Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MOLINA HEALTHCARE, INC. | d675322d8k.htm |

| EX-99.1 - EX-99.1 - MOLINA HEALTHCARE, INC. | d675322dex991.htm |

Investor Day 2014A

February 13, 2014

New York, New York

Exhibit 99.2 |

2

©

2014 Molina Healthcare, Inc.

Cautionary Statement

Safe

Harbor

Statement

under

the

Private

Securities

Litigation

Reform

Act

of

1995:

This

slide

presentation

and

our

accompanying

oral

remarks

contain

numerous

“forward-looking

statements”

regarding,

without

limitation:

our

2014

financial

guidance;

our

revenue,

revenue

mix,

and

membership

projections;

our

business

strategy;

duals

demonstration

projects

and

their

expected

implementation

start

dates;

the

ACA

annual

fee

or

excise

tax

and

its

reimbursement

by

states

on

a

grossed-up

basis;

the

2014

rate

environment;

the

hepatitis

C

drug

Sovaldi;

and

various

other

matters.

All

of

our

forward-looking

statements

are

subject

to

numerous

risks,

uncertainties,

and

other

factors

that

could

cause

our

actual

results

to

differ

materially.

Anyone

viewing

or

listening

to

this

presentation

is

urged

to

read

the

risk

factors

and

cautionary

statements

found

under

Item

1A

in

our

annual

report

on

Form

10-K,

as

well

as

the

risk

factors

and

cautionary

statements

in

our

quarterly

reports

and

in

our

other

reports

and

filings

with

the

Securities

and

Exchange

Commission

and

available

for

viewing

on

its

website

at

www.sec.gov.

Except

to

the

extent

otherwise

required

by

federal

securities

laws,

we

do

not

undertake

to

address

or

update

forward-looking

statements

in

future

filings

or

communications

regarding

our

business

or

operating

results. |

3

©

2014 Molina Healthcare, Inc.

Approx. Time

Topic

Speaker

12:30pm-12:35pm

Opening Remarks

Juan José

Orellana, SVP Investor

Relations

12:35pm-1:10pm

Business Overview

Dr. J. Mario Molina, Chief Executive

Officer

1:10pm-1:45pm

Medical Margin: Results & Initiatives

Terry Bayer, Chief Operating Officer

1:45pm-2:00pm

Q&A

2:00pm-2:15pm

Break

2:15pm-2:45pm

Changing Medical Cost Profile

Joseph White, Chief Accounting Officer

2:45pm-3:05pm

Q&A

3:05pm-3:50pm

Guidance

John Molina, Chief Financial Officer

3:50pm-4:30pm

Q&A

4:30pm

End of Program

Today |

Business Overview

J. Mario Molina, M.D.

President & Chief Executive Officer

February 13, 2014

New York, New York |

5

©

2014 Molina Healthcare, Inc.

Presence in Key Medicaid Markets

1.

Reflects

preliminary

enrollment

figures.

2.

As

of

September

1,

2013,

Illinois

health

plan

began

serving

ABD

members.

3.

As

of

January

1,

2014,

South

Carolina

health

plan

began

serving

South

Carolina

Medicaid

members,

as

a

result

of

the

South

Carolina

Solutions

asset

acquisition.

2.1 million members

Health Plan Enrollment as of February 2014

Footprint includes 4 of 5 largest Medicaid Markets

Enrollment by Product

Medicare 2%

CHIP

Aged,

Blind

or

Disabled

1 |

6

©

2014 Molina Healthcare, Inc.

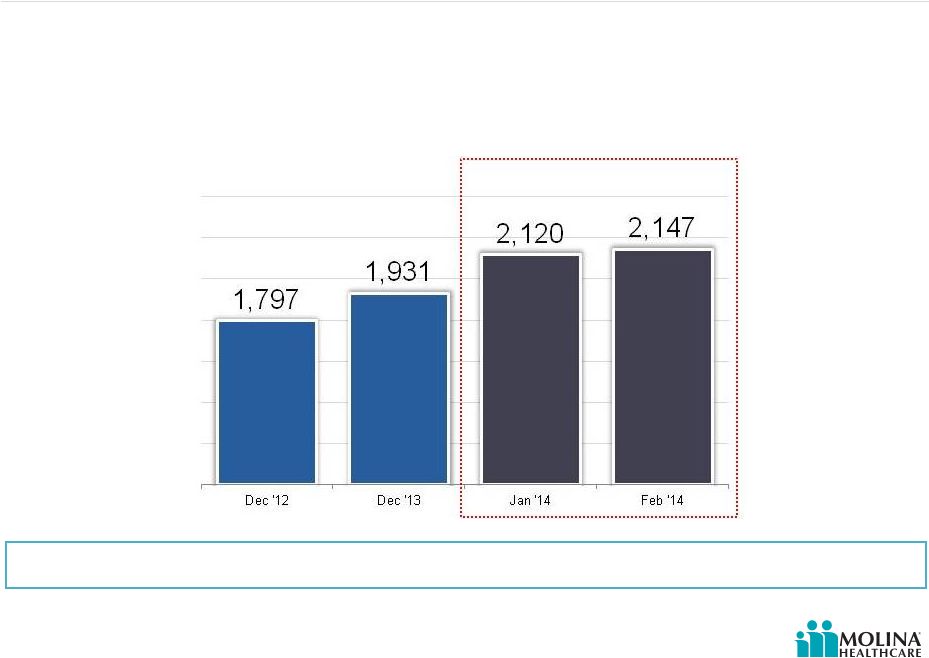

Health Plan Enrollment Growth

(in thousands)

Molina Healthcare

Health Plan Enrollment Growth

Dec 2013 -

Feb 2014

(1) (2)

Enrollment grew 11% since December 2013

1.

