Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - IMS Health Holdings, Inc. | d628679dex231.htm |

| EX-10.4 - EX-10.4 - IMS Health Holdings, Inc. | d628679dex104.htm |

| EX-10.9 - EX-10.9 - IMS Health Holdings, Inc. | d628679dex109.htm |

| EX-10.23 - EX-10.23 - IMS Health Holdings, Inc. | d628679dex1023.htm |

| EX-10.16 - EX-10.16 - IMS Health Holdings, Inc. | d628679dex1016.htm |

| EX-10.24 - EX-10.24 - IMS Health Holdings, Inc. | d628679dex1024.htm |

Table of Contents

As filed with the Securities and Exchange Commission on February 13, 2014

Registration No. 333-193159

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IMS HEALTH HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 7374 | 27-1335689 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

83 Wooster Heights Road

Danbury, CT 06810

(203) 448-4600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ari Bousbib

Chairman, Chief Executive Officer & President

83 Wooster Heights Road

Danbury, CT 06810

(203) 448-4600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Patrick O’Brien Louis T. Somma Ropes & Gray LLP Prudential Tower 800 Boylston Street Boston, MA 02199 (617) 951-7000 |

Harvey A. Ashman Senior Vice President, General Counsel, External Affairs and Corporate Secretary 83 Wooster Heights Road Danbury, CT 06810 (203) 448-4600 |

David Lopez Cleary Gottlieb Steen & Hamilton LLP One Liberty Plaza New York, New York 10006 (212) 225-2000 |

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x (Do not check if a |

Smaller reporting company ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated February 13, 2014

Preliminary prospectus

shares

IMS Health Holdings, Inc.

Common stock

$ per share

This is the initial public offering of our common stock. We are selling shares of our common stock. The selling stockholders identified in this prospectus are offering an additional shares. We will not receive any of the proceeds from the sale of the shares being sold by the selling stockholders. We currently expect the initial public offering price to be between $ and $ per share of common stock.

We have granted the underwriters an option to purchase up to additional shares of common stock to cover over-allotments.

After the completion of this offering, certain of our existing stockholders will continue to own a majority of the voting power of our outstanding shares of common stock. As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange. See “Principal and selling stockholders.”

We have applied to list our common stock on the New York Stock Exchange under the symbol “IMS.”

| Per share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds to us before expenses |

$ | $ | ||||||

| Proceeds to selling stockholders before expenses |

$ | $ | ||||||

Investing in our common stock involves risk. See “Risk factors” beginning on page 21.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to investors on or about , 2014.

| J.P. Morgan | Goldman, Sachs & Co. | Morgan Stanley | ||||

| BofA Merrill Lynch | Barclays | Deutsche Bank Securities | Wells Fargo Securities |

| TPG Capital BD, LLC | HSBC | SunTrust Robinson Humphrey | Mizuho Securities | RBC Capital Markets | ||||||

| Piper Jaffray | William Blair | Drexel Hamilton | Leerink Partners | Stifel | ||||||

Prospectus dated , 2014

Table of Contents

| Page | ||||

| 1 | ||||

| 14 | ||||

| 17 | ||||

| 21 | ||||

| 43 | ||||

| 45 | ||||

| 46 | ||||

| 48 | ||||

| 50 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

53 | |||

| 81 | ||||

| 99 | ||||

| 109 | ||||

| 144 | ||||

| 147 | ||||

| 150 | ||||

| 159 | ||||

| 163 | ||||

| Material United States federal income tax considerations for Non-U.S. Holders |

165 | |||

| 170 | ||||

| 177 | ||||

| 179 | ||||

| 179 | ||||

| 179 | ||||

| F-1 | ||||

We are responsible for the information contained in this prospectus and in any free writing prospectus we prepare or authorize. Neither we nor the underwriters have authorized anyone to provide you with different information, and neither we nor the underwriters take responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date.

Through and including , 2014 (25 days after the commencement of this offering), all dealers that effect transactions in shares of our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments or subscriptions.

i

Table of Contents

Industry and market data

This prospectus includes market data and forecasts with respect to the healthcare industry. Although we are responsible for all of the disclosure contained in this prospectus, in some cases we rely on and refer to market data and certain industry forecasts that were obtained from third party surveys, market research, consultant surveys, publicly available information and industry publications and surveys that we believe to be reliable. Other industry and market data included in this prospectus are from IMS analyses and have been identified accordingly. We are a leading global information provider for the healthcare industry and we maintain databases, produce market analyses and deliver information to clients in the ordinary course of our business. Our information is widely referenced in the industry and used by governments, payers, academia, the life sciences industry, the financial community and others. Most of this information is available on a subscription basis. Other reports and information are available publicly through our IMS Institute for Healthcare Informatics (the “IMS Institute”). In some cases, the information has been developed by us for purposes of this offering based on our existing data and is believed by us to have been prepared in a reasonable manner. All such information is based upon our own market research, internal databases and published reports and has not been verified by any independent sources.

We established the IMS Institute in 2011 to leverage collaborative relationships in the public and private sectors to strengthen the role of information in advancing healthcare globally. Its objective and mission is to provide policy setters and decision makers in the global health sector with unique insights into healthcare dynamics derived from granular analysis of information. The IMS Institute publishes reports to accelerate understanding and innovation critical to sound decision-making and improved patient care. These reports are available publicly, free of charge. With access to our extensive global data sets and analytics, the IMS Institute works in tandem with a broad set of healthcare stakeholders, including government agencies, academic institutions, the life sciences industry and payers, to drive research to address today’s healthcare challenges.

Trademarks and service marks

We own or have rights to trademarks and service marks that we use in connection with the operation of our business, including IMS Health, IMS, the IMS logo, IMS One, MIDAS, Xponent, DDD, AppScript, AppNucleus, MD360 Provider Performance Management and Evidence360. All other trademarks or service marks appearing in this prospectus that are not identified as marks owned by us are the property of their respective owners.

Solely for convenience, the trademarks, service marks and trade names referred to in this prospectus are listed without the ®, (sm) and (TM) symbols, but we will assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service marks and trade names.

ii

Table of Contents

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Unless the context requires otherwise, references in this prospectus to the “Company,” “Issuer,” “IMS,” “we,” “us” and “our” refer to IMS Health Holdings, Inc. and its consolidated subsidiaries. “IMS Health” refers to IMS Health Incorporated, our wholly owned indirect subsidiary. You should read the entire prospectus carefully, especially “Risk factors” and our financial statements and the related notes, before deciding to buy shares of our common stock.

Our Company

We are a leading global information and technology services company providing clients in the healthcare industry with comprehensive solutions to measure and improve their performance. We have one of the largest and most comprehensive collections of healthcare information in the world, spanning sales, prescription and promotional data, medical claims, electronic medical records and social media. Our scaled and growing data set contains over 10 petabytes of unique data and over 500 million comprehensive, longitudinal, anonymous patient records (i.e., records that are linked over time for each anonymous individual across healthcare settings). Based on this data, we deliver information and insights on approximately 90% of the world’s pharmaceuticals, as measured by sales revenue. We standardize, organize, structure and integrate this data by applying our sophisticated analytics and leveraging our global technology infrastructure to help our clients run their organizations more efficiently and make better decisions to improve their operational and financial performance. We have a presence in over 100 countries, including high growth emerging markets, and we generated 63% of our $2.54 billion of 2013 revenue from outside the United States.

