Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2014

Bitcoin Shop, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Nevada

|

333-151252

|

26-2477977

|

||

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

10020 Raynor Rd.

Silver Spring, Maryland

|

20901

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (248) 764-1084

101 West Big Beaver Road

Suite 1400

Troy, Michigan 48084

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 DFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

EXPLANATORY NOTE

On January 29, 2014, holders of a majority of the outstanding voting capital of Bitcoin Shop, Inc., formerly TouchIT Technologies, Inc., a Nevada corporation (“we” or the “Company”) voted in favor of filing a certificate of amendment to the Company’s Articles of Incorporation in order to (i) change the name of the Company to “Bitcoin Shop, Inc.” from “TouchIT Technologies, Inc.” (the “Name Change”) and (ii) effect a reverse split of its issued and outstanding common stock on a one for three hundred basis (the “Reverse Split”). On January 29, 2014, the Company filed the Certificate of Amendment to the Company’s Articles of Incorporation with the Secretary of State of the State of Nevada. On February 4, 2014, the Financial Industry Regulatory Authority (FINRA) approved the Reverse Split and the Name Change to go market-effective on February 5, 2014 and assigned the Company a new trading symbol “BTCS”, effective for our principal market, the over the counter bulletin board, on March 5, 2014. In the interim, the Company’s trading symbol will be “TUCND” reflecting the Reverse Split. Per share numbers and dollar amounts referenced in this Current Report on Form 8-K reflect the result of the Reverse Split.

ITEM 1.01 Entry into a Material Definitive Agreement.

ITEM 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

The Share Exchange

On February 5, 2014, the Company entered into a Securities Exchange Agreement (the “Exchange Agreement”) with BitcoinShop.us, LLC a Maryland Limited Liability Company (“BitcoinShop”), and the holders of the membership interests in BitcoinShop. Upon closing of the transaction contemplated under the Exchange Agreement (the “Share Exchange”), on February 5, 2014, the holders of BitcoinShop’s outstanding membership interests (the “BitcoinShop Members”) transferred all the outstanding membership interests of BitcoinShop to the Company in exchange for an aggregate of 100,773,923 shares of the Company’s common stock $0.001 par value per share (the “Common Stock”). As a result, BitcoinShop became a wholly-owned subsidiary of the Company.

Pursuant to the Share Exchange:

|

■

|

At the closing of the Share Exchange, all of the membership interests of BitcoinShop outstanding immediately prior to the closing of the Share Exchange was exchanged for the right to receive an aggregate of 100,773,923 shares of the Company’s common stock (the “Share Exchange Common Shares”). Concurrently, all members of BitcoinShop executed Lock-Up Agreements (the “Lockup Agreements”) pursuant to which they agreed to refrain from the sale of any securities of the Company, including the Share Exchange Common Shares, for a period of eighteen (18) months. The Lockup Agreement provides for a leak out provision, allowing the shareholder the right to sell 5% of its holdings in the Company per month beginning on the twelve month anniversary of the Lockup Agreement.

|

|

|

■

|

Upon the closing of the Share Exchange, Andrew Brabin resigned from all officer and director positions he held with the Company and Charles W. Allen was appointed Chief Executive Officer and Chief Financial Officer, Michal Handerhan was appointed Chief Operating Officer and Chairman of the Board, Timothy Sidie was appointed as Chief Technology Officer and Charles A. Kiser was appointed Chief Marketing Officer of the Company. In addition, Michal Handerhan (Chairman), Timothy Sidie and Charles W. Allen were appointed to the Company's Board of Directors.

|

|

|

■

|

Following the closing of the Share Exchange, the Company consummated a private placement of its units (the “Units”) at a purchase price of $0.50 per Unit (the “Purchase Price”) with each Unit consisting of (i) one share (the “Series C Shares”) of the Company’s Series C Convertible Preferred Stock, par value $0.001 per share, which is convertible into one (1) share of Common Stock, with such rights and designations as set forth in the Certificate of Designation of Preferences, Rights and Limitations of Series C Convertible Preferred Stock, attached as an exhibit to this Current Report (the “Series C Certificate of Designation”); and (ii) a three year warrant, attached as an exhibit to this Current Report (the “Warrant”), to purchase ½ share of Common Stock (the “Warrant Shares”) at an exercise price of $1.00 per share.

|

-1-

On February 6, 2014, the Company sold an aggregate of 3,750,000 Units in a private placement (the “Private Placement”) of its securities to certain investors (the “Investors”) at a purchase price of $0.50 per Unit pursuant to subscription agreements (the “Subscription Agreements”) for an aggregate purchase price of $1,875,000. The Units sold in the Private Placement are subject to a “Most Favored Nations” provision for a period of 12 months from the closing of the Private Placement in the event the Company issues Common Stock or securities convertible into or exercisable for shares of Common Stock at a price per share or conversion or exercise price per share which shall be less than $0.50 per share, subject to certain customary exceptions. Additionally, the shares of Common Stock issuable upon conversion of Series C Shares or the Warrant Shares underlying the Units sold in the Private Placement are subject to “piggy-back” and “demand” registration rights until such shares of Common Stock may be sold under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”). Each share of the Series C Shares is convertible into one (1) share of Common Stock and has a stated value of $0.001. The conversion ratio is subject to adjustment in the event of stock splits, stock dividends, combination of shares and similar recapitalization transactions. The Company is prohibited from effecting the conversion of the Series C Shares to the extent that, as a result of such conversion, the holder beneficially owns more than 9.99% (provided that certain investors elected to block their beneficial ownership at 4.99%), in the aggregate, of the issued and outstanding shares of the Company’s Common Stock calculated immediately after giving effect to the issuance of shares of Common Stock upon the conversion of the Series C Shares (the “Beneficial Ownership Limitation”). Each share of the Series C Shares is entitled to the number of votes equal to the number of shares of Common Stock such share is convertible into at such time, but not in excess of the Beneficial Ownership Limitation. Each Warrant is exercisable into ½ share of Common Stock at an exercise price of $1.00 per share. The Warrant may be exercised on a cashless basis. The Company is prohibited from effecting the exercise of Warrant to the extent that, as a result of such exercise, the holder beneficially owns more than 4.99%, in the aggregate, of the issued and outstanding shares of the Company’s Common Stock calculated immediately after giving effect to the issuance of shares of Common Stock upon the exercise of the Warrant.

Giving effect to (i) the closing of the Share Exchange and (ii) the closing of the Private Placement, there were approximately 111,536,838 shares of Common Stock issued and outstanding, 400,000 shares of Series B Preferred Stock outstanding and 3,750,000 shares of Series C Preferred Stock outstanding.

The Share Exchange Common Shares and the Series C Shares and the Warrants issued to investors in the Private Placement were not registered under the Securities Act, and were issued in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506 promulgated thereunder. Certificates representing these shares will contain a legend stating the restrictions applicable to such shares.

Changes to the Board of Directors and Executive Officers. On February 5, 2014, effective upon the closing of the Share Exchange, Andrew Brabin resigned from all officer and director positions held with the Company and Charles W. Allen was appointed Chief Executive Officer and Chief Financial Officer, Michal Handerhan was appointed Chief Operating Officer, Timothy Sidie was appointed as Chief Technology Officer, and Charles A. Kiser was appointed Chief Marketing Officer of the Company. In addition, Michal Handerhan (Chairman), Timothy Sidie and Charles W. Allen were appointed to the Company's Board of Directors.