February 2014 enrollment based on preliminary figures.

2.

As of January 1, 2014, South Carolina health plan began serving South Carolina

Medicaid members, as a result of the South Carolina Solutions asset acquisition.

Please refer to the Company’s cautionary statements.

|

7

©

2014 Molina Healthcare, Inc.

Long Term Revenue Growth

Estimated potential revenue run-rate by year-end 2015

Please refer to the Company’s cautionary statements.

1.

Estimated amounts are subject to change.

2.

Includes revenue estimates from: New Mexico (Lovelace), and South Carolina

(Community Health Solutions assets) acquisitions; dual eligibles in CA, MI, OH, SC, TX, IL; Medicaid expansion in CA,

IL,

MI, OH, NM, and WA; and Marketplace in CA, FL, MI, NM, TX, UT, WA, OH, and WI. Duals

in TX only applies to 2015. |

8

©

2014 Molina Healthcare, Inc.

Revenue by Product

Revenue shift to chronic care is changing our medical cost profile

Please refer to the Company’s cautionary statements.

1.

For 2014, TANF includes Medicaid expansion and Marketplace lives.

|

9

©

2014 Molina Healthcare, Inc.

Shift from an Acute Care Company to a Chronic Care Company

Business requirements are

changing as we take on more

complex patients

Member retention

Emphasis on quality and

ratings

Reduction of unnecessary

utilization

Risk adjustment |

10

©

2014 Molina Healthcare, Inc.

Health Plan Footprint & Planned Growth

Fully Integrated Dual Eligible Pilots

Long Term Care Medicaid

Health Plan Markets

WA

CA

UT

NM

TX

IL

MI

WI

OH

SC

FL

Please refer to the Company’s cautionary statements.

|

11

©

2014 Molina Healthcare, Inc.

Medicaid Expansion

Where Molina States Stand on Medicaid Expansion as of February 7,

2014

Expanding Coverage

Considering Expansion

Not Expanding Coverage at this Time

CA

WA

UT

NM

TX

WI

MI

FL

OH

SC

1.

The

Advisory

Board

Company.

Beyond

the

pledges:

Where

the

states

stand

on

Medicaid.

IL

1 |

12

©

2014 Molina Healthcare, Inc.

Medicaid Application Activity & Woodwork Effect

Surge in Medicaid applications

reported

Plagued by processing delays &

backlogs

Difference between ‘deemed’

eligible & actually enrolled

Transition time from federal

exchange to the state programs

unknown

Trust remains an issue |

13

©

2014 Molina Healthcare, Inc.

Molina Awarded Contract for Duals in Los Angeles County

Selected to participate as direct

contractor

Largest duals demo in the country

(State caps demo at 200K)

Leverages existing ABD and

Medicare SNP provider network

Complements other duals service

areas in the State: Riverside, San

Bernardino, San Diego

Passive enrollment to begin no

sooner than 7/2014

20K dual eligible members

anticipated

1.

Enrollment estimate does not include op-out.

1 |

14

©

2014 Molina Healthcare, Inc.

Molina Medicare-Medicaid Plan (MMP) Implementations

State

Estimated

Lives

in Molina

Markets

Voluntary

Enrollment

Passive

Enrollment

California

(Riverside, San Bernardino &

San Diego counties)

122K

4/1/14

5/1/14

California

(Los Angeles county)

200K

TBD

7/1/14

Illinois

18K

3/1/14

6/1/14

Michigan

62K

10/1/14

1/1/15

Ohio

48K

6/1/14

1/1/15

South Carolina

54K

7/1/14

1/1/15

TX

121K

1/1/15

1/1/15

1.

Estimated lives are based on state reports.

2.

All dates are subject to change.

3.

Reflects Medicare MMP passive enrollment. Medicaid MMP Passive enrollment occurs

6/1/2014. 1

2

2

3 |

15

©

2014 Molina Healthcare, Inc.

Cost of Care |

16

©

2014 Molina Healthcare, Inc.

Duals –

Model of Care

Integrated

LTSS/Acute

And Rx

Care

Transition

Programs

Measuring

Improvements

Individualized

Care Plans

Medication

Reviews

and

Medication

Therapy

Mgmt

Interdisciplinary

Care Teams

Health Risk

Assessments

Care

Management

Dual Eligibles

Most Common Diagnoses

Inpatient Services:

Affective psychosis

Septicemia

Care involving use of

rehab procedures

Pneumonia

Chronic bronchitis

Outpatient Services:

Essential hypertension

Respiratory and other

chest

Diabetes mellitus

Fever and fatigue

Joint disorders

Personal

Care

Attendants/

Caregivers

Dual

Eligible |

17

©

2014 Molina Healthcare, Inc.

Mitigating Our Risk with the Dual Eligible

Duals may have chronic

conditions and higher costs

over time

Risk adjusters

Rate corridors

Settlement agreement (CA)

Savings assumptions |

18

©

2014 Molina Healthcare, Inc.

Mitigating our Duals Risk –

Savings Assumptions

CMS Rate Setting Process

Guidance

Sample Aggregate Savings

Targets

Under the Demonstrations

1.

CMS Joint Rate Setting Process Under the Capitated Financial Alignment

Initiative. 2.

Memorandums of Understanding (MOU) between CMS and the State of California,

Illinois, Ohio, and South Carolina.

3.

Savings targets weighted by estimated 2014 member months.

