Attached files

| file | filename |

|---|---|

| EX-10.1 - EX10_1 - Well Power, Inc. | ex10_1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2014

Well Power, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 000-53985 | 61-1728870 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

11111 Katy Freeway - Suite # 910 Houston, Texas |

77079 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (713) 973-5738

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 — Entry into a Material Definitive Agreement

On January 22, 2014, Well Power, Inc., a Nevada corporation (the “Company”), entered into an Exclusive License and Distribution Agreement (the “License Agreement”) with ME Resource Corp. (“MEC”), a Canadian publicly listed company. The License Agreement is for five (5) years from the date of execution. By mutual agreement, the License Agreement may be extended for two (2) successive periods of an additional five (5) years each.

Under the terms of the License Agreement, MEC appointed the Company as its exclusive distributor of Wellhead Micro-Refinery Units (MRUs) for the initial state of Texas (“Territory”) and thereafter the first right of refusal on additional territories in the US, provided the Company maintains the financial, operational, and technical resources to expand into those additional territories (the “License”). The MRU technology relates to a method and an apparatus, which make use of heterogeneous catalysts, beginning with the partial oxidation of methane to produce synthesis gas followed by a second catalytic reaction to produce chemicals and/or heat/energy and/or water. In other terms, the Company’s goal is to provide an economically viable solution to develop wasted gas opportunities in the oil and gas sector into revenue streams with minimal capital expenditure. The Company hopes to be able to provide a novel and economically viable solution to utilize wasted natural gas resources for remote power and fuel generation while reducing greenhouse gas emissions. The License Agreement is limited to only oil and gas producers, operators and service providers.

The Company’s cost is $800,000 per MRU (the “Unit Cost”) which includes a container sized unit with the capability to process 100 mcf/day of natural gas (with H2S of no more than 50ppm) into engineered fuels (up to 10 bbls/day), clean power (min 35kW/max 70 kW) and fracking quality water (up to 80bbls/day). MEC retains the right to increase this cost if there are significant additional expenses in the manufacturing process but to no more than manufacturing cost plus 40%.

The Company agreed to consideration of $400,000, payable to MEC in two installments: $100,000 within thirty (30) days of the filing of this Current Report on Form 8-K and the balance of $300,000 within ninety (90) days after filing this Current Report on Form 8-K. The consideration of $400,000 as part of the Unit Cost will be applied to the technical and engineering development of the first demonstration MRU in the territory and may be used to develop catalyst for specific engineered fuels. Upon mutual consent of both parties, MEC will retain ownership and provide MRUs as a leased unit over a term of 10 years at 50% of Unit Cost and earn 50% of the net revenue from the operation of each MRU. The parties anticipate that this arrangement will occur in most cases.

All

intellectual property of MEC during the term related to promotional materials was licensed to the Company on a royalty-free basis.

The License to the Company includes all improvements to the licensed products.

To keep the exclusive License, the Company must meet minimum purchase requirements. The Company must purchase two (2) MRUs in the first year of the License Agreement and four (4) MRUs in each subsequent year thereafter. The License Agreement may be terminated by either party if a party commits a material breach that is not cured in thirty (30) days after the non-breaching party provides a notice of the breach.

The foregoing description of the License Agreement does not purport to be complete and is qualified in its entirety by reference to the complete text of the agreement, which is filed with the Securities and Exchange Commission as Exhibit 10.1 to this Current Report on Form 8-K.

Item 2.01 - Completion of Acquisition or Disposition of Assets

The Company entered into a License Agreement, effective January 22, 2014, with MEC and has obtained the exclusive License to distribute the micro refinery units in Texas. Reference is made to the disclosure set forth under Item 1.01 of this Current Report, which disclosure is incorporated herein by reference.

The Company’s arrangement with MEC is solely that of a license agreement. The Company did not acquire any operations of MEC, the Company did not enter into any joint venture or similar arrangements with MEC, and the Company did not hire any of MEC’s employees. MEC remains independent from the Company, as the Company remains independent from it. The Company has no equity interest in MEC, and has no rights of control over its management, such as the appointment of officers and directors. The Company does not have any control over MEC’s daily operations. The development and the manufacturing of products is the responsibility of MEC. www.meresourcecorp.com

Set forth below is a description of the Company’s business and other Form 10 information. Because the Company did not merge into or acquire any formerly operating business, there is no audited financial statements or pro forma financial information that can be updated in this Form 8-K.

