Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Vericel Corp | a14-5343_1ex23d1.htm |

| EX-5.1 - EX-5.1 - Vericel Corp | a14-5343_1ex5d1.htm |

|

As filed with the Securities and Exchange Commission on . |

|

Registration No. 333- |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

AASTROM BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

|

Michigan |

|

94-3096597 |

24 Frank Lloyd Wright Drive

Lobby K

Ann Arbor, Michigan 48105

(734) 418-4400

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dominick C. Colangelo

President and Chief Executive Officer

Aastrom Biosciences, Inc.

Lobby K

Ann Arbor, Michigan 48105

(734) 418-4400

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Mitchell S. Bloom

Danielle M. Lauzon

Goodwin Procter LLP

Exchange Place

Boston, Massachusetts 02109

Telephone: (617) 570-1000

Facsimile: (617) 523-1231

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement, as determined by the selling shareholder.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated |

|

Accelerated |

|

Non-accelerated filer o |

|

Smaller reporting |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

Proposed |

|

Proposed |

|

|

| |||

|

|

|

|

|

Maximum |

|

Maximum |

|

|

| |||

|

Title of Each Class of |

|

Amount to be |

|

Offering Price |

|

Aggregate |

|

Amount of |

| |||

|

Securities to be Registered(1) |

|

Registered (2) (3) |

|

Per Share (4) |

|

Offering Price (4) |

|

Registration Fee |

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock (no par value) |

|

1,748,063 |

|

$ |

3.47 |

|

$ |

6,065,779 |

|

$ |

781 |

|

(1) This Registration Statement also relates to the rights to purchase shares of Series A Junior Participating Cumulative Preferred Stock of the Registrant which are attached to all shares of Common Stock outstanding as of, and issued subsequent to, August 15, 2011, pursuant to the terms of the Registrant’s Shareholder Rights Agreement, dated August 11, 2011, as amended on March 9, 2012. Until the occurrence of certain prescribed events, the Rights are not exercisable, are evidenced by the certificates for the Common Stock and will be transferred with and only with such stock.

(2) The registrant is registering for resale, from time to time, up to 1,700,000 shares of its common stock that the registrant may sell and issue to Lincoln Park Capital Fund, LLC (or Lincoln Park) pursuant to a Purchase Agreement (or the Purchase Agreement), dated January 21, 2014, by and between Lincoln Park and the registrant relating to the sale of up to $15,000,000 in shares of common stock of the registrant. Pursuant to Rule 416(a) under the Securities Act of 1933, the registrant is also registering hereunder an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions.

(3) Represents (i) up to 1,700,000 shares that may be sold to Lincoln Park pursuant to the Purchase Agreement and (ii) up to 48,063 shares that will be issued to Lincoln Park as commitment shares.

(4) Estimated pursuant to Rule 457(c) solely for the purpose of calculating the registration fee, based upon the average of the high and low prices for the registrant’s common stock as reported on The NASDAQ Capital Market on February 4, 2014, a date within five business days of the filing of this registration statement, of $3.47.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

|

|

|

|

|

| ||

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED FEBRUARY 10, 2014 | ||||

|

|

|

|

|

| ||

1,748,063 Shares

of Common Stock

|

|

|

|

This prospectus relates to the resale, from time to time, of up to 1,748,063 shares of our common stock by Lincoln Park Capital Fund, LLC. Lincoln Park Capital Fund, LLC is sometimes referred to in this prospectus as “selling shareholder” or “Lincoln Park”. The shares of common stock being offered by Lincoln Park are issuable pursuant to a Purchase Agreement we entered into with Lincoln Park on January 21, 2014, which we refer to in this prospectus as the Purchase Agreement. See the section of this prospectus entitled “The Lincoln Park Transaction” for a description of the Purchase Agreement and the section entitled “Selling Shareholder” for additional information about Lincoln Park. Such registration does not mean that Lincoln Park will actually offer or sell any of these shares. We will not receive any proceeds from the sales of shares of our common stock by Lincoln Park; however, we may receive proceeds of up to $15,000,000 under the Purchase Agreement.

Lincoln Park is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended. Lincoln Park may offer the shares pursuant to this prospectus for resale in a number of different ways through public or private placement transactions and at varying prices. The prices at which Lincoln Park may sell the shares will be determined by the prevailing market price for the shares or in privately negotiated transactions. See “Plan of Distribution” for additional information.

Our common stock is traded on the NASDAQ Capital Market under the symbol “ASTM”. On February 4, 2014, the last reported sales price of our common stock was $3.56 per share.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

The date of this Prospectus is , 2014.

|

|

Page |

|

|

|

|

ii | |

|

|

|

|

1 | |

|

|

|

|

7 | |

|

|

|

|

9 | |

|

|

|

|

10 | |

|

|

|

|

23 | |

|

|

|

|

24 | |

|

|

|

|

24 | |

|

|

|

|

25 | |

|

|

|

|

26 | |

|

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

27 |

|

|

|

|

29 | |

|

|

|

|

33 | |

|

|

|

|

34 | |

|

|

|

|

35 | |

|

|

|

|

CERTAIN PROVISIONS OF MICHIGAN LAW AND OF OUR CHARTER AND BYLAWS |

38 |

|

|

|

|

39 | |

|

|

|

|

41 | |

|

|

|

|

41 | |

|

|

|

|

41 | |

|

|

|

|

42 | |

|

|

|

|

44 |

You may rely only on the information provided or incorporated by reference in this prospectus and the documents incorporated herein and therein by reference, or in a prospectus supplement or amendment thereto. We have not and Lincoln Park has not authorized anyone to provide you with information different from that contained in or incorporated by reference into this prospectus. We and the underwriters are offering to sell, and seeking offers to buy, common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus, any free writing prospectus, or document incorporated by reference is accurate only as of its date, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Information contained on our website is not part of this prospectus. You should read this prospectus together with additional information described under the heading “Where You Can Find More Information” below. In various places in this prospectus, we refer you to sections for additional information by indicating the caption heading of the other sections. All cross-references in this prospectus are to captions contained in this prospectus, unless otherwise indicated.

For investors outside the United States: We have not and Lincoln Park has not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

PRESENTATION NOTE: We implemented a twenty-to-one reverse stock split on October 16, 2013. All share numbers and prices in this prospectus have been adjusted to reflect the reverse stock split, unless indicated otherwise.

This summary highlights information contained elsewhere in this prospectus or incorporated by reference in this prospectus. This summary does not contain all of the information that you should consider in making your investment decision. You should read the entire prospectus carefully, especially the discussion regarding the risks of investing in our securities under the heading “Risk Factors” beginning on page of this prospectus and our financial statements and related notes incorporated by reference in this prospectus, before investing in our securities. In this prospectus, “Aastrom,” the “Company,” “we,” “us,” and “our” refer to Aastrom Biosciences, Inc. Please refer to our Glossary at the end of this Prospectus for certain industry-specific and technical definitions.

Aastrom Biosciences, Inc.

