Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - IEC ELECTRONICS CORP | v366489_8k.htm |

Exhibit 99.1

SLIDES TO BE PRESENTED AT ANNUAL MEETING OF STOCKHOLDERS HELD JANUARY 29, 2014

Shareholder meeting January 29, 2014

2 Forward Looking Statements This presentation contains certain statements that are, or may be deemed to be, forward - looking statements within the meaning of section 27A of the Securities Act of 1933 and section 21E of the Securities Exchange Act of 1934, made in reliance upon the protections o f s uch Acts. These forward - looking statements (such as when we describe what we “believe”, “expect” or “anticipate” will occur, and other similar s tatements) include, but are not limited to, statements regarding future sales and operating results, future prospects, the capabilities and capacities of business operations, any financial or other guidance and all statements not based on historical fact that reflect our current ex pectations concerning future results and events. Their ultimate correctness is dependent upon a number of known and unknown risks and ev ent s and is subject to various uncertainties and other factors that may cause our actual results, performance or achievements to be diffe ren t from any future results, performance or achievements expressed or implied by these statements. The following important factors, among others , c ould affect future results and events, causing those results and events to differ materially from those views expressed or implied in thi s p resentation: business conditions and growth or contraction in our customers' industries, the electronic manufacturing services industry an d t he general economy; variability of our operating results; our ability to control our material, labor and other costs; our dependence on a l imited number of major customers; the potential consolidation of our customer base; availability of component supplies; dependence on certain ind ustries; variability and timing of customer requirements; uncertainties as to availability and timing of governmental funding for our cus tomers; the types and mix of sales to our customers; our ability to assimilate acquired businesses and to achieve the anticipated benefits of s uch acquisitions; unforeseen product failures and the potential product liability claims that may be associated with such failures; the availab ili ty of capital and other economic, business and competitive factors affecting our customers, our industry and business generally; failure or breach of ou r information technology systems; natural disasters; and other factors that we may not have currently identified or quantified. Additional ris ks and uncertainties resulting from the restatement of our financial statements included in our Forms 10 - K/A and 10 - Q/A filed with the Securities and Exchange Commission (“SEC”) on July 3, 2013 could, among others, (i) cause us to incur substantial additional legal, accounting and ot her expenses, (ii) result in additional shareholder, governmental or other actions, or adverse consequences from the consolidated shareholder ac tio n or the formal investigation being conducted by the SEC, (iii) cause our customers, including the government contractors with which we deal, to lose confidence in us or cause a default under our contractual arrangements, (iv) cause a default under the Company’s arrangements with M&T B ank with respect to which, if the Bank chooses to exercise its remedies, the Company may not be able to obtain replacement financing o r c ontinue its operations, (v) result in delisting of the Company’s stock from NYSE MKT (the “Exchange”) if the Company fails to meet any Ex cha nge listing standard, or fails to comply with its listing agreement with the Exchange, during the twelve months ending July 9, 2014, or ( vi) result in additional failures of the Company’s internal controls if the Company’s remediation efforts are not effective. Any one or more of such ris ks and uncertainties could have a material adverse effect on us or the value of our common stock. For a further list and description of various risk s, relevant factors and uncertainties that could cause future results or events to differ materially from those expressed or implied in our forwa rd - looking statements, see the "Risk Factors” section contained in our Form 10 - K filed with the SEC on December 24, 2013. All forward - looking statement s included in this presentation are made only as of the date hereof and are expressly qualified by these cautionary statements. We do not und ertake any obligation to, and may not, publicly update or correct any forward - looking statements to reflect events or circumstances that su bsequently occur or which we hereafter become aware of. New risks and uncertainties arise from time to time and we cannot predict these events o r how they may affect us. When considering these risks, uncertainties and assumptions, you should keep in mind these cautionary statements and that our actual future results may be materially different from what we expect.

3 2013 in Review ▪ A challenging year – Started with slow growth of new customers and languishing growth from existing customers – A number of non - core business distractions stemming from the restatement + collateral impact – Culminated with the write down of goodwill associated with the Southern California Braiding (SCB) acquisition.

