Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WESTMORELAND COAL Co | d664520d8k.htm |

| EX-99.1 - EX-99.1 - WESTMORELAND COAL Co | d664520dex991.htm |

| EX-99.3 - EX-99.3 - WESTMORELAND COAL Co | d664520dex993.htm |

| EX-99.4 - EX-99.4 - WESTMORELAND COAL Co | d664520dex994.htm |

| EX-99.5 - EX-99.5 - WESTMORELAND COAL Co | d664520dex995.htm |

Exhibit 99.2

Following are excerpts from the Company’s disclosure in connection with its offering of senior notes.

Our Combined Company

We are an energy company whose operations as of September 30, 2013 included six surface coal mines in Montana, Wyoming, North Dakota and Texas, and two coal-fired power-generating units in North Carolina. We sold 21.7 million tons of coal in 2012 and 18.4 million tons through September 30, 2013, and had net revenues of $600.4 million for the year ended December 31, 2012. On December 24, 2013, we entered into a definitive Arrangement Agreement, which we refer to as the Arrangement Agreement, to acquire the coal operations of Sherritt International Corporation, or Sherritt, which consist of its Prairie Mines & Royalty Ltd. subsidiary, or PMRL or Prairie, and its Coal Valley Resources Inc. subsidiary, or CVRI or Mountain. We refer to this transaction and certain related transactions as the Sherritt Acquisition. Upon closing of the Sherritt Acquisition, PMRL and CVRI, which we refer to as the Sherritt Subsidiaries, will be wholly owned subsidiaries of Westmoreland. PMRL and CVRI collectively operate seven surface mines and a char production facility and hold a 50% interest in an activated carbon plant, which we refer to as the Sherritt Assets. Sherritt’s royalty business, currently held under its Prairie operations, will be transferred by Westmoreland to Altius Minerals Corporation concurrently with the closing of the Sherritt Acquisition. We expect the Sherritt Acquisition to be completed by the end of the first quarter of 2014.

Following the Sherritt Acquisition, we will be the sixth largest North American coal producer as measured by pro forma combined 2012 production of nearly 52 million tons, and we believe the 27 total dragline excavators we operate will make us the largest dragline operator among North American coal companies. We produce and sell thermal coal primarily to investment grade utility customers under long-term cost-protected contracts, as well as to industrial customers and barbeque briquettes manufacturers. Our U.S. coal operations are located in Montana, Wyoming, North Dakota and Texas. Our Canadian coal operations will be located in Alberta and Saskatchewan. Our focus is on coal markets where we can utilize dragline surface mining methods that historically have predictable and consistent costs and production rates and with which we have extensive operational experience. In addition, we focus on mine locations that allow us to take advantage of close customer proximity through mine-mouth power plants and strategically located rail transportation, with the goal of being the low-cost supplier of choice to the customers that we serve. We believe this business model has contributed to the stability of our cash flows and results of operations.

As of September 30, 2013, on a pro forma combined basis, we operated 13 surface mines and a char production facility, and held a 50% interest in an activated carbon plant. We have pro forma combined proven and probable coal reserves of approximately 1.2 billion tons. We believe that our total pro forma proven and probable reserves will support current production levels for more than 25 years. We also operate two coal-fired power generating units in North Carolina with a total capacity of approximately 230 megawatts. We have almost 2,900 employees on a pro forma combined basis.

For the twelve month period ended September 30, 2013, on a pro forma consolidated basis, we generated revenue of approximately $1.3 billion and Adjusted EBITDA of approximately $235 million.

Following the Sherritt Acquisition, we will operate our business in four segments consisting of three operating segments, Coal – U.S., which will hold our existing U.S. coal assets, Coal – Canada, which will hold the Sherritt Assets, Power, which will continue to hold our power generation assets, and a non-operating segment, Corporate, which we have historically reported as two separate segments, Corporate and Heritage, but are combining into a single reporting segment in connection with the Sherritt Acquisition.

Coal Segments (US and Canada): We sell substantially all of the coal that we produce to plants that generate electricity. Our mines and coal reserves are strategically located in close proximity to our customers which reduces transportation costs and provides us with a significant competitive advantage with respect to those customers. Ten of the thirteen mines that we will operate following the Sherritt Acquisition are mine-mouth operations, where our mine is directly adjacent to the customer’s property, with conveyor belt delivery systems linked to the customer’s facilities and power generators often built to the specification of the mine’s coal quality. The remaining mines utilize efficient rail and truck delivery. We typically enter into long-term supply contracts with our customers that range from approximately three years to 40 years. Our current coal sales contracts have a weighted average remaining term of 10 years, or of 6 years if the contract with the Genesee plant is excluded. For the twelve months ended September 30, 2013, substantially all of our tons of coal sold were sold under long-term contracts. We employ a rigorous capital spending and maintenance philosophy and believe our equipment is well maintained.

1

For the twelve month period ended September 30, 2013, on a pro forma combined basis, we sold 52 million tons of thermal coal.

Power Segment: We own and operate two coal-fired power generating units in North Carolina with a total capacity of approximately 230 megawatts, which we collectively refer to as ROVA. On December 23, 2013, Westmoreland Partners entered into a Consolidated Power Purchase and Operating Agreement with Dominion North Carolina Power providing for the exclusive sale to Dominion of all of ROVA’s net electrical output and dependable capacity, which we refer to as the Consolidated Agreement. The Consolidated Agreement amends, restates and consolidates in their entirety the prior agreements governing the sale of capacity and electric energy from ROVA. Among other things, the Consolidated Agreement: (i) contains certain provisions that we believe will allow Westmoreland Partners to remain cash flow positive; (ii) continues to provide a right of first refusal in favor of Dominion for the purchase of ROVA; and (iii) will terminate in March of 2019.

For the twelve month period ended September 30, 2013, we produced 1.6 million megawatt hours at our ROVA facilities and had an average capacity factor of 88%.

Corporate Segment: Our Corporate segment will include primarily corporate expenses and the cost of heritage benefits we provide to former mining operation employees. The heritage costs consist of payments to our retired workers for medical benefits, workers’ compensation benefits, and combined benefit fund premiums to plans for United Mine Workers of America, or UMWA, retirees required by statute. Canadian heritage costs include statutory workers’ compensation premiums and contributions to pension plans. Historically, we reported these benefit costs as a separate segment of our business, referred to as Heritage. In connection with the Sherritt Acquisition we are consolidating all of our benefit administration into our Corporate segment.

In addition, the Corporate segment contains our captive insurance company, Westmoreland Risk Management, Inc., or WRM, through which we have elected to retain some of our operating risks. WRM provides our primary layer of property and casualty insurance. By using this insurance subsidiary, we have reduced the cost of our property and casualty insurance premiums and retained some economic benefits due to our excellent loss record.