Charles W. Allen, age 38, was appointed our Chief Executive Officer and Chief Financial Officer and one of our directors upon the closing of the Share Exchange. Mr. Allen is responsible for our overall corporate strategy and direction as well as managing our corporate finances. Mr. Allen has extensive experience in business strategy and structuring and executing a variety of investment banking and capital markets transactions, including financings, IPO’s and mergers and acquisitions. From February, 2012 through January, 2014, Mr. Allen was a Managing Director at RK Equity Capital Markets LLC (“RK”) and focused on natural resources investment banking and added to RK's capital markets efforts. In August, 2012 Mr. Allen co-founded RK Equity Investment Corp. (“RKEIC”) and currently serves as a member of its board. RKEIC is an investment company established to co-invest in mining projects with JDS Energy and Mining Inc. Current RKEIC investments include Craigmont Industries Ltd. a coal washing magnetite and iron ore producer. Mr. Allen founded Allen Consulting LLC in January 2010 and currently serves as its president. Allen Consulting LLC provides financial and strategic consulting services to financial advisory firms, investment banks and corporate clients. In January, 2012 Mr. Allen co-founded ZA Investments LLC (“ZA”) and played an integral part in the evaluation of their investment opportunities and oversaw its investment in ADI Logistics, Corp. From January 2012, through April 2013 Mr. Allen served as board member of ADI Logistics, Corp. (“ADI”) a third party logistics company and advised, governed, and oversaw policy and direction, including expansion into west coast operations, as well as providing financial oversight. ZA was dissolved in December 2013 following the successful exit from

-2-

its investment in ADI. From March, 2010 through June 2012 Mr. Allen was the chief financial officer, secretary and a director of Pantheon China Acquisition Corp. II (“PCACII”) and Pantheon China Acquisition Corp. III (“PCACIII”). PCACII and PCACIII were public special purpose acquisition vehicles created by Mr. Allen and affiliates of Pantheon China Acquisition LTD to provide a means for small and medium size companies to access the U.S. capital markets. Pantheon China Acquisition LTD is a financial advisor and investment bank focused on the unique needs of foreign Small to Medium Enterprises. From October 2009 through May 2012 Mr. Allen was a Managing Director at TriPoint Global Equities, LLC, a boutique investment bank focused on helping small cap companies access the capital markets. Prior to joining TriPoint, Mr. Allen was a Managing Director at Broadband Capital Management LLC, where he also advised small and mid-cap companies concerning capital markets transactions. Mr. Allen worked at Broadband from March 2006 to October 2009. In 2005 Mr. Allen worked as an Associate for the Akul Group, an equity hedge fund and provided fundamental research coverage, investment strategies and risk management analysis. Mr. Allen began his career as a field engineer for Emcore Corporation, where he assisted customers in connection with their compound semiconductor manufacturing capabilities, and as a senior manufacturing engineer for Agility Communications, where he focused on the manufacture and development of tunable lasers for fiber optic communications. Mr. Allen received a B.S. in Mechanical Engineering from Lehigh University and a M.B.A. from the Mason School of Business at the College of William & Mary.

Michal Handerhan, age 37, was appointed our Chief Operating Officer and Chairman of the board of directors since the closing of the Share Exchange and was a co-founder of BitcoinShop. He supports both our business and development strategy across the management team. From February 2011 through February 2014 Mr. Handerhan served as an independent IT and web services consultant to the National Aeronautics and Space Administration (“NASA”). From October 2005 until February 2014Michal was the President and CEO of Meesha Media Group, LLC which provided high-definition (HD) video production services, Web 2.0 development, database management, and social media solutions. From March 2002 through October 2006 Mr. Handerhan served as a team leader for NASA in their Peer Review Services group. Prior to NASA Peer Review Services Michal served as the web developer for Folio Investments. Mr. Handerhan received a B.S. in Computer Science from Czech Technical University.

Tim Sidie, age 26, was appointed our Chief Technical Officer and one of our directors upon closing of the Share Exchange and was a co-founder of BitcoinShop. Mr. Sidie is overseeing the development of our technological plan and platform architecture. From May 2013 through February 2014 Mr. Sidie was a Software Engineer II at the Space Telescope Science Institute in its mission to support the Hubble Space Telescope and develop the James Webb Space Telescope. From June 2011 to July 2013 Mr. Sidie was a Software Engineer at NASA's Goddard Space Flight Center for the Direct Readout Laboratory, building software for earth observing satellite systems. After obtaining his Computer Science degree and prior to 2011, Mr. Sidie was a Support Engineer for Sourcefire, Inc., providing emergency response services to large corporations with pressing security issues. Mr. Sidie attended the University of Delaware from 2006 to 2008 and completed his B.S. in Computer Science from Ursinus College in 2010.

Charlie Kiser Jr., age 48, was appointed our Chief Marketing Officer upon closing of the Share Exchange and is responsible for our overall marketing and business development strategy. From March 2013 until January 2014 Mr. Kiser was the Chief Operating Officer and Director of Corporate Strategy for 60 Degrees Pharmaceuticals LLC, a Washington DC based pharmaceutical company focused on Tropical Diseases, with operations both in the U.S. and in Australia through its wholly owned subsidiary, 60P Australia, Pty. Ltd. Mr. Kiser remains a member of 60 Degrees Pharmaceuticals LLC. Mr. Kiser served as Director of Sales and Business Development for Apiphany Inc., an early stage application programming interface (“API”) management company also in Washington DC. He supported Apiphany as the first Sales, Marketing and Business Development employee resource from August 2012 to April 2013, and helped prepare the company for a successful acquisition by Microsoft in October 2013. From August 2010 until August 2011 Mr. Kiser consulted for, and then was employed by KZO Innovations Inc., an on-demand video management platform provider, as Director of Business Development. From December 2008 until June 2010 Mr. Kiser, as both a consultant and then employee, served as Vice President of Sales and Business Development for FortiusOne Inc., later renamed GeoIQ, Inc. Mr. Kiser has also served various other technology clients over the years as Chief Marketing Officer and Vice President of Sales. Along with serving as an Advisor to several early stage startup companies in the Washington DC region, Mr. Kiser is a Venture Mentor for AccelerateDC, the Washington, DC Economic Partnership Mentorship Program. Mr. Kiser graduated from West Virginia University in 1987 with a BS/BA Degree in Finance.

-3-

Mr. Handerhan, Mr. Sidie, Mr. Allen and Mr. Kiser do not have any family relationship with any other executive officers or directors of the Company. There are no arrangements or understandings between Mr. Handerhan, Mr. Sidie, Mr. Allen and Mr. Kiser and any other person pursuant to which such person was appointed as an officer or director of the Company. There have been no related party transactions in the past two years in which the Company or any of its subsidiaries was or is to be a party, in which any of Mr. Handerhan, Mr. Sidie, Mr. Allen and Mr. Kiser have, or will have, a direct or indirect material interest.

Allen Employment Agreement. On February 5, 2014, we entered into an employment agreement with Charles W. Allen (the “Allen Employment Agreement”), whereby Mr. Allen agreed to serve as our Chief Executive Officer and Chief Financial Officer for a period of two (2) years, subject to renewal, in consideration for an annual salary of $150,000. Additionally, under the terms of the Allen Employment Agreement, Mr. Allen shall be eligible for an annual bonus if the Company meets certain criteria, as established by the Board of Directors. Mr. Allen shall be entitled to participate in all benefits plans the Company provides to its senior executive. The Company shall reimburse Mr. Allen for all reasonable expenses incurred in the course of his employment. In the event Mr. Allen’s employment is terminated without Cause or by Mr. Allen with Good Reason (as such term is defined in the Allen Employment Agreement), Mr. Allen shall be entitled to a scaled severance package, including scaled salary benefits, 12 months of benefits commensurate to senior executives, and pro-rated bonuses earned. Additionally, pursuant to the terms of the Allen Employment Agreement, the Company has agreed to execute and deliver in favor of Mr. Allen an indemnification agreement and to maintain directors’ and officers’ insurance with terms and in the amounts commensurate with a senior executive of the Company.

