Attached files

| file | filename |

|---|---|

| EX-23.2 - CONSENT OF THOMAS J. HARRIS, CPA - Canso Enterprises Ltd. | canso_ex232.htm |

| EX-23.3 - CONSENT OF NEIL PETTIGREW, P. GEO. - Canso Enterprises Ltd. | canso_ex233.htm |

| EX-3.1 - ARTICLES OF INCORPORATION - Canso Enterprises Ltd. | canso_ex31.htm |

| EX-5.1 - LEGAL OPINION - Canso Enterprises Ltd. | canso_ex51.htm |

| EX-3.2 - BYLAWS - Canso Enterprises Ltd. | canso_ex32.htm |

Registration No. 333-________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CANSO ENTERPRISES LTD.

(Exact name of registrant as specified in its charter)

|

Nevada

|

1000

|

None

|

||

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(Primary Standard Industrial

Classification Number)

|

(IRS Employer

Identification Number)

|

Ave. Javier Rojo Gomez 630

Leyes de Reforma, Istapalapa

Mexico City 09310

Mexico

Telephone No.: +52 (01) 55-10843026

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

State Agent and Transfer Syndicate, Inc.

112 North Curry Street

Carson City, Nevada 89703

Telephone No.: (775) 882-1013

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Thomas E. Puzzo, Esq.

Law Offices of Thomas E. Puzzo, PLLC

3823 44th Ave. NE

Seattle, Washington 98105

Telephone No.: (206) 522-2256

Facsimile No.: (206) 260-0111

Approximate date of proposed sale to the public: As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective registration statement filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective registration statement filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

x |

|

(Do not check if a smaller reporting company)

|

|||

CALCULATION OF REGISTRATION FEE

|

Title of Each Class

|

Proposed Maximum

|

Proposed Maximum

|

||||||||||||||

|

of Securities

|

Amount to Be

|

Offering Price

|

Aggregate

|

Amount of

|

||||||||||||

|

to be Registered

|

Registered (1)

|

per Share

|

Offering Price

|

Registration Fee

|

||||||||||||

|

Common Stock, par value $0.001 per share

|

1,650,000

|

(2)

|

$

|

0.15

|

(3)

|

$

|

247,500

|

$

|

31.87

|

|||||||

|

TOTAL

|

1,650,000

|

$

|

-

|

$

|

247,500

|

31.87

|

||||||||||

(1) In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

(2) Represents the number of shares of common stock currently outstanding to be sold by the selling security holders.

(3) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) of the Securities Act.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be amended. The Registrant may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

i

The information in this prospectus is not complete and may be changed. This prospectus is included in the registration statement that was filed by us with the Securities and Exchange Commission. The selling security holders may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED JANUARY 31, 2014

CANSO ENTERPRISES LTD.

1,650,000 SHARES OF COMMON STOCK

This prospectus relates to the resale by certain selling security holders of Canso Enterprises Ltd. of up to 1,650,000 shares of common stock held by selling security holders of Canso Enterprises Ltd. We will not receive any of the proceeds from the sale of the shares by the selling stockholders. We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

The selling security holders will be offering our shares of common stock at a fixed price of $0.15 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. Each of the selling stockholders may be deemed to be an “underwriter” as such term is defined in the Securities Act of 1933, as amended (the “Securities Act”).

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority for our common stock to be eligible for trading on the Over-the-Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

OUR BUSINESS IS SUBJECT TO MANY RISKS AND AN INVESTMENT IN OUR SHARES OF COMMON STOCK WILL ALSO INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE FACTORS DESCRIBED UNDER THE HEADING “RISK FACTORS” BEGINNING ON PAGE 5 BEFORE INVESTING IN OUR SHARES OF COMMON STOCK.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is __________, 2014.

1

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

TABLE OF CONTENTS

|

Page

|

||||

|

Prospectus Summary

|

3

|

|||

|

Risk Factors

|

6

|

|||

|

Risk Factors Relating to Our Company

|

6

|

|||

|

Risk Factors Relating to Our Common Stock

|

8

|

|||

|

Use of Proceeds

|

12

|

|||

|

Determination of Offering Price

|

12

|

|||

|

Selling Security Holders

|

12

|

|||

|

Description of Securities

|

14

|

|||

|

Plan of Distribution

|

16 | |||

|

Description of Business

|

18

|

|||

|

Our Executive Offices

|

27

|

|||

|

Legal Proceedings

|

27

|

|||

|

Market for Common Equity and Related Stockholder Matters

|

27

|

|||

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

28

|

|||

|

Directors, Executive Officers, Promoters and Control Persons

|

33

|

|||

|

Executive Compensation

|

35

|

|||

|

Security Ownership of Certain Beneficial Owners and Management

|

37

|

|||

|

Certain Relationships and Related Transactions

|

37

|

|||

|

Disclosure of Commission Position on Indemnification for Securities Act Liabilities

|

38

|

|||

|

Where You Can Find More Information

|

38

|

|||

|

Interests of Named Experts and Counsel

|

38

|

|||

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

|

38

|

|||

|

Financial Statements

|

F-1

|

|||

Until ____________, 2014 (90 business days after the effective date of this prospectus) all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

2

A CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

PROSPECTUS SUMMARY

As used in this prospectus, references to the “Company,” “we,” “our”, “us” or “Canso Enterprises Ltd.” refer to Canso Enterprises Ltd. unless the context otherwise indicates.

