Attached files

| file | filename |

|---|---|

| EX-32.1 - CEO CERTIFICATION - Prospect Ventures Inc. | ex321_ceocert.htm |

| EX-31.1 - CEO CERTIFICATION - Prospect Ventures Inc. | ex311_ceocert.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| (Mark One) | |

| [X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended October 31, 2013 | |

| [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from __________ to __________ | |

| 000-52452 | |

| Commission File Number | |

| DUSSAULT APPAREL INC. | |

| (Exact name of registrant as specified in its charter) | |

| Nevada | 98-0513727 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| # 98 50 Carrera 73,Medellin, Colombia | N/A |

| (Address of principal executive offices) | (Zip Code) |

| 1(888)876-9995 | |

| (Registrant’s telephone number, including area code) | |

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

| |

| Title of each class | Name of each exchange on which registered |

| n/a | n/a |

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

|

| Common Stock |

| Title of class |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

| Yes | [ ] | No | [X] |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

| Yes | [ ] | No | [X] |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

| Yes | [X] | No | [ ] |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| Yes | [X] | No | [ ] |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

| Yes | [ ] | No | [X] |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

| Yes | [ ] | No | [X] |

| The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant was approximately $353,444 based on the closing price of $0.0010 on April 30, 2013 (the last business day of the registrant’s most recently completed second quarter), assuming solely for the purpose of this calculation that all directors, officers and greater than 10% stockholders of the registrant are affiliates. The determination of affiliate status for this purpose is not necessarily conclusive for any other purpose. |

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PAST 5 YEARS:

Indicate by check mark whether the issuer has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

| Yes | [ ] | No | [ ] |

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| 753,344,347 shares of common stock issued and outstanding as of February 7, 2014 |

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g. Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes.

| None |

Forward Looking Statements

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements. These statements relate to future events or our future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this Form 10-K. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

These risks include, by way of example and not in limitation:

| · | the uncertainty that we will not be able to successfully identify commercially viable resources on our exploration properties; |

| · | risks related to the large number of established and well-financed entities that are actively competing for limited resources within the mineral property exploration field; |

| · | risks related to the failure to successfully manage or achieve growth of our business if we are successful in identifying a viable mineral resource, and; |

| · | other risks and uncertainties related to our business strategy. |

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The safe harbors of forward-looking statements provided by Section 21E of the Exchange Act are unavailable to issuers of penny stock. As we issued securities at a price below $5.00 per share, our shares are considered penny stock and such safe harbors set forth under the Private Securities Litigation Reform Act of 1995 are unavailable to us.

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this Annual Report, the terms "we," "us," "Company," "our" and "Dussault" mean Dussault Apparel Inc., unless otherwise indicated.

Measurement & Currency

Conversion of metric units into imperial equivalents is as follows:

| Metric Units | Multiply by | Imperial Units |

| hectares | 2.471 | = acres |

| meters | 3.281 | = feet |

| kilometers | 0.621 | = miles (5,280 feet) |

| grams | 0.032 | = ounces (troy) |

| tonnes | 1.102 | = tons (short) (2,000 lbs) |

| grams/tonne | 0.029 | = ounces (troy)/ton |

Cautionary Note to United States Investors

We caution U.S. investors that the Company may have materials in the public domain that may use terms that are recognized and permitted under Canadian regulations, however the U.S. Securities and Exchange Commission (“S.E.C.”) may not recognize such terms. We have detailed below the differences in the SEC regulations as compared to the Canadian Regulations under National Instrument NI 43-101.

| S.E.C. Industry Code | National Instrument 43-101 (“NI 43-101”) | |

| Reserve: That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The United States Securities and Exchange Commission requires a final or full Feasibility Study to be completed in order to support either Proven or Probably Reserves and does not recognize other classifications of mineralized deposits. Note that for industrial mineral properties, in addition to the Feasibility Study, “sales” contracts or actual sales may be required in order to prove the project’s commerciality and reserve status. | Mineral Reserve: The economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. | |

| Proven Reserves: Reserves for which a quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes, grade and/or quality are computed from the results of detailed sampling; the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, share, depth and mineral content of reserves are well established. | Proven Mineral Reserve: The economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified. | |

| Probable Reserves: Reserves for which quantity and grade and/or quality are computed from information similar to that used for proven reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. | Probable Mineral Reserve: The economically mineable part of an indicated, and in some circumstances, a Measured Mineral Resource, demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, and economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

Background

The address of our principal executive office is #98- 50 Carrera 73, Medellin, Colombia. Our telephone number is 1(888)876-9995 The Company’s web-site is currently under development.

Our common stock is quoted on the OTC Markets Inc. owned and operated Inter-dealer Quotation System (“OTCQB”) under the symbol "DUSS".

We were incorporated on October 1, 2006 in the State Nevada under the name Release Your Lease Inc. Effective June 11, 2007, we completed a merger with our wholly subsidiary Dussault Apparel Inc., a company created solely for the purpose of the merger and change of name to Dussault Apparel Inc. Effective June 11, 2007 we effected a fourteen (14) for one (1) forward stock split of our authorized, issued and outstanding shares. As a result, our authorized capital increased from 75,000,000 shares of common stock with a par value of $0.001 to 1,050,000,000 shares of common stock with a par value of $0.001. From the date of the merger with Dussault Apparel Inc. until November 21, 2013, the Company operated solely in the garment industry initially by being a manufacturer–wholesaler and to licensing of its trademark to other wholesalers in the primarily in the Canadian market, while promoting its marque. The Company also purchased the trademark of a cosmetics line. Currently no sales, production or sampling of the cosmetic line has occurred or is planned. As business continued to decline, the Company renegotiated its licensing agreement in early 2013 to receive royalty income only for its designs with one current manufacturer.

On October 15, 2013, the Board of Directors and management changed with the appointment of Orlando Alberto Barrientos Acevedo (“Alberto Barrientos”) being appointed the sole officer and director. A review of the current business of the Company was made and a determination was made to change the business of the Company.