In connection with his employment with the Company, the Company granted Mr. Allen a five-year stock option to purchase up to 1,550,368 shares of the Company’s common stock at an exercise price of $0.50 per share (the “Allen Options”), which options shall vest in twelve (12) equal monthly installments, beginning on the one (1) year anniversary of the date of issuance and every one (1) month anniversary thereafter, provided Mr. Allen remains continuously engaged as a director or officer of the Company through the applicable vesting date. In the event that Mr. Allen is removed as a director, officer or employee by the Company at any time other than for “Cause” or resigns as a director, officer or employee for “Good Reason” the Allen Options shall immediately vest in full.

Handerhan Employment Agreement. On February 5, 2014, we entered into an employment agreement with Michal Handerhan (the “Handerhan Employment Agreement”), whereby Mr. Handerhan agreed to serve as our Chief Operating Officer and Chairman for a period of two (2) years, subject to renewal, in consideration for an annual salary of $160,000. Additionally, under the terms of the Handerhan Employment Agreement, Mr. Handerhan shall be eligible for an annual bonus if the Company meets certain criteria, as established by the Board of Directors. Mr. Handerhan shall be entitled to participate in all benefits plans the Company provides to its senior executive. The Company shall reimburse Mr. Handerhan for all reasonable expenses incurred in the course of his employment. In the event Mr. Handerhan’s employment is terminated without Cause or by Mr. Handerhan with Good Reason (as such term is defined in the Handerhan Employment Agreement), Mr. Handerhan shall be entitled to a scaled severance package, including scaled salary benefits, 12 months of benefits commensurate to senior executives, and pro-rated bonuses earned. Additionally, pursuant to the terms of the Handerhan Employment Agreement, the Company has agreed to execute and deliver in favor of Mr. Handerhan an indemnification agreement and to maintain directors’ and officers’ insurance with terms and in the amounts commensurate with a senior executive of the Company.

In connection with his employment with the Company, the Company granted Mr. Handerhan a five-year stock option to purchase up to 1,550,368 shares of the Company’s common stock at an exercise price of $0.50 per share (the “Handerhan Options”), which options shall vest in twelve (12) equal monthly installments, beginning on the one (1) year anniversary of the date of issuance and every one (1) month anniversary thereafter, provided Mr. Handerhan remains continuously engaged as a director or officer of the Company through the applicable vesting date. In the event that Mr. Handerhan is removed as a director, officer or employee by the Company at any time other than for “Cause” or resigns as a director, officer or employee for “Good Reason” the Handerhan Options shall immediately vest in full.

-4-

Sidie Employment Agreement. On February 5, 2014, we entered into an employment agreement with Timothy Sidie (the “Sidie Employment Agreement”), whereby Mr. Sidie agreed to serve as our Chief Technology Officer for a period of two (2) years, subject to renewal, in consideration for an annual salary of $140,000. Additionally, under the terms of the Sidie Employment Agreement, Mr. Sidie shall be eligible for an annual bonus if the Company meets certain criteria, as established by the Board of Directors. Mr. Sidie shall be entitled to participate in all benefits plans the Company provides to its senior executive. The Company shall reimburse Mr. Sidie for all reasonable expenses incurred in the course of his employment. In the event Mr. Sidie’s employment is terminated without Cause or by Mr. Sidie with Good Reason (as such term is defined in the Sidie Employment Agreement), Mr. Sidie shall be entitled to a scaled severance package, including scaled salary benefits, 12 months of benefits commensurate to senior executives, and pro-rated bonuses earned. Additionally, pursuant to the terms of the Sidie Employment Agreement, the Company has agreed to execute and deliver in favor of Mr. Sidie an indemnification agreement and to maintain directors’ and officers’ insurance with terms and in the amounts commensurate with a senior executive of the Company.

In connection with his employment with the Company, the Company granted Mr. Sidie a five-year non-qualified stock option to purchase up to 1,550,368 shares of the Company’s common stock at an exercise price of $0.50 per share (the “Sidie Options”), which options shall vest in twelve (12) equal monthly installments, beginning on the one (1) year anniversary of the date of issuance and every one (1) month anniversary thereafter, provided Mr. Sidie remains continuously engaged as a director or officer of the Company through the applicable vesting date. In the event that Mr. Sidie is removed as a director, officer or employee by the Company at any time other than for “Cause” or resigns as a director, officer or employee for “Good Reason” the Sidie Options shall immediately vest in full.

Kiser Employment Agreement. On February 5, 2014, we entered into an employment agreement with Charles A. Kiser (the “Kiser Employment Agreement”), whereby Mr. Kiser agreed to serve as our Chief Executive Officer and Chief Financial Officer for a period of one (1) year, subject to renewal, in consideration for an annual salary of $135,000. Additionally, under the terms of the Kiser Employment Agreement, Mr. Kiser shall be eligible for an annual bonus if the Company meets certain criteria, as established by the Board of Directors. Mr. Kiser shall be entitled to participate in all benefits plans the Company provides to its senior executive. The Company shall reimburse Mr. Kiser for all reasonable expenses incurred in the course of his employment. In the event Mr. Kiser’s employment is terminated without Cause or by Mr. Kiser with Good Reason (as such term is defined in the Allen Employment Agreement), Mr. Kiser shall be entitled to a scaled severance package, including scaled salary benefits, 12 months of benefits commensurate to senior executives, and pro-rated bonuses earned. Additionally, pursuant to the terms of the Kiser Employment Agreement, the Company has agreed to execute and deliver in favor of Mr. Kiser an indemnification agreement and to maintain directors’ and officers’ insurance with terms and in the amounts commensurate with a senior executive of the Company.

In connection with his employment with the Company, the Company granted Mr. Kiser a five-year non-qualified stock option to purchase up to 1,550,368 shares of the Company’s common stock at an exercise price of $0.50 per share (the “Kiser Options”), which options shall vest in twelve (12) equal monthly installments, beginning on the one (1) year anniversary of the date of issuance and every one (1) month anniversary thereafter, provided Mr. Kiser remains continuously engaged as a director or officer of the Company through the applicable vesting date. In the event that Mr. Kiser is removed as a director, officer or employee by the Company at any time other than for “Cause” or resigns as a director, officer or employee for “Good Reason” the Kiser Options shall immediately vest in full.

Changes to the Business. Following the closing of the Share Exchange, through our wholly owned subsidiary, BitcoinShop, we entered into the business of developing, marketing and operating an online marketplace for transacting business in virtual currency, such as Bitcoins (as defined below).

-5-

In addition, following the closing of the Share Exchange, the Company discontinued its prior operations as a manufacturer of touch based visual communication products. The Company entered into an Asset Purchase and Debt Assumption Agreement with Touchit Technologies Holdings, Inc., a privately held Nevada corporation (“Holdings Company”), pursuant to which Holdings Company purchased all of the Company’s rights, title and interest in and to those certain assets relating to the technology products under the TouchIT Technologies™ (collectively, the "Assets'). In consideration of the sale of the Assets, the Holdings Company agreed to assume and be solely responsible for satisfying the debt and obligations associated with the debts and liabilities reflected on the audited and/or reviewed financial statements of the Company immediately prior to the Share Exchange. In connection with the Share Exchange and the sale of the Assets, the Company entered into two Agreement and Releases (the “Release Agreements”) with the Company’s former officer and director, Andrew Brabin and the Company’s former officer and director Ronald Murphy. Pursuant to the Release Agreements Mr. Brabin and Mr. Murphy agreed to release the Company of any and all claims they may have against the Company and to release the Company of any and all obligations related to the $32,585.79 and $59,913.40 loans advanced to the Company by Mr. Brabin and Mr. Murphy, respectively, deeming any instrument evidencing such debts null and void.