Molina Duals States

Weighted Average Aggregate

Savings Targets

Savings targets may differ among

States with low historic Medicare spending,

low utilization of institutional long-term care

services, or a high penetration of Medicaid

managed care.

Savings percentages will be applied equally to the Medicaid and Medicare A/B

components. Rate updates will take place on January 1st of each calendar

year. 1

3

2 |

19

©

2014 Molina Healthcare, Inc.

Marketplace

Spanish language sites later start

8 out of 10 low-income Americans

still don’t understand the program

Molina pricing assumed higher

medical costs and utilization

Enrolled individuals at Molina health

plans are primarily the uninsured

and previous Medicaid recipients

that had lost their eligibility

Molina Marketplace enrollment

is

7,500

1.

Reflects February 2014 preliminary figures.

1

Enrollment ramp up has been slow

due to delays on federal and state

websites |

20

©

2014 Molina Healthcare, Inc.

New Medications & Treatments

Coverage of the cost of new

Hepatitis C treatment drug

should be carved out until

sufficient actuarial claims data is

available

Medicaid managed care rates

must factor in claims for the new

treatment (actuarial soundness)

Pricing is extraordinarily cost

prohibitive

Incidence of Hepatitis C in the

Medicaid population is uncertain

but certainly non-negligible

Providers have delayed initiating

alternative treatment resulting in

pent up demand |

21

©

2014 Molina Healthcare, Inc.

Manage our growth

•

Organic growth

•

Medicaid expansion

•

Dual eligible population

•

RFPs

Leverage our business portfolio

•

Health plan business

•

MMS

•

Direct delivery

Strive for operational excellence

•

Quality care

•

STAR ratings

Strategic Priorities

Our mission is to provide quality

health services to financially

vulnerable families and

individuals covered by

government programs.

Mission

Priorities |

22

©

2014 Molina Healthcare, Inc. |

Medical Margin: Results & Initiatives

Terry Bayer

Chief Operating Officer

February 13, 2014

New York, New York |

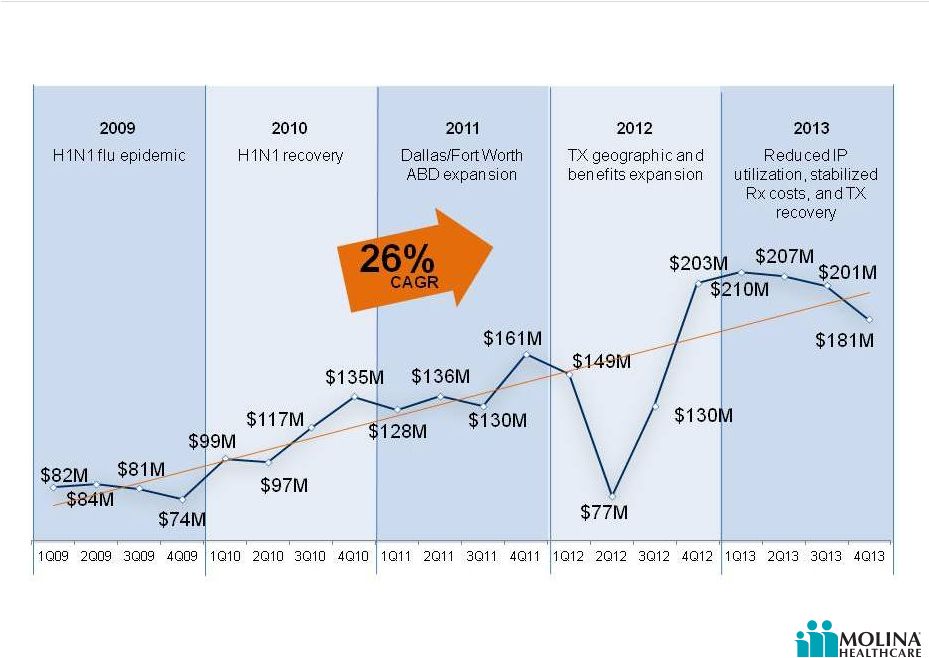

24

©

2014 Molina Healthcare, Inc.

Historical Medical Margin

Molina Medical Margin

Q1 2009-Q4 2013 |

25

©

2014 Molina Healthcare, Inc.

Key Impact Areas

Activities focused on improving

Medical Margins

Health Care Services (Model of

Care)

Focus on Quality

Member Retention |

26

©

2014 Molina Healthcare, Inc.

Key Impact Area -

Molina Care Model

The Model of Care

confirms/reestablishes the

member’s connection to their

Medical Home. Ensures

appropriate use of services

and facilities.

High touch

Focus on care transitions

Prevention of hospital

admissions/readmissions

Appropriate ER utilization |

27

©

2014 Molina Healthcare, Inc.

Model of Care –

Historical vs. Current

Historical Model:

Insurance driven by

acute, episodic care

Reactive

Silos

Discharge planning

Telephonic

management

Pharmacy on

formulary

Current Model:

Member centric

management & care

delivery

Proactive

Integrated team

Care transitions

Face-to-face

interactions

Medication therapy

management |

28

©

2014 Molina Healthcare, Inc.

Community Connector Case Study –

Washington

67-year-old woman with

multiple personalities,

depression, anxiety, a history

of suicidal ideations,

hypothyroidism, asthma,

hypertension, congestive

heart failure and

osteoarthritis.

Image for illustrative purposes only. Not actual patients.

|

29

©

2014 Molina Healthcare, Inc.

Community Connector Case Study –

South Carolina

Single father reached out for

assistance for behavior

modification for his teenage

daughter who is a Molina

member. Was not interested

in mental health services.

