Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST INTERSTATE BANCSYSTEM INC | a14-5449_28k.htm |

Exhibit 99.1

|

|

Sterne Agee Financial Institutions Investor Conference Boca Raton, FL February 13-14, 2014 |

|

|

Safe Harbor This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder, that involve inherent risks and uncertainties. Any statements about our plans, objectives, expectations, strategies, beliefs, or future performance or events constitute forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, assumptions, estimates and other important factors that could cause actual results to differ materially from any results, performance or events expressed or implied by such forward-looking statements. Such forward-looking statements include but are not limited to statements about revenues, income from the origination and sale of loans, net interest margin, quarterly provisions for loan losses, non-interest expense, loan growth, non-performing assets and net charge-off of loans, the benefits of the business combination transaction involving First Interstate BancSystem, Inc. (FIBK) and Mountain West Financial Corp (MTWF), including future financial and operating results, the combined company’s plans, objectives, expectations and intentions, and other statements that are not historical facts. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those projected, including but not limited to the following: the factors described in our Form 10-K and subsequent filings with the Securities and Exchange Commission (“SEC”), including under the sections entitled “Risk Factors,” the possibility that the merger does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all; the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which FIBK and MTWF operate; the ability to promptly and effectively integrate the businesses of FIBK and MTWF; the reaction of the companies’ customers, employees and counterparties to the transaction; and the diversion of management time on merger-related issues. The risk factors described in Forms 10-K are not necessarily all of the important factors that could cause our actual results, performance or achievements to differ materially from those expressed in or implied by any of the forward-looking statement contained in this presentation. Other unknown or unpredictable factors also could affect our results. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date they are made and we do not undertake or assume any obligation to update publicly any of these statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements. Additional Information About the Merger and Where to Find it FIBK intends to file with the SEC a proxy statement/prospectus and other relevant materials in connection with the merger, including the definitive merger agreement. The proxy statement/prospectus will be mailed to the shareholders of MTWF. Investors are urged to read the proxy statement/prospectus and the other relevant materials when they become available because they will contain important information about MTWF, FIBK and the merger. The proxy statement/prospectus and other relevant materials (when they become available), and any other documents filed by FIBK with the SEC, may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, investors may obtain free copies of the documents filed by FIBK with the SEC by contacting Amy Anderson, First Interstate BancSystem, Inc., 401 N. 31st Street, Billings, MT, 59101; telephone 406-255-5390. Page 2 |

|

|

Long Term History with Solid Performance Company Snap Shot Headquartered in Billings, MT with 68 banking offices across Montana, Wyoming and western South Dakota Total Assets of $7.6 Billion Total Loans of $4.3 Billion Regional bank offering retail and commercial banking, along with wealth management, cash management, credit card and mortgage services NASDAQ: FIBK Market Cap: $1.1B Company Performance Q4 2013 net income to common shareholders of $20.8 million, earnings per share of $.47 2013 net income of $86.1 million, or $1.96 per share, was the highest in the Company’s history Recently announced 14% increase in dividend per share to $.16 Continued improvement in credit quality trends Page 3 |

|

|

[LOGO] |

|

|

Impressive Market Shares First Interstate BancSystem Ranked #2 by market share in Montana and Wyoming, and #2 in the western South Dakota markets we serve. -Data Per SNL Financial Page 5 (June 30, 2013) |

|

|

Diversified Industries Agriculture Cattle Crops Page 6 Energy Oil and Natural Gas Greater Williston Basin Area Bakken formation Powder River Basin Coal MT Ranked #1 and WY ranked #3 in demonstrated Coal Reserves WY Ranked #1 in Production Wind MT, WY and SD in the top 10 for potential wind energy development MT has the fastest national growth rate for wind energy |

|

|

Influence of the Bakken Oil Field Page 7 Bakken Oil Field Canada Current plays Prospective plays South Dakota North Dakota Wyoming (US Energy Information Administration) |

|

|

Tourism Glacier National Park, MT Yellowstone National Park, WY Major National Parks Summer/Winter Opportunities Mount Rushmore, SD Page 8 Healthcare Aging population base Regional healthcare centers Veterans Administration healthcare Military /Government Ellsworth Air Force Base, SD Malmstrom Air Force Base, MT F.E. Warren Air Force Base, WY B1B Lancer, Ellsworth Air Force Base |