Following the Share Exchange, we will continue to be a “smaller reporting company,” as defined in Item 10(f)(1) of Regulation S-K, as promulgated by the SEC.

The foregoing description of the Share Exchange, the Lockup Agreements, the Private Placement, the Series C Shares, the Warrant, the Subscription Agreements, the Employment Agreements, the Asset Purchase and Debt Assumption Agreement, the Release Agreements and related transactions does not purport to be complete and is qualified in its entirety by reference to the complete text of the Exchange Agreement, Certificate of Designations of Preferences, Rights and Limitations of Series C Convertible Preferred Stock, the Warrant, the Form of Subscription Agreement, the Employment Agreements and the Asset Purchase and Debt Assumption Agreement which are filed as Exhibits hereto, and which are incorporated herein by reference.

Description of BitcoinShop’s Business

In this Current Report, unless the context provides otherwise, the terms “the Company,” “we,” “us,” and “our” refer toBitcoin Shop, Inc. and its wholly-owned subsidiary BitcoinShop.us, LLC.

GLOSSARY OF DEFINED TERMS

In this disclosure, each of the following quoted terms has the meanings set forth after such term:

“Bitcoin”—A type of a Digital Math-Based Asset based on an open source math-based protocol existing on the Bitcoin Network and utilizing cryptographic security.

“Bitcoin Exchange”—An electronic marketplace where exchange participants may trade, buy and sell Bitcoins based on bid-ask trading. The largest Bitcoin Exchanges are online and typically trade on a 24-hour basis, publishing transaction price and volume data.

“Bitcoin Exchange Market”—The global Bitcoin exchange market for the trading of Bitcoins, which consists of transactions on electronic Bitcoin Exchanges.

“Bitcoin Network”—The online, end-user-to-end-user network hosting the public transaction ledger, known as the Blockchain, and the source code comprising the basis for the math-based protocols and cryptographic security governing the Bitcoin Network.

“Blockchain”—The public transaction ledger of the Bitcoin Network on which Miners or Mining pools solve algorithmic equations allowing them to add records of recent transactions (called “blocks”) to the chain of transactions in exchange for an award of Bitcoins from the Bitcoin Network and the payment of transaction fees, if any, from users whose transactions are recorded in the block being added.

“Cryptocurrency,”—Currency that uses cryptography for security, making it difficult to counterfeit.

-6-

“Digital Math-Based Assets”—Collectively, all digital assets based upon a computer-generated math-based and/or cryptographic protocol that may, among other things, be used to buy and sell goods or pay for services. Bitcoins represent one type of Digital Math-Based Asset.

“FinCEN”—The Financial Crimes Enforcement Network, a bureau of the US Department of the Treasury.

“FINRA”—The Financial Industry Regulatory Authority, Inc., which is the primary regulator in the United States for broker-dealers, including Authorized Participants.

“Fiat Currency” — Currency that a government has declared to be legal tender, but is not backed by a physical commodity. The value of fiat money is derived from the relationship between supply and demand rather than the value of the material that the money is made of.

“Mining”—The process by which Bitcoins are created involving programmers solving complex math problems with the computers in the Bitcoin Network.

“SEC”—The US Securities and Exchange Commission.

Industry and Market Overview (Overview of Bitcoin)

Bitcoins are a digital or virtual currency that use peer-to-peer technology to facilitate instant payments. A Bitcoin is a type of alternative currency known as a cryptocurrency, which uses cryptography for security, making it difficult to counterfeit. Bitcoin issuance and transactions are carried out collectively by the Bitcoin Network, with no central authority, which allows users to make secure, verified transfers. We believe the market opportunities for Bitcoin are poised for significant growth in the future. Bitcoin is an accepted form of payment by a growing, but still limited number of businesses, while governments and regulators are beginning to create more regulation and structure to legitimize it as a currency. The opportunities as an asset class, a currency and a money transfer mechanism that has the potential to make Bitcoin an important alternative in the financial currency space.

The total number of Bitcoins that will be issued is capped at 21 million to ensure they are not devalued by limitless supply. They are divisible to 8 decimal places. Bitcoins exist only in digital form and can be bought with traditional currency through the internet. Users store their Bitcoins in a digital wallet, while transactions are verified by a digital signature known as a public-encryption key. The first Bitcoin specification and proof-of-concept was published in 2009 by an individual or individuals under the pseudonym Satoshi Nakamoto. Bitcoins are created through a “mining” process that involves programmers solving complex math problems with the computers in this network; this process currently creates 25 Bitcoins every 10 minutes (“Mining”). The limit of 21 million is expected to be reached in the year 2140, after which the total number of Bitcoins will remain unchanged.

Bitcoin Shop, Inc.

BitcoinShop was formed on July 28, 2013 as a Maryland Limited Liability Company and launched its ecommerce website in August 2013. On February 5, 2014, we entered into a Securities Exchange Agreement pursuant to which all holders of the membership interests in BitcoinShop exchanged their outstanding membership interests for an aggregate of 100,773,923 shares of the Company’s Common Stock. As a result, BitcoinShop became a wholly-owned subsidiary of the Company and we entered into the business of developing, marketing and operating BitcoinShop’s website, which offers its users an online marketplace for transacting business in virtual currency. Concurrently, the Company entered into an Asset Purchase and Debt Assumption Agreement with Touchit Technologies Holdings, Inc. pursuant to which we sold all of our rights, title and interest in and to those certain assets relating to the technology products under the TouchIT Technologies™ in consideration for the Holdings Company’s agreement to assume and be solely responsible for satisfying the debt and obligations associated with the debts and liabilities reflected on the audited and/or reviewed financial statements of the Company immediately prior to the Share Exchange. Accordingly, we discontinued our prior operations as a manufacturer of touch based visual communication products.

-7-

In connection with the Share Exchange, on January 29, 2014 the Company changed its name to “Bitcoin Shop, Inc.” from “TouchIT Technologies, Inc.” and effected a Reverse Split of its issued and outstanding Common Stock on a one for three hundred basis. On February 4, 2014, FINRA approved the Reverse Split and the Name Change to go market-effective on February 5, 2014 and assigned the Company a new trading symbol “BTCS”, effective for our principal market, the Over The Counter QB Marketplace, on March 5, 2014. In the interim, the Company’s trading symbol will be “TUCND” reflecting the Reverse Split. In addition, on February 6, 2014, the Company closed on a $1,875,000 private placement of 3,750,000 Units, each consisting of (i) one share of the Company’s Series C Convertible Preferred Stock, which is convertible into one (1) share of Common Stock; and (ii) a three year warrant to purchase ½ share of Common Stock at an exercise price of $1.00 per share.

The Company intends to list merchandise for customers to purchase with virtual currencies, primarily Bitcoin. Similar to other online retailers with solely an online presence, such as Amazon, eBay, or Rakuten, customers experience a traditional browse and checkout process, the major difference being able to pay with virtual currencies at checkout instead of Fiat Currency. Vendors can supply inventory information via private API access or traditional inventory management systems, and are paid in USD. The Company exists primarily as a medium between consumers wishing to spend Bitcoin and sellers wishing to receive sales driven by Bitcoin.

The online presence that the Company operates is hosted, maintained, and developed by the Company. We have developed software that allows us to interface with vendors in order to display up-to-date inventory, and present prices in Bitcoin according to the exchange rate from USD, updated every 15 minutes.

