Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TESSERA TECHNOLOGIES INC | d670906d8k.htm |

| EX-99.1 - EX-99.1 - TESSERA TECHNOLOGIES INC | d670906dex991.htm |

February 5, 2014

Fourth Quarter & FY 2013 Earnings Presentation

Exhibit 99.2 |

Safe

Harbor 2

This document contains forward-looking statements, which are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking

statements involve risks and uncertainties that could cause actual results to differ

significantly from those projected, particularly with respect to Tessera Technologies, Inc.’s

(the “Company”) financial results and projections, including projections on recurring

revenue, operating expenses and the Company’s target operating model; the Company’s

products and technology; growth of the Company’s served markets; market opportunities; and monetization of the

Company’s DigitalOptics (DOC) patent portfolio. Material factors that may cause results to differ

from the statements made include the plans or operations relating to the Company's businesses;

any need to spend more cash and/or incur greater charges than anticipated in connection with

the DOC restructuring, workforce reduction, facility closures and related activities; any need to

undertake further restructuring activities; market or industry conditions; changes in patent laws,

regulation or enforcement, or other factors that might affect the Company's ability to protect

or realize the value of its intellectual property; the expiration of license agreements and the

cessation of related royalty income; the failure, inability or refusal of licensees to pay royalties; initiation, delays,

setbacks or losses relating to the Company's intellectual property or intellectual property

litigations, or invalidation or limitation of key patents; the timing and results, which are

not predictable and may vary in any individual proceeding, of any ICC ruling or award,

including in the Amkor arbitration; fluctuations in operating results due to the timing of new license

agreements and royalties, or due to legal costs; the risk of a decline in demand for

semiconductor and products utilizing DOC technologies; failure by the industry to use

technologies covered by the Company's patents; the expiration of the Company's patents; the Company's ability to successfully

complete and integrate acquisitions of businesses; the risk of loss of, or decreases in production

orders from, customers of acquired businesses; financial and regulatory risks associated with

the international nature of the Company's businesses; failure of the Company's products to

achieve technological feasibility or profitability; failure to successfully commercialize the Company's products;

changes in demand for the products of the Company's customers; limited opportunities to license

technologies and sell products due to high concentration in the markets for semiconductors and

related products and camera modules; and the impact of competing technologies on the demand for

the Company's technologies and products. You are cautioned not to place undue reliance on the

forward-looking statements, which speak only as of the date of this release. The Company's filings

with the Securities and Exchange Commission, including its Annual Report on Form 10-K for

the year ended Dec. 31, 2012, and its Quarterly Report on Form 10-Q for the quarter ended

Sept. 30, 2013, include more information about factors that could affect the Company's financial results. The

Company assumes no obligation to update information contained in this press release. Although this

presentation may remain available on the Company's website or elsewhere, its continued

availability does not indicate that the Company is reaffirming or confirming any of the

