Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MEXICO FUND INC | mf8k020714.htm |

The Mexico Fund, Inc.

Monthly Summary Report

January 2014

Prepared By:

Impulsora del Fondo México, sc

Investment Advisor to the Fund

The information presented in this report has been derived from the sources indicated. Neither The Mexico Fund, Inc. nor its Adviser, Impulsora del Fondo México, S.C., has independently verified or confirmed the information presented herein.

January 31, 2014

|

I. The Mexico Fund Data

|

End of Month

|

One Month Earlier

|

One Year Earlier

|

|

Total Net Assets1 (million US$)

|

$394.20

|

$408.99

|

$432.83

|

|

NAV per share

|

$26.82

|

$28.60

|

$32.34

|

|

Closing price NYSE2

|

$27.52

|

$29.30

|

$32.37

|

|

% Premium (Discount)

|

2.61%

|

2.45%

|

0.09%

|

|

Shares traded per month2 (composite figures)

|

1,427,987

|

1,411,805

|

1,321,900

|

|

Outstanding shares3

|

14,700,450

|

14,298,699

|

13,381,884

|

|

Shares on Short Interest Position2

|

34,718

|

17,916

|

163,613

|

|

Note:

|

Past performance is no guarantee of future results.

|

|

II. Performance4

|

1 Month

|

3 Months

|

6 Months

|

1 Year

|

|

Market price

|

-5.92%

|

-1.22%

|

-2.72%

|

-5.30%

|

|

NAV per share

|

-6.22%

|

-2.37%

|

-5.13%

|

-7.82%

|

|

Bolsa IPC Index

|

-6.62%

|

-3.56%

|

-4.58%

|

-14.10%

|

|

MSCI Mexico Index

|

-6.77%

|

-4.00%

|

-4.23%

|

-12.98%

|

|

2 Years

|

3 Years

|

5 Years

|

10 Years

|

|

|

Market price

|

42.20%

|

36.48%

|

245.60%

|

355.54%

|

|

NAV per share

|

25.46%

|

18.35%

|

184.62%

|

304.43%

|

|

Bolsa IPC Index

|

6.69%

|

0.32%

|

123.84%

|

257.74%

|

|

MSCI Mexico Index

|

8.98%

|

3.54%

|

122.07%

|

221.48%

|

|

III. The Mexican Stock Exchange

|

End of Month

|

One Month Earlier

|

One Year Earlier

|

|

Bolsa IPC Index5

|

40,879.75

|

42,727.09

|

45,278.06

|

|

Daily avg. of million shares traded

|

302.9

|

341.8

|

384.2

|

|

Valuation Ratios6: P/E

|

17.94

|

19.50

|

19.99

|

|

P/BV

|

2.94

|

3.08

|

3.32

|

|

EV/EBITDA

|

9.34

|

9.69

|

10.03

|

|

Market capitalization (billion US$)

|

$529.56

|

$569.28

|

$590.43

|

1 Source: Impulsora del Fondo México, S.C. (Impulsora). Impulsora utilizes the spot exchange rate, provided by Bloomberg, to calculate the Fund’s Net Asset Value per share (NAV). The NAV is published every business day on the Fund’s website www.themexicofund.com.

3 During January 2014, under its Equity Shelf Program and Distribution Reinvestment and Stock Purchase Plan, the Fund issued 363,756 and 37,995 shares, respectively, at market prices above NAV.

4 Sources: Lipper, Inc., Bloomberg and Impulsora del Fondo México, S.C. Periods ended on the last US business day of the date of this report. Performance figures for the Fund take into account the reinvestment of distributions; however, performance figures for the Bolsa Index and MSCI Mexico Index do not.

6 Source: Impulsora del Fondo México, S.C. Figures represent the average obtained from a representative sample of companies listed on the Bolsa. P/E refers to Price/Earnings, P/BV refers to Price/Book Value and EV/EBITDA refers to Enterprise Value/Earnings before Interests, Taxes, Depreciation and Amortization.

|

IV. The Mexican Economy.

|

|||

|

End of Month

|

One Month Earlier

|

One Year Earlier

|

|

|

Treasury Bills7

|

|||

|

One month

|

3.14%

|

3.29%

|

4.15%

|

|

Six months

|

3.55%

|

3.51%

|

4.44%

|

|

One year

|

3.65%

|

3.64%

|

4.59%

|

|

Long-term Bonds

|

|||

|

Three years

|

5.06%

|

4.38%

|

4.87%

|

|

Five years

|

5.27%

|

5.12%

|

4.90%

|

|

Ten years

|

6.46%

|

6.33%

|

5.47%

|

|

20 years

|

N.A.

