Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NOVANTA INC | d678940d8k.htm |

Investor Presentation

February 19, 2014

Exhibit 99.1 |

Page 2

Forward-Looking Statements

The

statements

in

this

presentation

that

relate

to

guidance,

pro

forma

presentations,

and

future

plans,

goals,

business opportunities, events or performance are forward-looking statements that involve risks and

uncertainties, including risks associated with business and economic conditions, failure to

achieve expected benefits of the JADAK acquisition, failure to successfully integrate current and

future acquisitions, including JADAK, into our business, customer and/or supplier contract

cancellations, manufacturing risks, competitive factors, ability to successfully introduce new

products, uncertainties pertaining to customer orders,

demand

for

products

and

services,

growth

and

development

of

markets

for

the

Company's

products

and services, and other risks identified in our filings made with the Securities and Exchange

Commission. Actual results, events and performance may differ materially. Readers are

cautioned not to place undue reliance on these forward-looking statements, which speak only

as of the date of this presentation. The Company disclaims any obligation to update these

forward-looking statements as a result of developments occurring after the date of this

presentation. Readers are encouraged to refer to the risk disclosures described in the

Company’s Form 10-K for the year ended December 31, 2012 and subsequent filings with the

SEC, as applicable. Non-GAAP Measures

In this presentation, we present the non-GAAP financial measures of Adjusted EBITDA , free cash flow

and net

debt

.

Please

see

“Use

of

Non-GAAP

Financial

Measures”

and

the

subsequent

slides

in

the

Appendix

to

this presentation for the reasons we use these measures, a reconciliation of these measures to the most

directly

comparable

GAAP

measures

and

other

information

relating

to

these

measures.

The Company neither updates nor confirms any guidance regarding the future operating results of the

Company which may have been given prior to this presentation.

Note factors affecting future performance…

…and use of Non-GAAP financial measures |

Our

aspirations… 2012 Strategic Vision

A leading provider of precision photonic and

motion technologies for OEM’s in demanding

markets –

delivering attractive shareholder

returns through sustained profitable growth

Strategic Priorities

•

Organic growth mid to high single

digits

•

>20% Adj. EBITDA margins

•

Long term shareholder returns

above peer average

Performance Goals

Page 3

•

Accelerate growth (organic and M&A)

•

Improve mix (growth, volatility) –

more Medical, less Semiconductor

•

Strive to become a world class

operating company

…are

clear

and

achievable |

…to achieve our

strategic goals JADAK Technologies Inc.

“A significant milestone in our overall medical strategy to offer

a broad range

of enabling technologies to medical OEM’s.”

“A growing, profitable business with a strong management team and

an

exceptional customer and technology franchise.”

“A leader in data collection and machine vision technologies that

make

medical equipment safer, assure accuracy and reduce medical errors.”

