Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE AND EARNINGS RELEASE ATTACHMENTS - EXELON CORP | d666081dex991.htm |

| 8-K - FORM 8-K - EXELON CORP | d666081d8k.htm |

Earnings Conference Call

4

Quarter

2013

February

6

,

2014

Exhibit 99.2

th

th |

Cautionary Statements Regarding Forward-Looking Information

This presentation contains certain forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995, that are

subject to risks and uncertainties. The factors that could cause actual

results to differ materially from the forward-looking statements

made by Exelon Corporation, Commonwealth Edison Company,

PECO

Energy

Company,

Baltimore

Gas

and

Electric

Company

and

Exelon

Generation Company, LLC (Registrants) include those factors discussed herein,

as well as the items discussed in (1) Exelon’s 2012 Annual

Report on Form 10-K in (a) ITEM 1A. Risk Factors, (b) ITEM 7.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations and (c) ITEM 8. Financial Statements and

Supplementary Data: Note 19; (2) Exelon’s Third Quarter 2013 Quarterly Report

on Form 10-Q in (a) Part II, Other Information, ITEM 1A. Risk Factors; (b)

Part 1, Financial Information, ITEM 2. Management’s Discussion and

Analysis of Financial Condition and Results of Operations and (c) Part

I, Financial Information, ITEM 1. Financial Statements: Note 18; and (3)

other factors discussed in filings with the SEC by the Registrants.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which apply only as of the date of this

presentation. None of the Registrants undertakes any obligation to

publicly release any revision to its forward-looking statements to

reflect events or circumstances after the date of this

presentation. 2013 4Q Earnings Release Slides

1 |

2013 4Q Earnings Release Slides

2

2013 In Review

(1)

Represents adjusted (non-GAAP) operating EPS. Refer to the Earnings

Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating

EPS to GAAP EPS.

(2)

2014 earnings guidance based on expected average outstanding shares of ~860M.

Refer to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS guidance to GAAP EPS.

•

Utilities

•

Top quartile and best ever customer

satisfaction index scores; top

quartile in SAIFI (outage frequency)

•

ExGen

•

Nuclear capacity factor over 94%

•

Power dispatch match over 99%

and renewables

energy capture

over 93%

•

Utilities

•

Successful installation of 1.3M

smart

meters

•

ExGen

•

Added 158 MW of clean generation,

primarily from our AVSR solar

project

•

2013 adjusted operating results of

$2.50/share

(1)

•

Strong balance sheet and free cash

flow metrics

•

Achieved lower than forecasted O&M

•

Utilities

•

SB9

•

ComEd

and BGE rate cases

•

ExGen

•

Successful court outcomes

against subsidized generation

•

Continued effort to achieve market

reforms to protect competition

Operational

Excellence

Financial

Discipline

Regulatory

Advocacy

Growth

Investments

•

Delivered solid 2013 results in the middle of our guidance range

•

Providing

initial

2014

adjusted

operating

earnings

guidance

of

$2.25-$2.55/share

(2) |

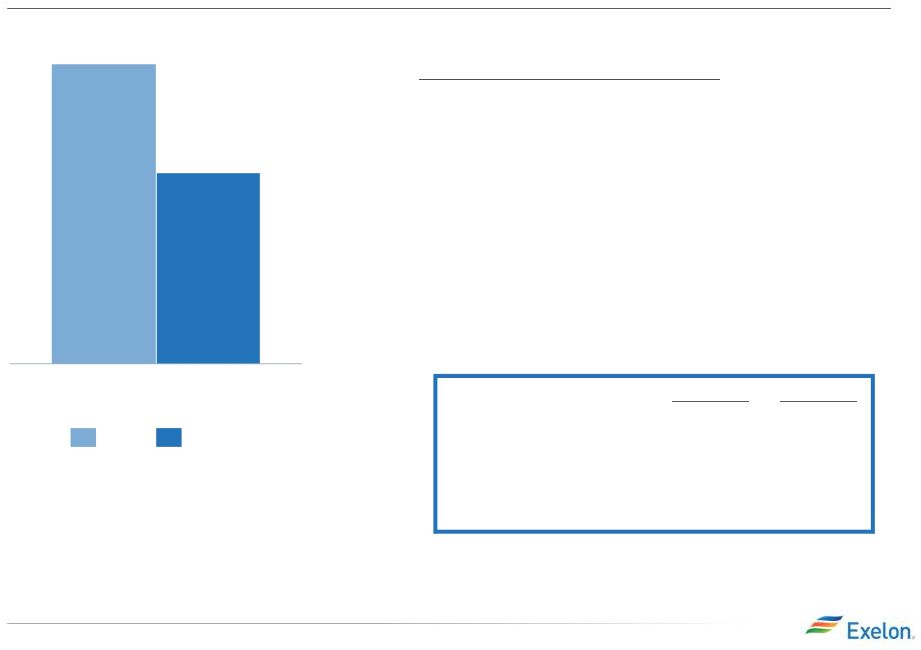

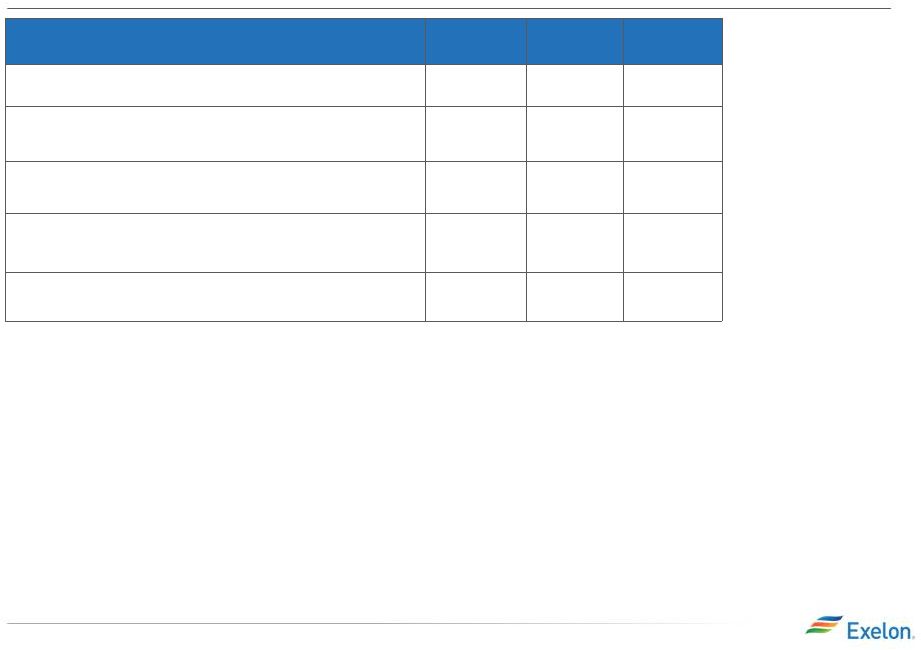

Exelon

Utilities

Adjusted

Operating

EPS

Contribution

(1)

3

2013 4Q Earnings Release Slides

4Q 2013

4Q 2012

$0.19

$0.13

$0.12

$0.31

$0.10

$0.02

$0.06

$0.31

BGE

PECO

ComEd

Numbers may not add due to rounding.

(1)

Refer

to

the

Earnings

Release

Attachments

for

additional

details

and

to

the

Appendix

for

a

reconciliation

of

adjusted

(non-GAAP)

operating

EPS

to

GAAP

EPS.

(2)

The discrete impacts include $(0.05) related to the reinstatement of the 2011

return on pension asset and $(0.04) related to 2012 pension asset costs recorded in the fourth quarter of 2012.

(3)

Due to the distribution formula rate, changes in ComEd’s earnings are

driven primarily by changes in 30-year U.S. Treasury rates (allowed ROE), rate base and capital structure in addition to

weather, load and changes in customer mix.

Key

Drivers

–

4Q13

vs.

4Q12

:

BGE

(+0.04):

•

Decreased storm costs: $0.02

•

Distribution revenue due to rate cases: $0.02

PECO

(+0.02):

•

Decreased storm costs: $0.03

•

Income taxes: $(0.01)

ComEd

(-0.06):

•

Discrete impacts of the 2012 distribution formula rate

order

(2)

: $(0.09)

•

Weather,

load

and

customer

mix

(3)

:

$0.02

2013 4Q Earnings Release Slides |

4

4Q

$0.21

2013

2012

(excludes Salem and CENG)

4Q12

Actual

4Q13

Actual

Planned Refueling Outage Days

113

94

Non-refueling Outage Days

1

33

Nuclear Capacity Factor

93.0%

92.3%

Key

Drivers

–

4Q13

vs.

4Q12

•

Lower gross margin, primarily due to lower

realized energy prices, partially offset by

increased capacity pricing: $(0.11)

•

Higher other expense, primarily due to lower

realized NDT fund gains: $(0.02)

•

Lower O&M costs, primarily due to merger

synergies:

$0.02

ExGen Adjusted Operating EPS Contribution

(1)

$0.33

(1)

Refer

to

the

Earnings

Release

Attachments

for

additional

details

and

to

the

Appendix

for

a

reconciliation

of

adjusted

(non-GAAP)

operating

EPS

to

GAAP

EPS.

2013 4Q Earnings Release Slides |

HoldCo

ExGen

ComEd

PECO

BGE

HoldCo

ExGen

ComEd

PECO

BGE

2014 Guidance

$2.25 -

$2.55

(2)

$1.10

-

$1.30

$0.50

-

$0.60

$0.40

-

$0.50

$0.20

-

$0.30

2013 Actual

$2.50

(1)

$1.40

$0.49

$0.46

$0.23

2014 Adjusted Operating Earnings Guidance

(1)

2013 results based on 2013 average outstanding shares of 860M. Refer to

Earnings Release Attachments for additional details and to the Appendix for a reconciliation of adjusted (non-

GAAP) operating EPS to GAAP EPS.

(2)

2014 earnings guidance based on expected average outstanding shares of ~860M.

