Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COMERICA INC /NEW/ | a2014creditsuisse8-k.htm |

Comerica Incorporated Credit Suisse Financial Services ForumFebruary 10-11, 2014 Curt FarmerVice Chairman, The Retail Bank and Wealth Management Karen ParkhillVice Chairman andChief Financial Officer 2 Safe Harbor Statement Any statements in this presentation that are not historical facts are forward-looking statements as defined in the Private Securities LitigationReform Act of 1995. Words such as “anticipates,” “believes,” “contemplates,” “feels,” “expects,” “estimates,” “seeks,” “strives,” “plans,” “intends,”“outlook,” “forecast,” “position,” “target,” “mission,” “assume,” “achievable,” “potential,” “strategy,” “goal,” “aspiration,” “opportunity,” “initiative,”“outcome,” “continue,” “remain,” “maintain,” “on course,” “trend,” “objective,” “looks forward” and variations of such words and similar expressions,or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” “may” or similar expressions, as they relate to Comerica or itsmanagement, are intended to identify forward-looking statements. These forward-looking statements are predicated on the beliefs andassumptions of Comerica's management based on information known to Comerica's management as of the date of this presentation and do notpurport to speak as of any other date. Forward-looking statements may include descriptions of plans and objectives of Comerica's managementfor future or past operations, products or services, and forecasts of Comerica's revenue, earnings or other measures of economic performance,including statements of profitability, business segments and subsidiaries, estimates of credit trends and global stability. Such statements reflectthe view of Comerica's management as of this date with respect to future events and are subject to risks and uncertainties. Should one or more ofthese risks materialize or should underlying beliefs or assumptions prove incorrect, Comerica's actual results could differ materially from thosediscussed. Factors that could cause or contribute to such differences are changes in general economic, political or industry conditions; changes inmonetary and fiscal policies, including the interest rate policies of the Federal Reserve Board; volatility and disruptions in global capital and creditmarkets; changes in Comerica's credit rating; the interdependence of financial service companies; changes in regulation or oversight; unfavorabledevelopments concerning credit quality; any future acquisitions or divestitures; the effects of more stringent capital or liquidity requirements;declines or other changes in the businesses or industries of Comerica's customers; the implementation of Comerica's strategies and businessmodels; Comerica's ability to utilize technology to efficiently and effectively develop, market and deliver new products and services; operationaldifficulties, failure of technology infrastructure or information security incidents; changes in the financial markets, including fluctuations in interestrates and their impact on deposit pricing; competitive product and pricing pressures among financial institutions within Comerica's markets;changes in customer behavior; management's ability to maintain and expand customer relationships; management's ability to retain key officersand employees; the impact of legal and regulatory proceedings or determinations; the effectiveness of methods of reducing risk exposures; theeffects of terrorist activities and other hostilities; the effects of catastrophic events including, but not limited to, hurricanes, tornadoes, earthquakes,fires, droughts and floods; changes in accounting standards and the critical nature of Comerica's accounting policies. Comerica cautions that theforegoing list of factors is not exclusive. For discussion of factors that may cause actual results to differ from expectations, please refer to ourfilings with the Securities and Exchange Commission. In particular, please refer to “Item 1A. Risk Factors” beginning on page 13 of Comerica'sAnnual Report on Form 10-K for the year ended December 31, 2012 and "Item 1A. Risk Factors" beginning on page 68 of the Corporation'sQuarterly Report on Form 10-Q for the quarter ended June 30, 2013. Forward-looking statements speak only as of the date they are made.Comerica does not undertake to update forward-looking statements to reflect facts, circumstances, assumptions or events that occur after the datethe forward-looking statements are made. For any forward-looking statements made in this presentation or in any documents, Comerica claimsthe protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

3 The Retail Bank & Wealth Management Organizational Goals 1Balance between the lines of business RetailBanking Small Business PrivateBanking Advisory Services The Retail Bank Wealth Management Balance1Funding Growth 4 The Retail Bank & Wealth ManagementKey Contributors As of and for the year ended 12/31/13 ● 1Segments’ revenues (FTE), calculated using fund transfer pricing (FTP) methodology, include net interest income from assets and liabilities as well as FTP funding credits and charges. Revenue percentage based on total revenues from major segments. Business Bank 78% Retail Bank 12% WM 10% Business Bank 60% Retail Bank 26% WM 14% Business Bank 52% Retail Bank 41% WM 7% 48% of Average Deposits40% of Revenue1 Business Bank 11% Retail Bank 42% WM 11% 53% of Employees 22% of Average Loans Service Co. & Operations36%

5 The Retail Bank & Wealth ManagementBuilding Momentum $ in millions 2013 Financial Results Retail Bank Wealth Management Total Retail & Wealth From 2012$ Change % Change Net interest income (FTE) $ 610 $ 184 $ 794 $ (40) (5)% Provision for credit losses 13 (18) (5) (48) N/M Noninterest income 175 252 427 (4) (1) Customer-driven income 155 234 389 5 1 Noninterest expenses 708 319 1,027 (16) (2) Net income 42 87 129 12 10 Selected average balances: Loans 5,289 4,650 9,939 103 1 Deposits 21,247 3,775 25,022 719 3 10% increase in net income reflects strong credit quality, tight expenses, stable fee income against headwinds of continuing low rates & regulatory environment 6 Retail Banking Line of BusinessStrong Deposit Generator At 12/31/13 ● 1Source: SNL Financial. 4Q13 interest incurred on deposits as a percentage of average deposits. Excludes BOKF, MTB, and SNV as amounts were not available as of 2/6/14. ● 2Source: SNL Financial. Excludes BOKF and MTB as amounts were not available as of 2/6/14. Deposit Growth(Average $ in billions) 16.7 18.0 18.6 2011 2012 2013 +11% 54 67 67 70 75 7 5 87 97 98 1 10 RF HBA N KEY BBT SNV FITB ST I FHN ZIO N CMA Higher Deposits per Banking Center2($ in millions) 23 21 21 21 20 20 13 12 9 HBA N FHN ST I BBT KEY FITB R F ZIO N CMA Lowest Cost of Deposits1(In basis points)Banking Center FocusServing our lines of business:Wealth ManagementSmall BusinessMiddle Market Not a mass market strategy