|

|

Stable Employment Page 9 MT 5.2%, Ranked 12th WY 4.4%, Ranked 7th SD 3.6%, Ranked 3rd 0% to 4% Best 5 Sates 4% to 6% 1 North Dakota 2.6% 6% to 8% 2 Nebraska 3.6% 8% to 10% 3 South Dakota 3.6% 10% or more 4 Utah 4.1% 5 Iowa 4.2% Worst 5 States 50 Rhode Island 9.1% 49 Nevada 8.8% 48 Illinois 8.6% 47 Michigan 8.4% 46 California 8.3% Source: Bureau of Labour Statistics Data as of: 12/31/2013 |

|

|

Page 10 Balance Sheet Asset Quality Trends and Earnings |

|

|

Diversified Loan Portfolio $4.3 Billion in Loans Credit opportunities Loans held for investment grew 3.5% over the last 12 months, with continued positive economic indicators Construction activity increasing Home sales increasing Low unemployment Disciplined credit practices In-house limit of $15 Million Disciplined pricing and terms |

|

|

Investment Portfolio Effective Duration of the portfolio is 3.74 years Average yield of the portfolio is 1.79% (as of 12/31/13) Strategy: Maintain short –duration with minimal credit risk and an emphasis on stable cash flows and extension risk mitigation. Page 12 Investment Portfolio $2.1 Billion |

|

|

Strong Core Deposit Base First Interstate BancSystem Page 13 (as of 12/31/2013) Low Cost of Funds Q4 2013 - .28% Average 2013 - .31% |

|

|

Strong Capital Ratios Page 14 * Redemption of $50 M Preferred Stock |

|

|

Improving Credit Quality Trends Page 15 (In millions) 70% reduction since peak in mid-2012 Earnings Improvement a result of improved Credit Metrics |

|

|

Meaningful Reduction in Criticized Loans Page 16 (In millions) $272 million , or 43%, decline over 2 years |

|

|

Earnings Improvement Page 17 |

|

|

Improved Earnings Ratios Page 18 ROAA for 2013 – 1.16% |

|

|

Strong Non- Interest Income Revenue Streams Page 19 NII opportunities Wealth Management growth AUM - $4 Billion and growing Wealth advisors positioned across our footprint Mortgage lending Ability to expand our market share Credit card activity Ability to further increase business card usage Local reward program |

|

|

Origination and Sale of Residential Loans First Interstate BancSystem Page 20 Revenue from Origination and Sale of Loans (In thousands) Revenues challenged, but increased mix is encouraging. |

|

|

Page 21 First Interstate BancSystem Merger with Mountain West Financial Corp. February 10, 2014 |

|

|

Transaction Highlights Page 22 Compelling Strategic Fit Low Execution Risk Enhances Shareholder Value Creates the #1 deposit market share franchise in the state of Montana Meaningfully expands Helena presence while creating consolidation opportunities in other market areas Adds scale within existing footprint with no anticipated divestiture required Adds strong customer base and talented people to FIBK organization Comprehensive due diligence process completed Knowledge of market area and similar business lines Thoughtful and conservative approach to financial modeling Meaningful cost savings opportunities Immediately accretive to FIBK’s EPS Modest dilution to tangible book value recaptured in approximately three years Anticipated IRR > 15% |

|

|

Pro Forma Branch Map Page 23 FIBK (76) MTWF (13) Deposit data as of June 30, 2013 Source: SNL Financial; FDIC Helena Great Falls Missoula Bozeman Kalispell Whitefish |

|

|

Top Market Share in Montana Page 24 Note: Deposit data as of June 30, 2013 Source: SNL Financial; FDIC Pro forma FIBK market share in the Helena area increases from #6 ($70 million in deposits) to #1 ($317 million in deposits) Pro forma FIBK market share in the Great Falls area increases from #3 ($258 million in deposits) to #1 ($397 million in deposits) |