Earnings guidance for OpCos may not add up to consolidated EPS guidance. Refer to the Appendix for a

reconciliation of adjusted (non-GAAP) operating EPS guidance to GAAP EPS. Key

Year-Over-Year Drivers •

Lower ExGen Total Gross Margin

primarily due to lower energy prices,

partially offset by higher capacity

revenue: $(0.17)

•

Higher ComEd RNF primarily from DST

revenues due primarily to increasing rate

base and higher expected treasury yields

impact on ROE: $0.09

•

Higher BGE RNF: $0.05

•

Higher O&M, mainly at the utilities,

driven primarily by inflation and storm

costs offset by synergies and lower

pension/OPEB expense: $(0.07)

•

Higher D&A: $(0.04)

•

Other expense, primarily lower ExGen

interest: $0.04

5

2013 4Q Earnings Release Slides

Expect

Q1

2014

Adjusted

Operating

Earnings

of

$0.60

-

$0.70

per

share |

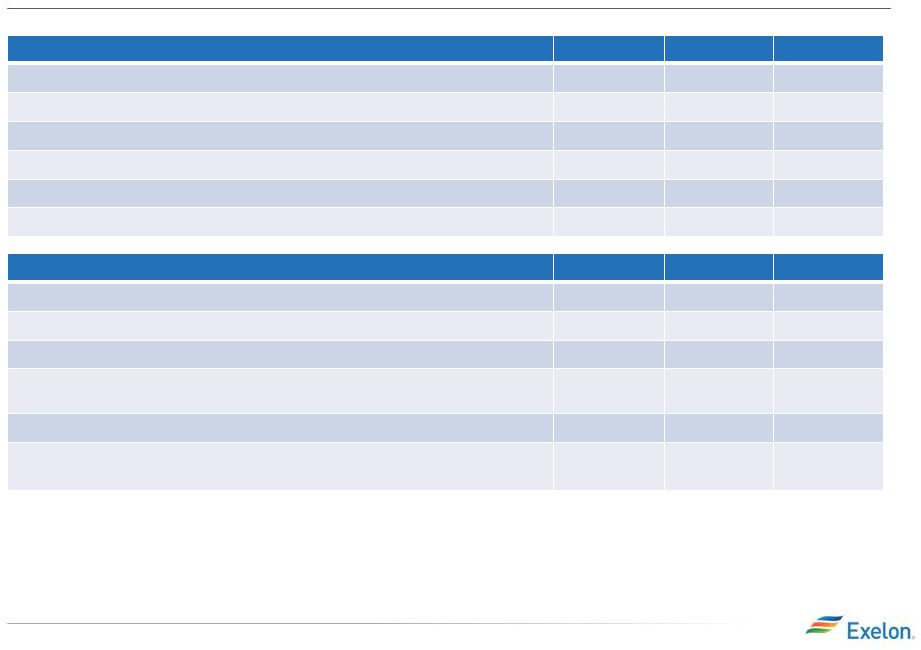

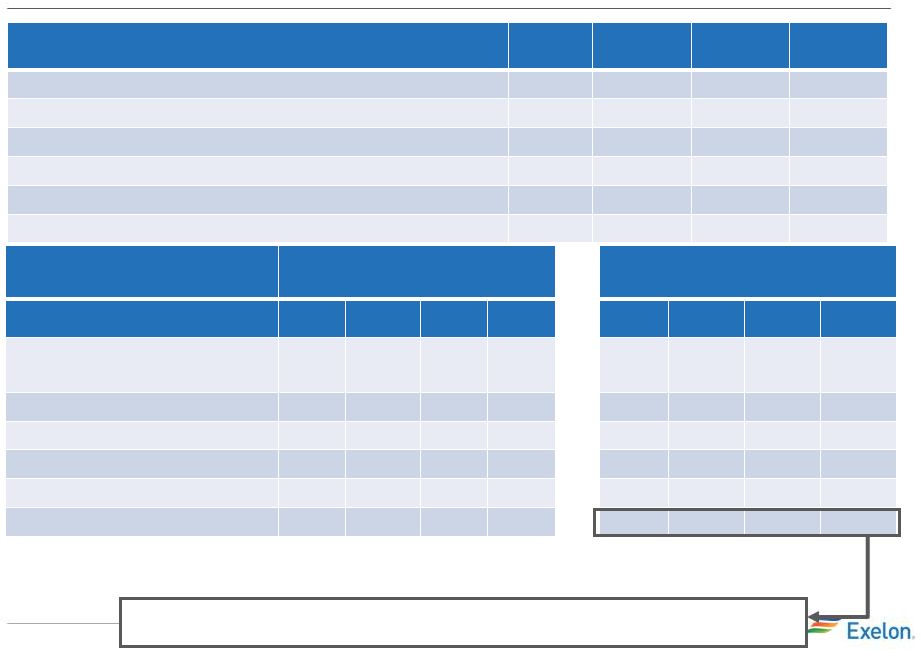

Exelon Consolidated Cash Flow: 2014 Expected vs 2013

Actuals

Key Messages

(6)

•

Adjusted Cash from Operations

(2)

is projected to be

$6,100M vs

2013A of $6,025M for a

$75M variance. This variance is primarily

driven by:

•

Cash from Financing activities is projected to be ($825M) vs 2013A of ($775M) for a ($50M) variance. This variance is

primarily driven by:

•

CapEx is projected to be

$5,475M vs 2013A $5,350M for a

($125M) variance. This

variance is primarily driven by: Projected Sources & Uses

(6)

6

2013 4Q Earnings Release Slides

2014

Projected

Sources

and

Uses

of

Cash

(7)

($ in millions)

BGE

ComEd

PECO

ExGen

Exelon

2014E

Exelon

2013A

Delta

Beginning

Cash

Balance

(1)

1,475

1,575

(100)

Adjusted Cash Flow from

Operations

(2)

650

1,525

600

3,175

6,100

6,025

75

CapEx (excluding other items

below):

(525)

(1,575)

(450)

(1,050)

(3,675)

(3,250)

(425)

Nuclear Fuel

n/a

n/a

n/a

(900)

(900)

(1,000)

100

Dividend

(3)

(1,075)

(1,250)

175

Nuclear Uprates

n/a

n/a

n/a

(150)

(150)

(150)

--

Wind

n/a

n/a

n/a

(75)

(75)

(25)

(50)

Solar

n/a

n/a

n/a

(200)

(200)

(450)

250

Upstream

n/a

n/a

n/a

(25)

(25)

(50)

25

Utility Smart Grid/Smart Meter

(75)

(200)

(175)

n/a

(450)

(425)

(25)

Net Financing (excluding

Dividend):

Debt Issuances

--

900

300

--

1,200

1,200

--

Debt Retirements

--

(625)

(250)

(525)

(1,375)

(1,600)

225

Project Finance/Federal Financing

Bank Loan

n/a

n/a

n/a

675

675

725

(50)

Other

(4)

(50)

300

100

(375)

(250)

150

1,275

1,475

(200)

(3) Dividends are subject to declaration by the Board of Directors.

(5) Includes cash flow activity from Holding Company, eliminations, and other

corporate entities. (6) All amounts rounded to the nearest $25M.

(1) Excludes counterparty collateral of $(28) million and $134 million at

12/31/12 and 12/31/13. In addition, the 12/31/14 ending cash

balance does not include collateral. (2) Adjusted Cash Flow from

Operations (non-GAAP) primarily includes net cash flows from operating activities and net cash

flows from investing activities excluding capital expenditures of $5.5B and

$5.4B for 2014 and 2013, respectively. (4) “Other”

includes CENG distribution to EDF, proceeds from stock options,

redemption of PECO preferred stock and

expected changes in short-term debt.

(7) Net 2014 sources and uses for each operating company are expected to be $0M, $325M, $125M

and $550M for BGE, ComEd, PECO and ExGen, respectively.

-

$350M Increase in ComEd’s 2014 distribution rates

-

$125M Income Taxes and Settlements

-

($150M) Higher working capital at the utilities

-

($225M) Lower ExGen Gross Margin

-

($350M) Higher ComEd investment in transmission, distribution and

Smart Grid / Smart Meter

-

$225M AVSR due to majority of work being completed in 2013

-

$100M Lower nuclear fuel expenditures

-

($75M) Maryland commitments

-

($400M) CENG distribution to EDF

-

$175M Increased ComEd LTD requirements primarily to fund

incremental capital investment

-

$175M Reduced dividend to common shareholders

(400)

(5)

(5)