DESCRIPTION OF BUSINESS

The Company has acquired an exclusive license from MEC, a Canadian publicly listed company that is creating mobile and scalable Wellhead Micro-Refinery Units (MRUs) deployable close to the wellhead to process raw natural gas into liquid fuels and clean power. As a result of the License Agreement, the Company is now a development stage company seeking to commence the new business of distributing MRUs in the State of Texas and from there into other geographical areas. See the description of the License Agreement in Item 1.01, which is incorporated by reference.

The Company is looking to position itself as a technology company, which will provide oil and gas producers and operators a solution to process otherwise wasted natural gas, including stranded, shut-in, flared and vented gas and produce valued end-products including Engineered FuelTM (diesel, diluents, synthetic crude) and electrical power. The Company has secured an exclusive License for a novel method and apparatus, the MRU, for producing chemicals, heat, energy and water from a methane-containing gas. The innovative method and apparatus makes use of heterogeneous catalysis in a single-vessel, beginning with the partial oxidation of methane to produce synthesis gas followed by a Fischer-Tropsch reaction to produce chemicals and other end products with no excess hydrogen.

During oil production, associated gas, a by-product, is often flared due to safety concerns, financial barriers to implementing flare reduction projects, low domestic gas prices, lack of incentives or market and financial barriers. It is also flared because it is not economically feasible to transport the commercial product to the customer. In remote areas, or areas without pipe-line infrastructure, the gas is stranded. Both these resources are waste gas with no-value and significant emissions of greenhouse gases. The MRUs will allow producers and operators the ability to take this no-value resource and create revenue streams, while simultaneously realizing a significant reduction in GHG emissions.

| 2 |

Each 100 Mcf of natural gas processed by the MRUs is expected to produce 10 barrels of Engineered FuelsTM, provide up to 70 kW of continuous power for use near the wellhead, and water which can be used for fracking or enhance oil recovery. When applied as a flaring solution, each 100 Mcf is expected to have the ability to reduce up to 1224 tonnes of CO2 emissions per year.

The Engineered FuelsTM produced by the MRUs range from diluents (C5 – C10) to diesel (C12-C24). Diluents are solvents that are blended with heavy oil to reduce the viscosity and allow for easier transport through pipelines and via tanker and demand prices as high as $200/bbl. Diesel prices are approximately $100/bbl, increasing in remote areas. The MRUs, producing 10/bbl of Engineered FuelsTM /day is estimated to generate revenues of between $365,000-$730,000 per annum, and, dependant on the cost of power and transport, the 70kW produced by the MRU could produce an additional $122,000 per annum.

The Railroad Commission of Texas issued 3,012 flaring permits in 2013 alone. Assuming 100 mcf/day flow of raw natural gas, the MRUs could be applied to these flaring sites, as well as to sites previously issued permits. In addition, the MRUs can be applied to stranded reserves for economic production and for temporary tie-ins where infrastructure does not yet exist. The U.S. Energy Information Administration reports that 47,530 Million Cubic Feet of natural gas was flared and vented in 2012 in Texas alone. Estimates of stranded reserves are as high as 6,000 Trillion Cubic Feet worldwide.

The Technology

An MRU is an assembly of proven commercial technologies with a proprietary micro synthesizing system as the key technology component. With the addition of catalytic reactors and power generation components, various liquid and power outputs can be achieved. The Company’s goal is to provide an economically viable solution to develop wasted gas opportunities in the oil and gas sector into revenue streams with minimal capital expenditure. The Company hopes to be able to provide a novel and economically viable solution to utilize wasted natural gas resources for remote power and fuel generation while reducing greenhouse gas emissions.

MEC and the Company, along with those involved in the manufacturing process, are currently working to develop a finished MRU product. The product is still in development, which is ongoing, and a finished MRU is expected to occur within a year. As such, the Company will not be able to realize any revenue from the sale of MRUs until the development has completed and a commercialized product is ready for launch.