We serve key healthcare organizations and decision makers around the world, spanning the breadth of life science companies, including pharmaceutical, biotechnology, consumer health and medical device manufacturers, as well as distributors, providers, payers, government agencies, policymakers, researchers and the financial community. The breadth of the intelligent, actionable information we provide is not comprehensively available from any other source and would be difficult and costly for another party to replicate. Our information and technology services offerings, which we have developed with significant investment over our 60-year history, are deeply integrated into our clients’ workflow. We maintain long-standing relationships and high renewal rates with our clients due to the value of the services and solutions we provide. The average length of our relationships with our top 25 clients, as measured by 2013 revenue, is over 25 years and our retention rate for our top 1,000 clients from 2012 to 2013 was approximately 99%. We have significant visibility into our financial performance, as historically about 70% of our revenue has recurred annually, principally because our information and technology services offerings are critical to our clients’ daily decision-making and are sold primarily through subscription and service contracts.

1

Table of Contents

We leverage our proprietary information assets to develop technology and services capabilities with a talented healthcare-focused workforce that enables us to grow our relationships with healthcare stakeholders. This set of capabilities includes:

| • | A leading healthcare-specific global information technology (“IT”) infrastructure, which we use to process data from over 45 billion healthcare transactions annually and to collect data from over 780,000 fragmented feeds globally, which we organize in a consistent and highly structured fashion using proprietary methodologies; |

| • | A staff of approximately 9,500 professionals across the globe, including over 1,200 experts in areas such as biostatistics, data science, bioinformatics, healthcare economics, outcomes research, epidemiology, pharmacology and key therapeutic areas; |

| • | Our intelligent cloud, IMS One, which opens our sophisticated global IT infrastructure to our clients and provides the ability to perform business analytics in the cloud with large amounts of complex data. Our cloud is unique in the healthcare industry because it pre-integrates applications with IMS data, eliminating the cost traditionally associated with integrating information, and provides interoperability across both IMS and third party applications, reducing the complexity traditionally associated with siloed data; and |

| • | A growing set of proprietary applications, which include: commercial applications supporting sales operations, sales management, multi-channel marketing and performance management; real-world evidence solutions helping manufacturers and payers evaluate the value of treatments in terms of cost, quality and outcomes; payer-provider solutions helping these constituents optimize contracting and performance management; and clinical solutions helping manufacturers and Clinical Research Organizations (“CROs”) better design, plan, execute and track clinical trials. |

At a time when the healthcare industry is experiencing transformational change driven by global expansion and the growth of new categories of medicines, intense cost pressures, a changing regulatory environment, and new payment and delivery models, we enable our clients to gain and apply insights designed to substantially improve operating performance. Our solutions, which are designed to provide our clients access to our deep healthcare-specific subject matter expertise, take various forms, including information, tailored analytics, subscription software and expert services.

2

Table of Contents

We believe our mission-critical relationships with our life science clients are reflected in the role we play within four important areas of decision-making related to their product portfolios: Research and Development, Pre-Launch, Launch and In-Market. Over the last three years, we have introduced software and services applications that have further deepened our level of client integration by enabling our clients to enhance and automate many of these key decision-making processes.

| • Market opportunity assessment

• Clinical trial feasibility/planning

• Site selection

• Patient recruitment

• Trial monitoring

• Performance management |

• Drug pricing optimization

• Launch readiness

• Commercial planning

• Brand positioning

• Message testing

• Influence networks

• Territory design |

• Market access

• Health technology assessment

• Commercial readiness

• Forecasting

• Resource allocation

• Call planning

• Stakeholder engagement |

• Commercial operations

• Sales force effectiveness

• Sales force alignment

• Multi-channel marketing

• Client relationship management

• Lifecycle management |

We believe that a powerful component of our value proposition is the breadth and depth of intelligence we provide to help our clients address fundamental operational questions.

| User | Illustrative Questions | |||||

| Sales | Which providers generate highest return on rep visit? | Does my sales rep drive appropriate prescribing? | How much should I pay my sales rep next month? | |||

| Marketing | What share of patients is appropriately treated? | Which underserved patient populations will benefit most from my new drug? | Is my brand gaining market share quickly enough to hit revenue forecasts? | |||

| Research & Development | Are there enough patients for my clinical trial? | Which study centers have the target patients? | How long will trial enrollment take to hit target patient volumes? | |||

| Real World Evidence (“RWE”)/Pharmacovigilance | What is the likely impact of new therapies on costs and outcomes? | Are new therapies performing better against existing standards of care in real world settings? | Does real world data indicate adverse events not detected in clinical trials? | |||

We generate revenue through local sales teams that manage client relationships in each region and go to market locally with our full suite of information and technology services offerings.

3

Table of Contents

Total global revenue from our information offerings, including national and sub-national information services, represented 60% of our 2013 revenue. Total global revenue from our technology services offerings, which include hosted and cloud-based applications, implementation services, subscription software, analytic services and consulting, represented 40% of our 2013 revenue. We believe the data from our information offerings, when combined with our technology services offerings, can provide valuable insights to our clients and can increase the speed and effectiveness of decision making while also simplifying processes and reducing complexity and costs. Increasing demand from our clients for broader and more integrated offerings has been an important driver of our growth in technology services revenue, which grew at a compound annual growth rate (“CAGR”) of 13% between 2010 and 2013.

Ari Bousbib was appointed as our Chief Executive Officer on August 16, 2010 following the purchase of our Company by our Sponsors in February 2010, which we refer to as the Merger. Over the past three years, Mr. Bousbib and the management team have made substantial investments in human capital, technology and services infrastructure to expand the breadth of our platform and the number of constituents we serve within the healthcare value chain. Examples of our strategic investments and operational changes include:

| • | improving our operating efficiency by streamlining our organization, deploying lean methodologies throughout our global operations, and standardizing and automating processes; |

| • | in-sourcing development activities and capabilities, with approximately 70% of our development resources in-house as of 2013 year end, compared to approximately 30% in 2010; |

| • | increasing our offshore delivery resources to over 2,000 people as of 2013 year end, compared to 250 in 2010, which has driven substantial productivity improvement; |

| • | shifting our employee mix, with over 50% now client-facing as of 2013 year end, compared to approximately 33% in 2010; and |

| • | expanding our offerings and capabilities by investing over $900 million in 22 complementary acquisitions, internal development projects and capital expenditures since the beginning of 2011 through 2013 year end. |

These strategic investments and operational changes have transformed our organization into a more customer-centric, service oriented, high-performance culture. Since the Merger through the end of 2013, we added approximately 7,600 employees to the organization and oversaw the departure of approximately 5,200 employees from the organization, reflecting the various strategic and operational changes described above. We estimate that about 60% of our approximately 9,500 employees have joined us since the Merger through the end of 2013.