Our acquisition of JADAK…

…further enhances our growing medical technology franchise

Page 4 |

…to achieve our

strategic goals JADAK Profile

JADAK is a strong technology company…

…with an excellent medical market presence

•

Leading provider of component level machine vision, auto ID, and

RFID technologies

to medical equipment OEM’s

•

Founded in 2000 -

based in N. Syracuse, NY –

130 employees -

privately owned

•

Revenue $50M+, EBITDA margins in high teens –

revenue doubled in past 5 years

•

Products sold to OEM’s for integration into a wide range of medical equipment

•

Exceptional technology and customer franchise –

strong relationships with premier

medical OEM’s

Page 5 |

JADAK has four

major product categories… Embedded

Components

Fixed Mount and

Smart Cameras

Handheld

Scanners

Machine Vision

Software

•

Barcode Options

•

Machine Vision

Options

•

RFID Options

•

Barcode Options

•

Machine Vision

Options

•

RFID Options

•

Corded / Wireless

Options

•

Medical Grade

•

Highly Customizable

•

Works on all

platforms

•

Allows user to

configure code

JADAK Product Lines

Page 6

…which are sold to major OEM customers |

…for leading OEMs in numerous medical applications

JADAK provides optical scanning technology…

Clinical Analysis

Equipment

Patient Monitors

Surgical Tools

Pharmacy Carts

Barcode

Optics Module

JADAK Applications

Portable Glucose Monitors

*

* VDC Research

CAGR 8%

Page 7

$0

$20

$40

$60

$80

$100

$120

$140

2011

2012

2013

2014

2015

2016

2017

Bar Code Scanning in Heathcare ($M) |

…through numerous dimensions

JADAK creates sustainable OEM relationships…

JADAK Customer Value Proposition

Medical OEM Customers

Medical OEM Customers

Page 8 |

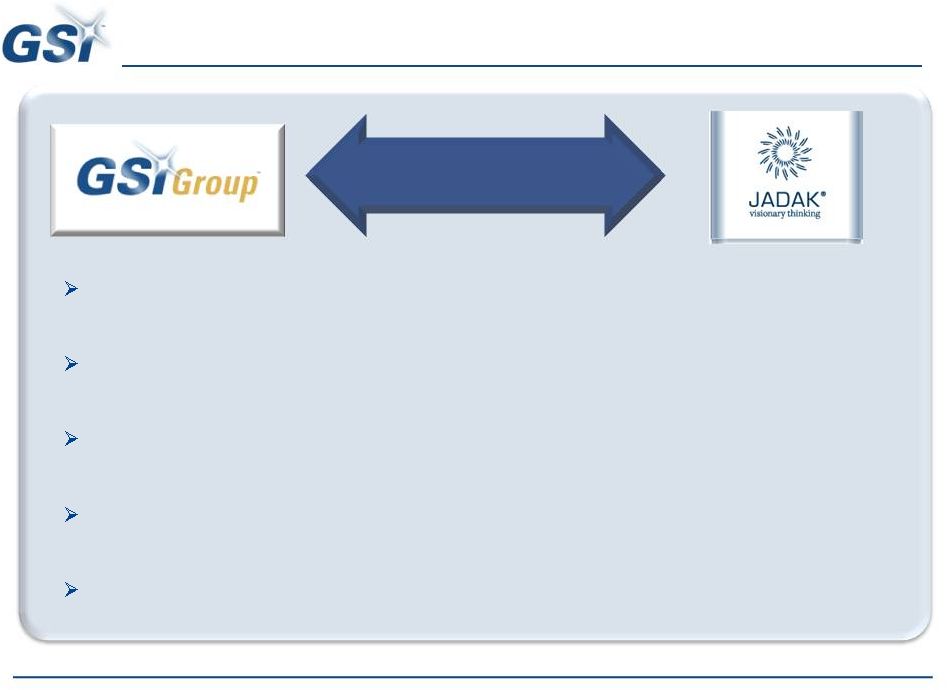

Common customers, application areas and channels with

existing GSI medical business

–

enables

medical

“key

account”

sales

strategy

Core

technologies

are

familiar

to

GSI

-

based

on

optoelectronic

image

sensor

technologies with significant application specific development

JADAK’s OEM business model

is virtually identical to GSI’s from technology

development to sales cycle to production

JADAK

brings

predictable,

profitable

growth

to

GSI

portfolio

–

growth

is

driven

by reductions in medical errors (improved safety)

