Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Fortress Investment Group LLC | d674349d8k.htm |

Fortress Investment Group LLC

2014 Credit Suisse Financial Services Forum

February 2014

Exhibit 99.1

All information contained herein is qualified in its entirety by the disclaimer on the next page of

this document. |

Disclaimer

1 |

2

“We

believe

a

highly

diversified,

global

asset

manager

delivering

top-

tier investment performance will create extraordinary opportunities

for earnings growth and value creation.”

-

Wes Edens, Fortress Co-Founder, Co-Chairman & Head of

Private Equity |

Fortress Today

3

Distressed & Undervalued

Assets

Operationally Intense,

Complex Transactions

Opportunistic Lending

Situations and Securities

Global Macro

Convex Asia

Endowment-Style

Affiliated Manager

Platform (Asia Macro)

(1)

Core-Based Fixed Income

Sector-Based Fixed Income

Short & Long Duration

High Yield

Emerging Markets Debt

Growth Equities

Three large, non-correlated alternative businesses complemented by a highly scalable

traditional asset management platform

Stable, recurring earnings base with significant incentive income

upside potential Core strategies provide foundation for organic

strategic growth Increasing scale of permanent equity platform

provides high multiple, perpetual fee-based earnings

Substantial balance sheet value relative to share price

Financial Services /

Mortgage Servicing

Transportation &

Infrastructure

Senior Living & Care

Permanent Equity Vehicles

Private Equity

$14.9B of AUM

Liquid Markets

$6.9B of AUM

Credit

$12.6B of AUM

Logan Circle

$23.6B of AUM

(1)

In January 2014, Fortress announced the launch of a new affiliated manager platform pursuant to which

Fortress takes a non-control economic interest in a fund manager and earns fees for

infrastructure, technology and related services, with Fortress Asia Macro Fund (“FAMF”) as

the first fund to join the platform.

(2)

Based on annualized YTD 2013 results.

On

pace

for

highest

full

year

of

distributable

earnings

since

2007

(2) |

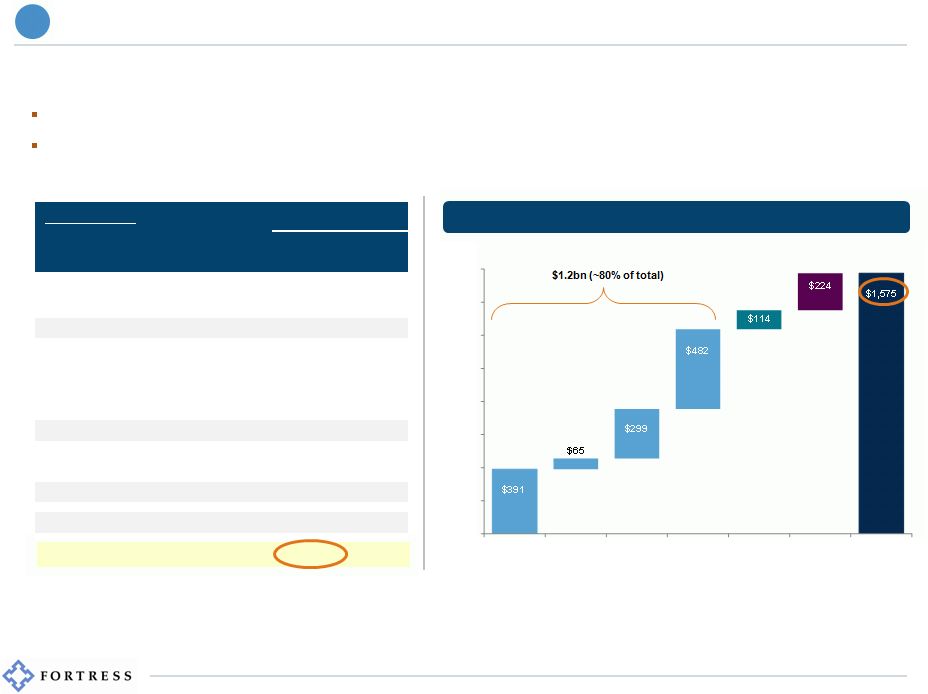

Strong YTD 2013 Results Reflect Strength of Earnings Model

4

(1)

Reflects the nine month period from January 1, 2013 through September 30, 2013 for

Management Fees and Incentive Income. As of September 30, 2013 for AUM, Gross Unrecognized Incentive

Income and Net Cash & Investments.

(2)

Reflects the nine month period from January 1, 2012 through September 30, 2012 for

Management Fees and Incentive Income. As of September 30, 2012 for AUM, Gross Unrecognized Incentive

Income and Net Cash & Investments.

(3)

Includes $1.2 billion of Private Equity Castle equity eligible for incentive.

(4)

Based on 495 million dividend paying shares outstanding as of September 30,

2013. (5)

Net Cash & Investments, which is a non-GAAP financial measure, means cash

& cash equivalents plus investments less debt outstanding, as described in Fortress’s third quarter 2013 earnings

release.

The

release

is

available

in

the

“Public

Shareholders

–

News”

section

of

Fortress’s

website,

www.fortress.com.

For

a

reconciliation

of

GAAP

Book

Value

Per

Share

to

Net

Cash

&

Investments

Per Share please see Appendix slide #6.

(6)

FIG stock price as of February 7, 2014.

$ millions

YTD 2013

(1)

YTD 2012

(2)

YoY

Fee-Paying AUM

$57,971

$51,475

+13%

Eight

consecutive

quarters

of

over

$1

billion

in

new alternative capital raised

Management Fees

$397

$348

+14%

$27.4

billion

of

AUM

in

permanent

equity

or

long-term investment structures

Incentive Income

$357

$164

+118%

$18.8 billion

(3)

of incentive-eligible NAV above

incentive income thresholds

Gross Unrecognized

Incentive Income

$807

$543

+49%

$1.63 per share

(4)

of gross embedded incentive

income yet to impact DE

Net Cash &

Investments

(5)

$1,575

$1,243

+27%

$3.18 per share

(4)

of Net Cash & Investments

represents 40%

of FIG’s share price

(6)

Financial performance and embedded value point to substantial

momentum

and

valuation upside potential |

5

Key Investment Themes

(1)

In January 2014, Fortress announced the launch of a new affiliated manager platform

pursuant to which Fortress takes a non-control economic interest in a fund manager and earns fees for

infrastructure, technology and related services, with Fortress Asia Macro Fund

(“FAMF”) as the first fund to join the platform. (2)

Source: Cambridge Associates, September 2013.

(3)

Net Cash & Investments, which is a non-GAAP financial measure, means cash

& cash equivalents plus investments less debt outstanding, as described in Fortress’s third quarter 2013 earnings

release.

The

release

is

available

in

the

“Public

Shareholders

–

News”

section

of

Fortress’s

website,

www.fortress.com.

For

a

reconciliation

of

GAAP

Book

Value

Per

Share

to

Net

Cash

&

Investments

Per Share please see Appendix slide #6.

Highly diversified and scalable core investment platforms

Meaningful growth potential from permanent capital vehicles and

sector-specific funds Opportunities

for

strategic

additions

to

Liquid

Markets

affiliated

manager

platform

(1)

Logan Circle build-out into broader traditional asset

manager Strong investment performance across businesses

Strong full year 2013 absolute returns in flagship liquid and credit

hedge funds Top-tier

Credit

PE

fund

performance

(2)

; all flagship Credit funds above preferred thresholds

Significant value appreciation in legacy PE buyout funds

Substantial, underappreciated balance sheet value

Zero debt obligations outstanding

$1.6

billion

of

Net

Cash

&

Investments

on

the

balance

sheet

(3)