On November 21, 2013, the Company entered into an Asset Purchase Agreement with Jervis Explorations, Inc. whereby the Company purchased various mineral claims referred to as “Montauban Gold Tailings” in exchange for 400,000,000 shares of the Company. This acquisition enacted a change of business of the Company and effected a change of control with Jervis Explorations, Inc. becoming the controlling shareholder of the Company. The Company is currently divesting itself of all of its prior business assets and will solely operate in the mining industry.

On December 9, 2013, the Company received a written consent in lieu of a meeting of stockholders from the holder of 400,000,000 shares of Common Stock (representing 53.1% of the issued and outstanding shares of Common Stock). The shares were issued book entry and certificated on February 7, 2014. The written consent adopted resolutions approving an amendment to the Company’s articles of incorporation changing the name of the Company from Dussault Apparel, Inc. to “Prospect Ventures, Inc.” In addition, the shareholders approved a reverse stock split at a ratio of 800:1. The name change and the reserve split are subject to the requisite regulatory approvals prior to becoming effective. As of the date of the filing of this Annual Report, the Company has not effected nor filed with the state of Nevada or FINRA. The Company anticipates filing with the state by the end of the month and beginning the application process before March 1, 2014.

.At the report date mineral claims, with unknown reserves, have been acquired. We have not established the existence of a commercially mineable ore deposit and therefore have not reached the development stage and are considered to be in the exploration stage.

We do not have any subsidiaries.

Other than as set out herein, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

Industry

By industry standards, there are various types of mining companies, dependent on the level of operations and the status of the assets. We are considered a “Pre-exploration” stage company. Typically, a mining company at the stage that we are currently at is focused on exploration to identify new, commercially viable gold deposits and to define reserves both proven and probable. “Junior mining companies” typically have proven and probable reserves of less than one million ounces of gold, generally produce less than 100,000 ounces of gold annually, and/or are in the process of trying to raise enough capital to fund the remainder of the steps required to move from a staked claim to production. “Mid-tier” and large mining “senior” companies may have several projects in production plus several million ounces of gold in reserve.

The gold mining and exploration industry has experienced several factors recently that are favorable to our Company, as described below.

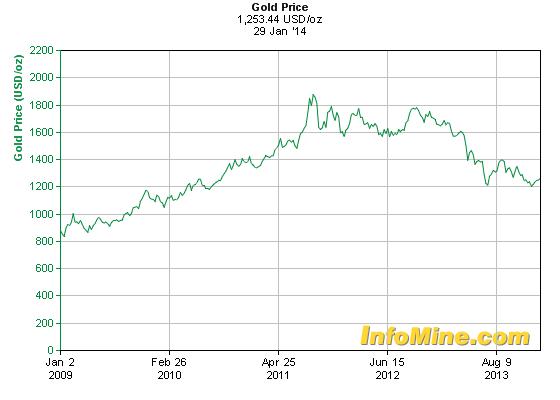

The spot market price of an ounce of gold has increased from a low of just over $800 in 2009 to a high of $1,908 in 2011 and is currently trading in the range of $1,250.

The increase in price levels has made it economically more feasible to produce gold, as well as making gold a more attractive investment for many. While prices have pulled back from their highs of 2011, we believe that there is the existence of an opportunity profit potential if we are successful in identifying and extracting gold at our property.

Further, gold reserves have generally been declining for a number of years for the following reasons:

- the extended period of low gold prices from 1996 to 2001 made it economically unfeasible to explore for new deposits for most mining companies, and

- the demand for and production of gold products have exceeded the amount of new reserves added over the last several consecutive years.

Reversing the decline in lower gold reserves is a long term process. Due to the extended time frame it takes to explore, develop, and bring new production on-line, the large mining companies are facing an extended period of lower gold reserves. Accordingly, junior companies that are able to increase their gold reserves more quickly should directly benefit with an increased valuation.

Additional factors causing higher gold prices over the past several years have come from a weakened U.S. dollar. Reasons for the lower dollar compared to other currencies include, but are not limited to, the historically low U.S. interest rates, the weak U.S. economy, the increasing U.S. budget and trade deficits, and the general worldwide political instability caused by the war on terrorism.

Our Current Business

We are an exploration stage company engaged in the exploration of mineral properties.

On November 21, 2013, the Company entered into an Asset Purchase Agreement with Jervis Explorations, Inc. whereby the Company purchased various mineral claims referred to as “Montauban Gold Tailings” in exchange for 400,000,000 shares of the Company.

We plan to undertake work on the Montauban Gold Tailings with a view to production on the mining claims.

We do not currently have funds available to undertake the planned work programs but are negotiating financing with various parties.

There is no assurance that a commercially viable mineral deposit, a reserve, exists until further work is undertaken and a comprehensive evaluation concludes economic and legal feasibility. We have not yet generated or realized any revenues from our business operations.

Should we be successful in raising sufficient funds in order to conduct our planned programs, the full extent and cost of which is not presently known, and such exploration programs results in an indication that production of our minerals of interest is economically feasible, then at that point in time we would make a determination as to the best and most viable approach for mineral extraction.

Competitive Business Conditions

As all of our minerals of interest are commodity products, they are expected to be readily saleable on an open market at then current prices. Therefore, we foresee no direct competition per se for the selling of our products, should we ever reach the production stage. However, we would be competing with numerous other companies in the region, in the country of Canada and globally, for the equipment, manpower, geological expertise and capital, required to fund, explore, develop, extract and distribute such minerals.

We compete with many companies in the mining business, including larger, more established mining companies with substantial capabilities, personnel and financial resources. Of the four types of mining companies, we believe junior mining companies represent the largest group of gold companies that are publicly listed. All four types of mining companies may have projects located in any of the gold producing continents of the world. Further, there is a limited supply of desirable mineral lands available for claim-staking, lease or acquisition in areas where we may conduct exploration activities. Because we compete with individuals and companies that have greater financial resources and larger technical staffs, we may be at a competitive disadvantage in acquiring desirable mineral properties. From time to time, specific properties or areas that would otherwise be attractive to us for exploration or acquisition are unavailable due to their previous acquisition by other companies or our lack of financial resources.

