Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - DIVERSIFIED HEALTHCARE TRUST | a14-5425_1ex99d1.htm |

| EX-2.1 - EX-2.1 - DIVERSIFIED HEALTHCARE TRUST | a14-5425_1ex2d1.htm |

| 8-K - 8-K - DIVERSIFIED HEALTHCARE TRUST | a14-5425_18k.htm |

Exhibit 99.2

|

|

[LOGO] |

|

|

Disclaimer. 2 THIS PRESENTATION CONTAINS FORWARD LOOKING STATEMENTS WITHIN THE MEANING OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER SECURITIES LAWS. ALSO, WHENEVER WE USE WORDS SUCH AS "BELIEVE," "EXPECT," "ANTICIPATE," "INTEND," "PLAN," "ESTIMATE," OR SIMILAR EXPRESSIONS, WE ARE MAKING FORWARD LOOKING STATEMENTS. THESE FORWARD LOOKING STATEMENTS ARE BASED UPON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS. FORWARD LOOKING STATEMENTS ARE NOT GUARANTEED TO OCCUR AND MAY NOT OCCUR. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS, INCLUDING SOME THAT ARE DESCRIBED IN OUR FORM 10-K FOR THE YEAR ENDED DECEMBER 31, 2012 AND SUBSEQUENT FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION. YOU SHOULD NOT PLACE UNDUE RELIANCE UPON ANY FORWARD LOOKING STATEMENT. EXCEPT AS REQUIRED BY APPLICABLE LAW, WE UNDERTAKE NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD LOOKING STATEMENT AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE. WE COMPUTE ADJUSTED EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION, OR ADJUSTED EBITDA, AS NET INCOME PLUS INTEREST EXPENSE, TAXES AND DEPRECIATION AND AMORTIZATION. WE ADJUST FOR ACQUISITION RELATED COSTS, GAIN OR LOSS ON SALE OF PROPERTIES, AND IMPAIRMENT OF ASSETS, IF ANY. NORMALIZED FUNDS FROM OPERATIONS, OR NORMALIZED FFO, IS NET INCOME, CALCULATED IN ACCORDANCE WITH GAAP, EXCLUDING GAIN OR LOSS ON SALE OF PROPERTIES AND IMPAIRMENT OF ASSETS, PLUS REAL ESTATE DEPRECIATION AND AMORTIZATION. OUR CALCULATION OF NORMALIZED FFO DIFFERS FROM NAREIT'S DEFINITION OF FFO BECAUSE WE EXCLUDE ACQUISITION RELATED COSTS. |

|

|

Investment summary. 3 |

|

|

The properties. Two 15-story Class A buildings; state-of-the-art new construction at 11 Fan Pier Boulevard and 50 Northern Avenue, Boston, MA. Built-to-suit for Vertex Pharmaceuticals; delivered in December 2013. 1,651,037 gross building square feet including: 1,082,417 square feet of biomedical research laboratory and corporate headquarters space; ~ 50K square feet of street level retail space; ~390K square feet of subterranean parking for 740 vehicles on 3 levels; Plus common areas. 4 LEED Gold Buildings. World-class architecture featuring high-end building systems and finishes. |

|

|

11 Fan Pier Boulevard. 5 |

|

|

50 Northern Avenue. 6 |

|

|

The Seaport District: Boston’s premier location. Prime real estate in the Seaport District, Boston’s fastest growing submarket and one of the nation’s top investment markets, which includes Boston’s “Innovation District” and Fan Pier. Billions of dollars of public investment in infrastructure for more than a decade has created unprecedented growth. Unparalleled venue to experience Boston Harbor as a dynamic place to work, live and dine. Positive net absorption and leasing velocity; rents have increased more than 30% in the past 12 months. Validation from some of Boston’s highest quality tenants who have relocated from the Financial District and Back Bay to the Seaport District: 7 “Rents have surged to the same level as those in the tony Back Bay – making both districts the most expensive office markets in the city.” “By the time the current wave of building is completed, the Innovation District will rival the Back Bay in the total size of its office market.” The Boston Globe, January 10, 2014 |