The following summary highlights selected information contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements, and the notes to the financial statements.

OUR COMPANY

Canso Enterprises Ltd. was incorporated on June 26, 2013, under the laws of the State of Nevada, for the purpose of conducting mineral exploration activities.

We are an exploration stage company formed for the purposes of acquiring, exploring, and if warranted and feasible, developing natural resource property. We raised an aggregate of $52,500 through private placements of our securities. Proceeds from these placements were used for working capital.

We are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see “RISK FACTORS--RISKS RELATED TO THIS OFFERING AND OUR COMMON STOCK - WE ARE AN `EMERGING GROWTH COMPANY’ AND WE CANNOT BE CERTAIN IF THE REDUCED DISCLOSURE REQUIREMENTS APPLICABLE TO EMERGING GROWTH COMPANIES WILL MAKE OUR COMMON STOCK LESS ATTRACTIVE TO INVESTORS” on page 4 of this prospectus.

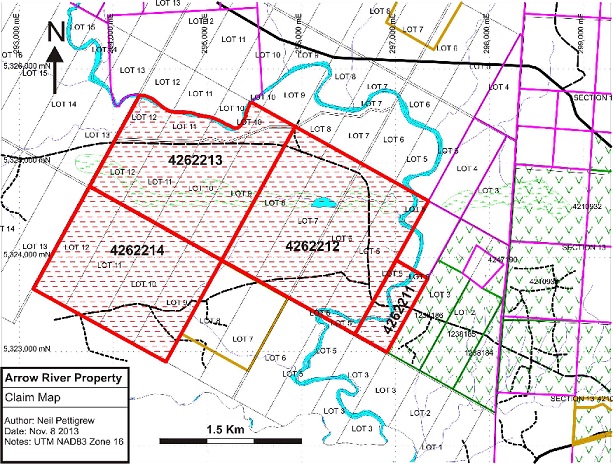

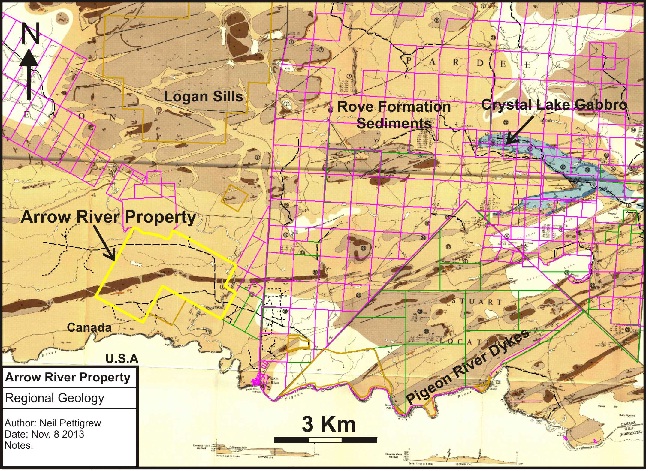

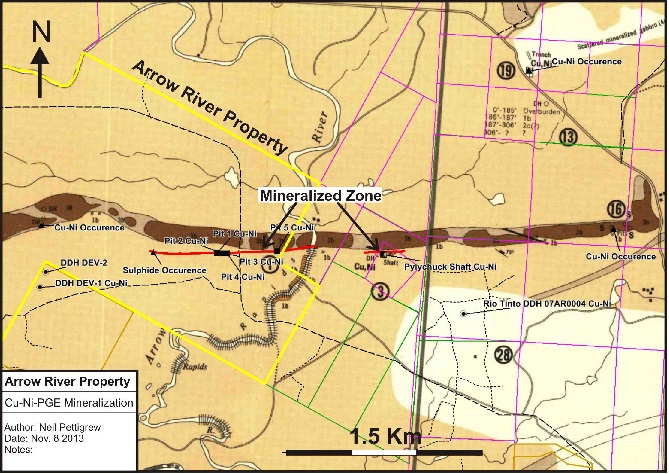

We have four mining claims, claims numbers 4262211, 4262212 and 4262213 and 4262214 (collectively, the “Arrow River Property”), located in the Thunder Bay Mining District of the Province of Ontario, Canada. The claims were recorded on October 29, 2013, with the Ministry of Northern Development and Mines, Province of Ontario, Canada, of Ontario, Canada. We have had a qualified consulting geologist prepare a geological evaluation report on the Arrow River Property, which report was delivered to us on November 12, 2013. We intend to conduct exploratory activities on the Arrow River Property and, if feasible, develop the Arrow River Property.

3

In order to execute against our plan of operations for the next 12 months, we will need to raise approximately $249,500. Until such funds are obtained by the Company via debt, equity or other form of financing, we will be unable to take concrete steps towards the implementation of our plan of operations. In order to commence work in accordance with Phase 1 of our plan of operation, detailed on page 27, we will need to secure additional financing. Currently, we have no plan or commitment which would provide us with the required capital to begin Phase 1.