Competition in the mining industry is not limited to the acquisition of mineral properties but also extends to the technical expertise to find, advance and operate such properties; the labor to operate the properties; and the capital needed to fund the acquisition and operation of such properties. Competition may result in our company being unable not only to acquire desired properties, but to recruit or retain qualified employees, to obtain equipment and personnel to assist in our exploration

activities or to acquire the capital necessary to fund our operation and advance our properties. Our inability to compete with other companies for these resources would have a material adverse effect on our results of operations and business.

As noted above, we compete with other mining and exploration companies, many of which possess greater financial resources and technical facilities than we do, in connection with the acquisition of suitable exploration properties and in connection with the engagement of qualified personnel. The gold exploration and mining industry is fragmented, and we are a very small participant in this sector. Many of our competitors explore for a variety of minerals and control many different properties around the world. Many of them have been in business longer than we have and have established more strategic partnerships and relationships and have greater financial accessibility than we have. Accordingly, given the significant competition for gold and silver exploration properties, we may be unable to continue to acquire interests in attractive gold and silver mineral exploration properties on terms we consider acceptable.

While we compete with other exploration companies in acquiring suitable properties, we believe that there would be readily available purchasers of gold and other precious metals if they were to be produced from any of the properties we currently have interests in. The price of precious metals can be affected by a number of factors beyond our control, including:

| · fluctuations in the market prices; |

| · fluctuating supplies; |

| · fluctuating demand; and |

| · mining activities of others. |

If we find gold mineralization that is determined to be of economic grade and in sufficient quantity to justify production, we may then seek significant additional capital through equity or debt financing to develop, mine and sell our production. Our production would probably be sold to a refiner that would in turn purify our material and then sell it on the open market or through its agents or dealers. In the event we should find economic concentrations of gold mineralization and were able to commence production, we do not believe that we would have any difficulty selling the gold we would produce.

We do not engage in hedging transactions and we have no hedged mineral resources.

General Government Regulations

Our mineral exploration program which we plan to undertake is subject to the regulations of the country of Canada, which sets forth rules for locating concessions, posting concessions, working concessions and reporting work performed. We are also subject to rules on how and where we can explore for minerals. We must comply with these laws to operate our business. Compliance with these rules and regulations will not adversely affect our operations. We are also subject to the numerous laws for the environmental protection of forests, lakes and rivers, fisheries, wild life, etc. These codes deal with environmental matters relating to the exploration and development of mining properties. We are responsible for providing a safe working environment, not disrupting archaeological sites and conducting our activities in a manner that prevents unnecessary damage to the property.

We will secure all necessary permits for exploration and, if exploitation is warranted, on the concessions, will file final plans of operation before we start any mining operations. We anticipate no discharge of water into any active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our operations and know what that will involve from an environmental standpoint. We are in compliance with all regulations at present and will continue to comply in the future. We believe that compliance with these regulations will not adversely affect our business operations.

We intend to subcontract exploration and exploitation work out to third parties under the guidance and direction of our management. We intend to use the services of contractors for manual labor exploration work.

Marketing and Distribution

Gold can be readily sold on numerous markets throughout the world and it is not difficult to ascertain its market price at any particular time. Benchmark prices are generally based on the London gold market quotations. Gold bullion is held as an asset class for a variety of reasons, including as a store of value and a safeguard against the collapse of paper assets such as stocks, bonds and other financial instruments that are traded in fiat currencies not exchangeable into gold (at a fixed rate) under a “gold standard”, as a hedge against future inflation and for portfolio diversification. Governments, central banks and other official institutions hold significant quantities of gold as a component of exchange reserves. Since there are a large number of available gold purchasers, we will not be dependent upon the sale of gold to any one customer. Gold price volatility remained high in 2012, with the price ranging from $1,195 per ounce to $1,693 per ounce. Current prices are in the range of $1,250 per ounce. Gold has continued to attract investor interest through its role as a safe haven investment, store of value and alternative to fiat currency due to concerns over global economic growth, geopolitical issues, sovereign debt and deficit levels, bank stability, future inflation prospects, and continuing accommodative monetary policies put in place by many of the world’s central banks. In particular, the current monetary policies of the U.S. Federal Reserve have a significant impact on the price of gold. The continuing uncertain macroeconomic environment and loose monetary policies, together with the limited choice of alternative safe haven investments, is supportive of continued strong investment demand. This is evidenced by the growth in Exchange Traded Funds (“ETFs”), as well as the worldwide demand for physical gold in forms such as bars and coins. Physical demand for gold for jewelry and other uses also remains a significant driver of the overall gold market. A continuation of these trends is supportive of higher gold prices. Product fabrication and bullion investment are two principal sources of gold demand. The introduction of more readily accessible and liquid gold investment vehicles has further facilitated investment in gold. Within the fabrication category, there are a wide variety of end uses, the largest of which is the manufacture of jewelry. Other fabrication purposes include official coins, electronics, miscellaneous industrial and decorative uses, dentistry, medals and medallions.

Employees

As of the date of the filing of this report have not entered into employment agreements with our current officer or director of the Company and we currently have no employees. We had prior paid consulting fees to our former officer and director of $2,500 per month.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports that we file with the Securities and Exchange Commission, or SEC, are available at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding reporting companies.

An investment in our securities should be considered highly speculative due to various factors, including the nature of our business and the present stage of our development. An investment in our securities should only be undertaken by persons who have sufficient financial resources to afford the total loss of their investment. In addition to the usual risks associated with investment in a business, the following is a general description of significant risk factors which should be considered. You should carefully consider the following material risk factors and all other information contained in this Annual Report before deciding to invest in our common stock. If any of the following risks occur, our business, financial condition and results of operations could be materially and adversely affected. Additional risks and uncertainties we do not presently know or that we currently deem immaterial may also impair our business, financial condition or operating results.

Risks Relating to our Company

Because we may never earn revenues from our operations, our business may fail and then investors may lose all of their investment in our Company.