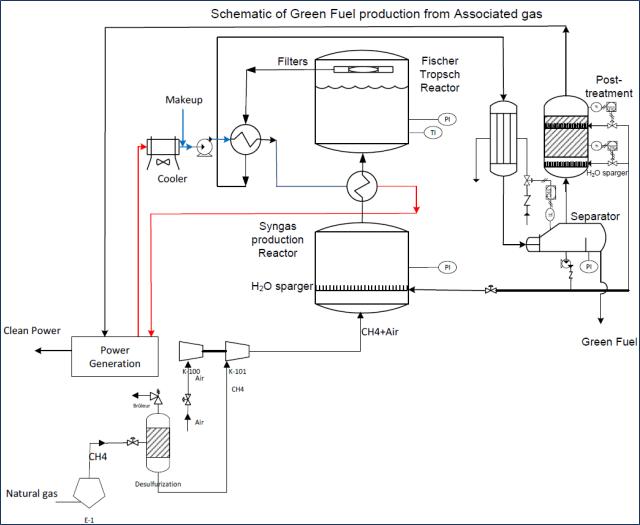

The objective is to produce green fuel from associated natural gas and thereby reduce emissions due to flaring and venting. The methane is first converted to CO and hydrogen (syngas), followed by Fischer-Tropsch in order to produce green fuel. Power is produced from heat generated by endothermic catalytic reactions and combustion of unreacted light hydrocarbons and C02. The final unit will be mobile, modular and economically feasible.

A MRU will convert associated gas into the following valued end products while reducing flared gas.

| 1) | Engineered Fuels: Light Synthetic Crude that can be used for blends or even fuels as high as $200/bbl. Each 100 mcf of natural gas will produce up to 10 barrels/day of Engineered Fuels. |

| 2) | Power: To provide up to 70 kW of continuous Power for use near the wellhead. |

| 3) | Flaring Reduction: Each MRU will have the ability to reduce up to 1224 tonnes CO2 per year. |

| 4) | Usable Water: Each MRU will produce 80 barrels/day of water that could be used for fracking or EOR. |

| 3 |

| · | Natural gas and oil separator |

Natural gas is recovered from petroleum fluids (+ water, +impurities) in the first separator. The condensable are returned to the pipeline. The separator contains a high efficiency mist eliminator to remove carry over water particles.

| · | Gas treatment column |

Sulphurous compounds (H2S, COS, CS2, etc.), acids and other impurities are then removed in a gas treatment column.

| · | Gas compressor |

The conditioned gas is compressed to approximately 20 bar in a gas compressor.

| · | Air Compressor |

Air is also compressed to reaction pressure (of about 20 bar) in a second larger compressor.

| · | Reaction vessel |

The natural gas and air are fed to the bottom of the syngas production vessel. The reaction is exothermic and controlled solely by the partial pressures of the reaction gases. The gases pass through the syngas production fluidized bed where they contact the FT catalyst and react. The temperature is controlled at around 250oC with a set of cooling coils installed in the reactor. The gases pass through the bed and into the freeboard. The gas velocity is sufficiently low so as to minimize the entrainment of catalyst powder to the filters. There is a provision to periodically blow back the filters as the pressure drop increases. The blow back sequence is timed in such a way as not to disrupt production.

| · | The first waste heat boiler |

The gas stream exits the reactor and is further cooled with water coming from air cooler in a waste heat boiler. The gas temperature drop in the waste heat boiler is about 100ºC. The produced steam is fed to steam turbine for power generation.

| · | Condenser |

The exit gas stream from the first waste heat boiler is cooled to 60ºC in the condenser.

| · | Three phase separator |

The mixture is then separated into three phases. The gas phase goes to a post treatment reactor to combust CO and other light hydrocarbons. The dense aqueous phase is either fed back to the reactor to help control the temperature (as well as the reaction kinetics) or it is fed to the post treatment reactor to control the temperature rise. The organic phase (+ some water) is fed to the pipeline or a storage tank, or separated to produce drop in diesel.

| · | Post treatment unit |

The gas phase coming from three phase separator contains light hydrocarbons and CO which are combusted to produce hot gas for steam generation in the second waste heat boiler.

| · | Gas expander |

The hot exit gas from the second waste heat boiler is fed to a gas expander to produce power for the gas compressors.

