Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - KM WEDDING EVENTS MANAGEMENT, INC. | kmwedding0117forms1a2ex101.htm |

| EX-10.2 - EXHIBIT 10.2 - KM WEDDING EVENTS MANAGEMENT, INC. | kmwedding0117forms1a2ex102.htm |

| EX-23.1 - EXHIBIT 23.1 - KM WEDDING EVENTS MANAGEMENT, INC. | kmwedding0117forms1a2ex231.htm |

| EX-10.3 - EXHIBIT 10.3 - KM WEDDING EVENTS MANAGEMENT, INC. | kmwedding0117forms1a2ex103.htm |

| EX-10.4 - EXHIBIT 10.4 - KM WEDDING EVENTS MANAGEMENT, INC. | kmwedding0117forms1a2ex104.htm |

| EX-10.5 - EXHIBIT 10.5 - KM WEDDING EVENTS MANAGEMENT, INC. | kmwedding0117forms1a2ex105.htm |

| EX-10.6 - EXHIBIT 10.6 - KM WEDDING EVENTS MANAGEMENT, INC. | kmwedding0117forms1a2ex106.htm |

| EX-5.1 - EXHIBIT 5.1 - KM WEDDING EVENTS MANAGEMENT, INC. | kmwedding0117forms1a2ex51.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 2

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Commission File Number: 333-192399

KM WEDDING EVENTS MANAGEMENT, INC.

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) |

7299 (Primary Standard Industrial Classification Code Number) |

46-1290754 (I.R.S. Employer Identification Number) |

11501 Dublin Blvd., Suite 200

Dublin, CA 94568

Phone: (925) 891-8029

Fax: (925) 891-8028

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Paracorp Corporation

2140 South DuPont Highway

Camden, DE 19934

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

From time to time after the effective date of this Registration Statement.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☑ .

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering.☐ .

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering.☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. .☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☑ |

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered

|

Amount to be Registered (1)

|

Maximum Offering Price Per Share

|

Maximum Aggregate Offering Price (2)

|

Amount of Registration Fee (2)

|

| Common Stock, $0.001 par value per share | 10,000,000 (3) | $0.30 | $3,000,000 | $386.00 |

| Common Stock, $0.001 par value per share | 7,912,660 (4) | $0.30 | $2,373,798 | $305.00 |

| (1) | In the event of a stock split, stock dividend or similar transaction involving the common shares of the Registrant, in order to prevent dilution, the number of shares of common stock registered shall be automatically increased to cover additional shares in accordance with Rule 416(a) under the United States Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Estimated solely for the purpose of calculating the registration fee under Rule 457(a) and (o) of the Securities Act. |

| (3) | Direct Public Offering. |

| (4) | Selling Security Holders. This Registration Statement also covers the resale under a separate resale prospectus (the “Resale Prospectus”) by Selling Shareholders of the Registrant of up to 7,912,660 ordinary shares previously issued to the Selling Shareholders as named in the Resale Prospectus. |

The Registrant hereby amends this Registration Statement (the “Registration Statement”) on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

| 2 |

Subject to completion, dated January 16, 2014

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

| · | Public Offering Prospectus. A prospectus regarding our offering of up to 10,000,000 shares of our Common Stock in a direct public offering, without any involvement of underwriters or broker-dealers (the “Public Offering Prospectus”). Should all shares being offered by the Company hereunder be sold, the Company would receive an aggregate of $3,000,000. The offering price is $0.30 per share for newly issued shares. |

| · | Resale Prospectus. A prospectus to be used for the resale by selling shareholders (the “Selling Shareholders”)of up to 7,912,660 shares of the Registrant’s common stock (the “Resale Prospectus”). The offering price is a fixed price of $0.30 per share for shares being sold by current shareholders. |

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

| · | they contain different outside and inside front covers; |

| · | they contain different Offering sections in the Prospectus Summary section beginning on page 7; |

| · | they contain different Use of Proceeds sections on page 18; |

| · | they contain different Plan of Distribution sections on page 19; |

| · | the Dilution section is deleted from the Resale Prospectus; |

| · | a Selling Security Holders section is included in the Resale Prospectus beginning on page 110; |

| · | references in the Public Offering Prospectus to the Resale Prospectus will be deleted from the Resale Prospectus; |

| · | they contain different outside back covers. |

| 3 |

The Registrant has included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Resale Prospectus as compared to the Public Offering Prospectus.

| The information in this prospectus is not complete and may be changed. We may not sell these securities until the Registration Statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where an offer or sale is not permitted. |

PRELIMINARY PROSPECTUS

KM WEDDING EVENTS MANAGEMENT, INC.

11501 Dublin Blvd., Suite 200

Dublin, CA 94568

Phone: (925) 891-8029

Fax: (925) 891-8028

PUBLIC OFFERING: 10,000,000 SHARES OF COMMON STOCK

RESALE OFFERING: 7,912,660 SHARES OF COMMON STOCK

This Registration Statement contains two prospectuses regarding our Public Offering of 10,000,000 shares of Common Stock of KM Wedding Events Management, Inc. and our Resale Offering by existing shareholders of 7,912,660 shares of Common Stock of the Company.

Under our Public Offering (the “Offering”), we are offering for sale a total of 10,000,000 shares of Common Stock at a fixed price of $0.30 per share for the duration of this Offering. There is no minimum number of shares that must be sold by us for the Offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. The Offering is being conducted on a self-underwritten, best efforts basis, which means our Officers and Directors, will attempt to sell the shares directly to friends, family members and business acquaintances. Our Officers and Directors will not receive commission or any other remuneration any such sales. In offering the securities on our behalf, our Officers and Directors will rely on the safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934. We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

The shares will be offered for sale at a fixed price of $0.30 per share for a period of one hundred and eighty (180) days from the effective date of this prospectus, unless extended by our Board of Directors for an additional 90 days. If all of the shares offered by us are purchased, the gross proceeds to us will be $3,000,000. However, since the Offering is being conducted on a “best-efforts” basis, there is no minimum number of shares that must be sold, meaning the Company shall retain any proceeds from the sale of the shares sold hereunder. Accordingly, all funds raised hereunder will become immediately available to the Company and will be used in accordance with the Company’s intended “Use of Proceeds” as set forth herein, investors are advised that they will not be entitled to a refund and could lose their entire investment.

