Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANK OF THE JAMES FINANCIAL GROUP INC | d679137d8k.htm |

Exhibit 99.1

Bank of The James FINANCIAL GROUP, INC.

Bank of The James FINANCIAL GROUP, INC. Forward Looking Statements This document may contain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “estimate,” “expect,” “intend,” “anticipate,” “plan” and similar expressions and variations thereof identify certain of such forward-looking statements which speak only as of the dates on which they were made. Bank of the James Financial Group (the “Company”) undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those indicated in the forward-looking statements as a result of various factors. Such factors include, but are not limited to competition, general economic conditions, potential changes in interest rates, and changes in the value of real estate securing loans made by Bank of the James (the “Bank”), a subsidiary of Bank of the James Financial Group, Inc. Additional information concerning factors that could cause actual results to materially differ from those in the forward-looking statements is contained in the Company’s filings with the Securities and Exchange Commission and previously filed by the Bank (as predecessor of the Company) with the Federal Reserve Board.

Bank of The James FINANCIAL GROUP, INC. Who We Are - Commercial banking franchise headquartered in Central Virginia also known as “Region 2000” - Founded in 1998 by group of experienced bankers, former bankers, and community leaders to fill a gap left by the acquisition by large banks of all local institutions - Currently 9 full service branches and 1 limited service branch within the Region - Loan production offices in Charlottesville and Roanoke - Employees: 120 - Listed on NASDAQ: “BOTJ” -Approximate Market Cap: $30 million - Funding through organic sources (deposits) – no brokered deposits or material borrowings - Multiple capital raises without an underwriter

Bank of The James FINANCIAL GROUP, INC. Our Market - Region 2000 MSA = 250,000+ . With addition of Roanoke and Charlottesville markets, total MSA increases to 756,000+ - Stable economic environment, real estate values - Major industries include 5 universities/colleges (Liberty University, Sweet Briar College, Randolph College, CVCC, Lynchburg College), major hospital/medical services system (Centra), nuclear power (Areva, Babcock & Wilcox), financial services (Genworth) - Lower cost of living has attracted retirees and investors in “university” real estate - Daily rail service connecting Lynchburg to Northeastern corridor – 2 trains per day in each direction. Regional air service connecting through Charlotte – US Airways hub - $4.5 billion+ deposit market

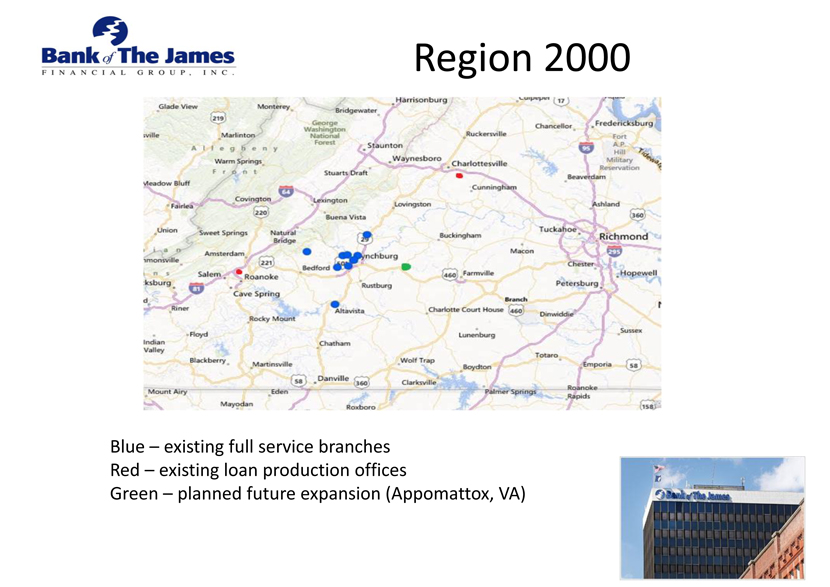

Bank of The James FINANCIAL GROUP, INC. Region 2000 Blue – existing full service branches Red – existing loan production offices Green – planned future expansion (Appomattox, VA)