The Company’s principal offices are located at Ave. Javier Rojo Gomez 630, Leyes de Reforma, Istapalapa, Mexico City 09310, Mexico, and our telephone number is +52 (01) 55-10843026.

|

Securities offered:

|

The selling stockholders are offering hereby up to 1,650,000 shares of common stock.

|

|

Offering price:

|

The selling stockholders will offer and sell their shares of common stock at a fixed price of $0.15 per share until our shares are quoted on the OTC Bulletin Board, if our shares of common stock are ever quoted on the OTC Bulletin Board, and thereafter at prevailing market prices or privately negotiated prices.

|

|

Shares outstanding prior to offering:

|

11,650,000

|

|

Shares outstanding after offering:

|

11,650,000

|

|

Market for the common shares:

|

There is no public market for our shares. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to eligible for trading on the Over The Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application.

There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale.

|

|

Use of proceeds:

|

We will not receive any proceeds from the sale of shares by the selling security holders

|

4

SUMMARY FINANCIAL INFORMATION

The tables and information below are derived from our audited financial statements for the period from June 26, 2013 (Inception) to November 30, 2013. Our working capital as at January 23, 2014 was $46,295.

|

November 30,

2013

($)

|

||||

|

Financial Summary

|

||||

|

Cash and Deposits

|

40,645

|

|||

|

Total Assets

|

46,295

|

|||

|

Total Liabilities

|

-0-

|

|||

|

Total Stockholder’s Equity

|

46,295

|

|||

|

Accumulated

From

June 26,

2013

(Inception) to

November 30,

2013

($)

|

||||

|

Statement of Operations

|

||||

|

Total Expenses

|

(6,205

|

)

|

||

|

Net Loss for the Period

|

(6,205

|

)

|

||

|

Net Loss per Share

|

-

|

|||

5

RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company’s common stock. You could lose all or part of your investment due to any of these risks.

RISKS RELATING TO OUR COMPANY

Our auditors have expressed substantial doubt about our ability to continue as a going concern.

Our financial statements for the period ended November 30, 2013 were prepared assuming that we will continue our operations as a going concern. We were incorporated on June 26, 2013 and do not have a history of earnings. As a result, our independent accountants in their audit report have expressed substantial doubt about our ability to continue as a going concern. Continued operations are dependent on our ability to complete equity or debt financings or generate profitable operations. Such financings may not be available or may not be available on reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty.

We will require additional funds which we plan to raise through the sale of our common stock, which requires favorable market conditions and interest in our activities by investors. If we are not be able to sell our common stock, funding will not be available for continued operations, and our business will fail.

Our current cash of $40,645 will not be sufficient to complete the first phase of any initial exploration program of any mining claim. Subsequent exploration activities will require additional funding. We will need $40,422 to complete phase 1 and a total of $249,500 to complete the three phases of our plan of operation detailed on page 27. Our only present means of funding is through the sale of our common stock. The sale of common stock requires favorable market conditions for exploration companies like ours, as well as specific interest in our stock, neither of which may exist if and when additional funding is required by us. If we are unable to raise additional funds in the future, our business will fail.

We have a very limited history of operations and accordingly there is no track record that would provide a basis for assessing our ability to conduct successful mineral exploration activities. We may not be successful in carrying out our business objectives.

We were incorporated on June 26, 2013 and to date, have been involved primarily in organizational activities and obtaining financing. Accordingly we have no track record of successful exploration activities, strategic decision making by management, fund-raising ability, and other factors that would allow an investor to assess the likelihood that we will be successful as an exploration stage company. Exploration stage companies often fail to achieve or maintain successful operations, even in favorable market conditions. There is a substantial risk that we will not be successful in our exploration activities, or if initially successful, in thereafter generating any operating revenues or in achieving profitable operations.

Due to the speculative nature of mineral property exploration, there is substantial risk that no commercially viable mineral deposits will be found on our Arrow River Property or other mineral properties that we acquire.

In order for us to even commence mining operations we face a number of challenges which include finding mining claims, qualified professionals to conduct exploration programs, obtaining adequate financing to continue exploration programs, locating viable mineral bodies, partnering with senior mining companies, obtaining mining permits, and ultimately selling minerals in order to generate revenue. Moreover, exploration for commercially viable mineral deposits is highly speculative in nature and involves substantial risk that no viable mineral deposits will be located on any future mineral properties. There is a substantial risk that any exploration program that we conduct on future claims may not result in the discovery of any significant mineralization, and therefore no commercial viable mineral deposit. There are numerous geological features that we may encounter that would limit our ability to locate mineralization or that could interfere with our exploration programs as planned, resulting in unsuccessful exploration efforts. In such a case, we may incur significant costs associated with an exploration program, without any benefit. This would likely result in a decrease in the value of our common stock.

6

We have not independently verified the mineral reserves on the Arrow River Property, nor have we personally visited the property and have relied solely on the representations and advice of our expert advisors.

The sole officer and directors of the Company have no formal training or prior experience in geology, mineral exploration or mining. Additionally, no members of management of the Company have personally visited the Arrow River Property. We have relied on the advice of our professional geologist, Neil Pettigrew, who is a qualified expert in Canada. Because we have not independently verified that there are mineral reserves, there may be no commercially viable mineral reserves located on the Arrow River Property.

Due to the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or may elect not to insure. We currently have no such insurance nor do we expect to obtain such insurance for the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all our assets and cease operations, resulting in the loss of your entire investment.

The market price for precious metals is based on numerous factors outside of our control. There is a risk that the market price for precious metals will significantly decrease, which will make it difficult for us to fund further mineral exploration activities, and would decrease the probability that any significant mineralization that we locate can be economically extracted.

