Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - AMAG PHARMACEUTICALS, INC. | a14-5162_1ex99d1.htm |

| 8-K - 8-K - AMAG PHARMACEUTICALS, INC. | a14-5162_18k.htm |

Exhibit 99.2

|

|

AMAG Pharmaceuticals, Inc. 1100 Winter Street Waltham, MA 02451 o 617.498.3300 www.amagpharma.com A SPECIALTY PHARMACEUTICAL COMPANY DEDICATED TO BRINGING TO MARKET THERAPIES THAT IMPROVE PATIENTS’ LIVES. AMAG Pharmaceuticals 2013 Financial Results February 6, 2014 |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. Forward Looking Statements 1 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Any statements contained herein which do not describe historical facts, including but not limited to: statements regarding (i) our strategic plan; (ii) our 2014 financial outlook, including projected sales, cost of goods sold, operating expenses and cash and investments balance; (iii) plans to drive revenue growth of Feraheme in the current indication and possible plans to seek to enhance Feraheme’s label and expand into new markets; (iv) commercial opportunities for Feraheme in the current indication; (v) the possibility and next steps for label expansion, including assumptions regarding the patient study and its return on investment; (vi) the expected timing and magnitude of milestone payments; (vii) expectations regarding the demand for MuGard and our s trategies to increase MuGard’s commercial success; (viii) our business development goals and opportunities, including our expectations that more than 50% of our revenues will be attributable to new products by 2018; (ix) the impact of business development transactions on EBITDA; (x) our ability to optimize after-tax cash flows with business development transactions; and (xi) our statement that AMAG is well positioned for success in 2014 and beyond are forward-looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, among others: (1) uncertainties regarding the likelihood and timing of potential approval of AMAG’s supplemental New Drug Application (sNDA) for Feraheme in the U.S. in the broader iron deficiency anemia (IDA) indication, (2) the possibility that following the FDA’s review of post-marketing safety data, including reports of serious anaphylaxis, cardiovascular events, and death, the FDA will request additional technical or scientific information, new studies or reanalysis of existing data, on-label warnings, post-marketing requirements/commitments or risk evaluation and mitigation strategies (REMS) in the current CKD indication for Feraheme, (3) uncertainties regarding our and Takeda Pharmaceutical’s ability to successfully compete in the intravenous iron replacement market both in the U.S. and outside the U.S., including the EU, including as a result of limitations, restrictions or warnings in Feraheme’s/Rienso’s current or future label that put Feraheme/Rienso at a competitive disadvantage, (4) uncertainties regarding Takeda’s ability to obtain regulatory approval for Feraheme in Canada, and Rienso in the EU, in the broader IDA patient population, (5) the possibility that significant safety or drug interaction problems could arise with respect to Feraheme/Rienso and in turn affect sales, or the company’s ability to market the product both in the U.S. and outside of the U.S., including the EU, (6) uncertainties regarding the manufacture of Feraheme/Rienso or MuGard, (7) uncertainties relating to our patents and proprietary rights both in the U.S. and outside the U.S., (8) the risk of an Abbreviated New Drug Application (ANDA) filing following the FDA’s recently published draft bioequivalence recommendation for ferumoxytol, (9) uncertainties regarding our ability to compete in the oral mucositis market in the U.S. and (10) other risks identified in our filings with the U.S. Securities and Exchange Commission (SEC), including our Quarterly Report on Form 10-Q for the quarter ended September 30, 2013 and subsequent filings with the SEC. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. We disclaim any obligation to publicly update or revise any such s tatements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. Agenda Topic Speaker Opening Remarks Bill Heiden, CEO 2013 Financial Highlights Frank Thomas, COO Commercial Performance, Expansion Opportunities and Business Development Bill Heiden, CEO 2014 Financial Outlook Frank Thomas, COO Closing Remarks Bill Heiden, CEO 2 |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. Mission: Build a Profitable, Multi-product Specialty Pharmaceutical Company Commercial Infrastructure Focus on Hematology/Oncology, Hospital and Nephrology Strong Balance Sheet Experienced Management Team Feraheme® U.S. CKD Business Feraheme IDA label Expansion* IV Iron Market Expansion Feraheme Geographic Expansion Product #3 3 MuGard® Product #4 *If regulatory approval is pursued and received. |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. 2013 Achievements • Outstanding 2013 financial performance Feraheme revenue +28% vs. 2012 Operating expenses -7% vs. 2012 Net loss -43% vs. 2012 • Record-breaking Feraheme performance In-market physician demand +20% vs. 2012 Evolution index of 113, gaining share of a growing market • Published key data from Feraheme clinical development program • First business development deal completed with license of MuGard® • Hired key executives to leadership team • Developed 5-year strategic plan Key long-term financial metrics established 4 |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. Feraheme 2013 Performance 5 Net ex-factory sales* ($ in millions) * Excludes the impact of changes in estimates made to product returns and Medicaid reserves in 2012 and 2013 |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. Outstanding 2013 Results 6 * Includes the recognition of $18 million in milestones ** Includes the upfront costs of the MuGard licensing transaction and $2.9 million of restricted cash as of 12/31/13. *** Excludes the following non-cash items: depreciation, stock compensation expense, and contingent consideration expense (2013 only). ($ in millions) 2012 2013 (unaudited) Total revenues $85.4* $80.9 U.S. net Feraheme sales $58.3 $71.4 Feraheme COGS (% of Feraheme global ne t sales) 24% 17% Operating expenses $88.6 $80.5 Net loss ($16.8) ($9.6) Cash and investments $227.0 $216.7** Adjusted (non-GAAP) net income (loss)*** ($8.4) $2.3 |