Image for illustrative purposes only. Not actual patients.

|

30

©

2014 Molina Healthcare, Inc.

Community Connector Case Study -

Washington

74-year-old member has COPD,

hypertension, diabetes, and

muscular degeneration. He is also

an alcoholic, has poor nutritional

habits, and no family to support him.

Image for illustrative purposes only. Not actual patients.

|

31

©

2014 Molina Healthcare, Inc.

Monitoring and Care Management: California

Reduction in manageable inpatient utilization in a previously unmanaged new

population Admits/K reduction of 7%

1.

Molina Internal Analytics.

Molina Healthcare of California

Admits/K

1 |

32

©

2014 Molina Healthcare, Inc.

Patient Centered Medical Home (PCMH) Impact: New Mexico

PCMH Readmits/K 63% less than Non PCMH

Readmission rates lower among PCMH members vs.

Non PCMH members

1.

Journal of Community Health. “Community Health Workers and Medicaid Managed

Care in New Mexico”, June, 2012. |

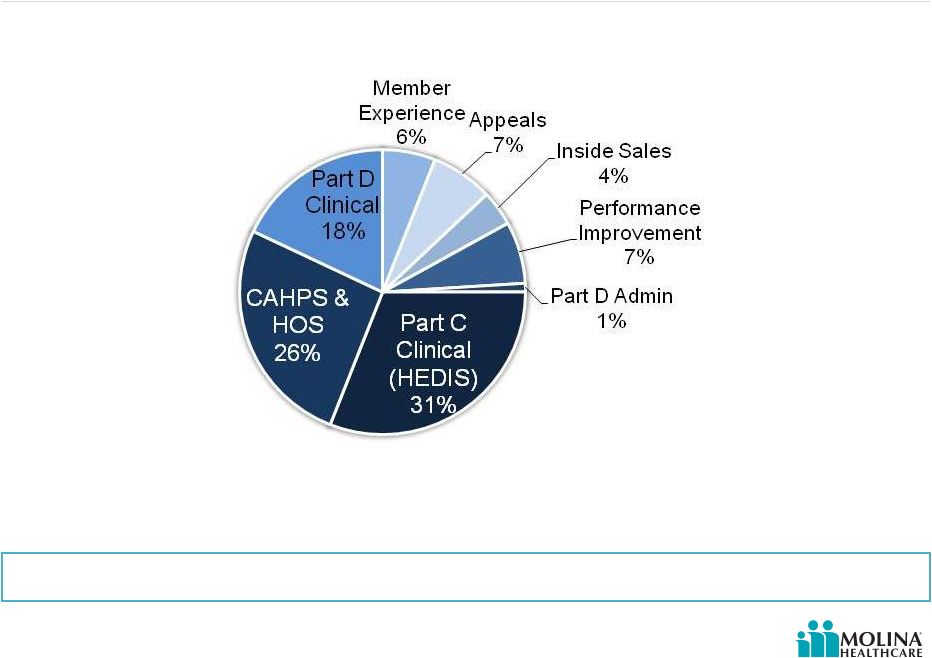

33

©

2014 Molina Healthcare, Inc.

Categories & Measurements Contributing to Medicare STAR Ratings

Quality improves margin by increasing pay for performance revenue &

removing barriers to care

Data to support STAR ratings come from surveys, claims data, and

medical records

CAHPS = Consumer Assessment of Healthcare Providers and Systems

HOS = Health Outcomes Survey

HEDIS = Healthcare Effectiveness Data and Information Set

|

34

©

2014 Molina Healthcare, Inc.

2012

2013

2014

2015

2016

Care

Delivered

Measurement

& Publication

2014 Ratings

In Use

2015 Ratings

In Use

Measurement

& Publication

Care

Delivered

2016 Ratings

In Use

Measurement

& Publication

Care

Delivered

Star Ratings Data Timeframes |

35

©

2014 Molina Healthcare, Inc.

Key Impact Area –

Focus on Quality

Align incentives to improve

quality results

Provider incentive programs

Member HEDIS incentive

programs

Align provider payments to quality

metrics |

36

©

2014 Molina Healthcare, Inc.

Key Impact Area -

Retention Model

Ensuring that members stay with

us as we grow, and that we are

meeting their healthcare needs

Welcome calls

30, 60, and 90 day touch point calls

Personal Care Assistant (PCA)