Numerous factors beyond our control may affect the marketability of minerals. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital and you may lose your entire investment in this offering by existing investors.

Our management’s lack of experience in and/or with mining and, in particular, mineral exploration activity, means that it is difficult to assess, or make judgments about, our potential success.

Our sole officer and directors have not had any prior experience with or ever operated a mining company. Only Jim Burns, our President, has limited and narrow experience in the mining industry, as a diamond driller. Additionally, neither of them has a college or university degree, or other educational background, in mining or geology or in a field related to mining. More specifically, they both lack technical training and experience with exploring for, starting, and/or operating a mine. With no direct training or experience in these areas, they may not be fully aware of many of the specific requirements related to mineral exploration, let alone the overall mining industry as a whole. For example, management’s decisions and choices may fail to take into account standard engineering and other managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to our future possible mistakes, lack of sophistication, judgment or experience in this particular industry. As a result, if we do obtain the funding or other means to implement a bona fide mineral exploration program, such program will likely have to be implemented and carried out by joint venturers, partners or independent contractors who would have the requisite mineral exploration experience and know-how that we currently lack.

Since the majority of our shares of common stock are owned by our sole officer and directors, our other stockholders may not be able to influence control of the company or decision making by management of the company, and as such, our sole officer and directors may have a conflict of interest with the minority shareholders at some time in the future.

Our sole officer and directors collectively beneficially own approximately 85.8% of our outstanding common stock. The interests of our may not be, at all times, the same as that of our other shareholders. Our officer and directors are not simply passive investors, but also executive officers of the Company, and as such their interests as executives may, at times be adverse to those of passive investors. Where those conflicts exist, our shareholders will be dependent upon our director exercising, in a manner fair to all of our shareholders, her fiduciary duties as officer or as member of the Company’s Board of Directors. Also, our sole officer and directors will have the ability to control the outcome of most corporate actions requiring shareholder approval, including the sale of all or substantially all of our assets and amendments to our Articles of Incorporation. This concentration of ownership may also have the effect of delaying, deferring or preventing a change of control of us, which may be disadvantageous to minority shareholders.

7

Since our sole officer and directors have the ability to be employed by or consult for other companies, their other activities could slow down our operations.

Our sole officer and directors are not required to work exclusively for us and do not devote all of their time to our operations. Therefore, it is possible that a conflict of interest with regard to their time may arise based on their employment by other companies. Their other activities may prevent them from devoting full-time to our operations which could slow our operations and may reduce our financial results because of the slowdown in operations. It is expected that Jim Burns, our President, will devote approximately 10 hours per week to our operations on an ongoing basis, and when required will devote whole days and even multiple days at a stretch when property visits are required or when extensive analysis of information is needed. We do not have any written procedures in place to address conflicts of interest that may arise between our business and the business activities of our sole officer and directors.

We have no employment or compensation agreements with our sole officer and directors and as such they may have little incentive to devote time and energy to the operation of the Company.

Our sole officer and directors are not subject to any employment or compensation agreement with the Company. Therefore, it is possible that either one or both of them may decide to focus their respective efforts on other projects or companies which have a higher economic benefit to either one or both of them. Currently, they is not obligated to spend any time at all on Company business and could opt to leave the Company for other opportunities or focus on other business which could negatively impact the Company’s ability to succeed. We do not have any expectation that either one of our officers or directors will enter into an employment or compensation agreement with the Company in the foreseeable future and the loss of either one would be highly detrimental to our ability to conduct ongoing operations.

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline.

The selling shareholders are offering up to 1,650,000 shares of our common stock through this prospectus. Our common stock is presently not traded or quoted on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is quoted will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent approximately 27.0% of the common shares outstanding as of the date of this prospectus.

It will be extremely difficult to acquire jurisdiction and enforce liabilities against our officers, directors and assets outside the United States.

All of our assets are currently located outside of the United States and our sole officer and directors reside outside of the United States as well. As a result, it may not be possible for United States investors to enforce their legal rights, to effect service of process upon our directors or officers or to enforce judgments of United States courts predicated upon civil liabilities and criminal penalties of our directors and officers under Federal securities laws. Moreover, we have been advised that Canada and Mexico do not have treaties providing for the reciprocal recognition and enforcement of judgments of courts in the United States. Further, it is unclear if extradition treaties now in effect between the United States and (i) Canada and (ii) Mexico would permit effective enforcement of criminal penalties of the Federal securities laws.

RISKS RELATING TO OUR COMMON STOCK

There is no liquidity and no established public market for our common stock and we may not be successful at obtaining a quotation on a recognized quotation service. In such event it may be difficult to sell your shares.

There is presently no public market in our shares. There can be no assurance that we will be successful at developing a public market or in having our common stock quoted on a quotation facility such as the OTC Bulletin Board. There are risks associated with obtaining a quotation, including that broker dealers will not be willing to make a market in our shares, or to request that our shares be quoted on a quotation service. In addition, even if a quotation is obtained, the OTC Bulletin Board and similar quotation services are often characterized by low trading volumes, and price volatility, which may make it difficult for an investor to sell our common stock on acceptable terms. If trades in our common stock are not quoted on a quotation facility, it may be very difficult for an investor to find a buyer for their shares in our Company.