The Company, through its ecommerce website, currently lists over 140,000 products for sale, however, we do not have any inventory and we seek to oversee the fulfillment process through delivery but are not a part of the logistics chain. We charge our customers a processing fee and an operational margin on transactions. Revenue generated in Bitcoins from our sales are converted to U.S. dollars to settle with our vendors. Approximately 80% of our gross profit is currently converted to cash and the remaining 20% is retained in Bitcoins, though management may change this ratio from time to time.

The Company has set its goal to be a leading virtual currency marketplace where consumers and sellers of products and services can use any virtual currency to transact business. We focus on delivering outstanding value and convenience to our online customers while providing a reliable and scalable platform for vendors and sellers.

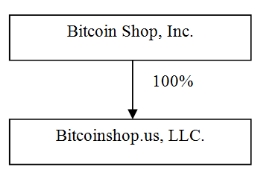

Corporate Structure:

Our current corporate structure is set forth below:

Consumers:

Customers access our website through the web and mobile devices. We place orders on behalf of our customers and oversee the fulfillment process through delivery. We support these transactions with strong customer service.

-8-

Vendors and Distributors:

We have consented to the terms of service of our current vendor and plan to enter agreements with other vendors and distributors to offer products for sale on our site. We are not the seller of record in these transactions, but instead earn a combination of processing fees and operational margin on the transactions. We use payment processers to manage the conversion of the virtual currency into the desired currency acceptable to the vendor, and we remit the final payment to the vendor or distributor. We manage the product data import into our platform on behalf of the vendor by leveraging both APIs (application programming interfaces) that allow fast and accurate integration between our online platform and their inventory and product category information, along with leveraging traditional product inventory management systems.

Competition

The virtual currency ecommerce ecosystem is in its infancy so there are currently few direct online retailers who offer a platform similar to ours. Our current and future competition is centered on the following areas:

1) Vendors and retailers that choose to accept virtual currencies at their branded websites and affiliate sellers websites.

2) Physical “brick and mortar” locations, distributors, vendors and manufacturers that sell products and accept virtual currencies as payment.

3) Other mobile applications, websites, shopping sites, niche aggregation sites, private sale sites and group buying sites that sell or distribute products in exchange for virtual currency; and

4) Virtual currency companies that offer exchange, payment processing, remittance, money transmission service, and financial services that enable consumers or vendors to exchange or improve the acceptance of virtual currency in online or physical consumer/seller transactions.

The main competitive factor which we believe drives our customers’ online shopping decisions center around our ability to accept virtual currency, provide a wide selection of products, and a convenient shopping experience with a focus on quality customer service. Many of our current and potential competitors have greater resources, longer histories, more customers, and greater brand recognition. They may secure better terms from suppliers, adopt more aggressive pricing, and devote more resources to technology, infrastructure, fulfillment, and marketing. Other companies also may enter into business combinations or alliances that strengthen their competitive positions.

Intellectual Property and Trade Secrets

Our trademark (in application), domain names, and proprietary technology are needed for us to remain competitive and we rely on trademark, copyright, patent law, trade-secret protection, and confidentiality and/or license agreements with our employees, customers, partners, and others to protect our proprietary rights. We have registered, or applied for the registration of, a number of U.S. and international domain names, and trademarks.

Technology

We use third party open source platforms as well as internally developed tools to operate our website, and a combination of proprietary technologies and commercially available licensed technologies and solutions to support our operations.

Seasonality

Based on comparable and established ecommerce trends we expect our business to be affected by seasonality throughout the year. From our inception through fiscal year end 2013 we had significant growth in the fourth fiscal quarter. We were unable to determine if this growth was due to our general business operations, or how much was attributable to year-end holiday shopping patterns. We expect this pattern may repeat in the future based on comparisons to established ecommerce marketplaces and traditional “brick and mortar” stores.

-9-

Growth Strategy

We plan to focus on three core areas: growing revenue, improving margin and building competitive differentiators. We anticipate that growing revenue will consist of both generating sales from our existing customer base, and increasing site traffic and acquiring new customers. In addition to site traffic, we plan on increasing the selection and categories of products offered to include higher per transaction sales that result in higher revenue and margin per transaction. We intend to leverage our corporate structure and our access to the public markets to increase our appeal to vendors, brands, and customers when compared to potential competitors.

As competition builds from brands and sites which start to accept Bitcoins and other virtual currencies we plan to be positioned both as a primary gateway partner for brands that are not prepared to develop their own solutions for virtual currency. We also plan to explore additional product offerings including digital media, and software.

R&D

The Company. believes that an agile development approach combined with being at the leading edge of technology trends in virtual currency could be a powerful competitive advantage for us. We enlist best practices engineering and development models from our founder’s experiences at NASA to deliver solutions that we believe will scale rapidly and reliably. We believe that new technologies will evolve rapidly within the virtual currency ecosystem. We anticipate that part of our value proposition will be our ability to successfully test and integrate new technologies, and to develop proprietary systems.

Our technology allows us to integrate with numerous vendors though we are currently only integrated with one major vendor. However when selection or pricing advantages can be sourced from alternative vendors, we source these on a limited case by case basis to the benefit of our customers. We intend to automate this process to achieve efficiencies that are scalable.

Risk Factors

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur, our business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of our common stock could decline and investors could lose all or part of their investment.

The Company intends to change the focus of its business to developing, marketing and operating the business of BitcoinShop. The Company may not be able to successfully compete in this business, and thus it may fail to realize all of the anticipated benefits of consummating the Share Exchange.

Risks Related to Our Business:

BITCOIN AND VIRTUAL CURRENCY RISKS

The further development and acceptance of the Bitcoin Network and other Digital Math-Based Asset systems, which represent a new and rapidly changing industry, are subject to a variety of factors that are difficult to evaluate. The slowing or stopping of the development of the Bitcoin Network or the acceptance of the Bitcoin may adversely affect an investment in the Company.

Digital Math-Based Assets such as Bitcoins may be used, among other things, to buy and sell goods and services are a new and rapidly evolving industry of which the Bitcoin Network is a prominent, but not unique, part. The growth of the Digital Math-Based Assets industry in general, and the Bitcoin Network in particular, is subject to a high degree of uncertainty. Because the respective values of the Trading Systems and the Exchange are closely related to and dependent upon the underlying value of the Bitcoin, any risk to the proper adoption, implementation, or functioning of Bitcoin also poses a risk to the Company’s ecommerce platform. The factors affecting the further development of the Digital Math-Based Assets industry, as well as the Bitcoin Network, include:

-10-

|

•

|

Continued worldwide growth in the adoption and use of Bitcoin;

|

|

•

|

Global Bitcoin supply;

|

|

•

|

Global Bitcoin demand, which is influenced by the growth of retail merchants’ and commercial businesses’ acceptance of Bitcoins as payment for goods and services, the security of online Bitcoin Exchanges and digital wallets that hold Bitcoins, the perception that the use and holding of Bitcoins is safe and secure, and the lack of regulatory restrictions on their use;

|

||

|

•

|

Government and quasi-government regulation of Bitcoin and its use, or restrictions on or regulation of access to and operation of the Bitcoin Network and derivative industries and technologies;

|

|

•

|

General global economic conditions, including interest rates, inflation, currency exchange rates, governmental monetary policies and trade restrictions;

|

|

•

|

Changes in consumer demographics and public taste preferences;

|

||

|

•

|

The availability and popularity of other forms or methods of buying and selling goods and services, including new means of using fiat currencies;

|

||

|

•

|

Investors’ expectations with respect to the rate of inflation;

|

||

|

•

|

Interest rates;

|

||

|

•

|

Currency exchange rates, including the rates at which Bitcoins may be exchanged for Fiat Currencies;

|

||

|

•

|

Fiat Currency withdrawal and deposit policies of Bitcoin Exchanges and liquidity on such Bitcoin Exchanges;

|

|

•

|

Investment and trading activities of large investors, including private and registered funds, that may directly or indirectly invest in Bitcoins;

|

|

•

|

Global or regional political, economic or financial events and situations; and

|

||

|

•

|

Expectations among Bitcoin economy participants that the value of Bitcoins will soon change.

|

Currently, there is relatively small use of Bitcoins in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in the Company.