information contained herein. |

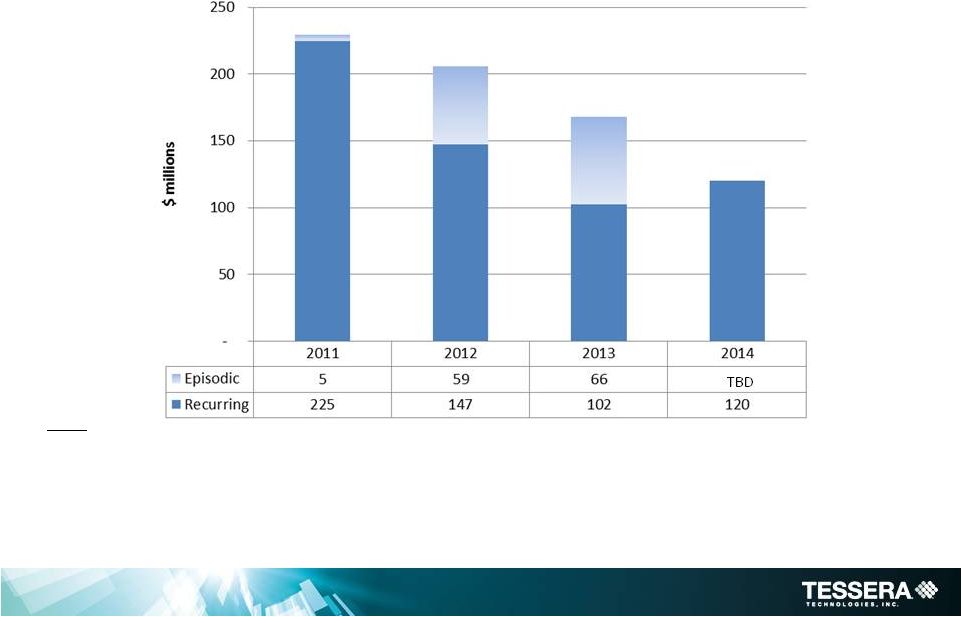

Recurring & Episodic Revenue

3

Notes:

"Episodic" revenue includes lump-sum settlement payments, damages awards from

courts and tribunals, back payments resulting from audits, initial license fees,

non-recurring engineering, and other revenue that is not paid over at least one year of a contract.

The company is not providing a forecast of Episodic revenue for 2014.

"Recurring" revenue includes the Company's IP business and its FotoNation (EIE)

business. FY2013 Recurring includes approximately $5M for a contract that ended in 2013

and approximately $6.5 million royalty catch-up payment. |

Recurring Revenue –

PTI & Micron Impact

4 |

SK

hynix and Samsung Recurring Revenue 5

125+% |

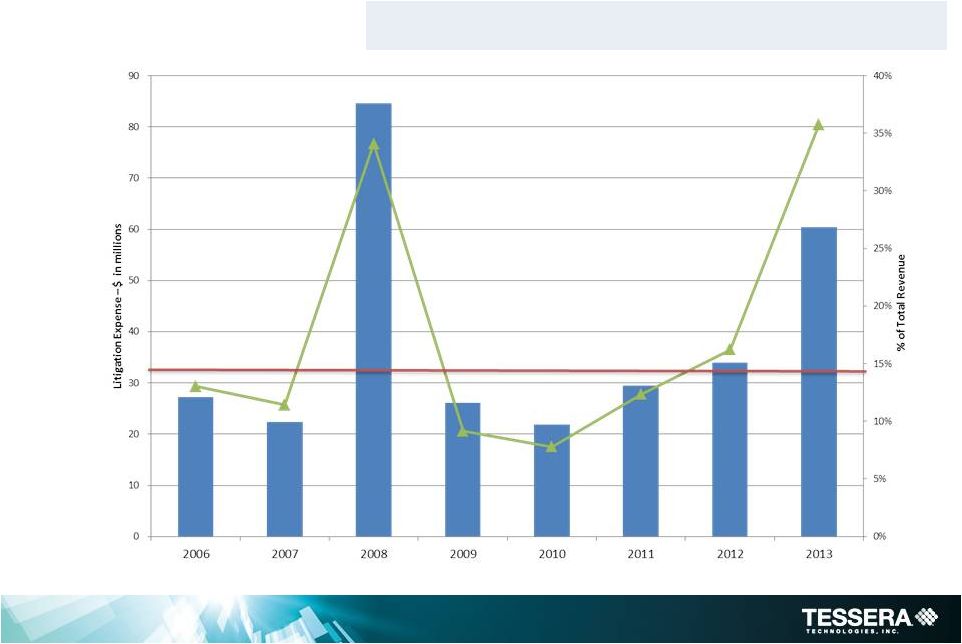

Litigation Spend

Litigation Spend in Near-term Target Operating Model is 14% of Total Revenue

(red line below)

6 |

Near-Term Target Operating Model

7

Notes:

Expenses and Operating Income are non-GAAP. Target Operating Model

assumes revenue in the range of $180 million -$200 million annually.