|

|

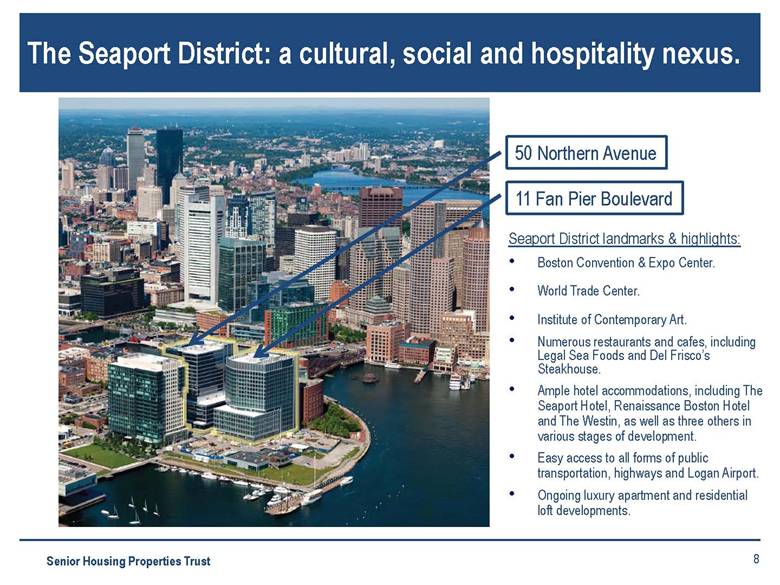

The Seaport District: a cultural, social and hospitality nexus. 8 50 Northern Avenue Seaport District landmarks & highlights: Boston Convention & Expo Center. World Trade Center. Institute of Contemporary Art. Numerous restaurants and cafes, including Legal Sea Foods and Del Frisco’s Steakhouse. Ample hotel accommodations, including The Seaport Hotel, Renaissance Boston Hotel and The Westin, as well as three others in various stages of development. Easy access to all forms of public transportation, highways and Logan Airport. Ongoing luxury apartment and residential loft developments. 11 Fan Pier Boulevard |

|

|

The tenant: Vertex Pharmaceuticals, Inc. Vertex Pharmaceuticals, Inc. (NASDAQ: VRTX) is a leading biopharmaceutical company that develops and commercializes therapies for Cystic Fibrosis and Rheumatoid Arthritis, among others. Vertex has a robust pipeline of late-stage medicines which positions them for long-term revenue and earnings growth. Founded nearly 25 years ago. Market cap of approximately $19B, with cash and marketable securities of $1.5B as of most recent Securities and Exchange Commission filings. Consolidating 10 satellite facilities from Cambridge to this new global headquarters in the Seaport District, which is expected to eventually have more than 1,300 employees. 9 |

|

|

Vertex lease and other revenues. Vertex is committed to the entire research lab and office space for a 15-year NNN lease term. Rent starting at $62.50 per square foot which is below market. $5 per square foot increases in both years 6 and 11. The Vertex lease represents 96% of the total rentable square footage, providing stable cash flows. In addition, approximately 50,000 square feet of street level retail space will include daycare, dining and banking. A portion of the retail space is pre-leased and the seller is protecting SNH on the vacant space for up to 15 years. The underground garage is immediately adjacent to the U.S. District Court and First Circuit Court of Appeals headquarters, and the surrounding area includes numerous restaurants and seaport area amenities. Parking is expected to experience strong demand in both daytime and night, and to provide increasing revenues. 10 |

|

|

Rent compares favorably to other destination medical office and lab space in the Boston area. 11 Property Industry City District SF Signed Start Term Average NNN rate per SF TI per SF Center for Life Sciences Biotech Boston Roxbury/Dorchester 50,529 5/1/11 5/1/11 10 years $95.00 $0.00 Center for Life Sciences Biotech Boston Roxbury/Dorchester 16,600 6/1/11 6/1/11 10 years $89.00 $0.00 Center for Life Sciences Biotech Boston Roxbury/Dorchester 24,000 1/1/09 1/1/11 10 years $89.00 $0.00 Center for Life Sciences Hospital Boston Roxbury/Dorchester 49,193 11/1/08 12/1/09 14 years $82.00 $0.00 75/125 Binney Street Biotech Cambridge East Cambridge 146,000 9/1/13 U/C 15 years $77.00 $185.00 75/125 Binney Street Biotech Cambridge East Cambridge 244,123 1/1/13 U/C 15 years $77.00 $185.00 200 Clarendon Street Financial Services Boston Back Bay 29,267 6/1/12 11/1/13 10 years $57.37(1) $40.00 200 Clarendon Street Financial Services Boston Back Bay 28,492 1/1/13 1/1/14 10 years $54.50(1) $58.00 Average 12 years $77.61 Vertex HQ Property Boston Seaport 1,082,417 12/17/13 15 years $67.50 $150.00 Vertex above/below market -$10.11 125 Binney Street, Cambridge, MA Center for Life Sciences, Boston, MA Note: Comparatives based on local broker data. (1) Average NNN rate for 200 Clarendon Street office property assumes $18.00/SF of operating expenses. 200 Clarendon Street, Boston, MA |