Under the Resale Offering, existing shareholders of the Company are offering for sale a total of 7,912,660 shares of Common Stock of the Company at a fixed price of $0.30 per share until our shares are quoted on the OTC Bulletin Board and thereafter at prevailing market prices or privately negotiated prices. Prior to being quoted on the OTCBB, the Selling Shareholders may sell their shares in private transactions to other individuals. If all of the shares offered by the Selling Shareholders under the Resale Prospectus are purchased, the gross proceeds will be $2,373,798. The Company will not receive any proceeds from the resale of shares by the Selling Shareholders. The Selling Shareholders will receive all of the net proceeds from the resale of the shares.

| Type of Offering | Offering Price to the Public Per Share | Commissions | Net Proceeds to Company

After Offering Expenses (10% of Shares Sold) | Net Proceeds to Company

After Offering Expenses (50% of Shares Sold) | Net Proceeds to Company

After Offering Expenses (100% of Shares Sold) | |||||||||||||||

| Common Stock | Public Offering | $ | 0.30 | Not Applicable | $ | 215,000 | $ | 1,415,000 | $ | 2,915,000 | ||||||||||

| Common Stock | Resale Offering | $ | 0.30 | Not Applicable | Not Applicable | Not Applicable | Not Applicable | |||||||||||||

| Total | $ | 0.30 | Not Applicable | $ | 215,000 | $ | 1,415,000 | $ | 2,915,000 | |||||||||||

There currently is no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our Common Stock is not traded on any exchange or on the over-the-counter market. There can be no assurance that our Common Stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

THE PURCHASE OF THE SECURITIES OFFERED THROUGH THE PUBLIC OFFERING PROSPECTUS AND RESALE PROSPECTUS INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ THE ENTIRE PROSPECTUSES, INCLUDING THE SECTION ENTITLED “RISK FACTORS” BEGINNING ON PAGE 11 HEREOF BEFORE BUYING ANY SHARES OF KM WEDDING EVENTS MANAGEMENT, INC.’S COMMON STOCK.

| 4 |

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Date of this prospectus is January 16, 2014.

| 5 |

TABLE OF CONTENTS

| Page | |

| Prospectus Summary | 7 |

| The Offering | 9 |

| Risk Factors | 11 |

| Determination of Offering Price | 18 |

| Use of Proceeds | 18 |

| Plan of Distribution; Terms of the Offering | 19 |

| Dilution | 21 |

| Description of Property | 22 |

| Description of Securities | 22 |

| Description of Business | 24 |

| Management’s Discussion and Analysis | 31 |

| Directors, Executive Officers, Promoters and Control Persons | 35 |

| Executive Compensation | 36 |

| Security Ownership of Certain Beneficial Owners and Management | 37 |

| Certain Relationships and Related Transactions | 38 |

| Legal Matters | 38 |

| Experts | 38 |

| Commission Position on Indemnification for Securities Act Liabilities | 39 |

| Where You Can Find More Information | 39 |

| Index to Financial Statements | 40 |

You should rely only on the information contained or incorporated by reference to this prospectus in deciding whether to purchase our Common Stock. We have not authorized anyone to provide you with information different from that contained in this prospectus. Under no circumstances should the delivery to you of this prospectus or any sale made pursuant to this prospectus create any implication that the information contained in this prospectus is correct as of any time after the date of this prospectus. To the extent that any facts or events arising after the date of this prospectus, individually or in the aggregate, represent a fundamental change in the information presented in this prospectus, this prospectus will be updated to the extent required by law.

| 6 |

PROSPECTUS SUMMARY

The following summary highlights material information contained in this prospectus. This summary does not contain all of the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the risk factors section, the financial statements and the notes to the financial statements. You should also review the other available information referred to in the section entitled “Where You Can Find More Information” in this prospectus and any amendment or supplement hereto.

Company Overview

KM Wedding Events Management, Inc. (the “Company” or “KM”) was incorporated in the State of Delaware on October 24, 2012.

On February 14, 2013, KM entered into a Stock Purchase Agreement with KM Matrimony Pvt Ltd, a company incorporated under the 1956 Companies Act of India (“KM India”), pursuant to which KM agreed to purchase ten million (10,000,000) shares of KM India’s common stock at a price of 11 Indian Rupees (approximately $0.21 USD) per share for an aggregate purchase price of up to two million one hundred thousand dollars ($2,100,000 USD) dollars. As of January 16, 2014, pursuant to the above agreement, KM has purchased 1,393,127 shares at 11 Rupees per share ($0.201 USD at the time of the sale) in KM India on April 3, 2013 for $280,000 USD. A true and correct copy of the Stock Purchase Agreement is attached hereto as Exhibit 10.5 and is incorporated herein by reference.

On February 14, 2013, KM entered into a Stock Purchase Agreement with the shareholders of KM India, comprised of Mr. Venkatesan Vaidhyanathan, Mrs. Meera Nagarajan, Mr. Sridhar Kalyanasundaram, Mr. Vijaya Bhaskar Venkatesan and Mrs. Nithya Vijaya Baskar, pursuant to which KM shall purchase Three Million One Hundred and Fifty Thousand (3,150,000) shares of KM India’s common stock from Mr. Venkatesan Vaidhyanathan, Mrs. Meera Nagarajan, Mr. Sridhar Kalyanasundaram, Mr. Vijaya Bhaskar Venkatesan and Mrs. Nithya Vijaya Baskar payable in two tranches as follows: (i) Tranche A: One Million One Hundred and Fifty Thousand (1,150,000) shares of KM India’s common stock at a purchase price of 11 Indian Rupees ($0.21 USD) per share (“Tranche A”); and, (ii) Tranche B: Two Million (2,000,000) shares of KM India’s common stock at a purchase price equal to the fair market value of KM India’s shares at the time of purchase (“Tranche B”). As of January 16, 2014, KM has purchased 1,120,018 shares in KM India on April 26, 2013 from Tranche A for an aggregate of $229,000 USD from two of the shareholders of KM India viz. Mr. Venkatesan Vaidhyanathan (562,455 shares for $115,000 USD) and Mrs. Meera Nagarajan (557,564 shares for $114,000 USD). The remaining Tranche A shares and the Tranche B shares have to be sold within 3 years from February 14, 2013. A true and correct copy of the Stock Purchase Agreement is attached hereto as Exhibit 10.6 and is incorporated herein by reference.

As a result of the Stock Purchase Agreements referenced above, KM now carries on the business of KM India as its primary business and KM India is a subsidiary of KM. KM currently holds 55.32% of KM India.

KM India has been involved in the wedding services industry in South India since 2004. KM is the brand, which is a short form for ‘Kalyana Malai’ meaning ‘Wedding Garland’ in South Indian language. The services offered by KM India include Matrimonial (Matchmaking) Services and Wedding Services. Unless otherwise specified, KM and KM India shall hereinafter be collectively referred to as “KM” or the “Company”.

KM’s Matrimonial Services include matchmaking and partner identification, through multiple delivery channels viz. print and visual media, website, physical centers and events. The Wedding Services of KM covers 15 different services, including food and beverages, guest services, decorations, event planning and event management. In order to increase the Wedding Services business, KM intends to lease and/or own wedding halls (physical infrastructures where a wedding is conducted, similar to banquet halls of hotels) and provide Wedding Services for the weddings conducted in these halls.

