Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Artisan Partners Asset Management Inc. | ye13form8-k.htm |

| EX-99.1 - PRESS RELEASE OF ARTISAN PARTNERS ASSET MANAGEMENT INC. DATED FEBRUARY 3, 2014 - Artisan Partners Asset Management Inc. | artisanye13earningsrelease.htm |

B U S I N E S S U P D A T E A N D F O U R T H Q U A R T E R 2 0 1 3 E A R N I N G S P R E S E N T A T I O N Artisan Partners Asset Management

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 1 BUSINESS UPDATE & QUARTERLY RESULTS DISCUSSION Eric R. Colson is President and Chief Executive Officer of Artisan Partners. Prior to joining the firm in January 2005, Mr. Colson was an executive vice president of Callan Associates, Inc. where he managed the institutional consulting group, providing business and investment advice to asset management firms. Prior to managing the institutional consulting group, he managed Callan's global manager research. Mr. Colson holds a BA in Economics from the University of California-Irvine. Mr. Colson is a Chartered Financial Analyst. • 21 years of industry experience • 8 years at Artisan Partners Charles (C.J.) Daley, Jr. is a Managing Director and Chief Financial Officer of Artisan Partners. Prior to joining the firm in July 2010, Mr. Daley was senior executive vice president, chief financial officer and treasurer of the global asset management firm Legg Mason, Inc. Mr. Daley holds a BS in Accounting from the University of Maryland. He is an inactive Certified Public Accountant. • 26 years of industry experience • 3 years at Artisan Partners

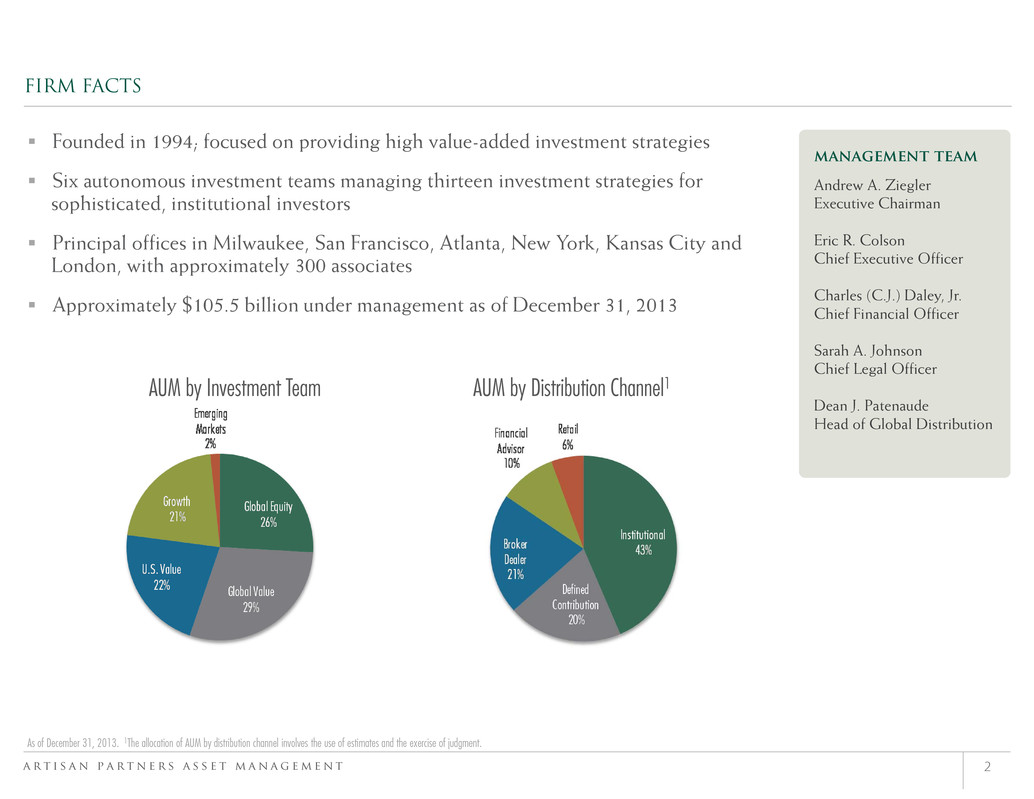

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 2 FIRM FACTS Founded in 1994; focused on providing high value-added investment strategies Six autonomous investment teams managing thirteen investment strategies for sophisticated, institutional investors Principal offices in Milwaukee, San Francisco, Atlanta, New York, Kansas City and London, with approximately 300 associates Approximately $105.5 billion under management as of December 31, 2013 AUM by Distribution Channel1 As of December 31, 2013. 1The allocation of AUM by distribution channel involves the use of estimates and the exercise of judgment. AUM by Investment Team management team Andrew A. Ziegler Executive Chairman Eric R. Colson Chief Executive Officer Charles (C.J.) Daley, Jr. Chief Financial Officer Sarah A. Johnson Chief Legal Officer Dean J. Patenaude Head of Global Distribution

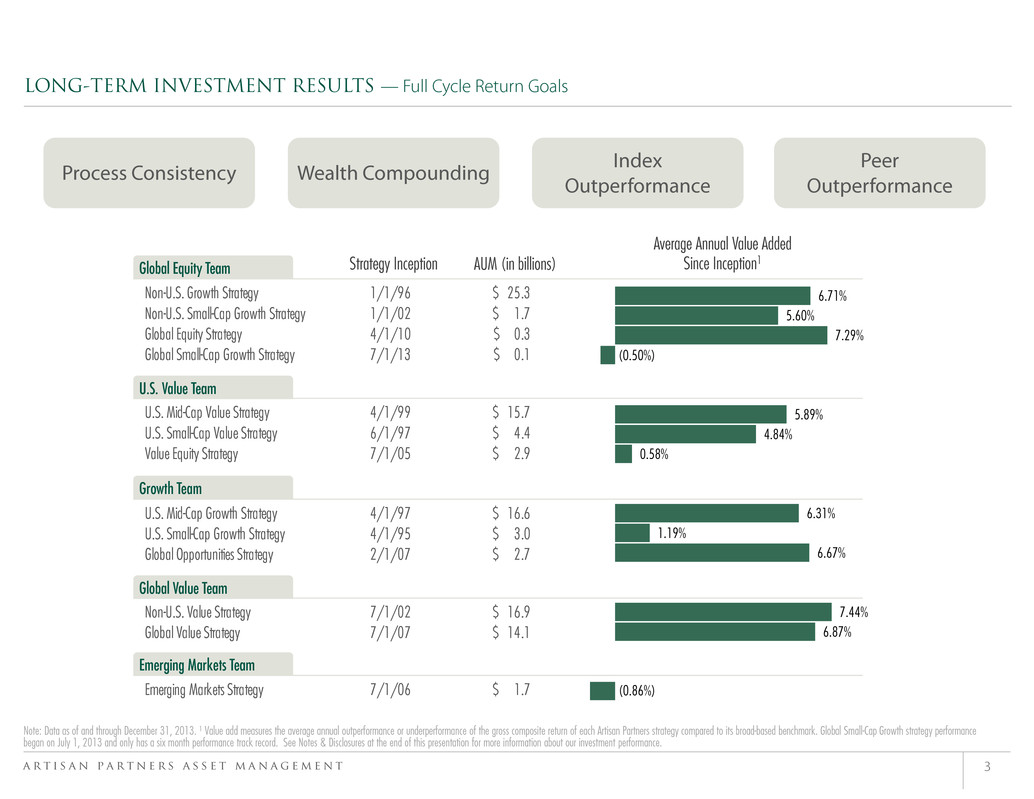

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 3 Global Equity Team Non-U.S. Growth Strategy 1/1/96 25.3$ Non-U.S. Small-Cap Growth Strategy 1/1/02 1.7$ Global Equity Strategy 4/1/10 0.3$ Global Small-Cap Growth Strategy 7/1/13 0.1$ U.S. Value Team U.S. Mid-Cap Value Strategy 4/1/99 15.7$ U.S. Small-Cap Value Strategy 6/1/97 4.4$ Value Equity Strategy 7/1/05 2.9$ Growth Team U.S. Mid-Cap Growth Strategy 4/1/97 16.6$ U.S. Small-Cap Growth Strategy 4/1/95 3.0$ Global Opportunities Strategy 2/1/07 2.7$ Global Value Team Non-U.S. Value Strategy 7/1/02 16.9$ Global Value Strategy 7/1/07 14.1$ Emerging Markets Team Emerging Markets Strategy 7/1/06 1.7$ LONG-TERM INVESTMENT RESULTS — Full Cycle Return Goals Note: Data as of and through December 31, 2013. ¹ Value add measures the average annual outperformance or underperformance of the gross composite return of each Artisan Partners strategy compared to its broad-based benchmark. Global Small-Cap Growth strategy performance began on July 1, 2013 and only has a six month performance track record. See Notes & Disclosures at the end of this presentation for more information about our investment performance. Process Consistency Wealth Compounding Index Outperformance Peer Outperformance U.S. Value Team Global Equity Team Growth Team Global Value Team Emerging Markets Team (0.86%) 6.87% 7.44% 6.67% 1.19% 6.31% 0.58% 4.84% 5.89% (0.50%) 7.29% 5.60% 6.71% Average Annual Value Added Since Inception1AUM (in billions)Strategy Inception