Bank of The James FINANCIAL GROUP, INC. Strategy and Vision -We position ourselves to be the financial institution of choice in the markets we serve, providing a return to our shareholders by: -Community – relationship and friendship driven -Growth – Region 2000 and beyond -Capacity – personnel/technology -Asset Quality – continued oversight -Earnings – we believe that success in the above four categories should drive future earnings

Bank of The James FINANCIAL GROUP, INC. Experienced, Young Team - Robert R. Chapman III – President and CEO, age 51 - J. Todd Scruggs – EVP and Chief Financial Officer, age 46 - Michael A. Syrek – EVP and Senior Loan Officer, age 42 - Harry P. Umberger – EVP and Senior Credit Officer, age 48 - Angelia R. Johnson – EVP and Retail Branch Administrator, age 51 - Brandon P. Farmer – EVP and Senior Operations Officer, age 35 - Brian E. Cash – President, Bank of the James Mortgage, age 34

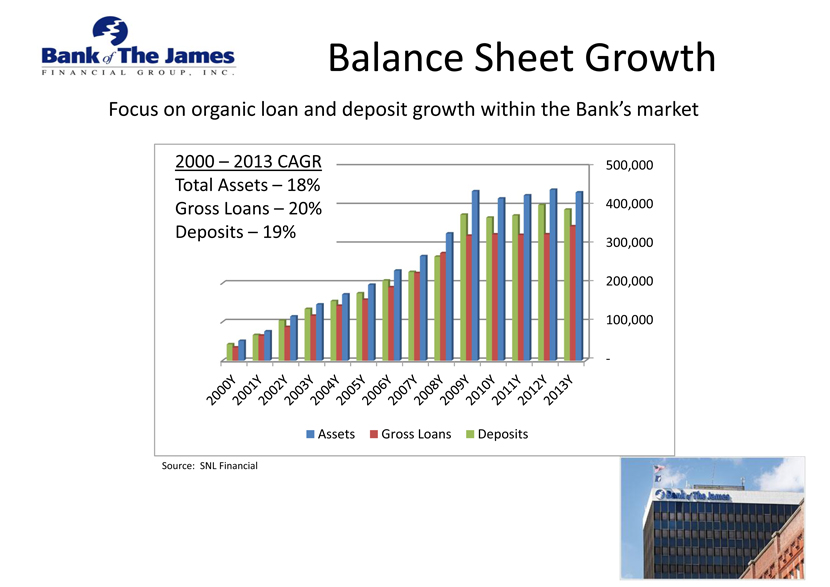

Bank of The James FINANCIAL GROUP, INC. - 100,000 200,000 300,000 400,000 500,000 Assets Gross Loans Deposits Balance Sheet Growth Focus on organic loan and deposit growth within the Bank’s market 2000 – 2013 CAGR Total Assets – 18% Gross Loans – 20% Deposits – 19% Source: SNL Financial

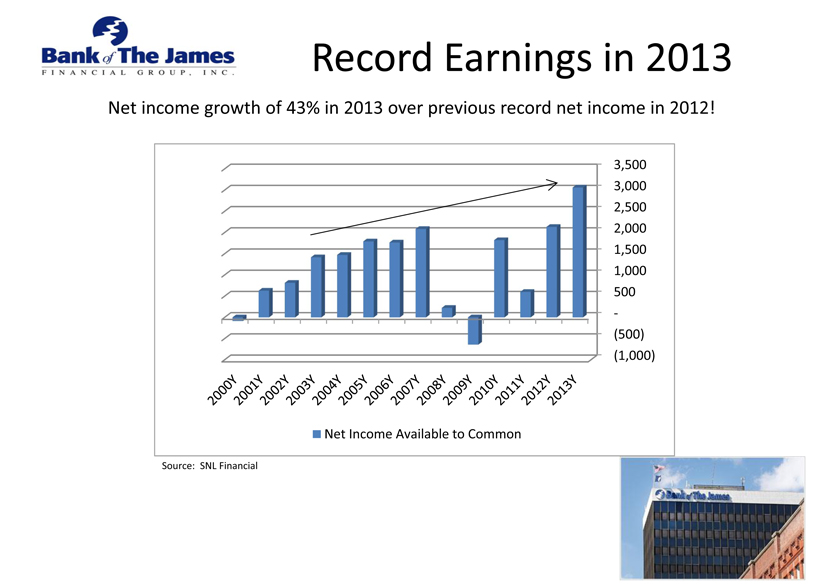

Bank of The James FINANCIAL GROUP, INC. Record Earnings in 2013 Net income growth of 43% in 2013 over previous record net income in 2012! (1,000) (500)—500 1,000 1,500 2,000 2,500 3,000 3,500 Net Income Available to Common Source: SNL Financial

