TREND

TOWARD

HIGHER

PERFORMANCE

MICS

KNOWLES

COMMITMENT TO

INNOVATION

Source: Knowles Management

3

Strategically Positioned to Capture Trend to Next Generation Microphone

Solutions |

Commitment to Innovation –

Speakers and Receivers

45

The best “acoustic brain”

in the industry with strong pre-development capabilities

Unique competence for ultra-thin future speaker solutions

Pushing beyond acoustics to include software, silicon, sensors and more

1997

2005

2013

World’s first Telecom

Micro-speaker

World’s first Rectangular

Micro-speaker

Over 6.6 billion pieces sold

3

Strategic Investment in R&D Drives Knowles Leading-edge Audio

Solutions |

Acoustic Content Growth

46

$1 -

2

$2 -

3

$3 -

5

Receiver

Dual Mics

Speaker

Receiver

Single Mic

Speaker

Receiver

Multi Mics

Integrated Speaker

Box/Antenna

Addressable

Content

2008

2012

FUTURE

Source: Knowles Management

4

Opportunities to Increase Content in Each Successive Generation

|

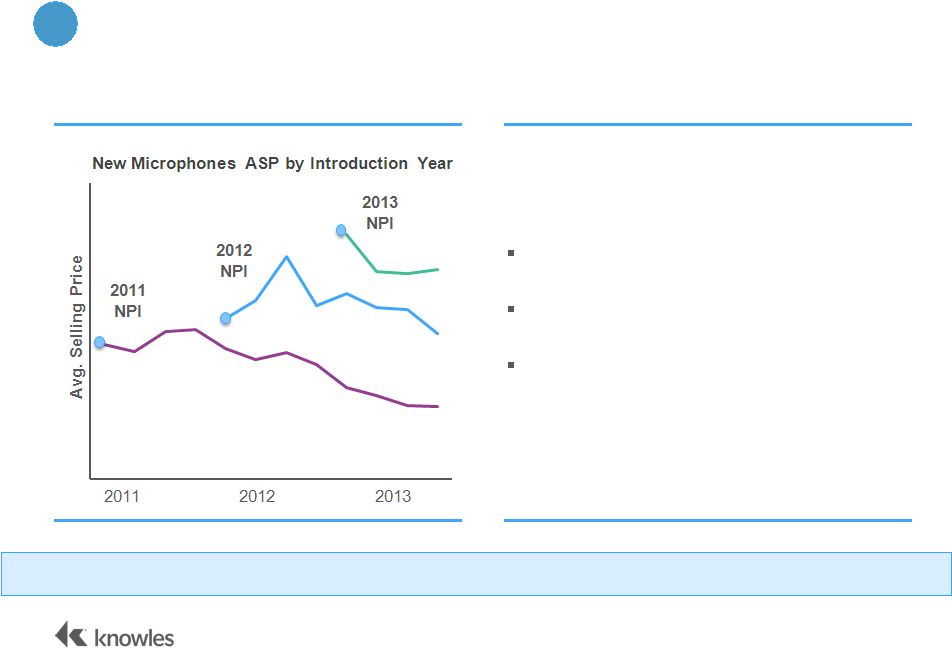

Acoustic Content Growth

47

WITH

EACH NEW PRODUCT,

SELLING PRICE RISES STRONG

AND

INNOVATIVE

INFRASTRUCTURE

Patented microphone technology

In-house ASIC, MEMs, and packaging

Robust product pipeline driven by new

use-cases

NPI = New Product Introduction

Source: Knowles Management

4

Product Innovation Resets ASPs |

Microphone

Speaker/Receiver

Integrated Audio

Components

Speaker

Modules

(Multi) Mic on Flex

Intelligent Audio Smart Mic

Intelligent Audio

Smart Speaker

Intelligent Audio

5

Capturing Value through Audio Integration

$

$$

$$$

Integrated Solutions Model –

Future Trends |

Intelligent Audio System

Integrated Speaker Box

Concert

Recording

AudioZoom

Stereo

Capture/Playback

2mic Noise

Reduction

5.1 Surround Sound

Capture / Playback

Wind Noise

Reduction

Gesture

Recognition

Active Noise

Cancellation

Playback

Optimization

Hardware / Software System

Future Knowles Products

Product

Platform

Intelligent

Solutions

Integrated Solutions Model –

Future Trends

49

5

Platform for Pioneering Intelligent Acoustic Applications

|

MCE:

Key Takeaways 50

Attractive Growth Markets

Market Leadership

Commitment to Innovation

Acoustic Content Growth

Transition to Integrated Audio Solutions

1

2

3

4

5 |

Financial Overview

51

John Anderson

Senior Vice

President &

Chief Financial

Officer |

Financial Highlights

52

Earnings Growth Through Robust Revenue Improvement and Margin Expansion

Significant

market and

content

growth

in

Mobile

Consumer

Strong track

record of

cash flow

generation

Margin

expansion

opportunity

to drive

earnings

growth

Stable

revenue

and

cash flow

from

Specialty

Components

Disciplined

approach to

capital

allocation |

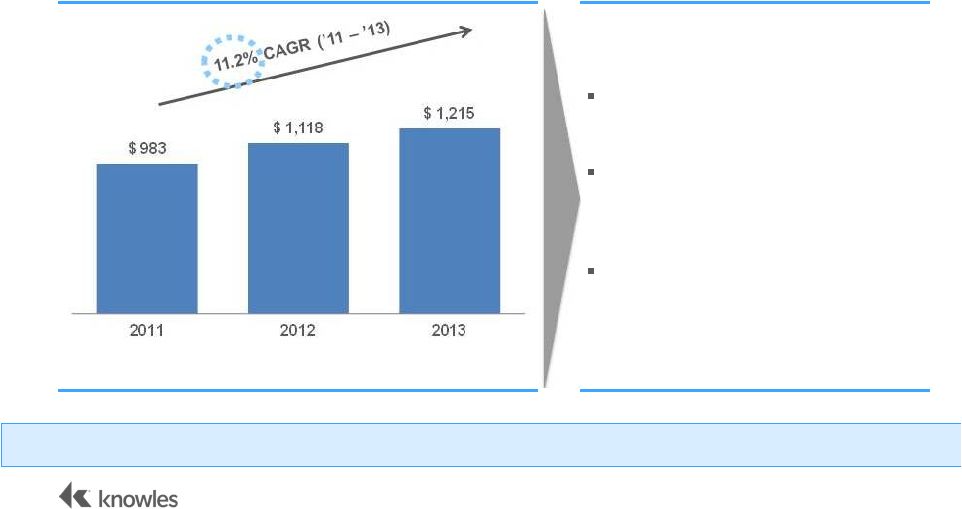

Track Record of Consistent Revenue Growth

53

REVENUE ($MM)