We have no history of revenues from mining operations and we have divested ourselves of all prior operations which generated minimal revenue. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Our Company has no operating history in our current business, is in the pre-exploration stage and has a history of operating losses. The success of our Company is significantly dependent on the uncertain events of the discovery and exploitation of mineral reserves on our properties or selling the rights to exploit those mineral reserves. If our business plan is not successful and we are not able to operate profitably, then our stock may become worthless and investors may lose all of their investment in our Company.

We have no revenues from operations in our chosen business and have divested of our small revenue generating business to concentrate on our mining operations. We will not receive revenues from operations at any time in the near future... We have incurred losses. There can be no assurance that our operations will ever generate any revenues to fund our continuing operations or that we will ever generate positive cash flow from our operations. Further, we can give no assurance that we will attain or sustain profitability in any future period.

The feasibility of mineral extraction on the our mining concessions has not been established, as we have not completed exploration or other work necessary to determine if it is commercially feasible to develop the properties.

We are currently a mining pre-exploration stage company (see “Item 2 Properties” of this Report for more information regarding our mining assets).

According to SEC definitions, our concessions do not have any proven or probable reserves. A “reserve,” as defined by the SEC, is that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. A reserve requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically extracted and produced. We have not carried out any feasibility study with regard to our mining concessions. As a result, we currently have no reserves and there are no assurances that we will be able to prove that there are reserves on our mining concessions.

We have no reported mineral reserves and if we are unsuccessful in identifying mineral reserves in the future, we may not be able to realize any profit from our property interests.

We are a pre-exploration stage company and have no reported mineral reserves. Any mineral reserves will only come from extensive additional exploration, engineering, and evaluation of existing or future mineral properties. The lack of reserves on our mineral properties could prohibit us from sale or joint venture of our mineral properties. If we are unable to sell or joint venture for development of our mineral properties, we will not be able to realize any profit from our interests in such mineral properties, which could materially adversely affect our financial position or results of operations. Additionally, if we or partners to whom we may joint venture our mineral properties are unable to develop reserves on our mineral properties, we may be unable to realize any profit from our interests in such properties, which could have a material adverse effect on our financial position or results of operations.

We are a pre-exploration stage company, and there is no assurance that a commercially viable deposit or “reserve” exists in the property in which we have claim.

We are a pre-exploration stage company and cannot assure you that a commercially viable deposit, or “reserve,” exists on our mineral properties. Therefore, determination of the existence of a reserve will depend on appropriate and sufficient exploration work and the evaluation of legal, economic and environmental factors. If we fail to find commercially viable deposits, our financial condition and results of operations will be materially adversely affected.

Mineral exploration is highly speculative in nature and there can be no certainty of our successful development of profitable commercial mining operations.

The exploration and development of mineral properties involve significant risks that even a combination of careful evaluation, experience and knowledge may not eliminate. There is no certainty that the expenditures made by us towards the exploration and evaluation of mineral deposits will result in discoveries of commercial quantities of ore. While the discovery of an ore body may result in substantial rewards, few explored properties develop into producing mines. Substantial expenses may be incurred to locate and establish mineral reserves, develop metallurgical processes, and construct mining and processing facilities at a particular site. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are the particular attributes of the deposit, such as size, grade, and proximity to infrastructure; metals prices which are highly cyclical; drilling and other related costs that appear to be rising; and government regulations, including those related to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital. If we are unable to establish the presence of commercially exploitable reserves of minerals on our properties, our ability to fund future exploration activities will be impeded, we will not be able to operate profitably and investors may lose all of their investment in our company.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications, and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, environmental permitting difficulties and delays and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineable mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claims. If this happens, our business will likely fail.

The nature of mineral exploration and production activities involves a high degree of risk and the possibility of uninsured losses that could materially and adversely affect our operations.

Exploration for minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Few properties that are explored are ultimately advanced to the stage of producing mines. Our current exploration efforts are, and any future development or mining operations we may elect to conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as, but not limited to the following:

| · | economically insufficient mineralized material; | |

| · | fluctuations in production costs that may make mining uneconomical; | |

| · | labor disputes; | |

| · | unanticipated variations in grade and other geologic problems; | |

| · | seismic activity | |

| · | environmental hazards; | |

| · | water conditions; | |

| · | difficult surface or underground conditions; | |

| · | industrial accidents; | |

| · | metallurgical and other processing problems; | |

| · | mechanical and equipment performance problems; | |

| · | failure of pit walls or dams, including retaining dams around tailing disposal areas; | |

| · | unusual or unexpected rock formations; | |

| · | personal injury, fire, flooding, cave-ins, rock bursts and landslides; | |

| · | bad or hazardous weather conditions and other acts of God; and | |

| · | decrease in reserves due to a lower gold price. |

Any of these risks can materially and adversely affect, among other things, the development of properties, production quantities and rates, costs and expenditures and production commencement dates and could also result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. We currently have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable.

If any of these risks and hazards adversely affect our mining operations or our exploration activities, they may: (i) increase the cost of exploration to a point where it is no longer economically feasible to continue operations; (ii) require us to write down the carrying value of one or more mines or a property; (iii) cause delays or a stoppage in the exploration of minerals; (iv) result in damage to or destruction of mineral properties or processing facilities; and (v) result in personal injury, death or legal liability. Any or all of these adverse consequences may have a material adverse effect on our financial condition, results of operations and future cash flows.

The potential profitability of mineral ventures depends in part upon factors beyond the control of our company and even if we discover and exploit mineral deposits, we may never become commercially viable and we may be forced to cease operations.

The commercial feasibility of mineral properties is dependent upon many factors beyond our control, including the existence and size of mineral deposits in the properties we explore, the proximity and capacity of processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production and environmental regulation. These factors cannot be accurately predicted and any one or a combination of these factors may result in our company not receiving an adequate return on invested capital. These factors may have material and negative effects on our financial performance and our ability to continue operations.