We believe our investments in people, technology and services have enabled us to significantly expand our addressable market and capture an additional portion of our clients’ spend by providing more powerful technology solutions and new insight-driven services. The following financial performance metrics have improved significantly between 2010 and 2013:

| • | revenue increased to $2.54 billion, generating a CAGR of 5.6% on an as reported basis and 5.9% on a constant dollar basis; |

4

Table of Contents

| • | Adjusted EBITDA increased to $829 million, generating a CAGR of 10.2% on an as reported basis and 10.6% on a constant dollar basis; and |

| • | Adjusted EBITDA as a percentage of revenue increased to 32.6% from 28.7%. |

We incurred a net loss of $199 million for the combined 2010 year-end period. Amounts expressed in constant dollar terms exclude the effect of changes in foreign currency exchange rates on the translation of foreign currency results into U.S. dollars. For additional information regarding these financial measures, including a reconciliation of our non-GAAP measures to the most directly comparable measure presented in accordance with United States generally accepted accounting principles (“GAAP”), see “Summary and pro forma consolidated financial data” included elsewhere in this prospectus. For additional information regarding foreign currency translation, see “Management’s discussion and analysis of financial condition and results of operations—Results excluding the effect of foreign currency translation and certain charges” included elsewhere in this prospectus.

Our market opportunity

We compete in the global information, technology and services market for the life sciences and the broader healthcare industry. Historically, we concentrated our efforts in the market for information and consulting services primarily supporting the commercial functions of life sciences organizations, which we estimate to be a $5 billion market. In response to the needs of a broader set of life sciences clients for more specialized information, such as longitudinal anonymous patient data and clinical trial analytics, we have expanded our offerings to serve the market for information and services, which we estimate to be a $22 billion market. In addition, in response to our life sciences clients’ need to streamline operations, we offer an expanded range of technology services that include data warehousing, IT outsourcing, software applications and other services in the broader market for IT services, which, together, represent an additional $28 billion market among our life sciences clients. As a result, we now operate across a life sciences marketplace for information and technology services that we estimate to be $50 billion. We also have newer offerings in the $25 billion market for information and technology services for payers and providers and view this rapidly expanding market as an opportunity for further growth.

We believe there are five key trends affecting our end markets that will create increasing demand for our information and technology services solutions:

Growth and innovation in the life sciences industry. The life sciences industry is a large and critical part of the global healthcare system, generating approximately $1 trillion in annual revenue. According to our research, revenue growth in the life sciences industry globally is expected to accelerate from 2.5% in 2013 to approximately 6% in 2017. The IMS Institute estimates that an average of 35 new molecular entities (“NMEs”) are expected to be approved each year from 2013 to 2017, up from 25 NMEs in 2010 and a return to mid-2000s levels. The reacceleration of industry growth is also the result of dramatically lower expected patent expirations on prescription medications versus the recent past.

Growth in access to healthcare in emerging markets. We believe there will be significant growth in healthcare spending in emerging markets, driven predominantly by a rapidly growing middle class in countries such as China and India. According to the IMS Institute, it is estimated that spending on pharmaceuticals in emerging markets will expand at a 10 to 13% CAGR

5

Table of Contents

through 2017. The rapid growth of emerging markets is making these geographies strategically important to life sciences organizations and we expect these organizations to apply a high degree of sophistication to their commercial operations in these countries. This requires highly localized information assets and analytics for both multinational and local market companies.

Financial pressures driving the need for increased efficiency. Despite the expected accelerating growth in the global life sciences market, we believe our clients will face operating margin pressure due to their changing product mix, pricing and reimbursement challenges, and rising costs of compliance. Based on our research, we believe large pharmaceutical companies must collectively reduce costs by approximately $35 billion from 2012 to 2017 to maintain historic operating margins. As a result, our clients are looking for new ways to simplify processes and drive operational efficiencies, including by using automation, consolidating vendors and adopting new technology options such as hosted and cloud-based applications.

Evolving need to integrate and structure expanding sources of data. Over the past decade, many health systems around the world have focused on digitizing medical records. While such records theoretically enhance access to data, relevant information is often unintegrated, unstructured, siloed in disparate software systems or entered inconsistently.

In order to derive valuable insights from existing and expanding sources of information, clients need access to statistically significant data sets organized into databases that can be queried and analyzed. For example, longitudinal studies require analysis of anonymous patient diagnoses, treatments, procedures and laboratory test results to identify types of patients that will likely best respond to particular therapies. We believe the opportunity to more broadly apply healthcare data can only be realized through structuring, organizing and integrating new and existing forms of data in conjunction with sophisticated analytics.

Need for demonstrated value in healthcare. Participants in the healthcare industry are focused on improving quality and reducing costs, both of which require assessment of quality and value of therapies and providers. As a result, there is increasing pressure on life sciences companies to support and justify the value of their therapies. Many new drugs that are being approved are more expensive than existing therapies, and will likely receive heightened scrutiny by payers to determine whether the existing treatment options would be sufficient. Additionally, many new specialty drugs are molecular-based therapies and require a more detailed understanding of clinical factors and influencers that demonstrate therapeutic value. As a result, leading life sciences companies are utilizing more sophisticated analytics for insight driven decisions.

We believe we are well positioned to take advantage of these global trends in healthcare. Beyond our proprietary information assets, we have developed key capabilities to assess opportunities to develop and commercialize therapies, support and defend the value of medicines and help our clients operate more efficiently through the application of insight-driven decision-making and cost-efficient technology solutions.

Our strengths

Comprehensive information assets and collection network. The scale of our information assets, breadth and depth of our data supplier network, and our global reach are distinct advantages as clients value quality, consistency and continuity across geographies to accurately measure trends

6

Table of Contents

and their performance. With over 10 petabytes of proprietary data sourced from over 100,000 data suppliers covering over 780,000 data feeds globally, we have one of the largest and most comprehensive collections of healthcare information in the world, which includes over 500 million comprehensive, longitudinal anonymous patient records. Based on this data, we deliver information and insights on approximately 90% of the world’s pharmaceuticals, as measured by sales revenue. We have proprietary healthcare data management and projection methodologies developed over a long history, which enable us to extrapolate more precise insights from large-scale databases to provide greater granularity and segmentation for our clients. We continue to invest in new technology to source data that is valued by our clients, including social media analytics and mobile health solutions, to continuously add records to our data sets, and refine our information and analytic methods. Use of our proprietary encryption technologies allows anonymous information to be linked across different care settings and across data sets, resulting in more complete healthcare information about anonymous patients and a deeper understanding of real world treatment, cost and outcomes.