The management team

is stable, cohesive and has demonstrated a long term

commitment

to

the

business

and

the

local

community

which

reduces

risk

JADAK is a strong fit…

…with GSI’s strategy and core competencies

Strategic Fit

Page 9 |

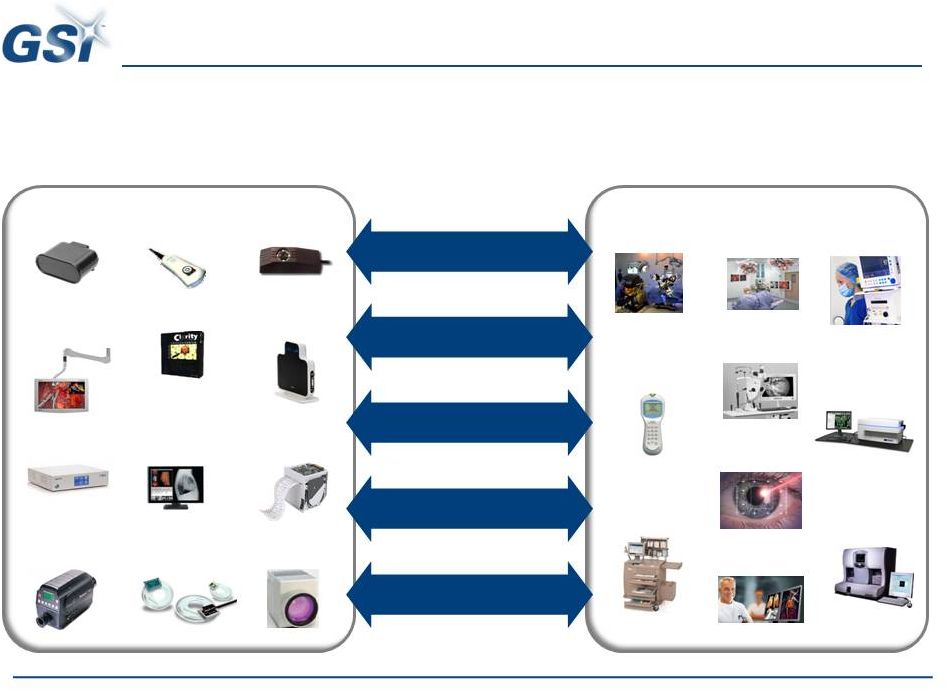

We

will offer a dozen medical enabling technologies… …to major

OEM’s in numerous applications Go Forward Medical Business

Page 10

Bar Code

Scanning

RFID

Machine

Vision

Surgical

Displays

Radiology

Displays

Wireless

Networking

Optical

Encoders

Thermal

Printers

Color

Analyzers

Software

Informatics

Laser

Scanning

Enabling Technologies

Major Applications

Blood

Analysis

Robotic

Surgery

Minimally

Invasive

Surgery

Radiology

Glucose

Monitoring

Drug

Delivery

Patient

Monitoring

Life

Sciences

Laser

Surgery

Retinal

Diagnostics

~$170M annual sales

Precision Technologies

Key Account Sales Force

Medical Quality System

OEM Design-in Expertise |

With

this transaction… …

the medical space is our largest market

Laser

Products

Medical

Technologies

Scientific

Medical

Micro-

electronics

GSI Pro Forma (w/ JADAK)

Industrial

Precision

Motion

Product Groups

End Market Mix

* Data presented represents last nine months, ended 3Q 2013, adjusted for

Jadak’s impact on GSI’s operation segments and end-market revenues on a pro forma basis.

Page 11 |

Key

Priorities for 2014 •

Acquisitions:

Successful integration of JADAK, potential

follow-on deals: Medical & Advanced Industrial Markets

(i.e. scanning & precision motion)

•

Organic Growth:

~$5M of growth investment in key

platforms –

driven by confidence in long-term prospects

•

Productivity:

Driving $5M+ savings in 2014, funding

internal investments, mitigating risks & delivering

potential upside results

We have clear focus…

…for success in 2014

Page 12 |

…assumes modest improvement in base business

$271M

Revenue Outlook

+25%*

Low Single

Digit Growth

13

Our conservative view of 2014…

+ JADAK ~$50M

annualized

2012

2013

2014 Outlook

*Includes acquisition of NDS Surgical Imaging on January 15, 2013. Reflects prior

full year guidance. The company is neither updating, nor confirming its prior guidance, but is simply using its prior guidance for comparison and illustrative purposes

Page 13 |

Page 14

2014 productivity funds ~$5M of growth investment…

Adjusted EBITDA Outlook

14

*Adjusted EBITDA is a non-GAAP measure. The reconciliation to our most comparable GAAP

numbers is provided in the appendix. ** 2013 Reflects prior full year guidance.