Ending

Cash

Balance

(1) |

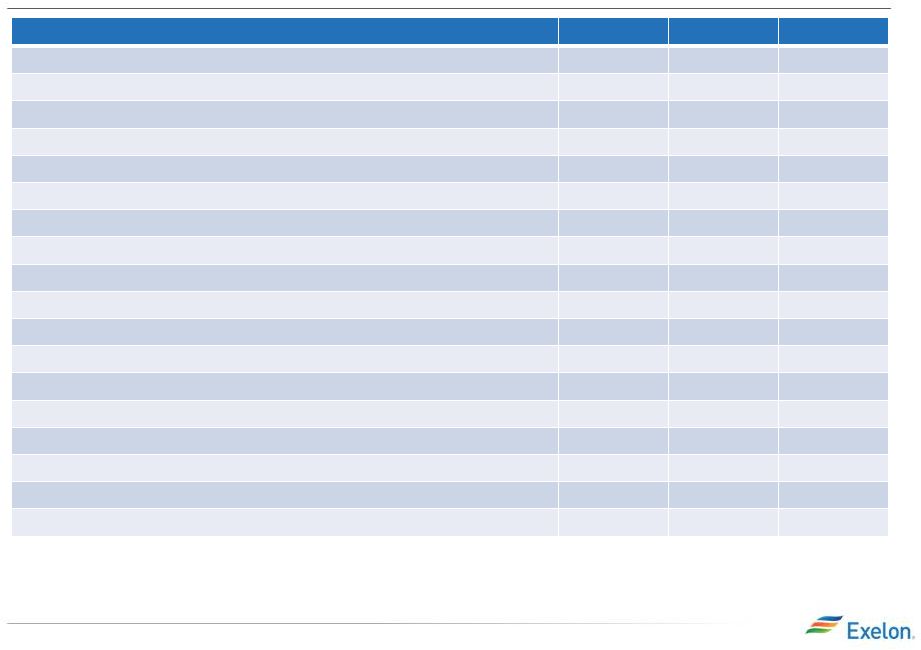

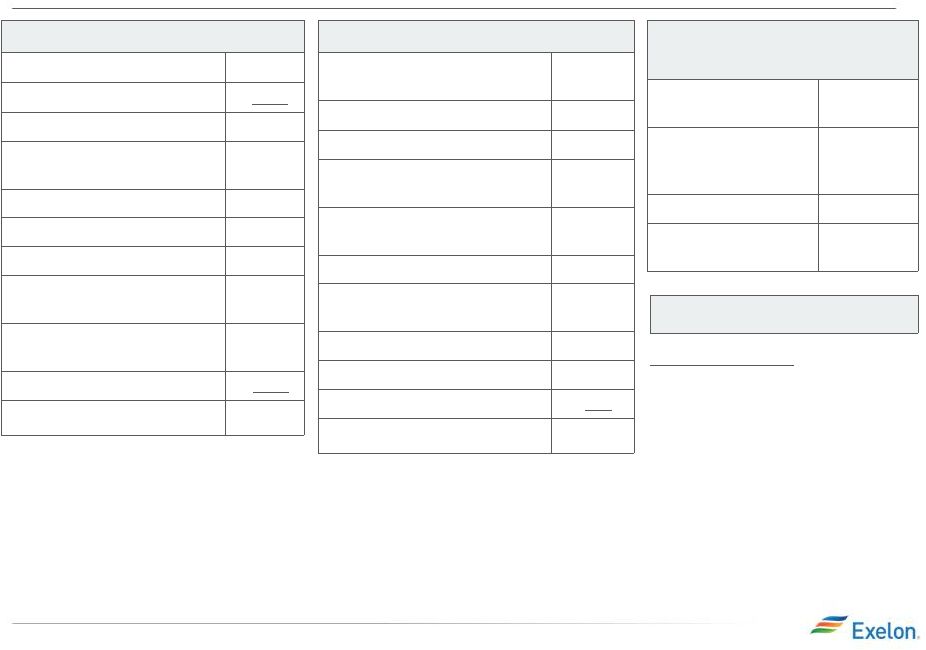

Adjusted O&M Forecast

(2)

•

2014

forecast

of

$6.6B

(1)

$550M run-rate Constellation merger synergies in 2014

Excludes costs to achieve which are considered non-operating

•

Expect CAGR of ~(0.6%) for

2014-2016

2014E

$6,575

(1)

-$75

$4,050

$1,225

$700

$675

2013 Actuals

$6,475

(1)

-$25

$4,000

$1,225

$650

$625

(in $M)

ExGen

(3)

ComEd

ComEd

PECO

PECO

BGE

Corp

(1)

Refer to the Appendix for a reconciliation of adjusted (non-GAAP) O&M

to GAAP O&M. Further, the Utilities adjusted O&M excludes regulatory O&M costs that are P&L neutral. ExGen adjusted

O&M excludes direct cost of sales for certain Constellation business,

P&L neutral decommissioning costs and the impact from O&M related to variable interest entities.

(2)

All amounts rounded to the nearest $25M.

(3)

Excludes CENG.

ExGen

(3)

BGE

7

Key

Year-over-Year

Drivers

(2)

•

Merger synergies, primarily at

ExGen:

$175M

•

Pension/OPEB: $75M

•

Inflation: $150M

•

Average Storm Costs: $50M

•

Other Utility O&M: $25M

•

Other ExGen O&M, primarily

contracting and other site,

corporate and project

expenses: $100M

Corp

2013 4Q Earnings Release Slides |

Exelon Utility 2014-16 Adjusted Operating EPS

Guidance

2013 4Q Earnings Release Slides

8

$1.35

$1.30

$1.20

$1.70

$1.65

$1.25

$1.60

$1.55

$1.50

$1.45

$1.40

$1.15

$1.10

$0.00

2016

$1.55

2015

$1.45

2014

$1.40

2013

$1.17

Exelon Utilities provide stable earnings growth based on sound investment and

strong operational performance

$1.25

$1.15

$1.10

(1)

Refer to Earnings Release Attachments and to the Appendix for a 2013

reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS and to the Appendix for a reconciliation of adjusted

(non-GAAP) Operating EPS guidance to GAAP EPS.

•

$15 billion of investment from 2014-2018 to upgrade aging infrastructure and

invest in new technologies to achieve rate base growth of 5-7%

•

Long-term target of 10% ROE at each utility by 2017

•

Managing the regulatory environment to achieve a fair rate of return at all

utilities |

Exelon Generation: Gross Margin Update

2013 4Q Earnings Release Slides

9

December 31, 2013

Change

from

Sept

30,

2013

(7)

Gross Margin Category ($M)

(1)

2014

2015

2016

2014

2015

2016

Open

Gross

Margin

(3)

margin)

5,850

5,700

5,650

250

(50)

(50)

Mark-to-Market

of

Hedges

(3,4)

750

500

250

(150)

50

-

350

650

700

(150)

(100)

(50)

Non-Power Margins Executed

100

50

50

-

-

-

300

350

350

-

-

-

7,350

7,250

7,000

(50)

(100)

(100)

Recent Developments

•

Severe weather in our load serving regions led to significant power and gas

volatility •

Our balanced generation to load strategy, as well as our geographic and

commodity diversity, allowed

us

to

navigate

through

several

offsetting

issues

such

as

gas

curtailments

and

nuclear

outages

•

The return of volatility to the markets may lead to more appropriate pricing of

risk premiums Non-Power

New

Business

/

To

Go

(5)

Power New Business / To Go

4)

Mark to Market of Hedges assumes mid-point of hedge percentages.

5)

Any changes to new business estimates for our non-power business are

presented as revenue less costs of sales.

6)

Based on December 31, 2013 market conditions

7)

Adjusted gross margin based on 8-K issued on December 9, 2013. Refer to

slide 41 for details.

1)

Gross margin categories rounded to nearest $50M.

(including South, West, Canada hedged gross

2)

Total Gross Margin (Non-GAAP) is defined as operating revenues less

purchased power and fuel expense, excluding revenue related to

decommissioning, gross receipts tax, Exelon Nuclear Partners and

variable interest entities. Total Gross Margin is also net of direct cost of

sales for certain Constellation businesses. See Slide 35 for a Non-GAAP to GAAP

reconciliation of Total Gross Margin.

3)

Includes Exelon’s proportionate ownership share of the CENG Joint

Venture. Total

Gross

Margin

(2) |

Hedging Activity and Market Fundamentals

10

(1)

Mid-point of disclosed total portfolio hedge % range was used

2015-Actual (excl NG hedges)

2015-Ratable

2015-Actual

We have shifted our strategy from fixed-price length to a larger

cross-commodity position leaving our exposure to power upside

4Q13

3Q13

2Q13

1Q13

4Q12

3Q12

$35

$15

$60

$55

$45

$40

$50

1Q11

4Q11

2Q12

3Q11

1Q13

4Q12

3Q13

4Q13

2Q13

3Q12

1Q12

2Q11

Fundamental View PJMW

Market PJMW

Market NiHub

Fundamental View NiHub

10%

20%

30%

40%

50%

60%

70%

Fundamental

View

vs.

Market

-

2015

2015: Rotating into a Large Heat Rate Strategy

•

We align our hedging strategies with our fundamental

views

•

As of 12/31/2013 we were 2-3% behind ratable in PJM and

are relying on an even larger amount of cross-commodity

hedges to capture our view that heat rates will expand

•

As of 12/31/2013, Natural gas sales represented 12-15%

of our hedges in 2015 and 2016

•

Late in Q4, as Cal 2015-2016 gas prices increased and

heat rates declined, we shifted our strategy from fixed-price

length to a longer cross-commodity position

•

Structural changes in the stack are expected to increase

volatility in the spot energy market and drive prices higher

than current market

•

Continue to see a disconnect in forward heat rates

compared to our fundamental forecast given current

natural gas prices, expected retirements, new generation

resources, and load assumptions

2013 4Q Earnings Release Slides

Impacts of our view on our hedging activity

Impacts of our view on our hedging activity |

ExGen’s Financial Flexibility

Declining base CapEx, cash vs. earnings differences and balance sheet capacity

result in significant financial flexibility and robust metrics when

evaluating ExGen on a cash basis Balance Sheet Focus

Free Cash Flow Benefits

Resulting 2014 Metrics

Pension Improvements

Rising interest rate environment

results in lower pension

expense and contributions

2015 forecast of just under

$100M lower contributions than

expense

(2)

Tax Position

Use of NOLs and various tax

credits provide substantial near-

term cash tax favorability

compared to book taxes

Longer term tax position shows

tax capacity for growth

opportunities

Robust Balance Sheet

Strong cash flow metrics to

maintain investment grade

ratings and fund incremental

growth opportunities

Declining Base CapEx

Management model process

prioritizes safety and reliability

Prior investment largely to

prepare for license extensions

and mitigate

asset

management

issues

Cost initiatives to reduce capital

including reverse engineering

Key

Cash

Metrics

(1)

2013 FFO/Debt

(3)

= 37%

Improving for 2014

Well above threshold for

investment grade

Adjusted

EBITDA

–

Base

CapEx

= $1,500M -

$1,800M

Reducing base CapEx by

$200M from 2013-16

mitigates declining RNF

$1,225M of FCF before Growth

CapEx and Dividend

Positive FCF in excess of

planned growth CapEx

and ExGen dividend

(1)

See Slides 36-37 for a Non-GAAP to GAAP reconciliation of

cash flow metrics. (2)

Reflects Exelon consolidated forecast with the majority of the difference due

to the expected ExGen amounts. (3)

FFO/Debt for ExGen is shown using S&P’s methodology and includes

parent company debt and interest. Final 2013 calculation is still pending agency review.