Mineralized material is based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, mineralized material presented in our filings with securities regulatory authorities, including the SEC, press releases, and other public statements that may be made from time to time are based upon estimates made by our consultants. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material on our properties. Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property’s return on capital. There can be no assurance that minerals recovered in small scale tests will be recovered at production scale. The mineralized material estimates have been determined and valued based on assumed future prices, cut-off grades and operating costs that may prove inaccurate. Extended declines in market prices for gold may render portions of our mineralized material uneconomic and adversely affect the commercial viability of one or more of our properties and could have a material adverse effect on our results of operations or financial condition.

The construction of mines are subject to all of the risks inherent in construction.

These risks include potential delays, cost overruns, shortages of material or labor, construction defects and injuries to persons and property. While we anticipate taking all measures which we deem reasonable and prudent in connection with construction, there is no assurance that the risks described above will not cause delays or cost overruns in connection with such construction. Any delay would postpone our anticipated receipt of revenue and adversely affect our operations. Cost overruns would likely require that we obtain additional capital in order to commence production. Any of these occurrences may adversely affect our ability to generate revenues and the price of our stock.

An adequate supply of water may not be available to undertake mining and production at our property.

The amount of water that we are entitled to use from wells or other water sources must be determined by the appropriate regulatory authorities. A determination of these rights is dependent in part on our ability to demonstrate a beneficial use for the amount of water that we intend to use. Unless we are successful in developing a property to a point where it can commence commercial production of gold or other precious metals, we may not be able to demonstrate such beneficial use. Accordingly, there is no assurance that we will have access to the amount of water needed to operate a mine at our properties.

Exploration and exploitation activities are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our company.

Exploration and exploitation activities are subject to laws, regulations, and policies, including laws regulating the removal of natural resources from the ground and the discharge of materials into the environment. Exploration and exploitation activities are also subject to laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment.

Various permits from government bodies are required for drilling operations to be conducted, and no assurance can be given that such permits will be received. Environmental and other legal standards imposed by the authorities may be changed and any such changes may prevent us from conducting planned activities or increase our costs of doing so, which would have material adverse effects on our business. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may not be able to or elect not to insure against due to prohibitive premium costs and other reasons. Any laws, regulations, or policies of any government body or regulatory agency may be changed, applied, or interpreted in a manner which will alter and negatively affect our ability to carry on our business.

Mineral exploration and development activities are subject to various laws governing prospecting, development, taxes, labor standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. We cannot assure you that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail our exploration or development of our properties.

Our operating costs could be adversely affected by inflationary pressures especially to labor, equipment and fuel costs.

The global economy is currently experiencing a period of high commodity prices and as a result the mining industry is attempting to increase production at new and existing projects, while also seeking to discover, explore and develop new projects. This has caused significant upward price pressures in the costs of mineral exploration companies, especially in the areas of skilled labor and drilling equipment, both of which are in tight supply and whose costs are increasing. Continued upward price pressures in our exploration costs may have an adverse impact to our business.

We may be unable to obtain the funds necessary to effect our business plan.

Currently we do not have funds to undertake any exploration or development on our current mining claims. We have been successful in obtaining financing for operations by way of loans but as an exploration company it is often difficult to obtain adequate financing when required, and it is not necessarily the case that the terms of such financings will be favorable. If we fail to obtain additional financing on a timely basis, we could forfeit our mineral property interests and/or reduce or terminate operations, our business could fail, and investors could lose their entire investment.

Because our business involves numerous operating hazards, we may be subject to claims of a significant size, which would cost a significant amount of funds and resources to rectify. This could force us to cease our operations.

Our operations are subject to the usual hazards inherent in exploring for minerals, such as general accidents, explosions, chemical exposure and cratering. The occurrence of these or similar events could result in the suspension of operations, damage to or destruction of the equipment involved and injury or death to personnel. Operations also may be suspended because of machinery breakdowns, abnormal climatic conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. The occurrence of any such contingency would require us to incur additional costs, which would adversely affect our business.

Damage to the environment could also result from our operations. If our business damages the environment, we may be subject to claims of a significant size that could force us to cease our operations.

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of federal, provincial, and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry. Although we intend to substantially comply with all applicable laws and regulations, because these rules and regulations frequently are amended or interpreted, we cannot predict the future cost or impact of complying with these laws.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulations could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the costs of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Our operations and properties are subject to extensive laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to health and safety. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences; (ii) restrict the types, quantities and concentration of various substances that can be released in the environment in connection with exploration activities; (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas; (iv) require remedial measures to mitigate pollution from former operations; and (v) impose substantial liabilities for pollution resulting from our proposed operations.

The exploration of mineral reserves are subject to all of the usual hazards and risks associated with mineral exploration, which could result in environmental damage possible legal liability for any or all damages. This would adversely affect our business and may cause us to cease operations.

Severe weather or violent storms could materially affect our operations due to damage or delays caused by such weather.

Our exploration activities are subject to normal seasonal weather conditions that often hamper and may temporarily prevent exploration activities. There is a risk that unexpectedly harsh weather or violent storms could affect areas where we conduct exploration activities. Delays or damage caused by severe weather could materially affect our operations or our financial position.

Our business is extremely dependent on gold, commodity prices, and currency exchange rates over which we have no control.

Our operations will be significantly affected by changes in the market price of gold and other commodities since the evaluation of whether a mineral deposit is commercially viable is heavily dependent upon the market price of gold and other commodities. The price of commodities also affects the value of exploration projects we own or may wish to acquire. These prices of commodities fluctuate on a daily basis and are affected by numerous factors beyond our control. The supply and demand for gold and other commodities, the level of interest rates, the rate of inflation, investment decisions by large holders of these commodities including governmental reserves and stability of exchange rates can all cause significant fluctuations in prices. Such external economic factors are in turn influenced by changes in international investment patterns and monetary systems and political developments. The prices of commodities have fluctuated widely and future serious price declines could have a material adverse effect on our financial position or results of operations.

Fluctuating gold prices could negatively impact our business plan.