Potential for increased shareholder distributions from realization

events 1

2

3 |

6

Highly Diversified Business Model

With Scalable Investment Platforms

1 |

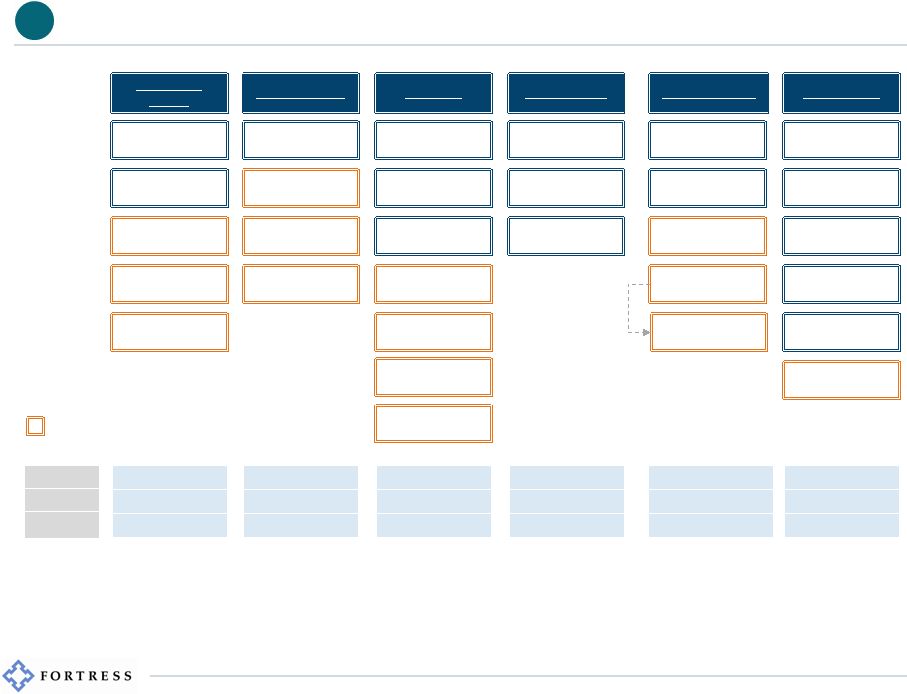

7

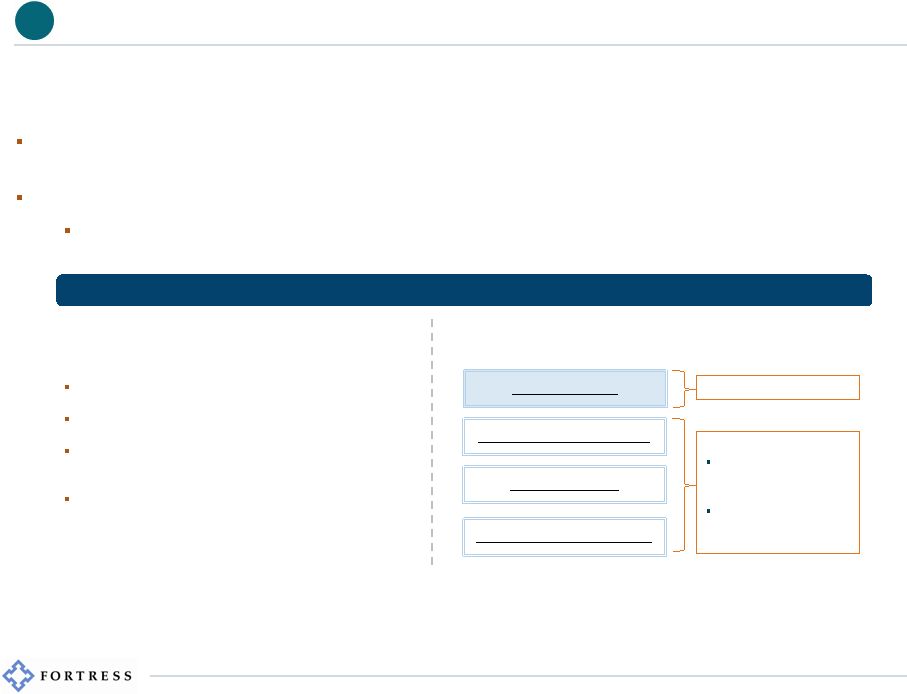

Diversified Business Model Continuing to Build From Core

Strategies Permanent

Equity

Newcastle

Eurocastle

New Residential

FTAI

(2)

New Media

(1)

Private Equity

Credit PE

Credit Hedge

Liquid Markets

Logan Circle

General Buyout

Funds (I-V)

MSR Funds (I-II)

Credit

Opps.

(I-II)

Infrastructure

(3)

Italian NPLs

(3)

Real Assets

Net Lease

Life Settlements

DBSO

Worden Funds

Value Recovery

Funds

Macro

Endowment Style

Convex Asia

Asia Macro

(5)

Core-Based

Fixed Income

Short & Long

Duration

High Yield

Emerging

Markets Debt

Growth Equities

(1)

The spin-off of Newcastle’s (NCT) media assets into New Media Investment

Group Inc. (“New Media”) has been approved by Newcastle’s Board of Directors and is expected to be completed with the

distribution

of

shares

of

common

stock

of

New

Media

(NYSE:

NEWM)

on

or

about

February

13,

2014.

(2)

Fortress’s ability to complete an IPO of Fortress Transportation and

Infrastructure Investors LLC (“FTAI”) is subject to certain conditions, including but not limited to, the SEC declaring the registration

statement relating to the IPO effective and approval of an application to list

FTAI’s common stock on the NYSE. (3)

Potential fund strategy or strategy still in fundraising period.

(4)

Japan Opportunity Fund was launched in June 2009; Japan Opportunity Fund II

was launched in December 2011. (5)

In January 2014, Fortress announced the launch of a new affiliated manager platform

pursuant to which Fortress takes a non-control economic interest in a fund manager and earns fees for

infrastructure, technology and related services, with Fortress Asia Macro Fund

(“FAMF”) as the first fund to join the platform. (6)

Subsequent to September 30, 2013, NCT raised $0.3 billion of permanent equity

capital. 7 –

10 years

$11.6 billion

1.2%

3 –

25 years

$6.9 billion

1.4%

Annual

$5.7 billion

2.0%

Monthly/Quarterly

$6.9 billion

1.8%

N/A

$23.6 billion

0.2%

Fund Life

AUM

Avg Mgmt

Fee Rate

Permanent

$3.2 billion

(6)

1.5%

Japan

Opps.

(I-II)

(4)

Credit Opps. III

Launched in last three years, in

fundraising or potential strategy

Real Estate

Affiliated

Manager Platform

Sector-Based

Fixed Income

1 |

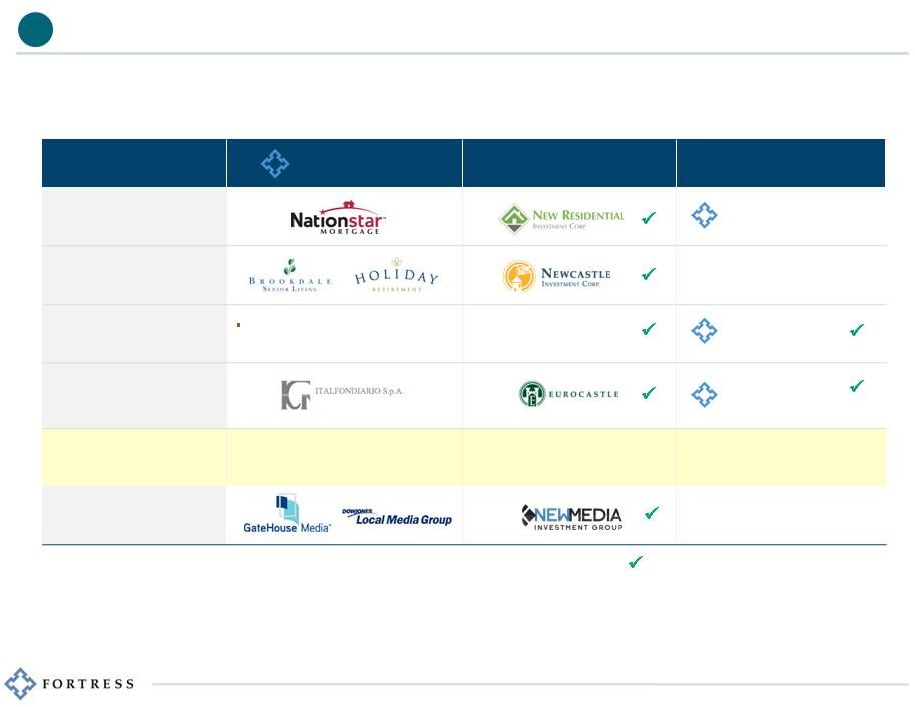

Investment Opportunity

Fortress Advantage

Permanent Capital Vehicles

Sector-Focused Funds

Mortgage Servicing Rights

(MSRs)

MSR Fund I & Fund II

Senior Housing & Care

Transportation &

Infrastructure

acquisition of over $15 billion of assets

worldwide since 2002

FTAI

(2)

Infrastructure Fund

(3)

Italian NPLs

Italian NPL Fund

(3)

Total Capital

Raised

(2012 –

December 2013)

$1.8bn

$2.6bn

(4)

Media

8

Build-out of Permanent Capital Vehicles & Sector PE Funds

Leverage investment and operating experience in core sectors that have large,

addressable markets, attractive supply/demand dynamics, favorable economics

and long duration assets Fund currently raising private

capital or public company with ability to raise additional

equity 1

(1)

Includes senior housing properties currently owned by Newcastle and managed by a FIG senior living

property management subsidiary.

(2)

Fortress’s ability to complete an IPO of FTAI is subject to certain conditions, including but not

limited to, the SEC declaring the registration statement relating to the IPO effective and

approval of an application to list FTAI’s common stock on the NYSE.

