Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - Intra-Cellular Therapies, Inc. | d652050dex11.htm |

| EX-23.1 - EX-23.1 - Intra-Cellular Therapies, Inc. | d652050dex231.htm |

| EX-23.2 - EX-23.2 - Intra-Cellular Therapies, Inc. | d652050dex232.htm |

| EX-5.1 - EX-5.1 - Intra-Cellular Therapies, Inc. | d652050dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 24, 2014

Registration No. 333-193313

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Intra-Cellular Therapies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 36-4742850 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

3960 Broadway

New York, New York 10032

(212) 923-3344

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Sharon Mates, Ph.D.

Chairman, President and Chief Executive Officer

Intra-Cellular Therapies, Inc.

3960 Broadway

New York, New York 10032

(212) 923-3344

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| William C. Hicks, Esq. Scott A. Samuels, Esq. John P. Condon, Esq. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. One Financial Center Boston, MA 02111 (617) 542-6000 |

Stuart Bressman, Esq. Proskauer Rose LLP Eleven Times Square New York, NY 10036 (212) 969-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities To be Registered |

Amount to be Registered(1) |

Proposed Maximum Offering Price Per Share(2) |

Proposed Maximum Offering Price(2) |

Amount of Registration Fee(3) | ||||

| Common Stock, par value $0.0001 per share |

5,750,000 | $20.00 | $115,000,000 | $14,812 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes shares that the underwriters have the option to purchase. |

| (2) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, on the basis of the average of the high and low selling prices of the Registrant’s Common Stock reported on the OTC Markets-OTC Tier as of a date (January 22, 2014) within five business days prior to filing this Registration Statement. |

| (3) | The Registrant previously paid $14,812 in connection with the initial filing of this Registration Statement. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, Dated January 24, 2014

PROSPECTUS

5,000,000 Shares of Common Stock

We are offering 5,000,000 shares of our common stock.

Our common stock is quoted on the OTC Markets—OTCQB tier, or OTCQB, under the symbol “ITCI.” As of January 23, 2014, the last reported sale price of our common stock on the OTCQB was $20.00 per share. We have applied to list our common stock on the NASDAQ Global Market under the symbol “ITCI.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 12 of this prospectus for a discussion of factors you should consider before buying shares of our common stock.

We are an “emerging growth company” as defined under the federal securities laws, and, as such, are eligible for reduced public company reporting requirements for this prospectus and future filings.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | We refer you to “Underwriting” beginning on page 123 of this prospectus for additional information regarding total underwriting compensation. |

The underwriters may also exercise their option to purchase up to an additional 750,000 shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Delivery of the shares of common stock will be made on or about , 2014.

Joint Bookrunning Managers

| Leerink Partners | Cowen and Company |

Co-Managers

| Guggenheim Securities | JMP Securities |

The date of this prospectus is , 2014

Table of Contents

| Page | ||||

| 1 | ||||

| 12 | ||||

| 35 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 43 | ||||

| UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION |

45 | |||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

47 | |||

| 58 | ||||

| 82 | ||||

| 90 | ||||

| 101 | ||||

| 105 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

111 | |||

| 114 | ||||

| 118 | ||||

| MATERIAL U.S. FEDERAL TAX CONSIDERATIONS TO NON-U.S. HOLDERS |

120 | |||

| 123 | ||||

| 128 | ||||

| 128 | ||||

| 128 | ||||

| F-1 | ||||

i

Table of Contents

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus and any free writing prospectus filed with the Securities and Exchange Commission. Neither we nor any of the underwriters have authorized anyone to provide you with additional information or information different from that contained in this prospectus filed with the Securities and Exchange Commission. We and the underwriters are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus or any free writing prospectus is accurate only as of the date of this prospectus or any free writing prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

It is important for you to read and consider all information contained in this prospectus in making your investment decision. You should also read and consider the information in the documents to which we have referred you in the section entitled “Where You Can Find More Information” in this prospectus.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to the registration statement of which this prospectus is a part were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

ii

Table of Contents

The following summary highlights selected information contained elsewhere in this prospectus. This summary is not complete and does not contain all the information that should be considered before investing in our common stock. Before making an investment decision, investors should carefully read the entire prospectus, paying particular attention to the risks referred to under the headings “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” and our financial statements and the notes to those financial statements.

As used in this prospectus, unless the context requires otherwise, the terms “Company,” “we,” “our” and “us” refer to Intra-Cellular Therapies, Inc. and our wholly-owned operating subsidiary, ITI, Inc.

Overview

We are a biopharmaceutical company focused on the discovery and clinical development of innovative, small molecule drugs that address underserved medical needs in neuropsychiatric and neurological disorders by targeting intracellular signaling mechanisms within the central nervous system, or CNS. Our lead product candidate, ITI-007, is in clinical development as a first-in-class treatment for schizophrenia. Current medications available for the treatment of schizophrenia do not adequately address the broad array of symptoms associated with this CNS disorder. Use of these current medications also is limited by their substantial side effects. ITI-007 is designed to be effective across a wider range of symptoms, treating both the acute and residual phases of schizophrenia, with improved safety and tolerability.

ITI-007 exhibited antipsychotic efficacy in a randomized, double-blind, placebo and active controlled Phase 2 clinical trial in patients with an acutely exacerbated episode of schizophrenia. In December 2013, we announced the clinical results from this Phase 2 trial. In this Phase 2 trial, 335 patients were randomized to receive one of four treatments: 60 mg of ITI-007, 120 mg of ITI-007, 4 mg of risperidone (active control) or placebo in a 1:1:1:1 ratio, orally once daily for 28 days. The primary endpoint for this clinical trial was change from baseline to Day 28 on the Positive and Negative Syndrome Scale, or PANSS, total score. In this study, ITI-007 met the trial’s pre-specified primary endpoint, improving symptoms associated with schizophrenia as measured by a statistically significant and clinically meaningful decrease in the PANSS total score. The trial also met key secondary outcome measures related to efficacy on PANSS subscales and safety. Additional data from the Phase 2 trial are set forth below in the section of this prospectus entitled “Description of Our Business—Our Clinical Programs—ITI-007 Program—ITI-007 for the treatment of exacerbated and residual schizophrenia—Phase 2 Clinical Trial (ITI-007-005).” We plan to request a meeting with the U.S. Food and Drug Administration, or FDA, to discuss our clinical development plans for ITI-007, including our plans to conduct separate, but overlapping, well-controlled clinical trials in schizophrenia and bipolar disorder.