As relatively new products and technologies, Bitcoins and the Bitcoin Network have not been widely adopted as a means of payment for goods and services by major retail and commercial outlets. Conversely, a significant portion of Bitcoin demand is generated by speculators and investors seeking to profit from the short or long-term holding of Bitcoins. The relative lack of acceptance of Bitcoins in the retail and commercial marketplace limits the ability of end-users to pay for goods and services with Bitcoins. A lack of expansion of Bitcoin into retail and commercial markets, or a contraction of such use, may result in increased volatility or a reduction in the Bitcoin price, either of which could adversely impact an investment in the Company.

-11-

The administrators of the Bitcoin Network’s source code could propose amendments to the Bitcoin Network’s protocols and software that, if accepted and authorized by the Bitcoin Network’s community, could adversely affect an investment in the Company.

The Bitcoin Network is based on a cryptographic, algorithmic protocol that governs the end-user-to-end-user interactions between computers connected to the Bitcoin Network. The code that sets forth the protocol is managed by a development team that was appointed by the Bitcoin Network’s purported creator, Satoshi Nakamoto. The development team can propose amendments to the Bitcoin Network’s source code through one or more software upgrades that alter the protocols and software that govern the Bitcoin Network and the properties of Bitcoins, including the irreversibility of transactions and limitations on Mining. To the extent that a significant majority of the users and miners on the Bitcoin Network install such software upgrade(s), the Bitcoin Network would be subject to new protocols and software that may adversely affect an investment in the Company. If less than a significant majority of the users and miners on the Bitcoin Network install such software upgrade(s), the Bitcoin Network could “fork” and two separate Bitcoin Networks could result, one running the pre-upgrade software and the other running the upgraded software. Such a fork could adversely affect an investment in the Company.

If a malicious actor or botnet obtains control in excess of 50 percent of the processing power active on the Bitcoin Network, such actor or botnet could manipulate the source code of the Bitcoin Network or the Blockchain in a manner that adversely affects an investment in the Company.

To the extent that a malicious actor or botnet (a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers) obtains a majority of the processing power on the Bitcoin Network, it could alter the source code and Blockchain on which the Bitcoin Network and all Bitcoin transactions rely. To the extent that such malicious actor or botnet does not yield its majority control of the processing power on the Bitcoin Network, reversing any changes made to the source code or Blockchain may not be possible. Such changes could adversely affect an investment in the Company.

As the number of Bitcoins awarded for solving a block in the Blockchain decreases, the incentive for miners to continue to contribute processing power to the Bitcoin Network will transition from a set reward to transaction fees. The requirement from miners of higher transaction fees in exchange for recording transactions in the Blockchain may decrease demand for Bitcoins and prevent the expansion of the Bitcoin Network to retail merchants and commercial businesses, resulting in a reduction in the value of Bitcoins.

If transaction fees paid for the recording of transactions in the Blockchain become too high, the marketplace may be reluctant to accept Bitcoins as a means of payment and existing users may be motivated to switch from Bitcoins to another Digital Math-Based Asset or back to fiat currency. Decreased use and demand for Bitcoins may adversely affect their value.

If the award of Bitcoins for solving blocks and transaction fees for recording transactions are not sufficiently high to incentivize miners, miners may cease expending processing power to solve blocks and confirmations of transactions on the Blockchain could be slowed. A reduction in the processing power expended by miners on the Bitcoin Network could increase the likelihood of a malicious actor or botnet obtaining control in excess of 50 percent of the processing power active on the Bitcoin Network or the Blockchain, permitting such actor or botnet to manipulate the source code of the Bitcoin Network in a manner that adversely affects an investment in the Company.

If transaction fees are not sufficiently high, miners may not have an adequate incentive to continue Mining and may cease their Mining operations. Miners ceasing operations would reduce the collective processing power on the Bitcoin Network, which would adversely affect the confirmation process for transactions and make the Bitcoin Network more vulnerable to a malicious actor or botnet obtaining control in excess of 50 percent of the processing power on the Bitcoin Network. Any reduction in confidence in the confirmation process or processing power of the Bitcoin Network may adversely impact an investment in the Company.

-12-

The acceptance of Bitcoin Network software patches or upgrades by a significant, but not overwhelming, percentage of the users and miners in the Bitcoin Network could result in a “fork” in the Blockchain, resulting in the operation of two separate networks until such time as the forked Blockchains are merged if they are in fact changed. The temporary or permanent existence of forked Blockchains could adversely impact an investment in the Company.

Bitcoin is an open source project and, although there is an influential group of leaders in the Bitcoin Network community including developers, there is no official developer or group of developers that formally controls the Bitcoin Network. Any individual can download the Bitcoin Network software and make any desired modifications, which are proposed to users and miners on the Bitcoin Network through software downloads and upgrades. However, miners and users must consent to those software modifications by downloading the altered software or upgrade implementing the changes; otherwise, the changes do not become a part of the Bitcoin Network. Since the Bitcoin Network’s inception, changes to the Bitcoin Network have been accepted by the vast majority of users and miners, ensuring that the Bitcoin Network remains a coherent economic system. However, a developer or group of developers could potentially propose a modification to the Bitcoin Network that is not accepted by a vast majority of miners and users, but that is nonetheless accepted by a substantial population of participants in the Bitcoin Network. In such a case, a fork in the Blockchain could develop and two separate Bitcoin Networks could result, one running the pre-modification software program and the other running the modified version. Such a fork in the Blockchain typically would be addressed by community-led efforts to merge the forked Blockchains, and several prior forks have been so merged. This kind of split in the Bitcoin Network could materially and adversely affect the value of Bitcoins, in the worst case scenario, harm the sustainability of the Bitcoin economy, in which case an investment in the Company may be negatively impacted.

Intellectual property rights claims may adversely affect the operation of the Bitcoin Network.

Third parties may assert intellectual property claims relating to the operation of Digital Math-Based Assets and their source code relating to the holding and transfer of such assets. Regardless of the merit of any intellectual property or other legal action, any threatened action that reduces confidence in the Bitcoin Network’s long-term viability or the ability of end-users to hold and transfer Bitcoins may adversely affect an investment in the Company. Additionally, a meritorious intellectual property claim could prevent the Company from accessing the Bitcoin Network.

The value of Bitcoins may be subject to momentum pricing whereby the current Bitcoin value may account for speculation regarding future appreciation in value. Momentum pricing of Bitcoins may subject Bitcoin to greater volatility and adversely affect an investment in the Company.

Momentum pricing typically is associated with growth stocks and other assets whose valuation, as determined by the investing public, accounts for anticipated future appreciation in value. Momentum pricing of Bitcoins has resulted, and may continue to result, in speculation regarding future appreciation in the value of Bitcoins, inflating and making Bitcoin more volatile. As a result, Bitcoins may be more likely to fluctuate in value due to changing investor confidence in future appreciation of Bitcoin, which could adversely affect an investment in the Company.

The Bitcoin exchanges on which Bitcoins trade are relatively new and largely unregulated and may therefore be more exposed to fraud and failure than established, regulated exchanges for other products. To the extent that the Bitcoin exchanges representing a substantial portion of the volume in Bitcoin trading are involved in fraud or experience security failures or other operational issues, such Bitcoin exchanges’ failures may result in a reduction in Bitcoin value and can adversely affect an investment in the Company.