(3)

Potential fund strategy or strategy still in fundraising period. (4)

Includes $1.1 billion raised for MSR Fund II, $0.6 billion raised for MSR Fund I, $0.6 billion raised

for Italian NPL Fund and $0.3 billion raised for WWTAI (now FTAI).

(5)

The spin-off of Newcastle’s media assets into New Media Investment Group Inc. (“New

Media”) has been approved by Newcastle’s Board of Directors and is expected to be

completed with the distribution of shares of common stock of New Media (NYSE: NEWM) on or about

February 13, 2014.

(5) |

9

NCT:

A

$2.0

Billion

REIT

(1)

&

Engine

for

Platform

Diversification

1

Newcastle focused on harvesting value in core real estate investments, strategically

acquiring senior housing properties and making opportunistic investments with

attractive returns Each new permanent capital vehicle has

meaningful growth prospects, which could drive additional management fees and

potential incentive income to Fortress

(1)

Market Capitalization based on share price and shares outstanding as of February 7,

2014. (2)

Newcastle, New Residential and New Media may invest in assets that differ

significantly from its current portfolio and each company’s portfolio may change meaningfully over time. Any dividend

declarations

are

at

the

sole

discretion

of

the

respective

company’s

Board

of

Directors

and

there

can

be

no

assurance

of

the

amount

or

timing

of

any

future

dividends.

New

Media’s

predecessor,

GateHouse Media, Inc., recently emerged from bankruptcy, and there can be no

assurance that it will be able to pay dividends. (3)

The spin-off of Newcastle’s media assets into New Media has been approved

by Newcastle’s Board of Directors and is expected to be completed with the distribution of shares of common stock of New

Media (NYSE: NEWM) on or about February 13, 2014.

NCT’s

market

cap

was

$8

million

in

2009;

combined

market

cap

of

NCT

&

NRZ

is

currently

$3.5

billion

(1)

Senior Housing, CDOs, Other Debt

Opportunistic REIT with Healthcare Focus

Spun out from NCT in May 2013 Excess MSRs, Servicer Advances, RMBS,

Residential Mortgage Loans Current Market Cap: $1.5 billion

(1)

Residential-focused Mortgage REIT Expected spin-off in February 2014 Local Newspapers, Local Directories, Digital

Marketing Services (Propel)

Dividend-Paying Local Media Owner

(1)

(2)

(3)

(2)

(2)

Current Market Cap: $2.0 billion

|

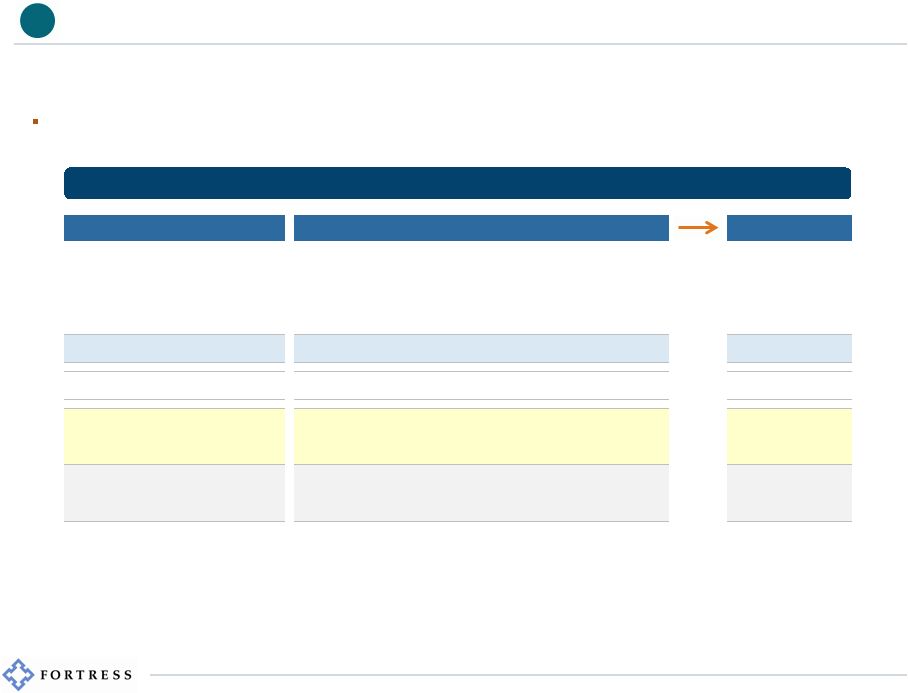

10

Meaningful Potential DE Upside from Growing Perm. Equity Platform

Total permanent equity capital of $3.2

billion as of September 30, 2013 (1)

There

can

be

no

assurance

that

Fortress

will

achieve

any

given

target

return.

Target

returns

are

subject

to

a

number

of

trends

and

uncertainties,

many

of

which

are

beyond

our

control,

that

could

cause

actual results to differ materially.

(2)

The

hypothetical

assumptions

for

AUM,

management

fees,

incentive

income,

net

returns

and

operating

margins

are

presented

solely

for

illustrative

purposes

and

actual

results

could

differ

materially.

(3)

Assumes

1.5%

management

fee

rate

on

incremental

permanent

equity

capital.

(4)

Assumes 25% incentive fee rate over 10% hurdle. Net returns reflect performance data

after taking into account management fees and expenses. (5)

Assumes 10% appreciation on option grants of 10% of specified AUM. Assumes Fortress

exercises its in-the-money Castle options and sells the resulting shares.

(6)

Assumes 70% operating margin.

(7)

Fund

Management

Distributable

Earnings

is

a

non-GAAP

financial

measure

described

in

Fortress’s

third

quarter

2013

earnings

release.

The

release

is

available

in

the

“Public

Shareholders

–

News”

section

of Fortress’s website, www.fortress.com. For a reconciliation of GAAP Net

Income to Fund Management Distributable Earnings please see Appendix slide #2.

(8)

Based on 495 million dividend paying shares outstanding as of September 30,

2013. Assumed Incremental AUM

$1,000

$2,000

$3,000

$10,000

Assumed Revenue

Management

Fees

(3)

$15

$30

$45

$150

$19

$38

$56

$188

Options

(5)

$10

$20

$30

$100

Total Revenue

$44

$88

$131

$438

Assumed

Expenses

(6)

($13)

($26)

($39)

($131)

Fund Mgmt DE

(7)

$31

$61

$92

$306

Fund Mgmt DE/share

(8)

$0.06

$0.12

$0.19

$0.62

Fund Mgmt DE at 15.0% net return

$26

$53

$79

$263

Fund Mgmt DE at 20.0% net return

$35

$70

$105

$350

Hypothetical

Permanent

Equity

Capital

Impact

to

Fortress

Earnings

(millions)

(2)

1

Every $1 billion of incremental permanent equity capital could potentially generate annual

distributable earnings of $26-35 million at a 15-20% target net investment return

(1)

Incentive

Income,

17.5%

net

return

(4) |

11

Recently launched new affiliated manager platform to expand Fortress’s footprint

in the liquid hedge fund investment space

Fortress to take a minority, non-control economic interest in high

potential start-up and established hedge fund managers

Funds will be able to leverage Fortress’s existing

technology, infrastructure and investor relationships Typical

platform participant will pay fee to Fortress for back-office support and capital raising capabilities

Liquid Markets: Scalability of New Affiliated Manager Platform

Fortress

Asia

Macro

Fund

(“FAMF”)

to

become

anchor

strategy

for

new

growth

platform

(1)

Asia Macro Funds have $1.8 billion of AUM

(2)

FY 2013 net returns of 17.1%

CIO Adam Levinson to remain as Graticule CIO and is

expected to join FIG Board of Directors

Fortress will retain perpetual minority interest in

Graticule, including economics generated by FAMF

and future Graticule funds

Potential Platform Growth

Fortress Asia Macro business will be rebranded

as Graticule Asset

Management Asia (“Graticule”) (1)

In January 2014, Fortress announced the launch of a new affiliated manager platform

pursuant to which Fortress takes a non-control economic interest in a fund manager and earns fees for

infrastructure, technology and related services, with Fortress Asia Macro Fund

(“FAMF”) as the first fund to join the platform. (2)

Combined

AUM

for

Fortress

Asia

Macro

Ltd,

Fortress

Asia

Macro

LP

and

Fortress

Asia

Macro

Managed

Accounts

as

of

September

30,

2013.

FAMF / Graticule

Multi-Manager / Multi-Strat

Global L/S Equity

Fixed-Income Relative Value

Anchor Strategy

Potential New Strategies

Intend to add one or

two managers each

year

Focused on smaller

managers ($25mm –

500mm in AUM)

1 |

12

Logan Circle’s AUM has more than doubled to $23.6 billion since acquisition in

2010 All Logan

Circle

fixed

income

strategies

currently

in

the

market

raising

new

capital

Recently launched new growth equities business; team that previously

managed $20 billion currently raising capital for

four new equity strategies with substantially higher fee rates

(60bps) Logan Circle: Focus on Organic Growth and Strategic

Expansion Hypothetical Annual Impact to DE from Assumed Logan

Circle AUM Growth (1)

Established, highly scalable global platform with potential to

generate substantial fee earnings (1)

The hypothetical assumptions for AUM growth, management fees, and operating margins

are presented solely for illustrative purposes and actual results could differ materially.