Business Overview

We are a clinical-stage biotechnology company focused on developing innovative cell therapies that repair and regenerate damaged tissue for use in the treatment of severe, chronic ischemic cardiovascular diseases. We are developing patient-specific (autologous) multicellular therapies utilizing our proprietary, highly automated and scalable manufacturing system. Our manufacturing technology platform, the Aastrom Replicell System (ARS), enables the expansion of a variety of cell types, including the production of multicellular therapies expanded from an adult patient’s own bone marrow, which can be delivered directly to damaged tissues using conventional syringes and cell injection catheter systems.

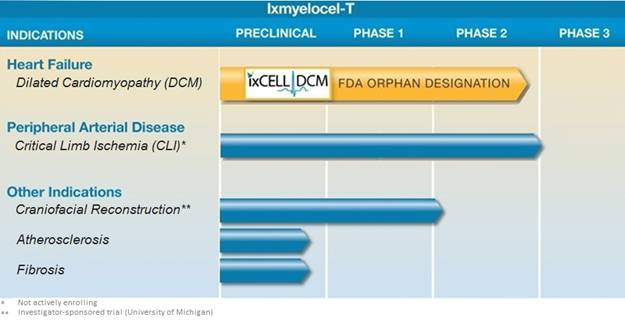

Our lead product, ixmyelocel-T, has demonstrated multiple biological activities that promote tissue repair and regeneration by reducing inflammation, promoting angiogenesis and remodeling ischemic tissue. Preclinical and clinical data suggest that ixmyelocel-T is safe and effective in treating patients with severe, chronic ischemic cardiovascular diseases such as advanced heart failure due to dilated cardiomyopathy (DCM), the third leading cause of heart failure, and critical limb ischemia (CLI), the most severe form of peripheral arterial disease (PAD).

Our lead ixmyelocel-T clinical development program is for the treatment of advanced heart failure due to ischemic DCM. Ixmyelocel-T has been granted a U.S. Orphan Drug designation by the U.S. Food and Drug Administration (FDA) for the treatment of DCM, which we believe provides an efficient and cost-effective path to approval for ixmyelocel-T in this heart failure indication. We are currently enrolling our phase 2b ixCELL-DCM study, which is a randomized, double-blind, placebo-controlled clinical trial for patients with advanced heart failure due to ischemic DCM. The study is designed to enroll 108 patients at approximately 35 sites across the United States and Canada. We also have ongoing ixmyelocel-T clinical programs for the treatment of CLI and craniofacial reconstruction, as well as preclinical research and development programs for the treatment of cardiovascular diseases.

Our Therapy

Ixmyelocel-T is a unique multicellular product derived from an adult patient’s own bone marrow. Our proprietary cell manufacturing process significantly expands the mesenchymal stromal cells (MSCs) and M2-like anti-inflammatory macrophages in the patient’s bone marrow mononuclear cells while retaining many of the hematopoietic cells. These cell types are known to regulate the immune response and play a key role in tissue repair and regeneration by resolving pathologic inflammation, promoting angiogenesis, and remodeling ischemic tissue. Ixmyelocel-T is the only multicellular product known to have expanded cell populations of both MSCs and M-2 like anti-inflammatory macrophages.

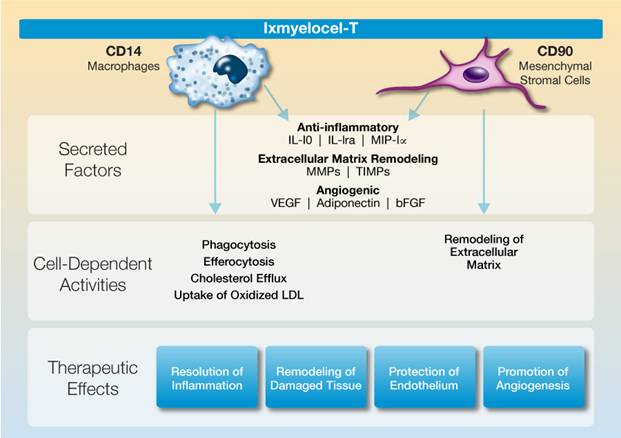

MSCs and M2-like macrophages have a wide range of biological activities that promote repair and regeneration of damaged tissues through the paracrine effects of their secreted factors, as well as their direct cell activities. These cells produce high levels of potent anti-inflammatory and angiogenic factors, as well as factors involved in extracellular matrix remodeling. These cells also have direct activities such as phagocytosis of cellular debris and apoptotic cells, which control the inflammatory response, uptake of LDL and removal of cholesterol, and

remodeling of extracellular matrix. We believe that, together, these paracrine effects and direct cell activities are responsible for ixmyelocel-T’s demonstrated therapeutic effects of resolving inflammation, promoting angiogenesis, and remodeling and repairing damaged tissue.

The following illustration summarizes the multiple biological activities of ixmyelocel-T that promote repair and regeneration of ischemic tissue:

Ixmyelocel-T has several features that we believe are primarily responsible for success in treating adult patients with severe ischemic cardiovascular diseases such as DCM and critical limb ischemia:

Patient-specific (autologous) — we start with the patient’s own cells, which are accepted by the patient’s immune system, allowing the cells to integrate into existing functional tissues. We believe that this characteristic of our therapy eliminates both the risk of rejection and the need to use immunosuppressive therapy pre- or post-therapy. Our data also suggests that ixmyelocel-T provides the potential for long-term engraftment and tissue repair.

Expanded — we begin with a small amount of bone marrow from the patient (up to 60 ml) and significantly expand the number of certain cell types, primarily MSCs and M2-like anti-inflammatory macrophages, to a substantially greater number than are present in the patient’s own bone marrow (up to 200 times the number of certain cell types compared with the starting bone marrow).

Multicellular — we believe the multiple cell types in ixmyelocel-T, which are normally found in bone marrow but in smaller quantities, possess the key functions required for reducing chronic inflammation and promoting angiogenesis and tissue repair. By reducing inflammation, we believe that ixmyelocel-T provides the ideal conditions to allow for the growth of new tissue and blood vessels.

Minimally invasive — our procedure for collecting bone marrow can be performed in an out-patient setting and takes approximately 15 minutes. Administration of ixmyelocel-T for the treatment of DCM is performed in the cardiac catheterization laboratory using a cell injection catheter system in a one-time procedure. For diseases such as CLI, administration of ixmyelocel-T is performed with a syringe in an outpatient setting in a one-time, approximately 20 minute procedure.

Safe — bone marrow and bone marrow-derived therapies have been used safely and efficaciously in medicine for over three decades. Ixmyelocel-T leverages this body of scientific study and medical experience, and appears well tolerated in over 200 patients treated to date.

Our Technology Platform

Our patient-specific multicellular therapies are manufactured using the Company’s proprietary Aastrom Repicell System (ARS) cell manufacturing system. Our manufacturing process is conducted in a highly-automated, fully-closed and rigorously controlled system. Our system is highly scalable and reproducible and located in a 5,000-square-foot centralized manufacturing facility in Ann Arbor, Michigan. Production is conducted under current Good Manufacturing Practices (cGMP) guidelines required by the FDA with current annual capacity to treat up to 3,000 patients.

Our Strategy

Our objective is to become the leading global biotechnology company in the development, manufacture, and commercialization of autologous multicellular therapies for the treatment of severe ischemic cardiovascular diseases. To achieve this objective, we intend to:

· Complete our phase 2b ixCELL-DCM clinical study for the treatment of advanced heart failure due to ischemic DCM and, if successful, progress ixmyelocel-T into pivotal phase 3 clinical studies for this orphan indication.