· Steam Turbine

The steam turbine is used to generate power for gas compression resulting from steam generated in the cooling coils in the fluidized bed reactor and waste heat boilers.

| · | Cooler |

The low pressure steam exit from steam turbine goes to a cooler to produce water for cooling coils and waste heat boilers.

| 4 |

Below is a schematic of the MRU and the beneficial by products it creates.

Product Development and Manufacturing

Under the License Agreement, the Company will pay MEC $400,000 for its exclusive License, which money will go toward the Unit Cost of an MRU at $800,000 or, alternatively, a revenue sharing arrangement where MEC leases the MRU at 50% Unit Cost and shares in 50% of the net revenue generated. In either event, this money will be applied to the technical and engineering development of the first demonstration MRU in the territory and may be used to develop catalyst for specific engineered fuels.

MEC has contracted to use a production facility in Alberta that will facilitate the mass fabrication of the MRUs.

MEC has formed a joint venture company with ABS Electric Group Ltd. of Alberta (“ABS”). ABS is a fully integrated power generation and electrical company in the Alberta oil and gas industry, which maintains and constructs electrical and power systems from millivolt to high voltage applications. ABS has 12 years of experience within the Alberta oil patch, employs 80 people with over 40 field-service vehicles and a 40,000 square foot fabrication and manufacturing facility. www.abselectric.com

The joint venture company is Waste Stream Energy Corp. (“WSE”), which has been granted a license (the “WSE License”) for MEC’s MRU for the territory of Canada. As per the terms of the joint venture and the WSE License, WSE will facilitate the commercialization and manufacturing of the MRUs. ABS will make available a dedicated staff, its full service and maintenance field teams, fabrication facilities and in-kind contributions to the joint venture to further this development. ABS ‘s existing clientele, which include Kinder Morgan, Pennwest and SNC Lavalin, as well as their valuable relationships with individual site operation managers, can be leveraged to assist in the development, commercialization and the eventual operation of the MRUs.

Research & Development Project Development Plan

The Company, in conjunction with MEC and their respective partners, has established a detailed timeline for the development and deployment of the Licensed technology. Below are the timelines up to the commercialization of the technology. Units will be deployable during Phase I and will be optimized with the research and development and catalyst optimization carried out at Ecole Polytechnique de Montreal. Construction and manufacturing partners, ABS Electric Group Inc and Waste Stream Energy, both in Alberta, will construct the units concurrently with the research program at Ecole Polytechnique.

| 5 |

Project Lead

Dr. Gregory Patience, Director, project oversight, Specialist in Catalytic Reactors. Professor at École Polytechnique de Montréal, PQ in the Department of Chemical Engineering. At École Polytechnique de Montréal Dr. Patience established a laboratory on heterogeneous catalysis and fluidization. His research interests include catalysis, gas-solids fluidization, reactor design and scale-up, circulating and turbulent fluidized beds and process design. Dr. Patience has extensive experience acting as a consultant to industry, specializing in new technology development, commercialization, process economics and catalysis.

Lab Scale and Bench Scale Proof-of-Concept Demo |

Completed by École Polytechnique de Montréal. This phase reviewed and engineered the novel MRU technology at a lab and bench scale and allowed for preliminary patent applications for certain processes and integrations. |

2014 Timeline

| Pilot Demonstration | This step includes the design and construction of our unit, engineering process design and mass catalyst production. |

| Phase IA | |

| Objective and Milestones | Optimization of baseline to optimization. |

| Catalyst optimization to increase conversion efficiency for both syngas and output conversion. | |

| •

Bulk catalyst, compressor/methane gas/lab supplies

• Lab Monitoring • Bench scale reactor to test stability • Separation Engineering, HAZOP and Safety • EPDM Indirect Cost and Administration | |