8

Our common stock is subject to the “penny stock” rules of the sec and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

Under U.S. federal securities legislation, our common stock will constitute “penny stock”. Penny stock is any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 75,000,000 shares of common stock. As of the date of this prospectus, the Company had 11,650,000 shares of common stock outstanding. Accordingly, we may issue up to an additional 63,350,000 shares of common stock. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

We intend to become subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended, which will require us to incur audit fees and legal fees in connection with the preparation of such reports. These additional costs will negatively affect our ability to earn a profit.

Following the effective date of the registration statement in which this prospectus is included, we will be required to file periodic reports with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934 and the rules and regulations thereunder. In order to comply with such requirements, our independent registered auditors will have to review our financial statements on a quarterly basis and audit our financial statements on an annual basis. Moreover, our legal counsel will have to review and assist in the preparation of such reports. Although we believe that the approximately $10,000 we have estimated for these costs should be sufficient for the 12 month period following the completion of our offering, the costs charged by these professionals for such services may vary significantly. Factors such as the number and type of transactions that we engage in and the complexity of our reports cannot accurately be determined at this time and may have a major negative affect on the cost and amount of time to be spent by our auditors and attorneys. However, the incurrence of such costs will obviously be an expense to our operations and thus have a negative effect on our ability to meet our overhead requirements and earn a profit.

However, for as long as we remain an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an “emerging growth company.” We will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that you become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

After, and if ever, we are no longer an “emerging growth company,” we expect to incur significant additional expenses and devote substantial management effort toward ensuring compliance with those requirements applicable to companies that are not “emerging growth companies,” including Section 404 of the Sarbanes-Oxley Act.

9

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart our Business Startups Act of 2012, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Under the Jumpstart Our Business Startups Act, “emerging growth companies” can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves to this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

However, for as long as we remain an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an “emerging growth company.”

We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year (A) following the fifth anniversary of our first sale of common equity securities pursuant to an effective registration statement, (B) in which we have total annual gross revenue of at least $1.0 billion, or (C) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, and (ii) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Because we are a shell company, you will not be able to resell your shares in certain circumstances, which could hinder the resale of your shares.

We are a “shell company” within the meaning of Rule 405, promulgated pursuant to Securities Act of 1933, as amended (the “Securities Act”), because we have nominal assets and nominal operations. Accordingly, the securities sold in this offering can only be resold through registration under Section 5 the Securities Act, Section 4(1), if available, for non-affiliates, or by meeting the conditions of Rule 144(i). Another implication of us being a shell company is that we cannot file registration statements under Section 5 of the Securities Act using a Form S-8, a short form of registration to register securities issued to employees and consultants under an employee benefit plan. Additionally, though exemptions, such as Section 4(1) of the Securities Act may be available for non-affiliate holders our shares to resell their shares, because we are a shell company, a holder of our securities may not rely on the safe harbor from being deemed statutory underwriter under Section 2(11) of the Securities Act, as provided by Rule 144, to resell his or her securities. Only after we (i) are not a shell company, and (ii) have filed all reports and other materials required to be filed by section 13 or 15(d) of the Exchange Act, as applicable, during the preceding 12 months (or for such shorter period that we may be required to file such reports and materials, other than Form 8-K reports); and have filed current “Form 10 information” with the SEC reflecting our status as an entity that is no longer a shell company for a period of not less than 12 months, can our securities be resold pursuant to Rule 144. “Form 10 information” is, generally speaking, the same type of information as we are required to disclose in this prospectus, but without an offering of securities. These circumstances regarding how Rule 144 applies to shell companies may hinder your resale of your shares of the Company.

10

Anti-takeover effects of certain provisions of Nevada state law hinder a potential takeover of our company.

Though not now, in the future we may become subject to Nevada’s control share law. A corporation is subject to Nevada’s control share law if it has more than 200 stockholders, at least 100 of whom are stockholders of record and residents of Nevada, and it does business in Nevada or through an affiliated corporation. The law focuses on the acquisition of a “controlling interest” which means the ownership of outstanding voting shares sufficient, but for the control share law, to enable the acquiring person to exercise the following proportions of the voting power of the corporation in the election of directors:

(i) one-fifth or more but less than one-third, (ii) one-third or more but less than a majority, or (iii) a majority or more. The ability to exercise such voting power may be direct or indirect, as well as individual or in association with others.

The effect of the control share law is that the acquiring person, and those acting in association with it, obtains only such voting rights in the control shares as are conferred by a resolution of the stockholders of the corporation, approved at a special or annual meeting of stockholders. The control share law contemplates that voting rights will be considered only once by the other stockholders. Thus, there is no authority to strip voting rights from the control shares of an acquiring person once those rights have been approved. If the stockholders do not grant voting rights to the control shares acquired by an acquiring person, those shares do not become permanent non-voting shares. The acquiring person is free to sell its shares to others. If the buyers of those shares themselves do not acquire a controlling interest, their shares do not become governed by the control share law.

If control shares are accorded full voting rights and the acquiring person has acquired control shares with a majority or more of the voting power, any stockholder of record, other than an acquiring person, who has not voted in favor of approval of voting rights is entitled to demand fair value for such stockholder’s shares.

Nevada’s control share law may have the effect of discouraging takeovers of the corporation.