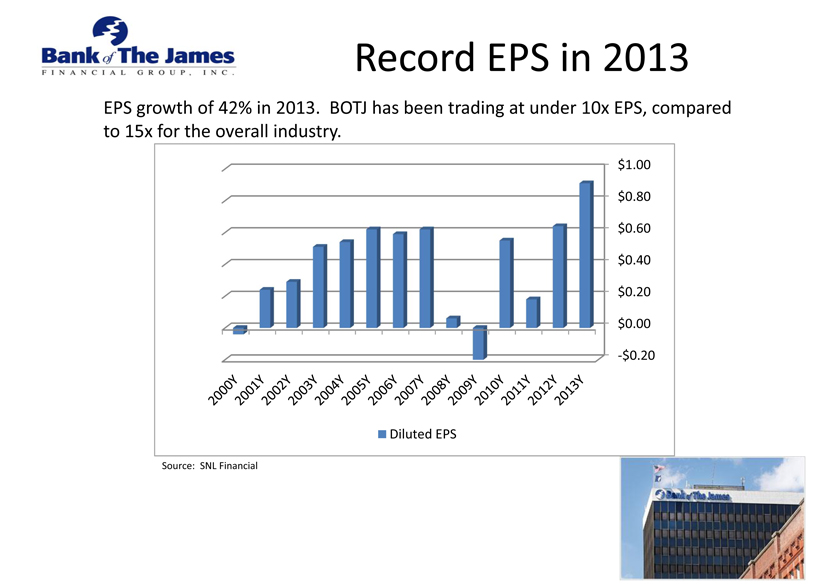

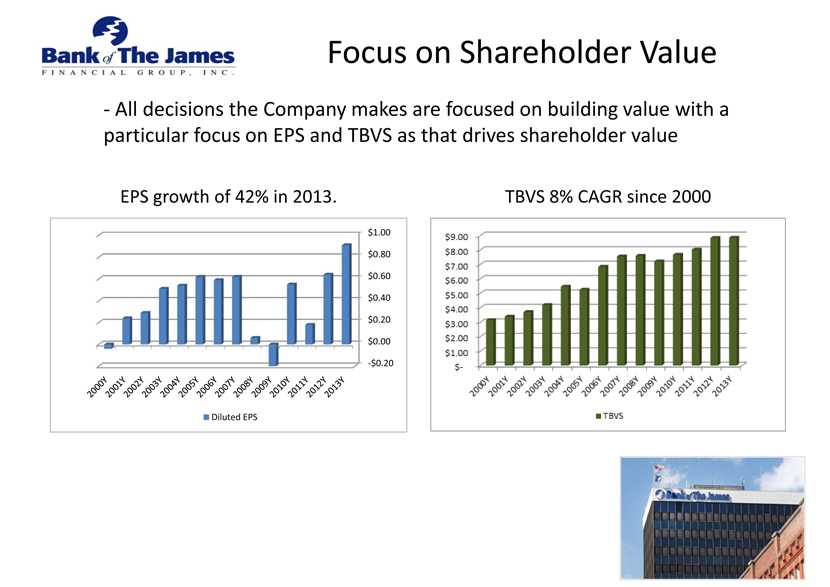

Bank of The James FINANCIAL GROUP, INC. EPS growth of 42% in 2013. BOTJ has been trading at under 10x EPS, compared to 15x for the overall industry. -$0.20 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 Diluted EPS Record EPS in 2013 Source: SNL Financial