Subject to discussions with the FDA, we intend to initiate Phase 3 clinical trials and additional supporting trials in patients with acute exacerbated schizophrenia in the second half of 2014 and plan to initiate separate additional trials in bipolar disorder in 2015. We expect that the planned trials in bipolar disorder will overlap in time with the clinical conduct of the planned trials in schizophrenia. We have not yet discussed our plans to develop ITI-007 for the treatment of bipolar disorder with the FDA. We currently anticipate conducting two placebo-controlled Phase 3 clinical trials of ITI-007 in patients with acute exacerbated schizophrenia, with approximately 300 to 400 patients per trial. We expect that one trial would include a four-week treatment duration and the other trial would include a six-week treatment duration. Subject to our discussions with the FDA, our finalization of the protocols for the Phase 3 clinical trials and timely enrollment, we anticipate that the results of these Phase 3 clinical trials of ITI-007 in patients with acute exacerbated schizophrenia could be available as soon as the fourth quarter of 2015. In addition to our Phase 3 clinical trials, we will need to complete other clinical and non-clinical trials and manufacturing and pre-commercialization activities necessary to support the submission of a planned NDA for ITI-007 in patients with acute exacerbated schizophrenia, which we currently expect could occur at the end of 2016 or the beginning of 2017.

1

Table of Contents

We are also pursuing clinical development of ITI-007 for the treatment of additional CNS diseases and disorders. At the lowest doses, ITI-007 has been demonstrated to act primarily as a potent 5-HT2A serotonin receptor antagonist. As the dose is increased, additional benefits are derived from the engagement of additional drug targets, including modest dopamine receptor modulation and modest inhibition of serotonin transporters. We believe that combined interactions at these receptors may provide additional benefits above and beyond selective 5-HT2A antagonism for treating agitation, aggression and sleep disturbances in diseases that include dementia, Alzheimer’s disease and autism spectrum disorders, while avoiding many of the side effects associated with more robust dopamine receptor antagonism. As the dose of ITI-007 is further increased, leading to moderate dopamine receptor modulation, inhibition of serotonin transporters, and indirect glutamate modulation, these actions complement the complete blockade of 5-HT2A serotonin receptors. In this dose range, we believe that ITI-007 will be useful in treating the symptoms associated with schizophrenia, bipolar disorder, major depressive disorder and other neuropsychiatric diseases.

Given the potential utility for ITI-007 and follow-on compounds to treat these additional indications, we may investigate, either on our own or with a partner, agitation, aggression and sleep disturbances in diseases that include dementia, Alzheimer’s disease and autism spectrum disorders; major depressive disorder; intermittent explosive disorder, or IED; non-motor symptoms and motor complications associated with Parkinson’s disease; and post-traumatic stress disorder. We hold exclusive, worldwide commercialization rights to ITI-007 and a family of compounds from Bristol-Myers Squibb Company pursuant to an exclusive license.

We have a second major program that has yielded a portfolio of compounds that selectively inhibits the enzyme phosphodiesterase 1, or PDE1. PDE1 helps regulate brain activity related to cognition, memory processes and movement/coordination. We have licensed the lead compound in this portfolio, ITI-214, and other compounds in this portfolio, to Takeda Pharmaceutical Company Limited, or Takeda. ITI-214 is the first compound in its class to successfully advance into Phase 1 clinical trials and is being developed for the treatment of cognitive impairment associated with schizophrenia, or CIAS, and other disorders. The results of our first Phase 1 clinical trial in 70 subjects in a randomized, double-blind, placebo-controlled study indicate that ITI-214 was safe and well-tolerated across a broad range of single oral doses. Other compounds in the PDE1 portfolio outside the Takeda collaboration are being advanced for the treatment of other indications, including non-CNS therapeutic areas.

Our pipeline also includes pre-clinical programs that are focused on advancing drug candidates for the treatment of cognitive dysfunction, in both schizophrenia and Alzheimer’s disease, and for disease modification and the treatment of neurodegenerative disorders, including Alzheimer’s disease.

According to the National Institute of Mental Health, over 1% of the world’s population suffers from schizophrenia, and more than 3 million Americans suffer from the illness in any given year. Worldwide sales of antipsychotic drugs used to treat schizophrenia and other CNS related disorders exceeded $40 billion in 2012. These drugs have been increasingly used by physicians to address a range of disorders in addition to schizophrenia, including bipolar disorder and a variety of psychoses and related conditions in elderly patients. Despite their commercial success, current antipsychotic drugs have substantial limitations, including inadequate efficacy and severe side effects.

We have assembled a management team with significant industry experience to lead the discovery and development of our product candidates. We complement our management team with a group of scientific and clinical advisors that includes recognized experts in the fields of schizophrenia and other CNS disorders, including Nobel Laureate, Dr. Paul Greengard, one of our co-founders.

2

Table of Contents

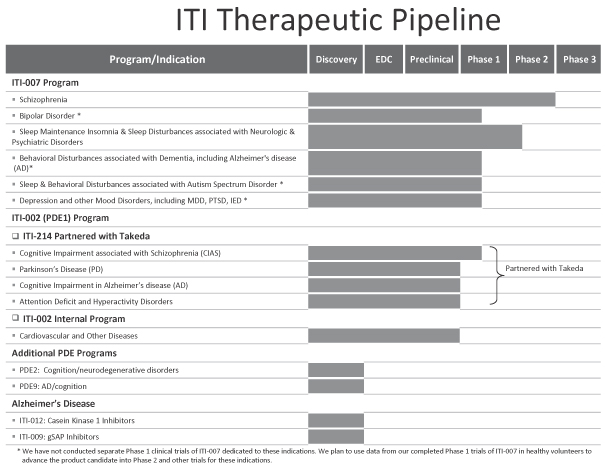

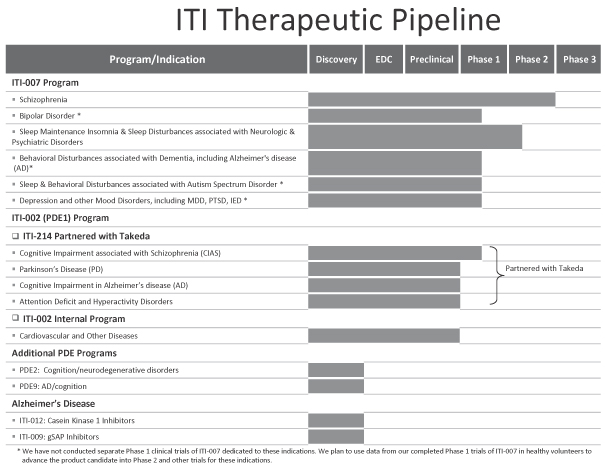

Our Product Candidates

Our pipeline includes two product candidates in clinical development and two product candidates in advanced pre-clinical testing. We believe that our product candidates offer innovative therapeutic approaches and may provide significant advantages relative to current therapies. The following table summarizes our product candidates and programs:

Our Strategy

Our goal is to discover and develop novel small molecule therapeutics for the treatment of CNS diseases in order to improve the lives of people suffering from such illnesses. Using our key understanding of intracellular signaling, we seek to accomplish our goal, using our in-house expert drug discovery and clinical development teams, in two ways:

| • | we seek to have the capability to develop first-in-class medications with novel mechanisms that have the potential to treat CNS diseases for which there are no previously marketed drugs; and |

| • | we seek to develop drugs that either can differentiate themselves in competitive markets by addressing aspects of CNS disease which are not treated by currently marketed drugs or can be effective with fewer side effects. |