(2)

Fund

Management

Distributable

Earnings

is

a

non-GAAP

financial

measure

described

in

Fortress’s

third

quarter

2013

earnings

release.

The

release

is

available

in

the

“Public

Shareholders

–

News”

section of Fortress’s website, www.fortress.com. For a reconciliation of GAAP

Net Income to Fund Management Distributable Earnings please see Appendix slide #2.

(3)

Based on 495 million dividend paying shares outstanding as of September 30,

2013. CORE FIXED INCOME

Assumed AUM

(millions)

$30,000

$40,000

$50,000

Assumed Mgmt Fee Rate (bps)

15

16

17

Gross Annual Mgmt Fees

$45

$64

$85

Assumed Operating Margin

20%

30%

40%

Fund Mgmt DE

(2)

$9

$19

$34

Fund Mgmt DE/share

(3)

$0.02

$0.04

$0.07

NEW GROWTH EQUITIES

Assumed AUM

(millions)

$5,000

$10,000

$20,000

Assumed Mgmt Fee Rate (bps)

60

60

60

Gross Annual Mgmt Fees

$30

$60

$120

Assumed Operating Margin

20%

30%

40%

Fund Mgmt DE

(2)

$6

$18

$48

Fund Mgmt DE/share

(3)

$0.01

$0.04

$0.10

1 |

Strong Investment Performance is

the Cornerstone of Growth &

Value Creation

13

2 |

14

Investment Performance Snapshot

For additional investment performance disclosure please see Appendix slide #1.

(1)

As of September 30, 2013.

Fortress Macro Funds FY 2013 net returns of

14.1% Fortress Asia Macro

Funds FY 2013 net returns of 17.1%

Fund performance drives new capital formation, higher incentive income

and earnings growth DBSO

LP

and

DBSO

Ltd

FY

2013

net

returns

of

18.4%

and

15.6%,

respectively

FCO,

FCO

II

and

FJOF

annualized

ITD

net

returns

of

25.9%,

18.4%

and

20.6%,

respectively

(1)

PE

Fund

YTD

2013

NAV

appreciation

of

17.2%

(1)

Over

$6

billion

of

value

created

since

the

beginning

of

2012

(1)

13

of

16

LCP

fixed

income

strategies

outperformed

respective

benchmarks

YTD

in

2013

(1)

All

16

LCP

fixed

income

strategies

have

outperformed

respective

benchmarks

since

inception

(1)

2

Credit

Private Equity

Liquid Markets

Logan Circle

Strong

YTD

investment

performance

has

led

to

$357

million

of

incentive

income

in

the

first

nine

months

of

2013,

a

28%

increase

compared

to

full

year

2012 |

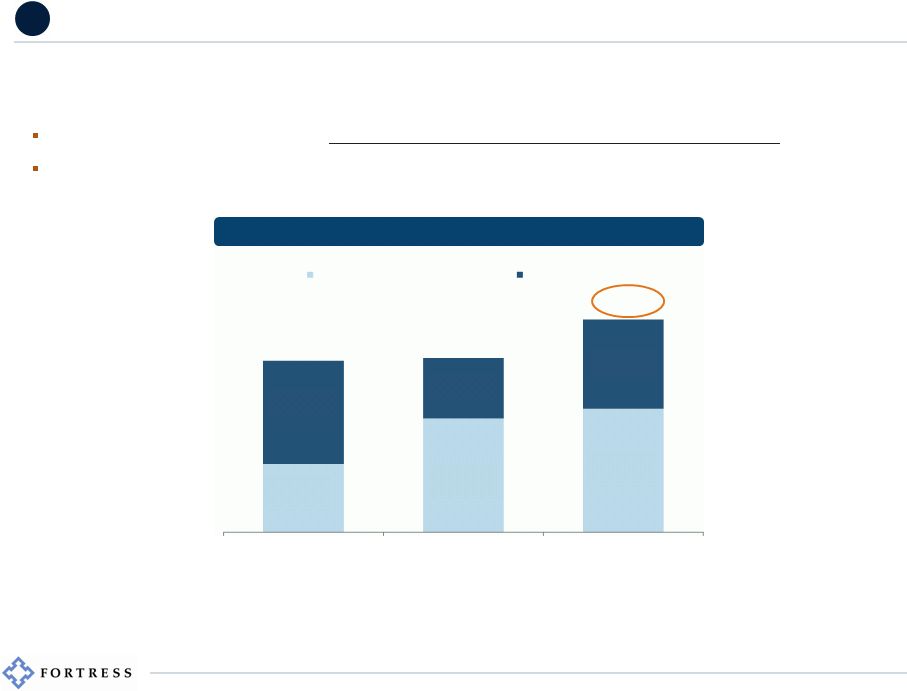

15

Performance Drives...Substantial Embedded Value Yet to Impact DE

$807

million,

or

$1.63

per

share

(1)

,

of

gross

unrecognized

incentive

income

$706

million,

or

$1.43

per

share

(1)

,

of

gross

unrecognized

incentive

income

from

Credit

Funds

$90

million

in

gross

unrecognized

incentive

income

from

in-the-money

options

for

PE

Castles

(2)

(1)

Based on 495 million dividend paying shares outstanding as of September 30,

2013. (2)

Unrecognized Incentive Income for Private Equity Castles includes incentive income

that would have been recorded in Distributable Earnings if Fortress had exercised all of its in-the-money Newcastle,

New Residential and Eurocastle options and sold all of the resulting shares at their

September 30, 2013 closing price. (3)

The Incentive Eligible NAV Above Incentive Threshold presented for Hedge Funds

excludes sidepocket investments. The Incentive Eligible NAV Above Incentive Income Threshold presented for Private

Equity Funds and Credit Private Equity Funds represents total fund NAV. Includes

$1.2 billion of Private Equity Castle equity eligible for incentive as of September 30, 2013.

(4)

Unrecognized Incentive Income presented above includes the impact of sidepocket

investments on Hedge Funds. Unrecognized Incentive Income for Private Equity Funds, Credit Private Equity Funds

and

Hedge

Fund

sidepocket

and

redeeming

capital

account

(RCA)

investments

has

not

been

recognized

in

Distributable

Earnings

and

will

be

recognized

when

realized;

Undistributed

Incentive

Income

for

other Hedge Fund investments was recognized in Distributable Earnings when earned.

Gross Unrecognized

Incentive Income

(4)

(millions)

Incentive Eligible

NAV Above Incentive

Threshold

(3)

Gross Unrecognized

Incentive Income

(4)

Credit PE Funds

$8,247

$612

Credit Hedge Funds

$4,794

$94

PE Funds

$737

$5

PE Castles

$1,196

$90

(2)

Liquid Hedge Funds

$3,831

$6

Total

$18,805

$807

Incentive Eligible NAV

Above Incentive Threshold

(3)

(billions)

(millions)

$16.3

$18.8

YE2012

3Q2013

$649

$807

YE2012

3Q2013

2 |

16

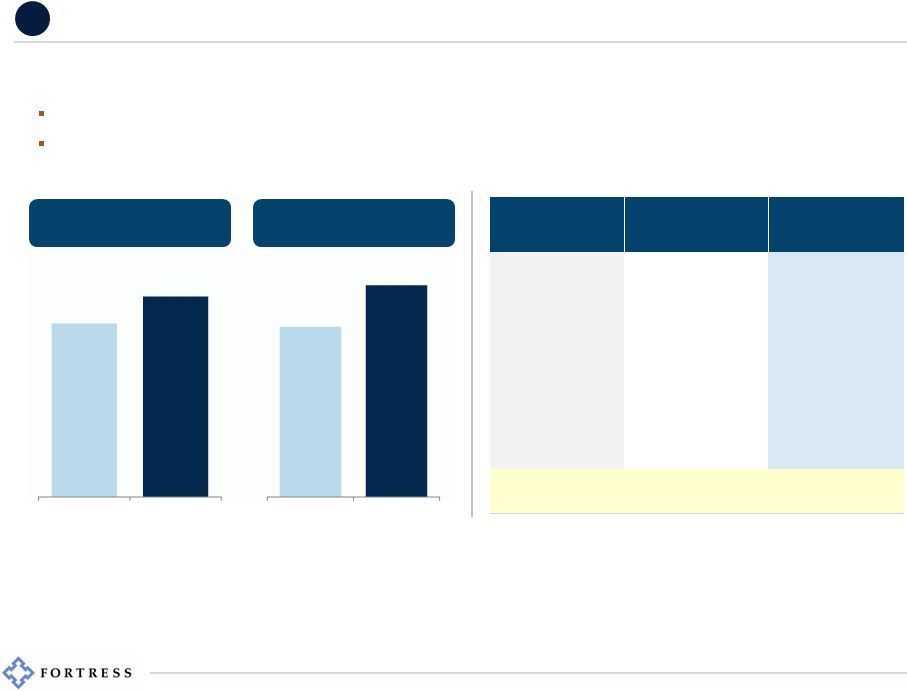

Performance Drives...Significant Credit Incentive Income

(1)