|

|

Overview of Mountain West Financial Corp. (OTCBB: MTWF) Page 25 For the year ended December 31, 2012 Note: Financial data as of or for the nine months ended September 30, 2013 unless otherwise indicated; dollar values in thousands Improved Asset Quality Overview Mountain West Bank, NA founded in 1991 With $647 million in assets, the 4th largest bank headquartered in MT December 2012: Office of the Comptroller of the Currency terminates Cease & Desist March 2013: Federal Reserve terminates written agreement April 2013: Mountain West reinitiates cash dividend to shareholders Loan Composition Deposit Composition Yield on Loans¹: 5.29% Cost of Total Deposits: 0.46% |

|

|

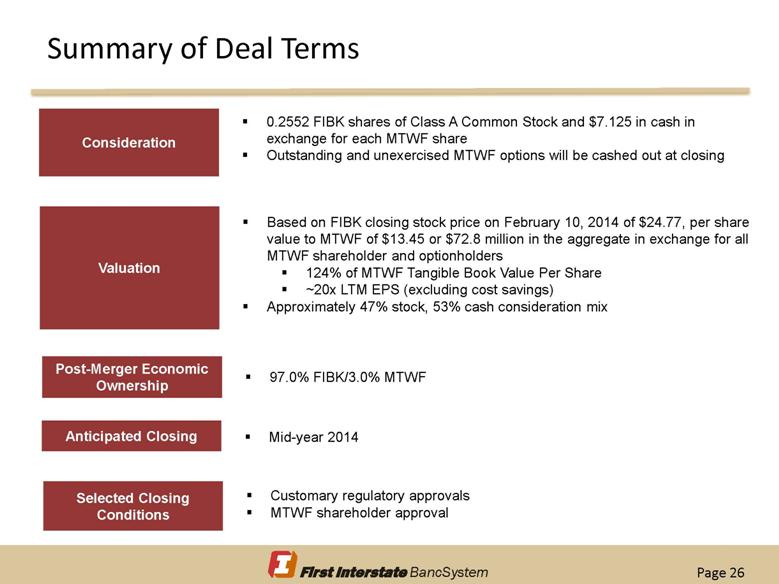

Summary of Deal Terms Page 26 Consideration 0.2552 FIBK shares of Class A Common Stock and $7.125 in cash in exchange for each MTWF share Outstanding and unexercised MTWF options will be cashed out at closing Valuation Based on FIBK closing stock price on February 10, 2014 of $24.77, per share value to MTWF of $13.45 or $72.8 million in the aggregate in exchange for all MTWF shareholder and optionholders 124% of MTWF Tangible Book Value Per Share ~20x LTM EPS (excluding cost savings) Approximately [49% stock, 51% cash] consideration mix Post-Merger Economic Ownership 97.0% FIBK/3.0% MTWF] Anticipated Closing Mid-year 2014 Selected Closing Conditions Customary regulatory approvals MTWF shareholder approval |

|

|

Summary Financial Assumptions and Impact Page 27 Cost Savings Approximately 35% of MTWF noninterest expense base One-time Deal Costs Approximately $7.2 million pretax Fair Market Value and Accounting Adjustments Loan portfolio mark-to-market ~4.4% of gross loans Core Deposit Intangible 1.50% amortized over 7 years Fixed asset write-down of $10 to $11 million Debt Redemption $19.8 million Trust Preferred redeemed at closing at par Impact to FIBK Shareholders 2015e EPS 6% to 7% EPS accretion (100% phase-in of cost savings) TBVPS Impact ~3% dilutive to tangible book value per share at closing Approximately 3 year earn-back Internal Rate of Return >15% |

|

|

Executive Summary Page 28 Compelling geographic fit produces #1 deposit market share franchise in Montana Strengthens position in Helena Creates expansion and cost savings opportunities in other attractive markets Thorough diligence effort along with market familiarity reduces execution risk Conservative financial modeling assumptions Value enhancing transaction for FIBK shareholders Immediately accretive to EPS Modest tangible book value dilution recovered in approximately three years Expected IRR > 15% Productive use of growing capital base |

|

|

Why invest in First Interstate BancSystem? Long Track Record of Profitability Leading Market Positions Attractive and Healthy Footprint Improving Credit Metrics Low-Cost Core Deposit Base Growth Opportunities Increasing Shareholder Returns First Interstate BancSystem Page 29 |