The company is neither updating, nor confirming its prior guidance, but is simply using its prior guidance for comparison and illustrative purposes

…while we deliver +8% profit growth ex. JADAK

$42M

~$50M*

+ 8-10%

+ JADAK ~$10M

annualized

2012

2013

2014 Outlook |

Deal

Financing We funded the transaction…

…through cash on hand and our new $215M credit facility

•

1

st

Quarter 2014:

Borrowing $68M from bank revolver at Libor

+ 275 basis points; total gross debt of approximately $140M,

and slightly more than $100M of net debt

•

Year-End 2014:

Expect to lower net debt to less than $70M,

with gross debt at Libor +250 basis points

($ in millions)

Sources

Amount

Uses

Amount

Cash & Cash Equivalents

26.0

$

JADAK Acquisition

93.5

$

Revolver ($175M)*

68.0

$

Transaction Fees

0.5

$

Total

94.0

$

Total

94.0

$

Sources and Uses

Page 15 |

Free Cash Flow

Outlook 2012

2013

2014

(pre-Acq)

2014

(Post-JADAK)

Net Debt

($16M)

~$15M

~($20M)

~$70M

*EXCLUDES ~$10.6M net cash refund related to U.S. IRS audit for

the GSI Group’s 2000 through 2008 tax years.

Significant cash generation…

…from stronger portfolio and better operating capabilities

2012

2013

2014 Outlook

$24M

$25-30M*

+ $35M

Page 16

*Free Cash Flow and Net Debt are non-GAAP measures. The reconciliation to our

most comparable GAAP numbers is provided in the appendix. Free cash flow and Net Debt reflects prior full year guidance. The Company is neither updating, nor confirming its prior guidance, but is

simply using its prior guidance for comparison and illustrative purposes

+ JADAK ~$5M

annualized |

Page

17 Appendix |

Page

18 Non-GAAP Measures

The non-GAAP financial measures used in this presentation are non-GAAP

Adjusted EBITDA, free cash flow, and net debt. The Company believes that the

non-GAAP financial measures provide useful and supplementary information to investors

regarding the Company’s financial performance. It is management’s belief

that these non-GAAP financial measures would be particularly useful to

investors because of the significant changes that have occurred outside of the Company’s day-to-day

business in accordance with the execution of the Company’s strategy. This

strategy includes streamlining the Company’s existing operations through

site and functional consolidations, strategic divestitures, expanding the Company’s business

through significant internal investments, and broadening the Company’s product

and service offerings through acquisition of innovative and complementary

technologies and solutions. The financial impact of certain elements of these activities,

particularly acquisitions, divestitures, and site and functional

restructurings, are often large relative to the Company’s overall

financial performance, which can adversely affect the comparability of its operating

results and investors’ ability to analyze the

business from period to period.

The Company’s Adjusted EBITDA, a non-GAAP financial measure, is used by

management to evaluate operating performance, communicate financial results to

the Board of Directors, benchmark results against historical performance and the performance

of peers, and evaluate investment opportunities including acquisitions and

divestitures. In addition, Adjusted EBITDA is used to determine bonus payments

for senior management and employees. Accordingly, the Company believes that this non-GAAP

measure provides greater transparency and insight into management’s method of

analysis. Non-GAAP financial measures should not be considered as

substitutes for, or superior to, measures of financial performance prepared in

accordance with GAAP. They are limited in value because they exclude charges that have a material effect on the

Company’s reported results and, therefore, should not be relied upon as the sole

financial measures to evaluate the Company’s financial results. The

non-GAAP financial measures are meant to supplement, and to be viewed in conjunction with, GAAP

financial measures. Investors are encouraged to review the reconciliation of these

non-GAAP financial measures to their most directly comparable GAAP

financial measures as provided in the tables accompanying this presentation.

