Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - LIGHTPATH TECHNOLOGIES INC | lpth-8k_013014.htm |

Exhibit 99.1

L IGHT P ATH T ECHNOLOGIES , I NC . (NASDAQ: LPTH) C OMPANY P RESENTATION A NNUAL SHAREHOLDER M EETING J ANUARY 30, 2014

Leaders in optical and infrared solutions S AFE H ARBOR S TATEMENT This presentation contains forward - looking statements . All statements in this presentation, other than statements of historical facts, which address activities, events or developments that we expect or anticipate will or may occur in the future, including such things as future capital expenditures, growth, product development, sales, business strategy and other similar matters are forward - looking statements . These forward - looking statements are based largely on our current expectations and assumptions and are subject to a number of risks and uncertainties, many of which are beyond our control . Actual results could differ materially from the forward - looking statements set forth herein as a result of a number of factors, including, but not limited to, our products’ current state of development, the need for additional financing, competition in various aspects of its business and other risks described in this report and in our other reports on file with the Securities and Exchange Commission . In light of these risks and uncertainties, all of the forward - looking statements made herein are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized . We undertake no obligation to update or revise any of the forward - looking statements contained in this presentation . NASDAQ: LPTH

Leaders in optical and infrared solutions C OMPANY O VERVIEW Corporate HQ - Orlando, FL China Facility – Jiading Shanghai LightPath Manages Light LightPath Technologies designs, develops and manufactures high volume, mid to low cost laser optics, custom optical modules and thermal imaging assemblies. Diversified product base, multiple markets • Glass aspheric optics - visible and infrared • Collimators, mounted lenses • GRADIUM glass lenses NASDAQ: LPTH China Facility - Zhenjiang

Leaders in optical and infrared solutions Company Product Lines NASDAQ: LPTH Molded Aspheric Lenses Molded Infrared Aspheric Lenses Fiber Optic Collimators Gradium Lenses

Leaders in optical and infrared solutions G LOBAL B LUE - C HIP C USTOMERS NASDAQ: LPTH

Leaders in optical and infrared solutions Market Business Drivers • Visible Lens Business – Optical Network Growth – Internet Mobility • Bandwidth Demand – Mobile Device Growth » Number of devices to exceed world population growth by 2016 (1.4 devices /person) – Preponderance of Video – 50% of all internet traffic in 2012 by 2016 estimated at 70% – Cloud Computing – Software and Infrastructure as a service – Machine to Machine Communication - 10X Growth to $50B by 2018 (metering, POS terminals, tele - health, security, remote monitoring) – Adoption of Digital Technology for Video Distribution • 4k commercial projector ( laser diode illumination, 100+ lenses per projector) – Industrial Tool Market is Back • New Applications – 2D Scanner • Commercial Construction in Asia NASDAQ: LPTH

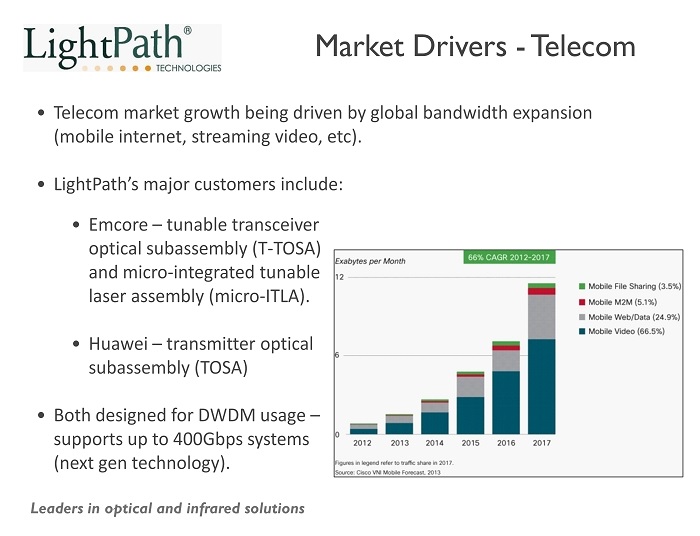

Leaders in optical and infrared solutions LightPath Confidential – DO NOT DISTRIBUTE Market Drivers - Telecom • Telecom market growth being driven by global bandwidth expansion (mobile internet, streaming video, etc ). • LightPath’s major customers include: • Emcore – tunable transceiver optical subassembly (T - TOSA) and micro - integrated tunable laser assembly (micro - ITLA). • Huawei – transmitter optical subassembly (TOSA) • Both designed for DWDM usage – supports up to 400Gbps systems (next gen technology).