The potential for profitability of our gold mining operations and the value of our mining properties are directly related to the market price of gold. The price of gold may also have a significant influence on the market price of our shares. If we obtain positive drill results and progress one of our properties to a point where a commercial production decision can be made, our decision to put a mine into production and to commit the funds necessary for that purpose must be made long before any

revenue from production would be received. A decrease in the price of gold at any time during future exploration and development may prevent our property from being economically mined or result in the write-off of assets whose value is impaired as a result of lower gold prices. The price of gold is affected by numerous factors beyond our control, including inflation, fluctuation of the United States dollar and foreign currencies, global and regional demand, the purchase or sale of gold by central banks and the political and economic conditions of major gold producing countries throughout the world. The volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can fully eliminate. In the event gold prices decline and remain low for prolonged periods of time, we might be unable to develop our properties or produce any revenue.

The volatility in gold prices is illustrated by the following table, which sets forth, for the periods indicated (calendar year), the high and low prices in U.S. dollars per ounce of gold, based on the daily London P.M. fix.

Gold Price per Ounce ($)

| Year | High | Low | ||||||

| 1999 | $ | 326 | $ | 253 | ||||

| 2000 | 312 | 263 | ||||||

| 2001 | 293 | 256 | ||||||

| 2002 | 349 | 278 | ||||||

| 2003 | 416 | 320 | ||||||

| 2004 | 454 | 375 | ||||||

| 2005 | 537 | 411 | ||||||

| 2006 | 725 | 525 | ||||||

| 2007 | 691 | 608 | ||||||

| 2008 | 1,011 | 713 | ||||||

| 2009 | 1,213 | 810 | ||||||

| 2010 | 1,421 | 1,058 | ||||||

| 2011 | 1,895 | 1,319 | ||||||

| 2012 | 1,791 | 1,540 | ||||||

Estimates of mineralized materials are subject to geologic uncertainty and inherent sample variability.

Although the estimated resources at our existing properties will be delineated with appropriately spaced drilling, there is inherent variability between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There also may be unknown geologic details that have not been identified or correctly appreciated at the proposed level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances can have a positive effect and others can have a negative effect on mining and processing operations. Acceptance of these uncertainties is part of any mining operation.

We may not be able to compete with current and potential exploration companies, some of which have greater resources and experience than we do in developing mineral reserves.

The natural resource market is intensely competitive, highly fragmented and subject to rapid change. Our competition includes established mining companies with substantial capabilities and with greater financial and technical resources than we have. We may be unable to compete successfully with our existing competitors or with any new competitors. We will be competing with many exploration companies that have significantly greater personnel, financial, managerial and technical resources than we do.

As a result of this competition, we may have to compete for financing and be unable to acquire financing on terms we consider acceptable. We may also have to compete with the other mining companies in the recruitment and retention of qualified managerial and technical employees. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

We may not have access to all of the supplies and materials we need to begin exploration, which could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials prior to undertaking exploration programs. If we cannot find the products, equipment and materials we need, we will have to suspend our exploration plans until we do find the products, equipment and materials.

We are subject to new corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with existing and future requirements, could adversely affect our business.

We may face new corporate governance requirements under the Sarbanes-Oxley Act of 2002, as well as new rules and regulations subsequently adopted by the SEC and the Public Company Accounting Oversight Board. These laws, rules, and regulations continue to evolve and may become increasingly stringent in the future. In particular, under rules proposed by the SEC on August 6, 2006, we are required to include management’s report on internal controls as part of our annual report pursuant to Section 404 of the Sarbanes-Oxley Act. We strive to continuously evaluate and improve our control structure to help ensure that we comply with Section 404 of the Sarbanes-Oxley Act. The financial cost of compliance with these laws, rules, and regulations is expected to remain substantial. We cannot assure you that we will be able to fully comply with these laws, rules, and regulations that address corporate governance, internal control reporting, and similar matters. Failure to comply with these laws, rules and regulations could materially adversely affect our reputation, financial condition, and the value of our securities.

We depend on our sole officer and director and the loss of this individual could adversely affect our business.

Our Company is completely dependent on our sole officer and director, Alberto Barrientos. We currently have no employees and the loss of this individual could significantly and adversely affect our business, could result in a complete failure of the Company. We do not carry any life insurance on the life of Mr. Barrientos.

Risks Relating to an Investment in our Securities

Because of the early stage of development and the nature of our business, our securities are considered highly speculative.

Our securities must be considered highly speculative, generally because of the nature of our business and the early stage of its development. We are engaged in the business of exploring and, if warranted and feasible, developing natural resource properties. Our mining claims are in the exploration stage only and are without proven reserves of natural resources. Accordingly, we have not generated any revenues nor have we realized a profit from our operations to date, and there is little likelihood that we will generate any revenues or realize any profits in the short term. Any profitability in the future from our business will be dependent upon locating and developing economic reserves of natural resources, which itself is subject to numerous risk factors as set forth herein. Since we have not generated any revenues, we will have to raise additional monies through the sale of our equity securities or debt in order to continue our business operations.

We may, in the future, issue additional common shares that would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of up to 1,050,000,000 common shares, $0.001 par value. The future issuance of common shares may result in substantial dilution in the percentage of our common shares held by our then existing stockholders. We may value any common shares issued in the future on an arbitrary basis. The issuance of common shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the common shares held by our investors, and might have an adverse effect on any trading market for our common shares.

Market for penny stock has suffered in recent years from patterns of fraud and abuse and our stock has been volatile.

Stockholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include: (i) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (ii) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (iii) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced salespersons; (iv) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and, (v) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequential investor losses.

Our management is aware of the abuses that have occurred historically in the penny stock market. The occurrence of these patterns or practices could in the future increase the volatility of our share price.

Our common shares are subject to the “penny stock” rules of the SEC, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted regulations that generally define a “penny stock” to be any equity security other than a security excluded from such definition by Rule 3a51-1 under the Securities Exchange Act of 1934, as amended. For the purposes relevant to our Company, it is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions.

Our common shares are currently regarded as a “penny stock”, since our shares are not listed on a national stock exchange or quoted on the NASDAQ Market within the United States, to the extent the market price for its shares is less than $5.00 per share. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by the SEC, to provide a customer with additional information including current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer's account, and to make a special written determination that the penny stock is a suitable investment for the purchaser, and receive the purchaser's written agreement to the transaction.