Over the past three years, many Bitcoin Exchanges have been closed due to fraud, failure or security breaches. In many of these instances, the customers of such Bitcoin Exchanges were not compensated or made whole for the partial or complete losses of their account balances in such Bitcoin Exchanges. While smaller Bitcoin Exchanges are less likely to have the infrastructure and capitalization that make larger Bitcoin Exchanges more stable, larger Bitcoin Exchanges are more likely to be appealing targets for hackers and “malware” (i.e., software used or programmed by attackers to disrupt computer operation, gather sensitive information or gain access to private computer systems).

-13-

A lack of stability in the Bitcoin Exchange Market and the closure or temporary shutdown of Bitcoin Exchanges due to fraud, business failure, or hackers or malware may reduce confidence in the Bitcoin Network and result in greater volatility in Bitcoin value. These potential consequences of a Bitcoin Exchange’s failure could adversely affect an investment in the Company.

Political or economic crises may motivate large-scale sales of Bitcoins, which could result in a reduction in Bitcoin value and adversely affect an investment in the Company.

As an alternative to Fiat Currencies that are backed by central governments, Digital Math-Based Assets such as Bitcoins, which are relatively new, are subject to supply and demand forces based upon the desirability of an alternative, decentralized means of buying and selling goods and services, and it is unclear how such supply and demand will be impacted by geopolitical events. Nevertheless, political or economic crises may motivate large-scale acquisitions or sales of Bitcoins either globally or locally. Large-scale sales of Bitcoins would result in a reduction in Bitcoin value and could adversely affect an investment in the Company.

The Company may be required to terminate and liquidate its business at a time that is disadvantageous to Shareholders.

If the Company is required to terminate and liquidate, such termination and liquidation could occur at a time that is disadvantageous to Shareholders, such as when the value of Bitcoin is lower than it was when Shareholders purchased their shares.

The United States tax rules applicable to an investment in Bitcoin businesses are uncertain and the tax consequences to an investor of an investment in the Company could differ from the investor’s expectations.

The relevant tax rules are complex, and no statutory, judicial, or administrative authority directly addresses the characterization of an investment in Bitcoins. The tax consequences to an investor of an investment in the Company could differ from the investor’s expectations.

Regulatory changes or actions may alter the nature of an investment in the Company or restrict the use of Bitcoins or the operation of the Bitcoin Network in a manner that adversely affects an investment in the Company.

Until recently, little or no regulatory attention has been directed toward Bitcoins and the Bitcoin Network by US federal and state governments, foreign governments and self-regulatory agencies. As Bitcoins have grown in popularity and in market size, certain US agencies (e.g., FinCEN) have begun to examine the operations of the Bitcoin Network, Bitcoin users and the Bitcoin Exchange Market. There is a possibility of future regulatory change altering, perhaps to a material extent, the nature of an investment in the Company and/or the Company’s ability to operate its Bitcoin business.

Currently, neither the SEC nor the CFTC has formally asserted regulatory authority over the Bitcoin Network or Bitcoin trading and ownership. To the extent that Bitcoins are determined to be a security, commodity future or other regulated asset, or to the extent that a US or foreign government or quasi-governmental agency exerts regulatory authority over the Bitcoin Network or Bitcoin trading and ownership, trading or ownership in Bitcoins, our ability to deliver an ecommerce platform based on virtual currency may be adversely affected.

To the extent that future regulatory actions or policies limit the ability to exchange Bitcoins or utilize them for payments, the demand for Bitcoins will be reduced. Furthermore, regulatory actions may limit the ability of end-users to convert Bitcoins into Fiat Currency (e.g., US Dollars) or use Bitcoins to pay for goods and services. Such regulatory actions or policies would result in a reduction Bitcoin value and by extension the Company’s Bitcoin business.

Bitcoin currently faces an uncertain regulatory landscape in not only the United States but also in many foreign jurisdictions such as the European Union. Various foreign jurisdictions may, in the near future, adopt laws, regulations or directives that affect the Bitcoin Network and its users, particularly Bitcoin Exchanges and service providers that fall within such jurisdictions’ regulatory scope. Such laws, regulations or directives may conflict with those of the United States and may negatively impact the acceptance of Bitcoins by users, merchants and service providers outside of the United States and may therefore impede the growth of the Bitcoin economy.

-14-

The effect of any future regulatory change regarding Bitcoins is impossible to predict, but such change could be substantial and adverse to the Company.

It may be illegal now, or in the future, to acquire, own, hold, sell or use Bitcoins in one or more countries.

Although currently Bitcoins are not regulated or are lightly regulated in most countries, including the United States, one or more countries may take regulatory actions in the future that severely restricts the right to acquire, own, hold, sell or use Bitcoins or to exchange Bitcoins for Fiat Currency. Such restrictions may adversely affect an investment in the Company.

We keep approximately 20% of our gross profit in Bitcoins.

Management from time to time may increase or decrease this amount, as well as considering diversifying our holdings in new and evolving alternative currencies like Bitcoin. As the value of Bitcoins fluctuates we may either benefit or suffer financial losses or gains in these holdings.

ECOMMERCE RISK FACTORS:

We are an ecommerce business and we depend on the continued use of the Internet and the adequacy of the Internet infrastructure.

Our business depends upon the widespread use of the Internet and ecommerce. Factors which could reduce the widespread use of the Internet for ecommerce include:

|

•

|

actual or perceived lack of security of information or privacy protection;

|

|

•

|

cyber attacks or other disruptions or damage to the Internet or to users’ computers;

|

|

•

|

significant increases in the costs of transportation of goods; and

|

|

•

|

taxation and governmental regulation.

|

We depend on our relationships with an independent fulfillment partner for the products that we offer for sale on our Website. If we fail to maintain this relationship, our business will suffer.

If we do not maintain our existing relationships or build new relationships with fulfillment partners on acceptable commercial terms, we may not be able to maintain a broad selection of merchandise, and our business and prospects would suffer severely. Our agreements with fulfillment partners are generally terminable at will by either party upon short notice.

We depend on our fulfillment partners to perform certain services regarding the products that we offer.

In general, we agree to offer the fulfillment partners’ products on our Website and these fulfillment partners agree to conduct a number of other traditional retail operations with respect to their respective products, including maintaining inventory, preparing merchandise for shipment to individual customers and delivering purchased merchandise on a timely basis. We may be unable to ensure that these third parties will continue to perform these services to our satisfaction or on commercially reasonable terms. In addition, because we do not take possession of these fulfillment parties’ products (other than on the return of such products), we are generally unable to fulfill these traditional retail traditional retail operations ourselves. If our customers become dissatisfied with the services provided by these third parties, our business and reputation and the BitcoinShop brand could suffer.

-15-

Risks associated with the supplier from whom our products are sourced and the safety of those products could adversely affect our financial performance.

Global sourcing of many of the products we sell is an important aspect of our business. We depend on our ability to access products from our qualified supplier in a timely and efficient manner. Political and economic instability, the financial stability of suppliers, suppliers’ ability to meet our standards, labor problems experienced by our suppliers, the availability of raw materials, merchandise quality issues, currency exchange rates, transport availability and cost, transport security, inflation, and other factors relating to the suppliers and the countries in which they are located are beyond our control. Further, our customers count on us to provide them with safe products. Concerns regarding the safety of products that we source from our supplier and then sell could cause shoppers to avoid purchasing certain products from us, or to seek alternative sources of supply for all of their needs, even if the basis for the concern is outside of our control. Any lost confidence on the part of our customers would be difficult and costly to reestablish. As such, any issue regarding the safety of any items we sell, regardless of the cause, could adversely affect our financial performance. Further, we sell products manufactured for us by third parties, some of which may be defective. If any product that we sell were to cause physical injury or injury to property, the injured party or parties might bring claims against us as the manufacturer and/or retailer of the product. Our insurance coverage may not be adequate to cover claims that could be asserted. Even unsuccessful claims could result in the expenditure of funds and management time and could have a negative impact on our business.