Relationship driven, Not mass market Competitive offering Reside on Comerica’s balance sheet:• Home Equity Loan (HELOC)• Installment Loan “White Label” third party providers:• Credit Card• Home Mortgage 7 Retail Banking Line of BusinessLoan Growth Building Momentum 1Based on the second half 2013 benchmarking survey of O'Connor & Associates, a New Jersey-based research firm. Number of Loan Originations Home Equity Loan Growth(Period-end $ in millions)1,537 1,498 1,474 1,501 1,517 4Q12 1Q13 2Q13 3Q13 4Q13 Consumer Credit Products 2,923 5,738 7,924 2011 2012 2013 Consumer Loans Mortgage Loans Continuing Sales & Service Emphasis Top score in:• Customer Reception• Customer Rapport • Needs Identification Comerica Bank’s call centers ranked #1 for the 12th consecutive report1 8 Banking Center Footprint Has EvolvedReflecting Our Balanced Growth Strategy 1At 12/31/13 2013 2003 72% 44% 14% 28% 12% 22% 2% 2% 4% 360 Banking Centers 483 Banking Centers 215 136 105 9 18 Banking Centers By State1

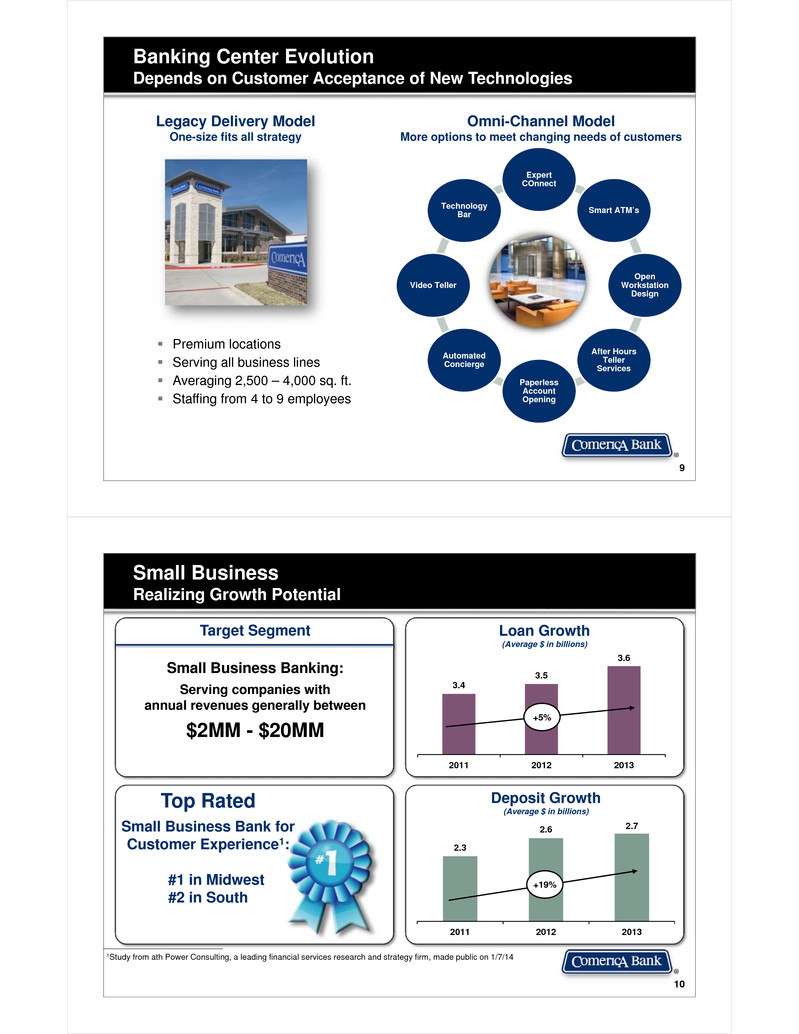

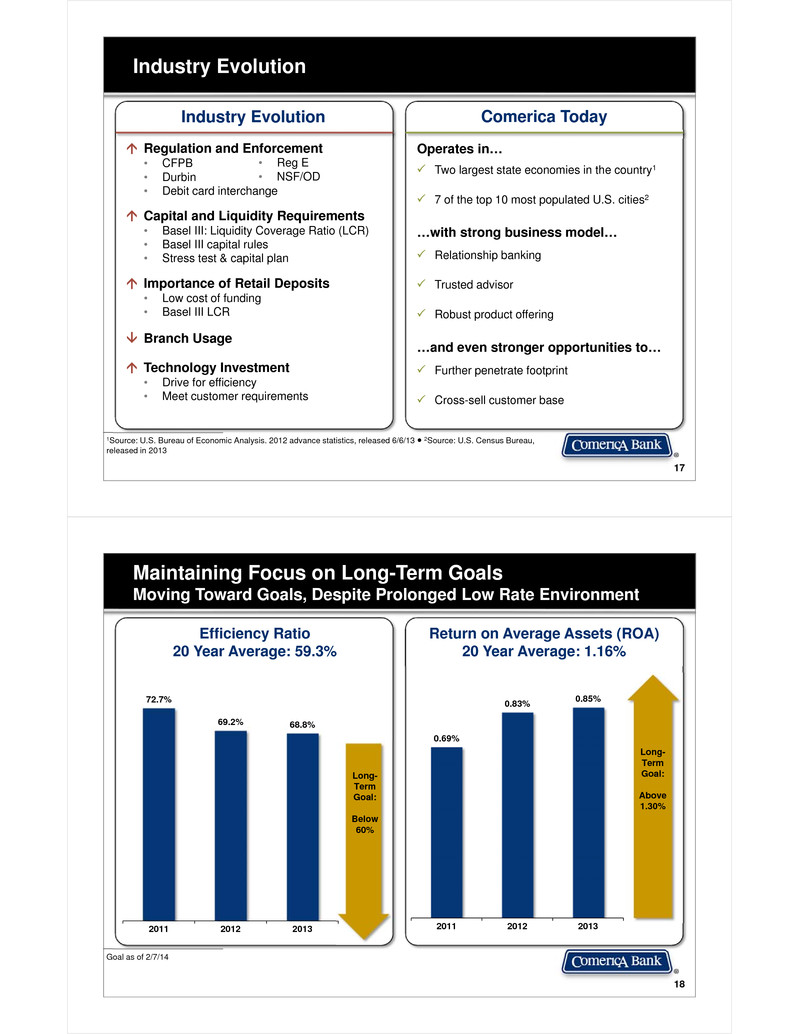

Banking Center EvolutionDepends on Customer Acceptance of New Technologies 9 Legacy Delivery ModelOne-size fits all strategy Premium locations Serving all business lines Averaging 2,500 – 4,000 sq. ft. Staffing from 4 to 9 employees Expert COnnect Smart ATM’s Open Workstation Design After Hours Teller Services Paperless Account Opening Automated Concierge Video Teller Technology Bar Omni-Channel ModelMore options to meet changing needs of customers 10 Small BusinessRealizing Growth Potential 1Study from ath Power Consulting, a leading financial services research and strategy firm, made public on 1/7/14 Deposit Growth (Average $ in billions) Loan Growth(Average $ in billions) 3.4 3.5 3.6 2011 2012 2013 2.3 2.6 2.7 2011 2012 2013 +19% +5% Target Segment Small Business Banking: Serving companies with annual revenues generally between$2MM - $20MM Top Rated Small Business Bank for Customer Experience1: #1 in Midwest #2 in South

Small BusinessFocus on Efficiency 11 Adding Relationship Managers in Texas, California & Arizona Streamlined loan approval process Expanded Business Banking Specialist Program 353 501 576 2011 2012 2013 Adding Relationship Managers(Number of Relationship Managers) Growth of Pipeline($ in millions) +63% Increasing Capacity Loan Outstandings Per Banker($ in millions) 3.1 4.3 6.0 2011 2012 2013 +95% 114 118 130 2012 2013 2014 FC +14% 12 2013 Greenwich Associates Excellence AwardsReceived the Most Awards of any U.S. Bank 