Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOLOGIC INC | d676722d8k.htm |

Presentation to

Lenders Presentation to Lenders

February 13, 2014

February 13, 2014

Exhibit 99.1 |

Safe Harbor

Statement 2

This presentation contains forward-looking information that involves risks and

uncertainties, including statements about the Company’s plans, objectives,

expectations and intentions. Such statements include, without limitation: financial or other

information included herein based upon or otherwise incorporating judgments or

estimates relating to future performance, events or expectations; the Company’s strategies, positioning, resources, capabilities, and expectations for

future performance; and the Company's outlook and financial and other guidance. These

forward-looking statements are based upon assumptions made by the Company as of the

date hereof and are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those

anticipated.

Risks and uncertainties that could adversely affect the Company’s business and prospects,

and otherwise cause actual results to differ materially from those anticipated, include

without limitation: the ability of the Company to successfully manage recent and ongoing leadership and organizational changes, including the

ability of the Company to attract, motivate and retain key employees; U.S., European and

general worldwide economic conditions and related uncertainties; the Company’s

reliance on third-party reimbursement policies to support the sales and market acceptance of its products, including the possible adverse impact of

government regulation and changes in the availability and amount of reimbursement and

uncertainties for new products or product enhancements; uncertainties regarding the

recently enacted or future healthcare reform legislation, including associated tax provisions, or budget reduction or other cost containment efforts;

changes in guidelines, recommendations and studies published by various organizations that

could affect the use of the Company’s products; uncertainties inherent in the

development of new products and the enhancement of existing products, including FDA approval and/or clearance and other regulatory risks, technical risks,

cost overruns and delays; the risk that products may contain undetected errors or defects or

otherwise not perform as anticipated; risks associated with strategic alliances and the

ability of the Company to realize anticipated benefits of those alliances; risks associated with acquisitions, including without limitation, the

Company’s ability to successfully integrate acquired businesses, the risks that the

acquired businesses may not operate as effectively and efficiently as expected even if

otherwise successfully integrated, the risks that acquisitions may involve unexpected costs or unexpected liabilities including the risks and challenges associated

with the Company’s recent acquisition of Gen-Probe and operations in China; the risks

of conducting business internationally, including the effect of exchange rate

fluctuations on those operations; manufacturing risks, including the Company’s reliance

on a single or limited source of supply for key components, and the need to comply with

especially high standards for the manufacture of many of its products; the Company’s ability to predict accurately the demand for its products, and

products under development, and to develop strategies to address its markets successfully; the

early stage of market development for certain of the Company’s products; the

Company’s leverage risks, including the Company’s obligation to meet payment obligations and financial covenants associated with its debt; risks

related to the use and protection of intellectual property; expenses, uncertainties and

potential liabilities relating to litigation, including, without limitation,

commercial, intellectual property, employment and product liability litigation; technical

innovations that could render products marketed or under development by the Company

obsolete; competition; and the Company’s ability to attract and retain qualified personnel.

The risks included above are not exhaustive. Other factors that could adversely affect the

company's business and prospects are described in the filings made by the Company with

the SEC. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any such statements presented

herein to reflect any change in expectations or any change in events, conditions or

circumstances on which any such statements are based. Hologic, Aptima, Cervista, Dimensions, Gen-Probe, MyoSure, NovaSure, Panther, ThinPrep,

TMA and associated logos, as may be used throughout this presentation, are trademarks

and/or registered trademarks of Hologic, Inc. and/or its subsidiaries in the United States and/or other countries.

|

Hologic, Inc.

("Hologic" or "the Company") (NASDAQ: HOLX) is a leading developer, manufacturer and supplier of premium

diagnostics products, medical imaging systems and surgical products, with an emphasis on

serving the healthcare needs of women

Hologic has continued to demonstrate consistent financial performance

Hologic has continued to generate strong cash flow

Hologic is seeking to reprice its Term Loan B

Transaction Overview

(1)

See the definition of non-GAAP financial measures and the reconciliation of GAAP to

non-GAAP in the Appendix. The Company’s GAAP net loss and GAAP net loss per

share for the same period were $5.4 million and $0.02, respectively

(2)

As provided on February 3, 2014.

(3)

See the definition in the Appendix.

3

—

For

the

quarter

ended

December

28,

2013,

the

Company

generated

$612.4

million

of

revenues,

$94.1

million

of

non-GAAP

net income and $213.5 million of adjusted EBITDA. Non-GAAP earnings per share was

$0.34 (1)

.