|

|

Transaction details. SNH’s strong balance sheet and sufficient liquidity enable this Class A transaction. Purchase price of $1.125B; approximately $682 per gross square foot. NOI is expected to average 7% per annum, including reasonable estimates of parking revenues. Immediately accretive to SNH shareholders on a normalized FFO per share basis by approximately $0.06 - $0.08 per year. The acquisition is also accretive on an AFFO/CAD per share basis because the property is new construction with a NNN lease to Vertex for 15 years, and SNH is only obligated to fund capital for roof, structure and certain other long lived assets. 12 |

|

|

Financing details. Acquisition funding will be an appropriate mix of debt and equity capital, depending on the cost of such financing and market conditions. Debt options: bank term loan (swapped to fixed rate), mortgage debt and unsecured senior notes. Equity options: both common and preferred shares. Simultaneous with entering the agreement to acquire these properties, SNH received a term loan commitment for $800 million from Jefferies Finance LLC and Wells Fargo Bank. The term loan will have an interest rate of LIBOR plus 140 basis points, can be repaid in part or whole at anytime without penalty and will mature five years from closing. Prior to closing, the term loan is expected to be syndicated to a group of banks, and the term loan is expected to close simultaneous with the acquisition of the Vertex buildings. The actual size of the term loan can be reduced depending on SNH’s funding needs at the time of closing and without any additional costs to SNH. Availability under SNH’s existing $750 million revolving credit facility, plus up to $800 million of term loan commitment, provides SNH with flexibility on when to access the capital markets for long term debt or equity financing for this acquisition. 13 |

|

|

Improved diversity of property type and portfolio mix: pro forma NOI is 97% private pay. 14 Note: Based on the three months ended 9/30/13, pro forma for the acquisition of the Vertex buildings for $1.125B and the sale of two rehabilitation hospitals for $90M on 12/31/13. Pro forma NOI by Property Type NOI by Tenant Mix |

|

|

Leverage and coverage ratios remain conservative. 15 Actual as of 9/30/13 SNH Pro forma(1) SNL US REIT Healthcare Index Total Debt / Total Market Capitalization 30% 37%(2) 30% Total Debt / Total Book Capitalization 41% 46% 47% Total Debt / Total Assets Capitalization 40% 46% 45% Total Debt / Gross Book Value of Real Estate Assets(3) 37% 44% 49% Adjusted EBITDA / Interest Expense 3.7x 3.4x 3.9x Total Debt / Adjusted EBITDA 4.4x 5.5x 5.5x Note: Leverage and coverage ratios as of and for the three months ended 9/30/13. Pro forma for the acquisition of the Vertex buildings for $1.125B (assuming long term funding of 75% debt and 25% equity) and the sale of two rehabilitation hospitals for $90M on 12/31/13. Pro forma Market Capitalization based on the 1/28/14 closing price. Gross Book Value of real estate is real estate properties, at cost, before depreciation, but after impairment write downs, if any. SNH’s balance sheet and liquidity remain strong and in line with peers post transaction. |

|

|

Acquisition further strengthens SNH’s medical office portfolio. 16 Medical Office Buildings Note: Percentages based on pro forma NOI assuming the acquisition of the Vertex buildings. |

|

|

Medical office building portfolio expansion. 17 Representative Tenants ($ in thousands) Square Feet Annualized Rental Income % Lease Expiration Vertex Pharmaceuticals 1,082,417(1) $75,248 28.1% 2028 Aurora Health Care, Inc. 643,000 $16,896 6.3% 2024 Cedars-Sinai Medical Center 115,000 $10,776 4.0% 2014 - 2018 The Scripps Research Institute 164,000 $10,328 3.8% 2019 Reliant Medical Group, Inc. 362,000 $7,661 2.8% 2019 HCA Holdings, Inc. 142,000 $5,373 2.0% 2014 - 2020 First Insurance Co. of HI/Straub Medical Center 111,000 $4,833 1.8% 2018 Covidien PLC 315,000 $4,669 1.7% 2017 Note: Information based on the three months ended 9/30/13, pro forma for the acquisition of the Vertex buildings and the sale of the two rehabilitation hospitals on 12/31/13. (1) Only includes office and lab square feet, excludes parking, retail and common area square feet. Pro forma average remaining lease term is 8.2 years, up from actual 5.6 years at 9/30/13 |

|

|

Investment summary. 18 |

|

|

[LOGO] |