Catalyst Development and Catalytic Conversion

2015 Timeline

| 6 |

Phase IB: Optimization Phase

| Objective and Milestones | Ensure safe and unmanned operation completed |

Includes Hazard and Operability Study (HAZOP), examination of process/operations to identify and evaluate risks, stability testing, instrumentation, including SCADIA, and Programmable Logic Controller modifications for the pilot unit, stress tests and operations manual creation, as well as study of economical and environmental benefits.

| |

• Container Upgrades +Storage Tanks • On Site monitoring 120 days + Site Prep and Deployment • Trailer, Container, Misc Tools • Engineering, HAZOP and Safety, Monitoring | |

Safety and Testing

ABS Electric Group Inc, Full staffing dedication

Well Power Inc. and MEC have partnered with ABS Electric, a fully integrated electrical company located in Calgary, Alberta.

Barriers to Entry

There are possible barriers to broad use of MRUs.

1) Economic Barriers such as:

- Economic Feasibility of the Capital Expenditure Per Unit: Each MRUs currently has to be custom built as a solution to the processing raw natural gas. As the Licensor develops the manufacturing process and increases the production volumes, the cost to fabricate each MRUs, and therefore capital expenditure will be reduced through economies of scale.

- Value of the Energy Outputs: The economic viability of the technology is correlated to the revenue from green fuel and the generated power.

| 7 |

Technical Barriers:

- Capacities of Feedstock: The current “sweet spot” for an MRUs is between 75 and 250 Mcf/d per unit. The feedstock must be consistent.

- Continuous Source of Gas Stream: The feedstock flow must be a steady stream since the steam reformer cannot be turned off and on immediately. Although the ideal solution maybe temporary storage tanks, this solution may not be feasible in circumstances such as the flaring of test gas wells or emergency release of gas at gas plants.

Intellectual Property Protection against Competition:

| · | The MRU technology is patented protected. |

| · | Certain items of the design such as the catalyst composition will be kept a trade secret and will be very difficult to reproduce. |

Flaring Regulations

Flaring in Texas is regulated by the Rail Road Commission of Texas. The link to the Regulations of Flaring by the Rail Road Commission of Texas can be found at http://www.rrc.state.tx.us/about/faqs/flaringfaq.php and some of the answers to the frequently asked questions on the Flaring Regulations from the Rail Road Commission of Texas are as follows:

1. Why does RRC allow flaring?

The Commission’s Statewide Rule 32 allows an operator to flare gas while drilling a well and for up to 10 days after a well’s completion for operators to conduct well potential testing. The majority of flaring permit requests received by the Commission are for flaring cashinghead gas from oil wells. Permits to flare from gas wells are not typically issued as natural gas is the main product of a gas well.

Flaring of casinghead gas for extended periods of time may be necessary if the well is drilled in areas new to exploration. In new areas of exploration, pipeline connections are not typically constructed until after a well is completed and a determination is made about the well's productive capability. Other reasons for flaring include: gas plant shutdowns; repairing a compressor or gas line or well; or other maintenance. In existing production areas, flaring also may be necessary because existing pipelines may have no more capacity. Commission staff issue flare permits for 45 days at a time, for a maximum limit of 180 days.

See

specifics on Statewide Rule 32 at the following link under §3.32 (Gas Well Gas and Casinghead Gas Shall Be Utilized for Legal

Purposes):

http://info.sos.state.tx.us/pls/pub/readtac$ext.ViewTAC?tac_view=4&ti=16&pt=1&ch=3&rl=Y

2. Why does RRC grant extensions to flaring permits?

If

operators want to pursue an additional 45 days past the initial 45-day flare permit time period, they must provide documentation

that progress has been made toward establishing the necessary infrastructure to produce gas rather than flare it. A copy of the

Statewide Rule 32 Exception Data Sheet can be found online at:

http://www.rrc.state.tx.us/forms/forms/og/pdf/swr32datasht.pdf

The most common reason for granting an extension to an initial flaring permit is the operator is waiting for pipeline construction scheduled to be completed by a specified date. Other reasons for granting an extension include operators needing additional time for well cleanup and pending negotiations with landowners.