|

7.18%

|

5.83%

|

|

30 years

|

7.59%

|

N.A.

|

N.A.

|

|

Currency Market8

|

|||

|

Exchange Rate (Ps/US$)

|

Ps. 13.3573

|

Ps. 13.0367

|

Ps. 12.7087

|

|

Month

|

Year to Date

|

Last 12

Months |

|

|

Inflation Rates on Previous Month

|

|||

|

Consumer Price Index9 (CPI)

|

0.57%

|

3.97%

|

3.97%

|

V. Economic Comments.

According to results of the monthly poll conducted during January 2014 by Mexico’s Central Bank (Banxico), economic analysts of the private sector estimate that Mexico’s gross domestic product (GDP) will increase 3.4% during 2014 and 3.9% during 2015. The inflation rate is estimated by analysts to be 4.1% for 2014 and 3.6% for 2015. The exchange rate of the peso against the dollar is expected to end 2014 at Ps. 12.84 and at Ps. 12.77 towards the end of 2015, while the interest rate for the 28-day Cetes (Treasury Bills) is estimated to be 3.5% and 4.1% for the same periods. The complete results of this and past polls are available at Banxico’s website, located at www.banxico.org.mx.

7 Monthly average of weekly auctions as published by Banco de México. N.A. means no auction for such instrument was scheduled for this month.

VI. Portfolio of Investments As of January 31, 2014 (Unaudited)

|

Percent of

|

|||||

|

Shares Held

|

COMMON STOCK - 92.26%

|

Value

|

Net Assets

|

||

|

Airports

|

|||||

|

700,000

|

Grupo Aeroportuario del Sureste, S.A.B. de C.V. Series B

|

$7,905,415

|

2.01%

|

||

|

1,500,000

|

Grupo Aeroportuario del Centro Norte, S.A.B. de C.V. Series B

|

4,654,758

|

1.18

|

||

|

12,560,173

|

3.19

|

||||

|

Beverages

|

|||||

|

1,500,000

|

Arca Continental, S.A.B. de C.V.

|

8,246,053

|

2.09

|

||

|

2,770,000

|

Fomento Económico Mexicano, S.A.B. de C.V. Series UBD

|

25,129,974

|

6.38

|

||

|

2,215,000

|

Organización Cultiba, S.A.B. de C.V. Series B

|

3,880,350

|

0.98

|

||

|

37,256,377

|

9.45

|

||||

|

Building Materials

|

|||||

|

29,000,000

|

Cemex, S.A.B. de C.V. Series CPO

|

35,888,241

|

9.10

|

||

|

Chemical Products

|

|||||

|

4,800,000

|

Alpek, S.A.B. de C.V. Series A

|

9,573,192

|

2.43

|

||

|

3,970,000

|

Mexichem, S.A.B. de C.V.

|

13,802,700

|

3.50

|

||

|

23,375,892

|

5.93

|

||||

|

Construction and Infrastructure

|

|||||

|

1,650,000

|

Empresas ICA, S.A.B. de C.V.

|

3,190,727

|

0.81

|

||

|

Consumer Products

|

|||||

|

7,000,000

|

Kimberly-Clark de México, S.A.B. de C.V. Series A

|

17,870,378

|

4.53

|

||

|

Energy

|

|||||

|

1,550,000

|

Infraestructura Energética Nova, S.A.B de C.V.

|

6,681,665

|

1.70

|

||

|

Financial Groups

|

|||||

|

1,200,000

|

Banregio Grupo Financiero, S.A.B. de C.V. Series O

|

6,575,281

|

1.67

|

||

|

4,000,000

|

Grupo Financiero Banorte, S.A.B. de C.V. Series O

|

25,280,558

|

6.41

|

||

|

4,500,000

|

Grupo Financiero Santander Mexicano, S.A.B de C.V. Series B

|

10,093,357

|

2.56

|

||

|

41,949,196

|

10.64

|

||||

|

Food

|

|||||

|

1,000,000

|

Gruma, S.A.B. de C.V. Series B

|

8,140,867

|

2.07

|

||

|

3,000,000

|

Grupo Bimbo, S.A.B. de C.V. Series A

|

7,979,906

|

2.02

|

||

|

1,000,000

|

Grupo Herdez, S.A.B. de C.V.