2013 4Q Earnings Release Slides

11 |

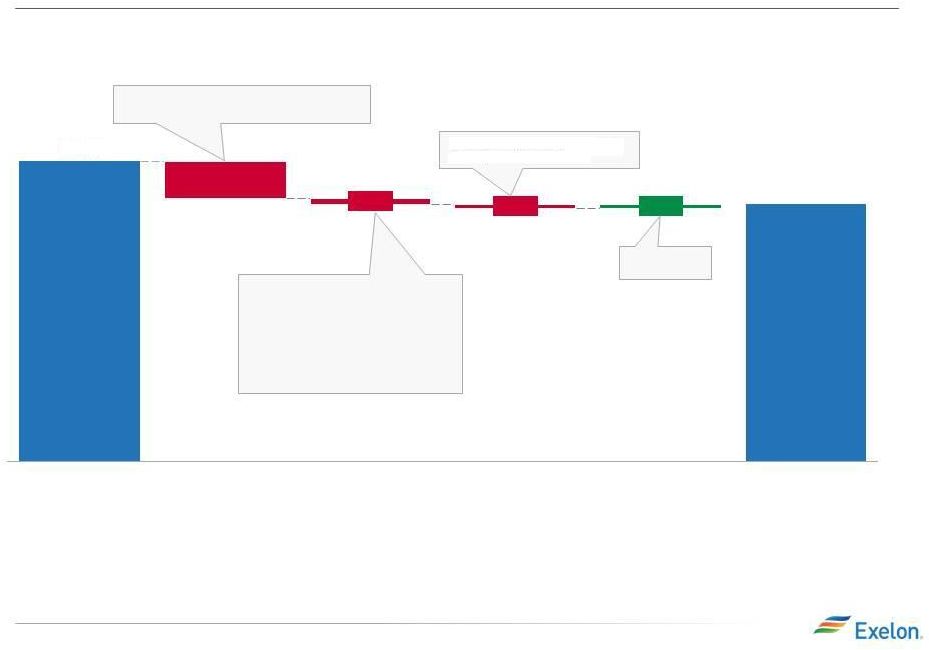

$1.10 -

$1.30

$1.15 -

$1.30

Long-Term EPS Growth Potential comes from controllable

actions, opportunistic investments and market upside

12

2013 4Q Earnings Release Slides

We are committed to drive shareholder value by streamlining operations, cutting

costs, optimizing our generation portfolio and deploying capital

to drive growth.

We firmly believe that our controllable efforts coupled with market upside

should help us deliver a positive earnings CAGR by end of our planning

period Controllable

Market/Advocacy Upside

•

Continued investments in utilities for stable

earnings and growth

•

Aggressive

cost

management

–

in

addition

to

our

merger synergies of $550M, we expect to pursue

incremental cost cutting measures across the

organization

•

Operational

efficiencies

–

productivity

enhancements and portfolio optimization efforts

to reduce operational costs

•

Asset

rationalization

–

potential

sale

or

retirement of unprofitable assets

•

Capital

deployment

–

pursue

growth

and

investments opportunities

•

Power

market

upside

–

manage

our

portfolio in line with our fundamental

view to maximize the benefit to our

asset value

•

Regulatory

policies

–

continue

to

pursue capacity market design

changes, GHG policy implementation

and other policies to get fair

compensation for our nuclear fleet |

13

Exelon Generation Disclosures

December 31, 2013

2013 4Q Earnings Release Slides |

14

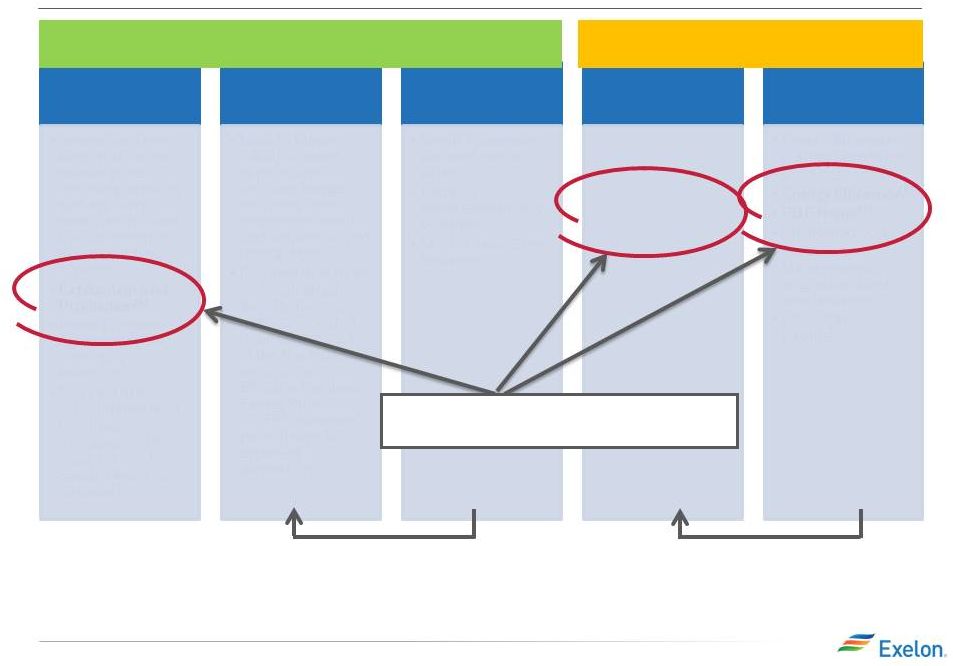

Portfolio Management Strategy

Protect Balance Sheet

Ensure Earnings Stability

Create Value

Exercising Market Views

Purely ratable

Actual hedge %

Market views on timing, product

allocation and regional spreads

reflected in actual hedge %

High End of Profit

Low End of Profit

% Hedged

Open Generation

with LT Contracts

Portfolio Management &

Optimization

Portfolio Management Over Time

Align Hedging & Financials

Establishing Minimum Hedge Targets

2013 4Q Earnings Release Slides

•

Aligns hedging program with financial

policies and financial outlook

•

Establish minimum hedge targets to

meet financial objectives of the

company (dividend, credit rating)

•

Hedge enough commodity risk to

meet future cash requirements under

a stress scenario

•

Ensure stability in near-term cash flows

and earnings

•

Disciplined approach to hedging

•

Tenor aligns with customer

preferences and market liquidity

•

Multiple channels to market that

allow us to maximize margins

•

Large open position in outer years to

benefit from price upside

Three-Year Ratable Hedging

Bull / Bear Program

•

Ability to exercise fundamental market

views to create value within the ratable

framework

•

Modified timing of hedges versus

purely ratable

•

Cross-commodity hedging (heat rate

positions, options, etc.)

•

Delivery locations, regional and zonal

spread relationships

Capital

Structure

Dividend

Capital &

Operating

Expenditure

Credit Rating

Strategic Policy Alignment |

15

Components of Gross Margin Categories

Margins move from new business to MtM of hedges over

the course of the year as sales are executed

(5)

Margins move from “Non power new business”

to

“Non power executed”

over the course of the year

Gross margin linked to power production and sales

Gross margin from

other business activities

2013 4Q Earnings Release Slides

•Retail, Wholesale

planned electric

sales

•Portfolio

Management new

business

•Mid marketing new

business

•Retail, Wholesale

executed gas sales

•Load Response

•Energy

Efficiency

(4)

•BGE

Home

(4)

•Distributed Solar

•Retail, Wholesale

planned gas sales

•Load Response

•Energy

Efficiency

(4)

•BGE

Home

(4)

•Distributed Solar

•Portfolio

Management /

origination fuels

new business

•Proprietary

trading

(3)

•Mark to Market

(MtM) of power,

capacity and

ancillary hedges,

including cross

commodity, retail

and wholesale load

transactions

•Provided directly at

a consolidated

level for five major

regions. Provided

indirectly for each

of the five major

regions via

Effective Realized

Energy Price

(EREP), reference

price, hedge %,

expected

generation

•Generation Gross

Margin at current

market prices,

including capacity

and ancillary

revenues, nuclear

fuel amortization

and fossils fuels

expense

•Exploration and

Production

(4)

•Power Purchase

Agreement (PPA)

Costs and

Revenues

•Provided at a

consolidated level

for all regions

(includes hedged

gross margin for

South, West and

Canada

(1)

)

(1) Hedged gross margins for South, West and Canada region will be included

with Open Gross Margin, and no expected generation, hedge %, EREP or reference prices provided for this region.

(2) MtM of hedges provided directly for the five larger regions. MtM of hedges

is not provided directly at the regional level but can be easily estimated using EREP, reference price and hedged MWh.

(3) Proprietary trading gross margins will remain within “Non Power”

New Business category and not move to “Non Power” Executed category.

(4) Gross margin for these businesses are net of direct “cost of

sales”. (5) Margins for South, West & Canada regions and optimization of fuel and

PPA activities captured in Open Gross Margin. 2013 4Q Earnings Release Slides

Open Gross

Margin

MtM of

Hedges

(2)

“Power”

New

Business

“Non Power”

Executed

“Non Power”

New Business |

16

ExGen Disclosures

Gross Margin Category ($M)

(1)

2014

2015

2016

Open Gross Margin

(including South, West & Canada hedged GM)

(3)

5,850

5,700

5,650

Mark to Market of Hedges

(3,4)

750

500

250

Power New Business / To Go

350

650

700

Non-Power Margins Executed

100

50

50

Non-Power New Business / To Go

(5)

300

350

350

Total

Gross

Margin

(2)

7,350

7,250

7,000

2013 4Q Earnings Release Slides

(1)

Gross margin categories rounded to nearest $50M.

(2)

Total Gross Margin (Non-GAAP) is defined as operating revenues less

purchased power and fuel expense, excluding revenue related to

decommissioning, gross receipts tax, Exelon Nuclear Partners and

variable interest entities. Total Gross Margin is also net of direct cost of

sales for certain Constellation businesses. See Slide 35 for a Non-GAAP to

GAAP reconciliation of Total Gross Margin.

(3)

Includes Exelon’s proportionate ownership share of the CENG Joint Venture.

(4)

Mark to Market of Hedges assumes mid-point of hedge percentages.

(5)

Any changes to new business estimates for our non-power business are

presented as revenue less costs of sales.

(6)

Based on December 31, 2013 market conditions.