Pro Forma Combined Reserve and Production Data:

The following table presents Westmoreland’s proven and probable reserves by mine as of December 31, 2012, on a combined pro forma basis. The table has been prepared for illustrative purposes only and is not necessarily indicative of the reserve data of Westmoreland had the Sherritt Acquisition occurred on December 31, 2012.

| Reserves | ||||||||||||

| Total | Proven | Probable | ||||||||||

| Thousands of tons | ||||||||||||

| United States |

||||||||||||

| Absaloka |

59,186 | 59,186 | — | |||||||||

| Rosebud |

306,949 | 306,949 | — | |||||||||

| Jewett |

34,487 | 34,487 | — | |||||||||

| Beulah |

43,198 | 27,682 | 15,516 | |||||||||

| Savage |

5,284 | 5,284 | — | |||||||||

| Kemmerer |

103,674 | 94,807 | 8,867 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

552,778 | 528,395 | 24,383 | |||||||||

| Canada |

||||||||||||

| Prairie |

654,441 | 567,249 | 87,193 | |||||||||

| Mountain |

22,046 | 8,598 | 13,448 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

676,488 | 575,847 | 100,641 | |||||||||

|

|

|

|

|

|

|

|||||||

| Pro Forma Combined (1) |

1,229,266 | 1,104,242 | 125,024 | |||||||||

| 1. | The pro forma combined data has been calculated by adding the Sherritt Assets data to the Westmoreland data. |

2

The following table presents the Westmoreland tons sold on a pro forma combined basis for the year ended December 31, 2012. The table assumes that the Sherritt Acquisition was completed on January 1, 2012. The table has been prepared for illustrative purposes only and is not necessarily indicative of the production data of Westmoreland had the Sherritt Acquisition occurred on January 1, 2012.

| 2012 Sales Tons |

||||

| Thousands of tons |

||||

| United States |

||||

| Absaloka |

2,714 | |||

| Rosebud |

8,018 | |||

| Jewett |

4,201 | |||

| Beulah |

2,267 | |||

| Savage |

298 | |||

| Kemmerer |

4,247 | |||

|

|

|

|||

| Total |

21,745 | |||

| Canada |

||||

| Prairie (2) |

22,284 | |||

| Mountain |

3,816 | |||

|

|

|

|||

| Total |

26,100 | |||

|

|

|

|||

| Pro Forma Combined (3) |

47,845 | |||

| 2. | Prairie sales exclude sales from the Highvale contract mining operation which was terminated in January 2013 and were included in Sherritt’s reports for the period shown. |

| 3. | The pro forma combined data has been calculated by adding the Sherritt Assets data to the Westmoreland data. |

3

Westmoreland Operations – Pro Forma after giving effect to the Sherritt Acquisition

Strategic Rationale

We believe that the Sherritt Acquisition offers numerous strategic benefits, including:

| • | Significantly increases scale: Annual production from the Sherritt Assets will approximately double Westmoreland’s reserves and production, creating the 6th largest North American coal producer as measured by 2012 production. |

| • | Highly complementary to existing operating model: The transaction complements Westmoreland’s core surface mining, mine-mouth model with similar long-term cost protected contracts, strategically located operations adjacent to its customers’ generating facilities and safe, environmentally responsible operations. |

| • | Enhances and diversifies asset portfolio: Provides geographic and regulatory diversification into Canada, a favorable mining jurisdiction. |

| • | Expansion into new markets and lines of business: The Mountain operations provide us access to the seaborne export market through strategic port facilities in western Canada that allow us to deliver premium thermal coal to the high-growth Pacific-rim market. The activated carbon and char operations represent value-added revenue streams and increase our presence in the industrial and consumer market. |

| • | Financially accretive: We expect that the acquisition of the Sherritt Assets will be financially accretive on a free cash flow basis beginning in 2014. |

We believe that these strategic benefits significantly enhance our competitive positioning as the leading North American supplier of coal to mine-mouth power plants.

4

Competitive Strengths

| • | Mine-mouth operations provide cost advantages and significant barriers to entry: We believe that each of our mines is the most economic supplier to its respective principal customer. Our mine-mouth positioning and shortened rail and truck routes provide us with a transportation advantage over other sources of coal. Ten of the thirteen mines we will operate after the Sherritt Acquisition supply mine-mouth customers by conveyor belt, the most economical delivery method. In certain cases, our conveyor systems are the only viable delivery method due to limited rail and truck access at customer facilities. Several customers have designed and built power plant facilities for the specific chemical specifications of the coal we supply. We believe that these factors provide significant barriers to entry and enhance our competitive position in the markets we serve. |

| • | Long-term low risk contracts with highly-rated customers provide stable and visible cash flows: The majority of our coal sales are via long-term cost-protected contracts with terms ranging from three to 40 years which limits a customer’s ability to switch suppliers. Our contracts include a variety of provisions, including, among others, return on capital investment and cost of production plus margin provisions. Our mines have provided coal to substantially all of their principal customers for over 25 years. Similarly, our power plant assets have a long-term off-take agreement with a contract length extending to 2019. The majority of our customers are investment-grade rated utilities. |

| • | Established exports of thermal coal to Pacific-rim countries with strategic access to port capacity: Sherritt’s Coal Valley mine that we will acquire is an established exporter of high-quality thermal coal with strategic access to port facilities. The majority of our anticipated 2014 Coal Valley mine production is already committed and priced |

| • | Experienced management team with a proven track record: We have a strong management team with a proven track record of operating a mine-mouth business model and integrating acquisitions. The team is responsible for significant growth through both organic investments and strategic acquisitions. Our management team led the successful acquisition and integration of the Kemmerer mine from Chevron in 2012. The Kemmerer acquisition exceeded financial projections as a result of operational and productivity improvements as well as improved labor relations. In addition, our management team has been successful in implementing significant cost reduction initiatives, such as our effort to reduce employee healthcare costs through a more efficiently administered prescription drug program that saved us over $100 million in the year the program was implemented. |

| • | Superior safety and environmental record: We have a long history of superior safety and environmental performance, consistently achieving performance better than the national average. Our highly skilled work force is well-trained with a culture focused on safety. We are a repeat winner of the National Mining Association’s Sentinels of Safety Award and the John T. Ryan award. In addition, in 2013 our Jewett Mine was recognized by the Texas Parks and Wildlife Department, the Railroad Commission of Texas – Surface Mining and Reclamation Division and the Texas Commission on Environmental Quality with a trio of awards in connection with recently completed reclamation work. |

Business Strategy

Our objective is to increase value for our stakeholders through free cash flow generation and sustained earnings growth, while protecting the Company’s liquidity and financial position. Our key strategies to achieve this objective are described below:

| • | Focus sales expansion efforts: We are focused on expanding our sales efforts using existing resources to maximize revenue and profitability. Areas on which we have focused our sales expansion efforts include: |

| • | Organic growth through contract extensions, renewals and renegotiations: we have improved our business through the extension and negotiation of our existing customer contract base and contract improvement opportunities, including length of contract, cost-plus provisions, reserve dedication payments and offsets for asset reserve obligations; |

5

| • | Open market growth: the Absaloka mine presents our primary U.S. open market growth opportunity. The location of the Absaloka mine provides a significant rail advantage over Southern Powder River Basin competitors for our sales to our principal customer and potential additional customers; |

| • | New market opportunities: new port capacity acquired through the Sherritt Acquisition adds attractive expansion opportunities to our business model, allowing us to deliver premium thermal coal into high growth Asian markets; and |

| • | Contract mining: following the Sherritt Acquisition, we may pursue contract mining opportunities on an opportunistic basis. Prospective customers select a contract miner on the basis of various factors, including (i) the terms of the proposal, (ii) the operating track record of the contract miner, and (iii) the capitalization and financial viability of the contract miner. We believe that these contract mining opportunities present a low-cost and low-risk avenue for business expansion. |

| • | Pursue strategic mining operations: We believe our core competency is running mine-mouth operations under long-term contracts with adjacent power plants and we have a proven record of successfully integrating existing operating assets. We will opportunistically pursue acquisition opportunities that fit and extend our core business model of providing superior service to the customers we serve, typically under long-term contracts with cost-protection features. The Sherritt Acquisition is an example of such an acquisition. |

| • | Continue to focus on managing costs for our customers: We strive to optimize our costs to ensure that our operations are run efficiently. By driving down costs and continuing to work with our customers to increase their dispatch rates, we believe that we further enhance each of our competitive positions and the potential for greater coal demand from our mines. The more cost efficient a plant is, the more likely it will be called upon to supply the grid, and the more coal demand we will be able to fulfill. |