KEY

GROWTH DRIVERS

Strong position in growing

smartphone and tablet market

Content growth through multi-mic

adoption and integrated acoustic

systems

Hearing aid penetration in aging

populations and developing markets

Revenue Expansion Driven by Smartphone Market Expansion and Content Growth

Note: 2011 includes a partial year of Sound Solutions revenue

|

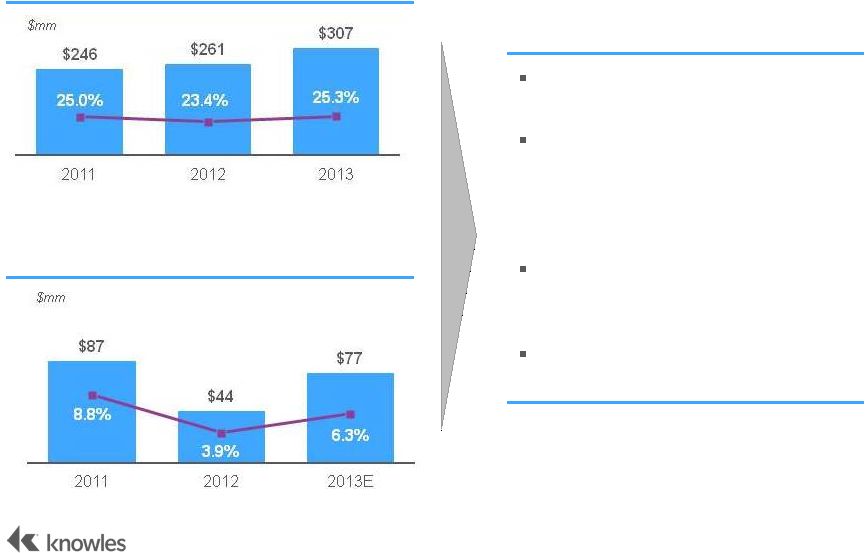

Strong Margins and Cash Flow Generation

54

ADJ.

EBITDA (AND

% MARGIN)¹

KEY

DRIVERS

Higher volumes and scale efficiencies

2013 Adj. EBITDA margin expansion

due to increased ASP on new

products and improved operating

leverage

Productivity and restructuring actions

beginning to lower costs

Significant capital spent on capacity

expansion and facility restructuring

FREE CASH FLOW

(AND % OF

REVENUES)²

¹

Adj.

EBITDA

is

defined

as

earnings

before

income

taxes

plus

(i)

depreciation

and

amortization

expense

and

(ii)

interest

expense,

excluding

restructuring costs, stock-based compensation, and acquisition transaction

costs. See Appendix for GAAP to Non-GAAP reconciliations. ²

Free cash flow is calculated as cash flow provided by operating activities less

capital expenditures. |

Margin Expansion Strategy

55

TODAY

MID

TERM

Footprint

Consolidation

Movement to

Lower-Cost

Regions

Operational

Excellence

Low cost materials sourcing

Lean focus / productivity enhancements

Further back office streamlining

Improved operating leverage

18

11

Suzhou

UK

Cebu

Suzhou

Expect to Drive $40mm -

$50mm Annualized Cost Savings

1: Exclusive of costs associated with restructuring. Restructuring of 4 of the 7

facilities has been announced and commenced. Annualized cost savings from

costs incurred in 2012 & 2013 are expected to be approximately $19 million of the expected

amount.

1 |

Efficient Capital Structure and Capital Allocation

56

Organic growth investments

Continued funding of research and

development

Productivity improvements

Expanding manufacturing footprint in cost-

competitive regions

Bolt-on acquisitions

Evaluate return of capital (mid-term)

STRONG BALANCE SHEET

AT SPIN

CAPITAL ALLOCATION

PRIORITIES (US$ in millions)

At Spin

Cash

$40

Total Debt

$400

Net Debt

$360

Total Debt / Adj. EBITDA¹

1.3x

Net Debt / Adj. EBITDA¹

1.2x

Intent to maintain

Investment Grade-like credit metrics

Focused on Efficient Capital Allocation to Drive Shareholder Value

1: Adj. EBITDA is defined as earnings before income taxes plus (i) depreciation and