|

|

[LOGO] |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. Demand Growth by Segment 8 2013 Results 20% increase in Feraheme provider demand 113 evolution index Source: IMS Health Data. |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. U.S. IV Iron Market: Competitive Landscape 9 *Aggregate of Ferrlecit Brand + Generic Ferric Gluconate Source: IMS DDD Data thru week ending 12/20/13 2013 Share of ~850,000 Gram Non-dialysis Market |

|

|

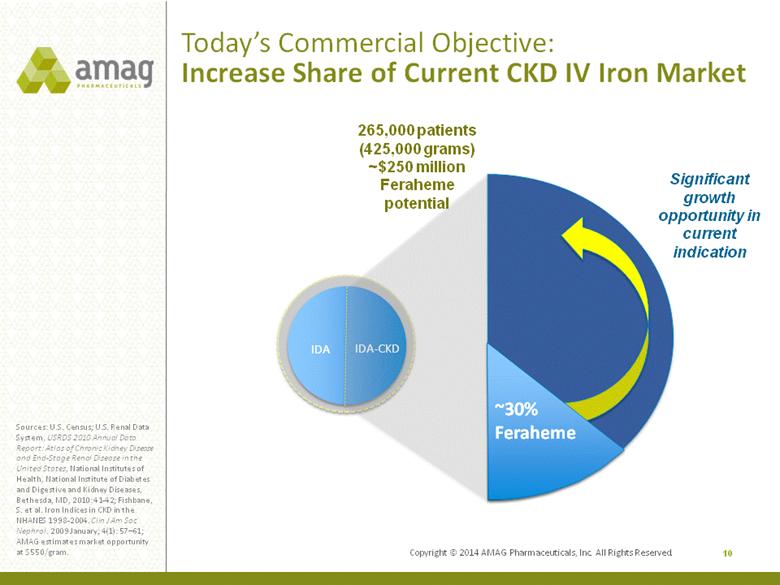

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. Today’s Commercial Objective: Increase Share of Current CKD IV Iron Market 10 Sources: U.S. Census; U.S. Renal Data System, USRDS 2010 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2010: 41-42; Fishbane, S. et al. Iron Indices in CKD in the NHANES 1998-2004. Clin J Am Soc Nephrol. 2009 January; 4(1): 57–61; AMAG estimates market opportunity at $550/gram. IDA IDA-CKD ~30% Feraheme Significant growth opportunity in current indication 265,000 patients (425,000 grams) ~$250 million Feraheme potential |