1Based on over 17,000 interviews with businesses with sales $1-$10MM across the country ● 2Based on nearly 14,000 interviews with businesses with sales of $10-$500MM across the country ● 3Comparisons are based on only those banks operating in each region. Middle Market2 Overall Satisfaction Relationship Manager Capability Financial Stability Investment Banking International Service Likelihood to Recommend Personal Banking Satisfaction Treasury Management: • Overall Satisfaction • Accuracy of Operations • Customer Service • Product Capabilities • Sales Specialist Performance 3 Small Business1 Overall Satisfaction – West3 Relationship Manager Capability Financial Stability Treasury Management: • Overall Satisfaction • Accuracy of Operations • Customer Service

Private BankingLeveraging our Business Bank & Retail Bank Relationships 13 4.7 4.5 4.7 2011 2012 2013 Loan Growth(Average $ in billions) 3.1 3.7 3.8 2011 2012 2013 Deposit Growth(Average $ in billions)Loan Outstandings per Banker($ in millions) Target Segments Business Owners Corporate Executives First Generation Wealth Foundations & Institutions 12.1 15.6 19.7 2011 2012 2013 +63% +3% +22% 14 Advisory ServicesGrowing Fiduciary Income 1Based on noninterest income for the year-ended 12/31/13 117 126 145 2011 2012 2013 Assets Under Management & Administration1($ in billions) 218 232 238 2011 2012 2013 Fee Income($ in millions) Personal Trust & Asset Mgmt.31% Institutional Trust & Asset Mgmt.20% Brokerage & Insurance30% Alliance19% Wide Array of Advisory Services1 +9% +24% 225 222 253 2011 2012 2013 Trust Assets per Trust & Estate Advisor($ in millions) +12%

Since 1995 13 alliance partners Agreement with broker/dealers to provide trust services to their clients Dedicated team with 14 offices in the US 15 Comerica Professional Trust AllianceUnique Fee Generating Business 1End of period balances Assets Under Management1($ in billions) 4.9 6.6 8.7 2011 2012 2013 +77% 30.3 35.7 44.8 2011 2012 2013 Fee Income($ in millions) +48% Key Facts Collaboration 16 Retail Banking Business Bank Wealth Management Small Business $546 million In Opening Balances3,795 Qualified Referrals 2013 Results Comerica Collaborates Educate, train, incent teamwork Building deep relationships Business Bank products:• Treasury Management• Commercial Card• Merchant Services• Letters of Credit• Foreign Exchange• Insurance Wealth Management products:• Private Banking • Asset Management• Securities/ Capital Markets • 401K/ Trust Advisory Retail Bank products:• On the Job Banking