KM currently focuses on the geographic locations of Tamil Nadu and Andhra Pradesh (two of the Southern States in India). We believe that the Company is well positioned to exploit the potential of the Wedding Services market because of its presence in this market since 2004 and respected brand name. The Company is also planning to expand its services in the United States during 2014. KM’s target customers include the Indian high-income group, higher middle-income group, and other affluent individuals both in the U.S. and India. This segment, being upwardly mobile and comfort and service focused, is the right target group for the business positioning of KM.

KM India has been servicing the Indian Diaspora in the United States through its website since 2004 which was followed up by Community Meets (events focused on bringing together individuals who are seeking a life partner and who share similar backgrounds (e.g. profession, socio-economic background, religion, etc.) conducted during the fiscal year 2011 in 5 cities (New York City, South Windsor (Connecticut), Boston, Houston & San Antonio) which was attended by around 1,200 prospective matrimonial customers. In October 2013, KM India also filmed for Sun TV across 6 different US cities (New York, South Windsor Connecticut), New Brunswick, San Jose, Dallas and Houston), which was attended by over 5,400 South Indian community members. KM’s TV show is a 30 minute matrimonial-related program produced by KM and telecast once a week by Sun TV. The TV program introduces profiles of individuals seeking to be matched and also incorporates an entertainment based “debate show” which covers various “topics of social impact” which are discussed and debated upon by professionals & experts.

| 7 |

Based on the experience gained from the above activities, KM believes that the Indian Diaspora in the United States presents a lucrative market that requires Matrimonial and Wedding Services offered by KM but also requires a customized and focused approach for exploiting the same. The plan for exploring this business opportunity includes setting up offices in the U.S. (fiscal 2014), providing Wedding Services for weddings to be conducted in India by Indians in the U.S. (fiscal 2014), launching a customized website for Matrimonial Services in the U.S. market (fiscal 2015) and providing Wedding Services for conducting weddings locally in the United States (fiscal 2016-17).

We are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company. For a description of the qualifications and other requirements applicable to emerging growth companies and certain elections that we have made due to our status as an emerging growth company, see “We are an “Emerging Growth Company” and we cannot be certain if the reduced disclosure requirements applicable to Emerging Growth Companies will make our Common Stock less attractive to Investors” on Page 12 of this prospectus.

| 8 |

SUMMARY OF THIS OFFERING

| The Issuer | KM Wedding Events Management, Inc. |

| Securities being offered | Up to 10,000,000 shares of Common Stock, our Common Stock is described in further detail in the section of this prospectus titled “DESCRIPTION OF SECURITIES – Common Stock.” |

| Offering Type | The Offering is being conducted on a self-underwritten, best efforts basis, there is no minimum number of shares that must be sold by us for the Offering to proceed, and we will retain the proceeds from the sale of any of the offered shares. |

| Per Share Price | $0.30 |

| No Revocation | Once you submit a Subscription Agreement and the Company accepts it, you may not revoke or change your subscription or request a refund of monies paid. All accepted subscriptions are irrevocable, even if you subsequently learn information about us that you consider to be materially unfavorable. |

| No Public Market | There is no public market for our Common Stock. We cannot give any assurance that the shares being offered will have a market value, or that they can be resold at the offered price if and when an active secondary market might develop, or that a public market for our securities may be sustained even if developed. The absence of a public market for our stock will make it difficult to sell your shares.

We intend to apply to the OTCBB, through a market maker that is a licensed broker dealer, to allow the trading of our Common Stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. |

| Duration of Offering | The Offering shall continue until all shares offered hereunder have been sold or until the expiration of a 180 day period from the date of effectiveness of this Registration Statement, unless such period is extended by our Board of Directors. |

| Number of Shares Outstanding Before the Offering | As of the date of this Registration Statement there are 41,646,160 shares of Common Stock, and 0 shares of Preferred Stock, issued and outstanding.

Upon the completion of the Offering under this Registration Statement, there will be 51,646,160 shares of Common Stock outstanding provided all of the shares offered hereby are sold. |

| Registration Costs | We estimate our total costs relating to the registration herein shall be approximately $85,000. |

| Net Proceeds to the Company | The Company is offering 10,000,000 shares of Common Stock, $0.001 par value and at an offering price of $0.30 per Share for maximum net proceeds to the Company of $3,000,000. The full subscription price will be payable at the time of subscription and any such funds received from subscribers in this Offering will be released to the Company when subscriptions are received and accepted.

Substantial expenditures will be required to enable the Company to scale up its operations and quality of services. While the Company believes that if all shares offered hereunder are sold, the net proceeds should be sufficient to permit the Company to continue operations and meet its capital requirements for approximately twelve (12) months, it is anticipated that the Company may need to raise additional capital to maintain operations, facilitate future growth and support its long-term growth initiatives. In addition, if not all of the Shares offered hereunder are sold, the Company will need to obtain substantial additional funds much sooner, and possibly within twelve (12) months after this Offering to grow and expand its operations. Therefore, it is likely that the Company would need to seek additional financing through subsequent future private sales of its debt or equity securities to fund its growth plans.

There can be no assurance, however, that such efforts can generate availability of additional funds when needed, or on terms acceptable to the Company, if at all. Any such additional financing may result in significant dilution to existing stockholders. If adequate funds are not available, the Company may be required to curtail its expansion plans, which will adversely affect its revenue and profitability.

|

| 9 |

| Use of Proceeds | If all of the shares of Common Stock offered hereunder are sold, the net proceeds to the Company from the sale of the shares will be approximately $3,000,000. The offering proceeds will be utilized mainly for capital expenditures relating the growth and expansion of the Company’s business in the United States. |

| Risk Factors | The Securities offered hereby involve a high degree of risk and immediate substantial dilution, and therefore, should not be purchased by anyone who cannot afford the loss of his or her entire investment. Prospective investors should carefully review and consider the factors set forth in the section of this Registration Statement entitled “Risk Factors,” as well as the other information set forth herein before subscribing for any of the shares offered hereby. |

| 10 |

RISK FACTORS

An investment in our Common Stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our Common Stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. Currently, shares of our Common Stock are not publicly traded. In the event that shares of our Common Stock become publicly traded, the trading price of our Common Stock could decline due to any of these risks, and you may lose all or part of your investment. In the event our Common Stock fails to become publicly traded you may lose all or part of your investment.

RISKS RELATED TO THE OFFERING

As there is no minimum for our Offering, if only a few persons purchase shares they will lose their investment.

There shall be no minimum amount of proceeds to be received by the Company upon the sale of the shares offered hereunder. After the payment of expenses, including attorney and accounting fees, general and administrative expenses, the retirement of certain debt of the Company and the marketing and distribution of the Company’s existing products, the Company may have only limited reserves allocated for contingencies. In the event additional expenses are incurred in addition to those currently budgeted for, this may have a material adverse impact on the business and operations of the Company.

We are selling this Offering without an underwriter and may be unable to sell any shares.