3

Table of Contents

The key elements of our strategy are to:

| • | complete the development of ITI-007 for its lead indication, treatment of acute symptoms in schizophrenia, and for additional neuropsychiatric indications, such as bipolar disorder and residual symptoms in schizophrenia; |

| • | expand the commercial potential of ITI-007 by investigating its usefulness in neurological areas, such as behavioral disturbances in dementia, including Alzheimer’s disease and autism spectrum disorder, and in additional neuropsychiatric indications, such as sleep disorders associated with neuropsychiatric and neurological disorders and major depressive disorder; |

| • | continue to develop with our collaboration partner, Takeda, PDE inhibitor compounds, such as ITI-214, for CNS indications such as CIAS; and |

| • | advance earlier stage product candidates in our pipeline. |

Risks Relating to Our Business

We are a biopharmaceutical company, and our business and ability to execute our business strategy are subject to a number of significant risks of which you should be aware before you decide to buy shares of our common stock. Among these important risks are the following:

| • | We currently do not have, and may never have, any products that generate significant revenues. |

| • | There is no guarantee that our planned clinical trials for ITI-007 in acute schizophrenia or in other indications will be successful. |

| • | If the FDA does not agree with our clinical development plans to advance ITI-007 for the treatment of schizophrenia and bipolar disorder with separate, but overlapping, well-controlled clinical trials in both indications, our development of ITI-007 may be delayed and the costs of our development of ITI-007 would increase. |

| • | We expect our net losses to continue for at least several years and are unable to predict the extent of future losses or when we will become profitable, if ever. |

| • | We will require substantial additional funding, which may not be available to us on acceptable terms, or at all, and, if not so available, may require us to delay, limit, reduce or cease our operations. |

| • | Our lead product candidate, ITI-007, is only part way through the clinical trials we anticipate needing to complete before we may be able to submit an NDA to the FDA. Clinical trials are long, expensive and unpredictable, and there is a high risk of failure. |

| • | Delays, suspensions and terminations in our clinical trials could result in increased costs to us, delay our ability to generate product revenues and therefore may have a material adverse effect on our business, results of operations and future growth prospects. |

| • | Safety issues with our product candidates, or with product candidates or approved products of third parties that are similar to our product candidates, could give rise to delays in the regulatory approval process, restrictions on labeling or product withdrawal after approval. |

| • | Preliminary and interim data from our clinical studies that we may announce or publish from time to time may change as more patient data become available. |

| • | We rely on third parties to conduct our clinical trials and perform data collection and analysis, which may result in costs and delays that prevent us from successfully commercializing our product candidates. |

| • | Even if we successfully complete the clinical trials of one or more of our product candidates, the product candidates may fail for other reasons. |

4

Table of Contents

| • | Following regulatory approval of any of our drug candidates, we will be subject to ongoing regulatory obligations and restrictions, which may result in significant expense and limit our ability to commercialize our potential products. |

| • | Relying on third-party manufacturers may result in delays in our clinical trials, regulatory approvals and product introductions. |

| • | We will need to continue to manage our organization and we may encounter difficulties with our staffing and any future transitions, which could adversely affect our results of operations. |

| • | Our ability to compete may be undermined if we do not adequately protect our proprietary rights. |

| • | Many of our competitors have greater resources and capital than us, putting us at a competitive disadvantage. If our competitors develop and market products that are more effective than our product candidates, they may reduce or eliminate our commercial opportunity. |

| • | Our stock price may fluctuate significantly and you may have difficulty selling your shares based on current trading volumes of our stock. In addition, numerous other factors could result in substantial volatility in the trading price of our stock. |

| • | There is a very limited public trading history for our common stock, so the public offering price in this offering does not reflect a reliable public trading price. |

| • | We have broad discretion in the use of net proceeds from this offering and may not use them effectively. |

| • | Purchasers in this offering will experience immediate and substantial dilution in the book value of their investment. |

| • | The price of our common stock could be subject to volatility related or unrelated to our operations. |

| • | Management and certain members of our board of directors beneficially own a substantial amount of our outstanding equity securities and will be able to exert substantial control over us. |

| • | Because we became a reporting company under the Securities Exchange Act of 1934, as amended, or the Exchange Act, by means other than a traditional underwritten initial public offering, or IPO, we may not be able to attract the attention of research analysts at major brokerage firms. |

For additional information about the risks we face, please see the section of this prospectus entitled “Risk Factors.”

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An emerging growth company may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| • | being required to provide only two years of audited financial statements in addition to any required unaudited interim financial statements, with correspondingly reduced disclosure in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus; |

| • | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley Act; |

| • | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| • | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

5

Table of Contents

We may take advantage of these provisions for up to five years after the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act. Our initial registration statement under the Securities Act, providing for the resale of up to 21,961,496 shares of our common stock by the selling stockholders named therein, became effective on December 18, 2013. However, if certain events occur prior to the end of such five year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1 billion or we issue more than $1 billion of non-convertible debt in any three year period, we would cease to be an emerging growth company prior to the end of such five year period.

We may choose to take advantage of some but not all of these reduced burdens. We have taken advantage of certain of the reduced disclosure obligations, which include providing only two years of audited financial statements and correspondingly reduced financial disclosures and reduced executive compensation disclosure in this registration statement and may elect to take advantage of other reduced burdens in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. However, we have irrevocably elected not to avail ourselves of this extended transition period for complying with new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

We are also a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act and have elected to take advantage of certain of the scaled disclosure available to smaller reporting companies.

Reverse Merger

On August 29, 2013, Oneida Resources Corp., which we refer to as the Company, we, our and us, completed a reverse merger transaction in which ITI, Inc., a Delaware corporation and wholly-owned subsidiary of the Company, or Merger Sub, merged with and into Intra-Cellular Therapies, Inc., a Delaware corporation, which we refer to as ITI, with ITI remaining as the surviving entity and a wholly-owned operating subsidiary of the Company. This transaction is referred to throughout this prospectus as the “Merger.” In the Merger, each outstanding share of capital stock of ITI was exchanged for 0.5 shares of our common stock, and we assumed each outstanding option and outstanding warrant of ITI. Following the Merger and the redemption of all of our then outstanding shares at the closing of the Merger, the former shareholders of ITI owned 100% of the shares of our outstanding capital stock. In connection with the Merger, ITI changed its name to “ITI, Inc.” and we changed our name to “Intra-Cellular Therapies, Inc.”

Shelf Registration Statement

We previously filed a registration statement, or the shelf registration statement, under the Securities Act of 1933, as amended, or the Securities Act, to register the resale of up to 21,961,496 shares of our common stock by the selling stockholders named therein, which became effective on December 18, 2013. The shares registered on the shelf registration statement represent substantially all of the shares that we issued in the Merger.