|

3,137,610

|

0.80

|

||

|

4,000,000

|

Grupo Lala, S.A.B. de C.V. Series B

|

8,534,659

|

2.16

|

||

|

27,793,042

|

7.05

|

||||

|

Holding Companies

|

|||||

|

9,500,000

|

Alfa, S.A.B. de C.V. Series A

|

26,813,054

|

6.80

|

||

|

1,620,000

|

Grupo Carso, S.A.B. de C.V. Series A1

|

8,471,547

|

2.15

|

||

|

700,000

|

Grupo KUO, S.A.B. de C.V. Series B

|

1,455,309

|

0.37

|

||

|

36,739,910

|

9.32

|

||||

|

Media

|

|||||

|

800,000

|

Grupo Televisa, S.A.B. Series CPO

|

4,660,822

|

1.18

|

||

|

Percent of

|

|||||

|

Shares Held

|

COMMON STOCK

|

Value

|

Net Assets

|

||

|

Mining

|

|||||

|

9,000,000

|

Grupo México, S.A.B. de C.V. Series B

|

29,168,320

|

7.40

|

||

|

Restaurants

|

|||||

|

2,500,000

|

Alsea, S.A.B. de C.V.

|

7,467,827

|

1.89

|

||

|

Retail

|

|||||

|

1,800,000

|

El Puerto de Liverpool, S.A.B. de C.V. Series C-1

|

18,909,211

|

4.80

|

||

|

2,740,000

|

Grupo Comercial Chedraui, S.A.B. de C.V. Series B

|

8,135,506

|

2.06

|

||

|

7,000,000

|

Wal-Mart de México, S.A.B. de C.V. Series V

|

16,769,856

|

4.26

|

||

|

43,814,573

|

11.12

|

||||

|

Telecommunications Services

|

|||||

|

33,000,000

|

América Móvil, S.A.B. de C.V. Series L

|

35,279,585

|

8.95

|

||

|

Total Common Stock

|

$363,696,728

|

92.26%

|

|

SHORT-TERM SECURITIES – 6.72%

|

|||||

|

Principal

Amount

|

|||||

|

Repurchase Agreements

|

|||||

|

$19,521,126

|

BBVA Bancomer, S.A., 3.44%, dated 01/31/14, due 02/04/14 repurchase price $19,528,587 collateralized by Bonos del Gobierno Federal.

|

19,521,126

|

4.95%

|

||

|

Time Deposits

|

|||||

|

$6,962,610

|

Comerica Bank, 0.01%, dated 01/31/14, due 02/03/14

|

6,962,610

|

1.77

|

||

|

Total Short-Term Securities

|

26,483,736

|

6.72

|

|||

|

Total Investments

|

390,180,464

|

98.98

|

|||

|

Other Assets in Excess of Liabilities

|

4,016,516

|

1.02

|

|||

|

Net Assets Equivalent to $26.82 per share on 14,700,450 shares of capital stock

outstanding

|

$394,196,980

|

100.00%

|

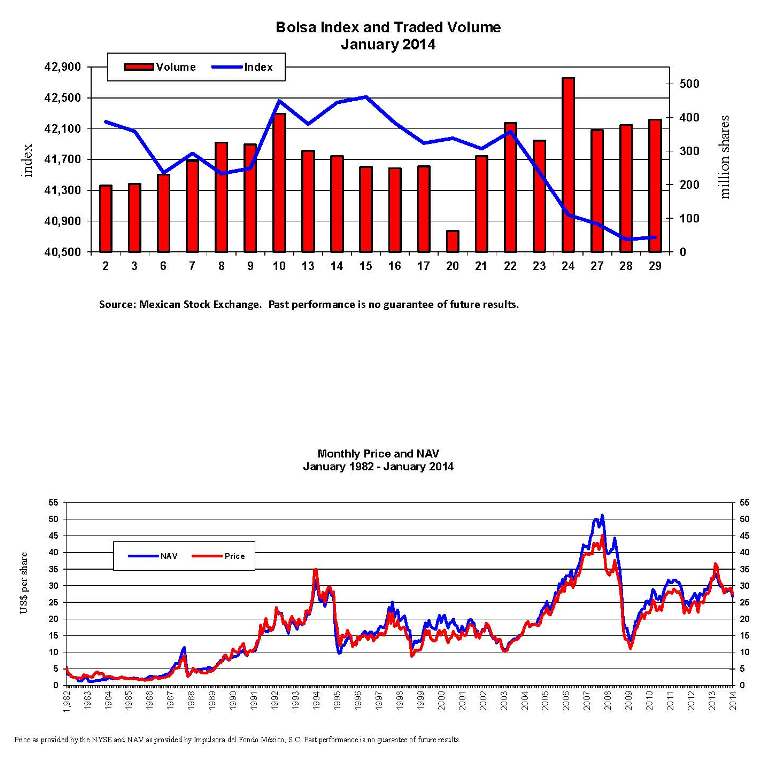

VII. The Mexico Fund, Inc. Charts

VII. The Mexico Fund, Inc. Charts (continued)