This Offering is self-underwritten, that is, we are not going to engage the services of an underwriter to sell the shares. We intend to sell our shares through our Founder and Chairman, who will receive no commissions or other remuneration from any sales made hereunder. He will offer the shares to friends, family members, and business associates; however, there is no guarantee that he will be able to sell any of the shares. Unless he is successful in selling all of the shares and we receive the maximum amount of proceeds from this Offering, we may have to seek alternative financing to implement our plan of operations.

You may have limited access to information regarding our business because we are a limited reporting company exempt from many regulatory requirements and our obligations to file periodic reports with the SEC could be automatically suspended under certain circumstances.

The Company will not become a fully reporting company, but rather, will be subject to the reporting requirements of Section 15(d) of the Securities Exchange Act of 1934. As of effectiveness of our registration statement of which this prospectus is a part, we will be required to file periodic reports with the SEC, which will be immediately available to the public for inspection and copying (see “Where You Can Find More Information” elsewhere in this prospectus). Except during the year that our registration statement becomes effective, these reporting obligations may be automatically suspended under Section 15(d) if we have less than 300 shareholders. If this occurs after the year in which our registration statement becomes effective, we will no longer be obligated to file periodic reports with the SEC and your access to our business information would then be even more restricted; however, that filing obligation will generally apply even if our reporting obligations have been suspended automatically under section 15(d) of the Exchange Act prior to the due date for the Form 10-K. After that fiscal year and provided the Company has less than 300 shareholders, the Company is not required to file these reports. If the reports are not filed, the investors will have reduced visibility as to the Company and its financial condition.

In addition, as a filer subject to Section 15(d) of the Exchange Act, the Company is not required to prepare proxy or information statements, and our common stock will not be subject to the protection of the ongoing private regulations. Additionally, the Company will be subject to only limited portions of the tender offer rules, and our officers, directors, and more than ten (10%) percent shareholders are not required to file beneficial ownership reports about their holdings in our Company, and will not be subject to the short-swing profit recovery provisions of the Exchange Act. Further, more than five percent (5%) holders of classes of our equity securities will not be required to report information about their ownership positions in the securities. This means that your access to information regarding our business will be limited.

Furthermore, as long as we remain an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), we intend to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an “emerging growth company.”

| 11 |

We will remain an emerging growth company until the earliest of: (A) the last day of the fiscal year following the fifth anniversary of our first sale of common equity securities pursuant to an effective registration statement, (B) the last day of the fiscal year in which we have total annual gross revenue of $1.0 billion or more, (C) the date that we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (D) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Rule 12b-2 of the Securities Exchange Act of 1934, as amended, defines a “smaller reporting company” as an issuer that is not an investment company, an asset-backed issuer), or a majority-owned subsidiary of a parent that is not a smaller reporting company and that:

| · | Had a public float of less than $ 75 million as of the last business day of its most recently completed second fiscal quarter, computed by multiplying the aggregate worldwide number of shares of its voting and non-voting common equity held by non-affiliates by the price at which the common equity was last sold, or the average of the bid and asked prices of common equity, in the principal market for the common equity; or |

| · | In the case of an initial registration statement under the Securities Act or Exchange Act for shares of its common equity, had a public float of less than $75 million as of a date within 30 days of the date of the filing of the registration statement, computed by multiplying the aggregate worldwide number of such shares held by non-affiliates before the registration plus, in the case of a Securities Act registration statement, the number of such shares included in the registration statement by the estimated public offering price of the shares; or |

| · | In the case of an issuer whose public float as calculated under paragraph (1) or (2) of this definition was zero, had annual revenues of less than $50 million during the most recently completed fiscal year for which audited financial statements are available. |

We qualify as a smaller reporting company, and so long as we remain a smaller reporting company, we benefit from the same exemptions and exclusions as an emerging growth company. In the event that we cease to be an emerging growth company as a result of a lapse of the five year period, but continue to be a smaller reporting company, we would continue to be subject to the exemptions available to emerging growth companies until such time as we were no longer a smaller reporting company.

After, and if ever, we are no longer an “emerging growth company,” we expect to incur significant additional expenses and devote substantial management effort toward ensuring compliance with those requirements applicable to companies that are not “emerging growth companies,” including Section 404 of the Sarbanes-Oxley Act.

We are an “Emerging Growth Company” and we cannot be certain if the reduced disclosure requirements applicable to Emerging Growth Companies will make our Common Stock less attractive to Investors.

We are an “emerging growth company,” as defined in the Jumpstart our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

Under the JOBS Act, “emerging growth companies” can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to “opt out” of such extended transition period and, therefore, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

You may be liable for damages if you breach the Subscription Agreement

The Company is charged with the burden of determining the suitability of an investor to invest in the Company. Nonetheless, the Subscription Agreement attached to this Offering requires the investors to represent, among other things, that they meet certain requirements and understand the risks associated with an investment in our shares and an investment in us, and that they can afford to lose all of the money they invest in us. Any investor who later makes a claim against us that is inconsistent with the representations in the Subscription Agreement will be in breach of the Subscription Agreement and will be liable for any damages that we, our affiliates and agents suffer as a result of such breach, including the cost of a successful defense against a lawsuit of the kind discussed above. Accordingly, members should take the representations in the Subscription Agreement seriously and not invest in us if they are not comfortable with the investment in us or will suffer financially or emotionally if they lose their investment.

| 12 |

Valuation of Securities Offered

The Company has arbitrarily determined the offering price of the shares. Therefore, purchasers of the shares may be exposed to a substantial risk of a decline in the market value of the Securities after the Offering should a market develop.

Purchasers in this Offering will experience immediate and substantial dilution in the book value of their investment.

The Offering price of our Common Stock of $0.30 is substantially higher than the $0.056 net tangible book value per share of our outstanding Common Stock immediately after the Offering, assuming that 100% of the shares offered hereunder are sold. Therefore, if you purchase shares of our Common Stock in this Offering at a price of $0.30, you will experience immediate dilution of $0.241 per share, the difference between the price per share you pay for our Common Stock and its net tangible book value per share as of September 30, 2013, after giving effect to the issuance of shares of our Common Stock in this Offering. This dilution is due in part to our arbitrary determination of the Offering price of the shares being offered. This dilution is also a result of the lower book value of shares of our Common Stock held by our existing stockholders. Additionally, if we issue additional shares of our Common Stock in the future, you may experience further dilution.

As a result of the concurrent offering by the Company and the Selling Shareholders, the Company may not be able to sell the shares being offered by us which will reduce the amount of capital available for our operations.

The Company and Selling Shareholders will be offering shares of the Company’s common stock at the same time, however, there are no Selling Shareholders who will also be selling shares on behalf of the Company. The sale of shares by the Selling Shareholders is not contingent upon the Company selling a minimum number of its shares. Due to the concurrent offering, the Company and Selling Shareholders may be competing for potential investors. While we do not believe we will be approaching the same potential investors, we may inadvertently do so and if there is a conflict, it is possible that we may not be able to fully subscribe our Offering. In that event, the overall proceeds to the Company from our Offering may be decreased which would decrease the amount of capital available for our business operations. Further, sales of a substantial number of shares of our common stock by the Selling Shareholders could impair our ability to raise capital through the sale of additional equity securities.