Scaled healthcare specific technology infrastructure. To manage our proprietary, global information base, we have built what we believe is one of the largest and most sophisticated information technology infrastructures in healthcare. By processing data from over 45 billion healthcare transactions annually, our infrastructure connects complex healthcare data while applying a wide range of privacy, security, operational, legal and contractual protections for data in response to local law, supplier requirements and industry leading practices. We have four Centers of Excellence and five operation hubs around the world, and approximately 9,500 associates, including over 1,200 experts in areas such as biostatistics, data science, bioinformatics, healthcare economics, outcomes research, epidemiology, pharmacology and key therapeutic areas. We believe the scale, global footprint and connectivity our infrastructure provides is unique within the healthcare vertical and will be of increasing value to our clients in a period where cost pressures will grow.

Highly differentiated technology services fully integrated with IMS information. Our ability to integrate technology services with our data creates mission-critical, actionable intelligence that improves our overall value proposition to our clients. Our expanding set of sophisticated human capital resources and technology services offerings combined with our deep understanding of our scaled information assets provides what we believe to be a competitive advantage in an environment where clients require better performance. For example, in 2012, we introduced our healthcare-specific intelligent cloud, IMS One, which helps our clients fully recognize the benefits of our infrastructure. Our cloud is unique in the healthcare industry because it pre-integrates applications with IMS data and provides interoperability across both IMS and third party applications. We envision that over time IMS One will become an industry standard around which applications are hosted and information shared on an interoperable basis.

Long standing client relationships that are expanding. The breadth of the intelligent, actionable information we provide is not comprehensively available from any other source and would be difficult and costly for another party to replicate. We believe our information and technology services are deeply integrated into our clients’ workflow. We maintain long-standing relationships and high renewal rates with clients due to the value of the services and solutions we provide, as well as support the need for globally consistent information to enable comprehensive trend analysis at the local, regional, national and multi-country levels. The

7

Table of Contents

average length of our relationships with our top 25 clients, as measured by 2013 revenue, is over 25 years and our retention rate for our top 1,000 clients from 2012 to 2013 was approximately 99%. Serving over 5,000 clients creates significant opportunity to expand the breadth of services we provide to our clients.

Unique and scalable operating model. We believe we have an attractive operating model due to the scalability of our solutions, the recurring nature of our revenue and the low capital intensity/high free cash flow conversion of our business. Given our global infrastructure and the fixed-cost nature of our data, we are able to scale our healthcare information, technology and service solutions rapidly and efficiently to generate high margins on incremental revenue. Our flexible technology platform has been built to accommodate highly complex analytics and significant data volumes. We believe our recurring revenue provides significant visibility to our financial performance, and when combined with our leading offerings, will contribute to our long-term growth, strong operating margins and flexibility in allocating capital.

Our growth strategy

We believe we are well positioned for continued growth across the markets we serve. Our strategy for achieving growth includes:

Build upon our extensive client relationships. We have a diversified base of over 5,000 clients in over 100 countries, and have expanded our client value proposition since the Merger to now address a broader market for information and technology services which we estimate to be $50 billion. We are in the early stages of penetrating this expanding market within our global life sciences client base. Key elements of this strategy include:

| • | further integrating our existing services to provide clients with interoperable solutions; |

| • | increasing the number of clients that leverage our technology services offerings, including IMS One; |

| • | using our global presence and efficient operating model to scale new applications and solutions rapidly and efficiently across clients, markets and geographies; and |

| • | expanding the number of clients that choose to drive efficiencies by consolidating their vendor needs with us. |

Capitalize on our presence in emerging markets. We believe China, India, Brazil and Russia, together with many of the 50-plus other emerging markets in which we operate, will accelerate their healthcare spending over the next five years. We have an established presence in these markets, generating $440 million of revenue for 2013 (approximately 17% of our revenue) and growing at an 11% constant dollar CAGR since 2010. We serve both multinational companies and local clients. Key elements of this strategy include:

| • | partnering with existing life sciences clients as they expand their businesses into emerging markets; |

| • | continuing to grow our existing services in emerging markets while simultaneously introducing new services drawn from our global portfolio; and |

| • | building relationships with local companies that are expanding beyond their home markets by capitalizing on the global credibility and consistency of our platform. |

8

Table of Contents

Continue to innovate. We believe a significant opportunity exists to continue to enhance our information and analytics offerings and expand our technology services offerings to capitalize on the evolving healthcare environment. Our recent investments in human capital, technology and services capabilities position us to continue to pursue rapid innovation within the life sciences sector and the broader healthcare marketplace. Examples of recent innovations include:

| • | development of applications in the mobile health space including AppScript, an enterprise solution for providers and payers to establish a curated formulary of mobile applications that can be prescribed securely and reconciled by prescribers just like drug prescriptions, and AppNucleus, which allows developers to build mobile applications with secure containers for patient information on devices and secure communication channels to physicians and other applications; and |

| • | development of Evidence360, a collection of specialized technologies for RWE, including tailor-made data warehouses integrating our data sets with patient registries and a cohort builder tool facilitating efficient definitions and tracking of narrow cohorts to determine outcomes in small patient populations. |

Expand portfolio through strategic acquisitions. We have and expect to continue to acquire assets and businesses that strengthen our value proposition to clients. We have developed an internal capability to source, evaluate and integrate acquisitions that have created value for stockholders. Since the beginning of 2011, we have invested approximately $586 million of capital in 22 acquisitions. As the global healthcare landscape evolves, we expect that there will be a growing number of acquisition opportunities across the life sciences, payer and provider sectors.

Expand the penetration of our offerings to the broader healthcare marketplace. We believe that substantial opportunities exist to expand penetration of our addressable market and further integrate our offerings in a broader cross-section of the healthcare marketplace. Key elements of this strategy include:

| • | continuing to sell innovative solutions to life sciences clients in areas we have recently entered, such as clinical trial analytics; |

| • | leveraging our comprehensive collection of healthcare information to provide critical insights to payers and providers, enabling advanced patient analytics and population health management; and |

| • | utilizing our proprietary information and analytics to address the evolving needs of the broader healthcare marketplace. |

Our offerings

We offer hundreds of distinct services, applications and solutions to help our clients make critical decisions and perform better. While historically our offerings focused mainly in information and analytics, we now routinely integrate information with technology services to ensure our clients receive the most value from our information to enable them to incorporate insights into their workflow. These offerings complement each other and can provide enhanced value to our clients when delivered together in an integrated fashion, with each driving demand for the other.