Litigation expense could vary significantly by period. The Company intends to

update this Target Operating Model as the business changes. |

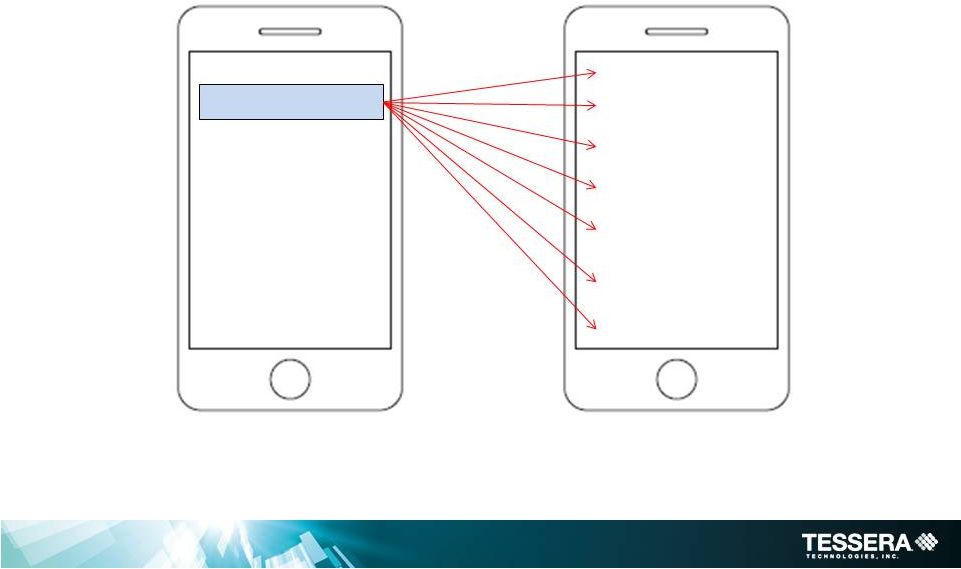

“Mobile”

is Driving Unit Volume/Licensing Opportunities

8

Source: Dr. Morris Chang, TSMC |

Imaging

is a Central Smartphone Feature Voice: Nuance

®

Audio: Dolby

®

Video: MPEG

®

Maps: Various

Imaging

Red Eye Removal

Face Recognition

Image

Stabilization

Face Detection &

Tracking

Panorama

Blink / Smile

Detection

Auto-Focus

9 |

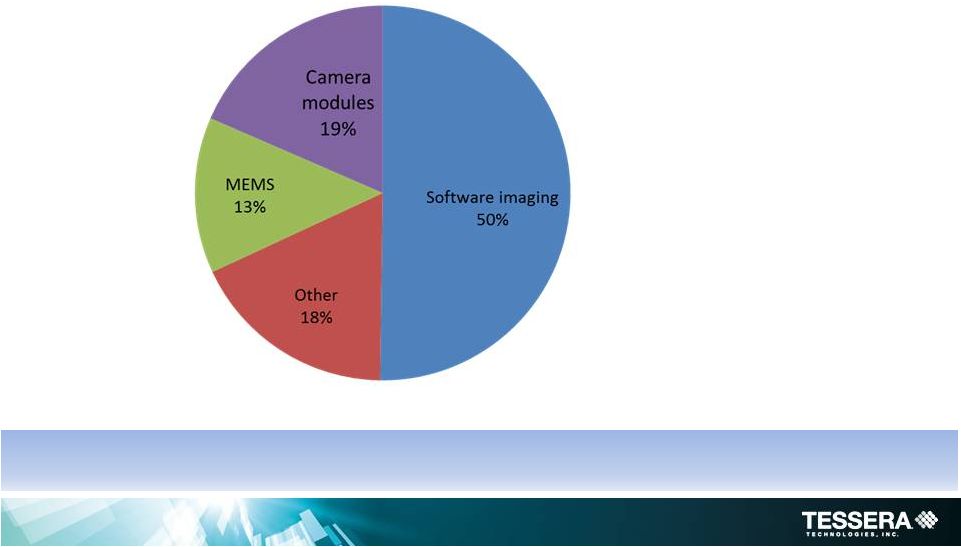

DOC

Patent Portfolio Targets Mobile Market * Smartphones: 1B in

2013 growing to 1.7B in 2017

* Tablets: 228M in 2013

growing to 407M in 2017

* Laptops: 204M in 2013

growing to 241M in 2017

Over 1140 Patents and Applications Covering a Wide Range of Mobile Imaging

Technologies Additional monetization opportunities may include a sale of the

portfolio, patent licensing, additional software/technology licensing, or

some combination thereof. 10 |

What’s Valuable in Mobile Hardware?