· Complete patient follow-up in the REVIVE-CLI study to evaluate safety and efficacy endpoints, and pursue opportunities through investigator-sponsored studies and strategic relationships to continue to develop ixmyelocel-T as a stand-alone and/or adjunct therapy for the treatment of critical limb ischemia.

· Conduct additional preclinical and clinical studies of ixmyelocel-T to pursue additional high-value indications for the treatment of severe ischemic cardiovascular diseases.

· Utilize our proprietary ARS cell-expansion manufacturing platform to expand our product portfolio of cell therapies for the treatment of immune/inflammatory, cardiovascular and fibrovascular diseases.

· Leverage our leading proprietary cell manufacturing platform and expertise to provide manufacturing services and capabilities to other development and commercial-stage biopharmaceutical companies.

· Prepare to commercialize ixmyelocel-T through continued development of our internal commercialization capabilities and/or strategic partnerships for North America, Europe and Asia.

Our Clinical Development Programs

Our clinical development programs are focused on addressing areas of high unmet medical need in severe, chronic ischemic cardiovascular diseases. We have completed our Phase 1/2 clinical trials in DCM and we are currently enrolling our phase 2b ixCELL-DCM study, which is a randomized, double-blind, placebo-controlled clinical trial for patients with advanced heart failure due to ischemic DCM. Ixmyelocel-T has been granted a U.S. Orphan Drug designation by the FDA for the treatment of DCM. We also have ongoing ixmyelocel-T clinical programs for the treatment of CLI and craniofacial reconstruction.

The following summarizes the status of our clinical programs:

Heart Failure Due to Dilated Cardiomyopathy

Heart failure represents a significant unmet medical need and a growing public health problem. The American Heart Association reports that there are approximately 6 million patients currently suffering from heart failure in the United States and an estimated 650,000 new cases in the U.S. each year. Current medical costs to treat these patients exceed $25 billion and this is expected to more than triple to nearly $80 billion by 2030 as a result of a growing patient population and the high cost of the limited treatment alternatives for advanced heart failure patients, as described below.

DCM is the third leading cause of heart failure and the leading cause of heart transplantation in the United States. DCM is a disease characterized by weakening of the heart muscle, thinning of the heart walls, enlargement of the heart chambers, and the inability to sufficiently pump blood throughout the body. Patients with DCM typically present with symptoms of congestive heart failure, including limitations in physical activity and shortness of breath. Ischemic DCM is associated with atherosclerotic cardiovascular disease and prior heart attacks and is the most common form of dilated cardiomyopathy, representing an estimated 60% of all DCM patients. Patient prognosis depends on the stage and cause of the disease, but is typically characterized by a very poor quality of life and a high mortality rate.

Current treatments for ischemic DCM patients that are refractory to further medical therapy such as prescription drugs, devices, and/or further revascularization procedures including bypass surgery and angioplasty, are limited to

heart transplantation and placement of left ventricular assist devices (LVADs). There are less than 2,500 heart transplantations in the United States each year. Many refractory DCM patients are not eligible for heart transplantation and transplants are extremely expensive at an estimated cost of over $1 million. LVADs are also expensive at an estimated cost of over $175,000 and have a mortality rate of 50% at two years.

A majority of advanced heart failure patients that are refractory to medical therapy have DCM, and we believe that the refractory ischemic DCM market represents a substantial market opportunity for ixmyelocel-T. These refractory ischemic DCM patients are currently the target patient population for our clinical development of ixmyelocel-T, with approximately 175,000 patients in the United States alone. Ixmyelocel-T has been granted a U.S. Orphan Drug designation by the FDA for the treatment of DCM, which we believe provides an efficient and cost-effective path to approval for ixmyelocel-T in this heart failure indication.

We have conducted two phase 2a multicenter, randomized, open-label clinical studies in patients with ischemic DCM and nonischemic DCM investigating surgical (IMPACT-DCM) and catheter-based (Catheter-DCM) delivery of ixmyelocel-T. We reported 12-month data for the surgical IMPACT-DCM study at the Heart Failure Society of America meeting in September 2011 and final 12-month results from the Catheter-DCM study at the Society for Cardiovascular Angiography and Interventions (SCAI) 2012 Scientific Sessions. Results from these studies demonstrated that ixmyelocel-T was well-tolerated in patients with DCM. In the Catheter-DCM study and post-surgery in the IMPACT-DCM study, the incidence of adverse events was comparable between the ixmyelocel-T groups and the control groups. Cardiac failure was reported more frequently in the control group relative to ixmyelocel-T in both studies.

While these exploratory phase 2a studies were not powered for determining differences in efficacy between treatment groups, there were consistent trends of clinically meaningful improvement in clinical endpoints observed in the ischemic DCM groups in both studies. In the combined ischemic DCM groups across both studies, major adverse cardiovascular events (MACE) were experienced by a lower percentage of ixmyelocel T-treated patients compared to control patients, representing a 45% reduction in the number of patients having a MACE event. Likewise, patients in the combined ischemic DCM groups that were treated with ixmyelocel-T had a lower average number of MACE events at 12 months compared to those in the control group, representing a 61% reduction in the average number of MACE events per patient. MACE is the recommended endpoint (mortality and cardiovascular hospitalizations) in Phase 3 heart failure studies as stated in the FDA 2009 Somatic Cell Therapy for Cardiac Diseases Draft Guidance. Consistent positive trends also were observed in several secondary efficacy measures in the ischemic DCM groups. The majority of ixmyelocel T-treated patients, but not placebo-treated patients (both IDCM and NIDCM), had improvement in NYHA Class over the 12 months following treatment. Improvement in NYHA Class is considered clinically meaningful. There was also a trend toward improved function, with a higher percentage of ixmyelocel T-treated IDCM patients showing an improvement in ejection fraction and increased 6 minute walk performance compared to the IDCM control patients.

We are currently enrolling patients in the Phase 2b ixCELL-DCM clinical study, which is a multicenter, randomized, double-blind, placebo-controlled study evaluating the efficacy and safety of ixmyelocel-T in patients with advanced heart failure due to ischemic DCM. The study is designed to enroll 108 patients at approximately 30 sites in the U.S. and Canada. Patients will be followed for 12 months for the primary efficacy endpoint of MACE events, defined as all-cause deaths, all-cause hospitalizations, and unplanned outpatient or emergency department visits for IV treatment of acute worsening heart failure. Secondary endpoints include clinical, functional, structural, symptomatic, quality of life, and biomarker measures at 3, 6 and 9 months. Patients will be followed for an additional 12 months for safety. We expect to complete enrollment of the ixCELL-DCM study by the end of the first quarter of 2014, and have top-line efficacy results in the second quarter of 2015.