9

Table of Contents

Our principal offerings include:

| • | National information offerings. Our national offerings comprise unique services in more than 70 countries that provide consistent country level performance metrics related to sales of pharmaceutical products, prescribing trends, medical treatment and promotional activity across multiple channels including retail, hospital and mail order. |

| • | Sub-national information offerings. Our sub-national offerings comprise unique services in more than 50 countries that provide a consistent measurement of sales or prescribing activity at the regional, zip code and individual prescriber level (depending on regulation in country). |

| • | Commercial services. We provide a broad set of strategic, workflow analytics and support services to help the commercial operations of life sciences companies successfully transform their commercial models, engage more effectively with the marketplace and reduce their operating costs. |

| • | Real-World Evidence (RWE) solutions. We integrate information from medical claims, prescriptions, electronic medical records, biomarkers and government statistics into anonymous, longitudinal patient journeys that provide detailed views of treatment patterns, disease progression, therapeutic switching and concomitant diseases and treatments. |

| • | Commercial technology solutions. We provide an extensive range of hosted and cloud-based applications and associated implementation services. The applications, hosted on IMS One, support a wide range of commercial processes including multi-channel marketing, customer relationship management (“CRM”), performance management, incentive compensation, territory alignment, roster management and call planning. |

| • | Clinical solutions. By bringing together our information with advanced predictive modeling technology, we help life sciences companies and CROs better design and execute clinical trials; and for payers and providers, we enable risk-sharing, pay-for-performance and population health management. |

Risk related to our business

An investment in our common stock involves a high degree of risk. Among these important risks are the following:

| • | our data suppliers might restrict our use of or refuse to license data, which could lead to our inability to provide certain products or services; |

| • | failure to meet productivity objectives under our internal business transformation initiatives could adversely impact our competitiveness and our ability to meet our growth objectives; |

| • | we may be unsuccessful at investing in growth opportunities; |

| • | data protection and privacy laws may restrict our current and future activities; |

| • | breaches or misuse of our or our outsourcing partners’ security or communication systems could expose us, our clients, our data suppliers or others to risk of loss; |

| • | hardware and software failures, delays in the operation of our computer and communications systems or the failure to implement system enhancements may adversely impact us; |

10

Table of Contents

| • | consolidation in the industries in which our clients operate may reduce the volume of products and services purchased by consolidated clients following an acquisition or merger; and |

| • | our ability to protect our intellectual property rights and our susceptibility to claims by others that we are infringing their intellectual property rights. |

For additional information about the risks we face, please see the section of this prospectus captioned “Risk factors.”

Our Sponsors

On February 26, 2010, IMS was acquired by affiliates of TPG Global, LLC (together with its affiliates, “TPG”), CPP Investment Board Private Holdings, Inc. (“CPPIB-PHI”), a wholly owned subsidiary of the Canada Pension Plan Investment Board (together with its affiliates, “CPPIB”) and Leonard Green & Partners, L.P. (“LGP” and collectively with TPG and CPPIB, the “Sponsors”) in an all-cash transaction. The acquisition was accomplished through the merger (the “Merger”) of the parent of IMS Health with and into Healthcare Technology Acquisition, Inc., an indirect wholly owned subsidiary of IMS Health Holdings, Inc., the Issuer, which is owned by investment entities controlled by the Sponsors and management.

TPG. TPG is a leading global private investment firm founded in 1992 with $55.7 billion of assets under management as of September 30, 2013 and offices in San Francisco, Fort Worth, Austin, Beijing, Chongqing, Hong Kong, London, Luxembourg, Melbourne, Moscow, Mumbai, New York, Paris, São Paulo, Shanghai, Singapore and Tokyo. TPG has extensive experience with global public and private investments executed through leveraged buyouts, recapitalizations, spinouts, growth investments, joint ventures and restructurings. The firm’s investments span a variety of industries, including healthcare, financial services, travel and entertainment, technology, energy, industrials, retail, consumer, real estate and media and communications.

CPPIB. CPPIB is one of the largest and fastest growing institutional investors in the world. It invests the funds not needed by the Canada Pension Plan to pay current benefits on behalf of 18 million Canadian contributors and beneficiaries. Headquartered in Toronto, with offices in London and Hong Kong, CPPIB is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At September 30, 2013, the Fund’s assets totaled C$193 billion, of which approximately C$48 billion is invested through the Private Investments group. A team of 135 dedicated Private Investment professionals manages investment activities in Direct Private Equity, Private Debt, Infrastructure, and Funds, Secondaries & Co-Investments. Direct Private Equity manages an approximately C$10 billion portfolio of investments and focuses on majority or shared control investments, typically alongside an existing fund partner, across multiple industry sectors worldwide. Current and previous healthcare and technology investments include Kinetic Concepts, Alliance Boots, Diaverum, LHP Hospital Group, United Surgical Partners, Skype, NEWAsurion and Aricent, among others.

LGP. LGP is a leading private equity firm with over $15 billion of private equity capital raised since inception. Founded in 1989, LGP has invested in 70 companies with aggregate value of $74 billion. Located in Los Angeles, California, LGP invests in established companies that are leaders in their markets. Significant investments include The Container Store, J. Crew Group, CHG Healthcare, CCC Information Services and Topshop/Topman.

11

Table of Contents

Following the completion of this offering, the Sponsors will own approximately % of our common stock, or % if the underwriters’ option to purchase additional shares of our common stock is fully exercised. As a result, we expect to be a “controlled company” within the meaning of the corporate governance standards of the New York Stock Exchange (the “NYSE”) on which we have applied for our shares to be listed. See “Risk factors—Risks relating to our common stock and this offering.”

12

Table of Contents

Corporate information and structure

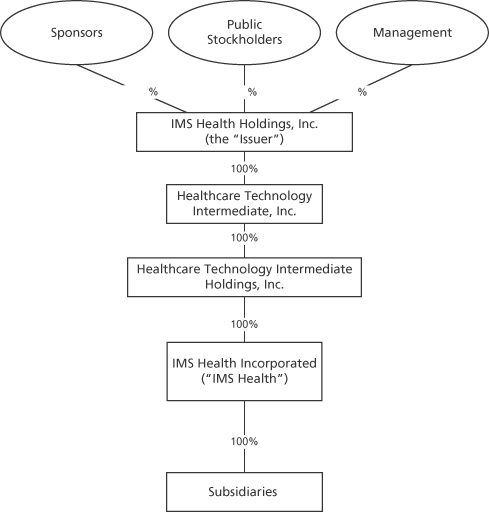

IMS Health Holdings, Inc. is a Delaware corporation that was formed in 2009 under the name Healthcare Technology Holdings, Inc. On December 20, 2013, the Company changed its name to IMS Health Holdings, Inc. Its only material assets are the shares of the equity of Healthcare Technology Intermediate, Inc., which is the holder of 100% of the equity of Healthcare Technology Intermediate Holdings, Inc., which is the holder of 100% of the shares of the equity of IMS Health Incorporated, which we refer to in this prospectus as IMS Health. IMS Health Holdings, Inc. does not conduct any operations other than with respect to its direct and indirect ownership of its subsidiaries and conducts all of its business through IMS Health and its subsidiaries. Our principal executive offices are located at 83 Wooster Heights Road, Danbury, Connecticut 06810. Our telephone number at that address is (203) 448-4600. Our website address is www.imshealth.com. Our website and the information contained on our website do not constitute a part of this prospectus.