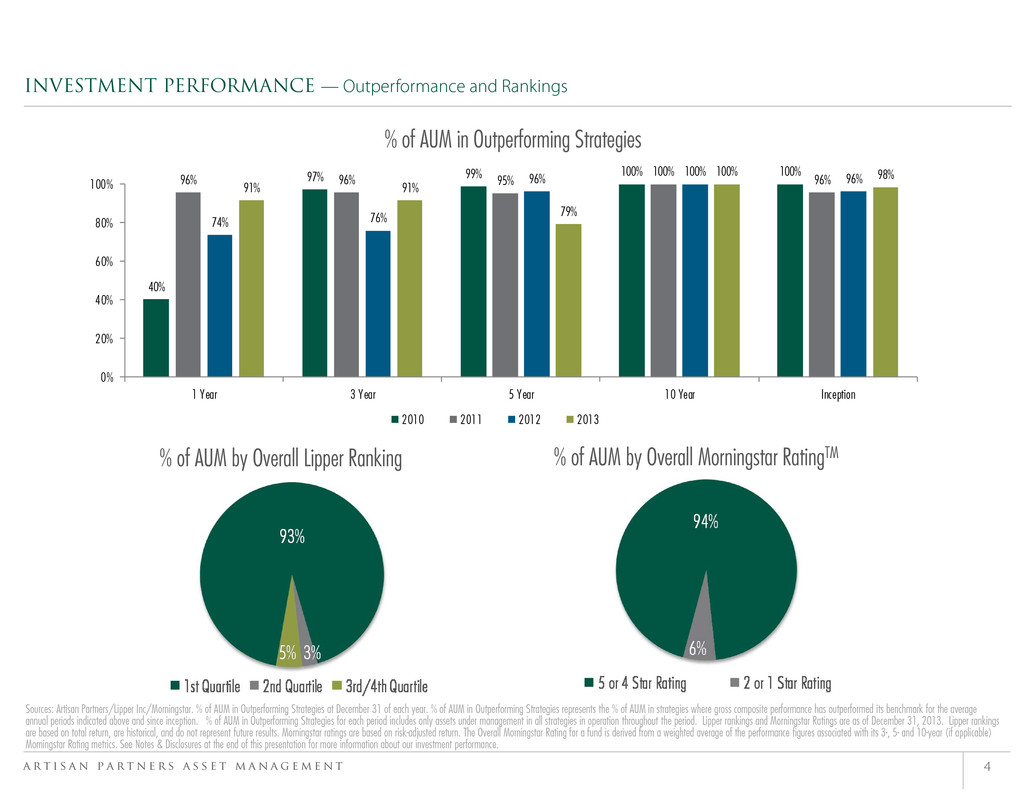

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 4 INVESTMENT PERFORMANCE — Outperformance and Rankings Sources: Artisan Partners/Lipper Inc/Morningstar. % of AUM in Outperforming Strategies at December 31 of each year. % of AUM in Outperforming Strategies represents the % of AUM in strategies where gross composite performance has outperformed its benchmark for the average annual periods indicated above and since inception. % of AUM in Outperforming Strategies for each period includes only assets under management in all strategies in operation throughout the period. Lipper rankings and Morningstar Ratings are as of December 31, 2013. Lipper rankings are based on total return, are historical, and do not represent future results. Morningstar ratings are based on risk-adjusted return. The Overall Morningstar Rating for a fund is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-year (if applicable) Morningstar Rating metrics. See Notes & Disclosures at the end of this presentation for more information about our investment performance. % of AUM in Outperforming Strategies 40% 97% 99% 100% 100%96% 96% 95% 100% 96% 74% 76% 96% 100% 96% 91% 91% 79% 100% 98% 0% 20% 40% 60% 80% 100% 1 Year 3 Year 5 Year 10 Year Inception 2010 2011 2012 2013 % of AUM by Overall Lipper Ranking % of AUM by Overall Morningstar RatingTM

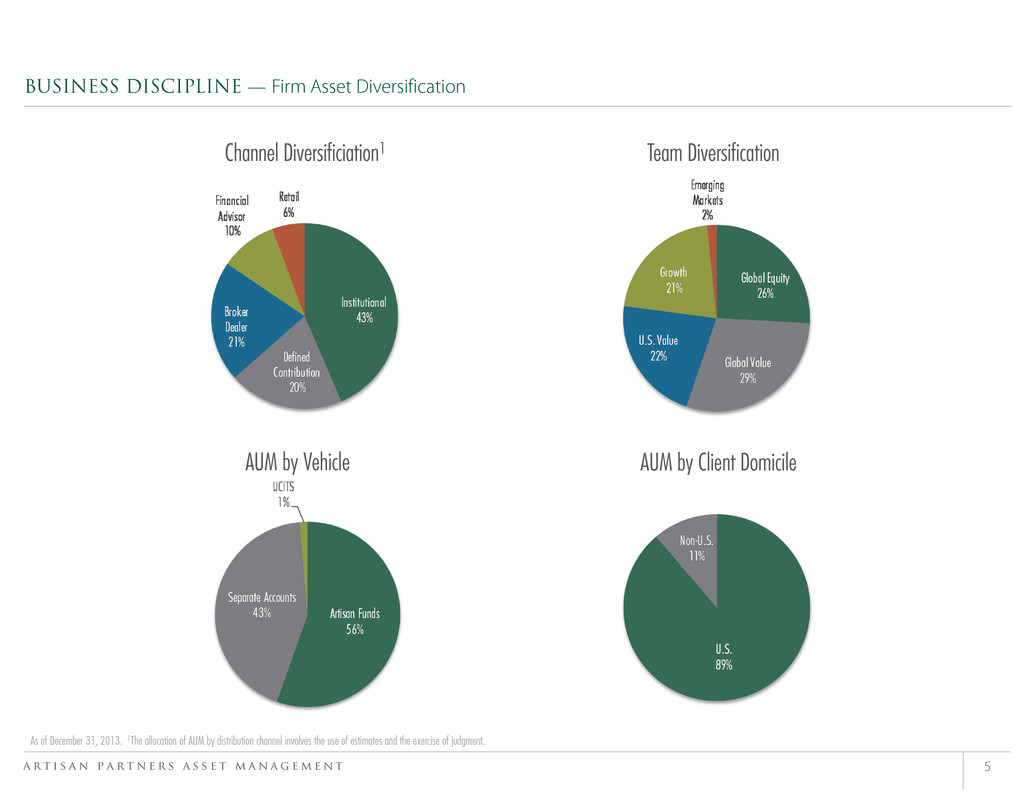

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 5 BUSINESS DISCIPLINE — Firm Asset Diversification Channel Diversificiation1 Team Diversification AUM by Client DomicileAUM by Vehicle As of December 31, 2013. 1The allocation of AUM by distribution channel involves the use of estimates and the exercise of judgment.

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 6 BUSINESS PHILOSOPHY & APPROACH Thoughtful Growth Active Strategies Autonomous Franchises Proven Results Designed for Investment Talent to Thrive Managed by Business Professionals Structured to Align Interests Active Talent Identification Entrepreneurial Commitment Focus on Long-Term Global Demand Since its founding, Artisan has built its business based upon a consistent philosophy and business model. Talent Driven Business Model High Value Added Investment Firm