Critical Limb Ischemia

CLI is the most serious and advanced stage of PAD resulting from chronic inflammation and lipid accumulation. PAD is a chronic atherosclerotic disease that progressively restricts blood flow in the limbs and can lead to serious medical complications. This disease is often associated with other serious clinical conditions including hypertension, cardiovascular disease, dyslipidemia, diabetes, obesity and stroke. CLI is used to describe

patients with chronic ischemia-induced pain (even at rest) or tissue loss (ulcers or gangrene) in the limbs, often leading to amputation and death. Many CLI patients are considered unsuitable for revascularization as they have exhausted all other reasonable treatment options and will likely require amputation. The one-year and four-year mortality rates for CLI patients that are unsuitable for revascularization that progress to amputation are approximately 25% and 70%, respectively. Currently, there are an estimated 250,000 CLI patients that are unsuitable for revascularization in the United States.

Ixmyelocel-T has shown significant promise in the treatment of CLI patients with existing tissue loss that are unsuitable for revascularization. Our U.S. Phase 2b RESTORE-CLI program was a multi-center, randomized, double-blind, placebo-controlled clinical trial designed to evaluate the safety and efficacy of ixmyelocel-T in the treatment of patients with CLI that are unsuitable for revascularization. It was the largest multi-center, randomized, double-blind, placebo-controlled cellular therapy study ever conducted in CLI patients. We completed enrollment of this trial in February 2010 with a total of 86 patients at 18 sites across the United States.

Final results of the Phase 2b RESTORE-CLI clinical trial were presented at the American Heart Association Scientific Sessions in November 2011 and published in the peer-reviewed journal Molecular Therapy in April 2012. Patients in the treatment arm showed a 62% reduction in risk relative to placebo in the primary efficacy endpoint of time to first occurrence of treatment failure (p=0.0032). While the study was not powered to show statistical significance in the secondary endpoint of amputation free survival, results from a subgroup of 45 patients with wounds at baseline (the approximate profile of the Phase 3 patient population) showed a 61% reduction in risk (21% ixmyelocel-T treated versus 44% control event rate; p=0.0802). The study also met the primary safety endpoint with no meaningful differences between the treated and control groups.

We initiated the Phase 3 REVIVE-CLI clinical study, a multicenter, randomized, double-blind, placebo controlled study to evaluate the efficacy and safety of ixmyelocel-T in patients with CLI, in 2012. We had previously received Fast Track Designation from the FDA for use of ixmyelocel-T for the treatment of CLI and reached agreement with the FDA on a Special Protocol Assessment. Patients were randomized 1:1 and were to be followed for 12 months for the primary efficacy endpoint of amputation-free survival. On March 27, 2013 we announced that we were stopping enrollment in the study for strategic business reasons. This study has been amended and is ongoing for the 41 patients that are enrolled in the study, and we plan to continue following these patients for 12 months to evaluate safety and certain efficacy measures. We expect to have results from this study in the second quarter of 2014.

Risks Associated with Our Business

An investment in our common stock involves a high degree of risk. You should carefully consider the risks summarized below. The risks are discussed more fully in the “Risk Factors” section of this prospectus beginning on page 10 of this prospectus. These risks include, but are not limited to, the following:

· We currently depend heavily on the success of ixmyelocel-T, our sole product candidate. Any failure to commercialize ixmyelocel-T, or significant delays in doing so, will have a material adverse effect on our business, operating results and financial condition.

· Our product development programs are based on novel technologies and are inherently risky.

· We may not be able to raise the required capital to conduct our operations and develop and commercialize our products.

· If we do not keep pace with our competitors and with technological and market changes, our products will become obsolete and our business may suffer.

· If our patents and proprietary rights do not provide substantial protection, then our business and competitive position will suffer.

· Our past losses and expected future losses cast doubt on our ability to continue as a going concern and operate profitably.

Company Information

We were incorporated under the laws of the State of Michigan on March 24, 1989. Our principal executive offices are located at 24 Frank Lloyd Wright Drive, Lobby K, Ann Arbor, Michigan 48105 and our telephone number is (734) 418-4400. Our website address is www.aastrom.com. The reference to our website is intended to be an inactive textual reference and, except for the documents incorporated by reference as noted above, the information on, or accessible through, our website is not part of this prospectus.

Agreement with Lincoln Park

On January 21, 2014, we entered into a Purchase Agreement and a Registration Rights Agreement (or the Registration Rights Agreement) with Lincoln Park, pursuant to which Lincoln Park has agreed to purchase from us up to $15,00,000 in shares of our common stock, subject to certain limitations from time to time over a 30-month period commencing on the date of effectiveness of the registration statement, of which this prospectus is a part, which provides for the resale of such shares pursuant to the Registration Agreement. The shares issuable to Lincoln Park under the Purchase Agreement are being offered pursuant to this prospectus.

Upon the effectiveness of the registration statement, and subject to the satisfaction of the other conditions of the Purchase Agreement, we may direct Lincoln Park from time to time and at our sole discretion to purchase shares of our common stock up to an aggregate amount of $15,000,000. By means of a Regular Purchase, so long as at least one business day has passed since the most recent purchase, we may direct Lincoln Park to purchase up to 50,000 shares of our common stock at the Regular Purchase Price, increasing to amounts up to 100,000 shares of our common stock depending upon the closing sale price of our common stock. Additionally, we may direct Lincoln Park to purchase additional amounts as Accelerated Purchases if on the date of a Regular Purchase the closing sale price of our common stock equals or exceeds $3.00.

There is no upper limit on the price per share that Lincoln Park must pay for our common stock under the Purchase Agreement, but in no event will shares be sold to Lincoln Park under a Regular Purchase on a day our closing price is less than the minimum floor price of $2.50 per share.

As consideration for Lincoln Park’s commitment to purchase our common stock pursuant to the Purchase Agreement, we issued to Lincoln Park 48,063 shares of our common stock (or the Initial Commitment Shares) on January 21, 2014 as consideration for its commitment to purchase shares pursuant to the Purchase Agreement. In the event the initial registration statement is insufficient to cover all of the shares issuable under the Purchase Agreement and we file a new registration statement to cover any remaining shares not covered by the initial registration statement, we will issue to Lincoln Park an additional 48,063 shares (or the Additional Commitment Shares).

The proceeds received by us under the Purchase Agreement are expected to be used for working capital and general corporate purposes as described further in this prospectus.

The Purchase Agreement limits our sales of shares of common stock to Lincoln Park to the maximum number of shares of our common stock that we may issue without breaching our obligations under applicable rules of the NASDAQ Capital Market (approximately 1,148,843 shares, or 19.99% of our total outstanding common stock as of the date of the Purchase Agreement, which we refer to as the 19.99% shareholder approval limitation) or obtaining shareholder approval under such rules, unless the average price of all applicable sales of common stock exceed a “Base Price” (or $4.13, representing our closing consolidated bid price on January 17, 2014, plus an incremental amount to account for the issuance of commitment shares) such that the sales to Lincoln Park are considered to be at least “at market” under applicable NASDAQ rules.

As a result, although the Purchase Agreement provides that we may sell up to $15,000,000 in shares of our common stock to Lincoln Park, only 1,748,063 shares are being offered under this prospectus, which represents (i) up to 1,748,063 shares that we may sell and issue to Lincoln Park from time to time in the future pursuant to the Purchase Agreement after the registration statement of which this prospectus forms a part is declared effective, and (ii) up to 48,063 shares as Initial Commitment Shares that we have previously issued to Lincoln Park under the Purchase Agreement. This aggregate number of shares may or may not cover all of such shares to be purchased by and issued to Lincoln Park under the Purchase Agreement, depending on the purchase price per share. In the event the initial registration statement is insufficient to cover all of the shares issuable under the Purchase Agreement, we may elect to file a new registration statement so as to cover all of the shares potentially issuable.