Annualized five-year net returns represent management’s unaudited return

estimates from January 1, 2009 through December 31, 2013. 2

Credit Hedge and Credit PE Fund performance has resulted in substantial recognized and

unrecognized incentive income

Based

on

annualized

YTD

2013

results,

Credit

business

on

pace

for

record

full

year

of

incentive

income

Annualized

five-year

net

returns

of

19.3%

an

20.3%

for

DBSO

LP

and

DBSO

Ltd,

respectively

(1)

Gross Recognized Credit Incentive Income

(millions) $196

$199

$243

$78

$130

$141

$118

$69

$102

FY 2011

FY 2012

YTD 2013

Credit Hedge Funds

Credit PE Funds |

17

Performance Drives...Carry Potential in Main PE Funds

2

Legacy

PE

funds

have

potential

to

generate

substantial

fees

over

next

three

to

five

years

$11.4 billion of value created since trough in 1Q 2009

Completed IPO of Springleaf (NYSE: LEAF) in 4Q 2013 at $17 per share,

representing a 10x multiple of invested capital (1)

For additional investment performance disclosure please see Appendix slide #1.

(2)

Multiple

equals

current

NAV

plus

inception

to

date

distributions,

divided

by

the

lesser

of

capital

committed

or

equity

invested.

For

purposes

of

calculating

the

gross

multiple,

equity

invested

excludes

capital

called

for

management

fees

and

other

expenses.

The

inclusion

of

such

amounts

would

reduce

the

gross

multiple.

Gross

multiple

is

not

an

accurate

indicator

of

the

Company’s

proximity

to

incentive income thresholds and is different from the statistic which would be

computed based on the Company’s periodic 34 Act reporting, which reports net amounts.

(3)

Florida includes Florida East Coast Railway and Flagler.

(4)

Includes Fund III Co, Fund IV Co, Fund V Co, FHIF, FECI, FRIC, FRID, FICO,

GAGACQ-Co and FFPF. (5)

Includes MSR Funds I & II and WWTAI (now FTAI).

PE Fund (vintage)

Current

Fund NAV

YTD

2013 Current Gross

NAV Appreciation

(1)

Multiple

(2)

Select Investments

Fund

II

(2002)

$0.1bn

7.8%

1.8x

GAGFAH*

Fund

III

(2004)

$2.8bn

45.5%

1.7x

Nationstar*, GAGFAH*

Fund

IV

(2006)

$4.4bn

23.7%

1.5x

Nationstar*, Florida

(3)

, Holiday

Fund

V

(2007)

$4.4bn

14.6%

1.3x

Florida

(3)

, CW Financial, Springleaf*, Penn Gaming*

Total Main Funds

$11.7bn

24.4%

1.6x

Co-investments

(4)

$5.6bn

5.0%

1.1x

Florida

(3)

, Holiday

Sector Funds

(5)

$0.6bn

13.0%

1.1x

MSRs, Transportation & Infrastructure Assets

Total PE Funds

$17.9bn

17.2%

1.4x

*Publicly traded company |

2

18

(1)

Represents Fortress Macro Onshore Fund LP, Fortress Macro Fund Ltd, Fortress Macro

MA1, Fortress Redwood Fund Ltd , Fortress Macro managed accounts, Drawbridge Global Macro Fund LP and

Drawbridge Global Macro Intermediate Fund LP.

(2)

Net returns are for Fortress Macro Fund Ltd only and exclude certain other funds,

which may have returns that are materially lower than those presented above. FY 2013 performance data are based on

management’s

unaudited

return

estimates

for

performance

from

January

1,

2013

to

December

31,

2013.

(3)

The incentive income figures presented above are gross of profit-sharing

expenses. Macro Fund

(1)

Incentive Income

(3)

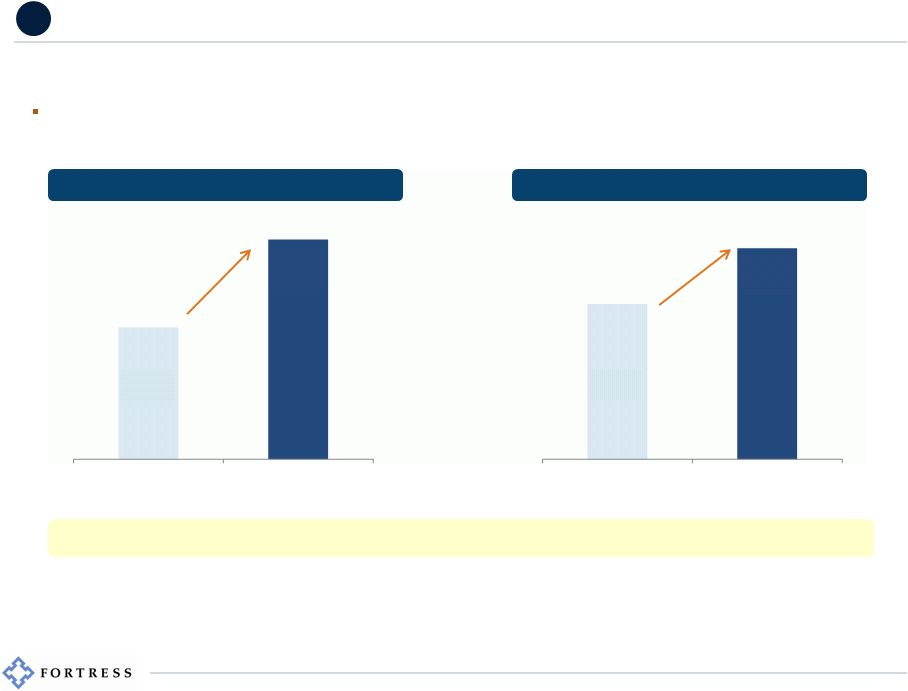

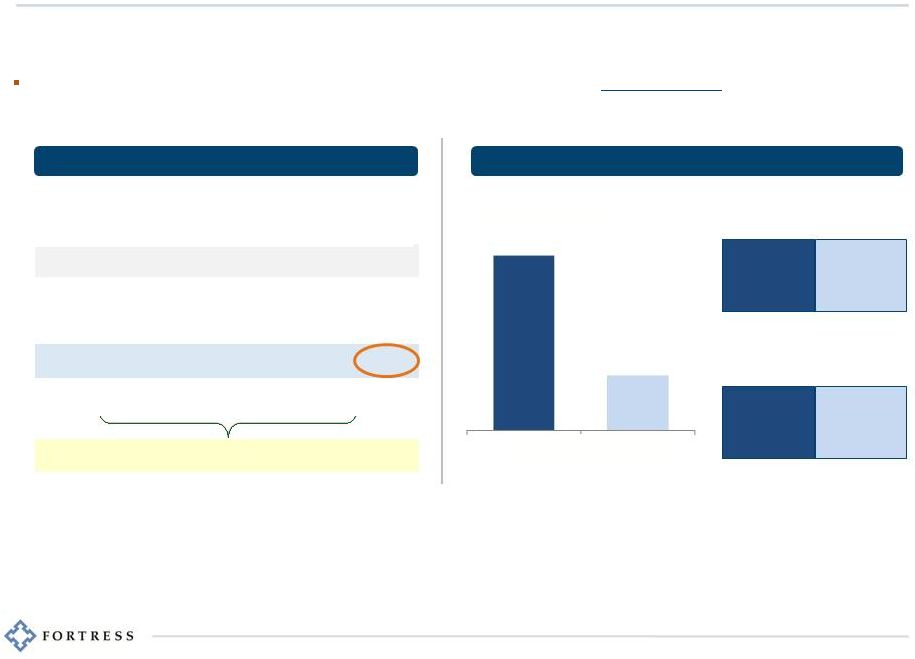

Performance Drives...Macro Fund Flows & Incentive Income

Macro Fund

(1)

Capital Raised

+58%

+36%

Continued

strong

Macro

Fund

(1)

performance

can

substantially

alter

earnings

dynamics

(billions)

(millions)

Macro

Hedge

Fund

(1)

performance

can

drive

meaningful

AUM

and

earnings

growth

Fortress

Macro

Fund

net

returns

of

14.1%

for

FY

2013

(2)

$0.6

FY 2012

YTD 2013

$1.0

$53

$72

FY 2012

YTD 2013 |

Substantial & Underappreciated

Value on Balance Sheet

19

3 |

20

Balance Sheet in Strongest Position Since IPO...