| • | Continue to pursue best-in-class safety record and environmental stewardship: Our commitment to safety, at both our coal mines and power plant facilities, is consistently recognized through special safety awards and honors. Safety performance at our mines continues to be significantly better than the national average for surface operations. Our U.S. mines had reportable and lost time incident rates for the nine months ended September 30, 2013 of 1.38 and 0.59, respectively, versus the national surface mine rates of 1.60 and .93, respectively. Our Canadian mines had recordable and lost time incident rates for the nine months ended September 30, 2013 of .42 and .08 respectively. In addition, ROVA recently achieved three consecutive years of operation without experiencing a lost time incident, while also setting a run time record at one ROVA unit during the summer of 2013. We are also committed to responsible environmental stewardship as evidenced by our environmental record and receipt of various environmental stewardship awards such as those noted above. Both safety and environmental stewardship are critical components of our business strategy. |

| • | Enhance coal reserve base through economical acquisitions: We are committed to economically maintaining and expanding our coal reserves to extend the life of our current mines by acquiring or leasing tracts of land on coal deposits that are in close geographic proximity to our existing footprint. This strategy will enable us to utilize our existing infrastructure at those facilities, thereby limiting the time and capital cost associated with expansions. We believe that a number of such opportunities are available in the marketplace and we continually assess such opportunities. We are also committed to pursuing acquisitions of operating coal mines having substantial contiguous coal reserves that fit our business model of operating mines with mine-mouth customers at transportation advantaged locations. In addition, we have historically avoided operating on U.S. federal lands that are subject to an open bidding process and are therefore often higher cost than similar non-federal leases, and we intend to continue this strategy in future expansions and acquisitions. |

6

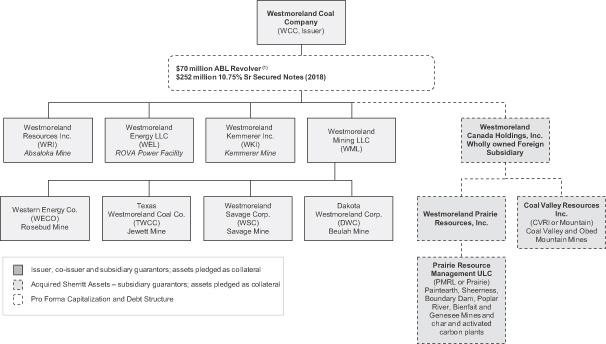

Simplified Corporate Structure

The following sets forth our simplified corporate structure following the Sherritt Acquisition, the WML Refinancing and the other transactions referenced under “Use of Proceeds” herein.

| (1) | Reflects anticipated available liquidity under our amended revolving credit facility which may be increased to $100 in our discretion. |

Increase in Revolving Credit Facility Availability

In connection with the Sherritt Acquisition, we intend to amend our existing revolving credit facility with The PrivateBank and Trust Company, which we refer to as the Revolving Credit Facility, to increase the maximum available borrowing amount to approximately $70 million (which we may increase to $100 million at our discretion), with a subfacility for letters of credit in an amount of up to $30 million. The Sherritt Acquisition is not contingent on our increasing such available borrowing capacity and it is possible that such increase will not be implemented until after the consummation of the Sherritt Acquisition. Consent from the holders of our outstanding notes is required before we can amend the Indenture to allow for such an increase in the borrowing amount under our Revolving Credit Facility. We intend to seek such noteholder consent and, if such consent is obtained, to implement the amended Revolving Credit Facility contemporaneously with the closing of the Sherritt Acquisition.

The WML Refinancing

In order to allow WML to be a guarantor with respect to our outstanding notes and for collateral underlying WML’s outstanding debt obligations to be available on a first priority basis as collateral with respect to our outstanding notes, we intend to (1) terminate WML’s existing credit facility, which we refer to as the WML Credit Facility, and (2) prepay WML’s outstanding 8.02% senior secured notes due 2018, which we refer to as the WML Notes. Subject to the receipt of the consent of the holders of the Existing Notes referred to above, we intend to terminate the WML Credit Facility contemporaneously with our implementation of the increase in borrowing capacity under our Revolving Credit Facility, which is expected to occur upon the closing of the Sherritt Acquisition. We intend to use approximately $92.5 million (consisting of $81 million in principal and interest and $11.5 million in make whole payments) of the net proceeds from this offering to prepay the WML Notes, which may be prepaid upon not less than 30 nor more than 60 days’ written notice to the holders thereof. We intend to issue a notice of prepayment promptly after the completion of the Sherritt Acquisition. We refer to the anticipated termination of the WML Credit Facility and the subsequent prepayment of WML Notes collectively as the WML Refinancing. Following the WML Refinancing, WML and its subsidiaries that are restricted subsidiaries will become guarantors of our outstanding notes, along with the other restricted subsidiaries of Westmoreland that are guarantors of our outstanding notes.

7

Recent Developments

Entry into new ROVA Power Purchase Agreement

On December 23, 2013, Westmoreland Partners entered into the Consolidated Agreement with Dominion North Carolina Power providing for the exclusive sale to Dominion of all of ROVA’s net electrical output and dependable capacity. The Consolidated Agreement amends, restates and consolidates in their entirety the prior agreements governing the sale of capacity and electric energy from ROVA. Among other things, the Consolidated Agreement: (i) contains certain provisions that we believe will allow Westmoreland Partners to remain cash flow positive; (ii) continues to provide a right of first refusal in favor of Dominion for the purchase of ROVA; and (iii) will terminate in March of 2019. Under the Consolidated Agreement, the ROVA units will run periodically for testing purposes and during some periods of peak electric energy demand. At other times when it is required to provide electric energy under the Consolidated Agreement, Westmoreland Partners may purchase such energy from one or more third party providers for sale to Dominion. We intend to hedge in the future the pricing of the electric energy to be acquired from third party providers and sold under the Consolidated Agreement.

Obed Mine Release

On October 31, 2013 a breach of an onsite water containment pond occurred at Sherritt’s Obed Mountain mine. The breach released 670,000 cubic meters of process water containing water mixed with naturally occurring materials into the Athabasca River, which we refer to as the Obed Mine Release. Pursuant to the Arrangement Agreement Sherritt will indemnify Westmoreland against past and future liability stemming from this incident.

Sherritt has begun remediation work on the containment pond and surrounding area. Testing on December 1, 2013 showed a continuous and rapid decline from the incident site and down river and turbidity (water clarity) readings appear to be reaching normal seasonal levels. Preliminary results show that the sediment in the river as a result of the breach had no measurable impact on fish. On December 6, 2013, Sherritt reported that comprehensive testing confirms that the water quality in the Athabasca River is safe, according to a team of third-party water quality and aquatic life experts. Following the closing of the Sherritt Acquisition, we will continue the remediation efforts and will be paid a fee above our expense reimbursement in connection with such efforts.

Indian Coal Production Tax Credits (ICTC) expiration

In October, 2013 our ICTC investment partner informed us they do not expect to extend our ICTC monetization transaction. While we are actively seeking a new partner, there can be no assurance that we will be able to find a new partner in a timely manner, or, if and when we are able to find a new partner, that they will agree to a partnership on the same terms. In addition, the ICTC were set to expire in December, 2013 unless the relevant provisions of the Internal Revenue Code were extended or renewed by the U.S. Congress. The ICTC has not been extended or renewed. Since 2009, we have experienced a yearly average of $3.0 million of income and $6.2 million of cash receipts from Absaloka Coal LLC’s participation in ICTC transactions. There is no assurance that a renewal, if any is enacted, would be enacted with retroactive effect. The provisions of any future renewal may not be as favorable as those that previously existed.