As of January 21, there were 5,747,087 shares of our common stock issued and outstanding, of which 5,318,519 shares were held by non-affiliates. If all of the 1,748,063 shares offered by Lincoln Park under this prospectus were issued and outstanding as of the date hereof, such shares would represent approximately 30% of the total common stock outstanding and approximately 33% of the total number of outstanding shares held by non-affiliates.

The actual number of shares to be purchased by Lincoln Park under the Purchase Agreement is variable, depending on the market price of our common stock at the time of each sale. Accordingly, we cannot predict the actual total number of shares to be issued to Lincoln Park. This prospectus covers 1,748,063 shares of common stock. As of the date hereof, we do not currently have any plans or intent to issue to Lincoln Park any shares pursuant to the Purchase Agreement beyond the 1,748,063 shares offered hereby. However, if we elect to issue and sell to Lincoln Park pursuant to the Purchase Agreement more than the 1,748,063 shares offered under this prospectus, which we have the right but not the obligation to do, up to the $15,000,000 maximum in shares of our common stock, we would first be required to register for resale under the Securities Act any additional shares we may elect to sell to Lincoln Park before we can sell such additional shares, which could cause additional substantial dilution to our shareholders. The number of shares issued pursuant to the Purchase Agreement and ultimately offered for resale by Lincoln Park depends on the number of shares purchased by Lincoln Park under the Purchase Agreement.

There are substantial risks to our shareholders as a result of the sale and issuance of common stock to Lincoln Park under the Purchase Agreement. These risks include substantial dilution, significant declines in our stock price and our inability to draw sufficient funds when needed. See “Risk Factors.” Issuance of our common stock to Lincoln Park under the Purchase Agreement will not affect the rights or privileges of our existing shareholders, except that the economic and voting interests of our existing shareholders will be diluted as a result of any such issuance. Although the number of shares of common stock that our existing shareholders own will not decrease, the shares owned by our existing shareholders will represent a smaller percentage of our total outstanding shares after any such issuance to Lincoln Park.

|

Issuer |

Aastrom Biosciences, Inc. |

|

|

|

|

Common stock offered by selling shareholder |

Up to 1,748,063 shares of common stock consisting of :

- 48,063 commitment shares issued to Lincoln Park and - 1,700,000 shares we may sell to Lincoln Park under the Purchase Agreement. |

|

|

|

|

|

|

|

Common stock outstanding before this offering |

5,890,980 shares of common stock. |

|

|

|

|

Common stock to be outstanding after this offering |

7,639,043 shares of common stock. |

|

|

|

|

Use of Proceeds |

We will not receive any proceeds from the sales of shares of our common stock by Lincoln Park; however, we may receive proceeds of up to $15,000,000 under the Purchase Agreement for the sale of such shares to Lincoln Park. See “Use of Proceeds” for a more complete description of our intended use of the net proceeds from this offering. |

|

|

|

|

Risk Factors |

You should carefully read “Risk Factors” in this prospectus for a discussion of factors that you should consider before deciding to invest in our common stock. |

|

|

|

|

NASDAQ Capital Market symbol |

ASTM |

The number of shares of our common stock that will be outstanding immediately after this offering is based on 5,890,980 shares of common stock outstanding as of January 31, 2014 and excludes common stock issuable upon the exercise of stock options, warrants, common stock issuable upon the conversion of preferred stock outstanding , and 48,063 shares of our common stock issued to Lincoln Park on January 21, 2014 as a commitment fee.

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below and in the documents incorporated by reference in this prospectus and any prospectus supplement, as well as other information we include or incorporate by reference into this prospectus and any applicable prospectus supplement, before making an investment decision. Our business, financial condition or results of operations could be materially adversely affected by the materialization of any of these risks. The trading price of our securities could decline due to the materialization of any of these risks, and you may lose all or part of your investment. This prospectus and the documents incorporated herein by reference also contain forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks described below and in the documents incorporated herein by reference, including (i) our Annual Report on Form 10-K for the year ended December 31, 2012 and (ii) other documents we file with the SEC that are deemed incorporated by reference into this prospectus.

Risks Related to Our Business

Our past losses and expected future losses cast doubt on our ability to continue as a going concern and operate profitably.

As of September 30, 2013, we had $10,816,000 of cash and cash equivalents. This is not sufficient to sustain our operations for one year. In light of our financial position, we are evaluating strategic and financial opportunities in the short-term in order to maintain adequate liquidity through December 31, 2014 and beyond. Other than the Purchase Agreement with Lincoln Park, which is subject to certain limitations and conditions (see “Recent Developments – Agreement with Lincoln Park”), we could continue to sell shares through an At-the-Market Sales Agreement (ATM) in order to raise additional capital, though there are certain factors, such as volume of trading in our common stock, our stock price and the ability to terminate the agreement with notice, which could limit the amount we could raise in a short period of time. On a longer term basis, we will need to raise additional funds in order to complete product development programs and complete clinical trials needed to market and commercialize our products. We cannot be certain that such funding will be available on favorable terms, if at all. Some of the factors that will impact our ability to raise additional capital and our overall success include: the rate and degree of progress for our product development, the rate of regulatory approval to proceed with clinical trial programs, the level of success achieved in clinical trials, the requirements for marketing authorization from regulatory bodies in the United States and other countries, the liquidity and market volatility of our equity securities, regulatory and manufacturing requirements and uncertainties, technological developments by competitors, and other factors. If we cannot raise such funds, we will not be able to develop or enhance products, take advantage of future opportunities, or respond to competitive pressures or unanticipated requirements, which would have a material adverse impact on our business, financial condition and results of operations. As a result of the need to raise additional capital and a net capital deficiency, there is uncertainty regarding our ability to maintain liquidity sufficient to operate our business effectively over at least the next twelve months, which raises substantial doubt as to our ability to continue as a going concern. The consolidated financial statements incorporated by reference in this prospectus do not include any adjustments that might result from the outcome of this uncertainty.

We were incorporated in 1989 and have experienced substantial operating losses since inception. As of September 30, 2013, we had accumulated a deficit of approximately $284,797,000 and we have continued to incur losses since that date. These losses have resulted principally from costs incurred in the research and development (including clinical trials) of our cell culture technologies and our cell manufacturing system, general and administrative expenses, and the prosecution of patent applications. We expect to continue to incur significant operating losses over the next several years and at least until, and probably after, product sales increase, primarily owing to our research and development programs, including preclinical studies and clinical trials, and the establishment of marketing and distribution capabilities necessary to support commercialization efforts for our products. We cannot predict with any certainty the amount of future losses. Our ability to achieve profitability will depend, among other things, on successfully completing the development of our product candidates, timely initiation and completion of clinical trials, obtaining regulatory approvals, establishing manufacturing, sales and marketing arrangements with third parties, maintaining supplies of key manufacturing components, acquisition and development of complementary activities and raising sufficient cash to fund our operating activities. Therefore, we may not be able to achieve or sustain profitability.

We may not be able to raise the required capital to conduct our operations and develop and commercialize our products.