2013 4Q Earnings Release Slides

Reference Prices

(6)

2014

2015

2016

Henry Hub Natural Gas ($/MMbtu)

$4.19

$4.14

$4.13

Midwest: NiHub ATC prices ($/MWh)

$31.45

$30.27

$30.32

Mid-Atlantic: PJM-W ATC prices ($/MWh)

$37.90

$36.45

$36.53

ERCOT-N ATC Spark Spread ($/MWh)

HSC Gas, 7.2HR, $2.50 VOM

$6.56

$7.43

$6.79

New York: NY Zone A ($/MWh)

$38.25

$35.85

$35.61

New England: Mass Hub ATC Spark Spread($/MWh)

ALQN Gas, 7.5HR, $0.50 VOM

$5.16

$2.86

$0.75 |

17

ExGen Disclosures

Generation and Hedges

2014

2015

2016

Exp. Gen (GWh)

(1)

208,800

201,700

203,600

Midwest

96,900

96,600

97,600

Mid-Atlantic

(2)

74,200

70,200

71,400

ERCOT

17,100

18,700

19,200

New York

(2)

12,700

9,300

9,300

New England

7,900

6,900

6,100

% of Expected Generation Hedged

(3)

91-94%

62-65%

30-33%

Midwest

88-91%

62-65%

29-32%

Mid-Atlantic

(2)

92-95%

64-67%

33-36%

ERCOT

99-102%

51-54%

33-36%

New York

(2)

95-98%

58-61%

25-28%

New England

96-99%

64-67%

14-17%

Effective Realized Energy Price ($/MWh)

(4)

Midwest

$33.50

$32.00

$32.50

Mid-Atlantic

(2)

$45.00

$44.50

$45.50

ERCOT

(5)

$10.50

$7.00

$5.00

New York

(2)

$37.00

$43.00

$38.50

New England

(5)

$4.00

$2.50

$5.00

2013 4Q Earnings Release Slides

(1) Expected generation represents the amount of energy estimated to be

generated or purchased through owned or contracted for capacity. Expected generation is based upon a

simulated dispatch model that makes assumptions regarding future market

conditions, which are calibrated to market quotes for power, fuel, load following products, and options.

Expected generation assumes 14 refueling outages in 2014 and 2015 and 12

refueling outages in 2016 at Exelon-operated nuclear plants, Salem and CENG. Expected generation

assumes capacity factors of 93.7%, 93.3% and 94.4% in 2014, 2015 and 2016

at Exelon-operated nuclear plants excluding Salem and CENG. These estimates of expected

generation in 2014, 2015 and 2016 do not represent guidance or a forecast of

future results as Exelon has not completed its planning or optimization processes for those years. (2)

Includes Exelon’s proportionate ownership share of CENG Joint Venture. (3)

Percent of expected generation hedged is the amount of equivalent sales divided by expected

generation. Includes all hedging products, such as wholesale and retail

sales of power, options and swaps. Uses expected value on options. (4) Effective realized energy price is

representative of an all-in hedged price, on a per MWh basis, at which

expected generation has been hedged. It is developed by considering the energy revenues and costs

associated with our hedges and by considering the fossil fuel that has been

purchased to lock in margin. It excludes uranium costs and RPM capacity revenue, but includes the

mark-to-market value of capacity contracted at prices other than RPM

clearing prices including our load obligations. It can be compared with the reference prices used to calculate

open gross margin in order to determine the mark-to-market value of

Exelon Generation's energy hedges. (5) Spark spreads shown for ERCOT and New England. |

18

ExGen Hedged Gross Margin Sensitivities

Gross Margin Sensitivities (With Existing Hedges)

(1, 2)

2014

2015

2016

Henry Hub Natural Gas ($/Mmbtu)

$110

$305

$515

$(40)

$(235)

$(480)

NiHub ATC Energy Price

$30

$290

$430

$(30)

$(285)

$(430)

PJM-W ATC Energy Price

$20

$175

$270

$(15)

$(165)

$(260)

NYPP Zone A ATC Energy Price

$5

$20

$35

$(5)

$(20)

$(35)

Nuclear Capacity Factor

(3)

+/-

$45

+/-

$40

+/-

$40

2013 4Q Earnings Release Slides

(1) Based on December 31, 2013 market conditions and hedged position. Gas price

sensitivities are based on an assumed gas-power relationship derived from an internal model that is

updated periodically. Power prices sensitivities are derived by adjusting the

power price assumption while keeping all other prices inputs constant. Due to correlation of the various

assumptions, the hedged gross margin impact calculated by aggregating

individual sensitivities may not be equal to the hedged gross margin impact calculated when correlations between the

various assumptions are also considered. (2) Sensitivities based on

commodity exposure which includes open generation and all committed transactions. (3) Includes Exelon’s proportionate

+ $1/Mmbtu

-

$1/Mmbtu

+ $5/MWh

-

$5/MWh

+ $5/MWh

-

$5/MWh

+ $5/MWh

-

$5/MWh

+/-

1%

ownership share of the CENG Joint Venture.

2013 4Q Earnings Release Slides |

19

Exelon Generation Hedged Gross Margin Upside/Risk

$5,000

$5,500

$6,000

$6,500

$7,000

$7,500

$8,000

$8,500

$9,000

2016

$8,550

2015

$7,950

2014

$7,650

$7,050

$6,650

$5,700

(1) Represents an approximate range of expected gross margin, taking into

account hedges in place, between the 5th and 95th percent confidence levels assuming all unhedged supply is sold

into the spot market. Approximate gross margin ranges are based upon an

internal simulation model and are subject to change based upon market inputs, future transactions and potential

modeling changes. These ranges of approximate gross margin in 2014, 2015 and

2016 do not represent earnings guidance or a forecast of future results as Exelon has not completed its

planning or optimization processes for those years. The price distributions

that generate this range are calibrated to market quotes for power, fuel, load following products, and options as of

December 31, 2013 (2) Gross Margin Upside/Risk based on commodity exposure

which includes open generation and all committed transactions. (3) Gross margin is defined as operating

revenues less purchased power and fuel expense, excluding revenue related to

decommissioning, gross receipts tax, Exelon Nuclear Partners and variable interest entities . See Slide 35 for a

Non-GAAP to GAAP reconciliation of Gross Margin.

2013 4Q Earnings Release Slides |

20

Illustrative Example of Modeling Exelon

Generation

2015 Gross Margin

Row

Item

Midwest

Mid-

Atlantic

ERCOT

New York

New

England

South,

West &

Canada

(A)

Start with fleet-wide open gross margin

$5.70 billion

(B)

Expected Generation (TWh)

96.6

70.2

18.7

9.3

6.9

(C)

Hedge % (assuming mid-point of range)

63.5%

65.5%

52.5%

59.5%

65.5%

(D=B*C)

Hedged Volume (TWh)

61.3

46.0

9.8

5.5

4.5

(E)

Effective Realized Energy Price ($/MWh)

$32.00

$44.50

$7.00

$43.00

$2.50

(F)

Reference Price ($/MWh)

$30.27

$36.45

$7.43

$35.85

$2.86

(G=E-F)

Difference ($/MWh)

$1.73

$8.05

$(0.43)

$7.15

$(0.36)

(H=D*G)

Mark-to-market value of hedges ($ million)

(1)

$110 million

$370 million

$(5) million

$40 million

$0 million

(I=A+H)

Hedged Gross Margin ($ million)

$6,200 million

(J)

Power New Business / To Go ($ million)

$650 million

(K)

Non-Power Margins Executed ($ million)

$50 million

(L)

Non-

Power New Business / To Go ($ million)

$350 million

(N=I+J+K+L)

Total Gross Margin

(2)

$7,250 million

(1) Mark-to-market rounded to the nearest $5 million.

(2) Total Gross Margin is defined as operating revenues less purchased power

and fuel expense, excluding revenue related to decommissioning, gross receipts tax, Exelon Nuclear

Partners and variable interest entities. See Slide 35 for a Non-GAAP

to GAAP reconciliation of Total Gross Margin. 2013 4Q Earnings Release

Slides |

21

Additional Disclosures

2013 4Q Earnings Release Slides

2013 4Q Earnings Release Slides |

2014

(4)(5)

$0.50 -

$0.60

Other

($0.02)

Depreciation &

Amortization

($0.01)

O&M

(3)

($0.00)

RNF

(2)

$0.09

2013

(1)

$0.01

ComEd Adjusted Operating EPS Bridge 2013 to 2014

Note: Drivers add up to mid-point of 2014 adjusted operating EPS

range. (1) Refer to the Earnings Release Attachments for additional

details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS.

(2)

Revenue

net

fuel

(RNF)

is

defined

as

operating

revenues

less

purchased

power

and

fuel

expense.

(3) O&M excludes regulatory items that are P&L neutral.

(4) Shares Outstanding (diluted) are 860M in 2013 and ~860M in 2014. Refer to

slide 33 for a reconciliation of adjusted (non-GAAP) operating EPS guidance to GAAP EPS.

(5) Guidance assumes an effective tax rate for 2014 of 39.9%.

$0.10 Distribution

$0.01 Transmission

($0.01) Weather/Volume

Interest

22

2013 4Q Earnings Release Slides

$0.02 Pension/OPEB

($0.02) Inflation

$0.49 |

2014

(4)(5)

$0.40 -

$0.50

Other

$0.01

O&M

(3)

($0.03)

RNF

(2)

$0.01

PECO Adjusted Operating EPS Bridge 2013 to 2014

23

2013 4Q Earnings Release Slides

2013

(1)

($0.02) Storm Costs

($0.01) Inflation

$0.01 Smart Meter Return

$0.46

Note: Drivers add up to mid-point of 2014 adjusted operating EPS range.

(1) Refer to the Earnings Release Attachments for additional details and to the

Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS.

(2) Revenue

net

fuel

(RNF)

is

defined

as

operating

revenues

less

purchased

power

and

fuel

expense.

(3) O&M excludes regulatory items that are P&L neutral.

(4)

Shares

Outstanding

(diluted)

are

860M

in

2013

and

~860M

in

2014.

(5)

Guidance

assumes

an

effective

tax

rate

for

2014

of

30.4%

Refer

to

slide

33

for

a

reconciliation

of

adjusted

(non-GAAP)

operating

EPS

guidance

to

GAAP

EPS. |

($0.03)

2014

(4)(5)

$0.20 -

$0.30

Other

$0.01

Depreciation &

Amortization

($0.01)

O&M

(3)

RNF

(2)

$0.05

2013

(1)

BGE Adjusted Operating EPS Bridge 2013 to 2014

($0.01) Storm Costs

($0.01) Inflation

($0.01) Other O&M

$0.05 Pricing/Mix

($0.01) Other RNF

24

2013 4Q Earnings Release Slides

$0.01 Interest

$0.23

2013 4Q Earnings Release Slides

Note: Drivers add up to mid-point of 2014 adjusted operating EPS

range. (1) Refer to the Earnings Release Attachments for additional

details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS.

(2) Revenue

net

fuel

(RNF)

is

defined

as

operating

revenues

less

purchased

power

and

fuel

expense.

(3) O&M excludes regulatory items that are P&L neutral.