8

Risks Related to the Sherritt Acquisition

We cannot be assured that the Sherritt Acquisition will be completed.

There can be no assurance that the Sherritt Acquisition will be completed, or will be completed in the time frame, on the terms or in the manner currently anticipated, as a result of a number of factors, including, among other things, the failure of one or more of the conditions to closing in the Arrangement Agreement. The conditions to closing of the Sherritt Acquisition, including approval in Canada under the Competition Act and under the Investment Canada Act, as well as a court order from the Court of Queen’s Bench of Alberta and a waiver or consent of a right of first refusal applicable to certain of the Sherritt Assets, may not be satisfied or waived or other events may intervene to delay or result in the failure to close the Sherritt Acquisition. The Arrangement Agreement may be terminated by the parties under certain circumstances, including, without limitation, if the Sherritt Acquisition has not been completed by June 30, 2014 (subject to extension in certain limited circumstances and exceptions). Any delay in closing or a failure to close could have a negative impact on our business.

We and Sherritt will be subject to business uncertainties while the Sherritt Acquisition is pending that could adversely affect our and its business.

Uncertainty about the effect of the Sherritt Acquisition on employees and customers may have an adverse effect on us and the Sherritt Subsidiaries. Although we and Sherritt intend to take actions to reduce any adverse effects, these uncertainties may impair our and their ability to attract, retain and motivate key personnel until the Sherritt Acquisition is completed and for a period of time thereafter. These uncertainties could cause customers, suppliers and others that deal with us and the Sherritt Subsidiaries to seek to change existing business relationships with us and them. Employee retention could be reduced during the pendency of the Acquisition, as employees may experience uncertainty about their future roles. If, despite our and Sherritt’s retention efforts, key employees depart because of concerns relating to the uncertainty and difficulty of the integration process or a desire not to remain with us, our business could be harmed.

The Sherritt Acquisition is subject to receipt of consent or approval from governmental authorities that could delay or prevent the completion of the Sherritt Acquisition or that could cause the abandonment of the Sherritt Acquisition.

To complete the Sherritt Acquisition, we and Sherritt are required to obtain approvals or consents from, or make filings with, certain applicable governmental authorities, including approval in Canada under the Competition Act and under the Investment Canada Act , as well as a court order from the Court of Queen’s Bench of Alberta. While we and Sherritt each believe that we will receive all required approvals, there can be no assurance as to the receipt or timing of receipt of these approvals. Furthermore, the receipt of such approvals may be conditional upon actions that the parties are not obligated to take under the Arrangement Agreement and other related agreements, which could result in the termination of the Arrangement Agreement by us or the other party, or, if such approvals are received, their terms could have a detrimental impact on us following the completion of the Sherritt Acquisition. A substantial delay in obtaining any required authorizations, approvals or consents, or the imposition of unfavorable terms, conditions or restrictions contained in such authorizations, approvals or consents, could prevent the completion of the Sherritt Acquisition or have an adverse effect on the anticipated benefits of the Sherritt Acquisition, thereby adversely impacting our business, financial condition or results of operations.

We may not have uncovered all risks associated with the Sherritt Acquisition and significant liabilities of which we are not aware may exist now or arise in the future.

Upon consummation of the Sherritt Acquisition, we will assume the risk of unknown, and certain known, liabilities at the Sherritt Subsidiaries. The Sherritt Acquisition is structured as a stock purchase in which we will purchase all of the stock and equity interests of the Sherritt Subsidiaries. Once we own the Sherritt Subsidiaries, we will be responsible for all of the liabilities of the Sherritt Subsidiaries other than those for which we are being indemnified by Sherritt. Many of the representations and warranties given by Sherritt in the Arrangement Agreement are limited in scope and limited to the knowledge of certain Sherritt employees. Additionally, many of the representations and warranties are made only with respect to liabilities that would cause a material adverse effect to the Sherritt Subsidiaries. There may be significant liabilities that do not meet this threshold, and therefore are not required to be disclosed to us by Sherritt and for which we will not be indemnified.

9

We may become responsible for unexpected liabilities that we failed or were unable to discover in the course of performing due diligence in connection with the Sherritt Acquisition or for costs associated with known liabilities that exceed our estimates. A portion of the consideration in the Sherritt Acquisition consists of the assumption of liabilities; accordingly, if those liabilities are greater than we expect, the effective cost of the acquisition could increase significantly. In accordance with the terms of the Arrangement Agreement, we will assume all liabilities attributable to the ownership of the Sherritt Subsidiaries and operation of the Sherritt Assets, regardless of whether incurred before or after the closing date, other than certain specified liabilities retained by Sherritt or for which we are indemnified by Sherritt. Furthermore, although the Arrangement Agreement requires that Sherritt indemnify us for certain losses we may incur in connection with the Sherritt Acquisition, we may not be able to recover all or any portion of such losses if we should elect to pursue any claims we may have against Sherritt pursuant to such indemnification provisions or otherwise.

The pro forma financial information included in this offering memorandum may not be representative of the results of Sherritt Assets after the consummation of the Sherritt Acquisition.

The pro forma financial information in this offering memorandum is presented for illustrative purposes only and may not be indicative of the combined company’s financial position or results of operations that would have actually occurred had the Sherritt Acquisition been completed at or as of the dates indicated, nor is it indicative of our future operating results or financial position. The pro forma financial information has been derived from our historical financial statements and the audited historical financial statements of the Sherritt Subsidiaries (which historical financial information was originally prepared in accordance with IFRS and not GAAP). Additionally, the pro forma financial information does not reflect future non-recurring charges resulting from the Sherritt Acquisition or future events that may occur after the Sherritt Acquisition, including the potential costs or savings related to the planned integration of the Sherritt Assets such as investments in environmental, health and safety matters that we intend to make following the Sherritt Acquisition, and does not consider potential impacts of current market conditions on revenues or expense efficiencies. The pro forma financial information presented in this offering memorandum is based in part on certain assumptions regarding the Sherritt Acquisition that we believe are reasonable under the circumstances. We cannot assure you that our assumptions will prove to be accurate over time.

The Sherritt Acquisition will substantially expand our business, making it difficult to evaluate our business based upon our historical financial information.

The Sherritt Acquisition will significantly increase our size, expand our geographic market, enter us into new lines of business and result in material changes to our revenues and expenses. As a result of the Sherritt Acquisition and our continued goal of targeted reserve acquisitions, our financial results for any period or changes in our results across periods may continue to dramatically change. Our historical financial results, therefore, may not provide an accurate prediction of our future operating results. Accordingly, an evaluation of our business going forward may be difficult.

We may not be able to determine the actual financial condition of the Sherritt Assets until after we complete the Sherritt Acquisition and take control of the Sherritt Assets.

Although we conducted what we believe to be a reasonable level of investigation and diligence regarding the Sherritt Subsidiaries and the Sherritt Assets, a certain level of risk remains regarding the actual operating and financial condition of the Sherritt Assets. For example, the financial information provided to us with respect to the Sherritt Subsidiaries was prepared by Sherritt’s management and any financial statements provided (which form the basis of the pro forma financial statements in this offering memorandum), were originally prepared in accordance with IFRS. We may not, therefore, have a fully accurate understanding of the historical financial condition and performance of the Sherritt Subsidiaries until we actually assume control of the Sherritt Assets and their operations, and may not be able to ascertain the actual value or understand the potential liabilities of the Sherritt Assets until such time as we incorporate them into our operations.

We face challenges with the mine plan at certain of the Sherritt mines that we may not be able to resolve.