We will require substantial additional capital resources in order to conduct our operations, complete our product development programs, complete our clinical trials needed to market our products (including a Phase 2b clinical trial for DCM), and commercialize these products and cell manufacturing facilities. In order to grow and expand our business, to introduce our new product candidates into the marketplace and to acquire or develop complementary business activities, we will need to raise a significant amount of additional funds. We will also need significant additional funds or a collaborative partner, or both, to finance the research and development activities of our cell product candidates for additional indications. Accordingly, we are continuing to pursue additional sources of financing.

Our future capital requirements will depend upon many factors, including:

· continued scientific progress in our research, clinical and development programs;

· costs and timing of conducting clinical trials and seeking regulatory approvals;

· competing technological and market developments;

· avoiding infringement and misappropriation of third-party intellectual property;

· obtaining valid and enforceable patents that give us a competitive advantage;

· our ability to establish additional collaborative relationships;

· our ability to effectively launch a commercial product;

· the effect of commercialization activities and facility expansions, if and as required; and

· complementary business acquisition or development opportunities.

We entered into an ATM on June 16, 2011 (as amended to date, the “ATM”), which allows us to raise approximately $20,000,000 through sales of our common stock from time to time. However, there are certain factors, such as volume of trading in our common stock, our stock price and the ability to terminate the agreement with notice, which limit the amount that can be raised in a short period of time through the ATM. Regardless of the usage of the ATM, we will need to raise additional capital in order to fund the clinical trials of ixmyelocel-T for DCM, complete our product development programs, complete clinical trials needed to market our products and commercialize these products.

Additionally, we may direct Lincoln Park to purchase up to $15,000,000 worth of shares of our common stock under the Purchase Agreement over a 30-month period generally in amounts up to 50,000 shares of our common stock on any such business day. However, there can be no assurance that we will be able to receive any or all of the additional funds from Lincoln Park because the Purchase Agreement contain limitations, restrictions, events of default and other provisions that could limit our ability to cause Lincoln Park to buy common stock from us, including that: (i) Lincoln Park shall not purchase any shares of our common stock on any business day that the closing sale price of our common stock is less than $2.50 per share, subject to adjustment as set forth in the Purchase Agreement, and (ii) Lincoln Park shall not own more than 9.99% of our common stock under the Purchase Agreement. Assuming a purchase price of $4.13 per share (the closing sale price of the common stock on January 17, 2014, plus an incremental amount to account for the issuance of commitment shares) and the purchase by Lincoln Park of the full 1,700,000 shares registered hereunder, proceeds to us would only be $7,021,000. In addition, under the applicable rules of the NASDAQ Capital Market, if we seek to issue shares which may be aggregated with shares sold to Lincoln Park under the Purchase Agreement in excess of 1,148,843 or 19.99% of the total common stock outstanding as of the date of the Purchase Agreement, we may be required to seek shareholder approval in order to be in compliance with the NASDAQ Capital Market rules.

Our reliance on Lincoln Park as a source of funding will depend on a number of factors, including the prevailing market price of our common stock and the extent to which we are able to secure working capital from other sources. If obtaining sufficient funding from Lincoln Park were to prove unavailable or prohibitively dilutive, we will need to raise additional funds in order to complete our product development programs, complete clinical trials needed to market our products (including clinical trials for our DCM program), and commercialize these products. Even if we sell all $15,000,000 under the Purchase Agreement to Lincoln Park, we may still need additional capital to fully implement our business, operating and development plans. Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, the consequences could be a material adverse effect on our business, operating results, financial condition and prospects

Because of our long-term funding requirements, we may try to access the public or private equity markets if conditions are favorable to complete a financing, even if we do not have an immediate need for additional capital at that time, or whenever we require additional operating capital. In addition, we may seek collaborative relationships, incur debt and access other available funding sources. This additional funding may not be available to us on reasonable terms, or at all. Some of the factors that will impact our ability to raise additional capital and our overall success include:

· the rate and degree of progress for our product development;

· the rate of regulatory approval to proceed with clinical trial programs;

· the level of success achieved in clinical trials;

· the requirements for marketing authorization from regulatory bodies in the United States and other countries;

· the liquidity and market volatility of our equity securities; and

· regulatory and manufacturing requirements and uncertainties, and technological developments by competitors.

If adequate funds are not available in the future, we may not be able to develop or enhance our products, take advantage of future opportunities, or respond to competitive pressures or unanticipated requirements and we may be required to delay or terminate research and development programs, curtail capital expenditures, and reduce business development and other operating activities. Should the financing we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, the consequences could have a material adverse effect on our business, operating results, financial condition and prospects.

Failure to obtain and maintain required regulatory approvals would severely limit our ability to sell our products.

We must obtain the approval of the FDA before commercial sales of our cell product candidates may commence in the United States, which we believe will ultimately be the largest market for our products. We will also be required to obtain additional approvals from various foreign regulatory authorities to initiate sales activities of cell products in those jurisdictions. If we cannot demonstrate the safety, purity and potency of our product candidates, including our cell product candidates, produced in our production system, the FDA or other regulatory authorities could delay or withhold regulatory approval of our product candidates.

Finally, even if we obtain regulatory approval of a product, that approval may be subject to limitations on the indicated uses for which it may be marketed. Even after granting regulatory approval, the FDA and regulatory agencies in other countries continue to review and inspect marketed products, manufacturers and manufacturing facilities, which may create additional regulatory burdens. Later discovery of previously unknown problems with a product, manufacturer or facility may result in restrictions on the product or manufacturer, including a withdrawal of the product from the market. Further, regulatory agencies may establish additional regulations that could prevent or delay regulatory approval of our products.

We currently depend heavily on the success of ixmyelocel-T, our sole product candidate. Any failure to commercialize ixmyelocel-T, or significant delays in doing so, will have a material adverse effect on our business, operating results and financial condition.

We have invested a significant portion of our efforts and financial resources in the development of ixmyelocel-T. Our ability to generate future product revenue depends heavily on the successful development and commercialization of ixmyelocel-T. The successful commercialization of ixmyelocel-T will depend on several factors, including the following:

· obtaining marketing approvals from the FDA and other foreign regulatory authorities;

· successful enrollment of patients in our ongoing clinical studies of ixmyelocel-T;

· successful completion of our ongoing clinical studies of ixmyelocel-T;

· the successful audit of our facilities by additional regulatory authorities;

· maintaining the cGMP and cGTP compliance of our manufacturing facility;

· maintaining current manufacturing arrangements with third parties and establishing new manufacturing arrangements;

· our development of a successful sales and marketing organization for ixmyelocel-T;

· an acceptable safety and efficacy profile of our product candidates following approval;

· the availability of reimbursement to patients from healthcare payers for our drug products, if approved; and

· other risks described in this “Risk Factors” section.

Any failure to commercialize ixmyelocel-T or significant delays in doing so will have a material adverse effect on our business, results of operations and financial condition.

Our sole product candidate, ixmyelocel-T, is still in clinical development. If we do not successfully continue or complete the clinical development of ixmyelocel-T, our likelihood of success as a company and our ability to finance our operations will be substantially harmed.