Our Corporate Information

We were originally incorporated in the State of Delaware in August 2012 under the name “Oneida Resources Corp.” Prior to the Merger, Oneida Resources Corp. was a “shell” company registered under the Exchange Act with no specific business plan or purpose until it began operating the business of ITI through the Merger transaction on August 29, 2013. ITI was incorporated in Delaware in May 2001 to focus primarily on the development of novel drugs for the treatment of neuropsychiatric and neurologic diseases and other disorders of the central nervous system. Effective upon the Merger, a wholly-owned subsidiary of the Company merged with

6

Table of Contents

and into ITI, and ITI continues as the operating subsidiary of the Company. See “Description of the Merger” for additional information concerning the Merger. As used herein, the words the “Company,” “we,” “us,” and “our” refer to the Delaware corporation operating the business of ITI as a wholly-owned subsidiary, which business continues as the business of the Company.

Our corporate headquarters and laboratory are located at 3960 Broadway, New York, New York, and our telephone number is (212) 923-3344. We also have an office in Towson, Maryland. We maintain a website at www.intracellulartherapies.com, to which we regularly post copies of our press releases as well as additional information about us. Our filings with the Securities and Exchange Commission, or SEC, will be available free of charge through the website as soon as reasonably practicable after being electronically filed with or furnished to the SEC. Information contained in our website does not constitute a part of this prospectus or our other filings with the SEC.

All brand names or trademarks appearing in this prospectus are the property of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this prospectus is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owners.

7

Table of Contents

THE OFFERING

| Common stock offered by us |

5,000,000 shares |

| Common stock to be outstanding after this offering |

27,159,446 shares |

| Option to purchase additional shares |

We have granted the underwriters an option for a period of up to 30 days to purchase up to 750,000 additional shares of common stock at the offering price. |

| Use of proceeds |

Assuming the issuance and sale of 5,000,000 shares of our common stock at the assumed public offering price of $20.00 (which is the last reported public sale price of our common stock on January 23, 2014), we estimate that the net proceeds from this offering will be approximately $92.8 million, or approximately $106.8 million if the underwriters exercise their option to purchase additional shares in full, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use substantially all of the net proceeds from this offering (i) to fund the completion of two proposed Phase 3 clinical trials of ITI-007 in patients with acute exacerbated schizophrenia; (ii) to fund the initiation of other planned clinical and non-clinical trials, including manufacturing, needed for anticipated regulatory approval of ITI-007 in patients with acute exacerbated schizophrenia and other potential additional indications; (iii) to fund the completion of proposed Phase 1/2 and Phase 2 clinical trials of ITI-007 for the treatment of patients with behavioral disturbances in dementia; (iv) to fund research and preclinical development of our other product candidates; and (v) for general corporate purposes, including general and administrative expenses, capital expenditures, working capital and prosecution and maintenance of our intellectual property. |

| See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. |

| Dividend policy |

We have never paid cash dividends on any of our capital stock and we do not intend to pay cash dividends to holders of our common stock in the foreseeable future. |

| Risk factors |

Investing in our common stock involves a high degree of risk. You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

Proposed NASDAQ Global Market

| symbol |

ITCI |

8

Table of Contents

The number of shares of common stock outstanding is based on an aggregate of 22,159,446 shares outstanding as of December 31, 2013, and excludes:

| • | 1,400,125 shares of common stock issuable upon exercise of outstanding options as of December 31, 2013, at a weighted average exercise price of $1.98 per share, of which 1,182,139 shares were vested as of such date; |

| • | 1,822 shares of common stock issuable upon the exercise of a warrant outstanding as of December 31, 2013, at an exercise price of $6.0264 per share; and |

| • | 837,390 shares of common stock reserved for future issuance under our 2013 Equity Incentive Plan, or the 2013 Plan, as of December 31, 2013, plus (i) up to an additional maximum of 1,400,125 shares which may be issued solely after the cancellation or expiration of any unexercised stock options that we assumed in the Merger, (ii) an additional 800,000 shares reserved for issuance under the 2013 Plan effective January 1, 2014 pursuant to evergreen provisions, and (iii) any future increases in the number of shares of common stock reserved for issuance under the 2013 Plan pursuant to evergreen provisions. |

Unless otherwise indicated in this prospectus, all share and per share figures reflect the exchange of each share of ITI common stock and each share of ITI preferred stock then outstanding for 0.5 shares of our common stock upon the effective time of the Merger, or the Effective Time, on August 29, 2013; however, the share and per share numbers in the audited financial statements of ITI for the years ended December 31, 2012 and 2011 included in this prospectus are not adjusted to give effect to the Merger.

Except as otherwise indicated, all information in this prospectus assumes no exercise by the underwriters of their option to purchase additional shares of our common stock.

9

Table of Contents

SUMMARY FINANCIAL DATA

The following tables summarize our financial data for the periods presented and should be read together with the sections of this prospectus entitled “Risk Factors,” “Unaudited Pro Forma Condensed Combined Financial Information,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our financial statements and related notes thereto appearing elsewhere in this prospectus. The statements of operations for the years ended December 31, 2011 and 2012 included in this prospectus have been derived from our audited financial statements and footnotes included elsewhere in this prospectus. The following summary statements of operations for the nine months ended September 30, 2012 and 2013 and the balance sheet data as of September 30, 2013 have been derived from our unaudited financial statements and footnotes included elsewhere in this prospectus. We have prepared the unaudited financial statements on the same basis as the audited financial statements and have included all adjustments, consisting only of normal recurring adjustments, which in our opinion are necessary to state fairly the financial information set forth in those statements. Our historical results are not necessarily indicative of the results we expect in the future, and our interim results should not necessarily be considered indicative of results we expect for the full year.

| Years Ended December 31, | Nine Months Ended September 30, | |||||||||||||||

| 2012 | 2011 | 2013 | 2012 | |||||||||||||

| (Audited) | (Unaudited) | |||||||||||||||

| Statements of Operations: |

||||||||||||||||

| Revenues |

$ | 3,117,991 | $ | 23,361,959 | $ | 1,909,471 | $ | 2,449,055 | ||||||||

| Costs and expenses: |

||||||||||||||||

| Research and development |

15,486,476 | 7,654,546 | 16,897,903 | 14,969,710 | ||||||||||||

| General and administrative |

4,034,925 | 4,612,450 | 3,245,585 | 2,916,139 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total costs and expenses |

19,521,401 | 12,266,996 | 20,143,488 | 17,885,849 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) from operations |

(16,403,410 | ) | 11,094,963 | (18,234,017 | ) | (15,436,794 | ) | |||||||||

| Interest expense |

(193,498 | ) | (15 | ) | (604,960 | ) | — | |||||||||

| Interest income |

39,002 | 62,315 | 11,589 | 29,730 | ||||||||||||

| Income taxes |

(32,921 | ) | (64,834 | ) | — | (24,690 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (loss) income |