Use of Non-GAAP Financial Measures |

Non-GAAP Free Cash Flow

& Net Debt

(a)

Free cash flow, a non-GAAP measure, is defined as cash provided by

operating activities less capital expenditures. (b)

Net debt, a non-GAAP measure, is defined as total debt less cash and cash

equivalents. Nine Months Ended

Twelve Months Ended

September 27, 2013

December 31, 2012

Cash provided by operating activities

$34,448

$28,430

Less: Capital expenditures

3,073

4,308

Free Cash Flow (a)

$31,375

$24,122

Debt

($78,375)

($50,000)

Less: Cash and cash equivalents

53,690

65,788

Net Debt (b)

$24,665

$15,788

* Free Cash Flow includes the cash flows of Continuing and Discontinued

Operations *

Page 19 |

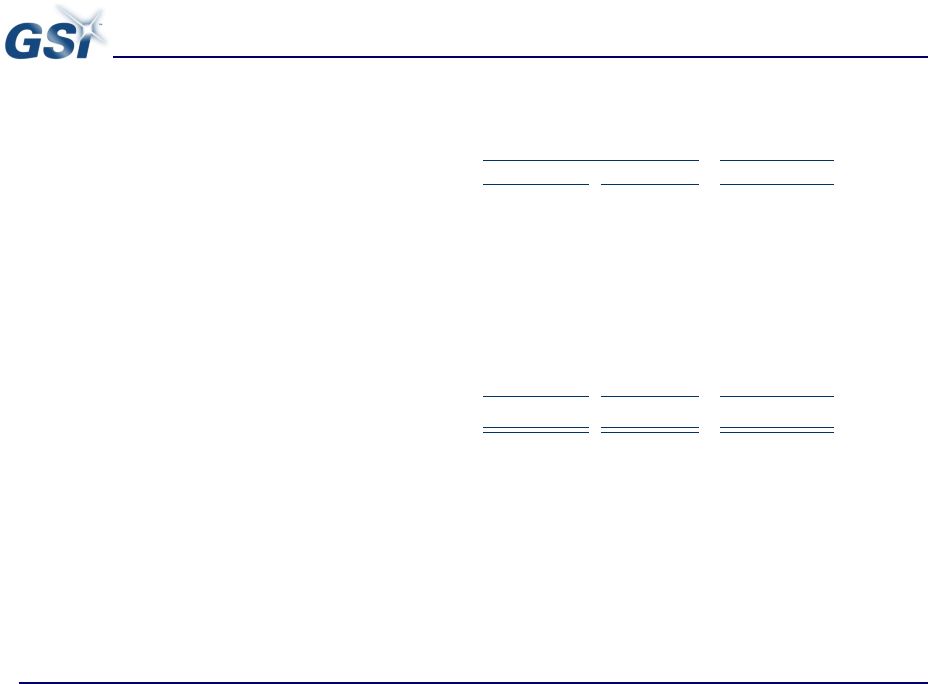

Non-GAAP Adjusted EBITDA Reconciliation

Twelve Months Ended

Last Twelve Months

December 31, 2012

December 31, 2011

September 27, 2013

(in thousands of dollars)

Income from operations (GAAP)

$ 15,007

$ 35,848

$ 14,311

Depreciation and amortization

13,196

14,467

18,458

Share-based compensation

4,580

3,276

5,313

Restructuring and other costs

8,842

2,406

7,338

Acquisition fair value adjustments

_

_

903

Net income attributable to noncontrolling interest

(40)

(28)

(37)

Adjusted EBITDA (Non-GAAP)

$ 41,585

$ 55,969

$ 46,286

Page 20 |