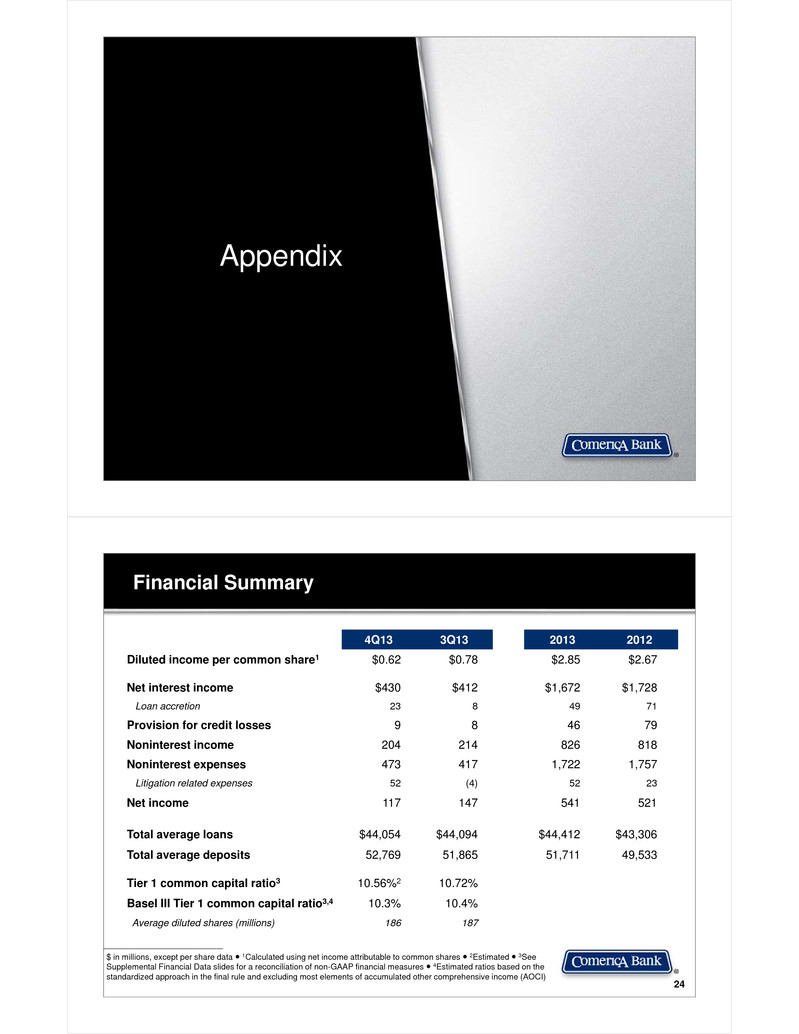

17 Industry Evolution 1Source: U.S. Bureau of Economic Analysis. 2012 advance statistics, released 6/6/13 ● 2Source: U.S. Census Bureau, released in 2013 Industry Evolution Regulation and Enforcement• CFPB• Durbin• Debit card interchange Capital and Liquidity Requirements• Basel III: Liquidity Coverage Ratio (LCR)• Basel III capital rules• Stress test & capital plan Importance of Retail Deposits• Low cost of funding• Basel III LCR Branch Usage Technology Investment• Drive for efficiency• Meet customer requirements Comerica Today Operates in… Two largest state economies in the country1 7 of the top 10 most populated U.S. cities2 …with strong business model… Relationship banking Trusted advisor Robust product offering …and even stronger opportunities to… Further penetrate footprint Cross-sell customer base • Reg E• NSF/OD 18 Maintaining Focus on Long-Term GoalsMoving Toward Goals, Despite Prolonged Low Rate Environment Goal as of 2/7/14 Efficiency Ratio20 Year Average: 59.3% Return on Average Assets (ROA)20 Year Average: 1.16% 72.7% 69.2% 68.8% 2011 2012 2013 0.69% 0.83% 0.85% 2011 2012 2013 Long-TermGoal: Above 1.30% Long-TermGoal: Below 60%

19 Controlling What We Can Control Loans and Deposits Continue to Grow 1Includes the acquisition of Sterling Bancshares during 2011 ● 2Source: SNL Financial 40.1 43.3 44.4 2011 2012 2013 Loan Growth(Average $ in billions) +11% 3.3% 3.0% 2.2% 2.2% 1.7% 1.4% 1.3% 1.1% 0.7% -0.1 % -1.2 % -1.2 % BOK F CMA ST I ZIO N SNV KEY HBA N FITB MTB FHN R F BBT Loan Growth vs. Peers2(Period-end 4Q13 vs. 3Q13) 43.8 49.5 51.7 2011 2012 2013 +18% Deposit Growth(Average $ in billions) 27% 27% 28% 29% 30 % 33% 33% 36 % 37% 38% 40 % 45% SNV BBT FHN HBA N STI RF FITB BOK F MTB KEY ZIO N CMA Noninterest-Bearing as a Percent of Total Deposits2(4Q13 average balances) +8%1 +3% +13%1 +4% Controlling What We Can ControlExpenses Decline, While Fee Income Increases 20 Introducing new and enhanced treasury management products Cross-sell to expand relationships Expand Trust Alliance to grow fiduciary fees Utilizing technology to improve productivity Selected outsourcing of services Lower pension expense due to improved market performance and long-term rates 1,771 1,757 1,722 2011 2012 2013 Expenses Decline($ in millions) -3% Fee Income Increases($ in millions) 792 818 826 2011 2012 2013 +4% Expenses Opportunities Revenue Opportunities

21 Continued Strong Credit QualityCredit Metrics Below Pre-Recession Levels 1Net loan charge-offs as a percentage of average total loans ● 2Nonperforming assets as a percentage of total loans ●3Source: SNL Financial 0.82 0.39 0.16 2011 2012 2013 Net Charge-off Ratio1 -0.0 9 0.12 0. 20 0.2 6 0.27 0.40 0.4 3 0.43 0 .49 0.51 0.67 1.45 BOK F CMA ZIO N MTB KEY ST I HBA N FHN BBT SNV FITB R F 4Q13 NCO Ratio1 vs. Peers3 Nonperforming Asset Ratio2 2.29 1.29 0.84 2011 2012 2013 -63% 22 Solid Shareholder ReturnIncreasing Bottom Line & Book Value 1Dividends per common share 2.09 2.67 2.85 2011 2012 2013 0.40 0.55 0.68 2011 2012 2013 Earning Per Share Growth($ per share) +70% Book Value Per Share Growth($ per share) 34.80 36.87 39.23 2011 2012 2013 +13% Dividends Per Share1 Growth($ per share) +36% 47% 79% 76% 19% 21% 23% FY11 FY12 FY13 Shares Repurchased Dividend Shareholder Payout