Our business depends on our Website, network infrastructure and transaction-processing systems.

As an ecommerce company, we are completely dependent on our infrastructure. Any system interruption that results in the unavailability of our Website or reduced performance of our transaction systems could reduce our ability to conduct our business. We use internally and externally developed systems for our Website and our transaction processing systems,. We have experienced system interruptions due to software failure in the past, which we expect will continue to occur from time to time. We may also experience temporary capacity constraints due to sharply increased traffic during sales or other promotions and during the holiday shopping season. Capacity constraints can cause system disruptions, slower response times, delayed page presentation, degradation in levels of customer service and other problems. We may also experience difficulties with our infrastructure upgrades. Any future difficulties with our transaction processing systems or difficulties upgrading, expanding or integrating aspects of our systems may cause system disruptions, slower response times, and degradation in levels of customer service, additional expense, impaired quality and speed of order fulfillment or other problems.

If the location where all of our computer and communications hardware is located is compromised, our business, prospects, financial condition and results of operations could be harmed. If we suffer an interruption or degradation of services at the location for any reason, our business could be harmed. Our success, and in particular, our ability to successfully receive and fulfill orders and provide high-quality customer service, largely depends on the efficient and uninterrupted operation of our computer and communications systems. These limitations could have an adverse effect on our conversion rate and sales. Our disaster recovery plan may be inadequate, and we do not carry business interruption insurance sufficient to compensate us for the losses that could occur. Despite our implementation of network security measures, our servers are vulnerable to computer viruses, physical or electronic break-ins and similar disruptions, the occurrence of any of which could lead to interruptions, delays, loss of critical data or the inability to accept and fulfill customer orders. The occurrence of any of the foregoing risks could harm our business.

Our platform requires frequent updates on pricing from our vendor. If these updates are inaccurate or do not occur, there could be a negative influence on our business.

We update the prices of products listed on our site frequently as the product vendor informs us of changes. If we are unable to obtain, or are not provided updated pricing information from our vendor, or if we fail to act on information provided by our vendor, then it could cause us to remedy the pricing difference to complete the transaction, or source the product from an alternative vendor at their price.

-16-

We rely upon paid and natural search engines like Google, Bing, and Yahoo to rank our product offerings and may at times be subject to ranking penalties if they believe we are not in compliance with their guidelines.

We rely on paid and natural search engines to attract consumer interest in our product offerings. Potential and existing customers use search engines provided by search engine companies, including Google, Bing, and Yahoo, which use algorithms and other devices to provide users a natural ranked listing of relevant Internet sites matching a user’s search criteria and specifications. Generally, Internet sites ranked higher in the paid and natural search results lists furnished to users attract the largest visitor share among similar Internet sites. Among retail Internet sites, those sites achieving the highest natural search ranking often benefit from increased sales. Natural search engine algorithms use information available throughout the Internet, including information available on our site. Rules and guidelines of these natural search engine companies govern our participation on their sites and how we share relevant Internet information that may be considered or incorporated into the algorithms used by these sites. If these rules and guidelines or the search engine algorithms change, or if we fail to present, or improperly present, our site information for use by natural search engine companies, or if any of these natural search engine companies determine that we have violated their rules or guidelines, or if others improperly present our site information to these search engine companies, we may fail to achieve an optimum ranking in natural search engine listing results, or we may be penalized in a way that could harm our business.

We are subject to cyber security risks and may incur increasing costs in an effort to minimize those risks and to respond to cyber incidents.

Our business is entirely dependent on the secure operation of our website and systems as well as the operation of the Internet generally. Our business involves the storage and transmission of users’ proprietary information, and security breaches could expose us to a risk of loss or misuse of this information, litigation, and potential liability. A number of large Internet companies have suffered security breaches, some of which have involved intentional attacks. From time to time we and many other Internet businesses also may be subject to a denial of service attacks wherein attackers attempt to block customers’ access to our Website. If we are unable to avert a denial of service attack for any significant period, we could sustain substantial revenue loss from lost sales and customer dissatisfaction. We may not have the resources or technical sophistication to anticipate or prevent rapidly evolving types of cyber-attacks. Cyber attacks may target us, our customers, our suppliers, banks, payment processors, ecommerce in general or the communication infrastructure on which we depend. If an actual or perceived attack or breach of our security occurs, customer and/or supplier perception of the effectiveness of our security measures could be harmed and we could lose customers, suppliers or both. Actual or anticipated attacks and risks may cause us to incur increasing costs, including costs to deploy additional personnel and protection technologies, train employees, and engage third party experts and consultants. A person who is able to circumvent our security measures might be able to misappropriate our or our users’ proprietary information, cause interruption in our operations, damage our computers or those of our users, or otherwise damage our reputation and business. Any compromise of our security could result in a violation of applicable privacy and other laws, significant legal and financial exposure, damage to our reputation, and a loss of confidence in our security measures, which could harm our business.

We rely on a third party payment processor to verify a successful transaction between us and our customers.

We rely on a third party processor to facilitate the transaction from the customer’s virtual currency wallet to our virtual currency wallet. If we are unable to source processors to verify these transactions our business could suffer.

Natural disasters and geo-political events could adversely affect our business.

Natural disasters, including hurricanes, cyclones, typhoons, tropical storms, floods, earthquakes and tsunamis, weather conditions, including winter storms, droughts and tornados, whether as a result of climate change or otherwise, and geo-political events, including civil unrest or terrorist attacks, that affect us or our delivery services, suppliers, credit card processors or other service providers could adversely affect our business.

-17-

We may not be able to compete successfully against existing or future competitors.

The online retail market is rapidly evolving and intensely competitive. Barriers to entry are minimal, and current and new competitors can launch new websites at a relatively low cost. We currently compete with numerous competitors, including:

|

·

|

liquidation e-tailers such as SmartBargains, Optoro and Overstock ;

|

|

·

|

online retailers with discount departments such as Amazon.com, Inc., eBay, Inc. and

|

Rakuten.com, Inc. (formerly Buy.com, Inc.);

|

·

|

private sale sites such as Rue La La and Gilt Groupe;

|

|

·

|

online specialty retailers such as Bluefly, Inc., Blue Nile, Inc. and Zappos.com; and

|

|

·

|

traditional general merchandise and specialty retailers and liquidators such as Ross Stores, Inc., Wal-Mart Stores, Inc., Costco Wholesale Corporation, J.C. Penny Company, Inc., Sears Holding Corporation, Target Corporation, Best Buy Co., Inc., Home Depot, Inc. and Barnes and Noble, Inc., all of which also have an online presence.

|

We expect the online retail market to become even more competitive as traditional liquidators and online retailers continue to develop and improve services that compete with our services. In addition, more traditional manufacturers and retailers may continue to add or improve their ecommerce offerings. Traditional or online retailers may create proprietary, store-based distribution and returns channels. Competitive pressures, including the introduction of same-day delivery capabilities, from any of our competitors, many of whom have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial, marketing and other resources than we do, could harm our business. Further, as a strategic response to changes in the competitive environment, we may from time to time make competitive pricing, service, marketing or other decisions that could harm our business.

If one or more states successfully assert that we should collect sales or other taxes on the sale of our merchandise or the merchandise of third parties that we offer for sale on our Website, or that we should pay commercial activity taxes, our business could be harmed.