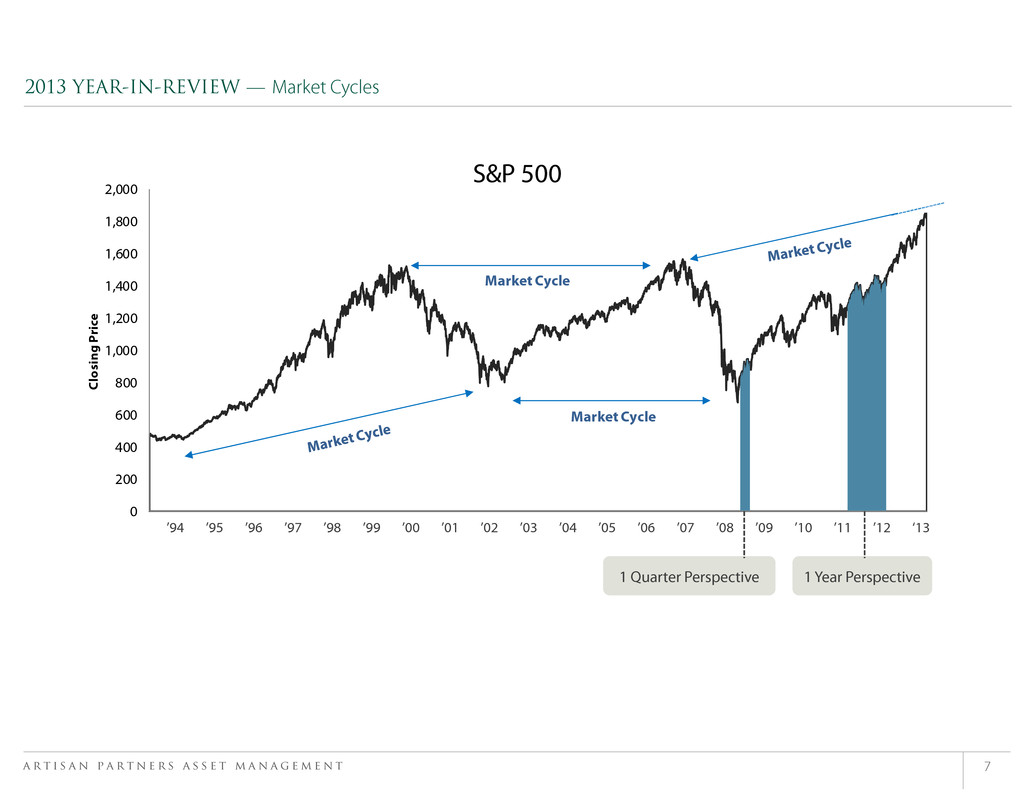

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 7 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 C l o s i n g P r i c e S&P 500 Market Cycle Market Cycle 2013 YEAR-IN-REVIEW — Market Cycles ’94 ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07 ’08 ’09 ’10 ’11 ’12 ‘13 1 Year Perspective1 Quarter Perspective

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 8 Capacity Management Talent Focus 2013 YEAR-IN-REVIEW — Business Strategy Investment Results Alignment of Interests Talent Focus Management Guideposts Strong Long-Term Investment Results Asset Diversification Financial Discipline 2013 Highlights

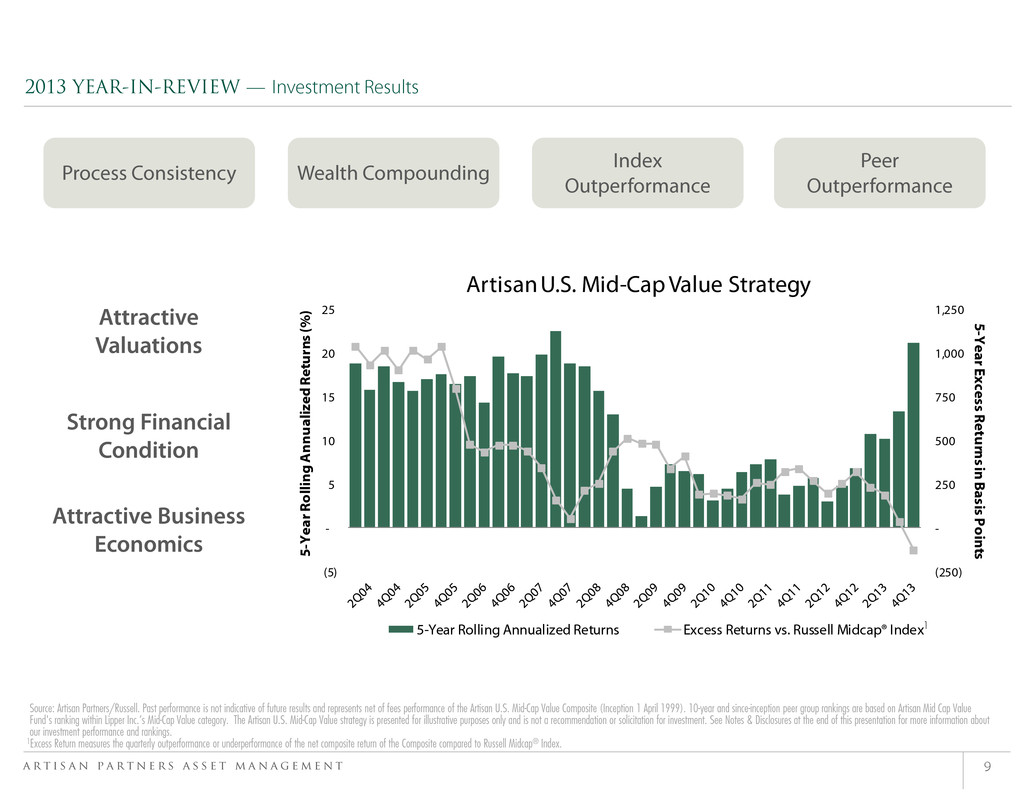

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 9 2013 YEAR-IN-REVIEW — Investment Results Process Consistency Wealth Compounding Index Outperformance Peer Outperformance Attractive Business Economics Strong Financial Condition Attractive Valuations Source: Artisan Partners/Russell. Past performance is not indicative of future results and represents net of fees performance of the Artisan U.S. Mid-Cap Value Composite (Inception 1 April 1999). 10-year and since-inception peer group rankings are based on Artisan Mid Cap Value Fund's ranking within Lipper Inc.’s Mid-Cap Value category. The Artisan U.S. Mid-Cap Value strategy is presented for illustrative purposes only and is not a recommendation or solicitation for investment. See Notes & Disclosures at the end of this presentation for more information about our investment performance and rankings. 1Excess Return measures the quarterly outperformance or underperformance of the net composite return of the Composite compared to Russell Midcap® Index. (250) - 250 500 750 1,000 1,250 (5) - 5 10 15 20 25 5-Y ear Excess R etu rn s in B asis P o in ts 5 - Y e a r R o l l i n g A n n u a l i z e d R e t u r n s ( % ) Artisan U.S. Mid-Cap Value Strategy 5-Year Rolling Annualized Returns Excess Returns vs. Russell Midcap® Index1

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 10 2013 YEAR-IN-REVIEW — Alignment of Interests Supports our equity ownership culture Created a mechanism for structured liquidity and broad and multi-generational equity ownership Allows ownership among value-producing employees Initial Public Offering Equity Grants Long-term interest alignment Talent acquisition and retention Merit-based award driven by consistent value creation Reflects reinvestment in talent, our private to public transition and business growth Targets the majority of annual adjusted earnings Designed to be responsive to firm profitability and business conditions Dividends

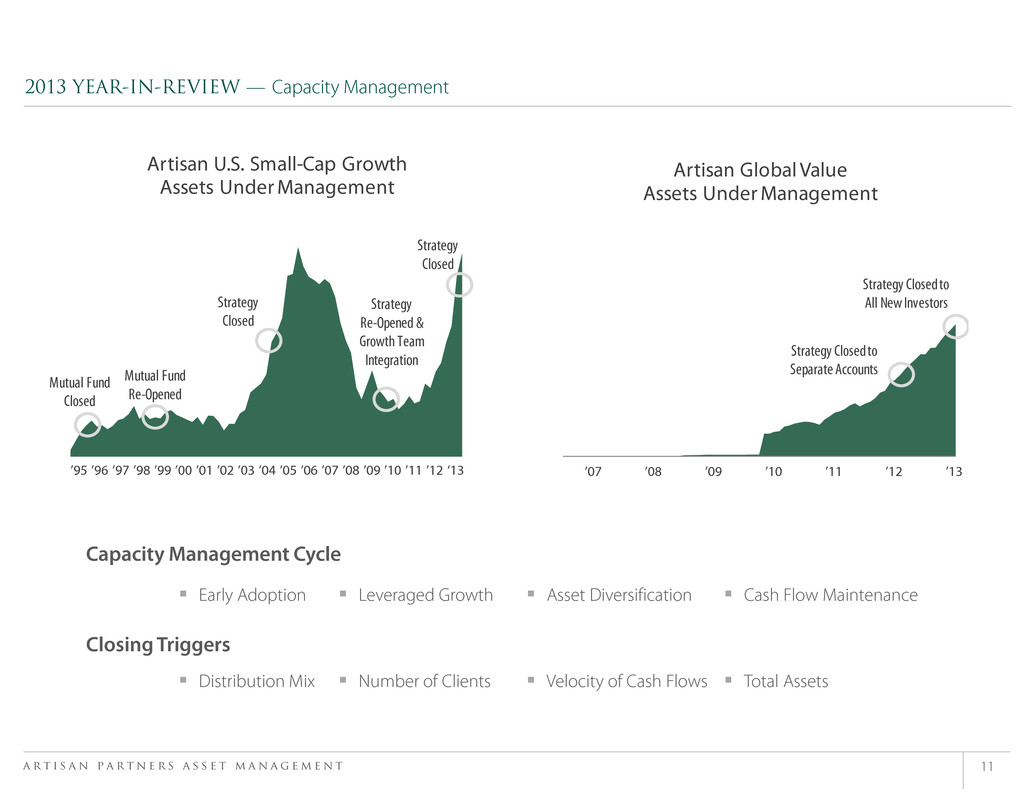

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 11 2013 YEAR-IN-REVIEW — Capacity Management Artisan Global Value Assets Under Management Strategy Closed to Separate Accounts Strategy Closed to All New Investors Artisan U.S. Small-Cap Growth Assets Under Management Strategy Closed Strategy Re-Opened & Growth Team Integration Strategy Closed Mutual Fund Closed Mutual Fund Re-Opened ’95 ’96 ’97 ’98 ’99 ’00 ’01 ’02 ’03 ’04 ’05 ’06 ’07 ’08 ’09 ’10 ’11 ’12 ‘13 ’07 ’08 ’09 ’10 ’11 ’12 ’13 Early Adoption Asset Diversification Capacity Management Cycle Closing Triggers Distribution Mix Velocity of Cash Flows Cash Flow Maintenance Leveraged Growth Number of Clients Total Assets

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 12 2013 YEAR-IN-REVIEW — Talent Focus Characteristics Business Model Fit Institutional Viability Cultural Fit Team and Product Philosophy Artisan Credit Team Development Hired portfolio manager Bryan Krug Building out Artisan Partners Credit Team Developing facilities and infrastructure for the team in Kansas City Fund in registration with the SEC1 Fixed Income product with broad investable universe Marketing plan development stage 1 The information in the fund's prospectus is not complete and may be changed. The securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state.