Our near-term prospects substantially depend upon our ability to successfully continue and complete clinical trials of our lead product candidate, ixmyelocel-T, and to demonstrate its safety and efficacy, as well as its superiority over existing therapies and standards of care, if any. We are currently enrolling patients with ischemic DCM for the ixCELL-DCM trial, a Phase 2b clinical trial, and have recently treated the first patients in the trial. All of our other potential product candidates are in preclinical research or early clinical development. Our ability to finance our company and to generate revenues will depend heavily on our ability to obtain favorable results in the ongoing and planned clinical trials of ixmyelocel-T, including the ongoing ixCELL-DCM Phase 2b clinical trial, and to successfully develop and commercialize ixmyelocel-T. Ixmyelocel-T could be unsuccessful if it:

· does not demonstrate acceptable safety and efficacy in clinical trials, or otherwise does not meet applicable regulatory standards for approval;

· does not offer sufficient, clinically meaningful therapeutic or other improvements over existing or future drugs used to treat the DCM indications for which it is being tested;

· is not capable of being produced in commercial quantities at acceptable costs; or

· is not accepted as safe, efficacious, cost-effective, less costly and preferable to current therapies in the medical

community and by third-party payers.

If we are not successful in developing and commercializing ixmyelocel-T or are significantly delayed in doing so, our financial condition and future prospects may be adversely affected and we may experience difficulties in raising the substantial additional capital required to fund our business.

Our product development programs are based on novel technologies and are inherently risky.

We are subject to the risks of failure inherent in the development of products based on new technologies. The novel nature of our therapeutics creates significant challenges in regard to product development and optimization, manufacturing, government regulation, third-party reimbursement and market acceptance. For example, if regulatory agencies have limited experience in approving cellular therapies for commercialization, the development and commercialization pathway for our therapies may be subject to increased uncertainty, as compared to the pathway for new conventional drugs.

Any changes in the governmental regulatory classifications of our products could prevent, limit or delay our ability to market or develop our products.

The FDA establishes regulatory requirements based on the classification of a product. Because our product development programs are designed to satisfy the standards applicable to biological licensure for our cellular products, any change in the regulatory classification or designation would affect our ability to obtain FDA approval of our products. Each of these cell products is, under current regulations, regulated as a biologic, which requires a BLA.

Our inability to complete our product development activities successfully would severely limit our ability to operate or finance operations.

In order to commercialize our cell product candidates in the United States, we must complete substantial clinical trials and obtain sufficient safety, purity and potency results to support required registration approval and market acceptance of our cell product candidates. We may not be able to successfully complete the development of our product candidates, or successfully market our technologies or product candidates. We, and any of our potential collaborators, may encounter problems and delays relating to research and development, regulatory approval and intellectual property rights of our technologies and product candidates. Our research and development programs may not be successful, and our cell culture technologies and product candidates may not facilitate the production of cells outside the human body with the expected results. Our technologies and cell product candidates may not prove to be safe and efficacious in clinical trials, and we may not obtain the requisite regulatory approvals for our technologies or product candidates and the cells produced in such products. If any of these events occur, we may not have adequate resources to continue operations for the period required to resolve any issues delaying commercialization and we may not be able to raise capital to finance our continued operation during the period required for resolution of any such issues.

We must successfully complete our clinical trials to be able to market certain of our products.

To be able to market therapeutic cell products in the United States, we must demonstrate, through extensive preclinical studies and clinical trials, the safety and efficacy of our processes and product candidates. If our clinical trials are not successful, our products may not be marketable. The results of early stage clinical trials do not ensure success in later clinical trials, and interim results are not necessarily predictive of final results.

Our ability to complete our clinical trials in a timely manner depends on many factors, including the rate of patient enrollment. Patient enrollment can vary with the size of the patient population, the proximity of suitable patients to clinical sites, perceptions of the utility of cell therapy for the treatment of certain diseases, and the eligibility criteria for the study. For example, patients enrolling in our studies need to provide an adequate amount of bone marrow to process and expand for injection and some patients may not be able to provide sufficient starting material despite our study inclusion and exclusion criteria designed to prevent this. Bone marrow is an inherently variable starting material. We have experienced delays in patient accrual in our previous clinical trials. On March 27, 2013, we announced that we were stopping enrollment in the Phase 3 REVIVE clinical trial due to the slow patient accrual rate for the study and to optimize the use of our financial resources. If we experience similar delays in patient enrollment

for other clinical trials, we could experience increased costs and delays associated with these trials, which would impair our product development programs and our ability to market our products.

Furthermore, the FDA monitors the progress of clinical trials and it may suspend or terminate clinical trials at any time due to patient safety or other considerations.

Our research programs are currently directed at improving product functionality for certain clinical indications, improving product shelf life, and decreasing the cost of manufacturing our products. These production process changes may alter the functionality of our cells and require various additional levels of experimental and clinical testing and evaluation. Any such testing could lengthen the time before these products would be commercially available.

Even if successful clinical results are reported for a product from a completed clinical trial, this does not mean that the results will be sustained over time, or will be sufficient for a marketable or regulatory approvable product.

We may rely on third parties to conduct some of our clinical trials, and their failure to perform their obligations in a timely or competent manner may delay development and commercialization of our product candidates.

We may use clinical research organizations (CROs) to assist in conduct of our clinical trials. There are numerous alternative sources to provide these services. However, we may face delays outside of our control if these parties do not perform their obligations in a timely or competent fashion, or if we are forced to change service providers. Any third party that we hire to conduct clinical trials may also provide services to our competitors, which could compromise the performance of their obligations to us. If we experience significant delays in the progress of our clinical trials, the commercial prospects for product candidates could be harmed and our ability to generate product revenue would be delayed or prevented. In addition, we and any provider that we retain will be subject to Good Clinical Practice, (GCP) requirements. If GCP and other regulatory requirements are not adhered to by us or our third-party providers, the development and commercialization of our product candidates could be delayed.

Any failure of such CRO to successfully accomplish clinical trial monitoring, data collection, safety monitoring and data management and the other services it provides for us in a timely manner and in compliance with regulatory requirements could have a material adverse effect on our ability to complete clinical development of our products and obtain regulatory approval. Problems with the timeliness or quality of the work of a CRO may lead us to seek to terminate the relationship and use an alternate service provider. However, making such changes may be costly and may delay our trials, and contractual restrictions may make such a change difficult or impossible. Additionally, it may be difficult to find a replacement organization that can conduct our trials in an acceptable manner and at an acceptable cost.

Failure of third parties, including Vention Medical, to manufacture or supply certain components, equipment, disposable devices and other materials used in our cell manufacturing process would impair our cell product development.

We rely on third parties, including Vention Medical (Vention), to manufacture and/or supply certain of our devices/manufacturing equipment and to manufacture and/or supply certain components, equipment, disposable devices and other materials used in our cell manufacturing process to develop our cell products. Vention is our sole supplier of cell cassettes for which it would be difficult to obtain alternate sources of supply on a short-term basis. If any of our manufacturers or suppliers fails to perform its respective obligations, or if our supply of certain components, equipment, disposable devices and other materials is limited or interrupted, it could impair our ability to manufacture our products, which would delay our ability to conduct our clinical trials or market our product candidates on a timely and cost-competitive basis, if at all.