amortization expense and (ii) interest expense, excluding restructuring

costs, stock-based compensation, and other items. See Appendix for GAAP

to Non-GAAP reconciliations. |

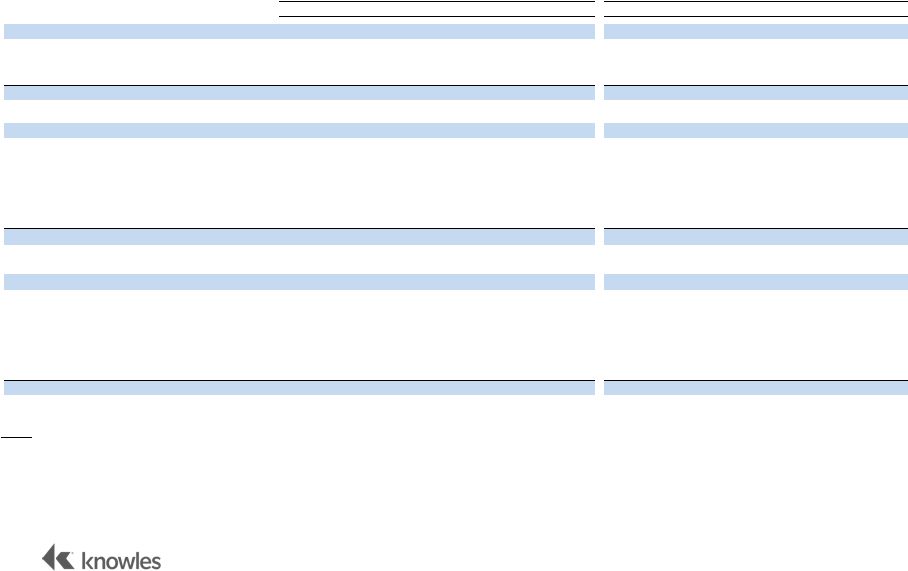

2013

Historical Data and Projections for Q1’14 (non-GAAP)

57

Note: See Appendices for GAAP to Non-GAAP reconciliations.

Q1’13

Q2’13

Q3’13

Q4’13

Q1’14E

Revenue ($M)

$276

$297

$312

$330

$260-265

Gross Profit ($M)

$97

$106

$122

$125

$88-91

Gross Profit Margin (%)

35.2%

35.7%

39.2%

37.9%

34.0-35.0%

Operating Profit ($M)

$39

$50

$69

$66

$31-33

Operating Margin (%)

14.2%

16.9%

22.1%

20.0%

12.0-13.0% |

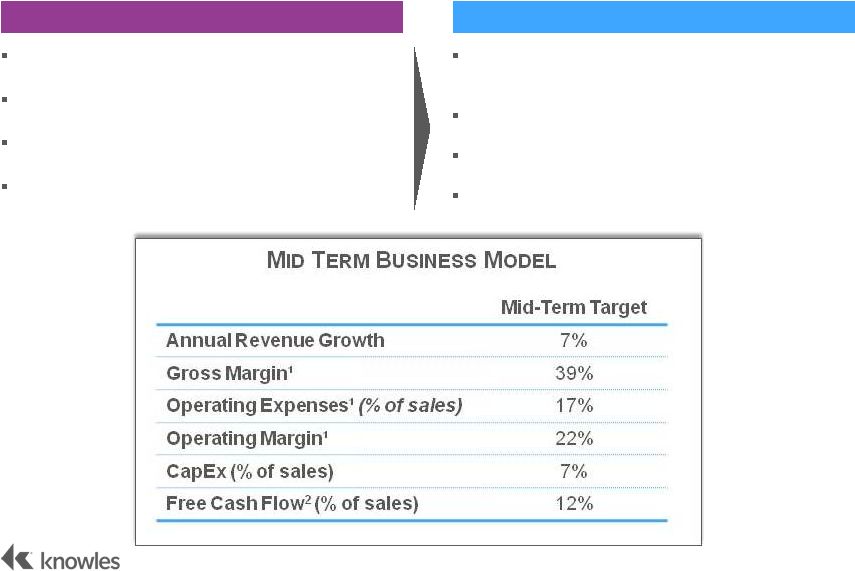

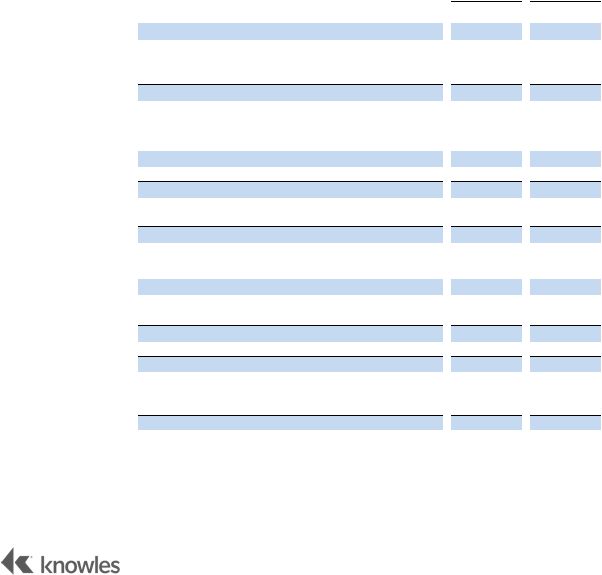

Where We Are

Where We Are Going

Mid Term Financial Model Targets

58

Increased market share in high growth, high

margin businesses

Expansion into adjacent markets

Additional customer penetration and content

Lower cost structure

Long-standing acoustic solutions market leader

Highly diversified products

Global footprint

Experienced management team

¹

Non-GAAP. See appendices for non-GAAP to GAAP reconciliations.