Leaders in optical and infrared solutions LightPath Confidential – DO NOT DISTRIBUTE Market Drivers - Telecom $ - $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $400,000 Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 (F) Q4FY14 (F) Telecom Bookings by Quarter

Leaders in optical and infrared solutions LightPath Confidential – DO NOT DISTRIBUTE Market Drivers – China Laser Tools • New construction in mainland china forecasted to continue to increase at a pace of 8.5% per year through 2017* • Growth of housing construction in China as well as worldwide increasing demand for laser assisted construction equipment: • Laser levels • Rangefinders • Laser guides • Laser plum lines • Laser based surveying instruments • LightPath Shanghai’s customers include HDOEI, Chervon , Bosch, Black & Decker, Geo, Ruide , Laitz , Lasense , Huanic , Zhongwei , and Precaster * Source: Construction Outlook in China (2013), The Freedonia Group Laser Levels and Rangefinders

Leaders in optical and infrared solutions LightPath Confidential – DO NOT DISTRIBUTE Market Drivers – China Laser Tools - 50,000 100,000 150,000 200,000 250,000 300,000 350,000 400,000 450,000 Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 (F) Q4FY14 (F) Quantity of Laser Tool Lenses Sold from LightPath Shanghai Factory

Leaders in optical and infrared solutions LightPath Confidential – DO NOT DISTRIBUTE • Laser Digital Cinema ready to launch in CY2014* • 40,000 theatre screens in US (120K worldwide) • $40K ASP for laser projector • $2.4B potential market assuming only 50% penetration • Major players* • Christie (40% market share) working with • Barco current customer • Sinolaser current customer • Sony captive supply of optics • NEC captive supply of optics • Unclear which suppliers will survive long term - strategy is to get design wins at as many suppliers as possible Market Drivers – Digital Cinema Sinolaser 35,000 lumen cinema projector (4K) Barco 33,000 lumen cinema projector (4K) * Source: Laser MarketPlace Forecast (2014) – Laser Focus World

Leaders in optical and infrared solutions LightPath Confidential – DO NOT DISTRIBUTE Market Drivers – Digital Cinema 0 10000 20000 30000 40000 50000 60000 70000 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 (F) Q4FY14 (F) Digital Cinema Revenue Sinolaser Barco Revenue from Red Digital Cinema Inc excluded due to cancelation of production line

Leaders in optical and infrared solutions Market Business Drivers • Infrared Lens Business – Shift to Commercial Growth – Four Key Markets – 23% Shipment Growth • Automotive, Surveillance, Low - end thermography & IR Imaging in Smart Phones – Low Cost is the key – Molding is an Enabling Technology for Commercial Growth Opportunities NASDAQ: LPTH

Leaders in optical and infrared solutions IR M ARKET D RIVERS • Significant cuts in the US military budget – S equestration and reduction of military operations in theater have had a negative impact on the global military market and the need for IR imaging applications – US budget portion of the global market is approximately 80% • M ilitary market decline for uncooled IR imaging has created a shift toward the commercial sector faster than expected Yole Développement , Sept 2013

Leaders in optical and infrared solutions IR M ARKET D RIVERS – C ON ’ T • Technological improvements of uncooled sensors, processes and wafer - level packaging are key to steady price decline in infrared imaging and unit growth has not kept pace with pricing decreases • The trend toward smaller uncooled infrared sensors fits the need for lower - cost and lower - resolution devices because of both established and new consumer applications such as Personal Vision, Smartphones and IR ‘Occupancy ’ sensors • The Thermography sector’s growth is being driven by the ultra - low - end market which consists of low - resolution cameras for basic radiometric purposes • Sales growth of IR imaging security applications has been below expectations because this market took longer than expected to develop