3. Does the Commission allow long-term flaring?

The majority of flaring permit requests that the Commission receives are for flaring cashinghead gas from oil wells. The Commission does not issue long-term permits for flaring from natural gas wells as natural gas is the main product of a gas well. Both oil and gas wells are allowed under Commission rules to flare during the drilling phase and for up to 10 days after a well’s completion for well potential testing. Rare exceptions for long-term flaring may be made in cases where the well or compressor are in need of repair.

4. Does the Commission track how much has been flared?

Operators are required to report to the Commission volumes of gas flared on their monthly Production Report form (PR form). The PR forms include actual, metered volumes of both gas well gas and casinghead gas reported by operators at the lease level.

| 8 |

5. How many flaring permits have been issued in Texas?

Total flaring permits approved statewide by the Commission for the past four fiscal years is as follows:

| FY 2013 | 3,012 |

| FY 2012 | 1,963 |

| FY 2011 | 651 |

| FY 2010 | 306 |

| FY 2009 | 158 |

| FY 2008 | 107 |

To put these numbers in context, Texas currently has more than 144,000 active oil wells, so flaring involves just a small fraction of the state’s oil wells.

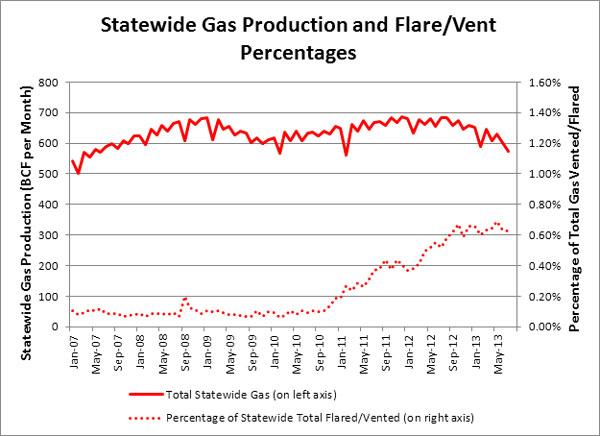

6. What percentage of total gas is reported flared?

Of the total amount of gas reported to the Commission, approximately 0.4 percent is flared/vented gas. The chart below reflects the percentage of total gas flared/vented.

| 9 |

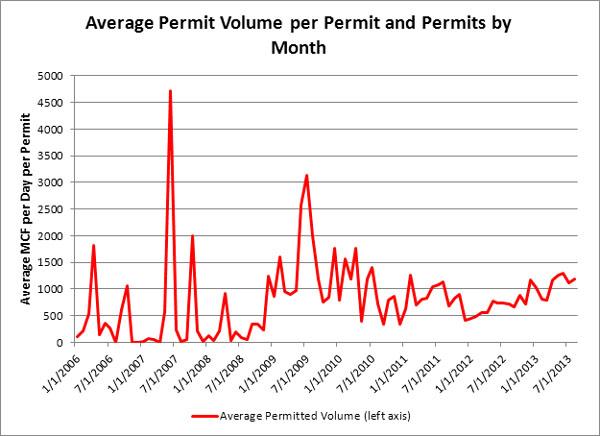

7. What is the average permitted flare volume?

The chart below reflects the average permitted flare volume by year.

8. How does RRC regulate flaring?

The Commission requires operators to obtain a permit to flare for most short-term requests and in every instance where the request is for an extended time period. Our trained staff works closely with operators to ensure compliance with Commission rules. RRC District Offices have inspectors available to witness operations, conduct inspections, provide information about permitting requirements, and ensure compliance with permits issued by the Commission.

Marketing and Customers

The Company can apply its technology to associated gas. Stranded gas is found in natural gas resources around the world where there is no gas processing or infrastructure available. Since infrastructure is permanent and requires a huge amount capital expenditure in investment, these stranded gas deposits are too small for conventional development but ideal for MRUs.

Stranded Gas is gas that has been discovered, but remains unusable for either physical or economic reasons. This phenomenon typically occurs when smaller reserves of gas are found, or the reserves are far from land. As gas pipeline infrastructure is expensive, small or distant quantities of gas often do not financially justify the building of a pipeline.

Associated Gas is gas that is found together with oil.

While oil is easy to transport due to its liquid composition, the associated gas typically does not warrant the investment of

pipeline infrastructure. Associated gas is typically flared, at great expense to the owner, as well as the environment.