The following chart shows our simplified organizational structure immediately following the consummation of this offering:

13

Table of Contents

| Common stock offered by us |

shares |

| Common stock offered by the selling stockholders |

shares |

| Common stock to be outstanding after this offering |

shares (or shares if the underwriters exercise their overallotment option in full) |

| Option to purchase additional shares |

The underwriters have an option for a period of 30 days to purchase up to additional shares of our common stock to cover overallotments. |

| Use of proceeds |

We estimate that the net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full, at an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We intend to refinance a portion of our existing long-term debt in connection with the closing of this offering (the “Refinancing”), comprised of (i) the entry into an amendment and restatement of our Senior Secured Credit Facilities to provide for, among other things, additional term loans (the “New Term Loans”) of $ and € and to increase our existing revolving credit facility to $ and (ii) the redemption of (x) all amounts outstanding under our $750.0 million 7.374%/8.125% Senior Payment-in-Kind Toggle Notes due 2018 (the “Senior PIK Notes”) and (y) all amounts outstanding under our $999.6 million 12.5% unsecured Senior Exchange Notes due 2018 (the “New 12.5% Senior Notes”) and the $0.4 million of 12.5% Senior Notes due 2018 (the “Old 12.5% Senior Notes,” and, together with the New 12.5% Senior Notes, the “12.5% Senior Notes”), in each case including related fees and expenses. We intend to use the net proceeds of this offering, along with borrowings under our New Term Loans and cash on our balance sheet, to (i) fund the redemption of all of our Senior PIK Notes and 12.5% Notes, (ii) pay an estimated amount of $ million in the aggregate to holders of outstanding cash-settled stock appreciation rights granted under our 2010 Equity Incentive Plan (“Phantom SARs”), and (iii) pay a one-time fee to terminate our management services agreement with the Sponsors of $ million. We intend to use the remainder of the net proceeds, if any, for |

14

Table of Contents

| general corporate purposes. We will not receive any of the proceeds from the sale of shares by the selling stockholders. See “Use of proceeds.” |

| Dividend policy |

Our board of directors does not currently intend to pay dividends on our common stock. However, we expect to reevaluate our dividend policy on a regular basis following the offering and may, subject to compliance with the covenants contained in our credit facilities and other considerations, determine to pay dividends in the future. The declaration, amount and payment of any future dividends on shares of our common stock will be at the sole discretion of our board of directors, which may take into account general and economic conditions, our financial condition and results of operations, our available cash and current and anticipated cash needs, capital requirements, contractual, legal, tax and regulatory restrictions, the implications of the payment of dividends by us to our stockholders or by our subsidiaries to us, and any other factors that our board of directors may deem relevant. See “Management’s discussion and analysis of financial condition and results of operations—Liquidity and capital resources,” “Description of indebtedness” and Note 11 to our audited consolidated financial statements included elsewhere in this prospectus for restrictions on our ability to pay dividends. |

| Risk factors |

You should read the “Risk factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| Proposed NYSE symbol |

“IMS” |

| Conflicts of interest |

Because certain affiliates of Goldman, Sachs & Co., an underwriter of this offering, hold a portion of our 12.5% Senior Notes and are therefore expected to receive more than 5% of the net proceeds of this offering and because affiliates of TPG Capital BD, LLC, an underwriter of this offering, own in excess of 10% of our issued and outstanding common stock, a “conflict of interest” under Rule 5121 of the Financial Industry Regulatory Authority, Inc. (“FINRA”) is deemed to exist. As required by FINRA Rule 5121, J.P. Morgan Securities LLC has agreed to act as “qualified independent underwriter” for this offering and has participated in the preparation of, and has exercised the usual standards of “due diligence” in respect of this prospectus. See “Use of proceeds” and “Underwriting—Conflicts of interest.” |

The number of shares of common stock to be outstanding after this offering is based on shares of common stock outstanding as of , 2014 and excludes the following:

| • | shares of common stock issuable upon exercise of stock options outstanding as of , 2014 at a weighted average exercise price of $ per share; and |

| • | shares of common stock reserved for future issuance under our equity incentive plans as of , 2014. |

15

Table of Contents

Unless otherwise indicated, this prospectus reflects and assumes the following:

| • | the adoption of our amended and restated certificate of incorporation and our amended and restated bylaws, to be effective upon the closing of this offering; and |

| • | no exercise by the underwriters of their option to purchase up to additional shares of our common stock in this offering. |

16

Table of Contents

Summary and pro forma consolidated financial data

The following table sets forth summary historical and pro forma consolidated financial data for the years presented and at the dates indicated below. We have derived the balance sheet data as of December 31, 2013 and December 31, 2012 and the statement of comprehensive income (loss) and cash flow data for each of the three years in the period ended December 31, 2013 from our audited consolidated financial statements included elsewhere in this prospectus.

Historical results are not necessarily indicative of the results to be expected for future periods. The following information should be read in conjunction with the section entitled “Management’s discussion and analysis of financial condition and results of operations” and our consolidated financial statements and the notes thereto contained elsewhere in this prospectus.

