Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NORTH VALLEY BANCORP | novb_8k.htm |

| EX-2.1 - NORTH VALLEY BANCORP | ex2_1.htm |

| EX-99.2 - NORTH VALLEY BANCORP | ex99_2.htm |

| EX-99.1 - NORTH VALLEY BANCORP | ex99_1.htm |

Exhibit 99.3

| Merger with North Valley Bancorp Creating the Premier Community Bank in Northern California Investor Presentation January 21, 2014 NASDAQ: TCBK NASDAQ: NOVB |

| Certain comments included in this presentation, including any projections of future revenues, cost savings and net income, may involve forward-looking statements, for which TriCo claims the protection of the "safe harbor" provisions created by Federal securities laws. Such forward- looking statements are subject to risks and uncertainties which may cause TriCo's actual results to differ materially from those contemplated by such statements. Such risks and uncertainties include whether shareholders approve the merger, whether the companies receive required regulatory approvals, the timing of the closing of the merger, whether the companies have accurately predicted acquisition and consolidation expenses, the timing and amount of savings from the merger, the expected earnings contributions of both companies and management's ability to integrate the companies effectively. You should not place undue reliance on forward- looking statements and TriCo undertakes no obligation to update any such statements. Additional information concerning certain of these risks and uncertainties is included in TriCo's Annual Report on Form 10-K for the fiscal year ended December 31, 2012 and TriCo's Quarterly Reports on Form 10-Q as filed with the SEC in fiscal 2013. Shareholders are urged to read the joint proxy statement/prospectus that will be included in the registration statement on Form S-4, which TriCo will file with the SEC in connection the proposed action because it will contain important information about TriCo, North Valley, the merger and related matters, including additional risk and uncertainties. Safe Harbor Statement |

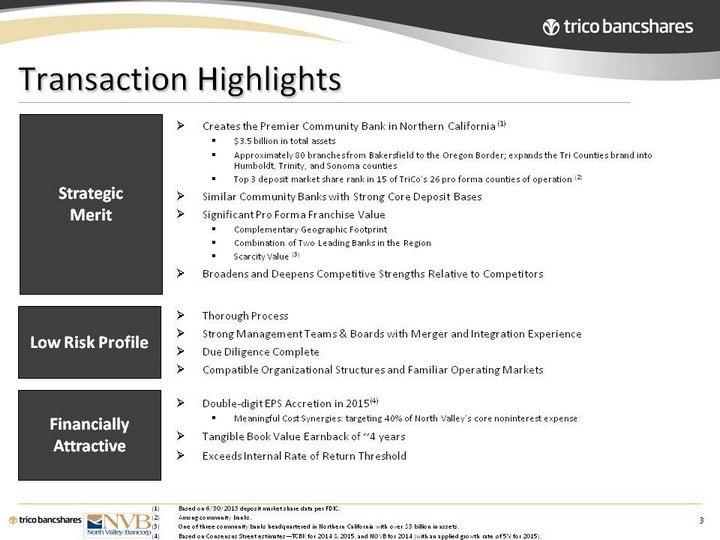

| Transaction Highlights Creates the Premier Community Bank in Northern California (1) $3.5 billion in total assets Approximately 80 branches from Bakersfield to the Oregon Border; expands the Tri Counties brand into Humboldt, Trinity, and Sonoma counties Top 3 deposit market share rank in 15 of TriCo's 26 pro forma counties of operation (2) Similar Community Banks with Strong Core Deposit Bases Significant Pro Forma Franchise Value Complementary Geographic Footprint Combination of Two Leading Banks in the Region Scarcity Value (3) Broadens and Deepens Competitive Strengths Relative to Competitors 3 Strategic Merit Financially Attractive Based on 6/30/2013 deposit market share data per FDIC. Among community banks. One of three community banks headquartered in Northern California with over $3 billion in assets. Based on Consensus Street estimates-TCBK for 2014 & 2015, and NOVB for 2014 (with an applied growth rate of 5% for 2015). Double-digit EPS Accretion in 2015(4) Meaningful Cost Synergies: targeting 40% of North Valley's core noninterest expense Tangible Book Value Earnback of ~4 years Exceeds Internal Rate of Return Threshold Low Risk Profile Thorough Process Strong Management Teams & Boards with Merger and Integration Experience Due Diligence Complete Compatible Organizational Structures and Familiar Operating Markets |