We intend to implement mine plan revisions and operational improvements at certain of the Sherritt mines being acquired. There are risks and uncertainties associated with these changes that could result in the planned operational improvements and mine plan revisions being less successful than anticipated, or impossible altogether. For instance, we may be unable to acquire regulatory approvals to initiate mine plan changes that would make operations at certain mines more efficient or profitable. In addition, we may not be able to acquire permit approvals to continue to operate in certain areas, or to mine new areas that would extend the lives of certain Sherritt mines. Finally, the demand and pricing for coal, which we do not control, could affect our ability to sell coal currently produced at certain Sherritt mines, which could result in changes to our plans for mining and developing those properties. Any delay or failure to implement the operational changes we intend to make at the Sherritt mines could adversely impact our anticipated results of operations and business.

10

We may not realize the anticipated benefits of our acquisition of the Sherritt Assets, including potential synergies, due to challenges associated with integrating the Sherritt Assets or other factors.

The Sherritt Acquisition constitutes a significant acquisition for us. The success of the Sherritt Acquisition will depend in part on the success of our management in efficiently integrating the operations, technologies and personnel of the Sherritt Assets. Our management’s inability to meet the challenges involved in successfully integrating the Sherritt Assets or to otherwise realize the anticipated benefits of the transaction could harm our results of operations.

The challenges involved in the integration of the Sherritt Assets include:

| • | integrating the operations, processes, people and technologies relating to the Sherritt Assets; |

| • | coordinating and integrating regulatory, benefits, operations and development functions; |

| • | demonstrating to customers that the Sherritt Acquisition will not result in adverse changes in coal quality, delivery schedules and other relevant deliverables; |

| • | managing and overcoming the unique characteristics of the Sherritt Assets, such as the specific mining conditions at each of the acquired mines; |

| • | assimilating and retaining the personnel of the Sherritt Subsidiaries and integrating the business cultures, operations, systems and clients of the Sherritt Subsidiaries with our own; |

| • | consolidating corporate and administrative infrastructures and eliminating duplicative operations and administrative functions; and |

| • | identifying the potential unknown liabilities associated with the Sherritt Subsidiaries and Sherritt Assets. |

In addition, the overall integration of the Sherritt Assets will require substantial attention from our management, particularly in light of the geographically dispersed operations of the acquired mines relative to our other mines and operations and the unique characteristics of the Sherritt Assets. If our senior management team is required to devote considerable amounts of time to the integration process, it will decrease the time they will have to manage our business, develop new strategies and grow our business. If our senior management is not able to manage the integration process effectively, or if any significant business activities are interrupted as a result of the integration process, our business could suffer.

Furthermore, the anticipated benefits and synergies of the Sherritt Acquisition are based on assumptions and current expectations, with limited actual experience, and assume that we will successfully integrate and reallocate resources without unanticipated costs and that our efforts will not have unforeseen or unintended consequences. In addition, our ability to realize the benefits and synergies of the Sherritt Acquisition could be adversely impacted to the extent that relationships with existing or potential customers, suppliers or the Sherritt workforce is adversely affected as a consequence of the Sherritt Acquisition, as a result of further weakening of global economic conditions, or by practical or legal constraints on our ability to successfully integrate the operations of the Sherritt Assets.

We cannot assure you that we will successfully or cost-effectively integrate the Sherritt Assets into our operations in a timely manner, or at all, and we may not realize the anticipated benefits of the acquisition, including potential synergies or growth opportunities, to the extent or in the time frame anticipated. The failure to do so could have a material adverse effect on our financial condition, results of operations and business.

We incurred and expect to continue to incur significant costs related to the Sherritt Acquisition that could have a material adverse effect on our operating results.

We expect to incur financial, legal, consulting and accounting costs of approximately $8.5 million in connection with the Sherritt Acquisition. We also anticipate that we will incur significant costs in connection with the integration of the Sherritt Assets which cannot be reasonably estimated at this time. These costs may have a material adverse effect on our cash flows and operating results in the periods in which they are recorded.

11

The acquisition of foreign companies and operations may subject us to additional risks.

We do not currently operate outside the United States. Upon consummation of the Sherritt Acquisition, a significant portion of our assets, operations and revenues will be located in Canada, and we will be subject to risks inherent in business operations outside of the United States. These risks include without limitation:

| • | impact of currency exchange rate fluctuations among the U.S. dollar, the Canadian dollar and foreign currencies relating to Sherritt’s export business, which may reduce the U.S. dollar value of the revenues, profits and cash flows we receive from non-U.S. markets or of our assets in non-U.S. countries or increase our supply costs, as measured in U.S. dollars in those markets; |

| • | exchange controls and other limits on our ability to repatriate earnings from other countries; |

| • | political or economic instability, social or labor unrest or changing macroeconomic conditions or other changes in political, economic or social conditions in the respective jurisdictions; |

| • | different regulatory structures (including creditor rights that may be different than in the United States) and unexpected changes in regulatory environments, including changes resulting in potentially adverse tax consequences or imposition of onerous trade restrictions, price controls, industry controls, safety controls, employee welfare schemes or other government controls; |

| • | increased financial accounting and reporting burdens and complexities resulting from the conversion and integration of the Sherritt Subsidiaries’ Canadian dollar denominated, non-GAAP results of operations and statement of financial condition into GAAP-complaint financial statements that can be consolidated with our historical financial reports; |

| • | tax rates that may exceed those in the United States and earnings that may be subject to withholding requirements or that may be subject to tax in the United States prior to repatriation and incremental taxes upon repatriation; |

| • | difficulties and costs associated with complying with, and enforcement of remedies under, a wide variety of complex domestic and international laws, treaties and regulations; |

| • | distribution costs, disruptions in shipping or reduced availability of freight transportation; and |

| • | imposition of tariffs, quotas, trade barriers and other trade protection measures, in addition to import or export licensing requirements imposed by various foreign countries. |

In addition, our management has limited experience managing foreign operations, and may be required to devote significant time and resources to adapting our systems, policies and procedures in order to successfully manage the integration and operation of foreign assets.

The Sherritt Assets include an export business, and the Sherritt Acquisition will therefore increase our exposure to the global coal market and the risks associated with exporting into that market.

Currently, we sell our coal production to United States customers, and do not have any significant export operations. The Sherritt Assets include a mine in western Canada that produces premium thermal coal for the Asian export market, and delivers that coal through committed port capacity in western Canada. There are significant financial and operational risks associated with the movement and delivery of coal in international markets with which we have limited experience. Our management team has limited operational experience managing an international coal export business or complying with regulations in multiple jurisdictions. For a discussion of the additional financial and market risks we will be exposed to as a result of our increased participation in the international coal market. In addition, ownership and operation of an export business may result in an increasing amount of our cash and cash equivalents being held outside the U.S. Repatriation of these funds could be subject to delay for local country approvals and could have potentially adverse tax consequences.

12

Economic conditions in Canada will have a direct impact on our business, financial condition, results of operations and cash flows.

Foreign economies, including the Canadian economy, may differ favorably or unfavorably from the United States economy in growth of gross national product, rate of inflation, market development, rate of savings, and capital investment, resource self-sufficiency and balance of payments positions, and in other respects. As a result of the Sherritt Acquisition, we will own and operate seven producing coal mines in Canada with an aggregate annual production capacity of approximately 27 million tons and total proven and probable reserves of approximately 676 million tons, which sell a substantial majority of their aggregate production to Canadian utilities and other Canadian customers. As of September 30, 2013 on a pro forma basis giving effect to the Sherritt Acquisition, 62% of our property, plant and equipment and reserves would have been owned by our Canadian subsidiaries, and 54% of our revenues would have been attributable to our Canadian operations. Fluctuations in the Canadian economy will therefore directly and indirectly impact both the revenues and cost structure of these Canadian assets. As a result of the foregoing, our business, financial condition, results of operations and cash flows will be in part dependent on economic conditions in Canada.