²

Free Cash Flow calculated as Operating Cash Flow less Capex.

|

Knowles

Conclusion + Q&A |

Key

Investment Highlights 60

Market-Leading Acoustic Supplier with Strong

Engineering Relationships

Attractive End-Markets

Innovative Technology Drives Differentiated

Solutions

Proprietary Operational Capabilities with Margin

Expansion Potential

Experienced Management with Proven Track

Records |

Appendices

61 |

62

KNOWLES CORPORATION

GAAP FINANCIAL MEASURES AND NON-GAAP FINANCIAL MEASURES

(1)

(unaudited, dollars in millions)

Q1

Q2

Q3

Q4

Total

Q1

Q2

Q3

Q4

Total

Revenue

276.2

$

296.7

$

311.6

$

330.3

$

1,214.8

$

261.1

$

260.7

$

299.6

$

296.6

$

1,118.0

$

Non-GAAP Gross profit

97.3

105.8

122.0

125.1

450.2

88.6

92.9

111.5

115.0

408.0

Non-GAAP Selling and administrative expenses

58.0

55.6

53.1

59.1

225.8

49.6

54.8

53.1

54.7

212.2

Non-GAAP Operating earnings

39.3

$

50.2

$

68.9

$

66.0

$

224.4

$

39.0

$

38.1

$

58.4

$

60.3

$

195.8

$

Notes:

2013

2012

(1) In addition to the GAAP financial measures included herein, Knowles has presented

certain non-GAAP financial measures. Knowles uses non-GAAP measures as supplements to its GAAP

results of operations in evaluating certain aspects of its business, and its Board of

Directors and executive management team focus on non-GAAP items as key measures of Knowles'

performance for business planning purposes. These measures assist Knowles in comparing

its performance between various reporting periods on a consistent basis, as these measures remove

from operating results the impact of items that, in Knowles' opinion, do not reflect its core

operating performance. Knowles believes that its presentation of non-GAAP financial measures is

useful because it provides investors and securities analysts with the same information that

Knowles uses internally for purposes of assessing its core operating performance. |

63

KNOWLES CORPORATION

RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES

(unaudited, dollars in millions)

Q1

Q2

Q3

Q4

Total

Q1

Q2

Q3

Q4

Total

GAAP Gross Profit

94.9

$

100.1

$

117.9

$

118.6

$

431.5

$

88.6

$

92.9

$

111.5

$

114.0

$

407.0

$

Asset Impairment and Related Inventory Charges

-

-

0.4

1.7

2.1

-

-

-

-

-

Restructuring Charges

1.8

4.0

1.0

1.0

7.8

-

-

-

0.4

0.4

Production Transfers Costs

(1)

0.6

1.7

2.7

3.8

8.8

-

-

-

0.6

0.6

Non-GAAP Gross Profit

97.3

$

105.8

$

122.0

$

125.1

$

450.2

$

88.6

$

92.9

$

111.5

$

115.0

$

408.0

$

Non-GAAP Gross Profit as % of Revenues

35.2%

35.7%

39.2%

37.9%

37.1%

33.9%

35.6%

37.2%

38.8%

36.5%

GAAP Selling and Administrative Expenses

72.4

$

72.5

$

66.2

$

73.0

$

284.1

$

62.9

$

68.2

$

66.6

$

73.2

$

270.9

$

Stock-Based Compensation Expense

(0.5)

(0.7)

(0.5)

(0.3)

(2.0)

(0.5)

(0.5)

(0.5)

(0.4)

(1.9)

Intangibles Amortization Expense

(11.6)

(12.3)

(11.5)

(10.5)

(45.9)

(11.7)

(12.1)

(11.1)

(13.6)