RISKS RELATED TO THE BUSINESS

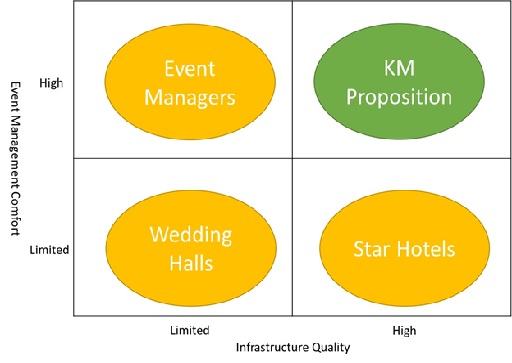

The market for wedding services is highly competitive, and competition is increasing as more companies, many that are larger and have greater resources than we do, are able to capture the market from us. Further, considering that the industry is largely unorganized, numerous small players can pose stiff competition to us by underpricing the types of services that we provide.

In regards to the wedding matchmaking services, there are various online matrimonial providers who are large players and who have already attained significant operations compared to us. These providers have greater financial back up, investments in technology, resources and market infrastructure to offer competitive service rates that may pose significant challenges to us. We also compete with numerous small and mid-size online companies, and unorganized traditional brick and mortar service providers who may offer services at cheaper price points than us which may have an adverse effect on our business, including increased price competition and loss of potential customers.

Our ability to grow our business is dependent on our ability to compete effectively against other providers and requires capital investment in marketing and advertisement. Many existing and potential competitors have longer operating histories and greater market share and brand recognition than we do. In addition, many of our existing and potential competitors are substantially larger than we are and may already have or could develop substantially greater financial and other resources than we have. We may also face price competition that results in decreases in the purchase and use of our products and services. To stay competitive, we may have to increase the incentives that we offer to our customers and decrease the prices of our products and services, which could adversely affect our operating results and profitability.

In regards to wedding services, we may face stiff price competition from established hotel chains who rent their banquet halls directly to consumers and other wedding services companies. Considering the industry is largely unorganized, we might also face stiff price competition from small time players including wedding catering contractors who might offer similar service offerings at a price point much lower than us. In such an event our business and profitability may be substantially affected.

We rely on our relationships with wedding infrastructure owners who lease out their land or buildings for the purpose of being used as a wedding infrastructure. The financial position of the Company may be adversely affected if we fail to obtain a good wedding infrastructure space at a fair lease rental value and fail to achieve optimum occupancy of these infrastructures.

The Company relies on its relationships with wedding infrastructure owners who lease out their halls and buildings for an annual lease rental for the purpose of being used as a wedding infrastructure. The financial position of the Company may be adversely affected if we fail to obtain suitable wedding halls. Even if we are able to obtain suitable wedding halls, we need to ensure optimum occupancy of these infrastructures; otherwise the business may be significantly affected.

| 13 |

The wedding industry is highly dependent on social structure and practices. Any major change in the same will adversely impact the business and thus the financial performance of the Company.

The wedding services industry is highly dependent on the social structure, religious practices and number of guest invites. Any major change in the same by the consumers will adversely impact the business and thus the financial performance of the Company.

Our business depends significantly on the market recognition of our Founder & Chairman, who is our brand ambassador, and if we are not able to maintain or enhance our brand recognition, our business, financial condition, results of operations and prospects may be materially and adversely affected.

In the event of the demise of our Founder and Chairman, Mr. Venkatesan (a.k.a Mr. Mohan), who is the brand ambassador and face of the Company, or any accident or injury or ill health caused to him, the Company may not be able to maintain its business and brand recognition, or enhance its brand appeal. This could significantly affect our business and operations.

Our ability to maintain our competitive position and to implement our business strategy is dependent to a significant extent on the performance of our senior management team and other key functional personnel.

We depend on our current senior management for the implementation of our strategy and the operation of our day-to-day activities. Furthermore, relationships of members of senior management are important to the conduct of our business. Competition for experienced management personnel in the wedding services industry is intense, the pool of qualified candidates is limited, and we may not be able to retain the services of our senior executives or key personnel or attract and retain high-quality senior executives or key personnel in the future. Consequently, there can be no assurance that these individuals will continue to make their services available to us in the future. Any significant loss of senior management or key personnel could materially and adversely affect our business, financial condition, results of operations and prospects.

In addition, if any member of our senior management team or any of our other key personnel joins a competitor or forms a competing company, we may consequently lose our proprietary know-how.

Our key management personnel have entered into confidentiality and/or non-competition agreements with us. However, if any disputes arise between any of our key management personnel and us, it may be difficult for us to enforce these agreements.

Our profitability is substantially dependent on scalability of wedding services which may be negatively affected by various factors.

Our profit margin is largely a function of service fees charged to our customers. These fees are affected by a number of factors, including:

| · | Our customer’s perception of our ability to add value through our services; |

| · | The introduction of better products or services by our competitors; |

| · | The stiff pricing policies of our competitors; |

| · | General economic recessionary conditions; |

| · | The increase in input cost of materials which we may not be able to pass on to the customers; and |

| · | Increase in lease rental costs charged by wedding infrastructure owners. |

If our service fees are not properly priced, our revenue will decline and we will not be able to sustain our profit margin, which could have a material adverse effect on our profitability.

We have entered into outsourcing and other agreements related to certain business operations, and any difficulties experienced in these arrangements could result in additional expense, loss of customers , and revenue or an interruption of our services.

We have entered into numerous outsourcing agreements with third parties to provide turnkey wedding event management services to our customers. As a result, we must rely on third parties over which we have limited control, to perform certain of our operations and, in the majority of cases, to interface with our customers. If these third parties are unable to perform to our requirement of high quality services we may be forced to pursue alternative strategies to provide these services, which could result in delays, interruptions, additional expenses to us and loss of customers. This may require us to pursue new third-party relationships. If we are unable to complete a transition to a new provider on a timely basis, or at all, we could be forced to temporarily or permanently discontinue certain services, which could disrupt services to our customers and adversely affect our business, financial condition and results of operations.

| 14 |

The inability to maintain or strengthen our brand may reduce our ability to retain and attract customers, which could adversely affect our business, financial condition and operating results.

The nature of the industry requires continuous efforts to increase brand awareness among our consumers. This will be an important part of our strategy to grow our business. Developing, promoting and maintaining our brand and image requires a consistent capital investment and expense, and this investment in our brand and image may not be successful. If we fail to develop, promote and maintain our brand and image, we may not be able to grow our customer base and our financial and operational results may suffer.

If we lose key personnel or are unable to attract additional qualified personnel as we grow, our business could be adversely affected.