—

For

the

quarter

ended

March

29,

2014,

the

Company

expects

to

report

revenues

of

approximately

$605-$615

million and

non-GAAP earnings per share of $0.32-$0.34

(2)

—

As

of

December

28,

2013,

Hologic

had

total

secured

leverage

of

2.2x

and

net

total

leverage

of

4.3x

—

Hologic

has

deleveraged

from

total

secured

leverage

of

2.8x

and

net

total

leverage

of

5.3x

at

the

time

of

the

original deal

in July 2012

—

During

the

quarter

ended

December

28,

2013,

net

cash

provided

by

operating

activities

was

$149.3

million

and

adjusted net cash provided by operating activities was $180.5 million

(3)

—

During

the

quarter

ended

December

28,

2013,

$521.3

million

of

debt

was

repaid |

Pro Forma

Capitalization Amounts as of December 28, 2013

($ in millions)

4

Source: Public filings. (1) Principal amount is $450 million. Principal amount listed net of

unamortized discount. Conversion price of approximately $23.03 per share.

(2)

Principal amount is $500 million. Principal amount listed net of unamortized discount.

Conversion price of approximately $31.18 per share.

(3)

Principal amount is $370 million. Principal amount listed net of unamortized discount.

Conversion price of approximately $38.59 per share.

(4)

Debt net of $250 million of cash as permitted by Credit Agreement for covenant compliance. (5)

As defined in the Credit Agreement. Includes an increase to the Company’s

adjusted EBITDA of $67 million, as calculated pursuant to the terms of the Credit

Agreement, to reflect the Company’s acquisition of Gen-Probe and certain other adjustments.

Current

Pro Forma

Amount

Amount

Leverage

Coupon

Floor

Maturity

Put Date

Cash

$ 449

$ 449

Revolver ($300mm)

-

-

-

L + 200

-

Aug-17

Term Loan A

932

932

1.0 x

L + 200

-

Aug-17

Extant Term Loan B

1,171

-

-

L + 275

1.00%

Aug-19

New Term Loan B

-

1,171

1.2 x

TBD

TBD

Aug-19

Total Secured Debt

$ 2,103

$ 2,103

2.2 x

Senior Unsecured Notes

1,000

1,000

1.1 x

6.25%

Aug-20

Total Guaranteed Debt

$ 3,103

$ 3,103

3.3 x

2.00% Exchange Convertible Sr. Notes

(1)

396

396

0.4 x

2.00%

Dec-37

Dec-16

2.00% Exchange Convertible Sr. Notes

(2)

467

467

0.5 x

2.00%

Mar-42

Mar-18

2.00% Exchange Convertible Sr. Notes

(3)

336

336

0.4 x

2.00%

Sep-43

Dec-17

Total Debt

$ 4,302

$ 4,302

4.5 x

Net Debt

(4)

$ 4,052

$ 4,052

4.3 x

LTM 12/28/2013 Consolidated Adjusted EBITDA

(5)