In addition to the control share law, Nevada has a business combination law which prohibits certain business combinations between Nevada corporations and “interested stockholders” for three years after the “interested stockholder” first becomes an “interested stockholder,” unless the corporation’s board of directors approves the combination in advance. For purposes of Nevada law, an “interested stockholder” is any person who is (i) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the corporation, or (ii) an affiliate or associate of the corporation and at any time within the three previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation. The definition of the term “business combination” is sufficiently broad to cover virtually any kind of transaction that would allow a potential acquiror to use the corporation’s assets to finance the acquisition or otherwise to benefit its own interests rather than the interests of the corporation and its other stockholders.

The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of Canso Enterprises Ltd. from doing so if it cannot obtain the approval of our board of directors.

Because we do not intend to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them. There is no assurance that stockholders will be able to sell shares when desired.

11

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholders. We will not receive any of the proceeds from the sale of the common shares being offered for sale by the selling security holders.

DETERMINATION OF THE OFFERING PRICE

The selling shareholders will sell our shares at $0.15 per share until our shares are quoted on the OTCBB, and thereafter at prevailing market prices or privately negotiated prices. This price was arbitrarily determined by us.

SELLING SECURITY HOLDERS

The following table sets forth the shares beneficially owned, as of the date of this prospectus, by the selling security holders prior to the offering by existing shareholders contemplated by this prospectus, the number of shares each selling security holder is offering by this prospectus and the number of shares which each would own beneficially if all such offered shares are sold.

Beneficial ownership is determined in accordance with Securities and Exchange Commission rules. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

25 of the selling security holders acquired their shares of common stock being resold hereunder directly from the Company for a purchase price of $0.01 per share, 10 of the selling security holders acquired their shares of common stock being resold hereunder directly from the Company for a purchase price of $0.10 per share, and 4 of the selling security holders acquired their shares of common stock being resold hereunder directly from the Company for a purchase price of $0.10 per share. The percentages below are calculated based on 11,650,000 shares of our common stock issued and outstanding as of the date of this prospectus. We do not have any outstanding options, warrants or other securities exercisable for or convertible into shares of our common stock.

12

|

Name of Selling Shareholder

|

Purchase

Price

per Share,

as Purchased

from the

Company

|

Shares

Owned

Before

the Offering

|

Total

Number of

Shares to be

Offered for

the Security

Holder’s

Account

|

Total Shares

Owned After

the Offering

is Complete

|

Percentage of

Shares owned

After

the Offering

is Complete

|

|||||||||||||

|

Robert Lovell

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Blair Green

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Harry Holden

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Travis Lee

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Jim Pearson

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Pat White

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Daric King

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Daniel King

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Jim Brown

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Stan Stein

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

John Carsley

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Alcan Gonzales

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Blair Cook

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Bill Hawke

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Matt Lopez

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Zita Romo

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Gerando Goryon

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Sally Henderson

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

David Unger

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Sharon Brown

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

David Vent

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Ann Sanders

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Terry Brown

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Ken Hart

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Susan Arthur

|

$0.01

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Otis Silk

|

$0.05

|

20,000

|

20,000

|

0

|

0

|

|||||||||||||

|

Gary Boorman

|

$0.05

|

20,000

|

20,000

|

0

|

0

|

|||||||||||||

|

Bob Cotton

|

$0.05

|

20,000

|

20,000

|

0

|

0

|

|||||||||||||

|

Ron Houls

|

$0.05

|

20,000

|

20,000

|

0

|

0

|

|||||||||||||

|

Robert Rouse

|

$0.05

|

20,000

|

20,000

|

0

|

0

|

|||||||||||||

|

Steve Owen

|

$0.05

|

20,000

|

20,000

|

0

|

0

|

|||||||||||||

|

Harold Morrison

|

$0.05

|

20,000

|

20,000

|

0

|

0

|

|||||||||||||

|

Susan Cook

|

$0.05

|

20,000

|

20,000

|

0

|

0

|

|||||||||||||

|

Edith Williams

|

$0.05

|

20,000

|

20,000

|

0

|

0

|

|||||||||||||

|

Steven Sails

|

$0.05

|

20,000

|

20,000

|

0

|

0

|

|||||||||||||

|

Terry Long

|

$0.10

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Ian Hill

|

$0.10

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

George Peters

|

$0.10

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Craig Clasen

|

$0.10

|

50,000

|

50,000

|

0

|

0

|

|||||||||||||

|

Totals

|

1,650,000

|

1,650,000

|

0

|

0

|

||||||||||||||

13

None of the selling shareholders has a relationship with us other than as a shareholder, has ever been one of our officers or directors, or is a broker-dealer registered under the Securities Exchange Act of 1934, as amended, or an affiliate of such a broker-dealer.

We may require the selling stockholders to suspend the sales of the securities offered by this prospectus upon the occurrence of any event that makes any statement in this prospectus, or the related registration statement, untrue in any material respect, or that requires the changing of the statements in these documents in order to make statements in those documents not misleading. We will file a post-effective amendment to the registration statement to reflect any such material changes to this prospectus.

DESCRIPTION OF SECURITIES

GENERAL

There is no established public trading market for our common stock. Our authorized capital stock consists of 75,000,000 shares of common stock, with $0.001 par value per share. As of the date of this prospectus, there were 11,650,000 shares of our common stock issued and outstanding that were held by 41 stockholders of record, and no shares of preferred stock issued and outstanding.