The wedding services business is highly labor intensive and requires constant efforts on training. We depend on the ability and experience of a number of our key personnel who have substantial experience in our line of operations. It is possible that the loss of the services of one or a combination of our senior executives or key managers would have an adverse effect on our operations. Our success also depends on our ability to continue to attract, train, manage and retain other qualified management and skilled personnel as we grow, and we may be unable to attract, manage or retain such personnel. Due to the competitive nature of our industry, we may also be vulnerable to attempts by our competitors to hire our employees.

Business, political and economic factors may affect our operations, the manner in which we conduct our business and our rate of growth.

The growth rate of the Indian economy has dropped over the last two years and unemployment rates are rising. If economic conditions and unemployment rates continue to deteriorate or do not improve, our target consumer base may be negatively affected due to the generally lower incomes of the customers. In addition, a large proportion of our target customers work in industries that may be disproportionately affectedby a downturn in the Indian economy, which may limit their disposable incomes and consequently, their discretionary spending. Stagnant economic growth and high unemployment are likely to negatively affect our customers' ability to pay for our services. The resulting impact of such economic conditions on our customers and on consumer spending could have a material adverse effect on demand for our services and on our business, financial condition and operating results.

If we are unable to adequately protect our intellectual property and brand image we may lose a valuable competitive advantage or be forced to incur costly litigation to protect our rights.

Our success depends in part on our ability to protect our intellectual property rights and brand image. Currently, the Company has the right to utilize certain intellectual property comprising of wedding design, catering knowhow, talent pool, skilled labor, vendor supply chain network, wedding hall owner’s network, sourcing strategy, proprietary recipe of signature dishes, etc. It is possible that third parties will infringe these rights and as a result, the Company may be forced to spend significant amounts of time or money to defend these rights. Further, the Company has not yet obtained trademark protection of the KM brand. Securing these protections will be material to our business as it will help protect our ideas and image from use by competitors with a similar business model.

Our failure to anticipate rapid changes in competition may negatively affect demand for our services in the marketplace.

The wedding services market may be subject to rapid and significant business changes. We expect that new services and concepts applicable to our industry will emerge in the future, and these new services and concepts may be superior to our services. Our future success will depend, in part, on our ability to develop new services according to changing business conditions. These initiatives are inherently risky, and they may not be successful or may have an adverse effect on our business, financial condition and results of operations.

The Company’s business is affected by various regulations and compliance with stringent health, safety and environmental laws is expected to be significant. The failure to comply with existing and new health, safety and environmental laws could adversely affect our results of operations.

A central component of our wedding service is catering, which is subject to Food Regulations. The Indian food and processing industry is governed by multiple legislations. Dealing with an array of food laws and governing bodies is also a challenge. In addition, we are also subject to regulations relating to local land use controls, permits planning permission, fire and safety standards. We could be subject to substantial civil and criminal liability and other regulatory consequences in the event that health, safety or environmental hazards were to be found. We may be the subject of consumer interest litigation in India relating to allegations of such hazards, as well as in cases having potential criminal and civil liability filed by regulatory authorities. If such cases are determined against us, there could be an adverse effect on our brand reputation, business and operations.

We and some of our third-party service providers are susceptible to the occurrence of catastrophic events, which could impair our ability to operate our business.

We and some of the third-party service providers on which we rely are vulnerable to damage from catastrophic events, such as power loss, natural disasters, terrorism, fires, accidents and similar events beyond our control. If we or our third-party service providers experience any of these events, our services to the customers may not function properly, we may lose customers and revenues, and we may have difficulty attracting new customers, any of which could have a material adverse impact on our business, financial condition and results of operations. In addition, the business interruption insurance we carry may not cover any or all of the losses we may experience as a result of such events. Any significant losses that are not covered by insurance could negatively affect our financial condition and results of operations.

| 15 |

Our business and activities will be regulated by the Competition Act, 2002 (India).

The Parliament of India enacted the Competition Act, 2002 (the “Competition Act”) for the purpose of preventing practices having an adverse effect on competition in the relevant market in India under the auspices of the Competition Commission of India (the “CCI”). Under the Competition Act, any arrangement, understanding or action, whether formal or informal, which causes or is likely to cause an appreciable adverse effect on competition is void and attracts substantial penalties. On March 4, 2011, the Government notified and brought into force the combination regulation (merger control) provisions under the Competition Act, effective from June 1, 2011. The combination regulation provisions require that acquisition of shares, voting rights, assets or control or mergers or amalgamations which cross the prescribed asset and turnover-based thresholds shall be mandatorily notified to and pre-approved by the CCI. In addition, on May 11, 2011, the CCI issued the final Competition Commission of India (Procedure in regard to the transaction of business relating to combinations) Regulations, 2011 that sets out the mechanism for implementation of the combination regulation provisions under the Competition Act.

The effect of the Competition Act on the business environment in India is currently unclear. If we are affected, directly or indirectly, by any provision of the Competition Act, or its application or interpretation, including any enforcement proceedings initiated by the Competition Commission and any adverse publicity that may be generated due to scrutiny or prosecution by the Competition Commission, it may have a material adverse effect on our business, results of operations, financial condition and prospects.

Our ability to raise foreign capital may be constrained by Indian law.

Our operating subsidiary, as an Indian company, will be subject to exchange controls that regulate investments in foreign currencies. Such regulatory restrictions limit our financing sources for our business operations or acquisitions and other strategic transactions, and consequently could constrain our ability to obtain financings. In addition, we cannot assure you that the required approvals will be granted to us, even if granted within the normal time limits.

If we are not able to obtain further financing, our business operations may fail.

Substantial expenditures will be required to enable the Company to scale up its operations and quality of services. While the Company believes that if all shares offered hereunder are sold, the net proceeds should be sufficient to permit the Company to continue operations and meet its capital requirements for approximately twelve (12) months, it is anticipated that the Company may need to raise additional capital to maintain operations, facilitate future growth and support its long-term growth initiatives. In addition, if not all of the shares offered hereunder are sold, the Company will need to obtain substantial additional funds much sooner, and possibly within twelve (12) months after this Offering to grow and expand its operations. The Company’s established bank-financing arrangements will not be adequate. Therefore, it is likely that the Company would need to seek additional financing through subsequent future private sales of its debt or equity securities to fund its growth plans.

There can be no assurance, however, that such efforts can generate availability of additional funds when needed, or on terms acceptable to the Company, if at all. Any such additional financing may result in significant dilution to existing stockholders. If adequate funds are not available, the Company may be required to curtail its expansion plans, which will adversely affect its revenue and profitability.

RISKS RELATED TO THE COMMON STOCK

The Company’s stock price may be volatile.

The market price of the Company’s Common Stock is likely to be highly volatile and could fluctuate widely in price in response to various potential factors, many of which will be beyond the Company’s control, including the following:

| · | products and services offered by the Company or its competitors; |

| · | additions or departures of key personnel; |

| · | the Company’s ability to execute its business plan; |

| · | operating results that fall below expectations; |

| · | industry developments; |

| · | economic and other external factors; and |

| · | period-to-period fluctuations in the Company’s financial results. |

| 16 |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of the Company’s Common Stock.