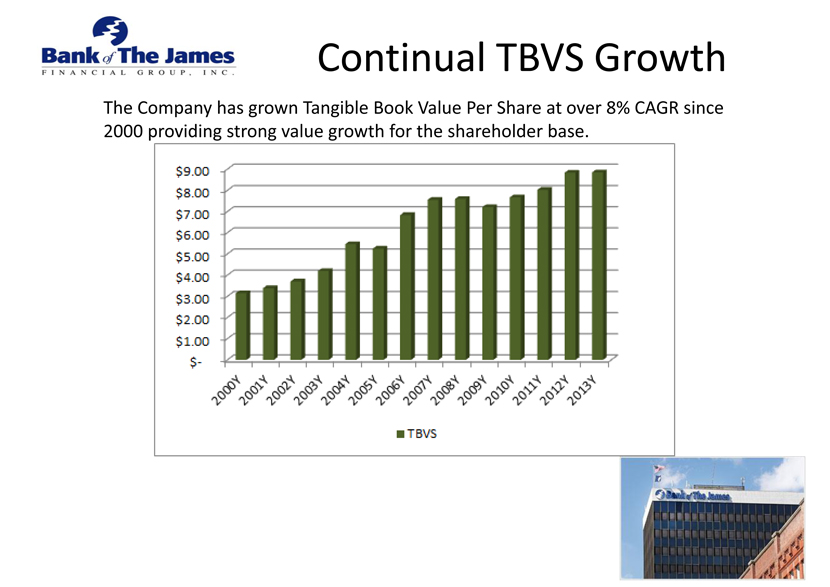

Bank of The James FINANCIAL GROUP, INC. Continual TBVS Growth The Company has grown Tangible Book Value Per Share at over 8% CAGR since 2000 providing strong value growth for the shareholder base.

Bank of The James FINANCIAL GROUP, INC. Strong regulatory capital - Bank level regulatory capital ratios at 2013 are strong: - Tier 1 Leverage Ratio 9.11% - Tier 1 Risk-based Ratio 11.93% - Total Risk-based Ratio 13.18% - Company tangible common equity ratio of 6.85% due to debt structure at holding company

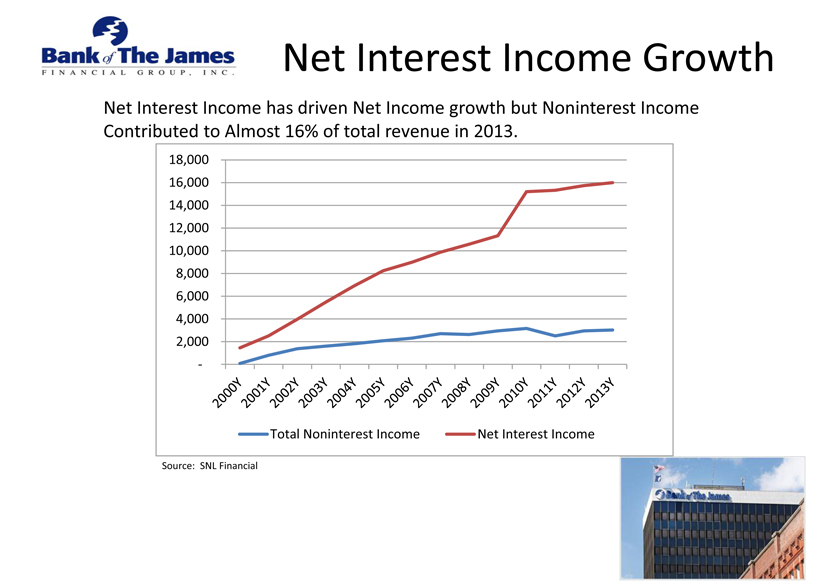

Bank of The James FINANCIAL GROUP, INC. Net Interest Income Growth Net Interest Income has driven Net Income growth but Noninterest Income Contributed to Almost 16% of total revenue in 2013.—2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 Total Noninterest Income Net Interest Income Source: SNL Financial