(4) Shares

Outstanding

(diluted)

are

860M

in

2013

and

~860M

in

2014.

Refer

to

slide

33

for

a

reconciliation

of

adjusted

(non-GAAP)

operating

EPS

guidance

to

GAAP

EPS.

(5) Guidance

assumes

an

effective

tax

rate

for

2014

of

39.1%. |

$0.02

Depreciation &

Amortization

(4)

$0.02

O&M

(3)

$0.03

Gross Margin

(2)

$0.17

2013

2014

(5)(6)

$1.10 -

$1.30

Other

ExGen Adjusted Operating EPS Bridge 2013 to 2014

($0.17) Generation Gross Margin primarily due

to lower pricing

$0.09 Merger synergies

$0.02 Pension/OPEB

($0.06) Inflation

($0.02) Contracting

($0.02) Site, Corporate and Project

Spending

($0.01) Nuclear Refueling Outages

($0.03) Other O&M

25

$0.01 Interest

$0.01 Other

$1.40

2013 4Q Earnings Release Slides

($0.02) Primarily AVSR and other

assets placed in service

(5) Shares

Outstanding

(diluted)

are

860M

in

2013

and

~860M

in

2014.

Refer

to

slide

33

for

a

reconciliation

of

adjusted

(non-GAAP)

operating

EPS

guidance

to

GAAP

EPS.

(6) Guidance

assumes

an

effective

tax

rate

for

2014

of

29.7%.

Note: Drivers add up to mid-point of 2014 adjusted operating EPS

range. (1) Refer to the Earnings Release Attachments for additional

details and to the Appendix for a reconciliation of adjusted (non-GAAP) operating EPS to GAAP EPS.

(2) Gross Margin (Non-GAAP) is defined as operating revenues less purchased

power and fuel expense, excluding revenue related to decommissioning, gross receipts tax, Exelon Nuclear Partners and

variable interest entities. Total Gross Margin is also net of direct cost of

sales for certain Constellation businesses. See Slide 35 for a Non-GAAP to GAAP reconciliation of Total Gross Margin.

(3)

O&M

excludes

items

that

are

P&L

neutral

(including

decommissioning

costs

and

variable

interest

entities)

and

direct

cost

of

sales

for

certain

Constellation

businesses.

(4) Depreciation & Amortization excludes cost of sales for certain

Constellation businesses, which are included in gross margin |

26

Additional 2014 ExGen and CENG Modeling

2013 4Q Earnings Release Slides

P&L Item

2014 Estimate

ExGen

Model

Inputs

(1)

O&M

(2)

$4,050M

Taxes Other Than Income (TOTI)

(3)

$300M

Depreciation & Amortization

(4)

$800M

Interest Expense

$325M

CENG

Model

Inputs

(at

ownership)

(1)(5)

Gross Margin

Included in ExGen Disclosures

O&M/TOTI

$400M -

$450M

Depreciation & Amortization/Accretion of Asset

Retirement Obligations

$100M -

$150M

Capital Expenditures

$75M -

$125M

Nuclear Fuel Capital Expenditure

$50M -

$100M

(3)

TOTI excludes gross receipts tax for retail of $100M.

(4)

ExGen Depreciation & Amortization excludes the impact of P&L neutral

decommissioning costs of $25M and cost of sales of ExGen’s non-power businesses of $25M.

(5)

Includes ~$35M potential synergies related to the integration of Exelon Nuclear

and CENG operations. The CENG model inputs are intended to support Exelon’s guidance range and do

not represent CENG’s final estimates. (2)

ExGen O&M excludes cost of sales of certain Constellation businesses,

certain impacts associated with the sale or retirement of generating stations, certain costs incurred associated with

the merger with Constellation, P&L neutral decommissioning costs, and the

impact from O&M related to variable interest entities. See Slide 33 for a Non-GAAP to GAAP reconciliation of

O&M.

(1)

ExGen amounts for O&M, TOTI and Depreciation & Amortization

exclude the impacts of CENG. CENG impact is reflected in “Equity earnings of unconsolidated affiliates” in the Statement

of Operations and Comprehensive Income. |

BGE

2014 load growth driven by a

stronger Residential class

and

improving economic conditions,

partially offset by

energy efficiency

27

Exelon Utilities Weather-Normalized Load

2014E

0.4%

-0.6%

-0.4%

-0.2%

2013

-0.3%

-0.5%

0.0%

-0.2%

Large C&I

Small C&I

Residential

All Customers

ComEd

2014 forecasted usage reflects a

continuation of the moderate growth

economy and on-going energy

efficiency programs

2014E

1.5%

-1.2%

-0.3%

0.3%

2013

1.5%

-1.1%

0.0%

0.3%

PECO

2014 load growth is driven by

modest economic growth and

strong growth in manufacturing

employment , partially offset by

energy efficiency.

2014E

0.0%

-0.4%

1.5%

0.6%

2013

-2.5%

2.4%

0.9%

-0.6%

Chicago GMP

2.3%

Chicago Unemployment

8.6%

Philadelphia GMP

2.1%

Philadelphia Unemployment

7.4%

Baltimore GMP

2.1%

Baltimore Unemployment

6.6%

2013 4Q Earnings Release Slides

Notes: Data is not adjusted for leap year. Source of 2013 economic

outlook data is Global Insight (November 2013). Assumes 2013 GDP of 1.7% and U.S unemployment of 6.7%.

ComEd has the ROE collar as part of the distribution formula rate and BGE is

decoupled which mitigates the load risk. QTD and YTD actual data can be found in earnings release tables.

BGE amounts have been adjusted for unbilled / true-up load from prior

quarters.

2013 4Q Earnings Release Slides |

2013 4Q Earnings Release Slides

28

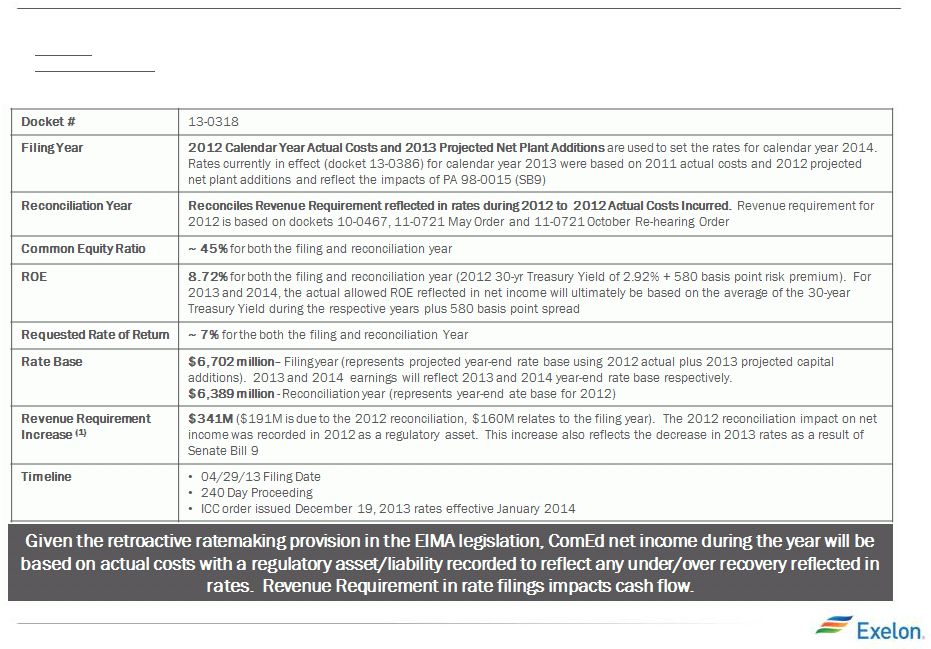

ComEd April 2013 Distribution Formula Rate Updated Filing

Note: Disallowance of any items in the 2013 distribution formula rate

filing could impact 2013 earnings in the form of a regulatory asset adjustment. Amounts above as of surrebuttal testimony.

The 2013 distribution formula rate filing establishes the net revenue

requirement used to set the rates that will take effect in January 2014 after the ICC’s

review. The filing was updated to reflect the impact of Senate Bill 9.

There are two components to the annual distribution formula rate filing:

•

Filing Year: Based on prior year costs (2012) and current year (2013)

projected plant additions. •

Annual

Reconciliation:

For

the

prior

calendar

year

(2012),

this

amount

reconciles

the

revenue

requirement

reflected

in

rates

during

the

prior

year

(2012)

in

effect

to

the

actual

costs

for

that

year.

The

annual

reconciliation

impacts

cash

flow

in

the

following

year

(2014)

but

the earnings

impact has been recorded in the prior year (2012) as a regulatory asset.

|

29

BGE Rate Case

2013 4Q Earnings Release Slides

Rate Case Order

Electric

Gas

Docket #

9326

Test Year

August 2012 –

July 2013

Common Equity Ratio

51.1%

Authorized Returns

ROE: 9.75%; ROR: 7.49%

ROE: 9.6%; ROR: 7.41%

Rate Base

$2.8B

$1.0B

Revenue Requirement Increase

$33.6M

$12.5M

Distribution Price Increase as % of

overall bill

1.7%

1.1%

Timeline

•

5/17/13: BGE filed application with the MDPSC seeking increases in gas &

electric distribution base rates •

8/5/13: Staff/Intervenors file direct testimony

•

8/23/13: Update 8 months actual/4 month estimated test period data with actuals

for last 4 months (March -

July 2013)

•

9/17/13: BGE and staff/intervenors file rebuttal testimony

•

10/3/13: Staff/Intervenors and BGE file surrebuttal testimony

•

10/18/13 –

11/1/13: Hearings

•

11/12/13: Initial Briefs

•

11/22/13: Reply Briefs

•

12/13/13: Final Order

•

New rates are in effect shortly after the final order

|

30

Appendix

Reconciliation of Non-GAAP

Measures

2013 4Q Earnings Release Slides |

4Q GAAP EPS Reconciliation

Three Months Ended December 31, 2013

ExGen

ComEd

PECO

BGE

Other

Exelon

2013 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$0.21

$0.13

$0.12

$0.06

$(0.02)

$0.50

Mark-to-market impact of economic hedging activities

0.16

-

-

-

-

0.16

Unrealized gains related to NDT fund investments

0.05

-

-

-

-

0.05

Plant Retirements and Divestitures

-

-

-

-

-

-

Merger and integration costs

(0.02)