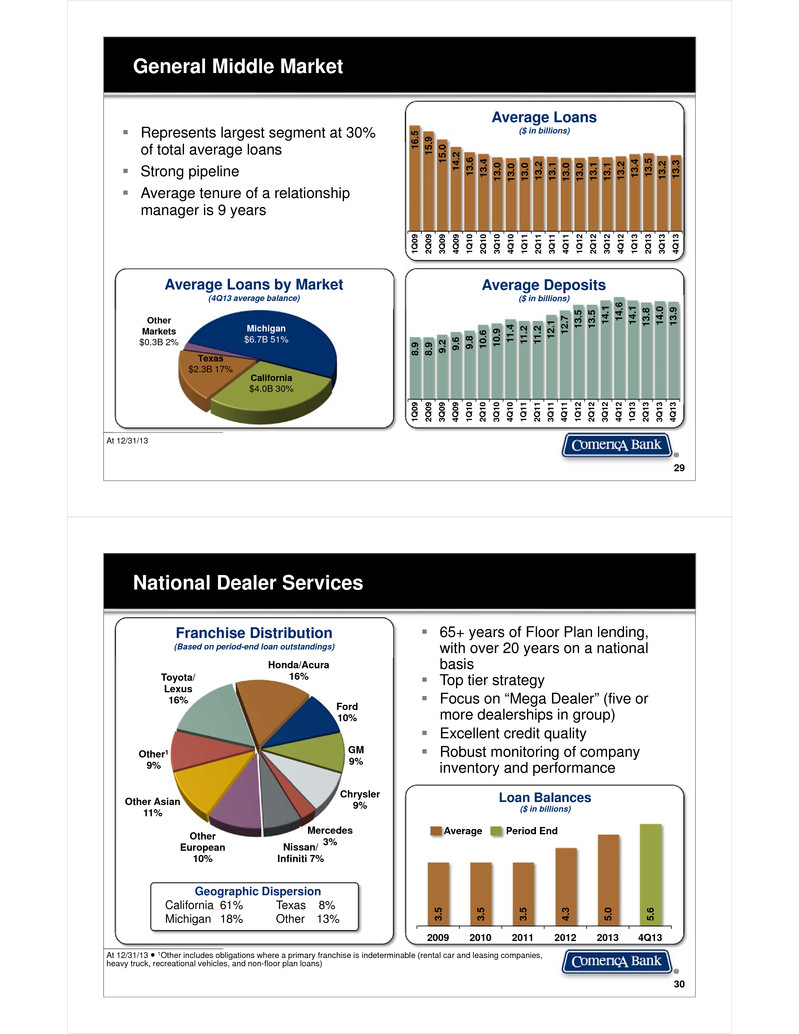

Appendix 24 Financial Summary $ in millions, except per share data ● 1Calculated using net income attributable to common shares ● 2Estimated ● 3See Supplemental Financial Data slides for a reconciliation of non-GAAP financial measures ● 4Estimated ratios based on the standardized approach in the final rule and excluding most elements of accumulated other comprehensive income (AOCI) 4Q13 3Q13 2013 2012 Diluted income per common share1 $0.62 $0.78 $2.85 $2.67 Net interest income $430 $412 $1,672 $1,728 Loan accretion 23 8 49 71 Provision for credit losses 9 8 46 79 Noninterest income 204 214 826 818 Noninterest expenses 473 417 1,722 1,757 Litigation related expenses 52 (4) 52 23 Net income 117 147 541 521 Total average loans $44,054 $44,094 $44,412 $43,306 Total average deposits 52,769 51,865 51,711 49,533 Tier 1 common capital ratio3 10.56%2 10.72% Basel III Tier 1 common capital ratio3,4 10.3% 10.4% Average diluted shares (millions) 186 187

25 Full-Year 2013 Results $ in millions ● Full-year 2013 compared to full-year 2012 ● 1Shares repurchased under the share repurchase program Net income up $20MM or 4% from 2012 Average loans up 3%, driven by National Dealer, general Middle Market and Energy Average deposits up 4%, growth across all markets Customer-driven fees up 2%, driven by Fiduciary and Card fees Noninterest expenses down 2%, driven by absence of restructuring charges. Continued tight expense control was offset by an increase in legal reserves due to an adverse litigation outcome EPS of $2.85 up 7% from 2012 Key Performance DriversFY13 From FY12Chg $ Chg %Total average loans 44,412 $1,106 3% Commercial loans 27,971 1,747 7 Total average deposits 51,711 2,178 4 Noninterest-bearing deposits 22,379 1,375 7 Net interest income 1,672 (56) (3) Loan accretion 49 (22) (31) Provision for credit losses 46 (33) (42) Net loan charge-offs 73 (97) (57) Noninterest income 826 8 1 Customer-driven fee income 763 13 2 Noninterest expenses 1,722 (35) (2) Net income 541 20 4 Shares repurchased1 7.4MM shares or $287MM 26 Fourth Quarter 2013 Results $ in millions ● 4Q13 compared to 3Q13 ● 1Shares repurchased under the share repurchase program Key Performance Drivers Period-end loan growth across almost all businesses Net interest income growth due to better than expected accretion from purchased credit-impaired loans Customer-driven fees impacted by strong 3Q13, slower economic activity and regulatory headwinds Noninterest expenses impacted by an increase in legal reserves due to an adverse litigation outcome Period-end Loans up $1.3B or 3% 4Q13 Change From3Q13 4Q12Total average loans 44,054 (40) (65) Commercial loans 27,683 (76) 221 Total average deposits 52,769 904 1,487 Noninterest-bearing deposits 23,532 1,153 774 Net interest income 430 18 6 Loan accretion 23 15 10 Provision for credit losses 9 1 (7) Net loan charge-offs 13 (6) (24) Noninterest income 204 (10) -- Customer-driven fee income 190 (5) (1) Noninterest expenses 473 56 46 Net income 117 (30) (13) Shares repurchased1 1.7MM shares or $72MM