4 In retrospect We took several steps backwards

5 Forward Steps ▪ Management changes were necessary to reinvigorate our sales force – We have not lost any key customers – we have added new customers across: Targeted markets ▪ Medical ▪ Military and Aerospace ▪ Industrial Capabilities ▪ Metals ▪ Electronics ▪ Cables ▪ Counterfeit chip inspection

6 Forward Steps (continued) ▪ Reshaped the operations of our Newark facility – From one large manufacturing business to three smaller market focused businesses ▪ Driving comparative advantage and operational performance – Work in progress ▪ Reshaped our West coast Military and Defense businesses – Leadership changes – Manufacturing shift – Adjusted some of our fixed costs

7 What Do We Think About SCB? ▪ Disappointing performance – Sales – Earnings – Cashflow ▪ Have confidence we can improve ▪ Strategically important: – Expanded IEC’s presence in the Military and Aerospace market – Brought new customers and opportunities to IEC

8 Why changes? To move the company over time back to a higher level of financial performance

9 Introductions and Shareholder Vote ▪ Board of Directors ▪ Management Team ▪ Public Accountants and Legal Counsel ▪ Shareholder Vote

10 2013 Year in Review Vince Leo, Chief Financial Officer

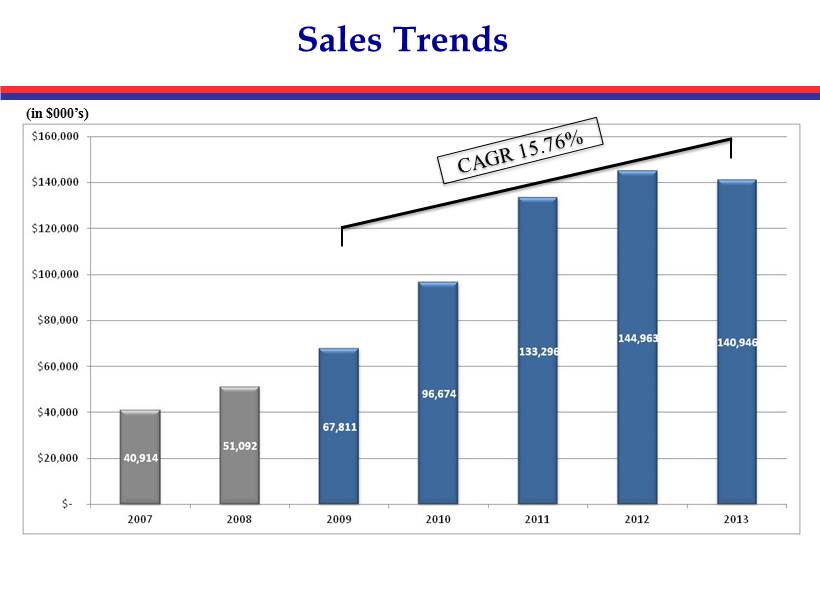

Sales Trends (in $000’s)