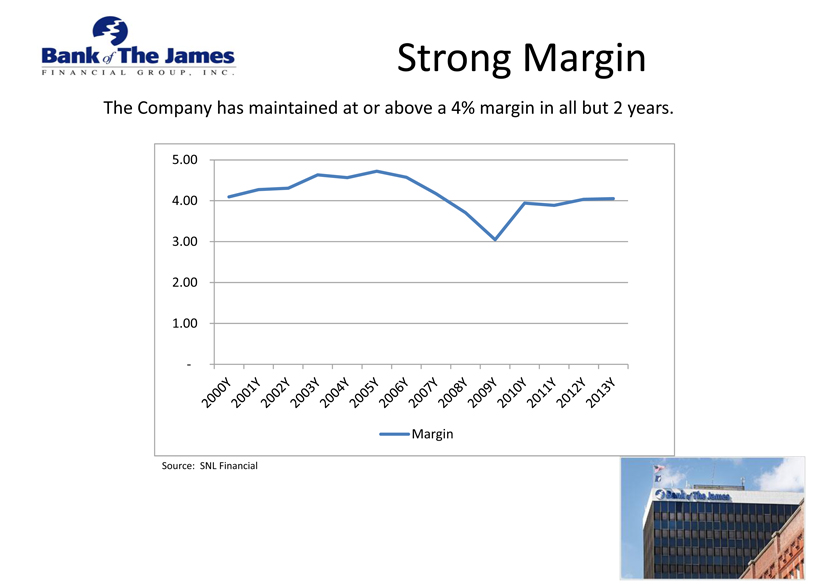

Bank of The James FINANCIAL GROUP, INC. Strong Margin The Company has maintained at or above a 4% margin in all but 2 years.—1.00 2.00 3.00 4.00 5.00 Margin Source: SNL Financial

Bank of The James

FINANCIAL GROUP, INC.

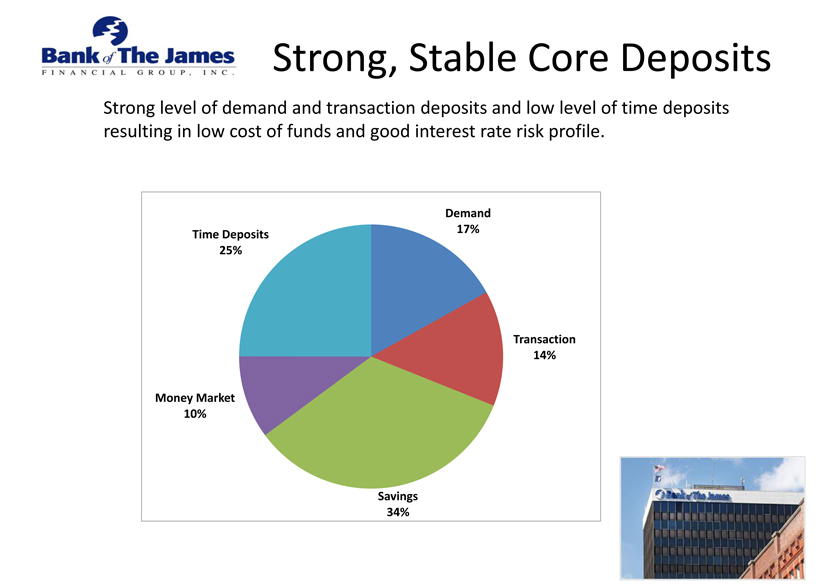

Strong, Stable Core Deposits Strong level of demand and

transaction deposits and low level of time deposits resulting in low cost of funds and good interest rate risk profile. Demand17%Transaction14%Savings34%Money Market10%Time Deposits25%

Bank of The James

FINANCIAL GROUP, INC.