27 Loans by Business and Market Average $ in billions Middle Market: Serving companies with revenues generally between $20-$500MM Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM Small Business: Serving companies with revenues generally under $20MM By Line of Business 4Q13 3Q13 4Q12 Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services $13.32.85.30.62.10.8 $13.22.94.90.62.00.8 $13.22.94.60.61.90.7 Total Middle Market $24.8 $24.4 $23.9 Corporate BankingUS BankingInternational 2.61.8 2.71.7 2.81.8 Mortgage Banker Finance 1.1 1.6 2.1 Commercial Real Estate 3.8 3.8 3.7 BUSINESS BANK $34.1 $34.2 $34.3 Small Business 3.6 3.6 3.5 Retail Banking 1.7 1.7 1.8 RETAIL BANK $5.3 $5.3 $5.3 Private Banking 4.7 4.6 4.5 WEALTH MANAGEMENT $4.7 $4.6 $4.5 TOTAL $44.1 $44.1 $44.1 By Market 4Q13 3Q13 4Q12 Michigan $13.4 $13.3 $13.4 California 14.4 14.0 13.3 Texas 9.8 9.9 9.8 Other Markets 6.5 6.9 7.6 TOTAL $44.1 $44.1 $44.1 28 Deposits by Business and Market Average $ in billions Middle Market: Serving companies with revenues generally between $20-$500MM Corporate Banking: Serving companies (and their U.S. based subsidiaries) with revenues generally over $500MM Small Business: Serving companies with revenues generally under $20MM By Line of Business 4Q13 3Q13 4Q12 Middle MarketGeneralEnergyNational Dealer ServicesEntertainmentTech. & Life SciencesEnvironmental Services $13.90.60.20.25.20.2 $14.00.50.20.15.10.2 $14.60.50.20.15.20.1 Total Middle Market $20.3 $20.1 $20.7 Corporate BankingUS BankingInternational 2.81.8 2.41.8 2.11.6 Mortgage Banker Finance 0.6 0.6 0.6 Commercial Real Estate 1.5 1.4 1.1 BUSINESS BANK $27.0 $26.3 $26.1 Small Business 2.8 2.7 2.7 Retail Banking 18.6 18.6 18.2 RETAIL BANK $21.4 $21.3 $20.9 Private Banking 3.9 3.8 3.8 WEALTH MANAGEMENT $3.9 $3.8 $3.8 Finance/ Other 0.5 0.5 0.5 TOTAL $52.8 $51.9 $51.3 By Market 4Q13 3Q13 4Q12 Michigan $20.6 $20.5 $20.0 California 15.2 14.6 15.5 Texas 10.5 10.3 9.8 Other Markets 6.0 6.0 5.5 Finance/ Other 0.5 0.5 0.5 TOTAL $52.8 $51.9 $51.3

29 General Middle Market At 12/31/13 Represents largest segment at 30% of total average loans Strong pipeline Average tenure of a relationship manager is 9 years 8.9 8.9 9.2 9.6 9.8 10 .6 10.9 11. 4 11.2 11.2 12 .1 12.7 13 .5 13.5 14. 1 14.6 14.1 13.8 14.0 13.9 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 16.5 15.9 15.0 14.2 13.6 13.4 13.0 13.0 13.0 13.2 13.1 13.0 13.0 13.1 13.1 13.2 13. 4 13.5 13.2 13.3 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 Average Loans($ in billions) Average Deposits($ in billions)Average Loans by Market(4Q13 average balance) California$4.0B 30% Texas$2.3B 17% Michigan$6.7B 51% Other Markets$0.3B 2% 30 National Dealer Services At 12/31/13 ● 1Other includes obligations where a primary franchise is indeterminable (rental car and leasing companies, heavy truck, recreational vehicles, and non-floor plan loans) Toyota/Lexus16% Honda/Acura 16% Ford 10% GM 9% Chrysler 9% Mercedes 3%Nissan/ Infiniti 7% Other European 10% Other Asian 11% Other19% Franchise Distribution(Based on period-end loan outstandings) Geographic DispersionCalifornia 61% Texas 8%Michigan 18% Other 13% 3.5 3.5 3.5 4.3 5.0 5.6 2009 2010 2011 2012 2013 4Q13 Loan Balances($ in billions) Average Period End 65+ years of Floor Plan lending, with over 20 years on a national basis Top tier strategy Focus on “Mega Dealer” (five or more dealerships in group) Excellent credit quality Robust monitoring of company inventory and performance