-

(0.00)

(0.00)

-

(0.02)

Reassessment of State Deferred Income Taxes

0.01

-

-

-

(0.02)

-

Amortization of commodity contract intangibles

(0.09)

-

-

-

-

(0.09)

Asset Retirement Obligation

-

-

-

-

-

-

Midwest Generation bankruptcy charges

(0.02)

-

-

-

-

(0.02)

Long-lived asset impairments

-

-

-

-

-

-

4Q 2013 GAAP Earnings (Loss) Per Share

$0.31

$0.13

$0.12

$0.05

$(0.04)

$0.58

NOTE: All amounts shown are per Exelon share and represent contributions

to Exelon's EPS. Amounts may not add due to rounding. 2013 4Q

Earnings Release Slides 31

Three Months Ended December 31, 2012

ExGen

ComEd

PECO

BGE

Other

Exelon

2012 Adjusted (non-GAAP) Operating Earnings Per Share

$0.33

$0.19

$0.09

$0.02

$0.00

$0.64

Mark-to-market impact of economic hedging activities

0.17

-

-

-

(0.03)

0.14

Unrealized gains related to nuclear decommissioning trust funds

-

-

-

-

-

-

Plant retirements and divestitures

(0.05)

-

-

-

-

(0.05)

Asset retirement obligation

0.01

-

-

-

-

0.01

Merger and integration costs

(0.04)

(0.00)

(0.00)

(0.00)

(0.00)

(0.05)

Amortization of commodity contract intangibles

(0.24)

-

-

-

-

(0.24)

Amortization of the fair value of certain debt

-

-

-

-

-

-

Non-cash remeasurement of deferred income taxes

(0.01)

-

-

-

0.01

-

Midwest Generation bankruptcy charges

(0.01)

-

-

-

-

(0.01)

4Q 2012 GAAP Earnings (Loss) Per Share

$0.16

$0.19

$0.09

$0.02

$(0.02)

$0.44 |

2013 4Q Earnings Release Slides

32

Twelve

Months

Ended

December

31,

2012

ExGen

ComEd

PECO

BGE

Other

Exelon

2012 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$1.89

$0.47

$0.47

$0.06

$(0.04)

$2.85

Mark-to-market impact of economic hedging activities

0.38

-

-

-

0.00

0.38

Unrealized gains related to nuclear decommissioning trust funds

0.07

-

-

-

-

0.07

Plant retirements and divestitures

(0.29)

-

-

-

-

(0.29)

Asset retirement obligation

(0.00)

-

-

-

-

(0.00)

Constellation merger and integration costs

(0.20)

(0.00)

(0.01)

(0.01)

(0.09)

(0.31)

Maryland commitments

(0.03)

-

-

(0.10)

(0.15)

(0.28)

Amortization of commodity contract intangibles

(0.93)

-

-

-

-

(0.93)

FERC settlement

(0.21)

-

-

-

-

(0.21)

Reassessment of state deferred income taxes

0.00

-

-

-

0.14

0.14

Amortization of the fair value of certain debt

0.01

-

-

-

-

0.01

Other acquisition costs

(0.00)

-

-

-

(0.00)

Midwest Generation bankruptcy charges

(0.01)

-

-

-

(0.01)

YTD 2012 GAAP Earnings (Loss) Per Share

$0.69

$0.46

$0.46

$(0.05)

$(0.14)

$1.42

Twelve

Months

Ended

December

31,

2013

ExGen

ComEd

PECO

BGE

Other

Exelon

2013 Adjusted (non-GAAP) Operating Earnings (Loss) Per Share

$1.40

$0.49

$0.46

$0.23

$(0.07)

$2.50

Mark-to-market impact of economic hedging activities

0.35

-

-

-

-

0.35

Unrealized gains related to NDT fund investments

0.09

-

-

-

-

0.09

Plant retirements and divestitures

0.02

-

-

-

-

0.02

Asset retirement obligation

(0.01)

-

-

-

-

(0.01)

Merger and integration costs

(0.09)

(0.00)

(0.01)

0.00

(0.00)

(0.10)

Amortization of commodity contract intangibles

(0.41)

-

-

-

-

(0.41)

Reassessment of State Deferred Income Taxes

0.01

-

-

-

(0.01)

-

Amortization of the fair value of certain debt

0.01

-

-

-

-

0.01

Remeasurement of like kind exchange tax position

-

(0.20)

-

-

(0.11)

(0.31)

Midwest Generation Bankruptcy Charges

(0.02)

-

-

-

-

(0.02)

Long lived asset impairments

(0.12)

-

-

-

(0.01)

(0.14)

YTD 2013 GAAP Earnings (Loss) Per Share

$1.24

$0.29

$0.45

$0.23

$(0.22)

$2.00

Full Year GAAP EPS Reconciliation

NOTE: All amounts shown are per Exelon share and represent contributions

to Exelon's EPS. Amounts may not add due to rounding. |

GAAP to Operating Adjustments

2013 4Q Earnings Release Slides

•

Exelon’s 2014-16 adjusted (non-GAAP) operating earnings excludes

the earnings effects of the following: –

Mark-to-market adjustments from economic hedging activities

–

Unrealized gains and losses from NDT fund investments to the extent not offset

by contractual accounting as described in the notes to the consolidated

financial statements –

Certain costs incurred associated with the Constellation and CENG merger and

integration initiatives –

Non-cash amortization of intangible assets, net, related to commodity

contracts recorded at fair value at the merger date for 2014

–

One-time impacts of adopting new accounting standards

–

Other unusual items

33 |

Adjusted O&M Reconciliations to GAAP

34

2013 Adjusted O&M Reconciliation (in $M)

(4)

ExGen

ComEd

PECO

BGE

Other

Exelon

GAAP O&M

$4,500

$1,400

$725

$625

$(0)

$7,250

Impacts associated with Sale or Retirement of Generating

Stations

-

-

-

-

-

-

Certain costs incurred associated with the integration of

Constellation and CENG

$(100)

-

-

-

-

$(100)

Long Lived Asset Impairments

$(150)

-

-

-

$(25)

$(175)

Asset Retirement Obligations

-

-

-

-

-

-

Regulatory O&M

(3)

-

$(175)

$(75)

-

-

$(250)

Decommissioning and other expense

(1)

$(50)

-

-

-

-

$(50)

Direct cost of sales incurred to generate revenues for

certain Constellation businesses

(2)

$(200)

-

-

-

-

$(200)

Adjusted O&M (Non-GAAP, as shown on slide

7) $4,000

$1,225

$650

$625

$(25)

$6,475

2014 Adjusted O&M Reconciliation (in $M)

(4)

ExGen

ComEd

PECO

BGE

Other

Exelon

GAAP O&M

$4,400

$1,475

$800

$700

$(75)

$7,300

Certain costs incurred associated with the integration of

Constellation and CENG

$(150)

-

-

-

-

$(150)

Regulatory O&M

(3)

-

$(250)

$(100)

$(25)

-

$(375)

Decommissioning and other expense

(1)

-

-

-

-

-

-

Direct cost of sales incurred to generate revenues for certain

Constellation businesses

(2)

$(200)

-

-

-

-

$(200)

Adjusted O&M (Non-GAAP, as shown on slide

7) $4,050

$1,225

$700

$675

$(75)

$6,575

2013 4Q Earnings Release Slides

(1)

Other expense primarily reflects O&M related to variable interest entities.

(2)

Reflects the direct cost of sales of certain Constellation businesses of

Generation, which are included in Total Gross Margin. (3)

Reflects P&L neutral O&M.

(4)

All amounts rounded to the nearest $25M. |

ExGen Total Gross Margin Reconciliation to GAAP

35

Total Gross Margin Reconciliation (in $M)

(5)

2014

2015

2016

Revenue

Net

of

Purchased

Power

and

Fuel

Expense

(1)(6)

$7,650

$7,650

$7,400

Non-cash amortization of intangible assets, net, related to

commodity

contracts

recorded

at

fair

value

at

the

merger

date

(2)

$50

-

-

Other Revenues

(3)

$(100)

$(100)

$(50)

Direct cost of sales incurred to generate revenues for certain

Constellation businesses

(4)

$(250)

$(300)

$(350)

Total Gross Margin (Non-GAAP, as shown on slide

9) $7,350

$7,250

$7,000

2013 4Q Earnings Release Slides

(1)

Revenue net of purchased power and fuel expense (RNF), a non-GAAP measure,

is calculated as the GAAP measure of operating revenue less the GAAP measure of

purchased power and fuel expense . ExGen does not forecast the GAAP

components of RNF separately. RNF also includes the RNF of our proportionate ownership

share of CENG.

(2)

The exclusion from operating earnings for activities related to the merger with

Constellation ends after 2014.

(3)

Reflects revenues from Exelon Nuclear Partners, variable interest entities,

funds collected through revenues for decommissioning the former PECO nuclear plants

through regulated rates and gross receipts tax revenues.

(4)

Reflects the cost of sales and depreciation expense of certain Constellation

businesses of Generation.

(5)

All amounts rounded to the nearest $50M.

(6)

Excludes the impact of the operating exclusion for mark-to-market due

to the volatility and unpredictability of the future changes to power prices. |

36

2013 ExGen/HoldCo FFO/Debt and 2014 ExGen Free Cash

Flow Reconciliations to GAAP

FFO

Calculation

($M)

(1)

GAAP Operating Income

$1,675

Depreciation & Amortization

$850

EBITDA

$2,525

+/-

Nonoperating activities

and nonrecurring items

$200

-

Interest Expense

($350)

-

Current Income Tax Expense

($300)

+ Nuclear Fuel Amortization

$925

+ PPA Depreciation

Adjustment

(3)

$325

+ Operating Lease

Depreciation Adjustment

(4)

$25

+/-

Other FFO Adjustments

(5)

$125

= FFO (a)

$3,475

(1)

All amounts rounded to the nearest $25M.

(2)

Using S&P Methodology –

final 2013 numbers still pending agency review.

(3)

Reflects net capacity payment -

interest on PV of PPA's (using 7% discount rate from S&P).

(4)

Reflects operating lease payments -

interest on PV of future operating leases payments (using 7% discount rate

from S&P). (5)

Includes pension adjustment, stock compensation adjustment, HoldCo interest

adjustment, and capitalized interest expense adjustment . (6)

Reflects PV of net capacity purchases (using 7% discount rate from

S&P). (7)

Reflects

PV

of

minimum

future

operating

lease

payments

(using

7%

S&P

discount rate).