Escalation team |

37

©

2014 Molina Healthcare, Inc.

Q&A |

©

2014 Molina Healthcare, Inc.

Changing Medical Cost Profile

Joseph White

Chief Accounting Officer

February 13, 2014

New York, New York |

39

©

2014 Molina Healthcare, Inc.

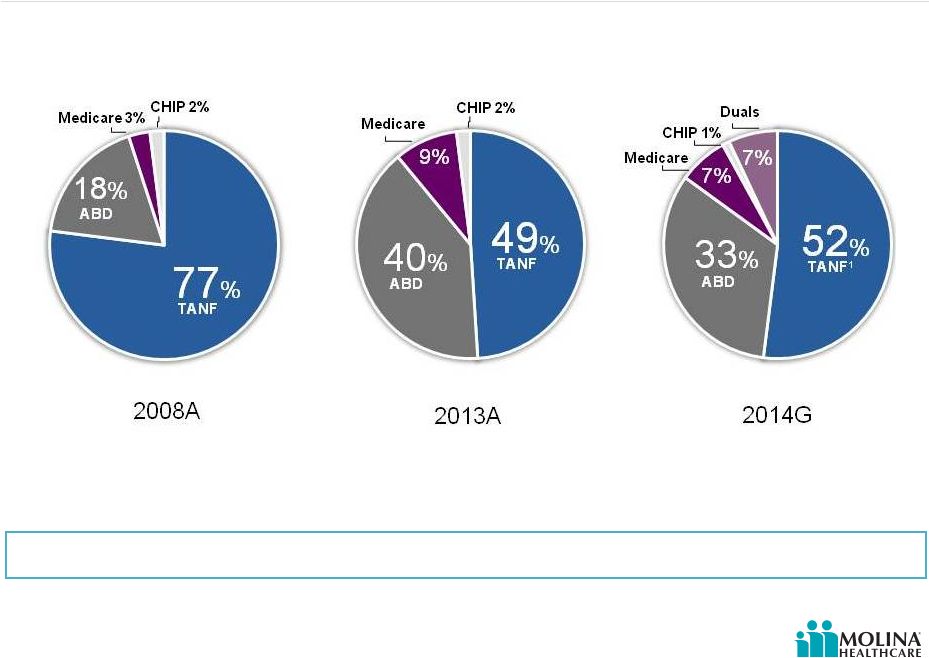

Revenue by Product

2008A

2013A

2014G

Revenue shift to chronic care is changing our medical cost profile

49%

TANF

40%

ABD

Medicare

9%

CHIP 2%

77%

TANF

18%

ABD

Medicare 3%

CHIP 2%

Please refer to the Company’s cautionary statements.

TANF¹

52%

33%

ABD

Medicare

7%

7%

Duals

CHIP 1%

1.

For 2014, TANF includes Medicaid expansion and Marketplace lives.

|

40

©

2014 Molina Healthcare, Inc.

Revenue Shift to Chronic Care is Changing our Medical Cost Profile

PMPM

Molina Healthcare of Ohio

Medical cost PMPM by type of member

LTC = Long Term Care

BH = Behavioral Health

Rx = Pharmacy

OP = Outpatient

IP = Inpatient

Please refer to the Company’s cautionary statements. |

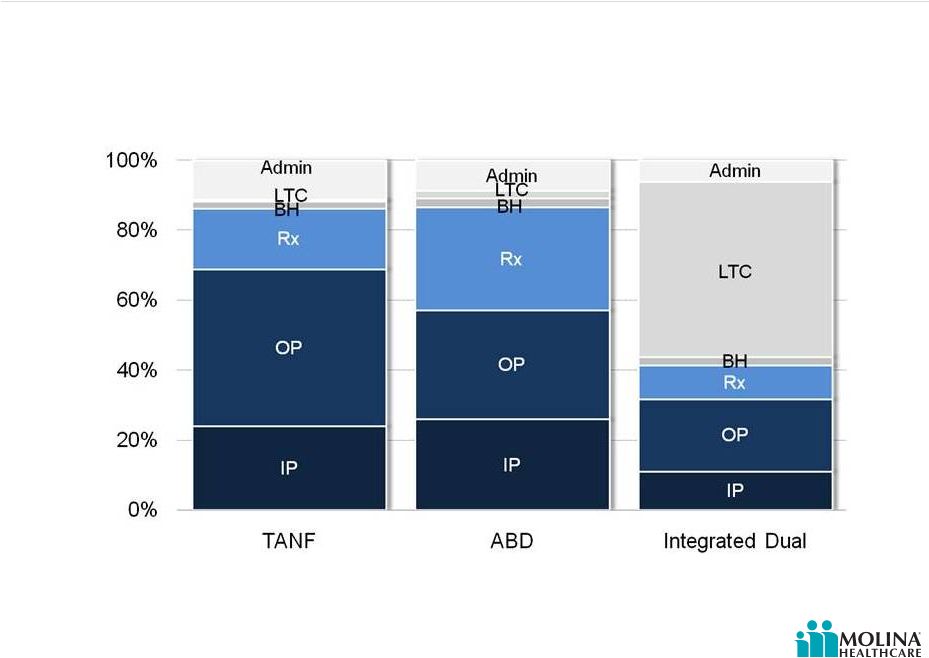

41

©

2014 Molina Healthcare, Inc.

% of Revenue

Molina Healthcare of Ohio

Medical Spend % by Type of Member

LTC = Long Term Care

BH = Behavioral Health

Rx = Pharmacy

OP = Outpatient

IP = Inpatient

Please refer to the Company’s cautionary statements.

Revenue Shift to Chronic Care is Changing our Medical Cost Profile

|

42

©

2014 Molina Healthcare, Inc.

Greater significance of risk adjustment

Payment linked to health status and demographic characteristics of the member

Document medical conditions

Process must lead to improved outcomes

Greater importance of medically related administrative cost

Care coordination

Community connectors

New contracts and new providers

Home Health providers

In home assessments

Shorter payment cycles

More claims

More frequent submission

Smaller dollars

Changing Medical Cost Profile

Chronic care needs of our members are changing our medical cost profile

|

43

©

2014 Molina Healthcare, Inc.

Risk Adjusted Revenue is Growing

1.

MMP = Medicare-Medicaid Plan (Duals).

Please refer to the Company’s cautionary statements. |

44

©

2014 Molina Healthcare, Inc.

Administrative Costs

TANF & ABD

Integrated Dual

% of Population

to be care

managed

1%

100%

$12

Administrative costs to support Integrated Duals members are nearly seven times

higher than a typical TANF or ABD member

Percentage of population requiring care

management

2014E Administrative Costs

Source: Molina Health of Ohio data. |

45

©

2014 Molina Healthcare, Inc.

Q&A |

©

2014 Molina Healthcare, Inc.

2014 Guidance

John Molina

Chief Financial Officer

February 13, 2014

New York, New York |

47

©

2014 Molina Healthcare, Inc.

Cautionary Statement

Safe

Harbor

Statement

under

the

Private

Securities

Litigation

Reform

Act

of

1995:

This

2014

Guidance

presentation

and

our

accompanying

oral

remarks

contain

numerous

“forward-looking

statements”

regarding:

expected

financial

results;

and

various

other

matters.