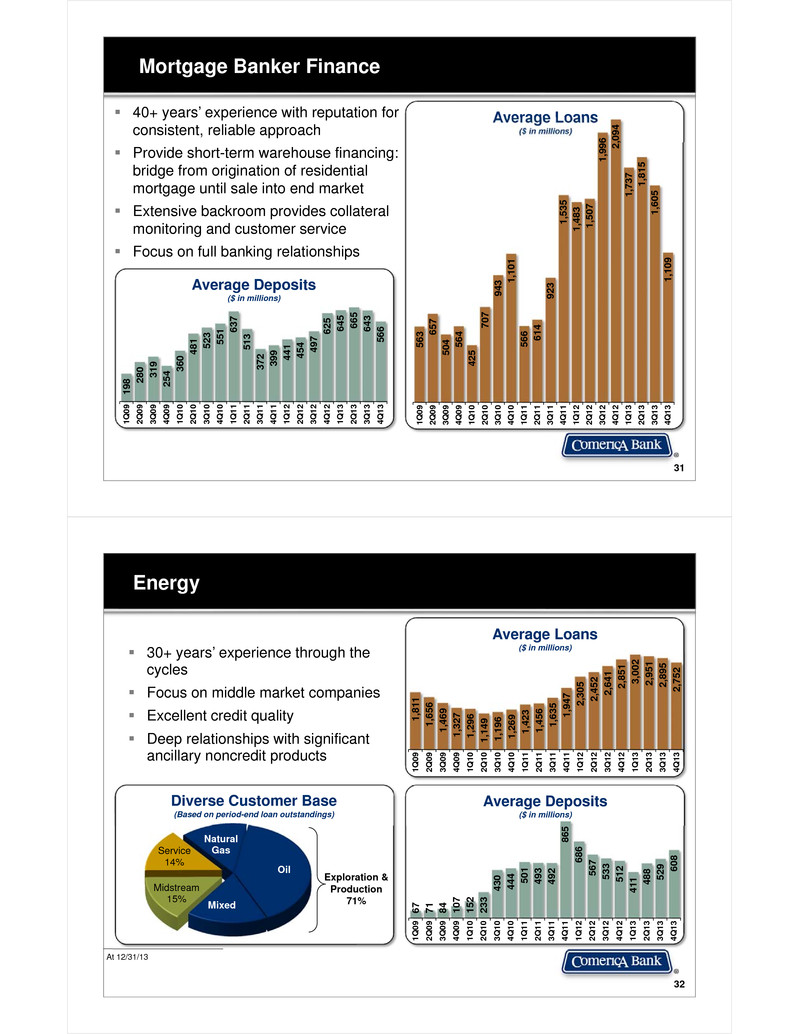

Mortgage Banker Finance 31 Average Deposits($ in millions) Average Loans($ in millions) 40+ years’ experience with reputation for consistent, reliable approach Provide short-term warehouse financing: bridge from origination of residential mortgage until sale into end market Extensive backroom provides collateral monitoring and customer service Focus on full banking relationships 198 2 80 319 254 3 60 4 81 523 551 637 513 372 399 44 1 454 49 7 62 5 645 665 643 566 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 563 6 57 504 56 4 425 707 943 1 ,101 566 61 4 923 1,53 5 1,48 3 1,50 7 1,99 6 2,09 4 1,73 7 1,81 5 1,60 5 1,10 9 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 32 Energy At 12/31/13 30+ years’ experience through the cycles Focus on middle market companies Excellent credit quality Deep relationships with significant ancillary noncredit products Average Loans($ in millions) 1,81 1 1,65 6 1,46 9 1,32 7 1,29 6 1,14 9 1,19 6 1,26 9 1,42 3 1,45 6 1,63 5 1,94 7 2,30 5 2,45 2 2,64 1 2,85 1 3,00 2 2,95 1 2,89 5 2,75 2 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 67 71 84 107 152 233 430 444 50 1 493 492 865 686 567 533 512 411 48 8 529 60 8 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 Average Deposits($ in millions) Natural Gas Oil Mixed Midstream15% Service14% Exploration & Production 71% Diverse Customer Base(Based on period-end loan outstandings)

33 Technology and Life Sciences At 12/31/13 20+ year history Products and services tailored to meet the needs of emerging companies throughout their lifecycle Strong relationships with top-tier investors National business headquartered in Palo Alto, CA, operating from 13 offices in the U.S. and Toronto Top notch relationship managers with extensive industry expertise Average Loans($ in millions) 1,71 6 1,52 1 1,37 1 1,28 0 1,09 8 1,14 7 1,12 0 1,16 2 1,19 3 1,21 7 1,34 6 1,51 7 1,64 3 1,65 9 1,83 1 1,88 6 2,00 8 1,91 3 2,02 4 2,12 5 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 2,64 9 2,72 7 2,85 6 3,19 8 3,26 9 3,42 4 3,34 5 3,49 8 3,73 0 4,11 6 4,23 1 4,44 0 4,70 3 5,06 5 5,20 8 5,16 6 5,02 6 4,99 6 5,05 1 5,17 6 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 Average Deposits($ in millions) 34 Commercial Real Estate Line of Business At 12/31/13 ● 1Includes CRE line of business loans not secured by real estate 6,84 3 6,65 2 6,36 5 6,04 5 5,74 4 5,37 4 5,09 6 4,75 4 4,42 8 4,03 4 4,43 6 4,57 7 4,36 5 4,30 5 3,92 4 3,72 7 3,69 3 3,79 1 3,75 2 3,74 1 1Q0 9 2Q0 9 3Q0 9 4Q0 9 1Q1 0 2Q1 0 3Q1 0 4Q1 0 1Q1 1 2Q1 1 3Q1 1 4Q1 1 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 Commercial MortgagesReal Estate ConstructionCommercial & Other Average Loans($ in millions) 4,444 4,753 4,796 4,926 5,238 4Q12 1Q13 2Q13 3Q13 4Q13 Commitments($ in millions; Based on Period-end commitments) 160+ years experience with focus on well-established developers, primarily in our footprint Provide construction and mini-perm mortgage financing Real Estate Construction average loans up for the past 5 quarters +18% 1

35 Shared National Credit Relationships Shared National Credit (SNC): Facilities greater than $20 million shared by three or more federally supervised financial institutions which are reviewed by regulatory authorities at the agent bank level. December 31, 2013: $9.4B(Period-end outstandings) Commercial Real Estate$0.6B 6% Corporate $2.6B 28% General$2.1B 22% National Dealer $0.4B 4% Energy$2.6B 28% Entertainment$0.2B 3% Tech. & Life Sciences$0.3B 3% Environmental Services $0.4B 4% Mortgage Banker$0.2B 2% = Total Middle Market (64%) Approximately 860 borrowers Strategy: Pursue full relationships with ancillary business Comerica is agent for approximately 16% Adhere to same credit underwriting standards as rest of loan book Credit quality mirrors total portfolio 36 Nonperforming Assets 4Q13 compared to 3Q13 December 31, 2013Nonaccrual Loans $350MM Middle Market$80MM Corporate $2MM Commercial Real Estate$79MM Private Banking$29MM Small Business$76MM Other$84MM Nonperforming Assets($ in millions) 587 555 500 478 383 1.27 1.23 1.10 1.08 0.84 4Q12 1Q13 2Q13 3Q13 4Q13 Nonperforming Assets as aPercentage of Total Loans + ORE Nonperforming Assets of $383MM, a $95MM decrease, included:• Nonaccrual loans down $87MM • Foreclosed Property down to $9MM Troubled Debt Restructurings (TDRs) of $181MM, included:• $57MM Performing Restructured• $24MM Reduced Rate • $100MM Nonaccrual TDR