Upon consummation of the Sherritt Acquisition, we will be subject to foreign exchange risk as a result of exposures to changes in currency exchange rates between the U.S. and Canada.

Upon consummation of the Sherritt Acquisition, we will be exposed to exchange rate fluctuations between the Canadian dollar and U.S. dollar. We will realize revenues from sales made from the Sherritt Assets in Canadian dollars, and many of the expenses incurred by the Sherritt Assets will also be recognized in Canadian Dollars. The exchange rate of the Canadian dollar to the U.S. dollar has been at or near historic highs in recent years. In the event that the Canadian dollar weakens in comparison to the U.S. dollar, earnings generated from Canadian operations will translate into reduced earnings in our consolidated statements of comprehensive loss reported in U.S. dollars. In addition, our Canadian subsidiaries also record certain accounts receivable and accounts payable, which are denominated in Canadian dollars. Foreign currency transactional gains and losses are realized upon settlement of these assets and obligations.

Following the Sherritt Acquisition, fluctuations in the U.S. dollar relative to the Canadian dollar may make it more difficult to perform period-to-period comparisons of our reported results of operations. For purposes of accounting, the assets and liabilities of our Canadian operations will be translated using period-end exchange rates, and the revenues and expenses of our Canadian operations will be translated using average exchange rates during each period. Translation gains and losses are reported in accumulated other comprehensive loss as a component of stockholders’ equity.

The historical financial statements and resource reserve reporting of the Sherritt Subsidiaries differ from financial and reserve reporting in the United States.

The historical financial statements of the Sherritt Subsidiaries and the historical reserve and resource estimates and reports regarding the Sherritt Assets are not directly comparable to our financial statement and reserve report filings that are subject to SEC reporting and disclosure requirements. Sherritt and the Sherritt Subsidiaries have historically produced their financial statements and reports and reported reserves and resources in accordance with Canadian practices. Those practices are different from the practices used by us. In particular, we use GAAP as our primary set of financial reporting standards, whereas Sherritt has historically produced its financial statements under IFRS. The SEC also has specific rules applicable to the measurement and reporting of resource reserves of U.S. companies that differ from the Canadian reserve reporting requirements applicable to Sherritt. Accordingly, the financial information and statements and reserves and resources information contained in the reports filed by Sherritt with Canadian securities regulators and provided to our management in connection with the Sherritt Acquisition, are not directly comparable to our reserve and resources reporting information that is subject to the reporting and disclosure requirements of the SEC.

The Obed Mine Release into the Athabasca River prior to the Sherritt Acquisition may result in significant liability arising after closing of the Sherritt Acquisition.

On October 31, 2013, a breach of an onsite water containment pond occurred at Sherritt’s Obed Mountain Mine near Hinton, Alberta. The contents of the release included 670,000 cubic meters of process water and low concentrations of suspended solids, mainly, clay, soil, shale and particles of coal. The released sediment, including organic debris it collected in its path, entered the Athabasca River. Sherritt notified the environmental regulators immediately upon discovery of the breach. On November 19, 2013, Alberta Environment and Sustainable Resource Development issued an environmental protection order. The order requires Sherritt to develop and implement assessment, management and remediation plans relating to the impact of the Obed Mine Release. Such plans will include short- and long-term plans for impact assessment, the recovery of solids, wildlife mitigation, waste management and mine wastewater management. Current work continues on impact assessment, next-stage remediation activities and the finalization of short-, medium- and long-term monitoring plans. After closing of the Sherritt Acquisition, Sherritt will work with the regulators and us on the remediation plan. Although the Arrangement Agreement requires that Sherritt indemnify us for losses resulting from the Obed Mine Release, we may not be able to recover all of such losses if we should elect to pursue any claims we may have against Sherritt pursuant to such indemnification provisions or otherwise.

13

Canadian licenses, permits and other authorizations may be subject to challenges based on Aboriginal or Treaty rights.

Section 35 of the Canadian Constitution Act of 1982, the Natural Resources Transfers Agreements of 1930 and certain Canadian judicial decisions have recognized and affirmed the continued existence of Aboriginal and Treaty rights in Canada, including in some circumstances title to lands continuously used or occupied by Aboriginal groups, as well as harvesting and other rights relating to Aboriginal groups’ traditional territories. In most cases, the precise nature and contours of these rights as well as their geographic scope remain undefined at this time, and are or may be the subject to ongoing or future claims, court cases and negotiations of significant complexity.

Pending resolution of such claims, the Supreme Court of Canada has also recognized a Crown obligation to consult with and, in some circumstances, accommodate Aboriginal interests where the Crown undertakes actions or contemplates decisions that could adversely affect claimed or established Aboriginal or Treaty rights. While this duty lies with the federal and provincial Crowns, it may have a significant impact on private mineral and other proprietary interests.

Westmoreland’s mineral and other proprietary interests may now or in the future be the subject of Aboriginal land or rights claims. The impact of any such claims on Westmoreland’s mineral and other proprietary cannot be predicted with any degree of certainty and no assurance can be given that a recognition of Aboriginal rights in the area in which Westmoreland’s mineral and other proprietary rights are located, by way of a negotiated settlement or judicial pronouncement, would not have an adverse effect on Westmoreland’s activities.

As issues relating to Aboriginal and Treaty rights and consultation continue to be argued, developed and resolved in Canadian courts, Westmoreland will continue to cooperate, communicate and exchange information and views with Aboriginal groups and government, and participate with the Crown in its consultation processes with Aboriginal groups in order to foster good relationships and minimize risks to mineral rights and operational plans. Due to their complexity, it is not expected that the issues regarding Aboriginal and Treaty rights or consultation will be finally resolved in the short term and, accordingly, the impact of these issues on mineral and other proprietary rights and on mining operations is unknown at this time.

Should a dispute arise between one or more Aboriginal groups and the Crown, it could significantly affect Westmoreland’s mineral and other proprietary interests and operations. Also, such action could have a detrimental impact on Westmoreland`s financial condition and results of operations as well as on customers.

Sherritt has significant operations in Cuba the funding of which with Acquisition Proceeds potentially could implicate U.S. Office of Foreign Assets Control (“OFAC”) restrictions.

Sherritt has provided assurances in the Arrangement Agreement that no proceeds from the Sherritt Acquisition will be used to fund or support any of its operations in Cuba. These assurances were based on specific review of past funding practices for Cuban operations. If Sherritt were to violate these contractual terms and use proceeds in a manner that funded or supported its Cuban operations, depending on the circumstances of that use, it is possible that OFAC could consider Sherritt’s use of these funds to implicate OFAC restrictions. If that occurred and depending on the circumstances, OFAC might pursue fines, penalties and other sanctions against Sherritt. Whether Westmoreland would be implicated in such an enforcement action would depend on the circumstances of the alleged non-compliance. Whether the contractual terms would serve to mitigate any alleged non-compliance on the part of Westmoreland would depend on circumstances and OFAC’s assessment of the relevant contract terms and the specific review conducted in support of those terms.

Because we are acquiring Sherritt’s royalty business and immediately selling that business, we could have liability with respect to the royalty business buyer.

We are acquiring Sherritt’s royalty business and immediately selling that business to Altius. We are not familiar with the royalty assets, have limited information regarding these assets and have not had and will not have operational control over these assets. Sherritt is making certain representations and warranties to us and to Altius regarding the royalty assets; however, this does not prevent Altius from pursuing claims against us with respect to the royalty assets they are acquiring.