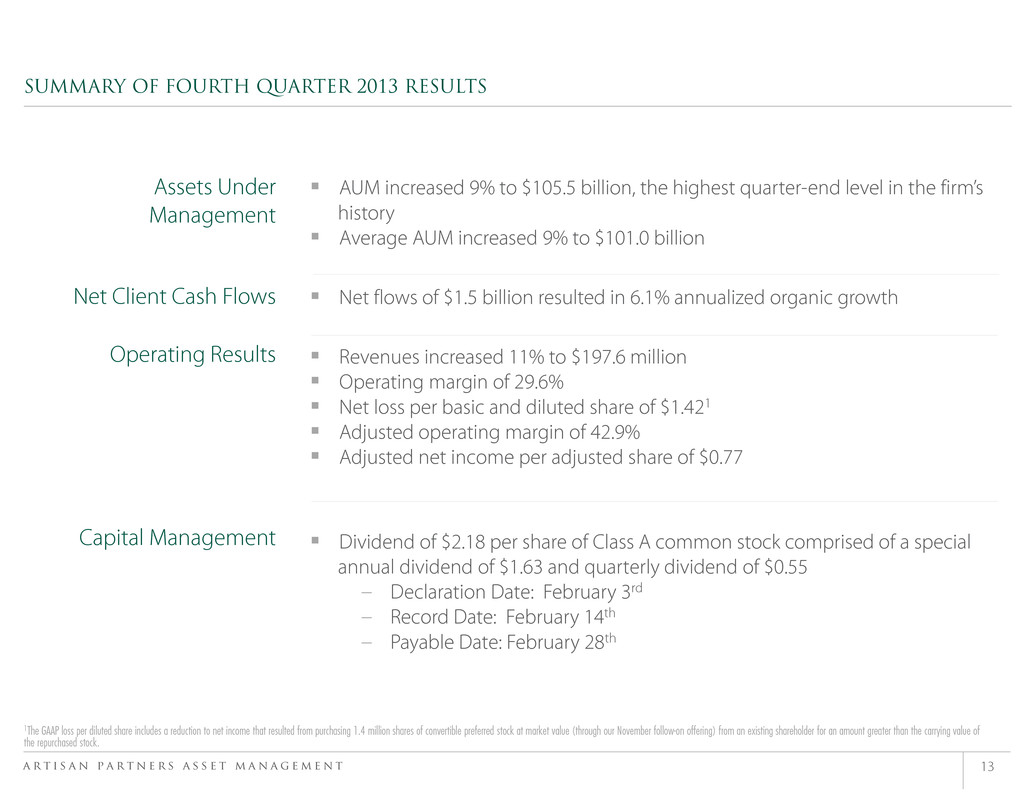

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 13 AUM increased 9% to $105.5 billion, the highest quarter-end level in the firm’s history Average AUM increased 9% to $101.0 billion Net flows of $1.5 billion resulted in 6.1% annualized organic growth Revenues increased 11% to $197.6 million Operating margin of 29.6% Net loss per basic and diluted share of $1.421 Adjusted operating margin of 42.9% Adjusted net income per adjusted share of $0.77 Dividend of $2.18 per share of Class A common stock comprised of a special annual dividend of $1.63 and quarterly dividend of $0.55 – Declaration Date: February 3rd – Record Date: February 14th – Payable Date: February 28th Assets Under Management Net Client Cash Flows Operating Results Capital Management SUMMARY OF FOURTH QUARTER 2013 RESULTS 1The GAAP loss per diluted share includes a reduction to net income that resulted from purchasing 1.4 million shares of convertible preferred stock at market value (through our November follow-on offering) from an existing shareholder for an amount greater than the carrying value of the repurchased stock.

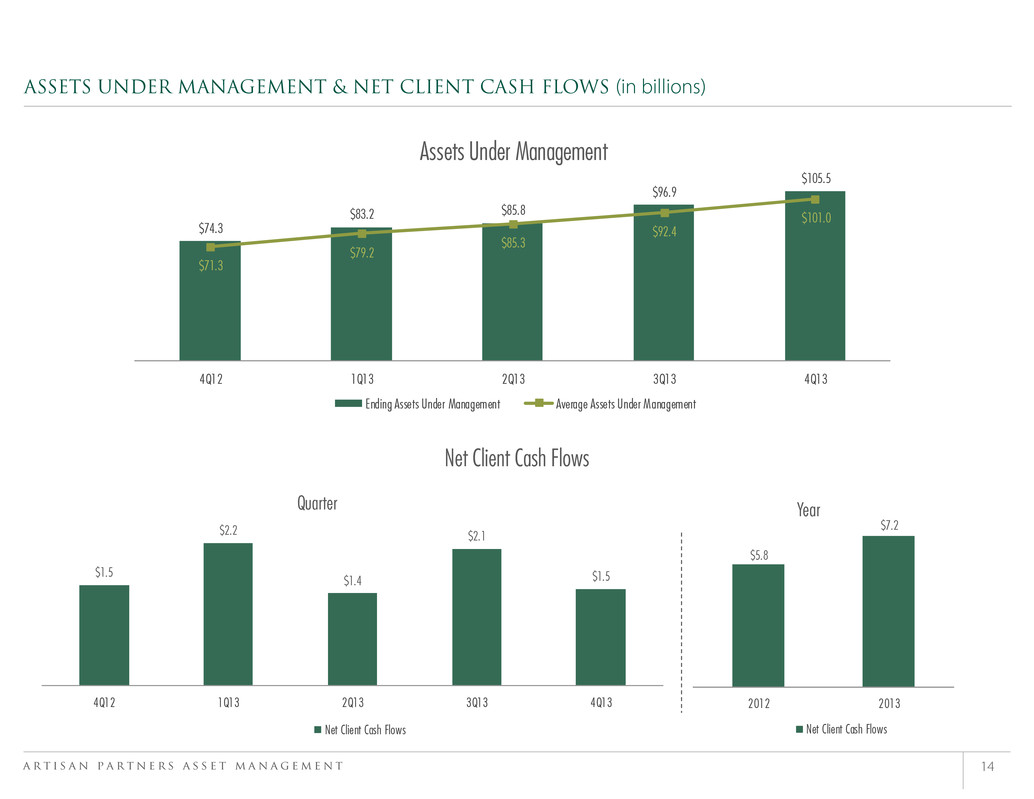

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 14 ASSETS UNDER MANAGEMENT & NET CLIENT CASH FLOWS (in billions) Net Client Cash Flows $74.3 $83.2 $85.8 $96.9 $105.5 $71.3 $79.2 $85.3 $92.4 $101.0 4Q12 1Q13 2Q13 3Q13 4Q13 Assets Under Management Ending Assets Under Management Average Assets Under Management $1.5 $2.2 $1.4 $2.1 $1.5 4Q12 1Q13 2Q13 3Q13 4Q13 Quarter Net Client Cash Flows $5.8 $7.2 2012 2013 Year Net Client Cash Flows