(48.5)

Asset Impairment Charges

(0.5)

-

-

(2.6)

(3.1)

-

-

(0.8)

(0.9)

(1.7)

Restructuring Charges

(1.6)

(5.5)

(1.0)

(0.4)

(8.5)

(1.0)

(0.7)

(0.8)

(3.0)

(5.5)

Production Transfers Costs

(1)

(0.2)

0.2

(0.1)

(0.1)

(0.2)

(0.1)

(0.1)

(0.3)

(0.6)

(1.1)

Other

-

1.4

-

-

1.4

-

-

-

-

-

Non-GAAP Selling and Administrative Expenses

58.0

$

55.6

$

53.1

$

59.1

$

225.8

$

49.6

$

54.8

$

53.1

$

54.7

$

212.2

$

Non-GAAP S&A Expenses as % of Revenues

21.0%

18.7%

17.0%

17.9%

18.6%

19.0%

21.0%

17.7%

18.4%

19.0%

GAAP Operating Earnings

22.5

$

27.6

$

51.7

$

45.6

$

147.4

$

25.7

$

24.7

$

44.9

$

40.8

$

136.1

$

Stock-Based Compensation Expense

0.5

0.7

0.5

0.3

2.0

0.5

0.5

0.5

0.4

1.9

Intangibles Amortization Expense

11.6

12.3

11.5

10.5

45.9

11.7

12.1

11.1

13.6

48.5

Asset Impairment and Related Inventory Charges

0.5

-

0.4

4.3

5.2

-

-

0.8

0.9

1.7

Restructuring Charges

3.4

9.5

2.0

1.4

16.3

1.0

0.7

0.8

3.4

5.9

Production Transfers Costs

(1)

0.8

1.5

2.8

3.9

9.0

0.1

0.1

0.3

1.2

1.7

Other

-

(1.4)

-

-

(1.4)

-

-

-

-

-

Non-GAAP Operating Earnings

39.3

$

50.2

$

68.9

$

66.0

$

224.4

$

39.0

$

38.1

$

58.4

$

60.3

$

195.8

$

Non-GAAP Operating Earnings as % of Revenues

14.2%

16.9%

22.1%

20.0%

18.5%

14.9%

14.6%

19.5%

20.3%

17.5%

Notes:

2013

2012

(1) Production Transfer Costs represent one-time and duplicate costs incurred to

migrate manufacturing to new facilities, primarily for speakers, hearing health products, and capacitors. These amounts

are included in the corresponding GAAP Gross Profit, GAAP Selling and Administrative Expenses

and GAAP Operating Earnings for each period presented. |

64

KNOWLES CORPORATION

(unaudited, dollars in millions)

2013

Mobile Consumer Electronics

Adjusted EBITDA

(1)

245.7

$

Asset Impairment and Related Inventory Charges

(5.1)

Restructuring Charges

(7.3)

Production Transfers Costs

(2)

(3.6)

EBITDA

(3)

229.7

$

MCE EBITDA as % of MCE Revenues

29.5%

Specialty Components

Adjusted EBITDA

(1)

106.2

$

Restructuring Charges

(9.2)

Production Transfers Costs

(2)

(5.2)

Other

1.4

EBITDA

(3)

93.2

$

SC EBITDA as % of SC Revenues

21.3%

Total Segments EBITDA

(3)

322.9

$

Corporate/Other

Adjusted EBITDA

(1)

(44.9)

$

Stock-Based Compensation Expense

(1.9)

EBITDA

(3)

(46.8)

$

Combined EBITDA

(3)

276.1

$

Interest Expense, net

(42.0)

Depreciation and Amortization Expense

(130.9)

Earnings before income taxes

103.2

$

RECONCILIATION OF SEGMENT NON-GAAP FINANCIAL MEASURES

TO GAAP FINANCIAL MEASURES

(1) Adjusted EBITDA is defined as net earnings plus (i) depreciation and amortization

expense, (ii) interest expense, and (iii) income taxes, excluding restructuring costs,

stock- based compensation, and acquisition transaction costs.