14

Risks relating to taxation and reassessment

The Arrangement Agreement provides that, in connection with the transfer of the Royalty Interest to Altius, the reorganization transactions Sherritt has undertaken in preparation for the transfer of the Royalty Interest and the Sherritt Acquisition itself, applicable tax returns and elections will be prepared and filed so as to comply with the Income Tax Act (Canada) and all applicable provincial tax legislation in Canada. However, such returns are subject to review and reassessment by the applicable taxation authority. PMRL and CVRI, after their acquisition by us pursuant to the Arrangement Agreement, may potentially be subject to higher than expected past or future tax liability, as well as interest and penalties, in the event of a successful reassessment, and such amounts could be material. Sherritt has agreed to indemnify us for certain tax matters and liabilities that may arise after closing of the Sherritt Acquisition.

Risk Factors Relating to our Combined Operations

Risks associated with being leveraged.

Following the completion of the Sherritt Acquisition and the WML Refinancing, we expect to have outstanding indebtedness of approximately $828 million, and a net leverage ratio of 3.3 (calculated by subtracting available cash from gross debt and dividing by EBITDA). We may also incur additional indebtedness in the future, including additional indebtedness of $70 million (which we may increase to $100 million at our discretion) under our Revolving Credit Facility if we complete our anticipated amendment of that facility. Our leverage position may, among other things:

| • | limit our ability to obtain additional debt financing in the future for working capital, capital expenditures, acquisitions, or other general corporate purposes; |

| • | require us to dedicate a substantial portion of our cash flow from operations to service our debt, reducing the availability of cash flow for other purposes; |

| • | increase our vulnerability to economic downturns, limit our ability to capitalize on significant business opportunities, and restrict our flexibility to react to changes in market or industry conditions; or |

| • | make it more difficult to pay our debts, including payment on our outstanding notes, which will mature in 2018. |

While we have received credit upgrades from both S&P and Moody’s within the last two years, on December 26, 2013, following the announcement of the Sherritt Acquisition, Moody’s Investor Service placed our ratings on watch for potential downgrade and there can be no assurance that rating agencies will not downgrade the credit rating on our outstanding indebtedness in the future. Any such downgrade, or any perceived decrease in our creditworthiness, could impede our ability to refinance existing debt or secure new debt or otherwise increase our future cost of borrowing and could create additional concerns on the part of our customers, partners, investors and employees about our financial condition and results of operations.

If we fail to comply with certain covenants in our various debt arrangements, it could negatively affect our liquidity and ability to finance our operations.

Our lending arrangements contain, among other terms, events of default and various affirmative and negative covenants. Should we be unable to comply with any future debt-related covenant, we will be required to seek a waiver of such covenant to avoid an event of default. Covenant waivers and modifications may be expensive to obtain, or, potentially, unavailable. If we are in breach of any covenant and are unable to obtain covenant waivers and our lenders accelerate our debt, we could attempt to refinance the debt or repay the debt by selling assets and applying the proceeds from such sales to the debt. Sales of assets undertaken in response to such immediate needs may be prohibited under our lending arrangements without the consent of our lenders, may be made at potentially unfavorable prices, or asset sales may not be sufficient to refinance or repay the debt, and we may be unable to complete such transactions in a timely manner, on favorable terms, or at all.

We may not generate sufficient cash flow at our operating subsidiaries to pay our operating expenses, meet our debt service costs and pay our heritage and corporate costs.

Our WML subsidiary, which owns the Rosebud, Jewett, Beulah and Savage mines, is currently subject to the WML Credit Facility that limits its ability to dividend funds to us. While we expect to terminate the WML Credit Facility if we are successful in amending our Revolving Credit Facility to the increase the amount of borrowings available thereunder, if we are not successful in doing so the WML Credit Facility will remain in effect. In that event, WML may not be able to pay dividends to us in the amounts and in the time required for us to pay our heritage health costs and corporate overhead expenses. Ultimately, if WML’s operating cash flows are insufficient to support its operations, amortize its debt and provide dividends to us in the amounts and time required to pay our expenses, we may be required to expend cash on hand or further leverage our operations through our Revolving Credit Facility or other borrowings to fund our heritage liabilities and corporate overhead. Should we be required to expend cash on hand to fund such activities, such funds would be unavailable to grow our business through strategic acquisitions or ventures or support the business through reclamation bonding, capital and reserve acquisition.

15

As a mine mouth operator, we provide coal to a small group of customers. This dependence could adversely affect our revenues if such customers reduce or suspend their coal purchases or if they become unable to pay for our coal.

During the nine months ended September 30, 2013, we derived approximately 67% of our total revenues from coal sales to five power plants: Colstrip Units 3&4 (18%), Naughton Power Station (16%), Limestone Generating Station (14%), Colstrip Units 1 & 2 (13%) and Coyote Station (6%). Similarly, for full-year 2013, the Sherritt Subsidiaries sold approximately 25% of their total aggregate coal production to two customers, SaskPower (13%) and Capital Power (12%). Interruption in the purchases of coal by our principal customers could significantly affect our revenues. Unscheduled maintenance outages or other outages at our customers’ power plants, unseasonably moderate weather, higher-than-anticipated hydro seasons or increases in the production of alternative clean-energy generation such as wind power, or decreases in the price of competing fossil fuels such as natural gas, could cause our customers to reduce their purchases. Five of our six mines are dedicated to supplying customers located adjacent to or near the mines, and these mines may have difficulty identifying alternative purchasers of their coal if their existing customers suspend or terminate their purchases.

Additionally, certain of our long-term contracts are set to expire in the next several years. Our contracts with the Sherburne County Station are three-year rolling contracts, with one-third of the tonnage expiring on an annual basis. Our contract with Coyote Station, located adjacent to our Beulah mine and averaging approximately 3 million tons of coal sold per year, expires in May 2016 and is not expected to be renewed. Our contract with Colstrip Units 3 & 4 expires in December 2019. Should we be unable to successfully renew any or all of these expiring contracts, the reduction in the sale of our coal would adversely affect our operating results and liquidity and could result in significant impairments to the affected mine should the mine be unable to execute a new long-term coal supply agreement. The long term agreements we are acquiring under the Sherritt Acquisition have long remaining terms with the exception of the contract applicable to Poplar River mine which is set to expire in 2015.

Similarly, interruption in the purchase of power by Dominion could also negatively affect our revenues. During the nine months ended September 30, 2013, the sale of power by ROVA to Dominion accounted for approximately 14% of our consolidated revenues. Although ROVA supplies power to Dominion under long-term power purchase agreements, if Dominion is unable or unwilling to pay for the power produced by ROVA in a timely manner, it could have a material adverse effect on our results of operations, financial condition, and liquidity.

Our ability to collect payments from our customers could be impaired if their creditworthiness deteriorates.

Our ability to receive payment for coal sold and delivered depends on the continued creditworthiness of our customers. If we determine that a customer is not creditworthy, we may not be required to deliver coal under the customer’s coal sales contract. If this occurs, we may decide to sell the customer’s coal on the spot market, which may be at prices lower than the contracted price, or we may be unable to sell the coal at all. Furthermore, the bankruptcy of any of our customers could materially and adversely affect our financial position. In addition, competition with other coal suppliers could cause us to extend credit to customers and on terms that could increase the risk of payment default.

Volatility in the equity markets or interest rate fluctuations could substantially increase our pension funding requirements and negatively impact our financial position.