Leaders in optical and infrared solutions IR M ARKET D RIVERS – C ON ’ T • Security camera sales are slowly increasing as consumers become used to the higher (than visible) IR camera pricing, and realize the benefits of thermal threat detection, as well as new competition in this market…..such as the introduction of affordable < $ 2,000 cameras initiated by DRS and followed by FLIR • Major manufacturers (such as DRS, FLIR, Raytheon, ULIS, GWIC) have now moved to 8” dia. wafer production lines instead of 6” dia. to reduce manufacturing costs

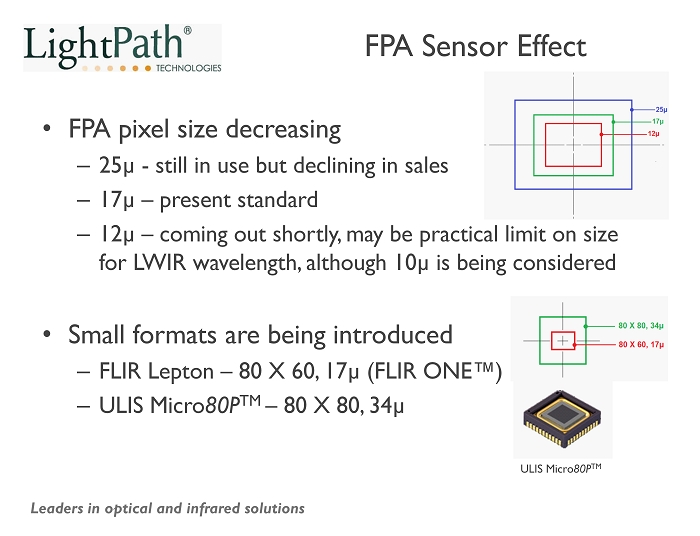

Leaders in optical and infrared solutions FPA Sensor Effect ULIS Micro 80P TM • FPA pixel size decreasing – 25µ - still in use but declining in sales – 17µ – present standard – 12µ – coming out shortly, may be practical limit on size for LWIR wavelength, although 10µ is being considered • Small formats are being introduced – FLIR Lepton – 80 X 60, 17µ (FLIR ONE ™) – ULIS Micro 80P TM – 80 X 80, 34 µ

Leaders in optical and infrared solutions Target Markets for Penetration – Con’t • Commercial – Homeland Security & Border Patrol – Police and Surveillance – EVS (Enhanced Vision System)

Leaders in optical and infrared solutions Target Markets for Penetration – Con’t • Commercial – Site Security – Fire – “Dumb” sensors • HVAC • Vehicle or room occupancy detection • Electrical enclosure monitoring • Gas plumbing monitoring

Leaders in optical and infrared solutions Target Markets for Penetration – Con’t • Commercial – Automotive o Driver’s Vision – Marine – Medical

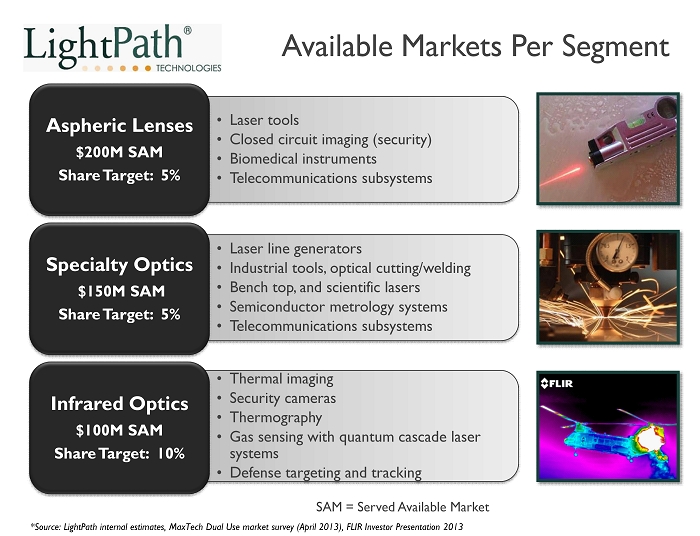

Available Markets Per Segment • Laser tools • Closed circuit imaging (security) • Biomedical instruments • Telecommunications subsystems Aspheric Lenses $200M SAM Share Target: 5% • Laser line generators • Industrial tools, optical cutting/welding • Bench top, and scientific lasers • Semiconductor metrology systems • Telecommunications subsystems Specialty Optics $150M SAM Share Target: 5% • Thermal imaging • Security cameras • Thermography • Gas sensing with quantum cascade laser systems • Defense targeting and tracking Infrared Optics $100M SAM Share Target: 10% SAM = Served Available Market *Source: LightPath internal estimates, MaxTech Dual Use market survey (April 2013), FLIR Investor Presentation 2013