3

Net Cash & Investments increased 37% YoY to $3.18 per share

$603

million of embedded gains that would be recognized in earnings if

investments were liquidated at current values $311

million

of

cash

&

cash

equivalents

and

no

outstanding

debt

obligations

as

of

September

30,

2013

Net Cash & Investments

(1)

(millions)

Outstanding Debt Obligations

(millions)

(per share)

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

$0

$250

$500

$750

$1,000

$1,250

$1,500

$1,750

4Q08

4Q09

4Q10

4Q11

4Q12

3Q13

Net Cash & Investments

Per Share

$0

$100

$200

$300

$400

$500

$600

$700

$800

4Q08

4Q09

4Q10

4Q11

4Q12

3Q13

Total Debt

(1)

Net Cash & Investments, which is a non-GAAP financial measure, means cash & cash

equivalents plus investments less debt outstanding, as described in Fortress’s third quarter 2013

earnings release. The release is available in the “Public Shareholders – News” section

of Fortress’s website, www.fortress.com. For a reconciliation of GAAP Book Value Per Share to Net

Cash & Investments Per Share please see Appendix slide #6. |

21

...With Considerable Upside Potential

(1)

GAGFAH, Newcastle, New Residential and Eurocastle shares.

(2)

Brookdale, Eurocastle, GAGFAH, Gatehouse, Walker & Dunlop, Penn Gaming and

Nationstar shares. (3)

Investments in GAGACQ, FRID, FRIC, FHIF and FECI.

(4)

Hedge Funds include Credit Hedge Fund and Liquid Hedge Fund Investments and related

sidepockets. (5)

Current Assets includes cash and direct investments in public stock.

Balance Sheet

As of Sept. 30, 2013

($ millions)

Carrying

Value

% of

Total

Cash & Cash Equivalents

311

20%

Direct Public Stock

(1)

80

5%

Cash & Direct Equity Investments

391

25%

Public Stock of Portfolio Co’s

(2)

161

10%

Private

Co-Investment

in

Portfolio

Co’s

(3)

430

27%

Direct Investment in PE Funds

216

14%

Direct Investment in Credit PE Funds

145

9%

Private Equity Fund Investments

952

60%

Liquid Capital

120

8%

Sidepocket Investments

104

6%

Hedge Fund Investments

(4)

224

14%

Other Direct Investments

8

1%

Total Cash & Investment Assets

1,575

100%

Potential for increased distributions from balance sheet realization events

Nearly 80% of balance sheet assets in cash, direct equity or 2007 or

earlier vintage funds $807 million of private equity fund

investments with meaningful upside potential Total Cash &

Investments by Vintage or Type (millions) 3

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

Current

Assets

Pre 2006

2006

2007

Post 2007

Hedge Funds

Total

(5) |

22

Summary |

23

Strong YTD 2013 Results With Significant Upside Potential

2007

2008

2009

2010

2011

2012

LTM

3Q2013

(2)

Annual

Average

(3)

Annual

High

(3)

Credit

61

35

44

168

138

126

177

95

168

PE & Castles

312

81

137

145

118

115

123

151

312

(4)

Liquid

161

102

28

64

14

45

108

69

161

Logan Circle

n/a

n/a

n/a

(15)

(17)

(10)

(10)

(14)

(10)

Total

(5)

524

216

208

358

253

277

398

301

631

Per share

(6)

$1.24

$0.48

$0.42

$0.69

$0.48

$0.52

$0.80

$0.61

$1.28

($ millions)

Fund Management Distributable Earnings –

By Business

(1)

Growth opportunities across every business can meaningfully alter earnings

dynamics New fund launches, growth of existing platforms and

strategic additions can drive higher management fee revenues

Hedge

fund

performance

and

increased

PE

realization

activity

can

drive

higher

incentive

income

Balance

sheet

gains

and

dispositions

can

drive

higher

investment

income

(1)

Fund

Management

Distributable

Earnings

is

a

non-GAAP

financial

measure

described

in

Fortress’s

third

quarter

2013

earnings

release.

The

release

is

available

in

the

“Public

Shareholders

–

News”

section of Fortress’s website, www.fortress.com. For a reconciliation of GAAP

Net Income to Fund Management Distributable Earnings please see Appendix slide #2.

(2)

Reflects the twelve month period from October 1, 2012 through September 30,

2013. (3)

Does not include LTM 3Q2013 results.

(4)

Fortress

has

reserved

$57

million

of

net

clawback

liabilities

in

respect

of

DE

previously

distributed.

(5)

Total Fund Management DE for 2007, 2008, 2009 and 2010 includes unallocated expenses

of $9 million, $2 million, $1 million and $4 million, respectively. (6)

Based

on

reported

weighted

average

dividend

paying

shares

outstanding

in

applicable

period

for

2007,

2008,

2009,

2010,

2011

and

2012.

Based

on

495

million

dividend

paying

shares

outstanding

as

of

September 30, 2013 for LTM 3Q2013, Annual Average and Annual High.

|

24

Substantial

Cash

Generation

Supports

Shareholder

Distributions

(1)

Increased base quarterly dividend by 20% to $0.06 per share in 4Q

2012 (1)

Any

dividend

declarations

or

share

buybacks

may

be

subject

to

approval

by

FIG’s

Board

of

Directors

and

there

can

be

no

assurance

of

the

amount

or

timing

of

any

future

dividends

or

share

buybacks.

(2)

Repurchased

51.3

million

shares

in

4Q

2012

for

a

total

purchase

price

of

$180

million.

534

million

shares

outstanding

at

time

of

purchase.

(3)

Represents

the

period

from

4Q

2011

through

3Q

2013.

Shareholder

Distributions

Over

Last

Eight

Quarters

(per

dividend

paying

share)

(3)

(2)

$0.00

$0.25

$0.50

$0.75

$1.00

$1.25

Base Quarterly Distributions

Share Repurchase

Total

Have distributed nearly 70% of post-tax DE over last eight quarters in the form of base quarterly

dividends and 4Q 2012 share repurchase

(2) |

25

Significant Discount to Traditionals: Room For Multiple Expansion

(1)

“Traditional

Asset

Managers”

defined

as

S&P

500

Asset

Management

and

Custody

Trust

Banks

Sub

Industry

Index

from

Bloomberg.

(2)

FIG stock price as of February 7, 2014.

(3)

Net Cash & Investments, which is a non-GAAP financial measure, means cash

& cash equivalents plus investments less debt outstanding, as described in Fortress’s third quarter 2013 earnings

release.

The

release

is

available

in

the

“Public

Shareholders

–

News”

section

of

Fortress’s

website,

www.fortress.com.

For

a

reconciliation

of

GAAP

Book

Value

Per

Share

to

Net

Cash

&

Investments

Per Share please see Appendix slide #6.

(4)

2013 consensus earnings estimates per Bloomberg.

(5)

Trailing two-year CAGR of DEPS for FIG and EPS for Traditional Asset Managers.

Based on annualized YTD 2013 results for FIG and FY 2013 results for Traditional Asset Managers.

(6)

Based on FIG’s stock price as of February 7, 2014 and annualized YTD 2013

dividend with no consideration given for potential 4Q top-up dividend. Annualized dividend yield for Traditional Asset

Managers sourced from Bloomberg.

(7)

Based on YTD 2013 operating margin for FIG. FY 2013 Traditional Asset Manager

operating margin sourced from Bloomberg. Earnings

Growth

(5)

Dividend

Yield

(6)

Operating

Margin

(7)

3.0%

FIG

1.8%

Trad. Asset

Managers

(1)

39%

FIG

27%

Trad. Asset

Managers

(1)

(1)

Price / Earnings Multiple Calculation (per share)

Superior Valuation Metrics to Traditionals

Current

FIG

Stock

Price

(2)

$7.89

Less:

Net

Cash

&

Investments

(3)

$3.18

Stock Price ex. B/S Value

$4.71

2013 Consensus DEPS

(4)

$0.75

Price / Earnings Ratio

10.5x

Price / Earnings Ratio (ex. B/S Value)

6.3x

Traditional Asset Manager Price / Earnings Ratio

(1)

16.1x

Implies FIG is trading at a ~60% discount to Traditionals

32%

10%

FIG

Trad. Asset

Managers

Fortress

trades

at

a

~60%

discount

to

traditional

asset

managers

(1)

(net

of

balance

sheet

value)

despite superior earnings growth and operating fundamentals

At

a

traditional

asset

manager

multiple

of

16x

earnings,

FIG

would

trade

at

over

$12.00

per

share

–

with

no

credit

for

embedded value and future growth |

Appendix

26 |

27

Appendix Slide #1

Liquid Hedge Funds

Net returns are for Fortress Macro Fund Ltd and Fortress Asia Macro Fund Ltd only

and exclude certain other funds, which may have returns that are materially

lower than those presented above. Net returns reflect performance data after taking into account management fees and expenses

borne

by

such

funds

and

incentive

allocations,

as

applicable.

