Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CONAGRA BRANDS INC. | d675605d8k.htm |

1

Feb. 18, 2014

Exhibit 99.1

CAGNY 2014 |

Agenda

•

Gary

Rodkin,

CEO

•

John

Gehring,

CFO

2 |

Note on forward-looking statements

3

This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking statements are

based on management’s current expectations and are subject to uncertainty and

changes in circumstances. These risks and uncertainties include, among other things:

ConAgra Foods’ ability to realize the synergies and benefits contemplated by the acquisition of Ralcorp

Holdings, Inc., and its ability to effectively integrate the business of Ralcorp; the timing

and ability to consummate the potential joint venture combining the flour milling

businesses of ConAgra Foods, Cargill, Incorporated, and CHS Inc., including,

satisfying the financing and other closing conditions as well as the divestiture of

flour milling facilities within the expected timeframe or at all; ConAgra Foods’ ability to realize the

synergies and benefits contemplated by the potential joint venture; the availability and

prices of raw materials, including any negative effects caused by inflation or adverse

weather conditions; the effectiveness of ConAgra Foods’ product pricing,

including any pricing actions and promotional changes; the ultimate outcome of

litigation, including the lead paint matter; future economic circumstances; industry

conditions; ConAgra Foods’ ability to execute its operating and restructuring

plans; the success of ConAgra Foods’ cost-saving initiatives, innovation, and

marketing investments; the competitive environment and related market conditions; operating

efficiencies; the ultimate impact of any ConAgra Foods product recalls; access to capital;

actions of governments and regulatory factors affecting ConAgra Foods’

businesses, including the Patient Protection and Affordable Care Act; the amount and

timing of repurchases of ConAgra Foods’ common stock and debt, if any; and other risks

described in ConAgra Foods’ reports filed with the Securities and Exchange Commission,

including its most recent annual report on Form 10-K and subsequent reports on

Forms 10-Q and 8-K. Investors and security holders are cautioned not to place

undue reliance on these forward-looking statements, which speak only as of the

date they are made. ConAgra Foods disclaims any obligation to update or revise statements contained in

this presentation to reflect future events or circumstances or otherwise. |

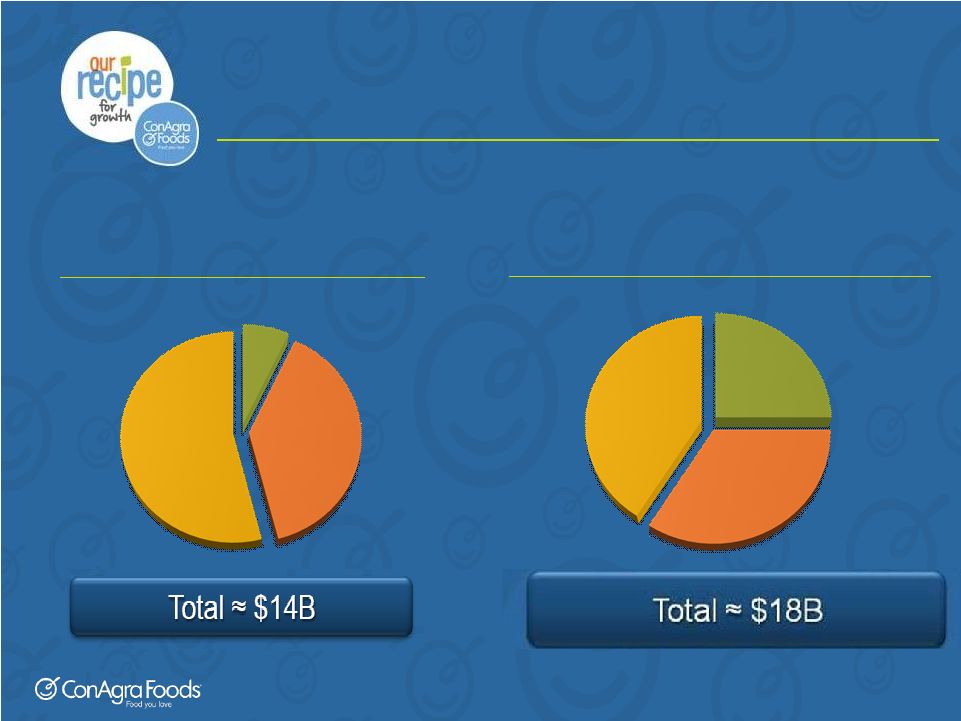

Current snapshot

4

ConAgra

Foods’