|

|

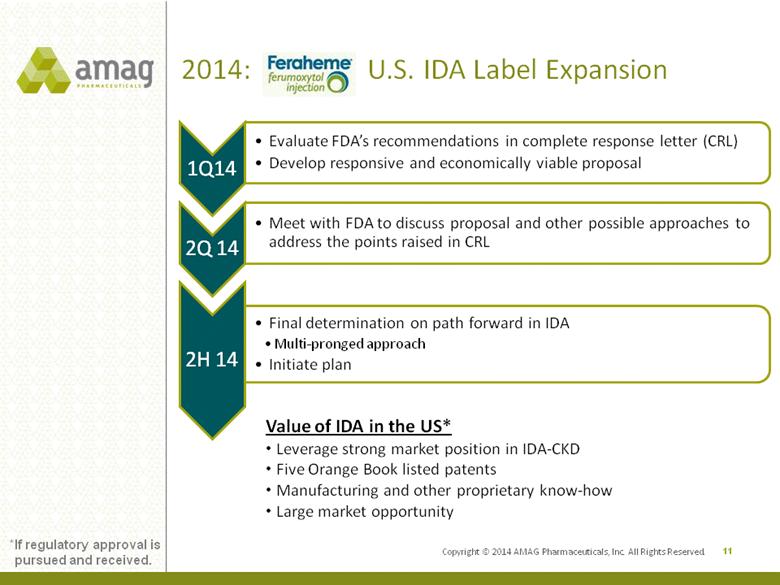

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. 2014: U.S. IDA Label Expansion 11 Value of IDA in the US* •Leverage strong market position in IDA-CKD •Five Orange Book listed patents •Manufacturing and other proprietary know-how •Large market opportunity *If regulatory approval is pursued and received. |

|

|

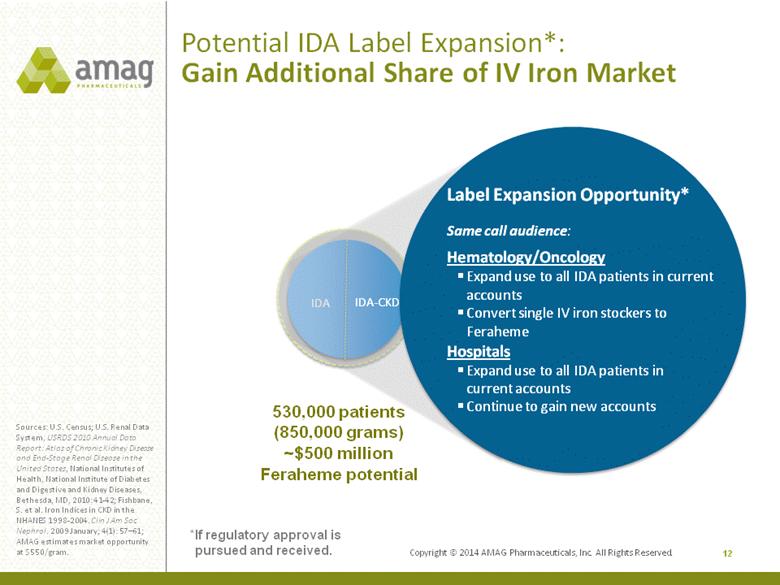

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. 12 Sources: U.S. Census; U.S. Renal Data System, USRDS 2010 Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, Bethesda, MD, 2010: 41-42; Fishbane, S. et al. Iron Indices in CKD in the NHANES 1998-2004. Clin J Am Soc Nephrol. 2009 January; 4(1): 57–61; AMAG estimates market opportunity at $550/gram. 530,000 patients (850,000 grams) ~$500 million Feraheme potential IDA IDA-CKD Label Expansion Opportunity* Same call audience: Hematology/Oncology Expand use to all IDA patients in current accounts Convert single IV iron stockers to Feraheme Hospitals Expand use to all IDA patients in current accounts Continue to gain new accounts Potential IDA Label Expansion*: Gain Additional Share of IV Iron Market *If regulatory approval is pursued and received. |