To the extent these requirements may be applicable, they will reduce the level of trading activity in the secondary market for the common shares and may severely and adversely affect the ability of broker-dealers to sell the common shares.

FINRA sales practice requirements may also limit a stockholders ability to buy and sell our stock.

In addition to the penny stock rules promulgated by the SEC, which are discussed in the immediately preceding risk factor, FINRA rules require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the ability to buy and sell our stock and have an adverse effect on the market value for our shares.

Our common stock may experience extreme rises or declines in price, and you may not be able to sell your shares at or above the price paid.

Our common stock may be highly volatile and could be subject to extreme fluctuations in response to various factors, many of which are beyond our control, including (but not necessarily limited to) (i) the trading volume of our shares; (ii) the number of securities analysts, market-makers and brokers following our common stock; (iii) changes in, or failure to achieve, financial estimates by securities analysts; (iv) actual or anticipated variations in quarterly operating results; (v) conditions or trends in our business industries; (vi) announcements by us of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; (vii) additions or departures of key personnel; (viii) sales of our common stock; and (ix) general stock market price and volume fluctuations of publicly-traded and particularly, microcap companies.

Investors may have difficulty reselling shares of our common stock, either at or above the price they paid for our stock, or even at fair market value. The stock markets often experience significant price and volume changes that are not related to the operating performance of individual companies, and because our common stock is thinly traded it is particularly susceptible to such changes. These broad market changes may cause the market price of our common stock to decline regardless of how well we perform as a company. In addition, there is a history of securities class action litigation following periods of volatility in the market price of a company’s securities. Although there is no such shareholder litigation currently pending or threatened against the Company, such a suit against us could result in the incursion of substantial legal fees, potential liabilities and the diversion of management’s attention and resources from our business. Moreover, and as noted below, our shares are currently traded on the OTC-PK and, further, are subject to the penny stock regulations. Price fluctuations in such shares are particularly volatile and subject to manipulation by market-makers, short-sellers and option traders.

We have not and do not intend to pay any cash dividends on our common shares and, consequently, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We have not, and do not, anticipate paying any cash dividends on our common shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

A decline in the price of our common stock could affect our ability to raise further working capital, adversely impact our ability to continue operations and may cause us to go out of business.

A prolonged decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital. Because we may attempt to acquire a significant portion of the funds we need in order to conduct our planned operations through the sale of equity securities, or convertible debt instruments, a decline in the price of our common stock could be detrimental to our liquidity and our operations because the decline may cause investors to not choose to invest in our stock. If we are unable to raise the funds we require for all our planned operations, we may be forced to reallocate funds from other planned uses and may suffer a significant negative effect on our business plan and operations, including our ability to develop new products and continue our current operations. As a result, our business may suffer, we may not be successful and we may go out of business. We also might not be able to meet our financial obligations if we cannot raise enough funds through the sale of our common stock and we may be forced to go out of business.

Item 1B. UNRESOLVED STAFF COMMENTS

None.

Executive Offices

Our sole officer and director, Alberto Barrientos, currently provides offices to the Company free of charge. Our offices are at #98 – 50 Carrera 73, Medellin, Colombia. Our telephone number is 1(888)876-9995.

Mineral Properties

Montauban Gold Tailings

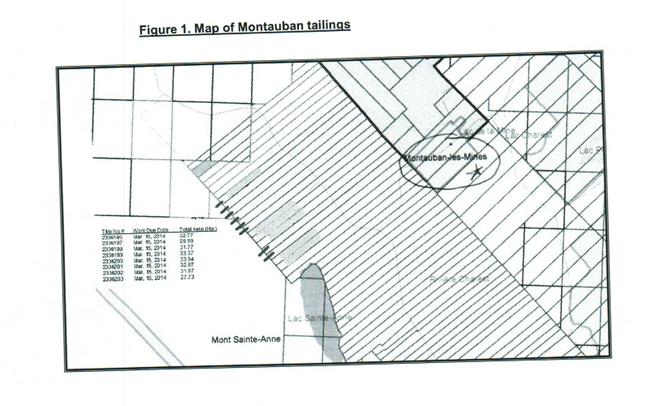

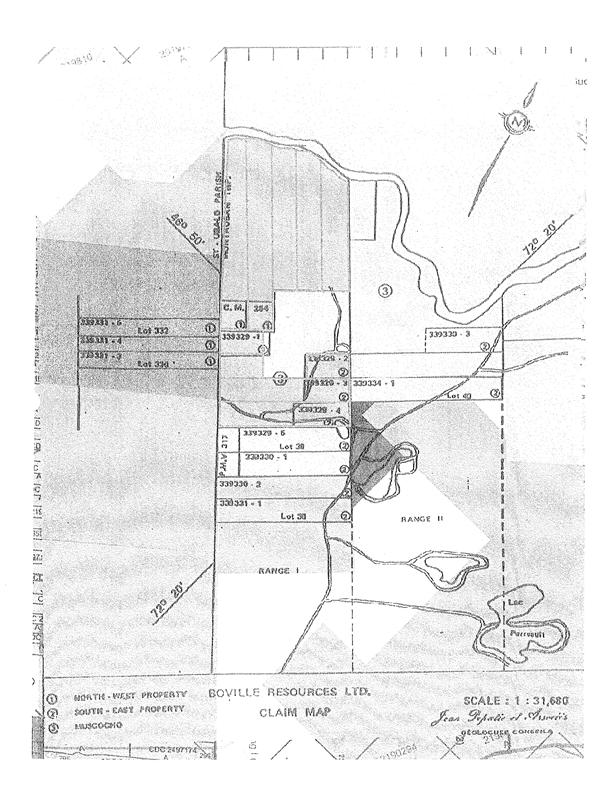

On November 21, 2013, we entered into an Asset Purchase Agreement with Jervis Explorations, Inc. whereby the Company purchased a 100% interest in various mineral claims referred to as “Montauban Gold Tailings” from the then current property holder Jervis Explorations Inc. (“Jervis”). The mineral claims consist of 8 separate titles as follows: CDC2336196, CDC2336197, CDC2336198, CDC2336199, CDC2336200, CDC2336201, CDC2336202, and CDC2336203. Jervis staked the property in March 2012 after Excel Mining, Inc. (“EMG”) abandoned their claim in 2011. EMG staked the claim in 2009 after a lapse of 20 years.