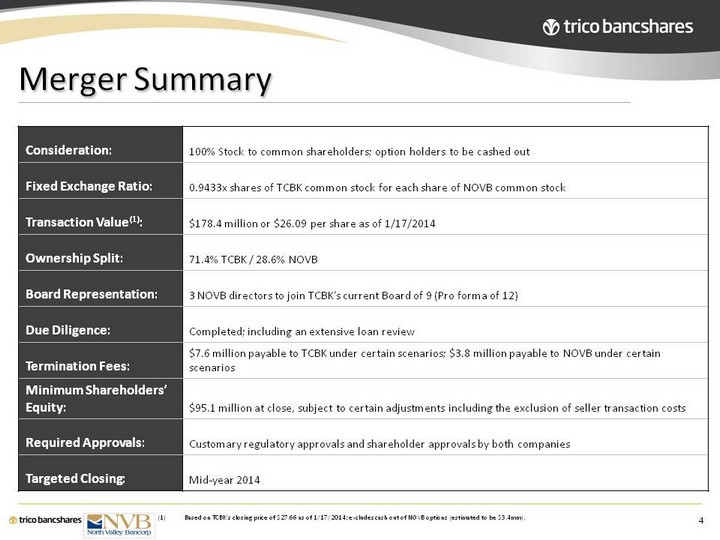

| Merger Summary 4 Based on TCBK's closing price of $27.66 as of 1/17/2014; excludes cash out of NOVB options (estimated to be $3.4mm). Consideration: 100% Stock to common shareholders; option holders to be cashed out Fixed Exchange Ratio: 0.9433x shares of TCBK common stock for each share of NOVB common stock Transaction Value(1): $178.4 million or $26.09 per share as of 1/17/2014 Ownership Split: 71.4% TCBK / 28.6% NOVB Board Representation: 3 NOVB directors to join TCBK's current Board of 9 (Pro forma of 12) Due Diligence: Completed; including an extensive loan review Termination Fees: $7.6 million payable to TCBK under certain scenarios; $3.8 million payable to NOVB under certain scenarios Minimum Shareholders' Equity: $95.1 million at close, subject to certain adjustments including the exclusion of seller transaction costs Required Approvals: Customary regulatory approvals and shareholder approvals by both companies Targeted Closing: Mid-year 2014 |

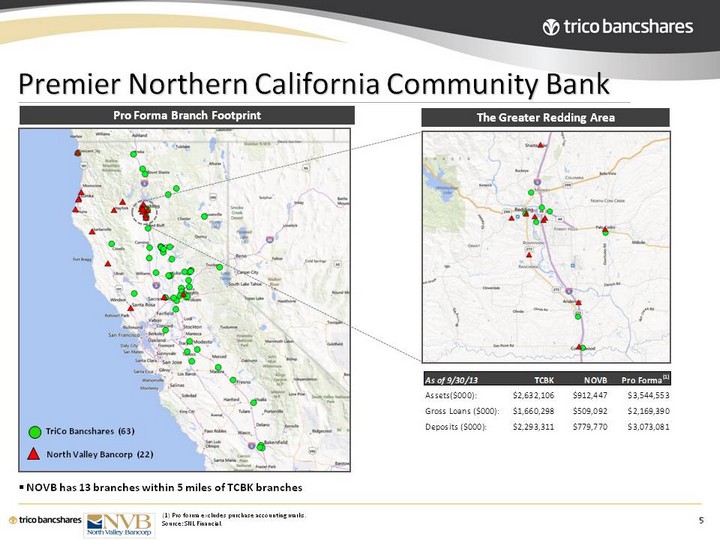

| Premier Northern California Community Bank 5 Pro Forma Branch Footprint TriCo Bancshares (63) North Valley Bancorp (22) The Greater Redding Area NOVB has 13 branches within 5 miles of TCBK branches (1) Pro forma excludes purchase accounting marks. Source: SNL Financial. |