FY

2013

sales

mix

ConAgra

Foods’

FY

2013

sales

mix

ConAgra

Foods’

FY

2014

(est.)

sales

mix

ConAgra

Foods’

FY

2014

(est.)

sales

mix

Commercial Foods

Commercial Foods

Consumer Foods

Consumer Foods

Private Brands

Private Brands

41%

35%

24%

Commercial Foods

Commercial Foods

Consumer Foods

Consumer Foods

Private Brands

Private Brands

54%

39%

7% |

Fiscal 2014: short-term issues

•

Ralcorp integration

•

Foodservice customer disruption

•

Consumer brand challenges

5 |

Largest private brand food

business in North America.

Makes and sells private

brands to retail customers.

24%

24%

41%

Consumer Foods

35%

Commercial Foods

Private

Private

Brands

Brands |

|

Cost synergies

8

•

On track to deliver on commitments

•

Using scale in sourcing and procurement contracts

•

Robust pipeline |

Engaging with customers

9

“We’re

excited

by

the

potential

of

leveraging

the

entire

portfolio.

It

really

simplifies

doing

business

with

you.”

–

ConAgra

Foods

retail

customer |

Fast-growing retailers:

a focus on Private Label

10

Source: High-focus Private Label retailers comprised of 5 retailers.

Kantar Retail – Edible Grocery; Planet Retail;

Deloitte American pantry study, Progressive Grocer; Nielsen.

Dollar Sales Growth

“You’re a key

partner on our

journey.

We

will

move from

good to great

with private

brands as our

differentiator.”

–

ConAgra Foods

retail customer

High Focus

High Focus

Private Label

Private Label

Retailers

Retailers

Remaining

Remaining

Top 30

Top 30

Retailers

Retailers

2x |

Private vs. National Brands

11

Source: Wall Street research. Comparisons based on a $10 national

brand retail price illustration. “We like your

strategy for

Private Brands.

You offer both

scale and

flexibility.”

–

ConAgra Foods

retail customer |

Private Brands + Consumer Brands

12 |

Growing appeal to consumers

13

Store brands as good as national brands

Source: 71% say brand names are not better products. 87% say they purchase store

brands occasionally or more often. Integer Group®

and M/A/R/C®

Research, 2013. PLMA 2013 survey of primary shoppers.

2010

57%

agree

71%

agree

2013 |

Private label growth

Private label growth

14

Source: Nielsen Jan. 13, 2014 Scantrack, Total U.S. –

All Outlets Combined, UPC-coded.

Bars reflect excess growth of private label vs. branded food in terms of

year-over-year dollar sales growth ($ billions). |

Distribution opportunity for ConAgra Foods

Potential: $20 million of

sales at one customer 15

= incremental sales opportunity

for ConAgra Foods in select categories |

|

Makes and sells

specialty food and ingredients to restaurants,

foodservice operators and other

food makers across the world.

35%

35%

24%

Private Brands

41%

Consumer Foods

Commercial Foods

Commercial Foods |

Commercial Foods

18 |

Lamb Weston

•

Leading North American supplier

•

Double-digit international growth

•

Major customer transition

•

Crop quality challenge |

Global growth opportunity

20

Source:

Euromonitor

projections.

34%

34%

represents

represents

nominal

nominal

growth

growth

from

from

2012

2012

–

–

2017.

2017. |

Ardent Mills: focused joint

venture

•

Proposed JV to be owned by

ConAgra Foods,

Cargill and CHS

•

Combine operations of

ConAgra Mills

and

Horizon

Milling

(a Cargill/CHS joint venture) to create a premier

flour milling company

•

Supported across North America by strong network of

mills and bakery mix facilities

•

Strategically and financially beneficial

21 |

Makes and sells

leading consumer

branded food to retail

customers. |

Consumer Foods

•

“Perfect at Retail”

4Ps approach

•

Brands to fix |

“Perfect at Retail”

24 |

Pricing

•

Right everyday pricing

•

Competitive promotions

•

Overall value

25 |

Value at multiple price-points

26 |

Packaging

27 |

Placement

•

More facings for best sellers

•

Shopper-oriented displays

•

Retailer-efficient

space designs

28

Source: IRI Sales, 13 weeks ended Jan. 26, 2014

Source: IRI Sales, 13 weeks ended Jan. 26, 2014 |

Promotion

29 |

Focused improvement

initiatives

30 |

Healthy Choice Turnaround

Transform by:

•

Focus on the core consumer

•

Leverage Café

Steamers

31 |

ConAgra Foods: moving forward

•

Progress on near-term issues in FY15

•

Conviction in differentiating strategy

•

Confident in long-term goals |

Feb. 18, 2014

CAGNY 2014

33

John Gehring

Chief Financial Officer |

CFO agenda

•

Financial priorities

•

Productivity

•

EPS outlook

34 |

Financial priorities

•

Strong earnings and cash flows

•

Healthy balance sheet and strong liquidity

•

Capital allocation

35

—

Debt repayment

—

Maintain strong dividend

—

Dividend growth, M&A, share repurchase

—

Debt repayment

Near term

Long term |

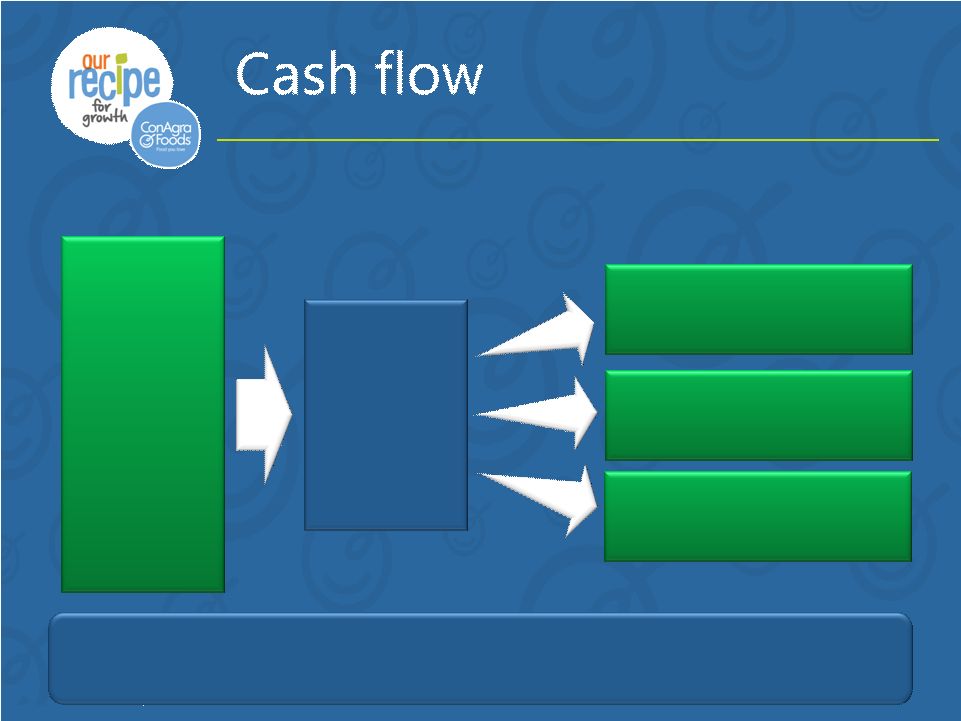

Cash flow

•

Strong earnings drivers

–

Top-line fundamentals

–

Productivity

–

SG&A discipline

•

Working capital efficiency

•

Capital expenditure discipline

36 |

37

Operating

&

free cash

flow growth

$1.5 billion of debt

repayment by FYE 2015

Strong dividend

Investment in growth &

cost savings

Earnings

growth

+

Working

capital

efficiency

+

CAPEX

discipline

Estimated operating cash flow:

FYE 2014 = $1.4 billion, FYE 2015 = $1.6+ billion |

Healthy balance sheet and strong

liquidity

•

Commitment to investment grade

•

Debt / EBITDA*

Long-term

target:

<

3.0x

•

$1.5 billion by FY15

•

Additional $400+ million (Ardent Mills proceeds)