$ 951 |

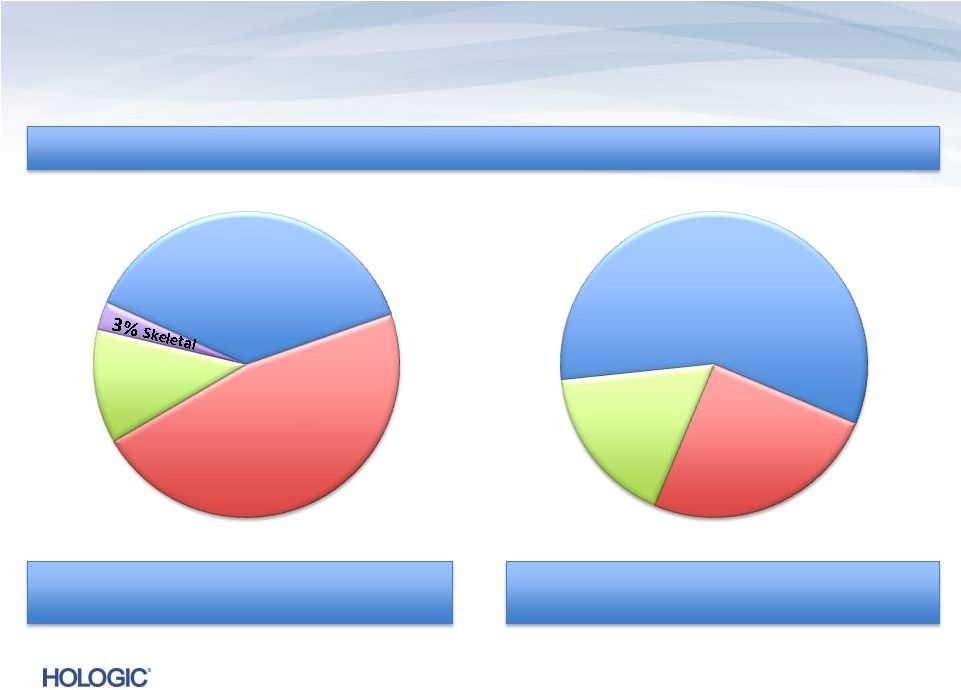

Consolidated

Q1’14 Revenues of $612.4M (unaudited) Consumables/Service ~80%

Capital Equipment ~20%

Total Revenues by Business Segment

47%

Breast Health

$226.5M

37%

GYN Surgical

$78.8M

13%

Skeletal Health

$21.3M

3%

5

Total Diagnostics

$285.8M

64%

Consumables

20%

Capital

Equipment

16%

Service |

•

Early stage of a promising replacement cycle with technology

superior to 2D digital

•

Additional peer-reviewed publications further support

adoption

•

Ability to offer class-leading automation to low-

and medium-

volume labs

•

Extends molecular diagnostics into hospital labs, the fastest-

growing market segment

•

Menu expansion on the horizon to further sustain growth

Two Exciting Product Cycles

are Just Beginning

Dimensions 3D Breast Tomosynthesis

Panther System

6 |

Diagnostics

– Leadership in Cytology and

Molecular Diagnostics

•

Premier automated solutions

•

Proprietary chemistries: TMA (Transcription-mediated

amplification) and Invader

•

Extending leadership from cytology into molecular via

Gen-Probe acquisition

•

Validated by #1 or #2 U.S. market share in key segments*

SHARE

* Hologic Estimates 2012

Cervical

Cytology

CT/NG

Testing

Blood

Screening

HPV

Testing

7 |

Comprehensive

Cervical Cancer Screening Solution

•

The only FDA approved complete

cervical cancer screening solution

to include liquid-based cytology

+ HPV (high-risk and genotyping)

•

All from our ThinPrep vial, the

gold standard in cervical cytology

•

Thoughtfully designed HPV

products designed to detect

disease by focusing on genes that

matter most:

•

Both Aptima and Cervista

meet the specific needs of our

customers through greater testing

alternatives

8 |

Breast Health

– Mammography

Leader in Breast Cancer Screening & Diagnosis

–

Market leadership: ~65% of current

U.S. installed base, ~40% OUS

–

Approximate $4 billion

addressable U.S. market

–

Strong competitive advantages

of 3D Dimensions

•

Clinical superiority to 2D

•

First-to-market with no U.S.

Tomo

competition

–

Substantial replacement

cycle expected

Robust Service Offering

–

Recurring revenue stream

driven by system placements

9 |

3D Dimensions

Tomosynthesis Tomosynthesis…uptake ahead of expectations

–

U.S. installed base of ~11,000 digital systems –

potential for conversion to Tomo

–

Met initial 3-year unit installation goal in U.S. and on track to reach our Fiscal 2014

goal of shipping over 500 in the U.S.

Superior Next-Generation Digital Mammography

10

Superiority

over 2D Digital

Mammography

Improved

Tissue

Visualization

and Detection

Lower

Recall Rates |

Tomosynthesis

Clinical Efficacy Oslo Tomosynthesis Screening Trial

reported breast cancer screening

with Hologic Tomosynthesis significantly

improves cancer detection

(1)

•

•

Body of clinical evidence continuing to grow

in invasive

cancer detection

40%

overall in

cancer detection

27%

Compared to 2D, U.S. sites report a significant

reduction in recalls with

Hologic Tomosynthesis

20-40% reduction

in recall rates

(based on site practices)

11

(1)

Skaane P. et. al. Comparison of Digital Mammography Alone and Digital Mammography Plus

Tomosynthesis in a Population-based Screening Program. Radiology. 2013 Jan 7

[Epub ahead of print].

(2)

Philpotts L. et al. Initial Experience With Digital Breast Tomosynthesis in Screening

Mammography. Presented at the ARRS 2012, Scientific Session 22 - Breast Imaging:

Screening/Emerging Technologies.

(3)

Destounis S. et al. Experience with Combination 2D/3D Breast Tomosynthesis vs FFDM in

the Screening Environment. Radiological Society of North America annual meeting.

Chicago, Il, 2012.