| Years ended December 31, |

||||||||||||

| (dollars in millions) | 2013 | 2012 | 2011 | |||||||||

| Financial Data: |

||||||||||||

| Revenue |

$ | 2,544 | $ | 2,443 | $ | 2,364 | ||||||

| Information |

1,525 | 1,521 | 1,532 | |||||||||

| Technology Services |

1,019 | 922 | 832 | |||||||||

| Operating costs of information |

648 | 675 | 698 | |||||||||

| Direct and incremental costs of technology services |

520 | 476 | 396 | |||||||||

| Selling and administrative expenses |

596 | 579 | 604 | |||||||||

| Depreciation and amortization(1) |

410 | 424 | 393 | |||||||||

| Severance, impairment and other charges |

16 | 48 | 31 | |||||||||

| Merger costs |

— | 2 | 23 | |||||||||

|

|

|

|||||||||||

| Operating income |

354 | 239 | 219 | |||||||||

|

|

|

|||||||||||

| Interest income |

4 | 4 | 3 | |||||||||

| Interest expense |

(332 | ) | (275 | ) | (277 | ) | ||||||

| Other loss, net |

(74 | ) | (29 | ) | (7 | ) | ||||||

|

|

|

|||||||||||

| Non-operating loss, net |

(402 | ) | (300 | ) | (281 | ) | ||||||

|

|

|

|||||||||||

| Loss before benefit from income taxes |

(48 | ) | (61 | ) | (62 | ) | ||||||

| Benefit from income taxes |

130 | 19 | 173 | |||||||||

|

|

|

|||||||||||

| Net income (loss) |

$ | 82 | $ | (42 | ) | $ | 111 | |||||

17

Table of Contents

| Years ended December 31, |

||||||||||||

| (dollars in millions) | 2013 | 2012 | 2011 | |||||||||

| Earnings (loss) per common share attributable to common stockholders: |

||||||||||||

| Basic earnings (loss) per share |

$ | 0.03 | $ | (0.02 | ) | $ | 0.04 | |||||

| Diluted earnings (loss) per share |

0.03 | (0.02 | ) | 0.04 | ||||||||

| Weighted average common shares outstanding: |

||||||||||||

| Basic |

2,800 | 2,795 | 2,788 | |||||||||

| Diluted |

2,870 | 2,795 | 2,793 | |||||||||

| Unaudited pro forma data(2): |

||||||||||||

| Basic income per common share |

||||||||||||

| Diluted income per common share |

||||||||||||

| Weighted average common shares outstanding: |

||||||||||||

| Basic |

||||||||||||

| Diluted |

||||||||||||

| Balance sheet data (at end of period): |

||||||||||||

| Cash and cash equivalents |

$ | 725 | $ | 580 | ||||||||

| Short-term investments |

4 | 61 | ||||||||||

| Accounts receivables, net of allowances |

313 | 308 | ||||||||||

| Total current assets |

1,327 | 1,237 | ||||||||||

| Total assets |

7,999 | 8,215 | ||||||||||

| Total current liabilities |

932 | 843 | ||||||||||

| Total debt |

4,960 | 4,177 | ||||||||||

| Total liabilities |

7,116 | 6,532 | ||||||||||

| Total shareholders’ equity |

883 | 1,683 | ||||||||||

| Statement of cash flow data: |

||||||||||||

| Net cash provided by (used in) |

||||||||||||

| Operating Activities |

$ | 400 | $ | 399 | $ | 334 | ||||||

|

|

|

|||||||||||

| Investing Activities |

(180 | ) | (209 | ) | (485 | ) | ||||||

|

|

|

|||||||||||

| Financing Activities |

(52 | ) | (63 | ) | 106 | |||||||

|

|

|

|||||||||||

| Other financial data: |

||||||||||||

| Capital expenditures |

$ | 41 | $ | 44 | $ | 30 | ||||||

| Additions to computer software |

81 | 64 | 74 | |||||||||

| Adjusted EBITDA(3) |

829 | 764 | 721 | |||||||||

| (1) | Includes charges related to acquired intangible assets. |

| (2) | Pro forma earnings per share |

| We declared and paid dividends to our stockholders of $753 million during 2013. Dividends declared in the year preceding an initial public offering are deemed to be in contemplation of the offering with the intention of repayment out of offering proceeds to the extent that the dividends exceeded earnings during such period. Unaudited pro forma earnings per share for 2013 gives effect to the sale of the number of shares the proceeds of which would be necessary to (i) pay the dividend amount that is in excess of 2013 earnings, (ii) fund the repayment of the debt and related fees and expenses described in “Use of proceeds” and (iii) pay holders of Phantom SARs as described in “Use of proceeds,” up to the number of shares assumed to be issued in this offering. |

| Additionally, unaudited pro forma earnings per share for 2013 gives effect to the reversal of interest expense relating to such debt, including the reversal of amortization related to debt issuance costs and discount. |

| For purposes of calculating unaudited pro forma earnings per share for 2013 we assumed shares are sold in this offering at a price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus. |

18

Table of Contents

The following presents the computation of pro forma basic and diluted earnings per share:

| Year ended December 31, 2013 |

||||

|

|

||||

| Numerator: |

||||

| Net income as reported |

$ | |||

| Pro forma adjustments: |

||||

| Interest expense, net of tax(a) |

||||

|

|

|

|||

| Pro forma net income |

$ | |||

|

|

|

|||

| Denominator: |

||||

| Weighted average common shares used in computing basic income per common share outstanding |

||||

| Adjustment for common stock issued whose proceeds will be used to pay dividends in excess of earnings(b) |

||||

| Adjustment for common shares used to repay outstanding indebtedness(c) |

||||

| Adjustment for common stock to pay holders of Phantom SARs(d) |

||||

| Pro forma weighted average common shares used in computing basic income per common share outstanding |

||||

|

|

|

|||

| Pro forma basic earnings per share |

$ | |||

|

|

|

|||

| Weighted average common shares used in computing diluted income per common share outstanding |

||||

| Diluted effect of securities |

||||

| Pro forma weighted average common shares used in computing diluted income per common share outstanding |

||||

|

|

|

|||

| Pro forma diluted earnings per share |

$ | |||

|

|

|

|||

|

|

||||

| (a) These adjustments reflect the elimination of the historical interest expense and amortization of debt issuance costs and discount after reflecting the pro forma effect of the Refinancing. |

||||

| (b) Dividends declared in the past twelve months |

$ | |||

| Net income attributable to IMS Health Holdings, Inc. in the past 12 months |

||||

|

|

|

|||

| Dividends paid in excess of earnings |

$ | |||

|

|

|

|||

| Offering price per common share |

$ | |||

|

|

|

|||

| Common shares assumed issued in this offering necessary to pay dividends in excess of earnings |

||||

| (c) Indebtedness to be repaid with proceeds from this offering |

$ | |||

|

|

|

|||

| Offering price per common share |

$ | |||

|

|

|

|||

| Common shares assumed issued in this offering to repay indebtedness |

||||

| (d) Number of Phantom SARs |

||||

| Excess of fair market value over exercise price |

||||

| Common shares assumed issued in this offering necessary to pay holders of Phantom SARs |

||||

|

| ||

| (3) | Adjusted EBITDA is a financial measure that is not defined under U.S. GAAP and is presented in this prospectus because our management considers it an important supplemental measure of our performance and our ability to service our debt and believes that it provides greater transparency into our results of operation and is frequently used by investors in the evaluation of companies in the industry. In addition, our management believes that Adjusted EBITDA is a useful financial metric to assess our operating performance from period to period by excluding certain material non-cash items, unusual or non-recurring items that we do not expect to continue in the future and certain other adjustments we believe are not reflective of our ongoing operations and our performance. Adjusted EBITDA is not a measure of net income, operating income or any other performance measure derived in accordance with U.S. GAAP, and is subject to important limitations. |

| Adjusted EBITDA, as we use it, is net income before interest, income taxes, depreciation, amortization, non-cash compensation expenses, expenses related to the early extinguishment of debt, transaction fees and the other items described below. |

| We understand that although Adjusted EBITDA is frequently used by securities analysts, investors and others in their evaluation of companies, it has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under U.S. GAAP. Some of these limitations are: |

| • | it does not reflect every cash expenditure, future requirements for capital expenditures or contractual commitments; |

| • | it does not reflect the significant interest expense or the cash requirements necessary to service interest or principal payments on our debt; |

19

Table of Contents

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced or require improvements in the future, and Adjusted EBITDA does not reflect any cash requirements for such replacements or improvements; |

| • | it is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows; |

| • | it does not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations; |

| • | it does not reflect limitations on our costs related to transferring earnings from our subsidiaries to us; and |

| • | other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure. |

| Because of these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or as measures of cash that will be available to us to meet our obligations. We compensate for these limitations by using Adjusted EBITDA along with other comparative tools, together with U.S. GAAP measurements, to assist in the evaluation of operating performance. These U.S. GAAP measurements include operating income (loss), net income (loss), cash flows from operations and cash flow data. We have significant uses of cash flows, including capital expenditures, interest payments, debt principal repayments, taxes and other non-recurring charges, which are not reflected in Adjusted EBITDA. Adjusted EBITDA is not intended as alternatives to net income (loss) as indicators of our operating performance, as alternatives to any other measure of performance in conformity with U.S. GAAP or as alternatives to cash flow provided by operating activities as measures of liquidity. You should therefore not place undue reliance on Adjusted EBITDA or ratios calculated using those measures. Our U.S. GAAP-based measures can be found in our consolidated financial statements and related notes included elsewhere in this prospectus. |