•

$1.5 billion revolver

•

Manageable debt maturities

38

Balance sheet

Debt repayment

Liquidity

*The

inability

to

predict

the

amount

and

timing

of

future

items

makes

a

detailed

reconciliation

of

projections

impracticable. |

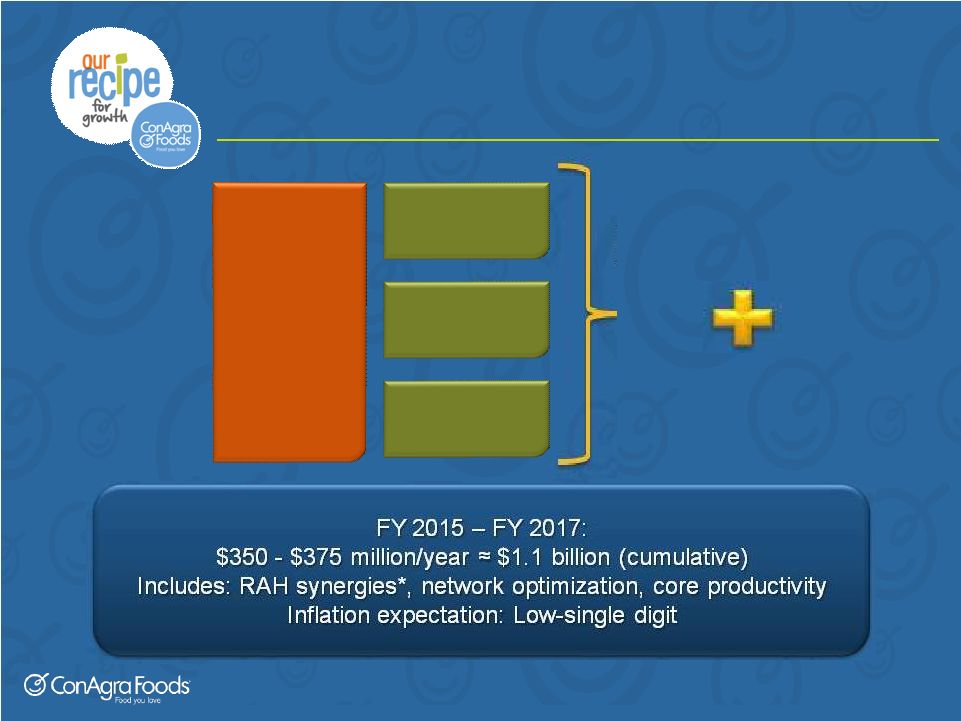

Productivity to fuel growth

39

Procurement

Manufacturing

Logistics

Supply

chain

Base productivity

Synergies

*$300 million cumulative by the end of fiscal 2017. All numbers

cited exclude items impacting comparability.

The inability to predict the amount and timing of future items makes a detailed

reconciliation of projections impracticable. |

Supply Chain Opportunities

–

Scale

–

Collaborative sourcing

–

Design for preference and value

–

Commodity procurement and hedging

–

ConAgra Performance System

–

Reliability improvement

–

Zero-loss culture

–

Network optimization

–

Scale

–

Transportation sourcing

–

Single distribution network

40

Procurement

Manufacturing

Logistics |

Incremental SG&A benefit

Enabled by restructuring

41

Corporate overhead / SG&A

Administrative efficiency

Incremental $ from SG&A efficiency initiatives:

$100+ million annual savings (run rate) by the end of FYE 2016

|

Earnings Per Share (EPS*)

•

FY 2014: $2.22 to $2.25 per share*

•

Q3: approximately $0.60 per share*

•

Q4: approximately $0.65 per share*

42

*Diluted EPS, adjusted for items impacting comparability. The inability to predict

the amount and timing of future items makes a detailed reconciliation of

projections impracticable. |

FY

2015 outlook - headlines

Top line

•

Address specific brand challenges

•

Stabilize and grow private brands

•

Drive international growth in Lamb Weston

Margin management

•

Low inflation

•

Strong

productivity

–

base

and

synergies

SG&A

•

Administrative cost efficiency

Ardent Mills first-year dilution

43

EPS growth

expected,

more details

with Q4

FYE 2014

release

Major drivers |

Long-term goals

Annual EPS* growth = 10%+

Annual EPS* growth 7-9%

44

ROIC:

targeting

a

low

double

digit

ROIC

in

3

years

FY 2016 –17

After FY 2017

*Diluted EPS and ROIC guidance in this presentation assumes adjustment for items

impacting comparability. The inability to predict the amount and

timing of future items makes a detailed reconciliation of projections impracticable.

Long-term

annual sales

growth target =

3 -

4%

~

~ |

|