All

of

our

forward-looking

statements

are

subject

to

numerous

risks,

uncertainties,

and

other

factors

that

could

cause

our

actual

results

to

differ

materially.

Anyone

viewing

or

listening

to

this

presentation

is

urged

to

read

the

risk

factors

and

cautionary

statements

found

under

Item

1A

in

our

annual

report

on

Form

10-K,

as

well

as

the

risk

factors

and

cautionary

statements

in

our

quarterly

reports

and

in

our

other

reports

and

filings

with

the

Securities

and

Exchange

Commission

and

available

for

viewing

on

its

website

at

www.sec.gov.

Except

to

the

extent

otherwise

required

by

federal

securities

laws,

we

do

not

undertake

to

address

or

update

forward-looking

statements

in

future

filings

or

communications

regarding

our

business

or

operating

results. |

48

©

2014 Molina Healthcare, Inc.

The Opaque Crystal Ball

Please refer to the Company’s cautionary statements.

|

49

©

2014 Molina Healthcare, Inc.

Themes

2013

2015

2014

Build

Transition

Consolidation

Pursuing new

business

Designing &

implementing

programs and systems

Documenting

readiness

Incurring cost before

2014 revenue

Upcoming:

o

SC & IL

o

MMP Duals

o

Marketplace

o

Medicaid expansion

o

NM & FL Re-procurement

o

WI Medicare

Transitioning

members into model

of care

Mitigating pent-up

demand

Right-sizing premiums

Mitigating transition

issues

Incurring cost before

2015 revenue

Refining & enhancing

model of care

Refining & enhancing

programs and systems

Improving margins

Please refer to the Company’s cautionary statements.

|

50

©

2014 Molina Healthcare, Inc.

Revenue

Premium Revenue

ACA Fee Reimbursement

Premium Tax Revenue

Service Revenue

Investment and Other Revenue

Total Revenue

Total Medical Care Costs

Medical Care Ratio

1

Total Service Costs

General & Administrative Expenses

G&A Ratio

2

Premium Taxes

ACA Insurer Fee

Depreciation & Amortization

Interest Expense

Income Before Taxes

EBITDA

Effective Tax Rate

Adjusted EPS

3

~$9.2B

~$140M

~$275M

~$210M

~$20M

~$9.9B

~$8.2B

~89%

~$170M

~$770M

~8%

~$275M

~$85M

~$100M

~$55M

~$210M

~$385M

55% -

59%

$4.00 -

$4.50

2014

Guidance

2014 Guidance

Note: Amounts are estimates and subject to change. Actual results may differ

materially. See our risk factors as discussed in our Form 10-K and other periodic filings.

1.

Medical

Care

Ratio

represents

medical

care

costs

as

a

%

of

premium

revenue.

2.

G&A

ratio

computed

as

a

percentage

of

premium

revenue,

plus

service

revenue.

3.

Assumes

47.7M

average

diluted

shares

outstanding.

Low

and

high

guidance

ranges

assume

full

reimbursement

of

the

ACA

fee

and

related

tax

effects.

See

Appendix

for

a

reconciliation

of

adjusted

EPS

to

GAAP

diluted

net

income

per

share.

Please refer to the Company’s cautionary statements.

|

51

©

2014 Molina Healthcare, Inc.

New Product Membership Included in 2014 Guidance

January

2014

March

2014

State

Various

CA, NM,

& WA

NM

SC

WI

OH

IL

4

Program

Type

Marketplace

Medicaid

Expansion

LTC

Medicaid

SNP

Medicaid

Expansion

MMP Duals

4

Eligible

2M

1.4M

44K

740K

28K

275K

18K

Enrollees

15K

160K

5K

125K

1K

30K

5K

Revenue

PMPM

$300

$550

$1,600

$200

$1,100

$450

$1,800

MCR

88%

88%

93%

90%

82%

86%

95%

Opt Out

N/A

N/A

N/A

N/A

N/A

N/A

40%

4

Note:

Constitutes forward-looking guidance. Amounts are estimates and subject to

change. Actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings.

1. Denotes total number of eligible members in Molina markets.

2.

Denotes

membership

assumed

in

guidance

at

year-end

2014.

MMP

Dual

denotes

enrollment

after

opt-out.

3. Revenue PMPM and MCR are net of premium tax and ACA fee. Denotes full premium for

MMP Duals. 4. IL assumes opt out however only waiver (HCBS) members can be

enrolled in MOH Medicaid. Non-waiver (HCBS) members that opt out return to Medicaid FFS. IL MMP Passive enrollment not until 6/1/2014 and 9/1/2014 for Nursing Home & LTSS.

Please refer to the Company’s cautionary statements.