| Years

ended December 31, |

||||||||||||

| (dollars in millions) | 2013 | 2012 | 2011 | |||||||||

|

|

||||||||||||

| Net income (loss) |

$ | 82 | $ | (42 | ) | $ | 111 | |||||

| Deferred revenue purchase accounting adjustments |

2 | 7 | 7 | |||||||||

| Non-cash stock-based compensation charges |

22 | 19 | 18 | |||||||||

| Restructuring and related charges(a) |

23 | 54 | 39 | |||||||||

| Acquisition-related charges |

10 | 11 | 13 | |||||||||

| Sponsor monitoring fee |

8 | 8 | 9 | |||||||||

| Depreciation and amortization |

410 | 424 | 393 | |||||||||

| Merger costs |

— | 2 | 23 | |||||||||

| Interest income |

(4 | ) | (4 | ) | (3 | ) | ||||||

| Interest expense |

332 | 275 | 277 | |||||||||

| Other loss, net |

74 | 29 | 7 | |||||||||

| Benefit from income taxes |

(130 | ) | (19 | ) | (173 | ) | ||||||

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 829 | $ | 764 | $ | 721 | ||||||

|

|

||||||||||||

| (a) | Restructuring and related charges includes severance and impairment charges and the cost of employee and third-party charges related to dual running costs for knowledge transfer activities. |

20

Table of Contents

This offering and investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all of the other information contained in this prospectus, including our consolidated financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our common stock. If any of the following risks actually occurs, our business, prospects, operating results and financial condition could suffer materially, the trading price of our common stock could decline and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face.

Risks related to our business

We rely on third parties to provide certain data. Our data suppliers might restrict our use of or refuse to license data, which could lead to our inability to provide certain services and, as a result, materially and adversely affect our operating results and financial condition.

Each of our information services is derived from data we collect from third parties. These data suppliers are numerous and diverse, reflecting the broad scope of information that we collect and use in our business.

Although we typically enter into long-term contractual arrangements with many of these suppliers of data, at the time of entry into a new contract or renewal of an existing contract, suppliers may increase restrictions on our use of such data, increase the price they charge us for data or refuse altogether to license the data to us. In addition, during the term of any data supply contract, suppliers may fail to adhere to our data quality control standards or fail to deliver data. Further, although no single individual data supplier is material to our business, if a number of suppliers collectively representing a significant amount of data that we use for one or more of our services were to impose additional contractual restrictions on our use of or access to data, fail to adhere to our quality-control standards, repeatedly fail to deliver data or refuse to provide data, now or in the future, our ability to provide those services to our clients could be materially adversely impacted, which may harm our operating results and financial condition.

Failure to meet productivity objectives under our internal business transformation initiatives could adversely impact our competitiveness and harm our operating results.

We are pursuing business transformation initiatives to update technology, increase innovation and obtain operating efficiencies. As part of these initiatives, we seek to improve our productivity, flexibility, quality, functionality and cost savings by investing in the development and implementation of global platforms and integration of our business processes and functions to achieve economies of scale. For example, we hired and trained more than 500 people to form a COE in Manila, The Philippines for standardizing and cleaning data received from data suppliers, developed updated tools for standardizing and cleaning data, are moving local standardizing and cleaning from countries around the world to the Manila COE, and retired local standardizing and cleaning systems. These various initiatives may not yield their intended gains, which may impact our competitiveness and our ability to meet our growth objectives and, as a result, materially and adversely affect our business, results of operation and financial condition.

21

Table of Contents

If we are unsuccessful at investing in growth opportunities, our business could be materially and adversely affected.

We continue to invest significantly in growth opportunities, including the development and acquisition of new data, technologies and services to meet our clients’ needs. For example, we are expanding our services and technology offerings, such as the development of a cloud-based platform with a growing number of applications to support commercial operations for life sciences companies (e.g., multi-channel marketing, marketing campaign management, CRM, incentive compensation management, targeting and segmentation, performance management and other applications). We also continue to invest significantly in growth opportunities in emerging markets, such as the development, launch and enhancement of services in China, India, Russia, Turkey and other countries. We believe healthcare spending in these emerging markets will continue to grow over the next five years, and we consider our presence in these markets to be an important focus of our growth strategy.

There is no assurance that our investment plans or growth strategy will be successful or will produce a sufficient or any return on our investments. Further, if we are unable to develop new technologies and services, clients do not purchase our new technologies and services, our new technologies and services do not work as intended or there are delays in the availability or adoption of our new technologies and services, then we may not be able to grow our business or growth may occur slower than anticipated. Additionally, although we expect continued growth in healthcare spending in emerging markets, such spending may occur more slowly or not at all, and we may not benefit from our investments in these markets.

We plan to fund growth opportunities with cash from operations or from future financings, and not with the proceeds from this offering, which will primarily be used to repay existing indebtedness. See “Use of proceeds.” There can be no assurance that those sources will be available in sufficient amounts to fund future growth opportunities when needed.

Any of the foregoing could have a material and adverse effect on our operating results and financial condition.

Data protection, privacy and similar laws restrict access, use and disclosure of information, and failure to comply with or adapt to changes in these laws could materially and adversely harm our business.

Patient health information is among the most sensitive of personal information and it is critical that information about an individual’s healthcare is properly protected from inappropriate access, use and disclosure. Laws restricting access, use and disclosure of such information include the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), the European Union’s Data Protection Directive, Canada’s Personal Information Protection and Electronic Documents Act and other data protection, privacy and similar national, state/provincial and local laws. We have established frameworks, models, processes and technologies to manage privacy for many data types, from a variety of sources, and under myriad privacy and data protection laws worldwide. In addition, we rely on our data suppliers to deliver information to us in a form and in a manner that complies with applicable privacy and data protection laws. These laws are complex and there is no assurance that the safeguards and controls employed by us or our data suppliers will be sufficient to prevent a breach of these laws. Failure to comply with such laws may result in, among other things, civil and criminal liability, negative publicity, damage to our reputation, data being blocked from use and liability under contractual provisions.

22

Table of Contents

Laws and expectations relating to privacy continue to evolve, and we continue to adapt to changing needs. Nevertheless, changes in these laws (including newly released interpretations of these laws by courts and regulatory bodies) may limit our data access, use and disclosure, and may require increased expenditures by us or may dictate that we not offer certain types of services. Any of the foregoing may have a material adverse impact on our ability to provide services to our clients or maintain our profitability.

There is ongoing concern from privacy advocates, regulators and others regarding data protection and privacy issues, and the number of jurisdictions with data protection and privacy laws has been increasing. Also, there are ongoing public policy discussions regarding whether the standards for de-identified, anonymous or pseudonomized health information are sufficient, and the risk of re-identification sufficiently small, to adequately protect patient privacy. These discussions may lead to further restrictions on the use of such information. There can be no assurance that these initiatives or future initiatives will not adversely affect our ability to access and use data or to develop or market current or future services.