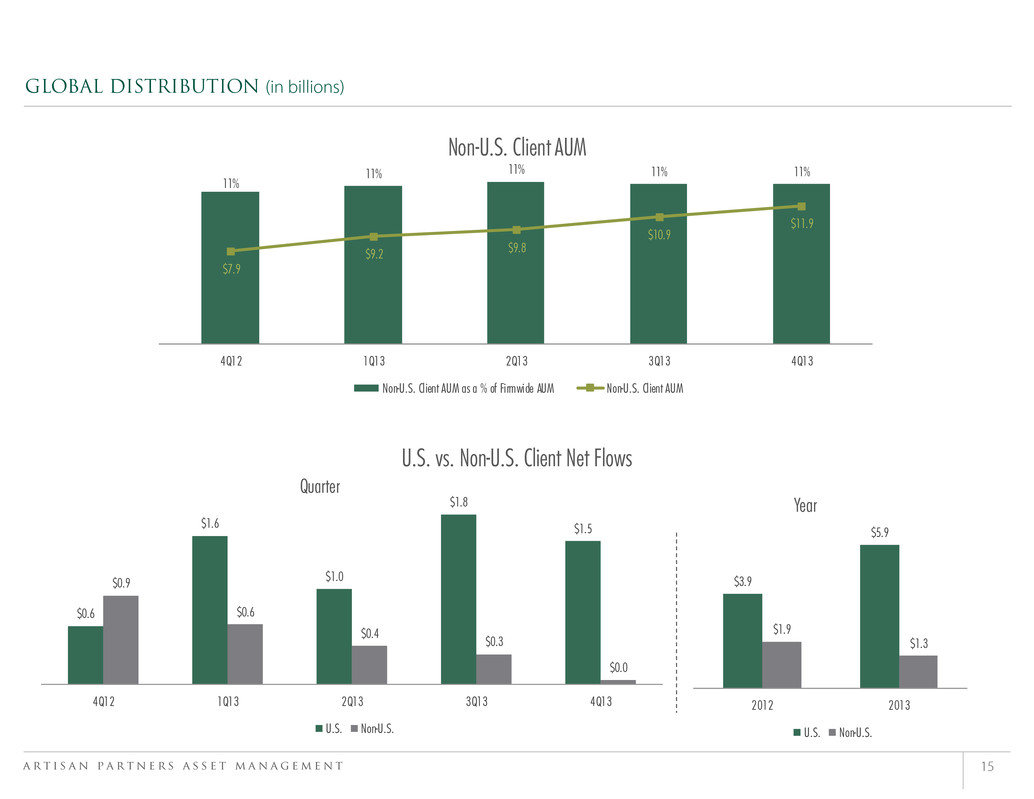

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 15 $0.6 $1.6 $1.0 $1.8 $1.5 $0.9 $0.6 $0.4 $0.3 $0.0 4Q12 1Q13 2Q13 3Q13 4Q13 Quarter U.S. Non-U.S. 11% 11% 11% 11% 11% $7.9 $9.2 $9.8 $10.9 $11.9 4Q12 1Q13 2Q13 3Q13 4Q13 Non-U.S. Client AUM Non-U.S. Cl ient AUM as a % of Fi rmwide AUM Non-U.S. Cl ient AUM GLOBAL DISTRIBUTION (in billions) U.S. vs. Non-U.S. Client Net Flows $3.9 $5.9 $1.9 $1.3 2012 2013 Year U.S. Non-U.S.

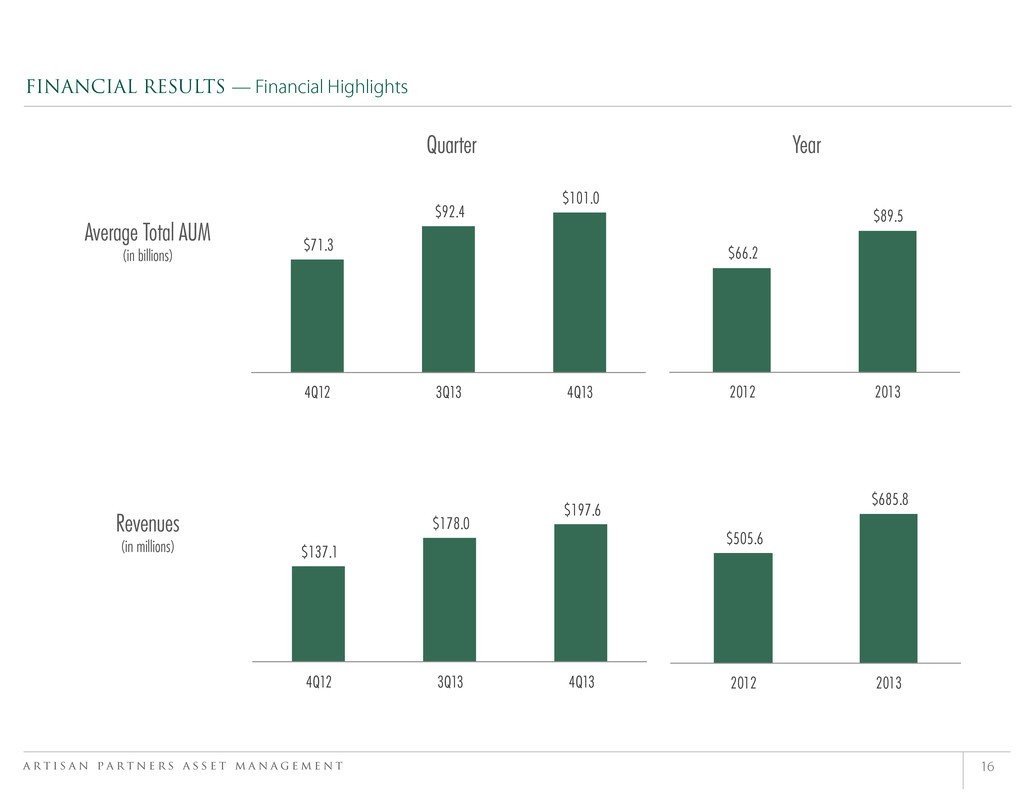

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 16 FINANCIAL RESULTS — Financial Highlights Average Total AUM (in billions) Revenues (in millions) Quarter Year $71.3 $92.4 $101.0 4Q12 3Q13 4Q13 $66.2 $89.5 2012 2013 $137.1 $178.0 $197.6 4Q12 3Q13 4Q13 $505.6 $685.8 2012 2013

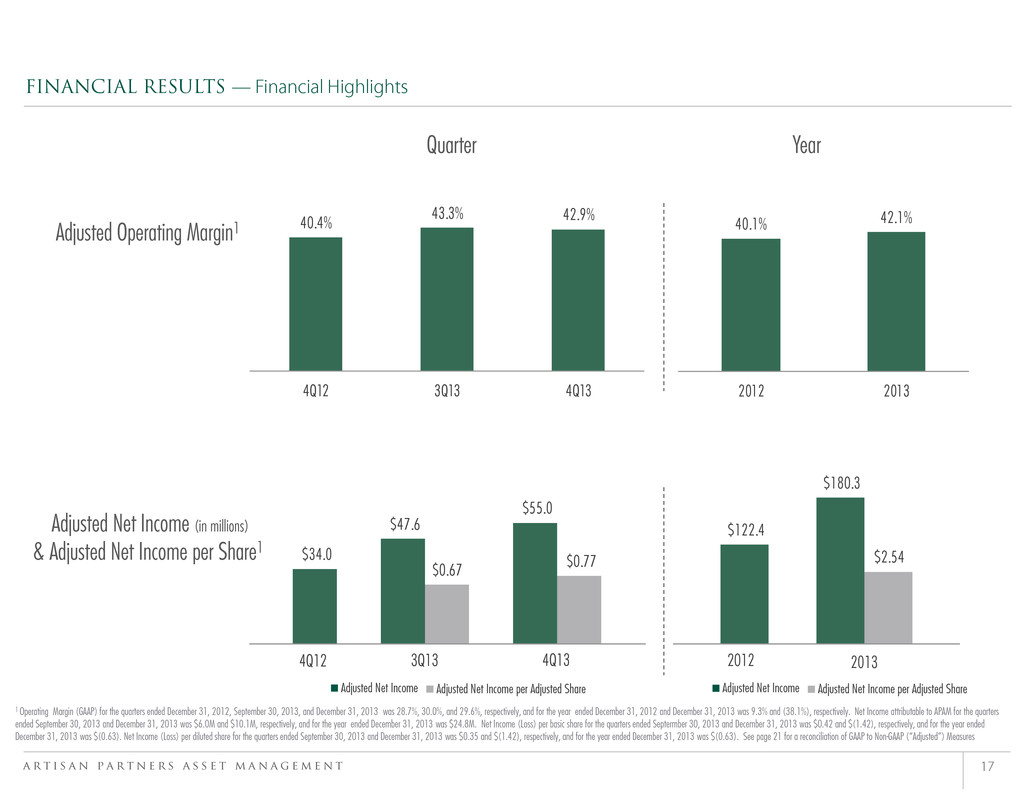

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 17 2013 40.4% 43.3% 42.9% 4Q12 3Q13 4Q13 FINANCIAL RESULTS — Financial Highlights Adjusted Operating Margin1 Adjusted Net Income (in millions) & Adjusted Net Income per Share1 Quarter Year 40.1% 42.1% 2012 2013 Adjusted Net Income per Adjusted ShareAdjusted Net Income Adjusted Net Income per Adjusted ShareAdjusted Net Income 4Q12 3Q13 4Q13 2012 $34.0 $47.6 $0.67 $55.0 $0.77 $122.4 $180.3 $2.54 1 Operating Margin (GAAP) for the quarters ended December 31, 2012, September 30, 2013, and December 31, 2013 was 28.7%, 30.0%, and 29.6%, respectively, and for the year ended December 31, 2012 and December 31, 2013 was 9.3% and (38.1%), respectively. Net Income attributable to APAM for the quarters ended September 30, 2013 and December 31, 2013 was $6.0M and $10.1M, respectively, and for the year ended December 31, 2013 was $24.8M. Net Income (Loss) per basic share for the quarters ended Septermber 30, 2013 and December 31, 2013 was $0.42 and $(1.42), respectively, and for the year ended December 31, 2013 was $(0.63). Net Income (Loss) per diluted share for the quarters ended September 30, 2013 and December 31, 2013 was $0.35 and $(1.42), respectively, and for the year ended December 31, 2013 was $(0.63). See page 21 for a reconciliation of GAAP to Non-GAAP (“Adjusted”) Measures