(8)

Reflects unfunded status, net of taxes at 35%.

(9)

Long term debt held at HoldCo imputed to ExGen.

(10)

Includes non-recourse project debt.

(11)

Offsets FV write-up of CEG and BGE (recorded at Corp) debt at merger.

(12)

Applies 75% of excess cash against balance of LTD.

(13)

Adjusted

Cash

Flow

from

Operations

(non-GAAP)

primarily

includes

net

cash

flows

from

operating

activities

and

net

cash

flows

from

investing

activities

excluding

capital

expenditures

of

5.5B

for

2014

2013 4Q Earnings Release Slides

Long-Term Debt (including

current maturities)

$7,725

Short-Term Debt

25

+ PPA Imputed Debt

(6)

$1,350

+ Operating Lease Imputed

Debt

(7)

$300

+ Pension/OPEB Imputed

Debt

(8)

$1,125

+ HoldCo Debt Adjustment

(9)

$1,400

-

Off-Credit Treatment of

Debt

(10)

($1,225)

-

Fair Value Adjustment

(11)

($375)

-Surplus Cash Adjustment

(12)

($950)

+/-

Accrued Interest

$75

= Adjusted Debt (b)

$9,450

2014 Free Cash Flow

Calculation

($M)

(1)

Adjusted Cash from

Operations

(13)

$3,175

Non-Growth CapEx

(includes MD

Commitments)

($1,050)

Nuclear Fuel CapEx

($900)

= FCF before Growth

CapEx and Dividend

$1,225

2013

FFO/Debt

(2)

FFO (a)

=

37%

Adjusted Debt (b)

Adjusted

Debt

Calculation

($M)

(1) |

37

2014 ExGen Adjusted EBITDA –

Base CapEx Reconciliation to

GAAP

Adjusted EBITDA

Adjusted Operating Net Income

(1)

$950M -

$1,125M

Depreciation & Amortization

(2)

$800M

Interest Expense

(2)

$325M

Taxes/Other

(3)

$275M -

$400M

Adjusted EBITDA

(6)

$2,350M -

$2,650M

Base CapEx

Total Capital Expenditures

(4)

$2,400M

Growth CapEx (Nuclear Uprates/Wind/Solar/Upstream)

(4)

($450M)

Nuclear Fuel

(4)

($900M)

Fukushima Response

(5)

($100M)

Maryland Commitments

(5)

($100M)

Base CapEx

(6)

$850M

2013 4Q Earnings Release Slides

(1)

Adjusted Operating Net Income (non-GAAP) is based on the adjusted

operating EPS range provided on slide 5 and ~860M shares outstanding. Refer to the

Appendix for a reconciliation of adjusted (non-GAAP) operating EPS guidance

to GAAP EPS.

(2)

Refer to slide 26 for details. ExGen Depreciation & Amortization excludes

the impact of P&L neutral decommissioning costs of $25M and cost of sales of ExGen’s

non-power businesses of $25.

(3)

Includes taxes based on the effective tax rate of 29.7%, decommissioning income

and other items.

(4)

Refer to slide 6 for ExGen CapEx amounts.

(5)

Fukushima Response and Maryland Commitments both included in the “CapEx

(excluding other items below” line item on slide 6 but are one-time in nature and

therefore excluded from Base CapEx.

(6)

Excludes CENG. |

38

Appendix

Change to Format of Exelon

Generation Disclosures

8-K issued December 9, 2013

All numbers as of September 30, 2013

2013 4Q Earnings Release Slides |

39

Change

to

Format

of

Exelon

Generation

Disclosures

–

Gross

Margin, O&M and Depreciation & Amortization Definitions

•

Direct costs incurred to generate revenues (“Cost of Sales”) for

certain Constellation businesses (Energy Efficiency, BGE Home and

Upstream) have been included in O&M or Depreciation &

Amortization (“D&A”) in previous Exelon Generation

disclosures •

Cost of Sales previously included in O&M and D&A is approximately $250M

- $300M/year

•

Including the Cost of Sales in Gross Margin better reflects the scale of these

Constellation businesses while reducing volatility in disclosures

resulting from only capturing changes in revenue

•

Beginning with Q4 2013 Exelon Generation disclosure, Exelon is revising

Gross

Margin

to

include

“Cost

of

Sales”

for

certain

Constellation

businesses;

while simultaneously reducing O&M and D&A by an equal amount

•

Effect of revised format:

Gross Margin

lowered by

$250M -

$300M

O&M/D&A

lowered by

$250M -

$300M

Net Change to EBIT

$0 |

40

Impacted Components of Gross Margin Categories

Margins move from new business to MtM of hedges over

the course of the year as sales are executed

Margins move from “Non power new business”

to

“Non power executed”

over the course of the year

Gross margin linked to power production and sales

Gross margin from

other business activities

•

Retail, Wholesale

executed gas sales

•

Load Response

•

•

Energy

Efficiency

(4)

•

BGE

Home

(4)

•

Distributed Solar

•

Retail, Wholesale

planned electric

sales

•

Portfolio

Management new

business

•

Mid marketing new

business

•

Mark to Market

(MtM) of power,

capacity and

ancillary hedges,

including cross

commodity, retail

and wholesale load

transactions

•

Provided directly at a

consolidated level

for five major

regions. Provided

indirectly for each of

the five major

regions via Effective

Realized Energy

Price (EREP),

reference price,

hedge %, expected

generation

•

Generation Gross

Margin at current

market prices,

including capacity

and ancillary

revenues, nuclear

fuel amortization

and fossils fuels

expense

•

Exploration and

Production

(4)

•

Power Purchase

Agreement (PPA)

Costs and Revenues

•

Provided at a

consolidated level

for all regions

(includes hedged

gross margin for

South, West and

Canada

(1)

)

•

Retail, Wholesale

planned gas sales

•

Load Response

•

Energy

Efficiency

(4)

•

BGE

Home

(4)

•

Distributed Solar

•

Portfolio Management

/ origination fuels new

business

•

Proprietary trading

(3)

(1) Hedged gross margins for South, West and Canada region will be

included with Open Gross Margin, and no expected generation, hedge %, EREP or reference prices provided for this region.

(2) MtM of hedges provided directly for the five larger regions. MtM of

hedges is not provided directly at the regional level but can be easily estimated using EREP, reference price and hedged MWh.

(3) Proprietary trading gross margins will remain within “Non

Power” New Business category and not move to “Non Power” Executed category.

(4) Gross margin for these businesses are net of direct “Cost of

Sales”. These

sections

going

forward

will

be

inclusive

of

Cost

of

Sales;

see

additional

Footnote

(4)

Open Gross

Margin

MtM of

Hedges

(2)

“Power”

New

Business

“Non Power”

Executed

“Non Power”

New Business |

41

ExGen Disclosures –

Previous and Revised Presentations

Sept

30,

2013

–

Revised

presentation

Change from previous

presentation

Gross Margin Category ($M)

2013

2014

2015

2016

2013

2014

2015

2016

Open Gross Margin

(including South, West, Canada hedged gross

margin)

$5,550

$5,600

$5,750

$5,700

($50)

($50)

($50)

($100)

Mark-to-Market of Hedges

$1,700

$900

$450

$250

0

0

0

0

Power New Business / To Go

$50

$500

$750

$750

0

0

0

0

Non-Power Margins Executed

$300

$100

$50

$50

($100)

($100)

($50)

($50)

Non-Power New Business / To Go

$100

$300

$350

$350

($100)

($100)

($150)

($150)

Total Gross Margin

$7,700

$7,400

$7,350

$7,100

($250)

($250)

($250)

($300)

These reductions shown in gross margin, are offset by commensurate

reductions in O&M and D&A; There is no impact on net income

Gross

Margin

Category

($M)

(1,2)

(as presented in EEI presentation slide 37)

2013

2014

2015

2016

Open Gross Margin

(including South, West & Canada hedged GM)

(3)

$5,600

$5,650

$5,800

$5,800

Mark to Market of Hedges

(3,4)

$1,700

$900

$450

$250

Power New Business / To Go

$50

$500

$750

$750

Non-Power Margins Executed

(5)

$400

$200

$100

$100

Non-Power New Business / To Go

(5)

$200

$400

$500

$500

Total Gross Margin

$7,950

$7,650

$7,600

$7,400

(1)

Gross margin (net of direct “cost of sales”) rounded to nearest $50M.

(2)

Gross margin does not include revenue related to decommissioning, gross

receipts tax, Exelon Nuclear Partners and entities consolidated solely

as a result of the application of FIN 46R.

(3)

Includes CENG Joint Venture.

(4)

Mark to Market of Hedges assumes mid-point of hedge percentages.

(5)

Any changes to new business estimates for our non-power business

are presented as revenue less costs of sales.

(6)

Based on September 30, 2013 market conditions. |

P&L Item

2013 Estimate

ExGen

Model

Inputs

(1)

O&M

(2)

$4,275M

$4,075M

Taxes Other Than Income (TOTI)

(3)

$300M

No change

Depreciation & Amortization

(4)

$825M

$775M

Interest Expense

$350M

No change

CENG

Model

Inputs

(at

ownership)

(5)

Gross Margin

Included in ExGen Disclosures

No change

O&M/TOTI

$400M -

$450M

No change

Depreciation & Amortization/Accretion of

Asset Retirement

Obligations

$100M -

$150M

No change

Capital Expenditures

$75M -

$125M

No change

Nuclear Fuel Capital Expenditure

$100M -

$150M

No change

42

Additional 2013 ExGen and CENG Modeling –

Previous and

Revised Presentations

EEI Slide 13 presentation

Revised presentation

(1)

ExGen amounts for O&M, TOTI and Depreciation & Amortization exclude the

impacts of CENG. CENG impact is reflected in “Equity earnings of unconsolidated affiliates” in the

Income Statement.

(2)

ExGen O&M excludes costs of sales for certain Constellation businesses,

P&L neutral decommissioning costs and the impact from O&M related to entities consolidated solely

as a result of the application of FIN 46R.

(3)

TOTI excludes gross receipts tax for retail.

(4)

ExGen Depreciation & Amortization excludes costs of sales for certain