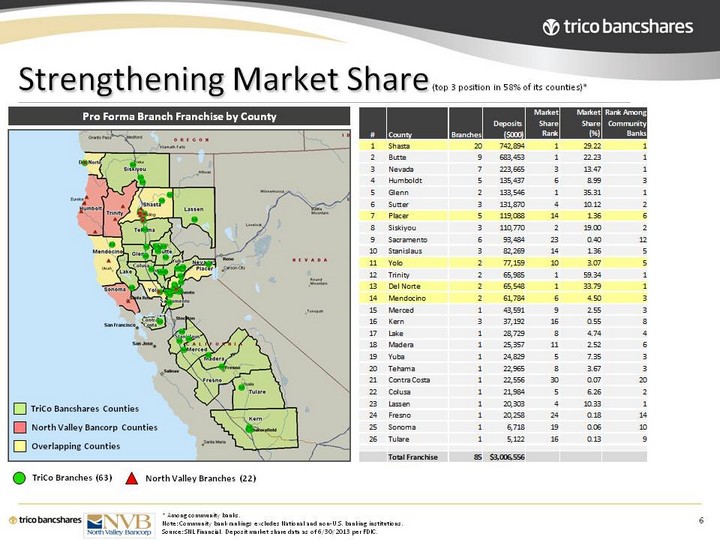

| Strengthening Market Share (top 3 position in 58% of its counties)* 6 Pro Forma Branch Franchise by County TriCo Bancshares Counties North Valley Bancorp Counties Overlapping Counties TriCo Branches (63) North Valley Branches (22) * Among community banks. Note: Community bank rankings excludes National and non-U.S. banking institutions. Source: SNL Financial. Deposit market share data as of 6/30/2013 per FDIC. |

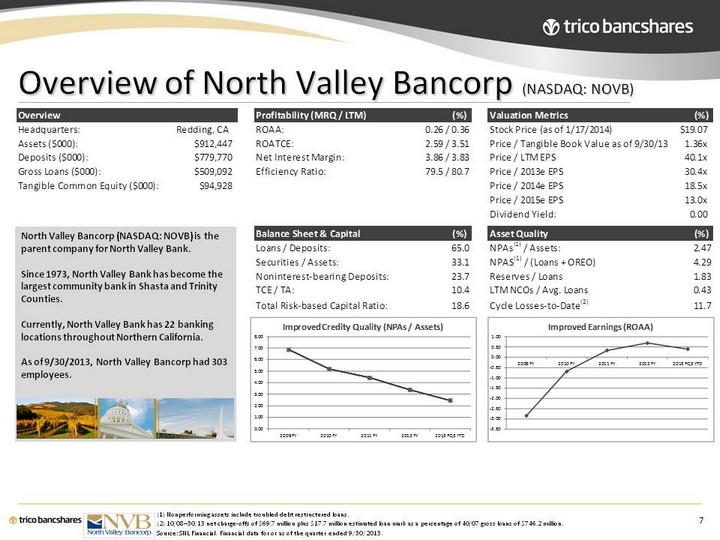

| Overview of North Valley Bancorp (NASDAQ: NOVB) 7 North Valley Bancorp (NASDAQ: NOVB) is the parent company for North Valley Bank. Since 1973, North Valley Bank has become the largest community bank in Shasta and Trinity Counties. Currently, North Valley Bank has 22 banking locations throughout Northern California. As of 9/30/2013, North Valley Bancorp had 303 employees. (1) Nonperforming assets include troubled debt restructured loans. (2) 1Q'08-3Q'13 net charge-offs of $69.7 million plus $17.7 million estimated loan mark as a percentage of 4Q'07 gross loans of $746.2 million. Source: SNL Financial. Financial data for or as of the quarter ended 9/30/2013. |

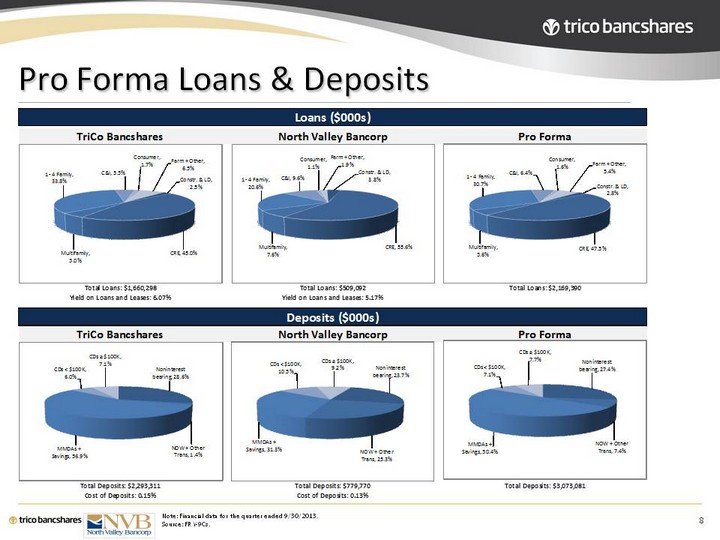

| Pro Forma Loans & Deposits 8 Note: Financial data for the quarter ended 9/30/2013. Source: FR Y-9Cs. |