Associated gas may also be re-injected to the well. Either way, a valuable resource is not being properly utilized.

Approximately 40% of the world's natural gas reserves are classified as stranded gas. It is estimated that there are currently 3,000 trillion cubic feet of stranded natural gas across the globe. The amount of energy that could be provided to the world with this quantity of natural gas is equivalent to the energy represented by the oil reserves of Saudi Arabia. Stranded gas therefore represents billions of dollars in unutilized assets.

The Company’s Licensed technology can be applied to various projects within the Texas resource extraction industry. Possible applications include: new well sites where flaring reduction and power are required; flaring sites where heavy oil is produced and diluent is necessary; flaring sites that require drop diesel where the Company can separate drop in diesel from Green Fuel and have residual hydrocarbons continue down the pipeline; units that operate with high levels of H2S and other various condensates; and coal bed methane sites.

| 10 |

The Company has partnered with MEC to deploy MRUs in Texas. The License Agreement is limited to only oil and gas producers, operators and service providers. Therefore, our Company’s marketing efforts will be to target:

- Oil Producers that are currently trying to economically reduce the amount of flared gas and require power and engineered fuels for remote oil production.

- Oil and Gas Service Providers which currently could use MRUs as an extension of their existing services to oil and gas producers.

- Concession Holders with Natural Gas Resources deemed to be undervalued for current production.

Competition

The Company believes it offers a unique product with little direct competition in terms of the MRU’s scale and size (processing between 75Mcf-250Mcf, and more when put in parallel, and producing 10bbl/day in Engineered FuelsTM and power), its transportability and mobility, its modular design, and most significantly its price, with initial payback estimates of 3 years. Other companies are developing small scale gas-to-liquid (GTL) solutions which are essential small scale gas processing plants producing 1000s bbl/day. The Company also has a technical advantage, as its patent pending technology is novel in its design, maintenance, cost and price. Below are companies engaged in small scale GTL technologies.

| Competition | Competitive Advantage |

| Compact GTL | Smaller modular and mobile units. |

| www.compactgtl.com | |

| Compact GTL starts from 25 tonne module. | |

| Velocys | Lower manufacturing costs. |

| www.velocys.com/ocge06.php | |

Utilizing catalytic coating on the surface of reactor plates, rather than conventional catalytic pellets for easy sourcing;

|

|

The reactor is of plate heat exchanger design incurring high construction cost with welding or brazing;

|

|

For pressurized operation, the cubical structure of the reactor needs to be placed in outer pressure vessels incurring extra cost.

|

|

Gastechno www.gastechno.com Short development and field operation track record since 2006;

Production of a specific mixture of Methanol, Ethanol with Formaldehyde;

Requiring on-site extraction of O2 from air to yield high quality product;

Process incurring relatively high pressure and temperature.

|

Lower manufacturing costs.

Higher quality chemical production.

|

| 11 |

Intellectual Property

The technology which the Company has Licensed is patent protected, and the Licensor’s patent application information is as follows:

Patent Information:

Patent Application in United States No. 61/899,523

Filing Date: November 4, 2012

Title: METHOD AND APPARATUS FOR PRODUCING CHEMICALS FROM A METHANE COINTAINING GAS

Patent Summary:

The present invention relates to a method and an apparatus for producing chemicals and/or heat/energy and/or water from a methane-containing gas. More specifically, the present invention is concerned with a method and an apparatus, which make use of heterogeneous catalysts, beginning with the partial oxidation of methane to produce synthesis gas followed by a second catalytic reaction to produce chemicals and/or heat/energy and/or water.

Employees

The Company has appointed Dr. Cristian Neagoe, a key member to its board due to his technical background and expertise. In addition, the Company plans on assembling a board of directors and a team of advisors whom are industry leaders in the oil and gas field and that can market and sell the product to achieve commercialization in the industry.

The Company also plans to strategically put together a team with expertise in the necessary areas to successfully commercialize and bring to market this green house reducing technology.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Reference is made to the disclosure in the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” set forth in the Form 10-K of the Company, filed with the Securities and Exchange Commission on July 26, 2013, and the disclosure in the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” set forth in the Form 10-Q of the Company, filed with the Securities and Exchange Commission on December 13, 2013, which is incorporated herein by reference. Such disclosure is supplemented by the information set forth in this Current Report on Form 8-K.