(3) EBITDA is defined as net earnings plus (i) depreciation and

amortization expense, (ii)

interest expense, and (iii) income taxes.

(2) Production Transfer Costs represent one-time and duplicate costs incurred to

migrate manufacturing to new facilities, primarily for speakers,

hearing health products,

and capacitors. |

65

KNOWLES CORPORATION

(unaudited, dollars in millions)

2012

2011

Mobile Consumer Electronics

Adjusted EBITDA

(1)

184.7

$

154.8

$

Asset Impairment and Related Inventory Charges

(1.7)

-

Restructuring Charges

(1.2)

-

Production Transfers Costs

(2)

(1.7)

-

EBITDA

(3)

180.1

$

154.8

$

MCE EBITDA as % of MCE Revenues

26.9%

30.4%

Specialty Components

Adjusted EBITDA

(1)

115.0

$

130.1

$

Restructuring Charges

(4.6)

(0.5)

EBITDA

(3)

110.4

$

129.6

$

SC EBITDA as % of SC Revenues

24.6%

27.4%

Total Segments EBITDA

(3)

290.5

$

284.4

$

Corporate/Other

Adjusted EBITDA

(1)

(38.3)

$

(39.2)

$

Stock-Based Compensation Expense

(1.9)

(1.9)

Acquisition Transaction Costs

(4)

-

(13.1)

EBITDA

(3)

(40.2)

$

(54.2)

$

Combined EBITDA

(3)

250.3

$

230.2

$

Interest Expense, net

(56.5)

(39.9)

$

Depreciation and Amortization Expense

(114.9)

(84.8)

$

Benefit from (provision for) income taxes

0.2

(7.1)

$

Net Earnings

79.1

$

98.4

$

(4) Acquisition Transaction Costs represent expenditures associated with the purchase

of the Sound Solutions business.

RECONCILIATION OF SEGMENT NON-GAAP FINANCIAL

MEASURES TO GAAP FINANCIAL MEASURES

(1) Adjusted EBITDA is defined as net earnings plus (i) depreciation and amortization

expense, (ii) interest expense, and (iii) income taxes, excluding restructuring costs,

stock-based compensation, and acquisition transaction costs.

(3) EBITDA is defined as net earnings plus (i) depreciation and

amortization expense, (ii) interest expense,

and (iii) income taxes.

(2) Production Transfer Costs represent one-time and duplicate costs incurred to

migrate manufacturing to new facilities, primarily for speakers, hearing health

products, and capacitors. |

66

KNOWLES CORPORATION

(unaudited, dollars in millions)

2013

Revenues

1,214.8

$

Earnings Before Taxes

103.2

Depreciation and Amortization Expense

130.9

Interest Expense, net

42.0

EBITDA

(1)

276.1

$

EBITDA margin

(2)

22.7%

RECONCILIATION OF EARNINGS BEFORE TAXES TO

EBITDA

(1) EBITDA is defined as net earnings plus (i) depreciation and amortization expense,

(ii) interest expense, and (iii) income taxes.

(2) EBITDA margin is defined as EBITDA as a percentage of revenue.

|

67

KNOWLES CORPORATION

(unaudited, dollars in millions)

2012

2011

2010

2009

2008

Revenues

1,118.0

$

983.3

$

730.4

$

587.0

$

630.4

$

Net Earnings

79.1

98.4

109.3

37.3

33.1

Depreciation and Amortization Expense

114.9

84.8

54.4

50.7

49.5

Interest Expense, net

56.5

39.9

20.3

21.2

37.5

Benefit from (provision for) income taxes

(0.2)

7.1

7.5

18.5

13.0

EBITDA

(1)

250.3

$

230.2

$

191.4

$

127.6

$

133.1

$

EBITDA margin

(2)

22.4%

23.4%

26.2%

21.7%

21.1%

(1) EBITDA

is

defined

as

net

earnings

plus

(i)

depreciation

and

amortization

expense,

(ii)

interest

expense,

and

(iii)

income

taxes.

(2) EBITDA margin is defined as EBITDA as a percentage of revenue.

RECONCILIATION OF NET EARNINGS TO

EBITDA |