11

Source: TechInsights |

Mobile

Portfolio Segmentation 12

CSP/BGA

Substrate

& Design

Advanced

Assembly

Copper

Pillar

Wafer-

Level

PoP

Stack

Die

800+

Patent Assets

MOBILE

•

Design layout

optimization

•

Dielectric structure and

fabrication techniques

•

Component construction

•

Assembly materials,

equipment, and process

•

Advanced Chip-Scale Packages (CSP)

•

High-Density Ball-Grid-Array (BGA)

components and interconnect

•

System-in-Package

•

Ultra fine-pitch level 1

interconnect technology

•

Planar-

and

stacked wafers

•

High-Density Package-

on-Package

•

Vertically stacked

devices in package |

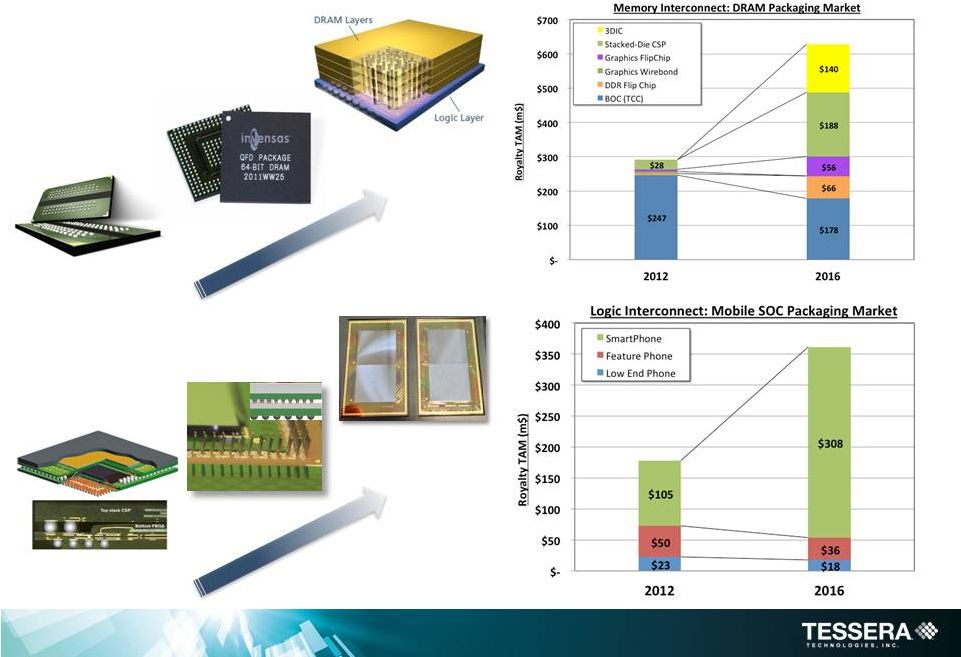

xFD™

BVA™

Current DRAM

Package (TCC™)

Current Package

on Package

3D-IC

(Memory)

3D-IC

(Mobile)

Addressable Markets vs. Innovation Roadmap

13 |

Non-GAAP

14

In addition to disclosing financial results calculated in accordance with U.S. Generally

Accepted Accounting Principles (GAAP), the Company’s presentation contains non-

GAAP financial measures adjusted for discontinued operations, either one-time or

ongoing non-cash acquired intangibles amortization charges, acquired in-process

research and development, all forms of stock-based compensation, impairment

charges on long-lived assets and goodwill, restructuring and other related exit costs,

and related tax effects. The non-GAAP financial measures also exclude the effects of

FASB Accounting Standards Codification 718, “Stock

Compensation” upon the number

of diluted shares used in calculating non-GAAP earnings per share. Management

believes that the non-GAAP measures used in this presentation provide investors with

important perspectives into the Company’s ongoing business performance. The non-

GAAP financial measures disclosed by the Company should not be considered a

substitute for, or superior to, financial measures calculated in accordance with GAAP,

and the financial results calculated in accordance with GAAP. The non-GAAP financial

measures used by the Company may be calculated differently from, and therefore may

not be comparable to, similarly titled measures used by other companies. |