COMMON STOCK

The following is a summary of the material rights and restrictions associated with our common stock. This description does not purport to be a complete description of all of the rights of our stockholders and is subject to, and qualified in its entirety by, the provisions of our most current Articles of Incorporation and Bylaws, which are included as exhibits to this Registration Statement.

The holders of our common stock currently have (i) equal ratable rights to dividends from funds legally available therefore, when, as and if declared by the Board of Directors of the Company; (ii) are entitled to share ratably in all of the assets of the Company available for distribution to holders of common stock upon liquidation, dissolution or winding up of the affairs of the Company.

(iii) do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions or rights applicable thereto; and (iv) are entitled to one non-cumulative vote per share on all matters on which stock holders may vote.

Our Bylaws provide that at all meetings of the stockholders for the election of directors, a plurality of the votes cast shall be sufficient to elect. On all other matters, except as otherwise required by Nevada law or the Articles of Incorporation, a majority of the votes cast at a meeting of the stockholders shall be necessary to authorize any corporate action to be taken by vote of the stockholders. A “plurality” means the excess of the votes cast for one candidate over any other. When there are more than two competitors for the same office, the person who receives the greatest number of votes has a plurality.

We do not have any preferred stock authorized in our Articles of Incorporation, and we have no warrants, options or other convertible securities issued or outstanding.

14

NEVADA ANTI-TAKEOVER LAWS

The Nevada Business Corporation Law contains a provision governing “Acquisition of Controlling Interest.” This law provides generally that any person or entity that acquires 20% or more of the outstanding voting shares of a publicly-held Nevada corporation in the secondary public or private market may be denied voting rights with respect to the acquired shares, unless a majority of the disinterested stockholders of the corporation elects to restore such voting rights in whole or in part. The control share acquisition act provides that a person or entity acquires “control shares” whenever it acquires shares that, but for the operation of the control share acquisition act, would bring its voting power within any of the following three ranges: (1) 20 to 33 1/3%, (2) 33 1/3 to 50%, or (3) more than 50%. A “control share acquisition” is generally defined as the direct or indirect acquisition of either ownership or voting power associated with issued and outstanding control shares. The stockholders or board of directors of a corporation may elect to exempt the stock of the corporation from the provisions of the control share acquisition act through adoption of a provision to that effect in the Articles of Incorporation or Bylaws of the corporation. Our Articles of Incorporation and Bylaws do not exempt our common stock from the control share acquisition act. The control share acquisition act is applicable only to shares of “Issuing Corporations” as defined by the act. An Issuing Corporation is a Nevada corporation, which; (1) has 200 or more stockholders, with at least 100 of such stockholders being both stockholders of record and residents of Nevada; and (2) does business in Nevada directly or through an affiliated corporation.

At this time, we do not have 100 stockholders of record resident of Nevada. Therefore, the provisions of the control share acquisition act do not apply to acquisitions of our shares and will not until such time as these requirements have been met. At such time as they may apply to us, the provisions of the control share acquisition act may discourage companies or persons interested in acquiring a significant interest in or control of the Company, regardless of whether such acquisition may be in the interest of our stockholders.

The Nevada “Combination with Interested Stockholders Statute” may also have an effect of delaying or making it more difficult to effect a change in control of the Company. This statute prevents an “interested stockholder” and a resident domestic Nevada corporation from entering into a “combination,” unless certain conditions are met. The statute defines “combination” to include any merger or consolidation with an “interested stockholder,” or any sale, lease, exchange, mortgage, pledge, transfer or other disposition, in one transaction or a series of transactions with an “interested stockholder” having; (1) an aggregate market value equal to 5 percent or more of the aggregate market value of the assets of the corporation; (2) an aggregate market value equal to 5 percent or more of the aggregate market value of all outstanding shares of the corporation; or (3) representing 10 percent or more of the earning power or net income of the corporation. An “interested stockholder” means the beneficial owner of 10 percent or more of the voting shares of a resident domestic corporation, or an affiliate or associate thereof. A corporation affected by the statute may not engage in a “combination” within three years after the interested stockholder acquires its shares unless the combination or purchase is approved by the board of directors before the interested stockholder acquired such shares. If approval is not obtained, then after the expiration of the three-year period, the business combination may be consummated with the approval of the board of directors or a majority of the voting power held by disinterested stockholders, or if the consideration to be paid by the interested stockholder is at least equal to the highest of: (1) the highest price per share paid by the interested stockholder within the three years immediately preceding the date of the announcement of the combination or in the transaction in which he became an interested stockholder, whichever is higher; (2) the market value per common share on the date of announcement of the combination or the date the interested stockholder acquired the shares, whichever is higher; or (3) if higher for the holders of preferred stock, the highest liquidation value of the preferred stock. The effect of Nevada’s business combination law is to potentially discourage parties interested in taking control of the Company from doing so if they cannot obtain the approval of our board of directors.

RULE 144

All 11,650,000 shares of our issued and outstanding shares of our common stock are “restricted securities” under Rule 144, promulgated pursuant to the Securities Act of 1933, as amended, but none of those 11,650,000 shares can be resold under Rule 144.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

15

PLAN OF DISTRIBUTION

As of the date of this prospectus, there is no market for our securities. After the date of this prospectus, we expect to have an application filed with the Financial Industry Regulatory Authority for our common stock to be eligible for trading on the OTC Bulletin Board. We do not yet have a market maker who has agreed to file such application. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop. Until our common stock becomes eligible for trading on the OTC Bulletin Board, the selling security holders will be offering our shares of common stock at a fixed price of $0.15 per common share. After our common stock becomes eligible for trading on the OTC Bulletin Board, the selling security holders may, from time to time, sell all or a portion of the shares of common stock on OTC Bulletin Board, in privately negotiated transactions or otherwise. After our common stock becomes eligible for trading on the OTC Bulletin Board, if at all, such sales may be at fixed prices prevailing at the time of sale, at prices related to the market prices or at negotiated prices.