(16,590,827 | ) | 11,092,429 | (18,827,388 | ) | (15,431,754 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net (loss) income per common share: |

||||||||||||||||

| Basic |

$ | (2.96 | ) | $ | 1.98 | $ | (2.43 | ) | $ | (2.75 | ) | |||||

| Diluted |

$ | (2.96 | ) | $ | 1.68 | $ | (2.43 | ) | $ | (2.75 | ) | |||||

| Weighted average number of common shares: |

||||||||||||||||

| Basic |

5,607,539 | 5,601,495 | 7,737,250 | 5,603,575 | ||||||||||||

| Diluted |

5,607,539 | 6,595,238 | 7,737,250 | 5,603,575 | ||||||||||||

10

Table of Contents

The following summary unaudited balance sheet data as of September 30, 2013 is presented:

| • | on an actual basis; and |

| • | on an as adjusted basis to give effect to our sale of 5,000,000 shares of common stock in this offering at the assumed offering price of $20.00 per share, which was the last reported closing price of our common stock on the OTCQB on January 23, 2014, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

The summary unaudited as adjusted balance sheet is for informational purposes only and does not purport to indicate balance sheet information as of any future date.

| September 30, 2013 | ||||||||

| Actual | As Adjusted(1) | |||||||

| (Unaudited) | ||||||||

| Balance Sheet data: |

||||||||

| Cash and cash equivalents |

$ | 44,072,012 | $ | 136,837,012 | ||||

| Total assets |

47,336,046 | 140,101,046 | ||||||

| Total liabilities |

7,774,662 | 7,774,662 | ||||||

| Accumulated deficit |

(49,523,687 | ) | (49,523,687 | ) | ||||

| Total stockholders’ equity |

39,561,384 | 132,326,384 | ||||||

| (1) | Each $1.00 increase (decrease) in the assumed public offering price of $20.00 per share, the last reported sale price of our common stock on the OTCQB on January 23, 2014, would increase (decrease) the as adjusted amount of cash and cash equivalents, total assets, and total stockholders’ equity by approximately $4.7 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the number of shares we are offering. Each increase (decrease) of 100,000 shares in the number of shares offered by us would increase (decrease) the as adjusted amount of cash and cash equivalents, total assets, and total stockholders’ equity by approximately $1.9 million, assuming that the assumed public offering price remains the same, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. The as adjusted information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. |

11

Table of Contents

Investing in our common stock involves a high degree of risk. In addition to the information, documents or reports included or incorporated by reference in this prospectus, you should carefully consider the risks described below in addition to the other information contained in this prospectus, before making an investment decision. Our business, financial condition or results of operations could be harmed by any of these risks. As a result, you could lose some or all of your investment in our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks not currently known to us or other factors not perceived by us to present significant risks to our business at this time also may impair our business operations.

Risks Related to Our Business

We currently do not have, and may never have, any products that generate significant revenues.

We have a limited operating history on which to evaluate our business and prospects. To date, we have not generated any product revenues from our product candidates currently in development. We cannot guarantee that any of our product candidates currently in development will ever become marketable products.

We must demonstrate that our drug candidates satisfy rigorous standards of safety and efficacy for their intended uses before the U.S. Food and Drug Administration, or FDA, and other regulatory authorities in the European Union and elsewhere will approve them for commercialization. Significant additional research, preclinical testing and clinical testing is required before we can file applications with the FDA or other regulatory authorities for premarket approval of our drug candidates. In addition, to compete effectively, our drugs must be easy to administer, cost-effective and economical to manufacture on a commercial scale. We may not achieve any of these objectives. ITI-007, our most advanced drug candidate, has just completed a Phase 2 clinical trial and ITI-214 is currently in Phase 1 clinical trials. We cannot be certain that the clinical development of these or any other drug candidates in preclinical testing or clinical development will be successful, that we will receive the regulatory approvals required to commercialize them or that any of our other research and drug discovery programs will yield a drug candidate suitable for investigation through clinical trials. Our commercial revenues from our product candidates currently in development, if any, will be derived from sales of drugs that will not become marketable for several years, if at all.

There is no guarantee that our planned clinical trials for ITI-007 in acute schizophrenia or in other indications will be successful.

In our Phase 1 and Phase 2 clinical trials, our lead product candidate, ITI-007, has demonstrated improved sleep maintenance, antipsychotic efficacy, and clinical signals consistent with reduction in negative symptoms associated with schizophrenia, depression and anxiety, and other symptoms associated with impaired social function. ITI-007 exhibited antipsychotic efficacy in a randomized, double-blind, placebo and active controlled Phase 2 clinical trial in patients with an acutely exacerbated episode of schizophrenia. Our preclinical studies and initial clinical trials demonstrate that ITI-007 has shown evidence of addressing the symptoms of schizophrenia without causing cardiovascular and metabolic abnormalities, or motor impairments. Further, ITI-007 was shown effective at a dose that did not cause adverse effects displayed by existing antipsychotic drugs that tend to lead to high rates of noncompliance by the patients who most need these drugs. We are currently planning confirmatory later-stage clinical trials.

The historical rate of failures for product candidates in clinical development and late-stage clinical trials is high. While we plan to conduct further clinical studies in patients with acute schizophrenia and other indications, there is no guarantee that we will have the same level of success in these trials as we have had in our earlier clinical trials, or be successful at all. We may need to conduct additional clinical trials before we are able to advance ITI-007 into Phase 3 clinical trials in patients with acute schizophrenia.

12

Table of Contents

In addition, although we believe that ITI-007 and follow-on compounds may also have clinical utility in indications other than acute schizophrenia, such as behavioral disturbances in dementia, bipolar disorder, intermittent explosive disorder, or IED, non-motor disorders associated with Parkinson’s disease, obsessive compulsive disorder and anxiety disorders and post-traumatic stress disorder, we have never tested ITI-007 in Phase 2 clinical trials in the patient population for these other indications.

If we do not successfully complete clinical development of ITI-007, we will be unable to market and sell products derived from it and to generate product revenues. Even if we do successfully complete clinical trials for ITI-007 in patients with acute schizophrenia, those results are not necessarily predictive of results of future pivotal trials that may be needed before we may submit a New Drug Application, or NDA, to the FDA for the initial or other future indications. Of the vast number of drugs in development, only a small percentage result in the submission of an NDA to the FDA, and even less result in the NDA ultimately being approved by the FDA for commercialization.

If the FDA does not agree with our clinical development plans to advance ITI-007 for the treatment of schizophrenia and bipolar disorder with separate, but overlapping, well-controlled clinical trials in both indications, our development of ITI-007 may be delayed and the costs of our development of ITI-007 would increase.