1

2

3

3 |

52

©

2014 Molina Healthcare, Inc.

New Product Membership Included in 2014 Guidance

April

2014

May

2014

June

2014

July

2014

October

2014

State

MI

CA

4

OH

5

FL

SC

IL

MI

6

Program

Type

Medicaid

Expansion

MMP Dual

4

MMP Duals

(Medicare

Voluntary)

5

Medicaid

(Re-

procurement)

MMP

Duals

Medicaid

Expansion

MMP

Duals

6

Eligible

500K

322K

48K

1.2M

54K

300K

62K

Enrollees

45K

30K

25K

140K

1K

25K

1K

Revenue

PMPM

$450

$2,000

$3,700

$280

$2,000

$550

$2,500

MCR

87%

94%

97%

88%

94%

88%

92%

Opt Out

N/A

50%

4

90%

5

N/A

50%

N/A

50%

6

Note:

Constitutes forward-looking guidance. Amounts are estimates and subject to

change. Actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings.

Please refer to the Company’s cautionary statements.

3

3

2

1

1. Denotes total number of eligible members in Molina markets.

2.

Denotes

membership

assumed

in

projection

at

year-end

2014.

MMP

Dual

denotes

enrollment

before

opt

for

CA,

OH

and

SC

and

after

opt-out

for

MI.

3. Revenue PMPM and MCR are net of premium tax and ACA fee; Denotes full

premium for MMP Duals. 4.

Riverside,

San

Bernardino

&

SanDiego

assume

50%

opt

out.

RS,SB,

SDopt

-outs

participates

in

MOH

Medicaid

LTSS.

MOH

awarded

20K

members

in

Los

Angeles,

assumes

50%

opt-out.

In

LA,

HNT

provides

Medicaid

LTSS

to

opt-outs.

5.

OH

passive

enrollment

for

MMP

Medicare

is

delayed

until

1/1/2015.

Only

members

that

volunteer

and

select

will

participate

in

both

Medicaid

and

Medicare

MMP.

6.

MI

assumes

50%

opt

out

and

members

that

opt

out

are

no

longer

enrolledin

MMP

program. |

53

©

2014 Molina Healthcare, Inc.

Status of Reimbursement –

ACA Fee in Molina States

Our

guidance

assumes

the

ACA

fee

and

related

tax

effects

will

be

fully

reimbursed

in

all

states.

Comments

ACA Fee

Gross Up

Reimbursemen

t Revenue

Reimbursement Not

Yet Achieved

Ohio

Actuarial rate memorandum (Mercer) calls for reimbursement of fee - silent on

tax impact.

$17M

$13M

$30M

$30M

Washington

Contract specifically calls for reimbursement of fee and tax impact.

$15M

$9M

$24M

$0M

Texas

Informal Support from State

$11M

$6M

$18M

$18M

Michigan

Actuarial rate memorandum (Milliman) calls for reimbursement of fee and tax

impact.

$10M

$6M

$16M

$16M

California

CA DHCS All Plan Meeting; "Mercer is working with DHCS…to develop an appropriate

reimbursement/addition….that recognizes MCO specific circumstances regarding the Fee"

2.11.14

$9M

$5M

$14M

$14M

New Mexico

State has indicated in a phone call Feb 4th with company staff they are awaiting

CMS guidance before committing

$7M

$4M

$11M

$11M

Florida

Letter from AHCA to FL Association of Health Plans 1/23/14; Our plan is to provide funds to managed

care plans once they have received federal invoices specifying the amount of liability

associated with their Florida Medicaid revenue….we also expect that it will be appropriate

to consider the income tax impact of the fee

$3M

$2M

$5M

$5M

Utah

Informal Support from State

$3M

$2M

$5M

$5M

Wisconsin

Contract specifically calls for reimbursement of fee and tax impact.

$3M

$1M

$4M

$0M

Illinois

Contract specifically calls for reimbursement of fee and tax impact.

$0M

$0M

$0M

$0M

Medicare

Included in bid pricing

$7M

$5M

$12M

$0M

TOTAL

$85M

$55M

$140M

$100M

Note:

Constitutes forward-looking guidance. Amounts are estimates and subject to

change. Actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings.

Please refer to the Company’s cautionary statements.

|

54

©

2014 Molina Healthcare, Inc.

Base Business Net Rate Changes Included in 2014 Guidance

State

FINAL

Effective Date

Rate Change

California

Oct-13

+2.5%¹

Florida

Sep-13

+1.0%²

Illinois

Jan-14

(-3.0%)¹

Michigan

Oct-13

+1.0%¹

New Mexico

Jan-14

0.0%

1,2

Ohio

Jan-14

2.0%

1,3

South Carolina

Jan-14

New Rates

Texas

Apr-14

0.0%²

Utah

Jan-14

+0.5%

Washington

Jan-14

0.0%

1, 2, 3

Wisconsin

Jan-14

+1.0%¹

Note:

1.

All rate changes exclude new product and benefit expansions effective after Dec 31,

2013. 2.

Net of fee schedule adjustments.

3.

All rate changes exclude risk adjustment.

Please refer to the Company’s cautionary statements.