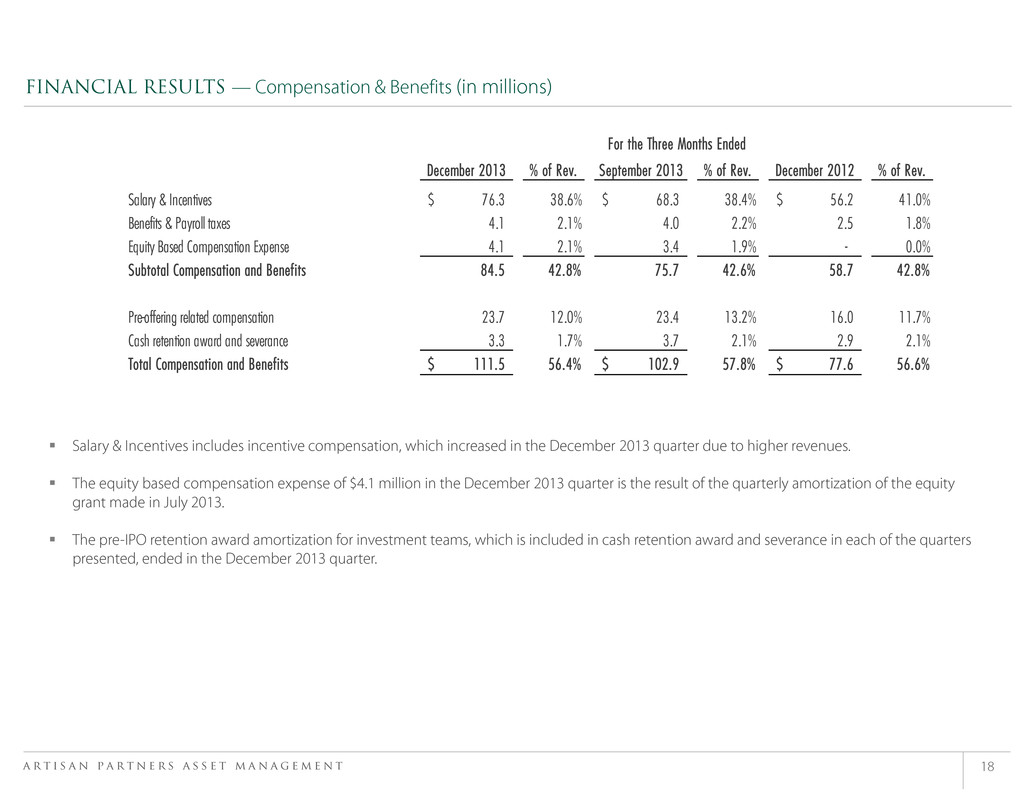

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 18 Salary & Incentives includes incentive compensation, which increased in the December 2013 quarter due to higher revenues. The equity based compensation expense of $4.1 million in the December 2013 quarter is the result of the quarterly amortization of the equity grant made in July 2013. The pre-IPO retention award amortization for investment teams, which is included in cash retention award and severance in each of the quarters presented, ended in the December 2013 quarter. FINANCIAL RESULTS — Compensation & Benefits (in millions) December 2013 % of Rev. September 2013 % of Rev. December 2012 % of Rev. Salary & Incentives 76.3$ 38.6% 68.3$ 38.4% 56.2$ 41.0% Benefits & Payroll taxes 4.1 2.1% 4.0 2.2% 2.5 1.8% Equity Based Compensation Expense 4.1 2.1% 3.4 1.9% - 0.0% Subtotal Compensation and Benefits 84.5 42.8% 75.7 42.6% 58.7 42.8% Pre-offering related compensation 23.7 12.0% 23.4 13.2% 16.0 11.7% Cash retention award and severance 3.3 1.7% 3.7 2.1% 2.9 2.1% Total Compensation and Benefits 111.5$ 56.4% 102.9$ 57.8% 77.6$ 56.6% For the Three Months Ended

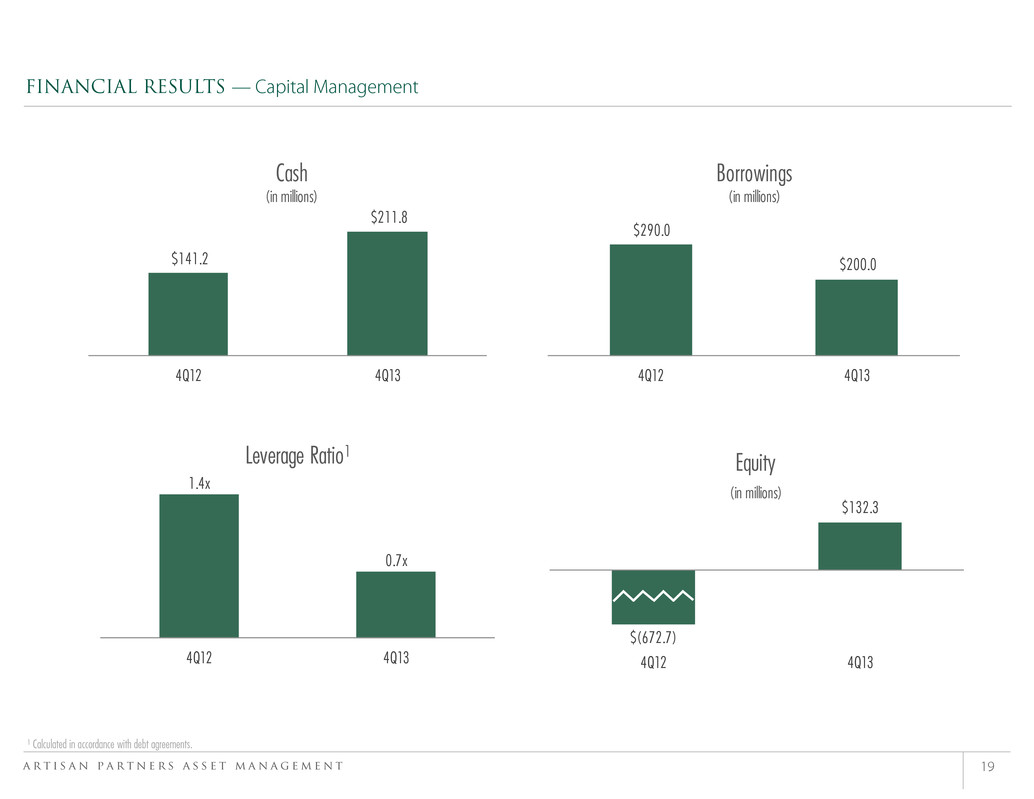

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 19 FINANCIAL RESULTS — Capital Management ¹ Calculated in accordance with debt agreements. $141.2 $211.8 4Q12 4Q13 Cash (in millions) $290.0 $200.0 4Q12 4Q13 Borrowings (in millions) 1.4x 0.7x 4Q12 4Q13 Leverage Ratio1 $(672.7) $132.3 4Q12 4Q13 Equity (in millions)