|

|

Copyright © 2014 AMAG Pharmaceuticals. All Rights Reserved. Opportunity: Grow U.S. IV Iron Market 13 IV Iron IDA* IV Iron IDA-CKD 4,000,000 patients diagnosed with IDA placed on oral iron therapy IV Iron IDA-CKD IV Iron IDA* Oral Iron IDA* Oral Iron IDA-CKD *If regulatory approval is pursued and received. 4,000,000 patients diagnosed with IDA placed on oral iron therapy Current CKD call points Potential future call points • Oncology • Nephrology • Women’s Health • Rheumatology • Gastroenterology |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. Takeda’s in Europe 14 Double-digit tiered royalties on all Takeda sales; additional potential milestones |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. MuGard’s Road to Success in 2014 15 MuGard is a prescription oral rinse for the management of oral mucositis |

|

|

BUILDING •Build our future by expanding our product portfolio |

|

|

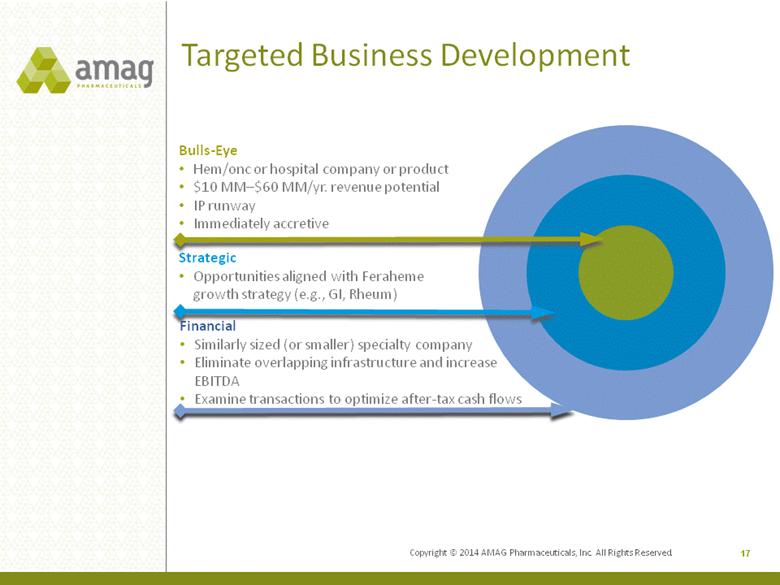

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. Targeted Business Development 17 Financial •Similarly sized (or smaller) specialty company •Eliminate overlapping infrastructure and increase EBITDA •Examine transactions to optimize after-tax cash flows Bulls-Eye •Hem/onc or hospital company or product •$10 MM–$60 MM/yr. revenue potential •IP runway •Immediately accretive Strategic •Opportunities aligned with Feraheme growth strategy (e.g., GI, Rheum) |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. 2014 Financial Outlook ($ in millions) Projections* Change from 2013 (calculated at midpoint of 2014 range) Total revenues $88 - $100 +16% U.S. Feraheme sales, net $75 - $85 +12% Feraheme COGS (% of Feraheme global net sales) 14% - 16% -12% Operating expenses, excluding COGS $80 - $85 +3% Net income Break-even -- Cash and investments $215 - $220 -- 18 * Exclude the impact of business development transactions , potential expenses associated with further development of Feraheme for the broad IDA indication and potential milestone associated with broad IDA approval in EU. |

|

|

Copyright © 2014 AMAG Pharmaceuticals, Inc. All Rights Reserved. 2014 Goals • Maximize Feraheme opportunities Drive market share and market growth within current U.S. IDA-CKD indication Optimize net revenue per gram Potential label expansion: IDA (non-CKD) oral iron failures - Expected E.U. action – mid-2014; broad IDA approval triggers significant milestone - Determine regulatory path forward in U.S. Pursue IV iron market expansion initiatives • Drive MuGard growth across oral mucositis patient population • Execute additional, quality business development transactions Continue to identify unique in-license/acquisition candidates Leverage balance sheet strength to consummate additional business development deals • Continue to operate the business with financial discipline 19 |

|

|

AMAG Pharmaceuticals, Inc. 1100 Winter Street Waltham, MA 02451 o 617.498.3300 www.amagpharma.com A SPECIALTY PHARMACEUTICAL COMPANY DEDICATED TO BRINGING TO MARKET THERAPIES THAT IMPROVE PATIENTS’ LIVES. Well positioned for success in 2014. . . and beyond. |