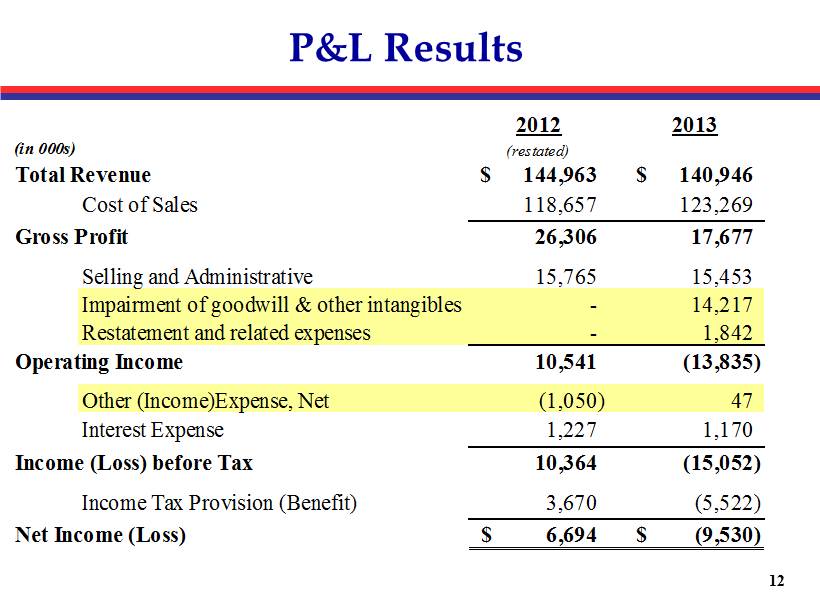

12 P&L Results 2012 2013 (in 000s) (restated) Total Revenue 144,963$ 140,946$ Cost of Sales 118,657 123,269 Gross Profit 26,306 17,677 Selling and Administrative 15,765 15,453 Impairment of goodwill & other intangibles - 14,217 Restatement and related expenses - 1,842 Operating Income 10,541 (13,835) Other (Income)Expense, Net (1,050) 47 Interest Expense 1,227 1,170 Income (Loss) before Tax 10,364 (15,052) Income Tax Provision (Benefit) 3,670 (5,522) Net Income (Loss) 6,694$ (9,530)$

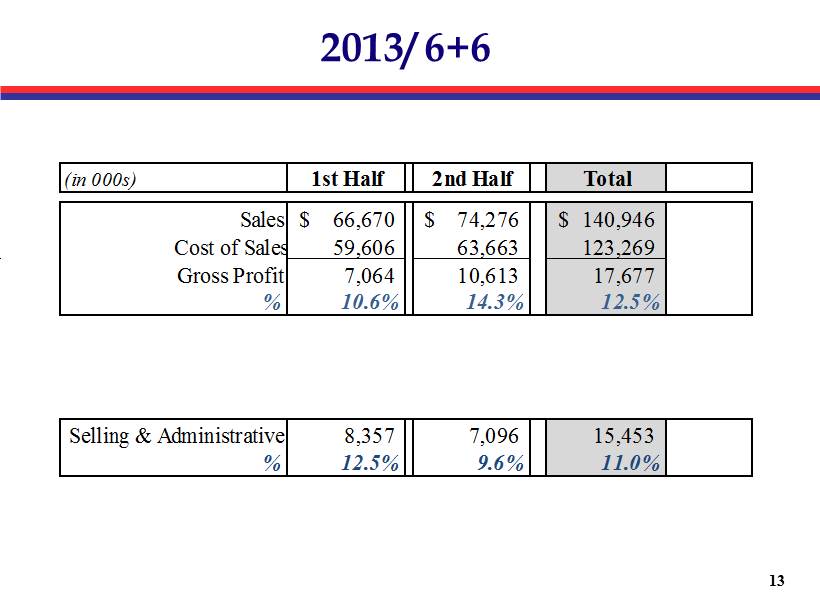

13 2013/ 6+6 1st Half 2nd Half Total Sales 66,670$ 74,276$ 140,946$ Cost of Sales 59,606 63,663 123,269 Gross Profit 7,064 10,613 17,677 % 10.6% 14.3% 12.5% Selling & Administrative 8,357 7,096 15,453 % 12.5% 9.6% 11.0% (in 000s)