Subject to discussions with the FDA, we intend to initiate Phase 3 clinical trials and additional supporting trials in patients with acute exacerbated schizophrenia in the second half of 2014 and plan to initiate separate additional trials in bipolar disorder in 2015. We expect that the planned trials in bipolar disorder will overlap in time with the clinical conduct of the planned trials in schizophrenia. We have not yet discussed our plans to develop ITI-007 for the treatment of bipolar disorder with the FDA. With the recent completion of the ITI-007-005 Phase 2 clinical trial in schizophrenia, we plan to request a meeting with the FDA to discuss our clinical development plans for ITI-007, including our plans to conduct separate, but overlapping, well-controlled clinical trials in schizophrenia and bipolar disorder. We currently anticipate conducting two placebo-controlled Phase 3 clinical trials of ITI-007 in patients with acute exacerbated schizophrenia, with approximately 300 to 400 patients per trial. We expect that one trial would include a four-week treatment duration and the other trial would include a six-week treatment duration. Subject to our discussions with the FDA, our finalization of the protocols for the Phase 3 clinical trials and timely enrollment, we anticipate that the results of these Phase 3 clinical trials of ITI-007 in patients with acute exacerbated schizophrenia could be available as soon as the fourth quarter of 2015. However, the FDA may not agree with our clinical development plans for advancing ITI-007, including our plans to conduct separate, but overlapping, well-controlled clinical trials in schizophrenia and bipolar disorder. In addition to our Phase 3 clinical trials, we will need to complete other clinical and non-clinical trials and manufacturing and pre-commercialization activities necessary to support the submission of a planned NDA for ITI-007 in patients with acute exacerbated schizophrenia, which we currently expect could occur at the end of 2016 or the beginning of 2017. Our clinical plans may change based on any discussions with the FDA, the relative success and cost of our research, preclinical and clinical development programs, whether we are able to enter into future collaborations, and any unforeseen delays or cash needs. If the FDA does not agree with our clinical development plans for ITI-007, our development of ITI-007 may be delayed and the costs of our development of ITI-007 could increase, which would have a material adverse effect on our business, financial condition and results of operations.

We expect our net losses to continue for at least several years and are unable to predict the extent of future losses or when we will become profitable, if ever.

We have experienced significant net losses since our inception. As of September 30, 2013, we had an accumulated deficit of approximately $49.5 million. We expect to incur net losses over the next several years as we advance our programs and incur significant clinical development costs. We have not received, and do not expect to receive for at least the next several years, any revenues from the commercialization of our product candidates. Substantially all of our revenues to date were from our license and collaboration agreement with Takeda and our agreements with various U.S. governmental agencies and other parties, including our research and development grants. We anticipate that our collaborations, which provide us with research funding and potential milestone payments, will continue to be our primary sources of revenues for the next several years. We

13

Table of Contents

cannot be certain that the milestones required to trigger payments under our existing collaborations will be achieved or that we will enter into additional collaboration agreements. To obtain revenues from our product candidates, we must succeed, either alone or with others, in developing, obtaining regulatory approval for, and manufacturing and marketing drugs with significant market potential. We may never succeed in these activities, and may never generate revenues that are significant enough to achieve profitability.

We will require substantial additional funding, which may not be available to us on acceptable terms, or at all, and, if not so available, may require us to delay, limit, reduce or cease our operations.

We have consumed substantial amounts of capital since our inception. Our cash, cash equivalents and investment securities totaled $46.1 million at September 30, 2013. On August 29, 2013, immediately prior to the Merger, ITI issued approximately $60.0 million in a private placement of common stock, which included approximately $15.3 million in principal and $0.8 million in accrued interest from the conversion of ITI’s then outstanding convertible promissory notes, and which resulted in net proceeds, after expenses, of approximately $40.0 million. In addition, assuming the issuance and sale of 5,000,000 shares of our common stock at the assumed public offering price of $20.00 (which is the last reported public sale price of our common stock on January 23, 2014), we expect to receive net proceeds of approximately $92.8 million from this offering. While we believe that our existing cash and cash equivalents, along with the net proceeds from this offering, together with interest on cash balances, will be sufficient to fund our operating expenses and capital expenditure requirements through the end of 2015, the amount and timing of our actual expenditures will depend upon numerous factors, including the ongoing status of our planned Phase 3 clinical trials of ITI-007 in patients with acute exacerbated schizophrenia and our other planned clinical and non-clinical trials. Furthermore, we anticipate that we will need to secure additional funding to complete the planned additional clinical and non-clinical trials, manufacturing and pre-commercialization activities needed for potential regulatory approval and commercialization of ITI-007 in patients with acute exacerbated schizophrenia, for further development of ITI-007 in patients with bipolar disorder and other indications, and for development of our other product candidates. If the FDA requires that we perform additional preclinical studies or clinical trials, our expenses would further increase beyond what we currently expect and the anticipated timing of any potential NDA would likely be delayed.

We intend to use substantially all of the net proceeds from this offering to fund the completion of two proposed Phase 3 clinical trials of ITI-007 in patients with acute exacerbated schizophrenia; to fund the initiation of other planned clinical and non-clinical trials, including manufacturing, needed for anticipated regulatory approval of ITI-007 in patients with acute exacerbated schizophrenia and other potential additional indications; to fund the completion of proposed Phase 1/2 and Phase 2 clinical trials of ITI-007 for the treatment of patients with behavioral disturbances in dementia; and to fund research and preclinical development of our other product candidates. Any remaining amounts will be used for general corporate purposes, including general and administrative expenses, capital expenditures, working capital and prosecution and maintenance of our intellectual property. As such, the expected net proceeds from this offering will not be sufficient to complete advanced clinical development of any of our product candidates other than ITI-007 in patients with acute exacerbated schizophrenia. Accordingly, we will continue to require substantial additional capital beyond the expected proceeds of this offering to continue our clinical development and commercialization activities. In particular, we anticipate that we will need to secure additional funding to complete the planned additional clinical and non-clinical trials, manufacturing and pre-commercialization activities needed for potential regulatory approval and commercialization of ITI-007 in patients with acute exacerbated schizophrenia, for further development of ITI-007 in patients with bipolar disorder and other indications, and for development of our other product candidates. Because successful development of our product candidates is uncertain, we are unable to estimate the actual funds we will require to complete research and development and commercialize our products under development.