In addition, we may not be able to continue our present arrangements with our suppliers, supplement existing relationships, establish new relationships or be able to identify and obtain the ancillary materials that are necessary to develop our product candidates in the future. Our dependence upon third parties for the supply and manufacture of these items could adversely affect our ability to develop and deliver commercially feasible products on a timely and competitive basis.

Manufacturing of our cell products in centralized facilities may increase the risk that we will not have adequate quantities of our cell products for clinical programs.

We are subject to regulatory compliance and quality assurance requirements at our production site in Ann Arbor, Michigan. This site could be subject to ongoing, periodic, unannounced inspection by regulatory agencies to ensure strict compliance with GMP regulations and other governmental regulations. We do not have redundant cell manufacturing sites. In the event our cell production facility is damaged or destroyed or is subject to regulatory restrictions, our clinical trial programs and other business prospects would be adversely affected.

Even if we obtain regulatory approvals to sell our products, lack of commercial acceptance could impair our business.

We will be seeking to obtain regulatory approvals to market our cell products for tissue repair treatments. Even if we obtain all required regulatory approvals, we cannot be certain that our products and processes will be accepted in the marketplace at a level that would allow us to operate profitably. Our products may be unable to achieve commercial acceptance for a number of reasons, such as the availability of alternatives that are less expensive, more effective, or easier to use; the perception of a low cost-benefit ratio for the product amongst physicians and hospitals; or an inadequate level of product support from ourselves or a commercial partner. Our technologies or product candidates may not be employed in all potential applications being investigated, and any reduction in applications would limit the market acceptance of our technologies and product candidates, and our potential revenues.

The market for our products will be heavily dependent on third-party reimbursement policies.

Our ability to successfully commercialize our product candidates will depend on the extent to which government healthcare programs, such as Medicare and Medicaid, as well as private health insurers, health maintenance organizations and other third-party payers will pay for our products and related treatments.

Reimbursement by third-party payers depends on a number of factors, including the payer’s determination that use of the product is safe and effective, not experimental or investigational, medically necessary, appropriate for the specific patient and cost-effective. Reimbursement in the United States or foreign countries may not be available or maintained for any of our product candidates. If we do not obtain approvals for adequate third-party reimbursements, we may not be able to establish or maintain price levels sufficient to realize an appropriate return on our investment in product development. Any limits on reimbursement from third-party payers may reduce the demand for, or negatively affect the price of, our products. For example, in the past, published studies suggested that stem cell transplantation for breast cancer, which constituted a significant portion of the overall stem cell therapy market at the time, may have limited clinical benefit. The lack of reimbursement for these procedures by insurance payers has negatively affected the market for our products in this indication in the past.

Managing and reducing health care costs has been a general concern of federal and state governments in the United States and of foreign governments. In addition, third-party payers are increasingly challenging the price and cost-effectiveness of medical products and services, and many limit reimbursement for newly approved health care products. In particular, third-party payers may limit the indications for which they will reimburse patients who use any products that we may develop. Cost control initiatives could decrease the price for products that we may develop, which would result in lower product revenues to us.

Use of animal-derived materials could harm our product development and commercialization efforts.

Some of the manufacturing materials and/or components that we use in, and which are critical to, implementation of our technology involve the use of animal-derived products, including fetal bovine serum. Suppliers or regulatory changes may limit or restrict the availability of such materials for clinical and commercial use. We currently purchase all of our fetal bovine sera from protected herds in Australia and New Zealand. These sources are considered to be the safest and raise the least amount of concern from the global regulatory agencies. If, for example, the so-called “mad cow disease” occurs in New Zealand or in Australia, it may lead to a restricted supply of the serum currently required for our product manufacturing processes. Any restrictions on these materials would impose a potential competitive disadvantage for our products or prevent our ability to manufacture our cell products. The FDA has issued draft regulations for controls over bovine materials. These proposed regulations do not appear to

affect our ability to purchase the manufacturing materials we currently use. However, the FDA may issue final regulations that could affect our operations. Our inability to develop or obtain alternative compounds would harm our product development and commercialization efforts. There are certain limitations in the supply of certain animal-derived materials, which may lead to delays in our ability to complete clinical trials or eventually to meet the anticipated market demand for our cell products.

Given our limited internal manufacturing, sales, marketing and distribution capabilities, we need to develop increased internal capability or collaborative relationships to manufacture, sell, market and distribute our products.

We have only limited internal manufacturing, sales, marketing and distribution capabilities. As market needs develop, we intend to establish and operate commercial-scale manufacturing facilities, which will need to comply with all applicable regulatory requirements. We will also need to develop new configurations of our cell manufacturing system for these facilities to enable processes and cost efficiencies associated with large-scale manufacturing. Establishing these facilities will require significant capital and expertise. We may need to make such expenditures when there are significant uncertainties as to the market opportunity. Any delay in establishing, or difficulties in operating, these facilities will limit our ability to meet the anticipated market demand for our cell products. We intend to get assistance to market some of our future cell products through collaborative relationships with companies with established sales, marketing and distribution capabilities. Our inability to develop and maintain those relationships would limit our ability to market, sell and distribute our products. Our inability to enter into successful, long-term relationships could require us to develop alternate arrangements at a time when we need sales, marketing or distribution capabilities to meet existing demand. We may market one or more of our products through our own sales force. Our inability to develop and retain a qualified sales force could limit our ability to market, sell and distribute our cell products.

If we do not keep pace with our competitors and with technological and market changes, our products will become obsolete and our business may suffer.

The markets for our products are very competitive, subject to rapid technological changes, and vary for different candidates and processes that directly compete with our products. Our competitors may have developed, or could in the future develop, new technologies that compete with our products or even render our products obsolete. As an example, in the past, published studies have suggested that hematopoietic stem cell therapy use for bone marrow transplantation, following marrow ablation due to chemotherapy, may have limited clinical benefit in the treatment of breast cancer, which was a significant portion of the overall hematopoietic stem cell transplant market. This resulted in the practical elimination of this market for our cell-based product for this application.

Our cell manufacturing system is designed to improve and automate the processes for producing cells used in therapeutic procedures. Even if we are able to demonstrate improved or equivalent results, the cost or process of treatment and other factors may cause researchers and practitioners to not use our products and we could suffer a competitive disadvantage. Finally, to the extent that others develop new technologies that address the targeted application for our products, our business will suffer.

The current credit and financial market conditions may exacerbate certain risks affecting our business.

We rely upon third parties for certain aspects of our business, including collaboration partners, wholesale distributors, contract clinical trial providers, contract manufacturers and third-party suppliers. Because of the recent tightening of global credit and the volatility in the financial markets, there may be a delay or disruption in the performance or satisfaction of commitments to us by these third parties, which could adversely affect our business.

If we cannot attract and retain key personnel, our business may suffer.

Our success depends in large part upon our ability to attract and retain highly qualified scientific and management personnel. We face competition for such personnel from other companies, research and academic institutions and other entities. Further, in an effort to conserve financial resources, we have implemented reductions in our work force on four previous occasions, most recently in the first quarter of 2013. As a result of these and other factors, we may not be successful in hiring or retaining key personnel. Our inability to replace any key employee could harm our operations.

Risks Related to Intellectual Property

If our patents and proprietary rights do not provide substantial protection, then our business and competitive position will suffer.