APPENDIX

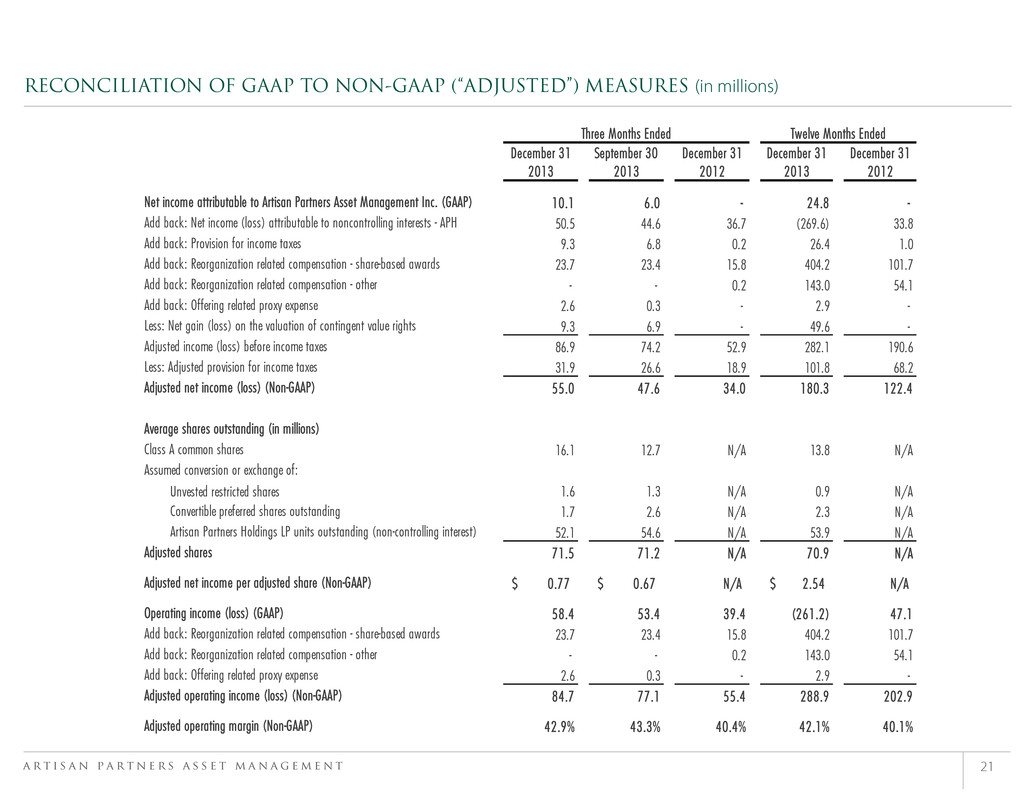

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 21 RECONCILIATION OF GAAP TO NON-GAAP (“ADJUSTED”) MEASURES (in millions) December 31 September 30 December 31 December 31 December 31 2013 2013 2012 2013 2012 Net income attributable to Artisan Partners Asset Management Inc. (GAAP) 10.1 6.0 - 24.8 - Add back: Net income (loss) attributable to noncontrolling interests - APH 50.5 44.6 36.7 (269.6) 33.8 Add back: Provision for income taxes 9.3 6.8 0.2 26.4 1.0 Add back: Reorganization related compensation - share-based awards 23.7 23.4 15.8 404.2 101.7 Add back: Reorganization related compensation - other - - 0.2 143.0 54.1 Add back: Offering related proxy expense 2.6 0.3 - 2.9 - Less: Net gain (loss) on the valuation of contingent value rights 9.3 6.9 - 49.6 - Adjusted income (loss) before income taxes 86.9 74.2 52.9 282.1 190.6 Less: Adjusted provision for income taxes 31.9 26.6 18.9 101.8 68.2 Adjusted net income (loss) (Non-GAAP) 55.0 47.6 34.0 180.3 122.4 Average shares outstanding (in millions) Class A common shares 16.1 12.7 N/A 13.8 N/A Assumed conversion or exchange of: Unvested restricted shares 1.6 1.3 N/A 0.9 N/A Convertible preferred shares outstanding 1.7 2.6 N/A 2.3 N/A Artisan Partners Holdings LP units outstanding (non-controlling interest) 52.1 54.6 N/A 53.9 N/A Adjusted shares 71.5 71.2 N/A 70.9 N/A Adjusted net income per adjusted share (Non-GAAP) 0.77$ 0.67$ N/A 2.54$ N/A Operating income (loss) (GAAP) 58.4 53.4 39.4 (261.2) 47.1 Add back: Reorganization related compensation - share-based awards 23.7 23.4 15.8 404.2 101.7 Add back: Reorganization related compensation - other - - 0.2 143.0 54.1 Add back: Offering related proxy expense 2.6 0.3 - 2.9 - Adjusted operating income (loss) (Non-GAAP) 84.7 77.1 55.4 288.9 202.9 Adjusted operating margin (Non-GAAP) 42.9% 43.3% 40.4% 42.1% 40.1% Three Months Ended Twelve Months Ended

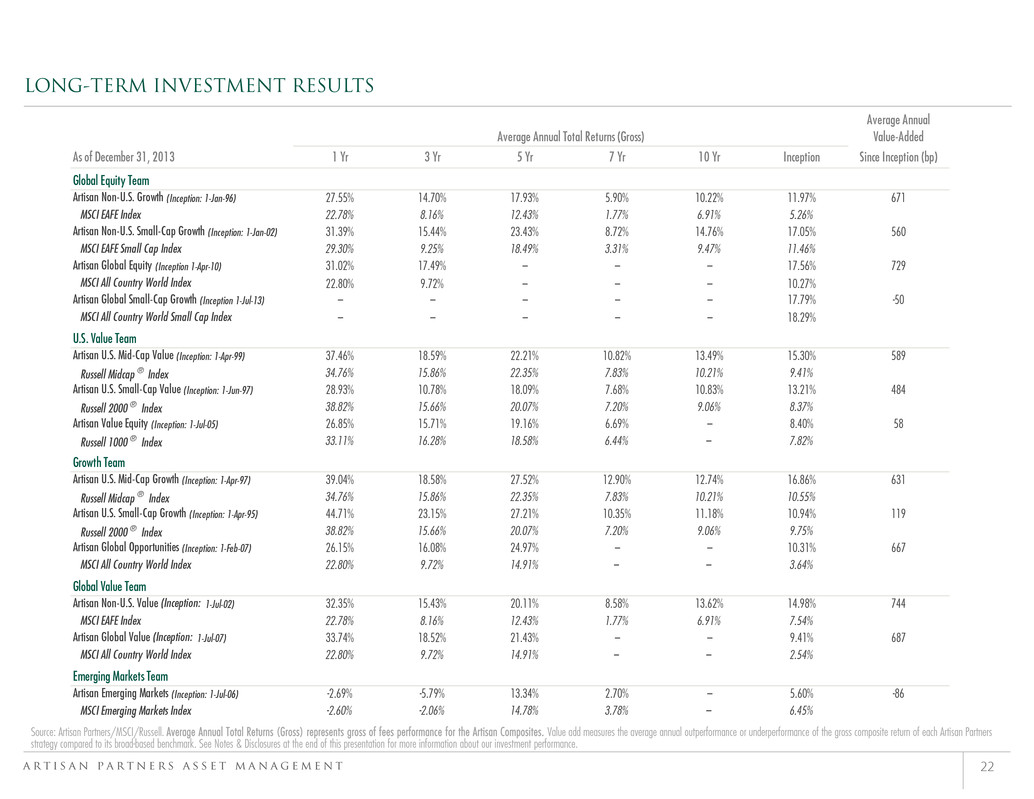

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 22 LONG-TERM INVESTMENT RESULTS Source: Artisan Partners/MSCI/Russell. Average Annual Total Returns (Gross) represents gross of fees performance for the Artisan Composites. Value add measures the average annual outperformance or underperformance of the gross composite return of each Artisan Partners strategy compared to its broad-based benchmark. See Notes & Disclosures at the end of this presentation for more information about our investment performance. Average Annual Value-Added As of December 31, 2013 1 Yr 3 Yr 5 Yr 7 Yr 10 Yr Inception Since Inception (bp) Global Equity Team Artisan Non-U.S. Growth (Inception: 1-Jan-96) 27.55% 14.70% 17.93% 5.90% 10.22% 11.97% 671 MSCI EAFE Index 22.78% 8.16% 12.43% 1.77% 6.91% 5.26% Artisan Non-U.S. Small-Cap Growth (Inception: 1-Jan-02) 31.39% 15.44% 23.43% 8.72% 14.76% 17.05% 560 MSCI EAFE Small Cap Index 29.30% 9.25% 18.49% 3.31% 9.47% 11.46% Artisan Global Equity (Inception 1-Apr-10) 31.02% 17.49% --- --- --- 17.56% 729 MSCI All Country World Index 22.80% 9.72% --- --- --- 10.27% Artisan Global Small-Cap Growth (Inception 1-Jul-13) --- --- --- --- --- 17.79% -50 MSCI All Country World Small Cap Index --- --- --- --- --- 18.29% U.S. Value Team Artisan U.S. Mid-Cap Value (Inception: 1-Apr-99) 37.46% 18.59% 22.21% 10.82% 13.49% 15.30% 589 Russell Midcap ® Index 34.76% 15.86% 22.35% 7.83% 10.21% 9.41% Artisan U.S. Small-Cap Value (Inception: 1-Jun-97) 28.93% 10.78% 18.09% 7.68% 10.83% 13.21% 484 Russell 2000 ® Index 38.82% 15.66% 20.07% 7.20% 9.06% 8.37% Artisan Value Equity (Inception: 1-Jul-05) 26.85% 15.71% 19.16% 6.69% --- 8.40% 58 Russell 1000 ® Index 33.11% 16.28% 18.58% 6.44% --- 7.82% Growth Team Artisan U.S. Mid-Cap Growth (Inception: 1-Apr-97) 39.04% 18.58% 27.52% 12.90% 12.74% 16.86% 631 Russell Midcap ® Index 34.76% 15.86% 22.35% 7.83% 10.21% 10.55% Artisan U.S. Small-Cap Growth (Inception: 1-Apr-95) 44.71% 23.15% 27.21% 10.35% 11.18% 10.94% 119 Russell 2000 ® Index 38.82% 15.66% 20.07% 7.20% 9.06% 9.75% Artisan Global Opportunities (Inception: 1-Feb-07) 26.15% 16.08% 24.97% --- --- 10.31% 667 MSCI All Country World Index 22.80% 9.72% 14.91% --- --- 3.64% Global Value Team Artisan Non-U.S. Value (Inception: 1-Jul-02) 32.35% 15.43% 20.11% 8.58% 13.62% 14.98% 744 MSCI EAFE Index 22.78% 8.16% 12.43% 1.77% 6.91% 7.54% Artisan Global Value (Inception: 1-Jul-07) 33.74% 18.52% 21.43% --- --- 9.41% 687 MSCI All Country World Index 22.80% 9.72% 14.91% --- --- 2.54% Emerging Markets Team Artisan Emerging Markets (Inception: 1-Jul-06) -2.69% -5.79% 13.34% 2.70% --- 5.60% -86 MSCI Emerging Markets Index -2.60% -2.06% 14.78% 3.78% --- 6.45% Average Annual Total Returns (Gross)