2-3

All

age

groups

and

breast

densities

reported

to

benefit

from

the

addition

of

Hologic

Tomosynthesis

screening

(1) |

MyoSure

Hysteroscopic Tissue Removal System •

Minimally-invasive technology to remove fibroids and polyps

•

Dynamic technology in early stages of adoption

•

Potential $300-400 million annual opportunity in the U.S.

•

Product line extensions offer flexibility to spur further adoption

Complemented by a portfolio of surgical

instruments addressing unmet needs in

women’s

health on a global basis

•

Including NovaSure, the market leader in treating abnormal

uterine bleeding with ~60% share in the U.S.

MyoSure a Growth Driver

in GYN Surgical

12 |

Q1 FY 2014

Overview Key Performance Metrics

Key Performance Metrics

Q1 FY 2014

Q1 FY 2014

Revenues*

Revenues of $612.4 million

•

Net Income*

GAAP net loss of $5.4 million and

non-GAAP net income of $94.1 million

•

Adjusted EBITDA*

$213.5 million

•

Quarter Ended December 28, 2013 (unaudited)

13

Revenues down $18.9 million, or 3.0%, vs. Q1’13

(1)

(and down $32.2 million or 5.0%

vs. Q1’13 non-GAAP revenues)

Non-GAAP net income down $7.6 million, or 7.5%, vs. Q1’13

Down $14.0 million, or 6.1%, vs. Q1’13

* See the definition of the non-GAAP financial measures and the reconciliation of those

measures to the comparable GAAP financial measures in the Appendix.

(1)

On a constant currency basis, total revenues would have decreased to $610.9M*, or 3.2%,

compared to Q1’13. The constant currency revenue amount for Q1’14 is a

non-GAAP number that reflects what revenues in that quarter would have been had the Company applied the foreign currency exchange

rates it used for determining its revenues in Q1’13.

|

Breakdown of

Q1 FY 2014 Revenues of $612.4M (unaudited) U.S. Revenues ~ 75%

International Revenues ~ 25%

20%

Capital Equipment

64%

Disposables

13%

GYN Surgical

37%

Breast Health

47%

Diagnostic

16%

Service

Four Business Segments

Disposables/Service ~ 80%

Capital Equipment ~ 20%

14 |

Amendment

Overview Hologic is seeking to reprice its Term Loan B

15

Term Loan B offered at par

101 soft-call refreshed for 6 months |

|

Reconciliation

of GAAP to Non-GAAP (unaudited) In thousands, except earnings per share

In thousands, except earnings per share

17

Three Months Ended

Three Months Ended

December 28, 2013

December 28, 2013

December 29, 2012

December 29, 2012

REVENUES

GAAP revenues

$612,448

$631,362

Adjustments primarily related to blood screening collaboration

-

13,275

Non-GAAP revenues

$612,448

$612,448

$644,637

$644,637

EARNINGS PER SHARE

$(0.02)

$0.01

Adjustments to net (loss) earnings (as detailed below)

0.36

0.37

$0.34

$0.34

$0.38

$0.38

GROSS MARGINS

GAAP gross margins

$305,596

$281,673

Adjustments:

Net adjustments to revenues

-

13,275

Amortization of intangible assets

76,666

75,287

Fair value write-up of acquired inventory sold

-

29,876

Fair value adjustment to depreciation expense

1,715

1,797

Acquisition and integration-related costs

2,815

1,141

Other

574

-

Non-GAAP gross margins

$387,366

$387,366

$403,049

$403,049

GROSS MARGIN PERCENTAGE

GAAP gross margin percentage

49.9%

44.6%

Impact of adjustments above

13.3%

17.9%

Non-GAAP gross margin percentage

63.2%

63.2%

62.5%

62.5%

Continued on next page

GAAP (loss) earnings per share – Diluted Non-GAAP

earnings per share – Diluted |

In

thousands In thousands

Three Months Ended

Three Months Ended

December 28, 2013

December 28, 2013

December 29, 2012

December 29, 2012

OPERATING EXPENSES

GAAP operating expenses

$244,311

$218,444

Adjustments:

Amortization of intangible assets

(26,216)

(28,526)

Contingent consideration

-

(39,526)

Acquisition and integration-related costs

(2,291)

(4,380)

Restructuring and divestiture charges

(18,350)

(3,933)

Gain on sale of intellectual property, net

-

53,884

Fair value adjustment to depreciation expense

(1,339)

(892)

Other

-

3,200

Non-GAAP operating expenses

$196,115

$196,115

$198,271

$198,271

INTEREST EXPENSE

GAAP interest expense

$61,290

$72,081

Adjustment:

Non-cash interest expense relating to convertible notes

(11,546)

(15,644)

Non-GAAP interest expense

$49,744

$49,744

$56,437

$56,437

PRE-TAX INCOME

GAAP pre-tax loss

$(1,419)

$(7,353)

Adjustments to pre-tax loss as detailed above

141,512

157,193

Debt extinguishment loss

2,940

-

Other

705

(167)

Non-GAAP pre-tax income

$143,738

$143,738

$149,673

$149,673

NET INCOME

GAAP net (loss) income

$(5,351)

$3,118

Adjustments to GAAP net (loss) income as detailed above

145,157

157,026

Income tax effect of reconciling items

(45,658)

(58,366)

Non-GAAP net income

$94,148

$94,148

$101,778

$101,778

EBITDA

Non-GAAP net income

$94,148

$101,778

Interest expense, net, not adjusted above

49,388

56,177

Provision for income taxes

49,590

47,895

Depreciation expense, not adjusted above

20,408

21,653

Adjusted EBITDA

$213,534

$213,534

$227,503

$227,503

Reconciliation of GAAP to Non-GAAP (unaudited)

Continued on next page

18 |

In

thousands In thousands

Three Months Ended

Three Months Ended

December 28, 2013

December 28, 2013

ADJUSTED NET CASH PROVIDED BY OPERATING ACTIVITIES

Net cash provided by operating activities (GAAP)

$149,266

Contingent consideration paid for acquisitions (GAAP, within operating activities)

31,202

Adjusted

net

cash

provided

by

operating

activities

(OCF)

1

$180,468

$180,468

Operating Cash Flow (unaudited)

19

(1)

Operating cash flow represents operating cash flow within operating activities, but before

Investing/Financing Activities (which include capital expenditures). |

Use of

Non-GAAP Financial Measures 20

Hologic has presented a number of non-GAAP financial measures that it uses to monitor its

business and present to investors as set forth and reconciled in the preceding pages.

Hologic defines its non-GAAP revenues to primarily include contingent revenue earned under the blood screening

collaboration post-acquisition which was eliminated under purchase accounting. Hologic

defines adjusted EBITDA as its non-GAAP net income plus net interest expense,

income taxes, and depreciation and amortization expense included in its non-GAAP net income. Hologic defines its non-GAAP

net income and EPS to exclude: (i) the amortization of intangible assets; (ii)

acquisition-related charges and effects, such as charges for contingent

consideration, transaction costs, integration costs including retention, and credits and/or

charges associated with the write-up of acquired inventory and fixed assets to fair

value, and the effect of a reduction in revenue primarily related to contingent revenue under the blood screening

collaboration, described above; (iii) non-cash interest expense related to amortization of

the debt discount for convertible debt securities; (iv) restructuring and divestiture

charges; (v) non-cash debt extinguishment losses and related transaction costs; (vi) litigation settlement charges

(benefits); (vii) other-than-temporary impairment losses on investments; (viii) other

one-time, nonrecurring, unusual or infrequent charges, expenses or gains that may

not be indicative of Hologic’s core business results; and (ix) income taxes related to such adjustments.

Hologic believes the use of non-GAAP revenues is useful to investors as it eliminates

certain effects of purchase accounting on its recognition of revenue. Hologic believes

the use of non-GAAP net income is useful to investors by eliminating certain of the more significant effects of its

acquisitions and related activities, non-cash charges resulting from the application of

GAAP to convertible debt instruments with cash settlement features, charges related to

debt extinguishment losses, investment impairments, litigation settlements, and restructuring and divestiture initiatives.

These non-GAAP measures also reflect how Hologic manages its businesses internally. In

addition to the adjustments set forth in the calculation of Hologic’s non-GAAP

net income and EPS, its adjusted EBITDA eliminates the effects of financing, income taxes and the accounting effects of capital

spending. As with the items eliminated in its calculation of non-GAAP net income, these

items may vary for different companies for reasons unrelated to the overall operating

performance of Hologic’s business. When analyzing Hologic’s operating performance, investors should not

consider these non-GAAP financial measures as a substitute for net income prepared in

accordance with GAAP. Hologic’s adjusted cash flow from operations represents Hologic’s cash flow from

operations increased by contingent consideration paid for acquisitions that were

included as a GAAP operating expense. Hologic believes that this adjustment is useful to investors as it eliminates one

of the more significant effects of its acquisitions and related activities to its cash flow

from operations, similar to its adjustments for other non-GAAP financial measures

described above.

|