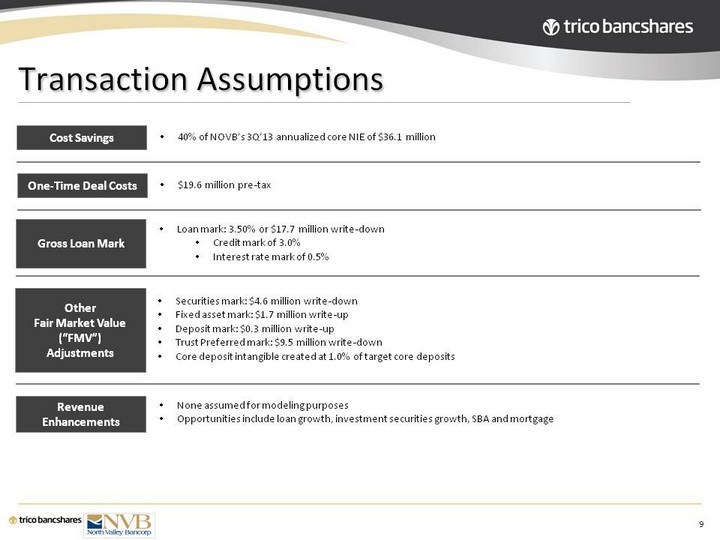

| Transaction Assumptions 9 40% of NOVB's 3Q'13 annualized core NIE of $36.1 million $19.6 million pre-tax Cost Savings Other Fair Market Value ("FMV") Adjustments One-Time Deal Costs Securities mark: $4.6 million write-down Fixed asset mark: $1.7 million write-up Deposit mark: $0.3 million write-up Trust Preferred mark: $9.5 million write-down Core deposit intangible created at 1.0% of target core deposits Gross Loan Mark Loan mark: 3.50% or $17.7 million write-down Credit mark of 3.0% Interest rate mark of 0.5% Revenue Enhancements None assumed for modeling purposes Opportunities include loan growth, investment securities growth, SBA and mortgage |

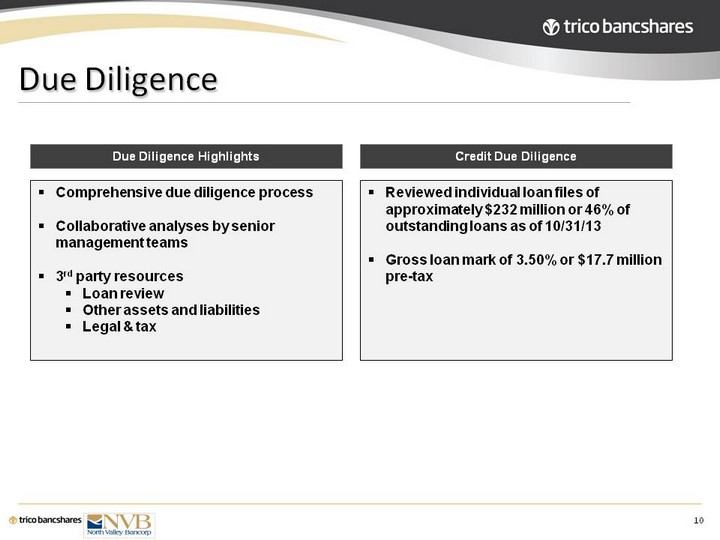

| Due Diligence 10 Due Diligence Highlights Credit Due Diligence Comprehensive due diligence process Collaborative analyses by senior management teams 3rd party resources Loan review Other assets and liabilities Legal & tax Reviewed individual loan files of approximately $232 million or 46% of outstanding loans as of 10/31/13 Gross loan mark of 3.50% or $17.7 million pre-tax |