PROPERTIES

The Company currently does not own any real properties.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The disclosure in the section entitled “Security Ownership of Certain Beneficial Owners and Management” set forth in the Form 10-K of the Company, filed with the Securities and Exchange Commission on July 26, 2013, is incorporated herein by reference.

DIRECTORS AND EXECUTIVE OFFICERS

The disclosure in the section entitled “Directors, Executive Officers and Corporate Governance” set forth in the Form 10-K of the Company, filed with the Securities and Exchange Commission on July 26, 2013, is incorporated herein by reference.

EXECUTIVE COMPENSATION

The disclosure in the section entitled “Executive Compensation” set forth in the Form 10-K of the Company, filed with the Securities and Exchange Commission on July 26, 2013, is incorporated herein by reference.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

The disclosure in the section entitled “Certain Relationships and Related Transactions, and Director Independence” set forth in the Form 10-K of the Company, filed with the Securities and Exchange Commission on July 26, 2013, is incorporated herein by reference.

LEGAL PROCEEDINGS

The disclosure in the section entitled “Legal Proceedings” set forth in the Form 10-K of the Company, filed with the Securities and Exchange Commission on July 26, 2013, is incorporated herein by reference.

| 12 |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND

ISSUER PURCHASES OF EQUITY SECURITIES

The disclosure in the section entitled “Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities” set forth in the Form 10-K of the Company, filed with the Securities and Exchange Commission on July 26, 2013, is incorporated herein by reference.

Description of Securities

The disclosure in the section entitled “Description of Securities” set forth in the Form SB-2 of the Company, filed with the Securities and Exchange Commission on June 22, 2007, is incorporated herein by reference.

INDEMNIFICATION OF DIRECTORS AND OFFICERS.

Section 78.7502 of the Nevada Revised Statutes and Article XI of our Bylaws permit us to indemnify our officers and directors and certain other persons against expenses in defense of a suit to which they are parties by reason of such office, so long as the persons conducted themselves in good faith and the persons reasonably believed that their conduct was in our best interests or not opposed to our best interests and, with respect to any criminal action or proceeding, had no reasonable cause to believe their conduct was unlawful.

Indemnification is not permitted in connection with a proceeding by us or in our right in which the officer or director was adjudged liable to us or in connection with any other proceeding charging that the officer or director derived an improper personal benefit, whether or not involving action in an official capacity.

FINANCIAL INFORMATION

No financial information, including pro forma financial statements, are required to be filed with this Current Report on Form 8-K to reflect the entry into the License Agreement and the change of business plan being pursued in respect of the distribution of the MRUs.

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTEMTN OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENT OF CERTAIN OFFICERS

On January 27, 2014, Melissa Lopez and Imelda Tin resigned as Directors of the Company. There was no known disagreement with either on the Company’s regarding our operations, policies, or practices.

ITEM 5.06 CHANGE IN SHELL COMPANY STATUS

The Company has been classified as a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act) until immediately before the execution of a License Agreement. Effective as of January 22, 2014, the Company has commence a new business venture by entering into the License Agreement set forth under Items 1.01 and 2.01 of this report, which disclosure is incorporated herein by reference. Consequently, the Company believes that the transaction has caused the Company to cease being a shell company.

SECTION 8 – OTHER EVENTS

Following the transactions described above, the Company’s corporate offices have been moved and its phone number has changed. The Company’s new office address and phone number is:

Suite # 9 10 – 11111 Katy Freeway

Houston, Texas 77079

(713) 973-5738

We expect to have our website up soon at www.wellpowerinc.com.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| Exhibit No. | Description |

| 10.1 | Exclusive License Agreement and Distribution Agreement by and between the Company and MEC dated January 22, 2014. |

| 13 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

WELL POWER INC.

|

||||

| Date: January 29, 2014 | By: | /s/ Cristian Neagoe | ||

Cristian Neagoe President and Chief Executive Officer | ||||

| 14 |