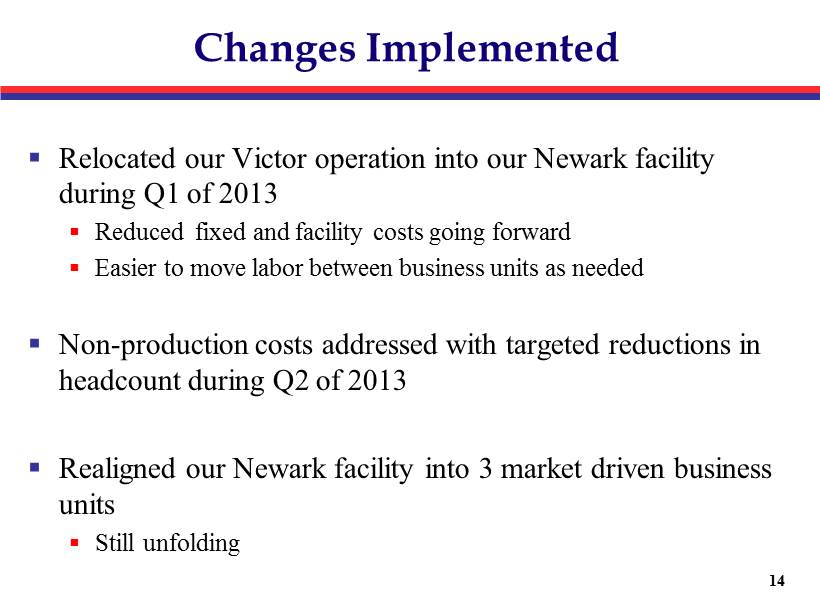

14 Changes Implemented ▪ Relocated our Victor operation into our Newark facility during Q1 of 2013 ▪ Reduced fixed and facility costs going forward ▪ Easier to move labor between business units as needed ▪ Non - production costs addressed with targeted reductions in headcount during Q2 of 2013 ▪ Realigned our Newark facility into 3 market driven business units ▪ Still unfolding

15 Barry Gilbert Moving Forward

16 Our market sectors Has our strategic focus changed?

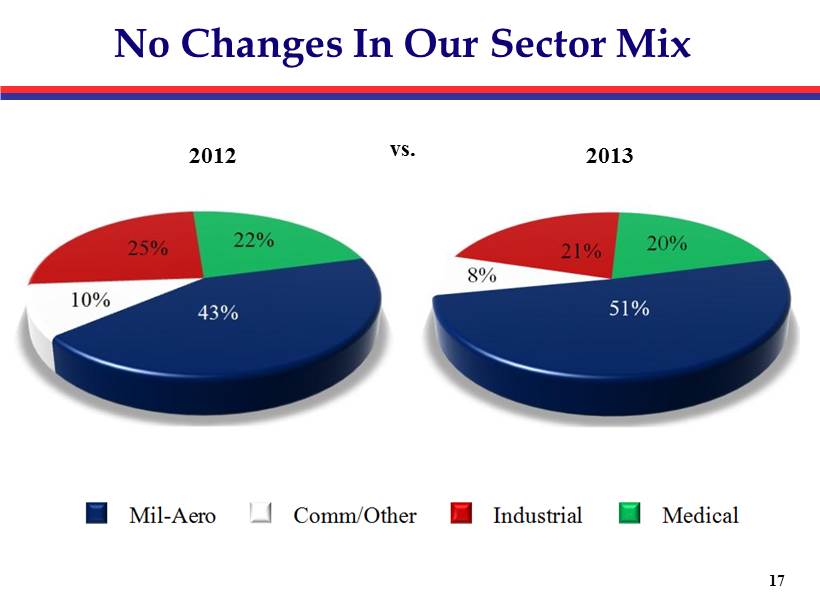

17 vs. No Changes In Our Sector Mix 2013 2012

18 We Have an Extraordinary Customer Base ▪ Mentioned earlier, we gained new customers in fiscal 2013, and have not lost any key customers ▪ However: – Unclear if target markets will benefit from overall economic growth ▪ Some existing customers have been languishing – FDA putting a product on hold for a Medical customer – New customers are increasing production slowly

19 Moving Ahead – Fiscal 2014 ▪ Making a Company more valuable to existing and potential customers over the long term ▪ We are making some progress, albeit slower than we like – Litigation and SEC investigation are ongoing ▪ Areas of concentration and focus

20 Long Term Approach ▪ Driving organic growth in our key markets – Working on programs that may take 2 or 3 years to develop and can last 10 to 15 years ▪ Never losing sight of our explicit obligation to make ourselves more valuable to our customers

Thank you for listening Questions