At December 31, 2012, the projected benefit obligation under our defined benefit pension plans was $172.3 million and the fair value of plan assets was $121.9 million. The difference between plan obligations and assets, or the funded status of the plans, significantly affects the net periodic benefit cost and ongoing funding requirements of those plans. Among other factors, changes in interest rates, mortality rates, early retirement rates, investment returns and the market value of plan assets can affect the level of plan funding, cause volatility in the net periodic benefit cost and increase our future funding requirements. During the nine months ended September 30, 2013, we made no contributions to these pension plans and accrued $2.6 million in expenses related thereto. The current economic environment increases the risk that we may be required to make even larger contributions in the future. Additionally, due to covenants in our WML Notes, we are required to maintain our pension plan funding at higher levels than would otherwise be required, increasing funding requirements and the chance that we will be required to make large contributions in the future.

16

If our assumptions regarding our future expenses related to employee benefit plans are incorrect, then expenditures for these benefits could be materially higher than we have assumed. In addition, we may have exposure under those plans that extend beyond what our obligations would be with respect to our own employees.

We provide various postretirement medical benefits and worker’s compensation benefits to current and former employees and their dependents. We calculate the total accumulated benefit obligations according to guidance provided by GAAP. We estimate the present value of our postretirement medical, black lung and worker’s compensation benefit obligations to be $333.8 million, $16.2 million and $9.5 million, respectively, at December 31, 2012. In addition, in connection with the Sherritt Acquisition, we assumed the obligation to provide postretirement health coverage for eligible current union employees, as described in greater detail below. We have estimated these unfunded obligations based on actuarial assumptions and if our assumptions do not materialize as expected, cash expenditures and costs that we incur could be materially different.

Moreover, regulatory changes could increase our obligations to provide these or additional benefits. We participate in defined benefit multi-employer funds that were established in connection with the Coal Industry Retiree Health Benefit Act of 1992, or Coal Act, which provides for the funding of health and death benefits for certain UMWA retirees. Our contributions to these funds totaled $1.7 million, $2.3 million and $2.6 million during the nine months ended September 30, 2013 and for the years ended December 31, 2012 and 2011, respectively. Our contributions to these funds could increase as a result of a shrinking contribution base as a result of the insolvency of other coal companies that currently contribute to these funds, lower than expected returns on fund assets or other funding deficiencies.

We could also have obligations under the Tax Relief and Health Care Act of 2006, or 2006 Act. The 2006 Act authorized up to a maximum of $490 million in federal contributions to pay for certain benefits, including the healthcare costs under certain funds created by the Coal Act for “orphans,” i.e. retirees from companies that subsequently ceased operations, and their dependents. However, if Congress were to amend or repeal the 2006 Act or if the $490 million authorization were insufficient to pay for these healthcare costs, we, along with other contributing employers and certain affiliates, would be responsible for the excess costs.

We also contribute to a multi-employer defined benefit pension plan, the Central Pension Fund of the Operating Engineers, or Central Pension Fund, on behalf of employee groups at our Rosebud, Absaloka and Savage mines that are represented by the International Union of Operating Engineers. The Central Pension Fund is subject to certain funding rules contained in the Pension Protection Act of 2006, or PPA. Under the PPA, if the Central Pension Plan fails to meet certain minimum funding requirements, it would be required to adopt a funding improvement plan or rehabilitation plan. If the Central Pension Fund adopted a funding improvement plan or rehabilitation plan, we could be required to contribute additional amounts to the fund. As of January 31, 2012, its last completed fiscal year, the Central Pension Fund reported that it was underfunded. If we were to partially or completely withdraw from the fund at a time when the Central Pension Fund were underfunded, we would be liable for a proportionate share of the fund’s unfunded vested benefits, and this liability could have a material adverse effect on our financial position.

In connection with the Sherritt Acquisition, we are assuming responsibility for and accepting obligations under the following pension plans:

| • | Prairie Mines & Royalty Lt. Pension Plan for Salaried Employees; |

| • | Prairie Mines & Royalty Lt. Pension Plan for Non-Union Employees; |

| • | Boundary-Bienfait Hourly Defined Benefit Pension Plan; |

| • | Boundary-Bienfait Hourly Defined Contribution Pension Plan; |

| • | Sherritt Executive Supplementary Pension Plan; and, |

| • | Sherritt Non-Union Pension Plan. |

We have evaluated these plans, and believe that certain of them may be underfunded by immaterial amounts. In the event the underfund amounts are larger than we anticipate, the Arrangement Agreement requires Sherritt to adjust the purchase price if such underfunded amount exceeds $3,000,000.

We are obligated to make contributions to these plans based upon agreement with the plan members and collective bargaining agreements with the representative unions. Our future contributions to these defined benefit plans are made in accordance with GAAP pursuant to applicable pension legislation and the Income Tax Act (Canada). Further contributions to the pension plans could be required based on actuarial valuations, agreements, the plan asset investment performance, and future legislated requirements.

Under Canadian provincial Workers’ Compensation legislation we remain obligated to fund workers’ compensation benefits arising from workplace injuries, disease and death of current and former employees. This obligation is based on premiums assessed by the applicable Workers’ Compensation Board which may vary based on the claims experience of the employer. We may be required to contribute additional premiums in the future depending on the number and amount of claims.

17

Our reserve estimates may prove to be incorrect.

The coal reserve estimates in this offering memorandum are estimates based on the interpretation of limited sampling and subjective judgments regarding the grade, continuity and existence of mineralization, as well as the application of economic assumptions, including assumptions as to operating costs, foreign exchange rates and future commodity prices. The sampling, interpretations or assumptions underlying any reserve estimate may be incorrect, and the impact on the amount of reserves ultimately proven to be recoverable may be material. Should the mineralization and/or configuration of a deposit ultimately turn out to be significantly different from that currently envisaged, then the proposed mining plan may have to be altered in a way that could affect the tonnage and grade of the reserves mined and rates of production and, consequently, could adversely affect the profitability of the mining operations. In addition, short term operating factors relating to the reserves, such as the need for orderly development of ore bodies or the processing of new or different ores, may cause reserve estimates to be modified or operations to be unprofitable in any particular fiscal period. There can be no assurance that our projects or operations will be, or will continue to be, economically viable, that the indicated amount of minerals will be recovered or that they will be recovered at the prices assumed for purposes of estimating reserves.

Any inaccuracies in our estimates of our coal reserves could result in decreased profitability from lower than expected revenues or higher than expected costs.

Our future performance depends on, among other things, the accuracy of our estimates of our proven and probable coal reserves. Our reserve estimates are prepared by our engineers and geologists or by third-party engineering firms and are updated periodically. There are numerous factors and assumptions inherent in estimating the quantities and qualities of, and costs to mine, coal reserves, including many factors beyond our control, including the following:

| • | quality of the coal; |

| • | geological and mining conditions, which may not be fully identified by available exploration data and/or may differ from our experiences in areas where we currently mine; |

| • | the percentage of coal ultimately recoverable; |

| • | the assumed effects of regulation, including the issuance of required permits, taxes, including severance and excise taxes and royalties, and other payments to governmental agencies; |

| • | economic assumptions, including assumptions as to foreign exchange rates and future commodity prices; |

| • | assumptions concerning the timing for the development of the reserves; and |

| • | assumptions concerning equipment and productivity, future coal prices, operating costs, including for critical supplies such as fuel, tires and explosives, capital expenditures and development and reclamation costs. |

As a result, estimates of the quantities and qualities of economically recoverable coal attributable to any particular group of properties, classifications of reserves based on risk of recovery, estimated cost of production, and estimates of future net cash flows expected from these properties may vary materially due to changes in the above factors and assumptions. Any inaccuracy in our estimates related to our reserves could result in decreased profitability from lower than expected revenues or higher than expected costs.

If the assumptions underlying our reclamation and mine closure obligations are materially inaccurate, we could be required to expend greater amounts than anticipated.