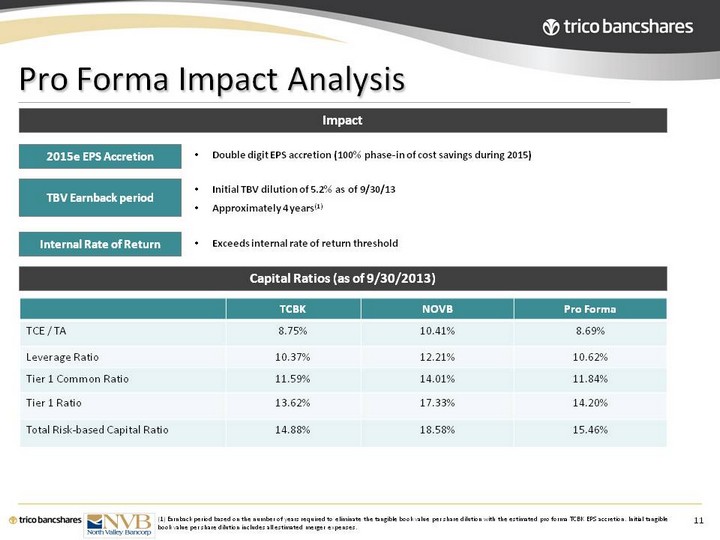

| Pro Forma Impact Analysis 11 Impact Capital Ratios (as of 9/30/2013) 2015e EPS Accretion Internal Rate of Return TBV Earnback period Double digit EPS accretion (100% phase-in of cost savings during 2015) Exceeds internal rate of return threshold Initial TBV dilution of 5.2% as of 9/30/13 Approximately 4 years(1) TCBK NOVB Pro Forma TCE / TA 8.75% 10.41% 8.69% Leverage Ratio 10.37% 12.21% 10.62% Tier 1 Common Ratio 11.59% 14.01% 11.84% Tier 1 Ratio 13.62% 17.33% 14.20% Total Risk-based Capital Ratio 14.88% 18.58% 15.46% (1) Earnback period based on the number of years required to eliminate the tangible book value per share dilution with the estimated pro forma TCBK EPS accretion. Initial tangible book value per share dilution includes all estimated merger expenses. |

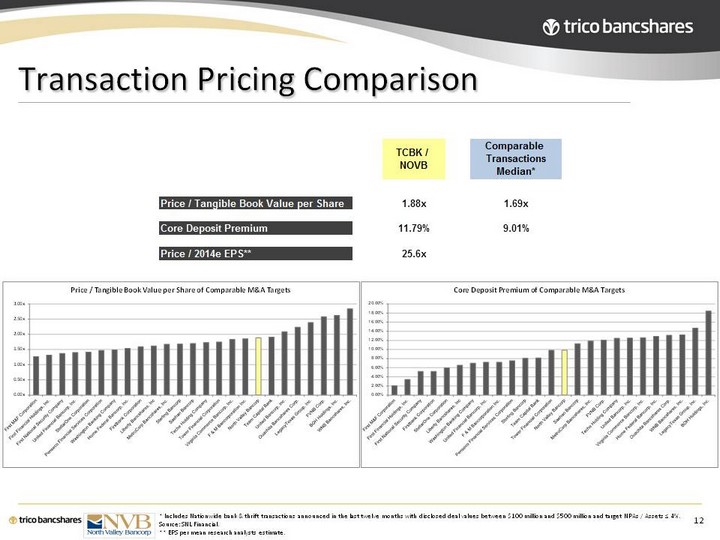

| Transaction Pricing Comparison 12 * Includes Nationwide bank & thrift transactions announced in the last twelve months with disclosed deal values between $100 million and $500 million and target NPAs / Assets ^ 4%. Source: SNL Financial. ** EPS per mean research analysts estimate. |

| Summary 13 Strategic Merit Capital Position Allows for Continued Growth Low Risk Profile Use of Strong Currency Attractive Financial Returns for Shareholders Increases Franchise Value Market Expansion Strong Cultural Fit #1 Community Banking Institution in Northern California Capital Position Allows for Continued Growth Attractive Financial Returns for Shareholders Strong Cultural Fit |

| Richard P. Smith (TriCo) President & Chief Executive Officer (530) 898-0300 (x8856) ricksmith@tcbk.com Thomas J. Reddish (TriCo) EVP & Chief Financial Officer (530) 898-0300 (x8870) tomreddish@tcbk.com Michael J. Cushman (North Valley) President & Chief Executive Officer (530) 221-4018 mcushman@novb.com Kevin Watson (North Valley) EVP & Chief Financial Officer (530) 226-2911 kwatson@novb.com |