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 23 NOTES & DISCLOSURES Forward-Looking Statements Certain information in this presentation, and other written or oral statements made by or on behalf of Artisan Partners, are “forward-looking statements” within the meaning of the federal securities laws. Statements regarding future events and developments and the company’s future performance, as well as management’s current expectations, beliefs, plans, estimates or projections relating to the future, are forward-looking statements within the meaning of these laws. These forward-looking statements are only predictions based on current expectations and projections about future events. These forward-looking statements are subject to a number of risks and uncertainties, and there are important factors that could cause actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements. Among the important factors that could cause actual results, level of activity, performance or achievements to differ materially from those indicated by such forward-looking statements are: fluctuations in quarterly and annual results, incurrence of net losses, adverse effects of management focusing on implementation of a growth strategy, failure to develop and maintain the Artisan Partners brand and other factors disclosed in the company’s filings with the Securities and Exchange Commission, including those factors listed under the caption entitled “Risk Factors” in the company’s most recent registration statement on Form S-1. The company undertakes no obligation to update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this presentation. Investment Performance We measure the results of our “composites”, which represent the aggregate performance of all discretionary client accounts, including mutual funds, invested in the same strategy except those accounts with respect to which we believe client-imposed socially based restrictions may have a material impact on portfolio construction and those accounts managed in a currency other than U.S. dollars (the results of these accounts, which represented approximately 8% of our assets under management at December 31, 2013, are maintained in separate composites, which are not presented in these materials). Results for any investment strategy described herein, and for different investment products within a strategy, are affected by numerous factors, including different material market or economic conditions; different investment management fee rates, brokerage commissions and other expenses; and the reinvestment of dividends or other earnings. The returns for any strategy may be positive or negative, and past performance does not guarantee future results. Composite returns presented net-of-fees were calculated using the highest model investment advisory fees applicable to portfolios within the composite. Fees may be higher for certain pooled vehicles and the composite may include accounts with performance-based fees. In these materials, we present “Value-Added”, which is the amount in basis points by which the average annual gross composite return of each of our strategies has outperformed or underperformed the market index most commonly used by our clients to compare the performance of the relevant strategy. The market indices used to compute the value added for each of our strategies are as follows: Non-U.S. Growth Strategy—MSCI EAFE® Index; Non-U.S. Small-Cap Growth Strategy—MSCI EAFE® Small Cap Index; Global Equity Strategy—MSCI ACWI® Index; U.S. Mid-Cap Value Strategy—Russell Midcap® Index; U.S. Small-Cap Value Strategy—Russell 2000® Index; Value Equity Strategy—Russell 1000® Index; U.S. Mid-Cap Growth Strategy— Russell Midcap® Index; U.S. Small-Cap Strategy—Russell 2000® Index; Global Opportunities Strategy—MSCI ACWI® Index; Non-U.S. Value Strategy—MSCI EAFE® Index; Global Value Strategy— MSCI ACWI® Index; Emerging Markets Strategy—MSCI Emerging Markets IndexSM. In this document, we present information based on Morningstar, Inc., or Morningstar, ratings for series of Artisan Partners Funds, Inc. (“Artisan Funds”). The Morningstar ratings refer to the ratings by Morningstar of the share class of the respective series of Artisan Funds with the earliest inception date and are based on a 5-star scale. Morningstar data © 2014 Morningstar, Inc.; all rights reserved. Morningstar data contained herein (1) is proprietary to Morningstar and/or its content providers, (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. For each fund with at least a three-year history, Morningstar calculates a Morningstar Rating™ which is based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund's monthly performance, including the effects of sales charges, loads, and redemption fees, placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. Ratings are based on risk-adjusted returns and are historical and do not represent future results. The Overall Morningstar RatingTM for a fund is derived from a weighted average of the performance figures associated with its three-year, five-year, and ten-year (if applicable) Morningstar Ratings metrics. The Artisan Funds, the ratings of which form the basis for the information reflected in the table on page 7, and the categories in which they are rated are: Artisan International Fund—Foreign Large Blend Funds Category; Artisan International Small Cap Fund—Foreign Small/Mid Growth Funds Category; Artisan Global Equity Fund—World Stock; Artisan Small Cap Value Fund—Small Value Funds Category; Artisan Mid Cap Value Fund—Mid- Cap Value Funds Category; Artisan Value Equity Fund—Large Value Funds Category; Artisan Mid Cap Fund—Mid-Cap Growth Funds Category; Artisan Global Opportunities Fund—World Stock; Artisan Small Cap Fund—Small Growth Funds Category; Artisan International Value Fund—Foreign Small/Mid Funds Category; Artisan Global Value Fund—World Stock; Artisan Emerging Markets Fund— Diversified Emerging Markets Funds Category. Morningstar ratings are initially given on a fund’s three year track record and change monthly.

a r t i s a n p a r t n e r s a s s e t m a n a g e m e n t 24 NOTES & DISCLOSURES We also present information based on Lipper rankings for series of Artisan Funds. Lipper rankings are based on total return, are historical and do not represent future results. The number of funds in a category may include multiple share classes of the same fund, which may have a material impact on a fund’s ranking within a category. Lipper, a Thomson Reuters company, is the owner of all trademarks and copyrights relating to Lipper rankings. Artisan Mid Cap Value Fund is ranked within Lipper Inc.'s Mid-Cap Value category. For the 10-year average annual return time period, the Fund ranked in the top 3% (2 out of 87) of its Lipper peer group and in the top 8% (3 out of 38) since the Fund’s inception on 28 March 2001. Our discussion of Warren Buffet’s underperformance compared to the S&P 500 refers to Mr. Buffett’s metric measuring the growth in book value of Berkshire Hathaway Inc. versus the S&P 500 Index over a rolling 5-year period. The metric compares the percentage increase in book value of Berkshire Hathaway against the percentage increase in the S&P 500 Index, a market- weighted index of 500 of the largest US companies. Berkshire Hathaway has not yet published 2013 year-end results. However, Mr. Buffett noted in his year-end 2012 letter to shareholders that if the market continued to advance in 2013, it would be the first time the company has had a five-year period of underperformance in 44 years. Mr. Buffet’s metric differs from the performance calculation of Artisan U.S. Mid-Cap Value strategy and the analogy is not intended to be used as a performance comparison. Financial Information Throughout these materials, we present historical information about our assets under management and our average assets under management for certain periods. We use our information management systems to track our assets under management and we believe the information in these materials regarding our assets under management is accurate in all material respects. We also present information regarding the amount of our assets under management sourced through particular distribution channels. The allocation of assets under management sourced through particular distribution channels involves estimates and the exercise of judgment. We have presented the information on our assets under management sourced by distribution channel in the way in which we prepare and use that information in the management of our business. Data sourced by distribution channel on our assets under management are not subject to our internal controls over financial reporting. Rounding Any discrepancies included in these materials between totals and the sums of the amounts listed are due to rounding. Trademark Notice The MSCI EAFE® Index, the MSCI EAFE® Growth Index, the MSCI EAFE® Small Cap Index, the MSCI EAFE® Value Index, the MSCI ACWI® Index and the MSCI Emerging Markets IndexSM are trademarks of MSCI Inc. MSCI Inc. is the owner of all copyrights relating to these indices and is the source of the performance statistics of these indices that are referred to in these materials. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.mscibarra.com) The Russell 2000® Index, the Russell 2000® Value Index, the Russell Midcap® Index, the Russell Midcap® Value Index, the Russell 1000® Index, the Russell 1000® Value Index, the Russell Midcap® Growth Index, the Russell 1000® Growth Index and the Russell 2000® Growth Index are trademarks of Russell Investment Group. Russell Investment Group is the source and owner of the Russell Index data contained or reflected in this material and all trademarks and copyrights related thereto. The presentation may contain confidential information and unauthorized use, disclosure, copying, dissemination or redistribution is strictly prohibited. This is a presentation of Artisan Partners. Russell Investment Group is not responsible for the formatting or configuration of this material or for any inaccuracy in Artisan Partners' presentation thereof. None of the information in these materials constitutes either an offer or a solicitation to buy or sell any fund securities, nor is any such information a recommendation for any fund security or investment service. Copyright 2014 Artisan Partners. All rights reserved. This presentation may not be reproduced in whole or in part without Artisan Partners’ permission.