After our common stock becomes eligible for trading on the OTC Bulletin Board, the shares of common stock being offered for resale by this prospectus may be sold by the selling security holders by one or more of the following methods, without limitation:

|

·

|

ordinary brokerage transactions and transactions in which the broker solicits purchasers;

|

|

·

|

privately negotiated transactions;

|

|

·

|

market sales (both long and short to the extent permitted under the federal securities laws);

|

|

·

|

at the market to or through market makers or into an existing market for the shares;

|

|

·

|

through transactions in options, swaps or other derivatives (whether exchange listed or otherwise); and

|

|

·

|

a combination of any of the aforementioned methods of sale.

|

In the event of the transfer by any of the selling security holders of its shares of common stock to any pledgee, donee or other transferee, we will amend this prospectus and the registration statement of which this prospectus forms a part by the filing of a post-effective amendment in order to have the pledgee, donee or other transferee in place of the selling security holder who has transferred his, her or its shares.

In effecting sales, brokers and dealers engaged by the selling security holders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions or discounts from a selling security holder or, if any of the broker-dealers act as an agent for the purchaser of such shares, from a purchaser in amounts to be negotiated which are not expected to exceed those customary in the types of transactions involved. Before our common stock becomes eligible for trading on the OTC Bulletin Board, broker-dealers may agree with a selling security holder to sell a specified number of the shares of common stock at a price per share of $0.15. After our common stock becomes eligible for trading on the OTC Bulletin Board, broker-dealers may agree with a selling security holder to sell a specified number of the shares of common stock at a stipulated price per share. Such an agreement may also require the broker-dealer to purchase as principal any unsold shares of common stock at the price required to fulfill the broker-dealer commitment to the selling security holder if such broker-dealer is unable to sell the shares on behalf of the selling security holder. Broker-dealers who acquire shares of common stock as principal may thereafter resell the shares of common stock from time to time in transactions which may involve block transactions and sales to and through other broker-dealers, including transactions of the nature described above. After our common stock becomes eligible for trading on the OTC Bulletin Board, such sales by a broker-dealer could be at prices and on terms then prevailing at the time of sale, at prices related to the then-current market price or in negotiated transactions. In connection with such re-sales, the broker-dealer may pay to or receive from the purchasers of the shares commissions as described above.

The selling security holders and any broker-dealers or agents that participate with the selling security holders in the sale of the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act in connection with these sales. In that event, any commissions received by the broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

16

From time to time, any of the selling security holders may pledge shares of common stock pursuant to the margin provisions of customer agreements with brokers. Upon a default by a selling security holder, their broker may offer and sell the pledged shares of common stock from time to time. After our common stock becomes eligible for trading on the OTC Bulletin Board, upon a sale of the shares of common stock, the selling security holders intend to comply with the prospectus delivery requirements under the Securities Act by delivering a prospectus to each purchaser in the transaction. We intend to file any amendments or other necessary documents in compliance with the Securities Act that may be required in the event any of the selling security holders defaults under any customer agreement with brokers.

To the extent required under the Securities Act, a post effective amendment to this registration statement will be filed disclosing the name of any broker-dealers, the number of shares of common stock involved, the price at which the shares of common stock is to be sold, the commissions paid or discounts or concessions allowed to such broker-dealers, where applicable, that such broker-dealers did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus and other facts material to the transaction.

We and the selling security holders will be subject to applicable provisions of the Exchange Act and the rules and regulations under it, including, without limitation, Rule 10b-5 and, insofar as a selling security holder is a distribution participant and we, under certain circumstances, may be a distribution participant, under Regulation M. All of the foregoing may affect the marketability of the shares of common stock.

All expenses of the registration statement including, but not limited to, legal, accounting, printing and mailing fees are and will be borne by us. Any commissions, discounts or other fees payable to brokers or dealers in connection with any sale of the shares of common stock will be borne by the selling security holders, the purchasers participating in such transaction, or both.

Any shares of common stock covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act, as amended, may be sold under Rule 144 rather than pursuant to this prospectus.

PENNY STOCK RULES

The Securities Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in “penny stocks” as such term is defined by Rule 15g-9. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The shares offered by this prospectus constitute penny stock under the Securities and Exchange Act. The shares will remain penny stock for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in our company will be subject to the penny stock rules.

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Commission, which: (i) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (ii) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities’ laws; (iii) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and significance of the spread between the bid and ask price; (iv) contains a toll-free telephone number for inquiries on disciplinary actions; (v) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (vi) contains such other information and is in such form as the Commission shall require by rule or regulation. The broker-dealer also must provide to the customer, prior to effecting any transaction in a penny stock, (i) bid and offer quotations for the penny stock; (ii) the compensation of the broker-dealer and its salesperson in the transaction; (iii) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (iv) monthly account statements showing the market value of each penny stock held in the customer’s account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those securities.

17

REGULATION M