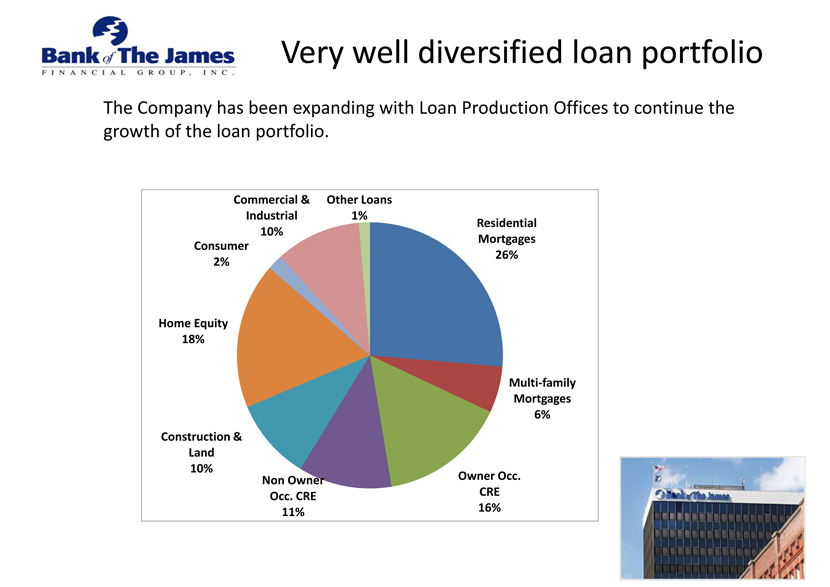

Very well diversified loan portfolio The Company has

been expanding with Loan Production Offices to continue the growth of the loan portfolio. Residential Mortgages26%Multi-family Mortgages6%Owner Occ. CRE16%Non Owner Occ. CRE11%Construction & Land10%Home

Equity18%Consumer2%Commercial & Industrial10%Other Loans1%

Bank of The James

FINANCIAL GROUP, INC.

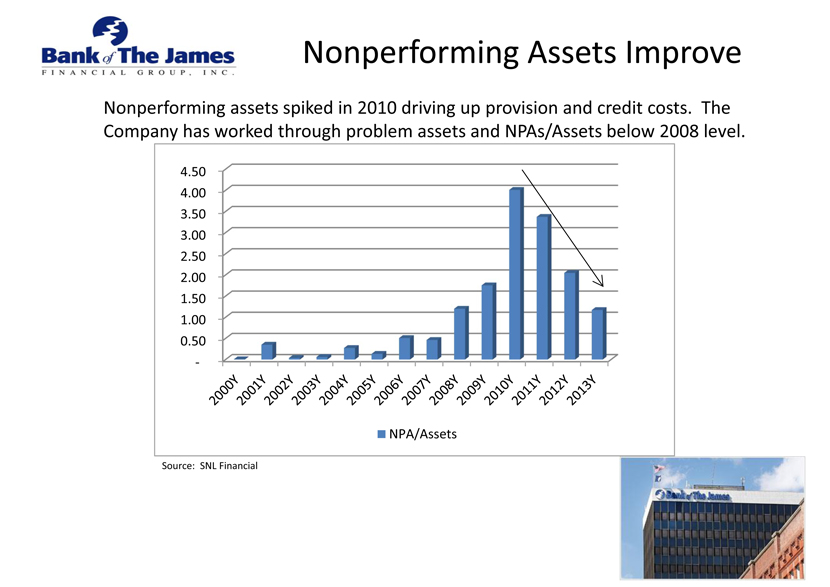

Nonperforming Assets Improve Nonperforming assets

spiked in 2010 driving up provision and credit costs. The Company has worked through problem assets and NPAs/Assets below 2008 level.—0.50 1.00 1.50 2.00 2.50 3.00 3.50 4.00 4.50 NPA/Assets

Source: SNL Financial

Bank of The James FINANCIAL GROUP, INC. Focus on Shareholder Value - All decisions the Company makes are focused on building value with a particular focus on EPS and TBVS as that drives shareholder value -$0.20 $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 Diluted EPS EPS growth of 42% in 2013. TBVS 8% CAGR since 2000

Bank of The James FINANCIAL GROUP, INC. Investor Summary - Strong growth in EPS and TBVS - Record earnings in 2013 following prior record in 2012 - Asset quality is significantly improved - Experienced but young management team - Strong margin and low cost of funds - Revenue stream with growing net interest income and diversification with noninterest income stream - Strong loan to deposit ratio - Strong level of demand and transaction deposits and low level of time deposits - Good interest rate risk profile with limited EVE sensitivity and NII that is projected to increase with rising rates - Limited utilization of wholesale funding - Strong branch franchise throughout Region 2000 of Virginia - Market becoming increasingly neglected by larger institutions

Bank of The James FINANCIAL GROUP, INC.