FY

2012

data

reflect

audited

returns,

while

FY

2013

performance

data

are

based

on

management’s

unaudited

return

estimates

for

performance

from

January

1,

2013

to

December

31,

2013.

Such

data

may

change

upon

completion

of

the month-end and year-end valuation procedures, and any such changes could

be material. Credit Hedge Funds

Net

returns

are

for

Drawbridge

Special

Opportunities

Fund

LP

and

Drawbridge

Special

Opportunities

Fund

Ltd

only

and

exclude

certain

other

funds,

which may have returns that are materially lower than those presented above. Net

returns reflect performance data after taking into account management

fees

and

expenses

borne

by

the

above

referenced

funds,

and

incentive

allocations,

as

applicable.

Performance

data

for

FY

2013

are

based

on

management’s

unaudited

estimates,

as

of

the

date

hereof,

for

performance

of

the

above

referenced

funds

from

January

1,

2013

to

December 31, 2013. Such data may change upon completion of the month-end and

year-end valuation procedures, and any such changes could be

material

Private Equity Funds

Percentages exclude certain other funds included in the Private Equity segment,

which, if included, could materially reduce the percentages presented.

Percentages represent the aggregate performance of multiple funds rather than any single fund. For additional detail regarding historical

performance

of

individual

funds,

which

presents

fund

performance

as

internal

rates

of

return,

please

see

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operation”

in

our

quarterly

report

on

Form

10-Q

for

the

period

ending

September

30,

2013.

FY

2012

data

reflect

audited returns, while YTD 2013 data reflects unaudited return estimates through

September 30, 2013. Such data may change upon completion of the

month-end and year-end valuation procedures, and any such changes could be material.

Credit PE Funds

Net returns are for Fortress Credit Opportunities Funds I, Credit Opportunities

Fund II and Japan Opportunity Fund only and exclude certain other funds,

which may have returns that are materially lower than those presented above. Net returns represent net annualized internal rates of return to

limited partners after management fees and incentive allocations, and are computed

on an inception-to-date basis consistent with industry standards.

Annualized inception-to-date data reflects management’s unaudited return estimates through September 30, 2013. Such data may

change upon completion of the month-end and year-end valuation procedures,

and any such changes could be material. |

2010

2011

2012

GAAP Net Income (Loss)

(782)

$

(1,117)

$

219

$

Principals' and Others' Interests in (Income) Losses of Consolidated

Subsidiaries 497

685

(141)

GAAP Net Income (Loss) Attributable to Class A Shareholders

(285)

$

(432)

$

78

$

Private Equity incentive income

38

44

(2)

Hedge Fund incentive income

3

-

-

Reserve for clawback

-

(5)

8

Distributions of earnings from equity

method investees 15

11

6

Losses (earnings) from equity method

investees (87)

(34)

(142)

Losses (gains) on options

(2)

5

(6)

Losses (gains) on other Investments

(1)

23

(41)

Impairment of investments

(5)

(4)

(1)

Adjust income from the receipt of

options -

(13)

(22)

Mark-to-market of contingent consideration in

business combination (1)

(3)

-

Amortization of intangible assets

and impairment of goodwill 1

22

-

Employee, Principal and director

compensation, primarily equity based 218

235

219

Principals' forfeiture agreement expense (expired in 2011)

952

1,051

-

Adjust non-controlling

interests related to Fortress Operating Group units (507)

(691)

133

Tax receivable agreement liability reduction

(22)

(3)

9

Taxes

55

36

39

Pre-tax Distributable Earnings

372

$

242

$

278

$

Investment Loss (income)

(34)

(8)

(16)

Interest Expense

20

19

15

Fund Management DE

358

$

253

$

277

$

GAAP Revenues

950

$

859

$

970

$

Adjust management fees

2

(1)

-

Adjust incentive income

44

41

5

Adjust income from the receipt of

options -

(13)

(22)

Other revenues

(156)

(179)

(196)

Segment Revenues

840

$

707

$

757

$

Twelve Months Ended December 31,

28

Appendix Slide #2

Reconciliation of GAAP Net Income (Loss) to Pre-tax Distributable Earnings and

Fund Management DE (dollars in millions) |

September 30,

2012

June 30,

2013

September 30,

2013

GAAP Net Income (Loss)

7

$

(2)

$

101

$

166

$

Principals' and Others' Interests in (Income) Losses of Consolidated

Subsidiaries (6)

-

(59)

(111)

GAAP Net Income (Loss) Attributable to Class A Shareholders

1

$

(2)

$

42

$

55

$

Private Equity incentive income

14

34

2

58

Hedge Fund incentive income

46

133

(6)

186

Reserve for clawback

-

-

1

3

Distributions of earnings from

equity method investees 2

5

3

12

Losses (earnings) from equity method

investees (48)

(24)

(57)

(117)

Losses (gains) on options

6

5

(3)

(27)

Losses (gains) on other Investments

(4)

(2)

4

(9)

Impairment of investments

(1)

(1)

-

(1)

Adjust income from the receipt of

options (9)

(10)

-

(36)

Amortization of intangible assets and impairment of

goodwill -

-

-

-

Employee, Principal and director

compensation, primarily equity based 49

13

6

34

Adjust non-controlling interests related to

Fortress Operating Group units 4

(4)

58

105

Tax receivable agreement liability reduction

-

-

-

8

Taxes

4

1

15

42

Pre-tax Distributable Earnings

64

$

148

$

65

$

313

$

Investment Loss (income)

(4)

(6)

(13)

(24)

Interest Expense

3

2

1

5

Fund Management DE

63

$

144

$

53

$

294

$

GAAP Revenues

181

$

223

$

232

$

699

$

Adjust management fees

-

-

-

-

Adjust incentive income

60

167

(3)

247

Adjust income from the receipt of options

(9)

(10)

-

(36)

Other revenues

(51)

(53)

(51)

(156)

Segment Revenues

181

$

327

$

178

$

754

$

Three Months Ended

Nine Months Ended

September 30,

2013

29

Appendix Slide #3

Reconciliation of GAAP Net Income (Loss) to Pre-tax Distributable Earnings and

Fund Management DE (dollars in millions) |

30

Appendix Slide #3A

‘‘Distributable earnings’’ is Fortress’s

supplemental measure of operating performance used by management in analyzing segment and overall

results. It reflects the value created which management considers

available for distribution during any period. As compared to generally accepted

accounting principles (‘‘GAAP’’) net income,

distributable earnings excludes the effects of unrealized gains (or losses) on illiquid investments,

reflects contingent revenue which has been received as income to the

extent it is not expected to be reversed, and disregards expenses which do

not require an outlay of assets, whether currently or on an accrued

basis. Distributable earnings is reflected on an unconsolidated and pre-tax

basis, and, therefore, the interests in consolidated subsidiaries

related to Fortress Operating Group units (held by the principals) and income tax

expense are added back in its calculation. Distributable

earnings is not a measure of cash generated by operations which is available for

distribution nor

should it be considered in isolation or as an alternative to cash

flow or net income in accordance with GAAP and it is not

necessarily indicative of liquidity or cash available to fund the

Company’s operations. For a complete discussion of distributable earnings and its

reconciliation to GAAP, as well as an explanation of the calculation

of distributable earnings impairment, see note 10 to the financial statements

included in the Company’s Quarterly Report on Form 10-Q for

the quarter ended September 30, 2013. Fortress’s management uses distributable earnings:

•

in its determination of periodic distributions to equity

holders;

•

in making operating decisions and assessing the performance of each

of the Company’s core businesses;

•

for planning purposes, including the preparation of annual operating

budgets; and

•

as a valuation measure in strategic analyses in connection with the

performance of its funds and the performance of its employees. Growing distributable earnings is a key component to the

Company’s business strategy and distributable earnings is the supplemental measure

used by management to evaluate the economic profitability of each of

the Company’s businesses and total operations. Therefore, Fortress believes

that it provides useful information to investors in evaluating its

operating performance. Fortress’s definition of distributable earnings is not based

on any definition contained in its amended and restated operating

agreement. “Fund management DE” is equal to pre-tax distributable

earnings excluding our direct investment-related results. It is comprised of “Segment

Revenues” net of “Segment Expenses” and

“Principal Performance Payments.” Fund management DE and its components are used by

management to analyze and measure the performance of our investment

management business on a stand-alone basis. Fortress defines segment

operating margin to be equal to fund management DE divided by segment

revenues. The Company believes that it is useful to provide investors

with the opportunity to review our investment management business

using the same metrics. Fund management DE and its components are

subject to the same limitations as pre-tax distributable

earnings, as described above. |

31

Appendix Slide #4

(1)

Includes both fully vested and nonvested restricted Class A shares.