As a public company, we will incur substantial expenses.

Upon declared effectiveness of this Registration Statement by the SEC, we will become subject to the information and reporting requirements of the U.S. securities laws. The U.S. securities laws require, among other things, review, audit, and public reporting of our financial results, business activities, and other matters. Recent SEC regulation, including regulation enacted as a result of the Sarbanes-Oxley Act of 2002, has also substantially increased the accounting, legal, and other costs related to becoming and remaining an SEC reporting company. If we do not have current information about our Company available to market makers, they will not be able to trade our stock. The public company costs of preparing and filing annual and quarterly reports, and other information with the SEC and furnishing audited reports to stockholders, will cause our expenses to be higher than they would be if we were privately-held. These increased costs may be material and may include the hiring of additional employees and/or the retention of additional advisors and professionals. Our failure to comply with the federal securities laws could result in private or governmental legal action against us and/or our sole officer and director, which could have a detrimental effect on our business and finances, the value of our stock, and the ability of stockholders to resell their stock.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

The Financial Industry Regulatory Authority (“FINRA”) has adopted rules that relate to the application of the SEC’s penny stock rules in trading our securities and require that a broker/dealer have reasonable grounds for believing that the investment is suitable for that customer, prior to recommending the investment. Prior to recommending speculative, low priced securities to their non-institutional customers, broker/dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative, low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker/dealers to recommend that their customers buy our Common Stock, which may have the effect of reducing the level of trading activity and liquidity of our Common Stock. Further, many brokers charge higher transactional fees for penny stock transactions. As a result, fewer broker/dealers may be willing to make a market in our Common Stock, reducing a shareholder’s ability to resell shares of our Common Stock.

We may be exposed to potential risks resulting from new requirements under section 404 of the Sarbanes-Oxley Act of 2002.

There are substantial penalties that could be imposed upon us if we fail to comply with all regulatory requirements. In particular, under Section 404 of the Sarbanes-Oxley Act of 2002 we will be required, beginning with our fiscal year ending 2013 to include in our annual report our assessment of the effectiveness of our internal control over financial reporting as of the end of fiscal 2012. We have not yet completed our assessment of the effectiveness of our internal control over financial reporting. We expect to incur additional expenses and diversion of management’s time as a result of performing the system and process evaluation, testing and remediation required in order to comply with the management certification and auditor attestation requirements.

If a market for our Common Stock does not develop, shareholders may be unable to sell their shares.

A market for our Common Stock may never develop. We intend to contact an authorized OTC Bulletin Board market-maker for sponsorship of our securities on the OTC Bulletin Board. However, there is no guarantee that our shares will be traded on the Bulletin Board, or, if traded, a public market may not materialize. If our Common Stock is not traded on the Bulletin Board or if a public market for our Common Stock does not develop, investors may not be able to re-sell the shares of our Common Stock that they have purchased and may lose all of their investment.

The Company’s Common Stock may be deemed “penny stock”, which would make it more difficult for investors to sell their shares.

If a market develops and the price of the Company’s stock is below $5.00 per share, or the Company does not have $2,000,000 in net tangible assets, or is not listed on an exchange or on the NASDAQ National Market System, among other conditions, the Company’s shares may be subject to a rule promulgated by the SEC that imposes additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and institutional accredited investors. For transactions covered by the rule, the broker-dealer must make a special suitability determination for the purchaser and receive the purchaser’s written consent to the transaction prior to the sale. Furthermore, if the price of the Company’s stock is below $5.00, and does not meet the conditions set forth above, sales of the Company’s stock in the secondary market will be subject to certain additional new rules promulgated by the SEC. These rules generally require, among other things, that brokers engaged in secondary trading of stock provide customers with written disclosure documents, monthly statements of the market value of penny stocks, disclosure of the bid and asked prices, and disclosure of the compensation to the broker-dealers and disclosure of the sales person working for the broker-dealer. These rules and regulations may affect the ability of broker-dealers to sell the Company’s securities, thereby limiting the liquidity of the Company’s securities. They may also affect the ability of purchasers in the Offering to resell their securities in the secondary market.

| 17 |

Additional issuances of our securities may result in immediate dilution to existing stockholders.

We are authorized to issue up to 300,000,000 shares of Common Stock, $0.001 par value per share, of which 41,646,160 are currently issued and outstanding. Further, we are authorized to issue up to 10,000,000 shares of Preferred Stock, $0.001 par value per share of which none are issued and outstanding. Our Board of Directors has the authority to cause us to issue additional shares of Common Stock, and to determine the rights, preferences and privileges of our preferred stock, without consent of any of our stockholders. We may issue either common or preferred stock in connection with financing arrangements or otherwise. Any such issuances will result in immediate dilution to our existing stockholders’ interests, which will negatively affect the value of your shares.

The elimination of monetary liability against the Company’s existing and future directors, officers and employees under Delaware law and the existence of indemnification rights to the Company’s existing and future directors, officers and employees may result in substantial expenditures by the Company and may discourage lawsuits against the Company’s directors, officers and employees.

The Company’s Certificate of Incorporation contain specific provisions that eliminate the liability of directors for monetary damages to the Company and the Company’s stockholders; further, the Company is prepared to give such indemnification to its existing and future directors and officers to the extent provided by Delaware law. The Company may also have contractual indemnification obligations under any employment agreements it may have with its officers and directors. The foregoing indemnification obligations could result in the Company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which the Company may be unable to recoup. These provisions and resultant costs may also discourage the Company from bringing a lawsuit against existing and future directors and officers for breaches of their fiduciary duties and may similarly discourage the filing of derivative litigation by the Company’s stockholders against the Company’s existing and future directors and officers even though such actions, if successful, might otherwise benefit the Company and its stockholders.

Absence of Public Market

There has never been any established “public market” for shares of Common Stock of the Company, and no assurance can be given that any market for the Company's Common Stock will develop or be maintained. If a public market ever develops in the future, the sale of “unregistered” and “restricted” shares of Common Stock pursuant to Rule 144 of the Act, may adversely affect the market price, if any, for the Company's shares and could impair the Company's ability to raise capital through the sale of its equity securities. In order to qualify for the resale of Common Stock under Rule 144, certain holding periods must be met and either legal opinions setting forth exemptions from the Act must be provided or registration statements must be in effect relating to such Common Stock. Further, there is no assurance that Rule 144 will be applicable to the Company and investors may not be able to rely on its provisions now or in the future.

Dividends

Payment of dividends on the Common Stock and Preferred Stock is within the discretion of the Board of Directors, is subject to state law, and will depend upon the Company's earnings, if any, its capital requirements, financial condition and other relevant factors.