Our future capital requirements will depend on, and could increase significantly as a result of, many factors, including:

| • | the progress in, and the costs of, our preclinical studies and clinical trials and other research and development programs; |

14

Table of Contents

| • | the scope, prioritization and number of our research and development programs; |

| • | the ability of our collaborators and us to reach the milestones, and other events or developments, triggering payments under our collaboration agreements or to otherwise make payments under these agreements; |

| • | our ability to enter into new, and to maintain existing, collaboration and license agreements; |

| • | the extent to which our collaborators are obligated to reimburse us for clinical trial costs under our collaboration agreements; |

| • | the costs involved in filing, prosecuting, enforcing and defending patent claims and other intellectual property rights; |

| • | the costs of securing manufacturing arrangements for clinical or commercial production; |

| • | the costs of preparing applications for regulatory approvals for our product candidates; |

| • | the costs of establishing, or contracting for, sales and marketing capabilities if we obtain regulatory clearances to market our product candidates; and |

| • | the costs associated with litigation. |

Until we can generate significant continuing revenues, we expect to satisfy our future cash needs through our existing cash, cash equivalents and investment securities, strategic collaborations, private or public sales of our securities, debt financings, grant funding, or by licensing all or a portion of our product candidates or technology. Turmoil and volatility in the financial markets have adversely affected the market capitalizations of many biotechnology companies, and generally made equity and debt financing more difficult to obtain. This, coupled with other factors, may limit our access to additional financing. This could have a material adverse effect on our ability to access sufficient funding. We cannot be certain that additional funding will be available to us on acceptable terms, or at all. If we do obtain additional funding through equity offerings, the ownership of our existing stockholders and purchasers of shares of our common stock in this offering will be diluted, and the terms of any financing may adversely affect the rights of our stockholders. In addition, the issuance of additional shares by us, or the possibility of such issuance, may cause the market price of our shares to decline. If funds are not available, we will be required to delay, reduce the scope of, or eliminate one or more of our research or development programs or our commercialization efforts. We also could be required to seek funds through arrangements with collaboration partners or otherwise that may require us to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us.

Our management has broad discretion over the use of our cash and we may not use our cash effectively, which could adversely affect our results of operations.

Our management has significant flexibility in applying our cash resources, including the net proceeds from the offering made hereby, and could use these resources for corporate purposes that do not increase our market value, or in ways with which our stockholders may not agree. We may use our cash resources for corporate purposes that do not yield a significant return or any return at all for our stockholders, which could adversely affect our future growth prospects.

Our lead product candidate, ITI-007, is only part way through the clinical trials we anticipate needing to complete before we may be able to submit an NDA to the FDA. Clinical trials are long, expensive and unpredictable, and there is a high risk of failure.

Preclinical testing and clinical trials are long, expensive and unpredictable processes that can be subject to delays. It may take several years to complete the preclinical testing and clinical development necessary to commercialize a drug, and delays or failure can occur at any stage. Interim results of clinical trials do not necessarily predict final results, and success in preclinical testing and early clinical trials does not ensure that

15

Table of Contents

later clinical trials will be successful. A number of companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in advanced clinical trials, even after promising results in earlier trials.

In connection with clinical trials, we face risks that a product candidate may not prove to be efficacious; patients may die or suffer other adverse effects for reasons that may or may not be related to the product candidate being tested; the results may not confirm the positive results of our earlier preclinical studies and clinical trials; and the results may not meet the level of statistical significance required by the FDA or other regulatory agencies. If we do not successfully complete preclinical and clinical development, we will be unable to market and sell products derived from our product candidates and to generate product revenues. Even if we do successfully complete clinical trials, those results are not necessarily predictive of results of additional trials that may be needed before an NDA may be submitted to the FDA or the FDA may approve the NDA.

Delays, suspensions and terminations in our clinical trials could result in increased costs to us, delay our ability to generate product revenues and therefore may have a material adverse effect on our business, results of operations and future growth prospects.

The commencement of clinical trials can be delayed for a variety of reasons, including: delays in demonstrating sufficient safety and efficacy to obtain regulatory approval to commence a clinical trial; reaching agreement on acceptable terms with prospective contract research organizations and clinical trial sites; manufacturing sufficient quantities of a product candidate; obtaining clearance from the FDA to commence clinical trials pursuant to an Investigational New Drug, or IND; obtaining institutional review board approval to conduct a clinical trial at a prospective clinical trial site; and patient enrollment, which is a function of many factors, including the size of the patient population, the nature of the protocol, the proximity of patients to clinical trial sites, the availability of effective treatments for the relevant disease and the eligibility criteria for the clinical trial.

Once a clinical trial has begun, it may be delayed, suspended or terminated due to a number of factors, including: ongoing discussions with regulatory authorities regarding the scope or design of our clinical trials or requests by them for supplemental information with respect to our clinical trial results; failure to conduct clinical trials in accordance with regulatory requirements; lower than anticipated screening or retention rates of patients in clinical trials; serious adverse events or side effects experienced by participants; and insufficient supply or deficient quality of product candidates or other materials necessary for the conduct of our clinical trials.

Many of these factors may also ultimately lead to denial of regulatory approval of a current or potential product candidate. If we experience delays, suspensions or terminations in a clinical trial, the commercial prospects for the related product candidate will be harmed, and our ability to generate product revenues will be delayed.

Safety issues with our product candidates, or with product candidates or approved products of third parties that are similar to our product candidates, could give rise to delays in the regulatory approval process, restrictions on labeling or product withdrawal after approval.

Problems with product candidates or approved products marketed by third parties that utilize the same therapeutic target or that belong to the same therapeutic class as our product candidates could adversely affect the development, regulatory approval and commercialization of our product candidates. In 2012, the FDA released draft guidance recommending that prospective suicidality assessments be performed in clinical trials of any drug being developed for a psychiatric indication. Our development programs are focused on psychiatric indications. Our PDE1 program is a novel target and may have unexpected safety effects that do not appear until late in clinical development or after commercial approval. To date, we have not experienced any treatment-related serious adverse effects, or SAEs, in clinical trials for any of our product candidates; however, some approved products marketed by third parties for psychiatric indications that utilize different therapeutic targets or are in a different therapeutic class have experienced SAEs. As we continue the development and clinical trials of our product candidates, there can be no assurance that our product candidates will not experience any SAEs.

16

Table of Contents

Discovery of previously unknown class effect problems may prevent or delay clinical development and commercial approval of product candidates or result in restrictions on permissible uses after their approval, including withdrawal of the medicine from the market. Many drugs acting on the central nervous system, or CNS, include boxed warnings and precautions related to suicidal behavior or ideation, driving impairment, somnolence/sedation and dizziness, discontinuation, weight gain, non-insulin dependent (type II) diabetes, cardiovascular side effects, sleep disturbances, and motor disturbances. If we or others later identify undesirable side effects caused by the mechanisms of action or classes of our product candidates or specific product candidates:

| • | we may be required to conduct additional clinical trials or implement a Risk Evaluation and Mitigation Strategies program prior to approval; |

| • | regulatory authorities may not approve our product candidates or, as a condition of approval, require specific warnings and contraindications; |

| • | regulatory authorities may withdraw their approval of the product and require us to take our drug off the market; |

| • | we may have limitations on how we promote our drugs; |

| • | sales of products may decrease significantly; |

| • | we may be subject to litigation or product liability claims; and |

| • | our reputation may suffer. |

Any of these events could prevent us from achieving or maintaining market acceptance of the affected product or could substantially increase our commercialization costs and expenses, which, in turn, could delay or prevent us from generating significant revenues from its sale.

Finally, if the FDA determines that a drug may present a risk of substance abuse, it can recommend to the Drug Enforcement Administration that the drug be scheduled under the Controlled Substances Act. Any failure or delay in commencing or completing clinical trials or obtaining regulatory approvals for our product candidates would delay commercialization of our product candidates, and severely harm our business and financial condition.