37 Government Card Programs At 12/31/13 ● 1Source: the Nilson Report July 2013 ● 2Final rule announced 12/22/10 ● 3Based on a June 2012 survey. Source: U.S. Department of the Treasury ● 4Checks eliminated since December 2010. Source: U.S. Department of the Treasury Growing Average Noninterest-Bearing Deposits($ in millions) 185 290 532 650 720 948 1,221 2007 2008 2009 2010 2011 2012 2013 US Treasury ProgramState Card Programs #1 prepaid card issuer1 in US Service 32 state and local government benefit programs Service US Treasury DirectExpress Program:• Exclusive provider of prepaid debit cards with a contract through January 2015• Over 4.5 million cards registered• Phasing out checks2As of 5/1/11, new benefit recipientsAs of 3/1/13, current check recipients• 95% of Direct Express card holders report they are satisfied3• Nearly 8MM monthly benefit checks eliminated, resulting in significant taxpayer savings4 38 Factors Expected to Drive Long-Term Efficiency Ratio Goal Goal as of 2/7/14 2012 Long-Term Goal1 Efficiency Ratio:69% Efficiency Ratio:<60% Expense Growth of 0 - 2% Fee Income Growth of 2 - 4% Loan Growth of 3 - 5% • Increase cross-sell penetration • Collaboration between businesses Focused growth:• Target markets • Allocation of resources to faster growing businesses • Relationship driven • Normalized rates not necessary to reach long-term goal • Continued focus on operating leverage ≈1% ≈2% Normal (≈3.5%) Fed Funds

39 Holding Company Debt Rating As of 2/4/14 ● Source: SNL Financial ● Debt Ratings are not a recommendation to buy, sell, or hold securities Senior Unsecured/Long-Term Issuer Rating S&P Moody’s Fitch BB&T A- A2 A+ BOK Financial A- A2 A Comerica A- A3 A M&T Bank A- A3 A- KeyCorp BBB+ Baa1 A- Fifth Third BBB+ Baa1 A SunTrust BBB Baa1 BBB+ Huntington BBB Baa1 A- Regions Financial BBB- Ba1 BBB- Zions Bancorporation BBB- Ba1 BBB- First Horizon National Corp BB+ Baa3 BBB- Synovus Financial Corp BB- B1 BB Wells Fargo & Company A+ A2 AA- U.S. Bancorp A+ A1 AA- JP Morgan A A3 A+ PNC Financial Services Group A- A3 A+ Bank of America A- Baa2 A Pee r Ba nks Larg e Ba nks Supplemental Financial DataReconciliation of non-GAAP financial measures with financial measures defined by GAAP ($ in millions) 40 The Tier 1 common capital ratio removes preferred stock and qualifying trust preferred securities from Tier 1 capital as defined by and calculated in conformity with bank regulations. The tangible common equity ratio removes preferred stock and the effect of intangible assets from capital and the effect of intangible assets from total assets.The Corporation believes these measurements are meaningful measures of capital adequacy used by investors, regulators, management and others to evaluate the adequacy of common equity and to compare against other companies in the industry.1Tier 1 Capital and risk-weighted assets as defined and calculated in accordance with regulation.2December 31, 2013 Tier 1 Capital and Risk-Weighted assets are estimated. 12/31/13 9/30/13 6/30/13 3/31/13 12/31/12 Tier 1 and Tier 1 common capital1,2Risk-weighted assets1,2Tier 1 and Tier 1 common capital ratio2 6,89565,31710.56% 6,86264,02710.72% 6,80065,22010.43% 6,74865,09910.37% 6,70566,11510.14% Total shareholders’ equityLess: GoodwillLess: Other intangible assets $7,15363517 $6,96963518 $6,91163520 $6,98863521 $6,94263522 Tangible common equity $6,501 $6,316 $6,256 $6,332 $6,285Total assetsLess: GoodwillLess: Other intangible assets $65,22763517 $64,67063518 $62,94763520 $64,88563521 $65,06963522Tangible assets $64,575 $64,017 $62,292 $64,229 $64,412Tangible common equity ratio 10.07% 9.87% 10.04% 9.86% 9.76%

Supplemental Financial DataTier 1 Common Equity under Basel III ($ in millions) 41 The Tier 1 common capital ratio removes preferred stock and qualifying trust preferred securities from Tier 1 capital as defined by and calculated in conformity with bank regulations. The Basel III Tier 1 common capital ratio further adjusts Tier 1 common capital and risk-weighted assets to account for the final rule approved by U.S. banking regulators in July 2013 for the U.S. adoption of the Basel III regulatory capital framework. The final Basel III capital rules are effective January 1, 2015 for banking organizations subject to the standardized approach. The Corporation believes these measurements are meaningful measures of capital adequacy used by investors, regulators, management and others to evaluate the adequacy of common equity and to compare against other companies in the industry.1Tier 1 Capital and risk-weighted assets as defined in accordance with regulation.2December 31, 2013 Tier 1 Capital and Risk-Weighted assets are estimated.3Estimated ratios based on the standardized approach in the final rule for the U.S. adoption of the Basel III regulatory capital framework and excluding most elements of AOCI. Basel III Tier 1 Common Capital Ratio 12/31/13 9/30/13 6/30/13 3/31/13 12/31/12 Tier 1 common capital2Basel III adjustments3 $6,895(6) $6,862(4) $6,800-- $6,748(1) $6,705(39) Basel III Tier 1 common capital3 $6,889 $6,858 $6,800 $6,747 $6,666 Risk-weighted assets1,2Basel III adjustments3 $65,3171,735 $64,0271,726 $65,2202,091 $65,0991,996 $66,1151,854Basel III risk-weighted assets3 $67,052 $65,753 $67,311 $67,095 $67,969 Tier 1 common capital ratio2Basel III Tier 1 common capital ratio3 10.6%10.3% 10.7%10.4% 10.4%10.1% 10.4%10.1% 10.1%9.8%