The purchase is subject to a 3% royalty payment to be made by the Company to Jervis Exploration, Inc. Per the terms of the Agreement, "3% Net Smelter Returns" means 3% of the net amount of money received by the Purchaser for its own account from the sale of ore, or ore concentrates or other mineral products from the Claims to a smelter or other mineral products buyer after deduction of smelter and/or refining charges, ore treatment charges, penalties and any and all charges made by the purchaser of ore, concentrates, or other mineral products, less any and all transportation costs which may be incurred in connection with the transportation of ore or concentrates, less all umpire charges which the purchaser may be required to pay.

With the execution of this agreement and the issuance of the share consideration we are the beneficial owner of a 100% interest in the Montauban Gold Tailings. The Montauban tailing claims comprises 8 mineral titles, totaling 253.31 hectares located near the small village of Montauban les Mines, about 75 miles west of Quebec City, in the Province of Quebec, Canada. While there are previous geological reports on the property which denote that there is a potential for processing of the tailings and producing gold, there are no reserve reports on which the Company can presently rely on to define reserves on the property. We do not have any ore body and have not generated any revenues from our operations. We acquired the Montauban Gold Tailings because the claim area has mine tailings which we believe may be processed to recover gold. silver and zinc.

We plan to undertake an evaluation of the mine tailing by way of metallurgical testing to determine the maximum recovery of the tailings for gold, silver and zinc and we are currently putting budgets in place in order to undertake this work. We do not presently have any funding for operations and we will be required to raise funding in order to undertake any work on the mining claims.

The Quebec Mining Act

On December 10, 2013, Bill 70 – An Act to amend the Mining Act (Bill 70), tabled by the Minister of Natural Resources (the Minister) on December 5, 2013, was adopted by the Québec National Assembly. Bill 70 is the current government’s second attempt to reform Québec’s mining legislation after Bill 43, tabled in June and which sought to replace the existing Mining Act, was blocked by the opposition on October 30.

Bill 70 includes most of the changes proposed by Bill 43; however, in order to obtain the opposition parties’ support, the government had to make certain concessions, discussed below, on important aspects of the bill.

Conditions for granting a mining lease

First, with respect to the conditions for granting a mining lease, the ore processing feasibility study proposed in Bill 43 and which mining investors viewed as a major irritant, has been replaced by a scoping and market study, expected to be both less costly and less time consuming.

Another controversial proposal of Bill 43 concerned the power given to the Minister to require, when granting a mining lease, that the lessee maximize the economic spinoffs of mining the mineral resources in Québec. While Bill 70 reiterates this proposal, it specifies that this requirement may only be imposed by the Minister on reasonable grounds. However, the obligation contained in Bill 43 for mining lease holders to establish and maintain a committee to monitor and maximize economic spinoffs for local communities remains as is.

Lastly, in the same manner as Bill 43, Bill 70 stipulates that a mining lease cannot be granted until a rehabilitation and restoration plan, for which the certificate of authorization required under the Environment Quality Act has been issued, has been submitted to the Minister. However, Bill 70 allows this condition to be waived if the time required to obtain the required certificate proves to be unreasonable and is likely to undermine the project’s realization.

Provisions applicable to claims

Concerning the provisions applicable to claims, Bill 70 maintains the current rule allowing the claim holder to use any excess amount spent for a claim on other claims located within a radius of 4.5 kilometres, unlike Bill 43, which proposed reducing this radius to 3.5 kilometres. The other amendments announced in Bill 43 remain, including (i) limiting the carry-forward period of work credits to 12 years; (ii) increasing the amount to pay to avoid performing mandatory exploration work to twice the cost of the work that should have been performed to renew a claim; and (iii) the obligation to send the Minister a report on the work performed in the previous year on each anniversary of the registration of the claim. Note that on this last point, unlike Bill 43, Bill 70 eliminates the obligation to also submit a plan of the work to be performed in the coming year. In addition, as provided in Bill 43, the new claim holder must notify the municipality and the landowner concerned of his claim within 60 days of registration; however, Bill 70 reduces to 30 days (compared to 90 days in Bill 43) the period within which the claim holder must notify the municipality and the landowner before performing work. Lastly, Bill 70 does not give the Minister the power to auction off certain claims, a measure that was proposed by the Québec Liberal Party during its attempt to reform mining legislation in 2011 and that was included in Bill 43.

Environmental assessments, public consultations and Native communities

Under Bill 70, theRegulation respecting environmental impact assessment and review is amended in order to make all mining projects with processing or production capacity of more than 2,000 metric tons per day subject to an environmental assessment while all projects relating to rare earth processing will be subject to this assessment regardless of their processing or production capacity. This is a compromise between the former regime which targeted mining projects of more than 7,000 tons per day and Bill 43, which sought to subject all mining projects to such environmental assessment.

While mining projects with a production capacity of less than 2,000 tons will not be subject to this environmental assessment, they will be required to hold a public consultation in the region concerned before applying for a mining lease.

Lastly, in response to criticism that Bill 43 did not sufficiently address Native issues, Bill 70 introduces a new chapter to the Mining Act providing that it be construed in a manner consistent with the obligation to consult Native communities and obligating the Minister to develop a Native community consultation policy specific to the mining sector.

Disclosure of information

As announced in Bill 43, mining companies will have increased disclosure obligations requiring them to make public the quantity and value of the ore extracted and royalties paid annually, as well as their rehabilitation and restoration plan. That said, Bill 70 tempers these disclosure requirements by specifying that data contained in exploration work reports in relation to amounts beyond the allowances that may be claimed under the Mining Tax Act remain confidential for five years. As well, in contrast with Bill 43, it provides that agreements between mining companies and communities do not have to be disclosed and that the data contained therein may only be used for statistical purposes.

Other amendments to the Mining Act