(2)

Includes both fully vested and nonvested Fortress Operating Group RPUs.

Reconciliation of Weighted Average Class A Shares Outstanding (Used for Basic EPS) to

Weighted Average Dividend Paying Shares and Units Outstanding (Used for

DEPS) 2010

2011

2012

Weighted Average Class A Shares Outstanding (Used for Basic EPS)

165,446,404

186,662,670

214,399,422

Weighted average fully vested restricted Class A share units with dividend

equivalent rights (4,450,465)

(4,082,385)

(3,194,380)

Weighted average fully vested restricted Class A shares

(174,203)

(480,777)

(737,309)

Weighted Average Class A Shares Outstanding

160,821,736

182,099,508

210,467,733

Weighted average restricted Class A shares

(1)

339,533

522,365

749,007

Weighted average fully vested restricted Class A share units which are entitled to

dividend equivalent payments

4,450,465

4,082,385

3,194,380

Weighted average nonvested restricted Class A share units which are entitled to

dividend equivalent payments

19,695,924

13,994,757

6,609,155

Weighted average Fortress Operating Group units

302,123,167

304,832,761

299,559,853

Weighted average Fortress Operating Group RPUs

(2)

31,000,000

22,563,471

12,817,851

Weighted Average Class A Shares Outstanding (Used for DEPS)

518,430,825

528,095,247

533,397,979

Weighted average vested and nonvested restricted Class A share units which are not

entitled to dividend equivalent payments

26,436,872

23,439,170

18,419,024

Weighted Average Fully Diluted Shares and Units Outstanding (Used for Diluted

DEPS) 544,867,697

551,534,417

551,817,003

Twelve Months Ended December 31,

“Dividend paying shares and units” represents the number of

shares and units outstanding at the end of the period which were entitled to receive

dividends or related distributions. The Company believes it is useful

for investors in computing the aggregate amount of cash required to make a current

per share distribution of a given amount per share. It excludes

certain potentially dilutive equity instruments, primarily non-dividend paying restricted

Class A share units, and, therefore, is limited in its usefulness in

computing per share amounts. Accordingly, dividend paying shares and units should be

considered only as a supplement and not an alternative to GAAP

basic and diluted shares outstanding. The Company’s calculation of dividend paying

shares and units may be different from the calculation used by other

companies and, therefore, comparability may be limited. |

32

Appendix Slide #5

(1)

Includes both fully vested and nonvested restricted Class A shares.

(2)

Includes both fully vested and nonvested Fortress Operating Group RPUs.

Reconciliation of Weighted Average Class A Shares Outstanding (Used for Basic EPS) to

Weighted Average Dividend Paying Shares and Units Outstanding (Used for

DEPS) Weighted Average Class A Shares Outstanding (Used for Basic EPS)

239,404,587

220,641,776

234,750,585

212,297,285

Weighted average fully vested restricted Class A share units with dividend

equivalent rights

(982,225)

(2,519,869)

(2,821,011)

(4,068,945)

Weighted average fully vested restricted Class A shares

(952,016)

(828,211)

(909,641)

(706,787)

Weighted Average Class A Shares Outstanding

237,470,346

217,293,696

231,019,933

207,521,553

Weighted average restricted Class A shares

1

952,016

828,211

909,641

722,413

Weighted average fully vested restricted Class A share units which are entitled to

dividend equivalent payments

982,225

2,519,869

2,821,011

4,068,945

Weighted average nonvested restricted Class A share units which are entitled to

dividend equivalent payments

5,744,629

6,434,147

4,759,829

6,667,917

Weighted average Fortress Operating Group units

249,534,372

299,397,765

249,534,372

301,815,314

Weighted average Fortress Operating Group RPUs

2

-

10,333,334

3,255,189

13,652,069

Weighted Average Class A Shares Outstanding (Used for DEPS)

494,683,588

536,807,022

492,299,975

534,448,211

Weighted average vested and nonvested restricted Class A share units which are

not entitled to dividend equivalent payments

14,766,136

16,426,317

15,761,068

19,212,189

Weighted Average Fully Diluted Shares and Units Outstanding (Used for

Diluted DEPS)

509,449,724

553,233,339

508,061,043

553,660,400

Three Months Ended September 30,

Nine Months Ended September 30,

2013

2012

2013

2012

“Dividend paying shares and units” represents the number of

shares and units outstanding at the end of the period which were entitled to receive

dividends or related distributions. The Company believes it is useful

for investors in computing the aggregate amount of cash required to make a current

per share distribution of a given amount per share. It excludes

certain potentially dilutive equity instruments, primarily non-dividend paying restricted

Class A share units, and, therefore, is limited in its usefulness in

computing per share amounts. Accordingly, dividend paying shares and units should be

considered only as a supplement and not an alternative to GAAP

basic and diluted shares outstanding. The Company’s calculation of dividend paying

shares and units may be different from the calculation used by other

companies and, therefore, comparability may be limited. |

33

Appendix Slide #6

Reconciliation of GAAP Book Value Per Share to Net Cash and Investments Per

Share (dollars and shares in thousands)

GAAP

Book Value

Net Cash and

Investments

GAAP

Book Value

Net Cash and

Investments

GAAP

Book Value

Net Cash and

Investments

Cash and Cash equivalents

311,114

$

311,114

$

104,242

$

104,242

$

253,731

$

253,731

$

Investments

1,263,392

1,263,392

1,211,684

1,211,684

1,169,306

1,169,306

Investments in options¹

100,123

-

38,077

-

30,316

-

Due from Affilitates

165,801

-

280,557

-

289,889

-

Deferred Tax Asset

370,944

-

402,135

-

379,372

-

Other Assets

146,259

-

124,798

-

102,787

-

Assets

2,357,633

1,574,506

2,161,493

1,315,926

2,225,401

1,423,037

Debt Obligations Payable

-

$

-

$

149,453

$

149,453

$

180,528

$

180,528

$

Accrued Compensation and Benefits

305,361

-

146,911

-

222,719

-

Due to Affiliates

343,495

-

357,407

-

345,009

-

Deferred Incentive Income

287,182

-

231,846

-

245,957

-

Other Liabilities

99,850

-

59,226

-

81,193

-

Liabilities

1,035,888

-

944,843

149,453

1,075,406

180,528

Net

1,321,745

$

1,574,506

$

1,216,650

$

1,166,473

$

1,149,995

$

1,242,509

$

GAAP

Basic Shares

Dividend Paying

Shares and Units

GAAP

Basic Shares

Dividend Paying

Shares and Units

GAAP

Basic Shares

Dividend Paying

Shares and Units

Class A Shares

238,613

238,613

217,458

217,458

219,361

219,361

Restricted Class A Shares

956

956

828

828

828

828

Fortress Operating Group Units

249,535

249,535

249,535

249,535

298,724

298,724

Fully Vested Class A Shares - Dividend Paying

-

21

-

556

-

637

Nonvested Class A Shares - Dividend Paying

-

5,745

-

6,434

-

6,434

Fortress Operating Group RPUs

-

-

-

10,333

-

10,333

Shares Outstanding

489,104

494,870

467,821

485,144

518,913

536,317

Per Share

2.70

$

3.18

$

2.60

$

2.40

$

2.22

$

2.32

$

As of

December 31, 2012

As of

September 30, 2013

As of

September 30, 2012

Net cash and investments represents cash and cash equivalents plus investments less debt outstanding.

The Company believes that net cash and investments is a useful supplemental measure because it

provides investors with information regarding the Company’s net investment assets. Net cash and investments excludes certain assets

(investments in options, due from affiliates, deferred tax asset, other assets) and liabilities (due

to affiliates, accrued compensation and benefits, deferred incentive income and other

liabilities), its utility as a measure of financial position is limited. Accordingly, net cash and investments should be considered only as a supplement and not an

alternative to GAAP book value as a measure of the Company’s financial position. The

Company’s calculation of net cash and investments may be different from the calculation

used by other companies and, therefore, comparability may be limited.

(1)

The definition of net cash and investments has been modified to exclude investments in options. The

intrinsic value of options in equity method investees totaled $90 million at quarter end and is

included in our undistributed, unrecognized incentive income. This value represents incentive income that would have been recorded in

Distributable Earnings if Fortress had exercised all of its in-the-money Newcastle, New

Residential and Eurocastle options and sold all of the resulting shares at their September 30,

2013 closing price and differs from the fair value derived from option pricing models included in the table above. All prior periods have been recast to

reflect this change

|

Fortress Investment Group LLC

1345 Avenue of the Americas

New York, NY 10105

Contact:

Gordon Runté, Managing Director of Investor Relations and Corporate

Communications +1 212 798 6082

grunte@fortress.com |