|

55

©

2014 Molina Healthcare, Inc.

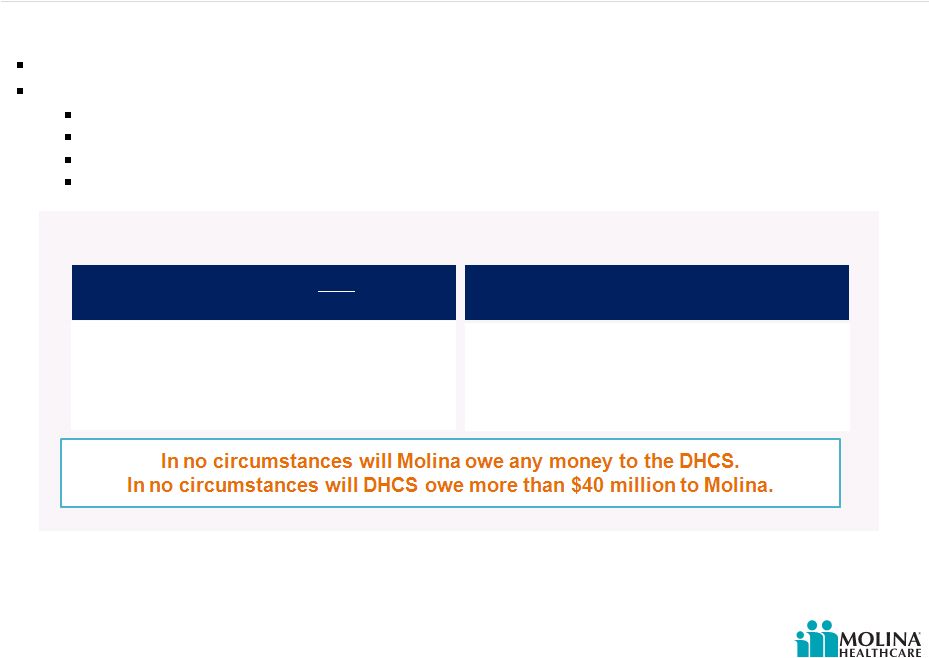

DHCS Agreement -

Settlement Account

Target

Profitability

margin

is

less

than

3.25% for any year

50% (75% for 2014 only) of difference between

actual and target profitability margins multiplied by

the applicable premium revenue is payable to

Molina

Target Profitability margin exceeds 3.25%

for any year

50% (75% for 2014 only) of difference between

actual and target profitability margins multiplied by

the applicable premium revenue reduces any

amount otherwise due to Molina under the

settlement from other years

Note -

profitability margin is calculated as follows:

Target

profitability

margin

-

Profit

÷

Premiums

earned

Premiums

earned

-

Gross

premiums:

(-)

Less

premium

taxes

and

ACA

insurer

fee

Profit -

Premiums earned: (-) Less medical cost and G&A expenses incurred

Effective January 1, 2014

Settlement account to serve as a risk corridor for all direct contracts with DHCS

Maximum of $40 million available over a 4 year period

Contracts directly with DHCS: Sacramento, San Bernardino / Riverside, & San

Diego Dual Eligible Demonstration contracts

Does NOT apply to Marketplaces, Medicare SNP & subcontract arrangements

Settlement Calculation

California settlement protects margin for California year 1 profitability

uncertainties Please refer to the Company’s cautionary statements.

|

56

©

2014 Molina Healthcare, Inc.

Guidance Assumes G&A Leverage

Our FY 2014 mid-point guidance assumes G&A

expenses of $770M or 8%

of total revenues.

Approximately $110M or 1% of our total

revenues is required to support growth.

G&A Expense

2014

2014 Growth

Current

Business

Note(s):

1.

G&A ratio computed as a percentage of premium revenue, net of premium taxes

& ACA fee reimbursement, plus service revenue. 2.

Constitutes forward-looking guidance. Amounts are estimates and subject to

change. Actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings.

Total G&A

2015 Implementation

Costs

1%

8%

2014 Guidance G&A

Ratio by Quarter

1, 2

Q114 –

8.9%

Q214 –

8.6%

Q314 –

7.9%

Q414 –

7.5%

$5M

Please refer to the Company’s cautionary statements.

7%

$770M

1

2 |

57

©

2014 Molina Healthcare, Inc.

Headwinds into 1Q2014

Net

($0.92)

Continued administrative spend ahead of revenue

G&A expenses incurred in anticipation of related revenues will reduce first

quarter GAAP & Adjusted EPS by (~$0.38)

Possible delay in revenue recognition

Delayed

recognition

of

ACA

fee

reimbursement

may

reduce

first

quarter

GAAP & Adjusted EPS by (~$0.33)

Delays

in

recognition

of

at

risk

revenue

may

reduce

first

quarter

GAAP

&

Adjusted EPS by (~$0.21)

Programmatic delays

Substantial uncertainty around Q1 results

1.

Constitutes forward-looking guidance. Amounts are estimates and subject to

change. Actual results may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings.

2.

Delayed recognition of ACA fee and related tax effects. Assumes no 1Q-14

recognition of ACA revenue in CA, FL, MI, NM, OH, TX and UT. Please refer to

the Company’s cautionary statements. 1

2

Note(s): |

58

©

2014 Molina Healthcare, Inc.

Appendix |

59

©

2014 Molina Healthcare, Inc.

Reconciling Adjusted EPS Ranges

Please refer to the Company’s cautionary statements.

Note(s):

Low End

High End

Adjusted net income per diluted share, continuing operations

$4.00

$4.50

Less non-cash adjustments, net of tax:

Depreciation, and amortization of capitalized software

$1.29

$1.29

Stock based compensation

$0.48

$0.48

Amortization of convertible senior notes and lease financing

obligations

$0.31

$0.31

Amortization of intangible assets

$0.27

$0.27

Net income (loss) per diluted share, continuing operations

$1.65

$2.15

*Assumes 47.7M average weighted diluted shares outstanding

1

2

2

1.

Constitutes forward-looking guidance. Amounts are estimates and subject to change. Actual results

may differ materially. See our risk factors as discussed in our Form 10-K and other periodic filings.

2.

Adjusted net income per diluted share, continuing operations, is a non-GAAP measure. The table

above reconciles adjusted net income per diluted share, which the Company believes to be the most comparable

GAAP measure to net income (loss) per diluted shares. GAAP stands for Generally Accepted Accounting

Principles. |