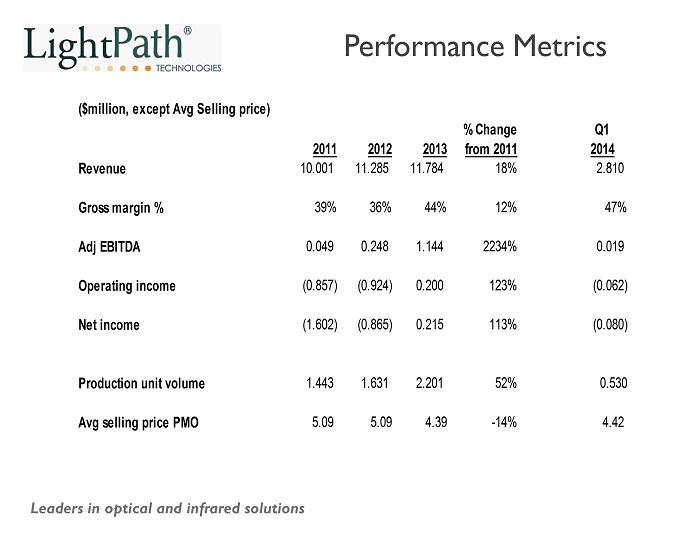

Leaders in optical and infrared solutions Performance Metrics Confidential 22 ($million, except Avg Selling price) % Change Q1 2011 2012 2013 from 2011 2014 Revenue 10.001 11.285 11.784 18% 2.810 Gross margin % 39% 36% 44% 12% 47% Adj EBITDA 0.049 0.248 1.144 2234% 0.019 Operating income (0.857) (0.924) 0.200 123% (0.062) Net income (1.602) (0.865) 0.215 113% (0.080) Production unit volume 1.443 1.631 2.201 52% 0.530 Avg selling price PMO 5.09 5.09 4.39 -14% 4.42

Market Capitalization & Balance Sheet Highlights Share Price $1.21 ADTV (90) 202,073 Basic Shares O/S 13,794,114 Market Cap $16,690,878 Add: Debt 0 Less: Cash 2,879,201 Enterprise Value $13,811,677 Capitalization Structure Capitalization Structure a/o 9/30/2013 Cash & Equivalents $2.88MM Working Capital $2.85MM Total LT Debt $0MM Quick Ratio 2.61x Disclosed Backlog $4.42MM Gross Tax Carry Forward ~$93MM NOL Tax Carry Forward ~$33MM Balance Sheet Highlights Capital Structure Notes : LightPath has an additional 2 . 45 M warrants at a weighted average exercise price of $ 1 . 36 (ranging between $ 0 . 87 - $ 2 . 48 ) relating to capital transactions since fiscal 2009 . The warrants have expiration dates between Dec 2013 - Dec 2017 . Options and Restricted shares awarded represent 1 . 42 M common shares, assuming full vesting and exercise . The company holds 848 , 012 shares in reserve under its incentive plan .

Leaders in optical and infrared solutions Company Highlights • Public company - NASDAQ Listing • Optics company with wholly owned manufacturing facility in China – Low cost manufacturing platform – Direct access to Asian markets – World - class custom design capability • Low cost, high volume manufacturer of laser optics and thermal imaging assemblies – Diversified product mix, global sales footprint – Blue chip customer base – Taking 25+ years of market experience to new, high volume customers and applications, larger markets • Significant growth opportunities – Cost structure offers access to larger markets • Telecommunications, digital imaging, industrial tools, medical – Molding is a key enabling technology to the commercialization of new applications in infrared systems • Low cost thermal imaging – funded by DARPA • Gas sensing, i nfrared lasers, spectroscopy • Security , defense, paramilitary, automotive night vision NASDAQ: LPTH