If we seek to enter into strategic alliances for our drug candidates, but fail to enter into and maintain successful strategic alliances, we may have to reduce or delay our drug candidate development or increase our expenditures.

An important element of a biotechnology company’s strategy for developing, manufacturing and commercializing its drug candidates may be to enter into strategic alliances with pharmaceutical companies or other industry participants to advance its programs and enable it to maintain its financial and operational capacity. We may face significant competition in seeking appropriate alliances. If we seek such alliances, we may not be able to negotiate alliances on acceptable terms, if at all. In addition, these alliances may be unsuccessful. If we seek such alliances and then fail to create and maintain suitable alliances, we may have to limit the size or scope of, or delay, one or more of our drug development or research programs. If we elect to fund drug development or research programs on our own, we will have to increase our expenditures and will need to obtain additional funding, which may be unavailable or available only on unfavorable terms.

To the extent we are able to enter into collaborative arrangements or strategic alliances, we will be exposed to risks related to those collaborations and alliances.

We are currently party to a license and collaboration agreement with Takeda Pharmaceutical Company Limited, or Takeda. Biotechnology companies at our stage of development sometimes become dependent upon collaborative arrangements or strategic alliances to complete the development and commercialization of drug

17

Table of Contents

candidates, particularly after the Phase 2 stage of clinical testing. If we elect to enter into collaborative arrangements or strategic alliances, these arrangements may place the development of our drug candidates outside our control, may require us to relinquish important rights or may otherwise be on terms unfavorable to us.

Dependence on collaborative arrangements or strategic alliances would subject us to a number of risks, including the risk that:

| • | we may not be able to control the amount and timing of resources that our collaborators may devote to the drug candidates; |

| • | our collaborators may experience financial difficulties; |

| • | we may be required to relinquish important rights, such as marketing and distribution rights; |

| • | business combinations or significant changes in a collaborator’s business strategy may also adversely affect a collaborator’s willingness or ability to complete its obligations under any arrangement; |

| • | a collaborator could independently move forward with a competing drug candidate developed either independently or in collaboration with others, including our competitors; and |

| • | collaborative arrangements are often terminated or allowed to expire, which would delay the development and may increase the cost of developing our drug candidates. |

Preliminary and interim data from our clinical studies that we may announce or publish from time to time may change as more patient data become available.

From time to time, we may announce or publish preliminary or interim data from our clinical studies. Preliminary and interim results of a clinical trial are not necessarily predictive of final results. Preliminary and interim data are subject to the risk that one or more of the clinical outcomes may materially change as patient enrollment continues and more patient data become available. As a result, preliminary and interim data should be viewed with caution until the final data are available. Material adverse changes in the final data compared to the interim data could significantly harm our business prospects.

We rely on third parties to conduct our clinical trials and perform data collection and analysis, which may result in costs and delays that prevent us from successfully commercializing our product candidates.

Although we design and manage our current preclinical studies and clinical trials, we do not now have the ability to conduct clinical trials for our product candidates on our own. In addition to our collaborators, we rely on contract research organizations, medical institutions, clinical investigators, and contract laboratories to perform data collection and analysis and other aspects of our clinical trials. In addition, we also rely on third parties to assist with our preclinical studies, including studies regarding biological activity, safety, absorption, metabolism, and excretion of product candidates.

Our preclinical activities or clinical trials may be delayed, suspended, or terminated if: the quality or accuracy of the data obtained by the third parties on whom we rely is compromised due to their failure to adhere to our clinical protocols or regulatory requirements or if for other reasons, these third parties do not successfully carry out their contractual duties or fail to meet regulatory obligations or expected deadlines, or these third parties need to be replaced.

If the third parties on whom we rely fail to perform, our development costs may increase, our ability to obtain regulatory approval, and consequently, to commercialize our product candidates may be delayed or prevented altogether. We currently use several contract research organizations to perform services for our preclinical studies and clinical trials. While we believe that there are numerous alternative sources to provide these services, in the event that we seek such alternative sources, we may not be able to enter into replacement arrangements without delays or incurring additional expenses.

18

Table of Contents

Even if we successfully complete the clinical trials of one or more of our product candidates, the product candidates may fail for other reasons.

Even if we successfully complete the clinical trials for one or more of our product candidates, the product candidates may fail for other reasons, including the possibility that the product candidates will:

| • | fail to receive the regulatory approvals required to market them as drugs; |

| • | be subject to proprietary rights held by others requiring the negotiation of a license agreement prior to marketing; |

| • | be difficult or expensive to manufacture on a commercial scale; |

| • | have adverse side effects that make their use less desirable; or |

| • | fail to compete with product candidates or other treatments commercialized by our competitors. |

If we are unable to receive the required regulatory approvals, secure our intellectual property rights, minimize the incidence of any adverse side effects or fail to compete with our competitors’ products, our business, financial condition, and results of operations could be materially and adversely affected.

Following regulatory approval of any of our drug candidates, we will be subject to ongoing regulatory obligations and restrictions, which may result in significant expense and limit our ability to commercialize our potential products.

With regard to our drug candidates, if any, approved by the FDA or by another regulatory authority, we are held to extensive regulatory requirements over product manufacturing, labeling, packaging, adverse event reporting, storage, advertising, promotion and record keeping. Regulatory approvals may also be subject to significant limitations on the indicated uses or marketing of the drug candidates. Potentially costly follow-up or post-marketing clinical studies may be required as a condition of approval to further substantiate safety or efficacy, or to investigate specific issues of interest to the regulatory authority. Previously unknown problems with the drug candidate, including adverse events of unanticipated severity or frequency, may result in restrictions on the marketing of the drug, and could include withdrawal of the drug from the market.

In addition, the law or regulatory policies governing pharmaceuticals may change. New statutory requirements may be enacted or additional regulations may be enacted that could prevent or delay regulatory approval of our drug candidates. We cannot predict the likelihood, nature or extent of adverse government regulation that may arise from future legislation or administrative action, either in the United States or elsewhere. If we are not able to maintain regulatory compliance, we might not be permitted to market our drugs and our business could suffer.

Our product candidates may not gain acceptance among physicians, patients, or the medical community, thereby limiting our potential to generate revenues, which will undermine our future growth prospects.

Even if our product candidates are approved for commercial sale by the FDA or other regulatory authorities, the degree of market acceptance of any approved product candidate by physicians, health care professionals and third-party payors, and our profitability and growth will depend on a number of factors, including:

| • | the ability to provide acceptable evidence of safety and efficacy; |

| • | pricing and cost effectiveness, which may be subject to regulatory control; |

| • | our ability to obtain sufficient third-party insurance coverage or reimbursement; |

| • | effectiveness of our or our collaborators’ sales and marketing strategy; |

| • | relative convenience and ease of administration; |

19

Table of Contents

| • | the prevalence and severity of any adverse side effects; and |

| • | availability of alternative treatments. |