DETERMINATION OF OFFERING PRICE

As a result of there being no established public market for our shares, the offering price and other terms and conditions relative to our shares have been arbitrarily determined by the Company and do not bear any relationship to assets, earnings, book value, or any other objective criteria of value. In addition, no investment banker, appraiser, or other independent third party has been consulted concerning the offering price for the shares or the fairness of the offering price used for the shares.

USE OF PROCEEDS

The net proceeds to be realized from this Offering will be approximately $3,000,000 if all the shares being offered are sold. The Company's management estimates that if all shares are sold, the net proceeds to the Company should be sufficient to meet the Company's funding requirements for the next twelve (12) months after this Offering. Management anticipates the proceeds will generally be used as follows, and the estimated use of proceeds set forth below is not intended to represent the order of priority in which the proceeds may be applied:

| 18 |

| Application of Proceeds | 100% of Shares Sold |

75% of Shares Sold |

50% of Shares Sold | |||

$ Amount |

% of Total |

$ Amount |

% of Total |

$ Amount |

% of Total | |

| Total Offering Proceeds | 3,000,000 | 100.00 | 2,250,000 | 100.00 | 1,500,000 | 100.00 |

| Offering Expenses | ||||||

| Legal Fees and Expenses | 45,000 | 1.50 | 45,000 | 2.00 | 45,000 | 3.00 |

| Audit Fees and Expenses(1) | 35,000 | 1.17 | 35,000 | 1.56 | 35,000 | 2.33 |

| SEC Registration Fee | 700 | 0.02 | 700 | 0.03 | 700 | 0.05 |

| Transfer Agent & Registration Fees & Expenses | 2,500 | 0.08 | 2,500 | 0.11 | 2,500 | 0.17 |

| Miscellaneous Expenses | 1,800 | 0.06 | 1,800 | 0.08 | 1,800 | 0.12 |

| Total Offering Expenses | 85,000* | 2.83 | 85,000* | 3.78 | 85,000* | 5.67 |

| Net Proceeds from Offering | 2,915,000 | 97.17 | 2,165,000 | 96.22 | 1,415,000 | 94.33 |

| Use of Net Proceeds | ||||||

| Business Infrastructure | 1,345,000 | 44.83 | 1,000,000 | 44.44 | 660,000 | 44.00 |

| Marketing | 1,000,000 | 33.33 | 745,000 | 33.11 | 490,000 | 32.67 |

| General and Administrative | 570,000 | 19.00 | 420,000 | 18.67 | 265,000 | 17.67 |

| Total Use of Net Proceeds | 2,915,000 | 97.17 | 2,165,000 | 96.22 | 1,415,000 | 94.33 |

| Total Use of Proceeds | 3,000,000 | 100.00 | 2,250,000 | 100.00 | 1,500,000 | 100.00 |

*Notes: Offering expenses have been rounded to $85,000.

(1) Audit fees are strictly related to the amount of work performed by our auditor, and the percentage of shares sold in this offering has no impact on our audit fees. If we do not raise sufficient funds from this offering to cover audit related fees, we will have to seek additional outside financing to cover such expenses.

THE FIGURES SET FORTH ABOVE ARE ESTIMATES. ACTUAL EXPENDITURES MAY VARY SUBSTANTIALLY FROM THESE ESTIMATES AS A RESULT OF FUTURE EVENTS. ALTHOUGH THERE ARE NO CURRENT PLANS TO DO SO, THE COMPANY'S BOARD OF DIRECTORS RESERVES THE RIGHT, IN THE EXERCISE OF ITS BUSINESS JUDGMENT; TO ALTER THE ESTIMATES AND ANTICIPATED USES SET FORTH HEREIN.

PLAN OF DISTRIBUTION; TERMS OF THE OFFERING

As of the date of this Registration Statement, the Company has 41,646,160 shares of Common Stock and 0 shares of Preferred Stock issued and outstanding. The Company is registering an additional 10,000,000 shares of its Common Stock for sale at the price of $0.30 per share. There is no arrangement to address the possible effect of the Offering on the price of the stock.

In connection with the Company’s selling efforts in the Offering, our officers and directors will not register as a broker-dealer pursuant to Section 15 of the Exchange Act, but rather will rely upon the “safe harbor” provisions of SEC Rule 3a4-1, promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Generally speaking, Rule 3a4-1 provides an exemption from the broker-dealer registration requirements of the Exchange Act for persons associated with an issuer that participate in an Offering of the issuer’s securities. Our officers and directors are not subject to any statutory disqualification, as that term is defined in Section 3(a)(39) of the Exchange Act. Our officers and directors will not be compensated in connection with their participation in the Offering by the payment of commissions or other remuneration based either directly or indirectly on transactions in our securities. Our officers and directors are not, nor have been within the past 12 months, a broker or dealer, and they are not, nor have they been within the past 12 months, an associated person of a broker or dealer. At the end of the Offering, our officers and directors will continue to primarily perform substantial duties for the Company or on its behalf otherwise than in connection with transactions in securities. Our officers and directors have not participated in another offering of securities pursuant to the Exchange Act Rule 3a4-1 in the past 12 months. Additionally, they have not and will not participate in selling an offering of securities for any issuer more than once every 12 months other than in reliance on the Exchange Act Rule 3a4-1(a)(4)(i) or (iii).

In order to comply with the applicable securities laws of certain states, the securities will be offered or sold in those states only if they have been registered or qualified for sale; an exemption from such registration or if qualification requirement is available and with which the Company has complied. In addition, and without limiting the foregoing, the Company will be subject to applicable provisions, rules and regulations under the Exchange Act with regard to security transactions during the period of time when this Registration Statement is effective.

| 19 |

Terms of the Offering

The Offering shall continue until all shares offered hereunder have been sold or until the expiration of a 180 day period from the date of effectiveness of this Registration Statement, unless such period is extended by our Board of Directors. Subscribers shall make all checks payable to KM Wedding Events Management, Inc. for payment of their subscription price. Upon acceptance of a subscription for Shares and corresponding receipt of payment, all funds will be immediately available to the Company. Subscribers may not withdraw subscription funds deposited in the KM Wedding Events Management, Inc. account. After release to the Company, subscription funds not applied to Company expenses or obligations may be invested by the Company in short-term highly liquid investments, which may include uninsured depositories.

Penny Stock Regulation

Our Common Shares are not quoted on any stock exchange or quotation system. The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC, that:

| · | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| · | contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties; |

| · | contains a brief, clear, narrative description of a dealer market, including “bid” and “ask” prices for penny stocks and the significance of the spread between the bid and ask price; |

| · | contains a toll-free telephone number for inquiries on disciplinary actions; |

| · | defines significant terms in the disclosure document or in the conduct of trading penny stocks; and, |

| · | contains such other information and is in such form (including language, type, size, and format) as the SEC shall require by rule or regulation. |

The broker-dealer also must provide the customer with the following, prior to proceeding with any transaction in a penny stock:

| · | bid and offer quotations for the penny stock; |

| · | details of the compensation of the broker-dealer and its salesperson in the transaction; |